SUCCESSION PLANNING CONFERENCE

THURSDAY 10TH APRIL 2025

THURSDAY 10TH APRIL 2025

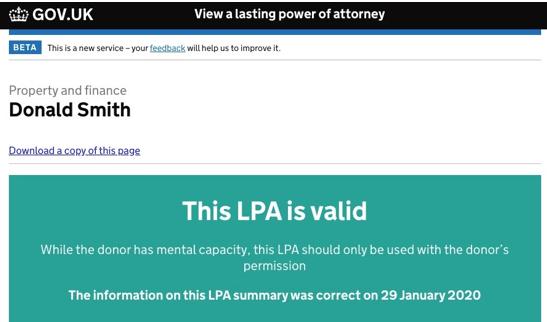

• Mrs Smith is 54 years old.

• She was widowed some years ago and has recently remarried.

• She has two adult children, Felix and Marie, from her first marriage. Her new husband, Garfield, has a daughter from his previous marriage.

• She owns her main residence and a rental property in her sole name.

• She has cash in the bank, some NS&I products and investments.

1. Will • Basic • Life Interest Trust

• Discretionary Trust

2. Lifetime trusts

3. Lasting Powers of Attorney

• Mrs Smith is 54 years old.

• She was widowed some years ago and has recently remarried.

• She has two adult children, Felix and Marie, from her first marriage. Her new husband, Garfield, has a daughter from his previous marriage.

• She owns her main residence and a rental property in her sole name.

• She has cash in the bank, some NS&I products and investments.

• She has an interest in a limited company which sells cats clothing and accessories.

• Mrs Smith is 54 years old and recently widowed.

• She has two adult children, Felix and Marie.

• She owns a farm which comprises of a farmhouse, 200 acres of land, 200 cattle and some rental cottages.

• Mrs Smith and Felix run the farming business under a partnership.

• She resides in the farmhouse and there are several properties on the farm which are rented out.

• She has cash in the bank, some NS&I products and investments.

1. Will

• Basic

• Life Interest Trust

• Discretionary Trust

• Undertake a review of the business activities to ensure it qualifies for APR/BPR – agricultural use and “wholly or mainly”

2. Lifetime trusts

3. Lasting Powers of Attorney – personal and business

4. Partnership agreement v. Partnership Act 1890

5. Life insurance

• Marie is in receipt of Personal Independence Payment due to a physical disability. She is likely to remain on state benefits for the remainder of her life and requires care.

• Marie resides in a property that Mrs Smith bought and adapted for her use.

• Felix has recently married and Mrs Smith is concerned about the longevity of his relationship.

1. Will

• Discretionary Trust

• Vulnerable Persons Trust

2. Lifetime trusts

3. Lasting Powers of Attorney

Nil rate band up to £325,000

Residence nil rate band up to £175,000

Transferrable nil rate band up to £325,000

Transferrable residence nil rate band up to £175,000

Qualifying business and agricultural property

relief EIS and AIM investments

relief Spouse exemption

relief

Mr Richard Dundee

Partner

Private Client

Estate Planning, Trusts and Capital Tax Mitigation

Married to a Criminal Defence Solicitor

Parent to Harry and Darcie

Peterborough United Football supporter

Changes to exemptions: Business Property Relief (BPR) and Agricultural Property Relief (APR)

Proposed revisions to trust treatment: consultation ongoing

Anti Forestalling Rules!

Digitalisation of Estate Planning

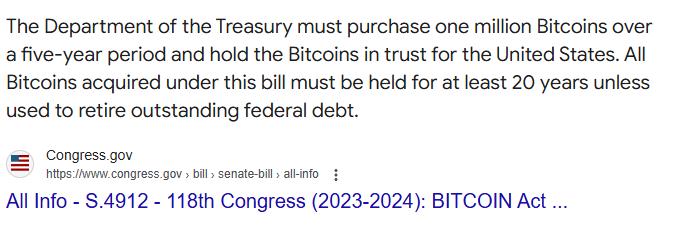

Cryptocurrency

Business Property Relief (BPR) and Agricultural Property Relief (APR)

“The new relief will apply to businesses generally, not restricted to the manufacturing sector; but investment concerns and dealers in land and shares will be excluded. This is a very important change, particularly for small businesses. It will substantially lighten the burden on transfer of businesses and will go a considerable way to meet the representations which have been made about the inhibiting effect of capital transfer tax on the small firm's sector. I believe that it will give the proprietors of small businesses greater confidence to invest and expand their activities”

“The (sic) relief will also apply to farmers. Here I have taken account of the work of the Interdepartmental Working Party on Capital Taxation and Agriculture, which was foreshadowed in the 1975 White Paper "Food from Our Own Resources". The (sic) relief will apply to the assets, including land, which are used in farming as it does to other businesses”

Chancellor: Denis Healey Government: Labour

HC Deb 17 May 1976 vol 911 cc1115-27

Mr. Parkinson (Hertfordshire South February 28, 1974 - June 9, 1983)

“Does the right hon. Gentleman now accept that all these exemptions under estate duty, which he persisted in describing as loopholes, were designed for just the same reason— to allow productive assets not to be penalised?”

Mr. Barnett (Chief Secretary to the Treasury 1974 – 1979)

“This is a matter of getting the balance right between equity, on the one hand, and helping small businesses, on the other”

“Change, There is nothing permanent, Except change”

Barry Can’t Swim – The Person You’d Like To Be

“The government is making the inheritance tax system fairer by reforming both agricultural property relief and business property relief from 6 April 2026”

- New £1,000,000 allowance, non-transferable between spouses.

- Everything over this amount receives 50% relief

- 50% relief

- Ensure that the business is structured in a way that qualifies and continues to qualify for BPR and APR

- Ensure that the Farm or the Business is split between Spouses (nontransferable allowance)

Be aware of the 10-year instalment plan:

From April 2026, the option to pay Inheritance Tax by equal annual instalments over 10 years, interest-free, will be extended to all property which is eligible for agricultural property relief or business property relief, regardless of the applicable rate of relief.

- Currently in consultation

- £1,000,000 allowance before Periodic / Anniversary charges apply

- Multiple trusts prepared after 30/10/24, allowance split

- Old Trusts, brought into new regime at next 10-year anniversary

Anti Forestalling Rules!

The Law Commission is consulting on:

• whether electronic wills could, or should, be able to comply with the formal requirements for a valid will

• whether, and how, it should be possible for wills to be executed or made using electronic means

• whether wills should be able to be stored and admitted to probate solely as electronic documents

Good legal professionals will always be needed, we just need to avoid the temptation that A.I provides!

“This short bill clarifies that certain digital assets, such as crypto-tokens, can be recognised as property, even if they do not fit into the 2 traditional categories of personal property in English and Welsh law.

This will help provide certainty and protection for people and businesses who own and transact with these assets”

• Mrs Smith is 54 years old.

• She was widowed some years ago and has recently remarried.

• She has two adult children, Felix and Marie, from her first marriage. Her new husband, Garfield, has a daughter from his previous marriage.

• She owns her main residence and a rental property in her sole name.

• She has cash in the bank, some NS&I products and investments.

1. Will • Basic • Life Interest Trust • Discretionary Trust 2. Lifetime trusts 3. Lasting Powers of Attorney

• Mrs Smith is 54 years old.

• She was widowed some years ago and has recently remarried.

• She has two adult children, Felix and Marie, from her first marriage. Her new husband, Garfield, has a daughter from his previous marriage.

• She owns her main residence and a rental property in her sole name.

• She has cash in the bank, some NS&I products and investments.

• She has an interest in a limited company which sells cats clothing and accessories.

1. Will

• Utilising full reliefs available on first death

2. Ensure an equalisation of fully relievable assets between spouses in lifetime

3. Lifetime trusts

• Reviewing previous lifetime settlements

• Consider additional settlements prior to April 2026

4. Lasting Powers of Attorney – personal and business

5. Shareholder agreement

6. Cross option agreements

7. Life insurance - higher liability

• Mrs Smith is 54 years old and recently widowed.

• She has two adult children, Felix and Marie.

• She owns a farm which comprises of a farmhouse, 200 acres of land, 200 cattle and some rental cottages.

• Mrs Smith and Felix run the farming business under a partnership.

• She resides in the farmhouse and there are several properties on the farm which are rented out.

• She has cash in the bank, some NS&I products and investments.

1. Will

• Utilising full reliefs available on death

• Consideration of other beneficiaries to avoid disputes

2. Considering the use PETs every seven years to pass wealth down the generations.

3. Lifetime trusts

• Reviewing previous lifetime settlements

• Consider additional settlements prior to April 2026

4. Lasting Powers of Attorney – personal and business

5. Partnership agreement v. Partnership Act 1890

6. Life insurance- higher liability

• Marie is in receipt of Personal Independence Payment due to a physical disability. She is likely to remain on state benefits for the remainder of her life and requires care.

• Marie resides in a property that Mrs Smith bought and adapted for her use.

• Felix has recently married and Mrs Smith is concerned about the longevity of his relationship.

1. Will

• Discretionary Trust

• Vulnerable Persons Trust

• changes to PIP eligibility

2. Lifetime trusts

3. Lasting Powers of Attorney

WITH ROBERT LEE

• Protecting wealth and pass this on to future generations

• Retaining Control

• Promotes family governance

• Efficient IHT management

Natural split between ownership and control

Ownership spread between family members

Control is with board of directors

Protection in the event of divorce of siblings

Alphabet shares to diversify voting, income and capital rights

Corporate structure

Protection for minors

• Division of ownership and control shareholder's alphabet shares may help to safeguard assets

• Share transfer rights are enshrined in the Articles, agreement, they can prohibit a transfer on divorce thus retaining ownership in the family. More protection than a shareholder's agreement.

High-net worth individual transfers cash into the FIC in exchange for a combination of shares and loans, they can then gift the shares to other family members as a potentially exempt transfer, no IHT if the donor lives for 7 years.

• Allows minors to hold shares and benefit from growth in value of investments through a trust

• Differing classes of shares, allow certain shareholders to retain control

• Dividend waivers, allowing profits to be distributed in different proportions

• Shares gifted with restricted rights

• Note of caution - dividend waivers/alphabet shares may be viewed as arrangements to divert profits to another- settlements legislation may be relevant

Step 1: Identify Shareholders

Step 2: Work out share capital

Step 3: Identify directors

Step 4: Design Articles of Association

Step 5: Consider Shareholder’s Agreement

Parents 70%

FAMILY INVESTMENT COMPANY Child

DIRECTORS: PARENTS

Step 1: Identify Shareholders

Step 2: Work out share capital

Step 3: Identify directors

Step 4: Design Articles of Association

Step 5: Consider Shareholder’s Agreement

Share Capital

• Ordinary shares

• Preference Shares

Valuation Issues

• >75% shares- total control

• <25%- uninfluential minority

• Restricted income and/or capital rights

• Voting/Non-Voting

Alphabet shares

• Can declare different times and rates of dividends for each share class

• Retain control

• Subscribe for shares

• Sale of Assets

• Interest free and repayable on demand

• Share for share exchanges

• Charging interest

• Gifts to a company

Step 1: Identify Shareholders

Step 2: Work out share capital

Step 3: Identify directors

Step 4: Design Articles of Association

Step 5: Consider Shareholder’s Agreement

Directors

• Day-to-day control of the company

• There may be one sole director

• Number of directors and quorum to be decided

• Right to appoint enshrined in the articles

• Attract the right talent and calibre of directors

• Dismissal procedures must be decided

• Service agreements

• Procedure for new appointments must be decided ( ie by ordinary resolution or board appointment)

• What happens if a director dies or loses mental capacity?

Step 1: Identify Shareholders

Step 2: Work out share capital

Step 3: Identify directors

Step 4: Design Articles of Association

Step 5: Consider Shareholder’s Agreement

• Internal rule book for the company

• Private agreement that generally requires the consent of all parties to vary

• Company must not fetter its ability to alter Articles

•

• Public document

• Both documents drafted to suit the family

• Develop a mission statement for the family office

• Restricted Transactions

• Share transfer rights

• Deed of adherence

• Remedies for breach

• Have a clear mission statement

• Consider tax treatment

• Keep things simple

• Think long-term, focus on wealth preservation and growth

Neal Patterson

Partner, Farms and Estates

T: 01926 880713

E: neal.patterson@wrighthassall.co.uk

Richard Dundee

Partner, Private Client

T: 01926 880748

E: richard.dundee@wrighthassall.co.uk

Robert Lee

Partner, Corporate

T: 01926880741

E: robert.lee@wrighthassall.co.uk

Siobhan Sibley

Senior Associate, Private Client

T: 01926 880743

E: siobhan.sibley@wrighthassall.co.uk

THANK YOU FOR JOINING US