2021 – 22 ANNUAL REPORT

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2021 - 22 1 | Page

16 November 2022

WINE INDUSTRY ASSOCIATION OF WA (INC.)

Introduction

2021-22 Strategic Priorities President’s Report

Chairman’s Report

Chief Executive Officer’s Report

Membership and APC Collection Report

Industry Production Report

Member Benefits

RD&E Report

Market Development

2021 22 Board of Directors 15

Appendices

2021 22 APC Budget

2021-22 Audited Financial Report

2016 21 State Vineyard and Production Data

2021-26 WA Wine RD&E Strategic Priorities Plan

2014 24 WA Wine Industry Strategic Plan Summary

2021-22 Wine Australia Regional Program Report

2021 22 WA Wines to the World Program Reports

Project reports

Monitoring and Evaluation report

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2021 - 22 2 | Page

3 4 5 6 7

Contents

10 11 12 13 14

Introduction

The Wine industry Association of Western Australia (Inc.) Wines of Western Australia), established in 1987, is the state’s primary organisation of wine producers.

It is our mission to provide a unified, strategically influential voice that creates opportunities for the fine wine regions of Western Australia.

Industry Overview

Wine is a major value adding industry with significant regional economic and employment benefits In 2021 22 the total value of the WA wine industry was estimated at over $750 million with a farm gate grape value of $65 million. Regarding market channels, 48% of total value was sold in WA, 44% in eastern Australia and 8% in exports.

The Western Australian wine industry produces about 45 million litres of wine annually representing 4% of the volume of Australia’s wine production but 8.5% of the value.

WA Wine Industry Vision

As outlined in the WA Wine industry Strategic Plan 2014 24, WA producers have a shared vision of:

“a Western Australian wine industry that grows sustainably and profitably, built on the reputation of its great fine wine regions”

The pathway to this vision is a unified and strategical influential industry focused on regional fine wines of provenance and authenticity. Producers and Regional Associations are the custodians of their Regional brand.

Wines of WA Charter

The strategic plan mandates that Wines of WA should, “provide stewardship of the industry” to create opportunities for producers and the fine wine regions of WA.

From an operational point of view, this service is provided through:

• Advocacy and Representation to ensure government, at all levels, understands our industry the benefits we provide to the state economy, particularly in regional WA and the assistance and resourcing we require to further develop our industry. We work to ensure our social license to operate is retained and strengthened. We continue to build strong partnerships with tourism, developing complimentary market development programs. We work raise the stature of our industry so that West Australians are truly proud of our wine industry

• Administration of technical and marketing program funding to provide Regional Associations and producers opportunities to improve business practises and market access.

• Communication to ensure wine industry participants are aware of the issues that affect their businesses, enabling them to make informed decisions on the direction of the industry and their individual businesses.

We look forward to working with Producers and Regional Associations in 2022 23 on developing a sustainable and profitable future for the WA wine industry.

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2019 20 Page | 3

Strategic Priorities 2021 - 22

Priority Priority Issues

INDUSTRY STRUCTURE AND DEVELOPMENT

Build a culture of collaboration with an expectation of success

Support industry development through partnerships and collaboration.

Provide administrative and governance resourcing for partnerships and collaborative projects

Activities and Progress

Amended Wines of WA constitution to ensure regional representation on Board of Directors.

Managed grants on behalf of industry.

Managed/facilitated Committees and working groups.

Managed relationships with state government agencies, Wine Australia, Australian Grape and Wine

MARKET DEVELOPMENT

Strategic regional collaboration driven by energised producers

Secure Export Market Development funding and resources in collaboration with RAs and producers

Build partnerships (government, value chain, allied sectors) to support Regional brand development and increase national and international consumer demand

Facilitated all of industry review of RDE strategic priorities

Managed compliance and administration of Export Growth Partnership including Industry Steering Committee.

Worked with Wine Australia, Austrade/TradeStart, Department of Primary Industries, Tourism WA, Development Commissions, local government and allied sectors to implement EGP

5 year RDE strategic priorities document ratified by all Regions.

SUSTAINABILTY, INNOVATION, RDE&A AND BIOSECURITY

All of industry best practise across the value chain

Smoke taint

Provide administrative and compliance support for Wine Australia funded Regional Program

Supported Regions and producers to manage prescribed burns programs. Built stronger relationships with DBCA and OBRM

In partnership with Department of Primary Industries, Technical Committee implemented programs to address identified challenges through the Wine Australia Regional Program

Monitor new planting material resources and availability

Ensure taxation regime offers best operational environment for WA fine wine producers.

Advocated for policy settings and government support to address identified challenges

Continued to share industry ratified position for further taxation reform with other regions/states.

ADVOCACY AND REPRESENTATION

Lean, proactive, unified and Influential

Ensure legislation and regulation offers best operational environment for WA fine wine producers.

Ensure an enduring social licence for WA wine producers.

Advocated for further amendments to Liquor Control Act; support national advocacy on mandatory labelling requirements; container deposit scheme; COVID restrictions; workforce issues

Worked with Australian Grape and Wine and other state associations to ensure aligned and strong communications/advocacy.

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2021 22 4 | Page

Chairman’s Report

Any reflection on the 2021 22 financial year must include the continuing impact of COVID 19 restrictions. It is easy to forget that unrestricted travel into and out of WA only resumed in March 2022. And following that, travel and movement of goods was more difficult and expensive than it was pre pandemic. This has impacted on many parts of the supply chain including access to temporary labour, servicing intestate and international markets, sourcing inputs and securing logistics to send product to market It is a testament to the resilience and energy of the WA wine industry that we quickly adapted to the rapidly changing operating environment WoWA’s remit is to ensure the best operational environment for WA producers We engaged with state and federal governments and industry stakeholders, ensuring the interests of WA producers were clearly understood.

Despite the requirement to maintain a watching brief on COVID 19 issues for much of 202122, as an industry, we still addressed our key strategic areas of focus

The framework for this is the 2014 24 WA Wine Industry Strategic Plan. The plan was reviewed in June 2021. While the agreed priorities (see below) for the final three years of the plan are simply stated, the impact of achieving them will be significant.

Funding/Partnerships providing ample resources to further drive industry growth and development Efficient, adequately resourced associations

Biosecurity and access to better plant material are key focus areas for projects going forward 100% of WA producers are Sustainable Winegrowing Australia (SWA) certified

The WoWA Board provided direction to executive and key committees to address these priorities working in partnership with Regional

Associations, national bodies and the state government.

The biggest project currently being implemented is the Export Growth Partnership which focuses on growth and diversification of export opportunities for WA producers across scale of production. The alignment of resources and funding achieved has been significant

While the main goal is increased export value and volume, the secondary outputs include increased capacity at regional association level through stronger stakeholder partnerships and more engaged producers.

There is a focus now on securing resources and funding to support RDE priorities as confirmed by the RDE strategic review completed in August 2022. The importance of SWA and how biosecurity is legislated and implemented was confirmed. Access to high quality planting material forms a part of this as is best practise on farm biosecurity.

With clear space to proactively advocate, we are now also providing input to further reform of the WA Liquor Control Act. This is an ongoing process with more work to be done in 2022 23.

Despite the challenges of the previous three years, the opportunities for the fine wine regions of WA are real and significant Consumer demand across a range of markets and wine styles is strong, driving a measured response by producers to these strong market signals to expand vineyards

Our industry is in a good position to grow sustainably and profitably. We now need to collectively set the strategic vision to guide the next ten years. WoWA will support the industry in doing so in 2022 23.

Trevor Whittington Independent Chair

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2021 22 5 | Page

Treasurer’s Report

The 2021-22 Financial Year has been a challenging and complex one for Wines of WA. The Association successfully commenced the Export Growth Partnership (the EGP - known as the WA Wines to the World Program) while continuing to deliver its core services of advocacy and representation, all within the context of an increasingly uncertain economic and political environment.

The Financial Review Committee (FRC) was set up early in the financial year and played a key role in overseeing the financial and risk implications of the EGP.

Overview

The summary of the Association’s income and expenditure is as follows: 20222021 $000's$000's

Operating activities Revenue

APC Producer Grant Funding 262232 Grant administration fees 25 Membership Fee 12 9 Cash Flow Boost 16 Wine Education Centre 10 8 Total Revenue 309265

Operating Expenditure (247)(215) Net Operating Surplus 6250

Grant activities Grant Income 623875 Grant Expenditure (623)(974) Net Grant Income/(Expenditure) (99)

Surplus/(Deficit) for the year 62(49)

Operating activities

Revenue from operating activities totalled $309,000 for the year compared with $265,000 in the prior year, an increase of $44,000. Most of this increase arose from APC Producer Grant Funding, which rose from $232,000 to $262,000 driven by the increase in the total tonnage from Vintage 20 (45,961 tonnes) to Vintage 21 (54,000 tonnes) In addition, the Association earned $25,000 from the administration of various grants during the year.

Overall operating expenditure increased from $215,000 in the prior year to $247,000 in the current year. This increase was due to the increase in various advocacy and representation activities as the remaining COVID 19 restrictions were lifted by the WA Government, together with additional costs for ensuring compliance with various grants.

As a result, the net operating surplus of the association increased from $50,000 to $62,000.

Grant activities

Grant activities comprise income and expenditures that relate specifically to various grant programs and are therefore excluded from Operating activities. Net grant income amounted to $nil compared with a net expenditure of $99,000 in the prior year

Deficit/Surplus for the year

The surplus for the year amounted to $62,000, versus a deficit of $49,000 in the prior year, and the year ending cash and equity positions remained strong at $777,000 and $166,000 respectively

As I am stepping down from my position as Treasurer, I would like to thank Larry, Trevor and the rest of the Board for the amazing support I have received since joining the Board at the beginning of last year. During my tenure there have been a number of interesting and challenging issues to deal with but it was made a lot easier having a dependable team to lean on for support. I would also like to thank Deb Bell who has been instrumental in setting up and maintaining additional processes to accurately record inflows and outflows from grant activities. This has been essential for accurate and timely reporting to provide the Board with an accurate overview to ensure compliance and monitor risk management.

David Bowyer

Treasurer

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2019 - 20 Page | 6

Chief Executive Officer’s Report

As outlined in Strategic Priorities for 2021 - 22 our focus for the year prioritised:

• Assisting Regions to implement strategic plans and secure funding and resources to implement these

• Securing funding and resources to implement programs for international and domestic market development including wine tourism

• Ensuring legislation and regulation offers the best operational environment for WA fine wine producers and a secure, enduring social licence for WA wine producers

• Addressing RD&E priorities through the WA wine technical committee, leveraging federal and state government agencies funding and resources

The key activities to achieve these aims were, Advocacy, Representation, Administration and Communication

Advocacy

In 2021 22, Wines of Western Australia advocated for the industry on the following issues:

• Continued engagement with the state government and Wine Australia to align Export Growth Partnership (EGP) resources to support export market development for WA wine producers In 2021 22, a total of $441,000 of state funding and $384,000 of federal funding was leveraged with $274,00 WA producers’ funding In total, an investment of $1.09 million to build strong and diverse export markets

• Developed a position paper for Liquor Control Act Reform process. To be submitted in October 2021

• Worked with all Regional Associations and the Department of Biodiversity Conservation and Attractions establishing late season burn off

protocols to ensure late harvested fruit was not affected by prescribed burning

• Worked at state and federal level to ensure that COVID 19 related restrictions were implemented with minimal impact on WA wine producers and ensuring continuity of operations during 2022 vintage, noting COVID restrictions were still in place

• Worked at state and federal level to ensure access to temporary workforce for 2022 vintage and winter vineyard operations

• Worked with DPIRD and AGW to manage confirmation of Graper Vine Red Blotch Virus in WA.

Representation

In 2021 22, Wines of Western Australia engaged the following government and industry bodies on the following issues:

• Minister for Agriculture and the Department of Primary Industries and Regional Development and Minister for Tourism and Tourism WA, advocating for increased alignment of funding for market development, wine tourism and industry development

• Department of Racing Gaming and Liquor to maintain direct communication links on issues affecting WA wine producers

• Liaised with government agencies (liquor licensing, tourism, primary industries) on a range of COVID 19 issues

• Maintained strong links with Australian Grape and Wine attending (AGW) State Association meetings, Small Winemaker Committee meetings and providing WA input to national advocacy processes

• Maintained strong links with Wine Australia Planned visit to WA by incoming executive team in August 2022

Administration

In 2020 12, Wines of WA administered the following projects on behalf of the WA wine industry:

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2019 20 Page | 7

• Worked with APC administration and Wine Producers’ Committee to refine collection process for FFS collection on the 2020 vintage

• Project management/compliance of the EGP with State Government, Wine Australia, Austrade and Regional Development Commissions

• Administration of the Wine Australia Regional Program in partnership with Department of Primary Industries and Regional Development

• Management of the WA Wine Technical Committee

• Negotiated terms for the WA wine industry service agreement with Australia Post

• Negotiated terms for the WA wine industry co-membership arrangement with CCIWA

Communication

In 2021 - 22, we continued our regular communications strategy including

• A weekly e-newsletter which provides non time sensitive information.

• Regular updates

• For urgent, critical information, members receive an email, text message or phone call directly from me

• Eye to eye on a regular basis to share a coffee or a glass wine, depending on the time of day, discussing what you feel are the key issues affecting your business and region Maintain www.winewa.asn.au as a highly ranked landing site for consumers and tourists and a resource for WA wine producers via assets listed below:

• the localista searchable database was linked directly to the Australian Tourism Data Warehouse which feeds into Australia.com, Tourism Australia’s consumer facing platform

• the Wine Adventurer guide to the fine wine regions of WA

• the Wine Exportal, a one stop information shop for WA producers

Human Resources

Wines of WA has one employee however, through contracted professional services and formalised working groups, our capacity to deliver value through the fee for service model has been greatly enhanced

We currently have the following contracted service providers:

• Trevor Whittington as Independent Chair

• Hydra Consulting as Project Manager of the EGP

• Robin Birch as Communications Consultant

We currently have the following Industry Working Groups:

• Wines of WA Technical Committee which provides oversight of the Wine Australia Regional Program other RDE&A activities and biosecurity issues for WA producers

• Liquor Licence Act Working Group which developed a submission to the Agency on further reforms to the Act to support WA wine producers

• RDE Working Group which is developing a business case for further support and resourcing from Wine Australia and DPIRD to address RDE strategic priorities

• Export Growth Partnership Industry Steering Committee Comprised of the WoWA CEO, industry representatives and DPIRD, this working oversees and approves the EGP program developed by Hydra Consulting

• Financial Review Committee (FRC) Comprised of the WoWA Executive Committee and Board members, the FRC provides oversight of WoWA’ grant funding financial commitments

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2019 - 20 Page | 8

National Representation

It is important that WA continues to provide energised and capable people at a national representative level to ensure our state issues are understood and addressed. In 2021 22, WoWA facilitated the following input at national level.

Australian Grape and Wine

Western Australian Board representatives were:

• Penny Dickeson (Small Winery Membership Committee)

• Larry Jorgensen WoWA (Small Winery Membership Committee)

Penny is Estate Manager for Cape Mentelle

Wine Australia

Cath Oates continued as a Board member of Wine Australia in 2021 22 and is Deputy Chair.

In addition to these formalised positions, Wines of WA has continued to strengthen our relationships with other State and Regional organisations. We will continue to communicate and collaborate with our inter state partners to advocate collectively where common interests exist.

In closing, I wish to acknowledge the contribution and support of the following people:

• Regional Association Committees who have provided input to the development of policies and programs to support industry development.

• Producers who have provided input to the development of policies and programs to support industry development.

• The Wines of WA Technical Committee, and specifically, Chair Lee Hasselgrove, Jim Campbell Clause, David Botting, Steve Partridge Richard Fennessy and Andrew Taylor.

• The Wines of WA Board of Directors, and specifically, Independent Chair, Trevor Whittington.

• Treasurer David Bowyer. David will retire from the Treasurer’s position at the AGM. His methodical, attention to detail custodianship of WoWA finances has set in place a solid framework to manage grant funding compliance. All delivered with grace, patience and humility.

Larry Jorgensen Chief Executive Officer

November 16 2022

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2019 20 Page | 9

APC Collection Report

The WA wine industry again utilised the fee for service APC funding model for the 2021 22 financial year. The fees were affected against the 2021 vintage. A fee per tonne was collected from the owner of the fruit at crush and distributed to Wines of WA to provide statebased services and to Regional Associations based on the GI origin of the fruit to provide regionally based services

The aggregated budgeted revenue from APC collections for 2021 - 22 was $702,750, based on a 55,000 tonne vintage. The final reported amounts at 30 June 2021 were $628,950 and 54,000 tonnes. This represents 90% of budgeted revenue and 98% of projected volume WoWA APC income was budgeted to be $280,000 with $261,500 collected. See APC Budget and the audited financial report in appendices.

Margaret River produces 58% of state volume and Great Southern 23%. The remaining 19% is comprised of Swan Valley (7%), Southern Forests (5%), Geographe (5%) Blackwood Valley (2%), Perth Hills (1%) and Peel (.1%).

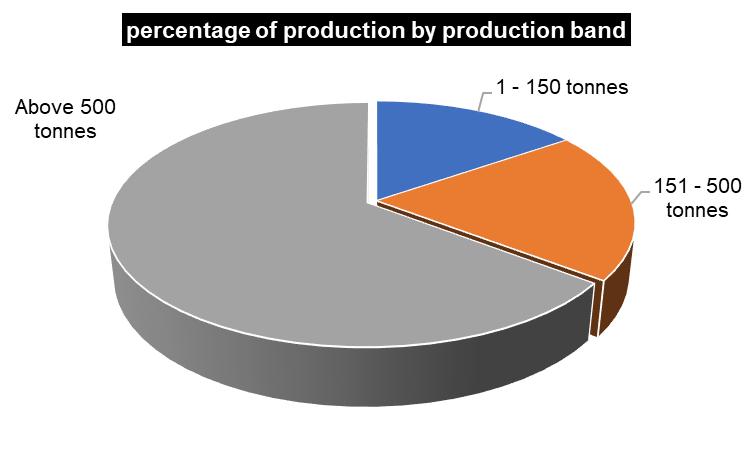

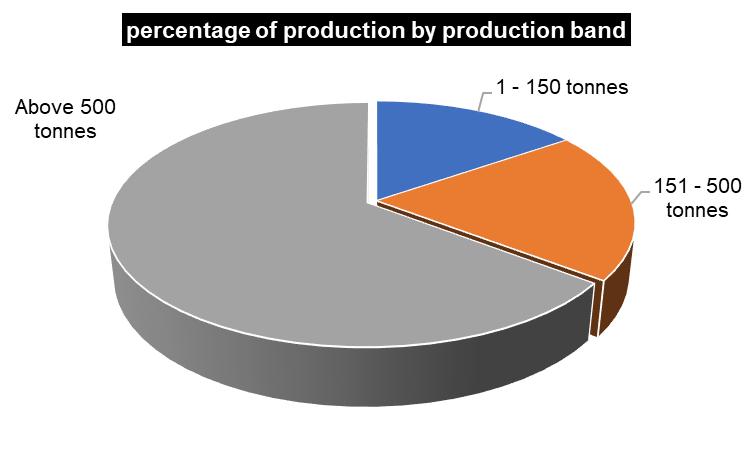

In total, 315 producers provided return forms for payment with a further 96 lodging “nil” returns Nil returns are attributable to the impact of smoke taint events, weather events and other factors which impact vineyards, annual production decisions to balance inventory and the variety of business models that exist. The number of producers skews towards under 150 tonnes at 81%. The share of aggregated production skews toward over 500 tonnes at 65%.

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2019 20 Page | 10

Industry Production Data

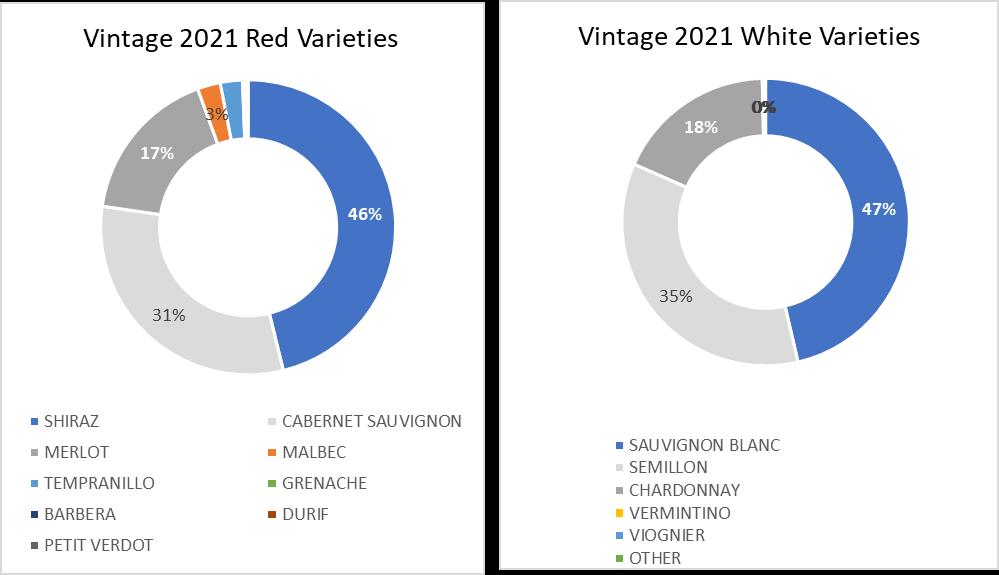

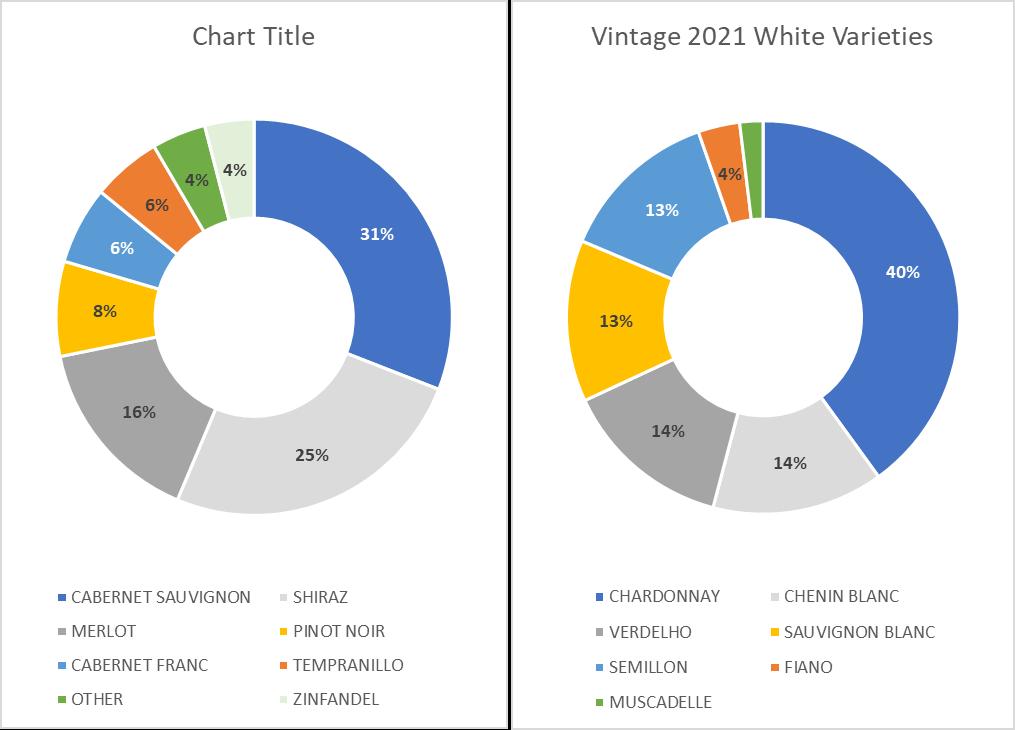

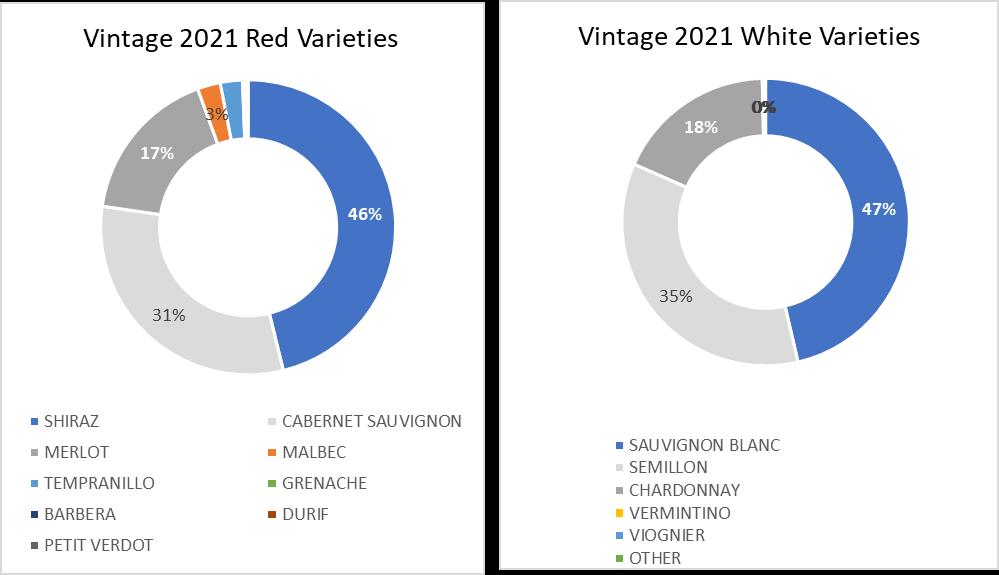

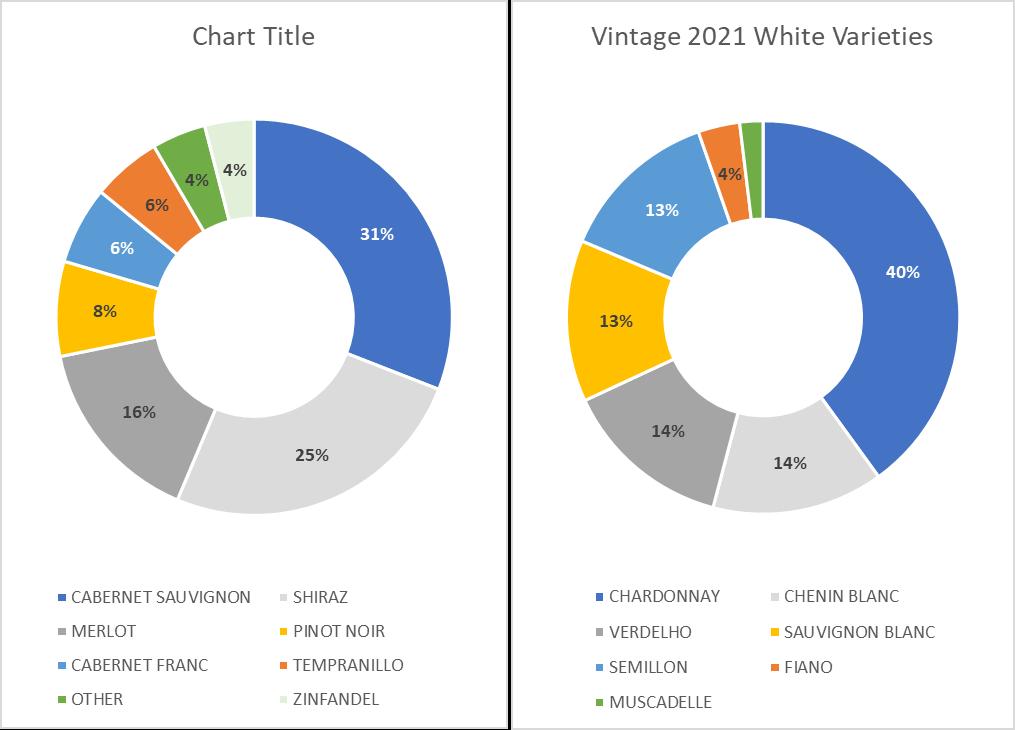

A significant benefit arising from the APC collection is resulting production data. Information collected via the process includes GI origin of fruit by variety. This provides an accurate snapshot of production capacity and will be invaluable to producers in dtermining how to structure their business to best meet market demand State level summary data follows.

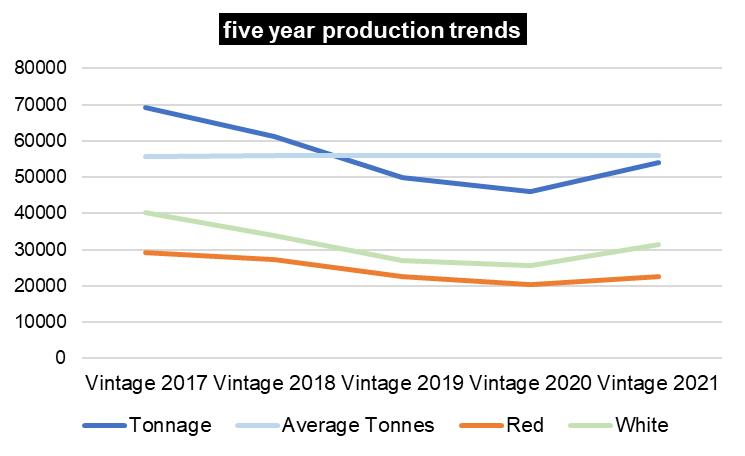

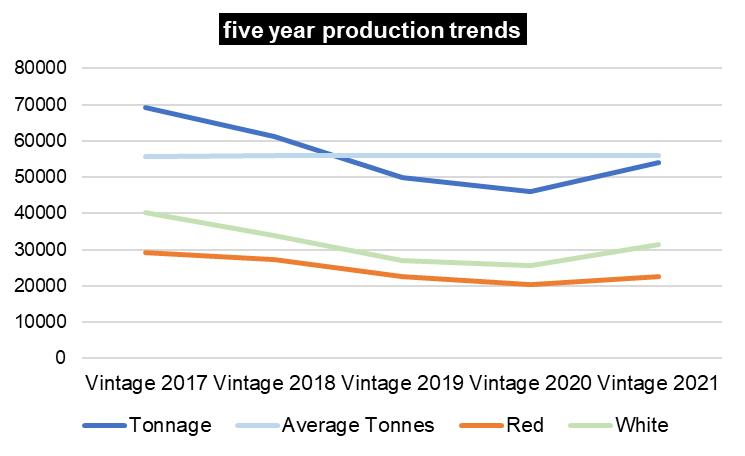

Average production over the five-year period from 2017 – 21 is 56,000, noting 2019 and 2020 vintages were weather affected resulting in sub 50,000 tonne vintages. The 2017 vintage can be considered an outlier also at 69,000 tonnes

Vineyard area of 11,700 hectares was confirmed via satellite scan and subsequent ground truthing in 2016.

Production is skewed towards white production at 56% of production.

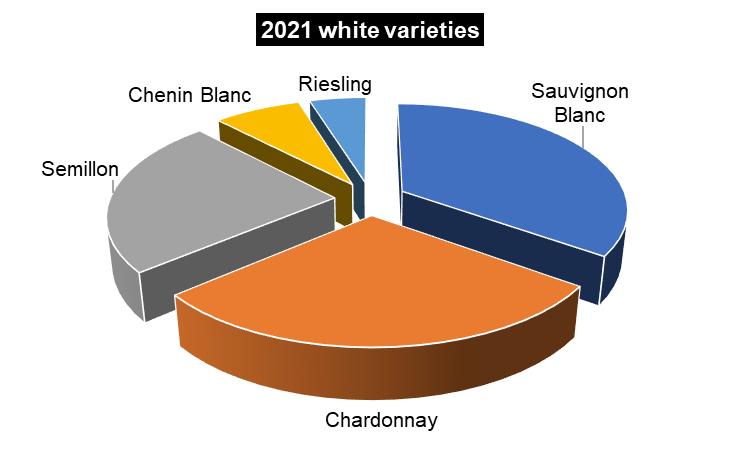

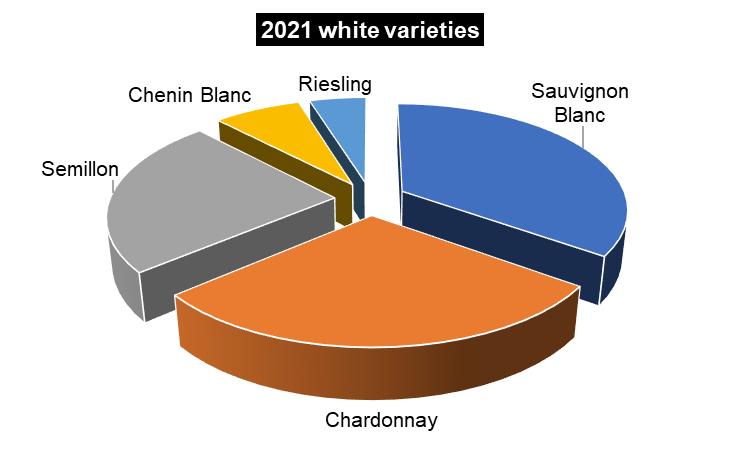

In 2021, the top five white varieties in order of volume were, Sauvignon Blanc, Chardonnay, Semillon, Chenin Blanc and Riesling.

The top five red varieties were Cabernet Sauvignon, Shiraz, Merlot, Pinot Noir and Malbec, noting Tempranillo and Grenache are similar in volume to Malbec.

The full report by region is available in the appendices

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2019 - 20 Page | 11

Member Benefits

Advocacy and support

The primary role of Wines of WA is to represent the interests of WA wine producers.

Access to Export Growth Partnership

All FFS paying producers can participate in EGP programs

Weekly Industry Update

Wines of WA provides access to essential information for WA wine producers through weekly emails

Australia Post

Membership entitles access to the Wines of WA alliance with Australia Post whereby members can take advantage of specialised wine handling and delivery services at significantly reduced prices in both the domestic and overseas markets.

Chamber of Commerce and Industry, WA (CCIWA)

Membership permits access to the dual Wines of WA / CCI membership agreement. This provides members with access to the full range of CCI member benefits including: advice and assistance on industrial relations, workplace agreements, worker’s compensation, occupational safety and health, industry training, trade, environmental compliance and more.

Localista listing on Wines of WA website

All FFS paying producers are listed for free on the Wines of WA website Localista searchable data base. The list is searchable by a number of criteria and is a useful online tool for wine tourists visiting the fine wine regions of WA.

Affiliate Membership Benefits

Affiliate members receive the following benefits:

• Receive regular issues of the WoWA Enewsletter and keeping up to date with all the latest wine industry news

• Access and notification to networking events and workshops with WOWA wine producers and growers

• Access to WA wine industry Australia Post parcel rates,

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2019 - 20 Page | 12

Research Development and Extension

Technical Committee

The Wines of WA Technical Committee oversees the development and implementation of the Wine Australia Regional Program for WA. The Program provides grants based funding for R&D projects with specific regional relevance.

The Committee also reviews:

• biosecurity

• water security

• resource management

• biosecurity issues

Committee Members for 2021 - 22 were:

Lee Hasselgrove – Mure Viticulture (Chair)

Jim Campbell Clause – AHA Viticulture

Dave Botting – Burch Family Wines

Con Simos – AWRI

Andrew Taylor - DPIRD

Jeremy Galbreath - Curtin University

Richard Fennessy – DPIRD

Keith Pekin – Perth NRM

Michael Considine – UWA

Larry Jorgensen – Wines of WA

Wine Australia Regional Program

The Regional Program is funded through Wine Australia. In each year, the Technical Committee identifies key issues using the RDESP to focus on priority issues to be addressed through extension programs.

Program administration is provided by WoWA. DPIRD provides project management through Richard Fennessy.

The 2021 22 program report is included in the appendices

RD&E 5 Year Strategic Plan

In July 2021, the Wines of WA facilitated a strategic planning session to identify the RD&E strategic priorities over the next 5 years. The 2021 – 26 WA Wine industry RD&E Strategic Priorities Plan (RDESP) is included in the appendices and is available on the Wines of WA website in the Technical Section

The process included a one day workshop attended by WA producers, regions, DPIRD, Wine Australia and other stakeholders

The RDESP is the guiding document in determining what issues are addressed by industry through research and extension in partnership with state and federal government agencies. The priorities identified were:

1. Understanding the intricacies of provenance and the fine wine regions of WA

2. Rapid access to new genetic plant material

3. Supporting WA producers to adopt Sustainable Winegrowing Australia (SWA)

4. Supporting WA producers to adopt on farm biosecurity practises

5. Declining vineyard yields

6.Low adoption rate of RDE in WA

A summary of outputs and strategic priorities is included in the appendices

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2019 - 20 Page | 13

Market Development

Export Growth Partnership

The Export Growth Partnership (EGP), with the customer facing project name, “WA Wines to the World” was initiated in 2021 - 22. The EGP is a five year partnership between the WA wine industry and the State government. Each partner will contribute $3 million dollars to support export market development and growth activities.

The aims are:

-to double the value of wine exported from WA to over $100 million, increase the average price per litre to over $12, increase the number of WA producers who are successfully and profitably exporting and

-Align investment and resources in international wine marketing, promotion, media and wine tourism to maximize profile and sales outcomes for WA fine wines

Pre program work completed in 2020 21 identified target markets, priority activities and strengthening relationships with key partners including Austrade, Wine Australia and state government overseas trade offices

The key markets currently are UK, USA, Singapore, Japan, Hong Kong, Canada and South Korea. As the program evolves, the focus will change through an industry led strategic review of opportunities

Given COVID restrictions on travel were in place in WA until March 2021, activities up to borders reopening focused on virtual engagement with customers and consumers in priority markets.

When international borders did open in late May 2022, the EGP supported Margaret River region

participated in the Aspen Food and Wine Classic as part of a collaborative project supported by Austrade, Wine Australia, Wine Victoria and South Australia Department of Trade and Investment

Other activities which leveraged funding and resources included:

-Regionally focused tastings in Japan, UK, USA, Canada and Hong Kong

-Support for WA producers to participate in the Wine Australia USA market entry program

Support for WA producer and regions to purchase space on Australian Wine Connect

Support for the Great Southern region to develop an Australian Wine Discovered educational module in partnership with Wine Australia

Collaboration with Austrade/Tradestart and TWA to implement a new to market program into the UK.

A full review of program activities and outcomes for 2021-22 is included in the appendices of this report.

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2019 - 20 Page | 14

Wines of WA Board of Directors 2021-22

Board Position

Skills Based Independent Chair

Trevor Whittington

Producer Under 150 TonnesLiz Maiorana – South by South West Wines

Producer 151 1000 Tonnes - Cameron Rhodes Fermoy Estate

Producer Over 1000 Tonnes Franklin Tate – Franklin Tate Estates

Regionally Appointed Perth Hills/Peel/Swan Valley (note one vote for this shared position)

Josh Davenport – Myattslfield Vineyard

Garth Cliff – Vino Volta

Regionally Appointed GeographeRyan Gibbs – Aylesbury Estate

Regionally Appointed Margaret River (note one vote for each regionally appointed position)

Liz Mencel – Margaret River Wine Association (retired April 2022)

Amanda Whiteland - Margaret River Wine Association

Regionally Appointed Blackwood Valley/Southern Forests (note one vote for this shared position) Andrew Mountford – Mountford Wines Craig Nield – Beulah Wines

Regionally Appointed Great Southern Tom Wisdom – Plantagenet

Skills Based Treasurer

David Bowyer

Skills Based -

Mike Calneggia – Calneggia Family Vineyards

Executive - Chief Executive Officer

Larry Jorgensen – Wines of WA

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2021 - 22 15 | Page

Wines of WA Board of Directors 2021-22

Schedule of Meeting Attendance and Summary of Terms

Board Position Appointment/ Retirement Date Jul Aug Sept Oct AGM Nov Dec Jan Feb Mar Apr May Jun

Skills Based Independent Chair

Trevor Whittington

Producer Under 150 Tonnes

David Mazza - Mazza Wines

Re appointed December 2020 P P P P P P P P P P P P P

Appointed to 2nd Term October 2019 Retired at 2021 AGM P A A A P P N/A N/A N/A N/A N/A N/A N/A

Livia Maiorana South by South West Appointed to 1st Term December 2021 N/A N/A N/A N/A A N/A N/A P P A P P P

Producer 151-1000 Tonnes

Cameron Rhodes Fermoy Estate Appointed to 1st term April 2021 P P P P P P P P P P P P P

Producer Over 1000 Tonnes

Mike Calneggia – Calneggia Family Vineyards

Appointed to 1st term December 2019 to 1st term December 2019 Retired at 2021 AGM

P 11:35 am - 12 pm

A P P A A P N/A N/A N/A P P A

Franklin Tate Tate Family Vineyards Appointed to 1st term December 2021 N/A N/A N/A N/A P N/A N/A P P P P P P

Perth Hills/Peel/Swan Valley

Josh Davenport Myattsfield

Appointed to 1st term November 2020 A A A P P P P A A A P P A

Appointed to 1st term October 2020 P A A P P P P A A P P P A Geographe Ryan Gibbs Aylesbury Estate Appointed to 1st term October 2020 A P A A P P A A A A P P P

Garth Cliff Vino Volta

Margaret River

Liz Mencel – Margaret River Wine Association Appointed to 2nd tern October 2020 P P P P A P P P P P P N/A N/A

Amanda Whiteland Margaret River Wine Association Appointed to 1st term October 2019 P P P A P P P P P P P P P

Southern Forests/ Blackwood Valley

Andrew Mountford/Mark Aitken/Monica Radomaljic Mountford Wines

Craig Nield Beluah Wines

Great Southern Tom Wisdom Plantagenet

Skills Based

Mike Calneggia – Calneggia Family Vineyards

Appointed to 1st term November 2021 N/A N/A N/A N/A P (MA) N/A P (MA) A A P (MR) P (MR) A A

Appointed to 1st term November 2020 A A A A A A P A P P A P P

Appointed to 2nd term October 2020 P P A A A P P P P A P P P

Appointed November 2021 N/A N/A N/A N/A N/A N/A N/A P A P P P A

Rob Mann - Corymbia Appointed to 1st term December 2018 Retired November 2021 P P A A A A N/A N/A N/A N/A N/A N/A N/A

Skills Based - Treasurer

David Bowyer Fenrgrove

Executive - Chief Executive Officer

Larry Jorgensen Wines of WA

P

Appointed January 2021 P P P P P P P P P A P P P

Originally appointed May 2013 Contract re confirmed March 2021 P P P P P P P P P P P P P

Meeting Notes

Present A Absent N/A Not Applicable

2021 – 22 Wines of WA APC Budget

WINES OF WESTERN AUSTRALIA ANNUAL REPORT 2021 - 22 16 | Page

The Committee members

Wine Industry Association of Western Australia Inc. Bentley Delivery Centre Locked Bag 4 Sort Bin 27 Bentley DC WA 6983

Dear Committee Members, AUDIT MANAGEMENT LETTER FOR THE YEAR ENDED 30 JUNE 2022

Following the completion of our final audit of Wine Industry Association of Western Australia Inc. for the year ended 30 June 2022, we have not identified any significant areas where improvement in procedures could be made or matters were noted which we feel should be considered by management.

Our test work was conducted on a sample basis and as such may not necessarily include all matters that exist within the systems.

Accordingly, our comments are not intended to cover all aspects of the Association’s internal controls and accounting systems and are limited to those matters that arose from our normal audit procedures.

We appreciate the opportunity to be of service to you and take this opportunity to thank your staff for their assistance and co operation during the course of our audit.

If you have any queries in respect of the report, please do not hesitate to contact us.

Yours faithfully

Viral Patel, CA, CPA

Registered Company Auditor number 333615

Director Australian Audit

Wine Industry Association of Western Australia Inc. ABN 23 095 700 543 Special Purpose Financial Report - 30 June 2022

Wine Industry Association of Western Australia Inc. Contents

30 June 2022

Committee's declaration 2

Committee's report 3

Auditor's independence declaration 4

Independent auditor's report to the members of Wine Industry Association of Western Australia Inc. 5

Statement of profit or loss and other comprehensive income 8

Statement of financial position 9

Statement of changes in equity 10

Statement of cash flows 11

Notes to the financial statements 12

General information

The financial statements cover Wine Industry Association of Western Australia Inc. as an individual entity. The financial statements are presented in Australian dollars, which is Wine Industry Association of Western Australia Inc.'s functional and presentation currency.

Wine Industry Association of Western Australia Inc is a not-for-profit incorporated association, incorporated and domiciled in Australia. Its registered office and principal place of business is:

Unit 3, 14 Brodie Hall Drive Bentley 6102

A description of the nature of the incorporated association's operations and its principal activities are included in the Committee's report, which is not part of the financial statements.

The financial statements were authorised for issue on 10 November 2022.

1

Wine Industry Association of Western Australia Inc.

Committee's declaration 30 June 2022

In the sole Committee's opinion:

• the incorporated association is not a reporting entity because there are no users dependent on general purpose financial statements. Accordingly, as described in note 1 to thefinancial statements, the attached specialpurpose financial statements have been prepared for the purposes of complying with the Western Australian legislation the Associations Incorporation Act 2015 and associated regulations;

• the attached financial statements and notes comply with the Accounting Standards as described in note 1 to the financial statements;

• the attached financial statements and notes give a true and fair view of the incorporated association's financial position as at 30 June 2022 and of its performance for the financial yearended on that date; and

• there are reasonable grounds to believe that the incorporated association will be able to pay its debts as and when they become due and payable.

Name: Larry Jorgensen Position: CEO

10 November 2022

Name: David Bowyer Position: Treasurer

2

Wine Industry Association of Western Australia Inc.

Committee's report 30June 2022

The sole Committee presents his report, together with the financial statements, on the incorporated association for the yearended30 June2022.

Committee members

The followingpersons were committeemembers of the incorporatedassociationduring thewhole of thefinancial year and up to the date of this report, unless otherwise stated:

Trevor Whittington Independent Chair Re-appointed December 2020

David Bowyer Treasurer Appointed January 2021

Larry Jorgensen - CEO Originally appointed May 2013 (Contract re-confirmed March 2021)

Rob Mann Appointed to 1st term December 2018 ;Retired November 2021

David Mazza Appointed to 2nd Term October 2019; Retired November 2021

Mike Calneggia Appointed to 1st term December 2019; Retired November 2021

Cameron Rhodes Appointed to first termApril 2021

Amanda Whiteland Appointed to 1st term October 2019

Liz Mencel -Appointed to 2nd term October 2020; Retired May 2022

Livia Maiorana -Appointed to 1st Term December 2021

Tom Wisdom Appointed to 2nd term October 2020

Ryan Gibbs Appointed to 1st term October 2020

Franklin Tate Appointed to 1st term December 2021

Garth Cliff Appointed to pt term October 2020

Josh Davenport Appointed to 1st term November 2020

Radomaljic Appointed to 1st term November2021

Craig Nield Appointed to 1st term November 2020

Mike Calneggia Appointed November2021 to skills- based position

Andrew Mountford-Appointed to 1st term November 2021

Principal activities

During the financial year the principal continuing activities of the incorporated association consisted of:

• Advocacy to confirm government, at all levels, understands the wine industry and also ensure the value of the wine industry is clearly understood by government, the community and other complimentary industry sectors.

• Administration of technical and marketing program funding to provide Regional Associations and producers access to opportunities to improve business practices and market access.

• Communication to ensure wine industry participants are aware of the issues that may affect their businesses.

Operating Result

The Surplus for the year ended 30June 2022 was$62,396 {2021:Deficit of$48,511)

Name: Larry Jorgensen

Position: CEO

10 November 2022

Name: David Bowyer

Position: Treasurer

3

AUDITOR’S INDEPENDENCE DECLARATION TO THE MEMBERS OF WINE INDUSTRY ASSOCIATION OF WESTERN AUSTRALIA INC

I declare that, to the best of my knowledge and belief, during the year ended 30 June 2022 there has been:

(i) no contraventions of the auditor independence requirements of the Associations Incorporation Act 2015 (WA);

(ii) no contraventions of any applicable code of professional conduct in relation to the audit.

Dated this 11th day of November 2022 Perth, Western Australia

Viral Patel, CA, CPA

Registered Company Auditor number 333615 Director Australian Audit

Directors: robert campbell RCA, CA Viral patel RCA, CA alastair abbott RCA, CA chassey DaViDs RCA, CA PO BOx 7465, ClOisteRs squARe PO, WA 6850 | level 8, 251 st GeORGes teRRACe, PeRth, WA 6000 (08)9218 9922 | infO@AusAudit COm Au | WWW AustRAliAnAudit COm Au | ABn: 63 166 712 698

Liability limited by a scheme approved under Professional Standards Legislation

Trade mark of Chartered Accountants Australia and New Zealand and used with permission

4

Directors:

robert campbell RCA, CA

Viral patel RCA, CA alastair abbott RCA, CA chassey DaViDs RCA, CA

INDEPENDENT AUDITOR’S REPORT

To the members of Wine Industry Association of Western Australia Inc. Report on the Audit of the Financial Report

Opinion

We have audited the special purpose financial report of Wine Industry Association of Western Australia Inc. (the Entity), which comprises the statement of financial position as at 30 June 2022, the statement of income and expenditure, statement of changes in equity and statement of cash flows for the period then ended, and notes to the financial statements, including a summary of significant accounting policies and the statement by the Members of the Committee.

In our opinion the accompanying financial report has been prepared in accordance with requirements of the Associations Incorporation Act 2015 (WA) including:

a) giving a true and fair view of the Entity’s financial position as at 30 June 2022, and of its financial performance and its cash flows for the period then ended; and b) complying with Australian Accounting Standards to the extent described in Note 1.

Basis for Opinion

We conducted our audit in accordance with Australian Auditing Standards. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Report section of our report. We are independent of the Entity in accordance with the ethical requirements of the Accounting Professional and Ethical Standards Board’s APES 110 Code of Ethics for Professional Accountants (the Code) that are relevant to our audit of the financial report in Australia. We have also fulfilled our other ethical responsibilities in accordance with the Code.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Emphasis of Matter – Basis of Accounting

We draw attention to Note 1 to the financial report, which describes the basis of accounting. The financial report has been prepared to assist the Entity to meet the requirements of the Associations Incorporation Act 2015 (WA). As a result, the financial report may not be suitable for another purpose. Our opinion is not modified in respect of this matter.

Responsibilities of Management and Those Charged with Governance for the Financial Report

Management is responsible for the preparation and fair presentation of the financial report and have determined that the basis of preparation described in Note 1 to the financial report is appropriate to meet the requirements of the Associations Incorporation Act 2015 (WA) and the needs of the

POBOx 7465, ClOisteRs squARe PO, WA6850| level 8,251 st GeORGes teRRACe, PeRth,WA6000 (08)9218 9922 | infO@AusAudit COm Au | WWW AustRAliAnAudit COm Au | ABn: 63 166 712 698 ,WA 6000 (08)92189922| AB : 63166

Liability limited by a scheme approved under Professional Standards Legislation

Trade mark of Chartered Accountants Australia and New Zealand and used with permission

5

members. The responsibility of Management also includes such internal control as management determines is necessary to enable the preparation and fair presentation of a financial report that is free from material misstatement, whether due to fraud or error.

In preparing the financial report, management is responsible for assessing the Entity’s ability to continue as a going concern, disclosing, as applicable, matters relating to going concern and using the going concern basis of accounting unless management either intends to liquidate the Entity or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Entity’s financial reporting process.

Auditor’s Responsibilities for the Audit of the Financial Report

Our objectives are to obtain reasonable assurance about whether the financial report as a whole is free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with the Australian Auditing Standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of this financial report.

As part of an audit in accordance with Australian Auditing Standards, we exercise professional judgment and maintain professional scepticism throughout the audit. We also:

• Identify and assess the risks of material misstatement of the financial report, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Entity’s internal control.

• Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

• Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Entity’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial report or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Entity to cease to continue as a going concern.

6

• Evaluate the overall presentation, structure and content of the financial report, including the disclosures, and whether the financial report represents the underlying transactions and events in a manner that achieves fair presentation.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

Viral Patel, CA, CPA

Registered Company Auditor number 333615 Director

Australian Audit

Date: 11 November 2022 Perth, Western Australia

7

Wine Industry Association of Western Australia Inc.

Statement of profit or loss and other comprehensive income

For the year ended 30 June 2022

Note 2022 2021 $ $

Revenue

Grant and Project Income 3 648,489 874,512

APC Producer Grant Funding 262,000 232,000 Membership Fee 12,485 9,386 Cash Flow Boost 16,110 Interest Income 10 105 Other income 3,520Wine Education Centre 10,227 7,928 936,731 1,140,041

Total revenue 936,731 1,140,041

Expenses

Grant Expenses 4 (623,489) (142,215) IWTG Expenses 5 (832,416) Employee Benefit 6 (143,015) (143,589) Accounting Fee (23,340) (6,080) Insurance (2,407) (3,429) Memberships (16,809) (4,752)

Representation and Consultants (27,178) (27,364) Computer Maintenance and Supplies (733) (2,569) Communication and PR (2,200) (1,556) Occupancy (5,665) (6,695) Administration (4,072) (2,788) MV Allowance (6,000) (923) Travel and Accomodation (4,880) (1,588) Venue Hire and Meeting (1,843) (407) WEC Expense (6,451) (5,233) Other expenses (4,786) (5,718) Finance costs (1,467) (1,230) Total expenses (874,335) (1,188,552)

(Deficit)/Surplus for the year attributable to the members of Wine Industry Association of Western Australia Inc. 15 62,396 (48,511)

Other comprehensive income for the year - -

Total comprehensive income for the year attributable to the members of Wine Industry Association of Western Australia Inc. 62,396 (48,511)

The above statement of profit or loss and other comprehensive income should be read in conjunction with the accompanying notes 8

Wine Industry Association of Western Australia Inc.

Statement of financial position

As at 30 June 2022

Note 2022 2021 $ $

Assets

Current assets

Cash and cash equivalents 7 776,698 285,561 Trade and other receivables 8 38,191 76,307 Total current assets 814,889 361,868

Non-current assets

Property, plant and equipment 9 1,832 1,832 Intangibles 10 2 2 Total non-current assets 1,834 1,834

Total assets 816,723 363,702

Liabilities

Current liabilities

Trade and other payables 11 54,578 4,926 Contract liabilities 12 554,625 220,915 Borrowings 13 6,660 2,935 Provisions 14 34,295 30,757 Total current liabilities 650,158 259,533

Total liabilities 650,158 259,533

Net assets 166,565 104,169

Equity Retained surpluses 15 166,565 104,169

Total equity 166,565 104,169

The above statement of financial position should be read in conjunction with the accompanying notes 9

Wine Industry Association of Western Australia Inc.

Statement of changes in equity

For

the

year ended 30 June 2022

Issued Retained capital Reserves surplus Total equity $ $ $ $

Balance at 1 July 2020 152,680 152,680

Deficit for the year (48,511) (48,511) Other comprehensive income for the year

Total comprehensive income for the year (48,511) (48,511)

Balance at 30 June 2021 104,169 104,169

Issued Retained capital Reserves surplus Total equity $ $ $ $

Balance at 1 July 2021 104,169 104,169

Surplus for the year 62,396 62,396 Other comprehensive income for the year

Total comprehensive income for the year 62,396 62,396

Balance at 30 June 2022 166,565 166,565

The above statement of changes in equity should be read in conjunction with the accompanying notes 10

Wine Industry Association of Western Australia Inc.

Statement of cash flows

For the year ended 30 June 2022

Note 2022 2021 $ $

Cash flows from operating activities

Receipts from customers

Payments to suppliers and employees

Interest received

Net cash generated/(used in) from operating activities

Cash flows from investing activities

Payments for property, plant and equipment

Net cash used in investing activities

Cash flows from financing activities

Repayment of borrowings

Hire Purchase

Net cash used in financing activities

Net increase/(decrease) in cash and cash equivalents

Cash and cash equivalents at the beginning of the financial year

Cash and cash equivalents at the end of the financial year

1,295,488 891,562 (804,361) (1,187,980) 10 104

17 491,137 (296,314) 9 (1,832) (1,832) 1,538 (10,619) (9,081) 491,137 (307,227) 285,561 592,788

7 776,698 285,561

The above statement of cash flows should be read in conjunction with the accompanying notes 11

Wine Industry Association of Western Australia Inc.

Notes

Note 1. Significant accounting policies

to the financial statements 30 June 2022

The principal accounting policies adopted in the preparation of the financial statements are set out below. These policies have been consistently applied to all the years presented, unless otherwise stated.

New or amended Accounting Standards and Interpretations adopted

The incorporated association has adopted all of the new or amended Accounting Standards and Interpretations issued by the Australian Accounting Standards Board ('AASB') that are mandatory for the current reporting period.

Any new or amended Accounting Standards or Interpretations that are not yet mandatory have not been early adopted.

Basis of preparation

In the sole Committee's opinion, the incorporated association is not a reporting entity because there are no users dependent on general purpose financial statements.

These are special purpose financial statements that have been prepared for the purposes of complying with the Western Australian legislation the Associations Incorporation Act 2015 and associated regulations. The Committees have determined that the accounting policies adopted are appropriate to meet the needs of the members of Wine Industry Association of Western Australia Inc..

These financial statements have been prepared in accordance with the recognition and measurement requirements specified by the Australian Accounting Standards and Interpretations issued by the Australian Accounting Standards Board ('AASB') and the disclosure requirements of AASB 101 'Presentation of Financial Statements', AASB 107 'Statement of Cash Flows', AASB 108 'Accounting Policies, Changes in Accounting Estimates and Errors', AASB 1048 'Interpretation of Standards' and AASB 1054 'Australian Additional Disclosures', as appropriate for not-for profit oriented entities.

Historical cost convention

The financial statements have been prepared under the historical cost convention, except for, where applicable, the revaluation of financial assets and liabilities at fair value through profit or loss, financial assets at fair value through other comprehensive income, investment properties, certain classes of property, plant and equipment and derivative financial instruments.

Critical accounting estimates

The preparation of the financial statements requires the use of certain critical accounting estimates. It also requires management to exercise its judgement in the process of applying the incorporated association's accounting policies. The areas involving a higher degree of judgement or complexity, or areas where assumptions and estimates are significant to the financial statements, are disclosed in note 2.

Revenue recognition

The incorporated association recognises revenue as follows:

Revenue from contracts with customers

Revenue is recognised at an amount that reflects the consideration to which the incorporated association is expected to be entitled in exchange for transferring goods or services to a customer. For each contract with a customer, the incorporated association: identifies the contract with a customer; identifies the performance obligations in the contract; determines the transaction price which takes into account estimates of variable consideration and the time value of money; allocates the transaction price to the separate performance obligations on the basis of the relative stand-alone selling price of each distinct good or service to be delivered; and recognises revenue when or as each performance obligation is satisfied in a manner that depicts the transfer to the customer of the goods or services promised.

12

Wine Industry Association of Western Australia Inc.

Notes to the financial statements 30 June 2022

Note 1. Significant accounting policies (continued)

Variable consideration within the transaction price, if any, reflects concessions provided to the customer such as discounts, rebates and refunds, any potential bonuses receivable from the customer and any other contingent events. Such estimates are determined using either the 'expected value' or 'most likely amount' method. The measurement of variable consideration is subject to a constraining principle whereby revenue will only be recognised to the extent that it is highly probable that a significant reversal in the amount of cumulative revenue recognised will not occur. The measurement constraint continues until the uncertainty associated with the variable consideration is subsequently resolved. Amounts received that are subject to the constraining principle are recognised as a refund liability.

Membership Fee

Revenue from the membership fee is recognised on receipt basis.

Rendering of services

Revenue from a contract to provide services is recognised over time as the services are rendered based on either a fixed price or an hourly rate.

Interest

Interest revenue is recognised as interest accrues using the effective interest method. This is a method of calculating the amortised cost of a financial asset and allocating the interest income over the relevant period using the effective interest rate, which is the rate that exactly discounts estimated future cash receipts through the expected life of the financial asset to the net carrying amount of the financial asset.

Other revenue

Other revenue is recognised when it is received or when the right to receive payment is established.

Income tax

As the incorporated association is a tax exempt institution in terms of subsection 50-10 of the Income Tax Assessment Act 1997, as amended, it is exempt from paying income tax.

Current and non-current classification

Assets and liabilities are presented in the statement of financial position based on current and non-current classification.

An asset is classified as current when: it is either expected to be realised or intended to be sold or consumed in the incorporated association's normal operating cycle; it is held primarily for the purpose of trading; it is expected to be realised within 12 months after the reporting period; or the asset is cash or cash equivalent unless restricted from being exchanged or used to settle a liability for at least 12 months after the reporting period. All other assets are classified as non-current.

A liability is classified as current when: it is either expected to be settled in the incorporated association's normal operating cycle; it is held primarily for the purpose of trading; it is due to be settled within 12 months after the reporting period; or there is no unconditional right to defer the settlement of the liability for at least 12 months after the reporting period. All other liabilities are classified as non-current.

Cash and cash equivalents

Cash and cash equivalents includes cash on hand, deposits held at call with financial institutions, other short-term, highly liquid investments with original maturities of three months or less that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value.

Trade and other receivables

Trade receivables are initially recognised at fair value and subsequently measured at amortised cost using the effective interest method, less any allowance for expected credit losses. Trade receivables are generally due for settlement within 30 days.

13

Wine Industry Association of Western Australia Inc.

Notes to the financial statements 30 June 2022

Note 1. Significant accounting policies (continued)

The incorporated association has applied the simplified approach to measuring expected credit losses, which uses a lifetime expected loss allowance. To measure the expected credit losses, trade receivables have been grouped based on days overdue.

Other receivables are recognised at amortised cost, less any allowance for expected credit losses.

Property, plant and equipment

Plant and equipment is stated at historical cost less accumulated depreciation and impairment. Historical cost includes expenditure that is directly attributable to the acquisition of the items.

Depreciation is calculated on a straight-line basis to write off the net cost of each item of property, plant and equipment (excluding land) over their expected useful lives as follows:

Buildings 40 years

Leasehold improvements 3-10 years

Plant and equipment 3-7 years

The residual values, useful lives and depreciation methods are reviewed, and adjusted if appropriate, at each reporting date.

Leasehold improvements are depreciated over the unexpired period of the lease or the estimated useful life of the assets, whichever is shorter.

An item of property, plant and equipment is derecognised upon disposal or when there is no future economic benefit to the incorporated association. Gains and losses between the carrying amount and the disposal proceeds are taken to profit or loss.

Impairment of non-financial assets

Non-financial assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss is recognised for the amount by which the asset's carrying amount exceeds its recoverable amount.

Recoverable amount is the higher of an asset's fair value less costs of disposal and value-in-use. The value-in-use is the present value of the estimated future cash flows relating to the asset using a pre-tax discount rate specific to the asset or cash-generating unit to which the asset belongs. Assets that do not have independent cash flows are grouped together to form a cash-generating unit.

Trade and other payables

These amounts represent liabilities for goods and services provided to the incorporated association prior to the end of the financial year and which are unpaid. Due to their short-term nature they are measured at amortised cost and are not discounted. The amounts are unsecured and are usually paid within 30 days of recognition.

Contract liabilities

Contract liabilities represent the incorporated association's obligation to transfer goods or services to a customer and are recognised when a customer pays consideration, or when the incorporated association recognises a receivable to reflect its unconditional right to consideration (whichever is earlier) before the incorporated association has transferred the goods or services to the customer.

Borrowings

Loans and borrowings are initially recognised at the fair value of the consideration received, net of transaction costs. They are subsequently measured at amortised cost using the effective interest method.

14

Wine Industry Association of Western Australia Inc.

Notes to the financial statements 30 June 2022

Note 1. Significant accounting policies (continued)

Finance costs

Finance costs attributable to qualifying assets are capitalised as part of the asset. All other finance costs are expensed in the period in which they are incurred.

Employee benefits

Short-term employee benefits

Liabilities for wages and salaries, including non-monetary benefits, annual leave and long service leave expected to be settled wholly within 12 months of the reporting date are measured at the amounts expected to be paid when the liabilities are settled.

Other long-term employee benefits

The liability for annual leave and long service leave not expected to be settled within 12 months of the reporting date are measured at the present value of expected future payments to be made in respect of services provided by employees up to the reporting date using the projected unit credit method. Consideration is given to expected future wage and salary levels, experience of employee departures and periods of service. Expected future payments are discounted using market yields at the reporting date on national government bonds with terms to maturity and currency that match, as closely as possible, the estimated future cash outflows.

Fair value measurement

When an asset or liability, financial or non-financial, is measured at fair value for recognition or disclosure purposes, the fair value is based on the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date; and assumes that the transaction will take place either: in the principal market; or in the absence of a principal market, in the most advantageous market.

Fair value is measured using the assumptions that market participants would use when pricing the asset or liability, assuming they act in their economic best interests. For non-financial assets, the fair value measurement is based on its highest and best use. Valuation techniques that are appropriate in the circumstances and for which sufficient data are available to measure fair value, are used, maximising the use of relevant observable inputs and minimising the use of unobservable inputs.

Goods and Services Tax ('GST') and other similar taxes

Revenues, expenses and assets are recognised net of the amount of associated GST, unless the GST incurred is not recoverable from the tax authority. In this case it is recognised as part of the cost of the acquisition of the asset or as part of the expense.

Receivables and payables are stated inclusive of the amount of GST receivable or payable. The net amount of GST recoverable from, or payable to, the tax authority is included in other receivables or other payables in the statement of financial position.

Cash flows are presented on a gross basis. The GST components of cash flows arising from investing or financing activities which are recoverable from, or payable to the tax authority, are presented as operating cash flows.

Commitments and contingencies are disclosed net of the amount of GST recoverable from, or payable to, the tax authority.

New Accounting Standards and Interpretations not yet mandatory or early adopted

Australian Accounting Standards and Interpretations that have recently been issued or amended but are not yet mandatory, have not been early adopted by the incorporated association for the annual reporting period ended 30 June 2022. The incorporated association has not yet assessed the impact of these new or amended Accounting Standards and Interpretations.

15

Wine Industry Association of Western Australia Inc.

Notes to the financial statements 30 June 2022

Note 2. Critical accounting judgements, estimates and assumptions

The preparation of the financial statements requires management to make judgements, estimates and assumptions that affect the reported amounts in the financial statements. Management continually evaluates its judgements and estimates in relation to assets, liabilities, contingent liabilities, revenue and expenses. Management bases its judgements, estimates and assumptions on historical experience and on other various factors, including expectations of future events, management believes to be reasonable under the circumstances. The resulting accounting judgements and estimates will seldom equal the related actual results. The judgements, estimates and assumptions that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities (refer to the respective notes) within the next financial year are discussed below.

Allowance for expected credit losses

The allowance for expected credit losses assessment requires a degree of estimation and judgement. It is based on the lifetime expected credit loss, grouped based on days overdue, and makes assumptions to allocate an overall expected credit loss rate for each group. These assumptions include recent sales experience and historical collection rates.

Fair value measurement hierarchy

The incorporated association is required to classify all assets and liabilities, measured at fair value, using a three level hierarchy, based on the lowest level of input that is significant to the entire fair value measurement, being: Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity can access at the measurement date; Level 2: Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly; and Level 3: Unobservable inputs for the asset or liability. Considerable judgement is required to determine what is significant to fair value and therefore which category the asset or liability is placed in can be subjective.

The fair value of assets and liabilities classified as level 3 is determined by the use of valuation models. These include discounted cash flow analysis or the use of observable inputs that require significant adjustments based on unobservable inputs.

Impairment of non-financial assets other than goodwill and other indefinite life intangible assets

The incorporated association assesses impairment of non-financial assets other than goodwill and other indefinite life intangible assets at each reporting date by evaluating conditions specific to the incorporated association and to the particular asset that may lead to impairment. If an impairment trigger exists, the recoverable amount of the asset is determined. This involves fair value less costs of disposal or value-in-use calculations, which incorporate a number of key estimates and assumptions.

Employee benefits provision

As discussed in note 1, the liability for employee benefits expected to be settled more than 12 months from the reporting date are recognised and measured at the present value of the estimated future cash flows to be made in respect of all employees at the reporting date. In determining the present value of the liability, estimates of attrition rates and pay increases through promotion and inflation have been taken into account.

16

Project Income 2022 2021 $ $ AGWA Regional program 17,098 30,415 Export Growth Partnership 631,391 99,829 Project - Growers Grant 26,002 IWTG Income Account 718,266 648,489 874,512

Note 3. Grant and

Wine Industry Association of Western Australia Inc.

Notes to the financial statements

30 June 2022

Note 4. Grant Expenses

AGWA Regional Program

2022 2021 $ $

12,098 30,415

Contractor fees - Growers Group 11,971 Export Growth 611,391 99,829 623,489 142,215

Note 5. IWTG Expenses

2022 2021 $ $

Product Development 5 Integrated Promotion 513,257 Regional Support 319,154 832,416

Note 6. Employee Benefit

2022 2021 $ $

126,377 119,038

LSL Expense 2,096 16,321

Annual Leave Provision 1,442 (3,166)

Superannuation 13,100 11,396 143,015 143,589

Note 7. Cash and cash equivalents

Current assets

2022 2021 $ $

Cash at bank 776,698 285,561

17

Wages & Salaries Expenses

Wine Industry Association of Western Australia Inc.

Notes to the financial statements

30 June 2022

Note 8. Trade and other receivables

Current assets

2022 2021 $ $

Trade receivables 34,968 63,249

APC Provisional debtor 1,50036,468 63,249

Pre Paid Expenses 1,723 -

GST Receivable 13,058 38,191 76,307

Note 9. Property, plant and equipment

Non-current assets

2022 2021 $ $

Office equipment - at cost 1,832 1,832

Note 10. Intangibles

Non-current assets

2022 2021 $ $

Prepaid APC Establishment 37,427 37,427

Less: Written down Expense on Prepaid APC Establishment (37,426) (37,426) 1 1

Wines of WA Brand 19,477 19,477

Less: Accumulated amortisation (19,476) (19,476) 1 1 2 2

Note 11. Trade and other payables

Current

liabilities

2022 2021 $ $

Trade payables 26,021 1,030

PAYG Withholding Payable 2,268 2,400

Superannuation Liability 3,855 1,496

Accrued Expenses 7,780Gst Paid 14,65454,578 4,926

18

Wine Industry Association of Western Australia Inc.

Notes to the financial statements

30 June 2022

Note 12. Contract liabilities

Current liabilities

2022 2021 $ $

AGWA Regional Progam 76,074 80,789 Export Growth Partnership 388,551 140,126 EMDG 90,000554,625 220,915

Note 13. Borrowings

Current liabilities

2022 2021 $ $

Credit Card 6,660 2,935

Other payroll Liabilities 23,168 23,168 Salary Package - Novated Lease (23,168) (23,168) 6,660 2,935

Note 14. Provisions

Current liabilities

2022 2021 $ $

Annual leave 15,878 14,436

Long service leave 18,417 16,321 34,295 30,757

Note 15. Retained surpluses

2022 2021 $ $

Retained surpluses at the beginning of the financial year 104,169 152,680 (Deficit)/Surplus for the year 62,396 (48,511)

Retained surpluses at the end of the financial year 166,565 104,169

Note 16. Constitutional Requirements

Under the Constitution, if the Association is wound up, any property of the Association that remains after satisfaction of the debts and liabilities of the Council and the costs, charges and expenses of that winding up,that property shall be distributed to another incorporated association having similar objects to those of Association for charitable or benevolent purposes .At the date of this report it would appear that there is no intent to have the Association wound up.

19

Wine Industry Association of Western Australia Inc.

Notes to the financial statements

30 June 2022

Note 17. Reconciliation of surplus/(deficit) to net cash generated / (used in) from operating activities

Surplus/(Deficit) for the year

Change in operating assets and liabilities:

2022 2021 $ $ 62,396 (48,511)

Increase/(Decrease) in trade and other receivables 38,116 145,508

Increase/(Decrease) in trade and other payables 49,652 (11,465)

Increase/(Decrease) in contract liabilities 333,710 (394,558)

Increase/(Decrease) in borrowings 3,725Increase/(Decrease) in benefits 3,538 12,712

Net cash (used in)/generated from operating activities 491,137 (296,314)

20

Australia Vintage 2021

Red Variety

Vintage 2018Vintage 2019Vintage 2020Vintage 2021vs prior year

CABERNET SAUVIGNON 10755.18930.48397.39220.610% SHIRAZ 10414.97748.07591.68381.710% MERLOT 2710.32123.91616.91814.412%

PINOT NOIR 812.2621.2695.4910.831% MALBEC 839.9515.9 507.6572.513%

TEMPRANILLO 487.0303.4 409.6484.518%

GRENACHE 279.9424.1 317.2462.946% OTHER 164.9109.6253.4197.4-22%

CABERNET FRANC 232.8150.7 212.5171.2-19%

PETIT VERDOT 230.8167.5 149.4143.1 -4%

SANGIOVESE 67.148.0 52.784.861%

ZINFANDEL 62.849.4 47.648.21%

MOUVEDRE 57.023.0 41.642.73%

NEBBIOLO 34.127.0 26.734.429% BARBERA 14.311.3 9.723.5141% DURIF 20.614.0 16.415.5 -6%

GRACIANO 3.7 9.9 9.411.522%

PINOT MEUNIER 0.8 1.8 3.010.6250% NERO D'AVOLA 6.0 8.7 8.3 9.111% GAMAY 1.9 3.8 3.9 8.8124% DOLCETTO 3.6 3.7 4.5 4.3 -4% MONTEPULCIANO 0.4 0.5 0.5 2.8421% SAPERAVI 1.9 1.8 1.9 2.426% LAGREIN 1.4

CHAMBOURCIN BRACHETTO 1.0 1.6 1.2 2.397% TANNAT 5.8 1.0 1.0 2.2113% MEUNIER 0.7 0.6 0.2 1.4474% AGLIANICONE 0.1 0.7898% RED (TOTAL) 27210.921300.920379.822664.1 11%

APC Wine Producers' Committee Western

White Variety

Vintage 2018 Vintage 2019 Vintage 2020 Vintage 2021 vs prior year

SAUVIGNON BLANC 10926.29 8997 7552.3517 10203.2 35%

CHARDONNAY 8910.54 8014 6979.344 8442.3 21%

SEMILLON 8880.30 6194 5946.925 7025.2 18%

CHENIN BLANC 2304.96 2186 2132.926 2156.1 1%

RIESLING 1350.63 1102 889.77 1398.1 57%

VERDELHO 799.22 705 603.211 645.7 7%

PINOT GRIS 159.61 237 321.302 469.4 46%

MUSCADELLE 189.97 179 199.721 181.7 -9%

SAVIGNIN BLANC 370.41 354 450.334 164.8 -63%

OTHER 213.57 235 83.603 161.4 93%

VIOGNIER 126.24 82 88.593 119.8 35%

PROSECCO 14.89 14 55.532 103.9 87%

VERMINTINO 76.21 61 55.426 101.6 83%

GEWURTZTRAMINER 51.61 18 40.228 83.1 106%

MUSCAT BLANC A PETITS GRAINS 47.43 111 98.318 80.5 -18%

FIANO 43.15 28 36.565 50.6 38%

VERDEJO 29.86 29 9.06 17.1 89%

ARNEIS 12.99 15 19.444 14.9 -24%

GRUNER VELTLINER 2 5.718 12.0 110%

TREBBIANO 4.00 5 4.118 9.2 124%

PEDRO XIMENEZ 14.31 8 7.573 4.6 -40%

SCHEUREBE 6.42 4 3.605 3.1 -14%

ROUSSANNE 1.37 1 1.349 2.0 50%

TRAMINER 8.40 2.14 2.0 -8%

HARSLEVELU 1

WHITE (TOTAL)

34,542.37 28,581.41 25,588.16 31,452.14 23% TOTAL 61,753.28 49,882.34 45,967.99 54,116.26 18%

Variety Tonnage Variety Tonnage

SHIRAZ 200.867 -9 SAUVIGNON BLANC 366.757

CABERNET SAUVIGNON 135.449 SEMILLON 278.51

MERLOT 74.63 CHARDONNAY 142.515

MALBEC 10.954 VERMINTINO 1

TEMPRANILLO 10.588 VIOGNIER 0.968

GRENACHE 1.5 OTHER 0.5

BARBERA 0.684 MUSCAT BLANC A PETITS GRAI 0.469