Actual Slaughter Under Federal Inspection

be certain petroleum products. At the same time an additional 10% tariff will be applied to all goods imported from China. Canada immediately responded with 25% tariffs on some US goods and China announced plans to apply tariffs to agricultural products coming from the US from March 10. These taxes will change trade practices, prices and protocols in ways that are unclear at this point. The immediate impact will be trade disruptions and interruptions.

Sales last week in the north were $197$199 while in the south mainly at $197, which was $2 lower than last week. Dressed sales were mainly at $313, with a few up to $315, also $2 lower. Falling futures were an influencing factor in this week’s failure to hold prices steady. Sales volumes were light in all areas.

Corn has taken a large hit and prices have fallen by more than $0.50 per bushel this past week and continued down to open this week. The status of our trade agreements with both Mexico and Canada are formative of prices for grain this year. Corn basis levels will switch to the May contract. Corn basis levels in Guymon, Oklahoma, are at $1.00, basis the May contract.

GERMAN PERSPECTIVE

This week: Last week, at least in Europe, everything centred around the Lineapelle trade fair in Milan. We wouldn’t say that there were any great expectations. Naturally, the trade fair only plays a limited role in the overall and global events in the leather industry. Nevertheless, it remains the epicentre for everything that revolves around fashion, creativity and the use of leather for the finer things in life. For the mass market, it can at best serve as inspiration. For mass production of shoes, furniture or even cars, it means very little.

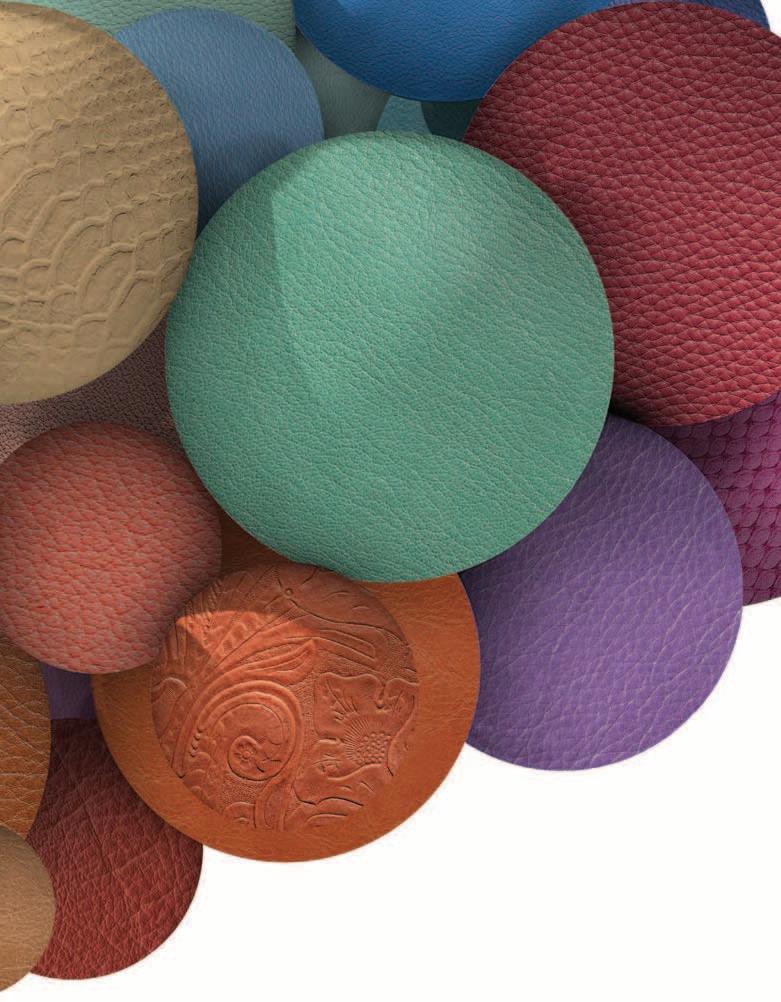

It is always a pleasure to be shown leather in all its beauty and elegance. Everything that can be done with the animal skin to refine it into leather is shown. The unbiased visitor can only be impressed. Except in very small sectors, we could not recognise any really remarkable new fashion trends. Naturalness, colour, touch and feel still play the dominant role, at least in Milan. Performance also, but in this show to a lesser degree.

Among the exhibitors, one had the feeling that everything more or less revolved around a few very successful and well connected leather producers. The household names that still serve the successful brands in the

leathergoods sector had the biggest stands and in some cases you got the impression that it was more a question of the social event than actually showcasing the products. In the end, this is also part of the business.

There were also many stands at which you could only very rarely really see any visitors and disappointment could be seen in many faces. To summarise briefly, we can say that the spectrum between satisfied and successful and disappointed was possibly wider than

ever before.

For raw materials suppliers, and therefore of course for us too, the trade fair is actually mostly just a place to meet and an opportunity to exchange ideas with colleagues and other people and to take away general impressions. It is clear to see that colleagues who are connected with slaughterhouses have been given clear directives that today’s low prices must come to an end. For many, it does not necessarily matter whether this is realistic or even objectively justifiable.

So far, these ambitions have only left their mark in the very high-end segment, but have not yet had any particular impact on the market for standard materials. The price changes are probably still rather minor for the time being, but tensions between the leather industry and meat producers are likely to increase in the coming months. However, this also means that some leather producers in Europe will take another critical look at their future.

LATEST HIDE AND SKIN PRICES FROM GERMANY

The kill: Slaughter remains relatively high despite the extremely high prices for live cattle. We are now entering the carnival season and normally this should reduce volumes, but there is little sign of this at the moment. However, it won’t be too much longer before beef demand declines seasonally and then we will see what balance between slaughter capacity, meat demand and cattle supply can be found in the second quarter.

What we expect: Impressions from Lineapelle will probably be discussed on many fronts. There is not really any great need for action in Europe for new contracts. Preparations are now being made for the APLF fair in Hong Kong, which will bring together visitors from all countries. Major suppliers from the US, South America and Oceania will be there so this will be more of a reflection of the situation in mass production and the global demand for massproduced goods. This will probably have a much greater impact on price trends in the coming months than Lineapelle. We do not expect any major changes until then. It is of course true that the time leading up APLF will mostly be characterised by suppliers trying to test the market with higher prices.

LONG READ

Leather and the Circular Economy: Circular Stories Good COP, bad COP

COP16 and COP29 – Conference of the Parties to the United Nations conventions on biodiversity and climate change – highlighted differences of opinion on accountability and financing and were generally thought of as falling short of desired results. But luxury groups used the platforms to announce stricter environmental targets, and a methane

reduction strategy could add impetus to the argument for tanning hides instead of landfilling.

Alongside representatives of most of the world’s governments at the 16th meeting of the Conference of the Parties to the United Nations Convention on Biological Diversity (CBD COP16) in Cali, Colombia, last autumn, were parties that saw themselves as an important piece of the jigsaw when it comes to preserving the world’s ecosystems. In fact, there were more business representatives than ever before, raising questions over influence and agenda, with groups such CropLife International and Exxon Mobil sending more delegates than some countries.

Represented among the businesses was luxury group Kering, which chose the conference to announce it was the first to adopt verified Science Based Targets for Nature (SBTN) for both land and fresh water following a year-long pilot study. The owner of Gucci, Saint Laurent, Bottega Veneta and Balenciaga has set its initial sights on the Arno basin in Tuscany, where most of its tanneries and supplier tanneries are located. It aims to reduce water use in the basin by 21% by 2030, a target that will be rolled out to other locations over the coming months. Shortly after the conference, it increased its stake in Colonna Group, a key leather supplier, through its subsidiary Gucci Logistica, from 51% to 100%. The move includes three tanneries - Marbella Pellami, Conceria 800 and Falco Pellami in Santa Croce sull’Arno – which will be central to achieving the target.

Kering suggested working with SBTN also helped strengthen its deforestation and conversion-free commitments, notably to include more detailed land-use change assessments associated with the group’s sourcing of leather. It will also focus on promoting regenerative practices and enhancing biodiversity in sourcing regions, including Olive Leaf’s Grass project in South Africa, from which it buys sheep wool and leather.

Luxury targets

The SBTN pilot included 17 other companies, such as rival luxury group LVMH, which also used the analysis to set more stringent targets on biodiversity, launched directly after COP16. New initiatives include a scheme with the World Wildlife Fund to preserve the Congo Basin rainforest, as part of its LIFE 360 programme. It has chosen to adopt SBTN targets relating to a wool supply chain in Asia and grapes in France.

LVMH’s total carbon footprint is 6.3 million metric tons of CO2 equivalent, and to align the carbon trajectory with the Paris Agreement it will need to reduce greenhouse gas emissions linked to site and store energy consumption by 50% by 2026 (compared with a base year of 2019) through a 100% renewable energy policy, and reduce Scope 3 (raw materials and transport) GHG emissions by 55% by 2030. At that point, all of the group's new products will follow an ecodesign process, and repair services will be

extended, as as well as upcycling or reusing leather through its Nona Source platform, which it has opened out to other companies.

Also by 2030, 100% of the group’s supply chains will have a dedicated traceability system. Part of this will include “strengthening the integration of livestock and tanning activities” - which could potentially mean some acquisitions. By 2023, it could specify country of origin for 96% of sheep and leather, but only 88% of wool. By 2026, all new products will include a dedicated information system.

The overall focus for COP16 was to write into legislation how important biodiversity is to the globe’s well-being and agree set plans for preserving it. The official line hailed the conference as a “resounding success” having “unprecedented impact”, highlighting the Cali Fund, a deal on Digital Sequence Information, whereby genetic information that has been sequenced from the natural world can be made available, and the establishment of a

permanent body for indigenous peoples and local communities. However, despite more than 170 official delegations, 40,000 people involved in discussions and a million visitors, the conference closed without agreement on who exactly should pay what and how it would be monitored.

Climate debates

Fast-forward 10 days and 12,700km and another important COP conference, COP29: the 2024 United Nations Climate Change Conference. Held in Baku, Azerbaijan, and attracting 70,000 attendees, this summit wanted build on an important agreement reached at the previous iteration in Dubai –namely, a move away from fossil fuels – and agree how the world would finance reducing its warming to the Paris Summit-agreed limit of 1.5 degrees. The event’s location in an oil-rich country was a bone of contention, as was the absence of some of the biggest players and, again, the proliferation of business interests.

In advance of the event, the International Council of Tanners, the Leather and Hide Council of America and Leather Naturally alongside 30 other bodies reissued a manifesto calling on delegates to recognise the positive role that long-lasting leather products can have in reducing consumption and the environmental impact of fashion industry, building on a document published three years ago for COP26. Expanding on previous messages, the latest manifesto called for leather “to be part of the solution to climate change”, as well as “informed, holistic measures of the impact of materials”. It urges regulators to recognise the challenges faced by the leather industry, noting that it is “constantly working towards ever greater sustainability and circularity”, but that its efforts will be undermined if regulators and brands do not give “proper consideration to the real impacts and benefits of natural materials like leather”. It also calls for measures of environmental impact, including lifecycle analysis, to take full account of all

aspects of the production of any material.

Methane focus

During the conference, the European Commission launched a Methane Abatement Partnership Roadmap to accelerate the reduction of methane emissions associated with fossil energy production and consumption. Under the Global Methane Pledge, launched by the EU and the US, more than 150 countries are implementing a collective goal of reducing global anthropogenic [agriculture, fossil fuels and landfill waste] methane emissions by at least 30% by 2030, from 2020 levels. While the pledge has been a catalyst for action, reports show the countries are falling short.

UNEP-convened Climate and Clean Air Coalition Technology & Economic Assessment Panel – a partnership of 182 governments, intergovernmental organisations and nongovernmental organisations – published a report on Digital Extension Services for Livestock (DSL), or tools that help farmers to

facilitate knowledge transfer and allow for a better understanding of the impact of animal diets, veterinary care and breeding on methane emissions. Launched at a COP29 side event, the report calls for investments to support the rollout of DSL – particularly given that agriculture contributes 40% of anthropogenic methane emissions but receives only 2% of total climate funding, it said.

Waste reduction

Champions of Best Practice

for a future where sustainability is a key driver for commercial decision making where is a driver for commercial decision making.

This ISP consists of four strands.

• The provision of the most accurate information about leather, sustainability and production.

• The championing of best practice at every point in the supply chain.

• The willingness to address the hard issues our industry faces.

• The sharing of information with members, manufacturers, consumers and the media.

Today we look at best practice.

U.S. Government environmental standards, and those of our supply chain’s animal care, rank among the world’s highest and assure buyers of U.S. hides and leather that they have been produced to exemplary standards in all areas including animal care, ESG and sustainability.

Building on our standards, we are now firmly established as one of the global champions of best practice. We accelerate the adoption of new standards and promote them in the U.S. and around the world.

Examples of recent industry developments championed by L&HCA, for example, reducing the use of water through the use of polymer balls, with an added benefit of speeding the tanning process.

Meanwhile filtration techniques have become more sophisticated and will easily remove chromium (III) for reuse. And evaporation is now being used for the removal of salt while coagulants can be added to the water which bind with waste to leave a sediment which can be safely disposed of.

Best practice does not stop at the border.

We do not just promote this framework domestically. We actively promote it worldwide. The more trusted leather is, from wherever it originates, the better it is for the U.S. leather industry and for the planet.

From trade communications to our global Real Leather. Stay Different. program reaching 100s of millions of consumers and influencers worldwide, our work today is repositioning leather as the material of choice for tomorrow.

Visit our website today to find out more USLeather.org

Since its launch at COP28 in Dubai, the Lowering Organic Waste Methane (LOWMethane) initiative has made progress. A coalition of 30 organisations is working with governments to accelerate delivery of the Global Methane Pledge and the Paris Agreement by cutting at least 1 million tonnes of annual methane emissions from the waste sector before 2030. Food waste accounts for 20% of all methane emissions, delegates heard. Thirty nations, representing half of global organic waste emissions, endorsed a declaration committing to tackling this. Among the comments was the idea that lowering methane emissions can be “our emergency brake in the climate emergency”.

Secretary of the International Council of Tanners Kerry Senior, who spent an “interesting and busy” few days at the conference, commented, “The impact of these policies for leather remains to be seen. Livestock will be an obvious target for reducing methane emissions. But minimising organic waste emissions may draw attention to the issue of hide disposal and the need to maximise their use. What better way to do that than to produce leather?”

This message ties in with new analysis from the Leather and Hide Council of America (LHCA) that suggests the previously accepted figures that that one tonne of wasted hides would generate emissions of around 850 kilos of CO2-equivalent is far too low, and the true figure is in fact closer to 13,000 kilos (see the previous issue of World Leather). “Choosing not to turn hides into leather generates emissions of more than 40 million tonnes of CO2e per year,” says Kevin Latner, vicepresident of LCHA, working on the basis that as many as 130 million hides might go to waste every year.

Mirroring COP16, at its conclusion, COP29 delegates were left unable to strike the deals and reach the agreements that the countries bearing the brunt of climate change were hoping for. However, developed countries did agree to provide at least $300 billion per year to developing countries by 2035 to drastically reduce greenhouse gas emissions. “I had hoped for a more ambitious outcome – on both finance and mitigation – to meet the great challenge we face,” UN Secretary-General Antonio Guterres said. “But this agreement provides a base on which to build.”

Dr Kerry Senior added the leather industry must find a way “to have its voice heard and to have policymakers understand the climatepositive benefit of avoiding hide waste”. He has called for senior representatives of the global leather industry to work as hard

possible to put this message across to political and business leaders at the next COP climate conference, which will be held in Belem, Brazil, in November.

NEWS ROUND-UP

Third edition of Italian craftsmanship awards launched by LVMH

For the third time, luxury group LVMH is running a competition aimed at preserving and promoting the savoir-faire and “artisanal excellence” of Made In Italy.

It launched the third edition of its Maestri d’Eccellenza Awards in Milan on February 27, in partnership with Italian industry groups Confartigianato Imprese and the Camera Nazionale della Moda Italiana.

LVMH said the competition confirms its commitment to preserving craftsmanship in Italy and pointed out that its brands employ more than 7,000 artisans in the country.

Artisans have until May 31 to apply for one of this year’s awards. There are three categories and LVMH will select three finalists for each.

Each artisan or company can apply for only one of the three categories. The winners in each category will receive €10,000 to reinvest in their business, media exposure and mentoring sessions.

The three categories are Maestro Artigiano d’Eccellenza, for professionals and businesses with at least 10 years’ experience, Maestro Emergente Artigiano d’Eccellenza, for those established less than 10 years ago, and Maestro dell’Innovazione d’Eccellenza, for professionals and businesses that have distinguished themselves through the ability to innovate, preserving traditional skills and knowledge while “reinterpreting them in a modern way”.

Poltrona Frau launches leathercraft training programme

Leather furniture specialist Poltrona Frau has introduced Atelier dei Saperi (Atelier of Knowledge), a training initiative focused on preserving traditional craftsmanship.

The programme is designed to pass down specialised leatherworking skills to younger generations, maintaining techniques that have been part of the company’s history for over a century.

Developed in collaboration with Regione Marche, IAL Marche Srl Impresa Sociale, Confindustria Macerata, and Assindustria Servizi Srl, with support from the GOL programme (Employability Guarantee for Workers), the initiative provides a 500-hour course for aspiring leathercraft designers. The curriculum includes theoretical lessons, practical workshops, and internships.

Tutors for the programme include two experienced Master Upholsterers from Poltrona Frau, supported by employees from across the company. The course combines traditional craftsmanship with modern techniques, aiming to provide participants

with skills relevant to the industry.

Launched in October 2024 and running until February 2025, the programme also aligns with broader efforts to support employment and skills development in the region.

IULTCS announces 2025 Young Leather Scientist research grant

winners

TheInternational Union of Leather Technologists and Chemists Societies (IULTCS) has awarded the 2025 Young Leather Scientist Research Grants to two researchers under 35, supporting innovation in the leather industry.

Basic Leather Research Grant: Mr. Zoheb Akhter (Pictured right - LASRA, New Zealand) for his study on the hydrolysis of zeolite and chrome shavings, exploring hydrolysate purity and the impact of tanning agents.

Professor Mike Redwood Sustainability/Environmental Grant: Dr. Yudan Yi (Pictured left - Jiaxing University, China) for

QUAKER COLOR A STEP AHEAD IN AUTOMOTIVE FINISHING

developing a dual-function copolymer to improve metal-free eco-leather production.

The Leather Machinery/Equipment Grant will not be awarded this year.

Dr. Volker Rabe, Chair of the IULTCS Research Commission, praised the winners' contributions and acknowledged the support of sponsors Tyson Leather and Leather Naturally.

Lineapelle concludes in Milan

As the leather industry wraps up the final day of Lineapelle (February 25 to 27), and players consider how political tensions, tariffs and conflicts might affect their businesses, show organisers have reported an overall decline in Italian leather production volumes and exports for 2024.

Around 1,100 suppliers, including tanneries, chemical companies and component makers, met in Milan for the twice-yearly three-day fair, showing collections and products for spring-summer 26, with the fair scheduled to coincide with footwear and leathergoods fairs

Supplying innovative finishes to the automotive industry for over six decades

Quaker Color is a division of McAdoo & Allen, with roots in the leather industry for over a century

Micam and Mipel.

Consultancy Spin360 once again organised Science-based Fashion Talks, with topics including leather’s durability, regenerative agriculture and reducing leather’s impact. Speakers represented companies including Hugo Boss, Fendi, Tod’s and Textile Exchange.

Based on 11-month figures from data provider ISTAT, there was a 4.3% decline in turnover and 7.6% fall in Italian leather production volumes in 2024.

The country-specific figures show wide variations. Among the top 20 export countries, Spain (+11 %), Vietnam (+23 %), Germany (+6 %) and India (+2 %) increased exports; France, China and South Korea were largely flat. Shipments to the US (-4%), Serbia (-3%) and the UK (-4%) declined slightly, while substantial declines were seen in Romania (11%), Tunisia (-10%), Portugal (-6%), Albania (-11%), Poland (-12%), Slovakia (-15%), Mexico, (-10%), Turkey (-30%), Czech Republic (-20%) and Hungary (-7%).

Italian footwear exports declined around 6% compared with 2023 while leathergoods

fell “double digits”, affected by international instability, the slowdown of markets such as China and Germany, and the difficulties of access to credit for Italian companies.

One positive sector was garments, which continues to absorb an increasing amount of leather.

The report said: “The ongoing international political tensions that have been a feature of the last few years, and their severe consequences at the economic level, have intensified an economic slowdown that affects consumer products and the supply chains. While on the global political level there have recently been signs of possible relaxation of existing conflicts, the prospects for trade still appear difficult and uncertain, with the risk of further exacerbation, and effects are difficult to fully discern at the global level.”

Growth for Stahl, despite ‘volatile market conditions’

Chemicals

group Stahl achieved full-year 2024 revenues of 930.2 million, parent

group, Wendel, has reported. This figure represents growth of 1.8% compared to 2023.

Wendel welcomed Stahl’s revenue growth, which it said had come “in the context of volatile market conditions for automotive and luxury”.

It said a pro-forma revenue figure for Stahl, discounting sales of chemicals for the wet end of leather manufacturing, would have been €759 million.

Stahl announced in mid-November that it intends to sell the wet-end division of its leather chemicals business to Brussels-based private equity firm Syntagma Capital. On announcing the 2024 results, Wendel said this deal should conclude in the course of the first half of 2025.

Leather finishing remains integral to the Stahl business, the group has said, while the wet-end part of the business will continue to operate independently.

Aston Martin job cuts

UK

car manufacturer Aston Martin is reportedly cutting 170 jobs, 5% of its workforce, after reporting a 21% increase in pre-tax losses to £289 million in 2023.

The company cited supply chain disruptions and production delays as key factors behind a 9% drop in wholesale volumes to 6,030 cars.

The job reductions affect all departments, including manufacturing, office roles, and management. The Warwickshire-based luxury carmaker described the move as a "difficult but necessary action" to align resources with future plans. It aims to achieve £25 million in annual savings, with half expected this year.

Despite challenges, Aston Martin has ramped up production of new models such as the Vantage and DBX707. Chief executive Adrian Hallmark, who took the helm in September, said the company must transition from "a high-potential business to a highperforming one.”

German car industry urges caution on US tariffs

Germany’s national automotive industry organisation VDA has warned that an increase in tariffs on exports of cars from the European Union to the US would directly affect the US economy.

In a statement in February, VDA said discussions about tariffs at the start of 2025 had led it to conclude that there is now a high risk of a global trade conflict, with negative effects on the global economy.

Customs duties for importing cars into the EU at the moment are 10%, compared 2.5% in the US. But VDA pointed out that the US charges 25% on imports of some vehicles, notably pick-up trucks, which are popular in that market.

It described suggestions from US president, Donald Trump, that a tariff of 25% on all vehicle imports from the EU as “a provocation”.

VDA urged the EU to enter into a constructive dialogue with the US on this subject, taking “mutual interests” into account. It then pointed out that German

manufacturers play an important role in the wider US car industry, producing 900,000 vehicles there in 2023, of which 50% were shipped to customers in other countries, boosting US exports.

Also in 2023, Germany imported 193,000 vehicles from the US, with a total value of €8 billion.

In addition, the German automotive sector is the source 138,000 jobs in the US, according to VDA, 48,000 in automotive manufacturing companies and 90,000 in supplier companies.

Coccinelle announces 2024 growth

Italian luxury brand Coccinelle has reported strong financial results for 2024, achieving double-digit growth and a turnover of €104 million, driven by a customer-focused strategy and global expansion.

The brand strengthened its presence in travel retail and opened new stores in Italy, Abu Dhabi, Malta, Austria, and Romania, while renovating key boutiques in Taormina, Naples, Athens, Shanghai, and Bangkok.

Europe led growth with a 12% increase, particularly in Germany, Austria, and Eastern Europe, while Italy grew by 13%, representing 45% of total sales. The Asian market remained stable, and expansion continued in the Middle East. E-commerce sales rose by 12%, now making up over 20% of revenue when including online wholesale.

For 2025, Coccinelle plans further growth, including the launch of its first Pet collection and the C-ME bag, the highlight of its Spring/Summer campaign.

Mipel: fresh ideas to support leathergoods manufacturers

Italy-based leathergoods fair Mipel has concluded in Milan (February 23 to 25), with 200 companies displaying collections for autumn-winter 2025.

The event has again been held concurrently, or partially overlapping, shoe fair Micam Milano, Milano Fashion&Jewels and leather fair Lineapelle, allowing buyers to access a range of manufacturers and suppliers.

The show is organised by Italian leathergoods manufacturers’ association Assopellettieri, with the support of the Ministry of Foreign Affairs and International Cooperation and the ITA-Italian Trade Agency – which invites “VIP” overseas buyers, and places emphasis on the Made in Italy heritage.

Novelties at this show include the Mipel Factory, where visitors watched leather keyrings being cut using machinery that recognises objects and autonomously programmes its work paths. The project, in collaboration with the Arsutoria school, highlights the increasingly central role of technology in preserving Italian craftsmanship excellence.

Embracing the digital and youth-driven marketplace, Italian fashion influencers were invited to the event before visitors, offering their followers style tips and insights into the collections.

Similarly, live streamers from Taiwan and

Singapore operated from stations within the fair, selling products live on their own social channels.

The show’s digital partner, ViaMadeInItaly, helped companies digitise their products, offering an online catalogue to a reported 24,000 buyers.

A new section, The Eastern Edge, featured companies from India and Pakistan.

Claudia Sequi, president of Mipel and Assopellettieri, said: "There is a lot of commitment and determination to face the challenges of the international market. We support companies in their digital transformation and internationalisation processes. The exhibition, today more than ever, represents a great business opportunity where global operators, observers and players converge.”

Lineapelle is part of Assomac’s world tour

Italian leather and footwear machinery manufacturers’ association Assomac has said its presence at Lineapelle in Milan (February

25-27) constitutes another leg on a tour of the world that the organisation is making in the first half of 2025.

It said its ‘Assomac Around the World’ programme had begun in Chennai for the India International Leather Fair (February 1-3), was continuing at Lineapelle, and would then move on to Hong Kong for APLF (March 1214) and to Lahore for the Pakistan Footwear, Material & Machinery Show (April 11-13).

Assomac said this initiative would help “reinforce the process of internationalisation” of its member companies’ business.

It added that ‘Assomac Around the World’ was aligned with the work of Italy’s export promotions agency, ICE.

Science-Based fashion talks on sustainability trends

Lineapelle in partnership with Spin360 is once again hosting the Science-Based Fashion Talks during the upcoming Lineapelle Show, from February 25 to 27.

The event will focus on key sustainability trends in the fashion industry, covering topics

such as the role of natural materials in decarbonisation, durability and eco-design, regenerative practices, sustainable leather sourcing, and the importance of data sharing and value chain collaboration.

Discussions will explore how renewable materials like cotton, wool, and silk contribute to sustainability, while also examining the role of durability and eco-design in setting new industry standards. The talks will cover key regulations such as the Product Environmental Footprint Category Rules (PEFCR) and Ecodesign for Sustainable Products Regulation (ESPR), and how these will shape future industry practices. Regenerative practices and innovations in leather sourcing will also be highlighted, with an emphasis on deforestation-free supply chains and data sharing for improved traceability and transparency.

These talks will bring together international experts to address the future of sustainable fashion at the Lineapelle Show.

Sorensen leather achieves B Corp certification

Danishleather supplier Sorensen has announced its achievement of B Corp certification, joining a global network of businesses committed to high social and environmental standards.

The certification, awarded by non-profit organisation B Lab, recognises companies that prioritise transparency, accountability, and sustainability in their operations.

To achieve certification, companies must complete the B Impact Assessment and score at least 80 points across five key categories: Governance, Workers, Community, Environment, and Customers. Sorensen Leather exceeded this threshold with a score of 99.7, demonstrating its commitment to responsible business practices.

CEO & Partner Louise Vesterskov Sorensen described the certification as a structured validation of the company’s sustainability efforts, reinforcing its dedication to

minimising environmental impact and fostering strong industry partnerships.

Sorensen Leather now joins a global community of over 9,400 B Corps across 105 countries and 160 industries, positioning itself as a leader in sustainable business practices within the leather sector.

Brands prioritise geopolitics over sustainability

Asurvey has shown that for the first time in several years, luxury and fashion brands have put geopolitical shifts at the top of their priority lists, pushing ‘sustainability’ into second place.

The research, by Euromonitor, was presented by Federico Brugnoli, CEO of consultancy Spin360, during a presentation at Italian footwear show Micam Milano.

“This is the most important priority now,” he said. “Companies want to know how it is going to affect their businesses.”

He moderated a high-level panel of brands, manufacturers and associations – including representatives from Manolo Blahnik and Tod’s - discussing how the need for data, sustainability and wider issues informed their decisions and sourcing habits.

Micol Costi, materials and sustainability manager at Italian footwear brand Diadora, said the pandemic, conflicts and geopolitical shifts were causing brands to focus on derisking strategies, including maintaining a diverse sourcing base. Tariffs have led to price distortion and unfair competition, she added, creating extra challenges for stakeholders.

A response to this is to create “strong, consolidated and clean supply chains”.

French leather industry puts key points to President Macron

France’s

president, Emmanuel Macron, met senior representatives of the country’s leather industry on the opening day of the Paris International Agricultural Show, February 22.

After the meeting, the president of Alliance France Cuir, Christophe Dehard, said he had taken the opportunity to tell President Macron about the challenges the leather sector faces, but also about its dynamism.

He pointed out to the president that the work of the leather industry in France, 145,000 tonnes of hides and skins, which he said was 20 times the weight of the Eiffel Tower.

He said that without cattle farming, there would be no leather industry, but that without the leather industry, there would be many tonnes of extra waste to deal with.

‘Resilience’ the key word for 99th Micam

Around850 companies – half of them Italian – are presenting autumn-winter 2526 footwear collections at the 99th edition of Micam in Milan (February 23 to 25).

This event’s theme is “game changers”, representing the footwear industry’s ability to “face change with courage while maintaining a strong bond with tradition”.

“The world of footwear is complex; it always requires new professionals, a visionary approach to the supply chain, creativity in inventing new styles, and a deep respect for a history of excellence,” said Giovanna Ceolini, president of Micam and shoemakers’ association Assocalzaturifici.

“2024 ended with a decline in exports (8.4% in value) and turnover (-9.4%), along with a drop in production. However, forecasts indicate a gradual market improvement by the end of the year, with recovery prospects driven by the industry's capacity for innovation and resilience.”

The show is preparing for its 100th edition this September.

Giorgio Possagno, CEO of Micam, said: “Through important investments planned in our industrial strategy, we aim to strengthen our positioning as the premier event that guarantees new commercial opportunities for our exhibitors. A new project will be unveiled in the coming months, designed to enhance the identity and centrality of the event.”

Link to Leder Reinhardt sees Wollsdorf rearrange furniture

Leather manufacturer Wollsdorf Leather has announced a change in its approach to the furniture market.

The Austrian manufacturer has entered into a new commercial partnership for furniture leather with German wholesaler Leder Reinhardt.

Based near Reutlingen, Leder Reinhardt has taken immediate possession of Wollsdorf’s “extensive stocks” of furniture leather. Wollsdorf said it had decided to make this move as part of a realignment that will allow it to focus on its “core competencies and the development of innovative leather solutions”.

Leder Reinhardt’s business development manager, Marc Reinhardt, told Leatherbiz that this would be an ongoing partnership. He explained that Wollsdorf intends to continue manufacturing leather collections for the furniture market, but that from now on it will work with its new partner to bring that leather to market.

According to Wollsdorf, this will be a good way to maintain and expand the quality and service for which it is known in the furniture leather segment.

Italian court lifts oversight on Armani

AnItalian court has lifted the special administration imposed on Giorgio Armani Operations, a unit of the Armani fashion group, after the company took corrective action regarding its subcontractors’ labour practices, according to Reuters.

The Milan court had placed the unit under judicial oversight in April after an investigation revealed that it had subcontracted work to Chinese-owned companies accused of worker exploitation. In a recent statement, the court said Armani had implemented the necessary organisational and supplier control measures.

Judges noted that the company quickly severed ties with high-risk suppliers and

introduced best practices that gained court approval. Giorgio Armani Operations welcomed the ruling, stating that two of its suppliers had violated the group's core values, but emphasised that its supply chain control system was already well-structured.

The decision follows a similar ruling in October that lifted court oversight of the Alviero Martini fashion brand. Meanwhile, an Italian subsidiary of French luxury group LVMH remains under judicial administration as investigations into labour practices in the country's luxury sector continue.

Leather Naturally releases new guide on leather LCA

Campaign group Leather Naturally has released a comprehensive guide to Life Cycle Assessments (LCAs) in the leather industry, providing valuable insights for stakeholders and consumers interested in the environmental impact of leather production. With a focus on cow leather, the guide draws on industry research to offer data-driven analysis and practical applications.

LCAs assess a product’s environmental footprint across its entire life cycle, from raw material sourcing to disposal. This approach helps companies evaluate sustainability at every stage and align with increasing regulatory requirements.

A key outcome highlighted in the guide is the updated Higg Index dataset, developed in collaboration with the Leather Working Group (LWG). The new data indicates that the environmental impact of bovine leather is 55% to 67% lower than previously reported, with Global Warming Potential reduced by 60%.

Q1 growth for Birkenstock Footwear

brand Birkenstock has reported revenues of € 362 million for the first quarter of its current financial year, the three months ending December 31, 2024.

It said this figure was an increase of 19% year on year.

Revenues were up by 16% to € 210.7 million in the Americas, up by 17% to €102.7 million in Europe, and up by 47% to € 47.1 million in Asia.

Chief executive, Oliver Reichert, said Birkenstock its clogs, shoes and boots were in demand. He added that these products had proved popular as gift options over the Christmas season.

New leather traceability standard endorsed

Industry representative body COTANCE has announced that the Leather Traceability Cluster (LTC) has officially endorsed a new set of traceability requirements.

Developed in collaboration with ICEC, the Sustainable Leather Foundation, Oeko-Tex, and the Leather Working Group, this endorsement marks a significant step towards increased transparency and accountability across the leather supply chain.

The newly adopted draft standard outlines common traceability requirements and

verification elements, providing a framework for industry-wide certification. Following a formal vote conducted under the LTC Terms of Reference (Section 5), the members of the cluster have approved the standard for progression through the fast-track CEN (European Committee for Standardisation) standardisation process.

Since its establishment in 2022, the LTC has convened 24 meetings, fostering collaboration among stakeholders to align on minimum requirements for traceability and verification. This ongoing cooperation is expected to contribute to a stronger and more sustainable leather industry.

This milestone highlights the industry’s collective effort to implement robust certification processes and ensure compliance with best practices in traceability.

Almost 30,000 visitors at Première Vision

Theorganisers of Premie`re Vision Paris have said the recent of the event, which ran from February 11-13, attracted almost 30,000 visitors. These visitors came from 126 different countries and represented 13,000 companies.

In total, there were 1,100 exhibitors, displaying collections of materials, including leather, aimed at meeting buyers’ needs for the spring-summer 2026 fashion season.

HDSL celebrates 75th anniversary

The Federal Association of the Shoe and Leather Goods Industry (HDSL) marks its 75th anniversary this year. The association, founded in 1950, represents the interests of German shoe and leather goods manufacturers, offering support on economic, legal, and sustainability issues.

To celebrate, an anniversary event will take place on June 25, 2025, in Ludwigshafen, hosted by BASF. The event will feature the HDSL general meeting, followed by a ceremony with guests from politics, industry, and trade.

HDSL general manager Manfred Junkert said: “We are delighted to celebrate this special anniversary with our members and guests, offering exciting presentations and inspiring talks.”

Next generation leather launched by Elmo

Swedish leather manufacturer Elmo has introduced Elmoorganic, a new range of automotive leather designed with enhanced sustainability in mind.

The leather is made using bio-based tanning methods, incorporating a by-product from the food industry as a tanning agent. This results in a material that combines natural character and aesthetics, with a "touch that improves with age".

The Elmoorganic range is part of Elmo’s broader efforts to reduce the environmental impact of leather production. This next generation, biobased ‘Zero Waste Leather’ technology reduces chemical and water consumption during manufacturing, and

lowers emissions to water by more than 70% compared to traditional chrome-free leathers. Additionally, Elmoorganic is free from aldehydes and metals, making it a more environmentally friendly alternative to conventional leather.

This new range aims to address the increasing demand for more sustainable options in the automotive industry without compromising on quality or luxury.

Serbia meeting for consortium addressing skills gaps

European tanners’ association COTANCE

joined representatives from 19 organisations at a meeting in Serbia to advance the Erasmus+ Blueprint AEQUALIS4TCLF project, which aims to upskill workers in the textiles, clothing, leather and footwear industries (TCLF).

Universities, industry representatives and eduction providers from Belgium, Croatia, Czechia, Finland, Lithuania, the Netherlands, Serbia and Slovenia, gathered in Belgrade to agree on new plans.

AEQUALIS4TCLF aims to develop EU and national TCLF skills strategies to address skills gaps, anticipate new companies’ needs, and ensure their long-term competitiveness. The consortium will also develop new curricula and training courses.

Beyond the classroom, AEQUALIS4TCLF aims to strengthen collaboration among public authorities, social partners and education centres at regional levels across Europe. It will develop a regional TCLF Pact for Skills and set up two European networks: one bringing together TCLF education providers and another engaging regional public authorities in the modernisation of TCLF education.

Hermès homes in on Kering figures

If both luxury groups maintain current growth rates, Hermès could overtake Kering in terms of revenue in the course of 2025.

Full-year figures for 2024 showed revenues of € 17.2 billion for Kering, down by 12% compared to the previous year. If its revenues were to fall by 12% again this year, it would take Kering to just over €15 billion.

In 2024, Hermès achieved revenues of €15.2 billion, growth of 13%. Similar growth this year would take it to revenues of almost € 17.2 billion for 2025 and the gap of € 2 billion between the two groups would be reversed.

As recently as 2022, Kering achieved record revenues of € 20 billion, which was € 8.4 billion more than Hermès posted that year.

LVMH remains by far the biggest luxury group, with 2024 revenues of almost € 85 billion, including a figure of more than €40 billion for its leathergoods and fashion division.

Visitor numbers exceed 10,000 at IFLS

The forty-ninth edition of the International Footwear & Leather Show (IFLS) closed in

Bogotá on February 7.

On this occasion, there were 430 exhibitors, 41 of which were from outside Colombia.

Across the four days of the show, just over 10,000 visitors attended.

Organisers said these figures showed that IFLS is one of the most important event in the region for the leather and footwear industries. In 2023, there were more than 480 exhibitors, but visitor numbers were closer to 8,000.

FILK keynote announced alongside renewed call for papers

The 13th Freiberg Leather Days will be held on May 21 and 22, 2025, at the ‘Tivoli’ concert hall and ballroom in Freiberg, Germany. Professor Peter Heck, from the Institute for Applied Material Flow Management (IfaS) at Trier University of Applied Sciences, will deliver the keynote speech on ‘Livestock as a Value-Adding Component in Regional Material Flow Management.’

Organisers are currently accepting submissions for presentations from industry professionals, researchers, and innovators in the fields of tanning, leather technology, and related industries. The event offers an excellent opportunity to share new ideas, research, and applications with an engaged audience of industry peers.

Several speakers have already confirmed their participation, and those interested in contributing are encouraged to submit their proposals by February 25, 2025.

ASIA

Biggest Loewe store in Asia opens in Shanghai

Leathergoods brand Loewe has opened a new flagship store in Shanghai. Covering 650 square-metres over two floors, the new store, on the city’s on West Nanjing Road, is the brand’s biggest in Asia. It has given the flagship store the nickname of The Golden Cube.

Tiles imported from Spain adorn the exterior of the building, giving it a golden sheen. For the project, Loewe worked with Barcelona-based ceramic specialist Cumella to source more than 35,000 of these tiles.

Call for papers for UITIC 2025 World Congress

The International Union of Shoe Industry Technicians (UITIC) has launched a call for papers for its twenty-second World Congress, which will take place in Shanghai from August 31- September 3.

UITIC said the event will bring together footwear industry professionals from around the world to discuss the challenges facing the footwear industry. The 2025 congress will have competitiveness and sustainability in the era of artificial intelligence as its main theme.

It has invited researchers, academics, and industry professionals to submit ideas for papers on this theme and on a wide range of topics related to footwear manufacturing, technology and sustainability. Interested

parties have until April 11 to submit an abstract.

Prospective speakers will be notified of the acceptance or rejection of their ideas on May 9.

President of UITIC, Sergio Dulio, said: “The future of footwear lies at the intersection of AI-driven innovation and sustainable practices. This conference will explore how companies can leverage both to thrive in a rapidly evolving market and shape a more sustainable future for the industry.”

AMERICAS

Brazilian tanneries make their way to Milan for

Lineapelle

Five leather manufacturers from Brazil have travelled to Milan to take part in this year’s edition of Lineapelle (February 25-27).

The five companies, Couro e Arte, Courovale, Curtume Bolzano, Fuga Couros and Nova Kaeru, will showcase leather collections for summer 2026.

Their presence at the event is with the support of the Brazilian Leather Project, a partnership between industry body CICB and export promotions agency ApexBrasil.

Educational opportunities in Cincinnati

The Leather Research Laboratory at the University of Cincinnati will, once again, host a series of educational opportunities in 2025.

It will run its two-day leather orientation course twice, first on April 9 and 10, and then again on September 17 and 18. This course covers the physical structure of leather, species identification, hide supply, wet-end and finishing operations, regulations, testing and customer acceptance issues.

The cost is $1,100 per person with a discounted price of $1,000 for additional participants from the same company.

In the summer, the Leather Research Laboratory will run a course on how to make wet blue from raw hides. This will involve classroom and hands-on training, and will run from July 14-18 at a cost of $2,500 per person.

Agreement in place for Caleres to acquire Stuart Weitzman

Footwear

group Caleres has signed a definitive agreement to acquire the Stuart Weitzman brand from Tapestry. It said it will pay $105 million for the deal, “subject to customary adjustments”, and that the acquisition cement its “leadership position in women’s fashion footwear, particularly in the contemporary segment of the market”.

Chief executive of Caleres, Jay Schmidt, said he had long admired Stuart Weitzman for the brand’s “pivotal role in shaping the footwear industry”. He said Caleres was committed to preserving its legacy of craftsmanship, quality and fit, “while driving it forward”.

His counterpart at Tapestry, Joanne Crevoiserat, said the Stuart Weitzman brand and its teams had added “to the passion,

creativity and craftsmanship of our organisation over the last decade”.

But she added that Tapestry wanted to “maintain a sharp focus” on its largest valuecreation opportunities and that this sale would allow the group “to sustain Coach’s leadership and momentum while reinvigorating Kate Spade”.

The transaction is expected to close in the summer of 2025.

Fire at major meat plant in Argentina

Amajor

fire broke out at one of Argentina’s biggest meat-packing plants on February 17.

Firefighters in La Plata said it had taken them three hours to bring the blaze at the Frigorífico Gorina packing plant there under control, but reported that all workers had been safely evacuated and that there were no injuries.

Gorina is one of the five biggest meat factories in Argentina and announced plans last year to increase production at its plant in La Plata by 50%. The plant’s processing capacity is 27,000 head of cattle per month.

In 2024, Frigorífico Gorina said it was exporting 70% of its production to China.

Visitor numbers exceed 10,000 at IFLS

The forty-ninth edition of the International Footwear & Leather Show (IFLS) closed in Bogotá on February 7.

On this occasion, there were 430 exhibitors, 41 of which were from outside Colombia.

Across the four days of the show, just over 10,000 visitors attended.

Organisers said these figures showed that IFLS is one of the most important event in the region for the leather and footwear industries. In 2023, there were more than 480 exhibitors, but visitor numbers were closer to 8,000.

Capri promotes for top brand role Fashion group Capri Holdings - owner of Versace, Jimmy Choo and Michael Korshas promoted Philippa Newman to chief brand and product officer.

Ms Newman has been with Michael Kors for over 16 years, most recently serving as the chief product officer.

CEO John Idol said: “Ms Newman is an exceptional leader with deep brand expertise and a strategic mindset. By bringing product and marketing under one cohesive leadership structure, we are creating greater synergy across our business, enabling a clear and consistent brand vision, and strengthening our ability to connect with consumers globally.”

Philippa Newman added: “I look forward to working alongside John, Michael, and our talented teams to effectively execute our product and brand strategies and drive longterm growth.”

At the start of February, Capri reported revenues of $3.4 billion for the first nine months of its current financial year, a decline of 13.7% compared with the same period last year.