15 minute read

CHAPTER I PRE-RETIREMENT PLANNING

CHAPTER I

PRE-RETIREMENT PLANNING

“Planning is bringing the future into the present so that you do something about it now”

ALAN LAKEIN Author, Personal Time Management

Conducting Your Financial Health Assessment

Like conducting a regular annual wellness checkup, your financial wellness checkup is equally important. Knowing the current state of your financial health is critical to identifying where to begin by correcting the trajectory of your wealth curve. A wealth curve is a process where money grows over time due to compound interest. It is reported that

9

Albert Einstein stated that “compound interest is the most powerful force in the universe”. Unfortunately, many do not realize the full growth potential of their wealth curve due to life changing events. The ability to contribute to one’s wealth curves without disturbance over one’s lifetime would result in an astounding wealth accumulation for many. Here is an example based on 2015 data from the US Census Bureau, where the average salary in America was reported as $35,000. Assuming the average remained constant over a 40-year career, the average American would earn roughly $1,400,000 in their lifetime. Let us assume the average American worker invested approximately 18 percent ($250,000) of their lifetime earnings in an employer sponsored 401(k) retirement account with an annual rate of return of 10 percent without interruption, by year 40 the average worker would have accumulated $11,314,814. This example is illustrated in graph 1-1.

Graph 1-1

40 Year Wealth Curve Without Disruption

BudgetWorksheets.org

Each time there is a break in the wealth curve process, the actual growth of wealth accumulation is drastically reduced. See graph 1-2 the cost of falling off the wealth curve.

Graph 1-2

The Cost of Falling Off the Wealth Curve

Gane Financial, May 2017

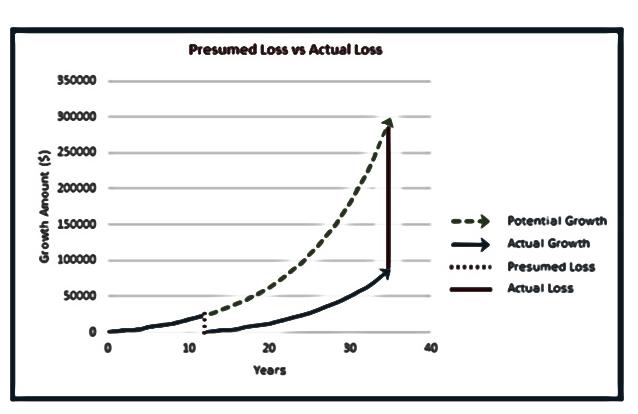

Imagine the example in graph 1-2 represents a 401(k) plan that is generating an annual return of 10 percent over the past 10 years and the account has grown to $250,000. You are over the age of 50 and currently fully funding your 401(k) account $19,500 ($750 per 26 weeks’ pay period) and catch-up $6,500 ($250 per 26 weeks’ pay period) contributions. The catch-up contribution allows individuals aged 50 years

or older to make additional contributions for the purpose of having enough savings for retirement. Suddenly a life emergency occurs at an expense of $40,000 with the assumption you do not have any other savings than your 401(k)-retirement plan to cover this unexpected expense. You borrow against your retirement account to manage your life crisis. The current Internal Revenue Service (IRS) tax code allows a maximum withdrawal up to $50,000 without penalty if the withdrawal amount is repaid up to a period of five years for a general loan withdrawal and up to 15 years for a home loan. So, the $40,000 withdrawal is well within your borrowing limits. Your 401(k) balance is reduced to approximately $210,000. Although you are repaying the loan amount plus interest to your retirement account along with normal bi-weekly contributions, the withdrawal amount triggers loss earnings within your wealth curve.

As illustrated in the graph 1-2 example, the dashline represents the potential growth of the wealth curve if there were no interruption in the funding stream and compounding interest flow. For the sake of this example, the $40,000 withdrawal occurred in the month of January with 25 bi-weekly pay periods left in

the year. If there were no withdrawal interruption of $40,0000 at the end of December 31st the investment account would have conceivably grown to $303,600 ($250,000 + $26,000) *.10 = $27,600 + $276,000 = $303,600. Using the same example based on the $40,000 withdrawal the account balance is reduced to $210,000 this amount would grow to $258,500 ($210,000 + 25,000) * .10 = $23,500 + $235,000. The overall effective loss in wealth generating earnings would be -$45,100 ($303,600-$258500), in the first year alone. Remember over time this wealth gap grows exponentially. The upside is the financial life crisis was managed without creating debt to a creditor and the interest paid on the loan is paid to your investment account.

Now, here is a scary reality, remember in the introduction, where 25 percent of workers between 45 and 59 did not have savings or a pension. If you fall within this statistic, your life crisis just got worse! Conducting a financial audit of one’s current state will help mitigate the risk of being underfunded or cashpoor in one’s retirement years. The following are some recommendations for addressing and kick-starting your wealth building machine.

Jump Starting Your Wealth Building Machine

Take a pulse-check of where you are in your life financially. Identify if there have been any major life event changes, e.g., marriage, divorce, health issues, purchase of a new home, etc. Incorporate SMART (Strategic, Measurable, Attainable, Realistic and Timely) objectives during this phase of financial analysis to ensure your expectations are properly aligned with the realities of your situation.

Goal Setting and Asking Yourself Tough Questions

Determine what your financial goals are by asking yourself the following questions.

What age do I want to retire?

How much will I need to save for retirement and how long will it take?

How much do I currently have saved today towards my retirement tomorrow?

What are some investment tools available I can use to meet my retirement goals?

Who can assist me with reaching my retirement goals?

Asking yourself these questions becomes a moment of truth! Self-discipline, dedication, and commitment are the levels of self-investment required to accomplish your retirement goals. Goal setting allows you to chart out your vision and create a plan of direction that can be executed. This is your take charge moment, “carpe diem” (Cease the Day)!

Audit Your Finances

Assess how money is distributed from your existing paycheck. Meaning, identify if you are paying more in taxes than you are contributing to your 401(k)retirement plan. This is one of the single greatest opportunities to fully fund your investment account and take advantage of company matching programs as well as reduce your overall tax liabilities. High income earners have a huge opportunity cost of leveraging this approach and often can realize an increase in overall net income with making the proper adjustments to tax withholdings. As I am not a licensed financial adviser, please consult a licensed financial professional prior to engaging with this strategy.

Six Simple Steps to Creating a Budget

Gaining control of your finances should be your primary objective towards achieving financial stability in retirement. Developing a personal budget allows you to track spending habits and plan how you will save and spend money each month. Below are six simple steps to creating a budget.

1. Gather all financial statements, e.g., sources of income and investments (assets) and all debt, rent, utility bills, credit card statements, etc., (liabilities). Identify the monthly averages of both income and expenses 2. Add up and record all your income earned for the month 3. Create a list of all monthly expenses 4. Divide monthly expenses into “essential”, e.g., rent, mortgage, auto, utilities, groceries, and

“discretionary”, e.g., charge card payments, savings, charitable donations, travel, etc. 5. Subtract your expenses from your total income.

Determine if you are spending more or breaking even with your monthly income 6. Adjust your expenses. The goal is to ensure your actual expenses do not exceed your income.

Table 1-3: Personal Budget Worksheet

PERSONAL BUDGET WORKSHEET

INCOME

Salary Partner's Salary Alimony/Child Support Real Estate Income Disability Income Other

Total Income MONTH

Budget Actual

EXPENSES FIXED

Rent/Mortgage/Property Taxes Auto Insurance, Home, Rental Insurance, Auto

EXPENSES VARIABLE

Utilities, (Electric, Gas, Water/Sewage) Health Care, (Medical. Dental, Optical, Prescription) Homeowner’s Association, (HOA) Telephone/Cell Groceries Cable Home Repairs

TRANSPORTATION

Fuel Parking Auto Repairs Other

MISCELLANEOUS

Church/Religious Organizations Charity/Gifts Savings Other

Total Expenses TOTAL INCOME - TOTAL EXPENSES

For some of you, this may be the first time you take the time to thoroughly examine your finances. It is utterly amazing how your financial picture comes into greater focus once you understand exactly where your money is going. There are many financial tools available you can use to develop and maintain a monthly budget. Once you gain a better financial picture of your monthly income versus debt, it is time to explore how to eliminate unnecessary spending by putting yourself on a financial diet. It is time to get lean!

Debt Reduction and Elimination Strategies

Your primary goal is to work towards eliminating debt. Consider implementing the debt snowball method, where you pay-off debt from lowest to highest by transferring payments of paid debt to the next largest bill and repeat this process until all debt is paid in full. I first implemented this debt elimination method during the early nineties as a young man in my early twenties while serving in the United States Air Force deployed in support of Desert Storm. Prior to my deployment, I provided my mother with financial power-of-attorney along with a list of my debt obligations and payment schedule. After a six-month

tour -of-duty, I returned home 100 percent free from debt. The feeling of pride and financial empowerment is something I will never forget! These recommended solutions require self-discipline and determination. Working with a financial accountability partner can help ensure you remain on track with meeting your financial goals.

Credit Management

Know your credit scores and the information that is reported on your credit history. If cash is “King”, then credit is “Queen”. Over time, many of you will experience peaks and valleys with fluctuations of creditworthiness. Your credit score is your calling card to the financial world and informs lenders of the strength of your borrowing power. 90 percent of lenders use the Fair Isaac Corporation (FICO) scoring system that ranges from 350-850 to determine how much credit to extend to borrowers. A FICO Score consists of a three-digit number based on information obtained from your credit report and helps lenders determine how likely you are to repay a loan. FICO scores below 580 are considered Poor, 580-669 = Fair, 670-739 = Good, 740-799 = Very Good and scores 800 and above Exceptional.

Developing good spending and debt repayment habits is the difference between drowning in debt and living a debt-free, stress-free life. A recommended approach to manage this process is to purchase a monthly subscription with a reputable credit reporting service to ensure you are notified when changes occur in your credit scores and history profiles.

There are three major credit reporting companies, Equifax, Experian, and Transunion. Each of these credit reporting organizations are required by federal law to provide consumers with free copies of their credit report annually. However, credit scores are generally not provided as a free service. In some instances, if you agree to allow the credit reporting bureaus to share your personal information among their partners and affiliates in exchange, they will grant you monthly access to your credit scores at no additional cost. Remember, great credit grants you access to lower interest rates, especially when making major purchases such as homes and automobiles. Having excellent credit and knowing how to leverage credit can strategically position you with realizing enormous cost savings over time.

Protecting your credit is key to preserving your credit. Your credit profile speaks volumes to who you are regarding how responsible you are with your personal finances. Here are some helpful tips for managing your credit:

• Check your credit reports and scores for errors - Review your credit reports and scores monthly and check for discrepancies, inaccurate or missing information. File a dispute with the appropriate credit reporting agency for errors identified during your review. • Pay Your Bills on Time – How you pay your bills accounts for 35 percent of your FICO score.

Delinquencies, collections, and late payments will adversely impact your credit rating if only a few days late. These negative credit performances remain on your credit report for seven years. Use payment reminder and/or automatic payment enrollment bank debit options when possible. • Control the Amount of Debt You Incur – The amount of credit you use accounts for 30 percent of your FICO score. This segment of the

FICO score considers the total balance owed,

the number of accounts with balances and how much of your available credit is being used. • Maintain A Lengthy Credit History – Your length of credit history accounts for 15 percent of your FICO score. This portion of the FICO score examines the age of your oldest account, the age of your newest account, and the average age of your accounts. A major mistake some people make is closing a credit card account once the account is paid-in-full.

Typically, a closed account remains part of your credit history for 10 years. After 10 years the credit history is removed from the credit report which lowers the overall average age of your credit history and credit score. • Manage the Amount of New Credit – The FICO score factors the number of new accounts recently opened and represents 10 percent of your credit score. Applying for too many new credit accounts in a short period of time indicates higher credit risk. Each time you apply for a new account a credit inquiry is initiated as a hard pull (when a creditor reports the activity to a credit bureau). Credit inquiries remain on

your credit report for two years and lower your credit score with each hard inquiry. There are two types of credit inquires, hard and soft inquiries. o Hard Inquiry – occurs when lenders access your credit as part of a decisionmaking process o Soft Inquiry – occurs when you check your own credit or when lenders review your credit profile for pre-approval/ promotional offers • Have A Good Credit Mix - The types of credit accounts you use represent 10 percent of your

FICO score. These accounts may include various credit cards, retail accounts, installment loans, mortgages, and lines of credit. Having a diverse range of credit is not a key factor in determining your FICO score but plays a larger role if your credit report lacks other information to base a score.

Asset Protection Insurance

Ensure you are properly insured! Often, insurance is something that many do not give much consideration until it is time to do so. I recommend having a broad mix of insurance coverages to provide protection and peace-of-mind for life’s unexpected events. Consider insurance coverages such as health, life, disability, auto, renters, and supplemental home (appliances, plumbing, electrical, pool, etc.). Each of these insurance types have extended protection called riders and in most instances rider premiums will come at a higher price but are well worth the additional costs when an unexpected event arises. This segment of the financial review process will require you to work closely with a licensed insurance professional.

Insurance and its many connecting components can be extremely complicated and requires attention to details for grasping an understanding of what is being protected and what areas require protection. Ensure you conduct a review of your insurance premiums and deductibles at a minimum annually. Compare and bargain shop for the best insurance coverages and prices in the marketplace. Do not just “set it”, and “forget it”. Taking a proactive stance in this area

provides a level of confidence and certainty that when life mishaps occur you are well positioned and protected to manage whatever comes your way.

Estate Planning for Asset Protection

Proper estate planning is essential to ensuring your family and loved ones are not left with huge financial and legal challenges once you are gone. More importantly, estate planning allows you to control how your financial affairs will be managed even in death. The process legally preserves your wishes to ensure the smart, hard work and great care you have devoted to building a wealth legacy is not eroded by someone’s careless actions after you are gone. I recommend creating a family trust to preserve the wealth you have accumulated for your family and avoid state probate.

Probate is a formal oversight process managed by each state for determining the distribution of assets of a deceased person. The use of a family trust is an excellent legal instrument that can be used to avoid probate, taxes and provide asset protection. A family trust has multiple components, e.g., will, living will, power of attorney’s (financial and medical), advance directives, beneficiaries, executor, or trustee. Trusts

are classified by the type of documents used to create the trust. If the trust is created while you are alive (Grantor), the instrument is called a “Living Trust”, if the document is created in the grantor’s last will and testament, it is called a “Testamentary Trust”. For control, trusts are also classified into two types, (Revocable and Irrevocable).

Revocable Trust allows the grantor to cancel or revoke the trust. If the grantor elects to revoke the trust, all assets are transferred back to the grantor. In the event the grantor dies the trust becomes irrevocable. This trust option is primarily used to avoid probate.

Irrevocable Trust precludes the grantor from having control over the trust unless the trustee and beneficiaries agree. Irrevocable trusts also avoid probate and are used to gain additional benefits, such as avoiding taxes, gaining asset protection from creditors, and allowing the grantor to qualify for public benefits. This type of trust historically has been used by the ultra-wealthy as it offers the greatest amount of liability protection. A note of caution, if you are going to take the time and invest the financial resources to establish a trust, please ensure to fully leverage the asset protection vehicle and transfer your assets, e.g.,

homes, vehicles, retirement accounts, business, etc. into the trust. Failure to do so, will trigger a probate event upon your death. Executed correctly, these components work in concert to provide optimum protection of your estate. Depending on where you establish your family trust, state laws will differ.

Knowing the current state of your financial health serves as the initial phase of gaining and improving financial literacy and charting a path to developing a plan of action that can mitigate those gaps identified during your financial assessment. Remember to seek the advice of financial and legal professionals prior to making estate planning, tax, and investment decisions.