S & G STORES HITS THE GAS ON GROWTH

S&G is on track to reach 85 stores this September as it targets 150 locations in the next five years. p. 12

S&G is on track to reach 85 stores this September as it targets 150 locations in the next five years. p. 12

www.cstoredecisions.com

EDITORIAL

VP EDITORIAL — FOOD, RETAIL & HOSPITALITY

Danny Klein dklein@wtwhmedia.com

EDITOR-IN-CHIEF

Erin Del Conte edelconte@wtwhmedia.com

SENIOR EDITOR Emily Boes eboes@wtwhmedia.com

ASSOCIATE EDITOR Kevin McIntyre kmcintyre@wtwhmedia.com

EDITOR EMERITUS John Lofstock

CONTRIBUTING EDITORS

Anne Baye Ericksen Marilyn Odesser-Torpey

EVENTS DIRECTOR OF EVENTS

Jen Osborne josborne@wtwhmedia.com

EVENTS MANAGER Brittany Belko bbelko@wtwhmedia.com

EVENTS MANAGER

Jeannette Hummitsch jhummitsch@wtwhmedia.com

EVENTS COMMUNICATIONS COORDINATOR Emma Paul epaul@wtwhmedia.com

WTWH MEDIA, LLC 1111 Superior Ave. Suite 1120 Cleveland, OH 44114 Ph: 888-543-2447

SUBSCRIPTION INQUIRIES:

LEADERSHIP

CHIEF EXECUTIVE OFFICER Matt Logan mlogan@wtwhmedia.com

CHIEF OPERATING OFFICER George Yedinak gyedinak@wtwhmedia.com

CHIEF REVENUE OFFICER Scott Kelliher skelliher@wtwhmedia.com

VP OF OPERATIONS Virginia Goulding vgoulding@wtwhmedia.com

SENIOR VP, AUDIENCE GROWTH Greg Sanders gsanders@wtwhmedia.com

CREATIVE SERVICES

VP, CREATIVE DIRECTOR Matthew Claney mclaney@wtwhmedia.com

CREATIVE DIRECTOR Erin Canetta ecanetta@wtwhmedia.com

CONTENT STUDIO

VP, CONTENT STUDIO Peggy Carouthers pcarouthers@wtwhmedia.com

WRITER, CONTENT STUDIO Ya’el McLoud ymcloud@wtwhmedia.com

WRITER, CONTENT STUDIO Drew Filipski dfilipski@wtwhmedia.com

SALES TEAM

SENIOR VICE PRESIDENT OF SALES & STRATEGY Matt Waddell

mwaddell@wtwhmedia.com (774) 871-0067

KEY ACCOUNT MANAGER John Petersen jpetersen@wtwhmedia.com (216) 346-8790

SALES DIRECTOR Patrick McIntyre pmcintyre@wtwhmedia.com (216) 372-8112

SALES DIRECTOR Mike Peck

mpeck@wtwhmedia.com (917) 941-1883

MARKETING MANAGER Jane Cooper jcooper@wtwhmedia.com

CUSTOMER SERVICE

REPRESENTATIVE Annie Paoletta apaoletta@wtwhmedia.com

To manage current print subscription or for a new subscription: https://cstoredecisions.com/cstore-decisions-subscriptions/

SUBSCRIPTIONS: Qualified U.S. subscribers receive CStore Decisions at no charge. For others, the cost is $80 a year in the U.S. and Possessions, $95 in Canada, and $150 in all other countries. Single copies are available at $9 each in the U.S. and Possessions, $10 each in Canada and $13 in all other countries.

CStore Decisions (ISSN 1054-7797) USPS Publication #5978 is published monthly by WTWH Media, LLC., 1111 Superior Ave., Suite 1120, Cleveland, OH 44114, for petroleum company and convenience store operators, owners, managers.

Periodicals postage paid at Cleveland, OH, and additional mailing offices.

POSTMASTER: Send address changes to CStore Decisions, 1111 Superior Avenue, Suite 1120, Cleveland, OH 44114. GST #R126431964, Canadian Publication Sales Agreement No: #40026880.

CSTORE DECISIONS does not endorse any products, programs or services of advertisers or editorial contributors.

Copyright© 2025 by WTWH Media, LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, or by recording, or by any information storage or retrieval system, without written permission from the publisher.

6

Leading Through Innovation

CStore Decisions is a three-time winner of the Neal Award, the American Business Press’ highest recognition of editorial excellence.

EDITORIAL ADVISORY BOARD

Nate Brazier, CEO

Stinker Stores • Boise, Idaho

Robert Buhler, President and CEO

Open Pantry Food Marts • Pleasant Prairie, Wis.

Herb Hargraves, Chief Operating Officer

Sprint Mart • Ridgeland, Miss.

Bill Kent, Chairman and CEO

The Kent Cos. Inc. • Midland, Texas

Nick Triantafellou, Director of Marketing & Merchandising

Weigel’s Inc. • Knoxville, Tenn.

Dyson Williams, Vice President

Dandy Mini Marts. • Sayre, Pa.

NATIONAL ADVISORY GROUP (NAG) BOARD (RETAILERS)

Greg Ehrlich, (Board Chairman) President

Beck Suppliers Inc. • Fremont, Ohio

Joy Almekies, Senior Director of Food Services

Global Partners • Waltham, Mass.

Jeff Carpenter, Director of Education and Training

Cliff’s Local Market • Marcy, N.Y.

Richard Cashion, Chief Operating Officer

Curby’s Express Market • Lubbock, Texas

Megan Chmura, Director of Center Store

GetGo • Pittsburgh

Ryan Faville, Director of Purchasing

Stewart’s Shops Corp. • Saratoga Springs, N.Y.

Cole Fountain, Director of Merchandise

Gate Petroleum Co. • Jacksonville, Fla.

Kalen Frese, Director of Merchandising

Warrenton Oil Inc. • Warrenton, Mo.

Joe Hamza, Chief Operating Officer

Nouria Energy Corp. • Worcester, Mass.

Beth Hoffer, Vice President

Weigel’s • Powell, Tenn.

David Land II, Director of Marketing

The Kent Cos. Inc. • Midland, Texas

Brent Mouton, President and CEO

Hit-N-Run Food Stores • Lafayette, La.

Lenny Smith, Vice President

Crosby’s • Lockport, N.Y.

Dyson Williams, Vice President

Dandy Mini Marts • Sayre, Pa.

Hussein Yatim, Vice President

YATCO • Marlborough, Mass.

Vernon Young, President and CEO

Young Oil Co. • Piedmont, Ala.

Supplier Members

Kyle May, Director External Relations

Reynolds Marketing Services Co. • Winston-Salem, N.C.

Todd Verhoven, Vice President of Sales

Hunt Brothers Pizza • Nashville, Tenn.

Steve Yawn, Director of Sales

McLane Company Inc. • Temple, Texas

We are not a franchise. We do not have franchise fees, royalty fees or marketing fees.

Boost your c-store profits with Hunt Brothers® Pizza. Our easy-to-execute program is designed for c-stores, delivering 50% or more in pizza profits. Start making more dough today with a branded pizza program built for success.

Editor’sMemo

IN AUGUST, YOUNG EXECUTIVES from across the convenience store industry attended CStore Momentum, hosted by Weigel’s, which operates 85 c-stores in east Tennessee.

The event offered an inside look into Weigel’s rich history; foodservice innovation; loyalty program; Name, Image, Likeness athletic partnerships; and operations best practices. We also discussed leadership strategies and toured Weigel’s new commissary and two Weigel’s stores.

What struck me most is how the Powell, Tenn.-based chain has reinvented itself over the years — from its origins as a dairy and milk depot, to pioneering self-serve gas pumps in 1970, to launching its Gen 4 prototype design in 2022. Attendees had the chance to see firsthand how the chain reimagined one legacy store by transforming a former checkout area into a kitchen and opening up a wall to make space for a modern checkout area. The chain’s brand-new, 110,000-square-foot commissary is especially impressive, as is its ability to produce 40 pizzas in just one minute. What was less impressive was how we all looked in our hairnets, beard guards and protective coats as we toured the new facility.

Like Weigel’s, S&G Stores, with 85 locations in Ohio and Michigan, featured in this month’s cover story, has embraced innovation amid growth. That has included changing its name to S&G Stores from Stop & Go, modernizing stores through remodels as it works to unify its design, launching and expanding its On The Go Bistro foodservice program, and introducing S&G pay last November. It is also testing self-checkout and has plans to build a tunnel car wash. What Weigel’s and S&G show us is that success in the c-store industry requires constant reinvention and evolution. Exactly what that evolution looks like is different from chain to chain. For some it means adding vertical integration, while

for others it might mean zeroing in on a cohesive design, foodservice and new technology. What’s important is that c-store chains are preparing for what’s to come so they’re ready when it arrives.

Stinker Stores, with 104 locations in Idaho, Wyoming and Colorado, is another standout example of a chain focused on continued innovation. Most recently, the chain introduced a new logo, and it’s testing new technology from self-checkout to an artificial intelligence program around its roller grill program. Its latest store prototype features the chain’s Pete’s Eats foodservice program as a central focus of the store. And it’s been busy on the back end, revamping its training program, adding a new human resources management system and much more.

If you’re heading to the NACS Show in Chicago, c-store retailers are invited to join us on the evening of Oct. 15 at Roof on theWit to celebrate Stinker Stores as CStore Decisions’ 2025 Chain of the Year. The event schedule is as follows:

5:30 p.m. Cocktails

6:30 p.m. Buffet Dinner

7:15 p.m. Award Ceremony Honoring Stinker Stores

Retailers must RSVP to attend: https://cstoredecisions. com/2025-chain-of-the-year.

Can’t wait to see you there!

Supplier companies must be sponsors to attend. Suppliers interested in sponsorship opportunities should contact Pat McIntyre at PMcIntyre@wtwhmedia.com.

Economic factors may influence retailers’ business outlook, but those who adapt to evolving consumer values and trends are better positioned to boost sales.

Eighty-nine percent of retailers surveyed in Q3 2024 believed the next six months would see business improve, while 81% held the same sentiment in Q1 2025.

Social media product recommendations are growing. According to CivicScience, 56% of those aged 18-29 have purchased a product promoted by an influencer.

Source: CivicScience, “Gen Z Media Consumption in 2025: How Social Media Influencers Are Reshaping Spending,” July 2025, 1,366-plus responses

Source: Upside, “Winning the Uncommitted Customer,” June 2025, survey of 6,527 retailers from the general population, conducted across four waves from 2023-2025. ‘Get much worse’ excluded with <1% of responses

Catering to consumers by generation will likely boost sales, as shoppers of different ages tend to respond differently to marketing tactics. For Gen Z, according to Mintel, retailers are advised to:

• Be authentic and transparent

• Highlight sustainability and the social responsibility your business takes on

• Innovate with omnichannel engagement

• Personalize the experience

• Leverage social commerce

Source: Mintel, “Gen Z Online Shopping Behaviour & Trends: What Brands Need to Know,” July 2025

Tariff concerns are still top of mind for retailers and consumers alike. According to Datassential:

• Sixty-six percent of operators say all of the uncertainty around tariffs is negatively affecting the U.S. economy.

• Fifty-two percent of operators find it difficult to keep track of new developments that are related to tariffs.

• Seventy-one percent of operators agree that tariffs are just one more challenge on top of inflation, labor shortages and supply chain issues.

Source: Datassential, “Midyear Trends Preview Report,” July 2025

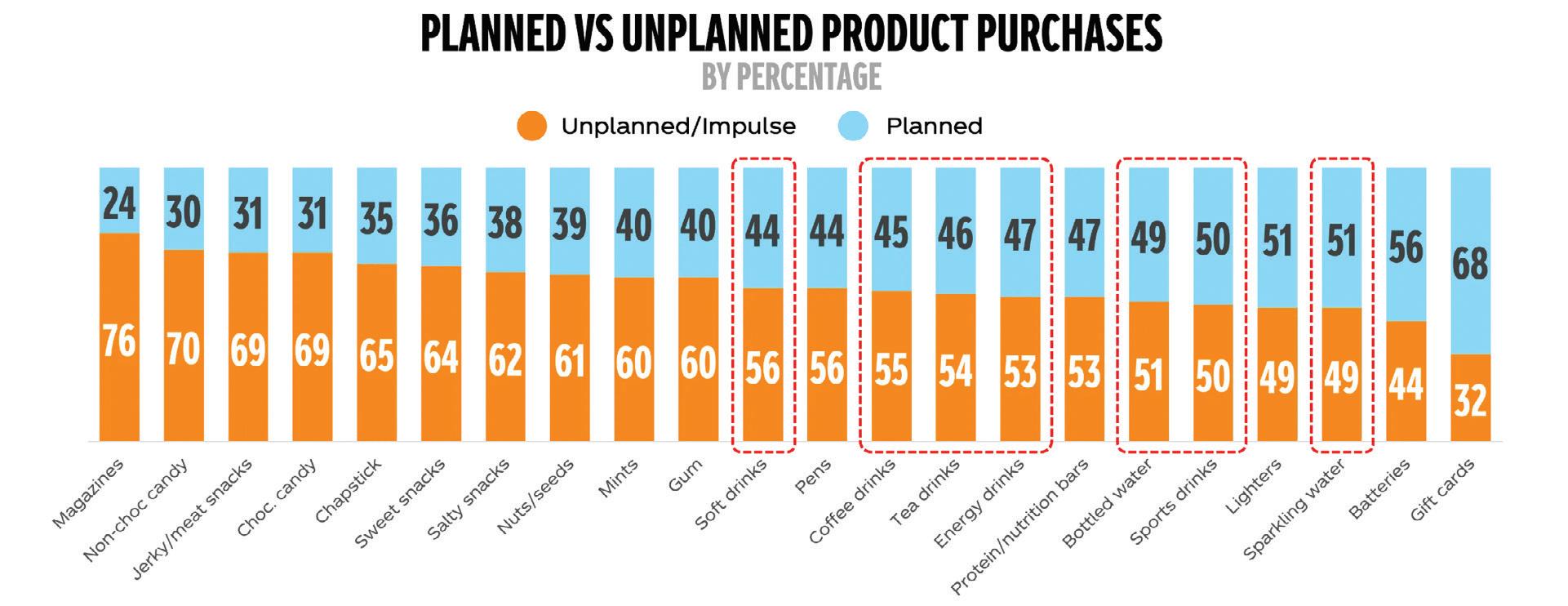

C-store retailers often look to promote impulse purchases to increase basket size. According to Coca-Cola Lens, magazines are the top impulse buy, and gift cards are the most planned purchase.

Source: Coca-Cola Lens, “The Perfect Formula for the Register,” June 2025

CStore Decisions is proud to announce Stinker Stores as its 2025 Chain of the Year. The Boise, Idaho-based chain stands out from its best-in-class new-to-industry stores to its revamped loyalty program and mobile app to its commitment to a people-first culture, foodservice and future-focused growth. But what truly sets Stinker Stores apart is its unwavering commitment to continuous improvement, consistently upgrading and refining its systems and programs. Refusing to settle for “good enough,” the chain remains focused on modernizing and adapting to meet the needs of tomorrow. Stinker Stores was founded in 1936, and today it operates 104 stores in Idaho, Wyoming and Colorado.

CStore Decisions’ Chain of the Year Award honors a c-store, travel center or petroleum chain that has established itself as a superior retailer and innovator in the industry.

CONGRATULATIONS TO THE CSTORE DECISIONS CHAIN OF THE YEAR!

OCT. 15 5:308:30pm

THANK YOU TO OUR

S&G is on track to reach 85 stores this September as it targets 150 locations in the next five years.

Erin Del Conte Editor-in-Chief

DAN RIDI, FOUNDER AND CEO OF S&G STORES, never planned to build a lifelong career in the convenience store industry, let alone create his own thriving c-store chain. “It just happened that way,” Ridi said.

After completing both his bachelor’s degree and MBA, Ridi’s original plan was to “join corporate America,” but then, in 1999, he saw an opportunity to purchase a Toledo, Ohio, convenience store and jumped at it. He called the store Stop & Go. A short time later, a former Dairy Mart store came up for sale, and he purchased that store, too — “still not thinking that I’m going to be in this industry,” he laughed.

But after growing to four locations, Ridi soon realized he was all in on the c-store business.

In 1999, Dan Ridi, owner of S&G Stores, bought his first convenience store in Toledo, Ohio. He had not originally planned to build a career in the c-store industry, but after growing to four stores, he was committed. By 2010, he expanded his business into Michigan.

S&G expanded to 30 stores with the purchase of 17-store chain In & Out Mart in 2013. Today, S&G Stores owns and operates 76 locations in Ohio and Michigan and leases another 15 sites to other operators.

By 2010, he expanded his business into Michigan.

“I started this chain from nothing, really. So, we didn’t have the base, we didn’t have the foundation that others had for many, many years,” Ridi said. “And we grew the chain, really, one purchase at a time. Then we started buying small chains.”

In 2013, S&G purchased a c-store chain called In & Out Mart, with 17 sites, which helped expand S&G’s footprint to 30 stores. It was then that Ridi recognized that in order to scale, he’d need to put the proper corporate structure in place to support a much larger chain.

From 2013 to 2019, S&G Stores only added two locations to its footprint as it focused on building the right corporate framework. The chain hired a VP of marketing, a VP of IT, a maintenance director and a director of foodservice.

S&G originally went by the name “Stop & Go” across its entire footprint, but around 2015, it rebranded to S&G Stores. “There was a chain that

We provide the snacks and frozen treats that make memories in consumers’ minds. The ones associated with delight and good times. And they all come from one source.

Stop by booth S6454 at the NACS Show for a free sample or visit jjsnackfoodservice.com/sample/

got created locally, and they called it Stop-N-Shop, and that created a little bit of a confusion,” Ridi explained. “So we changed the trademark to S&G, which still stands for Stop & Go, and that’s what we’re really known as. A lot of people still call us Stop & Go anyway.”

With its new name and updated corporate structure, “our growth took off,” Ridi said. “From 2019 to the end of 2021, we added about 45 locations.”

That included an 11-store acquisition from Schafer Oil Co. in the Dayton, Ohio, area; 12 locations from Barney’s in the Toledo, Ohio, area; a number of smaller acquisitions; and 10 sites from StopN-Shop. “That’s the company that was created to compete with our company (and the reason for the name change to S&G), and they ended up going out of

business,” he explained.

After its rapid growth spurt, S&G paused for a few years as it worked to integrate the sites into the chain. Now, S&G is once again in growth mode.

Today, S&G Stores owns and operates 76 locations in Ohio and Michigan and leases another 15 sites to other operators. And, the chain has more growth on the horizon.

“We actually took over a site yesterday in Mansfield, Ohio,” Ridi said, “and we’re acquiring seven sites in Michigan.” At press time, that deal was set to close on Aug. 11. S&G expects to close on the acquisition of another eight sites in Ohio on Sept. 8 and another one-store acquisition in Michigan, which will bring the chain’s company-owned and -operated footprint to 85 stores.

Including these acquisitions, Ridi estimated that between November 2024 and November of this year the chain will have added a grand total of 25 locations to its portfolio.

“We’ve really been growing in a big way since 2019. And (after these acquisitions close), I’m going to let the dust settle on the purchases that we have done … and then continue the growth,” he said.

In 2024, S&G completed two raze-andrebuilds at stores 85 and 104, with three more slated for the coming years. Over the past five years, the company has also fully renovated 15 additional sites.

Because S&G has predominately grown through acquisitions, its store

sizes vary from 1,000 square feet to 6,000 square feet. The goal behind the remodels and the raze-and-rebuilds has been to create a more uniform look across the c-store chain.

On the exterior, that includes stonework and oval S&G signage. The chain’s signature colors of red, white and blue are visible from the canopies to the pumps. The majority of S&G stores feature S&G-branded gas, with the exception of four sites that are branded Arco and one branded Marathon. Inside, renovations have also helped make room for foodservice.

Six locations feature in-bay car washes. “Our intention is to explore the tunnel car wash model next to some of our sites that have extra properties,” Ridi said. “We acquired a property next to store

40 with the intention to build one tunnel car wash to test it out and see how things go. And if things go well, then we might expand it. …”

When it comes to food, S&G created a proprietary concept called On The Go Bistro, which it operates at 17 sites with another five stores set to roll out the program over the next month.

S&G began its foodservice journey about three years ago and has spent time testing menu items to determine which offerings appeal most to customers. Today, the full-service menu features made-to-order hot sandwiches as well as fresh deli sandwiches, fresh pizza and chicken. At stores that feature a more limited version of the On The Go Bistro

concept, customers can find pizza and sandwiches on the menu. S&G also makes its own cookies fresh in-store.

The chain also partners with Subway at three locations and Krispy Krunchy Chicken at a few sites.

S&G is known for a special menu item it calls a GoGo, which is similar to a Kolachi but filled primarily with ground beef, sausage and/or cheese. “They’re unique to S&G, and they’re selling well,” Ridi said.

S&G is currently testing a proprietary frozen yogurt program at three locations. Each of the stores piloting the program have two frozen yogurt machines and a total of four self-serve flavors. If the program is successful, Ridi plans to roll it out to additional locations.

As the chain prioritizes foodservice,

it’s putting the right people in place to help grow the program. That includes its foodservice director and a new foodservice district manager, whose focus will be on taking the program to the next level and expanding it across the convenience chain’s footprint.

“We’re investing in our sites, and we’re still revisiting our menus as we get feedback from our customers,” Ridi said.

S&G has a few stores that feature drive-throughs, including one of its newly razed and rebuilt sites (store 85) located near the Toledo airport. S&G partners with DoorDash to offer delivery.

S&G is staying on top of tech innovation as it grows. It features the Real Deal Rewards loyalty program, powered by

Paytronix, which is available through the chain’s mobile app. Through the Real Deal Rewards program, customers earn points on purchases inside the store and at the pump. In November of 2024, the chain introduced S&G Pay, an Automated Clearing House program that links directly to the customer’s checking account and gives them six cents off per gallon of gas. If they enroll in the Real Deal Rewards program and use S&G Pay, they get 12 cents off per gallon. S&G is currently running a promotion where newly enrolled S&G Pay customers can save 50 cents on fuel for the first 60 days

or first 100 gallons purchased. In the past year, it added an S&G Fleet program as well to extend the benefits of S&G Pay to fleet drivers.

S&G is also testing self-checkout kiosks at five locations. The program “seems to be working well,” Ridi said, noting that given the success, it’s possible it will be expanding the program in the future.

Now, S&G is looking ahead to new tech advancements. It’s set to pilot auto replenishment. “We’re with PDI, and we’re going to utilize their system to do auto replenishment starting with cigarettes and

see where that takes us,” Ridi said. “And if everything goes well, who knows, we might just take the entire chain and move it to auto replenishment.”

When it comes to artificial intelligence, Ridi noted that his team is talking about it. “We’re looking forward to it. We just need to learn more. We don’t know how that whole thing is going to help us out, but if it’s there, we’ll jump at it.”

Ridi initially aspired to grow the chain to 150 stores by his 55th birthday, now just two years away. While Ridi acknowledged he is unlikely to hit that goal in the next two years — due to having to pause store expansion from 2013 to 2019 to build the infrastructure for sustainable expansion — he still has his sights set on reaching the 150-store milestone as soon as possible through a combination of new store builds and acquisitions.

“I think this could be very real in the

next five years,” he said.

As it grows, S&G prides itself on treating its employees with respect and as family. Employees working full-time — at 30 hours or more per week — receive full health benefits, including dental, vision, a 401k, paid vacations and bonuses based on performance.

“We try to have an environment where everyone is given the opportunity to advance their careers,” he said.

Every year, S&G holds an annual fundraising day called S&G Day of Thanks and Giving, where the managers and their teams select their favorite charity for a store donation, which the corporation then matches.

“S&G is a locally owned chain that is committed to local causes. I have four children myself, so I value organizations and charities that are helping children, knowing how important they are. …”

Ridi said.

“S&G, like everybody else (in the

c-store industry), we’re facing fierce competition. A lot of (convenience store chains are) arriving, pushing into different new markets. And to us, we see this as positive. That’s what is keeping us moving. That’s what is keeping us growing and improving. So, we don’t really see that as negative. We see it as a positive thing,” he said. “That’s the reason we’re growing and remodeling. And, you know, competition is healthy. It keeps everyone healthy. “

Twenty-six years into a successful convenience store career he happened into, Ridi hasn’t just built a livelihood, he’s created a local c-store empire and is now focused on making a difference in the lives of team members and the communities where S&G serves.

“It’s not all about just making a profit,” Ridi said. “It’s all about giving back, also, rewarding good performance, giving back to the community and creating opportunities for our team, as well.” CSD

C-stores look to tap new offerings and fourth-tier options to support combustible tobacco sales.

Anne

Baye Ericksen • Contributing Editor

TO SAY REGULATIONS DOMINATE the tobacco and nicotine category is an obvious understatement. After all, flavor bans, age-restriction laws and tax increases have affected the category for years. But it’s a misnomer to say regulations are the only factor influencing one of the top-performing categories for convenience stores across the country. Changing consumer purchase patterns also are morphing backbars, and cigarettes and cigars are not immune.

While modern oral nicotine products gain greater market share month after month, combustible products have been trending downward for quite some time. Cigarette transactions in U.S. convenience stores, once again, posted losses over the past year. Per Circana, a Chicago-based market research firm, cigarettes lost more than 3% in dollar sales for the 52 weeks ending July 13, and unit sales fell by more than 8%. That said, cigarettes remain the biggest performer within the category, tallying up more than $50 billion over those 52 weeks.

GAME® LEAF GIVES CUSTOMERS WHAT THEY WANT

In 2015 Game Leaf was introduced as part of the Garcia y Vega portfolio of cigars, revolutionizing the Rolled Leaf cigar category. Now, as part of our 10th anniversary celebration, we’re reintroducing Game Leaf with colorful, eye-catching, consumer-tested 3-cigar packaging designed to bring Rolled Leaf customers more of what they want.

AVAILABLE AT 3 FOR $2.19 TRIAL PRICING AND SAVE ON 3

3 REASONS FOR 3-PACK SALES

In 2024, the 3-pack was the only Rolled Leaf format to show volume growth, along with a 5.7% increase in share of the market.

While all other Rolled Leaf formats showed velocity declines in 2024, the velocity for 3-packs rose by 15%.

Rolled Leaf 3-packs were added to shelves in over 9,700 c-stores in 2024, an 11% increase in store count over 2023.

3 REASONS TO GO WITH GAME LEAF

Game Leaf is able to build on the tremendous brand equity of Game, the #1 selling Natural Leaf cigar in the US.

Game Leaf’s commitment to quality and stringent quality standards—from broadleaf crop selection through manufacturing—ensure the best quality Rolled Leaf cigar available.

Consumers equate the Game Leaf brand with the Garcia y Vega tradition of quality and craftsmanship, as Garcia y Vega has been making Natural Leaf cigars since 1882.

Despite the ups and downs of cigarette and cigar sales, the two mainstays combined for nearly $54.5 billion in sales in U.S. c-stores for the 52 weeks ending July 13.

Source: Circana, total U.S. convenience store data for the 52 weeks ending July 13, 2025

Cigars followed a similar path: -1.3% in dollar sales and -7.4% in units. Circana reported little cigars sustained the largest falloff at -37% in dollar sales. Even a price hike of 64% over the past year didn’t compensate.

“Year-over-year volume decline rates for combustibles in 2025 are consistent

with the more accelerated declines we saw last year, resulting from more aggressive price increases and with consumers often downtrading to meet their needs,” said Adam Long, senior category manager at The Rutter’s Cos. The York, Pa.-based business owns and operates 90 convenience stores in Pennsylvania,

Maryland and West Virginia.

Meanwhile, Faiz Simon, president of Island Lane Capital, said performance of little cigars is rebounding in his Simon Xpress store. The company also operates 14 other sites under a different banner name.

“Sales have been up 7% only on cigarillo and cigar products, not on cigarettes, which have been down 8%,” he explained.

When asked which has had a bigger impact on cigarettes and cigars — regulations or nicotine pouches — Simon responded, “All of the above, as well as vape, (which) has taken business.”

However, macroeconomic conditions — inflation and possible tariffs — may be driving customers to reconsider purchases, too.

“The primary factor affecting our cigarette sales is pricing. Manufacturers implement multiple price hikes throughout the year, pricing many products out of reach for our customers. As a result, we’ve seen growth in our lower-priced cigarette offerings, while higher-priced options have seen a decline in sales. Notably, we’ve seen strong sales growth in our fourth-tier cigarette offerings, which were introduced in the second quarter of 2024,” said Sean Bumgarner, VP for Scrivener Oil Co., which runs 12 Signal Food Stores in southwest Missouri.

When assessing the category’s overall status, it’s important to calculate the value of dual use for a more comprehensive overview. This development emerged within the past few years, and customers appear to have really latched on to the flexibility of using a variety of tobacco/ nicotine products.

“Dual use continues to be a trend, not only between cigarettes, cigars and nicotine pouches, but also involving smokeless tobacco and nicotine pouches,” said Bumgarner.

Capitalizing on consumers’ evolving preferences demands careful inventory management. This means positioning cigarettes and cigars properly so that people add them to their basket.

“We leverage the dual-use trend by strategically merchandising these products in high-visibility areas, ensuring they’re easily accessible and clearly visible to customers,” said Bumgarner.

“The keys to taking advantage of this opportunity for any marketer are to be sourcing the right products, offering those at prices that customers can approach, building awareness and delivering value through a sound promotional plan,” advised Long.

Additionally, he believes mixing in alternatives or new offerings, especially

for the cigar segment, could attract consumer curiosity.

“We’ve seen the rise of a new subcategory of natural leaf cigar wraps that is worth noting,” Long explained. “It is a new space for some notable brands like Backwoods and, at the same time, a space where other smaller brands are innovating in packaging and freshness processes — like Toucan using Boveda freshness pouches — to deliver a quality end product to the consumer.”

While data on smoking rates show the demographic continues to shrink and probably will in the future, today’s trends open opportunities for c-stores to balance out backbars. CSD

• Little cigars incurred a 64% price hike since last summer.

• Pricing, nicotine pouches, vape and regulations are all impacting combustible sales.

• Dual use continues to define tobacco/nicotine customers.

Convenience stores are reinventing their breakfast offerings with fresh menu ideas and strategic promotions to adapt to changing consumer routines and reignite morning traffic.

Marilyn

Odesser-Torpey • Contributing Editor

WITH MANY CONSUMERS WORKING FROM HOME, the times and duration of the breakfast daypart have shifted at some convenience stores. A combination of menu innovation and promotions is helping retailers woo these morning customers back and attract new demographics.

Breakfast has always been the busiest foodservice daypart at Global Partners’ Alltown Fresh and Honey Farms stores, but as customer needs and expectations have changed, it has taken a constantly evolving strategy to keep the category going and growing strong, said Jac Moskalik, VP, head of food, innovation and strategy, Global Partners.

“Even with many people still working remotely, the stores get a breakfast rush, but now it’s a little later — between 9 a.m. and 11 a.m.,” Moskalik explained. “In fact, at Alltown Fresh, our breakfast selections are so craveable and popular that we offer them all day.”

All-day breakfast also appeals to younger consumers who generally “have disposable income and do things on their own schedules,” she went on. While breakfast burritos (“we sell between 70 and 200 per day at each Alltown Fresh store”) are king and biscuits and gravy a top seller, she pointed out, the stores “innovate a ton” at breakfast.

“We’ve seen huge sales increases spanning generations in this daypart,” she remarked.

According to Moskalik, younger consumers are looking for clean and local ingredients; spicy flavors; and interesting, fun combinations.

Breakfast eggs are cage free, and ingredients are sourced locally whenever possible. French folded eggs add an

upscale touch to morning sandwiches. Brioche buns and croissants elevate breakfast sandwiches at Alltown Fresh. Keeping abreast of trends via new menu additions and quarterly limitedtime offers gives the two brands a competitive edge at breakfast time, she noted. One example at Alltown Fresh is giving customers the option to turn burrito ingredients into a gluten-free bowl, or

Global Partners uses cagefree breakfast eggs with locally sourced ingredients when possible. French folded eggs can be a plus with morning sandwiches, as well as brioche buns and croissants.

Global Partners’ Alltown Fresh sells between 70 and 200 breakfast burritos per day per store. It’s one of the most popular items during the breakfast daypart. Biscuits and gravy is also a top seller, and the chain brings plenty of innovation to its breakfast menu, as well.

they can have it made in a vegan version or substitute tortilla chips for nachos. On other selections, Mike’s Hot Honey tops smoked ham, eggs and cheese on a toasted brioche bun, and avocado toast features house-made guacamole.

At Honey Farms stores, six featured breakfast sandwiches are offered on a choice of sourdough or honeywheat bread. The Beehive layers mayo, fig jam and chicken sausage; The Killa Beez brings together brisket, mayo and pickled red onion; and the vegan The Farmhouse combines avocado, roasted red pepper, pickled red onion, spinach, Just Egg and vegan cheese.

On the sweet side, all-butter pastries and “over-the-top” giant doughnuts baked off in the stores lend “a huge freshness halo effect” to the foodservice offerings all day, Moskalik added.

Tailored promotional offers through the newly launched Bee’s Knees Benefits loyalty program add extra incentives to make the stores a regular morning stop. The program offers special breakfast bundles and coffee promotions.

Alltown Fresh has 16 locations in Massachusetts, New Hampshire, Connecticut and New York. Honey Farms has four locations in Massachusetts.

Honey Farms offers breakfast sandwiches on sourdough or honeywheat bread, such as The Beehive, The Killa Beez and the vegan The Farmhouse. At Alltown Fresh, a sandwich with Mike’s Hot Honey, smoked ham, eggs and cheese has been offered.

A STEADY MORNING BUSINESS

Breakfast accounts for about 60% of foodservice sales and continues to grow at Clark’s Pump ‘n Shop, which has more than 65 locations in Kentucky, Ohio and West Virginia. The stores’ market areas are less affected by remote workers than by the schedules at surrounding schools. Morning business is steady even when the schools are out, said Jessica Russell, Clark’s food service director. A large number of customers arrive each day, especially for their breakfast favorites from

the menu, which has remained virtually unchanged, except for a few new additions, over the past 10 years.

Clark’s offers a selection of 16 different biscuit and toast sandwiches and is well known for its biscuits and gravy. Other popular selections are the breakfast burritos and the Café Special, which consists of two eggs, one biscuit and gravy, and one sausage or three strips of bacon.

Although made-in-store grab-and-go sandwiches are available, 98% of customers opt to have their breakfast items

made to order, Russell stated.

“We are one of the very few places left that use fresh eggs and will prepare them any way the customer would like,” she noted.

Aside from loyalty program exclusives, customer word-of-mouth provides Clark’s with its most powerful promotions.

“We hear all the time from new customers that they had no idea how good our breakfast is until they heard it from a co-worker or friend,” Russell pointed out. CSD

• All-day breakfast appeals to customers — especially younger shoppers who do things on their own schedule.

• Younger customers want clean and local ingredients; spicy flavors; and interesting, fun combinations for their food choices.

For easy, sustainable grab-and-go solutions, Placon’s Fresh ‘n Clear® Bowls, Trays, and GoCubes deliver.

Made from our EcoStar® post-consumer recycled PET, these durable containers with anti-fog lids ensure clear visibility and freshness while keeping food secure. From snacks to party-sized salads, Placon makes it easy for customers to see, grab, and go—without sacrificing quality or the environment.

Visit Placon.com to learn more about our full lines of grab and go packaging solutions.

C-store retailers are doubling down on coffee efforts by increasing customization, sourcing highquality products and widening menu offerings.

Kevin McIntyre • Associate Editor

COFFEE HAS ALWAYS BEEN A DIFFERENTIATOR for c-store retailers, offering consumers a quick, convenient and affordable morning pick-me-up that quick-service giants like Starbucks and Dunkin’ can’t always match. As operators continue to fight for market share, they are learning that an enhanced focus on quality and variety can make all the difference.

“Coffee used to be about inexpensive, limited choices and convenience,” said Bruce Reinstein, partner at Kinetic12, a management consulting firm. “The expectations now are about variety, quality standards and customization.”

Reinstein noted that there has been a push in recent years for better-quality coffee, especially when it comes to cold brew, espresso-based drinks and customizable options. Iced and cold options, he said, are now more important than ever.

“Cold coffee continues to be the hottest part of the coffee segment,” he continued. “Cold brew has become a mainstay as all age groups are looking for customized iced coffee concoctions.”

Over the past few years, the c-store industry has seen a strong push from younger consumers, led by Gen Z, for increased variety from the cold coffee segment. Now, according to Reinstein, that trend is becoming synonymous across more demographics.

“Iced coffee and cold brew now appeal to all age groups,” he said. “The younger consumer continues to look for more and more innovation, though.”

At Idaho Falls, Idaho-based Good 2 Go, which operates 81 c-stores across Idaho, Wyoming, Montana, Utah, Colorado, Arizona and New Mexico, Reinstein’s insights prove accurate.

“We’ve definitely seen a shift toward specialty and customization in recent years,” said Sean Carroll, director of category management for Good 2 Go. “Our customers — who we call our Friends — are increasingly looking for premium experiences, even in a convenience store setting. Bean-to-cup machines, cold brew and espresso-based drinks are becoming the norm, not the exception.”

Carroll added that iced and cold-brew options are driving strong sales across all dayparts, even into the evening.

“While convenience is still a major factor, the expectation has changed — customers now want coffee shop-level quality from their c-store coffee, and we’re focused on delivering exactly that,” he said.

Currently, Good 2 Go offers a mix of bean-to-cup and brewed coffee across its stores, with select locations featuring café-style options like lattes, mochas and cappuccinos. The beanto-cup program also allows customers to create iced versions of their drinks, and select stores feature a Frazil “Café Tango” frozen coffee slush program.

“Cold coffee isn’t just a seasonal trend anymore; it’s a year-round expectation, and we’re making sure our offerings reflect that,” Carroll said.

The chain’s coffee strategy is centered around freshness, customization and quality — giving customers “the ability to craft a beverage that feels personal and indulgent,” Carroll continued. “From syrups and creamers to sweeteners and toppings, we’ve built out a condiment station that lets our friends create their own masterpiece.”

Ready-to-drink (RTD) coffee is also gaining steam at Good 2 Go, especially among Gen Z and millennials who value portability and flavor innovation, however the growth doesn’t quite compare to dispensed and specialty offerings.

“Our bean-to-cup machines and frozen Café Tango offerings are pulling some of that demand back toward dispensed, thanks to the elevated experience and value they provide,” Carroll said. “RTD plays an important role in our overall mix, but we’re focused on making our in-store coffee feel like a destination, not just a convenience.”

Limited-time offers (LTOs) and exclusive deals can be significant sales drivers for

Good 2 Go offers a mix of bean-to-cup and brewed coffee across its stores. Select locations feature caféstyle options like lattes, mochas and cappuccinos. The bean-to-cup program also allows Good 2 Go customers to create iced versions of their drinks, and select stores feature a Frazil “Café Tango” frozen coffee slush program.

retailers looking to capitalize on alwayschanging consumer preferences.

“LTOs create a sense of urgency and anticipation, especially when tied to holidays or seasonal shifts,” explained Carroll. “Customers look forward to them, and they often drive repeat visits and impulse purchases.”

Good 2 Go focuses on storytelling when it comes to LTOs, tying in holidays and seasonal aesthetics to its offerings.

“Whether it’s the cozy vibe of fall or the festive energy of winter, these offerings tap into emotion and tradition,” Carroll continued. “And when paired with strong in-store visuals and digital engagement, they become more than just drinks — they’re experiences.”

There is no one easy answer when it comes to unlocking the potential of your coffee program. Consumers have unique preferences in every market — the key to maximizing coffee profits is paying close attention to customer behavior and how it changes over time. Experimenting with LTOs, unique condiments and new products is essential to ensure that consumers remain engaged and loyal.

“Tell a story with your coffee. If you are just selling a commodity based upon convenience, it does not matter. If you want to be competitive and stand out in

today’s marketplace, you need to have some differentiation that makes your coffee stand out,” said Reinstein.

It’s important that the coffee being served is consistent for every visit, he added, noting that store associates must be trained on best practices.

“Coffee is something that most consumers have every day. If you are not consistent, you will not only lose the coffee business, but everything else that goes with it,” he concluded. CSD

• Cold coffee remains a significant sales driver across all dayparts, with its popularity expanding to new demographics.

• Customization is now a necessity — retailers need to expand their offerings with condiments that keep coffee programs fresh and appealing.

• Limited-time offers and seasonal flavors are key for turning c-store visits into experiences, rather than simple transactions.

Retailers prioritize data and efficiency as they upgrade the point of sale and back office.

Emily Boes • Senior Editor

AS INNOVATIONS WITH PAYMENT CAPABILITIES, loyalty programs, personalized marketing and more continue to sweep through convenience stores, retailers look to improve the point of sale (POS) and back office to keep up with the industry’s changing pace.

“When looking at a modern POS system, c-store retailers need to shift their lens to be looking for a platform that reaches well beyond the traditional POS system. Retailers need to focus on a POS system that is part of a platform solution that enables the retailer to maintain an efficient, flexible and growth-supporting enterprise platform,” said Perry Kramer, managing partner at Retail Consulting Partners.

The modern POS, now termed customer engagement system, according to Kramer, must be able to interact with ordering, fuel, loyalty, inventory, age verification and other systems.

As these systems become more data rich and flexible, they are beginning to more efficiently adapt to local markets, products and compliance challenges.

For some chains, modernization means focusing in on specific areas of interest.

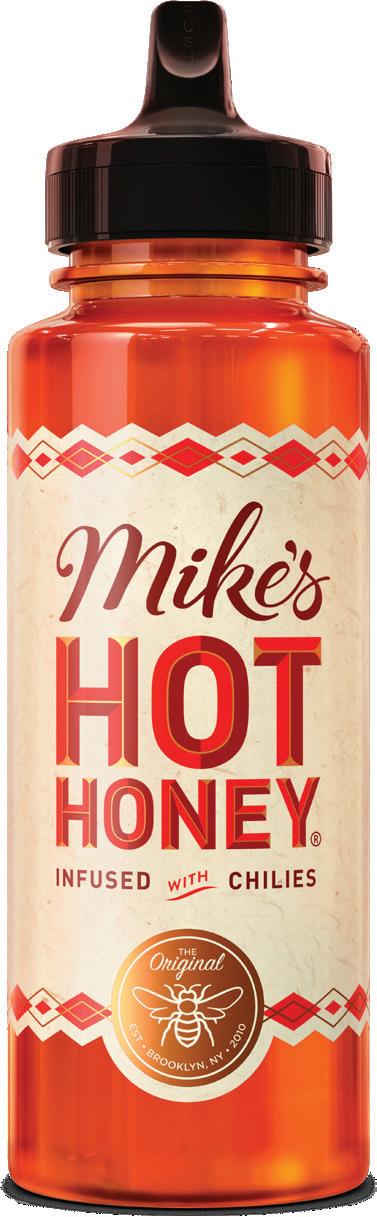

There are a few key areas of focus regarding the future of the point of sale (POS) and back office, according to Perry Kramer, managing partner at Retail Consulting Partners.

• PCI PTS 5, the fifth version of the payment card industry credit card standard for terminals, expires on April 30, 2026, which will drive the move to new payment terminal models for many convenience store operators.

• Item image recognition for self-checkout technology continues to improve and come down in cost. Credit-only self-checkout lanes typically cost 50-75% less than cash-and-credit lanes and are becoming more accepted by consumers.

• Retailers need to be choosing an extensible and open application programming interface-based platform to allow integration of the rapid expansion of different service features in the c-store, including foodservice.

• Having 2D scanners will become important at the POS in the next five years.

• The importance of being able to have your POS system integrated to a customer data platform (CDP) will become increasingly important for analyzing customer key performance indicators in the future. If the c-store does not have a CDP, it should consider investing in one as part of a POS upgrade. Having reliable and accurate customer data will be a critical analytical platform with AI enablement in the future.

• Retailers need to align with a stable vendor/partner. There is a lot of consolidation and shifting product alignment with the many new POS vendors entering the market.

For Weigel’s, which operates 85 stores in Tennessee, customer experience enhancement, operation optimization, and security and loss prevention are the three areas of focus for development.

“When we talk about the customer experience, we’re talking in terms of convenience and speed. Our customers demand fast checkout, and we need systems to facilitate a broad range of payments in a hurry — from cash and standard credit cards to mobile payment wallets

and contactless payments,” said Joe Stalsworth, I.T. retail systems manager, Weigel’s. “Loyalty promotions and targeted promotions are also a huge part of this; new systems need to interact with these programs seamlessly to give us better customer data and help us drive repeat business.”

It’s important to Weigel’s to find systems with good reporting and analytics to give actionable insights into sales patterns, staff performance and business health.

Operationally, inventory management is a priority. Weigel’s uses automated reordering alerts, which have been a “lifesaver.” With efficiency the ultimate operational goal, the chain adopted centralized management of all stores’ pricebooks to ensure consistency and accuracy and save time.

Additionally, for loss prevention and security, systems must be payment card industry compliant with a good security makeup built into them. Realtime video surveillance integration with POS data to aid in the detection and deterrence of internal and external theft is an example, Stalsworth noted. Echoing Kramer, Stalsworth added, “It’s more about finding a solution that’s an integrated, whole platform, not some bunch of discrete individual systems. They all need to speak to one another for us to have a global view of our business.”

Herb Hargraves, chief operating officer of 103-store chain Sprint Mart, located in Alabama, Louisiana and Mississippi, also believes the customer

experience is a top priority for backoffice upgrades.

Consistency is key, and the technology must be easy to use and understand. Also, like Stalsworth, Hargraves understands the value of having all payment methods available to customers.

In addition, Hargraves recognizes loyalty integration, customer and company information security, fuel pricing software and logistics software as major emerging influential technologies in POS modernization.

Further confirming the importance of seamless integration with technology vendors, Brenda Elsworth, chief operating officer of Pete’s Convenient Stores, which operates 53 locations in Missouri, Oklahoma and Kansas, noted it as a high priority for the chain. She values the capability for multiple loyalty integrations and stacking them;

“The goal is to create a platform that is efficient, where you can make sure you don’t have to hire a ton of people in the back office, and you can make changes quickly and easily.”

- Perry Kramer, managing partner at Retail Consulting Partners

seamless integration with the back office and POS around promotions, pricing, sales data, trends and business intelligence tools; a user-friendly user interface for the sales associates; and support and consulting services.

The goal, Kramer explained, is to create a platform that is efficient, where you can “make sure you don’t have to hire a ton of people in the back office, and you can make changes quickly and easily.”

Of course, upgrading POS and backoffice software doesn’t come without its challenges.

“You can’t just flip a switch; upgrading older systems is complex. The challenges can be daunting, but they can be surmounted with the right strategy,” said Stalsworth.

One of the biggest hurdles to overcome is resistance and staff training.

Staff are familiar with the old systems, Stalsworth said, with muscle memory and quick fixes. “There’s always going to be fear of change and a factor of learning curve, which can knock back productivity in the short term.”

As a solution, Weigel’s developed a

comprehensive change management and training plan.

Store managers and employees are involved at the beginning, offering suggestions during pilot testing. They are shown the benefits of the new system and are given hands-on training and continuing support “to win their approval and make them champions of the change,” said Stalsworth.

At Sprint Mart, modernization challenges are similar. Hargraves noted both employees and customers might face a learning curve. Functionality may differ from previous systems, and the troubleshooting steps employees are used to might change.

For Pete’s, challenges have included

Weigel’s focuses on customer experience enhancement, operation optimization, and security and loss prevention when it considers back-office and point-of-sale modernization.

third-party vendors struggling to keep up with retailer innovation. The chain used a consulting firm to develop what it needed.

Looking ahead, there’s still much for c-store operators to consider in terms of back-office modernization.

For instance, camera artificial intelligence (AI) to alert chains about outof-stocks is ramping up in use. Also, Elsworth noted, c-store retailers should be on the watch for electronic shelf labels controlled by the back office and AI capability to see daily margin trends by category.

AI is also on Stalsworth’s radar — “There is huge AI and machine learning coming into the picture.”

And its abilities extend beyond previous demand data extrapolation.

“It can actually analyze sales patterns but integrate external factors such as local events, weather forecasts and even social media trends to predict what we will sell,” he said.

With this in use, ordering is optimized, food waste is minimized, and

the correct products are placed on the shelf at the right time.

AI can also be helpful for loss prevention and customized customer experiences.

“It’s not so much about one shiny new gadget; it’s more of a concerted effort,” Stalsworth said.

Kramer noted cloud technology is allowing retailers to reduce their tech footprint in the back office. Mobile inventory devices are also becoming a component of in-store efficiency. Product recognition through image recognition has resulted in labor savings, “however, the model does not work in every market and demographic, so it must be supported by the selected POS solution but is not a one-size-fitsall solution.”

As retailers look to optimize their back-office and POS systems, they must strategize for future tech needs.

“The future is all about data. The new POS isn’t just a cash register anymore; it’s an information point. Merchants need to choose systems that capture not only transactions but also detailed, rich information about customer behavior, product performance and operational efficiency. The real value is in what you do with that data,” said Stalsworth.

Projecting demand for specific goods, staffing correctly for traffic flow and preparing offers on a one-to-one basis in real time are a few actions retailers can take.

Additionally, with the establishment

of c-stores as foodservice destinations, integrating food into the tech ecosystem is a crucial development.

Sprint Mart will soon be utilizing modules inside of the PDI back office to streamline foodservice operations. Pete’s, too, is integrating foodservice.

Kramer noted some retailers shy away from offering foodservice ordering kiosks in case it reduces units per transaction if customers choose not to shop for additional items.

“Tech in this industry changes rapidly, so keeping your head on a swivel and adapting quickly to that change is crucial. Your team, with the aid of vendor support, should be able to implement new integrations and technologies as soon as they become available to you,” said Stalsworth. CSD

As M&A heats up, c-store chains consider integration strategies and future outlooks as they plan their next moves.

Emily Boes • Senior Editor

MERGERS AND ACQUISITIONS (M&A) in the convenience store industry are not slowing down. In fact, M&A seems to be speeding up as consolidation continues to be headline news.

In the past couple of years alone, Maverik acquired Kum & Go, creating an 800-plus store behemoth; Nouria acquired Enmarket, expanding operations to the South; and industry giant Alimentation Couche-Tard attempted to buy 7-Eleven parent company Seven & i Holdings, a move from which it has since withdrawn.

As more regional and independent operators are bought, c-store retailers must decide on their futures now.

“Never before have you ever seen some major players — and I’m talking about the Wawas, the Sheetzes, the RaceTracs, the Buc-ee’s, even — … expanding into other states (at such a fast rate). And it tells me this is the shadow of things to come,” said Terry Monroe, president and founder of American Business Brokers & Advisors.

On a global level, international companies are expanding into the U.S., as evidenced by FEMSA’s acquisition of Delek US. FEMSA, owner of the popular Mexican c-store chain OXXO, operates over 25,000 stores across Mexico, Latin America and the U.S., with 249 stores, concentrated primarily in Texas, New Mexico and Arkansas, as part of the newly acquired Delek network.

Announced one year ago, the noteworthy acquisition made waves due to the new retailer entering the U.S. market.

“Our entry into the U.S. convenience market stems from a long-term strategic vision. We identified a significant opportunity to build a scalable platform in a dynamic and sizable market.

Delek’s retail network — mainly the DK stores — represents a strong foundation in key markets like Texas, which are crucial to our strategy. We chose this acquisition because of its potential for learning, adaptation and growth, leveraging our experience with OXXO in Mexico and Latin America,” said Constantino Spas, CEO of proximity, Americas and mobility at FEMSA Proximity and Health.

FEMSA has begun a gradual rebranding process of the new stores, beginning with a few Texas sites.

“Our goal is to progressively introduce the OXXO value model to the U.S. market, adapting it to local expectations,” Spas said.

As of the end of Q2, 40 stores have been transitioned. However, the chain is retaining a branded fuel partnership with Alon and DK Fuel, owned by Delek.

Integration is ongoing; the process has included system migrations, alignment of key processes, and establishing a local operating structure that reflects FEMSA Proximity and Health standards and DK’s legacy.

Still, it’s been a challenge for the company to

harmonize organizational cultures and operating systems.

“However, the professionalism and commitment of the teams have been key to moving forward successfully. We are continuously learning and adjusting to the realities of the U.S. market,” said Spas.

A notable pleasant surprise, he continued, was the widespread affection for the OXXO brand.

“While we expected high brand awareness among employees and consumers in the El Paso market, the level of enthusiasm and familiarity with OXXO in Midland and Lubbock has been particularly encouraging. This positive reception reinforces our confidence in the U.S. expansion project,” he said.

According to Monroe, growth is concentrated in the Carolinas, southeast Florida and Texas — “where the people are at, where they’re going to.”

The notion puts OXXO in a great spot for expansion with its entry into the Texas market, and OXXO plans to build a relevant convenience presence in the U.S. by leveraging its regional experience and execution capabilities, of which this acquisition is the first step.

“North America is a priority region for us,” said Spas.

As operational integration continues, the brand is also focusing on cultural assimilation. OXXO has promoted open dialogue from the outset, Spas said, as

well as respect for local heritage and the gradual incorporation of FEMSA Proximity and Health values. “We are building a shared culture that combines the best of both companies, with a focus on talent, inclusion and a common purpose.”

At this stage, OXXO’s focus is gaining a deeper understanding of the U.S. market, reflecting the right value proposition that identifies with local needs. The chain is observing, testing and continuously refining while already leveraging OXXO’s operational capabilities, “which allow us to be more efficient and sustainable in key back-office processes — laying a solid foundation as we scale and adapt innovations over time,” said Spas.

“We are excited about this transformational step for FEMSA Proximity and Health,” he continued. “We see a great opportunity to contribute to the development of the U.S. sector, create value for our stakeholders and continue evolving as a company that generates a positive impact in the communities where we operate.”

Longtime U.S. players in the convenience store industry have been making substantial moves in M&A, as well, particularly Couche-Tard, which recently acquired GetGo Café + Market.

GetGo, which had 272 locations in Ohio, Pennsylvania, West Virginia,

Maryland and Indiana, is operating as its own distinct business unit of CoucheTard, overlaid geographically with two Circle K business units.

Canadian-headquartered Couche-Tard operates in total over 7,300 U.S. stores.

“Consolidating the U.S. convenience store market through M&A is one of the key planks of our growth strategy, and we continue to seek out new opportunities to expand our network in the U.S. by acquiring high-quality retail assets in desirable locations in key existing and new markets,” said Aarron Smorodin Lindgren, head of M&A for Couche-Tard. “GetGo has gained a loyal customer base through quality stores and a fantastic team focused on winning the customer and serving and supporting its communities while delivering best-inclass food and loyalty programs.”

As of now, Couche-Tard’s only plan with the acquisition is completing a smooth integration. The company has had practice with this with its previous acquisitions, and as before, it’s going to watch and learn what the GetGo team does and look for ways to scale the chain’s best practices across CoucheTard’s business.

“We have a long and successful track record of integrating acquired businesses and bringing the talented leaders and people from those businesses into our larger, global organizations. In fact,

Below:

Right: Couche-Tard has a successful track record of integrating acquired businesses; currently, the company is integrating GetGo Café + Market.

numerous senior leaders within CoucheTard have come to us via major acquisitions,” said Smorodin Lindgren.

The integration process involves crossfunctional project management starting early, with subject matter experts diving deep into all areas of the business. This continues through the acquisition’s close, with challenges varying from project to project but often relating to IT systems and back-office integrations.

In GetGo’s case, “the back office, IT, supply chain and vendor relationships, of course, have been closely integrated with Giant Eagle, but no matter the acquisition, there are always legacy programs, processes, systems and relationships that have to be reconciled,” said Smorodin Lindgren. “What’s unique about this acquisition is that the relationship is continuing with the seller in important ways. GetGo and Giant Eagle continue to partner on loyalty and marketing programs, and the GetGo team continues to office out of Giant Eagle’s headquarters, so we see that impact as beneficial.”

Beyond GetGo, Couche-Tard is continuing to seek to expand via M&A.

“There are numerous files we are working at any given time, and we see opportunities to both expand into new and existing markets in the U.S. as well as strengthen our reach across the globe,” said Smorodin Lindgren.

The company is also amidst a five-year plan to build 500 new-to-industry stores

primarily in North America, along with raze-and-rebuild projects and remodels at most existing sites to better offer a more consistent brand experience and operational excellence.

Like Monroe, Brian Young, VP of Young Oil, operating 13 Grub Marts in Alabama, doesn’t see M&A activity slowing.

However, he believes it has eliminated the competition for the one-to-two-storeoperator acquisitions.

“They just don’t hit (larger operators’) radar,” he said.

Grub Mart is still growing and, fortunately, Young believes the chain has received good deals on locations that were previously unprofitable for others.

Most recently, Grub Mart purchased a single store in January, and as of press time it had placed offers on other stores.

Young believes there will eventually be a decrease in independent operators.

“I think our industry is going to see a reduction just because of the volume. I don’t think overall volume is going to be going up any — or much, if it is. I think that it’s better-run, better-looking stores that will get more of the volume, so then that’s going to make the other ones go down in numbers,” Young said.

At some point, a retailer might come to a crossroads, and they will have to decide: “Do I sell today … or keep fighting the fight for another 10 years?” Monroe said.

Young believes much of this type of decision-making is family based. If a retailer doesn’t have an interested party to whom they can pass the business, they might consider taking the money.

“There’s all kinds of scenarios. The family dynamic is always there,” he said.

For those looking to grow, the decision comes to: Do you still want to be active in the business? And then the question becomes whether you think you can operate a store more efficiently than others had previously.

If you decide to grow as a smaller operator, according to Monroe, “you know you’ve got to get bigger. And then to get there, you can’t build them faster, so that means you’ve got to do acquisitions.”

And as Young noted, the decision will often come to the family — what does the family want to do?

“I don’t think (most people) understand that it’s really more personal than it is numbers and assets and boxes,” said Monroe. “It’s a personal decision because predominantly, most (chains) are family owned. It’s a situation with families. If they’ve got family there for succession, then they can continue to buy themselves jobs. … That’s great. They should keep doing it, but if they don’t have another generation behind them, I think it’s time that they should seriously consider, either you’ve got to get big, or you’ve got to get out. The cards are being played right in front of us.” CSD

McLane Co. Inc. unveiled HiBird, its new premium chicken program designed for convenience stores. HiBird, part of the McLane Fresh family of brands, brings a lineup of fresh food offerings tailored for convenience stores including chicken sandwiches, chicken strips, potato wedges, and white cheddar mac and cheese. The program kicks off with HiBird’s bold new signature sauce, one that’s creamy, tangy, savory and mildly spicy. HiBird provides comprehensive support — from implementation and training to merchandising and equipment. With a long shelf life and the flexibility to be prepared in either a fryer or rapid cook oven, HiBird products offer versatile solutions that adapt seamlessly to various store formats.

McLane Co. Inc. www.mclaneco.com

Celsius announced the launch of two Fizz-Free flavors: Pink Lemonade and Dragonfruit Lime. Originally available in powder form as part of the CELSIUS OnThe-Go line, Dragonfruit Lime has been introduced as a ready-to-drink Fizz-Free flavor. CELSIUS Fizz-Free Dragonfruit Lime blends the flavors of exotic, sweet dragon fruit with the vibrant tang of lime, creating a balanced, smooth, crisp taste.

To meet the growing consumer demand for additional Fizz-Free options, Celsius also introduced Pink Lemonade. CELSIUS Fizz-Free Pink Lemonade delivers a refreshing summertime flavor that’s a reimagined classic.

Celsius www.celsiusholdingsinc.com

Fred’s Pepper Jack and Tequila Lime Mac & Cheese Bites are great for a graband-go meal or snack. These crispy, tortilla chip-breaded bites are filled with a blend of creamy mac and cheese with the spicy kick of pepper jack, the tangy zest of lime and the subtle flavor of tequila for those looking for a flavor combination that is both comforting and adventurous. Whether customers are heading to work, running errands or on their way home, these bites are easy to prep and easy to take on the go.

Ajinomoto Foods www.ajinomotofoodservice.com

Rich Products’ new On Top Chocolate Soft Whip cold foam allows foodservice operators to easily add chocolate flair to trending specialty beverages. The versatile topping is a pourable, ready-to-use cold foam with a light texture that allows for layering in hot and cold beverages. Operators simply thaw and pour Chocolate Soft Whip to add to most any beverage, from specialty coffees to shakes, dirty sodas, smoothies and cocktails. The rich cocoa-flavored topping joins the Rich’s On Top Soft Whip cold foam portfolio, which includes On Top Soft Whip with a sweet cream flavor and plant-based On Top Oat Milk Soft Whip Pourable Topping. Chocolate Soft Whip arrives frozen in 19-ounce cartons, 12 per case, with a shelf life of 365 days frozen and 21 days refrigerated.

Rich Products Corp. www.richsconvenience.com

Bangers Snacks launched its 200-milligram caffeinated potato chips. Each 2.5-ounce bag of Bangers Energy Chips packs the same caffeine punch as two cups of coffee. Available in two bold flavors — smoky BBQ and sweet Paradise — the snack is priced around $3.49. The chips come with a clear caffeine warning label, much like energy drinks, advising they’re not for kids, pregnant women or the caffeine-sensitive. In a marketing play, the company embedded branded vending machines and billboards across 150-plus Roblox games, tapping into over 6 billion total visits and more than 250 million monthly active users. Through immersive in-game product placements, players can interact with Bangers chips in races, grocery runs and even snack-themed parks.

Bangers Snacks www.eatbangers.com

Introducing Krispy Krunchy Chicken’s reformulated and redesigned dipping sauce program. Designed to pair perfectly with the brand’s freshly made, handbreaded chicken tenders and the highly successful chicken nuggets launched earlier this year, this new line of sauces enhances every bite. Each dipping sauce now comes in a convenient 1.5-ounce cup, sporting a refreshed design that reflects the bold taste inside. This program update reinforces Krispy Krunchy Chicken’s dedication to quality and provides an elevated taste experience for every consumer.

Krispy Krunchy Chicken www.krispykrunchy.com

LOC Software and Diebold Nixdorf have joined forces to simplify self-checkout solution implementation for retailers. Based on its open platform approach for checkout solutions, this strategic partnership will enable Diebold Nixdorf to easily run LOC’s ThriVersA software natively on the company’s self-checkout and kiosk systems. LOC’s retail management software is designed to be used as a single database for transactions on Diebold Nixdorf’s self-service solutions, point-of-sale terminals or mobile devices. Additionally, its flexible screen design allows both cashiers and customers to easily navigate the checkout process, helping stores optimize retail performance. Diebold Nixdorf’s self-checkout and kiosk systems are highly modular and open, delivering uptime and reliability. This allows c-store operators to confidently deploy self-service solutions.

LOC Software Diebold Nixdorf www.locsoftware.com www.dieboldnixdorf.com

A strong workplace culture is essential to the success of any c-store, and at Cliff’s, taking care of employees is a top priority.

Emily Boes • Senior Editor

Company culture is a major factor in employee morale, which in turn affects interactions with customers, hiring and retention, and the bottom line. CStore Decisions spoke with Jeff Carpenter, director of education and training for Cliff’s Local Market, which operates 22 stores in Central New York, about Cliff’s take on company culture.

{CStore Decisions (CSD)} How would you describe your company culture?

{Jeff Carpenter (JC)} Cliff’s company culture is that of a caring “people-first” environment. As an organization, our team members are people first and employees second. Across our operation, our team does a great job of knowing our people as individuals and their lives beyond just the workplace, getting to know them on a personal level — their family situation, their interests and what motivates them. We also focus on flexibility, open communication and work-life balance.

{CSD} How do company values show up day to day in stores?

{JC} Excellent company culture can be found where there is intentional effort. Trust, respect, open communication, inclusivity, empowerment, positivity, safety, clear mission and values, and permission to have fun while hard at work are key areas of organizational development for each and every day when looking to build strong culture.

{CSD} What initiatives support employee well-being and engagement?

{JC} One of the things I implemented

was to take each location out to lunch. We get coverage for the store so that each store team member can attend and, additionally, (we) have members of senior management join and take them out to any restaurant of their choice. We have a blast! It is our time to thank them for their contributions. We also go around the table and ask them to share something they’d change, something we should be doing or something they just really enjoy about being a part of the Cliff’s team. This creates a really open and honest conversation that is usually very uplifting. It also creates a level of comfort and communication amongst all employees to speak to members of senior leadership. We have some really great ideas come out of these conversations that we have implemented organizationally.

{CSD} How does the culture affect the store’s dynamic with customers?

{JC} Culture is everything. One employee’s attitude (good or bad) can change the entire demeanor of the store. Our customers know our employees, just as we know our customers — those interactions become real connections. Our customers enjoy seeing our employees as much as our team members enjoy seeing them. I like to tell our employees that they may be the only interaction someone has in a day, and a smile with some friendly conversation can change someone’s day — and they have that opportunity numerous times each shift.

As a consumer, you can tell the difference between someone who loves their job and someone who despises it — and

that is not exclusive to the convenience industry. Similarly, this really is no different for store employees looking to leadership. I’m proud to say that our team truly does a great job of exuding positivity and company buy in but, most importantly, makes time for and regularly engages with ALL team members to continually build on our existing strong and resilient culture.

{CSD} How has fostering company culture had a positive effect on operations?

{JC} Not all employees may be able to give you a textbook definition of what company culture is or how to build it, but they know a good one from a bad one. When you work in a positive environment, you’re more likely to enjoy what you do and have fun doing it. And just as customers can recognize a dirty store from that of a clean one, they, too, know a culturally good operation when they see one.

{CSD} What advice do you have for c-store chains looking to improve company culture?

{JC} Good company culture starts at the top — it must be what you lead with first and be centered at the core of how you operate. Perpetuating defined company values must be an expectation and requirement for all roles. At Cliff’s, our “support team” from our “support center” is there to support our stores, because our stores have the very important job of supporting our customers. That is the perspective we drive. It’s really quite simple: take care of your people, and they’ll take care of your customers.

Kayak tubs are excelling with over 137% YTD volume growth.

SOURCE: MSAI YTD ENDING 6/14/2025

10.4% Store Distribution Growth in the past yearleading the BD MST category.

Portfolio includes some of the best moving SKUs in Branded Discount MST.