Economic Development in the World’s Third Largest Economy

Economic Development in the World’s Third Largest Economy

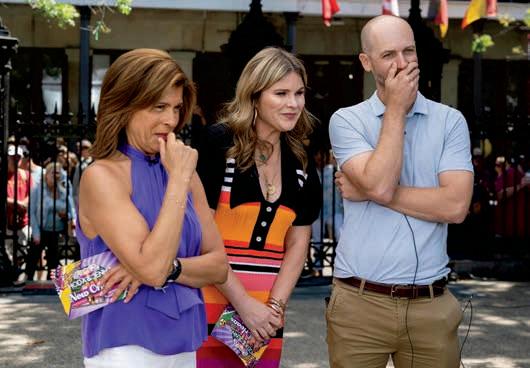

Some of the finest minds in economic development in the South gathered to exchange ideas at the annual Southern Economic Development Roundtable

“The

Erik Eschen, CEO of Vacuumschmelze

Erik Eschen, CEO of Vacuumschmelze

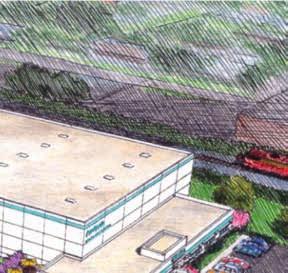

150,000 Sq. Ft. Pad-Ready Site Available

150,000 SQ.

Directly adjacent to I-26, nearest to the Port of Charleston in the TVA service area, with easy access to I-40 and I-81. CSX rail lines onsite. Unicoi County, TN: Speed-to-Market Advantage, Quality of Place, Business-Friendly Environment.

In the heart of the South’s Automotive Corridor, we are ready for your next venture. With active CSX rail and I-26 next door near I-81 and I-40 our 150,000 sq. ft. pad-ready site is an ideal location.

A large regional workforce with comprehensive development, education, and apprenticeships keeps industry ahead.

With ample TVA power, a ready and willing workforce in one of the most beautiful cities in the South, we’re confident our Tennessee location is a great place to call home.

Schedule a site visit today with Austin Finch 423-735-4578 | AFinch@e-u.cc UnicoiCountyECD.com

Schedule a site visit today with Austin Finch 423-735-4578 I Afinch@e-u.cc UnicoiCountyECD.com RealWildUnicoiCounty.com

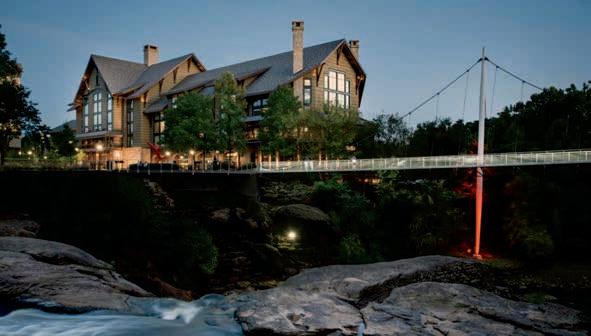

A CITY WHERE HISTORY INSPIRES TODAY’S PROGRESS, AND A NEW GENERATION IS WRITING TOMORROW’S STORY. In 2022, the Montgomery Chamber celebrated a record breaking year with unprecedented economic growth, new investment and world-wide interest in Montgomery.

• 23 Announced Projects

• $1.7B in Capital Investment DRIVING ECONOMIC GROWTH TO BUILD A

Access to more than 16,000 miles of navigable water and nearly half of the

Access to more than 16,000 miles of navigable water and nearly half of the continental

Access to more than 16,000 miles of navigable water and nearly half of the continental U.S. Shortest distance between Mid-America and the Gulf of Mexico

Shortest distance between Mid-America and the Gulf of Mexico

Available

Support

Available certified industrial & port sites

Available certified industrial & port sites

Business

Support from local, state and federal officials

Support from local, state and federal officials

Business friendly environment Intermodal

Business friendly environment Intermodal options

PRESENTED BY

This invitation-only, non-profit event gathers many of the South’s finest economic development minds together in one room to discuss economic development in the region, the economy in general and the massive impact of the South’s automotive industry.

Alan Amici CEO Center for Automotive Research

Michael Randle Owner & Publisher Southern Business & Development

Taiber Automotive Engineering Clemson University

Alan Amici CEO Center for Automotive Research

Michael Randle Owner & Publisher Southern Business & Development

Taiber Automotive Engineering Clemson University

To give you a brief teaser, the Center for Automotive Research (CAR) data shows that in 2018, only about $4 billion was invested in North America by OEMs. In 2023, that figure ballooned to $82.5 billion, almost all of which was linked to electrification.

To receive an invitation, contact Michael Randle at 205.370.6039 or michael@sb-d.com

Dr. Joachim

30

52 A Recap of the Roundtable

Many of the finest minds in economic development in the South attended the 2024 Southern Economic Development Roundtable. Here is a summary of some of the presentations.

Under 50 to Watch

The talent level of economic development practitioners in the South is truly unmatched anywhere in the U.S., especially those who are in their forties as they hone their craft.

20

Top stories from the last quarter relative to business and economic development

Relocations & Expansions

All of the significant new starts, expansions and relocations announced in the South in the last quarter

SouthernAutoCorridor.com

The ten largest

LOUISIANA PORT NETWORK Inland Coastal Developing

6 Interstates 6 Deepwater Ports Certified Sites

6 Class 1 Railroads

Six deepwater ports. Thirteen inland and nine coastal ports. Unrivaled global transport infrastructure. Explore the advantages at OpportunityLouisiana.gov.

Is what’s going on in the automotive industry real? A mirage? Maybe it’s somewhere in between?

IN OVER 40 YEARS OF STUDYING THE GAME of economic development (which has always reminded me of the board game Stratego, complete with miners, bombs, spies, scouts and generals), I have never seen numbers like these. Not even close.

Are we so frenzied with daily political drama we don’t even notice the billions being invested, or at least announced. . .so many billions that they boggle the mind? Are there simply too many distractions, such as social media and streaming services, to even care that in just three short years about $150 billion in investments have been announced by automotive OEMs in the electrification of a really old industry?

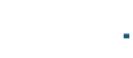

SB&D tracks everything with the resources we have. And in the automotive world, so does the Ann Arbor, Mich.-based Center for Automotive Research (CAR). CEO Alan Amici spoke to our Southern Economic Development Roundtable group in January (SEDR@ThePearl) and he and others will present at our Southern Automotive Corridor Summit, August 15-17 at the Grand Bohemian Lodge in downtown Greenville, S.C. Want to go? Let me know. You must be invited to attend.

I touched on the subject in this issue’s cover story. According to Amici, and CAR, $4 billion in investments were announced in North America by automakers in 2018. From 2021 to 2023, $146 billion in investments were announced, almost all on the electrification of automotive; $82.5 billion in 2023 alone. As Amici said at SEDR@ThePearl, “We are in the fourth year of a 110-year-old industry.” Whoa!

An “announcement” of a deal is one thing. For the deal to work and be real is another. What is going on now with next-generation mobility is not sustainable. There is just way too much competition and incentives too great to pass up.

It seems that each quarter an EV startup announces a deal. This past quarter it was Scout Motors (South Carolina) and Imola Automotive (Georgia). Imola Automotive? Will Imola really house 7,500 workers at a proposed plant in Fort Valley,

Ga., after Rivian Automotive officially delayed the groundbreaking of its plant east of Atlanta? And after Tesla just cut nearly 3,000 jobs at its gigafactory in Austin in April?

I was there when the late Gov. Carroll Campbell announced BMW in Greer, S.C. A watershed moment for the South. It was a long time ago and we will be back there with our Southern Automotive Corridor Summit this summer at the Grand Bohemian Lodge in downtown Greenville, S.C.

I was also there when Alabama announced Mercedes-Benz, on a hillside in Tuscaloosa County, and someone in our group said, “Can’t you just smell the paint shop from here?” That was over 30 years ago.

Those two deals and so many more in the third largest economy in the world were sound, solid projects that have changed the economies of those two states forever. Yet, at the time, like today, they were considered crap shoots.

As for the electric vehicle industry, it remains to be seen how it will shake out. After all, we are only in the “fourth year of a 110-year-old industry.” It better work out. . .there’s just too much money on the table for it not to. J

Southern Business & Development (ISSN 1067-8751) is a registered trademark TM. Founded in 1992 and published quarterly by MCR Publishing, Inc. Affiliated Websites include www.SouthernBusiness.com, www.SB-D.com, www.SouthernAutoCorridor.com. Office address: 8086 Westchester Place, Montgomery, AL 36117. To subscribe, email stacy@sb-d.com. Annual subscription: $25. Single edition delivery by three-day mail: $10. Information contained in SB&D and on its websites is gathered from reliable sources, however, the accuracy of this information is not guaranteed. All rights reserved. Permission must be granted by SB&D for reprint rights, in whole or in part. Copyright 1992-2024. Southern Business & Development TM 1997. Southern Auto Corridor and Southern Automotive Corridor TM 2003.

For real-time news on business, politics and economic development in the South, go to SouthernBusiness.com. For all projects announced in the South and more, go to SouthernBusiness.com and SB-D.com. For more on the auto industry in the South, go to SouthernAutoCorridor.com.

After ranking as the No.1 place to live by U.S. News and World Report in 2023, Huntsville, Ala., has been named the second-best place to live in the United States in the 2023-2024 rankings.

The city’s thriving job market, low cost of living and high quality of life were cited as the primary reasons for its top ranking.

U.S. News and World Report’s top 10 places to live in the U.S.

U.S. News and World Report recently named their pick of the best places to live in the U.S. in 2023 and 2024, and Green Bay, Wisc., claimed first place. Huntsville, Ala., came in second. Raleigh/Durham was third, followed by Boulder, Colo., and Sarasota, Fla., making up the top five. Those cities were followed by Naples, Fla.; Portland, Me.; Charlotte, N.C.: Colorado Springs, Colo., and Fayetteville, Ark.

Construction workforce shortage tops 500,000

According to the Associated Builders and Contractors, the labor crunch in the U.S. construction industry shows no signs of ending anytime soon. The industry needs to attract an estimated 501,000 additional workers beyond the normal pace of hiring this year, and 454,000 new workers in 2025, as construction demand is expected to slow.

CBRE’s 2024 U.S. Investor Intentions Survey shines on the South

Included in the top 10 of CBRE’s top 10 markets for total commercial property returns were Dallas/Fort Worth, South Florida, Raleigh/Durham, Nashville, Atlanta, Charlotte, Tampa and Washington, D.C. Making the top 10 outside the South were Boston and New York City.

Alabama sets record for exports

For the second consecutive year, Alabama has set a new value record for exports with $27.4 billion. Overseas shipments of Alabama-made vehicles, aerospace parts, minerals and metals, as well as other products, rose more than 6 percent from the 2022 mark of $25.5 billion, according to the Alabama Department of Commerce.

“Looking forward, the potential for greater export growth is there, and we are already exploring new and expanding markets for Alabama companies,” said Alabama Department of Commerce Secretary Ellen McNair.

New aluminum project forges ahead in South Alabama, even though costs have risen 60 percent

Novelis is building a monster of an aluminum production plant in North Baldwin County, Ala. The site is at the former South Alabama Me-

gasite. Initially, the project was to cost a tad over $2.5 billion. Now, it’s estimated the plant, which will take up much of the 3,000-acre site, will cost just over $4 billion to build.

Steve Fisher, CEO of Novelis, said that the facility will be a “true plant of the future,” giving the lifetime of the plant “decades.” The facility was announced to house 1,000 employees. According to Fisher, automotive and beverage contracts have already been secured ensuring the factory will be profitable well into the future.

Airbus continues building three new A320 hangar bays in Mobile, Ala.

The aerospace giant’s major expansion is slated to bring 1,000 new jobs to the Mobile facility, doubling its industrial footprint in Alabama.

Mississippi County, Ark., awards $720K in infrastructure grants Mississippi County, where

More Kentucky-made products were shipped around the world in 2023 than in any other year on record. Aerospace products and parts, such as landing systems from Safran in Walton, Ky., once again led Kentucky’s exports.

Lakeland and Winter Haven metro area at 3.8 percent. The Ocala area was fourth at 3.4 percent, and the Port St. Lucie area was fifth-highest at 3.1 percent, according to the census data. The only area outside of Florida in the top five was the Myrtle Beach, S.C., area, which grew 3.7 percent.

more steel is made than in any county in the country, announced in the winter the recipients of its 2024 infrastructure grant program, awarding $720,050 to support seven critical water and sewer infrastructure improvements and projects. Big River Steel, Nucor and others in the metals manufacturing industry all operate in Mississippi County, Ark., employing thousands.

Nation’s fastest-growing areas in Florida

Florida had four of the five fastest-growing metropolitan areas in the country from 2022 to 2023, led by the area that includes The Villages retirement community, according to data released recently by the U.S. Census Bureau. The population in the area that includes The Villages and Wildwood increased by 4.7 percent from July 1, 2022, to July 1, 2023.

The second-fastest growth rate in the country was in the

By capturing so many data centers, Georgia now needs more power Georgia Power has approached regulators in the Peach State to request approval to bring more electric power to the state, even after the company just started up the nation’s first new nuclear reactor in decades last year. The wave of economic development projects Georgia has captured in the electric vehicle and battery industry, along with a slew of data centers, is already putting a strain on the grid in the state.

Company officials claimed in the winter that it needed to produce more power and fast. Most of that additional electrical capacity will come in the form of fossil fuels being burned at this point. Much of the forecasted additional demand — about 80 percent — is driven by the power needed by new data centers slated for the state.

CONTINUED

Amazon Web Services plans to invest $10 billion to build two data center complexes in Madison County, Miss., marking the single largest capital investment in Mississippi’s history.

Plant Vogtle, the first new nuclear power plant to be built in the U.S. in decades, reaches milestone

The second new reactor has been connected to the power grid for the first time. The new Vogtle units will ultimately produce enough electricity to power 1 million homes.

Kentucky exports break all-time record in 2023

More Kentucky-made products were shipped around the world than ever in 2023. The commonwealth broke its single-year total with $40.2 billion in exports, a 16.6 percent increase over the previous year. According to the U.S. Census Bureau, Foreign Trade Division, aerospace products and parts once again led Kentucky’s exports in category in 2023.

Kentucky’s $9 billion bourbon economic impact

The Kentucky Distillers’

Association held its 2024 Bourbon Economic Impact Report in the winter. Gov. Andy Beshear was quoted as saying to the crowd, “Bourbon is America’s native spirit, and even during a time when Kentucky’s whole economy is on fire, this industry continues to play a unique and enormous role in driving our economy and representing Kentucky to the rest of the world.” The 2023 report, titled “The Economic and Fiscal Impacts of the Distilling Industry in Kentucky,” valued the collective economic impact at $9 billion.

Wind farms and carbon capture not likely to share the same areas off Louisiana’s coast

A turf war is brewing off the Southwest Louisiana coast where carbon capture projects and wind farms want the same seafloor off of Cameron Parish. From reports: “Companies that plan to store tons

of carbon dioxide under vast stretches of sea floor south of Cameron Parish are objecting to an overlapping development in the area with wind turbines that have yet to be built.” The carbon-capture companies told the state Department of Natural Resources, which signed agreements for both uses on the same footprint along state-managed waters near Holly Beach and Creole, that the two uses likely can’t coexist.

Mississippi captures its largest single investment Amazon Web Services (AWS) is investing $10 billion to establish multiple data center complexes in two Madison County industrial parks. The project is a planned $10 billion corporate investment and will create at least 1,000 high-paying, high-tech jobs.

This investment by AWS is the single largest capital investment in Mississippi history and four times the size

of the previous largest economic development project. AWS is the world’s most comprehensive and broadly adopted cloud. These data centers will enable customers of all sizes and across all industries — such as health care, manufacturing, automotive, financial services, public sector, telecom and more — to transform their businesses. The new data centers will contain computer servers, data storage drives, networking equipment and other forms of technology infrastructure used to power cloud computing.

Bill Cork, Executive Director of the Mississippi Development Authority (MDA), said about the project, “MDA is proud to have been instrumental in the successful culmination of this transformative $10 billion project. This monumental win underscores Mississippi’s attractiveness for major investments and signifies a boost to our economic landscape.”

New North Carolina megasite?

A Charlotte-area landowner is seeking rezoning of nearly 800 acres of land in several parcels in Davidson County for heavy industrial use to create a site that would approach that of state-level megasites. “This property is extremely well-suited for industrial development from the standpoint of infrastructure,” the county planning staff noted.

With no Epic Games HQ in sight for the prime Cary site, expert weighs in on property’s future

One of the most exciting announcements in the South in several years no longer

seems to be a reality. From the Triangle Business Journal:

“As the months go by with no word about the future of the former Cary Towne Center property, it seems apparent that Epic Games has no immediate plans to move forward with building a new headquarters on the prime site in a town that’s attracting plenty of developers.

“Real estate watchers in the Triangle are starting to wonder what the future of the former mall property will look like as the town continues its development spree. On the other side of Cary Towne Boulevard, the highly popular mixed-use project Fenton is moving toward starting its second phase.

And downtown Cary continues to transform with new retail and residential projects in the works. Meanwhile, west Cary is seeing construction boom for residential and commercial developments.

“Dennis Donovan, a site selection consultant with WDG Consulting, said it might be tough to attract another headquarters campus like the one Epic Games proposed back in 2021 after buying the property, which today has an assessed value of more than $100 million.

“First, there aren’t many HQ relocations,” he said, adding that a stronger possibility for the site, should Epic relinquish it, might be a tech company consolidating office

operations, ‘some of which might already be based in the Raleigh, Durham area.’

“Donovan said the real demand is happening with sites that are ready to go. Starting from scratch, which would be the case in Cary, ‘becomes very difficult.’ ”

South Carolina announces second highest year in industry investment in state history

The South Carolina Department of Commerce reported that from January to December 2023, the state saw $9.22 billion in capital investment with 14,120 announced jobs, the second highest total ever. Notably, there were three

Work has begun on the stalled Phase 2 of Amazon’s HQ2 project in Arlington, Va., which includes the Helix, a tree-covered, 350-foottall glass spiral. Phase 1 of Amazon HQ2, known as Metropolitan Park, opened to workers in May of 2023.

announcements with investments of $1 billion or more last year — Scout Motors, Albemarle Corporation and QTS Data Centers.

Oracle moves on with its plans to build 1.2 millionsquare-foot campus in Nashville

The tech giant has purchased the industrial riverfront on the east bank of the Cumberland River in downtown Nashville, signaling the continuation of its $1.35 billion investment in the River North campus announced in 2021. The project will create 8,500 jobs by 2031.

Apple moving more jobs from California to Austin By relocating about 120 jobs to Austin from California in the winter, tech giant Apple is growing its AI operations

in the capital city of Texas. According to Bloomberg, Apple is moving employees who work at the company’s Data Operations Annotations unit that will be merging with the Texas portion of the group. The unit involved workers in artificial intelligence and Apple’s virtual assistant, Siri. Apple currently employs about 7,000 workers in the Austin area, more than any other place outside of the company’s Silicon Valley headquarters.

Dallas workers’ return to office ranks No. 1 among major U.S. cities

Dallas workers are returning to the office more so than other major U.S. cities, a new report says. Placer.ai, which analyzes foot traffic data for office properties in the U.S., reports Dallas came in first, beating the national average of 18.6 returning to the office after three years of some

workers leaving as a result of the pandemic.

Austin’s job market ranked best in Texas — here’s how it scores nationally Austin has the hottest job market in Texas, and it’s considered one of the best in the country. That’s according to The Wall Street Journal’s annual ranking of America’s hottest job markets. The Texas capital ranked No. 7 overall — tied with Nashville — and beat out Dallas (No. 10), Houston (No. 19) and San Antonio (No. 25, tied with Denver and Boston).

Salt Lake City took the top spot this year, followed by three cities in Florida — Jacksonville, Orlando and Tampa. Oklahoma City came in at No. 5, followed by Miami at No. 6. Austin, which fell five spots in this year’s ranking, had the strongest labor-force

participation among large metro areas, according to the WSJ.

Companies like Samsung Electronics, Tesla and Apple have made huge investments in the Austin area, positioning them to add thousands more employees there in the coming decade.

Samsung’s current economic effect on the Austin region is enormous

South Korean chipmaker Samsung Electronics put out new numbers this winter to show the mighty effect the company has on the Austin area.

Samsung said in February it has invested $26.8 billion into the economy in the past year, which includes its long-running chip plant in Austin and its new factory being built in Taylor, Texas. The company employs

For real-time news on business, politics and economic development in the South, go to SouthernBusiness.com. For all projects announced in the South and more, go to SouthernBusiness.com and SB-D.com. For more on the auto industry in the South, go to SouthernAutoCorridor.com.

Brasfield & Gorrie to expand HQ in Birmingham, Ala.

One of the nation’s largest privately held construction firms will expand its national headquarters with an $18.9 million investment. The expansion project will create 85 new, quality jobs.

OMCO Solar to hire 70 in North Alabama

lion to renovate an existing building and to construct a new hub to process, store and distribute raw pecans. The expansion will employ 120 skilled workers.

Conecuh Sausage expanding in Andalusia

The iconic Alabama maker of hickory smoked sausages will invest $58 million and create 110 jobs with its second production facility in the state.

Americold holds ribboncutting in Russellville

underway in Hope, Ark.

The $37 million project is expected to create 266 new jobs.

Renewable energy project breaks ground near Orlando

Arizona-based OMCO Solar, a manufacturer of steel structures for solar panels, is investing $10 million in its second facility in Alabama in Limestone County. The deal will create 70 jobs.

Medical supply startup plans Birmingham production hub

Primordial Ventures, a veteran and minority-owned medical supplies manufacturing startup, plans to create 30 new jobs at its Alabama facility.

Southern Roots Nut Company to hire 120 in Dothan

The New Mexico-based company will invest $16.6 mil-

The global leader in temperature-controlled logistics is investing $90 million to expand its operations in Russellville, adding 30 new jobs.

Elopak breaks ground on $70 million production facility

The plant will produce PurePak® cartons for milk and other liquids. The new production facility at the Port of Arkansas near Little Rock will employ more than 100 workers.

Walther Manufacturing to expand firearm manufacturing facility in Fort Smith

The company plans to spend $30 million in western Arkansas, creating 76 new jobs.

Hope Baking expansion is

Panacea Global Energy secured 63 acres in Osceola County for a green tech campus, and will create 1,200 jobs. A subsidiary of French renewable energy leader CMG Clean Tech, Panacea Global Energy will build a flagship green garden village, a first-of-its-kind renewable energy research park.

Apple to open offices in South Florida

The global tech giants signed a 42,000-square-foot office lease deal in Coral Gables, south of Miami.

Kaseya to create 3,400 jobs in Miami

The global IT management software firm will make a capital investment of more than $16 million to expand in Miami-Dade County, creating up to 3,400 high-paying jobs.

AJC moves offices to Midtown Atlanta

The Atlanta-Journal Constitution is moving its operations from the Atlanta suburbs to

a new office on Midtown’s Peachtree Street. The media property will lease 21,000 square feet in its relocation to the city’s center. AJC is looking to hire 100 new workers in the move. Its goal is to top 500,000 in its subscription base.

Amazon buys 430-acre site east of Atlanta

One of the world’s largest companies has purchased a massive site within the fast-growing industrial corridor east of Atlanta. Amazon Data Services Inc., a subsidiary of online retail giant Amazon, paid $36 million for the Covington, Ga., site that could soon house a large data center campus.

Gerresheimer to expand in Peachtree City

The medical device manufacturer is expanding with an $88 million investment in a new facility at the Southpark International Industrial Park. Bringing 200 new jobs to Fayette County, operations at the new facility will begin in fall 2024.

Qcells signs 2,000-job deal to build solar panels for Microsoft

Solar panel maker Qcells will supply tech giant Microsoft with Georgia-made solar panels, enough solar modules to power 1.8 million homes. The project is considered one of the largest such deals in history.

Solarcycle to create 600 jobs in Polk County

Missile manufacturer breaks ground on plant in East Camden, Ark.

R2S, a joint venture between Rafael Advanced Systems and Raytheon, broke ground on a new manufacturing facility in late February in East Camden. Sixty workers will be hired to build the Tamir missile for the Iron Dome Weapon System. Tamir missiles are short-range interceptors designed to destroy rockets, artillery shells and drones. R2S will invest $63 million in the project.

gy-based solar recycling company will invest $344 million in a first-of-its-kind solar glass manufacturing facility in Cedartown. The facility will use retired solar panels to make new solar glass.

Meissner plans $250 million life sciences facility near Athens

The company, which specializes in micro-filtration and pharma products, plans to build a manufacturing, laboratory and distribution facility in Clarke County.

Fantasy sports company PrizePicks expands in Atlanta

FEAM Aero holds grand opening of $45 million expansion in Boone County

The company’s new threebay hanger at the Cincinnati/ Northern Kentucky International Airport will support nearly 250 full-time positions.

Goose Creek Candles breaks ground on distribution facility expansion in Casey County

The family-owned candle maker will invest $5 million and employ 160 people.

The company will invest $25 million in its new headquarters, hiring 1,000 new workers over the next seven years.

The advanced technolo-

LanzaJet Freedom Pines Fuels opens $70 million facility

Located in Soperton, Ga., the world’s first alcohol-to-jet aviation fuel production facility will employ 250. The $70 million facility will produce 10 million gallons a year of sustainable aviation fuel.

North American Stainless to celebrate $244 million Carroll County expansion Gov. Andy Beshear joined local officials and leadership from North American Stainless and its parent company, Spain-based Acerinox, to celebrate the one-year mark since the company announced a $244 million expansion at its Carroll County facility, a project creating 70 full-time jobs. The expansion to the company’s 4.4 millionsquare-foot Ghent facility

MSC Group to open $100 million North American Cruise HQ in South Florida

The international shipping company will open a 120-squarefoot cruise division in Miami’s downtown. The new headquarters is expected to create 668 new jobs.

Mailchimp cuts ribbon on new Atlanta headquarters Intuit recently celebrated the opening of its new Atlanta office, a 360,000-square-foot innovation hub that is also now home to Mailchimp, the popular email and marketing platform that the company acquired in 2021. The whimsical Beltlineadjacent office space was designed to inspire creativity and innovation.

consists of a new cold rolling mill, new roll grinders, extensive upgrades of anneal and pickling lines to support the new rolling mill, a new temper mill and the expansion of the melt shop building.

Crown Verity USA Inc. to expand operations in Warren County

The grill and cookware manufacturer will spend $9.7 million to expand and consolidate its fabrication operation, creating 73 jobs in Kentucky.

Atlanta-based company to open its first distillery in Kentucky

Staghorn, an Atlanta-based spirits company, will open its first distillery, Garrard Coun-

ty Distilling Co., in Garrard County, Ky. The $250 million facility will support 60 new jobs. This is the first commercial distillery in the formerly dry county.

Belmark to locate new operation in Allen County

The manufacturer of packaging will invest $99 million in its new 156,000-square-foot flexible packaging plant, creating 159 full-time jobs.

India-based pipe and tube manufacturer selects Northwest Louisiana for first U.S. plant

Global Seamless Tubes & Pipes, a leading manufacturer and exporter of carbon, alloy

and stainless steel cold drawn and hot finish seamless tubes and pipes, announced it will invest $35 million to establish its first U.S. production facility in Northwest Louisiana. The India-based company expects to create 135 new direct jobs in DeSoto Parish.

Lincoln Foodservice Equipment to establish operations in Caddo Parish

Lincoln Foodservice Equipment, a Welbilt company that produces commercial-grade food-service equipment, will create 99 new direct jobs with salaries above $50,000.

Boise Cascade announces $75 million expansion in Allen Parish

The wood products and veneer maker will create a total of 107 direct and indirect jobs for Southwest Louisiana.

Bowling

Horsburgh & Scott Company establishes 32,000-square-foot facility in Slidell

The Cleveland-based company will create 40 new high earning jobs with its $4.9 million investment in St. Tammany Parish. The international manufacturer repairs, services and assembles industrial gearboxes for the defense industry.

Japan-based UBE Corporation will invest $500 million in Jefferson Parish

The chemicals company will establish its first U.S. manufacturing facility to produce battery components dimethyl carbonate (DMC) and ethyl methyl carbonate (EMC), which are used to create electrolyte solvents in lithium-ion batteries.

The state-of-the-art, $355 million food production facility will create nearly 450 full-time jobs in Warren County, Ky. At 400,000 square feet, the facility will produce classic Tyson brands like Jimmy Dean and Wright Brand bacon. The advanced facility is equipped with high-tech robots for increased efficiency.

CORE X Partners to establish cold storage in Gulfport

The global supply chain and cold storage industry leader will break ground this year on a 150,000-square-foot cold storage facility. Serving food producers and manufacturing across the Southeast, the company will create a total of 73 jobs.

Owl’s Head Alloys locating aluminum processing plant in West Point, Miss.

The Bowling Green, Ky.based company will invest $29 million and create 68 new jobs. The company will supply recycled aluminum to Aluminum Dynamics.

Siemens Energy is bringing more than 500 jobs to North Carolina

Approximately 500 manufacturing jobs will be coming to Mecklenburg and Wake counties. The jobs are high paying, with minimum wages of more than $87,000, according to the company. Siemens Energy plans to invest nearly $150 million across both counties, where it already has operations. In Mecklenburg County, the company will establish its first manufacturing

site in the U.S. to build Large Power Transformers (LPTs), a critical component of the nation’s power grid.

Cummins plans

$580 million investment in Nash County

The engine and generator manufacturer will create 80 jobs in Eastern North Carolina with its investment in new equipment and upgrading its assembly line “for next-generation products.”

Germany-based Schott Pharma unveils plans to construct $371 million factory in Wilson, N.C.

The factory, which will produce glass and polymer pre-fillable syringes, will employ 400 by 2030.

Dominion Energy buys 500 acres for massive North Carolina facility

The land buy in Person County precedes the ground-breaking on a liquefied natural gas storage facility.

Aircraft MRO to open at Piedmont Triad

International Airport Marshall USA is scheduled to open its new aircraft maintenance facility at Greensboro’s Piedmont Triad International Airport. The project will create 240 jobs.

Dehn Inc. will invest $38.6 million and create 195

Agile Cold Storage announces 150,000square-foot facility in St. Tammany Parish

The Georgia-based diversified storage and logistics solutions company will invest $45.9 million in its new cold storage facility. The project will bring a total of 195 direct and indirect jobs to Southeastern Louisiana.

The family-owned German electrical engineering company manufactures surge and lightning protections systems and safety equipment.

Food manufacturer to open $42.25 million operation in Gaston County

Häns Kissle cut the ribbon at its new facility, where it plans to employ more than 200 workers. The company makes salads and prepared foods that are sold in grocery stores.

Japan-based pharma Kyowa Kirin selects North Carolina for $200 million project

The life sciences company will create more than 100 high-paying jobs at its pharmaceutical manufacturing complex at the new Helix Innovation Park at the Brickyard in Lee County.

Fujifilm Diosynth expanding again in North Carolina

Fujifilm is investing another $1.2 billion into its biomanufacturing complex in Holly Springs, N.C. The investment into the facility brings total investment to over $3.2 billion. About 680 jobs will be created.

Nova Molecular Technologies expanding Sumter, S.C., facility

Nova Molecular Technologies (Nova), a highpurity solvents manufacturer, announced it is expanding its operations in Sumter County. The company’s $23.75 million investment will create 20 new jobs. Nova is a leader in highvalue solvent recovery technology. The company’s Recover and Return model launched in 2017 helps customers reduce their environmental impact by recovering chemicals that would otherwise be sent to waste disposal. Nova also manufactures and markets chemicals that are used in the biopharma, analytical and agricultural markets.

GXP-Storage is developing $80 million campus in Nash County

The biopharma storage firm will locate its headquarters at the Middlesex Corporate Centre, near Raleigh. The company plans on hiring nearly 100 employees.

Stardust Power selects Muskogee to build battery-grade lithium refinery

The company will invest more than $1 billion in the lithium refinery. Stardust Power said it selected Muskogee for its central refinery because of Oklahoma’s central location in the country, which will help with the delivery and shipment of lithium products.

AAR breaks ground on MRO facility in Oklahoma City

AAR Corp., a provider of aviation services, broke ground on the expansion of its maintenance and repair facility. The new facility will accommodate all 737 variants.

North American Air Exchange grows in Muskogee

The heat exchange manufacturer moved to Wagoner County in 2023, and is set to bring 100 new jobs with its planned expansion.

Automated production machine maker bdtronic to expand in Broken Arrow

The announcement secures 60 new jobs with an average wage of $66,000.

Tech giant Google to build data center in South Carolina

Google has purchased a property in Dorchester County. The exact location of the property and Google’s investment amount has not been disclosed.

Delta Children to invest $33.1 million in South Carolina

Children’s furniture manufacturer Delta Children has selected Orangeburg County (its first in South Carolina) to construct a 400,000-squarefoot manufacturing and distribution facility, creating 123 new jobs.

Ferroglobe establishing operations in Marlboro County

Ferroglobe, a producer of silicon metal, will invest $20 million and hire 19 workers for its quartz filtering operation in Wallace, S.C.

DCC Metal Recycling announces expansion in Dillon County

The metal recycling company will create 78 new jobs with

its $11 million investment. The new 48-acre site will be the company’s seventh South Carolina operation.

Switzerland-based pharma manufacturer to expand in North Charleston

SHL Medical, a provider of advanced drug delivery solutions, is building a $150 million facility to meet the demand of the auto-injector market. The project will create 165 jobs in the Charleston area.

SC Ports expanding rail service

Construction of the new Navy Base Intermodal Facility is underway in North Charleston. Once operational in 2025, the cargo facility will have six rail-mounted gantry cranes that will move containers on and off CSX and Norfolk Southern trains.

Type One Energy moves HQ to Tennessee from Wisconsin

Tennessee has selected its first recipient of Gov. Bill Lee’s nuclear energy fund. Type One Energy Group Inc. will receive funding tied to its $223 million investment in East Tennessee, according to a news release from the state Department of Economic and Community Development. The company will build the world’s most advanced stellarator at TVA’s Bull Run Fossil Plant. The energy company will move its headquarters from Madison, Wisc., to Knoxville, and expand its research and development center in Clinton, Tenn.

Genera to expand its Sustainable Biomaterials

Campus in Vonore, Tenn.

The vertically integrated manufacturer of circular, compostable packaging solutions will spend $350 million in capital investment, creating 230 new jobs.

Xxentria Technology announces $45 million investment to establish facility in Mt. Pleasant Based in Taiwan, the leading manufacturer of metal composite material will create 85 new jobs at the Cherry Glen Industrial Park.

Custom Foods of America to expand in Knox County

The Tennessee-based food product manufacturer will create 249 new jobs with a $51 million investment at its Pleasant Ridge location.

Concrete manufacturer to establish operations in Wilson County NewBasis, a fiberglass and polymer concrete manufacturer, will create 249 new jobs.

Baltimore Aircoil to expand in Rhea County

The HVAC and refrigeration manufacturer will create 63 new jobs and invest $16.5 million to expand operations at its Manufacturers Road location in Dayton, Tenn.

Landmarks Ceramics cuts ribbon on plant expansion in Mt. Pleasant, Tenn.

Landmarks Ceramics invested $70 million to add a new kiln to increase production, creating a North American logistics hub for the Gruppo Concorde-owned company.

Bridgetown Natural Foods LLC to expand in Middle Tennessee

The West Coast company will invest $78.3 million to open a manufacturing and distribu-

tion center in Lebanon, creating 219 new jobs.

Schneider Electric to expand, add 455 jobs

The energy management and automation company will invest $85 million in Wilson and Rutherford counties, continuing its growth in the energy sector.

INTOCAST announces state-of-the-art factory in Carroll County, Tenn.

The German-based company, which specializes in manufacturing refractory products for the steel industry, will spend $15 million and create 103 new jobs. The operation will be the company’s first in the U.S.

Japanese Samsung supplier gets new digs in Austin

Samsung supplier Tokyo Electron has a new home in Austin. Tokyo Electron, which is based in Japan but considers Austin its North American headquarters, supplies customers with equipment used to manufacture semiconductors and other electronics.

Battery chemicals producer Orion breaks ground on plant near Houston

Orion, a specialty chemicals company formerly known as Orion Engineered Carbons, has broken ground on a new plant near Houston to manufacture battery ingredients.

The company, incorporated in Luxembourg, began construction on its second plant producing acetylene-based conductive additives in April. The deal represents a $140 million investment.

Natural gas power plant slated for Texas east of Austin

The Sandow Lakes Energy Company is building a 1,200-megawatt natural gas power plant in Milam County, Texas, at the former site of the 31,000-acre Alcoa aluminum plant. It is near where Samsung is building its multi-billion semiconductor campus.

Firefly Aerospace is growing in Central Texas It all started with one rocket testing stand in the rural Central Texas town of Briggs, north of Leander. Today, Firefly Aerospace has grown into a commercial space payload company that plans four rocket launches this year, six to eight next year and a dozen in 2026. The company has doubled its manufacturing space and added new rocket stands as its new contract with Northrup Grumman takes off.

MGC Pure Chemicals America plans

$130 million expansion in Killeen, Texas

The chemicals manufacturer will double capacity to serve customers like Samsung, which is building a $1 billion plant 60 miles away.

Frozen Mexican food giant relocates HQ to Frisco, Texas

Ruiz Foods, formerly based in Dinuba, Calif., has moved its corporate headquarters to Texas, and will ultimately employ more than 100 people there.

Grainger to open large facility in Hockley, Texas Illinois-based W.W. Grainger, a distributor of maintenance and repair products, is opening one its largest U.S. facilities near Houston. The 1.2-million-square-foot facility will house 400 workers.

Arlington-based RTX subsidiary Raytheon lands $118 million contract with the U.S. Army

The defense company will produce common sensor payloads for the California-based General Atomics Aeronautical Systems’ MQ-1C Gray Eagle, serving as “eyes” for the unmanned aircraft.

FreezPak Logistics to invest $77.5 million, create 80 new jobs

The cold and dry storage leader will build a 245,000-squarefoot facility in Suffolk, near the Port of Virginia.

Tucker Door & Trim to create 50 jobs in Henrico County

The Georgia-based manufacturer of doors and windows will spend $10 million for its facility in Henrico County. J

HP Hood announces $83.5 million expansion in Frederick County, Va.

The national dairy processor will expand its dairy processing operations at its Winchester-area facility.

For real-time news on business, politics and economic development in the South, go to SouthernBusiness.com.

For all projects announced in the South and more, go to SouthernBusiness.com and SB-D.com. For more on the automotive industry in the South, go to SouthernAutoCorridor.com.

On November 10, 2021, EV startup Rivian — backed by investments from Amazon and Ford Motor Co. — became public through an initial public offering (IPO) and began trading on the NASDAQ under “RIVN.”

way in EV and EV-related investments in all of North America.

Yes, the South has captured more next-generation mobility (EV) investments than all of Canada, Mexico, the Northeast and the West combined in just four years.

Detroit and the Midwest are competing with the South in these electrification investments, but they are substantially behind at this point. The Southern Automotive Corridor, at least out of the gate, can be compared with American Pharoah, the thoroughbred that won the Triple Crown and Breeders Cup in the same year. The rest of the world, so far, is eating Southern dust at this point.

The opposition to EV startup Rivian’s assembly plant in Social Circle, Ga., is even more intense now as the site is cleared, but no construction imminent. Citizens are complaining of runoff from the cleared site.

After its first day on the market, RIVN closed at $100.73 per share for a $100 billion valuation. As of mid-April of this year, Rivian’s stock had plunged to under $10. Its lone products are two electric SUV models made in Normal, Ill.

In December 2021, Rivian announced that it would build a $5 billion plant east of Atlanta along I-20 in southern Walton and Morgan counties that would house thousands of workers.

The Rivian project was one of the first startups out of the electrification blitzkrieg that has fallen from the skies on the Southern Automotive Corridor, as the region leads the

Some of those greenfield EV projects announced in the last four years, such as Ford’s BlueOval City north of Memphis and its battery plant in Hardin County, Ky., Hyundai’s metaplant near Savannah and Toyota’s battery facility in Randolph County, N.C., are going well. Some, specifically the startups, are not going so well. And let’s not forget, one of the largest (if not the largest) electric vehicle plant in the world is located in Austin, Texas. That would be Elon Musk and Tesla.

Some existing combustion engine plants that have already designed and implemented new EV assembly lines also seem to be getting off to good starts, including Mercedes and Hyundai in Alabama, BMW in South Carolina, Nissan in Tennessee and others such as GM near Nashville and Toyota in Kentucky.

Rivian announces delay in Georgia plant

In the winter quarter, Rivian officials announced that its grand plans for a major Georgia production facility have been put on hold, stunning Georgia economic development officials and lawmakers. Until March of this year, Rivian seemed to be near breaking ground on the plant, which, again, represents a $5 billion investment involving 7,500 jobs and 400,000 electric SUV units produced each year. At the time of the announcement in late 2021, the Rivian deal was the largest in Georgia history.

Yet, should we be surprised when one or more OEMs put on hold billions in investments or even fail completely in what is essentially the “fourth year of a 110-yearold industry” as it just gets started?

Alan Amici, the CEO of the Ann Arbor, Mich.-based Center for Automotive Research, said just that at our Southern Economic Development Roundtable in January (SEDR@ThePearl@RosemaryBeach).

I found Amici’s statement, “We are in the fourth year of a 110-year-old industry” so profound. (Amici will also attend our Southern Automotive Corridor Economic Development Summit in Greenville, S.C., August 1517, 2024 at the Grand Bohemian Lodge if you would like to meet and hear him. If you would like to receive an invite, please let me know.)

I liken this surge — and that it is — in EV competition and investments to the banking crisis from 2007 to 2009. Some of the banks failed. Some were purchased and their names are gone forever. And then some strived and thrived.

How is the one of the world’s newest industries also one of the world’s largest (based on investment) not a crap shoot when the automotive industry has essentially done it the same way for 100 years any different?

Yes, there will be losers, but there also will be big winners.

Alabama claims No. 1 spot last year for auto-exporting states for the first time Alabama has become the nation’s No. 1 auto-exporting state, with international vehicle shipments surging past $11.2 billion in 2023 to overtake long-time leader South Carolina, according to new trade data.

Alabama’s auto exports have climbed 45 percent in value since 2021, when they totaled $7.7 billion, according to figures from the Alabama Department of Commerce. “Alabama’s auto industry has become an exporting powerhouse, with vehicles produced in the state finding markets around the world,” said Ellen McNair, secretary of the Alabama Department of Commerce.

While Alabama’s auto exports have been climbing, South Carolina’s have remained steady at just over $10 billion a year since 2021, according to the data. Other top auto-exporting states include Michigan, California and Texas.

Alabama auto exports landed in 78 countries in 2023, with major trading partners Germany, China and Canada being the leading desti-

Led by Mercedes, automobiles are Alabama’s No. 1 export.

nations, according to Commerce data.

Toyota begins production on new engine line in Huntsville Toyota Alabama announced that it has begun production of its i-FORCE 2.4-liter turbo engine line at its Huntsville engine plant, culminating a $222 million corporate investment in the project. The 2,000-employee plant will provide powertrains for the new Tacoma pickup.

Hyundai supplier to create 200 jobs in Georgia

Doowon Climate Control America will build a new plant near Metter in Candler County, Ga. The $30 million investment will create 200 new jobs. Gov. Brian Kemp said that Georgia’s expanding EV industry is benefiting rural corners of the state. “In fiscal year 2023, alone, 82 percent of new jobs created and more than $20 billion of investments went to communities outside the metro Atlanta area,” Kemp said in a news release.

Imola Automotive USA establishing a plant in Fort Valley

The Italian electric car manufacturer will break ground in the third quarter of 2024, eventually employing 7,500.

Life for Tyres Group Limited announces $46 million tire recycling facility in Louisiana Europe’s largest end-of-stage tire recycling company will establish its first U.S. processing facility at the Port of South Louisiana, creating 46 direct new jobs in St. John the Baptist Parish.

Toyota boosts investment to $1.3 billion for Kentucky battery production

Volkswagen and others have invested in Scout Motors and plan a $2 billion factory capable of making up to 200,000 of the iconic vehicles in South Carolina.

The automotive leader announced the investment in its flagship Toyota Motor Manufacturing, Kentucky (TMMK) facility in Georgetown, cementing its commitment to being a long-term employer and establishing the automotive plant as a central part of Toyota’s electrification strategy. The company plans on producing an all-new, threerow battery electric SUV. With a total investment of $10 billion, TMMK is Toyota’s largest production facility globally, having produced 12 million vehicles including the Camry, America’s best-selling sedan.

Cummins, Daimler Truck and Paccar to build $1.9 billion battery facility in Marshall County

The tri-venture will bring 2,000 jobs to the Chickasaw Trails Industrial Park in Byhalia, Miss. The operation will produce batteries for medium- and heavy-duty commercial electric trucks.

Fujihatsu & Toyotsu Battery Components, North Carolina to invest $60 million near Toyota plant in Randolph County The venture will produce prismatic aluminum cell cases and cell covers with discharge values. The Toyota supplier will create 133 jobs.

Scout Motors to be revived in South Carolina

We are seeing startups and reboots of models not assembled in decades as automakers make a beeline to electrification. Recently announced, the old Scout brand that was built by International Harvester decades ago (and which many consider the first SUV) is being revived. Volkswagen and others have invested in Scout Motors and plan a $2 billion factory capable of making up to 200,000 of the iconic vehicles in South Carolina. Reports state that Scout Motors will build its factory in Blythewood about 20 miles north of Columbia, which will ultimately employ 4,000 people on 1,600 acres right in the middle of the developing “battery belt.” The plant itself will occupy 1,100 acres of that property.

AESC is spending over $3 billion in South Carolina AESC, a world-leading battery technology company, announced the expansion of its lithium-ion electric vehicle battery manufacturing operations in Florence Coun-

ty, S.C. The company’s $1.5 billion investment will create 1,080 new jobs. This investment follows AESC’s initial announcement in December 2022, and expansion announcement in December 2023, resulting in a total investment of $3.12 billion and supporting 2,700 new jobs across the local community.

In 2022, the company announced a multi-year partnership with BMW to supply technology-leading battery cells to be used in the nextgeneration electric vehicle models produced at Plant Spartanburg. AESC’s latest expansion will extend the partnership to additionally provide electric vehicle battery components for BMW Group’s Mexico Assembly Operations.

Tesla to establish first South Carolina facility in Greenville County

The electric car company plans to lease 251,100 square feet to create a regional parts distribution facility.

Progress at Ford’s BlueOval City near Memphis Work on West Tennessee’s

BlueOval City is entering a new phase.

Last year, Ford hit peak construction employment in Q3 2023, matching the timing given years ago when Ford first came to town. In fact, when plant manager Kel Kearns first gave that timeline, BlueOval City was still an empty field.

Months later, it was an active construction site about 50 percent complete — with plenty of mud still around — when Ford CEO Jim Farley visited in March 2023. The company has spent billions on construction and supplies, and is now entering the installation phase.

As of April, machinery is being installed in BlueOval City’s paint shop, vehicle assembly and stamping areas. That means work now moves inside the massive facilities on campus, with literal tons of equipment installed in a way that has been planned for months to ensure top-level efficiency.

Now, as the campus begins installing machines and new workers arrive, Ford will begin producing trucks to be

delivered to customers in 2026.

Ford doubling down on EVs, hybrids as BlueOval City’s T3 gets release window Ford Motor Co. announced that it is embracing electric vehicles (EVs) and hybrid vehicles for its Ford Blue division. By the end of the decade, it plans to offer hybrid powertrains on every model.

LG Chem signs $19 billion deal with GM

With construction of LG Chem’s $3.2 billion factory in Clarksville, the largest foreign investment in Tennessee history, the South Korean battery maker has agreed to provide GM with battery materials able to power 5 million all-electric vehicles with a 300-mile range.

Elon Musk wants to move Tesla, SpaceX incorporation to Texas

The Tesla, SpaceX and X chief executive said the company will hold a shareholder vote to decide whether to incorporate in the Lone Star State.

Tesla to occupy 1 million

square feet in Kyle, Texas EV automaker and Austin-headquartered Tesla is moving forward with a warehouse and light assembly facility in Kyle. No word on jobs.

Norwegian EV parts supplier set to spend millions, hire hundreds in Mesquite, Texas Hexagon Purus ASA, which makes batteries and systems for electric vehicles, is moving into existing facilities in Mesquite. The project will create 250 jobs.

Vehicle parts manufacturer for Tesla to open plant in Austin metro US Farathane, parts supplier to Tesla’s Austin factory, announced in the winter it will open a plant in North Austin. The project will create 100 jobs.

Global automotive parts supplier to invest $100 million north of Austin Hanwha Advanced Materials, a massive global automotive parts supplier, is investing $100 million and hiring hundreds as it sets up shop in Williamson County, north of Austin. The company will build its new plant in Georgetown. J

As of April, machinery is being installed in BlueOval City’s paint shop, vehicle assembly and stamping areas. That means work now moves inside the massive facilities on the campus near Memphis, Tenn.

The 11th annual Southern Economic Development Roundtable (SEDR) took place at the Pearl Hotel in Rosemary Beach, Fla., January 15-17, 2024. Many of the finest minds in economic development in the South were invited. SEDR members participated in two days of discussion, laughter and camaraderie that this year included three economists, as well as educators, workforce training directors, commercial real estate contractors and site consultants.

This section on what occurred and what was discussed at SEDR in late January is designed to brief you on the subject matter as it relates to the South’s economy and economic development trends in the region. In no particular order, the following is a long-form report, including some commentary, on SEDR@ThePearl2024’s speaker presentations.

SEDR speakers are like a “super group” of doctorate-level economic minds, an all-star team chosen from a “traveling baseball squad,” if you will. You get the picture.

Dr. Walter Kemmsies is the managing partner of The Kemmsies Group, where he executes initiatives for clients with interests in or properties proximate to sea, river and inland rail ports throughout North America. His expertise extends to the infrastructure, where he assists both public agencies and investors in underwriting, financing and evaluating new investment vehicles and opportunities.

Dr. Kemmsies is widely viewed as one of the foremost experts on ports, rail and infrastructure in the U.S.

Achievements

Walter currently advises several major U.S. Port Authorities and is routinely asked to work on complex issues with various investment banks, private equity firms and public regulatory agencies. He provides substantial support to the freight movement industry via presentations at major international industry conferences and advising the U.S. Department of Commerce on supply chain competitiveness. Walter recently testified to the U.S. Senate Transportation and Commerce Subcommittee on issues affecting the freight industry. He has also published research in scholarly journals and provided expert testimony to the U.S. Senate Transportation and Commerce Subcommittee.

Walter previously led JLL’s Ports Airports and Global Infrastructure practice. Before that he was the Chief Economist for Moffatt & Nichol, a leading global maritime infrastructure advisement firm. Preceding his experience working with Moffatt & Nichol, Walter was the Head of European Strategy at JP Morgan in London and, earlier, Head of Global Industry Strategy at UBS in Zurich and London.

Education and Affiliations

Walter is an advisor to the U.S. Department of Commerce Advisory Committee on Supply Chain Competitiveness. He was a member of the Department of Transportation’s National Task Force on Transportation Infrastructure Valuation from 2012 to 2018.

He holds a Doctorate degree in Economics from Texas A&M University, a Master of Arts in Economics from Florida Atlantic University, and a Bachelor of Arts in Economics from Florida Atlantic University.

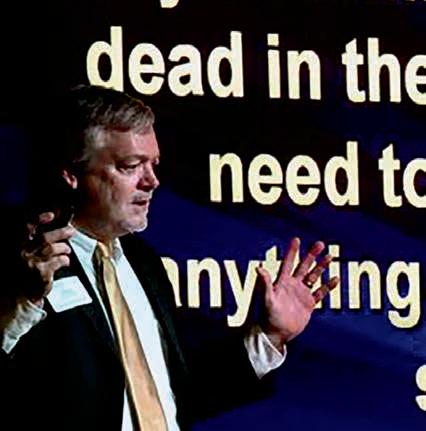

Dr. Walter Kemmsies is the founder, CEO and Chief Economist of The Kemmsies Group in Savannah, Ga. His presentation was titled “Still Climbing the Wall of Worry?”

With some quarters approaching 4 percent GDP growth in the last two and a half years, you would think Kemmsies’ presentation “Still Climbing the Wall of Worry” goes without saying. Indeed, the data shows an economy earning more than a “soft landing.” The resiliency of the nation’s economy, specifically the South’s economy, has been more like a massive “land-and-bounce” based on the data.

There are two incredibly important factors in that “bounce,” because for the last three years, they are happening at the same time. There is a maturing reshoring market as the U.S., specifically the South, is soaking up the trend of manufacturers bringing back factories from Asia and elsewhere to the U.S. to make things for U.S. consumption.

The wind of reshoring is peaking at the same time unprecedented investments are being made in the Southern Automotive Corridor with the electrification of automobiles, trucks and even planes.

Dr. Kemmsies’ focus points during his presentation:

• Base case: +/- 2 percent RGDP growth, recession risk has declined but geopolitical tensions could change that.

• “Fiscal policy in the form of the IIJA (Infrastructure Investment and Jobs Act) and IRA (Inflation Reduction Act) prevented monetary policy from causing a recession.

“Two sets of structural changes have confused economists and policymakers,” Kemmsies said. “The first is the recovery from the effects of excessive COVID fiscal stimuli that saw consumer spending surge over 20 percent in a short period of time. This created extreme congestion, helped inflation surge, and transportation services pro-

Dr. Walter Kemmsies January 16, 2024

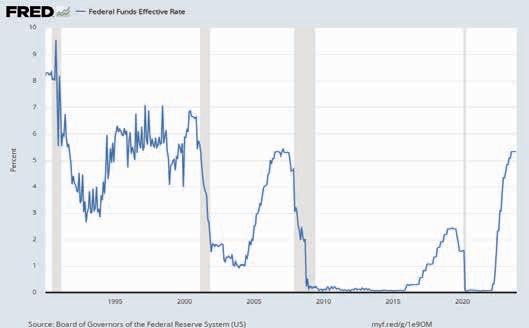

Will the Fed Achieve a Soft or Hard Landing?

Since 1990s, the Fed’s track record is 50/50 on mid -cycle tightening. Greenspan achieved a soft-landing in 1994-5, Bernanke caused a very hard landing in 2007-2009 (longest recession since the Great Recession). Powell is not an economist and talks as if the 2020s are like the 1970s.

Source: FRED, TKG

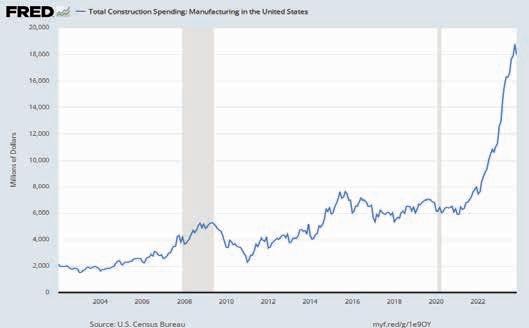

IIJA, US

There is a lot of construction of manufacturing facilities going on, especially in the “Smile” states according to JLL

Source: FRED, TKG

As companies shift their sourcing to Western Asia, Africa and South America, they will seek to use Southeast U.S. ports more heavily.

- Walter Kemmsies

Selected GDP Growth in the U.S. 2013-2023 Quarter Rate

Q1 2013 1.6 percent (Obama)

Q1 2014 1.3 percent

Q1 2015 3.8 percent

Q1 2016 1.6 percent

Q1 2017 2.1 percent (Trump)

Q1 2018 3.3 percent

Q1 2019 1.9 percent

Q1 2020 1.2 percent* (Biden)

Q2 2020 -7.5 percent*

Q1 2021 1.6 percent*

Q2 2021 11.9 percent*

Q1 2022 3.6 percent

Q1 2023 1.7 percent

Q2 2023 2.4 percent

Q3 2023 2.9 percent

Q4 2023 3.1 percent

*Skewed up or down by the pandemic

viders have significantly over-invested in capacity.

“The second set reflects changes to the macro economy via a declining working age population growth rate, the subsidies to manufacturing, the U.S. and Europe pulling away from China, significant efforts to upgrade U.S. infrastructure, technological advances such automation, robotics and artificial intelligence. Overcoming significant labor shortages in the U.S. requires significant investments in automation.”

Dr. Kemmsies’ geopolitical concerns include a range of outcomes regarding the “localized” Russia-Ukraine and Israel-Hamas and Hezbollah conflicts as well as the Houthis in Yemen committing random acts of terrorism (localized) on shipping in the Red Sea and the Gulf of Aden. An expansion of these tensions could have impacts on GDP and trade, etc. He mentioned that Taiwan and Ukraine (Europe) conflicts, if expanded, could have a potential global scale effect.

One other risk Kemmsies discussed during his SEDR presentation was the labor shortage, a subject SB&D brought up in a cover story almost 10 years ago. Labor demographics are dismal and Kemmsies made the point that in 2023, the U.S. unemployment rate averaged 3.6 percent, the lowest in 50 to 60 years. We have read for years now that job openings exceed the number of unemployed people seeking work. Kemmsies said, “The labor shortage will persist because of historically low working age population growth and an out-of-date U.S. immigration policy. Automation will increasingly fill the gap. However, mechanization allowing workers to work from home might be the best intermediate solution.”

As SB&D has reported, according to many demographic studies, on average in 2023, about 1,000 people a day in the U.S. turned working age (which is age 16 as defined by the U.S. Census). However, every day on average in 2023, about 10,000 people turned age 64 (the last year the Census counts as working age).

Without some semblance of an immigration policy — Kemmsies called the policies in place “outdated” — there are just so many years of losing 8,000 to 9,000 people in the workforce every day (more counting deaths) before we literally run out of labor.

For example, we are currently observing something never seen before in economic development in the South. State economic development agencies are actually going public that they intend to recruit/steal trained labor from other states through various marketing programs, especially in the automotive manufacturing sector.

Chicago

The China factor is no more. The new threat to the South and reshoring is Mexico.

When labor becomes significantly eroded in the U.S. — and it is happening every day — companies will begin to slow their interest in the South and focus their gaze on Mexico, where labor can be backfilled for decades moving forward. That is why a vetted, smart immigration policy must be implemented. Mexico is our new great competitor. Why?

Site consultants and economists will say that it is impossible at this point to prove to a manufacturer or service firm that labor can be backfilled 25 years from now in the U.S. In the South, the labor situation is a little more favorable as migration from other U.S. regions

Jackson

Federal tax incentives, which will increase from $2,500 up to $7,500 per new electric vehicle in 2024, are incredibly lucrative for automakers, according to Alan Amici.

means millions of people each year are moving to sunnier climes, whether they be in Alabama, Kentucky, Louisiana, Texas or South Carolina. . .really, any Southern state.

However the facts are this:

Fertility rate U.S.: 1.6 percent

Fertility rate Mexico.: 1.9 percent

People aged 65 or older U.S.: 17.3 percent

People aged 65 or older Mexico: 8.3 percent

Source: Statista

Kemmsies’ statement regarding “the effects of excessive COVID fiscal stimuli that saw consumer spending surge over 20 percent in a short period of time” is correct in my view.

In less than 20 years, the U.S. has faced two of the most daunting challenges to its economy in six generations. Those, of course, would be the Great Recession under President Bush/Obama and COVID under President Trump/Biden. Yet, the stimuli designed to quell those two catastrophes were pretty much opposites.

There was a ridiculous spending spree to save small businesses, families and individuals during and after the pandemic, to the tune of about $5 trillion. That does not even count the IIJA and IRA tax incentives of over $2 trillion.

Sure, stimulus checks were given out to individuals, families and small businesses in Biden’s first year in 2020 and beyond. But it was like treating a dire case of pneumonia with a grenade.

Then again, COVID was a new challenge, an unfamiliar one. Did the U.S. overreact? Maybe. But I probably knew about 100 people who died from it.

No one seemed to know how much needed to be apportioned to try and find a way for the economy to land softly from the pandemic. Just like no one seems to know what the market share will be for electric vehicles in 2032. (See the next segment.)

But, the $5 trillion worked. The data

clearly shows that it did.

The Federal response to COVID was different from the response to the Great Recession.

First and foremost, only about $1 trillion was doled out between 2007 and 2009 by the Obama administration to boost the economy, compared to arguably $7 trillion to soft land and actually bounce after COVID. We all knew many small businesses that didn’t make it through the Great Recession.

But COVID wiped out so many more. If you recall, no one was flying much, meaning working from home became the norm. Public transportation shut down; you could not go to a movie or a restaurant. You could barely go to the market or your physician.

But the spread of the virus was curtailed.

For you nonbelievers, ask yourself, “What if the Federal, state and local response to COVID had not worked? Today, this nation would be in a world of hurt.

An excerpt from The New York Times about COVID stimuli

Here is part of a story written by Alicia Parlapiano, Deborah B. Solomon, Madeleine Ngo and Stacy Cowley published in The New York Times about two years ago in March 2022:

“Stimulus bills approved by Congress beginning in 2020 unleashed the largest flood of federal money into the United States economy in recorded history. Roughly $5 trillion went to households, mom-and-pop shops, restaurants, airlines, hospitals, local governments, schools and other institutions around the country grappling with the blow inflicted by COVID-19.

“Economists largely credit these financial jolts with helping the U.S. economy recover more quickly than it otherwise would have from the largest downturn since the Great Depression: The pandemic recession was the shortest on record, lasting only three months.

“What the money did was to basically

make sure that when we could reopen, people had money to spend, their credit rating wasn’t ruined, they weren’t evicted and kids weren’t going hungry,” said Louise Sheiner, an economist with the Brookings Institution. “It is a lesson that if you don’t want a recession to have really long-lasting bad effects you spend a bunch of money and you prevent it.” (The New York Times, March 11, 2022)

Here is where the COVID response funds went:

Recipient Amount

Individuals and families

Businesses

State and local aid

Health care

Other

Source: White House

$1.8 trillion

$1.7 trillion

$745 billion

$482 billion

$288 billion

In contrast, President Obama was far more conservative in his administration’s dole-outs during and after the

Great Recession. Most of that fiscal stimulus was to save the financial services industry, the housing industry and the domestic automotive industry, specifically General Motors and (at the time) Chrysler. Well-known banking institutions didn’t make the stimuli list, some were bought out, and some simply disappeared.

To conclude this report on Kemmsies presentation, Walter said, “Since the 1990s, the Fed’s track record is 50/50 on mid-cycle tightening. Greenspan achieved a soft landing in 1994-1995, Bernanke caused a very hard landing in 2007-2009 (longest recession since the Great Recession). Powell is not an economist and talks as if the 2020s are like the 1970s.” (That statement was quite interesting since the Federal Reserve was in the room at The Pearl.)

Alan Amici is the CEO at the Center for Automotive Research based in Ann Arbor, Mich. His presentation was titled “The EV Transition.”

The Center for Automotive Research is an independent, non-profit organization producing industry-driven research and fostering dialogue on critical issues facing the automotive industry and its impact on the U.S. economy and society.

Alan Amici spent most of his career with Chrysler, which is now part of Stellantis NV. Stellantis is the result of a merger between Fiat Chrysler and PSA Group, forming one of the largest automakers in the world. Stellantis owns several subsidiaries in addition to Fiat and Chrysler, including Comau, Teksid, Mopar and Maserati.

SB&D brought Amici down from

The South Carolina Technology & Aviation Center is the Southeast’s only business park dedicated to serving the robust needs of the automotive and aerospace industries. As Global Home of the Lockheed Martin F-16 and home to South Carolina’s world-class automotive test track, the International Transportation Innovation Center, there’s good reason why it’s all systems go at SCTAC.

Alan Amici is the President and CEO of the Center for Automotive Research (CAR) based in Ann Arbor, Mich. Alan joined CAR after a 35-plus year career with Chrysler and TE Connectivity, holding a variety of positions in engineering, manufacturing and service.

His roles at TE Connectivity include

• VP & CTO, Transportation Solutions

• VP Engineering, Automotive Americas

Highlights of his tenure at Chrysler include:

• Head of Global Uconnect – Infotainment and Connected Car Platform

• Head of Electrical/Electronics Engineering (Torino, Italy & Auburn Hills, Michigan)

• Senior Manager, Global Service & Parts (Stuttgart, Germany)

Alan is the owner of two patents and is the recipient of the Walter P. Chrysler Technology Award. He holds an MBA, a Master of Science degree, and a Bachelor of Science degree in Electrical Engineering from the University of Michigan. He currently serves on the Board of Advisors at Penn State Harrisburg and the Department of Industrial Engineering at Wayne State University. He is a graduate of the Chrysler Institute of Engineering.

Michigan as the foremost expert on all that is happening in the electrification of the automotive industry, of which the South is leading all U.S. regions in EV and EV-related investments.

Amici showed the audience exactly how much has been invested by automotive original equipment manufacturers in North America each year since 2009 all the way up to the end of 2023.

To give you some examples, in 2009, approximately $4 billion was invested by combustion OEMs in North American (non-EV). From 2009 to 2020, 2015 saw the most investments, almost all of which was then non-EV with approximately $37 billion invested.

In 2018, just six years ago, only about $4 billion was invested in North America by OEMs. That $4 billion was split down the middle for non-EV and EV investments.

Fast forward to 2020, almost $10 billion was invested, most of which was EV-related.

Then, Amici showed SEDR members that in 2021, nearly $10 billion was spent by OEMs on the continent (95 percent EV-related), $53.8 billion in 2022, and $82.5 billion in 2023. Again, almost all of which was on electrification.

That totals $146 billion spent on EV and non-EV investments in three short years, with only about $13 billion spent in North America on non-EV, or combustible engine vehicles and parts.

At that point, an SEDR member in the back yelled out, “Then this better work, right?”

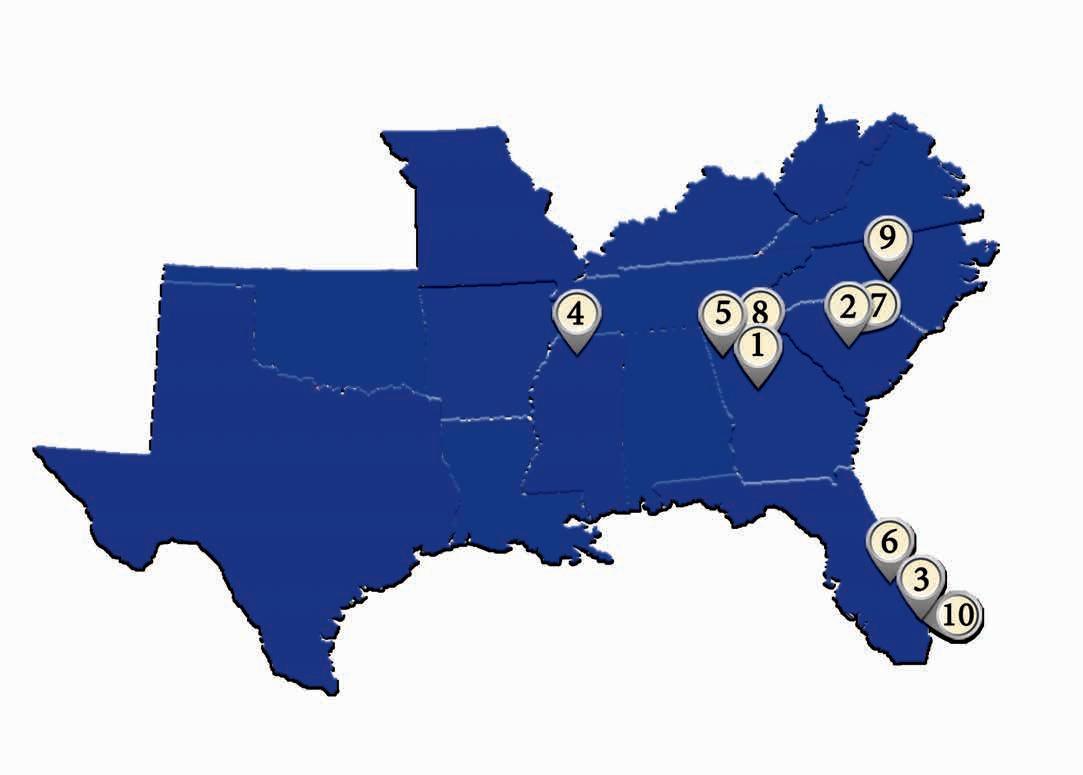

Automaker announced electrification investment by region in North America (2018-2023):

Region Investment ($USD)

United States $133.0 billion

U.S. South $67.1 billion

U.S. Great Lakes $61.1 billion

U.S. Other $4.8 billion

Canada $24.0 billion

Mexico $12.6 billion

Automaker announced investment

North America, 2009 –2023 YTD

Automaker announced e e lectrification investment by region

North America, 2018 – 2023 YTD

Note: U.S. South includes: Alabama, Florida, Georgia, Mississippi, North Carolina, South Carolina, Tennessee and Texas

U.S. Great Lakes includes: Illinois, Indiana, Kentucky, Michigan, Ohio and Missouri.

So, as you can see by Amici’s EV investment data, the South and what we call the Midwest dominate the EV game, with only $4.8 billion being invested in the Northeast and the West. Yes, the South and the Midwest have rung up almost $130 billion in mostly EV-related investments in less than six years.

It should also be noted that SB&D considers the South to include Kentucky and sometimes Missouri, so the gap is somewhat wider between the South and the Midwest in EV investments.

Then again, essentially, the vast majority of domestic automaker R&D and a lot of foreign R&D is located in Michigan, which leads all states with $32.2 billion invested since 2018. Georgia ($22.1 billion) and North Carolina ($22.1 billion) are sitting in second and third place so far.

Like Kemmsies, Amici also spoke about the Inflation Reduction Act and

the Infrastructure Investment and Jobs Act and how it has almost overnight impacted the automotive industry in the U.S.

All of the massive investments being made in the EV industry will see losers and winners. We have already had a delay in Rivian’s $5 billion plant east of Atlanta. However, since 2019, 87 percent of the total $191.4 billion invested by OEMs in North America is an investment in electrification and next generation mobility.

Why? Easy answer: Federal incentives are incredibly lucrative for automakers

Gulf South Commerce Park is Louisiana’s most accessible site for advanced manufacturing, logistics and distribution, R&D, and health and science companies. The site’s proximity to critical infrastructure provides a unique opportunity to tap into the region’s logistics infrastructure, expertise and efficiencies for companies looking to grow.

Adrienne C. Slack is vice president and regional executive of the Federal Reserve Bank of Atlanta (“Atlanta Fed”), New Orleans Branch. As part of her role, Adrienne is responsible for the New Orleans Branch Board of Directors, regional Energy Advisory Council, and for providing insight and counsel to the Atlanta Fed’s monetary policy process. She also contributes to the Atlanta Fed’s strategic planning process and advises on regional community and economic development matters, including economic mobility and resilience.

Achievements