TWENTY TWENTY TWO ANNUAL REPORT

WHOLESALE & SPECIALTY

INSURANCE ASSOCIATION

i

ABOUT WSIA

The Wholesale & Specialty Insurance Association (WSIA) is a world-class member service organization representing the entirety of the wholesale, specialty and surplus lines industry. WSIA’s membership consists of 724 member firms, including U.S. Wholesale, U.S. Insurance Market, Associate and Service members, representing tens of thousands of individual brokers, insurance company professionals, underwriters and other insurance professionals worldwide conducting business in the U.S. surplus lines market.

WSIA members of all shapes and sizes gain a competitive advantage in the marketplace through active participation in the only association dedicated specifically to the wholesale, specialty and surplus lines insurance industry.

MISSION

The Wholesale & Specialty Insurance Association is the non-profit association of professionals and specialty market leaders dedicated to the wholesale distribution system. The Wholesale & Specialty Insurance Association represents the interests of its members and the valuable role they play in the insurance market through networking, education, talent recruitment and development, regulatory and legislative advocacy for the wholesale, specialty and surplus lines industry, and by promoting the value of the wholesale distribution channel.

CONTENTS

1 President’s Message

2 Performance Benchmarking Study

3 Membership

4 Networking and Events

6 Education

8 Talent Outreach, Internship and U40

10 Legislative Advocacy, Compliance and PAC

12 WSIA Award Honorees

14 WSIA Education Foundation

16 WSIA Diversity Foundation

21 Wholesale Value

22 WSIA Financials

24 Committee Roster

28 Leadership

ii

W ISI A ANNUAL

POR

R E

T

MESSAGE

DEAR WSIA MEMBERS,

On behalf of the Wholesale & Specialty Insurance Association Board of Directors,

I am pleased to present the 2022 Annual Report, highlighting WSIA’s accomplishments and financial health for the year. This report is an excellent summary of the past year and a reminder of all that we have to be proud of as an association and industry. WSIA celebrated its fifth anniversary as our new, merged association in August 2022, and it’s been a tremendous five years.

While 2022 ushered in a measured return to in-person events, programs and meetings, there is no doubt that we continue to find ourselves adapting to new ways of doing business and living. The necessity to evolve and transform we’re experiencing is fairly natural for us as an industry, one built on emerging trends and risks, and I believe that it has pushed us to continue improving what we do and how we do it for our customers and insureds. The association has also followed suit, and I think that the benefits WSIA offers to members continue to become more valuable as well.

Despite the last few tumultuous years, the association’s financial strength has remained impressive, and we have maintained a healthy operating reserve, within parameters set forth by the WSIA Board of Directors. This is a result of proactive contract management and detailed budgeting and strategy, which has allowed the

association to move forward in decision-making that’s rooted not only in the best interest of the bottom line, but also in the best interest of members during changing times. Decisions like moving future Annual Marketplace events to San Diego to accommodate growing attendance and changing attendee patterns are examples of opportunities that are available to us because of this intentional approach.

The membership’s continued support of the association’s programs and events is fundamental to our collective success. The unwavering dedication of more than 400 committee and program volunteers is a testament to your commitment not only to the association, but also to this rewarding industry. The level of volunteer commitment we have in our ranks is a huge component of our ability to deliver unparalleled returns on member investments. Thank you each for your time and thought leadership; the wholesale, specialty and surplus lines industry is better for it, and we have much to look forward to in this new year.

1

TWENTY TWENTY TWO

Bryan Clark

WSIA President

WSIA PRESIDENT’S

PERFORMANCE BENCHMARKING HIGHLIGHTS

WSIA AGGREGATED MEMBER DATA HIGHLIGHTS

PERFORMANCE

BENCHMARKING STUDY

• WSIA partnered with Reagan Consulting to conduct a Performance Benchmarking Study in 2022. It was sent all wholesale and associate member intermediaries. 38 WSIA firms submitted surveys.

• Participating firms received customized performance benchmarking reports to help compare their firms against other similarly sized WSIA firms.

• The data, updated annually, provides valuable insights about WSIA’s member firms and the portion of the market the association’s members represent.

2

6,490

21,411

Employees

WSIA member firms providing 2021 premium data comprised 59% of the 2021 U.S. surplus lines premium according to AM Best.

$78,585,751,169

2

Lowest

# of Employees

Highest

# of Employees

Total # of

Female Male White Non-white 59% 41% 82% 18% EMPLOYEE COUNT EMPLOYEE DIVERSITY TOTAL 2021 GROSS PREMIUM REVENUE INFORMATION BREAKDOWN OF GROSS PREMIUM VOLUME Non-Admitted 62% Admitted 38% ● Commercial Lines ● Personal Lines ● Group Benefits ● Supplemental ● Other 85.8% 8.2% 3.8% 2 .0% 0.3% ● Wholesale Brokerage ● Wholesale Binding Authority ● Reinsurance ● Retail Brokerage

Wholesale Program Administration ● Other 12.7% 13.9% 0.2% 72.8% 0.4% .01%

●

WSIA MEMBERSHIP

During 2022, the Membership & Ethics Committee reviewed 100 new membership applications and approved 21 U.S. Wholesale applications, 24 U.S. Insurance Market applications, 7 Associate and 48 Service Member applications.

WSIA MEMBERSHIP

This 2022 Annual Report highlights WSIA’s fiscal year financial performance and accomplishments, and we continue to be very proud of the stability of the wholesale distribution system and the wholesale, specialty and surplus lines industry, as well as the association. The WSIA Board of Directors and team collaborate with a strong group of more than 400 dedicated industry volunteers, whose work during the last year ensured the association continues to deliver a valuable return on your membership investment.

WSIA MEMBERS BY TYPE

We remain committed to providing premier networking and business events, education programs and services for all types and sizes of firms, and exceptional representation and advocacy for the wholesale, specialty and surplus lines industry. Thank you for your support to ensure that WSIA, the WSIA Diversity Foundation and the WSIA Education Foundation remain strong and effective in these endeavors.

Brady Kelley Executive Director

WSIA COMMITTEE

VOLUNTEERS BY THE NUMBERS

• WSIA’s 422 committee volunteers in 2022 had a combined 1,342 years of committee service

• 127 of those committee volunteers were new in 2022

• 40% are U.S. Wholesale Members

• 37% are U.S. Insurance Market Members

• 7% are Associate Members

• 16% Service Members

• 25% are also members of WSIA’s U40

WSIA’S VALUE PROPOSITION

The Wholesale & Specialty Insurance Association is the only trade association that serves the entirety of the wholesale, specialty and surplus lines industry. WSIA strengthens members’ competitive advantage in the insurance marketplace by promoting the market and value of wholesale distribution, protecting and advocating for an effective regulatory and legislative environment, supporting business through networking and enabling professionals with education, professional training and talent development opportunities.

3

Service 160 U.S. Wholesale 301 Associate 76 U.S. Insurance Market 187 US Wholesale Members 301 U.S. Insurance Market Members 160 Associate Members 76 Service Members 187 Total Member Firms 724 943 branch offices 1,667 total offices

NETWORKING EVENTS

WSIA members rely on the association for the unparalleled networking opportunities offered at Underwriting Summit and Annual Marketplace. These events, and the Insurtech Conference and U40 Annual Meeting, provide forums for WSIA member professionals, from all sizes and types of firms to network, conduct business and expand their industry knowledge.

UNDERWRITING SUMMIT

The Underwriting Summit offers designated time for networking and business meetings for the underwriting, delegated authority, program specialist and professional and financial lines segments of the WSIA membership, as well as firm leadership. In 2022, Underwriting Summit returned in-person with strong attendance.

• 1,204 members from 303 member firms participated in Orlando, FL, March 13-15.

• 49 firms reserved 61 Club Tables.

• Pro Football Hall of Fame inductee, Terry Bradshaw, was keynote speaker for the event and WSIA Annual Business Meeting and Awards recognition were featured.

• Participants were: 38% Wholesale Market Members, 31% Insurance Market Members, 20% Associate Members and 12% Service Members.

Participants by member type were:

INSURTECH

The Insurtech Conference focuses on industry disruption and transformation and sessions highlight the why and how of developing a digital strategy, with solutions to streamline the distribution chain and enhance the customer experience. The 2022 event returned with a hybrid format. The in-person event was held March 20-23 in New Orleans, LA, with an opportunity for members to view sessions online after the event.

• 403 WSIA industry professionals participated in-person, with an additional 88 virtual participants.

• Those participants came from 211 different firms.

• 45 exhibiting firms participated in the exhibit hall.

• More than 50 speakers presented on a variety of technology topics.

ANNUAL MARKETPLACE

Annual Marketplace is the premier wholesale, specialty and surplus lines industry event. Members attend the event for networking and business meetings throughout the week in the Brokers’ Lounge and The Club. The 2022 event was held in-person in San Diego, CA, September 11-14.

• 6,496 registered participants, representing 551 member firms, set an event record.

• 599 Professional & Financial Lines Specialists participated.

• 178 Club Tables were reserved.

• Participants were: 43% Wholesale Market Members, 38% Insurance Market Members, 12% Associate Members and 7% Service Members.

• Events and meetings were headquartered at both the Manchester Grand Hyatt and Marriott Marquis to accommodate growing attendance.

• Enhancements included a Hospitality Zone, additional reception and lounge areas, increased number of zones for the Brokers’ Lounge and enhancements of events at the Marriott, which significantly increased co-headquarter branding between the hotels.

U40 ANNUAL MEETING

The U40 Annual Meeting is a forum for connection for under-40 wholesale, specialty and surplus lines industry young professionals for education and the exchange of industry information. In 2022, the event was held in Phoenix, AZ.

• 191 registered participants from 69 member firms gathered October 23-25.

• The agenda featured professional development, education, peer-led discussion panels, actionable DE&I tactics, networking and a philanthropic team building event to support literacy programs at Phoenix-local public schools.

4

NETWORKING

5 38% U.S. WHOLESALE MARKET 31% INSURANCE MARKET 12% SERVICE 20% ASSOCIATE UNDERWRITING SUMMIT PARTICIPANTS BY MEMBER TYPE 43% U.S. WHOLESALE MARKET 38% INSURANCE MARKET 7% SERVICE 12% ASSOCIATE ANNUAL MARKETPLACE PARTICIPANTS BY MEMBER TYPE NETWORKING

EDUCATION AND PROFESSIONAL DEVELOPMENT

IN 2022,

WSIA provides a full slate of technical training, leadership and professional development programs to advance careers of WSIA members’ employees. The association presents and develops programs for new and seasoned E&S professionals that are offered in a progressive format, so participants are appropriately challenged through every phase of their careers.

In 2022, 683 member professionals participated in eleven on-site WSIA education programs. The Collaborative Selling and Negotiations and Leader As Coach programs were retooled mid-year and presented by new facilitators with updated curriculum, and additional webinars were presented throughout the year at no charge to members.

683 MEMBER PROFESSIONALS PARTICIPATED IN ELEVEN ON-SITE WSIA EDUCATION PROGRAMS.

Excess & Surplus Lines – 106 participants

Marcus Payne Advanced E&S – 52 participants

Collaborative Selling and Negotiations –56 total participants

Kansas City, MO – 18 participants

New York, NY – 18 participants

Scottsdale, AZ – 20 participants

Leader as Coach – 37 total participants

Online – 17 participants

Scottsdale, AZ – 20 participants

Underwriting Boot Camp – 69 participants

Contractors, Habitational and Vacant Risks

Technical Training – 30 participants

WSIA University – 243 participants

Surplus Lines Management – 49 participants

Executive Leadership Summit – 41 participants

ONLINE, ON-DEMAND COURSES

Surplus Lines Fundamentals – 202 member participants, 171 student participants

Surplus Lines Compliance – 260 participants

WEBINARS

• WSIA hosted eight free member webinars during the year, and 531 members participated during the live sessions. Recordings of the webinars are posted on the WSIA website and have been viewed by an additional 133 members.

• Webinars were hosted by the WSIA Diversity Foundation, WSIA Education Committee, Emerging Issues & Innovation Committee and U40 on topics including Retaining Diverse Talent, Racial Injustice Stops With Me, Ally: What Does it Mean to Be One?, Parametric Insurance, Confronting Social Inflation, Managing Unconscious Bias, The Workplace 2022 and Beyond, and The Great Resignation.

EMERGING ISSUES & INNOVATION TREND REPORTS

• The WSIA Emerging Issues & Innovation Committee updated one trend report on Data Analytics and infographic summary to offer a visual overview of the analysis. Additional work began on Hiring and Retention and Cannabis. The committee also began collaboration with Hal Weston, Distinguished Chair of Risk Management and Insurance at Georgia State University, to deliver an additional series of white papers on Climate Change.

EDUCATION

7

IN 2022, 683 MEMBER PROFESSIONALS PARTICIPATED IN ELEVEN ON-SITE WSIA EDUCATION PROGRAMS.

TALENT OUTREACH INTERNSHIP AND U40

WSIA develops awareness and interest in surplus lines career opportunities among young and emerging talent through campus and student visits, education opportunities, symposiums and career fairs and scholarships. The association’s Talent Outreach Committee, Internship Committee, the WSIA Diversity Foundation and WSIA Education Foundation collaborate on this work.

TALENT OUTREACH

• Talent Outreach Committee, U40 members and Diversity Speakers Bureau volunteers reached 2,782 college students promoting career opportunities in wholesale, specialty and surplus lines with virtual and in-person presentations.

• With financial support from the WSIA Education Foundation, conducted five Extreme Risk Taker student symposiums.

o Extreme Risk Takers – Los Angeles | 113 students from 8 schools

o Extreme Risk Takers – Chicago | 145 students from 13 schools

o Extreme Risk Takers – Santa Barbara | 38 students from 4 schools

o Extreme Risk Takers – Tempe | 64 students from 7 schools

o Extreme Risk Takers – Atlanta | 295 students from 22 schools

o 52 WSIA member firms participated in symposium career fairs with the opportunity to meet and talk with students from across the country during these symposiums.

• Participated in four Gamma Iota Sigma events and visited with 652 students during hosted career fairs and roundtable discussions.

o Continued a financial partnership with Gamma Iota Sigma, as a Sustaining Partner, focused on growth and diversification of the insurance industry’s talent pipeline.

• The WSIA Education Foundation committed a total of $100,000 to 20 students at 14 universities through the Derek Hughes Scholarship Program.

• Hosted the WSIA White Paper Contest to expand surplus lines awareness and knowledge for risk management and insurance students. Students submit papers on one of three pre-selected topics and winners are awarded cash prizes.

o Spring 2022 contest - 16 participants from 6 universities submitted research papers on the topics of: Mergers and Acquisitions, That Talent Crisis Within the Insurance Industry, and Rising Costs of Construction.

o Fall 2022 contest - 16 participants from 7 universities submitted research papers on the topics of Catastrophic Events Affecting Insurance Availability and Capacity, Inflation and the Impact on the Insurance Industry, and Women in Insurance: Narrowing Pay Gaps and the Leadership Divide.

INTERNSHIPS

• Selected 25 WSIA interns to be hosted by 29 WSIA member firms. Summer 2022 positions were hosted both virtually and on-site, and each intern had at least one in-person opportunity. Additionally, 10 WSIA Diversity Foundation Interns were hosted by seven member firms in the program’s first year.

• WSIA Interns participated in a three-day orientation program in Kansas City before beginning their first position and were paired with mentors.

• The top ten interns were selected to participate in Annual Marketplace, and two of those were selected as J.H. Blades Scholars at Marketplace. They will study the London market in 2023.

8

WSIA’S U40

U40 is a dynamic group of insurance professionals under the age of 40 who are currently employed by WSIA member firms. U40 encourages the exchange of educational and industry critical information among members, promotes professionalism and is an avenue for young insurance professionals to become more involved in the surplus lines community.

• Grew WSIA’s U40 membership to more than 1,300.

• Hosted the U40 Annual Meeting in Phoenix, AZ with three days of education and networking opportunities for 191 U40 members.

LEGISLATIVE ADVOCACY COMPLIANCE POLITICAL ACTION COMMITTEE

WSIA helps members promote and protect their position in the market by advocating for governing principles and objectives that lead to more uniform and efficient business operations within the wholesale, specialty and surplus lines industry. With the support and direction of the Legislative Committee and Board of Directors, WSIA represents its members before state and federal legislators, insurance regulators and other groups influencing and impacting the industry’s compliance and business practices.

The PAC helps the association educate members of Congress about the importance and impact of the wholesale, specialty and surplus lines industry on the nation’s economy. The PAC offers an influential voice on the industry’s complex insurance issues and can also offer financial support to candidates who advance WSIA members’ core legislative goals and principles.

IN 2022, THE ASSOCIATION:

• Invested $375,426 in state and federal advocacy services focused on:

o Representation and support of the surplus lines industry in states with legislative proposals impeding WSIA members’ ability to provide coverage to insureds

o State regulatory reforms and revisions to the National Association of Insurance Commissioners (NAIC) Nonadmitted Insurance Model Act 870 to uniformly maintain the Nonadmitted and Reinsurance Reform Act (NRRA)

o Reform and clarifications of state insurance codes regarding surplus lines policy fees

o Education and advocacy with state and federal regulators and legislators regarding necessary safe harbor provisions and protections within financial services for the insurance industry when providing valid services in states where cannabis has been legalized, including support of the SAFE Banking Act

o Long-term reauthorization of the National Flood Insurance Program (NFIP), reforms that would enhance WSIA members providing private flood insurance, and improvements to the federal definition of private flood to reflect the NRRA

STATE ADVOCACY

• Continued work with the NAIC Surplus Lines Task Force on revisions to its Model Law – The Nonadmitted Insurance Model Act (870) – providing comments and suggestions to improve and encourage uniformity through the drafting process with the goal to focus the Revisions to incorporate the NRRA and other modernizations.

• Collaborated with LSLA to educate legislators in LA on the impact SB 162 would have on the ability of the industry to provide coverage to Louisiana property owners.

• Worked to amend and eliminate concerning proposed regulations in FL and OK that, if passed, would have negatively impacted surplus lines activities in the states.

WSIA PAC

• Contributions to the WSIA PAC came from 499 individuals and totaled $253,282, a record for the PAC.

• During 2022, the WSIA PAC contributed $144,940 to federal candidates who advance WSIA’s core legislative principles and those of WSIA member firms.

ADVOCACY

11

Contributions to the WSIA PAC came from 499 individuals and totaled $253,282 , a record for the PAC.

VINCENT DONAHUE/ CHARLES MCALEAR INDUSTRY AWARD

CHRIS BEHYMER, MARKEL

Chris Behymer was honored with the Vincent Donahue/Charles McAlear Industry Award, the association’s highest distinction. The award honors individuals who have made significant contributions to the association and the wholesale, specialty and surplus lines industry. It is named after Vincent Donahue and Charles McAlear, legacy organization pioneers. Donahue served as president of Jefferson Insurance Company and was instrumental in encouraging competitors to join AAMGA. McAlear initiated organizational efforts to form NAPSLO as the national surplus lines association in the early 1970s and served as its first president from 1975 to 1977.

Chris serves as Director, Client Education, for Markel where he has been a part of the team for 15 years. He holds a BA in Risk Management from the University of Wisconsin. Chris has served as a member of the legacy association and WSIA Education Committees for many years during his career and has presented in countless education programs over that time. He has supported the learning and development of thousands of our industry professionals, and his guidance to the Education Committee has prepared and will impact the association’s programming for years to come.

EARLE DILLARD AWARD

PATRICK ALBRECHT, ASSOCIATED INSURANCE ADMINISTRATORS, INC.

Patrick Albrecht was honored with the Earle Dillard Award, which honors the contributions and outstanding service of a Committee Chair. The award is named after Earle Dillard who served as president of Bloss & Dillard and as AAMGA President from 1973-1974. He led many AAMGA initiatives over many years, including the mid-1960s group that shaped many of the AAMGA’s operating policies and the formation of the AAMGA University Foundation in 1988.

Patrick serves as President of Associated Insurance Administrators, Inc. and has more than 20 years of industry experience. He earned a BS in Environmental Engineering from the Air Force Academy and an MBA from the University of Colorado. Patrick joined the legacy AAMGA Board of Directors and the WSIA Board of Directors in 2017 and has served as Chair of the Membership & Ethics Committee since that time.

It was a privilege to recognize Patrick for his exceptional leadership to the Membership Committee and its recordbreaking 89 new member applications. While our industry and member firms’ operations continue to evolve, the committee’s commitment to wholesale-dedicated markets, distribution and service providers is unwavering thanks to Patrick’s leadership.

12

2022

AWARD HONOREES AWARDS

DANA ROEHRIG AWARD RICHARD BOUHAN LEGISLATIVE ADVOCACY AWARD

Josh Ammons was honored as the Richard Bouhan Legislative Advocacy Award recipient, which honors individuals whose advocacy helps advance the legislative interests of the wholesale, specialty and surplus lines industry. It was created in 2006 in recognition of Dick Bouhan’s outstanding legislative work as Executive Director of the association from 1988 to 2011.

Josh has served in various roles with Amwins for the last 15 years. He holds a BS in Business Administration from Appalachian State University. He has served WSIA as president of the U40 board and as the U40 representative to the WSIA Board of Directors, on the WSIA Talent Outreach Committee, and he has participated in several WSIA Legislative Fly-In events.

He was recognized for his exceptional support of the WSIA PAC. Josh has been an outspoken advocate for the PAC with the U40 group and with his Amwins colleagues and has been instrumental in encouraging them to contribute to the PAC.

Tony Chimera was honored with the Dana Roehrig Award. Named after Dana Roehrig, who served as the second president of NAPSLO, the award recognizes the efforts of outstanding volunteers to one of the association’s working committees.

Tony is the Chief Talent Officer at Westfield Specialty. Prior to joining Westfield Specialty, he served in various roles with Sompo International and AXIS Capital. He holds a BS in Management from Auburn University and an MBA from the University of Georgia. He has served as a volunteer to the association’s committees, most recently the WSIA Internship Committee, for twelve years.

Tony was honored for his unwavering dedication to WSIA’s internship program. He has been a key volunteer in developing and supporting the intern orientation program, hosted in Kansas City, and he serves as a mentor to interns each year in addition to his commitment to serving as an intern host and as part of the committee’s selection process. He has also led professional development sessions for WSIA’s U40.

13

JOSH AMMONS, AMWINS

TONY CHIMERA, WESTFIELD SPECIALTY

TO VIEW A LIST OF ALL PAST WSIA AND LEGACY ASSOCIATIONS AWARD HONOREES, VISIT WWW.WSIA.ORG/AWARDS

AWARDS

WSIA EDUCATION FOUNDATION

THE WSIA EDUCATION FOUNDATION

is dedicated to encouraging the educational development of all those interested in the excess and surplus lines business and to overcoming the misperceptions of the excess and surplus lines market.

During 2022, the WSIA Education Foundation invested $923,445 in programs to encourage educational development of WSIA members and students interested the wholesale, specialty and surplus lines industry, in addition to its ongoing support of the WSIA Diversity Foundation. The WSIA Education Foundation ended fiscal year 2022 with $12.4 million in assets.

2022 investments included:

TALENT OUTREACH INITIATIVES

• Scholarships totaling $100,000 to 20 students through the Derek Hughes Scholarship Program, bringing the total invested to more than $1.4 million to 349 students since 1988.

• Administration of student-focused educational programs, symposiums, scholarships and grants to support and reward exceptional students who have an interest in an insurance career.

• Student-centered recruiting initiatives including:

o Five student symposiums and career fairs for risk management and actuarial science students.

o Grants totaling $12,500 to university risk management and insurance programs that increase awareness and visibility of the wholesale, specialty and surplus lines market.

o Visionary-level partnership with Gamma Iota Sigma (GIS) to facilitate growth in the talent pipeline for the wholesale, specialty and surplus lines industry by premiering WSIA, the WSIA Education Foundation, the WSIA Diversity Foundation and WSIA member firms at GIS events and programs.

MEMBER-FOCUSED EDUCATION INITIATIVES

• $72,818 in registration fees, lodging and travel stipends to 38 WSIA members to participate in WSIA education programs.

• Support of the 156 conferred Associate in Surplus Lines (ASLI) designees, bringing the total to 2,629 since 1997.

• Sponsorship of the 2022 AM Best Special Report – U.S. Surplus Lines Market Review, an important tool for the industry and WSIA members.

• Continued work with Georgia State University to enhance the role the WSIA Distinguished Chair in Risk Management and Insurance and its value to WSIA members with white paper development.

• Support from the E.G. Lassiter Lecture Series to fund exceptional speakers during WSIA’s Annual Business Meeting.

• An ongoing commitment of $1 million to the WSIA Diversity Foundation to support its diversity, equity, and inclusion initiatives over the next four years.

14

BOARD OF DIRECTORS

15

WSIA DIVERSITY FOUNDATION

PRESIDENT Brian Van Cleave Huntersure Chicago, IL

VICE PRESIDENT Nick Abraham Amwins Group Atlanta, GA

TREASURER Michael D. Miller Ategrity Specialty Insurance Company Scottsdale, AZ

SECRETARY Brady R. Kelley WSIA Kansas City, MO

Scott Anderson

Concorde General Agency Fargo, ND

Maureen C. Caviston Amwins Group Stamford, CT

Tripp Duesenberg Southern Insurance Underwriters Alpharetta, GA

Sarah Gavlick Markel Specialty Glen Allen, VA

Hank Haldeman Amwins Group Los Angeles, CA

Janet Jordan-Foster AXIS New York, NY

Regina Kirwan GenStar Stamford, CT

Jennifer Larsen Erickson/Larsen, Inc. Maple Grove, MN

Matt Lynch Risk Placement Services Minneapolis, MN

Terrance Meade Amwins Birmingham, AL

David Nelson Nationwide E&S Scottsdale, AZ

Clint Nokes RSUI Atlanta, GA

Kristen Skender Jimcor Agencies Pittsburgh, PA

Danielle Wade Jackson Sumner Associates Boone, NC

WSIA DIVERSITY FOUNDATION

THE WSIA DIVERSITY FOUNDATION was founded in 2020 as a 501(c)(3) charitable organization. Its founding came after the WSIA Board of Directors identified enhancing diversity in the wholesale, specialty and surplus lines segment as a strategic initiative in 2019, with financial support from WSIA member firms and individuals committed to bringing the initiative to the forefront. Since its launch in 2020, the Diversity Foundation has received pledges and contributions totaling $2.9 million from WSIA member firms, individuals and the WSIA Education Foundation.

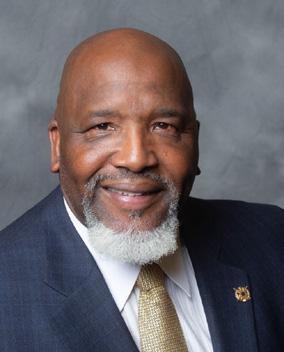

FROM CARLTON MANER

The WSIA Diversity Foundation is committed to enhancing and supporting a diverse, equitable and inclusive association and industry where all feel welcomed. It’s a tall task, but I am immensely proud of the work the foundation has undertaken in the last year, and I believe we’re making meaningful progress.

The Diversity Foundation’s work assists member organizations in intentionally nurturing inclusive mindsets and workplace experiences, and improving opportunities for underrepresented populations, therefore advancing the industry. We believe that when people experience this culture in action they are more innovative and possess a sense of belonging that improves employee retention, customer retention and profitability. I have learned during my years in this industry that building a high-performing team requires mutual trust, and the best way to establish trust is by listening, responding to the needs of your team, and being authentic and transparent in your interactions with them. The Diversity Foundation’s initiatives are making tools available to help me and other professionals improve these skillsets.

I am also really proud of the Foundation’s work to improve awareness about careers in wholesale, specialty and surplus lines insurance among a more diverse group of students. The opportunity to provide summer internships to diverse candidates and engage them in conversations about the industry at industry events and on their campuses will move the needle. This industry has so much to offer and providing scholarships and other forms of support to students from a wide range of perspectives and backgrounds helps all of us personally and professionally.

It is an honor to present this 2022 Annual Report with highlights of this work during the last year, but I know we are just beginning this journey and we look forward to enhancing and growing these initiatives into the future.

Carlton Maner, AXIS Insurance Chair, Diversity Foundation Board

16

WSIA DIVERSITY FOUNDATION MISSION STATEMENT

The WSIA Diversity Foundation, founded in 2020, promotes diversity in areas including, but not limited to, race, gender, disability, and the LBGTQ+ community, and influences meaningful progress in the diversity of the wholesale, specialty and surplus lines insurance industry and its talent pipeline. The Foundation offers tools and resources to help WSIA member firms, and their employees, with ongoing learning to promote diversity, equity and inclusion in its broadest sense to enhance their diversity, equity, and inclusion journey.

The foundation strives to:

• Promote diversity and inclusion with the larger, unified voice of the entire insurance industry;

• focus energy and purpose to influence meaningful progress in the diversity of the insurance industry and its talent pipeline;

• coordinate programs to promote diversity, develop inclusive workplace cultures, and attract diverse talent to the insurance industry; and

• foster synergy among the diversity programs and initiatives of a large number of industry participants.

THE WSIA DIVERSITY FOUNDATION, FOUNDED IN 2020, PROMOTES DIVERSITY IN AREAS INCLUDING, BUT NOT LIMITED TO, RACE, GENDER, DISABILITY, AND THE LBGTQ+ COMMUNITY, AND INFLUENCES MEANINGFUL PROGRESS IN THE DIVERSITY OF THE WHOLESALE, SPECIALTY AND SURPLUS LINES INSURANCE INDUSTRY AND ITS TALENT PIPELINE.

DIVERSITY

17

WSIA DIVERSITY FOUNDATION

WSIA DIVERSITY FOUNDATION INITIATIVES

TALENT OUTREACH INITIATIVES

• Diversity Speakers’ Bureau volunteers visited with 243 college students with informational sessions promoting career opportunities during presentations to INROADS and 6 colleges and universities.

o Dallas College (Brookhaven), Dillard University, Morehouse University, Paul Quinn University, Prairie View A&M University, Texas Southern University

• Selected 10 WSIA Diversity Foundation Interns, hosted by seven firms, during the first year of the program. In addition to a competitive hourly wage and learning opportunities for the summer, each student received a $5,000 scholarship to continue their studies at the successful conclusion of the internship.

• Supported eight students and two faculty from Morgan State University, a Historically Black Colleges and University (HBCU), with a grant to cover cost of attendance at the WSIA Extreme Risk Takers Symposium in Atlanta to enhance their understanding of, and interest in, the wholesale, specialty and surplus lines industry.

• Supported Gamma Iota Sigma (GIS) as a Sustaining Partner and its Gamma SAID Initiative (Solutions for Authenticity, Inclusion and Diversity) in their work to cultivate a more diverse talent pipeline for the industry.

• Became a Founding Partner of the GIS Foundation with a $50,000 investment, the purpose of which is to funnel industry contributions directly back to students, lower barriers to entry to our industry, and ensure all students, regardless of means, could be set up for success.

• Became a sponsor of the Emerging Leaders Program, hosted by the University of Southern California, which partners with HBCUs to offer a five-day academic and professional development program on the USC campus followed by a summer internship program to develop risk management leaders.

MEMBER-FOCUSED TALENT RETENTION AND INCLUSIVE CULTURE INITIATIVES

• Launched a partnership with Blue Ocean Brain, a microlearning platform that makes short, interactive videos, games and DE&I lessons available to members.

o The Foundation’s investment initially made monthly content available to all WSIA members, which is also promoted monthly in the WSIA DE&I e-News.

o Full licenses were initially made available to 150 WSIA member firms. That license makes additional content available each week and allows firms to track usage and trends with platform login credentials.

o By year-end, all licenses were assigned, and the Foundation invested in an additional 16,000 licenses allowing all WSIA member firms full access. 95% of license holders report they find the platform intuitive and the content succinct and relevant.

o There were 7,765 pieces of content viewed in the platform during the year.

• Twelve monthly DE&I e-Newsletters were sent to all WSIA member individuals in the membership database, including a link to the Blue Ocean Brain themed content and other relevant news and DE&I resources. Those messages had an average 20.05% open rate.

• Social media banners and monthly themed cultural awareness resources were posted to the WSIA DE&I webpage and promoted in the monthly e-News for members. The resources include videos, podcasts, suggested readings and additional resources for personal education and to use in social media posts throughout the year.

• The Diversity Foundation’s LinkedIn and Twitter followers increased 155% and 166% during the year, with a total of 280 LinkedIn followers and 16 Twitter followers. Social media content is updated there several times a week and ties to monthly themed learning opportunities.

• There were four DE&I webinars offered to members including, Racial Injustice Stops With Me, Ally: What Does it Mean to Be One?, Managing Unconscious Bias and Diversity, and Retaining Diverse Talent.

o Those webinars were viewed by 693 participants.

o Recordings remain on the WSIA website to view on demand.

18

• WSIA became a CEO Action Signatory. CEO Action is a coalition of more than 2,400 CEOs who have signed a pledge committing to creating more inclusive workplaces. An additional 12 WSIA member firm CEOs have signed on as signatories. A video featuring current signatories was filmed and shared with members as a tool to encourage future commitments.

• Four DE&I Practitioners’ Forums were held during the year with an average of 40 participants from member firms. The forum is a place for practitioners to share best practices to increase employee engagement in DE&I programs and address common challenges.

• Two DE&I sessions were presented during Annual Marketplace with more than 150 attendees. A CEO panel discussed how and why their firms are acting on their commitment to DE&I, and a second moderated panel discussed their perspectives on how to approach DE&I topics to encourage an inclusive mindset.

• WSIA Committee volunteers participated in Unconscious Bias training at the outset of the committee year to improve awareness about how it impacts our interactions with others.

BOARD AND ASSOCIATION GOVERNANCE INITIATIVES

• The Diversity Foundation Board was expanded to include seven new board members, for a total of 13 directors.

• WSIA’s governance and processes were examined with a DE&I lens, which led to updates for the Diversity Foundation’s Mission Statement, adoption of a Diversity Statement for the association and a review of the Code of Ethics, Board Selection Framework and other documents for opportunities to enhance their inclusivity.

• The Diversity Foundation Board drafted and approved a three-year strategic roadmap to guide actionable talent outreach and inclusive workplace development. The roadmap focuses on three pillars of work – Student and Talent Outreach, Member-Focused Inclusive Culture and Association-Focused DE&I — and supporting milestones and success measures.

19

Diversity Speakers’ Bureau volunteers visited with 243 college students with informational sessions promoting career opportunities during presentations to INROADS and 6 colleges and universities.

WSIA DIVERSITY FOUNDATION

BOARD OF DIRECTORS

• Foundation incorporated

• Six directors appointed to board

• Mission statement drafted

• Initial pledge of $1 million from Amwins

• Director of Diversity, Equity & Inclusion hired

• Diversity Speaker’s Bureau launched

• Social media accounts launched

• Internship/Scholarship Program began

• Internship and Talent Outreach Committees engaged in DE&I work

• Pledged to CEO Action

• DE&I e-Newsletter and education platform launched

• DE&I Practitioners’ Forum begins

• WSIA Diversity Foundation Board expanded to 13 members

• WSIA Diversity Statement, revised Code of Ethics, revised Mission Statement adopted

• 2023-2025 roadmap approved

20

Carlton Maner, Chair AXIS Atlanta, GA

Brenda (Ballard) Austenfeld RT Specialty Naples, FL

Carey Bond Lloyd’s America Atlanta, GA

Tony Chimera Westfield Specialty Alpharetta, GA

Thurston (TJ) Davis Jr. RT Specialty Birmingham, AL

Gerald Dupre Core Specialty Atlanta, GA

Emma Garner CRC Group New York, NY

Janet Jordan-Foster AXIS New York, NY

Duffy Koller Paragon Excess & Surplus Lines Chicago, IL

Phillip McCrorie RSUI Atlanta, GA

Terrance Meade Amwins Group Birmingham, AL

Jacque Schaendorf Insurance House Atlanta, GA

Molly Shah Amwins Group Charlotte, NC

TIMELINE 2020 2021 2022

WSIA WHOLESALE VALUE

WSIA is committed to its members and to the wholesale distribution system. In honoring that commitment, WSIA messages the value of the wholesale distribution system to the retail marketplace by incorporating the benefits of the wholesale distribution system in all internal and external communications and consistently linking the key attributes of WSIA member wholesalers to the WSIA message. Additionally, WSIA proactively cultivates relationships to leverage earned media placements promoting the wholesale distribution system.

DURING 2022, WSIA:

• Hosted 217,757 user sessions on www.wsia.org, with 673,427 total pageviews.

• Invested $210,158 in the Wholesale Value messaging campaign in fiscal year 2022, which generated an estimated $121,393 in earned editorial placement, and approximately 3.4 million impressions through paid advertising.

• Delivered 176 WSIA newsletters and e-News updates to members, with an average open rate of 35.9%.

• Utilized LinkedIn and Twitter to cross-promote WSIA news and events and provide members with an alternate way to learn and stay connected, and reposted WSIA Diversity Foundation cultural awareness theme content across both profiles.

o Ended the year with 8,918 LinkedIn followers and 449 Twitter followers.

21

IN 2022, WSIA’s financial results emerged from two years impacted by the COVID-19 pandemic with operating revenues of $11.5 million. 2022 operating revenues were up $3.2 million from 2021 and up $1.2 million from pre-pandemic levels with all networking events, education programs and operations at full capacity. The most significant improvement in 2022 revenues resulted from the association’s 2022 Annual Marketplace in San Diego with a record 6,496 members attending, an increase of 29% from its now second largest Annual Marketplace in 2019. 2022 operating expenses were up $3.5 million from 2021 and up $1.2 million from pre-pandemic levels also driven by the 2022 Annual Marketplace and the cancellation of the 2024 and 2026 Annual Marketplace contracts in Nashville. Prudent event contracts and long-term relationships with hotel partners have been instrumental in the association’s management of the pandemic’s financial impact and the growth experienced in 2022.

During 2022, the association continued to invest in valuable committee work, in-person networking events and education programs, regulatory and legislative advocacy and important reforms for the industry, its communication campaign promoting the value of wholesale distribution, the good work of the WSIA Diversity Foundation and WSIA Education Foundation to develop a larger and more diverse pipeline of talent for our industry. Three staff positions were added in late 2021 to support growth a several areas

of the association’s services to members, including the Director-level position to provide staff administration and support to the WSIA Diversity Foundation and its operations and DE&I strategies. Offsetting the association’s operating growth was $1.2 million of unrealized investment losses on WSIA’s investment portfolio, consistent with peer performance in 2022. Nonetheless, WSIA closed fiscal year 2022 in strong financial position with net assets of $14.4 million, representing an operating reserve of 125%.

The WSIA team and board continue to carefully review and benchmark the association’s operating reserve to invest in services to members and to maintain appropriate financial strength for many years to come. WSIA’s financial statements and investment results are monitored by the Audit & Compliance Committee and were reviewed by independent auditors, Mayer Hoffman McCann P.C. Their report included an unmodified audit opinion, no financial statement adjustments, and noted no weaknesses in WSIA’s internal control structure.

22

WSIA FINANCIALS 2022

The most significant improvement in 2022 revenues resulted from the association’s 2022 Annual Marketplace in San Diego with a record 6,496 members attending, an increase of 29% from its now second largest Annual Marketplace in 2019.

WSIA BALANCE SHEET

WSIA INCOME STATEMENT

23

Dec. 31, 2022 Dec. 31, 2021 Assets Cash $ 4,062,617 $ 4,136,567 Investments 12,557,963 12,853,590 Deferred Compensation Assets 110,479 Receivables 226,125 1,203,015 Prepaid Expenses 657,187 526,984 Property and Equipment 84,634 102,809 Operating Lease Assets 735,478 Total Assets $ 18,434,483 $ 18,822,965 Liabilities and Net Assets Liabilities Accounts Payable $ 350,225 $ 1,460,559 Accrued Expenses 353,367 404,945 Deferred Compensation Liability 110,479 Deferred Rent 68,963 Deferred Revenue 2,406,212 1,638,688 Operating Lease Liabilities 790,373 Total Liabilities 4,010,656 3,573,155 Net Assets Unrestricted 14,423,827 15,249,810 Total Liabilities & Net Assets $ 18,434,483 $ 18,882,965 Dec. 31, 2022 Dec. 31, 2021 Revenues Membership Dues $ 2,741,498 $ 2,704,824 Program Service Revenue 8,768,219 5,117,874 PPP and ERC Revenue 533,180 Total Revenues 11,509,717 8,355,878 Expenses Program Services 7,822,945 5,288,045 Committee Activities 1,827,586 1,168,259 General and Administrative 1,441,184 1,143,848 Total Expenses 11,091,715 7,600,152 Investment Income (1,243,985) 1,112,577 Change in Net Assets (825,983) 1,868,303 Net Assets, Beginning of Year 15,249,810 13,381,507 Net Assets, End of Year $14,423,827 $15,249,810

For the Years Ending

WSIA COMMITTEE ROSTER

AUDIT & COMPLIANCE COMMITTEE

CHAIR, Carlton Maner

AXIS Insurance

Nick Abraham

Amwins Brokerage

Jennifer Cunningham Atlantic Casualty Insurance Co.

Jim Damonte Upland Capital Group

William Fink Jencap Insurance Services Inc

Alan George MountainCreek Solutions

Duffy Koller Paragon Insurance Holdings, LLC

Douglas Lang Convex Group Ltd.

Leslie Oches

North Light Specialty Insurance Co.

Patrick Porter

MUSIC

Milos Rados Outsource Insurance Professionals, Inc.

Socorro Sanchez

Inter Insurance Agency Svcs Ltd.

Drew Stock Upland Capital Group

EDUCATION COMMITTEE

CHAIR, Danny Kaufman Burns & Wilcox

Erika Apuan

Amwins Access

David Archiable

Great American Risk Solutions

Chris Behymer Markel

Brian Braden

Crum & Forster

Jennie Carr Arlington/Roe

Kellie Dainton Hamilton

Josephine Del Gatto Surplus Line Association of CA

Cara Delestienne MacNeill Group, Inc.

Jeff Diefenbach

Burns & Wilcox

Thomas Dillon

Amwins Brokerage

Erin Dolan

RSUI

Renee Eldridge Markel

Jennifer Fisher

AXIS Insurance

Helen Fry

Nationwide E&S/Specialty

Angie Fylak Nautilus Insurance Group

Peggy Giancola

RT Specialty

Aneisha Goldsmith Atrium Underwriters

Limited

Gregg Golson J.S. Held LLC

Eva Gonzalez MUSIC

Emma Gros

Liberty Specialty Markets

Barbara Habel

HDI Global Insurance Company

Emily Hathcoat Risk Placement Services

Julia Keenan Lexington Insurance Company

Rachel Khatkhate Seneca Specialty

Regina Kirwan GenStar

Mick Kroll Amwins Access

Paul Lefcourt

Socius Insurance Services

Jeff McDonald

TDC Specialty Insurance Company

Natasha Morrow Amwins Group

Rachel Pagliarulo

GenStar

Chip Pecchio RSUI

Rick Pitts

Arlington/Roe

Lora Robbins

RT Specialty

Christopher Schramm Argo Group

Kristen Skender Jimcor Agency, Inc.

Rodney Smith Lloyd’s

Dina Tennekoon At-Bay

Lisa Van Leuvan

Risk Placement Services

Jackie White MUSIC

EMERGING ISSUES & INNOVATION COMMITTEE

CHAIR, Robert Sanders Preferred Specialty, LLC

Bruce Bahn Risk Placement Services

Jeffrey Baker Choice Legal

Wesley Becknell RockLake Insurance Group, Inc.

David Blocker

TDC Specialty Insurance Company

Dawn Brost

Nationwide E&S/Specialty

Zachary Burch

Amwins Access

Shaun Cawley

Great American Risk Solutions

Ken Distel Atlantic Casualty Insurance Co.

Matthew Dunn Jencap Group LLC

Craig Gerhard RT Specialty

Jessica Hahn

XPT Specialty

Patrick Hanley Socius Insurance Services

Wes Henry RT Specialty

Barbara Ingraham One80 Intermediaries

Harry Jardine Aon Benfield Ltd.

Ronald Keller

IFG Companies

Daniel Kerr MarketScout Corporation

Clif Kersey Upland Capital Group

Toni Leone

Great American Risk Solutions

Simon Lewis Atrium Underwriters Limited

Michael Marks Nationwide E&S/Specialty

William Nichols Amwins Brokerage

Matija Obradovic

Outsource Insurance Professionals, Inc.

Eric Quinn

Ryan Specialty Underwriting Managers

Mark Rector

Lloyd’s

Luka Ristovic

Outsource Insurance Professionals, Inc.

Brett Ross

Carr Allison

Skyler Severns Dark Matter InsurTech, LLC

Tracey Sharis

Liberty Mutual Insurance

Paul Smith Burns & Wilcox

Andrea Tanaskovic Outsource Insurance Professionals, Inc.

Michelle Thompson Markel

Greg Watson CRC Group

Chris Zoidis Burns & Wilcox

EVENTS COMMITTEE

CO-CHAIR, Brenda (Ballard) Austenfeld RT Specialty CO-CHAIR, Dave Obenauer CRC Group

Reiko Akimoto At-Bay

Mamadou Bah RT Specialty

Grainne Bohan UFG Specialty

Lynn Bordelon MHI, an Amwins Company

Jonathan Brislin Mutual Boiler Re

Alison Burgess Markel

Veronica Davis Atlantic Casualty Insurance Co.

Diana DePaola Staff Boom

Randy Doss CRC

Daniel Drennen Amwins Brokerage

Kyle Enderle

Great American Risk Solutions

Jason Feldman Hamilton

Shayna Fitzgerald Sompo International

Chris Giadrosich

Intact Insurance

Specialty Solutions

Dawn Gordon Brown & Riding Insurance

Jon Grimsley

Great American Risk Solutions

Elizabeth Hayes

AmRISC, LLC

Nicole Hissong

Velocity Risk Underwriters

Christie Hubbard Ascot Group

Stephanie Lawson

Great American Risk Solutions

Addie Lopez

R.E. Chaix & Assoc. Inc.

Valerie Martin Brown & Riding Insurance

Maureen McCall

Admiral Insurance Group

Carmen McKeon CRC

Lynnette Mends-Cole

Admiral Insurance Group

LJ Modafferi Zurich

Steven Moore Great American Insurance Group

Stephen Nadeau Coaction Specialty Insurance Group

Nicole Noland

Aspen Insurance

Stacie O’Brien

Resnick & Louis PC Atty

William Palmer

Markel

Meghan Phelps

Great American Risk Solutions

Eden Rhoden Golden Bear Insurance Company

Karla Rodriguez Bass Underwriters, Inc.

Lisa Rodriguez Brown & Riding Insurance

Caryn Siebert

AJG - Gallagher Bassett

Victoria Snow

CapSpecialty

Zahnie Soe Myint Koeller Nebeker Carlson & Haluck LLP

Steve Tralongo Markel

INSURTECH COMMITTEE

CHAIR, Shannon Dahlke

Amwins Access

Lori Bibb

Morris, Manning & Martin, LLP

Braden Bond Nationwide E&S/Specialty

Marciana Bradley

Tokio Marine Specialty Insurance Co

Cristy Brewer

Atlantic Casualty Insurance Co.

Dan Brown

Eversheds Sutherland

Adam Care

Hartford Steam Boiler

Inspection & Ins.

Chase Courtney

Imperial PFS

Ana Daves

Penn-America Group

Brent Davis Texas Specialty Underwriters

Chasity Devasurendra CRC

Anthony DiBuono

Amelia Underwriters Inc.

Mimi Dobbins

Jackson Sumner & Associates

Lisa Doherty Business Risk Partners

Mike Fieseler

EOX Vantage

Bob Frady Guidewire Software

Dana French First Insurance Funding

Nir Gabay

Admiral Insurance Group

Patrick Hayes Lloyd’s

Gilbert Hine

Amwins Access

Davie Holt

Imperial PFS

24

Timothy Horton

USG Insurance Services, Inc.

Anthony Iatesta

Allianz Global Corp & Specialty

Ron Jager

Raphael & Associates

Ben Johnson Ironshore Inc.

Arvind Kaushal Cogitate Technology Solutions

C.J. Ketterer

Dark Matter InsurTech, LLC

Julia O’Connor

Amwins Access

Vladimir Peraza

CRC

Marie Reed-Harris

Nationwide E&S/Specialty

James Riviezzo

Briza

Mark Roth

OWIT Global

Scott Sauter

Amwins Access

Jacqueline Schaendorf Insurance House, Inc.

Yuvaraj Selvaraj

EOX Vantage

Marc Stevens

XPT Specialty

Mladen Subasic Outsource Insurance Professionals, Inc.

Chris Sylvester XS Brokers Insurance Agency

Tarek Timol Hallmark Financial Services, Inc.

Tate Tooley Bloss & Dillard, Inc.

Nate Trimble Loadsure

Nikola Vucetic Outsource Insurance Professionals, Inc.

Ben Woodward Admiral Insurance Group

Christyn Yoast Beazley Group

INTERNSHIP COMMITTEE

CO-CHAIR, Gerald Dupre Core Specialty

CO-CHAIR, Wendy Houser Markel

Maddie Beja Risk Placement Services

Matt Blessing

RT Specialty

Brett Blumencranz IFG Companies

Chad Brown Alternative Risk Company

Stacey Bullock RPS SeaCoast

Jasmine Canlas Markel

Gabe Carrieri

XS Brokers Insurance Agency

Tony Chimera

Westfield Specialty

Faith Cochran

CRC

Dan Confalone Markel

Caroline Creed Markel

Tammy Culmone

Amwins Access

Meredith Dearing Markel

Jim DeSimone AXIS Insurance

Douglas Dick Sompo International

Dennis Dunne Trigon, Inc.

Scott Epstein Scottish American

Anthony Ferro Johnson & Johnson, Inc.

Heather Gay AmTrust E&S Insurance

Cara Gilligan RSUI

John Goolsby Bridge Specialty Grp.ECC

Bob Greenebaum CRC

Nathan Hall

Great American Insurance Group

Carson Herron Velocity Risk Underwriters

Noah Hicks

Amwins Brokerage

Troy Hidle

Amwins Brokerage

Hannah Huggins RT Specialty

Ben Hughes Upland Capital Group

Ebony Hunt

Amwins Access

Kristin Jones

Amwins Access

Kelsey Jules

Amwins Brokerage

Katie Katzman

Amwins Group

Logan Krause

Bridge Specialty Grp.Peachtree

Paul Krutek

Denali Specialty Group LLC

Jeff Lamb

Markel

Brooke Leadbetter Amwins Brokerage

Tricia Loney CNA

Camara Magaoay Ironshore Inc.

Andrew May Admiral Insurance Group

Adam Mazan Risk Placement Services

Jonathan McKenzie Commercial Sector Ins. Brokers

Jehane Myers Orchid Underwriters Agency, Inc.

Christa Nadler Risk Placement Services

Jackie Neuhalfen Mission Underwriters

Shannon Nisi Beazley Group

Shannon Piotrowski

AmTrust E&S Insurance

Houston Pittman Amwins Access

Robert Polansky RT Specialty

Gary Romay

KW Specialty Insurance Co

Bryan Ruef

Great American Risk Solutions

Richard Schmitzer

James River Insurance Company

Meredith Scott

RT Specialty

Zachary Snow Westchester

Erika Sreenan RT Specialty

Bryant Steele Burns & Wilcox

Alexandra Stoughton Amwins Brokerage

Linsey Tabor

Amwins Brokerage

Hugo Teles Da Silva

Great American Insurance Group

Allison Thayer

Ironshore Insurance Services

Chad Thibodeaux Amwins Brokerage

Chad Trainor CRC

Mariah Wilson Amwins Brokerage

Lindsey Wingerning Ironshore Insurance Services

Barbara Winsky

Jencap Group LLC

Ethan Witting

AXIS Insurance

Gregory Woods GenStar

Alexander Wright Crum & Forster Surplus & Specialty Lines

Michelle Yuko Amwins Brokerage

LEGISLATIVE COMMITTEE

CO-CHAIR, Phillip McCrorie RSUI

CO-CHAIR, Coryn Thalmann Jimcor Agency, Inc.

Tom Albrecht Associated Insurance Administrators, Inc.

John Briggs Nautilus Insurance Group

H. Michael Byrne

McDermott Will & Emery LLP

Kathy Colangelo Bridge Specialty Group

Thomas DeCotis DeCotis Specialty Insurance

David DeMott

Gridiron Insurance Underwriters

William Evans RT Specialty

Seth Fischer

W.H. Greene & Assoc., Inc.

Troy Fornof MacNeill Group, Inc.

Bill Graham Carr Allison

Hank Haldeman

Amwins Group

Rob Halsey Lexington Insurance Company

Larry Hamilton Mayer Brown LLP

Paul Hanley CRC Group

Michelle Heckman

CRC

Ilana Hessing Ryan Specialty Underwriting Managers

Amicia Hine Amwins Access

Alan Kaufman Burns & Wilcox

Dan Klempay At-Bay

David Luca Coverys Specialty Insurance Company

Daniel Maher ELANY

Yusuf Mayet Surplus Line Association of CA

Robert McEwen

The Parks Group, Inc.

Benjamin McKay Surplus Line Association of CA

Kathy McVaney Amwins Group

Lindsay Moore

Amwins Brokerage

Jason Murrey RT Specialty

Clint Nokes RSUI

David Ocasek Surplus Line Association of IL

D. Conor O’Leary

Shelly, Middlebrooks & O’Leary

Robert Owens

Westchester

Brian Radell

XS Brokers Insurance Agency, Inc.

Bob Reardon USG Insurance Services, Inc.

James Roe

Arlington/Roe

Anthony Roehl Morris, Manning & Martin, LLP

Amanda Ruppel CRC

Kathy Schroeder XPT Specialty

Lee Sjostrom RSUI

Bachman Smith Johnson & Johnson, Inc.

Jerry Sullivan G.J. Sullivan Co. Reinsurance

Josh Taylor

Scottish American

Nelli Thomas AmeriTrust Group, Inc.

Tracy Wade

Brit Group Services Ltd

Tiffany Way RT Specialty

Randy West AmRISC, LLC

MEMBERSHIP & ETHICS COMMITTEE

CHAIR, Patrick Albrecht Associated Insurance Administrators, Inc.

Neil Baker

Shepherd Compello Ltd.

Patrick Barton Lexington Insurance Company

Kevin Bolger Afco Direct

Andrew Bown Tysers

Jim Dowdy Ryan Specialty Underwriting Managers

Ross Driscoll National E&S Insurance Brokers, Inc.

Peggy Dronet Mississippi Surplus Lines Assn.

Jeff Fields

Markel

Michelle Fisher Markel

Lindy Gardner

Admiral Insurance Group

Andrew Grim

Brown & Riding Insurance

Jennifer Hopson Munich Re Syndicate Limited

25

COMMITTEE ROSTER

Samuel Hufstedler

Tenco Services, Inc.

Robert Itzinger

RT Specialty

Michael James Lockton Re

Neil Kessler

CRC

Justin Lehtonen

Amwins Brokerage

Matt Lynch Risk Placement Services

Tony Madden

AmTrust E&S Insurance

Milica Rajkovic Outsource Insurance Professionals, Inc.

Jeff Short Brown & Riding Insurance

Chris Siegel Burns & Wilcox

Sarah Sloan

Risk Placement Services

Charles Smith

Carnegie Agency Inc.

Van Spanos

Core Specialty

Tatjana Spasojevic

Outsource Insurance Professionals, Inc.

Kevin Sullivan

AXA XL

Greg Youngblood

Crawford & Company

PAC COMMITTEE

CO-CHAIR, Cristi Carrington Brown & Riding Insurance

Matthew Brady Burns & Wilcox

Cliston Brown

The Surplus Line Association of California

Joel Cavaness

Risk Placement Services

Zac Crosley

CRC

Andrew Davidson

RT Specialty

Mimi Fiske

Markel

John Head Risk Placement Services

Kacy Pierson Jones

Ascot Group

Fred Karlinsky

Greenberg Traurig

Robert Pedersen

Brown & Riding Insurance

Bryan Sanders

Markel

Kerri Senger

Denali Specialty Group LLC

TALENT OUTREACH COMMITTEE

CO-CHAIR, Henry Lopez

Navigators, a brand of The Hartford

CO-CHAIR, Danielle Wade

Jackson Sumner & Associates

Andrew Adams River Valley Underwriters

Russ Allison Carr Allison

Josh Ammons

Amwins Brokerage

Philip April Lexington Insurance Company

Jessie Berger Upland Capital Group

Leslie Bingham

Navigators, a brand of The Hartford

Devon Borisoff

Monarch E&S Insurance Svcs.

Alyssa Bouchard

Gamma Iota Sigma

Kaileigh Bowe

Tokio Marine Highland

Mike Brennan CRC

Debra Buettner Risk Placement Services

Kyle Burch

W.H. Greene & Assoc., Inc.

Christopher Carlson

CRC

Brett Carter The Jacobson Group

Timothy Chaix

R.E. Chaix & Assoc. Ins.

Jeremy Chaseley

AXIS Insurance

Trish Christensen

Nationwide E&S/Specialty

Robert Costa

Great American Insurance Group

Joe Dahlvig

Admiral Insurance Group

Thurston Davis RT Specialty

Annie Dawson RT Specialty

Kaitlyn DeBandi Amwins Brokerage

Donald DeMent Nautilus Insurance Group

Jocelyn Dewey DeCotis Specialty Insurance

Brett Dresner

Amwins Brokerage

Ross Driscoll National E&S Insurance Brokers, Inc.

Kari Edwards AmRISC, LLC

Samantha Fritch Amwins Group

Mike Gallagher Risk Placement Services

Michael Garrison Navigators, a brand of The Hartford

Bill Gatewood Burns & Wilcox

Albert Geraci Risk Placement Services

Steve Girard Markel

Rebecca Gitig Aspen Insurance

Brett Glaser GenStar

Nick Graham Nautilus Insurance Group

Timothy Hamer Mission Underwriters

Enya He Lloyd’s

Michael Hisey Tower Hill Insurance Group

Kristen Ilsemann Munich Re

Anita Jim Nationwide E&S/Specialty

Courtney Kerr MarketScout Corporation

Victoria Killingsworth Core Specialty

Lee Koonce Beazley Group

Perri Leung

Crum & Forster

David Lewison

Amwins Brokerage

Leslie Lloyd

Amwins Access

Matt Madar Core Specialty

Sharon Mielke Markel

Kaitlyn Miller

Great American Insurance Group

Alexander Mortimer IFG Companies

Ryan Mroz Admiral Insurance Group

Elaina Nicholson Risk Placement Services

Leah Ohodnicki Ethos Specialty Insurance Services

Giselle Palladino Gallagher Re

Stephen Pannucci Zurich

Ravi Patel Hallmark Financial Services, Inc.

Tracy Pitre Insurity

Jennifer Porter Munich Re

Jeannie Reilly Argo Group

Rebecca Roberts Burns & Wilcox

Kathleen Sanchez James River Insurance Company

David Sarnoski

Admiral Insurance Group

Allison Sellers Great American Risk Solutions

Brian Sloan

Great American Risk Solutions

Scott Smith RSUI

Brandon Stevis GenStar

Blake Stock

Bridge Specialty Grp.Combined Group

John Tatum AXIS Insurance

Matthew Terry Westchester

Calvin Thompson RT Specialty

Bryan Touchstone

Amwins Brokerage

Terry Turon Crawford & Company

Caroline West Lexington Insurance Company

Brent Wright Risk Placement Services

Hollis Zyglocke Markel

26

WSIA

RIGHT : WSIA Annual Marketplace attendees enjoy networking at Opening Reception in San Diego.

LEADERSHIP

OFFICERS

PRESIDENT

Bryan Clark Gorst & Compass Insurance Los Angeles, CA

VICE PRESIDENT

Dave Obenauer CRC Group Charlotte, NC

BOARD OF DIRECTORS

SECRETARY Brenda (Ballard) Austenfeld RT Specialty Naples, FL

TREASURER Carlton Maner AXIS Atlanta, GA

IMMEDIATE PAST PRESIDENT Davis Moore Amwins Los Angeles, CA

WSIA TEAM

Liz Bermond Office Coordinator

Lynley Darkow Event Manager

Julie Fritz Director of Operations

Susan Henderson Director of Communications

Debbie Hill Director of Events

Lindsay Holland Education Coordinator

Brady Kelley Executive Director

Keri Kish General Counsel and Policy Director

Chelsea Lenhart Event Manager

Denise Marshall Student Programs Manager

John Meetz Director of Government Relations

Vanessa Sims Director of Diversity, Equity & Inclusion

Emily Stubbs Controller

Elizabeth Tice Marketing Coordinator

Chris Timmerman Senior Manager of Student Relations

Josh Vengley Senior Technical Manager

28

Henry Lopez Navigators Schaumburg, IL

Phillip McCrorie RSUI Atlanta, GA

Robert Sanders Preferred Specialty, LLC Columbia, SC

Coryn Thalmann Jimcor Agencies Montvale, NJ

Danielle Wade Jackson Sumner & Associates Boone, NC

U40 Representative Adam Care HSB Austin, TX

Patrick Albrecht Associated Insurance Administrators, Inc. Montgomery, AL

Cristi Carrington Brown & Riding Seattle, WA

Shannon Dahlke Amwins Access Houston, TX

Gerald Dupre Core Specialty Atlanta, GA

Wendy Houser Markel Specialty Dallas, TX

Danny Kaufman Burns & Wilcox Farmington Hills, MI

Ten WSIA summer interns were invited to attend 2022 Annual Marketplace in San Diego

Ten WSIA summer interns were invited to attend 2022 Annual Marketplace in San Diego

30 4131 N. Mulberry Drive Ste. 200 Kansas City, MO 64116 816.741.3910 www.wsia.org ANNUAL REPORT © 2023 Wholesale & Specialty Insurance Association

Ten WSIA summer interns were invited to attend 2022 Annual Marketplace in San Diego

Ten WSIA summer interns were invited to attend 2022 Annual Marketplace in San Diego