7 STEPS TO GROW YOUR USED CAR DEALERSHIP & BOOST PROFITS KEY STRATEGIES FOR RUNNING A PROFITABLE WASHINGTON INDEPENDENT CAR DEALERSHIP DEALER ALERT: WSIADA Education Fairs are Heating Up - Don’t be left out! Dealers are Stayin’ Alive as Retail Continues to Shift Catalytic Converter Thefts Top 64,000 in 2022: New data is just a snapshot of an underreported crime The Sales Objections You Need to Master in 2023 PLUS 6 Reasons Why Consumer Lending is Ready for an Overhaul THE FRONT ROW JULY 2023 • WSIADA.COM THE MAGAZINE FOR WASHINGTON INDEPENDENT AUTO DEALERS SINCE 1988

Stop by the Manheim Seattle booth at the WSIADA Education Fair – East July 18th from 9am-5pm in Spokane to learn about the tools and services Manheim offers our buyers and sellers. Fill out an entry form for a chance to WIN a special Manheim Seattle prize!

Maximize your vehicle value before it hits the lanes or your lot for the best ROI!

Manheim Seattle offers pre- and post-sale recon services including Body & Paint, Inspections, Mechanical Repairs, Detail, and Wash & Vacuum.

Ask us how Manheim Seattle can help you be successful because Our Mission Is Yours!

THE FRONT ROW

The official magazine of the WASHINGTON STATE INDEPENDENT AUTO DEALERS ASSOCIATION WSIADA.COM

707 Auburn Way South | Auburn, WA 98002 T: 253-735-0267 | F: 253-804-0844 staff@wsiada.com | WSIADA.COM

EXECUTIVE BOARD

Wasim Azzam, Board President

All Right Auto Sales | President@wsiada.com

Badie Darwazeh, Board Vice-President

Seattle Auto Haus | VPresident@wsiada.com

J.T. Curry, Board Secretary Motors Northwest | Secretary@wsiada.com

Emil Scarsella, Board Treasurer

Town & Country Auto Sales | Treasurer@wsiada.com

CHAPTER PRESIDENTS

Tony Bonnallie – North Cascade Mission Motors | NoCascade@wsiada.com

Victor Perez – North Sound

Route527 Motorsports | NoSound@wsiada.com

David Magarrell – South Sound Auto Sales Consultants, LLC | SoSound@wsiada.com

Rachel Frankel - Vancouver

Top Auto Brokers | Vancouver@wsiada.com

Vacant Position – Yakima

Yakima@wsiada.com

Vacant Position – Tri-Cities

Tri-Cities@wsiada.com

Vacant Position – Spokane

Spokane@wsiada.com

AT-LARGE BOARD

Randy Fletcher, Board President (Emeritus)

In-N-Out Auto Sales

Ken Williamson, Board President (Emeritus)

John’s Auto Mart, LLC

WSIADA STAFF

Rick Olson, Director of Operations

Mila Froman, Membership Manager

Mary Walton, Accountant

Lane Schulz, Retail Associate

PRODUCTION EDITOR

2

6

8 DEALERS ARE STAYIN’ ALIVE AS RETAIL CONTINUES TO SHIFT

The challenge for dealers is to embrace continued enthusiasm for pre-ordering and grow their online offerings, including F&I.

13 THE MORE YOU LEARN, THE MORE YOU’LL EARN Your business, your customers, employees, and your pocketbook all benefit from a commitment to an awareness of trends in your industry, and continued learning of the best practices operating a dealership.

16 6 REASONS WHY CONSUMER LENDING IS READY FOR AN OVERHAUL

The consumer lending industry’s limitations are becoming more evident, which means it’s time to rethink things and overhaul it in a more holistic, consumer-friendly and inclusive way.

19 CATALYTIC CONVERTER THEFTS TOP 64,000 IN 2022

20 READ & RESPOND QUIZ

THE FRONT ROW | WSIADA.COM JULY 2023 | 1

EDUCATION FAIRS HEAT UP! Make sure you’re part of these informative events.

THE SALES OBJECTIONS YOU NEED TO MASTER Climbing interest rates and fluctuating used car prices have brought on new fears and doubts for car shoppers this year.

Professional Mojo Copyright 2023 | WSIADA

CONTENTS JULY 2023 10 AUCTION LISTING | 18 SERVICE PROVIDER DIRECTORY GROW YOUR USED CAR DEALERSHIP

A strong reputation is the foundation of your dealership leading to better word of mouth Work on reviews and transparency Incorporate online tools that allow customers to browse view, finance and even purchase your vehicles online DIVERSIFY INVENTORY Consider expanding inventory to reach a wider range of buyers and stay informed about consumer trends PROVIDE FINANCING Offering flexible financing can boost sales Seek out and partner with reputable lenders Utilize both traditional and digital marketing but do it with purpose and intent knowing your customer base

TO CEMENT YOUR REP DEVELOP A STRATEGY REV UP ONLINE TRAIN YOUR PEEPS invest in training and developing your employees Great employees result in more sales Forge strategic partnerships with local businesses and organizations to expand your dealership's reach MAKE FRIENDS

7

AND BOOST PROFITS

7 STEPS

14

STEPS TO GROW YOUR USED CAR DEALERSHIP & BOOST PROFITS Running a successful Washington independent car dealership requires strategic planning, excellent customer service, and effective marketing strategies.

Washington Association of Vehicle Subagents Department of Licensing Department of Revenue Attorney General of Washington WSIADA recognizes the unique and complex challenges faced by independent automobile dealers in today's economic, political, and social environments To address these challenges, we offer two Education Fairs to aid dealerships in staying regulatory compliant and ahead of their competition. Be sure make the most of these opportunities! CONFIRMED SPEAKERS: Doubletree by Hilton, 322 N Spokane Falls Ct. Spokane, WA 99201 | (800) 757-6131 *Ask for the WSIADA Education Fair Rate EDUCATION 2023 F A I R SAVE YOUR SEAT!* WSIADA'S Education Fair in July will bring together hundreds of the brightest independent automobile dealers in the area with renowned speakers to accelerate business success and give back to the communities in which we live. wsiada.com/education-fairs Agenda coming soon! *Every attendee MUST be registered No guests allowed EMPOWER YOUR DEALERSHIP EAST, JULY 18 9:00AM - 5:00PM Washington State Independent Auto Dealers Association 707 Auburn Way S, Auburn, WA 98002 (253) 735-0267 J U L Y

Slate of nominees for NIADA Board of Directors finalized

The slate of nominees for the NIADA Board of Directors was finalized, May 25, 2023, and will be voted on at the 2023 NIADA Annual Meeting, June 19, 2023, during the NIADA Convention and Expo at the Wynn in Las Vegas.

The 12 members nominated for the NIADA Board were announced in April. The Board is responsible for all policy and financial oversight of the Association. It also hires and provides oversight of its CEO, who manages day-to-day operations.

To fill these positions, the Board appointed a Leadership Development Committee Chaired by the NIADA Board Chairman. The committee reported its recommendations to the past presidents who set the final nomination of Board candidates and notified the membership per NIADA bylaws.

May 19, 2023, was the deadline, 30 days prior to the annual meeting, for members not nominated by the past presidents to petition for a nomination. No petitions were received.

NIADA Board of Directors 2024 nominees are as follows:

President, Gordon Tormohlen

President-elect, Michael Darrow

Senior Vice President, Don Griffin

Treasurer, Darla Booher

Secretary, Dan Johnson

Vice President Region 1, Chris Maher, Sr.

Vice President Region 2, Ken McFarland

Vice President Region 3, Greg Zak

Vice President Region 4, Brenna Stansberry

Vice President At Large (2 positions), Bentley Nolan and Nick Markosian

Chairman of the Board, Scott Allen

The Board members will start their terms at the convention and represent the Association at events throughout the year, including the Policy Conference and BHPH Super Forum.

CARFAX

finds 2.5M vehicles tagged for recalls on roads

Early in May, BMW joined Ford, Honda and Fiat Chrysler, issuing a “Do Not Drive” warning for 90,000 vehicles built between 2000 and 2006 for the recall of a defective Takata air bag. Two weeks later Chrysler announced a “Park Outside” warning with the recall of 2014 to 2016 Jeep Cherokees due to a fire risk.

Unfortunately many of the dire warnings of life- and property-threatening defects are not being heeded. A new study released by CARFAX shows more than 2.5 million vehicles tagged with “Do Not Drive” or “Park Outside” safety recalls remain unrepaired as of May 1.

“Do Not Drive” and “Park Outside” notifications are recalls issued by automakers and federal safety officials. A “Do Not Drive” recall advises drivers not to operate their vehicles because a serious safety issue could lead to an accident or physical harm. A “Park Outside” recall is issued for vehicles with a high risk of causing a fire, and owners are advised to park these vehicles outside of garages and parking structures, and away from buildings.

“It’s heart-breaking. On average 20 to 25 percent of these vehicles are not getting fixed and the need is so urgent,” said Patrick Olsen, Editor in Chief at CARFAX. “CARFAX is working to raise awareness and trying to bring those numbers down.”

CARFAX studied five years of recalls and painstakingly searching through individual registrations and safety inspection reports to see if consumers had the repairs made to the vehicles.

Olsen suggested a variety of factors could have impacted the lack of repairs, including the notifications being required to be sent through first-class mail, or consumers dismissing the notices as scams. “There’s also a significant portion of people that don’t have the time or the ability to give up their vehicles for a period of time. It’s how they get to work and is part of their livelihood,” Olsen said. Under the two orders, the National Highway Traffic Safety Authority (NHTSA) states repairs are free and the dealership and manufacturer will tow the vehicle for free.

In the CARFAX study, six states had more than 100,000 unrepaired vehicles, with California leading the way (245,000). The other state with more than 100,000 recall vehicles still on the road were Texas (242,000), Florida (237,000), New York (118,000), Pennsylvania (106,000) and Ohio (101,000).

In November, the NHTSA reported a person being killed by an airbag rupture in a Ford Ranger under a “Do Not Drive” warning. “These are real concerns and could unfortunately have real consequences if they are not worked out,” Olsen said.

Consumers and dealerships may check for free to see if their car has any open recalls at Carfax.com/recall. n

“We were startled by the numbers we found,” Olsen said.

INDUSTRY NOTES: RECALLS

Register for the Success of your Dealership

RICK OLSON, DIRECTOR OF OPERATIONS

Here it is, already the month of July. As the mid-point of the year has arrived, we find ourselves looking forward to the second half of the year with much potential and hope. With that mid-point comes the annual Education Fairs with the WSIADA.

WSIADA Office Gets Security Upgrades

The WSIADA office located in Auburn has been going through some upgrades in the past few months to combat some of the secuity concerns in the area. Like so many other business’s locations, we have had external damage to our office and our staff has begun to feel unsafe.

In June, we upgraded our main entrance with security panel access. In an effort to protect our staff, visitors will be required to “buzz in” before having permission to enter our facility. The access panel is located to the right of the main door with an easily seen sign.

At the time of this article, we have had some positive responses, as well as negative, to the installation of this new security feature.

The WSIADA will also begin to require visitors to the office to show their dealership identification card, or the “Blue Card,” when purchasing or picking up products from WSIADA headquarters.

The Blue Card should already have been issued to each dealership employee to utilize the dealer license plates. Currently, our staff verbally asks for dealer numbers during

The Spokane Education Fair is returning, once again to the Doubletree Hilton Convention Center in Downtown Spokane on July 18. This is the day before the big MAG Auctions Rock & Roll Sale Concert Event. We hope dealers coming to the area will join us before enjoying the concert.

The Education Fair has always been a fun experience with speakers, vendors, and interacting with peers - all while gaining the annual renewal credits for your business’s

next year of operation. This year we will have vendors from SiriusXM, Manheim Seattle, Shepard & Shepard and more for dealers to visit during the vendors’ lunch.

Registration is available for dealership employees to sign up with an opportunity to ask our guest speakers questions prior to the event. Additionally, a goodie bag from WSIADA will be available to each person who registers for the events. We look forward to seeing you there! n

transactions with dealership representatives either in person or by phone. So, this shouldn’t pose any inconvenience. This verification process is required in an effort to limit false orders because misrepresentation can harm member dealers.

Generally, this identification number is given without issue; however, after recent responses such as “I don’t know, can’t

you look up the dealership name?” it is a growing concern that is worth mentioning and reminding dealers of the process. This is particularly important in many instances where a different address is provided that is not on record for the dealership. We appreciate your acknowledgment and acceptance of our operating procedures. If you have any questions, we look forward to speaking with you. n

4 | THE FRONT ROW | WSIADA.COM JULY 2023

q

OF

MESSAGE

DIRECTOR

OPERATIONS

Rick Olson (left), Director of Operations for WSIADA visits Washington Association for Vehicle Sub-agents (WAVS) Convention in Wenatchee Washington in May.

AROUND WASHINGTON

WSIADA TITLE WORKSHOP

$125 MEMBER // $175 NON-MEMBER

This Workshop is designed to give dealers an in-depth understanding of the business practices, state/federal requirements, and forms needed to complete a transaction. This course offers 3 hours toward Continuing Education requirements and allows attendees to ask the instructor individual and dealership-specific questions. Any employee of a dealership may take this course. Continuing Education hours are issued to the dealership, not to individuals attending.

The curriculum for this workshop includes, but is not limited to:

• How to transfer a title properly in Washington State

• Avoiding common dealer errors including how to detect and avoid fraud.

• How to use e-Permitting, Contracted Plate Search, and other state systems accurately.

• Proper procedures on processing Consignments, Trade-In’s and Private purchases.

• Tips on how to avoid costly penalties with efficiency and organization skills.

You may register and pay online. You’ll receive an email confirmation after your registration is complete. Registration is available until 2:00PM the day the class. In-person registrations on the day of the class are not accepted.

THE FRONT ROW | WSIADA.COM JULY 2023 | 5 HARNESS

POWER OF

MANAGE YOUR DEALERSHIP THE PROGRAMS ARE OURS THE BENEFITS ARE YOURS Monitor Inventory & Sales Process Instant Approvals 24/7 Prompt ACH Funding Full Spectrum Financing Competitive Rates Aggressive Advances Flexible Terms Local Branch Offices Training & Support www.lobelfinancial.com │ 800.871.8051 │ ds@lobelfinancial.com © 2021 Lobel Financial. All rights reserved. Member NIADA. 263087-Lobel Harness the Power7.367x4.811.indd 1 11/5/2020 10:26:46 AM

THE

OUR DMS PLATFORM

CLICK HERE TO REGISTER » WSIADA.COM/EDUCATION/TITLE-WORKSHOP HOSTED IN CONJUNCTION WITH FREE TITLE CLERK STAMP WITH REGISTRATION! ($40 VALUE)

The Sales Objections You Need to Master in 2023

By Susan Gaytan, Director of Dealer Engagement & Training, Alan Ram’s Proactive Training Solutions

Climbing interest rates and fluctuating used car prices have brought on new fears and doubts for car shoppers this year. Being proficient with these objections is essential for sales teams to survive and thrive in the current market.

When it comes to converting sales prospects, here are the top three sales objections I hear reps struggle with along with some pro tips on how to effectively respond to these objections. These tips will work for training across the board, including automotive phone sales training, automotive BDC training, auto Internet-BDC and even sales managers.

#1

What’s your best interest rate?

I’ve had meetings with six different dealers in the past week regarding interest rates and the challenges that higher rates pose to shoppers. The Federal Reserve raised interest rates for the ninth time in a row in March, and this has ultimately affected the way that your inbound sales calls are being handled. Sales and BDC reps are getting the rate question come up while working sales prospects on the phone and online, and they’re handling the question like an objection or roadblock. They are not equipped with the right responses and will eventually either go down a rabbit hole or just turn the client away unintentionally.

To sustain volume and gross, reps need to master this part of the call. You want to address the question without regurgitating everything you have heard about interest rates. This is not the time to show off what you know. “I understand your concern, and I assure you that our finance team will do everything they can to help with that. When would be a good time to review interest rate options with you?” is an example of addressing the rate question and offering a solution. Here’s a tip: Leverage your finance managers. You have professionals that are there to help you. They are

trained in special circumstances. Get them involved if you need to and tell the customer to “set up an appointment to come and see our finance specialist.” Automotive sales training at this stage is so important in order to arm salespeople and BDC reps with the best responses.

#2

Your price is too high, can you come down? Ahh…the age-old price question. Your sales team, including managers, is probably rusty in this area so this is definitely one that you want to review with your team. After re-stating your ad price, reps need to immediately include any valuable perks that would benefit the shopper. What makes your experience different? Does your dealership offer something that others don’t? This is precisely the time to include those perks, instead of waiting until after the sale. If a shopper persists on price, make sure that you are including the value of their trade. To the educated buyer today, the most important thing is the bottom line price which must include their trade value. If you wait to bring up their trade after the fact, you could run into more price challenges.

#3

I need your best offer on my trade before I come down. Vehicle trades and acquisitions are hot and most dealerships have recognized the opportunity by pushing more trade and appraisal activity through their sales teams. But naturally, some folks won’t come down to the dealership unless they know they’re getting the best offer for their car. Sales reps need to know how to navigate this objection. Simply put, they need to know how to get them into the dealership so they can accurately evaluate their trade in person. “Mr. Shopper I completely understand. I have found that the most aggressive trade-in offers typically happen here at the dealership where we can see your car in person. When would be a good time for us to get together?” is an option.

The Bottom Line

You want to encourage your shoppers to come and see you in person whenever (Continued on next page)

6 | THE FRONT ROW | WSIADA.COM JULY 2023

(Continued from previous page) possible. Shoppers are going to be more flexible in person at the dealership because their decision-making process goes from logical to emotional. Aim to get your online leads on the phone and you’ll have a much better time communicating and addressing those concerns.

Once you’ve heard the shopper’s objection, respond with care. There is no need to get defensive or impatient. They are voicing a concern. They are telling you what you will need to do to close them later. Express your desire to truly help them. This is ultimately what people want. The way that you respond to their objection will make or break the deal. And always, always, end your response with a question to bring the conversation back to your conversion steps.

A shopper’s objection is not a rejection. It is merely an inquiry that needs clarification. These could be golden opportunities for you to win the shopper’s trust and gain a customer for life. n

Susan

at Alan Ram’s

Gaytan, Director of Dealer Engagement & Training

Proactive

Training Solutions, brings over twenty years of automotive experience and dealership management expertise to her role. She is responsible for integrating training solutions and helping dealerships maximize the effectiveness of training.

THE FRONT ROW | WSIADA.COM JULY 2023 | 7 Give 3-month trials to your customers. No credit card required. Visit SiriusXMDealerPrograms.com to learn more. SIRIUSXM’S FREE PRE-OWNED PROGRAM

Dealers are Stayin’ Alive as Retail Continues to Shift

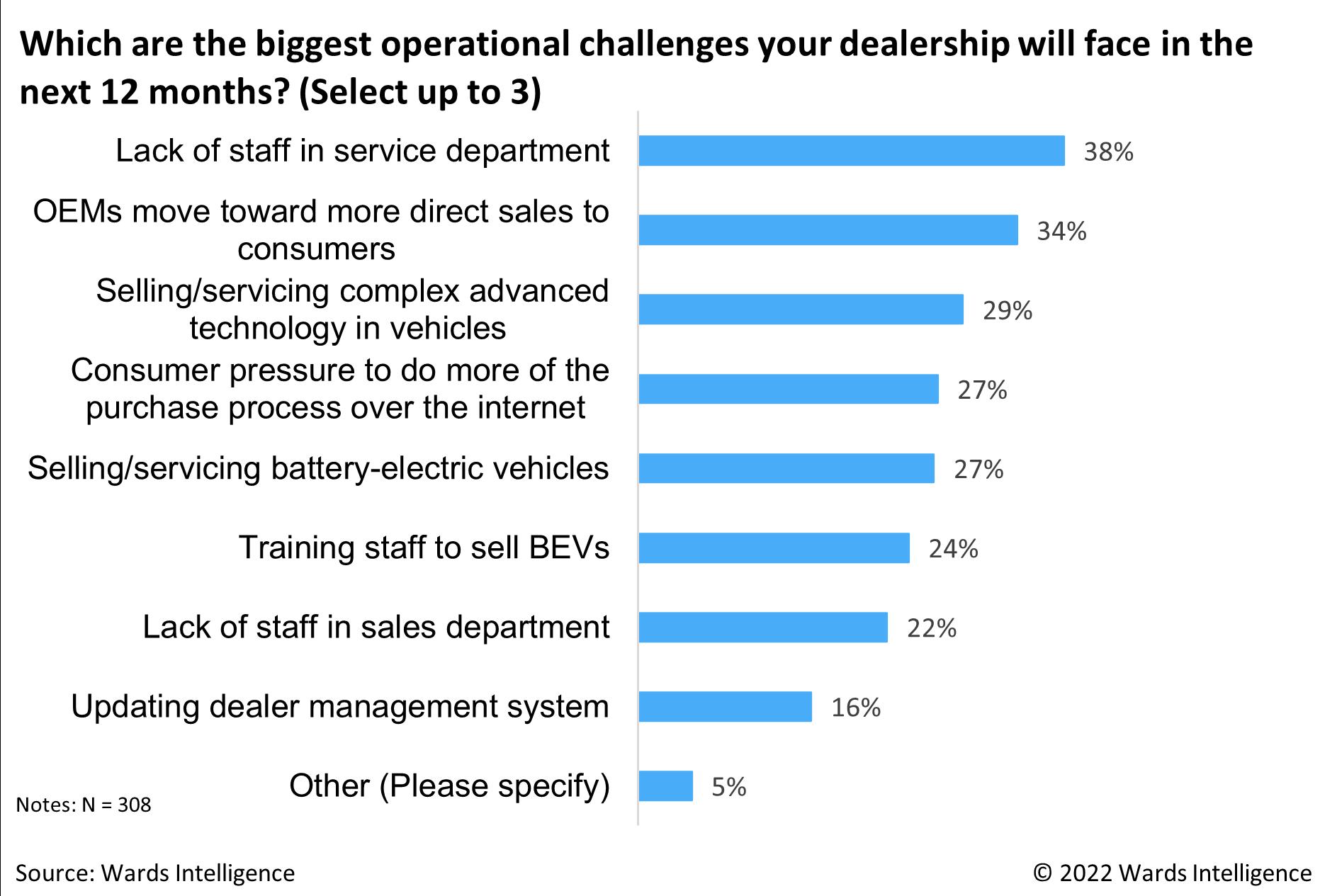

The challenge for dealers is to embrace continued enthusiasm for pre-ordering and grow their online offerings, including F&I.

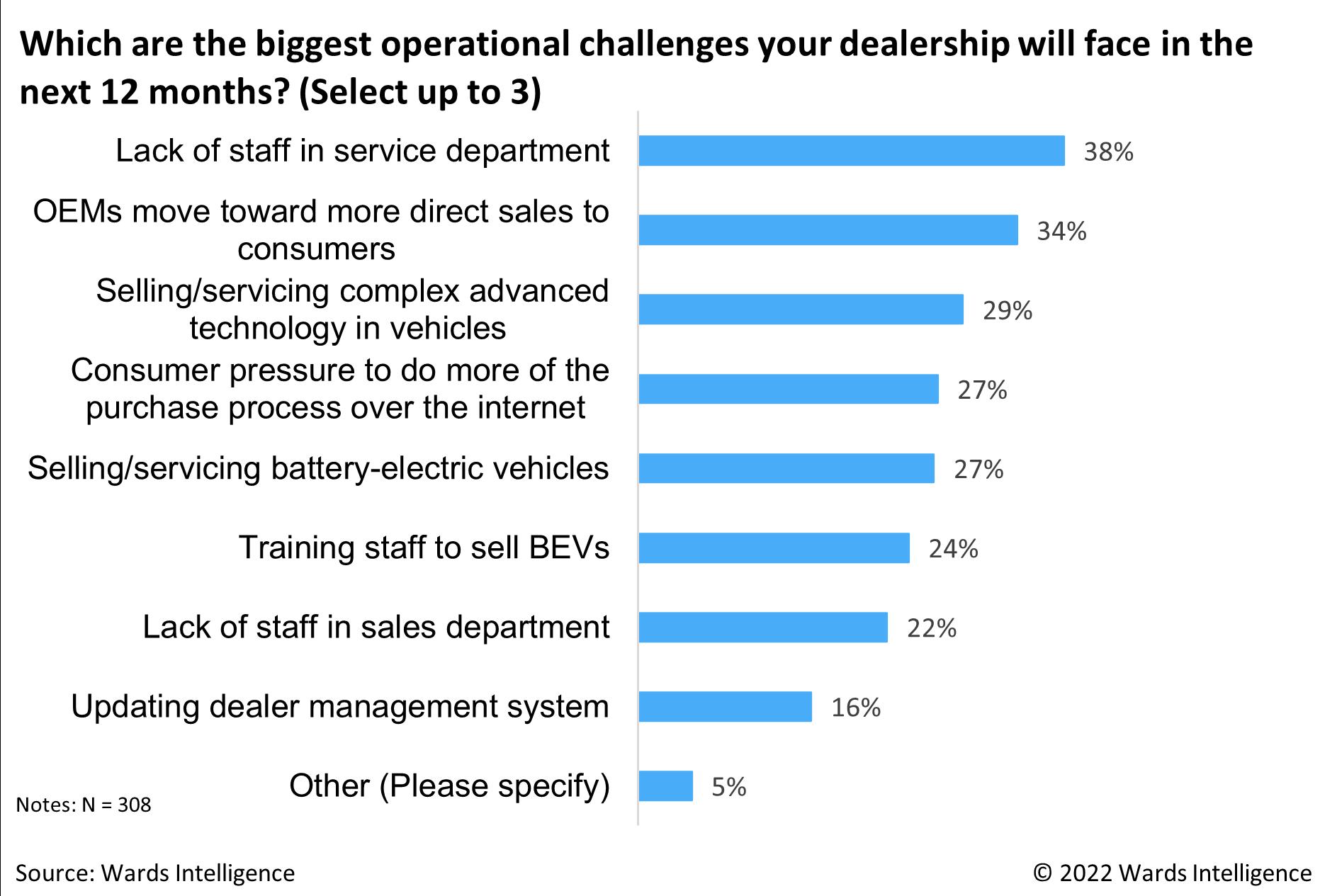

Wards Intelligence surveyed dealers throughout the U.S. to chart retail automotive's present health, electrification challenges and future opportunities. This is part of a series analyzing our survey results.

“There are more tears shed over answered prayers than over unanswered prayers.”

That well-known quote may sum up the situation many car dealers currently face. Our January report noted the most prevalent 2023 wish by dealers was more inventory. Well, that wish was granted – and then some – for many dealers who report their lots now are flooded with inventory.

But that’s not true throughout the retail landscape. In general, the availability of most models across vehicle segments remains below historical levels. Although U.S. new-vehicle inventory finished April at nearly 55% above April 2022, the overall 35 days’ supply pales compared with prepandemic norms of 65 days or more.

Light-duty trucks are one exception to the lower-than-usual inventory. During the chip shortage, automakers tended to focus on producing high-margin models, such as pickups, so less pent-up demand existed for the trucks once the chip crisis began to ease. Now, Ford is offering significant incentives to keep trucks moving off lots. General Motors, which idled some Silverado/Sierra plants for two weeks to keep inventories in check, is expected to do the same, Karl Brauer, executive analyst with iSeeCars, tells Wards.

Yet dealers need vehicles priced below $25,000-$30,000. It’s unclear if automakers will fill that void. GM’s reintroduction of the budget-friendly Trax, which has a sticker price of $20,400, may start a trend for automakers looking to attract those who

By Nancy Dunham

want vehicles under $25,000, but it’s too soon to forecast, Brauer says.

Industry insiders have long predicted that the demand for vehicles of the past few years would end once chip availability rebounded, production increased and pricing weakened. That is now coming to fruition, with control of the market shifting more toward buyers and away from sellers.

Of course, rollercoaster production that has recently led to an array of shortages and quickly turned to overabundance is just one headache dealers now face. As Silicon Valley Bank and other financial institutions struggle to remain afloat in some form, the economic index sinks and the stock and bond markets experience turmoil. Those factors leave dealers facing higher costs –from payroll to supplies and utilities – and lower sales volumes.

The Wards Intelligence survey of more than 300 U.S. owners/operators, general managers, chief financial officers and sales and service staff from dealerships of various sizes provides some insights into the state of the industry. The cross-section of respondents from both new- and usedvehicle dealers ranges from small (monthly sales of 80 units and below) to large (monthly sales of 81 or more units).

So, with these new economic factors in mind, how will dealers increase revenue in the next 12 months? (See chart below)

Dealer respondents projected that fixed ops would be an area of growth for them during 2023, and so far they seem to be correct.

AutoNation reports parts and service revenue increased 7.6% in the first quarter vs. a year ago, to $1.1 billion on a same-store basis. Lithia Motors’ Q1 revenue for service,

8 | THE FRONT ROW | WSIADA.COM JULY 2023

body and parts was $669.9 million, up 9.4% vs. a year ago, also on a same-store basis.

The same growth can’t be said for used-car prices, which were riding high during the chip shortage that hampered new-vehicle production but have fallen ever since. March 2023 prices fell almost 5% from September and nearly 9% from March 2022, according to iSeeCars.

The Cox Automotive Group reports March 2023 used-vehicle sales through dealerships (not private-party transactions) came in at an estimated 1.8 million in March, down 3.5% from March 2022. The statistics may be skewed due to a rise in cash sales, Cox reports, a trend that has taken hold due to rising interest rates.

Perhaps it’s not surprising that most survey respondents (86%) say streamlined F&I processes and improved relationships with lenders (cited by 81%) are the factors most critical to their dealerships’ future successes. Dealers and other retailers know the recent pandemic changed shoppers’ expectations about service.

As we reported earlier, data from the 2022 Cox Automotive Buying Journey Study shows the majority (61%) of vehicle buyers were “satisfied” with their car buying processes, but that’s down five percentage points from the previous year.

High satisfaction with pre-ordering, including solid communication among dealers and customers, may explain why satisfaction rates remained high as the pandemic lingered, Cox reports.

The challenge is for dealers to embrace continued enthusiasm for pre-ordering and grow their online offerings, including F&I. That could further boost dealers’ profits.

Cox reports buyers purchased more F&I products in 2022 (67%) than in 2021 (59%).

Dealers may have some breathing room with bringing F&I online as only 30% of car buyers applied for credit online and 15% signed paperwork online in 2022, according to Cox.

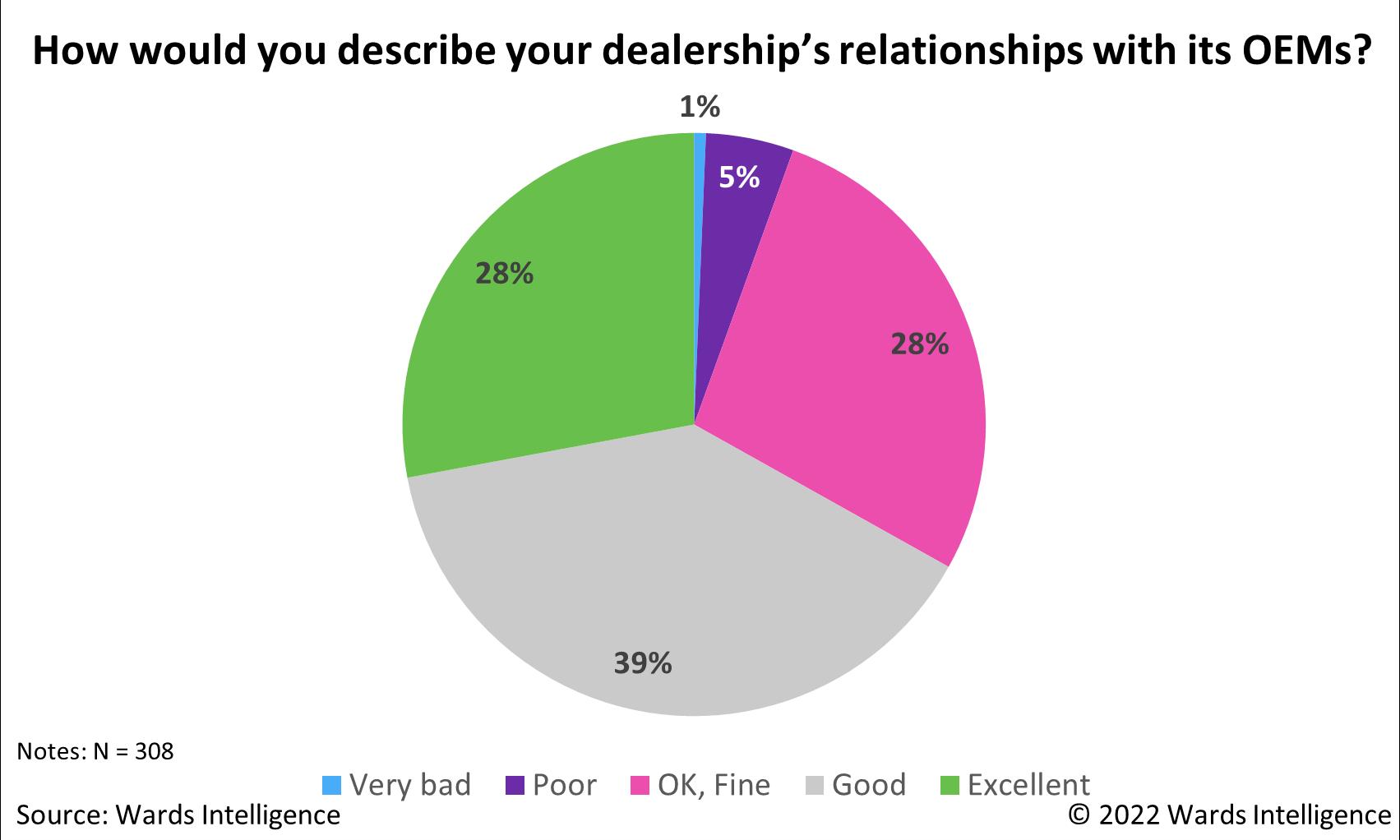

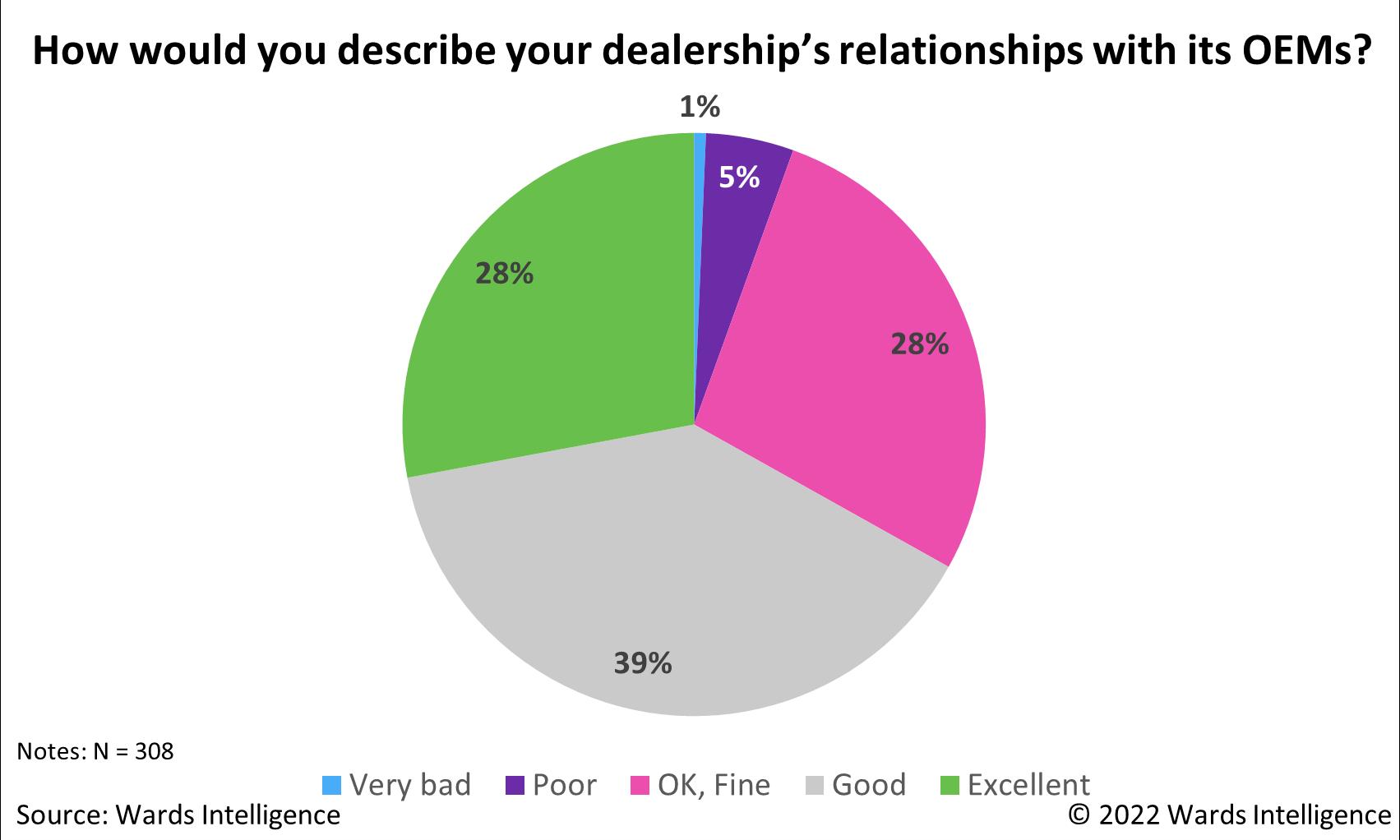

Despite 42% of dealers citing improved relations with OEMs as important to their futures, most appear satisfied with how their OEMs treat them, with only 6% saying their relationships are poor or worse.

Dealers indicate they need continually improved relationships and strong

Lenders seem to be rising to the challenge of working more closely with dealers. Equifax is one such company offering lending based on “alternative credit data” that gives a holistic view of customers’ financial pictures. Analysts expect to see such partnerships grow as vehicle prices continue to rise.

Another interesting finding from the Wards Intelligence survey responses is that most retailers (82%) believe improved relationships with their OEMs are critical. Historically, automakers and dealers generally have had a less-than-harmonious relationship from time to time. That heightened as manufacturers over-built vehicles and pushed dealers to take them, many of which sat on lots for weeks.

partnerships with manufacturers and stronger brand loyalty to continue retail success.

But manufacturers’ fast-track plans to sell, and service electric vehicles currently is a pain point for dealers.

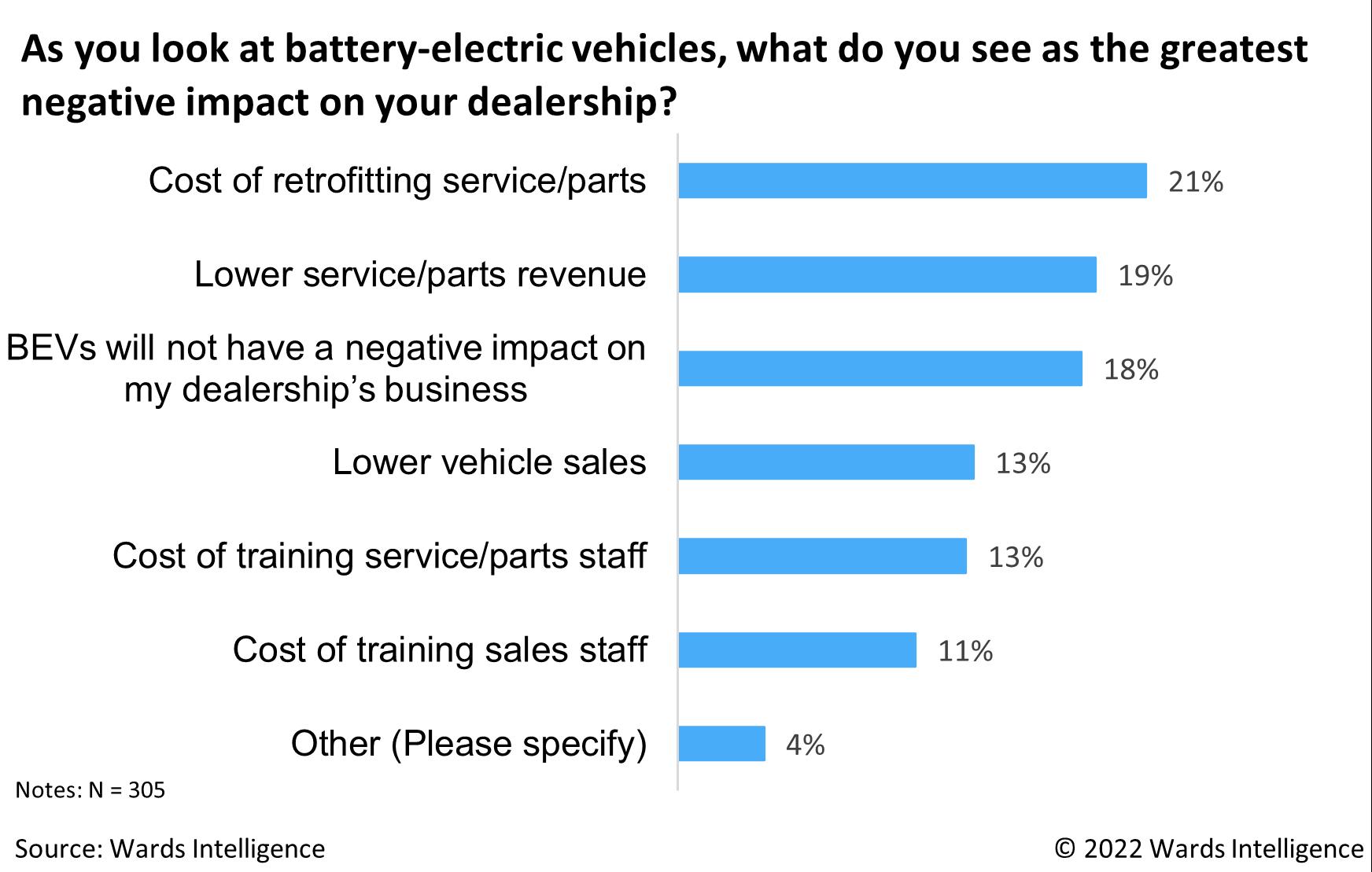

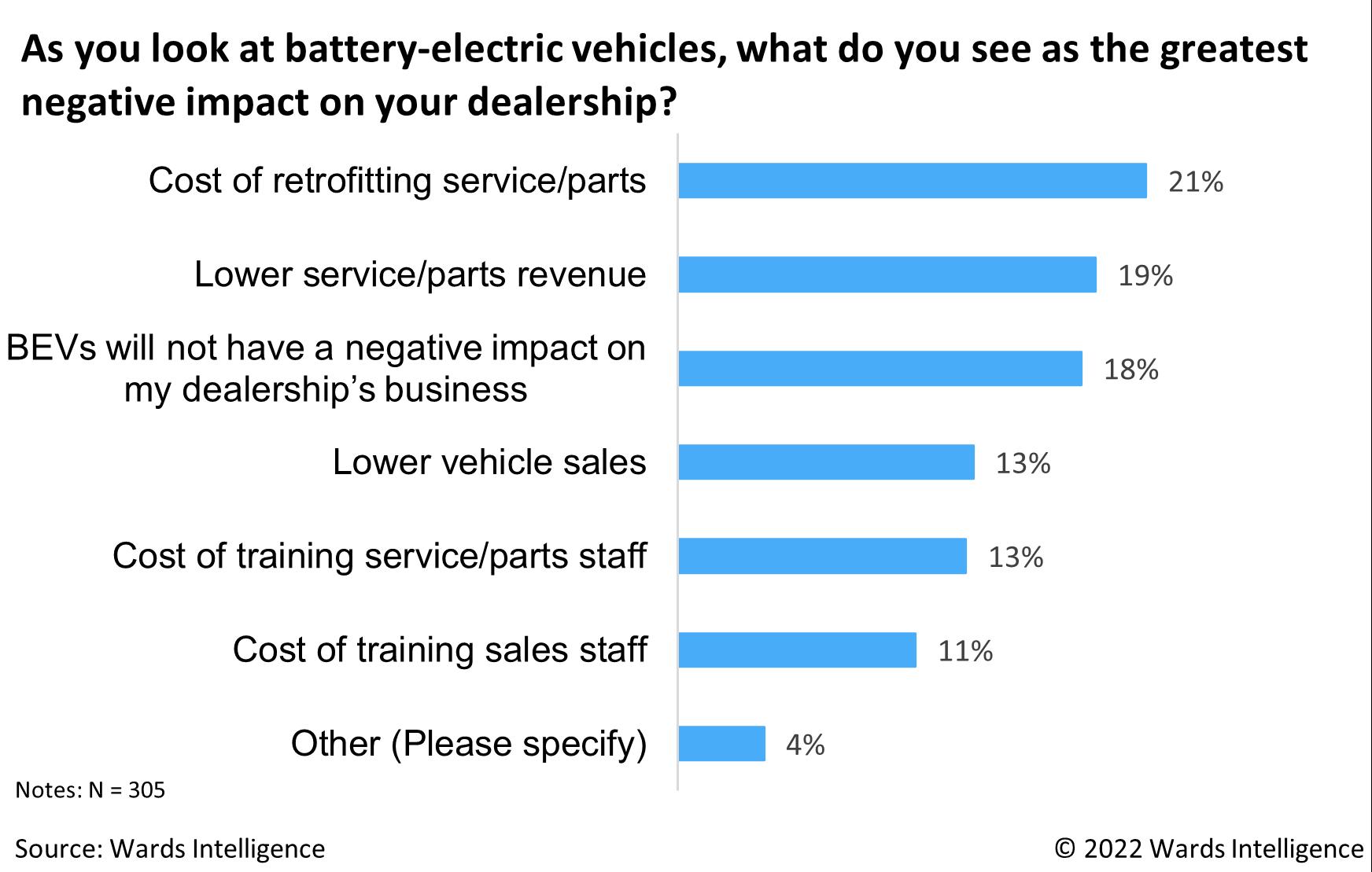

Most survey respondents (81%) report electric-vehicle adoption will negatively impact their businesses in some way. The top reasons include the cost of retrofitting their service departments and stocking necessary parts (21%), the potential drop in service/ parts revenue (19%) and lower vehicle sales (13%). Only 18% of respondents do not expect BEVs to impact some part of their operation negatively.

(Continued on next page)

THE FRONT ROW | WSIADA.COM JULY 2023 | 9

(Continued from previous page)

If findings in a recent J.D. Power study are accurate, the manufacturer-dealer divide may grow further as the BEV activity heightens.

The J.D. Power study shows pricing and accessibility of public charging and ambiguous tax credits play a significant role in buyers’ decisions not to purchase BEVs.

Adding to that is a dip in BEV sales, down from 8.5% in February 2023 to 7.3% in March 2023.

The decline is a concern because J.D. Power data shows an increase in consumers who are “very unlikely” to consider an EV for

their subsequent purchases. That number has grown steadily in the first three months of this year to 21% in March 2023.

Chairman Geoffrey Pohanka sought to smooth relations between dealers and manufacturers in his inaugural address at the National Automobile Dealers Assn.’s 2023 show in Dallas.

“Dealers and their OEMs essentially want the same things: to give customers a great buying experience and to sell a lot of cars and trucks,” he told attendees at the January show.

Whether dealers or automakers can truly define that “great buying experience” and deliver it cost-effectively is the question. n

In a desire to be more accessible to dealers and maintain a footing in the ever expanding digital age, WSIADA has its own mobile app for dealerships to utilize features that the Association has available. The app is for members and nonmembers. It’s free and easily downloadable through your smartphone app store. Options that are available:

• Dealer Alerts

• Events Calendar

• Online Store

• Smart Dealer Auction Discounts

• the Front Row Magazine

• Dealer Auction Schedules

• Sponsor Contact Information

• and much, much more!

10 | THE FRONT ROW | WSIADA.COM JULY 2023

Online shopping, e-news, alerts and more! Download the WSIADA App!

5.5’ STICKERS

New designer look with non-fade inks! Stickers come in a variety of eye-catching colors and are adhesive for windshields. An inexpensive yet highly effective sales tool to advertise a year model or price. Sold by the dozen {12 per pack}. Size: 5 1/2” tall x 3” wide. Neatly shrink wrapped in packs of a dozen with a chipboard backer to prevent curling during storage. Made of durable, waterproof vinyl, these bright, non-fade numbers demand attention! Each number is slit on the back for easy application. Removable adhesive allows easy, clean removal. This is a Special Order item. Please allow two weeks for delivery.

The WSIADA WEBSTORE offers a variety of popular products, supplies, and forms that dealers find most useful at discounted prices. Members get 15% off on most products. Save yourself time by ordering through the online store and have it picked up from one of our locations. Be sure to check the store and buy from WSIADA!

12 | THE FRONT ROW | WSIADA.COM JULY 2023 Filling your lot Fueling your dreams Learn more at autofinance.com AFC’s Washington team is committed to making your impossible possible. Seattle Branch 253-333-0300 4508 Auburn Way North Suite C Auburn, WA 98002 Spokane Branch 509-244-1766 11011 W. 21st Ave Suite 1 Airway Heights, WA 99001 Portland Branch 971-284-8413 23585 NE Sandy Blvd. © 2022 Automotive Finance Corporation. All rights reserved. DEALER FLOORPLAN FINANCING

THE MORE YOU LEARN, THE MORE YOU’LL EARN

BY TODD SHEPARD, FOUNDER OF SHEPARD & SHEPARD INSURANCE SOLUTIONS

BY TODD SHEPARD, FOUNDER OF SHEPARD & SHEPARD INSURANCE SOLUTIONS

Knowledge is power. Your business, your customers, employees, and your pocketbook all benefit from a commitment to an awareness of trends in your industry, and continued learning of the best practices operating a dealership. Whether you are starting out or you’ve been in the car business your whole life, it is difficult to imagine anyone that wouldn’t benefit from a little more education, isn’t it?

Most professions, including auto dealers, are required to take a few hours of continuing education every year or two to maintain their State issued license. While some view this requirement to be an inconvenience, others embrace the opportunity to learn more about their chosen profession.

In Washington, the annual requirement for dealer licensing is to attend five hours of live or online training. Continuing to learn about your craft through classes, reading, or online research has proven, through multiple studies, to increase income and prevent losses through error. In short, blocking out time to learn should be as big a part of your business plan as attending auctions, online marketing, and making sure your inventory is clean and ready for the next sale.

WSIADA is hosting two Education Fairs this year. July 18th is the East side offered in Spokane, and September 21st will be on the West side. These fairs offer the opportunity to hear from representatives of State organizations such as Department of Licensing, Department of Revenue, and the Attorney General’s office. Vendors that support the association will also be

there to present ideas and display products and services to help your business operate smoother and be more profitable. Q&A sessions and panels during these events allow dealers to learn current regulations, tips, and get answers to real life questions that impact their businesses on a day-today basis. All this education is provided primarily by volunteers that support the efforts of your association. I have had the pleasure of attending and speaking at these events for many years, and it seems a new and valuable lesson is discovered each time.

Consider attending one or both of this year’s Education Fairs. The time investment is minimal, and at the very least it’s an easy and fun way to fulfill your continuing education. If you cannot personally budget the time, contact the association to learn how to send someone on your behalf while still meeting the licensing requirements. Imagine the benefits of another person on your staff with knowledge learned directly at the source. I look forward to seeing you at the Education Fairs! For more information or to register visit WSIADA.com n

Todd Shepard is the founder of Shepard & Shepard Insurance Solutions, WSIADA speaker, and regular contributor to the Front Row. For more info or a competitive insurance quote visit shepquote.com.

THE FRONT ROW | WSIADA.COM JULY 2023 | 13 INSURANCE HIGHLIGHT

7 Steps to Grow Your Used Car Dealership & Boost Profits

BY PROFESSIONAL MOJO MARKETING

Running a successful Washington independent car dealership requires strategic planning, excellent customer service, and effective marketing strategies. With the right approach, you can expand your dealership and increase your profits, while still ensuring every customer gets the care they demand. Let’s discuss seven essential steps to grow your Washington independent car dealership and achieve long-term success.

BUILD A SOLID REPUTATION

Establishing a strong reputation is crucial for any business, and that is doubly true for a used car dealership, which is an industry historically plagued by poor word of mouth. Any independent auto dealer can overcome the preconceived ideas, however, if it focuses on providing excellent customer service, transparency, and fair pricing. Encourage satisfied customers to leave positive reviews online and leverage word-of-mouth referrals. A reputable dealership will attract more customers, leading to increased sales opportunities. One of the best things you can do is join the Washington Independent Automobile Dealers Association. Consumers know that WSIADA dealers abide by a solid code of ethics and will receive a fair shake.

DEVELOP A COMPREHENSIVE MARKETING STRATEGY

To expand your customer base, invest in a comprehensive marketing strategy. Utilize both traditional and digital marketing channels to reach a wider audience. Consider implementing search engine optimization (SEO) techniques to improve your website’s visibility in search engine results. Utilize social media platforms, online classifieds, and email marketing campaigns to engage potential customers and promote your inventory effectively. Don’t let others dissuade you from using any of these tools. Some will say that email is outdated or TikTok is only for 15 year olds. Both are wrong. Each marketing channel still delivers real value in your overall marketing strategy if you know your target audience and you provide the right message at the right time in the right way. If you are unsure about how to craft a marketing strategy, we recommend that you research other independent auto dealerships who have a successful plan in place or consider taking a few courses to develop a customized game plan for your business. Creative tactics go a long way in achieving your long-term marketing goals.

ENHANCE ONLINE PRESENCE

A strong online presence is essential for business growth. Create a user-friendly website that showcases your inventory with detailed descriptions and high-quality images. Incorporate online tools that allow customers to browse your inventory, schedule test drives, and even apply for financing online. Leverage social media platforms to share engaging content, interact with potential customers, and run targeted advertising campaigns. Trust us, even if you believe you are doing the most already on social, you can still do more. It is time consuming, but less so if you use wise tools and focus on your target audiences.

DIVERSIFY YOUR INVENTORY

Given the current inventory market, this is a tough one. Expand your inventory to cater to a wider range of customers. Offer a variety of vehicles in different price

7 STEPS TO

GROW YOUR USED CAR DEALERSHIP AND BOOST PROFITS

CEMENT YOUR REP

A strong reputation is the foundation of your dealership, leading to better word of mouth Work on reviews and transparency

DEVELOP A STRATEGY

Utilize both traditional and digital marketing, but do it with purpose and intent, knowing your customer base

REV UP ONLINE

Incorporate online tools that allow customers to browse, view, finance and even purchase your vehicles online

DIVERSIFY INVENTORY

Consider expanding inventory to reach a wider range of buyers and stay informed about consumer trends

PROVIDE FINANCING

Offering flexible financing can boost sales Seek out and partner with reputable lenders

TRAIN YOUR PEEPS

invest in training and developing your employees. Great employees result in more sales.

MAKE FRIENDS

Forge strategic partnerships with local businesses and organizations to expand your dealership's reach.

14 | THE FRONT ROW | WSIADA.COM JULY 2023

ranges, from budget-friendly options to luxury models. Consider stocking hybrid or electric vehicles to attract eco-conscious buyers. Stay informed about market trends and popular models to ensure you have a well-rounded selection that meets the demands of your customer base. A WSIADA membership includes thousands of dollars in savings at participating auctions.

PROVIDE FINANCING OPTIONS

Offering flexible financing options can significantly boost your sales. Partner with reputable lenders to provide competitive interest rates and flexible terms. Ensure your financing process is streamlined and customer-friendly. Promote your financing options prominently on your website and in your marketing materials to attract buyers who may need assistance in purchasing a vehicle. WSIADA members receive access to vetted partners who are ready to help you grow your business and provide the right financing for your customer base.

GROW YOUR USED CAR DEALERSHIP AND BOOST PROFITS

INVEST IN EMPLOYEE TRAINING AND DEVELOPMENT

Your dealership’s success heavily relies on your staff’s expertise and professionalism. Invest in continuous training and development programs to enhance their knowledge of the automotive industry, customer service skills, and sales techniques. Encourage a positive work environment and motivate your employees by offering performance-based incentives. A well-trained and motivated team will help you deliver exceptional customer experiences, resulting in customer loyalty and increased sales.

COLLABORATE WITH LOCAL BUSINESSES AND ORGANIZATIONS

Forge strategic partnerships with local businesses and organizations to expand your dealership’s reach. Consider collaborating with auto repair shops, car rental agencies, and insurance providers. Offer exclusive discounts or cross-promotional opportunities

AUCTION LISTINGS

to their customers, and in return, they can refer potential buyers to your dealership. Participating in community events and sponsoring local sports teams or charities will also increase your dealership’s visibility and enhance your reputation.

No matter your level of experience, growing a used car dealership requires a multi-faceted approach that encompasses reputation building, marketing strategies, online presence, inventory diversification, financing options, employee training, and collaboration with local businesses. By implementing these seven steps, you can position your dealership for even greater success, attract a broader customer base, and boost profits. Remember that consistency and adaptability are key as you navigate the ever-evolving automotive industry. With dedication and strategic planning, your dealership can thrive and establish itself as a trusted and sought-after destination for used car buyers. Why not start today by leveraging the expertise found at WSIADA? We’re here for you. n

THE FRONT ROW | WSIADA.COM JULY 2023 | 15 VISIT WSIADA.COM/CALENDAR/AUCTION FOR FULL AUCTION LISTINGS. q

A strong reputation is the foundation of your dealership leading to better word of mouth Work on reviews and transparency Incorporate online tools that allow customers to browse, view, finance and even purchase your vehicles online DIVERSIFY INVENTORY Consider expanding inventory to reach a wider range of buyers and stay informed about consumer trends PROVIDE FINANCING Offering flexible financing can boost sales Seek out and partner with reputable lenders Utilize both traditional and digital marketing, but do it with purpose and intent knowing your customer base 7 STEPS TO CEMENT YOUR REP DEVELOP A STRATEGY REV UP ONLINE TRAIN YOUR PEEPS invest in training and developing your employees Great employees result in more sales Forge strategic partnerships with local businesses and organizations to expand your dealership's reach MAKE FRIENDS

6 Reasons Why Consumer Lending is Ready for an Overhaul

The consumer lending industry’s limitations are becoming more evident, which means it’s time to rethink things and overhaul it in a more holistic, consumer-friendly and inclusive way.

BY AMITAY KALMAR

BY AMITAY KALMAR

Today’s consumer lending industry is steeped in tradition carved out over several decades. Although the general public – or anyone else, to be sure – doesn’t know all the factors that comprise the modern credit score, there’s a general understanding that a higher score equals more creditworthiness and better offers from lenders.

Conversely, a lower credit score – or no credit score at all – equates to subprime loan offers with unfavorable terms or in many cases, no ability to secure loans.

Unfortunately, while the latter category does include car buyers whose credit histories are questionable, it also includes consumers with stellar incomes and payment histories who simply haven’t had the opportunity to build sufficient credit according to traditional means. For example, a doctor who recently immigrated to the U.S. from a foreign country may not have a history that the credit bureaus track, leaving them with no credit score and no ability to secure financing for a car whose payments they can certainly afford.

Under traditional credit models, the only option for borrowers in this situation is to consider subprime lenders. A strong borrower should not be banished to the subprime category simply because traditional credit ratings don’t account for the entire picture.

Among the limitations of the current consumer lending model are:

1Old Methodologies. Although it’s seen as the industry standard, the FICO model is decades old and is limited in the scope of data it considers. New lending models from several new lending players see borrowers as “more than just a score,” analyzing thousands of data points to determine creditworthiness. While the data points will include FICO when a score is available, creditworthiness is judged in a much more holistic manner.

16 | THE FRONT ROW | WSIADA.COM JULY 2023

FINANCIAL HIGHLIGHT

2

A Lack of Transparency. The loan process is an often slow, analog and opaque process, especially for consumers. From application to signing the contract, more modern lending technologies allow for consumers to handle the entire process on their phones. The process becomes much more appealing for borrowers who prioritize transparency and speed.

“

Complexity: Many lenders can pre-approve borrowers “quickly” based on a soft credit pull, but the formal approval process can move at a much slower pace. The technology exists to provide faster, easier approvals and funding; companies working toward transforming the industry are making use of such technology, making the process friendlier for everyone involved.

3

Good Consumers Being Left Out. Would-be car buyers with no Social Security number, no ITIN, or thinto no-credit histories are usually denied loans for vehicles they desperately need to be productive and successful. Rather than relying on a single source, such as a FICO score, to determine the consumer’s ability to secure a loan, companies are disrupting tradition by introducing neverbefore-seen levels of fairness, equity and opportunity through holistic approaches to the loan process.

4

Buyers Getting Stuck with NonCompetitive Loans. Predatory loans with high rates, long terms and little protection are common for those who don’t conform to traditional credit scoring models. When consumers are limited in terms of their borrowing options, the outcome can be far worse than getting no loan at all. New models and technologies that consider a much broader set of data points eliminate the need to have a traditional credit score but doesn’t disqualify buyers from securing loans with competitive terms.

5

their revenue and creates bad feelings and reputations. Dispensing with outdated credit scores that only offer a narrow snapshot of a buyer’s creditworthiness allows dealers to turn those buyers into loyal, happy customers.

6Dealers Losing Opportunities. Car dealers have become accustomed to turning away car shoppers with thin to no credit history. This limits

New methods can open new revenue streams, however. For new-car sales, margin contraction and limited profit potential are cyclical issues dealers face. New lending technologies offer guaranteed backends for franchise dealers. Further, while traditional funding leaves dealers waiting days to receive payment for the car, new lending partners make same-day funding the norm.

The consumer lending industry has relied on a legacy-based approach, but its limitations are becoming more evident, which means it’s time to rethink things and overhaul it in a way that’s more holistic, consumerfriendly and inclusive. It’s a win-win for everyone and a welcome improvement in an industry ready for change. n

Amitay Kalmar is the co-founder and CEO of Lendbuzz, which provides auto loans to deserving borrowers, including those without a Social Security number, no credit history or thin credit.

THE FRONT ROW | WSIADA.COM JULY 2023 | 17

The consumer lending industry has relied on a legacy-based approach, but its limitations are becoming more evident, which means it’s time to rethink things and overhaul it in a way that’s more holistic, consumer-friendly and inclusive.

SERVICE PROVIDER DIRECTORY

WSIADA service providers are best in class.

We invite you to explore their services and please mention that you saw their listing in the Front Row magazine.

Accounting & Tax Services

CLA Connect (509) 664-9630 claconnect.com

RH2 | Rekdal Hopkins Howard (425) 658-1400 rh2cpas.com

Auctions

ACV Auctions (800) 553-4070 acvauctions.com

Adesa Portland (503) 492-9200 adesa.com/portland

Adesa Seattle (253) 735-1600 adesa.com/seattle

Copart Auto Auction (253) 847-8300 copart.com

CTM Unlimited Auctions (877) 396-5808 ctmunlimitedauction.com

Ehli Auctions (253) 572-0990 ehliauctions.com

Insurance Auto Auction

(IAA) Seattle (206) 658-6900

iaai.com

Insurance Auto Auction

(IAA) Spokane (509) 891-2388

iaai.com

Kaman Auctions (425) 640-5111 kamanauctions.com

MAG Auctions Spokane (509) 244-4500 magauctions.com/daanw

Learn more on inside front cover

MAG Auctions Seattle (253) 737-2200 magauctions.com/daasea

Learn more on inside front cover

Manheim Portland (503) 286-3000 manheim.com

Manheim Seattle (206) 762-1600 manheim.com

Learn more on inside back cover

Yarbro Auctioneers (509) 765-6869 yarbro.com

Benefits & Health Insurance

Washington Retail Association (360) 943-9198 waretailservices.com

Bonds and Commercial Insurance Farmers - Karen Dunn Insurance Agency (253) 964-7070

business.farmers.com/karendunn

Shepard & Shepard Insurance Solutions (855) 396-0488

shepquote.com

Learn more on page 14

Dealer Management Systems

Carousel Software (509) 926-8848 carouselsw.com

Digital Marketing

Glo3D (416) 575-4448

glo3d.com/washington-glo3d

Finance and Insurance

Dynamic Dealer Services, Inc (208) 818-6931

dynamicdealerservices.com

NW Dealer Financial Services (425) 922-3560

northwestdealerservices.com

Learn more on page 11

OneMain FinancialSouthern WA (360) 726-3263

jason.eidsvik@omf.com

Learn more on page 7

Southwest Dealer Services (206) 571-3068

swds.net

Floor Plan Companies AFC (253) 333-0300

afcdealer.com

Learn more on page 11

Floorplan Xpress (503) 621-9260

floorplanxpress.com

Legal Services

Davies Pearson, P.C. (253) 620-1500

dpearson.com

Lending Lobel Financial Corp. (503) 653-8000

lobelfinancial.com

Nationwide Northwest (206) 259-0203

nac-loans.com

Reliable Credit Association (253) 240-1818

reliablecredit.com

Satellite Radio SiriusXM (866) 659-3961

siriusxmdealerprograms.com

Learn more on page 7

Risk Management

ATTM Technologies (206) 350-2886

attm-tech.com

Vehicle and Fleet Management

Passtime GPS (866) 335-2611

passtimegps.com

Vehicle Service Plans

GWC Warranty (425) 233-4705

gwcwarranty.com

18 | THE FRONT ROW | WSIADA.COM JULY 2023

TITLE WORKSHOPS

July 26 | 9:00 am - 12:00 pm

Aug 16 | 9:00 am - 12:00 pm

EDUCATION FAIRS

Catalytic Converter Thefts Top 64,000 in 2022

By UsedCarNews Staff

A new report based on insurance claims released by the National Insurance Crime Bureau shows a surge in catalytic converter thefts across the country. In total, the nation experienced more than 64,000 catalytic converter thefts in 2022, which represents a 207% increase from 2021. Leading the country are California and Texas, which experienced more than 32,000 catalytic converter thefts last year.

“This new data is just a snapshot of an underreported crime that affects communities across the nation,”

said David J. Glawe, President and CEO of NICB.

Based on insurance claims, thefts of catalytic converters increased significantly from 2020 through 2022. Insurance claims for these thefts increased 288% from 16,660 claims in 2020 to 64,701 in 2022. Catalytic converter theft claims had an upward trend trajectory throughout 2020 and 2021 and theft claims in 2022 were significantly higher than in previous years.

EAST - JULY 18

9:00 am - 5:00 pm

Doubletree by Hilton, Spokane (800) 757-6131

WEST SEPT 21

9:00 am - 5:00 pm

Doubletree by Hilton, Seattle (855) 610-8733

*Ask for WSIADA Education Fair Rates

For these and other upcoming events, REGISTER AT WSIADA.COM

Catalytic Converter Theft by State

Mandated in the U.S. since 1975, catalytic converters neutralize harmful gases in engine exhaust that contribute to air pollution and smog and are bolted to the underside of cars or trucks as part of their exhaust system. Catalytic converters contain platinum, rhodium, and palladium, rare earth metals that are more valuable than gold. Often metal recyclers pay between $50 to $250 for a catalytic converter and up to $800 for one removed from a hybrid vehicle. It can cost between $1,000 and $3,500 or more to replace a catalytic converter that is stolen, depending on the type of vehicle.

Legislative efforts are under way to address the rising number of thefts. New bills and amendments are being introduced to increase requirements for catalytic converters sellers, impose due diligence obligations on metal recycling entities, and establish penalties for unauthorized sellers and buyers engaging in fraudulent practices related to catalytic converter purchases. In 2022, NICB’s Office of Strategy, Policy, and Government Affairs tracked 163 legislative bills across 37 states, with 31 bills enacted. So far in 2023, 94 bills are being tracked across 39 states, with 12 bills already enacted. n

THE FRONT ROW | WSIADA.COM JULY 2023 | 19

READ & RESPOND: JULY

The WSIADA READ AND RESPOND quiz allows the reader to earn one hour of continuing education credit toward the dealership’s required annual renewal. Payment options are available for members of the association and non-members also for notification to the Washington State Department of Licensing. A passing grade will be granted for scores of 80% or greater. If a passing grade is not granted, the reader may retake the quiz.

1: More customers will be attracted by a reputable dealership, leading to increased sales opportunities.

A: True

B: False

2: OEMs and these types of business want to give customers a great buying experience.

A: Flooring companies

B: Dealers

C: Auto industry associations

D: Insurance agencies

3: This state had the most catalytic converters stolen in 2022.

A: Illinois

B: Texas

C: Washington State

D: California

4: Customers are willing to come down to dealerships for the worse offer for their trade-in vehicle?

A: True

B: False

5: Offering a variety of vehicles at difference price ranges, including electric vehicles, is known as?

A: Diversifying

B: Marketing Strategy

C: Collaboration

D: Financing

6: Used cars have fallen nearly what percentage from March 2023?

A: 5%

B: 9%

C: 12%

D: 15%

7: Catalytic converters were mandates in the United States in 1975 for which purpose on vehicles?

A: Aftermarket parts

B: Increased thefts

C: Quieter sounding engines

D: Neutralize harmful exhaust gases

8: Investing in this opportunity will help enhance knowledge and automotive industry.

A: Professionalism

B: Continuous training and development

C: Expertise

D: Inventory

9: Dealer Identification Cards are also known by what name for employees in Washington State?

A: Yellow card

B: Green card

C: Red card

D: Blue card

10: Used-vehicle inventory finished 55% above April 2022.

A: True

B: False

Please be advised that the information contained in WSIADA’s the Front Row is, to the best of our knowledge, current and correct. However, we caution readers not to use the information provided to them as final authority. Its purpose is to be a guide. Any legal advice should be regarded as general information. It is strongly recommended that one contact an attorney for counsel regarding specific circumstances. Some articles may express opinions and/or suggestions for best practices. Likewise, the appearance of advertisers or their identification as members of WSIADA, does not constitute an endorsement of the products or services featured.

q I have read and understand the disclaimer above.

Name Motor Vehicle Dealer No. Date

Taker’s Name Signature Email Position Business Phone Fax CIRCLE THE CORRECT ANSWER.

Dealership

Quiz

your completed quiz to WSIADA at education@wsiada.com

SEND YOUR COMPLETED QUIZ TO WSIADA AT EDUCATION@WSIADA.COM Send

magauctions.com Score Some Summer Fun with MAG! Friday, August 4th 9:00 AM Thursday Night, August 3rd 7:30 to 10:00 PM | Pier 55 Featuring live music from Third Tuesday of every month at 1:00 PM with Timed Auctions on the following Friday - Monday NEW: MAG Highline Sales on MAG Now, Powered by EBlock! All information subject to change without notice. Private party for DAA Northwest customers by invitation only; no public admittance. For guests’ safety, no weapons, purses, or bags larger than a cell phone will be allowed in the concert gates; no outside food, beverages, pets, children, or cameras, please. Featuring Don’t miss WSIADA’s Education Fair East on Tuesday, July 18th! Scan for the latest Rock & Roll Sale info!

BY TODD SHEPARD, FOUNDER OF SHEPARD & SHEPARD INSURANCE SOLUTIONS

BY TODD SHEPARD, FOUNDER OF SHEPARD & SHEPARD INSURANCE SOLUTIONS

BY AMITAY KALMAR

BY AMITAY KALMAR