Published by the North American Hardware and Paint Association Serving Hardware, Home Center & Building Material Retailers Volume 224 • Issue 1 • January 2023 • hardwareretailing.com Capturing Applicants With Culture Page 44 Industry Insights and a Focus on the Future Page 24 Market Measure 3 Steps to Become an LBM Leader Page 54 2023

Jan 31 - Feb 2, 2023 Las Vegas Convention Center | South Hall New Products. New Connections. New Experiences. Our ongoing efforts to reimagine NHS are intended to deliver you more value. Whether you’re looking to reconnect with customers, peers and colleagues, discover the latest trends in the home improvement & DIY industry or explore new products and innovations – your experience at NHS will provide you the tools to grow your business. NHS is focused on continuing to celebrate innovation, deepening industry connections and growing our global footprint. Register Today For NHS at nhs23.com/NHPA-Free REGISTER TODAY! USE CODE NHPA FOR A FREE EXPO PASS! Untitled-1 1 11/8/22 7:50 AM Untitled-1 1 12/12/22 3:44 PM JANUARY ISSUE SPONSOR

Published by the North American Hardware and Paint Association Serving Hardware, Home Center & Building Material Retailers Volume 224 • Issue 1 • January 2023 • hardwareretailing.com Capturing Applicants With Culture Page 44 Industry Insights and a Focus on the Future Page 24 Market Measure 3 Steps to Become an LBM Leader Page 54 2023

“We’ve been in this industry for 46 years, we pride ourselves on carrying inventory that you can’t get at the “big box stores”, it’s one of the things that sets us apart.”

“We consider ourselves experts in old school quality and service, carrying Midwest allows us to provide our customers with an outstanding selection of quality fasteners.”

Exceeding Expectations. One Hardware Destination at a Time!

- Mike Fullaway & Jodie Brixey Calaveras Lumber Angels Camp, CA

- Mike Fullaway & Jodie Brixey Calaveras Lumber Angels Camp, CA

For your very own Hardware Destination, contact Glen @ 800-444-7313 x 120 800.444.7313 fastenerconnection.com

HEADQUARTERS

CONNECTIONS

Follow Us Online

1025 East 54th St. Indianapolis, Indiana 317-275-9400

NHPA@YourNHPA.org

YourNHPA.org

OUR MISSION

The North American Hardware and Paint Association (NHPA) helps independent home improvement and paint and decorating retailers, regardless of affiliations, become better and more profitable retailers.

NHPA BOARD OF DIRECTORS

CHAIRMAN OF THE BOARD

Jared Smith, Jared’s Ace Hardware, Bishopville, South Carolina

EXECUTIVE VICE CHAIRMAN

Jackie Sacks, Round Top Mercantile Co., Round Top, Texas

DIRECTORS

Alesia Anderson, Handy Ace Hardware, Tucker, Georgia

Jay Donnelly, Flanagan Paint & Supply, Ellisville, Missouri

Ned Green, Weiders Paint & Hardware, Rochester, New York

Scott Jerousek, Farm and Home Hardware, Wellington, Ohio

Joanne Lawrie, Annapolis Home Hardware Building Centre, Annapolis Royal, Nova Scotia

Ryan Ringer, Gold Beach Lumber Yard Inc., Gold Beach, Oregon

SECRETARY-TREASURER

Bob Cutter, NHPA President and CEO

STATE & REGIONAL ASSOCIATIONS

MIDWEST HARDWARE ASSOCIATION

Jody Kohl, 201 Frontenac Ave., P.O. Box 8033 Stevens Point, WI 54481-8033 800-888-1817; Fax: 715-341-4080

NHPA CANADA

NHPA CANADA

Michael McLarney, +1 416-489-3396, mike@hardlines.ca

330 Bay Street, Suite 1400 Toronto, ON, Canada M5H 2S8

CIRCULATION, SUBSCRIPTION & LIST RENTAL INQUIRIES

CIRCULATION DIRECTOR

Richard Jarrett, 314-432-7511, Fax: 314-432-7665

Keeping Up With Technology

From cell phones to vehicles to televisions, when it comes to technology, it can feel like the minute you implement the latest and greatest it’s already obsolete. Hardware Retailing spoke with several home improvement retailers who share their road maps for getting started and the routes you can take to successfully bring technology into your operation.

Hardware Retailing (ISSN0889-2989) is published monthly by the North American Paint and Hardware Association, 1025 East 54th St., Indianapolis, IN 46220. Subscription rates: Hardware Retailing (Payable in advance): U.S. & possessions $50/year. Canada $75/year. All other countries $110/year. Single copy $7. The Annual Report issue can be purchased for $30.

Periodical postage paid at Indianapolis, Indiana, and additional mailing offices.

POSTMASTER: Send address changes to Hardware Retailing P.O. Box 16709, St. Louis, MO 63105-1209.

All editorial contents © 2023 North American Paint and Hardware Association. No editorial may be reproduced without prior permission of the publisher.

REPRINTS: For price quotations, contact the Editorial Department at editorial@YourNHPA.org. Printed in the U.S.

EXECUTIVE STAFF

PRESIDENT & CEO

Bob Cutter

CHIEF OPERATING OFFICER & PUBLISHER

Dan Tratensek

CHIEF FINANCIAL OFFICER & EXECUTIVE VICE PRESIDENT, BUSINESS SERVICES

David Gowan

EXECUTIVE DIRECTOR, ADVANCED RETAIL EDUCATION PROGRAMS

Scott Wright, swright@YourNHPA.org

EXECUTIVE DIRECTOR, INNOVATION & ENGAGEMENT

Whitney Daulton

COMMUNICATIONS

317-275-9400, editorial@YourNHPA.org

COMMUNICATIONS & CONTENT MANAGER

Melanie Moul, mmoul@YourNHPA.org

SENIOR EDITOR

Lindsey Thompson, lthompson@YourNHPA.org

ASSOCIATE EDITOR

Carly Froderman, cfroderman@YourNHPA.org

RETAIL TRAINING EDITOR

Jess Tillman, jtillman@YourNHPA.org

GRAPHIC DESIGNER

Autumn Ricketts

GRAPHIC DESIGNER

Olivia Adam

DIGITAL MEDIA SPECIALIST

Kevin Trehan

PRODUCTION MANAGER

Austin Vance

COMMUNICATIONS & PRODUCTION COORDINATOR

Kallahan Beatty

SALES & PRODUCTION ASSISTANT

Freda Creech

MARKETING MANAGER

Julie Leinwand

SALES

DIRECTOR OF SALES & SOUTHERN SALES DIRECTOR

Scott Gilcrest, sgilcrest@YourNHPA.org, 317-508-7680

NORTHERN SALES DIRECTOR

Jordan Rice, jrice@YourNHPA.org, 217-808-164

ASSOCIATION PROGRAMS

800-772-4424, NHPA@YourNHPA.org

DIRECTOR OF MEMBER SERVICES & EVENTS

Katie McHone-Jones, kmchone-jones@YourNHPA.org

DIRECTOR OF ORGANIZATIONAL

DEVELOPMENT & CONSULTING

Kim Peffley, kpeffley@YourNHPA.org

TRAINING MANAGER & EDITOR

Jesse Carleton, jcarleton@YourNHPA.org

RETAIL ENGAGEMENT SPECIALIST

Renee Changnon, rchangnon@YourNHPA.org

HARDWARE RETAILING | January 2023 2

COMING IN FEBRUARY

Jan 31 - Feb 2, 2023 Las Vegas Convention Center | South Hall New Products. New Connections. New Experiences.

Register Today For NHS at nhs23.com/NHPA-Free REGISTER TODAY! USE CODE NHPA FOR A FREE EXPO PASS!

Our ongoing efforts to reimagine NHS are intended to deliver you more value. Whether you’re looking to reconnect with customers, peers and colleagues, discover the latest trends in the home improvement & DIY industry or explore new products and innovations – your experience at NHS will provide you the tools to grow your business NHS is focused on continuing to celebrate innovation, deepening industry connections and growing our global footprint.

In Every Issue

Market Measure

With the new year brings the launch of the industry’s annual report. Explore the highlights on how the industry fared, including big-box operational metrics, see the projections for 2023 and beyond and get insights from industry wholesalers and partners. Read the industry’s only data-driven guide created for the independent channel.

44 OPERATIONS

Starting With Culture

Discover how creating descriptive job summaries with a focus on culture can bring in ideal candidates to build your business and retain your employees.

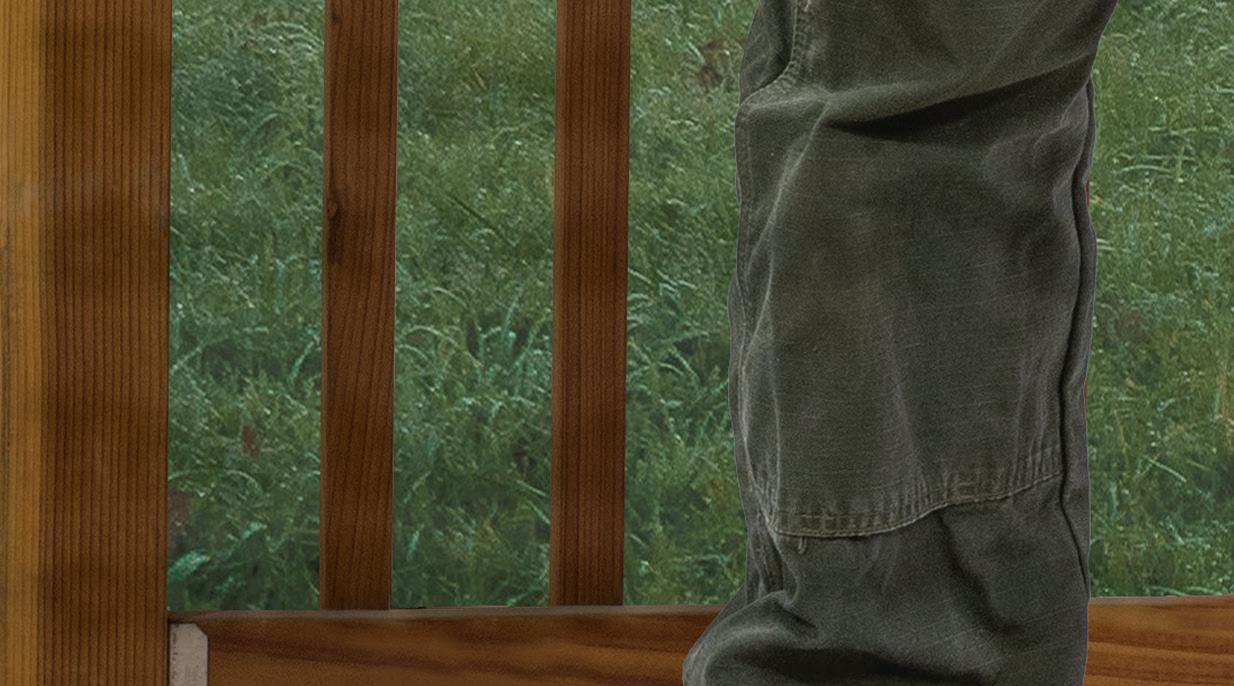

Building to Be the Best

With recent lumber pricing fluctuations and supply chain challenges, finding ways to optimize your LBM category to run efficiently and grow sales can be tricky. Identify best practices, merchandising tips and more to boost your LBM sales.

HARDWARE RETAILING | January 2023 4 CONTENTS Volume 224 | Issue 1 | January 2023

24 COVER

STORY

ON THE WEB EDITORIALLY SPEAKING TAKING CARE OF BUSINESS NHPA NEWS TRENDS NEW PRODUCTS CHECKOUTS CALENDAR LAST WORD 44 54 04 06 08 10 14 16 58 60 62

54 CATEGORY SPOTLIGHT

Do it Best provides the freedom to grow your business your way. Better yet, you can reinvest your record-breaking rebate to make it happen. Expand your sales floor to attract new customers. Use powerful Do it Best ecommerce tools to create a dynamic online shopping experience. Maximize your market share with a full store reset. Acquire a new location or build one from the ground up.

No matter which growth strategy is right for you, Do it Best stands ready with the resources, support, and guidance of the only total solution in the independent home improvement industry.

The time has never been better to take the next step in your business growth plan. Call us today at 888-DO-IT-BEST (888-364-8237) or visit doitbestonline.com.

THE INDUSTRY’S ANNUAL REPORT

While we have all grown somewhat hardened to hearing terms like “uncertainty” and “unprecedented” over the past two years, as we close the books on 2022, we are still left trying to accurately define what the home improvement market is going through and how to measure its trajectory.

RESEARCH

Factoring in decades-high inflation, fluctuations in sales through the pro versus consumer markets, and a supply chain that is still struggling to recover there remain a number of questions as we wrap up last year and head into 2023.

Stay Informed

Scan this QR code or visit hardwareretailing.com/january to read these stories and more.

INSIGHTS

From the Experts

industry to a two-year stacked increase of more than 30%. In the 2022 Market Measure Report, NHPA estimated that the size of the U.S. home improvement retailing market hit nearly $527 billion in 2021. Those consumer-led investments contributed to the unprecedented growth in the industry, which not only gave the independent channel an increase in its overall market share, but also saw independent retailers posting record-setting profits.

Beyond the Numbers

Looking back to the beginning of 2022, home improvement retailers were coming off of two of the strongest years the North American Hardware and Paint Association (NHPA) has ever recorded. The twoyear period of 2020-2021 saw consumers embrace investment in their homes and home improvement projects like never before. This pandemic-fueled spending propelled the U.S. home improvement

There is more to Market Measure than the numbers on the page. See what else there is to discover about the industry’s annual report online.

Details Abound

HARDWARE

According to the 2022 Cost of Doing Business Study, independent home improvement retailers’ net profits were as much as three times what we would see in a typical year in 2021. For example, in 2021, the average hardware store saw net operating profits of approximately 9.1% of sales—this is up from a typical average of about 3%.

Despite posting strong sales and profitability numbers, however, as 2021 wound down, most home improvement retailers were very cool on the prospects of additional growth in 2022.

Download the full Market Measure report for a comprehensive resource to refer to this month and throughout 2023. The resource includes additional insights into the paint and decorating channel.

Expert Insight

Read what the experts economists have to say about the market and how things have changed. Get insight into the projected trends for the 2023 market.

Watch or Listen

Join NHPA’s Dan Tratensek and Grant Farnsworth from The Farnsworth Group for a Market Measure podcast episode launching Jan. 9, or watch the conversation in the webinar later this month.

Get additional recaps and forecasts from two analysts at hardwareretailing.com/2023-insights

Find More Online

Much of this conservative outlook was being driven by the major uncertainties the industry was facing in the supply chain and the economy overall, along with a pressing pessimism that there was no way the pace of the previous 24 months could persist.

PROFILE Stronger Together

When Matt’s Building Materials experienced a major fire last year, employees and the staff rallied around the Smith family to help them rebuild even better than before. Read how a strong company culture helped the company recover.

Entering 2022, additional external factors gave rise to even more concerns about how the industry would perform. From rising gas prices, decades-high inflation, interest rate hikes, war in Eastern Europe and the continuing specter of COVID-19, it felt like everyone was bracing for a crash not seen since the Great Recession.

previous year, the number of transactions continued a downward trend throughout 2022. The same was true for transaction unit count, which was down by nearly 4%.

On the positive side, the majority of independent retailers are reporting that, despite inflation and price changes, they were managing to maintain or grow their gross margins through most of the year. However, as we entered the fourth quarter, this trend appeared to be wavering.

OPERATIONS Attracting Applicants

However, as we trudged along throughout 2022, it became apparent that despite all of these gail-force headwinds, the strength of consumers’ desire to spend money on their homes was not in steep decline. In fact, at the midway point in the year, roughly two-thirds of independent retailers were reporting sales increases over the previous year. As far as the overall home improvement market, NHPA pegged growth through June around 7%.

Beyond writing a detailed, culture-focused job description is getting applicants into your business. Here are six tips on how to advertise your job opening and bring candidates in.

It is important to note a few things about this growth that do somewhat muddy the waters on how great a year the industry was actually having.

While sales for the industry were up, inflation of roughly 9.5% on home improvement items actually meant that, comparing apples to apples, the year was flat to down.

Entering the fourth quarter, most categories and regions appeared to be softening from the strength they had seen in the first three quarters of the year. This waning appears to be dragging industry growth back from the mid 6% range to high 5%. All in all, NHPA is predicting that the overall U.S. home improvement retail market will hit approximately $566.1 billion in sales in 2022, representing a year-over-year growth of 5.9%.

This growth, while primarily fueled by inflationary prices and strong sales to the pro market, should translate to another strong year of profitability for independent retailers who have managed to hold margins.

PODCAST A Year in Review

It’s also worth mentioning that while most home improvement retailers were reporting increases in transaction size over the

Looking ahead, we’re anticipating the word of the moment to shift to “sustainable.” While we do anticipate industry sales to soften in 2023 and early 2024, there is normalcy on the horizon. Over the next two to three years, industry growth will return to slower growth in the mid 2% range through 2026.

Listen to stand-out soundbites from five of the most popular episodes of “Taking Care of Business” in 2022. Featured guests range from paint and hardware retailers to wholesale and co-op leaders.

Scan the QR code or visit the website below to listen.

YourNHPA.org/podcasts

HARDWARE RETAILING | January 2023 6 ON THE WEB

RETAILING | January 2023 January 24

HardwareRetailing HardwareRetail HardwareRetailing FOLLOW US ON SOCIAL ONLINE

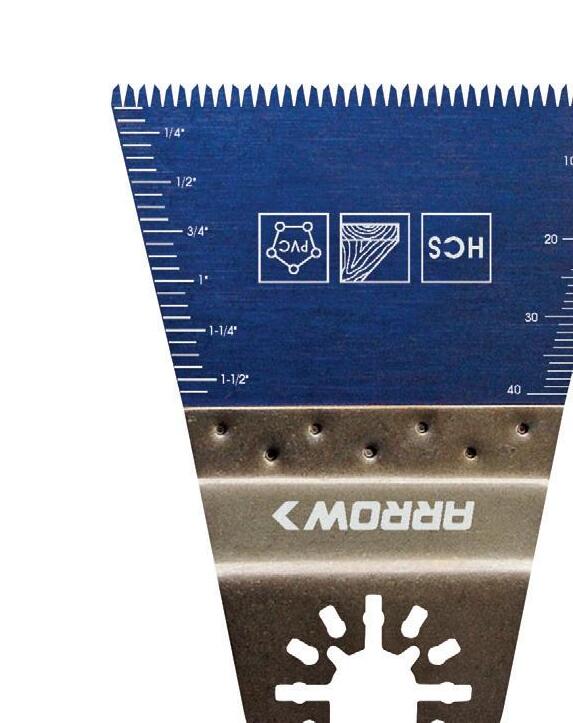

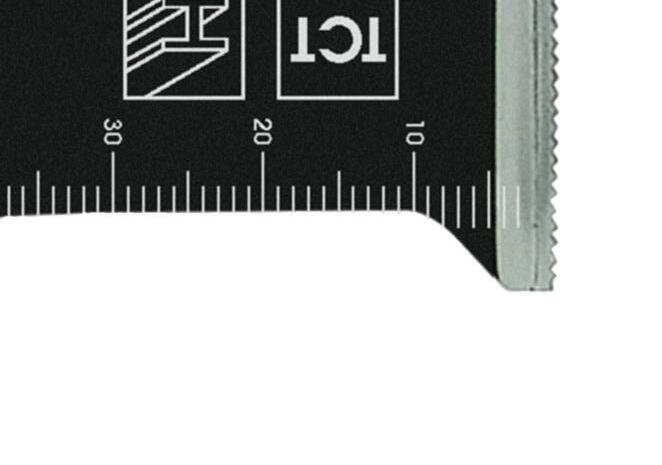

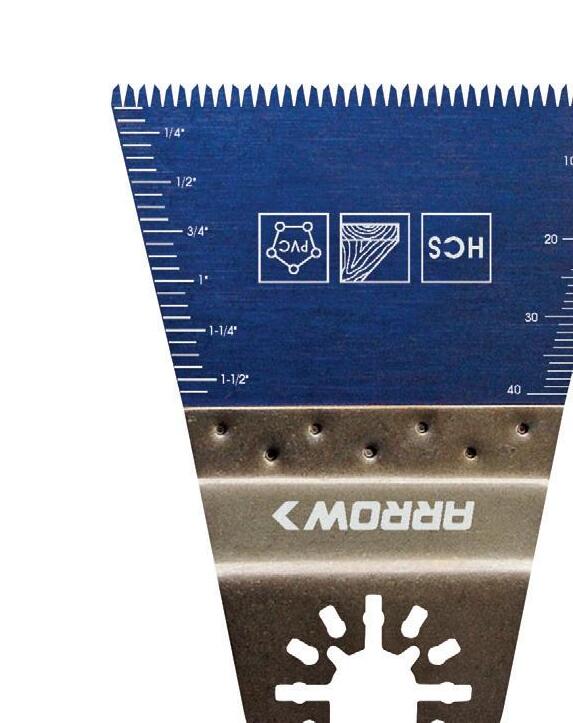

SHARPEN YOUR OSCILLATING BLADE GAME WITH

We know not just any oscillating blades will cut it in your store. You’re after the performance, sales support, and universal tool compatibility that only comes with a market leader. That’s why Arrow, the leader in heavy-duty staple guns and staples, is changing the landscape in pro-grade oscillating blades with a lineup of blades made from the highest-quality materials and performance features we know your customers demand. Choose from three unique planograms that feature single packs and value-priced multipacks, and take 50% off your first order. Due to high demand, we’ve extended this offer through February 28. But hurry, planograms are limited. Secure yours before it’s gone!

CLAIM OFFER! arrowfastener.com/bladedeal PRICED TO MOVE PRODUCED TO PERFORM DESIGNED TO FIT Compatible with non-Starlock Bosch and FEIN tools. Adapter included for Dremel ® models MM45 and MM50. Limited to one purchase per retail location.

DEAL EXTENDED!

EDITORIALLY SPEAKING

CONNECTIONS

Send Melanie a Message

mmoul@YourNHPA.org

Melanie Moul

How Prepared Are You?

IF YOU ARE READING THIS at any point after the first week of the New Year, there’s a good chance I’m not in the office at NHPA headquarters

It’s much more likely I am in the thralls of a mental void caused by the sleep deprivation and utter chaos that come in the first few weeks of having a newborn.

As I write this, I am exactly four weeks out from my due date with my second child. This pregnancy has gone by unimaginably fast. I can’t decide if 2022 would have gone by equally as fast had I not slept through my first trimester and then been in preparation overload for the rest of the year.

Preparedness is a loaded word when it comes to having a baby. When people say you can’t ever be prepared for this monumental addition to your life, it’s really true. That being said, I do feel slightly more prepared having done this before, but that was more than four years ago. For the most part, you wouldn’t think things have changed very much since the fall of 2018.

But think back to where your business was at the end of 2018. Most of you were probably budgeting for moderate growth, and you probably saw your budgets remain fairly consistent in 2019, leading you to budget again for moderate growth in 2020.

Many of you may have relied on industry projections from NHPA’s Market Measure Report, which in those years projected year-over-year growth at 4.9% and 3% respectively. If at the end of 2019, you budgeted for 3% growth in 2020, that’s a little bit like preparing for one baby and getting surprise triplets. (I am confident that will not happen to me.)

Starting on Page 24, you can read the complete 2023 Market Measure Report. I won’t spoil our projections for the year here, but I will say that calculating our five-year outlook proved to be a challenging task. There are still uncertainties that make predicting the future of the industry difficult, even though we’ve been doing this every year for nearly two decades.

While I’m out, you’ll be hearing from Kim Peffley, director of organizational development and consulting for NHPA. With over 20 years of industry experience, she’s a wealth of knowledge on retail operations, company culture and much more. Although she doesn’t have a crystal ball when it comes to inflation or the supply chain, she can offer you tools to help you manage your team and your business while we all do the best we can with the information that we have.

Melanie Moul Communications & Content Manager

HARDWARE RETAILING | January 2022 8

“There are still uncertainties that make predicting the future of the industry difficult.”

Dan Tratensek

Dan Tratensek

It’s Show Time!

IN JUST A FEW WEEKS , a good portion of the North American Hardware and Paint Association (NHPA) team will be headed to Las Vegas and the National Hardware Show (NHS).

That’s right, in case you haven’t heard, the National Hardware Show is being held Jan. 31-Feb. 2 in Las Vegas. It will be taking place in conjunction with a number of other shows including the NKBA Kitchen & Bath Industry Show, the NAHB International Builders’ Show and the Las Vegas Market.

That’s a lot of bang for your buck right there. The ability to buy one ticket and hit all these major industry shows at once offers time-pressed attendees a lot of value. And, as in the past, NHPA will have a big presence at the show, though the programming we have planned for Vegas has evolved a bit from what we would typically do.

This year, we will be hosting our first-ever Foundations of Merchandising Management Live! course during NHS. There’s no better place to host a group of retailers looking to hone their merchandising, buying, negotiation and assortment planning skills than in a live-show environment.

And while I’d strongly encourage anyone reading this to join us in Vegas, take advantage of all these great shows occurring in one location and connect with the team from your association, I also want to take a minute to talk about how we all got to this point.

In any business, your ultimate goal is to identify the needs of your customers and find ways to meet those needs, right? You likely do it all the time in your business, and it’s no different for folks like us here at NHPA or over at NHS. The industry changes, its needs change and the demands of our members and customers change.

In fact, the development of our Foundations of Merchandising Management Live! course was actually based on calls from retailers telling us they needed help in this area.

The same holds true for the staff of NHS. They are constantly talking to attendees and exhibitors to determine how to make the show more welcoming and responsive to their changing needs. This new combined show format and change in dates is all part of how the show is working to better suit the needs of its customers.

I know change can feel a bit uncomfortable at times, and we all get set in our ways, but just like you making changes to improve or better tailor your business to your market’s needs, I applaud any business willing to adapt.

So, as we start this new year full of promise and opportunity, I ask you to look at your business and think for a moment about what changes you might be able to make to adapt to the changing market.

And do me a favor, if you’re out in Vegas, make sure you stop by and say hello.

Dan M. Tratensek Chief Operating Officer &

HARDWARE RETAILING | January 2023 10 TAKING CARE OF BUSINESS CONNECTIONS Send Dan a Message

dant@YourNHPA.org

YourNHPA.org/tcb-pod

Publisher

“I know change can feel a bit uncomfortable at times and I applaud any business willing to adapt.”

Increase Margins with Screen Repair Why Provide Screen Repair Services? Big Box Stores Don’t Offer It Increase Store Traffic Increase Margins Opportunity To Promote Other Store Services We manufacture a full line of Made in the U.S.A. products for your screen repair service, including aluminum, fiberglass, pet-resistant and sun protection screening. We can provide banners and other marketing materials to help support your screening services. Phifer has special order and drop ship programs in place for all major wholesalers, buying groups and co-ops. Call Phifer for all your screening needs and dealer support. 800.841.9473 phifer.com

10 Ways NHPA Works For You

LEARN HOW THE North American Hardware and Paint Association (NHPA) can help you by taking advantage of our resources, tools, events and training. Below are 10 ways NHPA works for you.

1. Two Magazines

NHPA publishes Hardware Retailing and Paint & Decorating Retailer, which feature operations best practices, retailer stories and product trends.

2. Employee Training

The association offers online training, including compliance training and courses on product knowledge, project sales, customer service and more.

3. Manager Training

NHPA provides online training courses to help new and seasoned leaders with leadership, finances, team building and more.

4. Advanced Store Operations Training

The Retail Management Certification Program teaches business owners and key employees profit-focused retail operations.

5. Roundtables

NHPA hosts and moderates retailer roundtables on topics such as finance, human resources, technology and more.

6. Podcast

NHPA’s podcast features unique perspectives on industry trends, retail success stories and management advice.

7. E-Newsletters

NHPA produces several e-newsletters to help retailers dive into the topics most important to them, including industry news, products and more.

8. Business Services

The association offers a wide range of business services, including health insurance, to help retailers save time and money.

9. Cost of Doing Business Study

NHPA has fielded this study for more than 100 years to help retailers compare their businesses to industry averages.

10. Virtual and Live Events

NHPA hosts several events throughout the year, including the NHPA Independents Conference and Young Retailer of the Year Awards.

Subscribe to NHPA News and Content

To subscribe or update your preferences, visit YourNHPA.org/subscribe

NHPA News, Events, Education and Training

Get regular association updates, including events, new training programs, business service solutions and more.

NHPA Retail Marketplace

Receive the latest updates on businesses for sale, to see retailers interested in buying and open job postings.

Hardware Retailing Digital Magazine

Once a month, Hardware Retailing staff pick highlights from the new issue. Plus access digital archives, online exclusives and more.

Hardware Retailing Newsmakers

Get industry headlines and retail insights in this weekly newsletter curated by Hardware Retailing editors.

Hardware Retailing Hot Products

Delivered twice monthly, read articles on today’s popular category trends and see some of the latest products.

HARDWARE RETAILING | January 2023 12 ASSOCIATION Membership

YourNHPA.org/membership to make the most of your NHPA membership.

Visit

ASSOCIATION

NHPA NEWS

ASSOCIATION Get on the List

For the latest updates on the 2023 NHPA Independents Conference, including registration details, visit YourNHPA.org/conference

EVENTS

Keynote Speakers From Amazon, Google Announced

GAIN OPERATIONAL AND STRATEGIC INSIGHTS from former Amazon executive John Rossman and Google’s head of business innovation and strategy Chris Hood, keynote speakers for the 2023 NHPA Independents Conference. Held Aug. 2-3 in Dallas, the conference is focused on providing technology-based solutions for the independent home improvement retail channel. These keynote speakers will address how you can innovate like Amazon and how to navigate continuous technological change and grow customer loyalty like Google.

About John Rossman

John Rossman is a business strategist, operator and expert on digital transformation, leadership and business reinvention. He has consulted with notable companies including Novartis, Fidelity Investments, Microsoft, Walmart and Nordstrom. He served as senior innovation advisor at T-Mobile and senior technology advisor to the Gates Foundation. At Amazon, he was responsible for launching the Amazon marketplace business in 2002. He has authored three books: “The Amazon Way” series and The Digital Leader Newsletter.

About Chris Hood

Chris Hood is a digital strategist and technology entrepreneur with over 30 years of experience in online entertainment and marketing for tv, film, music and video games. As the head of business innovation and strategy for Google, Chris engages with some of the world’s top companies to develop digital transformation strategies that grow business value. Chris also teaches in the information technology department for Southern New Hampshire University and Colorado Technical University.

TRAINING

Formalize Your Training Program

For your free copy of the Train the Trainer Guide, go to YourNHPA.org/train-the-trainer

A CONSISTENT APPROACH to training leads to better results on the salesfloor. When all employees receive the same training in selling skills and product knowledge, they can deliver a consistent customer service experience. A formal training program increases accountability and ensures everyone has the knowledge you want them to have as they represent your business. Regular training also increases employee engagement, which is a key factor in reducing turnover.

If you’re looking for a way to jumpstart your training program for the new year, download NHPA’s free Train the Trainer Guide. The guide makes it easy to get started by outlining what it takes to have a successful training program. It includes best practices and easyto-understand instructions, valuable either to retailers setting up a training program for the first time or those who want to refine an existing system.

After you’ve set up a formal program, select from a variety of courses from NHPA’s Academy for Retail Development. The Academy offers courses for all levels of employees on topics including selling skills, product knowledge and operations. Retailers must be NHPA Premier Members to register for courses. More information is available at YourNHPA.org/membership.

TRAINING NEW EMPLOYEES?

If you’re hiring, you need a plan for onboarding the new members of your team. Get started with NHPA’s Onboarding Handbook, which includes checklists for the first three months, best practices, links to additional resources and more. Managers and trainers can use the handbook to develop an onboarding program customized for their business. The handbook is available as a downloadable PDF for $9.99 at YourNHPA.org/shop

January 2023 | HARDWARE RETAILING 13

RESOURCES Young Voices

Learn more about how Gen Zers behave as both consumers and employees at hardwareretailing.com/qa-genz

TRENDS

HAND A HELPING

PROMOTE THESE PROJECTS TO CAPTURE GEN Z DIYERS

SOME SKILLS ARE LEARNED over a lifetime, so for younger generations, like Gen Z, developing DIY skills is still to come. Being aware of and promoting the skills where Gen Zers are lacking, along with the products they need to accomplish these projects, allows you to build relationships with your Gen Z customers and create lifelong customer loyalty and trust.

Gen Zers are twice as likely as Baby Boomers and Gen Xers to outsource home repairs, which can be pricey. Becoming the go-to knowledge base for Gen Z can:

Source: TheSeniorList.com online survey

HARDWARE RETAILING | January 2023 14

Percentage of Generation That Knows How to Fix a Leaky Faucet 29% 40% 49% 53% Gen Zers Millennials Gen Xers Baby Boomers Percentage of Generation That Knows How to Clean Gutters 36% 41% 55% 62% Gen Zers Millennials Gen Xers Baby Boomers SAVE THEM MONEY INCREASE CUSTOMER LOYALTY BOOST SALES

Zac Smith, the owner of COR Building Products in Hanceville, Alabama built on the tradition of a previous family-owned business to open a contractor-based hardware store. House-Hasson provided the product assortment, store design and merchandising that appeals to pro customers.

House-Hasson’s store design team, including Vice President of Retail Development John Sullivan, created a revamped 10,000-square-foot sales floor that would appeal to pros and contractors. Smith’s methodical, systematic approach to the retail hardware business revolves around being the go-to store for contractors in northwest Alabama. House-Hasson’s store design team and store set team would stretch themselves beyond the typical store setup to create a contractor-friendly space for the location. “I really wanted the displays to be next level and House-Hasson’s flexibility has paid off.”

Ready for a change? Let’s have a conversation! Call John Sullivan Vice President of Retail Development: 1-800-333-0520 | jsullivan@househasson.com House-Hasson Hardware Company, Inc. Knoxville, Tennessee | www.househasson.com Are You Looking To Remodel Your Store?

Zac Smith, Owner of COR Building Products in Hanceville, Alabama

NEW PRODUCTS

PRODUCTS

Retailer Recommendations

Send a note to editorial@YourNHPA.org about products you can’t keep on the shelf. Include your name, your business name and reasons why you love it.

Oscillating Sprinkler

The Wagner D300 is ideal for sanitizing small to medium spaces. It is compatible with water-based disinfectants, includes exchangeable cups (800 mL and 1400 mL) and sanitizes up to 10 times faster than a spray bottle with complete and even coverage of surfaces. The disinfectant nozzle is designed to spray optimal micron size droplets (45 microns).

WAGNER SPRAYTECH | wagnerspraytech.com or 800-328-8251

Sprinkler

Fine-tune your watering area with the Melnor 4,000 square feet CrossStream Turbo Oscillating Sprinkler. Keep the water on the lawn and off the driveway with TwinTouch™ controls to set the width and range of the watering pattern. Adjust each control independently for precision watering and even coverage. The dependable Dirt-Resistant Drive provides smooth movements for consistent coverage that will not puddle. The unique system is key for homeowners with well water. Easily water just the right area and enjoy green grass and flourishing flowers all season long.

MELNOR | melnor.com

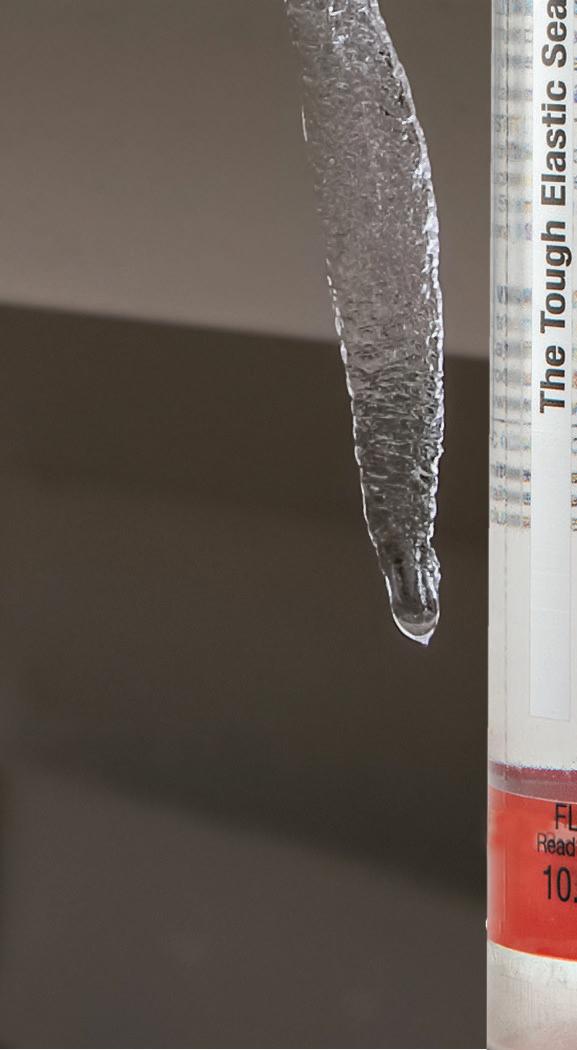

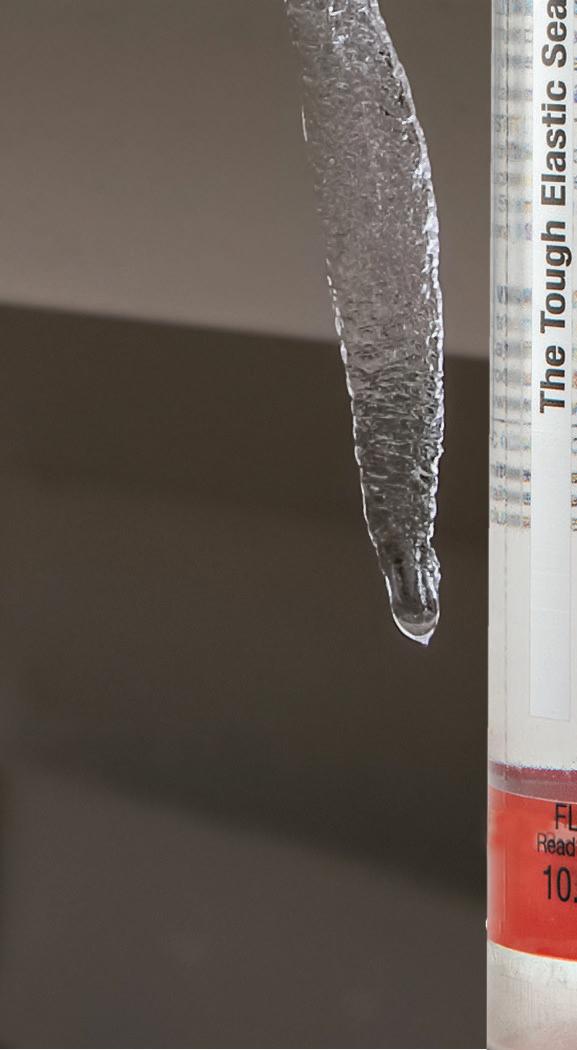

Acrylic Flashing Tape

At only 12 mm thick, THICC Acrylic Roof/Deck/Window & Door Flashing Tape, meets the AAMA 711-20 certification to seal seams, decks, roofs, windows and doors for extreme weather conditions. It is easy to apply, offers strong adhesion and is thin enough not to get in the way of construction. It is available in 4-inch and 6-inch x 65 foot rolls.

NATIONAL ADHESIVE | thicctape.com or 855-674-4583

HARDWARE RETAILING | January 2023 16

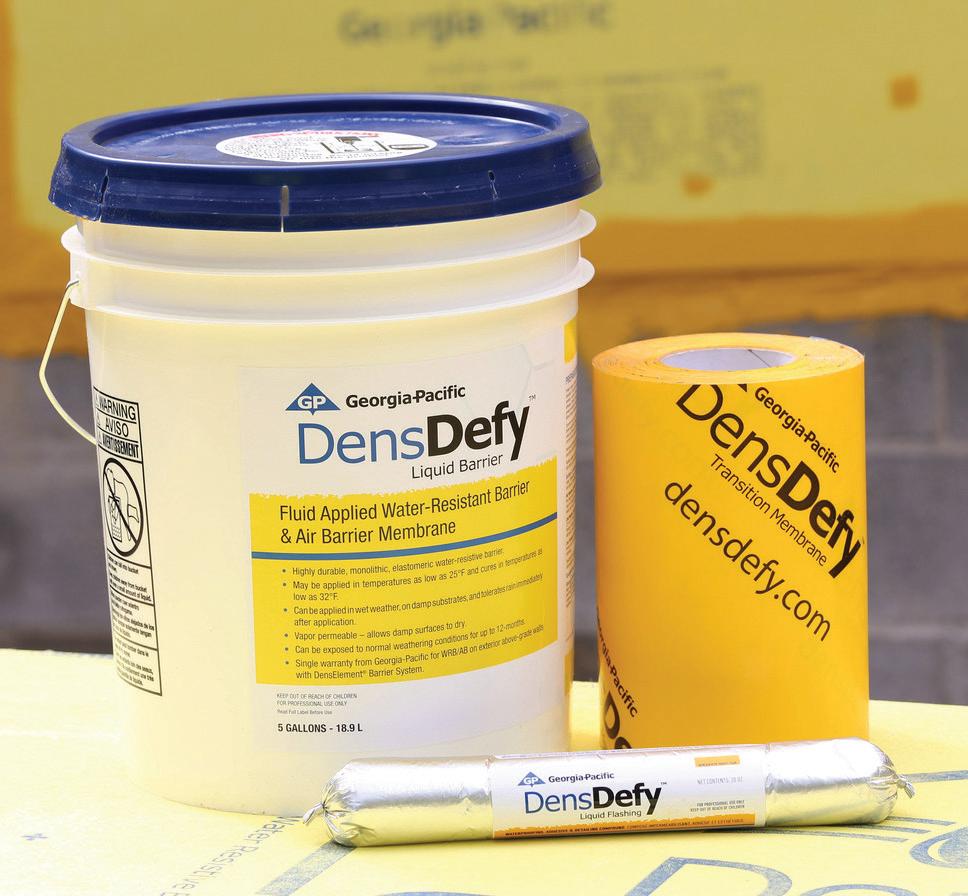

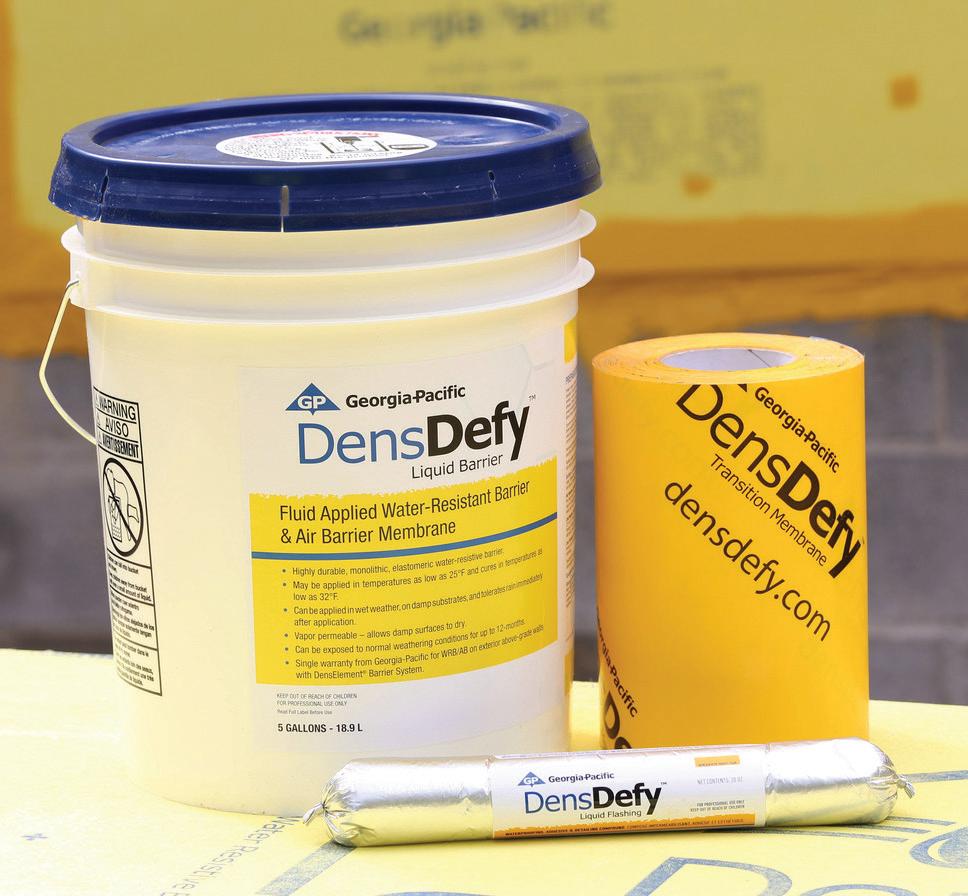

Water-Resistant Barrier

DensDefy™ Liquid Barrier provides a durable, seamless and water-resistant air-barrier membrane on common construction surfaces such as CMU, concrete, OSB, plywood and galvanized steel and wood framing. It is compatible with a wide range of sealants and waterproofing or air barrier components. It can be applied in temperatures as low as 25 F, cures in temperatures as low as 32 F, and can be applied via roller or spray.

GEORGIA-PACIFIC BUILDING PRODUCTS buildgp.com or 800-225-6119

Rod Rack

Midwest Fastener’s threaded rod rack is completely customizable, so you only carry what you need. Every inch of the rack has been designed to be utilized by the store because space matters—if 1-foot rods aren’t needed, that space is replaced by more tilt-out bins for coupling nuts, rod hangers and more. In addition, the front price grid allows for easy price readability, quick size locating and is color-coded for fast stocking. With hundreds sold in less than a year, it’s quickly proven to be the best rack in the market.

Threaded Rod Rack Features Include:

• Fully customizable

• Holds 1 foot-6 foot rods

• Front price grid for easy shopping and stocking

• 35 Available slots for rods

• Can hold 30 or 12 tilt-out bins

• Diameter sizing chart included

• Two fully loaded presets available

• Complete threaded rod program selection

MIDWEST FASTENER fastenerconnection.com

Rawhide Chews

J.J. Fuds’ rawhide chews are made with all American beef hide and are available in bacon, chicken and beef flavors. They’re easily digestible and the 3-foot length allows owners to select the appropriate treat size for their companions.

J.J. FUDS INC.

jjfuds.com or 219-531-1566

January 2023 | HARDWARE RETAILING 17

“These chews are so wonderful.

We have trouble keeping them in stock. They last forever and our customers and their canines just love them.”

—Tim Branneky, Branneky True Value Hardware

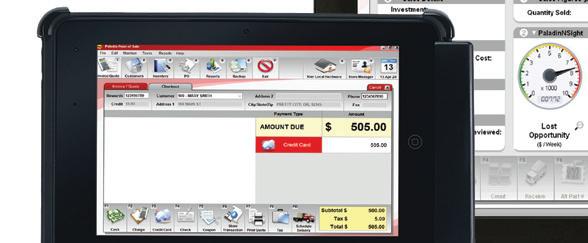

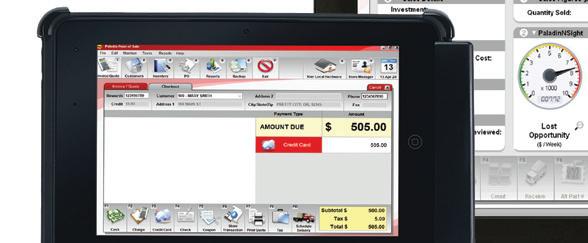

Point-of-Sale System

Paladin provides an easy-to-use point-of-sale solution and sophisticated inventory management system that helps independent retail stores increase profitability by reducing the time, effort and labor required to manage daily business processes. With Paladin, you’ll get responsive customer support and a unique solution that combines the best of both worlds—the reliability and security of an on-premises point-of-sale system and the convenience of cloud-based access for best-in-class performance. Also, check out Paladin Managed Services™ for data preservation and security, PaladinPilot™ for remote business access and Mobile2™ applications with expanded sales and delivery features for an improved customer experience at paladinpointofsale.com.

PALADIN POINT OF SALE | paladinpointofsale.com

HARDWARE RETAILING | January 2023 18 NEW

PRODUCTS

For Wholesale Pricing and Information Call Howard Products, Inc. 800.266.9545 Or Visit Our Website www.HowardProducts.com FOLLOW US ON Food-Grade Wax Food-Grade Wax Wax-It-All

Call 800.725.2346 to learn more and get ready to tell your employees you’re going shin’. Think of the things you can do with Paladin Point of Sale. With Paladin you’ll have greater exibility and options for managing your business. The time savings alone is worth the move to Paladin, and our unsurpassed customer support ensures you’ll succeed. For over 40 years we’ve focused on simplifying end-to-end business processes to help independent store owners (like you) save time while increasing e ciency and pro ts. Simplify. Get Paladin. A Powerfully Simple Point-of-Sale Solution. paladinpointofsale.com | 800.725.2346

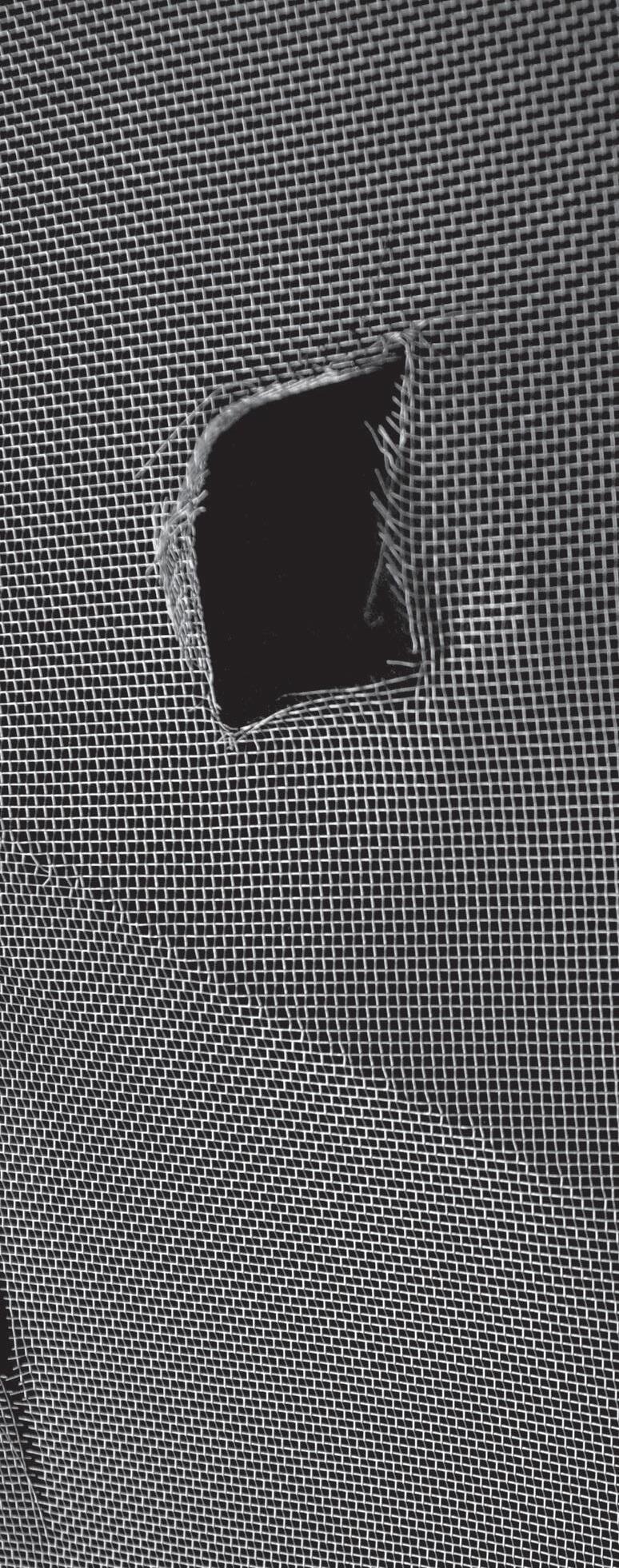

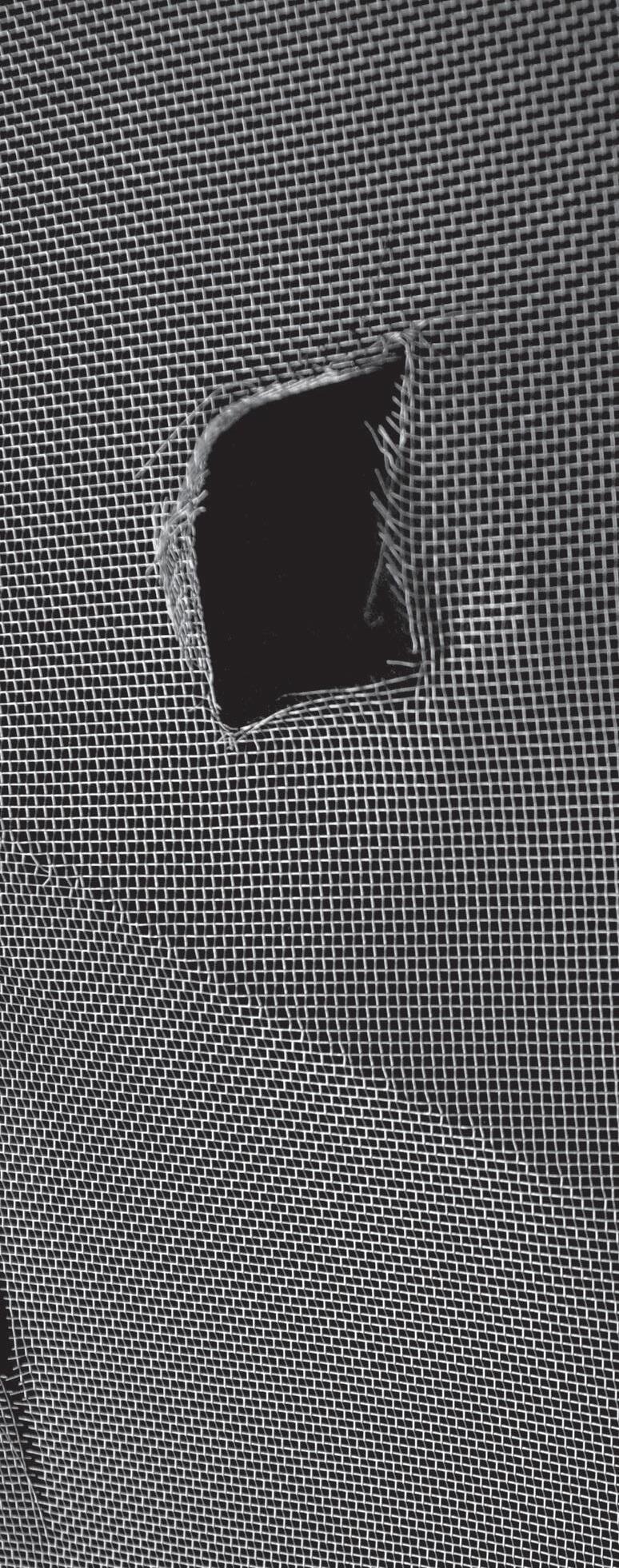

Window Screen

TuffScreen® insect screening is made from durable vinyl-coated polyester yarns, making it tear and puncture resistant and one of the most versatile screen options on the market. An ideal choice for windows, screened porches and pool enclosures, TuffScreen is backed by a 10-year limited warranty.

PHIFER TUFFSCREEN | phifer.com

Microfiber Towel

The Clean Paw Towel is a microfiber and chenille towel that soaks up water and dries pets off fast. It features corner hand pockets for a secure fit, is machine washable and is available in a variety of colors.

ETHICAL PRODUCTS INC. ethicalpet.com or 800-223-7768

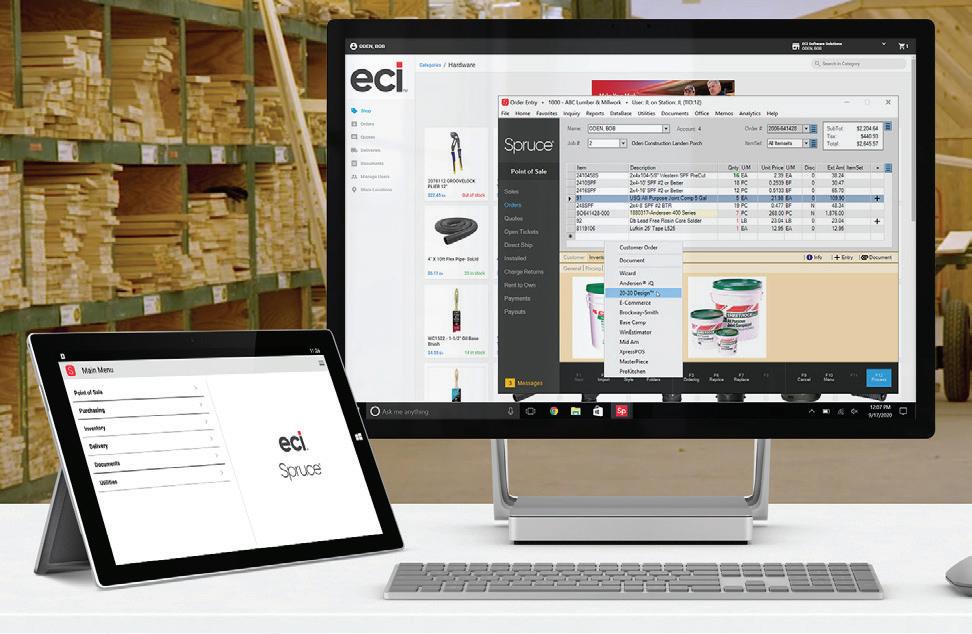

ERP Software

Spruce® business management software is an easy-to-use enterprise resource planning (ERP) that simplifies operations to help with growth. The software is cloud-based and completely integrated, from purchasing through delivery, to help streamline processes and reduce costly errors. It also allows retailers to access their data from anywhere to make decisions based on facts to improve their bottom line.

SPRUCE SOFTWARE | ecisolutions.com

HARDWARE RETAILING | January 2023 20

NEW PRODUCTS

The best deck fasteners. The best cordless system.

Drive more screws, more easily than ever — with the cordless Quik Drive® PRO300SG2 decking system from Simpson Strong-Tie. Using our advanced Deck-Drive™ screws specially designed for the most demanding deck projects, you’ll install more fasteners per battery charge. A powerful DeWalt ® motor and lightweight extension make repetitive installation simple and ergonomic. And without the hassle of a cord, you’ll get the job done safely and quickly.

Save time on your next deck job. Visit go.strongtie.com/quikdrivecordless or call (800) 999-5099 today.

© 2023 Simpson Strong-Tie Company Inc. QDCORDLESS21

Deck-Drive™ DCU COMPOSITE Screw Deck-Drive™ DSV WOOD Screw

Deck-Drive™ DWP WOOD SS Screw

DeWalt® is a registered trademark of Black & Decker Inc., a subsidiary of Stanley Black & Decker.

PRODUCTS See More Products

To stay informed about new innovations and trends, subscribe to the twice monthly Hot Products newsletter at hardwareretailing.com/subscribe

Point-of-Sale System

Epicor for Retail is an advanced point of sale (POS) and retail management system. This robust, fully integrated software solution features built-in best practices and a host of tools. These features allow small and midsize lawn and garden retailers to improve productivity and drive results by streamlining operations, growing revenue and improving labor.

EPICOR FOR RETAIL | epicor.com

HARDWARE RETAILING | January 2023 22 NEW PRODUCTS 22_003827_Hardware_Retailing_JAN Mod: October 21, 2022 2:49 PM Print: 11/22/22 10:50:20 AM page 1 v7

BY 6 PM FOR SAME DAY SHIPPING COMPLETE CATALOG 1-800-295-5510 uline.com OVER 40,000 ITEMS ALWAYS IN STOCK π

ORDER

Tile Nippers

MARSHALLTOWN’s Tile Nippers are designed for small, curved or irregular nipping of ceramic or porcelain tiles. They feature DuraSoft® handles and a die cast aluminum body for lightweight durability. These tile nippers work with ceramic and porcelain tiles as well as glass and mosaics. The tungsten carbide tips and wheels are replaceable. Internal torsion springs help prevent damaged or lost springs.

MARSHALLTOWN | marshalltown.com or 800-888-0127

Pet Door Insert

The PlexiDor Glass Series French Door Insert is the answer to the problem of installing a functional pet door into French doors. The saloon-style panels are lined with industrial weatherseal and the heavy-duty aluminum frames are powder coated and scratch-resistant. The doors include a cylinder lock, two keys and a steel security plate.

PLEXIDOR

plexidors.com or 888-738-3667

January 2023 | HARDWARE RETAILING 23

THE INDUSTRY’S ANNUAL REPORT

While we have all grown somewhat hardened to hearing terms like “uncertainty” and “unprecedented” over the past two years, as we close the books on 2022, we are still left trying to accurately define what the home improvement market is going through and how to measure its trajectory.

Factoring in decades-high inflation, fluctuations in sales through the pro versus consumer markets, and a supply chain that is still struggling to recover there remain a number of questions as we wrap up last year and head into 2023.

Looking back to the beginning of 2022, home improvement retailers were coming off of two of the strongest years the North American Hardware and Paint Association (NHPA) has ever recorded. The twoyear period of 2020-2021 saw consumers embrace investment in their homes and home improvement projects like never before. This pandemic-fueled spending propelled the U.S. home improvement

industry to a two-year stacked increase of more than 30%. In the 2022 Market Measure Report, NHPA estimated that the size of the U.S. home improvement retailing market hit nearly $527 billion in 2021. Those consumer-led investments contributed to the unprecedented growth in the industry, which not only gave the independent channel an increase in its overall market share, but also saw independent retailers posting record-setting profits. According to the 2022 Cost of Doing Business Study, independent home improvement retailers’ net profits were as much as three times what we would see in a typical year in 2021. For example, in 2021, the average hardware store saw net operating profits of approximately 9.1% of sales—this is up from a typical average of about 3%.

Despite posting strong sales and profitability numbers, however, as 2021 wound down, most home improvement retailers were very cool on the prospects of additional growth in 2022.

HARDWARE RETAILING | January 2023 24

INSIGHTS From the Experts

Get additional recaps and forecasts from two analysts at hardwareretailing.com/2023-insights

Much of this conservative outlook was being driven by the major uncertainties the industry was facing in the supply chain and the economy overall, along with a pressing pessimism that there was no way the pace of the previous 24 months could persist.

Entering 2022, additional external factors gave rise to even more concerns about how the industry would perform. From rising gas prices, decades-high inflation, interest rate hikes, war in Eastern Europe and the continuing specter of COVID-19, it felt like everyone was bracing for a crash not seen since the Great Recession.

However, as we trudged along throughout 2022, it became apparent that despite all of these gail-force headwinds, the strength of consumers’ desire to spend money on their homes was not in steep decline. In fact, at the midway point in the year, roughly two-thirds of independent retailers were reporting sales increases over the previous year. As far as the overall home improvement market, NHPA pegged growth through June around 7%.

It is important to note a few things about this growth that do somewhat muddy the waters on how great a year the industry was actually having.

While sales for the industry were up, inflation of roughly 9.5% on home improvement items actually meant that, comparing apples to apples, the year was flat to down.

It’s also worth mentioning that while most home improvement retailers were reporting increases in transaction size over the

previous year, the number of transactions continued a downward trend throughout 2022. The same was true for transaction unit count, which was down by nearly 4%.

On the positive side, the majority of independent retailers are reporting that, despite inflation and price changes, they were managing to maintain or grow their gross margins through most of the year. However, as we entered the fourth quarter, this trend appeared to be wavering.

Entering the fourth quarter, most categories and regions appeared to be softening from the strength they had seen in the first three quarters of the year. This waning appears to be dragging industry growth back from the mid 6% range to high 5%. All in all, NHPA is predicting that the overall U.S. home improvement retail market will hit approximately $566.1 billion in sales in 2022, representing a year-over-year growth of 5.9%.

This growth, while primarily fueled by inflationary prices and strong sales to the pro market, should translate to another strong year of profitability for independent retailers who have managed to hold margins.

Looking ahead, we’re anticipating the word of the moment to shift to “sustainable.”

While we do anticipate industry sales to soften in 2023 and early 2024, there is normalcy on the horizon. Over the next two to three years, industry growth will return to slower growth in the mid 2% range through 2026.

January 2023 | HARDWARE RETAILING 25

This Market Measure report is compiled by NHPA staff from a variety of sources that are attributed throughout. What We’ll Cover Industry Breakdown 26 Chain Results 28 Financial Profiles 29 Cost of Doing Business Study 30 Industry Insights 32 HIRI Analysis 40 Canadian Retailer Report 42

INDUSTRY BREAKDOWN 2022

2021-2026

Sales by Store Type

2021-2026

Outlets

HARDWARE RETAILING | January 2023 26

Home Improvement Sales by Month (in billions) January $33.8 February $33.5 March $44.5 April $46.1 May $50.1 June $48.2 July $43.5 August $45.2 Septmber $42.6 YTD $387.5

(in billions) 2021 Hardware Stores $63.1 Home Centers $335.1 Lumberyards $136.4 TOTAL $534.6 2022 Hardware Stores $66.2 Home Centers $354.8 Lumberyards $145.1 TOTAL $566.1 2023 Hardware Stores $68.1 Home Centers $361.4 Lumberyards $148.5 TOTAL $578.0 2024 Hardware Stores $71.4 Home Centers $370.4 Lumberyards 151.3 TOTAL $593.1 2025 Hardware Stores $74.2 Home Centers $379.7 Lumberyards $155.7 TOTAL $609.6 2026 Hardware Stores $78.8 Home Centers $389.1 Lumberyards $158.2 TOTAL $626.1 Compound Annual Growth Rate 2021-2026 Hardware Stores 4.5% Home Centers 3.0% Lumberyards 3.0% TOTAL 3.2%

2021 Hardware Stores 18,600 Home Centers 9,650 Lumberyards 9,580 TOTAL 37,830 2022 Hardware Stores 18,350 Home Centers 9,600 Lumberyards 9,520 TOTAL 37,470 2023 Hardware Stores 18,100 Home Centers 9,525 Lumberyards 9,510 TOTAL 37,135 2024 Hardware Stores 17.950 Home Centers 9,485 Lumberyards 9,480 TOTAL 36,915 2025 Hardware Stores 17,910 Home Centers 9,450 Lumberyards 9,465 TOTAL 36,825 2026 Hardware Stores 17,870 Home Centers 9,400 Lumberyards 9,395 TOTAL 36,665 Percent Change 2021-2026 Hardware Stores -3.9% Home Centers -2.6% Lumberyards -1.9% TOTAL -3.1% Sales Growth 2021 vs. 2022 January 9.3% February 14.5% March 3.4% April -0.8% May 8.2% June 7.3% July 5.6% August 14.1% September 9.6% YTD 7.5% Source: U.S. Department of Census/Monthly Retail Sales Report NAICS 444/NSA Source: NHPA calculations

U.S. Home Improvement Industry Sales

Quarterly Report: Independent Retailer Index

The Independent Retailer Index, developed with the North American Hardware and Paint Association and The Farnsworth Group, is a regular measure of the independent channels’ performance. Access data at YourNHPA.org/retailer-index each quarter. All data is presented in aggregate. The Index tracks quarterly and year-over-year changes in various business areas including:

• Total sales

• Transaction count

• Inventory investment

• Cost of goods

• Gross profit margins

Home Improvement Product Sales Performance

• Future expectations

• Investment plans: inventory, staff, property, plant and equipment

Q1 2023 Anticipated Investments

56% of retailers intend to make some investment in technology solutions

54% of retailers intend to make some investment in inventory

Home Improvement Retail Sales

50% of retailers intend to make some investment in property, plant or equipment

47% of retailers intend to make some investment in employees

Source: Independent Retailer Index, Q3 2021-2022 YOY Performance Survey, NHPA & The Farnsworth Group, November 2022

January 2023 | HARDWARE RETAILING 27

Home Improvement Research Institute/IHS Projections at Current Prices Compound Annual Growth 2021-2026 = 3.2% 100 200 300 400 500 600 0 2021 2022 2023 2024 2025 2026 $526.7 15.8% $564.5 7.2% $573.2 1.5% $588.5 2.7% $603.5 2.6% $618.0 2.4% IN USD BILLIONS Sales YOY Growth LEGEND

North American Hardware and Paint Association Projections Compound Annual Growth 2021-2026 = 3.2% 100 200 300 400 500 600 0 2021 2022 2023 2024 2025 2026 $534.6 7.5% $566.1 5.9% $578.0 2.1% $593.1 2.6% $609.7 2.8% $626.1 2.7% IN USD BILLIONS 700 100 200 300 400 500 600 0 2016 2017 2018 2019 2020 2021 IN USD BILLIONS

U.S. Department of Census Monthly Retail Sales Report NAICS 444/NSA Compound Annual Growth 2016-2021 = 6.5% $349.4 5.4% $365.7 4.7% $377.5 3.2% $384.5 1.9% $425.6 10.7% $477.8 12.3%

Top Chains: Individual Performance

Sources: Company reports and NHPA research

‡Store counts include operations in the U.S., Canada, Mexico and all other locations

^Store counts include operations in the U.S. and Canada, including RONA operations

*Source: National Retail Federation Top 100 Retailers 2022 List

Market Share Profile

Top Chains: Industry Share

Top Chains: Combined Performance

Source: NHPA calculations

Note: For the 2023 Market Measure Report, NHPA eliminated lumber chains from its data. As such, percentage point change and compound annual growth rate are not represented in this year’s report.

HARDWARE RETAILING | January 2023 28 CHAIN

RESULTS

2021 Sales (in billions) Stores at End of FY2021 Stores in 2022 (as of Dec. 1, 2022) Home Depot Atlanta $151.2 2,317‡ 2,319‡ Lowe’s Mooresville, North Carolina $96.3 1,971^ 1,969^ Menards Inc. Eau Claire, Wisconsin $13.1* 328* Tractor Supply Brentwood, Tennessee $12.7 2,181 2,027

Sales (as % of total industry) No. of Stores (as % of total industry) Net Sales (in billions) No. of Stores (at the end of FY2021) 2017 51.9% 17.7% 2017 $168.6 6,988 2018 52.5% 18.0% 2018 $183.6 6,941 2019 51.3% 15.4% 2019 $208.5 6,983 2020 50.7% 15.6% 2020 $252.6 7,043 2021* 51.1% 18.0% 2021* $273.3 6,797

2021 Financial Profiles of Leading Publicly Held Chains

January 2023 | HARDWARE RETAILING 29 FINANCIAL

PROFILES

Operating and Productivity Profile Home Depot Lowe’s Number of Stores (at end of FY2021) 2,317 1,971 Distribution Centers ~200 37* Average Size of Selling Area (sq. ft.) 104,000 106,000 Total Sales $151.2 billion $96.3 billion Total Asset Investment $71.9 billion $44.6 billion Total Inventory $22.1 billion $17.6 billion Sales Per Square Foot $604 $908 Inventory Turnover 1.5x 3.6x Net Sales to Inventory 6.9x 5.5x Total Sales Per Employee $308,194 $283,236 Average Size of Transaction $83.04 $96.09 Gross Margin Return on Inventory 230.3% 182.1% Income Statement Home Depot Lowe’s Net Sales 100.0% 100.0% Cost of Goods Sold 66.4% 66.7% Gross Margin 33.6% 33.3% Total Operating Expenses 18.4% 19.0% Net Income (Before Taxes) 15.2% 14.3% Balance Sheet Home Depot Lowe’s Total Current Assets 19.2% 21.4% Cash 0.8% 1.2% Receivables 2.3% n/a Inventory 14.6% 18.3% Other 0.8% 1.1% Fixed Assets 80.8% 78.6% Total Assets 100.0% 100.0% Current Liabilities 39.9% 44.1% Long-Term Liabilities 62.5% 66.7% Net Worth -2.4% -10.8% Total Liabilities and Net Worth 100.0% 100.0% Sources: Company annual reports *Includes U.S., Canada and the Caribbean; #Includes locations in U.S., Canada, Latin American and the Caribbean region

RESEARCH Benchmark Your Business

To purchase your copy of the 2022 Cost of Doing Business Study to analyze your operation, visit YourNHPA.org/codb

THE COST OF DOING BUSINESS

ANNUAL BENCHMARKING STUDY

The 2022 Cost of Doing Business Study presents the North American Hardware and Paint Association’s (NHPA) annual financial and operational profile of independent hardware stores, home centers, lumber and building materials (LBM) outlets and paint and decorating outlets. This study assesses the financial performance of home improvement retailers who graciously submitted confidential financial reports for fiscal year 2021 to NHPA. The study presents composite income statements and balance sheets plus averages for key financial performance ratios.

Retailers can use this data to measure their own performance against industry averages. The data develops benchmarks retailers can use to establish financial plans to improve profitability.

Hardware Stores

Hardware comparable store sales were up 5.46%, which was the lowest amount of the four home improvement categories; however, this is on top of a 22.3% increase in the prior year. Typical store sales reached record levels exceeding $2.9 million. While customer count was down 8.3%, sales per customer grew to $32, eclipsing last year’s record amount by $3.

Despite supply chain issues and inflation worries, cost of goods sold actually dropped 70 basis points to 59.6%, which helped drive gross margin after rebates to 42.5%. Employee headcount dropped from 14 to 12, and yet payroll expenses rose 50 basis points from 18.8% to 19.3%. Owners’ payroll rose 70 basis points, which offset the loss in headcount and savings in employee payroll.

With occupancy expenses remaining fairly flat and other operating expenses dropping 50 basis points, the result was another record-breaking year, with profit before taxes finishing at 9.1%.

Home Centers

Comparable sales at home centers were up an incredible 16.5% on top of the 25.5% a year ago. Customer count was down 6.8%, but sales per customer increased to a five-year high of $49.

Home centers felt the effects from inflation as cost of goods sold rose 160 basis points to 67.7%, which drove gross margin after rebate to 33.9%. Home centers also saw more revenue with fewer employees, with headcount dropping by 1. This lowered payroll expenses to 17%, its lowest level since 2017. That said, employee productivity rose for the fourth year in a row, as both sales ($302,463) and gross margin per employee ($102,535) reached all-time highs.

With the rise in revenue, a slight uptick in cost of goods sold and the lowering of operating expenses—including occupancy expenses at its lowest level since 2010—home centers again experienced record profits of 8.3%.

One concern for home centers is inventory levels. The 43.9% inventory level on the balance sheet is the lowest level since 2015, which led to inventory per square foot being reduced by $20 over the prior year.

Lumber and Building Material Outlets

As one might expect, lumber was the segment with the biggest fluctuations in financial statements. Comparable store revenue rose 21.9% on top of 24.6% the previous year. Customer count dropped 12.7% and was down for the fourth consecutive year, and yet sales volume per store ($14.1 million) and sales per customer ($782) reached all-time highs.

Cost of goods sold rose 200 basis points, and at 75%, is at the highest level since 2017. However, even though lumber was the only segment to actually add employee count, payroll expenses fell compared to the prior year, reaching the lowest level since 2017. Coupled with all-time lows in occupancy and other operating expenses, lumber retailers achieved another record year with profits of 6.9%.

Lumber retailers are sitting on more assets than ever before, which exceed $5 million and cash at its highest level since 2010. Inventory levels also increased for the fourth consecutive year. The excess cash retailers have lowered debt to equity (0.6) to its lowest level since 2018.

The high price of lumber commodities pushed sales ($2,720), gross margin ($715) and inventory per square foot ($416) all to record levels.

HARDWARE RETAILING | January 2023 30

Hardware Stores

Home Centers

Lumber and Building Material Outlets

January 2023 | HARDWARE RETAILING 31

Key Business Indicators 0% 10% 2021 20% 30% 40% 50% Gross Margin After Rebate Total Payroll Profit Before Taxes Typical High-Profit Median Sales Per Customer $20 2017 2018 2019 $25 $30 Typical High-Profit $35 42.5% 43.8% 19.3% 17.2% 9.1% 15.2% $33 $23 $24 $23 $32 $30 $29 $24 $21 $22 2020

Key Business Indicators Median Sales Per Customer Gross Margin After Rebate Total Payroll Profit Before Taxes $20 2017 2018 2019 2021 $40 $120 $60 $80 $100 Typical High-Profit Typical High-Profit $40 $68 $69 $42 $49 $91 $44 $37 $43 $91 33.9% 37.4% 17.0% 16.0% 8.3% 11.2% 0% 10% 20% 30% 40% 50% 2020

Key Business Indicators Median Sales Per Customer Gross Margin After Rebate Total Payroll Profit Before Taxes $100 2017 2018 2019 2021 $550 $700 $850 $400 $250 Typical High-Profit Typical High-Profit $206 $191 $104 $112 $311 $512 $782 $211 $259 $213 26.3% 29.1% 12.2% 11.4% 6.9% 10.6% 2020 0% 10% 20% 30% 40% 50%

John

Venhuizen

President & CEO | Ace Hardware

What were some challenges in 2022 and how did Ace address them?

Inflation is a beast and the “tools” to tackle it—Federal Reserve tightening and interest rate hikes—are all designed toward demand degradation.

In uncertain times like these, the natural inclination is to hunker down, but it is important to remain strategically consistent and control what you can control. For over 98 years, Ace Hardware has shown that when we stay true to our game, it serves us well. We want to continue to be the best at service and leverage the convenience our retailers offer in their neighborhoods.

What types of operational investments will Ace make in 2023 and what will be the impact on your members?

Despite headwinds and uncertainty, Ace’s capital expenditures in 2023 will be the largest in company history. We want to stay strategically consistent and operationally aggressive, but will also stay fiscally conservative, being more judicious with spending while still investing in the resources and capital that are fueling the business. We believe we have a plan for what’s working, and we are going to stay consistent with that strategy. We’re not cutting back on what drives our growth and expands our capacity, which includes all of our retail tools and initiatives and the expansion of our distribution center capacity. Ace has committed to investing $800 million in the next five years to Ace’s supply chain, focusing on personnel, technology and network expansion.

We remain enthusiastically bullish about the continued prospect for new store growth. I applaud our local Ace owners for the pace with which they’ve integrated our digital efforts with our physical assets. Seventy percent of Acehardware.com orders are picked up in store, and 20% are delivered to customers by our own red-vested heroes, thus further advancing the relevance and necessity of our neighborhood stores.

How are you helping your members address technology?

Our digital transformation initiatives began long ago. We are thankful first, to be agnostic as to how, when and where customers shop and also to have the resources to continuously invest in technology to improve speed, reduce cost, and drive the business forward.

How are you helping your members address business transition and succession planning?

We have internal and external resources for business planning, succession planning and business valuation. When the time comes, our passion is to help hardware store owners (of any affiliation) monetize their life’s work.

How are you helping your members address company culture and employee engagement?

We have a plethora of tools to help Ace owners measure employee and customer engagement, improve employee and customer engagement, and to operationalize these initiatives into the values and culture of the business.

There’s really no silver bullet to solve hiring issues, and while it’s not perfect, the Ace way of retailing includes numerous paths, from recruiting to onboarding to development, that offer hiring tools and resources for retailers along every step. Local owners can also use their store and community culture to their advantage to recruit and retain employees. When store owners are capable of executing on the basic tools we offer them, their culture is what will help bring in and retain good workers.

What are your projections for 2023 for the industry and for your organization?

The battlefield is fraught with challenges, but we believe we are up for the fight.

HARDWARE RETAILING | January 2023 32 INDUSTRY INSIGHTS

F O R W A R D T HIN K I N G W I T H

Dent Johnson

Executive Vice

How did business change for Do it Best in 2022 compared to 2021?

There were several notable business changes over the last year. We announced a major e-commerce initiative that will put our members in an even stronger position in-store and online with fully integrated point-of-sale and customer convenience at the forefront. The next big one for us was the onboarding of a record number of new stores—over 300. That includes member acquisitions and new store expansions, as well as those joining our industry with new businesses. That pace hasn’t slowed. And we’re continuing to make major investments in growth-driven infrastructure to support that additional business. At the same time, we have been actively monitoring pricing in an inflationary period to ensure our members are protecting their margins. This last year has also seen a greater stabilization of the supply chain and we’ve been aggressively working with our vendor partners to drive service level improvements.

What were some challenges in 2022 and how did Do it Best address them?

Our No. 1 priority has been to ensure our members have product to sell. That has required solid partnerships with our key vendors to provide more than our share of inventory. It has also meant developing relationships with new vendors and exploring new product lines. We also increased our management of port congestion issues by opening up new channels to move more product from the ports on to our distribution centers. This effort is improving our agility and enhancing our member responsiveness.

What operational investments will you make in 2023 and how will they impact your members?

We’re aggressively investing in the elements of the business that drive and support member growth. E-commerce is central in that strategy as we set members up to drive more traffic in-store and online.

President

of Operations | Do it Best

We’re focused on supporting member growth through our Gear Up 4 Growth initiatives. With low-interest loans, rebate advances, preference share redemption and substantial incentives for major store improvement projects, we’re helping our members expand their businesses. We’re also continuing to invest in the infrastructure that supports this substantial growth, including a new distributed order management system, our next-gen warehouse management system, a comprehensive overhaul of our core financial systems and targeted facility expansion.

How are you helping your members address key industry challenges, including technology, business transition, and culture and employee engagement?

Earlier this year, we announced a preferred partnership with Epicor, a leader in POS systems. This closer working relationship will offer our members numerous tech benefits to enhance their business operations.

We also have increased our engagement with our members to strengthen their e-commerce capabilities, with an eye on driving online customers into the store. For example, at our last spring market, we debuted the very popular automated locker system for online orders. We’re supporting these efforts with a new white glove service to provide in-store support to implement these major technology projects.

What are your projections for 2023 for the industry and for your organization?

While we believe the overall economy will slow in 2023, we are excited about our growth prospects. We’re projecting continued unit sales growth, with some softening in pricing, especially in lumber. Our members are moving forward to re-invest in their businesses with a record number of store resets and expansions in the pipeline, including a focus on acquisitions to drive even more growth.

January 2023 | HARDWARE RETAILING 33 INDUSTRY INSIGHTS

F O R W A R D T HIN K I N G W I T H

Steve Synnott & Shari Kalbach CEO President

How did business change for HDA in 2022 compared to 2021?

Distribution America and PRO Group joined forces in April 2022 to form Hardlines Distribution Alliance (HDA). We are striving to become a larger, more impactful and more efficient organization by combining the best of both organizations. Generally, in 2022, supply chain issues improved (though not yet to pre-pandemic performance), while distributor sales outperformed 2021 in high single digits.

What were some challenges in 2022 and how did HDA address them?

Staffing, fuel costs and transportation were three top challenges experienced by HDA members. A gradual return to face-to-face office environments validated the importance of physical presence that platforms like Zoom and Teams simply cannot deliver. Staff have adapted once again to an office environment, but we did learn the importance of virtual interactions during the pandemic, prompting hybrid schedules and more regular, interactive virtual communications. A portion of rising fuel and transportation costs had to be passed on to customers, but members also absorbed a portion of these costs. We are optimistic that 2023 will be less inflationary with respect to fuel and transportation.

How are you helping your members address technology?

HDA has just signed a commitment to outsource software that will streamline rebates and member purchase data, improving the accuracy and turnaround time to members in 2023.

Periodically, we conduct an operational performance survey that gathers key metrics and

comparables that help members identify how their companies compare to their peers. Access to this data helps prioritize member technology investments that make the most sense. We have scheduled a warehouse operations workshop in April 2023 where members will bring in their top logistics personnel to share best practices in material handling and order fulfillment to retailers. Automation is a major focus of the workshop, and it’s the first time we have been able to gather in-person since the pandemic.

Additionally, we have updated and streamlined the Central Pay process to accommodate more frequent payments that improves benefits to wholesalers and suppliers.

How are you helping your members address succession planning?

We have several members who are focused on growth via acquisition. HDA is in a good position to identify and then facilitate communication between members who have transition and succession opportunities over the next several years.

What are your projections for 2023 for the industry and for your organization?

We believe the economy will show less growth than 2022, but we still see solid opportunities for business improvement by becoming more efficient as an organization. By continuing to communicate, share best practices and adopt the most efficient processes and technology available, we will strive to help all member businesses capture margin and productivity gains that will lead to a stronger overall performance in 2023.

HARDWARE RETAILING | January 2023 34 INDUSTRY INSIGHTS

OF R W A R D T HIN K I N G W I TH

Hardlines Distribution Alliance

The industry’s marketplace for buying and selling independent home improvement businesses and posting jobs.

BUSINESS FOR SALE

Northwest Farm & Home Supply Co.

Location: Lemmon, SD

Gross Revenue: $3.21 million

The main building is a total 27,213 sq. ft. of retail and warehouse space on 4 acres. The main bldg. was constructed in 1994 with additions constructed in 2002 & 2004. Single story with 22’ clear height in 11,459 sq. ft. of lumber warehouse, three grade level doors and two dock height doors.

BUSINESS FOR SALE

Central Vermont Paint, Flooring, and Decorating

Business

Location: Vermont

Gross Revenue: $2.82 million

Price: $1.1 million

Full-service decorating store providing flooring, paint, window treatments, kitchen/bathroom remodeling, cabinetry product offerings, design assistance, specialized service, and professional installation.

SEEKING BUSINESSES The Aubuchon Company

BUSINESS FOR SALE

Home Improvement Supply Store

Location: Missouri

Gross Revenue: $1.04 million

This historic home improvement and hardware store is a staple of its community and operates from its headquarters in Missouri. The Company is a long-standing retailer and installer of consumer and commercial improvement products.

BUSINESS FOR SALE

Hoosick True Value

Location: Hoosick Falls, New York

Gross Revenue: $1.26 million

Price: $1.875 million

This opportunity offers a turnkey sale of a general hardware operation located in northeastern Rensselaer Co., New York. The business serves five towns, southwestern Bennington Co., Vermont, and 25 miles east of Troy, New York.

BUSINESS FOR SALE

Private Business

Location: Alabama

Gross Revenue: $2.21 million

Price: $649,000

For our next acquisition, we are looking for:

Single-store and multi-store hardware operations

• Located in northeast and southeast United States

• Store size of 5,000-30,000 ft2

• At least $3 million in average store sales

SEEKING BUSINESSES

Bolster Hardware

We are looking for:

• Geography agnostic With or without real estate

• Store revenues of $1.5M+

• We prefer to honor the family name and heritage in the local community by not changing the name

• We prefer to keep all employees as part of the acquisition

Post a Job | Sell Your Business | Buy a Store | Public and Private Listings Available

see full listings, visit YourNHPA.org/marketplace or email

Now Offering Business Valuations

To

marketplace@yournhpa.org

Rob Wallace

How did business change for Home Hardware in 2022 compared to 2021?

Home Hardware Stores Ltd. stepped into 2022 focused on our vision to be Canada’s most trusted and preferred home improvement retail brand. Throughout the year, our team worked to update and implement our strategic approach, adapt to market conditions and ensure Home dealers had the products, services and resources they need to serve the communities in which they operate. We leveraged the lessons learned during the pandemic, such as the importance of data-driven decision making, strengthening our omnichannel experience, enhancing our supply chain and warehouse operations and ensuring our team members have opportunities to collaborate on achieving our goals.

What were some challenges in 2022 and how did Home Hardware address them?

Customers are expecting us to provide an omnichannel experience and give them options to shop. We have addressed this by providing a full range of services that extend from our brick-and-mortar locations to online. We also lean into what we do best—providing quality service and the product knowledge customers are looking for to complete their projects, big and small.

What operational investments are you making 2023 and how will they impact your members?

Looking into 2023, we plan to continue optimizing our processes and operations to support our dealer network and strengthen our distribution operations across the country. This will include adjustments that will leverage our warehouse management system and its technology to reduce our environmental impact. We look forward to future environmental benefits such as decreasing single use cardboard, scheduling more efficient deliveries, decreasing our use of paper in our distribution centers and, in some areas, eliminating the need for paper altogether.

As part of the logistics improvements, the St. Jacobs project included the addition of an automated storage and retrieval system that will benefit us with greater efficiencies and accuracy. These supply chain initiatives lay the foundation to optimize operating costs and allow a streamlined flow of products to move through the system.

All of our initiatives are designed to support the success of our dealer-owners, as we remain focused on our goal to provide the best program for independent home improvement retailers in Canada.

How are you helping your members address technology?

Our Home team has been working hard to strengthen our e-commerce capabilities and has made several significant enhancements to various platforms. We are working with customer data to make informed decisions, as well as performance-related items to enhance the overall website experience, specifically in terms of speed.

We’ve made changes to our buying strategies by optimizing and leveraging the data we collect from stores to provide our customers with what they want, when they want it and how they want it. To optimize the flow of goods through our supply chain and respond to the record level of e-commerce orders, we hired new team members, repurposed areas within our distribution centers, set up electrical requirements, sorting stations, packing stations and processing stations.

What are your projections for 2023 for the industry and for your organization?

We will be joining Scene+, one of Canada’s largest and most flexible loyalty programs, in summer 2023. Scene+ allows Home Hardware to bring the best rewards program to our loyal customers, giving them the opportunity to earn and redeem points for entertainment, travel, shopping, dining, banking, grocery—and in summer 2023—home improvement.

HARDWARE RETAILING | January 2023 36 INDUSTRY INSIGHTS

F O R W A R D T HIN K I N G W I T H

Chief Retail Operations Officer | Home Hardware Stores Ltd.

DON’T TRUCK AROUND

WORK WITH THE BRAND WHO’S GOT YOUR BACK.

With millions of bags delivered every week and on-the-ground support you can count on, partnering with Sakrete means you spend less time waiting — and more time racking up sales.

Become a Dealer at Sakrete.com/Dealer

Boyden Moore

President and CEO | Orgill

How did business change for Orgill in 2022 compared to 2021?

After two strong years of growth, we began to see growth moderate in 2022 and expect to end the year with an 8% increase in sales, which is likely more the result of inflation. After a very intense period of price changes in the past two years, we are now seeing much more stability in pricing. In fact, we have the lowest level of price change requests in process than we’ve seen in a long time and are even beginning to see some declines in pricing. With demand moderating, we were able to make more and sustained progress improving our service levels to our customers. As COVID has decreased, we’ve had fewer absences and more reliable staffing levels.

What operational investments will you make in 2023 and how will they impact your customers?

We celebrated the one-year anniversary of our newest distribution center in Rome, New York, in June. We’ve made a lot of progress in the first full year of having that facility online, but we have more opportunity to continue to improve our operations there. We completed a significant expansion of our Hurricane, Utah, distribution center this year which will really have more impact on our business in 2023. We recently announced the investment in a new distribution center in Tifton, Georgia, to replace our current facility in the same area. This new distribution center will include robotics in a goods-to-man picking solution that we expect to drive more efficiency, accuracy and speed. That project will be ongoing in 2023 and begin to impact our business in 2024. We continue to make these investments to support our customers’ growth and our ability to provide the lowest possible prices “to help our customers be successful.” We also continue to invest in our fleet and drivers. Our truck drivers are key in the relationships we build with our customers delivering goods reliably and efficiently.

How are you helping your customers address technology?

We are using our CNRG stores as a lab environment to develop and test technology solutions in our own stores then sharing best practices where we are able to build demonstrable success. Those solutions include technology that supports merchandising, marketing, e-commerce, loyalty programs, pricing, store communications, staff scheduling, managing shrink and more. We have a big vision for how we can work on technology solutions for our customers as part of our mission “to help our customers be successful” and we have a lot of opportunities to continue to improve this.

How are you helping your customers address succession planning?