From one tree grows a thousand possibilities

Södra is to add tannin to its range of forestbased products and seeks partners to develop new tannin-based sustainable alternatives to fossil products in a range of applications.

Södra is investing in a production line at its Värö facility in Sweden, which will create a vegetable tanning agent from bark. This new tannin can be used to process leather in a more environmentally friendly way. The line will have the capacity to produce tannin for millions of square metres of leather.

“Now is the time to unite and maximise the potential of every tree, exploring innovative applications for tannin collaboratively. Together, we can develop fossil-free products and contribute to a more sustainable future," said Viktor Odenbrink, Sales Director, Södra Bioproducts.

Are you one of our potential partners? Contact us here:

Viktor Odenbrink Sales Director, Södra Bioproducts viktor.odenbrink@sodra.com

sodra.com

This is Södra

Södra is the largest forest-owner association in Sweden and an international forest industry group. With raw material from the sustainably managed forests of more than 50,000 forest owners, Södra produces timber products, pulp, energy and bioproducts, such as biochemicals – and is always looking to develop new products from trees.

News

2 News map News highlights from around the global leather industry.

4 Industry & Innovation New technology, new ideas from leather industry suppliers and service providers.

6 Leatherscene People from around the industry and famous lovers of leather who have made the headlines in recent weeks.

8 Backtrack Headlines from www.leatherbiz.com, the industry’s best and most complete news website. Leatherbiz is now in its 25th year. You can read about almost everything that has happened in the global leather industry this century on leatherbiz. No other news archive comes close.

Leather Leaders

10 Perfect fit The future is the circular economy, the secretary general of COTANCE, Gustavo González-Quijano, says. He is working to make clear that leather is the perfect material for that future.

Special Report

14 APLF 2025 The forty-first edition of APLF took place in Hong Kong in March. Our review suggests the mood at the show reflected the current caution within the global leather industry, but there were still 600 exhibitors from 40 different countries present, and plenty of lively discussion.

Technology

19 Power play Commitment to renewable energy is one of the reasons leather chemicals group GSC has invested in a new facility in Montebello Vicentino. It will cover 12,000square-metres, around one-third of which will have solar panels installed.

22 Carbon synch Chief executive of the Ars Tinctoria leather laboratory, Gustavo Defeo, outlines his reasons for optimism that the European technical committee responsible for standardisation for bio-based products will ensure transparency, reliability, and consistency.

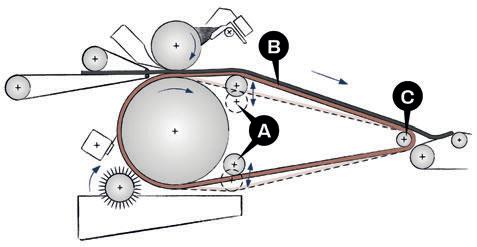

24 Reverse psychology The Greenstar roller-coater is designed as an advanced solution for the reverse finishing of whole hides and bovine sides, as manufacturer Gemata explains.

Leather and the Circular Economy

26 Thought Leadership: Trust fund Campaign group WWF has launched a new $10 million fund to help remove links to deforestation from the leather supply chain.

30 Thought Leadership: Data burden Tiny companies in Italy’s footwear manufacturing industry are bearing an unfair share of the weight when it comes to satisfying sustainability regulations.

32 Circular Stories: What liberation? Huge increases in the tariffs the US is imposing on its partners are putting the global trading framework for raw materials at risk. Who could have imagined that hides could be too renewable for their own good?

38 Circular Stories: Bad news for finished goods Cars, bags and shoes are among the finished product categories that are caught up in the chaos unleashed by April’s tariff turmoil.

42 Circular Stories: Fooled by fast fashion An unwillingness on the part of other contributors to see the importance of leather’s longevity and repairability has led COTANCE to withdraw from a group working to establish category rules for calculating the environmental impact of footwear.

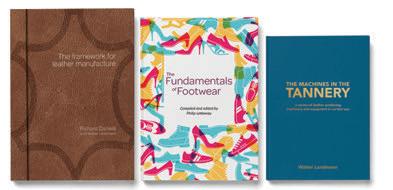

44 Essential reading

IBC Advertisers’ index

Cover image: Wet blue hides. Hides have to go to where the tanning drums turn, but shipments of US wet blue to tanners in China have suddenly more than doubled in price.

CREDIT: SHUTTERSTOCK/AFROZEE

World Leather iPad edition

The world’s best leather industry magazine is now available to download on iPad from www.leatherbiz.com

@WTPworldleather

@WTPworldleather

linkedin.com/showcase/wtpworldleather

@WTPworldleather

World Trades Publishing Ltd 2025. Contributions: The editor welcomes news items, articles and photographs for consideration and possible publication but no responsibility can be accepted for the loss or non-publication of such material. Opinions expressed by individual contributors do not necessarily reflect the view of the editor or publisher.

• Whilst every effort is made to ensure accuracy in reproduction, no responsibility can be accepted for the technical content or for claims made by manufacturers for product performance that are published. Publication in World Leather cannot be construed as an endorsement for a claim or product by the publisher.

• World Leather is published 6 times per year by World Trades Publishing, The Old Stone House, Teeton, Northampton NN6 8LH UK. Price UK £90, ROW: £150 per year (six issues).

Graphic origination by WTP. Print by Bishops Printers, Walton Road, Portsmouth, Hampshire PO6 1TR, England. All rights reserved. ISSN 0894-3087

The World Leather team has been publishing a series of original, dynamic podcasts since 2019. The whole series is available on Anchor, Spotify, Apple Podcasts, Google Podcasts, Pocket Casts, Overcast and other podcasting platforms. Just search for the World Leather Podcast on the platform you prefer.

World Trades Publishing 2025: All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means mechanical, electronic, recording, photocopying or otherwise, without the written permission of the publisher. World Leather®, Tannery of the Year® and Nothing to Hide® are registered trademarks

The World of News

EUROPEAN UNION The official statistics office of the European Union, Eurostat, has published figures that put the European Union’s cattle population at the start of this year at 72.2 million head. It said this figure was down by 2.3% from the total at the start of the previous year, meaning the 27-state European Union lost 1.7 million head of cattle in the course of 2024. Commentators have pointed out that dry conditions in many parts of Europe over a prolonged period in 2022 and 2023 is one of the main factors in cattle herds reducing in size.

SPAIN Spanish double-face and nappa producer Inpelsa has won court approval to take over the tannery that Tenerías Omega ran in Navarra in northern Spain until last year. Valencia-based Inpelsa is run by current COTANCE president, Manuel Ríos Navarro. It will relaunch the Tenerías Omega business as Inpelsa Calf. As part of the deal, Inpelsa will take on 44 of the 79 employees that Tenerías Omega had when it closed down in September.

HUNGARY The country has deployed soldiers and introduced new disinfection measures to contain an outbreak of foot-and-mouth disease in its north western region bordering Slovakia and Austria, as reported by Reuters. The country’s first case in over 50 years was detected on a cattle farm in March and has since spread to two more farms in Gyor-Moson-Sopron county, affecting 3,500 cattle. Neighbouring Slovakia has also reported outbreaks at five locations and stepped up containment efforts.

ITALY The ‘Amici per la Pelle’ exhibition has begun a tour of schools in Italy, with the aim of inspiring students to work in the leather sector. It began at the Banti middle school in Santa Croce sull’Arno, with the launch event attended by industry representatives. The exhibition then moved to the Leonardo da Vinci Institute in Castelfranco di Sotto. In the coming weeks, it will head to schools in Ponte a Egola, Fucecchio and Santa Maria a Monte.

TURKEY The advertising authorities in Turkey have announced fines for two footwear brands for putting shoes containing pigskin on sale in the country without notifying consumers. An advertising monitoring body connected to Turkey’s ministry of trade, announced a fine of around $45,000 for New Balance, and one of around $22,000 for Vans. It also told Camper that it had to stop advertising several of its models in Turkey. It said the brands had made shoes available to consumers in Turkey without clear enough information about their composition. Turkey is a country with a large Muslim majority.

RWANDA Rwanda has suspended until November 2026 an 80% ‘development levy’ on raw hides and skins exported outside the East African Community (EAC). The decision aims to address stockpiling caused by limited regional market demand. Reports in local media stated that the move is part of efforts to establish Rwanda’s leather industry and enhance value addition. The government has identified a 20-hectare site in Bugesera District for a tannery park.

UGANDA The president of Uganda, Yoweri Museveni, has reaffirmed his commitment to youth empowerment through vocational training, calling it key to Uganda’s economic transformation. Speaking at the commissioning of the Bunyoro Zonal Presidential Skilling Hub in Masindi District, he described the initiative as part of Africa’s industrial awakening. Mr Museveni highlighted Uganda’s progress in leather production, noting the country’s shift from exporting raw hides to manufacturing leather products locally.

KENYA The Common Market for Eastern and Southern Africa (COMESA) has launched a leather value chain strategy aimed at enhancing regional industrialisation. Unveiled in Nairobi, the 2025-2029 strategy seeks to shift the region from exporting raw materials to producing value-added leather products. COMESA’s secretary general, Chileshe Kapwepwe, highlighted the importance of skills development, SME support, innovation and sustainability to improve global competitiveness and job creation.

CHINA In the first two months of 2025, China’s tanners sourced 233,000 tonnes of raw hides and skins from other countries, investing around $200 million. These figures represent an increase of 2.6% in volume, but a fall of 6.6% in value. In the same months, China’s tanning sector brought in 113,000 tonnes of semi-finished hides, paying $160 million, an increase of almost 38% year on year in the volume of imports of semi-finished leather for these months, and a rise of 6.6% in value.

JAPAN Luxury industry representative body Altagamma took “a testament to the value of Italy’s high-end craftsmanship, design and creativity” to Expo 2025 in Osaka. The world exhibition opened in the Japanese city on April 13 and will run until October 13. Altagamma set up an installation of its own inside the Italy pavilion and the organisation said it used its presence there as the venue for a celebration of National Made in Italy Day on April 15.

The World of News

US Capri Holdings has entered into a definitive agreement to sell Versace to Prada Group for $1.375 billion in cash, subject to certain adjustments. The transaction is expected to close in the second half of 2025, pending regulatory approvals and other customary closing conditions. Versace, founded in 1978 by Gianni Versace, was acquired by Capri Holdings in 2018. Capri stated that the sale is intended to strengthen its balance sheet and support future investments in its remaining brands, Michael Kors and Jimmy Choo.

PAKISTAN Pakistan’s leather sector achieved 7% growth in export revenue during the first eight months (July to February) of the 2024-2025 financial year. According to data compiled by the Federal Bureau of Statistics, total revenue rose to $613.5 million. Increased exports of leather gloves and shoes primarily drove this growth.

INDIA The government of India has highlighted the strong performance of the leather industry in a new economic survey, picking out the state of Tamil Nadu for particular praise. It said Tamil Nadu contributes 38% of the country’s total production of footwear and leather products, and for 47% of its total leather exports, generating 200,000 Tamil Nadu jobs. Tamil Nadu is also home to India’s Central Leather Research Institute, the Council for Leather Exports and the Footwear Design and Development Institute.

BRAZIL The country’s national footwear industry association, Abicalçados, has said it hopes the South American country will emerge from the current tariff disputes in a good position for claiming a larger share of the US shoe market. For Brazil, so far, tariff rates have only been put at 10%, while competitor countries will, potentially, face much higher rates. This has led the executive president of Abicalçados, Haroldo Ferreira, to say: “This can make our shoes more competitive in the US.”

TAIWAN Luxury leathergoods brand Hermès has reopened its store in Taichung, Taiwan’s second-largest city. The reopening follows a redesign of the store, which first opened in 2012, at the hands of Parisian architecture and design agency RDAI. According to Hermès, the new interior is inspired by “the rolling hills and fluid contours of Taiwan’s tea plantations”. It said this would allow it to display its leathergoods, equestrian, footwear, gloves and other products “against a contrasting light palette, natural materials and organic textures”.

INDONESIA Leather manufacturing group Hung Fu has hosted a ceremony to mark the breaking of ground on a new facility in Indonesia. Hung Fu has its roots in China and already runs a tannery in Vietnam, where it produces around 40 million square-feet of finished bovine leather per year. It supplies a large number of international footwear brands. It is constructing its new facility, PT Hung Fu Leather Indonesia, near Cimanggu in West Java. The site will cover 30,000 square-metres.

Industry & Innovation

Expansion for PrimeAsia in Vietnam

Leather manufacturing group PrimeAsia held an event on March 8 to celebrate the completion of an expansion project at its tannery in Vietnam.

The group said that the expansion at PrimeAsia Vietnam, at Ba Ria in Vung Tau in the south of Vietnam, takes production capacity there to more than 8 million square-feet of finished leather per month.

Globally, PrimeAsia’s total production capacity is now 12.5 million square-feet per month.

Guests at the event toured the facility and joined PrimeAsia in what it called a celebration of the ongoing dedication of its partners and its own teams.

Simplifications will reduce cost of EUDR burden

The European Commission claims to have simplified “the administrative burden” that operators and traders will face when the EU Deforestation Regulation starts to come into force at the end of this year.

In mid-April, the Commission published new guidance documents that it said contained “clarifications and simplifications” of the requirements, with updates to its guidance and to the important set of frequently asked questions (FAQs) relating to EUDR. It explained that these changes reflected input from member states, partner countries, businesses and industry.

It said these additions would “provide companies, EU member states’ authorities and partner countries with additional simplified measures and clarifications on how to demonstrate that their products are deforestation-free”.

The European Commission has calculated that these new measures will lead to a 30% reduction in the administrative cost and burden for companies. “This will ensure a simple, fair and cost-efficient implementation of this key piece of legislation,” it added.

Simplification measures include companies now being allowed to submit due diligence statements annually, instead of for every shipment or batch of products they place on the EU market.

Also, large companies downstream will be able to use the reference numbers of due diligence statements collected from their upstream suppliers for use in their own submissions.

UNIDO: Private sector key to leather revival in Ethiopia

The United Nations Industrial Development Organization (UNIDO) has highlighted the need for stronger private

Buckman acquired to expand innovation and growth

Pritzker

Private Capital (PPC) has signed a definitive agreement to acquire chemicals manufacturer Buckman. The investment, made alongside members of the Buckman family and management, aims to accelerate growth, advance product innovation, and expand the company’s market reach.

Buckman, founded in 1945, operates six manufacturing hubs and serves customers in over 90 countries. Its leadership team, including CEO Junai Maharaj, will remain in place following the acquisition.

Robert Buckman, chairman emeritus and former CEO, expressed confidence in PPC’s ability to uphold the company’s legacy, while Junai Maharaj highlighted the partnership as a key step in scaling operations and enhancing digital innovation. PPC investment partner, Thomas Chadwick, noted the potential for strategic acquisitions and further expansion.

The financial terms of the transaction were not disclosed. The deal is expected to close in the second quarter of 2025, subject to regulatory approvals.

sector involvement to revitalise Ethiopia’s leather industry and boost its global competitiveness.

LISEC UNIDO representative and regional office director, Aurelia Calabrò, told local media that private sector participation is crucial for accelerating the sector’s recovery and integration into global markets. She pointed to the industry’s potential for job creation and economic growth, stressing the importance of investment and collaboration.

Ms Calabrò noted that ongoing economic reforms are helping to address key challenges, including import barriers. Despite a recent drop in exports, UNIDO continues to support women-led MSMEs, providing facilities and resources to strengthen local tanneries.

UNIDO’s long-term efforts include promoting cleaner technologies, improving wastewater treatment, and enhancing productivity. The organisation is also conducting studies to support the development of eco-friendly leather parks and improve environmental compliance in the sector.

Bentley employs AI to detect hide defects

Bentley Motors has invested in a hide inspection system that uses AI and cameras to detect tiny imperfections, reducing waste and optimising leather usage.

Around nine hides are required for a luxury Bentayga SUV interior but insect bites, holes and scars can affect trim quality, it said.

The program works alongside existing cutting processes to optimise leather use for over 200 trim parts per car. Bentley claims the strategy can reduce emissions, equal to 135.7 kg CO2 per car.

Andreas Lehe, member of the board for manufacturing at Bentley, said: “Hide Inspection showcases how cutting-edge innovation and Bentley’s traditional craftsmanship techniques can co-exist side-by-side.

“It is just one of many industry-first innovations at our Dream Factory in Crewe, where all Bentley models are built. Our Beyond100+ strategy will see the company reinvent its entire product range to support

a more sustainable, electrified future.

"That includes Bentley’s new digital, zero environmental impact manufacturing and quality facility, as well as the development of our first BEV (battery electric vehicle).”

Sustainable

tannin solutions now online with NTE

South African wattle specialist NTE has launched a new website that brings its Mimosa and Bondtite product ranges under a single online platform. The updated site aims to provide easier access to product information, application insights, and the latest company developments across various industries.

For over a century, NTE has been producing natural tannins extracted from the Acacia mearnsii tree, commonly known as the black wattle. These plantbased products serve a wide range of sectors, including leather tanning, water treatment, adhesives, animal feeds, and ore processing.

Stahl releases 2024 ESG report

Stahl has released its 2024 Environmental, Social and Governance (ESG) report, highlighting progress toward its climate targets, product compliance milestones, and workforce initiatives.

The company reported a 39% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2021 baseline, along with a 31% reduction in Scope 3.1 emissions (purchased goods and services). Environmental improvements included the installation of solar water heaters at sites in Italy and Mexico.

As of December 2024, 2,200 Stahl products, accounting for 94% of revenue from the Leather Finishing division, achieved Level 3 of the ZDHC Gateway (MRSL 3.1), the highest level of compliance. Over half of 2024 revenue, excluding the Packaging Coatings division, came from water-based products. A total of 377 products now include lifecycle assessment (LCA) or product carbon footprint (PCF) data.

The company also reported growth in workforce diversity, including more women in senior roles, and full employee participation in a company-wide equity training programme. Last August, Stahl received Living Wage certification from the Fair Wage Network. It also launched new leadership mentoring and safety initiatives.

To align with the EU’s upcoming Corporate Sustainability Reporting Directive (CSRD), Stahl updated its double materiality assessment, examining both the company’s impact and exposure across environmental and social areas.

Industry & Innovation

“2024 was a transformational year for Stahl as we took further steps to become not only a pure-play speciality coatings leader, but also a sustainability leader in our field,” said Chief Executive Officer Maarten Heijbroek.

Pasubio opens leather processing plant in Mexico

Automotive leather supplier Conceria Pasubio Group has opened a new facility in León, Guanajuato, with an initial investment of $13 million.

The plant will focus on cutting leather for seats, headrests and door panels, supplying materials for brands including BMW, Maserati, Volkswagen, Skoda and Stellantis. The company expects to generate 540 direct jobs over the next three years.

Government representatives attended the opening ceremony, noting León’s history in leather production and its role in the automotive supply chain. The new plant adds to Pasubio’s existing operations in Italy, Germany, Serbia and South Africa, increasing its presence in North America.

With this expansion, the company now operates 13 factories worldwide.

AI transforms leather grading at JBS

Mindhive

Global has signed a multiyear deal with JBS Couros to expand its AI-powered leather grading system across 13 wet-blue processing sites in Brazil, with rollout set for completion by this June. The system processes up to 360 hides per line, per hour, with grading accuracy exceeding 91%.

CEO of JBS’s leather division, Guilherme Motta, said the technology would enhance efficiency. “This will set new standards for leather grading, ensuring every hide meets the highest criteria for our global customers,” he explained.

Webinar on sustainable leather tanning

The American Leather Chemists Association (ALCA) hosted a free webinar on April 22, focused on current developments in sustainable leather tanning.

Titled Smart & Sustainable: ALCA’s Global Tips & Updates for Today’s Leather Tanner, the 45-minute session featured two technical presentations. Matías Cobo of Cromogenia-Units discussed recent developments in Manufacturing Restricted Substances Lists (MRSLs) and Restricted Substances Lists (RSLs).

This was followed by Mi Yan of Stahl, who provided an overview of Zero Discharge of Hazardous Chemicals (ZDHC) initiatives.

Prada eyes AI

Enterprise

AI software provider o9 has announced the successful implementation of its advanced production and procurement planning capabilities within Prada Group’s leather goods division.

The partnership aims to optimise planning across Prada Group’s complex, multi-tier global supply chain. The Italian luxury fashion house, whose portfolio includes Prada, Miu Miu, Church’s, Car Shoe, and Marchesi 1824, will use o9’s Digital Brain platform to improve production planning, gain visibility into factory and supplier capacity, and align raw material procurement with manufacturing needs.

TFL publishes 2024 ESG report

Leather chemicals group TFL has published its 2024 ESG report, detailing key achievements in environmental and social responsibility.

The report highlights the progress in reducing its environmental footprint, with significant reductions in water and energy consumption across its production sites, achieving decreases of 40% and 31%, respectively, in line with its long-term sustainability goals.

Additionally, the company says it has advanced chemical innovation, introducing more eco-friendly tanning solutions and achieved a 21% reduction in Scope 1 and 2 emissions.

TFL also reports improvements in supply chain transparency, collaborating closely with suppliers to strengthen sustainability standards. The company continues to prioritise workplace safety and employee well-being, underscoring its commitment to ethical business practices.

‘Silk’ finishing

Thailand-based tannery Chun Wang is planning to double its capacity this year, following the purchase of new Italian machinery, which enables it to process more sustainably and efficiently.

The tannery, launched in 1935, is now run by the fourth generation of the family and supplies to the leathergoods and footwear sectors, working with European hides, from raw to finished leather.

Based in a tanning cluster near Bangkok, the tannery also works with European chemical suppliers and offers a bio-based finish, Activated Silk, made from silkworm cocoons, the brainchild of US-based Evolved by Nature.

Chun Wang returned to the Lineapelle leather fair in February after a five year hiatus, ready to promote its new efficiencies and ecological offerings to the European market.

Leather scene

Change of chief executive at TFL

Leather chemicals group TFL has announced André Lanning as its new chief executive. He took up the post on March 1.

It said Mr Lanning was replacing Russell Taylor, who became TFL’s chief executive, originally on an interim basis, in July 2023, at the time of the departure of Wolfgang Schütt. It said Mr Taylor was stepping down for personal reasons.

André Lanning has joined from Trinseo, a Pennsylvania-based producer of plastics and latex binders that was spun off from Dow Chemical in 2010. He was Trinseo’s chief commercial officer.

Earlier in his career, he held senior roles at Kemira, Yara International, Nuon, Advanced Refining Technologies (ART) and WR Grace.

TFL said the new chief executive’s strategic priorities included driving commercial excellence, expanding market share, optimising operational synergies and pursuing organic growth opportunities. Additionally, it said he would explore strategic merger and acquisition initiatives “to further strengthen TFL’s competitive position”.

The plan at Hermès is still working well

Luxury leathergoods group Hermès has reported first-quarter revenues of more than €4.1 billion, an increase of 8.5% compared to the same quarter last year. It achieved growth in all markets. Revenues in Asia were up by 5.1% to reach almost €2.4 billion. The figure for Europe was €857 million, up by 13.3%, while revenues in the Americas reached €695 million, also up by 13.3%.

It said the remaining €185 million had come from other markets, but placed particular emphasis on the market in the Middle East for this, giving growth there of 16.8% year on year.

Its leathergoods and saddlery division achieved sales revenues of €1.8 billion in the first quarter, growth of 11.4%. For its second-largest category, ready-to-wear and accessories, which includes shoes, gloves and small leathergoods, it reported a figure of more than €1.1 billion, up by 8.3%.

Executive chairman, Axel Dumas, said Hermès was “strengthening its fundamentals more than ever”, in a complex geopolitical and economic context. Explaining what these fundamentals are, he listed “uncompromising quality, creativity at the heart of all development, vertical integration, and a guarantee of preserving unique savoir-faire”.

He said Hermès customers trust the company and that its employees are committed to continuing their good work.

New ICHSLTA president puts sustainability and transparency top of her list

TheInternational Council of Hides, Skins, and Leather Traders Association (ICHSLTA) has elected Micaela Topper as its new president.

Ms Topper is the executive manager of her family’s hide processing and export company, AI Topper. She has also worked extensively on sustainability on behalf of the Australian Hides, Skins and Leather Association (AHSLEA).

Her work at AHSLEA has also included completing an industry framework and roadmap, as well as education and communication strategies to drive change. She has also worked closely with key Australian cattle, meat and hide industry groups on traceability, with the aim of enabling greater transparency across supply chains.

After her election, she said: “I am honoured to serve as president of ICHSLTA. My focus will be on working closely with all industry stakeholders to address key challenges such as sustainability, traceability, and transparency. By fostering collaboration and open dialogue, we can drive positive change across the global supply chain and ensure a robust future for our industry.”

Chen Zhanguang of the China Leather Industry Association and Nick Winters of the French Hides & Skins Federation were elected as vicepresidents of ICHSLTA, and Lénaïg Manéat will continue to manage the administration of the organisation.

The company described the performance of its leathergoods and saddlery division as robust, driven by “sustained demand and the enrichment of collections”. Examples it gave of success with new products included its Médor and Mousqueton bag models.

It pointed out that its efforts to increase its production capacity in France were ongoing and were paying off. A new leathergoods workshop will open this year at L’Isle d’Espagnac, another will open next year at Loupes and another the year after at Charleville-Mézières.

Developing and training new generations of artisan leathergoods craftspeople in France will keep Hermès anchored to its home country, the company said.

China is an inspiration, Bentley CEO says

High-end

automotive brand Bentley Motors remains optimistic about growth in China.

Its chief executive, Dr Frank-Steffen Walliser, was present at the Auto Shanghai 2025 event and said in a press conference on April 23 that the company was “excited and motivated” by the future opportunities that the Chinese market offers.

“Our China customers and the luxury market here continue to inspire and push us to explore new boundaries,” he said.

His comments came at a time when trade tensions between China and the US show little sign of easing.

The White House said on April 23 that the US would consider lowering tariffs on imports of goods from China in a bid to deescalate the tension. As things stand, products entering the US from China are subject to tariff rates of 145%. In response, China has imposed tariffs of 125% on goods entering its market from the US.

Both markets matter greatly to UKbased Bentley Motors. In the most recent market figures the company has confirmed, which were for the first half of 2024, sales in the Americas and in China amounted to 3,577 vehicles.

This means these two markets together provided Bentley with 54% of its total vehicle sales.

Creative power

Georgian designer Demna Gvasalia has been named as the next artistic director of Gucci. He will move to his new role in early July from Balenciaga, where he has been artistic director since 2015. Gucci and Balenciaga are both owned by Parisbased group Kering.

Chief executive, François-Henri Pinault, said Demna Gvasalia’s “creative power” was “exactly what Gucci needs. As I thank him for everything he has accomplished

over the past 10 years, I look forward to seeing him shape Gucci’s new artistic direction.”

Gucci’s previous artistic director, Sabato de Sarno, left the role in February, just before Kering published weak annual results. Gucci, its biggest brand, contributed €7.7 billion to total group revenues in 2024, a decline of 23% year on year.

The group posted total revenues of €17.2 billion, a fall of 12%.

Dior door opens

Luxury group LVMH has confirmed that Irish designer Jonathan Anderson has taken up the role of artistic director at its Christian Dior brand.

Mr Anderson stepped down as creative director of the group’s Loewe brand in March, a role he had held for 12 years.

The founders of New York-based brand Proenza Schouler, Jack McCollough and Lázaro Hernández, will replace Jonathan Anderson as creative directors of Loewe.

On confirming the appointment, Loewe said the pair had played a fundamental role in defining modern fashion, with designs based in “a rigorous exploration of craftsmanship, filtered through artistic sensitivity”. It said this was in keeping with Loewe’s values.

China appoints new chief trade negotiator

With no sign of any rapprochement between China and the US in the global trade disputes at which they are the central antagonists, China has appointed a new chief trade negotiator.

Its ambassador to the World Trade Organization (WTO), Li Chenggang, is to step into the new role. A former assistant minister at China’s ministry of commerce, Mr Li moved to Geneva to become its ambassador to the WTO in 2021.

One of his last actions in his role at the WTO was to initiate on April 8 formal dispute consultations over the additional tariffs the US has sought to impose.

Swathe of appointments at USDA

The US Department of Agriculture has announced 24 senior appointments, “selected to implement President Trump’s America First agenda”.

The appointments include Bailey Archey as policy advisor for marketing and regulatory programmes; Kelsey Barnes as senior advisor to the Secretary for Rural Development; and Bill Beam as administrator for the Farm Service Agency.

Aubrey Bettencourt has been named chief of the Natural Resource Conservation Service; Jordan Bonfitto appointed as chief of staff for marketing and regulatory programmes; and Trey Forsyth will serve as chief of staff for food safety.

Last month, Secretary of Agriculture Brooke Rollins announced a review of federal funding in California to “ensure that students do not fall victim to a radical transgender ideology”.

Moore & Giles announces key executive promotions

Virginia-based designer and developer of leather collections

Moore & Giles has announced the promotion of two executives as part of its strategy to drive innovation and growth.

Elizabeth Stroud has been appointed vice president of marketing and lifestyle sales. In her new role, she will lead initiatives to expand brand presence, enhance customer engagement in the luxury market, and develop strategic partnerships.

Brittany Sydnor has been named vice president of merchandising and product development. She will oversee product innovation with a focus on purposeful design while maintaining the company’s legacy of craftsmanship.

“We are excited to have Elizabeth and Brittany in these key roles,” said CEO, Sackett Wood. “They both bring an elevated level of professionalism, style, taste and creative energy that will help us execute on our key strategic initiatives.

Leather scene

Backtrack

World Leather’s publishing cycle and limitations on space make it impossible for us to run more than a carefully selected sample of news from across the industry. However, we publish hundreds more stories on leatherbiz.com. The site is updated every day with news from every continent and every part of the industry, making leatherbiz.com one of the most comprehensive archives of news anywhere on the web for the global leather industry.

We list below just a few of the headlines that have appeared on the site in recent weeks and can still be accessed.

25 April 2025

Strong Q1 for Skechers, but uncertainty follows Collagen and Leather journal gains international indexing

24 April 2025

Q1 results confirm difficult start to 2025 for Kering

China’s footwear exports down, but leather shoes fare better

Puma collaboration features

Charles F Stead suede

23 April 2025

New leather workshop announced by Hermès

Operating profit falls in 2024 for Valentino

22 April 2025

Ethiopian leather could benefit from US tariffs, suggests business director

Modest growth across brands for Piquadro

17 April 2025

Volumes up, values down at Stella International

16 April 2025

New York listing moves closer for JBS

15 April 2025

Rebranding exercise complete at PrimeAsia

Bader – driving in style

14 April 2025

‘Good resilience’ for leathergoods at LVMH in Q1

Stellantis backs Maserati amid slump and tariff pressure

11 April 2025

What tariffs on four luxury groups might contribute to US coffers

10 April 2025

COTANCE walks away after group goes for fast fashion’s idea of durability

Pause for 90 days, but not for China

09 April 2025

A turning point in trade policy, VDA says

08 April 2025

WWF to hold supply chain traceability webinar

France calls for safeguard clause in Mercosur trade deal talks

07 April 2025

LHCA’s concession will be hard to implement, unfortunately

Warning of accelerated disintegration of global trade in goods

TFL releases autumn/winter 2026–27 colour trends catalogue

04 April 2025

Stock markets and trading partners respond to US tariffs

India eyes tariff opportunity shift

03 April 2025

Beef features in tariff thinking

Liberation Day likely to tie the world up in new trade war

Dr Martens celebrates iconic boot anniversary

One third of materials from recycled sources – LVMH

02 April 2025

Interior design tipped for strong growth Spring event of shoemaking returns in 2025

01 April 2025

Australian meat industry responds to US tariff speculation

ACEA: Tariffs will hurt automakers and US manufacturing

31 March 2025

British Pasture Leather promotes next field day

Suede celebration from Smit & Zoon AEC claims growth for Futurmoda

28 March 2025

Leather Days keynote to focus on Livestock in Material Flow Management

New research suggests overestimation of feedlot methane emissions

27 March 2025

Trump’s latest tariffs rock automotive sector

Fimec 2025 strengthens global industry connections

World Leather Day set for April

JBS reports a doubling of profit in 2024

26 March 2025

Study highlights potential for Brazilian footwear in Germany

Event celebrates tanners’ influence on Tuscan culture

25 March 2025

Caleres reports 2024 financial decline

Shoe exports up in volume for China, but values fall

24 March 2025

Government advances PLI scheme for leather

China: imports of hides and leather went up in volume in 2024

Firm focus on high-quality shoes at Stella International

21 March 2025

France maintains strong position in global leather trade

20 March 2025

Minerva foods reports record quarterly earnings

Tod’s extends blockchain to tell shoes’ stories

19 March 2025

Charlie Chaplin’s ‘Little Tramp’ boots to be auctioned in March

Tannery shares figures to celebrate World Recycling Day

Porsche to cut 4,000 jobs amid market challenges

Shoe division brings 7% growth for Inditex and partners

18 March 2025

Slight increase for global car sales in 2024

Jonathan Anderson to leave Loewe

17 March 2025

China: 30-point plan to boost domestic consumer spending

Eurofins introduces commodity chemical testing solution

New space for Hermès in Indonesia

Rag & Bone to push into leathergoods

Leather Leaders: Gustavo González-Quijano

A clearer identity

The secretary general of the industry’s main representative body in the European Union is hopeful of greater support for industry in general from the new European Commission. He believes leather stands to gain because it will stand out as “the perfect material for the circular economy”.

How would you sum up the situation of the global leather industry in 2025?

Well it is really a very difficult moment that we are living through, globally, not only in the European industry. This is because of the geopolitical challenges that exist, starting with the implication of the wars (in the plural, unfortunately) that are going on. There are very important problems to face in Ukraine, in the Middle East and elsewhere. Beyond the human tragedy, all that has an impact on global trade; a lot of freight goes through the Strait of Hormuz and the Suez Canal. Energy prices are rocketing. US president, Donald Trump, seems to be a little bit nervous when it comes to applying tariffs to many trading partners. With all of this, Europe’s competitiveness is falling and you have a panorama that is not very easy. But it is important that we recognise these things, take stock and address the issues. We have to live in the real world. But, at the same time, we need to bear in mind that, in leather, we have a product that holds lots of good cards for the future.

What, within this, is the state of play in the leather industry in Europe?

The situation in Europe is the result of the policies that the previous EU Commission developed around its Green Deal strategy, with Frans Timmermans as the vice-president who had responsibility for climate action and for the Green Deal between 2019 and 2023. He gave a lot of leeway to DG Environment, the directorate-general of the European Commission that has responsibility for environmental policy. With very good intentions, DG Environment put forward a number of regulations that have had a serious impact on the European economy, weakening the economy overall and prompting important companies to exit Europe. This is now going to be addressed by the current Commission, which took office in December 2024. It has already put forward a number of so-called ‘omnibus packages’ in an attempt to reduce red tape and improve efficiency. Now we have the Competitiveness Compass, a new roadmap to boost economic growth. We all want the objectives to be achieved, but the way the

Secretary general of COTANCE, Gustavo González-Quijano.

CREDIT: WTP

objectives have materialised in regulations is totally unrealistic. That is why it is important for a kind of redrawing of the legislation to take place and make it more realistic.

What is the European Commission’s level of sympathy for and understanding of the work of the hide traders, tanners and craftspeople who work in the leather value chain in the European Union?

It is still early days for this new Commission. We will need to wait and see what the proposals look like when they arrive. For the time being, I don’t yet have too much of a sense of how things are going to go. We have written to the commissioner for the environment and to the commissioner

for industry to ask for meetings with them. So far, we are still waiting for a response. What I can say is that it looks as though the new policies that the new Commission has outlined will be much more aligned with the needs of the industry, and not only of our industry, but all industries. For example, it will address Farm to Fork, a strategy it first published in 2020, and there will be new agricultural objectives. And, for industry, there will be a new competitiveness deal that will be implemented.

Based on long years of working to build unity and leadership in the leather industry, what, in your opinion, are the main factors that have prevented higher levels of both unity and leadership in the global industry?

The leather industry is a fragmented sector. We do not have any leverage with our suppliers and we do not have any capacity to influence our customers. We are squeezed between two worlds. Maybe we are going to continue to be torn between these two worlds, or maybe we are going to become part of one or the other, part of the world of the meat companies that supply the hides, or part of the luxury and fashion sectors that use finished leather. I don’t know. But, in any case, the industry is struggling to find its place and occupy it. We have medium-sized enterprises, small and micro enterprises, and many craft enterprises. It is difficult to bring all of these together. We have a fantastic organisation at international level, the International Council of Tanners, managed wonderfully by its secretary, Dr Kerry Senior, from Leather UK, and under the current leadership of Bekir Burak Uyguner from Turkey. They are doing a really good job of making people from different countries understand how important it is to come together under one system of governance. There is no need to create a new organisation or a new association. That is not necessary. But we need to use the organisations that exist in the sector already. They can bring people together and make sure we are all pulling on the same thread together. We don’t need a new organisation. What we need is fewer free-riders.

What have been the main consequences of the lack of a single voice for the industry?

The consequences are clear to everybody: we don’t have the influence that we should have. Other industries have been able to bring together the whole value chain and to speak with one voice, and they are more successful than us. If we do not achieve this unity, we are going to struggle in the future. I think now is the time to make this paradigm shift and come together to pull on the same thread at the same time and achieve our objectives.

What could bring about this paradigm shift in the current context in which we are living and working?

What we are working to make clear is that leather is the perfect material for the circular economy and that is the future. We hold all the cards for achieving this. Leather is a natural material. It is biodegradable at the end of life. It is renewable at the beginning of the lifecycle. It is one of the most beautiful materials that exist and one of the most durable materials for the future. Recognition of these qualities is what we need to push for. If we can push all together we may achieve our objectives.

A clearer identity

“ We have hope for the future; the circular economy is going to be a game-changer for many industries, including for our industry.”

What grounds are there for optimism that the industry can achieve this in the second half of the 2020s?

Europe is maybe one of the regions that is introducing most of the regulations that are driving changes in the global leather industry. We need to come up with authenticity rules. The US is doing this with the proposed Consumer Protection and Automotive Transparency Act in the state of New York. We in Europe are working on integrating leather authenticity rules into textile labelling regulations. This is going to give to the industry a clearer identity and the chance to link to this identity a number of features that are important for the circular economy. That is why we have hope for the future. The circular economy is going to be a game-changer for many industries, including for our industry. For our industry it is going to have a positive impact because we will be able to show that our environmental credentials put leather ahead of other materials that are competing for the same markets. I think our customers and brands are going to be able to identify leather as one of the most sustainable materials you can have.

Will this also impact public spending? If public spending needs to go on sustainable products, will this help make sure there is leather in the furniture, footwear, cars, public transport and so on that governments spend money on?

There are rules about public procurement and there are going to be more rules in place for green public procurement. For now, textiles is a sector that is much more active in this area. We need to work to make leather part of the requirement for green public procurement. That’s why it is important to make sure there are sound eco-design requirements and an EU identity in the textile labelling regulation. Eco-design requirements for footwear are coming in 2026 or 2027 and we are already working on relevant horizontal aspects and looking at what is going on in the textiles sector. Requirements for textiles are probably going to be used as a model for setting up the requirements for leather. Yet, questions concerning durability and biodegradability are not the same for leather as for textiles. For example, we want biodegradability to be recognised as recycling at the end of life. It is recycling, with nature. Over time COTANCE has been participating in, contributing to, sponsoring and promoting peer-reviewed scientific papers. These include one on the absence of links between leather and deforestation that the Sant’Anna School of Advanced Studies in Pisa published last year, and one on carbon analysis that Ars Tinctoria published in 2023. There was also the paper comparing leather against synthetic substitutes that FILK published in 2021. We have a number of science-backed documents that we can use to put forward the environmental credentials of leather, from a factual point of view.

leather.evolvedbynature.com

“Accentuate the positive Eliminate the negative Latch on to the affirmative” *

Now entering its fifth decade, the 41st edition of APLF didn’t quite match the buzz of the previous year. The 40th event, returning to Hong Kong after a pandemic hiatus, brought a renewed sense of excitement that helped the industry push through lingering challenges. However, by 2025, with two major trade shows already held in India and Italy, the atmosphere felt more subdued. While global conflicts and ongoing uncertainties kept leather demand somewhat muted, the political landscape — marked by shifting trade relations and fluctuating messages — further slowed the momentum seen in earlier editions.

The days of major deals being struck at trade shows belong to the past. Today, relationship management takes precedence, and for many, simply keeping business afloat during tough times is the best they can hope for as they await a return to more prosperous days. Despite these challenges, the industry continues to adapt, focusing on the positives and celebrating the “little wins”.

These small victories were certainly a topic of discussion. Innovations in tanning technologies were met with enthusiasm, and the industry’s growing acceptance of Life Cycle Assessment (LCA) data marked a significant shift. What was once met with resistance is now seen as a valuable tool for transparency and collaboration across the entire leather supply chain. This progress has been encouraged by

the revised Higg Index and its updated MSI data. On that note, it is worth remembering that Ecoinvent’s data sets for fossil-based materials were also updated late last year, increasing their recorded environmental impact. One can’t help but wonder: Will the full supply chain of plastic-based leather alternatives ever be scrutinised with the same rigour, including drilling, extraction, and refining? We can but hope and whilst we may be asked to justify our existence, these are the cards that we have been dealt and we must keep moving.

The event featured just over 600 exhibitors from 40 countries and regions, including 24 group pavilions. These numbers indicate a slight decline compared to 2024, which is not surprising given the current state of the industry. This decline highlights a sense of caution within the sector.

“Accentuate

the positive, eliminate the negative, latch on to the affirmative”

The Hong Kong Convention and Exhibition Centre viewed from the Star Ferry in the Victoria Harbour ALL CREDITS: WTP

shaping market trends and influencing leather prices throughout the first three quarters of 2025. With 25 side events — including seminars, talks, and business-matching meetings — spread across three days, Ms Lee noted that these additions were a direct response to visitor feedback, particularly the demand for more in-depth industry insights and a strong focus on educating Generation Z. She also pointed out that such initiatives had previously led to increased foot traffic. The exhibition’s proximity to mainland China continues to make it a strategic stop for visitors, whether before or after the event. Additionally, Hong Kong’s compact city layout ensures that post-show networking remains centralised in familiar venues, with Joe Bananas being a notable hotspot.

Looking at the economic data from 2024 and 2025 in general, there is a clear contrast between regions, with geopolitical tensions still influencing growth and confidence levels and, as much as these numbers give us a snapshot, the ever-changing political landscape means these figures can be as stable as a house of cards – so do not be too surprised if they shift soon!

On a positive note, the attendee list included representatives from past exhibitors, which is an encouraging sign. This suggests that while the event continues to attract interest, some companies may find it more valuable to allocate their budgets towards directly engaging key customers and holding meetings away from the exhibition stands instead of exhibiting. Figures released by the organisers indicate that attendance was down slightly, by just under 10%. This is not unexpected, as last year’s event was dubbed the “Hong Kong Reunion”.

As with many recent shows, the distribution of industry sectors — hide merchants, chemical manufacturers, machinery manufacturers, and tanners — followed a familiar pattern. With the industry as a whole remaining flat, the main source of optimism came from hide suppliers and chemical manufacturers, while machinery manufacturers took a more cautious, if not pessimistic, view.

One key takeaway from the event is that, despite past speculation that the larger ACLE show might overshadow or even end the Hong Kong event, reality has unfolded differently. The Shanghai exhibition has largely become a domestic affair, catering primarily to the Chinese industry with only limited participation from European and international businesses. In contrast, APLF has firmly established itself as a truly international trade show, focusing on volume production leathers rather than the high-fashion offerings typically showcased at Lineapelle.

Crunching the numbers

Many international organisations, including the IULTCS, ICHSLTA, ICT, and Leather Naturally, hold their annual meetings at APLF, underscoring the event’s global significance. At the inaugural press conference on March 12, newly appointed event director Janice Lee marked the exhibition’s entry into its fifth decade. She expressed confidence that APLF participants would play a key role in

In 2024, according to reports in Trading Economics, the Euro area’s GDP growth was stagnant at 0.1%, while India and China were set to grow at 7.6% and 5.2%, respectively. The US economy expanded by 3.1%, thanks to government subsidies. Consumer confidence in India and China was strong (92.3 and 87.6), while the Euro area (-15.5) and the US (79.6) were weaker. PMI data mirrored this, with India at 56.7, China at 50.8, the US at 51.1, and the Euro area at 46.1.

In 2025, the Euro area’s GDP growth remains sluggish at 0.2%, with India and China expected to grow at 7.3% and 5.0%. The US economy is forecast to grow at 2.9%, a slight dip. Consumer confidence in India and China has dropped slightly to 116.4, while the US (80.2) and Euro area (21) remain lower. PMI figures show India at 55.2, China at 51.3, the US at 50.7, and the Euro area at 45.9, according to the reports. While the Euro area has seen minor improvements, it still faces challenges. India and China continue to outperform, despite global uncertainties, while the US is showing slower growth than last year.

Breakfast communication

At the Leather Naturally (LN) breakfast, held on the morning of the second day, its chairman Luis Zugno opened the meeting with a rather different message, thought provoking and tackling a difficult topic — the sustainability of the leather industry as a whole, which is under threat from multiple factors. He highlighted not just the potentially water-intensive processing and the chemicals used but also the sheer amount of power required — not only in the tanning process itself but also in the physical movement of raw materials and finished products, a system that has remained largely unchanged for the last 4,000 years. Expanding on his point, he turned to the end-of-life challenge, noting that while many leathers are biodegradable, few are truly compostable. This is just one of several pressing issues facing the industry,

“Accentuate

alongside increasing regulatory challenges. However, Mr Zugno asserted that Leather Naturally has the potential to drive change and help the industry navigate these obstacles as it moves forward.

Following this, Kim Sena, a member of the LN board and currently Sustainability Director for JBS Couros, took the floor to provide an overview of the recent LCA guide, in which Leather Naturally played a key role. The guide offers valuable insights for stakeholders and consumers interested in the environmental impact of leather production. LCAs assess a product’s environmental footprint across its entire life cycle, from raw material sourcing to disposal, helping companies evaluate sustainability at every stage while keeping pace with evolving regulations.

Focusing on bovine leather, the guide draws on industry research to present data-driven analysis and practical applications. It covers 56 different LCA studies from six major tanning companies across 11 different locations. One of its key takeaways is the updated Higg Index dataset, developed in collaboration with the Leather Working Group (LWG). The new data shows that the environmental impact of bovine leather is 55% to 67% lower than previously reported, with global warming potential reduced by 60%, while metrics for eutrophication and chemical impact have both fallen by over 60%.

Mr Sena noted that these findings could and should prompt brands to rethink their stance on leather, as the data challenges common misconceptions and has meaningful implications for material selection. He also emphasised that this is far from the final word — ongoing process optimisation will continue to drive further reductions in LCA values over time.

To close the meeting, Dr Kerry Senior, a newly appointed Leather Naturally board member, moderated an open Q&A session to gather the audience's insights. Comprising members, supporters, and other interested parties, the audience was invited to share their views on the future of Leather Naturally. Dr Senior acknowledged the valuable content on the LN website and the quality of the session's presentations, then posed a critical question: Why are membership numbers declining?

This led to a lively discussion on whether LN should focus its messaging on consumers or brands. Several participants cited practical examples where consumerfacing campaigns had failed to gain traction, suggesting that consumers, while influential, often only purchase what's readily available. One audience member, who supplies leather to major shoe producers, highlighted that brands will not stock products that do not sell, and ultimately, it is the brands that must educate consumers. The conversation also touched on the need for greater communication within the supply chain, though a reluctance to share messaging with competitors complicates matters. In the end, it was clear that while the industry is educated, the messaging needs to be amplified externally, where we can all play our own personal role.

Side events

APLF 2025 hosted a series of onsite events focused on education, information sharing, and industry engagement, reinforcing APLF’s commitment to serving the leather

sector. The Global Footwear Summit brought together 100 top executives, industry leaders, and professionals from the global footwear industry, offering a platform for discussing key topics such as sustainability and compliance, with World Leather Technical Editor Mat Abbott serving as a panellist. The third edition of the LED Project saw designers from China, Vietnam, Japan, and Pakistan collaborate with top tanners to create distinctive leather fashion pieces, showcasing the versatility of Tuscan vegetable-tanned leather.

The Best of APLF Awards recognised outstanding exhibitors across APLF Leather, Materials+, and Fashion Access, setting a standard for future industry participation. Additionally, the Design-A-Bag Online Competition concluded with Eliane Yahari from Argentina emerging as the overall winner for her design, the Yvoty Bag, while Uthra S Ganesh from India and Jiang Si Mi from China were named finalists.

APLF 2026 is already in planning, with the next event set to take place in Hong Kong, 12-14 March 2026.

* Johnny Mercer, US lyricist, 1944.

Eliane Yahari from Argentina was the overall winner of the APLF Design-ABag online competition for her design, the Yvoty Bag.

makes it

Renewable sources

Nobody does it like Ecotan! We have pioneered the most innovative technology for naturally tanning leather, introducing a truly biocircular process. This ensures unparalleled quality, hygiene and comfort, alongside robust sustainability in every leather article right from the initial design phase. The ultimate choice for car interiors.

GSC Group outlines latest sustainability initiatives

GSC Group, a long-established manufacturer in the leather chemicals sector, has outlined its latest sustainability initiatives in its 2023

Sustainability Report. With nearly 50 years of experience, the company seeks to integrate technological advancement with environmental responsibility, focusing on circular economy principles, energy efficiency, and innovation in leather processing chemicals.

The latest report from the Italian chemical manufacturer highlights key areas of progress, including investment in renewable energy, bio-based chemistry, emissions reductions, and sustainable research. While these efforts demonstrate an ongoing commitment to environmental and social responsibility, The GSC Group acknowledges the complexities and challenges involved in making the leather industry more sustainable. One of its stated priorities is to increase reliance on self-generated renewable energy. In 2023, the company generated 15% of its total energy needs through photovoltaic systems, which, it claims, prevented 132.5 tonnes of CO₂ equivalent emissions. However, it acknowledges that further efforts are needed to reduce its dependence on external energy sources and fossil fuels.

R&D Manager, Francesco Serafini, explains, “To increase the percentage of self-generated renewable energy, it is essential to expand the available photovoltaic surfaces. Therefore, we have invested in a new 12,000-square-metre facility in Montebello Vicentino, where around 4,000 square metres of solar panels will be installed. This will allow us to double our energy self-production and improve operational sustainability.”

These developments align with broader industry trends, where manufacturers are under increasing pressure to shift towards renewable energy sources. However, it remains to be seen whether these measures will be sufficient to meet long-term decarbonisation targets, given the energyintensive nature of leather chemical production.

GSC Group’s sustainability journey began in the early 2000s, driven by innovation, technology, and expertise, continuously expanding in plants, products, and certifications.

CREDIT: GSC GROUP

Advancing bio-based chemistry

The development of bio-based chemicals is a key focus as it seeks to reduce reliance on fossil-derived raw materials. However, one of the main challenges in transitioning to more sustainable alternatives is maintaining the same level of performance as traditional petrochemicalbased products.

To address this, the company states that it has adopted a rigorous research and development process. More than 10% of its annual budget is allocated to R&D, with additional investments planned for new laboratory facilities and equipment. It also claims that its quality control system is designed to ensure that bio-based formulations meet performance expectations, with over 60,000 chemical and application tests carried out annually.

“We continuously invest in R&D to formulate bio-based products using high-quality raw materials, testing them to ensure both effectiveness and stability. On average, our laboratories verify 20,000 products per year, conducting up to 100,000 quality control analyses. This level of testing is critical to maintaining high performance standards while transitioning to more sustainable chemistry,” says Mr Serafini.

Customer collaboration is also a factor in product development, with approximately 53,000 leather tests conducted and 6,500 leather samples verified on request annually. This approach is intended to allow continuous optimisation of formulations based on real-world applications. However, the wider adoption of bio-based chemicals across the industry remains a gradual process. While these efforts indicate a commitment to sustainability, challenges such as raw material availability, cost, and regulatory compliance continue to shape the pace of change.

Addressing Scope 3

Scope 3 emissions — those generated across the supply chain — represent one of the biggest challenges for companies seeking to reduce their overall environmental impact. According to Mr Serafini, indirect emissions account for the majority of its carbon footprint, particularly those associated with raw material procurement. “The reduction of Scope 3 emissions represents a strategic goal for our business, achieved through close collaboration with suppliers across the entire production chain. We prioritise suppliers that provide bio-based and renewable raw materials, reducing dependence on petrochemical derivatives and lowering overall CO ₂ emissions as much as possible.”

To support these efforts, the company adheres to the Zero Discharge of Hazardous Chemicals (ZDHC) programme, with 417 registered products meeting ZDHC compliance standards. In 2023, it claims to have achieved a 4.2% reduction in the sales of Manufacturing Restricted Substances List (MRSL) chemicals, which it attributes to investments of approximately €100,000 in safer alternatives. Transportation-related emissions are another area of focus. The company claims that it has taken steps to reduce its logistical carbon footprint by favouring local and regional suppliers where possible. Additionally, it was the first Italian business in the leather chemicals sector to participate in Carbon Footprint Italy, a national programme

aimed at monitoring and reducing greenhouse gas emissions. While these measures indicate progress, the effectiveness of supplier engagement strategies in significantly reducing Scope 3 emissions remains a challenge across the industry. The extent to which such initiatives contribute to overall emission reductions will likely depend on the broader availability of sustainable raw materials and supply chain efficiencies.

Innovation and collaboration

A key investment in its long-term sustainability strategy is the construction of a new leather application laboratory in Zermeghedo. Scheduled for completion in September this year, the 6,500-square-metre facility is expected to be one of the largest of its kind in Europe.

The laboratory will focus on the development of new formulations for wet-end and finishing processes, with plans to introduce an integrated digital system for tracking formulations, which it claims will improve efficiency and record-keeping in the development process. A dedicated area will also be allocated to customer support, offering physical leather testing and colour analysis services.

Although research into new sustainable raw materials will remain within the Montebello Vicentino headquarters, the new facility aims to contribute to the development of more environmentally friendly technical formulations with improved Life Cycle Assessment (LCA) results.

The Zermeghedo laboratory will be featured in an upcoming issue of World Leather, where further details of its research focus and expected impact will be explored.

Looking ahead

The group’s latest sustainability report provides an insight into its ongoing efforts to integrate environmental and social responsibility into its operations. It claims to have made significant progress in key areas such as renewable energy expansion, bio-based product development, and supply chain emissions reduction. However, the extent to which these initiatives contribute to broader industry decarbonisation goals will depend on their long-term impact and scalability.

The completion of the Zermeghedo laboratory will represent a substantial investment in research and collaboration, signalling the intent to remain at the forefront of sustainable leather chemistry. The company seeks to use this facility as a platform for industry engagement, supporting both product development and wider sectoral innovation.

Nevertheless, challenges remain. The transition towards sustainability in the leather chemicals industry is a complex process, influenced by factors such as regulatory developments, raw material availability, and economic pressures. While the group’s initiatives align with global sustainability objectives, ongoing assessment will be required to determine the effectiveness of these measures in achieving meaningful environmental improvements.

As the industry continues to evolve, the ability of the company to adapt and expand its sustainability strategies will likely play a key role in its future positioning. The coming years will provide a clearer picture of how these investments translate into measurable progress towards a lower-impact leather chemicals sector.

Carbon unleashed: the circular carbon revolution

Gustavo Adrián Defeo FSLTC CTC Ars Tinctoria

As the demand for sustainable materials continues to rise, understanding the carbon content of various products has become crucial. The origin of carbon, whether fossil-based or bio-based, plays a key role in determining the environmental impact of materials. The shift from fossil fuels to bio-based sources can significantly reduce carbon emissions, even at the end of a product’s life cycle. Accurate quantification of bio-based carbon is essential for transparency in sustainability claims, enabling industries, policymakers, and consumers to make informed decisions. Standards, such as those developed by CEN/TC 411, provide clear guidelines for measuring and certifying bio-based content, supporting the transition towards a more sustainable, circular economy.

Carbon, along with other biogenic elements such as nitrogen, oxygen, and hydrogen, was pivotal in the emergence of life on Earth, leading to the creation of vast reserves of fossil carbon throughout the planet's evolution. Fossil carbon, found in coal and oil, belongs to a bygone biospheric equilibrium. For centuries, these fossil fuels have been used by humanity to generate heat and light. However, the large-scale use of fossil carbon as an energy source since the Industrial Revolution has accelerated the depletion of these resources, simultaneously increasing the emission of carbon dioxide into the atmosphere. The rise of horizontal drilling for oil extraction, a method where a well is first drilled vertically and then turned horizontally to access a wider area of the underground reservoir, has also contributed to this, releasing additional fossil methane. Horizontal drilling has enabled the extraction of fossil fuels from challenging geological formations like shale, making it more efficient to access larger volumes of oil and gas. Both carbon dioxide and methane are the leading greenhouse gases, and their unbalanced increase is a key driver of global warming. Historically, clothing, footwear, belts, and other accessories were crafted from natural, renewable, bio-based materials. Leather and fur were the first materials mankind learned to

preserve, maintaining their unique protective qualities. With the advent of agriculture, natural fibres including cotton, wool, hemp, and silk evolved from artisan crafts to mass production, particularly after the Industrial Revolution, leading to increased environmental impact.

Over the past two centuries, the petrochemical industry has grown exponentially. The invention of Bakelite in 1907 marked the beginning of the synthetic polymer era, followed by the widespread development of plastics such as polyethylene, nylon, polyurethane, and polyester. These materials spurred innovation across various industries, enabling mass production of goods like packaging, disposable tools, fashion items, and cheap consumables. However, the rise of synthetic polymers has also posed significant environmental challenges, as these materials persist in the environment, evolving into so-called “forever chemicals” with limited biodegradability. Their breakdown process results in the gradual formation of micro- and nano-plastics. While plastic recycling is possible, the reality is that less than 9% of produced plastics are recycled. This presents a significant issue in dealing with plastic waste, as recycling still produces persistent plastic forms, while incineration increases atmospheric carbon dioxide, and ongoing fossil drilling continues to release methane. In response, several

governments have implemented policies, such as the EU Green Deal and UN Sustainable Development Goals, to reduce the use of fossil-based materials and address this environmental crisis.

Leather, however, has remained a cornerstone of the fashion industry, appreciated for its durability, versatility, and enduring appeal. As the industry transitions to sustainability, leather continues to be a valuable bio-based material, offering a natural alternative to synthetic, petroleum-derived textiles. Unlike plastic-based vegan alternatives to leather, which contribute to microplastic pollution, responsibly sourced leather can be one of the most sustainable options when produced using ethical, eco-friendly methods.

In recent years, various bio-based material alternatives have emerged, claiming to be derived from renewable biological sources including plants, fungi, and agricultural waste. These materials promised sustainable solutions to the environmental impact of traditional textiles and leather, though many still rely on fossil-based polymers, toxic chemicals, and resourceintensive processes.

In this context, the origin of carbon plays a crucial role in sustainability and circularity, particularly considering its harmful environmental impact when mismanaged or overused. Shifting from fossil carbon to bio-based sources can significantly reduce atmospheric carbon emissions, even when incinerated at the end of their lifecycle. The ability to quantify the proportion of fossil versus bio-based carbon in materials has become a key parameter for transparent sustainability claims.

However, bio-based content alone does not provide insight into a product’s overall environmental impact or sustainability, which can be evaluated through life cycle assessments (LCA) and sustainability criteria.

While bio-based content is a valuable parameter for assessing a material's circularity, it is not the only consideration. Sustainable materials result from a series of circular processes, where factors such as energy consumption, transport, land and water use, waste management, and end-of-life options must also be accounted for.

In this context, CEN/TC 411, the European technical committee responsible for the standardisation of bio-based products, is working to develop standards that ensure transparency, reliability, and consistency in the production, labelling, and certification of materials derived from renewable biological resources. These standards are critical for facilitating the transition from fossil-based to biobased economies by providing clear criteria for sustainability, bio-content determination, and performance evaluation and communication.

CEN/TC 411’s standards cover key areas such as terminology, testing methods, sustainability assessment, certification schemes and communication for bio-based products. By establishing harmonised standards across Europe, the committee enables industries, policymakers, and consumers to make informed decisions, fostering innovation while ensuring both environmental and economic benefits.

The standards developed by this commission are transversal across all sectors, enabling the comparison of material performance regardless of origin. This is crucial in an eco-design context, where it is essential to assess different materials using the same parameters. Such comparability helps avoid misleading or greenwashed approaches.

As with most standardisation committees, a common

language is established through clearly defined terms. For CEN TC 411, these definitions are provided in EN 16575:2014 (Bio-based products — Vocabulary).

The biomass content of materials is defined in two key standards:

• EN 16640 (Bio-based products — Determination of the bio-based carbon content of products using the radiocarbon method)

• EN 16785, Parts 1 and 2

Part 1: Determination of the bio-based content using radiocarbon and elemental analysis

Part 2: Determination of the bio-based content using the material balance method