17 minute read

CHAPTER VI EXECUTING YOUR RETIREMENT STRATEGIES

CHAPTER VI

EXECUTING YOUR RETIREMENT STRATEGIES

“Wealth is not about having a lot of possessions. It’s about having a lot of options”

CHRIS ROCK ACTOR/COMEDIAN

Putting Your Retirement Plan to Work

By now many of you have a clearer picture of how well you are prepared for retirement. This chapter picks up from chapter I and focuses on the execution of retirement planning related to addressing current retirement challenges, implementing saving strategies and forecasting future retirement challenges. For many of you the execution phase of retirement

115

planning is your greatest challenge. Developing your retirement plan is your first plan of action. Now that you have developed your plan, let us put it into action. Consider committing to executing the following retirement strategies.

Pay-Off Your Home

Data analysis conducted by Zillow, revealed 37% of Americans owned their homes free and clear of a mortgage in 2017. During that same time, 41% of BabyBoomers were mortgage free.

An immediate benefit of being mortgage free is the elimination of approximately 30% of living expenses. As a rule of thumb, housing expenses should account for no more than 30 percent of your monthly income. If you are a homeowner this amount includes your home (principle, mortgage interest and taxes), maintenance and insurance. For renters, this amount includes rent/lease and utilities.

Home Mortgage Payoff Strategies

So, eliminating your mortgage can contribute significantly to reducing your overall monthly debt expenditure in retirement. If you are 10-15 years away from retirement, applying additional payments toward

mortgage principle will help pay off your home sooner. Use a mortgage pay off calculator to determine how much additional funds you will need to contribute each month to pay off your home for the remaining years you have left before you plan to retire. I recommend using Dave Ramsey’s mortgage payoff calculator: https://www.daveramsey.com/mortgage-payoffcalculator. If the amount you discovered is greater than you can afford, factor-in an amount you can comfortably contribute each month into the mortgage payoff calculator, the number of years remaining to pay off your home can serve as a barometer for the number of years remaining before you should retire.

My rule of thought in most instances is if your home is not free and clear of a mortgage you are not prepared to retire. This paradigm is based on simple math. If on average the American workers will lose 70% or greater of their pre-retirement salary in retirement and housing expense accounts for nearly 30% of the gross monthly retirement income, retirement is truly not an option. The numbers simply do not add up! Remember every dollar applied to mortgage principle reduced the time it will take to pay off your home.

Refinance Your Home

Currently, mortgage home loans are at an all-time low. Depending on credit score, a 30-year mortgage loan is as low as 2.58% or lower at the time of writing this guide. For example, if you own a home with a $300,000 balance at 4.58% your total house payment including mortgage principal, taxes and insurance would be $2,081. Refinancing the same loan amount at 2.58% would produce a monthly mortgage of $1,744 including principle, taxes, and insurance. Doing so, would realize a monthly savings of $337 per month in mortgage payments. By adding an additional $173 to your $337 monthly savings, you could essentially apply an additional $500 each month towards your mortgage principle. Note: When applying additional mortgage payments, ensure to apply payments toward principle only and NOT interest. Additional payments towards principle pays down the mortgage balance faster which benefits you! Any additional payments towards interest benefits the financer of your mortgage loan.

Now assuming you are comfortable with paying an additional $500 towards your mortgage principal, doing so, would eliminate 11 years of mortgage

payments or 19 years before your home is totally paid off. Now, for some of you 19 years maybe outside of your time horizon for retirement. If so, you have three options, one, increase the amount of additional monthly mortgage principal payments. In this example your goal is to retire within 15 years, you would need to increase your additional monthly payments by $300 for a total of $800 per month towards mortgage principle. Option two, is to write a check for the remaining balance, and option three, and the least popular, you continue to work over the next 19 years until your home is paid off. Note: If you elect to withdraw funds from a retirement account to pay off your home, consider taking the withdrawal in the year following your retirement to avoid being taxed at a higher income bracket. Individuals who employ this home payoff strategy often retire in the month of December and payoff their homes the following January. As previously stated, please consult with a financial adviser or tax professional for guidance.

Okay! Some of you may be wondering, why not refinance into a 15-year loan. I strongly caution you against refinancing into a mortgage loan at the 15 year or less as you are locking yourself into a higher

fixed loan payment each month. I advocate leveraging your resources to its maximum potential, meaning a 20 or 30-year mortgage provides lower payment terms which offers greater flexibility built into your mortgage payoff strategy but still allows for adjustments against unpredictable shifts in your life, financial markets and overall economic factors that may compromise your current lifestyle. See example below:

Using the above example, your all-in mortgage payment after refinancing is $1,744. You can comfortably afford your current mortgage and the additional mortgage principal payment of $800. By chance if some unfortunate life altering event occurs, you are not locked into a higher mortgage, say $2,544 ($1,744 + $800). You now have the flexibility to divert those funds to other critical areas within your household budget until you can recover from your life crisis.

Downsize Your Home

Transitioning into a smaller home maybe a viable option as you become older. Many variables must be considered, e.g., related costs for downsizing, amount of equity in home, healthcare related issues, etc., prior

to making such a huge lifestyle change. Avoiding emotional attachments to your home, family and friends may be a huge hurdle to overcome when deciding to downsize and potentially relocate to another state, city, or country. Mental preparation will be crucial to ensure a smooth transition in lifestyle change. Another factor to consider, is your current home too large and too expensive to maintain on a fixed retirement income?

Leveraging Your Home Equity

For many of you, the equity you have built in your home essentially is your retirement. If you are fortunate enough to have $200K or greater of home equity, you may be strategically positioned to sell your home and take the proceeds to purchase a smaller home outright for cash and still have some funds remaining for a rainy-day. If you have not saved enough for retirement this well may be a better option than attempting to retire in a home that is too costly to maintain on less money than you made in preretirement.

Before pursuing any of these mortgage options, do your homework! Avoid overestimating the value of

your home. Work with a realtor to obtain comparable pricing in your area to estimate the home resale value. Also, avoid huge remodeling projects, e.g., basement, swimming pool, etc., as these projects typically come at a high cost with low return on investment. However, if your home requires updating, consider upgrading your home kitchen and bathrooms as these rooms can significantly enhance the resale value of your home. Remember, chances are the new homeowner’s taste, style and preference may differ from yours. Instead, consider freshening up the walls with neutral white paint and improving the curb appeal of your home. These are low-cost solutions that can aid with the sale of your home sooner. Ultimately, downsizing can help free up cash that has built up over time in your home towards a better retirement. It is important that you be wise by conducting your due diligence and crunching the numbers to ensure this is the right decision for you.

Maximizing A Two-Household Income

Those of you with two-household incomes can have an advantage over those planning for retirement on a single income. As a rule, I recommend living on one income and reserving the second income for investing

and savings. So, which income should you choose to live on? Whomever has the most stable career in terms of being the least likely to become unemployed is recommended as the primary household income for daily living expenditures. Chances are the most stable income may not be the greater of the two incomes, and that is okay! The goal is to ensure your household can withstand a potential life crisis that awaits many families. If you are planning to retire within the next 10-15 years, executing this savings and investment strategy can trim years off a delayed retirement plan. High income earners who discover themselves playing a game of retirement planning catch-up can potentially have an easier time bridging the retirement gap using this approach. Consider implementing the following:

Padding Checking & Saving Accounts

Establish a baseline floor balance in both household checking and saving accounts. I recommend a $5,000 baseline for checking and $10,000 for savings. When either account reaches its baseline level it is equivalent to a zero balance in your account. Doing so, ensures your household can withstand life’s unforeseen emergencies. Typically, most household emergencies will not exceed $3,500. As an additional safety-net,

strive to keep cash-on-hand in the home, somewhere between $1,000 to $10,000. In the event you are not able to withdraw funds from your banking institution, you will have access to cash to take care of immediate financial matters.

Maximize Roth IRAs

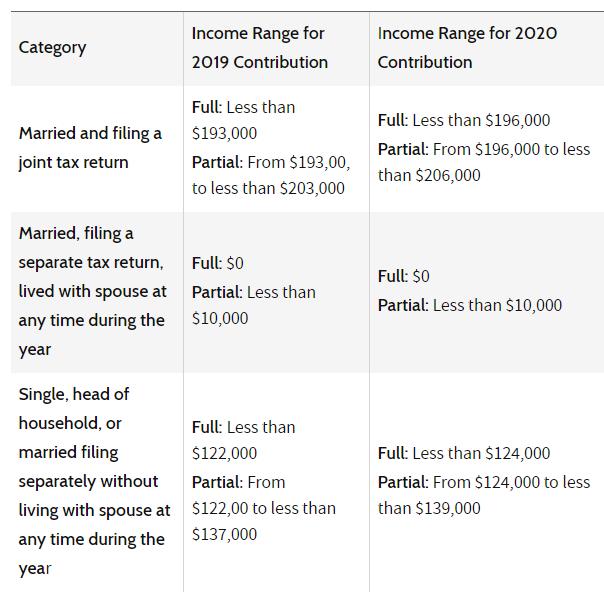

Fully funding a Roth IRA is an excellent retirement strategy to bridge retirement gaps. Money invested in Roth IRAs grows tax-free and the account holder can maintain the account indefinitely. Again, if you are 1015 years out from retiring taking advantage of this investing option can prove to be beneficial in retirement. If you are earning an income you may contribute to a Roth IRA under certain income earning limits. See Table 6-1 Roth Income Qualification below:

Table 6-1 Roth Income Qualification

Investopedia, August 2020

For those who are married, a spouse can fund a Roth IRA on behalf of their married partner who earns little to no income. The account must be established in the spouse’s name separately from the spouse making the contribution. In 2020, the maximum annual

individual contribution was $6,000 and $7,000 for those 50 years of age and older. Using this strategy married couples could save a combined total of $14,000 annually. Over a 10-15-year period this amount could grow substantially with only modest annual returns of six to eight percent. A Roth can be established at any time. However, contributions must be made by the account holder by the tax-filing deadline, generally by April 15 of the following year. Note: Tax-filling extensions do not apply.

Health Savings Account (HSA)

A health savings account is a tax-advantage savings account designed for individuals with high deductible health plan coverages. HSA contributions are 100% tax-deductible along with any qualified medical expenses. Contributions may be made by an employee or employer and can be used to pay for qualified expenses that are not covered by high deductible health plans. Also, participant’s beneficiaries inherit their balances tax-free. In 2022 Individuals may make a maximum contribution of $3,650 and $7,300 for a family. Contributors 55 years or older by the end of the tax year can make a catch-up contribution of an additional $1,000.

To open an HSA the required minimum deductible is $1,400 for an individual or $2,800 for a family in 2022. The plan must have an annual out-of-pocket maximum which caps participants out-of-pocket medical expenses. For 2022, the maximums are $7,050 for individuals and $14,100 for families. Note: HSA participants are not permitted to contribute beyond age 65; however, any funds contributed to the plan prior to maximum age can continued to be used for qualified medical expenses beyond age 65. In the event of a non-qualified medical expense withdrawal prior to age 65, a 20% penalty will be assessed along with applicable income tax on withdrawn funds. The 20% tax penalty does not apply at age 65 and over.

An additional benefit, HSAs can also serve as an investment tool. The Internal Revenue Service does not require a mandatory withdrawal from health savings accounts. A variety of investment assets can be funded through health savings accounts, such as real estate, stocks, bonds, cryptocurrencies, precious metal, etc. Work with a tax and legal professional to setup a self-directed health savings account. Note: A strategy is to allow HSA contributions to remain long-

term as assets grow tax-free and can help improve your overall financial landscape.

Health Insurance Considerations

Unfortunately, healthcare considerations are one of the last things that comes to mind for most when planning for retirement. Ironically, once in retirement, healthcare concerns are at the forefront for nearly two-third of retirees aged 65 years and older. There are various reasons for accelerated retirement health costs. Particularly, people are living longer, healthcare inflation continues to outpace the rate of general inflation and the average American retires at age 62. Sadly, many people believe Medicare will cover their healthcare costs in retirement, which is a false assumption. These are some initial factors to consider when estimating what it will cost to live in retirement.

The Cost of Health Insurance in Retirement

According to an August 2020 analysis by Fidelity, the average retiree spends nearly 15% of their annual retirement income on health-related expenses, which includes Medicare premiums and out-of-pocket expenses. Even more troubling, healthy male-female couples age 65 can expect to pay approximately

$295,000 in healthcare expenses throughout their retirement lifecycle. This figure is dependent on various factors such as, when you retire, the quality of your health, and overall lifespan. This expense does not account for long-term care.

Should you be among the group of retirees who elect to retire by age 62 you will need to have a contingency plan on how to cover healthcare expense in retirement. See Table 6-2 Early Retiree Healthcare Options for how to bridge healthcare insurance prior to being eligible for Medicare.

Table 6-2 Early Retiree Healthcare Options

Fidelity, August 2020

If you are still working and under age 65, one strategy may be to fund your health savings account (HSA). As stated in this chapter, an HSA is an excellent investment vehicle that offers several tax benefits, where contributions are pretax, or tax deductible, and savings grow tax free. Funds contributed to an HSA must be used for a qualified medical expense. HSAs can help absorb medical costs especially for costly medical procedures or chronic medical conditions.

Understanding Medicare

Medicare can be a complicated and confusing process to navigate. The program is managed by the Centers for Medicare & Medicaid Services (CMS) which works with the Social Security Administration for enrolling people in Medicare. Note: Participants are not required to re-enroll in Medicare each year but can review and change plans annually.

When enrolling in Medicare, participants have two options of coverage to select, (Original Medicare and Medicare Advantage). Original Medicare includes Medicare Part-A and Part-B where participants pay as they go. Plan deductibles are due at the beginning of each year and typically participants pay 20% of the cost

of the Medicare-approved service or co-insurance. Those seeking drug coverage can add a separate drug plan (Part-D). This level of coverage pays for most but not all the covered health care services and supplies. Many participants opt to add a Medicare Supplement Insurance (Medigap) to cover remaining health care costs like, copayments, coinsurance, and deductibles. Additionally, Medigap policies also cover services that Original Medicare does not cover, like medical care when traveling outside the United States.

Medicare Advantage known as Medicare Part-C serves as an all-in-one alternative to Original Medicare and those electing Medicare Advantage Plans will need to first enroll in Original Medicare (Part-A and B). These are bundled private insurance plans that include Part-A, Part-B, and usually Part-D coverages. Typically, these plans offer extended benefits that Original Medicare does not cover like, vision, hearing, dental and more. A third-party provider, Medicare Advantage Plans have yearly contracts with Medicare and must abide by Medicare coverage rules. The private insurance provider must notify participants of any changes prior to the start of the next enrollment year.

Original Medicare -vs- Medicare Advantage

Not all health care plans are created equal and understanding the pros and cons between coverage can assist with determining which plan is best for you. Many variables can impact which level of coverage is best, like health care needs, budget, and personal preferences. Table 6-3 Original Medicare -vs- Medicare Advantage shows a side-by-side comparison of the two plans.

Table 6-3 Original Medicare -vs- Medicare Advantage

Category Original Medicare Medicare Advantage

Benefits

Medicare Part-A and Part-B Covered Services

Prescription Drug Coverage

Choice of Doctor Who Accepts Medicare Yes

Include limited prescription drug coverage. Doesn’t include take home drugs.

Yes Yes

Yes, with most plans (not all)

It depends on the plan.

Additional Benefits, e.g., Vision, Hearing

Covered Service When Traveling Within the USA No

Yes

Covered Service When Traveling Outside the USA

Out-Of-Pocket Costs

Deductibles

Coinsurance or Copayments

Premiums

Other Features

Annual Maximum OutOf-Pocket Spending Limits No Yes. The amount may vary among plans and change year-to-year

Yes. In certain situations.

Yes

Typically, yes for most services

Medicare Part-A premium, although most do not have to pay.

Medicare Part-B premium for most people. Yes, with many Plans. Benefits may var among different plans.

Usually, no. Must live within plan’s service area, except in emergencies.

Yes. In certain situations.

May vary among plans.

Typically, yes for most services

Depends on plan. Some pay $0 in premiums.

Required to pay monthly Medicare Part-B premium.

As I researched the difference between the two plans, my initial take-away was that Original Medicare Plans offer participants greater flexibility with receiving health care from any health care provider accepting Medicare versus Medicare Advantage Plans that require participants to remain in their network which may delay treatment when seeking specialty health care services. Again, the decision to determine which plan is best for you will depend on your personal preference, quality of health and budget.

The Four Basic Parts of Medicare

Medicare is broken down into four basic parts, (Part A-Hospital Coverage, Part-B Doctor & Outpatient Services, Part-C Medicare Advantage and Part-D Prescription Drugs), and is a federal health insurance program for:

• People who are 65 or older • Certain younger people with disabilities • People with End-stage renal disease-ERSD (permanent kidney failure requiring dialysis or a transplant)

Part-A (Hospital Coverage) also known as Premium-A coverage, covers inpatient hospital stays, skilled

nursing facility, hospice, and some home health care. Typically, most people do not pay monthly premiums for this level of Medicare coverage if they or their spouse have contributed between 30-39 quarters. Generally, Part-A is paid through social security via an employer deduction for approximately 10 years. Those who work in public service whose employer does not contribute to social security but have paid social security prior to working in public service may still qualify for premium free Part-A coverage.

Although many may avoid paying Part-A premiums, participants can expect to experience costs related to deductibles, copays, and coinsurances. Those who qualify for free coverage (those who paid Medicare taxes for 30-39 quarters) can expect to pay $274 in monthly deductible while those who have paid less than 30 quarters through social security can expect to pay a deductible up to $499 per month.

Part-B (Doctor & Outpatient Services) covers certain doctors’ services, outpatient care, medical supplies, and preventive services to diagnose or treat medical conditions that meet accepted standards of medical practice. Participants do not incur out-of-

pocket expenses for most preventive services from providers accepting plan coverage.

Planning for retirement can be a tricky proposition, especially when determining if your financial affairs are in order and the steps required to help get you on the right track. This chapter provides some practical solutions to ensure you retire with peace of mind knowing you can live well in retirement. Evaluating all the resources you have in retirement is critical to include social security, pensions, retirement accounts, home equity and other assets. Hopefully, you are not more than 10 years out from your retirement time horizon. Remember, successful retirement planning requires time to develop. Using the recommended solutions provided in this chapter can aid with reducing the amount of time it will take to establish and execute your retirement plan. Seek assistance as needed, as you should not travel this journey alone. Ultimately, you will receive in retirement what you invested into retirement! “Nothing ventured, nothing gained”!