3 minute read

Insights

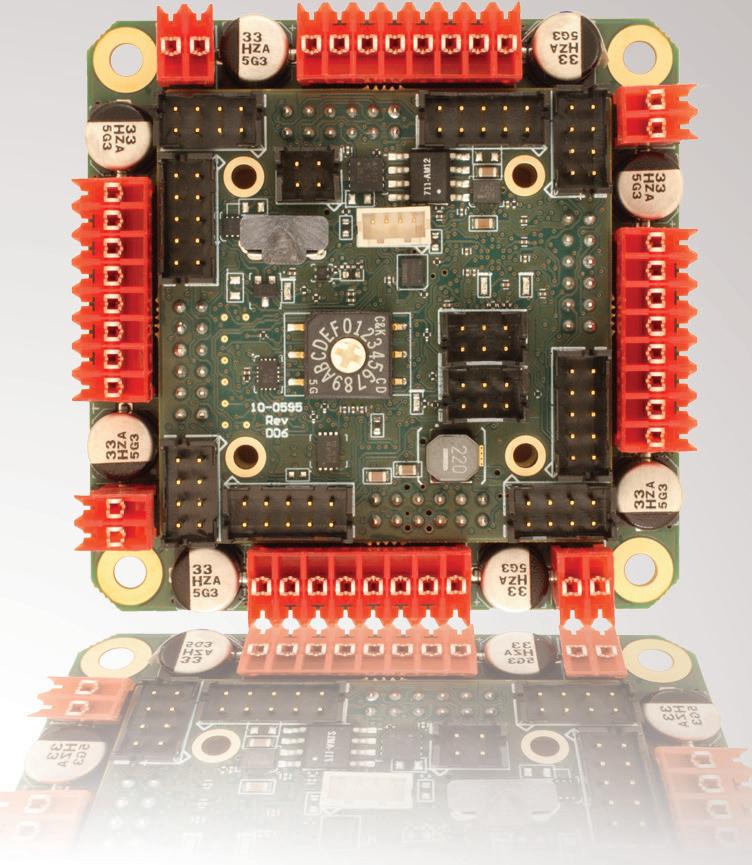

NEW!

4 AXIS SERVO

from

2.25”

- brushed or bldc motors - 5 amps per axis - 16 analog inputs - 16 on/off drivers - home and limit in - live tech support - made in the USA

See the EZQUAD SERVO in action!

WWW.ALLMOTION.COM (510) 471-4000

30097 Ahern Avenue Union City, CA 94587

Technical Support (408) 460-1345

Insights

How to manage in an uncertain economy

A er a full 15 months of being homebound, it was exciting — and a little daunting — to take my fi rst business trip since the COVID-19 pandemic began. But it was great to see other fully vaccinated people meeting and networking at the NAHAD Annual Convention in Scottsdale, and wonderful to feel even a little bit of a return to normalcy. One of the standout speakers there was Connor Lokar of ITR Economics, who talked about the current economy and how companies can manage the business in these strange times. Lokar, who shared largely positive economic news, explained that 2021-2023 will be growth years, and the acceleration of the last six months is going to continue. The supply chain and infl ation are most American manufacturers’ biggest concerns right now, and Lokar noted that industrial markets are red hot — and accelerating past some of the lagging markets, such as non-residential construction, oil, gas, and commodities. He said that 2021 will be a year of recovery and business cycle rise, 2022 will be a transaction to the backside of the business cycle, and 2023 will be a year of expansion, but at a slower pace

Beyond that, here are a few longer-term things he suggested we all keep in mind: • Over the next eight or nine years, the United States is going to keep kicking the can down the road. We’re going to keep managing infl ation. We’ll probably keep the printing press going and just keep kind of throwing money at things. A er many years of that, things will catch up to us around 2030, with a huge down-turn. • ITR thinks there’s a recession risk for the 2025-2026 timeline. But starting around 2030, it’s going to be two to four years of general downside before we pick up the pieces. Part of the reason is that, looking at actuarial projections, half of baby boomers will have passed away by 2036. That will decrease some cost pressure om the U.S. government’s perspective and allow it to move in a more growth accommodating direction in terms of spending. • The ability to hire, train and retain is going to be the biggest competitive advantage in this economy over the next fi ve years. Those that have the talented workers and can keep them will succeed. Alternatively, invest in automation and spend where you can, to wipe out your productivity bottlenecks.

On the talent ont, Lokar stressed that it is only going to get harder — there’s no surge of folks coming in who are going to want the positions that you’re trying to fi ll. Manufacturers will be struggling to fi nd higher-end talent for the next several years. So now’s the time to start fi guring out an action plan. DW

Paul J. Heney - VP, Editorial Director pheney@wtwhmedia.com On Twitter @wtwh_paulheney