37 minute read

CHAPTER V UNDERSTANDING THE FEDERAL TSP

CHAPTER V

UNDERSTANDING THE FEDERAL THRIFT SAVINGS PLAN (TSP)

“An Investment in Knowledge Pays the Best Interest.”

U.S. FOUNDING-FATHER, INVENTOR, BENJAMIN FRANKLIN

Getting the Most Out of Your TSP

There are many 401(k) retirement plans offered by employers in the U.S., but most pales in comparison to the federal Thrift Savings Plan better known as TSP. TSP functions similarly as many private 401(k) plans but offers several advantages that are not offered by other retirement plans. Although this chapter will focus on the federal TSP, many of the functionalities of the plan can be applied to other retirement saving

71

plans. What will differ are the types of mutual funds that exist within each plan, e.g., maturity, price, organizational mix, etc. TSP is the ultimate investor friendly retirement plan and has become more flexible with the passing of the SECURE Act, 2019 that extends the retirement minimum distribution age from 70 ½ to 72. Moreover, the TSP Modernization Act of 2017 provides greater flexibility among participants for how and when they can access money from their TSP accounts. The following are changes under the TSP Moderation Act.

Withdrawal Deadline

After separation from service, participants can now take multiple post-separation partial withdrawals. Previous laws required participants who separated from service to make a full withdrawal election once they reached age 70 and a half and failure to take the withdrawal would have resulted initiating an abandonment of account. The TSP Modernization Act eliminated the account abandonment process. Those participants with abandoned accounts can have their accounts reinstated.

Today, employees 59½ and older are allowed up to four in-service withdrawals each year. Retirees can now elect to receive monthly, quarterly, or annual payments as well as stop and start payments anytime. Under prior guidelines participants could only opt to receive monthly payments and if monthly payments were stopped the participant was required to receive the remaining balance in a final withdrawal or transfer funds to an IRA or other eligible retirement plan.

Other Advantages

TSP costs per $1,000 range from 0.026% and 0.039%, meaning for every $10,000 saved in the plan participants only pay $2.60 to $3.90 in annual fees. When compared to other 401(k) plans members can experience hundreds or even thousands of dollars in costly annual fees. TSP also has two simple yet comprehensive plan options for the Individual Funds “(G, F, C, S and I) and Life Cycle Funds or L-Funds consisting of five funds (L-Income, L-2025, L-2030, L2L-040, L-2045, L-2050, L-2055, L-2060 and L-2065) comprised of a mixture of Individual Funds (G, F, C, S and I) to meet investment objectives based on members time horizons. These funds provide an optimum balance between expected risk and return.

Over time the investments within the funds become more conservative as participants’ retirement target date approaches.

Individual Funds

Government Securities Investment Fund (G-Fund) –

Assets are internally managed by the Retirement Thrift Investment Board. These funds are designed to be low risk and keep pace with inflation. The G-Fund secures nonmarketable U.S. Treasury securities that are guaranteed by the U.S Government via the Thrift Savings Plan Act of 1987. In terms of risk, the G-Fund is the safest of all funds in the federal TSP plan as the fund is not subject to credit default, meaning it will never lose money. Historically, the G-Fund 10-year average is 1.93% and 4.3% since its inception on April 1, 1987.

From a strategic position, the G-Fund is best suited for short-term investments for protecting a portion or all a member’s TSP account from loss. Generally, retirees elect to hold 70 percent or more of their retirement savings in the G-Fund in retirement to guarantee long-term stability of retirement income.

Fixed Income Index Investment Fund (F-Fund) –

assets mimic the performance of the Bloomberg Barclays U.S. Aggregate Bond Index, representing a broad mix of the U.S. bond market. These funds are issued in the U.S. bond market and managed in a separate account from the G-Fund by the BlackRock Institutional Trust Company. The fund is passively managed, meaning funds remain invested according to its investment strategy regardless of bond market condition or the economy. From a risk perspective, the F-Fund is subject to inflation, market, and credit default risks. As interest rate go up, the bond market goes down and rises when interest rates fall. The fund overall risk is low compared to other fixed income investments. Historically, the F-Fund 10-year average is 2.99% and 5.8% since its inception on January 29, 1988.

Strategically, the F-Fund includes only investmentgrade securities, meaning investors are rewarded with the opportunity to earn a higher rate of returns over longer periods of time compared to investing in shortterm investments such as the G-Fund.

Common Stock Investment Fund (C-Fund) – These assets follow the performance of the Standard and

Poor’s 500 (S&P 500) Index, consisting of various stocks of the top 500 large and medium-sized U.S. companies. Like the F-Fund, the C-Fund is managed by BlackRock using the same passive investment indexed strategy regardless of market or economic conditions. Regarding risk, the C-Fund is subject to market and inflation risks. Since the fund mimics the S&P 500 Index it rises and falls in a similar manner and may lack sufficient growth to maintain pace with inflation. Historically, the C-Fund 10-year average is 16.16% and 11.2% since its inception on January 29, 1988.

Investing in the C-Fund offers a strategic advantage to investors providing the opportunity to experience gains from equity ownership among large and midsized U.S. companies. Participants can also benefit by investing alongside other index and bond funds as each track different segments of the overall market without overlapping and reducing exposure to market volatility.

Small Capitalization Stock Index Fund (S-Fund) –Assets are designed to match the performance of the Dow Jones U.S. Completion Total Stock Market Index. The fund consists of broad market index of U.S. companies not included in the S&P 500 index. Like the

F and C-Funds, the S-Fund is managed by BlackRock using the same passive investment strategy. The Sfund also move in the market like the Dow Jones U.S. Completion Total Stock Market Index and take on similar market and inflation risks. Historically, the SFund 10-year average is 14.37% and 11.4% since its inception on May 1, 2001.

A strategic benefit of investing in this fund is that it offers investors the opportunity to gain equity ownership of small to mid-sized U.S. companies. Like the F and C-Funds, S-Fund participants can also benefit by investing alongside other index and bond funds across different market segments thereby reducing exposure to market volatility.

International Stock Index Investment Fund (I-Fund) These assets mirror performance of the Morgan Stanley’s Capital International (MSCI), Europe, Australasia, and Far East (EAFE) Index. The fund works like the S&P 500 Index but represents 900 stocks from 21 countries of small to large market caps across EAFE regions. Like the F, C and S-Funds, the I-Fund is managed by BlackRock using the same passive investment strategy. Risk associated with the I fund differs from the other index funds due to currency risk

in valuation shifts of the U.S. dollar compared to the currencies of the countries represented in the EAFE Index. The I-Fund is also exposed to inflation risk thereby reducing investors’ purchasing power.

A strategic outcome of investing in the I-Fund is that it offers investors the opportunity to gain equity ownership in non-U.S. companies further diversifying their TSP portfolio. Like F, C and S-Funds, I-fund participants can also benefit by investing alongside other index and bond funds across different market segments thereby reducing exposure to market volatility. Historically, the I-Fund 10-year average is 8.39% and 6.10% since its inception on May 1, 2001.

Life Cycle Funds

L-Income Fund – Is designed for participants currently receiving monthly payment withdrawal from their TSP accounts or those who will begin withdrawing before 2021. The L-Income objective is to level outgrowth with high emphasis on preservation of assets. Asset allocation is distributed among the five individual funds (G, F, C, S, and I). Currently, these fund distribution mix will automatically adjust quarterly through July 2028. At the time of writing this book, the

percentage of fund allocation were as follows; G-Fund 72%, F-Fund 6%, C-Fund 11%, S-Fund 3%, and I-fund 8%. These percentages represent a balance portfolio for optimizing a rate of return that can out-pace inflation. The L-Income Funds combined 10-year average return is 4.51%. Note: After July 2028, the LIncome Fund will not change but rebalance daily to preserve its target investment mix. The L-Income Funds are comprised of several L-Fund types (L-2025,

L-2030, L-2035, L-2040, L-2045, L-2050, L2055, L-2060

and L-2065) that vary in individual funds allocation mix based on retirement time horizons.

L-2025 Fund – is for participants who will withdraw funds from their TSP account beginning the year 2021 through 2027. The L-2025 Fund objective is to achieve moderate level growth with moderate emphasis on preserving assets. Asset allocation across (G, F, C, S, and I) Funds are like the L-Income Fund percentages and is distributed as follows; G-Fund 50.75%, F-Fund 6.18%, C-Fund 22.36%, S-Fund 5.63%, and I-Fund 15.08%. The L-2025 Fund is designed to provide consistent yields above the rate of inflation. The fund retains more than 50% of participants holdings in GFund to ensure a sizable portion of retirement savings

avoid market risks. Currently, the L-2025 Fund does not have 10 years of performance as the fund is among the newer funds added to the L-Income Fund family as of July 1, 2020. The fund has a return of 13.7% since its inception.

L-2030 Fund – is created for participants who will withdraw their money beginning 2028 through 2032. The objective of the L-2030 Fund is to achieve a moderate to high level of growth with a low emphasis on preserving assets. The L-2030 asset allocation also consists of TSP Individual Funds, (G, F, C, S and I) with the following percent allocations; G-Fund 33.38%, FFund 6.5%, C-Fund 31.03%, S-Fund 8.05% and I-Fund 21.04%. Compared to the L-Income, the L-2030 mimics its funds distribution. The L-2030 Fund 10-year average return is 9.46% and 7.3% since its inception.

L-2035 Fund – is created for participants who will withdraw their money beginning 2033 through 2037. The objective of the L-2035 Fund is to achieve a moderate to high level of growth with a low emphasis on preserving assets. The L-2035 asset allocation also consists of TSP Individual Funds, (G, F, C, S, and I) with the following percent allocations; G-Fund 26.78%, FFund 7.28%, C-Fund 33.86%, S-Fund 9%, and I-Fund

23.08%. The L-2035 funds do not have 10 years of performance as the fund is among the newer funds added to the L-Fund family as of July 1, 2020. The fund has had a return of 18.7% since its inception.

L-2040 Fund – is for participants who will withdraw money beginning year 2038 through 2042. The L-2040 Fund objective is to promote high growth with low emphasis on preserving assets. Assets in the L-2040 Fund are allocated across (G, F, C, S, and I) Funds and are adjusted quarterly. The allocation is as follows; GFund, 20.75%, F-Fund, 7.5%, C-Fund 36.65%, S-Fund, 9.99%, and I-Fund, 25.11%. The investment strategy becomes more aggressive in the L-2040 Fund as participants have more time to invest prior to retirement. The L-2040 average 10-year return is 10.7% and 7.9% since its inception om August 1, 2005.

L-2045 Fund – is for participants who will withdraw money beginning year 2043 through 2047. The L-2045 Fund objective is to promote high growth with low emphasis on preserving assets. Assets in the L-2045 Fund are allocated across (G, F, C, S, and I) Funds and are adjusted quarterly. The allocation is as follows; GFund, 15.22%, F-Fund, 8.03%, C-Fund 38.88%, S-Fund, 11.01%, and I-Fund, 26.86%. The investment strategy

becomes more aggressive in the L-2045 Fund as participants have more time to invest prior to retirement. The L-2045 funds do not have 10 years of performance as the fund is among the newer funds added to the L-Fund family as of July 1, 2020. The fund has had a return of 21.8% since its inception.

L-2050 Fund – is for participants who will withdraw money beginning year 2048 through 2052. The L-2050 Fund objective is to promote high growth with low emphasis on preserving assets. Assets in the L-2050 Fund are allocated across (G, F, C, S, and I) Funds and are adjusted quarterly. The allocation is as follows; GFund, 10.42%, F-Fund, 7.83%, C-Fund 41.22%, S-Fund, 11.92%, and I-Fund, 28.61%. The investment strategy becomes more aggressive in the L-2050 Fund as participants have more time to invest prior to retirement. The L-2050 Fund 10-year average return is 11.79% and 10.4% since its inception.

L-2055 Fund – is for participants who will withdraw money beginning year 2053 through 2057. The L-2055 Fund objective is to promote high growth with low emphasis on preserving assets. Assets in the L-2055 Fund are allocated across (G, F, C, S, and I) Funds and are adjusted quarterly. The allocation is as follows; G-

Fund, 0.5%, F-Fund, 0.49%, C-Fund 49.84%, S-Fund, 14.52%, and I-Fund, 34.65%. The investment strategy becomes more aggressive in the L-2055 Fund as participants have more time to invest prior to retirement. The L-2055 funds do not have 10 years of performance as the fund is among the newer funds added to the L-Fund family as of July 1, 2020. The fund has had a return of 28.5% since its inception.

L-2060 Fund – is for participants who will withdraw money beginning year 2058 through 2062. The L-2060 Fund objective is to promote high growth with low emphasis on preserving assets. Assets in the L-2060 Fund are allocated across (G, F, C, S, and I) Funds and is adjusted quarterly. The allocation is as follows; GFund, 0.44%, F-Fund, 0.55%, C-Fund 49.84%, S-Fund, 14.52%, and I-Fund, 34.65%. The investment strategy becomes more aggressive in the L-2060 Fund as participants have more time to invest prior to retirement. The L-2060 funds does not have 10 years of performance as the fund is among the newer funds added to the L-Fund family as of July 1, 2020. The fund has a return of 28.5% since its inception.

L-2065 Fund – is for participants who will withdraw money beginning year 2063 and later. The L-2065 Fund

objective is to promote high growth with very low emphasis on preserving assets. Assets in the L-2065 Fund are allocated across (G, F, C, S, and I) Funds and are adjusted quarterly. The allocation is as follows; GFund, 0.37%, F-Fund, 0.64%, C-Fund 49.83%, S-Fund, 14.51%, and I-Fund, 34.65%. The investment strategy becomes more aggressive in the L-2060 Fund as participants have more time to invest prior to retirement. The L-2065 funds do not have 10 years of performance as the fund is among the newer funds added to the L-Fund family as of July 1, 2020. The fund has had a return of 28.5% since its inception.

TSP Eligibility

TSP is a retirement savings plan designated for federal (civil and uniformed service) employees. Participant’s retirement system will determine employee eligibility. Members become eligible if they are in the following groups:

• A federal employee covered by the Federal

Employees Retirement System (FERS) • A federal employee covered by the Civil Service

Retirement System (CSRS)

• A member of the uniformed services and [Those covered under the legacy Blended Retirement

System (BRS)] • A civilian in certain other categories of federal service such as some congressional, justice and judge positions

Types of TSP Contributions

The Thrift Savings Plan consist of three contribution sources, (Employee, Agency/Service Automatic (1%) and Agency/Service Matching) contributions. These mixes of contributions are designed to provide participants with long-term investment and retirement savings. Investors in TSP experience the following account flexibility:

• Automatic payroll deductions • A diversified selection of investment options, (Individual and Life-cycle Funds) • A variety of tax treatments for contributions o Traditional (Pre-Tax) contributions and tax deferred investment earnings o Roth (After-Tax) contributions with tax free earnings • Low administrative and investment expenses

• Agency/service contributions • Access to money while employed by the federal government (Under certain conditions as established the IRS) • A beneficiary participant account established for spouse in the event of death • Other withdrawal options

Employee Contributions – consist of two types of contributions, regular employee contributions, (including automatic enrollment contributions) and catch-up contributions (for participants aged 50 or older).

Employee Contributions - Under this contribution source, participants can make contributions any time through automatic pay-roll deductions from their basic pay. Contribution elections are conducted through each agency’s pay-roll system. Participants elect to make investment contributions to Traditional, Roth or both. As a reminder, contributing to the Traditional retirement plan at the agency match level is highly recommend ensuring receipt of agency matched funds (free money). Note: Members of the uniformed services may contribute in addition to basic pay under special conditions. These additional contributions may

consist of pay incentives, special pay or bonuses ranging from 1 to 100 percent if at least 1% is contributed from basic pay.

Catch-Up Contributions - Using this contribution source, participants may elect to contribute any time beginning the year they turn age 50. Like regular employee contributions, catch-up contributions are deducted from participants’ pay. The current maximum contribution amount is $6,500 or $250 per 26 weeks’ pay period. Note: Catch-up contributions end once the maximum amount is reached or at the end of the calendar year. Remember, catch-up contributions must be renewed each calendar year. FERS and BRS participants do not receive matching contributions on any catch-up contributions to TSP.

Agency/service Automatic (1%) Contributions - For FERS and BRS employees’ federal agencies will contribute an amount equal to one percent of their basic pay per pay period to their TSP accounts. The contribution amount is not deducted from employee’s pay and does not reduce employee income for tax deferment purposes. This contribution source is made regardless of an employee contribution to TSP.

Agency/Service Matching Contributions - Employees participating in FERS are entitled to receive matching TSP contributions up to five percent of their salary. Unfortunately, federal employees participating in CSRS do not receive agency matching TSP contributions. Each federal agency matches the first 3% of TSP contributions dollar-for-dollar and the next 2% $0.50 for each dollar contributed. See the following example:

An employee with an annual salary of $100,000 would need to contribute to their traditional account a minimum of $5,000 or $192.30 per 26 week pay periods. When using the agency match contribution formula, the first $3,000 of TSP contributions would be matched dollar-for-dollar and the next $2,000 would be matched at $0.50 per dollar contributed thereafter or $1,000 for a total agency matched contribution of $4,000. By year’s end the employee would have accumulated $9,000 realizing an 80% return on investment before any compounded interest would have accrued. Note: As a word of caution, avoid contributing more than the maximum allowable contribution of $789 per 26 weeks’ pay period, as this will reduce the number of months you can contribute throughout the year.

An example, contributing $850 per 26 weeks’ pay period would result in approximately 23 payroll deductions to the Thrift Saving Plan. It is important to remember that the agency matched contribution stops once the maximum TSP contribution is reached. Using this example, the employee would forgo three weeks of agency matched contributions for the remaining pay periods within that calendar year. On another note, catch-up contributions do not count against the TSP maximum contributions as it does not receive a match of any kind.

Type of TSP Investment Transactions

TSP participants have two investment transactions (Contribution Allocation and Interfund Transfer) types for directing and moving funds to optimize long-term growth of their investments.

Contribution Allocation – allows participants to direct how new money flows into their TSP accounts. These deposits include future employee contributions, agency/service contributions (FERS or BSR), any special pay, incentive pay, or bonus contributed by members of the uniformed services or money transferred into TSP from other retirement plans and any TSP loan

payments. Note: Contribution allocations remain in effect until a new election is made.

Interfund Transfer – allows participants to move money currently in TSP account among investment funds. Movement of funds can be distributed among funds by percentages totaling 100 percent in aggregate. Transfer of specific dollar amounts is not allowed among funds. Note: If participants have both Traditional and Roth accounts, the interfund transfer will be distributed proportional to the percentage specified by participants. Interfund transfer is limited to the first two interfund transfers used each calendar month. A special note, interfund transfers that occur near the end of the month may not execute until the beginning of the new month thereby counting as a transaction made in the new month rather than the previous month as intended by participant election. Maintaining this level of awareness is crucial to investment strategies during market turbulence. After the first two transfers, the only interfund transfer that can be made is into the G-Fund. Participants have unlimited interfund transfers into the G-Fund. These rules apply to both civilian and uniformed services accounts.

Contributing Allocation or Interfund Transfer

Participants may elect to make both contribution allocation or interfund transfer either online at tsp.gov or by phone through the ThriftLine (1-877-968-338). When using the ThriftLine participants will need their account number and ThriftLine PIN. Contribution allocations or interfund transfers made before 12 noon eastern time are generally processed that business day. Participant will receive a confirmation notification by mail or email if the transaction is conducted using the TSP website.

TSP Loans

TSP loans are available only to participants who are currently employed, who are in a pay status and have contributed their own money to TSP. Taking a TSP withdrawal is not recommended as it interrupts one’s wealth-curve. However, life circumstances are inevitable and if the need arises, it is comforting to know participants can borrow from their contributions to take care of life’s happenstances. Essentially, borrowers become their own bank as repayment restores the amount of the loan, as well as interest paid to the TSP account. The interest rate paid is the

interest rate for the G-Fund at the time the loan application is processed. Members are assessed a fee of $50 for each loan. This fee covers the cost of processing and servicing the loan and is deducted from the amount of the loan.

TSP Loan Types

There are two types of TSP loans, (General Purpose Loan and Residential Loan). Participants may only have one general purpose and one residential loan outstanding at a time. Borrowers are limited to their contributions and the earnings on those contributions. Participants may not borrow less than $1,000 or more than $50,000. Note: in lieu of recent Coronavirus-19 pandemic, under the CARES Act the maximum loan amount on a general-purpose loan increased to $100,000, and the portion of available balance that can be borrowed raised from 50% to 100%. All other TSP loan rules still apply. Application deadline for loan increase ended on September 18, 2020. Additionally, TSP loan payments were suspended for the rest of the 2020 calendar year for current and loans taken through November 30, 2020. The CARES Act required participants to file form TSP-46 to request loan suspension.

Eligibility for Temporary Loan Options

Under the CARES Act participants could receive a temporary load from their TSP accounts through selfidentification and have qualified individuals by meeting at least one of the following criteria through December 2021. Note: Providing supporting documentation was not required for verification purposes.

• Participant diagnosed with the virus SARS-CoV2 or with coronavirus-2019 (COVID-19) disease by test approved by the Centers Disease

Control and Prevention (including a test authorized under the Federal Food, Drug and

Cosmetic Act) • Participant spouse or dependent (as defined in section 152 of the Internal Revenue Code of 1986) is or has been diagnosed with such virus or disease by such test • Due to COVID-19, participants are experiencing adverse financial consequences because of the participant, participant spouse or household member o Being quarantined

o Being furloughed or laid off or having work hours reduced o Being unable to work due to lack of childcare o Having to close or reduce hours of a business o Having a reduction in pay or selfemployment income; or o Having a job offer rescinded or a start date for a job delayed

The CARES Act allowed participants to withdraw up to $100,00 from their TSP accounts without incurring the usual 10% penalty. Participants were given the option to evenly spread-out taxable income from their withdrawals over three years if they chose. The CARES act allowed participants to repay all, or part of the amount withdrawn to an eligible retirement account if the loan is repaid within three years of taking the distribution. Repaid coronavirus-related loans are not assessed a federal income tax on the distribution. Note: Participants who withdrew funds under the CARES Act are responsible to pay tax on any portion of the loan that was not repaid to their eligible retirement accounts.

General Purpose Loan – may be used for any purpose, requires no documentation, and has a repayment term of 1 to 5 years. The following are eligibility rules for securing a general-purpose loan:

• Must be employed by the Federal Government or a member of the uniformed services • Must be in pay status because payments are established through payroll deductions • Can only have one outstanding general-purpose loan and one residential loan from any one TSP account at a time • Must have at least $1,000 of participants own contribution and earnings in their TSP account (agency contribution and earnings cannot be borrowed) • Must not have a repaid a TSP loan of the same type in full within 60 Days. (If participant have both a civilian TSP account and a uniformed services TSP account, the 60-day waiting period applies separately to each account) • Must not have a taxable distribution of a loan within the past 12 months unless it was the result of participant separation from Federal

Service

• Must not have a court order against participant

TSP account

Residential Loan – may only be used for the purchase or construction of a primary residence, requires documentation, and has a repayment term of 1 to 15 years. The following are eligibility rules for securing a residential loan:

• A residential loan can only be used for purchasing or constructing a primary residence, which may be any of the following: o House o Townhouse o Condominium o Shares in a cooperative housing corporation o Boat o Mobil Home o Recreational Vehicle • A residential loan cannot be used for: o Refinancing or prepaying an existing mortgage o Construction of an addition to an existing residence o Renovation to an existing residence

o Buying out another person’s share in the borrower’s current residence o The purchase of land only

TSP Borrowing Limits

The minimum TSP loan is $1,000. Participant’s account balance must consist of their own contributions and earnings on those contributions and equal at least the minimum loan amount. The maximum loan amount is the smallest of the following:

• Participant’s own contributions and earning on those contributions in the TSP account from which they intend to borrow, not including any outstanding balance • 50% of participant’s vested account balance (including any outstanding loan balance) or $10,000, whichever is greater, minus any outstanding loan balance; or • $50,000 minus participant highest outstanding balance, if any, during the last 12 months. Even if the loan is currently paid in full, it will be factored in the calculation if it was opened at any time during the last 12 months

Note: If a participant has both a civilian and uniformed services accounts, the combined account balances and outstanding loan amounts will be used to calculate the maximum loan amount. TSP account balances are recalculated at the end of each business day based on daily share prices. As a result, the maximum loan may change daily.

Type of TSP Withdrawals

TSP is designed to serve as a long-term investment vehicle that benefits participants in retirement. As such, there are rules that restrict when and how much money members can withdraw out of their accounts while still employed. However, once participants leave federal service more withdrawal options are available.

Withdrawals from participant’s accounts are paid proportionally from each TSP fund they are invested in. This rule applies to tax-exempt contributions in participant traditional balance even if participant is a member of the uniformed services. TSP withdrawal automatically defaults proportionally from traditional and Roth balances if participant has both. However,

members may elect to receive withdrawals from either traditional or Roth balances.

In-Service Withdrawals

In-service withdrawals are withdrawals taken from participants accounts while they are still employed. This withdrawal type is available to all active participants. TSP does not charge a fee for making an in-service withdrawal. However, participants are responsible for paying federal and in some cases, state income taxes on the taxable portion of the withdrawal and may be subject to a 10% early withdrawal penalty. Note: When an in-service withdrawal is incurred, participants permanently deplete their retirement savings by the amount of the withdrawal and any future earnings. Again, the wealth-curve is drastically interrupted!

Types of In-service Withdrawals

There are two types of in-service withdrawals, (Financial Hardship and Age-Based “59 ½”).

Financial Hardship In-service Withdrawals – is a withdrawal certified by participant under penalty of perjury, that participant has a financial hardship because of a recurring negative cash flow, legal

expenses for separation or divorce, medical expenses, or personal casualty loss. Members may only withdraw their contributions they accrued. Participant can request $1,000 or more but the amount that is requested cannot exceed the actual amount identified on the certified financial hardship.

Age-Based “59 ½” In-service Withdrawals – can be made any time after a participant reaches age 59½, providing the member is still a federal employee or in the uniformed services. Part or all the vested account balance may be withdrawn. Withdrawal amounts may be taken from traditional or Roth balances (even if the balance selected is less than $1,000). Note: Members are permitted to take up to four age-based in-service withdrawals per calendar year. In certain instances, spouses may have rights regarding in-service withdrawals. Participants who are married FERS or uniformed service members, spouses must consent to in-service withdrawals. Married CSRS participants must notify their spouses prior to an in-service withdrawal. These rules apply even if member is separated from their spouse.

Separation Withdrawals

Participants with a vested account balance of $200 or more after separating from federal service can leave their money in TSP or withdraw all or a portion from their account. If the account balance is below $200, TSP will automatically forward a check to the last known address of record. Note: TSP recommends members maintain an updated address on file in the TSP system prior to separation from federal service. Members may select from three post-separation withdrawal types, (Installment Payments, Single Withdrawals and Annuity Purchases). Participants can choose one or a combination of these methods.

TSP Installment Payments – allow participants to receive payments from their account monthly, quarterly, or annually. Payments will continue unless stopped or once the total account balance reaches zero. Participants may elect to withdraw from either traditional or Roth accounts. Once funds are depleted from the initial selection, payments will continue from the other source automatically. Members may choose to receive a specified dollar amount ($25 minimum) or have TSP calculate payment based on life expectancy.

After installment payments are established, members can stop or make changes at any time.

TSP Single Withdrawal – participants may opt for a single withdrawal of $1,000 or more. There is no limit in the number of single withdrawals members can make, but TSP will not process more than one withdrawal in any 30-calendar-day period. Members can take a single or partial withdrawal from their account even if they are currently receiving installment payments, previously made annuity purchases or other withdrawals.

TSP Annuity Purchases – provide participants benefits (or their survivor) every month for life. TSP will purchase the annuity on the behalf of the member from a private insurance company. Annuity acquisition may be purchased with all or a portion of the TSP account balance. The minimum amount for purchasing an annuity is $3,500. This amount applies to traditional and Roth accounts separately.

Note: Once a life annuity has been purchased it cannot be revoked or changed. If married, certain spouse rights for withdrawal may be required even if separated from spouse. This requirement does not

apply to account withdrawals with balances of $3,500 or less. Beneficiary participant accounts are also excluded from these requirements.

Members who are married FERS or uniformed services participants, spouses are entitled by law to receive a joint life annuity with a 50% survivor benefit, level payments and no cash refund feature. If a member chooses any other withdrawal or combination of options, the spouse must provide a signed notarized consent and waive the right to the annuity with respect to the amount withdrawn before the withdrawal can be processed. The same will apply if member elects to change the frequency of installment payment as this could impact the dollar amount available for an annuity. CSRS participants must notify their spouses of withdrawal to include any changes in frequency of installment payments. Please refer to a financial/tax professional for additional guidance.

Filing Bankruptcy and TSP Loans

Participants who may experience bankruptcy must continue TSP loan payments as TSP is not a creditor and loans are not considered as debt. As a result,

bankruptcy courts do not have jurisdiction over TSP loans.

Combining Multiple TSP Accounts

Some TSP participants may have two separate (federal civilian and uniformed services) TSP accounts. Members who separate from one of these services may make post-separation withdrawals only from the TSP account related to the type of employment from which they separated. Participants also have the option of combining two accounts into one but can only move the account related to the separation to the other TSP account. If separated from both services, the participant may choose which account they want to keep and combine the other with that account. Should a participant have an account with an outstanding loan from the account they are moving, that loan account must be repaid prior to combining accounts. (TSP recommend paying outstanding loans off at least 90 days prior to separation). To combine both accounts, members should use Form TSP-65, Request to Combine Civilian and Uniformed Services TSP Accounts. This request is only permitted up to the end of the calendar year prior to the year participant turn age 72.

Note: The traditional portion of a uniformed services TSP account that includes a tax-exempt balance cannot be transferred into a civilian TSP account. These funds will remain in the uniformed services account until the member elects to take a withdrawal. The funds will continue to accrue tax-deferred earnings until a withdrawal election is made. However, Roth taxexempt balances can be transferred into the civilian TSP account.

Tax Considerations on TSP Withdrawal

Participants are required to pay income taxes on the taxable portion of withdrawals. In most cases, TSP is required to withhold part of member’s distribution for federal income tax. State and local taxes are not withheld by TSP, but the withdrawal is reported to the state of residence at the time of payment. Payment of state and local taxes is the responsibility of the participant. In certain instances, participants may request an increase or decrease in the percentage withheld or a waiver of withholding. There are rules that apply to each TSP payment type. See Table 5-1.

Table 5-1 Tax Treatment for TSP Payments

Type of TSP Payment

Tax Withholding Rate Increase/Decrease Withholding

Waive Withholding

Automatic Enrollment Refund Single Withdrawal Installment Payments < 10yrs Installment Payments 10yrs + Installment Payments IRS Life Expectancy Automatic Cash-Out (less than $200) Required Minimum Distribution Payment Age-based in-service “59 ½” Withdrawal Financial Hardship InService Withdrawal 10%

20%

20%

Same as married with 3 dependents

None

10%

20%

10%

Loan Taxable Distribution – Default (by Separation) Not Applicable Loan Taxable Distribution – (Tax Already Default (while still Paid) employed) Court Order Payment (to a current or former spouse) 20% Court Order Payment (not to a current or former spouse) IRS Tax Levy Death Benefit (from a beneficiary participant account) Death Benefit (to a nonspouse) Annuity Purchase 10%

20%

10%

20% Yes/No

Yes/Yes

N/A

Yes/No

N/A

Yes/No

No

Yes/No

Reported by annuity provider

Yes-complete Form TSP-25

No

Yes

N/A

Yes

No

Yes

N/A

No

Yes

No

Roth Withdrawals

Participants will not be required to pay taxes on any portion of a withdrawal from Roth contributions. Taxes will only be required for non-qualified earnings (participants under the age 59½ and earnings less than five years old). Members may transfer Roth funds to a Roth IRA or Roth account maintained by an eligible employer plan. Note: Those taking Roth distributions under age 59 ½ may incur an IRS early 10% withdrawal tax penalty. However, public safety employees who separate from service after age 55, or the year they reach age 50, will not be subject to the 10% early withdrawal penalty. See Internal Revenue Code, section 72(t)(10)(B)(ii).

Understanding Required Minimum Distributions

By law, participants must take required minimum distributions (RMD) once they have separated from service in the calendar year they reach age 72, by April 1st of the following year and subsequence years by December 31st . Note: In the first year following age 72, participants will generally be required to take two distributions, an April 1st withdrawal, and an additional withdrawal by December 31st . However, in the first

year, members may also elect to make their first withdrawal by December 31st of the year they turn age 72 instead of waiting until April 1st of the following year which delays the distribution to the following year and reduces the taxable income of the current year distribution.

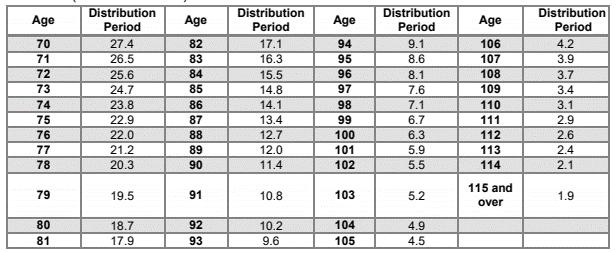

All withdrawals taken will count towards the RMD requirements. Any shortfall amounts not taken to satisfy the RMD will be automatically issued as a supplemental payment by TSP to the participant before the deadline of each year. This process serves as a safeguard provided by TSP to help members avoid incurring a 50% excise tax for failure to take the required minimum distribution for that year. Additionally, the Internal Revenue Service provides a worksheet for calculating required minimum distribution. See the following example and Table 5-2.

Example: IRS Instructions:

1. IRS Balance on December 31 of the previous year $1,000,000 2. Distribution period from table below for your age ___

24.7 on your birthday this year

3. Line 1 divided by number entered on line 2. $40,485.82

This is your required minimum distribution for this year

4. Repeat steps 1 through 4 for each of your IRAs

Table 5-2 IRA Required Minimum Distribution Worksheet Table III (Uniform Lifetime)

IRA Required Minimum Distribution Worksheet irs.gov

Using the above IRS instructions and Table 5-2, (Table III Uniform Lifetime), a federally separated service member aged 73 with a traditional IRA balance of $1,000,000 would incur an RMD of $40,485.82. Based on this example the distribution period rating is 24.7. This number is divided into the IRA balance of the previous year to determine the RMD due by year end. The member would need to take the entire $40,485.82 distribution by December 31 for that year to avoid the 50% IRS excise tax. Remember, participants may opt to receive distributions, monthly, quarterly, or annually.

The RMD amount in this example is in alignment with the “Rule-of-4” retirement distribution strategy as it represents approximately four percent of the member’s total investment savings. Assuming the traditional IRA will grow on average six to eight percent annually, the withdrawal requirements established by the IRS will typically draw down on capital gains rather than member’s principal contributions ensuring longterm sustainability of retirement savings. Moreover, based on Table 5-1 using this example for an RMD payment, TSP would withhold 10% or $4,486 for federal income tax. Note: If a participant has multiple IRAs each RMD will need to be determined separately and aggregated for a combined total to satisfy the RMD amount due for that year. Depending on the participant’s filing status, separate tables (Single Life Expectancy and Joint Life and Last Survivor Expectancy) may be required to determine distribution amounts and payout periods.

• Table I - Single Life Expectancy is used for beneficiaries who are not the spouse of the IRA owner • Table II – Joint Life and Last Survivor

Expectancy is used for owners whose spouses

are more than 10 years younger and are the IRA’s sole beneficiaries.

Inherited IRAs and Required Minimum Distributions

The SECURE Act distinguishes between an “eligible designated beneficiary” and other beneficiaries who inherit an IRA. Eligible inherited designees include a surviving spouse, a disabled individual, a chronically ill individual, minor child, or individual who is not more than 10 years younger than the account owner. As a qualified plan, the TSP administrator will provide the beneficiary with their options. These RMD pay-out options may be as short as five years, or up to the life expectancy of the beneficiary. Note: The surviving spouse of the owner can also opt to treat the IRA as their own account and delay the distribution until the end of the year that the IRA owner would have turned age 72. However, minor children must take the remaining distributions within 10 years of reaching age 18.

Qualified Longevity Annuity Contract (QLAC)

If you anticipate living longer, a QLAC may be an option to ensure you have enough retirement savings and not outlive your money. A qualified longevity contract can be used as a strategy to defer a portion of the required minimum distribution until age 85. QLACs are funded with either a qualified retirement plan or individual retirement account and provide guaranteed monthly retirement income until death. This annuity type also helps protected against market volatility. Under IRS rules, contributors can spend 25% or $135,000 (whichever is less) of their retirement savings account or IRA to purchase a QLAC. For example: If you have an IRA balance of $300,000 you can purchase a QLAC for up to $75,000. If your retirement savings balance is $540,000 and above you can purchase a QLAC for up to the maximum $135,000 limit. Periodically, the cap may be adjusted for inflation.

Only the QLAC premium is deferred up to age 85 with the remaining RMD due at age 72. The strategy here lowers the RMD tax liability up to age 85.

For example: A retiree with $540,000 in retirement savings can contribute up to the $135,000 limit reducing the taxable RMD at age 72 to $405,000. The approximate RMD would be $16,200 compared to $21,600 based on the $540,000 retirement savings amount. Remember 10% is automatically deducted for federal tax withholdings. Purchasing a QLAC would yield an immediate savings of $5,400 ($21,600 $16,200) remaining in your retirement savings account.

The QLAC $135,000 premium is a lifetime limit across all funding sources. For example: participants may elect laddering (spreading out investments across multiple maturity dates) their premiums to create liquidity and lower market risks. Should investors select opening multiple QLACs, their total investments across all QLACs cannot exceed the $135,000 limit.

QLAC owners may opt to add a cost-of-living adjustment to their contract, which indexes the fund against inflation. Note: selecting the cost-of-living rider will reduce the initial QLAC payout. Lifetime payout is extended using the premium invested amount. Also, avoid using Roth saving plans to fund QLACs as these funds are already tax-free.

Hopefully by now, this chapter has provided relevant insights to better understanding the Thrift Saving Plan. Federal and military employees have the benefit of contributing to the largest defined contribution plans in the world, with over 5 million participants and more than $5 billion in assets. For those contributing to defined plans other than TSP all is not lost as many of the attributes provided by TSP exist within other defined retirement plans as well. No matter which defined plan you contribute to, I recommend you become familiar with the details and offerings of the plan that will allow you to make informed investment decisions. I know taking the time of becoming better familiar with your investment options can be both scary and time consuming, especially for first time investors. When at all possible, work with both financial and tax professionals to help navigate the decision-making process that will be the best fit for you in retirement. Remember everyone’s retirement journey will be different as well as the strategies needed to plan for retirement.