Streamlining Your Business Finances with Expert GST Filing and Audit Solutions

The intricacy of Singapore's tax structure makes managing taxes a challenging chore for enterprises. Firms must continue to comply with the most recent laws in order to avoid penalties and legal issues. A critical part of the financial and accounting process for Singaporean businesses is GST registration. Businesses must regularly register and gst filing Singapore. Consumption of products and services within the country is subject to this levy. Businesses are required to submit accurate and timely returns for GST in order to avoid penalties and maintain compliance with Singapore's tax rules.

Corporations must maintain compliance with the most recent legislation to avoid fines and legal difficulties. Gst filing in Singapore is a critical stage in the financial and accounting process for businesses in Singapore. Businesses must regularly register and file their GST returns. This fee must be paid for all goods and services consumed domestically. To avoid fines and preserve compliance with Singapore's tax laws, businesses are expected to submit correct and punctiliously filed GST filings.

Efficient Financial Management with Professional Tax and Audit Services

Any business must manage its finances effectively, and a key component of financial management is making sure that tax laws are followed and that tax savings are maximized. We provide a variety of options at our tax consulting services to assist your company in adhering to tax laws and reducing taxes. We can take care of everything for you, from the creation and

submission of Form C and tax computation for corporation tax to registration, de-registration, and filing of quarterly tax returns for GST. Additionally, we provide withholding tax services, tax planning, individual tax services, and help with IRAS tax dispute resolution. Similarly, using a professional audit company in Singapore can help you improve your business operations by giving you insightful information about your financial performance. Your financial accounts and transactions can be thoroughly examined by our team of expert auditors, who can then make recommendations on how to strengthen your financial systems and processes. In the end, this improves your company's productivity and profitability while gaining the confidence and respect of stakeholders.

You can concentrate on other areas of your organization, like sales and marketing, while we take care of your financial management needs by outsourcing your tax and audit needs to us. You may be sure that your company will have effective financial management due to our knowledge and commitment to providing high-quality services.

Optimizing Your Business Taxes with Professional Tax Consultant Services

We provide a variety of options at our tax consulting services to make sure your company complies with tax laws and is set up to save money on taxes. We offer a variety of services, such as Form C preparation and submission, tax computation for corporation tax, registration and deregistration for GST, quarterly tax return filing, withholding tax preparation, individual tax services, tax planning, IRAS tax issue resolution, and income tax services. Our team of knowledgeable tax experts can assist you in navigating the complexity of tax laws and make sure that your company stays on course.

WhytoChooseus?

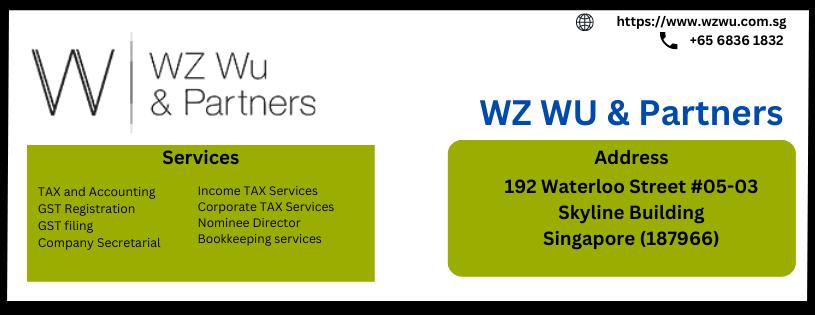

Your Reliable Partner for gst filing in Singapore and Auditing. WZ WU is the company to work with if you need a dependable and trustworthy partner for your GST filing and audit requirements. With more than years of expertise, we have made a name for ourselves as one of the best audit company Singapore.

From preparation to submission, our staff of qualified experts can help you with all facets of gst filing in Singapore. You may have peace of mind knowing that your taxes will be filed appropriately and on time, avoiding any penalties or fines. We also want to assist you increase the profitability and financial efficiency of your company through our auditing services. In-depth analysis, along with suggestions for enhancement, will be provided once we thoroughly review the transactions and data.

We take great pride in providing unique and customized options at WZ WU in order to cater to the specific demands of each of our customers. We are dedicated to creating enduring connections with our clients by giving them the assistance and knowledge they require to thrive.

Conclusion

Gst filling in Singapore is a significant for venture. If you are running a firm and looking for audit company in Singapore then let us connect. GST returns must be submitted accurately and on time in order to avoid fines and penalties. While freeing up time and resources for other aspects of the business, a recognized organization may help ensure compliance. Similar to this, performing regular audits can provide valuable data about financial performance and help improve procedures and systems, both of which eventually lead to better profitability and credibility with stakeholders. With the assistance of knowledgeable and professional personnel, businesses can navigate the complexity of tax regulations and optimize their financial operations.

Source:- https://neservicee.com/gst-filing-singapore/