WOMEN

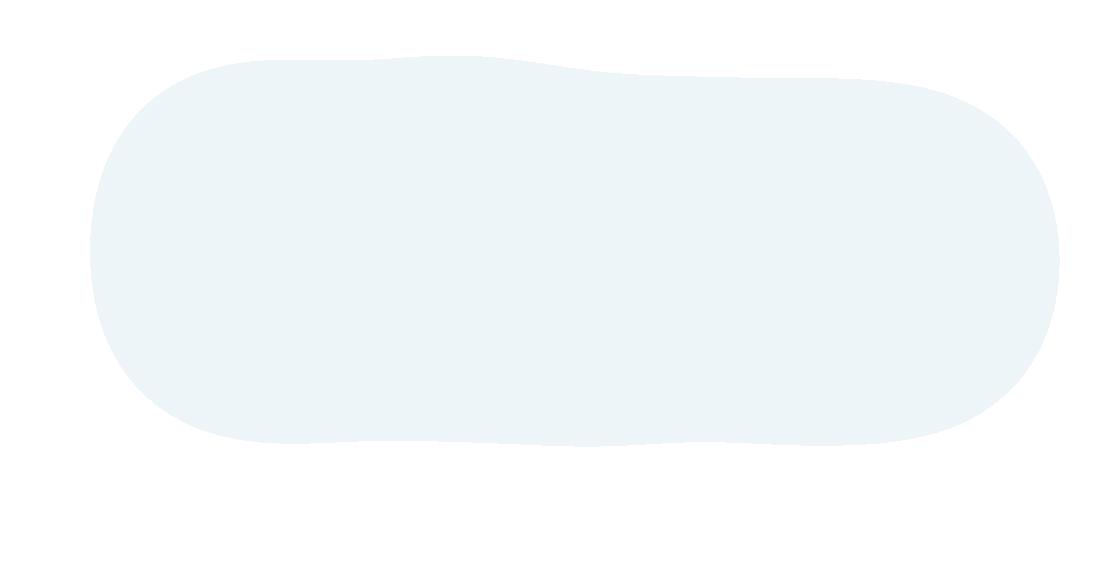

Baxter Chief Operating Officer

Heather Knight looks back at the crisis after Hurricane Helene and shares lessons about leadership, emergency management and supply chain resiliency.

WOMEN

Baxter Chief Operating Officer

Heather Knight looks back at the crisis after Hurricane Helene and shares lessons about leadership, emergency management and supply chain resiliency.

As your behind-the-scenes partner, our mission is to ensure your greatest MedTech ambitions become a reality. That’s why Resonetics is laser-focused on the details—ensuring every aspect of your critical components is engineered, prototyped, and manufactured to the highest specifications. And with our unmatched dedication, we’re able to move rapidly from design to full-scale production so you can bring exciting developments to market. Speak to an engineer by visiting resonetics.com.

EDITORIAL

Editor in Chief Chris Newmarker cnewmarker@wtwhmedia.com

Managing Editor Jim Hammerand jhammerand@wtwhmedia.com

Senior Editor Danielle Kirsh dkirsh@wtwhmedia.com

Senior Editor Sean Whooley swhooley@wtwhmedia.com

Editorial DirectorDeviceTalks Tom Salemi tsalemi@wtwhmedia.com

Managing EditorDeviceTalks Kayleen Brown kbrown@wtwhmedia.com

Editor in ChiefR&D World Brian Buntz bbuntz@wtwhmedia.com

CREATIVE SERVICES

VP, Creative Director Matthew Claney mclaney@wtwhmedia.com

VP, Operations Virginia Goulding vgoulding@wtwhmedia.com

Digital Marketing Manager Taylor Meade tmeade@wtwhmedia.com

CEO Matt Logan mlogan@wtwhmedia.com

Senior Vice President Courtney Nagle cseel@wtwhmedia.com 440.523.1685

PRODUCTION SERVICES

Customer Service Manager Stephanie Hulett shulett@wtwhmedia.com

Customer Service Rep Tracy Powers tpowers@wtwhmedia.com

Customer Service Rep JoAnn Martin jmartin@wtwhmedia.com

Customer Service Rep Renee Massey-Linston renee@wtwhmedia.com

Customer Service Rep Trinidy Longgood tlonggood@wtwhmedia.com

AUDIENCE DEVELOPMENT

Director, Audience Growth Rick Ellis rellis@wtwhmedia.com

Audience Growth Manager Angela Tanner atanner@wtwhmedia.com

Ryan Ashdown 216.316.6691 rashdown@wtwhmedia.com

Jami Brownlee 224.760.1055 jbrownlee@wtwhmedia.com

Mary Ann Cooke 781.710.4659 mcooke@wtwhmedia.com

Mike Francesconi 630.488.9029 mfrancesconi@wtwhmedia.com

Jim Powers 312.925.7793 jpowers@wtwhmedia.com

Brian Toole 267.290.2386 btoole@wtwhmedia.com

Amy Vodraska 862.274.1348 avodraska@wtwhmedia.com

from Medtronic, Insulet and more taking action in the face of

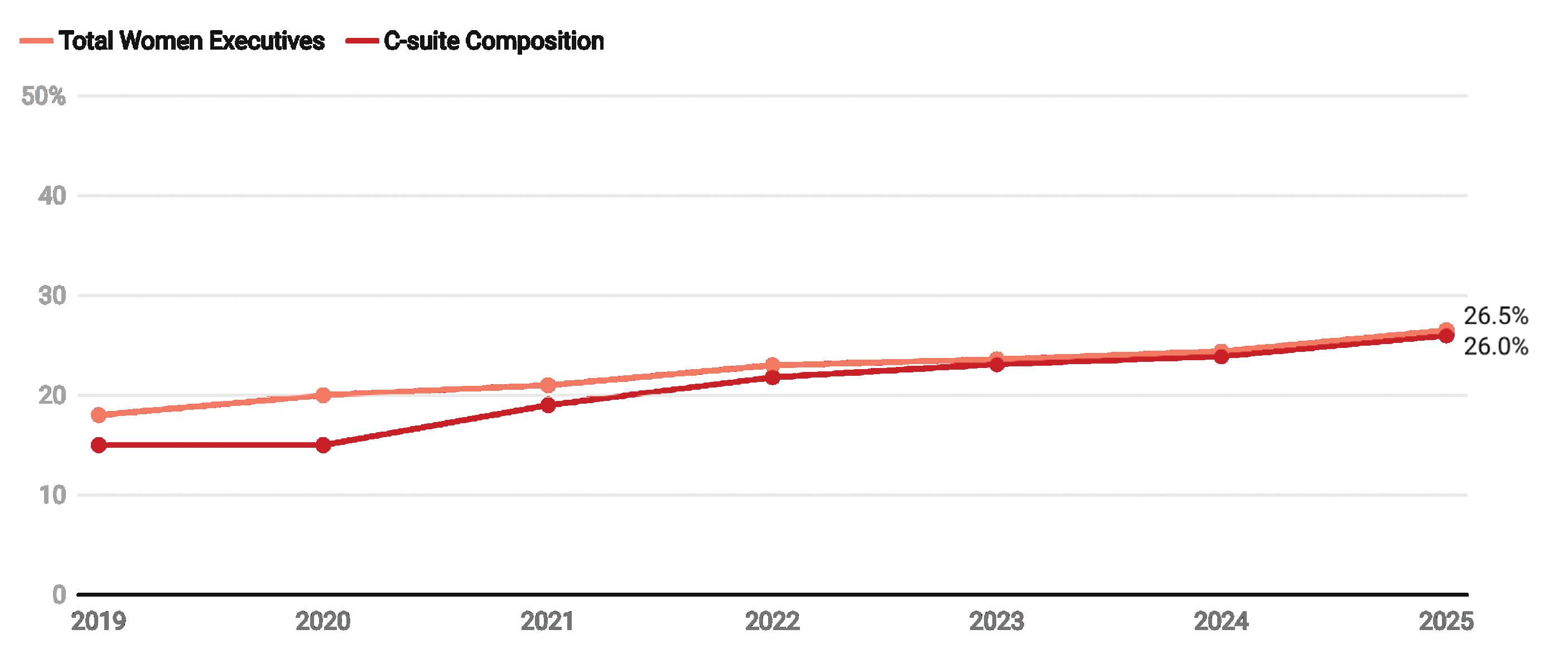

analysis of Medtech Big 100 companies shows more women in C-suites and nearly double the number of CEOs compared to last year, yet women remain considerably underrepresented in medtech leadership.

Designing efficient systems involves much more than simply understanding a few basic principles. There is a true art to balancing the specific requirements of an application in order to achieve the desired goals in the best possible way. Help us understand the unique needs of your application and together, we’ll develop something that surpasses what any of us could have done alone.

Contact your distributor to learn more, or visit clippard.com to request a free catalog and capabilities brochure.

Diversity is under attack as medtech continues its efforts to make the industry’s leaders more representative of the patient population we serve.

This annual Women in Medtech special issue highlights some of medtech’s leading executives, engineers and innovators. In our cover story, Baxter Chief Operating Officer Heather Knight shares what she saw after the catastrophic flooding at a manufacturing plant that caused a critical shortage of IV products across the country, and what can be learned from the response by her company and the community to bring the facility back online.

Another feature by DeviceTalks Managing Editor Kayleen Brown offers advice from fearless leaders to help others band together and face the ever-mounting political and economic challenges threatening medtech, including renewed opposition to diversity, equity and inclusion initiatives by some of the most powerful men in the most powerful positions.

those Medtech Big 100 companies. That figure has slowly and steadily increased since then to 26% in Kirsh’s latest feature, which includes perks and policies that companies can adopt to pick up the pace.

But it’s up to today’s leaders to accelerate that momentum, and those leaders are overwhelmingly men. Men at all levels have an obligation to support underrepresented colleagues, if not because it is just, then because it is good for business and the customers who depend on life-saving devices.

“ THIS IS A CALL FOR FAIR PAY, FLEXIBLE WORK ARRANGEMENTS, BETTER FAMILY CARE BENEFITS AND EQUAL OPPORTUNITIES. THIS IS A CALL FOR CORPORATE INITIATIVES TO RECRUIT MORE WOMEN INTO MEDTECH AND ELEVATE THEM.”

This is a call for empathy and a deeper understanding of the everyday challenges and unique barriers women must overcome. This is a call for fair pay, flexible work arrangements, better family care benefits and equal opportunities. This is a call for corporate initiatives to recruit more women into medtech and elevate them.

Medtech, for its part, is making incremental progress toward achieving gender parity in the executive ranks of its largest device companies.

Five years ago, Senior Editor Danielle Kirsh calculated that women held just 15% of the C-suite roles at

Men must make it a priority to bridge the gender gap in medtech. It is not a natural disparity. It’s a man-made malady that we can solve together.

As always, I hope you enjoy this edition of Medical Design & Outsourcing. Thank you for reading.

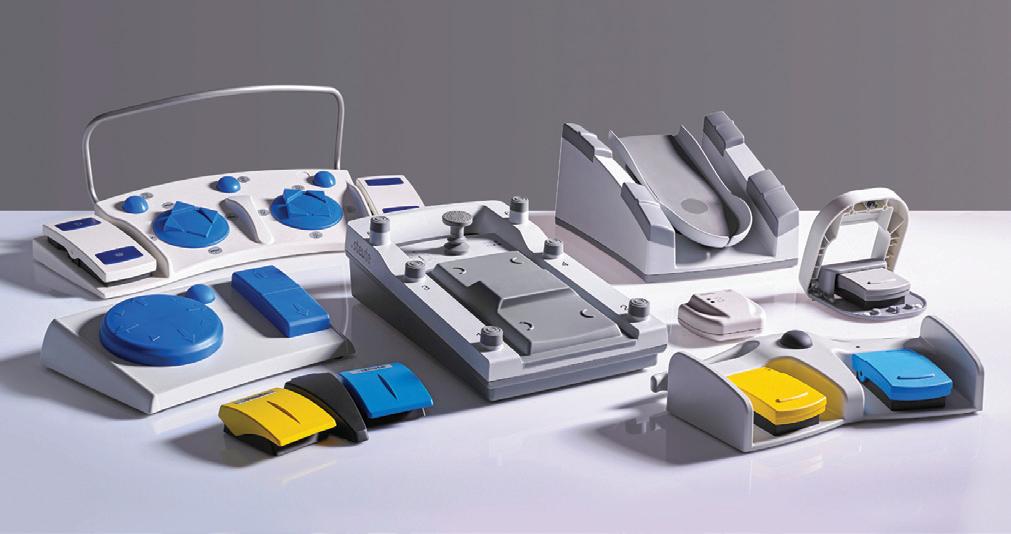

To be sure, Medical Device OEM’s face a lot of challenges. But there are 3 things that are fundamentally important to your product image and profitability:

• Product Reliability and Quality – Steute foot switches are built to last, not built too fast. All models are hand-assembled, IPX-8 rated and put through a stringent battery of durability tests before they are shipped to you: drop tests, IP test (submerged for 30 minutes in water), test for 1 million actuations and a 100% final inspection test to ensure your medical device remains up and running.

• Technology – We have been the world leader for over 35 years in medical-grade foot switches because each product optimizes functionality, user-comfort, ease-of-use and aesthetic appearance. And we stay ahead of the trends by offering custom options with no tooling or NRE. These include actuator styles, consoles/platforms, cable type/colors, wiring configurations, console colors and finishes, and many more.

• Pre-certification and Documentation – Steute saves its customers a lot on documentation headaches, pre-certification costs and time wasted, which disproportionately tie up your engineers, R&D and regulatory people. We will address (partial list): ISO 9001, ISO 13485, MDR & FDA requirements, cybersecurity, IEC 60601 and applicable subclauses and risk management protocols (plan, report and governance & control)

We deliver all of this while remaining price-competitive with other foot switch suppliers.

Challenge your current supplier to match a ll that Steute offers you!

David Spangler, Sales Leader

Tubing,

Swiss-

Femtosecond

Electropolishing

PVD

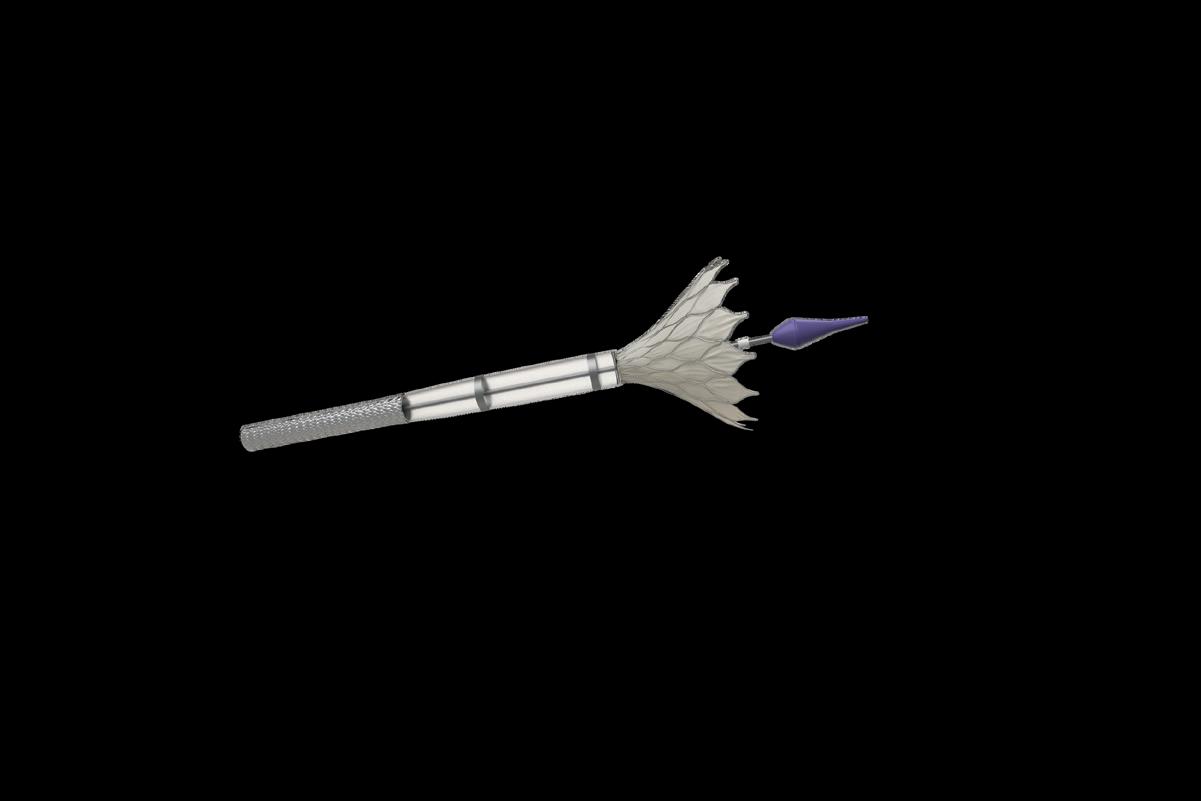

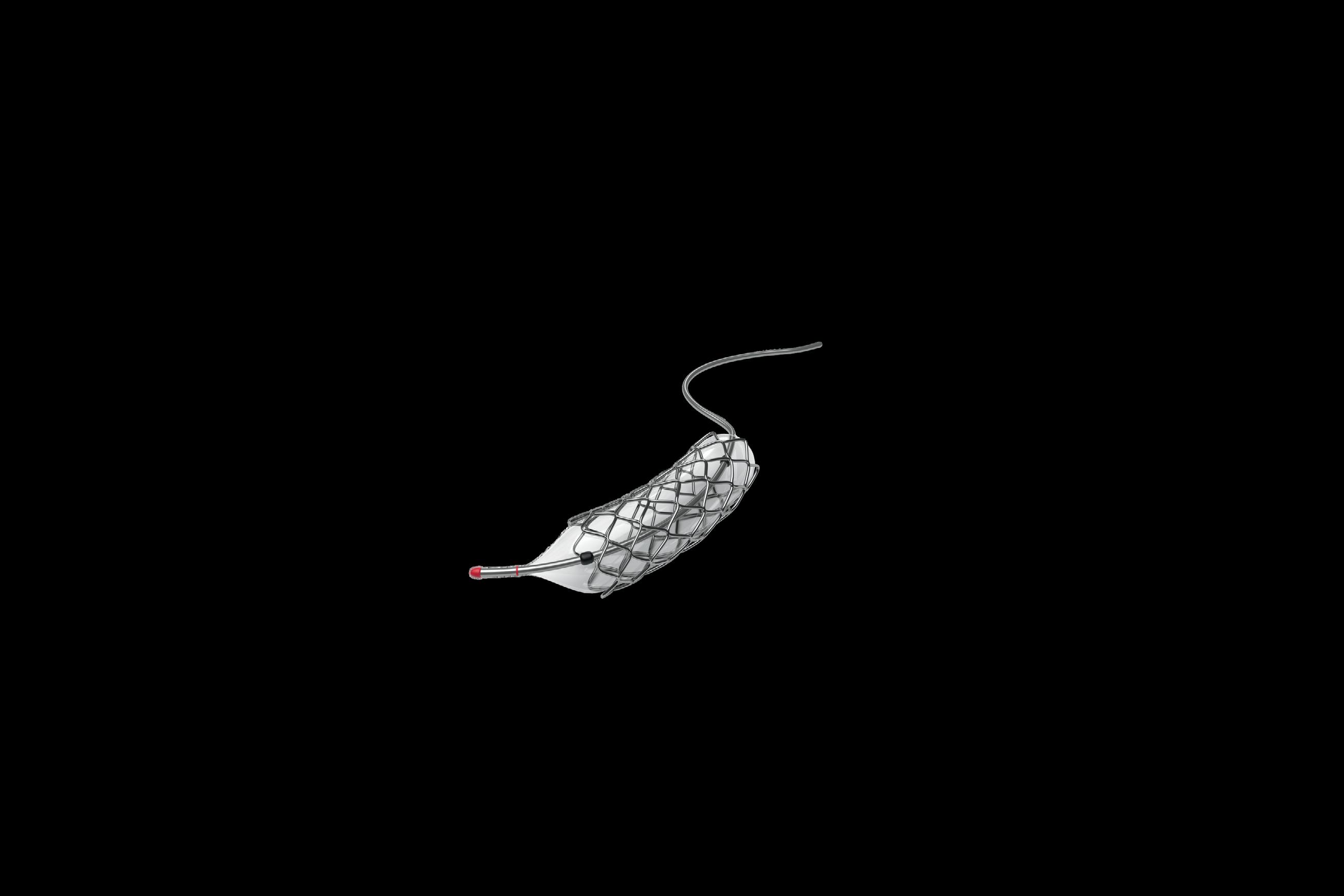

Ahead of Capstan Medical‘s first-inhuman procedure this year, CEO Maggie Nixon offered Medical Design & Outsourcing an update on her structural heart surgical robotics startup’s technology and her perspective on minimally invasive medtech.

In that same interview, we also discussed her team’s work with nitinol, funding from Intuitive Ventures and what Nixon has learned about leadership in the time since the former Intuitive Surgical engineer-turned-executive became Capstan’s CEO.

The excerpts below have been lightly edited for space and clarity.

MDO: Can you share anything Capstan has learned about nitinol with our readers?

Nixon: “Some of it is in our secret sauce, so we like to be sensitive to it. But what I say more than anything is you’ve got to partner with your manufacturers. We work so closely with not just our nitinol raw material suppliers making sure that we’re getting a consistent supply chain set up, but we work so closely with our manufacturer through our development process and implementation, all the way through their pilot line transfers and whatnot. If you view that as something where you throw it over the wall to a supplier and expect that you’re going

to get something back that works, it’s just not how it works. Nitinol is among our closest supplier relationships and we navigate those very carefully because we view that as a partnership.”

Do you want to give a shout out to any of those partners that you’re working with on nitinol?

Nixon: “We work with Admedes in Germany and and they are fantastic partners.”

What have you learned about leadership since you became CEO?

Nixon: “I stepped in in 2022 to lead Occam Labs, which is the incubator that Capstan has come out of. And then in 2023 I moved into the focused Capstan Medical CEO role. We were about 15 people when I came in. So I went from Intuitive — which was 12,000 or 13,000 people — into a company that was 15 people. The first thing I did was built a desk and a chair and and got my computer running. And the most incredible part of all of it is just the energy around what we’re seeking to accomplish. That’s been the exciting thing. We’ve grown our team to probably a little over 75 on the Capstan side alone, but really what it’s about is everybody’s got that same mentality and passion as we’re seeking

The structural heart surgical robotics startup’s CEO also shared what she’s learned about leadership since taking the helm at Capstan.

By Jim Hammerand Managing Editor

to address this space and the creativity that we’re bringing to the table in order to address it in a new way. Keeping that momentum is one of my biggest priorities as a leader in the coming years for Capstan. That foundational energy from the team is going to fuel us just as much as the dollars that come through the fundraises.”

And everything’s friendly with Intuitive?

Nixon: “My time at Intuitive was immensely valuable, and I’m still close friends and collaborators with them. Intuitive Ventures continued their investment and I think the world of everything that Intuitive is doing. I still use them deeply in my network.”

MDO: Do you have advice for how to get in front of Intuitive Ventures or make a deal happen?

Nixon: “Murielle Thinard McLane and Vivian Golfin (De Ruijter) and that team are so active. At a lot of the investment conferences, you’ll see them on panels and whatnot. Honestly, the best way to engage with them is grab them at one of those conferences. At least that’s my perspective. They’re constantly scanning the environment for for incredible opportunities, and they are some of the most active, especially in the early-stage conferences.”

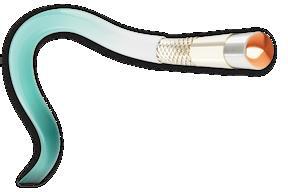

The experts in design, development, and scalable manufacturing of interventional catheter-based devices and implants. Your trusted partner for bringing current and future medical devices to market

Learn more about our offerings at www.confluentmedical.com or email sales@confluentmedical.com for a custom quote.

“We’ve got this unique window of opportunity,” says Highridge Medical CEO Rebecca Whitney.

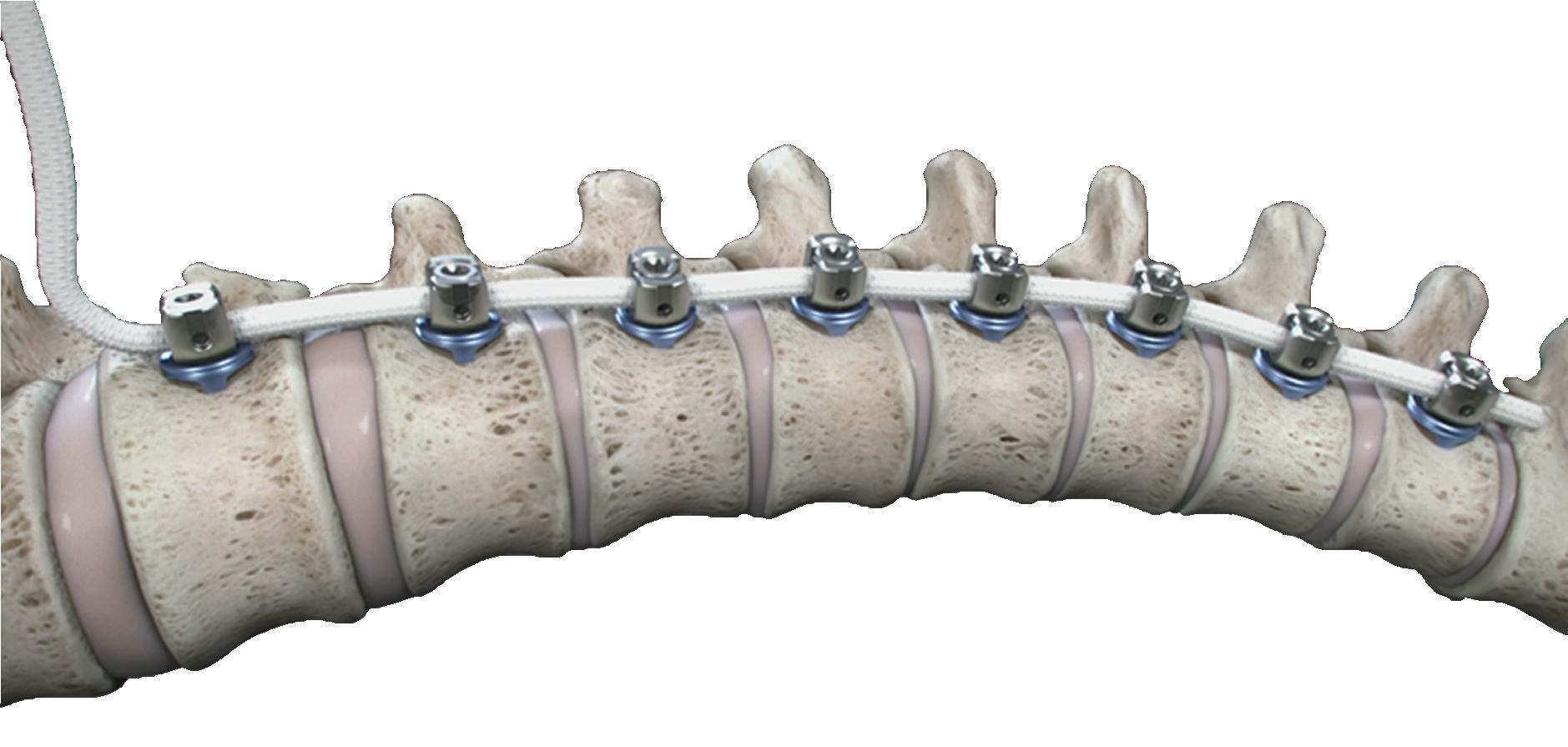

ighridge Medical has returned to the spine tech developer’s roots and is betting big on some key technologies, CEO Rebecca Whitney says in an exclusive interview.

We spoke with Whitney ahead of Highridge’s announcement that it sold its EBI bone healing business to focus on spine tech as a pure-play company.

Highridge Medical has now doubled its investment in spine tech R&D and is expanding its portfolio, with an eye toward enabling tech partnerships and external expertise, Whitney said.

“Historically, we really focused on our two most differentiated brands, which are the Mobi-C Cervical Disc and the Tether for pediatric scoliosis,” Whitney said. “We lead the market in both segments. We’ve got a No. 1 share position, which a lot of people don’t fully recognize or understand. But we’re not stopping there.”

Tether leads complex spine, with Highridge Medical building out its pedicle screw system and posterior cervical system to support the segment.

“We’re not just doing it for product innovation. We’re Triple Diamond sponsors of the Scoliosis Research Society (SRS). It’s only us and Medtronic,” she said, “and Medtronic is obviously about eight times the size we are, so we’re making a big push into that surgical community.”

Cervical disc leads Highridge’s motion segment, and the company is also considering adding a lumbar disc for more relevance and differentiation, Whitney said. (After our interview, Highridge licensed the U.S. rights of B.Braun’s activL to launch its own lumbar disc and purchased product lines from Accelus.)

The Tether system is FDA approved for adolescent idiopathic scoliosis under a humanitarian device exemption.

Highridge Medical is “essentially standing up three verticals in parallel,” she said: complex spine, motion preservation and minimally invasive surgeries (MIS).

Minimally invasive investment at Highridge

But Highridge’s biggest R&D investment is in MIS for new and nextgeneration procedures and enabling technology, she said.

“We fully appreciate and understand that to be a major player in the spine market, we’ve got to have our own enabling tech solution [and] we’re looking for the right partnerships and external experts to help us get there,” she said. “… We’re looking at AI, we’re looking at predictive analytics, preoperative planning, navigation, augmented reality. The nice thing about our position is we’re the largest implant company without a unique, proprietary enabling tech solution, so a lot of these other companies out there are highly motivated to work with a company of our size and scale for distribution.”

“That’s not something that we would invent internally,” she continued. >>

“It would take us far too long, and it’s not our skill set. We’re in a nice, privileged position of being able to look at all these different options and pick and choose, and we don’t have to go with just one.”

Whitney compares MIS in spine to building a ship in a bottle.

“You’re trying to do this very precise, intricate surgical procedure blind, essentially. Unlike open, long construct deformity solutions where you open up the back and can see everything, it’s very challenging to correct the spine when you’re working blind through a keyhole,” she said. “You need image support, whether it’s navigation or whatever, to help fill in those blind spots.

“But even more importantly, spine outcomes — especially in the lumbar spine — are still only mid 60% when you look at patient-reported outcomes,” she continued. “Most of the time, patients are not incredibly pleased with their procedure, and it’s because the spine is 26 joints. There’s too much arts and crafts that goes into this, and with AI and predictive analytics and this machine learning that’s really starting to take hold — not just clinically when it comes to spine, but in life in general — there’s a tremendous opportunity to harness AI to better inform patient selection and treatment plans that should have a very positive impact on clinical outcomes. … The implants and the instruments are fantastic, and those need to continue

What’s special about spine Whitney’s been in medtech for more than 25 years and in spine for the past 11, most recently as CEO of Highridge and as leader of the spine business before its 2024 sale by ZimVie, which itself spun off from Zimmer Biomet in 2022.

Zimmer and Biomet merged in 2015, with Biomet buying spine-tech developer Lanx before the deal and Zimmer Biomet later buying another spine company, LDR.

“Our roots are actually in LDR and Lanx. … Both were pure-play spine companies, growing very rapidly, very innovation-driven, surgeon-focused,” Whitney said. “And then as these acquisitions continue to happen, we got swallowed up inside of Zimmer. So I watched these companies get absorbed into a big conglomerate and then slowly spin back out, and now we’re kind of back to where we started, which is fantastic.”

What’s special about the spine tech market are uniquely close partnerships with hands-on surgeons.

“I was told when I first got into spine that spine is a high-touch sport, and I think that’s absolutely true,” she said. “It’s very relationship-driven, but not just for the sake of the relationships. It’s that customer intimacy to be able to lock arms, where our engineers and our product marketing team can sit across the table from thought-leading surgeons around the world and innovate together. It’s very different from other sectors of medtech, and it takes a unique perspective and passion for this business to really embrace

Highridge Medical CEO

Rebecca Whitney

The biggest challenge facing Highridge Highridge Medical is owned by private equity firm H.I.G. Capital, and private equity firms traditionally like to exit their investments within three to five years. But that clock is ticking slower for Highridge Medical, Whitney said.

“H.I.G. Capital has multiple funds, and where we sit they actually hold these companies for quite a bit longer,” she said. “That was critically important to me, because I have a lot invested in this company and it was important to me that we had enough runway to really build this thing and create some value. I anticipate that Highridge will be private-equity-backed for quite some time, which is really good, especially for a company that’s gone through so much transition over the last 10 years. It’s been a stabilizing effect. I think you’ll see us owned by H.I.G. Capital as Highridge for the foreseeable future.”

“ MOST OF THE TIME, PATIENTS ARE NOT INCREDIBLY PLEASED WITH THEIR PROCEDURE, AND IT’S BECAUSE THE SPINE IS 26 JOINTS. THERE’S TOO MUCH ARTS AND CRAFTS THAT GOES INTO THIS, AND WITH AI AND PREDICTIVE ANALYTICS AND THIS MACHINE LEARNING THAT’S REALLY STARTING TO TAKE HOLD — NOT JUST CLINICALLY WHEN IT COMES TO SPINE, BUT IN LIFE IN GENERAL — THERE’S A TREMENDOUS OPPORTUNITY TO HARNESS AI TO BETTER INFORM PATIENT SELECTION AND TREATMENT PLANS THAT SHOULD HAVE A VERY POSITIVE IMPACT ON CLINICAL OUTCOMES.”

to be innovative. But the real leapfrog forward for us as an industry is going to be around better predicting treatment pathways and then being able to tie that to a predictive result.”

Those predictive results would be based on patient size, patient history, and massive amounts of data to compare any one patient to hundreds of thousands of similar cases to forecast outcomes based on different treatments, she said.

it and understand some of the quirks.”

And it’s not always an efficient business, with the cost of surgeon engagement, sales force compensation and the inventory needed to support surgeries.

“It doesn’t behave like any other sector, and it doesn’t even behave like hips and knees,” she said. “I spent a couple years on the Zimmer Biomet hip and knee team. It’s very different.”

Instead, when asked about the biggest challenge facing Highridge Medical as if refocuses on spine, Whitney identified herself as “a fairly impatient person.”

“Our biggest challenge is I want to do it all yesterday,” she said. “There’s so much we’re taking on and [I want to] get there as fast as we possibly can. We’ve got this unique window of opportunity where we’ve established ourselves as a nimble, relatively small, fast-growing, innovative company, and that is starting to take hold. Now it’s just making sure we don’t miss this opportunity to deliver.”

By Susan Kimmel Claricity Consulting

Tasked with gathering medical device customer input but unsure where to begin?

Elevate your customer visits with these six tips that will help you set yourself up for success, maximize the customer interaction, and capture the key takeaways.

1. Paperwork first

Start the process by ensuring that your proposed customer visit is compliant with industry and company regulations. Your legal and regulatory colleagues will have the required documents and guidance. This can include executing clinician consultant agreements that contain terms regarding nondisclosure, intellectual property, payment, and other issues.

Don’t forget to review your firm’s product experience handling processes so that you are prepared if a reportable product complaint occurs.

2. Create a core question set.

Needs assessment and product testing are the most common types of customer input sought during product development. In customer needs research, clinicians are asked broad open-ended questions about how they use current products and areas for improvement. When product testing, customers are asked to provide specific feedback on potential new products and capabilities.

Work with your team to create a core set of “must-have” questions to be covered during all interviews. You can also include a few additional questions that can be covered time allowing. Plan for questions to take 60-90 seconds each, depending on the amount of follow-up discussion required.

Avoid common pitfalls and transform your customer visits into powerful catalysts for user-inspired device design and innovation.

3. Find the right clinicians.

While it may be tempting to focus solely on frequently consulted “friendly” physicians, do your best to include the full range of clinicians who will be using the product. This includes going beyond industry key opinion leaders (KOLs).

I’ve seen major device firms spend millions of dollars designing advanced capabilities for leading academic physicians, only to watch them fail because they were too complex for most users.

4. Talk less, listen more.

During sessions, minimize the amount of time you are talking and maximize the clinician’s airtime.

If you are seeking product/feature feedback, provide clinicians with a brief written description that takes less than a minute to review. Avoid telling clinicians about your own point of view and resist the temptation to openly promote your ideas. Don’t be the entrepreneur who wastes valuable time arguing with clinicians about their views rather than focusing on understanding them.

Be prepared to redirect curious physicians who sidetrack the discussion with their own questions or going off-topic. An effective tool that helps focus the discussion is to begin with introductory ground rules that set clear expectations. This should include introducing the topic, explaining that your purpose is to listen, and warning that you may have to redirect the conversation to stay on track.

5. Dive deeper.

“Should it have a knob or a touchscreen?” is a type of question often asked. If clinicians say touchscreen, should you do it? If it’s because they

think touchscreens are cool, maybe not. If it’s because they think they will be more accurate, then it’s worth considering.

The most important feedback is finding out the underlying reasons why something is preferred. Doing this requires follow-up probes to dig into the what and why of opinions.

Some interviewers are afraid that asking follow-up questions will make them look bad or irritate clinicians. Fortunately, this rarely happens if clarifying questions are thoughtful. Helpful probes include “Tell me more about …,” “Help me understand…” and “Can you please explain ...?”

6. Document, document, document Customer feedback is only as good as its documentation. Either invite a colleague to handle note-taking, or record the session so that you can focus your attention on asking good questions. If taking notes, save time by setting up a Microsoft or Google form for inputting responses. These online forms allow you to input answers to questions in real time and output the notes into an organized spreadsheet for review.

If recording, obtain permission to audio record the conversation for note-taking purposes only. AI software can generate a cost-effective transcript of the audio, but generally requires human editing as outputs will contain some errors.

Using these steps, you can transform your customer visits into powerful catalysts for user-inspired product innovation.

Susan Kimmel is the president of Claricity Consulting and has more than 20 years of expertise in market research within the medical device industry.

From components and finished devices to the next generation of medical technologies, now more than ever, you can count on us.

Strengthen your innovation with our rapid prototyping and clinical know-how to take you seamlessly from concept to production

Get to market faster by utilizing our platform technologies and market-ready products that provide differentiated performance and portfolio expansion

Extend your reach through our global R&D and manufacturing capabilities to consistently achieve design requirements, quality standards, and on-time delivery

By Naomi Schwartz Medcrypt

The FDA’s Center for Devices and Radiological Health (CDRH) is experiencing significant workforce shortages that will affect the timely review of medical devices submitted to the FDA for review in 2025, particularly in areas requiring specialized technical expertise like artificial intelligence (AI) and machine learning (ML), wireless connectivity, interoperability, and cybersecurity.

This could put device submissions at risk of delayed or inexpert review. Understanding how the FDA’s staff works and their current workplace pressures can help device manufacturers manage these risks.

Manufacturers must account for possible extended timelines for FDA review, consider the possibility of staff cuts affecting review quality and timeliness,

A former FDA reviewer offers advice to help innovative medtech avoid new and more dangerous pitfalls.

and develop submission packages with completeness, clarity, and conciseness in mind. There are proactive steps to achieve a timely review with minimal interaction with scientific reviewers, reducing the likelihood of deficiency letters and the need for additional documentation — or worse, the need to make device design changes followed by a new round of verification and validation.

What is the FDA’s workforce like, and why does this matter now?

The FDA has historically had a high staff turnover rate. Estimates are ~8% recently, but with an average of 5-6.5% in most years. Turnover has been exacerbated by the current administration’s attempts to reduce federal employment numbers dramatically in 2025.

The FDA workforce is aging, meaning a large number of staff may be eligible for early retirement incentives, leaving a shortage in well-trained and experienced scientific review staff in the centers that oversee drugs, devices and biologics. Additionally, scientific review staff let go during a reduction in force (RIF) earlier this year and offered their positions back did not all accept the offer to return. Other staff are choosing to leave because they were offered remote roles and cannot work onsite as requested in a January executive order. All of this could mean reduced staff in review divisions despite senior leadership claiming that scientific review staff are not the targets of RIFs.

In addition to scientific review staff, CDRH employs skilled specialists in areas like microbiology, biocompatibility,

electromagnetic compatibility, wireless coexistence and AI/ML who perform critical research functions and develop regulatory science tools. The Office of Science and Engineering Laboratories (OSEL) staff researches emerging technologies to develop appropriate techniques for evaluating the risks and benefits of those new technologies. The roles of some technical staff lost their appeal due to changes in priorities across CDRH, with those employees moving on to new opportunities rather than staying at an FDA whose approach to achieving the mission has shifted during their tenure.

Dr. Omar al-Kalaa — the preeminent expert in 5G cellular connectivity — is just one notable example of the agency’s recent loss of expertise.

How can medtech manufacturers minimize the risk of regulatory delays?

Medical device manufacturers should be proactive in preparing filings by ensuring

systems are designed to achieve their intended use, performing the appropriate verification and validation activities, and documenting design and testing consistent with FDA regulations and guidance. By organizing and structuring the documentation in a consistent fashion and ensuring that each piece of evidence answers a specific question asked by FDA (through the electronic Submission Template And Resource (eSTAR), for example), manufacturers can ensure that they are checking the literal boxes for review staff, and organizing documentation to minimize the review staff’s need to search for a key element.

Especially for cybersecurity documentation, where FDA has new (as of 2023) and explicit authority to ask for detailed descriptions of design, implementation and testing, it is crucial that manufacturers provide a straightforward way for review staff to locate and confirm the presence of

requested or required elements. This minimizes the need for a specialist to review the material and reduces the likelihood of additional delays where staff availability is inadequate for expert review. While it’s obviously necessary for documentation to be complete, manufacturers should also ensure it’s concise. When describing cybersecurity controls, it’s not necessary to include a dissertation on how each control is intended to work. Reviewers want to see that you demonstrate a requirement for the control and that the implementation is validated through appropriate testing. This reduces the total amount of material that a reviewer must sift through.

How to reduce friction when a reviewer is asking additional questions If a reviewer is asking questions a manufacturer is unfamiliar with or finds confusing, it’s important to take the time to understand what they’re actually asking

CDMO / CMO Services

Minimally Invasive Device Solutions

Co-development Opportunities

Access, Delivery, & Retrieval Systems

Wire & Catheter Based Devices

Contract Manufacturing

Vascular Access Devices

Guidewires, Therapeutic & Diagnostic Braided & Coiled Catheter Shafts Class 8 Clean Room

for. Confirm whether they have appropriate expertise or if they are asking questions about a topical area they don’t understand.

If there might be a gap in understanding, try to reframe by focusing on the use cases. Walk the reviewer through the threats from a use-case perspective and where the problems arise, and then show how your controls protect in those instances.

How can we avoid this worsening in the future?

Industry should set expectations during future Medical Device User Fee and Modernization Act (MDUFA) negotiations that the FDA hires staff with appropriate skills and not just those with high-level degrees.

Today, the typical scientific reviewer is more likely to hold a Ph.D. or other doctorate than they are to hold a master’s or bachelor’s degree. In some fields, a doctorate is beneficial. In others, it may be overkill, leading to an impossible hire.

Electrical engineers, computer scientists, data scientists and similar fields often produce very skilled system analysts, designers and developers without advanced degrees doing incredibly cutting-edge research — in some instances, without any degree in that specific field at all. In these cases, what FDA needs are staff with experience and “some dirt under their fingernails,” to quote one device manufacturer product security lead, rather than people with massive research credentials but little practical experience.

FDA should get hiring authority under the 21st Century Cures Act to bring on staff with the right combination of skills, credentials, and education rather than being laserfocused on the staff fellow route.

If you’re a medical device manufacturer or a health delivery organization buying products from a device manufacturer, you need to reach out to your legislators and share your voice now. Make sure that the FDA retains highly skilled staff with the right types of experience to ensure that medical innovation and patients do not suffer.

Naomi Schwartz is the VP of services at Medcrypt and leverages over 20 years of systems engineering and regulatory expertise in advancing device commercialization.

bbott is studying deep brain stimulation (DBS) as a potential treatment for depression, taking the technology in a direction that could advance other mental health therapies.

Abbott received FDA Breakthrough Device Designation for DBS in 2022 to investigate the technology’s potential for treating treatment-resistant depression, a diagnosis for people with a major depressive disorder who have unsuccessfully tried multiple treatments.

The first patient in Abbott’s TRANSCEND (Treatment Resistant Depression Subcallosal Cingulate Network DBS) study recently had an Abbott Infinity DBS system implanted in them.

DBS systems send electricity from a chest implant through tiny leads that run up a patient’s neck and into their brain. DBS systems are already approved by the FDA for treating

epilepsy and movement disorders like Parkinson’s and essential tremor.

“A deep brain stimulator is like a pacemaker for the brain. It’s sending electrical pulses that are meant to disrupt the electrical activity,” Abbott Neuromodulation Global Clinical & Regulatory Divisional VP Jenn Wong said in an interview.

“The area that we’re targeting is thought to be involved in depression,” she continued. “… Depression represents a change for us from movement disorders into a more psychiatric space.”

As researchers home in on the exact part of a patient’s brain where stimulation could treat depression, a key technology unlocking this approach is modern tractography, imaging that models nerve tracts in three dimensions to help neurosurgeons place brain implants.

“The most important part of neuromodulation is the right patient and the right target,” Wong said.

Magnetic resonance imaging (MRI) and CT scans are used before and during the implantation procedure for accurate and precise placement of the leads in the brain.

“Whether you’re going to have a good therapeutic effect depends on how close you are to the area that you’re stimulating, so that imaging process is very important,” Wong said. “… There are patient-specific considerations for the way they access the tract. That’s where the tractography comes in, because you have to be aware of the vasculature within the brain to be accurate.”

All of the patients in the study will have the Infinity DBS system implanted, but some will not receive any stimulation therapy for the first 12 months. After the first year, all patients will have their devices activated. That’s one reason the randomized, double-blind trial uses Abbott’s non-rechargeable Infinity DBS system rather than the rechargeable Liberta RC DBS system.

“An important aspect is making sure the patients don’t know if the stimulation is on or off, and if we had a rechargeable, that would be a little bit more challenging to manage,” Wong explained.

Researchers at the Icahn School of Medicine at Mount Sinai placed the first implant for the TRANSCEND trial.

“ BECAUSE DEPRESSION CAN AFFECT ANYONE AT ANY POINT IN THEIR LIVES, WE WANT TO MAKE SURE OUR ENROLLMENT IS REFLECTIVE OF THE U.S. ADULT POPULATION AND INCLUDES A BALANCED REPRESENTATION OF MEN AND WOMEN ACROSS THE NATION WITH DIVERSE BACKGROUNDS.”

Patient selection is critical to find those that are likely to benefit from DBS, Wong said. That’s one factor that may be responsible for the failure of previous studies into DBS for depression.

Abbott is only opening the TRANSCEND study to patients who have failed at least four different depression treatment approaches, but is aiming for a broad spectrum of patients.

“Because depression can affect anyone at any point in their lives, we want to make sure our enrollment is reflective of the U.S. adult population and includes a balanced representation of men and women across the nation with diverse backgrounds,” Wong said.

Another potential factor for the failure of previous trials is that they may not have been long enough. Abbott’s multi-center TRANSCEND trial will evaluate DBS therapy for patients with over 36 months.

Patients “need to be able to agree to and maintain a fairly regimented schedule for check-ins with the trial team,” Wong said. “We want to monitor and track progression on a regular basis over the course of three years, which is a significant commitment for most people to make.”

Mount Sinai’s Nash Family Center for Advanced Circuit Therapeutics founder Dr. Helen Mayberg pioneered the science behind DBS for treatmentresistant depression, Mount Sinai said in an announcement of that first implantation.

“She is credited with identifying the subcallosal cingulate as a signaling hub for depression in the brain and discovering that modulation of this brain area can help alleviate depression symptoms,” Mount Sinai said. “Previous research, much of it pioneered by Dr. Mayberg through independent, single-arm, open-label, grant-funded studies at several leading academic research institutions and for the past seven years at Mount Sinai, has shown sustained improvement in symptoms of depression.”

If the TRANSCEND study is successful and the therapy passes regulatory review, doctors will have a new option for treating some of the toughest depression cases.

“For physicians, the most important thing is for them to have the range in their toolbox to work with those patients, especially because not only

are there compliance concerns with drugs, there are also side effects for those drugs, especially over the long term,” Wong said. “Patient tolerance of different side effects may drive a preference for more surgical options.”

The factors that make DBS appealing for treating depression extend to other potential applications.

“The thing about DBS is because it is something that’s permanently implanted, it’s well suited for these chronic diseases where people have a lot of suffering over time,” Wong said. “That’s something that we also noticed about depression and why we’re focused on treatment-resistant depression — also called difficult-to-treat depression — because these patients spend a lot of time trying other therapies that tend to have more of an acute effect.

“That’s the way that I would look at different patient populations that are eligible for DBS in the future,” she continued. “Which patients spend a long time focusing on their disease and the symptoms over their lifetime, and is that an opportunity for DBS to make a difference?”

Wong said she and her team are monitoring other studies into chronic pain and anxiety-driven disorders like obsessive-compulsive disorder.

With researchers learning more about the different targets in the brain and the needs of patients, she said, “the door is open.”

Abbott Neuromodulation

Global Clinical & Regulatory Divisional VP Jenn Wong

At Aptyx, we specialize in solving complex challenges. Across demanding markets such as interventional, robotics, and more, our engineering firepower and integrated capabilities turn “can’t be manufactured” into “commercialized at scale.”

Powered by people, driven by purpose.

What sets us apart is more than what we make. It’s how we work: fearless problem solving, unmatched collaboration, and experts who bring hands-on excellence every day. For our partners and our people, that means doing meaningful work with a team that delivers.

THow medical device companies can lead the move from PFAS

The medical device industry can take steps right now on PFAS for safety, sustainability and to steer other industries in the right direction.

here is a growing awareness and concern in the medical community around the use of per- and polyfluoroalkyl substances (PFAS). Certain chemical properties of PFAS like durability, stiffness, biocompatibility, and resistance to water and temperature are beneficial for use in medical devices. Unfortunately, these same properties turn PFAS into “forever chemicals,” so named because they do not break down easily in either the body or the environment. Exposure to PFAS is linked to chronic human health effects including cancers and organ and tissue damage.

While there isn’t significant federal regulatory pressure on the medical device industry right now, it is all but inevitable in the future. Furthermore, increased conversation around the issue will prompt customers and patients to demand change. Better to begin now before the issue intensifies. But how?

Challenges facing manufacturers

Let me back up a bit. I have experience managing PFAS across a variety of sectors and industries. I’ve worked in government, energy, transportation, and the commercial and industrial sectors.

Why can’t companies simply replace PFAS-containing materials with other less hazardous alternatives? If only it were that simple. There are alternatives on the market — such as medical-grade silicone — but none have completely replicated the performance properties of PFAS used in many medical device applications. Some even come with their own safety concerns.

And yet, regulatory updates that may be enacted over the next few years will propel change for the medical device industry. While there has been relatively limited federal movement on PFAS regulation, actions are emerging in nearly two dozen states, including California, Maine, Minnesota and New Mexico.

This is further complicated by the regulations around medical devices writ large, as even minor changes to device components can trigger extensive, multiyear FDA reviews, increasing costs and delays. Decisive actions must be taken quickly, a tricky imperative when the path forward appears hazy at best.

While there has not been a comprehensive replacement strategy for PFAS usage in medical devices to date, there are several steps medical device companies can take.

One of those steps is a material audit to identify non-essential PFAS uses. This process focuses on function and fit-for-purpose by finding lowhanging fruit where alternatives can be implemented with minimal impact, such as adjusting the adhesive or absorbent pad on a bandage. This may be a halfmeasure, but it demonstrates that a company is taking the issue seriously.

Another way to make progress in the eventual move away from PFAS is investing in research that tests and validates PFAS-free materials. Other industries have done this successfully. For example, outdoor brands that traditionally used PFAS-coated materials for water repellency and durability have switched to PFAS-free treatments for their fabrics while reporting no performance loss.

The medical device industry has made some progress in research already, with several PFAS chemicals phased out entirely. Still, there’s plenty of work to do. For example, polytetrafluoroethylene (PTFE, a kind of PFAS) remains vital for the function of catheters, surgical implants and other key medical devices.

Perhaps most important is to collaborate with manufacturers and other industry partners. Meet with industry associations, regulatory bodies and stakeholders to share knowledge

and move forward on safer alternatives. This drives progress and is vital for demonstrating transparency and cooperation, particularly with regulators.

This has worked previously to drive sustainability in the pharmaceutical industry. The Pharmaceutical Supply Chain Initiative (PSCI) was established over a decade ago and has made industry-wide improvements, like creating the PSCI Code of Conduct setting supplier standards for sustainability, safety and labor rights.

The road toward an eventual resolution will be long and difficult. But this opportunity to improve safety and sustainability in medtech while encouraging other industries to adopt similar measures can improve the health of the entire country. In the healthcare industry, there is no better reason to make a change.

Shalene Thomas is the emerging contaminants program manager for Battelle, where she drives technology investments as well as service offerings for Battelle’s growing PFAS and other emerging contaminant programs.

BY JIM HAMMERAND MANAGING EDITOR

BAXTER CHIEF OPERATING OFFICER HEATHER KNIGHT LOOKS BACK AT THE CRISIS AFTER HURRICANE HELENE AND SHARES LESSONS ABOUT LEADERSHIP, EMERGENCY MANAGEMENT AND SUPPLY CHAIN RESILIENCY.

Three days after catastrophic flooding inundated Baxter’s North Cove manufacturing plant in Marion, North Carolina, Heather Knight waded through knee-deep mud and water inside the dark and damaged facility.

“I couldn’t see the hand in front of my face,” Knight recalled in a Medical Design & Outsourcing interview. “The power’s out. It’s pitch black, and you’re just trying to feel your way through what you know is a hallway and a cafeteria and an education center.”

The 1.4 million-square-foot facility is Baxter’s largest manufacturing plant in the U.S. It produces 60% of the domestic intravenous fluid supply, shipping out about 1 million units (or 90 truckloads) per day. Ahead of the storm, employees moved product to the facility’s high bays as a precaution, but nobody expected the remnants of Hurricane Helene to be so destructive.

Flooding from the remnants of Hurricane Helene took Baxter’s North Cove manufacturing plant offline in September 2024, triggering a nationwide shortage of IV solution products. But the plant would soon resume limited operations as crews cleaned and repaired equipment.

Photos courtesy of Baxter

“This was unlike anything that this team had ever experienced in this part of the country,” Knight said.

Helene and smaller rainstorms just ahead of it dropped an estimated 40 trillion gallons of water on the eastern U.S. in September 2024. Nowhere got more rain than the 30.8 inches in Busick, North Carolina, just 12 miles southwest of Marion.

The probability of that much rain over three days is less than 1 in 1,000 in any given year. The unprecedented precipitation and hurricane-force wind gusts caused flash floods, landslides, debris flows, and more than 100 fatalities in North Carolina alone.

Running along Baxter’s North Cove plant, the North Fork Catawba River swelled to a record river crest, beating the previous high-water mark by 3.6 feet. The floodwaters swept homes away, breached a levee upstream and destroyed bridges

leading to the plant, including the span connecting it to U.S. Highway 221 on the other side of the river.

“I’ve been in healthcare 32 years and running global businesses for half my career. I’ve never seen anything like this,” said Knight.

Inside the plant, damaged pallets and boxes of products were breaking and collapsing in the muddy waters.

“You could hear them falling around you, but you couldn’t see,” she said. “Things were not stable in the facility, and it became clear this was going to have an impact on U.S. healthcare.”

The initial response

With nowhere else to go, many employees showed up to the plant the Monday after the storm as Knight and her team surveyed the damage.

“We had to focus on the community and our people, what was going on with the plant, and then how that was going to impact supply,” Knight said. “… In those first 24, 48, 72 hours, there was a real acute need for basic necessities: food, water, showers, washers, dryers, all the things you need to support a community. And because there were a lot of access issues, we were one of the first — if not the only —

on the ground serving the community at large. We weren’t turning people away.”

Phone lines and cell service were down. Employees went to each other’s homes to check on each other. It would take three weeks to account for all of the plant’s 2,500-some employees.

At the same time, Baxter warned its hospital customers and government agencies — including the FDA, FEMA and the Administration for Strategic Preparedness and Response (ASPR) — of the imminent supply shortage. The company activated its other plants around the globe to import product, and temporarily halted all shipments from North Cove to take stock of the site’s remaining inventory.

“It was first, stop and pause,” Knight said. “Let’s just assess where we are before we let any more product go out the door, and then start to put in place a fair-share allocation based on historical utilization.”

Transparent, open communication with customers was key, Knight said, with regular updates posted to Baxter’s website instead of individual emails or calls for every new detail. But every day, Baxter was in touch with the federal government to discuss product shipments and utilization rates.

Recovery and reset

Baxter employees came from as far as Switzerland to assist the recovery effort. Engineers built a temporary bridge from metal pylons and rocks found on-site to let trucks start shipping usable product.

“When that first truck went over, we were cheering and hooting and hollering,” Knight said.

Workers used toothbrushes, cotton swabs and fine rags to clean the plant’s equipment before rebuilding it, isolating and focusing on the high-speed lines first.

One 72-year-old retiree who helped open the plant more than 50 years ago returned to help with the recovery, Knight said, while other employees who came from afar stayed in the homes of locals.

“People stepped up,” Knight said. “… People who lost a lot: their homes, their cars, a number of people lost family members. Some were multigenerational employees of our facility and showed up every day to help each other and to recover the plant because they knew the impact it had on healthcare.”

Within three weeks after the storm hit, Baxter had moved more than 450 truckloads of product from the site. With the FDA’s permission, Baxter ramped up production at plants in Canada, China, Ireland and the U.K. for importation.

By the end of October, Baxter restarted North Cove’s high-speed line, which represented a quarter of the facility’s production before Helene. The second line restarted in mid-November, bringing the facility up to 50% of its prestorm level. By the end of 2024, eight of the plant’s ten lines were up and running.

While production was coming back online at North Cove in late 2024, Baxter flew nearly 18,000 tons of IV products into the U.S. That’s equal to more than 200 Boeing 747 aircraft, and Knight credited the federal government for helping successfully pull off the IV airlift during the busy holiday air cargo season.

“They had some amazing whizzes at air traffic and airflow that were instrumental. I don’t think we could have done that on our own,” Knight said.

The last two North Cove lines restarted in January 2025 and the

plant was back to its pre-hurricane production levels in February. By August 2025 — nearly a year later — the FDA officially declared an end to the IV saline solutions shortage.

Baxter estimates the recovery took more than 2.5 million hours of labor.

“We said we will spare no expense and no resource available, and we didn’t,” Knight said. “It was financially very, very costly for the company, but we did what we did with speed, and we didn’t spare any expense to make sure patients were taken care of. I’m super proud of that. As a business leader, you hope that in a time of crisis it’s not about profits, it’s about the patient. And this crisis, for me, really proved that.”

“My job in this was to help people believe that there was going to be another side of this, that we were going to get through it and believe in the plans,” she later continued. >>

Baxter Chief Operating Officer Heather Knight said regular communication with government agencies expedited the construction of temporary bridges to the North Cove site.

Baxter’s North Cove plant produces about 60% of the nation’s IV solution supply.

Baxter built a temporary bridge to allow trucks to access its North Cove plant and start shipping out product that had not been damaged in the flood. Baxter flew nearly 18,000 tons of IV products into the U.S. while production was coming back online at North Cove in late 2024. Photos courtesy of Baxter

“When we said our high-speed lines are going to be up in four weeks as we were remediating the plant, [some] people in the market said it was going to take us a year. No, we have a good plan. We’re going to execute the plan. If it’s not four weeks, maybe it’s five, but this is the plan, and we’re going to go through it.”

Lessons learned

Puerto Rico’s Hurricane Maria in 2017 informed Baxter’s emergency response plan. Like all of Baxter’s facilities, North Cove was equipped with generators and satellite phones. Baxter also offers relief funds for employees experiencing personal hardship or disasters.

But before Helene, this part of North Carolina was considered a “climate haven” because global warming seemed more threatening to the coasts and drier regions. In fact, the water purity from the local aquifer is one of the reasons the IV solutions plant was built there.

“You have to think of not just

hurricanes, but tornadoes or extreme rain events or mudslides,” Knight said. “… It’s hard to imagine a lot of places being completely immune to it. It feels like every corner of the Earth is touched by extreme weather at this point. It’s always a conversation as we think about new plants and new infrastructure. … We’ve spent a lot of time on enterprise risk management, knowing weather just continues to get more extreme.”

Baxter is still debriefing with customers to identify successes from this crisis and areas where there’s room for improvement. Knight said Baxter’s supply chain technology and automation investments offered visibility into the situation and options to respond quickly.

“We weren’t trying to build that on the fly,” Knight said. “We already had the information to know how we were going to flex our manufacturing footprint.”

That also allowed Baxter to keep federal officials updated, decide how to allocate the limited output, and

correct misinformation.

“Everybody thought the government has a stockpile of this, and there isn’t. There’s not a stockpile of IVs,” Knight said. “There’s been a lot of education through this because people expected there is a safety net in place. And it has changed how we work with our customers around supply chain management and those things that are really vital and critical to healthcare.”

In February, Knight was promoted from her role as EVP and president of the medical products and therapies group (Baxter’s largest segment with $5.2 billion, nearly half of the company’s total 2024 revenue) to EVP and chief operating officer.

“I learned a lot about myself, about my leadership resiliency and how to lead a broad, cross-functional team in a time of crisis,” Knight said. “I don’t think many leaders get an opportunity like that, and it’s not anything I would wish on anyone, but I learned a lot about myself and my team. I’m really proud of them.”

BY KAYLEEN BROWN MANAGING EDITOR — DEVICETALKS

LEADERS FROM MEDTRONIC, INSULET AND MORE TAKING ACTION IN THE FACE OF POLICY AND ECONOMIC CHALLENGES OFFER TOOLS FOR OTHERS TO DO THE SAME.

The medical device industry is facing unprecedented pressures, straining our ecosystem to the point of breaking. Supply chain disruptions continue to impact the availability and cost of critical components and devices, creating uncertainty in production and delivery timelines. Compounding those issues are worldwide healthcare labor shortages, which slow the adoption and ultimately the

implementation of new technologies. Shifting U.S. policies are impacting reimbursement and market access as regulatory uncertainty intensifies with structural changes at the U.S. Department of Health & Human Services and its agencies. Diversity, equity, and inclusion (DEI) rollbacks are compromising efforts to achieve more representative workforce and clinical trial populations.

“We have tariffs, the biggest changes to the world trading system since 1947,” former Philips VP and GM Heather Hudnut-Page said during our Women in MedTech Breakfast at DeviceTalks Minnesota in June. “If those tariffs all hit, it could increase the cost of care by more than 15%.”

How are leaders expected to lead in these uncertain times? That was the question facing Hudnut-Page and four panelists: Insulet SVP of Global Commercial Capabilities & U.S. GM Carolyn Sleeth, Medtronic CRM Marketing Communications VP Ravyn Miller, Patient Square Capital Operating Executive Ellie Humphrey, and The Bailey Group CEO Ann Houser. >>

“As we see government departments completely shut down, we see funding for healthcare shut down, we see grants going away, I think some businesses are seeing license to be a bit more mercenary in the work they’re doing,” Houser said. “The result may be doing things like mass layoffs, return-to-work edicts. … I’m seeing these extremes in our society that we’re dealing with, and some extremes in business, and that leads to leadership behaviors that feel a bit more extreme.”

The panelists offered advice to larger organizations.

“The uncertainty today, whether it be tariffs or what’s going to happen with Medicaid, is just making that mismatch between those who need investment and those who can provide investment even worse,” Humphrey said. “You’re seeing kind of a paralysis, to a certain extent. If you’re at a big company, that means you’re going to have to be really creative on deal structures to find some of those unique opportunities that, in the past, you could just pay with your stock.”

“Don’t panic,” Miller said. “As these new things are getting interrupted, give yourself enough time to understand and contextualize what’s actually happening. As you do that, you see the thing starts to settle down.”

From reaction to pro-action, the panelists suggest that these unprecedented economic challenges can also create opportunities.

“We just hosted one of our largest conventions in the world. China did not come out of fear. Canada did not come out of principle,” Miller said. “… So what did we do instead? We made a decision that if our customers don’t feel comfortable coming to us, we will go and visit our customers. This is an opportunity for us to lean in and hear our customers differently perhaps than what we have before. How are they understanding the market? How can we find mutual benefit and then move forward towards execution together? And thus far, it’s proven to be very beneficial.”

“Ten thousand HHS roles have been eliminated, 300 CMS roles, 3,500 (or 20%) of the FDA, which could impact timely approvals for big companies and startups, and especially those startups

who are dependent on hitting milestones to continue their investments,” said Hudnut-Page. “And then big cuts to NIH and NSF will affect foundational research that we depend on as we work within the medtech space.”

These recent developments, plus EU MDR requirements and potential policy shifts, have introduced new complexities for medtech companies as changes to healthcare coverage, like Medicaid, have compromised patient access to care.

“We have to be very, very patientoriented because diabetes is actually quite a consumer business,” said Sleeth. “I’ve got to think about how else I might get my diabetes medical products covered. And thinking through that entire patient journey and saying, ‘Where are the moments that we could help that maybe we weren’t thinking about before?’ Because it’s the entire experience, not just the product we’re selling.”

Restructuring, cutbacks, changes to policy and coverage, and more have brought uncertainty to medtech companies at all stages of fundraising.

“What you’re going to be facing in a small company is the really ruthless decisions about your ability to raise capital to fund your innovation,” Humphrey said. “You’re going to have to be ruthless about prioritization. … If you don’t, you’re going to have significant capital constraints and potentially liquidity crises. … The last thing you want … is to be in a crisis that makes you vulnerable to somebody coming in and effectively taking your company out from underneath you at a cheap price.”

Adding to Humphrey’s point, Miller said, “There’s now the opportunity to talk about radical prioritization. What are the must-dos in the company in order to still maximize our impact across the world? And what are some things that we need to trade off? … It gives us a chance to check back in with our strategy to say, ‘Is this sustainable, or is this where we need to make some tweaks? Do we need to continue to do things offshore? Is there an opportunity to bring local manufacturing? Is there a way for us to design our way out of this because we were looking at new components anyway?’”

The panelists also had advice for those at the end of their funding journey.

“If you’re at a mid-sized company and you’re looking for an exit or a sale, you’re

Hear honest talk from medtech leaders about what it takes to grow, lead, and stay grounded in this industry at Women in MedTech Breakfast events during all of our DeviceTalks shows and on the Women in MedTech podcast. Go to devicetalks.com to learn more and follow me at linkedin.com/in/ kayleenbrown for the latest updates.

“THE TOP QUARTILE FOR GENDER DIVERSITY ON EXECUTIVE TEAMS ARE 25% MORE LIKELY TO HAVE ABOVE-AVERAGE PROFITABILITY. ETHNICALLY DIVERSE COMPANIES ARE 36% MORE LIKELY TO OUTPERFORM COMPETITORS.”

going to have to be patient,” Humphrey said. “You’re going to have to be seeing those complicated deal structures and understanding you’re probably going to have to take on more risk than you might have had to in the past.”

Diversity, equity and inclusion

“The top quartile for gender diversity on executive teams are 25% more likely to have above-average profitability,” Hudnut-Page said. “Ethnically diverse companies are 36% more likely to outperform competitors. We also know that the FDA is removing the diversity requirement in many of their clinical trials, which we need to get approval.”

Equity is increasingly politicized, and with federal cutbacks, making access to information and health challenging, the panelists shared how their organizations are responding.

“At The Bailey Group, we are big fans of DEI, and we’re still doing it because it resonates with our beliefs and values. I think organizations should try to be as true to their values as possible,” said Houser. “And oftentimes, I think they may find that their values have an underpinning in DEI.”

Sleeth said it is “an absolute imperative that our sales team represents our customers … and the marketing teams and the product development teams are listening to folks, listening to our field and saying, ‘What is it this patient needs?’ A patient living in the Bronx is going to be very different than a patient living in Sacramento Valley.”

“And if we don’t have people … thinking differently with a different set of experiences, mindset, and bringing that forward, you’re not going to get the most innovative solutions,” she continued. “We continue to prioritize inclusion and diversity to make sure we’ve got that.”

Miller cited a study reported in the American Scientific Journal that found diverse teams don’t make the same assumptions as homogeneous teams.

“And because of that, we have not

shifted, we have not changed,” she said. “We are still going to move forward with that because it impacts patients’ lives.”

Talent is the most important factor for a company’s success, Humphrey said.

“Scour every corner of every part of the world to find the best talent,” she said. “The data is so clear about the value of diversity and how much better diverse companies perform. And I think the key is to remember that progress isn’t linear, and we’ve made so much progress on this dimension over the past 20 years, and to not let us be deterred. We need to stay focused on why we’re doing this, which is to get the best talent, produce the best results. Whether it’s at Patient Square, whether it’s with any of our over a dozen portfolio companies, nobody is backing off. You’ve got to recognize that you can’t be bullied into doing something that isn’t the best thing for you and your customers and your patients.”

Leading fearlessly

We will always face uncertainty, and a fearless leader doesn’t wait for volatility to pass. They know disruption is the norm, but they lead anyway. These fearless leaders shared how they communicate operational changes and decisions internally.

“Communicate honestly, communicate openly, and communicate often,” said Houser. “Give people space to process what’s going on and to stay on top of the changes.”

Miller offered up what she calls the Five Cs.

“The first is to contextualize. Contextualize the situations that we’re facing so people are very clear about what this is and what this isn’t,” she said. “The second is criticality. Who are the critical people who need to hear the critical message … and what is the critical action that they need to take? Three and four go together: candor, concise. People like candor. They trust you. They rely on you. It builds credibility. But keep it concise. And finally, communicate whatever channel that is.”

“Those five Cs have served us well,” she continued. “It has served us with retention. It has served us with people doing the right thing at the right time for the right outcome.”

Humphrey offered two more Cs: courage and conviction.

“It’s up to all of us to decide how we’re going to behave in an environment of change and uncertainty and how we’re going to show up to our teams and our companies, how we’re going to show up in our communities,” she said.

The panelists end the conversation by sharing hard-won advice on how best to lead teams for better outcomes.

“I’m a huge fan of positive intelligence and positive psychology, the premise being that the more positive we can be, the more we see opportunity, the more we have good results,” said Houser. “… [Ask yourself] what actions do you want to take so you can be that best version of yourself 10 years from now.”

Said Humphrey, “We run a company with efficiency and integrity and don’t compromise on compliance or cut corners. Staying focused on the original purpose and how we’ve created value for decades in this industry, those are the things that are going to continue to create value in the future.”

Sleeth said she’s constantly telling her team, “You’re my eyes and ears. I rely on you. I want to listen to you and make sure you feel heard and valued. We’re going to get a lot better information, and we can move forward with confidence and conviction.”

But for the person leading the team, Sleeth said, “Manage yourself. That self-care really helps you to be able to step forward.”

Listening more often with empathy is a winning strategy for Miller’s organization, she said.

“Our superpower is our authenticity,” she added. “We don’t need to be anybody else. Nobody else is trying to be us. And as we do that, we will see the best of our work, which then proves to be the best for our patients.”

“Stay true to the moral compass of your company and stay true to yourself through authenticity,” Miller continued. “Those two things will guide you through any challenge and elevate all opportunities.”

From design to finished device, we help bring life-enhancing medical devices to market faster, smarter, and with the quality patients deserve.

BY DANIELLE KIRSH SENIOR EDITOR

PERCENTAGE OF WOMEN IN MEDTECH C-SUITE POSITIONS

Seven years of data show that the growth in the percentage of women in executive roles is rising slowly.

Composition refers to the number of women in leadership roles as a share of the total number of executives within a certain company.

OUR ANALYSIS OF MEDTECH BIG 100 COMPANIES SHOWS MORE WOMEN IN C-SUITES AND NEARLY DOUBLE THE NUMBER OF CEOS COMPARED TO LAST YEAR, YET WOMEN REMAIN CONSIDERABLY UNDERREPRESENTED IN MEDTECH LEADERSHIP.

AMedical Design & Outsourcing analysis of Medtech Big 100 companies’ online leadership pages shows women held 26.5% of the 913 leadership roles listed, with each company averaging a C-suite composition of 26% women.

Those numbers are up more than two percentage points from 2024, when women held 24.4% of executive leadership roles.

At this rate of 2 percentage points a year, medtech won’t reach a 50-50, menwomen parity among its highest leadership

levels until we’re nearing the 2040s.

“While it is always encouraging to see a positive trajectory, at this rate, frankly, it will be a very long time before there is anything close to parity or representation of the patients being served,” Yvonne Bokelman, executive director of MedtechWomen, told MDO. “We should want to do better.”

The number of women in CEO positions nearly doubled year-over-year as well, with 13 women leading some of the largest medtech companies in the world.

Bokelman, though, noted that women remain significantly underrepresented among CEOs, too.

Here are the 13 women-led medtech companies and their CEOs:

• Accuray: Suzanne Winter

• Ambu: Britt Meelby Jensen

• B. Braun: Anna Maria Braun

• Barco: An Steegen

• Fresenius Medical Care: Helen Giza

• Highridge Medical: Rebecca Whitney

• Insulet: Ashley McEvoy

• Integra LifeSciences: Mojdeh Poul

• Masimo: Katie Szyman

• Merit Medical Systems: Martha Aronson

• Novocure: Ashley Cordova

• Paul Hartmann: Britta Fünfstück

• Si-Bone: Laura Francis

The underrepresentation trend isn’t isolated to medtech. It’s true for corporate leadership in general.

Catalyst, a nonprofit focused on driving change for women in the workplace, reported women held 10.4% of CEO roles and 33% of board seats across the Fortune 500 in 2024. Fortune’s 2025 list counted 11% women CEOs. McKinsey has found that women fill about 30% of healthcare executive roles but only 15% of CEO positions, leaving medtech slightly behind pharma and biotech at the top job, while near the same level in the C-suite.

Slow gains in the C-suite

Said MedtechWomen’s Bokelman: “I believe the growth we are seeing is partially due to deliberate hiring practices, although anecdotally, that is reportedly feeling more fragile and uneven in some areas.”

Women are better represented in some leadership tracks than others. Liz Moyles, global medtech and healthtech executive recruiter at U.K.based Guided Solutions, told MDO that women are often found in support positions and less often in operational executive positions.

“You tend to find a lot of women in roles like clinical and regulatory, and in marketing and sales. Fewer move through finance, operations, or R&D, which are common pathways to the corner office,” Moyles said.

Integra LifeSciences had the highest percentage of women in C-suite roles

at 55%, including Poul, who became CEO in January. The company’s board of directors also has women holding an equal number of seats as men.

Just five companies in our analysis reported having closed the gender leadership gap, with more than half of executive roles being held by women: Arjo (55%), Getinge (50%), Johnson & Johnson MedTech (50%), Royal Philips (50%), and Solventum (50%). In 2024, only one company (Ambu) reported having women in half of all C-suite roles.

“Institutional commitments where they recognize the value of a balanced leadership team are positively contributing, as well as the growth of women in middle management and other leadership levels, providing an increasing pipeline of qualified candidates,” Bokelman said.

Four companies had no women in executive leadership roles shown on their websites this year, including Alphatec, Bruker, Medacta, and OrthoPediatrics. Women also hold a less-than-average number of seats on the boards at three of those companies: Alphatec (11%), Medacta (20%), and OrthoPediatrics (9%).

In 2024, three companies — Alphatec, Demant and Medacta — reported no women in top leadership roles. The situation is an improvement from the seven companies with no female executives in top roles in 2023 and 14 in 2022.

“I do expect incremental increases to continue, but we need to continue to provide the structure for growth and hopefully acceleration,” Bokelman said.

What will drive acceleration?

Whether medtech can sustain or accelerate the pace of change will depend on how companies approach succession planning, policy support and sponsorship of female talent.

“The big difference makers include mentorship and intentional sponsorship for senior leaders, deliberate succession planning, more access and movement into operational roles that include P&L and commercialization, which can lead to CEO roles, focused training, and continued networking and visibility,” Bokelman said.

Several companies setting the pace in female leadership also back it with workplace policies. For instance, Getinge offers a global family leave

program that provides all employees — regardless of gender — with 16 weeks of paid parental leave and an additional four weeks of paid caregiver leave for ailing relatives, extending to birth, adoption or surrogacy cases.

Similarly, Integra LifeSciences offers paid parental leave, backup daycare support and flexible benefits and health coverage for working parents.

Industry groups have also launched initiatives aimed at women in medtech, ranging from networking associations to leadership development programs. Some of the more notable groups include MedtechWomen, MedTech Color, MedExecWomen, and Stripes.

“Other potential impacts which could add to the growth are the technological advances in medtech, consumer-centric focused products, and the growth of the FemTech market, allowing opportunities for more female executives,” Bokelman said.

Said Arvita Tripati, an advisor at The Batchery, a Silicon Valley group of veteran medtech investors, advisors, and mentors: “The momentum in women’s leadership in medtech will only accelerate from here. More women in leadership roles means more women supporting women — as mentors, as role models, as advocates for workplace equity, and as much-needed forces in the industry.”

DeviceTalks Managing Editor Kayleen Brown contributed to this article.

Director of Business Development Aptyx

Samantha Wagner is Director of Business Development at Aptyx, where she bridges integrated experience in engineering, clinical research, and business development. She began as an R&D engineer at Medical Murray, focused on class II and III cardiovascular devices. Today at Aptyx, Samantha plays a key role in supporting clients and guiding MedTech devices toward market success. She is driven by a belief that precision engineering and true collaboration – among engineers, clinicians, and innovators – are essential to delivering better outcomes. Inspired by her family’s history with heart health and her early work in pediatric cardiology, Samantha remains committed to advancing solutions that are both innovative and life-changing.

What initially attracted you to the medtech industry? How has your perspective on the industry evolved over the course of your career?

I was initially drawn to the medtech industry because of a combination of patient impact and innovation. I come from a family with a history of heart health issues, so cardiovascular disease has always been personally meaningful to me. I started out studying biomedical engineering with plans to go to medical school, but I discovered that developing cardiovascular devices offered another way to make a difference and intervene earlier at the innovation level rather than directly in the clinic.

As I moved into customer-facing roles, my perspective on the industry broadened. I’ve come to appreciate that bringing a device to market is challenging in stages: innovating novel technology, securing regulatory clearance, and ultimately ensuring it reaches patients through commercial and clinical adoption. Success at each of these stages requires strong collaboration, and I’ve grown to value how interconnected the medtech community is. Engineers, clinicians, and commercial teams all play a role in driving meaningful impact. I’m excited to see that collaboration continue to expand, enabling more innovations to reach the patients who need them.

In your opinion, what areas or applications within medtech have the greatest potential for growth and innovation? Why are they promising?

Pediatrics is a huge area of need and potential. I started my career in pediatric cardiology, so it’s also close to my heart. Devices are generally designed for adults, then adapted for children off-label because pediatric-specific solutions aren’t available. That’s finally starting to change.

One especially exciting direction is implants that can grow or expand with the patient, so kids don’t need as many surgeries in their early years of life. Pair that with advances in minimally invasive access, and you can see the potential for better outcomes with a lot less burden on patients and families.

From a broader perspective, how do you see the role of medtech engineering in shaping the future of healthcare? What impact do you anticipate it will have on patient care and outcomes?

At its core, medtech engineering is about turning ideas into meaningful and impactful solutions for patients. I think that’s exciting. With smaller devices, more accurate navigation, less invasive procedures, and increased personalization all on the horizon, the possibilities are endless. We’ll see all kinds of improvements – shorter recoveries, expanded patient populations served, and overall better patient outcomes. I’ve never been more optimistic about the role that medtech engineering gets to play.

For the rest of Samantha Wagner’s insights, visit www.medicaldesignandoutsourcing.com/women-in-medtech

Sr Engineering Manager (Transfers and New Products)

Confluent

Medical