SHE GOES

WORLD VIEW

By Mansha Daswani.

UPFRONTS

New content and services.

TECH TRENDS

Bedrock’s Jonas Engwall.

MILESTONES

Rainbow’s Iginio Straffi.

IN FOCUS

CJ ENM’s Jangho Seo.

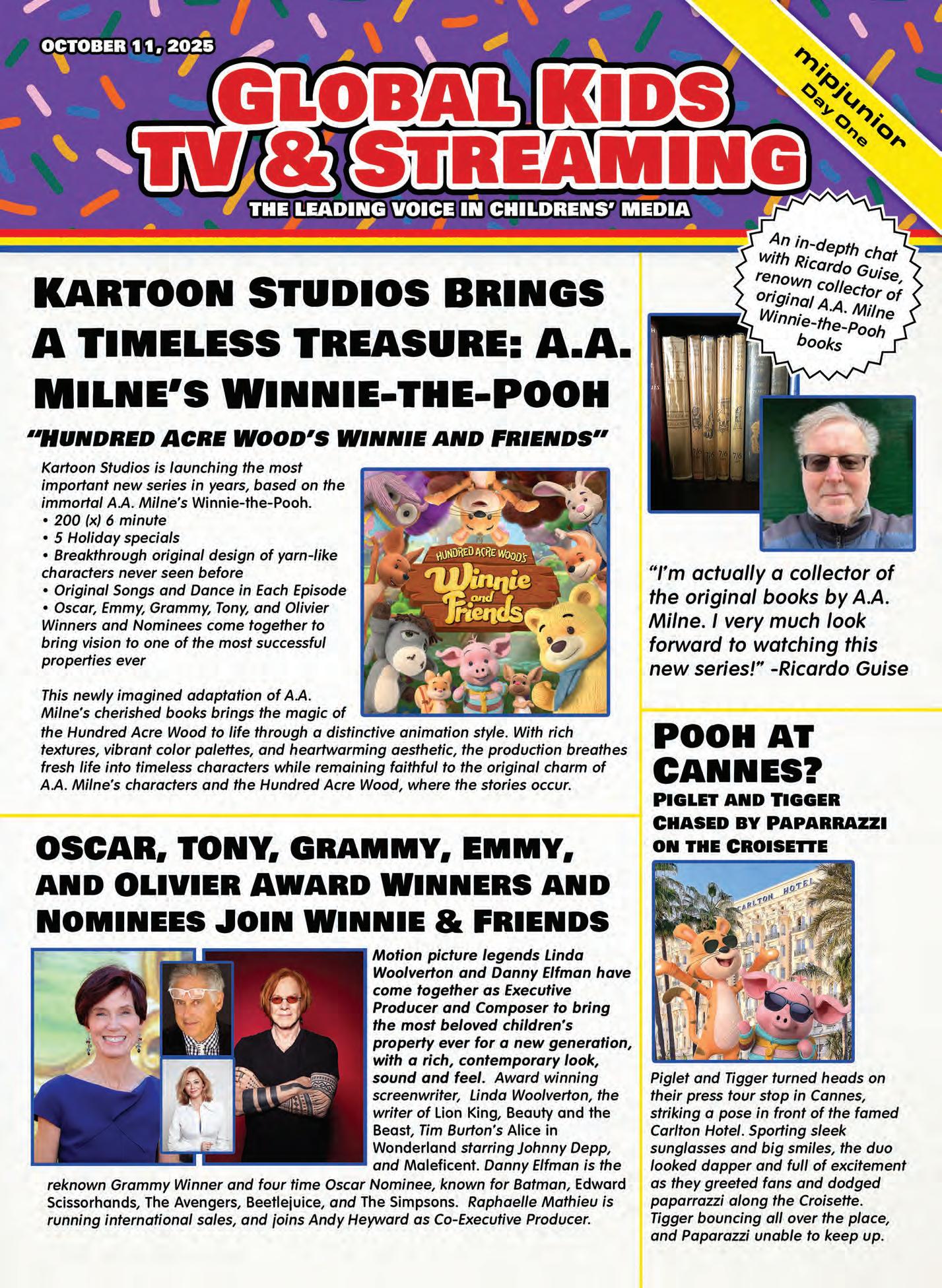

SPECIAL REPORT

Bavaria Media’s Helge Köhnen & Tanja Grinscher.

TV LISTINGS

Listings for some 80 IP owners attending MIPCOM.

PLATFORM VIEW

Pluto TV’s Olivier Jollet.

TRENDING ON

Trending clips on our video portals.

The stars of Boston Blue, a spin-off of Blue Bloods, discuss what drew them to the upcoming series, which is set for a world premiere screening this MIPCOM.

SPOTLIGHT

NBCUNIVERSAL’S MICHAEL BONNER

The president of NBCUniversal Global TV Distribution on the sustained need for procedurals, AVOD opportunities and collaborating with clients.

MARKET TRENDS

LIONSGATE’S JIM PACKER

The indie studio’s president of worldwide television distribution is driving innovation in AVOD and FAST deals.

IN THE NEWS

FOX ENTERTAINMENT GLOBAL’S PRENTISS FRASER

The president of the FOX Entertainment commercial division shares what attracted her to the opportunity and how she is building on the unit’s gains.

INDUSTRY SHIFTS

FACING THE FUTURE

From FAST services to YouTube channels, we hear from several IP owners about their direct-to-consumer initiatives.

ONE-ON-ONE

RTL GROUP’S THOMAS RABE

On the heels of his transformative Sky Deutschland deal, the CEO of RTL Group talks scale, AI and more.

ON THE RECORD

ZDF’S NORBERT HIMMLER

In his third year at the helm of the German public broadcaster, ZDF’s directorgeneral showcases how it is maintaining its relevance and positioning itself for the future.

Publisher

Ricardo Seguin Guise

Editor-in-Chief

Mansha Daswani

Managing Editor Jamie Stalcup

Associate Editor Kloudia Sakowski

Editor, Spanish-Language Publications

Elizabeth Bowen-Tombari

Associate Editor, Spanish-Language Publications

Rafael Blanco

Production & Design Director

David Diehl

Online Director

Simon Weaver

Sales & Marketing Director

Dana Mattison

Sales & Marketing Manager Genovick Acevedo

Bookkeeper Ute Schwemmer

Ricardo Seguin Guise President

Mansha Daswani

Associate Publisher & VP, Strategic Development

BY MANSHA DASWANI

For the first time in more than a year, WARC had a reason to upgrade its advertising revenue forecasts; citing a “social media windfall,” the research company said it now expects 2025 ad revenues to rise by 7.4 percent to $1.17 trillion.

“Global ad spend is growing rapidly, with digitalfirst platforms capturing almost all the new money,” said James McDonald, director of data, intelligence and forecasting at WARC and author of the report.

“Despite economic headwinds, including disruption to global trade and reduced purchasing power among consumers, brands are doubling down on Meta, Alphabet and Amazon, while emerging players like TikTok are growing fast but from smaller bases.”

Advertisers are going where the audiences are, so “traditional” content companies—whatever that means today—have to do so as well. That was a recurring theme in all of the conversations I had with senior media executives for this edition. From pursuing alliances with the creator economy to developing vertical shorts to making sense of how best to use AI and analytics, everyone is in some state of restructuring or rebuilding.

“The international media industry is in the middle of a fundamental transformation, with big opportunities for those prepared to shape the future,” says RTL Group CEO Thomas Rabe in my interview with him in this edition. The European media giant is driving its transformation via the acquisition of Sky Deutschland, exploring all the benefits of AI, scaling its streaming operations and investing in its content engine, Fremantle.

“The transformation of the media industry demands and opens up new paths,” Norbert Himmler, director-general of ZDF, says in my Q&A with him in this edition that addresses how the public broadcaster is keeping itself relevant to local audiences.

that launched in the U.S. this summer. “We do the premium licensing first, and when there’s an opportunity to maximize a shorter window, we do that.”

Discussing the studio’s approach to YouTube, AVOD and FAST, Packer referenced the importance of responding to the data, another theme that cropped up in so many of my conversations for this edition. Pivot, adjust, listen to your audience and what the market is telling you might be a white space. And be prepared to move quickly; being slow to react doesn’t suit a media economy increasingly driven by rapidly produced, bitesized entertainment.

Not that long-form, premium production is going anywhere. It’s not. The same young adults who spend most of their media time daily on social video turned up in droves to the theaters to see KPop Demon Hunters after driving that film to the top of Netflix’s ratings charts worldwide. We are in the attention economy, though, so if you’re living only in one space—linear, social, SVOD or FAST— discovery is an uphill battle; and it’s only going to get harder once AI video floods the market.

We are in the attention economy, so if you’re living only in one space— linear, social, SVOD or FAST—discovery is an uphill battle.

“The media landscape is dynamic and constantly evolving, and I feel it’s important that we not only acknowledge its ever-changing nature but also proactively adapt to it and explore ways to turn disruption into a catalyst for opportunity,” is how NBCUniversal’s Michael Bonner describes the current landscape. He weighs in on AVOD, FAST, windowing and more in this edition as he marks his first MIPCOM leading the powerhouse’s global distribution operations.

“You have to be comfortable with the massive changes taking place around you,” Lionsgate’s Jim Packer told me during our conversation about how the indie studio came to be one of Roku’s flagship content partners in Howdy, the new low-cost SVOD service

AI came up in many of my conversations, but I don’t think there was a single chat that did not involve YouTube: Where it sits in your overall monetization strategy and how to optimize your business to make the most sense of it. As it marks its 20th anniversary, YouTube will have its first major presence at MIP COM, occupying a branded area inside the Palais and staging workshops centered on areas like audience growth and monetization. “Their ongoing goal is nurturing new partnerships across the TV industry,” RX France’s Lucy Smith told me ahead of the market. The transformation of the media business brought about by the creator economy is resulting in the “biggest shift in a generation for MIPCOM,” Smith added. “The creator economy is shaping the future of the industry. Our goal is to bring together the creator economy with mainstream media to help find new ways of working together. As the industry’s biggest global gathering, we can help bridge that gap.” And, of course, collaboration is the other trend shaping the business, from the New8 alliance, made up of European pubcasters, to the game-changing streamer and broadcaster alliances that have made headlines over the last few months.

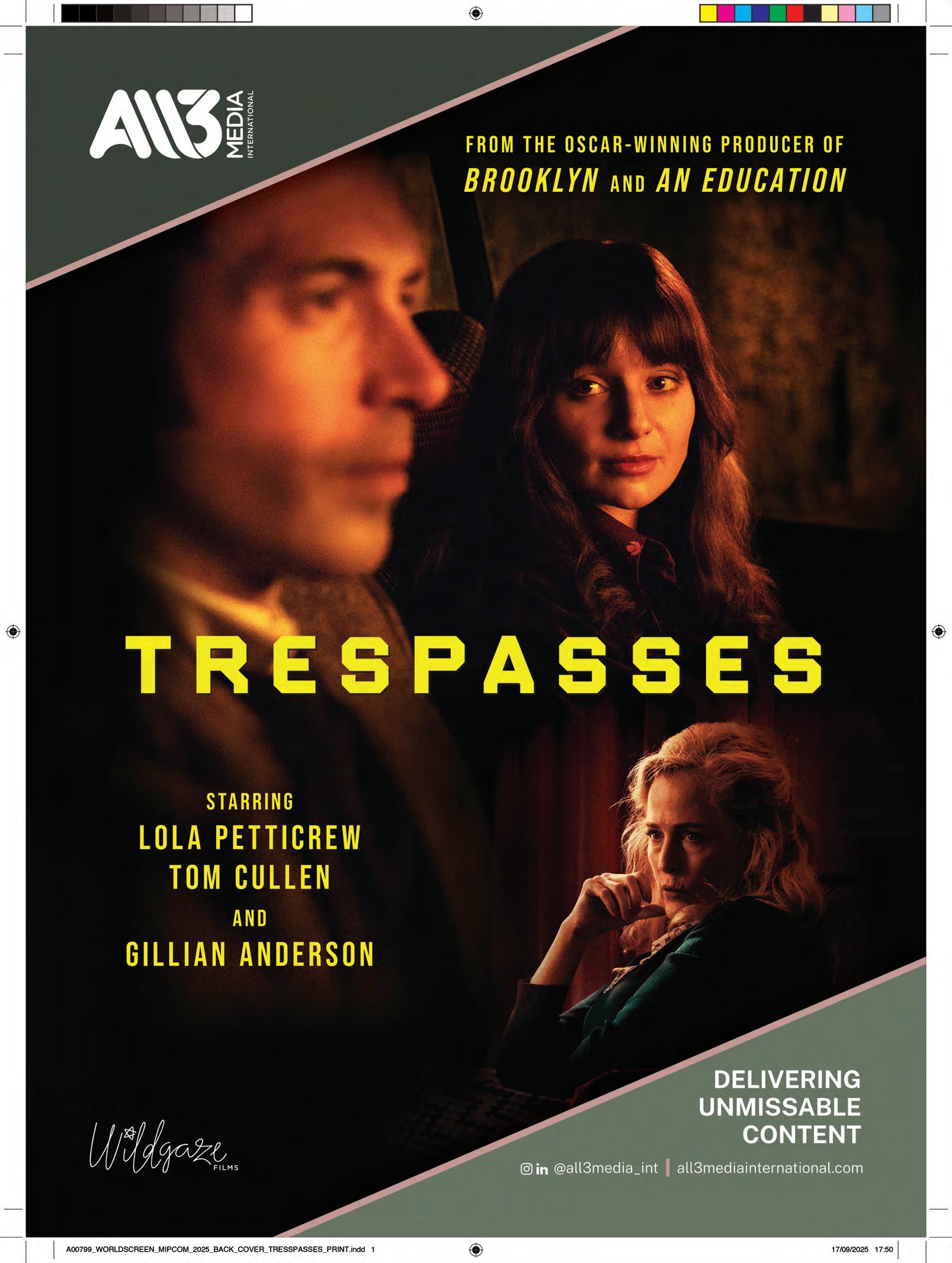

Trespasses / The Inheritance / American Prince: JFK Jr.

Set in 1970s Belfast, All3Media International’s Trespasses tells the story of Cushla, who meets and dives into an affair with a married Protestant barrister. The Inheritance is a reality game of wit, willpower, persuasion and betrayal where a group of strangers are lured by one irresistible opportunity: to inherit a chunk of a vast fortune. “Set in a vivid, glamorous setting, this reality competition format has the power to attract A-list talent, with Elizabeth Hurley fronting the recently launched U.K. version,” says Jennifer Askin, executive VP for the Americas. American Prince: JFK Jr. is a three-part series about John F. Kennedy, Jr. EverWonder Studio’s documentary provides unprecedented archive footage and access to his life and legacy. “It’s a fascinating story about a long-lost prince,” adds Askin.

“[American Prince: JFK Jr.] will appeal to those looking for both a glamorous and escapist watch—the series transports audiences back to the halcyon days of 1990s New York.”

—Jennifer Askin

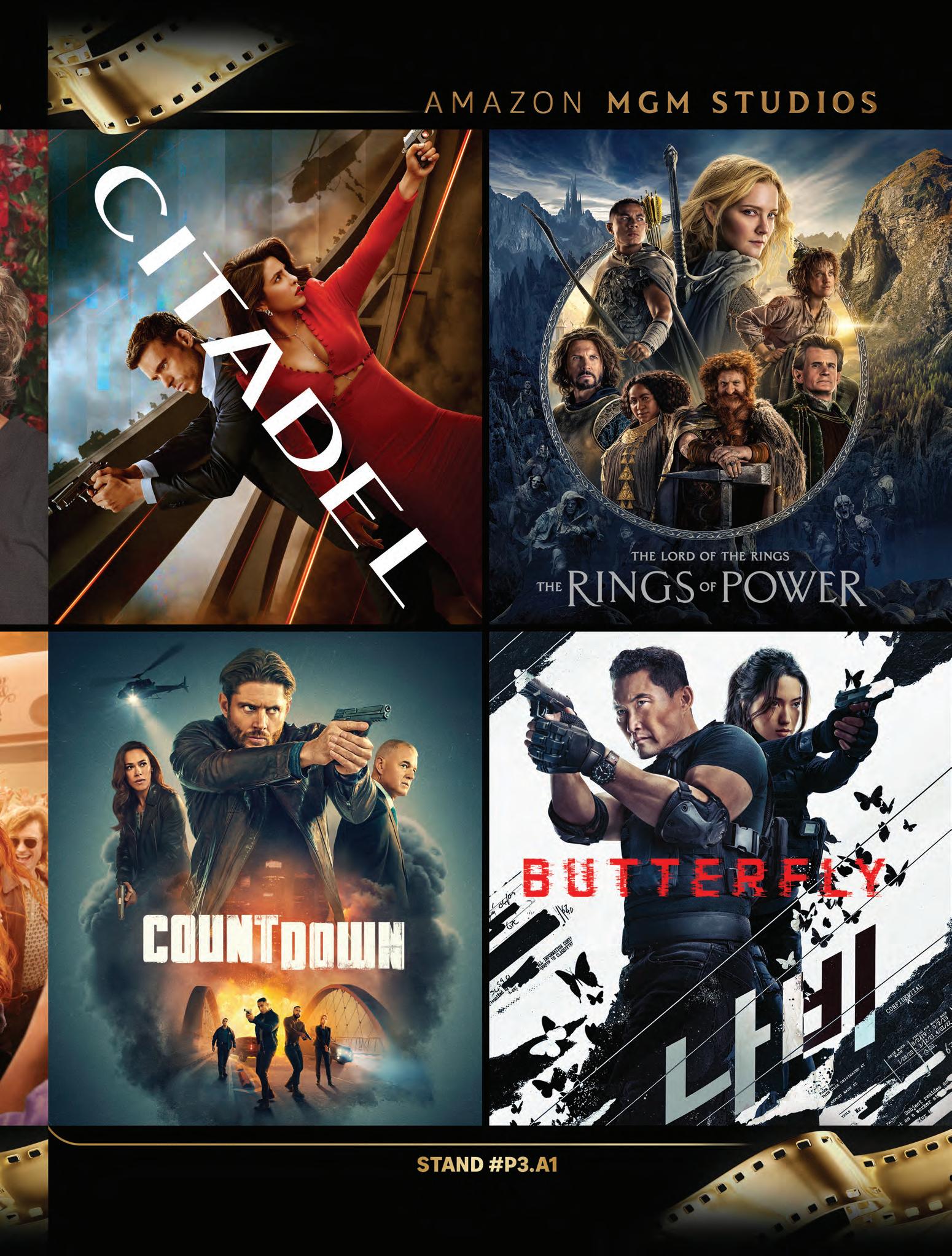

Daisy Jones & the Six / The Summer I Turned Pretty / Project Hail Mary

The Amazon MGM Studios Distribution offering includes Daisy Jones & the Six and The Summer I Turned Pretty, hit book adaptations that have both “created viral sensations and cultural moments in the U.S. and internationally,” says Chris Ottinger, head of worldwide distribution. “In addition, the two series have demonstrated strong staying power beyond their initial launches, with music, fashion and fan engagement continuing to drive cultural relevance and international reach.” Project Hail Mary, adapted from Andy Weir’s book of the same name, is also on the slate, as are Crime 101, Masters of the Universe and Three Bags Full: A Sheep Detective Movie “At MIPCOM, we’re focused on expanding the reach of our films and series by partnering with international buyers who want content that entertains and resonates,” Ottinger says.

Among the titles ARD Plus is presenting at MIPCOM, the drama naked “offers a modern, bold format that clearly sets itself apart from classic love stories,” says Malgorzata Obes, senior sales manager for international distribution. Starring Svenja Jung, it tells a story of toxic love, sex addiction and emotional dependence. The hospital drama David and Goliath addresses the topic of mental health in the workplace as it follows a psychotherapist working in a clinical practice. Helix, based on Marc Elsberg’s best-selling book, “combines a highly topical issue—genetic research and its ethical limits— with an exciting thriller plot,” Obes explains. It is “ideal for platforms looking for socially relevant content with suspense and depth.” The title tells the story of a BKA bodyguard who becomes enmeshed in a global conspiracy.

David and Goliath

“Our goal is simple: deliver stories that spark engagement, create long-term value and connect with audiences worldwide.”

—Chris Ottinger

“We look forward to connecting with partners from all over the world, discovering new opportunities for collaboration and sharing the strength of German storytelling.”

—Malgorzata Obes

/

Tap

At MIPCOM, Artist View Entertainment will showcase Fortress, a war docuseries exploring some of Europe’s unique forts and castles. Alongside it is Love on Tap, a romantic comedy starring Alex Moffat and Kennedy McMann. “For mystery lovers, A Murder Between Friends delivers a tightly woven thriller in the tradition of Agatha Christie and Knives Out, featuring an ensemble cast including Joan Collins, Jacob Young, TobyAlexander Smith, Nadia Bjorlin, Simon Cotton, India Thain, Hana Vagnerová, Jim Borstelmann and Espen Hatleskog,” says Scott J. Jones, president. Other titles include Six Days in Evergreen, 25 Miles to Normal, The Ghost Trap, The Legend of Van Dorn and A Chrismystery. Jones adds, “At MIPCOM, our focus is always on strengthening the valued relationships we’ve built while continuing to form new ones.”

December 2-5, Marina Bay Sands

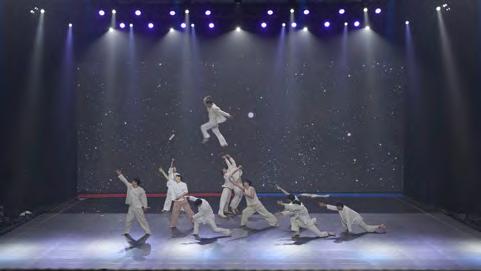

ATF is returning to Singapore’s Marina Bay Sands, putting the spotlight on the fast-developing media business across the region. A key focus this year is a look at micro-dramas. “ATF 2025 will reflect the level of serious commitment to this subgenre boom—activities will include a keynote session, an elevated panel discussion with key players in micro-drama, a masterclass, a showcase and distinct companies who intend to buy this genre,” says Hui Leng Yeow, group project director at RX Global, which organizes the annual show. On the market floor, Italy, Macau, South Korea and the Philippines will be presenting new pavilions, and Thailand will have a strong presence. “The ATF has matured in tandem with the rise of Asia on the global entertainment content stage,” Yeow says.

“Our slate is carefully curated to appeal to a wide range of audiences, offering something for everyone.”

—Scott J. Jones

“With attendees from 60 countries and regions, ATF is the most international event in Asia, where the industry congregates to celebrate the best talents and storytelling.”

—Hui Leng Yeow

Calinos Entertainment’s Lies After Lies, adapted from the Korean drama Lie After Lie, “brings a fresh emotional intimacy and a distinctly Turkish storytelling tone,” says Onur Sözener, head of sales. “It’s a powerful tale of memory, motherhood and one woman’s relentless fight to be heard in a world that refuses to believe her.” Chasing the Sun tells the story of two wounded people who cross paths when they least expect it. For My Children is an Arabic-language adaptation of the Turkish drama Kadın. “While this version reflects the cultural texture of the Arabic-speaking world, the emotional core of the story is universal,” Sözener says. He adds, “There’s a shared DNA across all three [titles]: well-developed main characters, high emotional stakes and themes like identity, resilience and personal transformation.”

“Today, we stand as a truly global distributor, representing a diverse slate that includes not only Turkish dramas but also a growing portfolio of international series.”

Date My Friend

Dear X / Date My Friend / Infinite Loop

CJ ENM is presenting Dear X, a drama that follows an unconventional romance led by a dangerously charming sociopathic woman. “It redefines the romantic genre through a complex female antihero and emotionally layered narrative,” says Sebastian Kim, VP of the international content business department. Date My Friend sees celebrities introduce their friends to people who they believe are genuinely good, Kim says. “The friendship-driven matchmaking angle sets it apart from typical romance formats.” In the survival game-show format Infinite Loop, six contestants are trapped in a hexagonal maze of identical rooms and must try to outwit each other to win unlimited prize money. “At CJ ENM, we strive to deliver original stories and never-before-seen formats that push the boundaries of entertainment,” Kim says.

La Subasta (The Auction) / AMIA / Power Couple

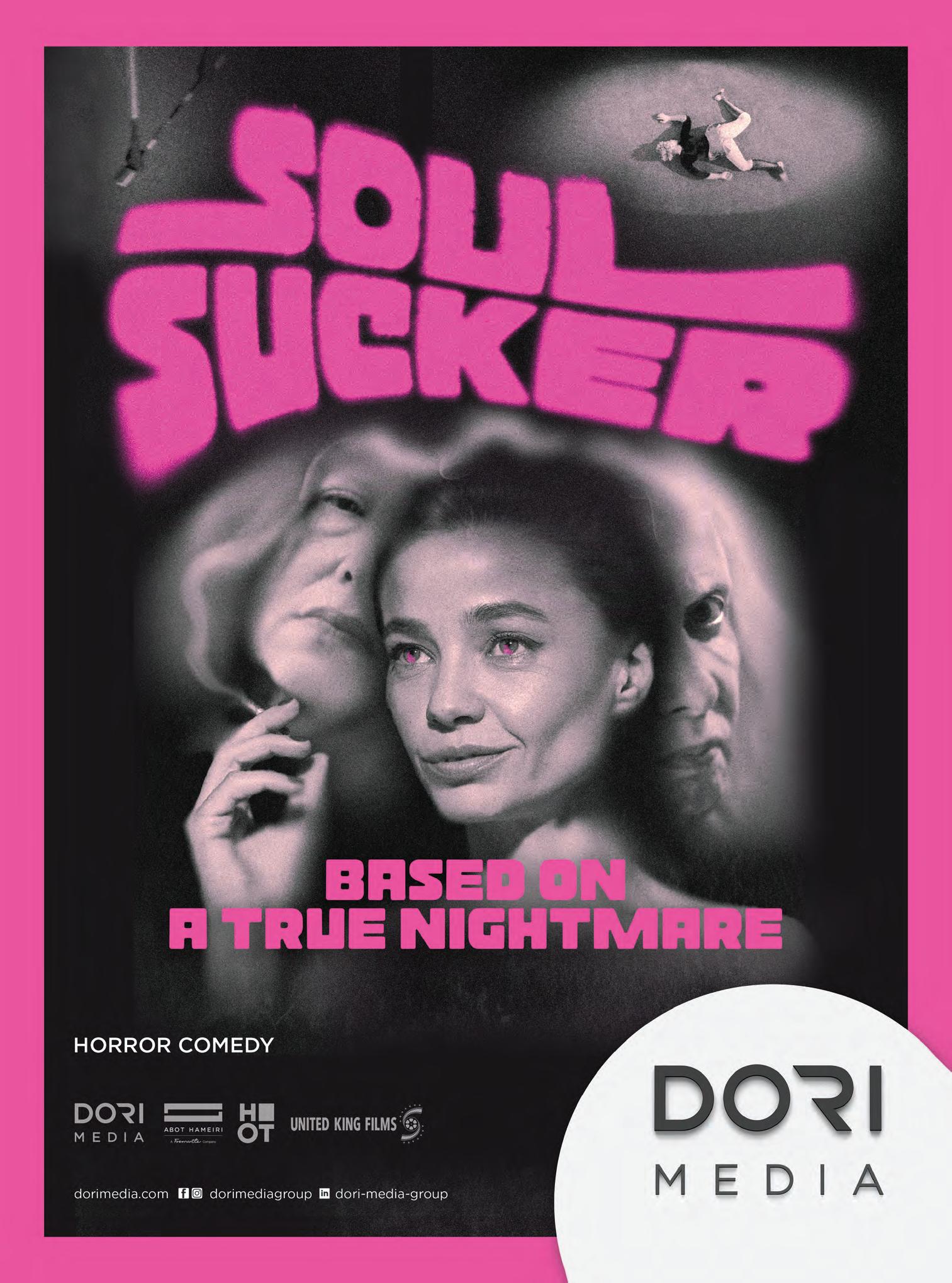

Dori Media Group is bringing to MIPCOM La Subasta (The Auction), a game-show format in which contestants take part in a competition that combines intuition, humor, adrenaline, courage and luck. “It’s easy for audiences to play along at home, making it perfect for family viewing,” says Carolina Sabbag, VP of sales for Western Europe, the U.S. and Canada. The political action drama AMIA follows Diego, a Mossad agent whose sister was killed in an Argentinean terrorist attack, as he teams up with a local journalist to track down those responsible. The Power Couple format, following as eight couples are tested on how well they know each other, “stands out as an exceptionally versatile format, equally effective as weekly or daily programming,” Sabbag notes. The horror comedy Soul Sucker is also on offer.

“Our

mission is to lead global content trends by introducing diverse Korean content that resonates with audiences in many countries.”

—Sebastian Kim

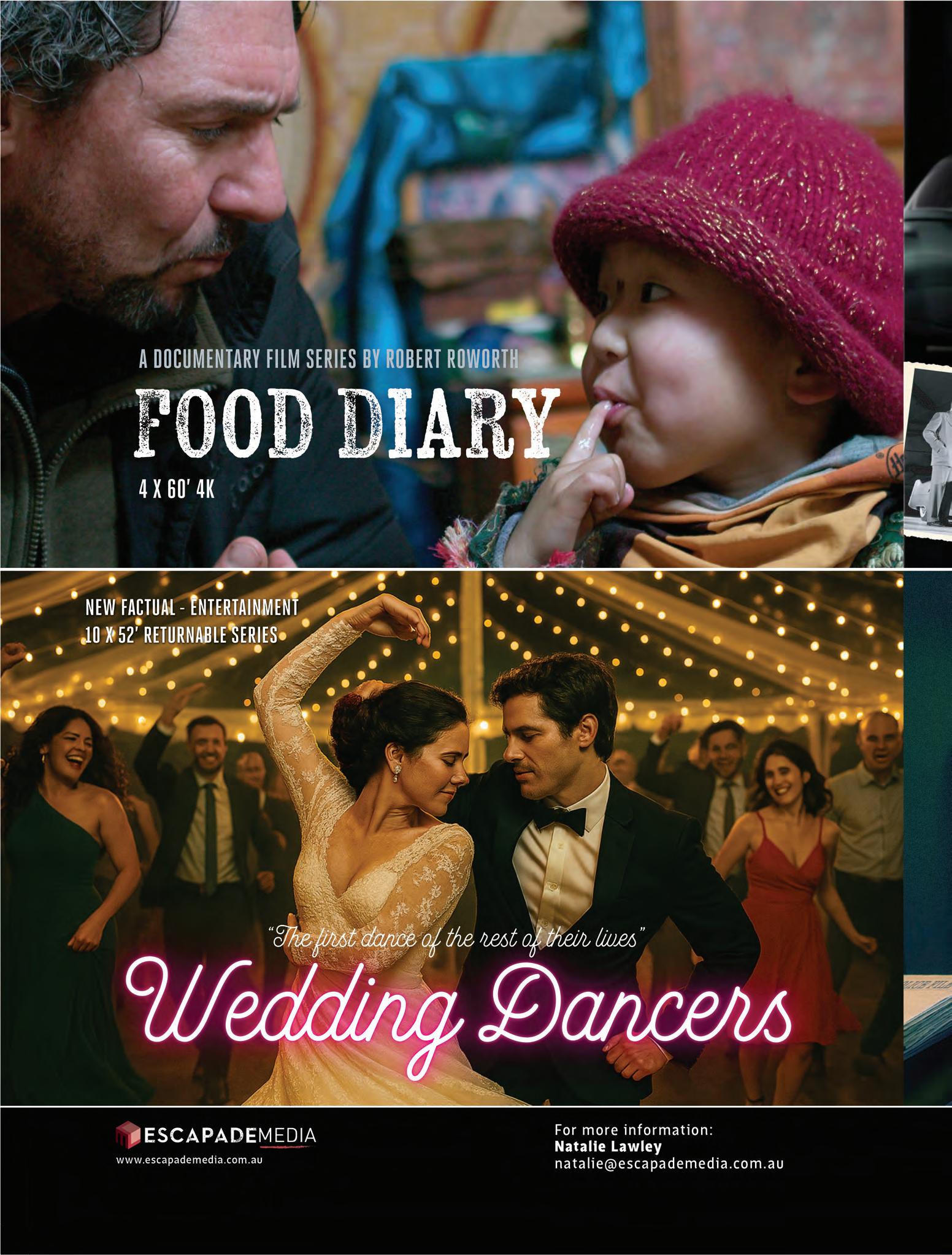

Escapade Media’s A Season with Isabella Rossellini provides a portrait of the Oscar-nominated icon, reflecting on her life as the daughter of famous filmmaking parents Ingrid Bergman and Roberto Rossellini. It “unveils the unique charm and playfulness of Isabella and follows her diverse pursuits,” says Natalie Lawley, managing director. Marian Lacombe directs the one-hour documentary. Wedding Dancers follows couples across the U.K. in the six months leading up to their big day. “It is the ultimate feel-good series where we learn as much about ourselves as we do about the couples,” Lawley says. The Colin Fassnidge-led travelogue Food Diary “is a visceral journey through countries that rarely top tourist lists, where food, politics, history and humanity collide in ways that feel both jarringly foreign and deeply familiar,” she explains.

“We firmly believe that bringing global stories to the market and refreshing exceptional formats with timely and relevant narratives is the key to achieving remarkable success.”

—Carolina Sabbag

Wedding Dancers

“A number of our completed titles have been fully funded privately so we can offer the rare opportunity of worldwide rights for the right client.”

—Natalie Lawley

Not for Sale (Ravalear) / Mouths of Sky / Dating in Barcelona

On offer from Filmax, Not for Sale (Ravalear) tells the story of a family-owned restaurant in Barcelona’s Raval under threat from an investment fund. Directed by Pol Rodríguez and Isaki Lacuesta, it “is a fast-paced, stylish and modern thriller, grounded in a reality that resonates far beyond Barcelona and is instantly recognizable to audiences in cities around the world,” says Iván Díaz, head of international. Mouths of Sky serves as a four-part follow-up to Mouths of Sand, following a Basque police officer. The second season of Dating in Barcelona “captures the vibrant essence of Barcelona— blending heartfelt storytelling with humor and the charm of everyday life,” Díaz says. It “offers an authentic portrait of modern relationships, rich with complexity, diversity and emotional honesty.” A third season is in preproduction.

Among the slate of titles FOX Entertainment Global is presenting at MIPCOM, the medical procedural Best Medicine sees a city surgeon adjust to small-town life. In Extracted, untrained competitors are sent out into the wilderness while their family members watch from afar and control their access to vital resources. “With scalable production, flexible locations and built-in relatability, Extracted is positioned as both a highimpact series and a repeatable global format,” says Prentiss Fraser, president of FOX Entertainment Global. The adult animated comedy Breaking Bear stars Brendan Fraser, Sarah Michelle Gellar, Annie Murphy, Elizabeth Hurley and Josh Gad. Each of these three titles “is designed to fully entertain its audience, giving our partners compelling, programmable and promotable content for their services,” Fraser says.

“We believe these projects will generate significant buzz in the market, and our top priority is to secure strong sales both with broadcasters and platforms.”

—Iván Díaz

“We are thrilled to bring such a distinctive and dynamic trio of titles to MIPCOM this year.”

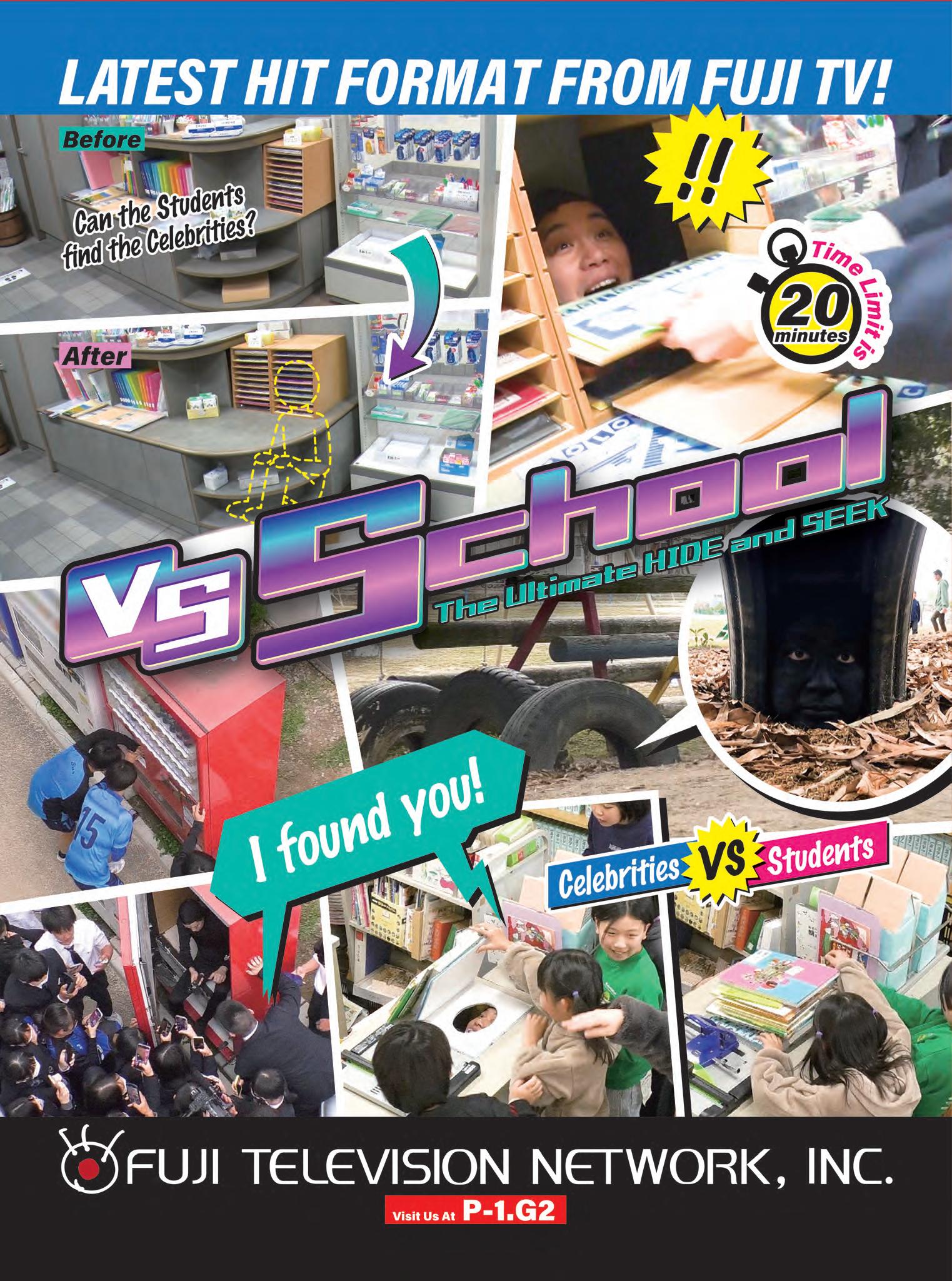

I Doubt it! / The Forbidden Duel / Rich Man, Poor Woman

The studio-based game show I Doubt it! leads the offering from Fuji Television Network. “This format is the ultimate psychological battle to discern truth from lies, as well as an entertainment show that offers a glimpse into the true personalities of celebrities,” explains Ryuji Komiya, head of international distribution for unscripted formats. In The Forbidden Duel, professionals from different industries compete to demonstrate their expertise. The slate also features scripted formats such as Rich Man, Poor Woman, a romantic drama about the unlikely relationship between a genius CEO and an ordinary young woman. In addition to its latest formats, Fuji Television Network is also presenting “formats that have garnered significant attention in the past, including Iron Chef and Hole in the Wall,” Komiya says.

“With an extensive catalog of titles, we look forward to engaging with buyers who are interested in Asian content.”

—Ryuji Komiya

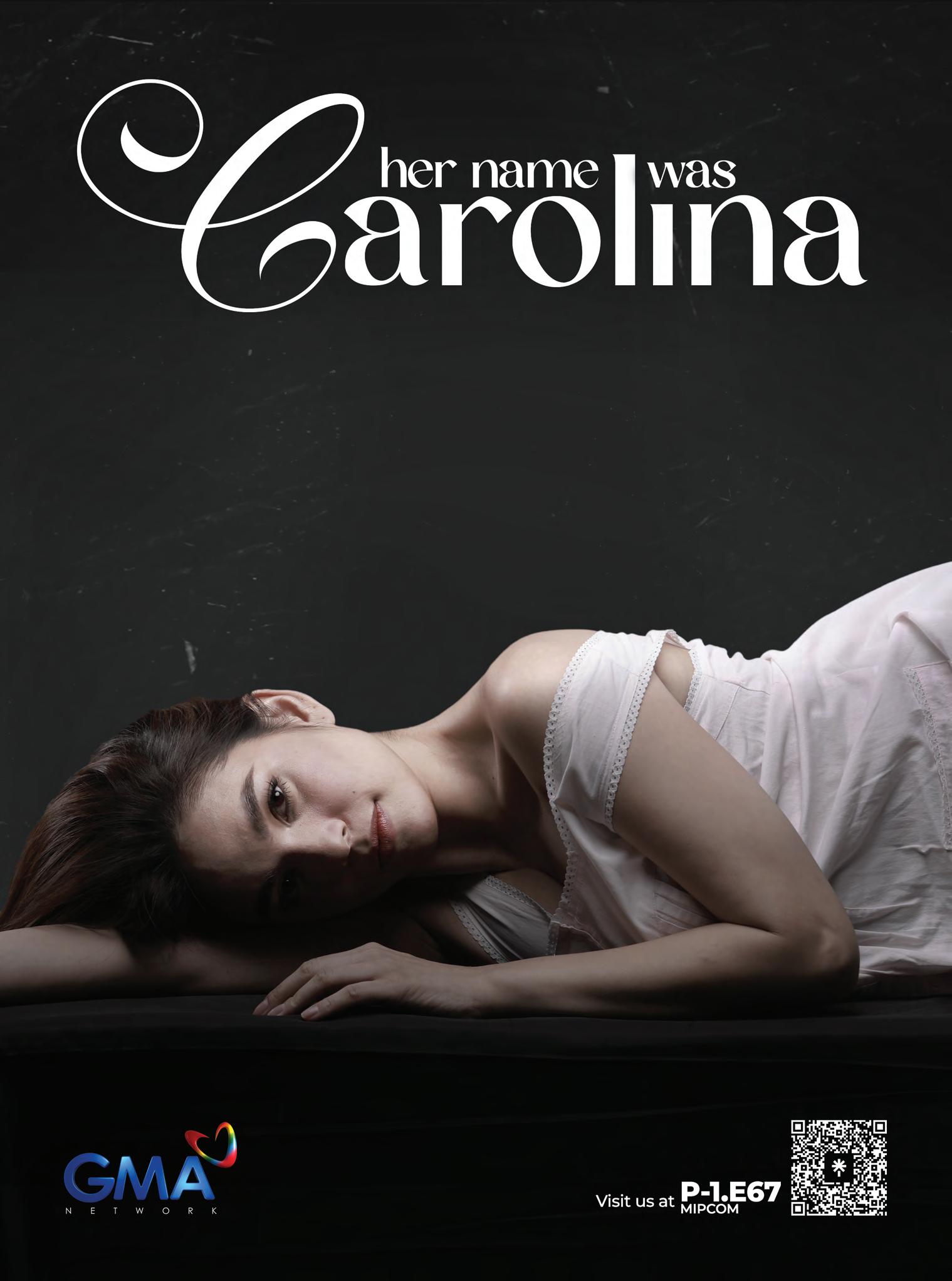

Her Name Was Carolina / Hearts on the Badge / Sang’gre

From GMA Network comes Her Name Was Carolina , a drama about love, betrayal and a woman’s fight to clear her name after being accused of murder. Hearts on the Badge tells the story of a police officer who crosses paths with an undercover cop seeking revenge. Together, they uncover a deadly conspiracy involving two rival action stars. In Sang’gre, a young woman discovers she is the last princess of Encantadia, and, with her newfound powers, she must defend both realms from an evil queen and embrace her true destiny. “All three titles feature strong female leads at the heart of the story and deliver universal themes such as betrayal, justice, love, revenge and destiny, all resonating across cultures,” says Rochella Ann Salvador, assistant VP of the Worldwide Division.

Eshref Ruya / Valley of Hearts / Heartstrings

Çağatay Ulusoy and Demet Özdemir star in the lead roles of Eshref Ruya, a drama on offer from Inter Medya. It centers on a high-ranking member of a mafia syndicate, whose long-lost childhood love ends up entangled in his world while working as an informant for the police. Love, betrayal and power collide. In Valley of Hearts , twins Nuh and Melek seek revenge on their mother, who abandoned them as newborns and went on to marry a wealthy man. Heartstrings follows the lives of two women whose daughters were switched at birth. When Mahinur struggles to care for her sick daughter, Bade, she turns to Aras for help, and they discover the truth of their daughters’ identities through DNA tests, sparking new conflicts. They join forces to save Bade.

“We

aim to expand the reach of Filipino content, ensure it gains visibility worldwide and turn new opportunities into lasting partnerships.”

Just For Laughs Gags / Just For Laughs LOL / About Antoine

Just For Laughs Distribution’s MIPCOM offering features new seasons of Just For Laughs Gags, a hidden-camera comedy show, and Just For Laughs LOL, a scripted sketch show performed by comedians. The two titles “present universal themes and travel very well in all parts of the world,” says Alex Avon, chief marketing and strategy officer. The slate also includes stand-up comedy specials from the Just For Laughs Festivals in Montreal and Toronto this summer. In addition, Just For Laughs Distribution is premiering the Englishlanguage-dubbed version of the dramedy About Antoine, “about a family facing everyday challenges to which families all over the world can relate,” Avon notes. “We are coming strong to MIPCOM with both distribution and development executives and are pleased to debut a new, larger stand.”

“Our mission is to ‘keep the world feeling good’ with top comedy and feel-good programming, and we are ready to deliver at this year’s event.”

—Alex Avon

Robin Hood / Spartacus: House of Ashur / The Rainmaker

Lionsgate’s MIPCOM highlights include Robin Hood, Spartacus: House of Ashur and The Rainmaker, which all “feature strong casts and powerful characters, bringing familiar narratives to life in fresh and modern ways,” says Agapy Kapouranis, president of international television and digital distribution. Additional titles on the slate include Breaking Bread, hosted by Tony Shalhoub, and the procedurals The Rookie and Private Eyes. “Our titles combine the appeal of proven formats with the energy of fresh, original storytelling,” Kapouranis notes. “In a market where buyers are cautious about taking risks, these series stand out for their great talent, creative narratives and relevance for today’s audiences.” The company’s extensive library also features the series The Chosen and Amandaland

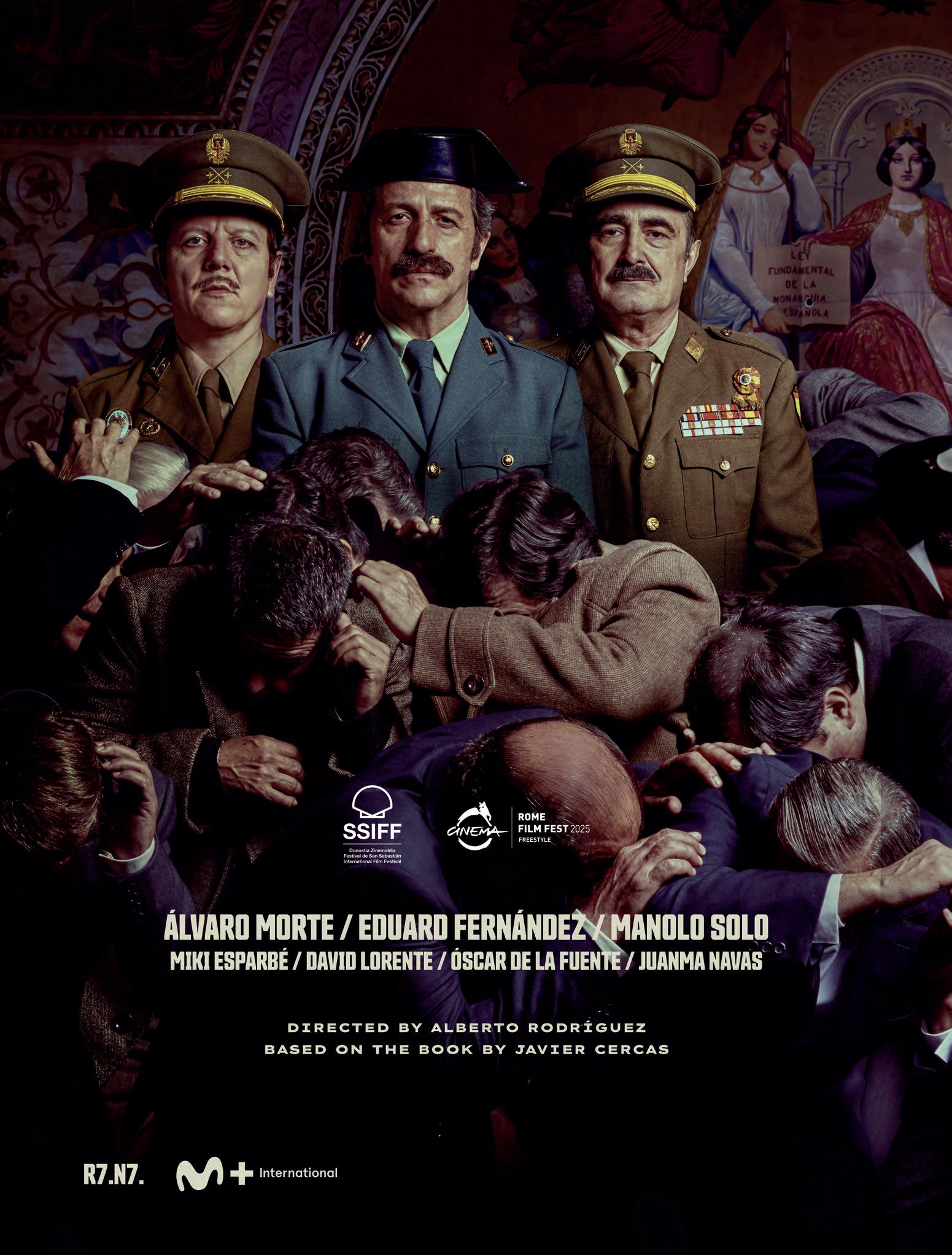

The Center / The Nameless / The Anatomy of a Moment

Highlighting Movistar Plus+ International’s upcoming plans and projects, Rebeca Aguilar Domínguez, distribution manager, says, “Over the coming months, Movistar seeks to continue consolidating its position as one of the most important players at the European level.” She continues, “This fall’s premieres reinforce the message of content that is relevant in Spain and resonates abroad.” For MIPCOM, Movistar Plus+ International is showcasing the espionage thriller The Center, providing a look at the challenges faced by members of the National Intelligence Center. The Nameless tells the story of Claudia, a woman who loses her daughter Ángela in a traumatic event, only to discover years later that her daughter may still be alive. Also joining the lineup is the original series The Anatomy of a Moment

“Our mission will always be to provide buyers with a premium selection of content from a range of genres that resonate with audiences globally and deliver long-term value.”

—Agapy Kapouranis

“We are strongly committed to continuing to offer our clients content that delivers value and stands out.”

PONIES / The ’Burbs / Under Salt Marsh

Set in Moscow, NBCUniversal Global TV Distribution’s PONIES follows two U.S. Embassy secretaries who become CIA operatives after their husbands are mysteriously killed in the USSR. The cast includes Emilia Clarke and Haley Lu Richardson. Set in a fictional Welsh town, Under Salt Marsh begins when a former detective finds the body of one of her students and must reconcile with her estranged policing partner as the murder reopens a cold case that tore them apart. When a mysterious new neighbor moves in next door in The ’Burbs, it completely upends a couple’s life as old secrets are brought to light and new deadly threats shatter the illusion of their quiet neighborhood. “We’re extremely proud to present our upcoming film and TV lineup, which spans a diverse range of genres and formats,” says Michael Bonner, president.

“We

are looking forward to reuniting with our clients at MIPCOM; the value of having that in-person interaction with them is immeasurable.”

—Michael Bonner

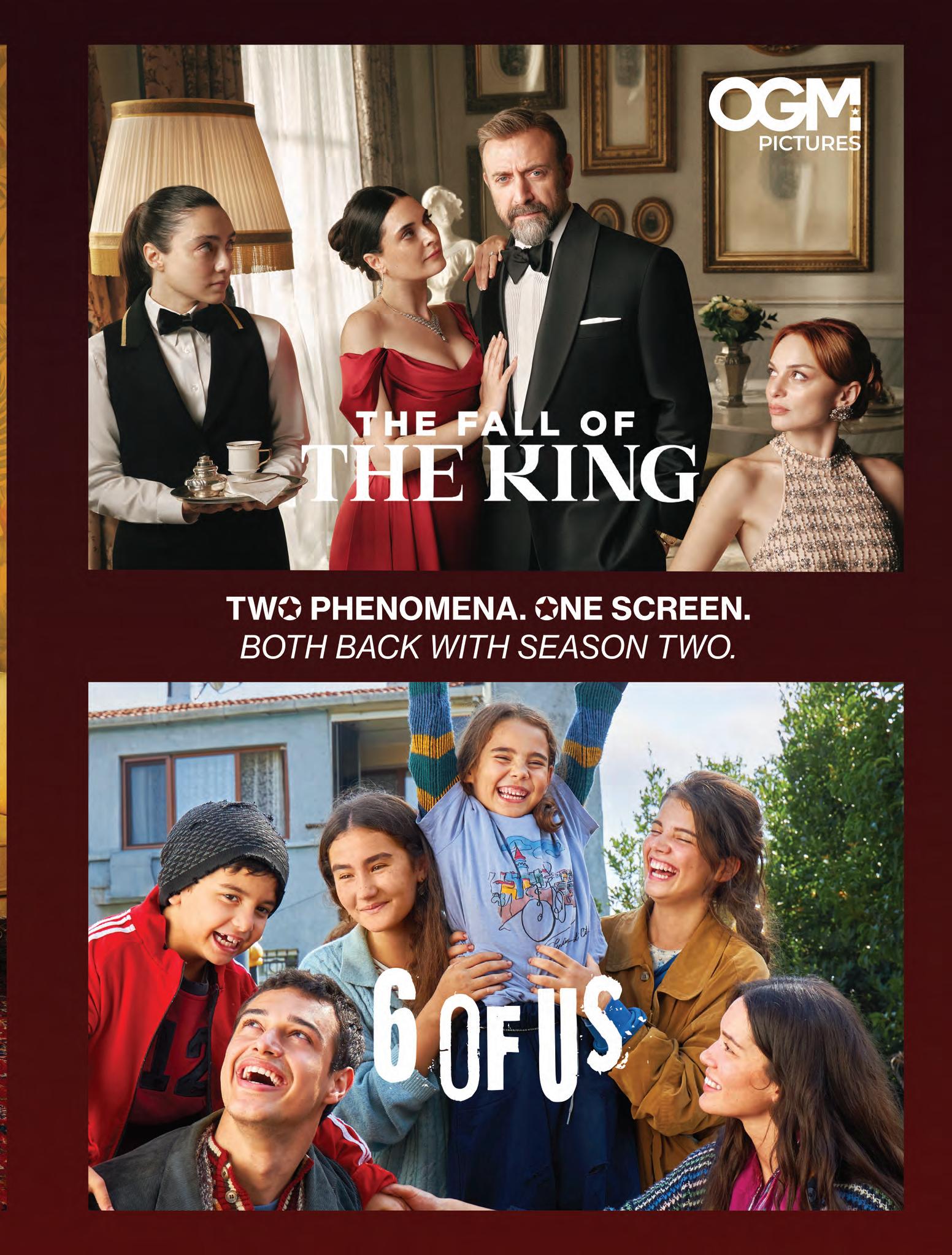

Reborn / The Fall of the King / 6 of Us

On the heels of its strong launch in Turkey on Star TV, the drama Reborn makes its debut at MIPCOM via OGM UNIVERSE. Kerem Bürsin and Lizge Cömert lead the cast of the production, produced by Onur Güvenatam, directed by Burcu Alptekin and written by Deniz Dargı, Cem Görgeç and Mevsim Yenice. The company is also showcasing a slate of returning hits, among them The Fall of the King with Halit Ergenç; 6 of Us , about six siblings who struggle to cope after the murder of their parents; and Shahrazad: Tears of Istanbul , billed as a cinematic series set against the lush backdrop of Istanbul. Rounding out the company’s slate are additional highlights such as Dilemma ; The Tailor , with three seasons available; and Lost in Love

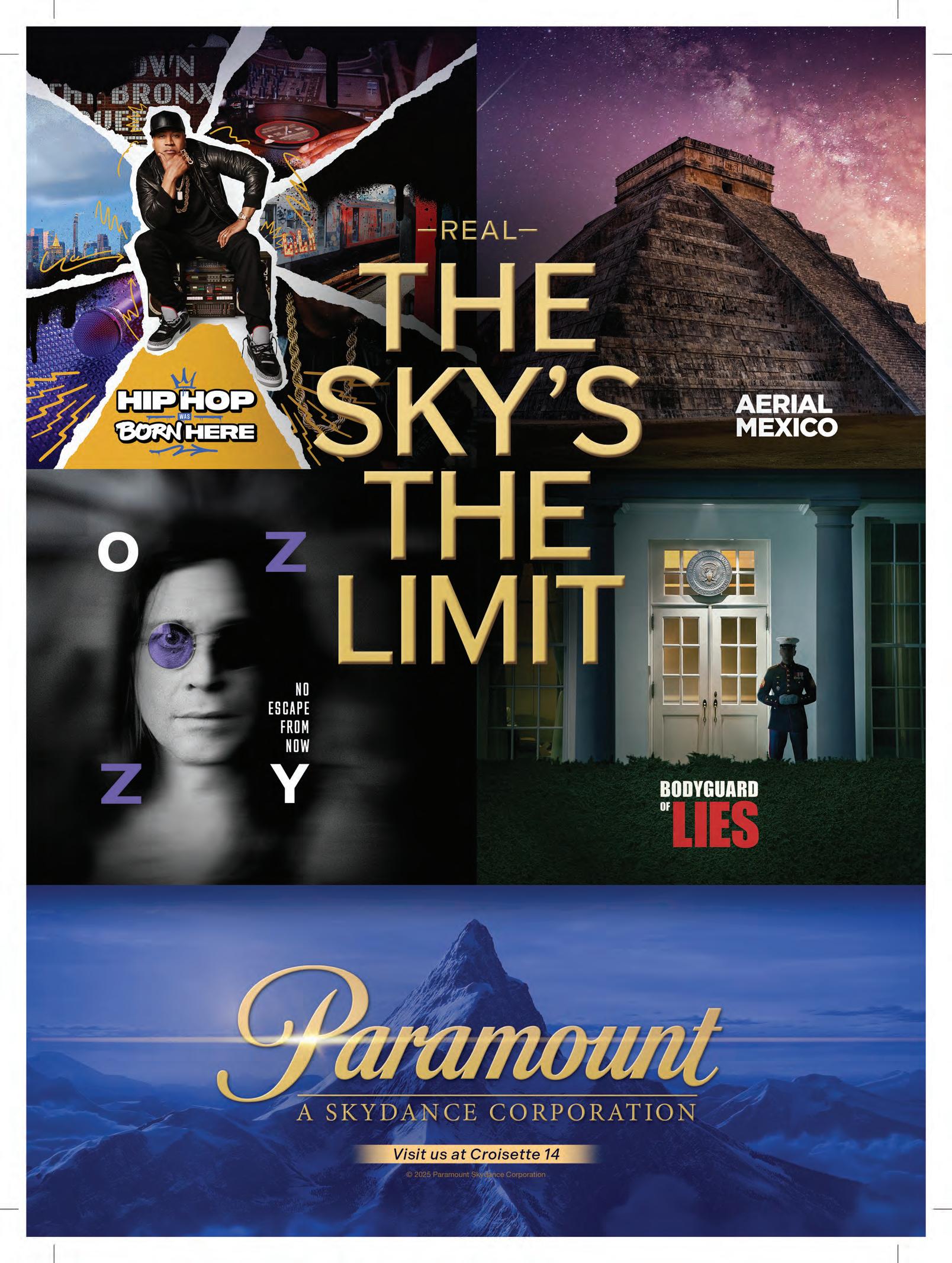

Boston Blue / DMV / Sheriff Country

Boston Blue , a spin-off of Blue Bloods on offer from Paramount Global Content Distribution, sees Donnie Wahlberg reprise his role as Danny Reagan. DMV “is a procedural with a twist—each episode is anchored by a case or storyline tied to the people who come through the Department of Motor Vehicles,” says Lisa Kramer, president of international content licensing. Sheriff Country expands the universe of Fire Country. The catalog also includes the upcoming titles M.I.A., from MRC and Ozark co-creator Bill Dubuque, and CIA, an expansion of Dick Wolf’s FBI. “This is the first MIPCOM as the new Paramount under Skydance, and we want to introduce our clients to the new strategy to invest in the most premium film and television content than ever before,” Kramer says.

“Our

goal is to make Paramount the leading studio and share this with the clients.”

—Lisa Kramer

The Last Supper , available from Pinnacle Peak Pictures/Panoramic Pictures, centers on the days leading to Judas’s betrayal of Jesus and the unraveling of a gathering of disciples. “It opened at number six in the U.S. box office and has currently grossed more than $6.5 million worldwide,” says Ron Gell, VP of international sales and distribution. Little Angels centers on a Division I football coach who makes misogynistic comments about female athletes and is forced to coach a 12-year-old girls’ soccer team for the rest of the season. The second season of County Rescue continues to tell the stories of paramedics. “County Rescue season two and Little Angels both continue the spirit of our unique focus on family-friendly content for all media and all audiences across the world,” Gell says.

“As always, we are striving to provide the highest quality films and series for all our clients around the world, whether they be theatrical, broadcast or digital.”

—Ron Gell

Golden Princess films / Medici / Forensic Files

With the combined libraries of FilmRise and Shout! Studios, Radial Entertainment has a diverse catalog on offer. John Woo classics such as Hard Boiled and The Killer are included, as well as the rest of the acquired Golden Princess film library. “Hard Boiled emerged as one of the most influential action films of all time among film aficionados,” notes Julie Dansker, co-head of sales, distribution and strategy and executive VP of global licensing for TVOD and international distribution. She adds, “We are excited to distribute and hold the international rights to Hong Kong cinema’s most prestigious catalog and genre-defining films.” The historical series Medici stars Dustin Hoffman and Richard Madden, among others. Radial also has on offer the rights to Forensic Files in additional territories and in languages such as Castilian Spanish.

Savvy scheduling and acquisitions have helped Rewind Networks drive gains across its entire channel portfolio, says founder and CEO Avi Himatsinghani. “We launched our HITS and HITS MOVIES channels on Now TV in Hong Kong earlier in the year. On HITS NOW, our live event strategy has paid off with increased viewership for marquee titles such as the Golden Globes, the Emmys and other major award shows. We’ve also seen great traction with our ‘Movie of the Month’ strategy. Collectively, these initiatives have strengthened our channels’ performance and reinforced our position as a destination for iconic television and movie entertainment.” Highlights for the end of the year include star-driven features on HITS MOVIES, classics such as Roots on HITS and the latest dramas and reality competitions from the U.S. on HITS NOW.

Broadcast operations are increasingly becoming dependent on complex applications that require high-performing, reliable and cost-effective network access, says Jon M. Sonsteby, VP of North America sales at SES. “Current connectivity options like cellular and terrestrial networks are often unreliable and lack the bandwidth required for video applications. Satellite networks have always provided broadcasters with ideal connectivity due to their reliability, wide coverage and immunity to events and damage that can occur to ground equipment. Today, broadcasters still require that same reliability, but want it in a more accessible way.” As a result, SES has developed a LEO satellite solution to meet the needs of video applications. “FlexMove LEO is designed for flexibility and performance.”

“Our

goal is to expand our international footprint as we acquire more international rights to both series and feature films.”

—Julie Dansker

“Over the past year, our portfolio has seen strong momentum across all three channels.” —Avi Himatsinghani

operations

“Broadcasters no longer need to choose between quality and mobility—they get both. The new era of media connectivity is here.”

—Jon M. Sonsteby

Yakarta / Raza Brava / El Resto Bien (So Far So Good)

The Mediapro Studio is attending MIPCOM with a lineup of scripted and unscripted titles. Created by Diego San José, Yakarta centers on a young badminton player and her coach, a former Olympic player. Raza Brava “uses the passion for Chile’s Colo-Colo football club as a starting point to explore deeper themes such as social identity, loyalty and human contradictions,” says Javier Esteban, director of international. El Resto Bien (So Far So Good), created by Daniel Burman, portrays a man’s crisis as he turns 50. The format El Conquistador is on the slate as well. Esteban notes, “The Mediapro Studio productions stand out for their genre diversity, creative talent both behind and in front of the camera and a level of technical and narrative quality that positions the studio as a global benchmark.”

“While many of our stories originate from local contexts, they are all designed with a universal reach.”

It’s a Beautiful World / Eating Inn / Women Rising

The Television Syndication Company is presenting a slate of factual, lifestyle and documentary content and heads to the market with a view to “strengthening partnerships with broadcasters and exploring fresh opportunities across both traditional outlets and emerging platforms,” says Cassie M. Yde, president. The slate of titles includes It’s a Beautiful World, taking viewers on a journey across the globe, and Eating Inn, delving into five-star venues across Asia and Australasia. Also on offer is Women Rising “Each series not only entertains but also celebrates cultural diversity, offering a window into traditions, flavors and perspectives that bring people closer together,” Yde explains. “At their core, these programs resonate globally because they highlight the richness of human experience and the universal connections that unite us all.”

“Our mission remains to deliver high-quality, engaging programming from visionary producers to audiences across the globe.”

Vanguard, on offer from Viaplay Content Distribution, tells the story of a media mogul who broke state monopolies and reshaped the media landscape in ways that stretched beyond Sweden. “With cinematic scope and high-end production value, it’s a compelling choice for audiences drawn to stories of power, legacy and disruption,” says Vanda Rapti, executive VP of Viaplay Select and content distribution. A Life’s Worth follows young Swedish soldiers on their first UN mission in Bosnia, where a peacekeeping assignment turns into a brutal conflict. Its cast includes Young Royals star Edvin Ryding. The four-part docuseries Sport vs. Money takes a deep dive into how football became a billion-dollar business, hosted by Simon Jordan, the Premier League’s youngest-ever club owner.

“Our mission in Cannes is to reaff irm Viaplay as the home of premium Nordic and European scripted and non-scripted.”

—Vanda Rapti

My Heart Remembers / When Cats Fly / Alien Invasion: Rise of the Phoenix

The romantic family film My Heart Remembers headlines Wonderphil Entertainment’s catalog. Set in 1903, the film tells the story of a young woman whose life is upended when her adoptive brother reveals she is not biologically part of the family either. In When Cats Fly, a gang of kids works to save a cat shelter that lost its funding. Alien Invasion: Rise of the Phoenix follows as an asteroid shower lands in the Grand Canyon and begins to spread mysterious pods. “These three show the diversity of our content—a Jane Austen-type love story, a children’s feel-good movie and a sci-fi/action popcorn flick,” says Phil Gorn, CEO of Wonderphil Entertainment. “Each story has a universal theme—something many people can relate to, regardless of country or language.”

Ku’damm 77 / Into the Universe / The Lady Grace Mysteries

ZDF Studios is “bringing bold, emotionally resonant dramas with international appeal, fresh and imaginative junior programming that inspires and entertains and unscripted titles that push boundaries” to MIPCOM this year, says Dr. Markus Schäfer, president and CEO. The drama offering is led by Ku’damm 77, a continuation of the Ku’damm franchise, taking place in the ’70s. “The series offers strong, female-led storytelling with emotional depth and universal themes,” Schäfer says. Into the Universe, delving into astronomical enigmas, leads the unscripted slate. The kids’ catalog features The Lady Grace Mysteries, based on the children’s detective novels. “Set in a unique historical world, it blends mystery, humor and adventure in a way that’s both entertaining and educational,” notes Schäfer.

“We have always had a diverse lineup of various genres from around the world.”

“MIPCOM

is a key moment to drive growth, spark collaboration and reinforce our commitment to premium storytelling.”

—Dr. Markus Schäfer

Ahe ad of its launch on CBS in the U.S. in October, Boston Blue is set for a world premiere screening at MIPCOM. From CBS Studios and Jerry Bruckheimer Television and on off er from Paramount Global Content Distribution, the series is a spin-off of the successful CBS procedural Blue Bloods, which ran for a whopping 14 seasons. The new series takes Donnie Wahlberg’s Blue Bloods character, Danny Reagan, from New York to Boston, where he joins the local force and is partnered with Sonequa Martin-Green’s Lena Silver, who also hails from a prominent law enforcement family. Wahlberg and Martin-Green, who are heading to Cannes for the international launch, talk to World Screen about what drew them to the highly anticipated new procedural. By Mansha Daswani

WS: Donnie, when did you first become involved in the spin-off? Was it being set in your hometown of Boston always part of the plan?

WAHLBERG: For years, I walked with this duality. I had the thought that Blue Bloods would never end, and also the thought that when it does, it would be fun to play Danny Reagan as a fish out of water somewhere. Of course, I was thinking of places like Texas, L.A. or Vegas, somewhere like that. When the show ended, I was very passionate about trying to keep Blue Bloods on the air. The fans wanted it to keep going. The cast wanted it to keep going. I thought for a minute that someone was going to call and say, “Hey, bring it over to our network,” or, “Let’s do it on Netflix.” That didn’t happen. I got a call from [CBS] about the idea of doing the fish-out-of-water exploration. And they said, What do you think about Boston? They hooked me like a fish! Not only because I’m from Boston, but because being from Boston and being a New Yorker for 14 years, I learned this dynamic of the way New Yorkers tease Bostonians and the whole competitive dynamic that happens. I thought it would be fun to explore. It’s challenging to go to Boston and act like I don’t like the city when I like it so much! It started with a great script. It started with two great writers who listened to my thoughts and ideas and were very understanding, welcoming and inviting. Everything made it feel more right. Meeting Sonequa for the first time, I knew she got it in a way that informs us as the producers. She’s informing us on this character in ways that we couldn’t even have thought of.

WS: Sonequa, you’ve had quite the eclectic career over the last few years, from zombies to the final frontier! What appealed to you about the show?

MARTIN-GREEN: God has really blessed me. It’s shocking to me when I look at the path that I’ve been on. I did not think that I would land in another huge franchise! Similar to what Donnie was saying, there were just those big moments of “yes.” When I first saw the script, I could immediately feel the heart of it. I could feel the richness. Here you have a familyoriented story that carries those themes from Blue Bloods as Donnie has said, faith, family and tradition. It was screaming from the page. And then seeing this family put faith first, and seeing a multi-faith family. It just spoke to me. Also, knowing what Blue Bloods did, what it accomplished. We’re talking about pure storytelling. That is my passion. Those things got me. Danny and Lena see each other. There’s a bridge created between the two of them. There was such a kinship that developed between Donnie and me on the first Zoom we all had. It’s also on the page. And I appreciated that because what you usually see is the conflict. You see the bickering. The fight, fight, fight, fight until we bond. These two come from the same place, even though they couldn’t be more different. You have this white man and this Black woman, but they both come from these law enforcement families, and they understand each other in an intangible way. We all felt like family on that Zoom call.

WS: How does the dynamic between these two characters evolve over the course of the season?

CBS’s upcoming Boston Blue, distributed by Paramount Global Content Distribution, will have its world premiere screening at MIPCOM.

WAHLBERG: It’s evolving every day. In [our first scene together] in the episode, Anthony Hemingway, the director, kept coming over and saying, You guys are getting along too much! You’re in an alley, climbing a fence and she’s trying to stop you; you can’t act like you’re already friends! We couldn’t be at that point in the partnership yet, but there could be a knowing, a sense. Danny’s in a new world, and he’s a guy who keeps his cards close to the vest. But he’s curious. He sees something in Lena that, for whatever reason, inspires him to ask questions. And it’s not in a romantic way. It’s in a friendship way, a partnership way. If you talk to cops, they will tell you their partners become the closest people in their lives. They will build that bond over time. It comes in the evolution of who we know Danny as. He’s starting to change. He is in a new world. He’s not just treating the new world like New York. As a New Yorker, he may not have the most respect for Boston, but as a cop and as a human being, he has a lot of respect for this family, these cops and this world. It’s putting me as an actor in a unique position. As characters, it puts Danny and Lena in a unique position. She plays her cards close to the vest, too, but something about this guy is able to ask questions in a way that maybe nobody has. And it creates a dynamic that I think is fascinating, allowing us to learn about Danny in a new way and understand Lena from the inside out.

WS: I was moved by that dinner scene in the opening episode; two very different yet similar families sharing their opposing opinions with respect. How important is it, in polarized times, for audiences to see people engaging with each other in that way?

WAHLBERG: In Blue Bloods, [the characters] were all related; they all came from the same family, but everyone had a unique perspective at the table. Some people at the table leaned more to the right, while others leaned more to the left. Some people leaned into their faith; some people did not. Everyone would argue and debate many topics. The thing was, a lot of times, everyone at that table looked the same. With this show, everyone doesn’t look the same. But they’re having similar conversations. Families talk about issues. Families can sit at a table and not agree on every single thing. Everyone has a unique perspective, and there’s a place for everyone to give voice to their thoughts, knowing that they can do so and it’s going to be OK. We can disagree, but we can still love and care for each other. That meant a

lot to many people on Blue Bloods, and I think it will mean a lot to people on this show as well. Danny and Lena, as much as they get each other right out of the gate, don’t always agree at the table. They come right back to their friendship.

MARTIN-GREEN: [Television] affects how we think. It challenges our paradigms. That’s what stories do. We’re wired for stories because they change us and they impact us.

WS: Donnie, tell us about your EP hat and being at the top of the call sheet. What sort of environment did you want to foster with your other cast members?

WAHLBERG: To me, number ten on the call sheet is just as important as number one, and the caterer and the craft service people—it all counts. We’re all getting to have this amazing opportunity. Every role is critical to the success of any endeavor. We’re all there, showing up to work. I understand what it means. I’ve seen other actors respect whatever that position is. I’ve seen other actors not respect it. For the New Kids On The Block, I’m the creative director. I do a lot of the planning and strategizing for the band, as well as what we do long-term. Creatively, I’m there for six months building the show, but I long for the moment when I can just be a New Kid. I can’t worry about which light didn’t come on. I can’t worry about the timing not being perfect with the special effects. I’ll make a note, but I want to be a New Kid now. I want to have fun. I want to connect with the audience. I try to be mindful of the two hats. Sometimes, they converge in a moment. But generally speaking, I want to show up and be an actor. I try to pick my spots of when to be a producer and when to chime in. To me, a good producer, director or leader trusts people to do their job. It’s not my job to start policing everybody and looking over their shoulder. Yes, we can lend thoughts and ideas, but at some point, you have to let people do their work and trust that they’re going to do their best. And if they do, then I’ve done my best.

Sonequa’s done it. It helps me to have her there. She’s capable of doing everything that I’m doing, and she’s also being a leader in her own right by supporting me when I need it and stepping up when we need it. This opportunity is a real blessing. I want to make the most of it, not only as an actor and someone in this industry, but also as a human being. Hopefully, I’m just respecting my coworkers and supporting all of them. We all feel like we’re putting our best foot forward. The rest is up to the audience.

By Mansha Daswani

ichael Bonner succeeded Belinda Menendez at the helm of NBCU niversal Global TV Distribution earlier this year, tasked with maximizing the company’s vast slate—encompassing more than 170,000 episodes and 6,500 feature films—with a network of more than 1,800 clients across 200 territories. A veteran of Uni versal Pictures Home Entertainment, Bonner is wellversed in the intricacies of exploiting titles across multiple windows. Ahead of his first MIPCOM as president of NBCU niversal Global TV Distribution, Bonner talks to World Screen about the sustained need for procedurals, the AVOD and FAST opportunity and collaborating with clients during these transformative times.

WS: You took on oversight of NBCUniversal’s global TV distribution operations amid a time of significant upheaval in the media business. What’s been your topline strategy for your teams around the world against the backdrop of these global shifts?

BONNER: The media landscape is dynamic and constantly evolving, and I feel it’s important that we not only acknowledge its ever-changing nature but also proactively adapt to it and explore ways to turn disruption into a catalyst for opportunity. With that, our strategy remains simple: bring NBCU’s amazing TV and film content to audiences around the world through creative and targeted distribution partnerships, while embracing new platforms, business models and shifting consumer behaviors. It’s actually a really exciting time where we get to help shape the future of distribution and ensure a resilient and thriving media business.

WS: The market for U.S. content has changed over the years as international markets have scaled their own output. What’s driving demand? What’s cutting through for your clients today?

BONNER: Procedural series continue to be in high demand and perform exceptionally well for us, across both linear and streaming platforms worldwide. And this may come as no surprise, but premium content with bold, original storytelling and high production values increasingly breaks through the crowded landscape for our distribution partners and their audiences. We have several series— The Day of the Jackal , All Her Fault , The Paper and Amadeus —that currently exemplify this, and viewers can expect more to come. Additionally, Hollywood films remain in constant global demand. NBCU’s diverse portfolio includes several blockbuster franchises— Fast & Furious, Jurassic Park , The Super Mario Bros ., Wicked and more—that continue to resonate with audiences around the world.

WS: How important are productions from outside of the U.S. to your global distribution operations?

BONNER: We are fortunate to have several renowned international production powerhouses within the Comcast NBCUniversal ecosystem creating content for us to distribute. For example, Universal International Studios (UIS) is home to multiple in-house production companies, including Carnival Films ( Downton Abbey , The Day of the Jackal , Lockerbie: A Search for Truth ); Working Title Films ( We Are Lady Parts ); Heyday Television ( The Capture , Apples Nev er Fall); Matchbox Pictures (House of Gods, Bad Behaviour ) and Universal Television Alternative Studio UK ( Made in Chelsea , The Real Housewives of Cheshire ). UIS is also a minority stakeholder in Canada’s Lark Productions ( Law & Order Toronto: Criminal Intent , Allegiance ) with a first-look distribution deal. Further, Sky Studios produces prestige U.K. series like The Day of the Jackal , Atomic , Amadeus , Under Salt Marsh and more.

These international productions are a valuable part of our overall content portfolio and a reflection of NBCU’s passion for bringing audiences the best in entertainment from around the world.

WS: We’ve seen lots of changes in terms of windowing in the feature film distribution segment. What’s been your approach to maximizing these releases after the theatrical window?

BONNER: The theatrical release of our feature films remains the cornerstone of our business, and NBCU tailors each film’s rollout to maximize its global audience. After the theatrical release, we follow with transactional release and then move into the more traditional pay- and free-TV windows. Every title is evaluated individually, with a strategic, global windowing approach designed to maximize reach and long-term value.

WS: What role do output deals play for you? Are clients looking for large slates to deploy across their multiple platforms, or are they more interested in cherry-picking individual titles today?

BONNER: It really depends on the territory, the client and whether we’re talking about film or TV. That said, output deals remain more common on the film side, particularly in the premium pay window, where they’ve long been a key part of the business.

WS: NBCU has a significant portfolio of FAST channels in the U.S. How is your division approaching the FAST and AVOD sectors internationally as it relates to capitalizing on your deep film and TV library?

BONNER: Yes, we have a large portfolio of very successful FAST channels in the U.S. and began expanding internationally in 2023, when we launched several FAST channels in the U.K. and Germany. That global rollout continues as we include more channels and territories around the world and across a variety of FAST platforms. We see FAST and AVOD as exciting business opportunities to introduce our beloved content to both

new and returning audiences. At the same time, we take a thoughtful and strategic approach to ensure that these models can coexist with and complement our existing distribution partnerships.

WS: You’ve been engaging with your international clients throughout this challenging year; what most excites you about how broadcasters and platforms worldwide are approaching the transformations in the business?

BONNER: We are as invested in our clients’ success as they are in ours, and we view every challenge as a chance to innovate and develop creative solutions that drive our business forward. It’s exciting to see how our partners around the world are embracing new ways of connecting with audiences amid shifting content consumption habits. At the same time, the appetite for highquality, diverse programming continues to grow, and that’s where we really shine. NBCU’s expansive content portfolio spans all genres and formats, enabling us to cater to a wide range of tastes and viewing behaviors. This versatility allows us to not only meet the evolving demands of the global market but also reinforces our role as a trusted partner for our clients seeking compelling content that resonates worldwide.

WS: What are your goals for the division as we head into MIPCOM and the 12 to 18 months ahead?

BONNER: Our goal is to keep doing what we’re doing—to continue building on the strong foundation we’ve established. We have a world-class distribution team and longstanding partnerships across the globe, and I’m incredibly proud of the work we’re doing. I’m looking forward to returning to MIPCOM, connecting with clients, listening to their content needs and showcasing the exciting films and TV series that we have coming up and in development. As the markets continue to evolve, our focus remains on getting ahead of change and collaborating with partners in ways that create value for everyone involv ed.

From Universal Television for Peacock, PONIES is a new period thriller that NBCUniversal Global TV Distribution is bringing to MIPCOM.

By Mansha Daswani

This summer, Roku entered the SVOD business with the lau nch of Howdy, priced at just $2.99 a month and delivering some 10,000 hours from launch partners Lionsgate, Warner Bros. Discovery and FilmRise. Jim Packer, president of worldwide television distribution at Lionsgate, has long been on the hunt for innovative ways to monetize the indie studio’s extensive film and television library. He talks to World Screen about the AVOD and FAST spaces, opportunities on YouTube and meeting the needs of buyers.

WS: How did the deal to supply content to Roku’s new Howdy SVOD service come about?

PACKER: I’ve been working closely with Roku since 2017, when we did our first AVOD rev-share deal with them. We had finally gotten to the point where we had a critical mass of films and TV to do rev-share. Licensing will always be

our primary goal, but when we have a one-month gap for a particular movie, there’s no reason for us not to monetize it. I view [the opportunity] like open hotel rooms. We do the premium licensing first, and when there’s an opportunity to maximize a shorter window, we do that. We also took a chance when we decided to make Roku our exclusive launch partner for our 50 Cent Action channel, rather than going the non-exclusive route. And since launching on the platform, the channel has amassed 45 million hours viewed. I’m comfortable with Roku and the way they operate. They came to us and said, “We’re thinking of launching this lower-cost subscription service, but structuring it more in line with how we do rev-share on AVOD and FAST.” I liked [the concept]. If I look at our content library, I don’t think everything should be on AVOD all the time. Some titles benefit from a break—monetizing with fewer eyeballs can actually give content time to breathe. This felt like a smart way to do that. So, we’re one of the three launch partners [on Howdy], and Roku has been very collaborative.

WS: What have been some of the lessons learned on this AVOD licensing journey?

PACKER: You have to be comfortable with the massive changes taking place around you. You also have to accept that you may have some pressure on your ad revenue. That means you have to get smarter about how you program. We’ve been using AI to help us program more effectively. If you have 750 pieces of content live on Roku, you had better make sure they’re the right 750 pieces of content. There’s less room for error when ad sales are under pressure. As a result, we’ve become more tactical and analytical in how we program to address the degradation in some of the ad sales CPMs.

WS: Does broad distribution across AVOD or FAST devalue content in the eyes of traditional licensing buyers?

PACKER: That might be true for unscripted shows with thousands of episodes that have been on FAST for years. But just because something is really successful on FAST doesn’t mean SVOD licensing might not also happen. Take The Conners—it performs really well both on FAST and on Netflix. People live in their existing ecosystems. Nobody comes home on a Friday night and says, “I want to try four new AVODs and download those apps and do some new sign-ins!” They find a couple that they like. These ecosystems complement each other. [FAST] has not developed as quickly internationally as it has domestically, and it’s going to take longer for those markets to catch up. We’re monitoring the landscape, and I have seen some interesting trends emerging in specific territories. In those regions, we’re leaning into YouTube more because of its strong monetization and large audience. In some situations, we may launch a channel on YouTube before FAST, flipping the usual paradigm. In the U.S., we started with a lot of FAST networks, then expanded into YouTube channels.

WS: What has been your overall approach to YouTube?

PACKER: We’ve always been a leader on YouTube when it comes to our TVOD and EST businesses. We’re a very big player in their AVOD rev-share business, and we’re expanding on the channel side—we currently have 10 to 15 proprietary channels, but we’re increasing that number

significantly. For example, we partnered with our friends at Disney when Wicked Tuna was canceled. Since we control global rights to the entire franchise, rather than just starting a FAST network, we started a [Wicked Tuna] YouTube channel from scratch. We’re also creating some original content that we’re going to be putting on the channel. And the algorithms have done their job. We started with no subscribers, and now we have 35,000, with that number growing every week. We also have our [Wicked Tuna] FAST channel on YouTube. Rather than launching the FAST channel first, we flipped [the typical model] a bit. Instead, we launched the YouTube channel first and then added a FAST channel on YouTube. It’s a different way to think about things. [You benefit from] the analytic back end. If the show is performing well in a territory like South Africa, then my team can go in and try to license it. We can take the data and say to a client, “You don’t have to sit here and believe my sales pitch, just analyze my data.” Pitching becomes much more compelling and effective when you can leverage data to act as a smart distributor for your partners.

WS: What are you hearing from your partners about their needs currently?

PACKER: I’m starting to see a lot more green shoots from international [partners]. Big streaming platforms realize they can’t just rely on their own content. There was a period when licensing activity might have been impacted by [the major streamers] focusing on profitability. Many streamers made adjustments to the amount of content they kept live. However, the reality is that consumers still need new, fresh and intriguing content. We’ve done more business with Disney recently than we have in the past. With HBO, also. We’ve always had great business with Amazon and Netflix, but now more platforms understand they can’t just rely on their own libraries—they need to supplement. For example, our two big non-exclusive partners dramatically expanded their footprints on The Rookie. On a show that strong, it’s a sign [that streamers] need to compete in every country. That, to me, is encouraging.

WS: How are you keeping on top of all the new opportunities that come up, especially around pop-up channels in FAST?

PACKER: We try not to walk away from smart ideas, even in creating channels. We’re up to over 25 channels in the FAST space, and yet we just did a proprietary channel deal with DIRECTV. We wanted to tap into DIRECTV’s very high CPMs, since they excel at ad sales. That’s an opportunity that nobody else took advantage of, but we pursued it. Of course, you have to set your team up to execute effectively and, fortunately, we have the resources to do so. And if we can use AI to help us sift through thousands of movies

and TV shows to make [the process] more efficient, so much the better.

WS: You had a great night at the Emmys with The Studio What’s guiding the thinking behind your slate for MIPCOM?

PACKER: I’m excited by the diversity that we’re able to bring to MIPCOM. We have Spartacus: House of Ashur , which is deep IP, and Robin Hood, a compelling reimagining of the classic story. We also have The Rainmaker , based on a best-selling John Grisham novel—which is also a great movie. We now control Heartland , which premiered its 19th season [on CBC]. The 18th season, which debuted on Netflix, even made the top ten. People still love that show. So, if you want family, we’ve got it. If you want high-end, premium library, we’ve got Mad Men , Weeds and Nurse Jackie . If you want down-the-middle procedurals, we’ve got The Rookie. One thing that makes our company unique is that we’re only 25 years old. We have a contemporary, relevant library that we can tailor to the needs of any client.

WS: What other industry trends are you keeping an eye on?

PACKER: I don’t think there is a single one of the big six streaming platforms that’s not leveraging studios’ deep libraries. Take Twilight, for example—a nearly 20-year-old movie that still reached the top ten when we released it on Netflix this year, competing against brand-new releases. In 2024, we had 56 movies that hit the top ten on the big six platforms. So far this year [as of September], we’re already at 60—and I expect to hit the 70s by year-end. Some titles will repeat, but many of them will be different. I think [this trend] bodes well for us. Audiences want fresh content, but they also appreciate familiarity at times. That’s especially true in FAST, where recognizable titles perform strongly. We’re in a great position at Lionsgate after the Entertainment One acquisition. We’ve gotten to a point where we have so much content that we can put it to work in many smart ways.

By Mansha Daswani

After partnering with M6 last year on the launch of M6+, Bedrock is now firmly focused on migrating RTL+ in Germany to its tech stack in 2026. Part of the wider Bertelsmann family, Bedrock has been working closely with RTL Group on its streaming operations and applying those lessons to its other clients as it rolls out its portfolio of streaming solutions. Jonas Engwall, CEO of Bedrock, talks to World Screen about working with broadcasters to amp up their on-demand and live streaming capabilities and tracking digital innovation around the world.

WS: YouTube’s dominance on the living room television has been one of the headline themes of this year. Do you think that’s been a wake-up call of sorts for broadcasters that perhaps haven’t fully embraced their own digital transitions?

ENGWALL: There are a few different ways to look at YouTube. We see it as one of several global streaming giants, like Prime Video, Netflix or Spotify. They’ve built impressive technology and have become a powerful way to reach audiences, especially younger ones. YouTube just keeps getting stronger. There’s more premium content on the platform now, better recommendations and a growing presence on the big screen. In that sense, it’s part of the benchmark we’re all working against.

As a media company, you can’t ignore YouTube. You have to treat it as a kind of frenemy. It can help you reach certain segments, but it shouldn’t replace your own service. Some broadcasters in the U.K. are using YouTube to connect with younger viewers, and it’s working for them, especially expanding their distribution to other English-speaking audiences outside the U.K. It’s not necessarily taking away from their core audience. But getting those viewers to come back to your own platform is a much harder challenge. So no, I don’t think the right move is to just put everything on YouTube. That’s not a sustainable direction for the industry. The real question is how you use a platform like that to reach people, while still giving them a reason to return to your own destination. I think a lot of broadcasters in Europe are still working out how to do that well.

WS: How are you positioning your suite of services to broadcasters struggling with this transition?

ENGWALL: If you’re a leading media company or a traditional broadcaster, having your own streaming service today isn’t optional; it’s just a must. You can absolutely use YouTube as part of your distribution strategy, but you still need your own destination.

That’s what Bedrock is built for. We’re specialized in building and operating large-scale streaming platforms. We’re actually a joint venture between M6 in France and RTL Group, which gives us a really solid foundation in both media and technology. It also means we understand the business challenges our partners face, not just the tech side.

As a European player, you need to play at the same level as the global giants. And to do that, you need scale. That’s where Bedrock serves an important role. We already operate platforms in multiple countries, and that scale lets us keep investing in innovation and spread the cost across markets. It means our partners get access to a state-of-theart platform at a very reasonable cost.

We’ve proven that this model works. Our partners can focus on their content, their brand and their audience while knowing the product experience is world-class. That combination (scale, efficiency and local control) is how we help them stay competitive in today’s market.

WS: You’re inching closer and closer to the RTL+ transition. How have the lessons learned from the M6+ transition informed your journey in Germany?

ENGWALL: We are knee-deep in this migration, and as always, it’s tricky and time-consuming. But we’ve done this many times now. It’s difficult, but absolutely doable. We aim to complete it in the first half of 2026. Every migration is a learning process. Each time, we improve, refine and optimize our methods. Everything we learned from the M6+ launch is being applied to Germany.

This is also a fantastic next chapter for us. RTL+ is expanding into a broader catalog (live, on-demand, podcasts and sports), and we’re now able to offer a better platform at a lower cost because of the scale we’ve achieved. There’s also news about RTL’s planned acquisition of Sky Deutschland, which is still under approval. If that goes through, it would, of course, be an exciting evolution for us to support even more scale in Germany with the addition of the WOW service.

WS: How do you see the connected TV opportunity as linear ad giants like RTL make the transition to streaming and ondemand with their clients?

ENGWALL: When streaming started, everyone was focused on SVOD as the shiny new model. SVOD is great and adds a new revenue stream, but in the end, you need hybrid models. Advertising is critical, and the whole industry recognizes that now.

We’ve been working in connected TV for a long time, and it’s finally gaining serious momentum. Pre-rolls and midrolls are here to stay, but the exciting part is the new opportunities. Contextual ads, overlays, dynamic formats— there’s a lot happening in this space. The technology has advanced, and we work with all the big connected TV brands across Europe to make sure broadcasters can take full advantage of that.

WS: How are you using your streaming walls to track what platforms around the world are doing?

ENGWALL: We actually have two streaming walls with a range of TVs and devices, granting teams access to the most relevant streaming platforms globally. It’s a way for us to keep track of what’s happening in the industry and spot new ideas. Not everything translates directly to Europe, but you can be inspired.

It’s also a unique tool for our teams. Product managers can test things, compare experiences and benchmark against global leaders. It helps us stay close to innovation worldwide and make sure our own platform is moving in the right direction.

WS: Tell us about how you are scaling your European footprint. Are you looking to expand to Asia, the U.S. or other international markets?

ENGWALL: In Europe, we’re expanding into Germany with RTL+ and opening a new office in Cologne. We also have our Lisbon hub, and we’re growing from around 400 to 500 people. That scale matters because it lets us move faster and build better.

Right now, our main focus is on Germany, but we are also having interesting conversations outside Europe. More and more media companies are discovering Bedrock, and once

we’ve delivered on RTL+, we’ll be in a strong position to support new partners.

WS: What’s been your approach to AI?

ENGWALL: There are different levels to how we’re using AI. Behind the scenes, our platform already uses a lot of AI to monitor stability, detect problems and scale resources efficiently. We’re also using it in development itself, which is a powerful tool for our engineers.

Now, we’re entering the next phase with agentic AI. You define what you want and let the agent do the work. That’s where I think we’ll see a real revolution in efficiency.

And then, of course, there’s the user experience. Personalization is the holy grail of streaming, and AI will play an even bigger role in making sure the right content finds the right audience at the right time.

WS: What KPIs are you focusing on amid this uncertain climate?

ENGWALL: One of the things we’ve been looking at is how to measure operational excellence in a way that’s meaningful. That’s led us to a new benchmark we call the Streaming Platform Ratio. It measures the percentage of streaming platform technology and development costs (including hosting/CDN) compared to streaming revenues. For context, it’s no surprise that Netflix is leading this KPI at around 8 percent. Our ambition is to enable all of our partners to operate at 10 percent (some of our partners are already at this level), which, to our knowledge, is really best in class in Europe.

Thanks to our shared operating model and economies of scale, we can unlock this level of cost efficiency without compromising on innovation, quality or pace. It’s a very tangible KPI, and it shows how platform financial performance itself can become a real competitive advantage.

But, of course, our number one KPI right now is to fully migrate RTL+ in Germany!

On a broader level, RTL Group is targeting profitability in streaming by 2026, and Bedrock will be fully profitable in 2026 as well. For us, that means constantly making the platform more efficient: increasing our speed, optimizing resources and making sure every improvement delivers significant value for all our clients. We’ve now reached the scale to do this continuously and to deliver a platform that is competitive with the very best in the global streaming market.

WS: Tell us about Rainbow’s positioning today as you mark your 30th anniversary.

STRAFFI: For kids’ and family animation, we have created a few IPs with worldwide success, and we are wellknown as an independent studio. Even with the current challenging market conditions, we are managing to survive. Many of our friends and competitors are no longer in business, a consequence of a loss of attention toward kids and families from streamers, lower budgets for public broadcasters, and commercial broadcasters losing audiences and, therefore, advertising revenues. Times are not easy, but we are recognized as a producer with a good track record of international content, especially for kids. The group has undergone significant evolution. For about ten years, we have also been producing liveaction content, both directly as Rainbow and through our other companies, such as Colorado Film, which we acquired eight years ago. Animation and licensing remain as core businesses for our company. The success of KPop Demon Hunters on Netflix is further evidence that animation is well-received by kids, families and young adults. Nevertheless, there has been a lack of investment from major platforms and broadcasters.

WS: What did the acquisition of Colorado Film mean for your live-action ambitions, and how are you approaching this space?

STRAFFI: We do look at every genre, with a specific eye on YA. This aligns with our expertise; productions like Fate: The Winx Saga on Netflix or, more recently, the movie The Tearsmith. We have a particular focus in our editorial strategy on young women and girls. There is still much to discover in the female world that can be told in an original way. We’ve acquired a few strong titles in the YA genre. We are working on adapting A Game of Gods. We also have other series based on bestsellers. We have a title for an older target, still within the romantic comedy genre. We have developed one directed by Francesco Carrozzini starring Michele Morrone together with a famous American actress who I cannot disclose yet. We will continue to develop further in the coming years. At the same time, we have successfully explored action movies like My Name Is Vendetta. We believe a lot in IPs. We are working on adapting Corto Maltese, a well-known graphic novel character in Italy, France, Spain and Latin America. Many, many strong IPs to become hopefully successful TV series and movies.

WS: Speaking of strong IPs, we have to talk about Winx Club. Tell us about the new season and how you’ve kept that franchise so successful year after year.

By Mansha Daswani

This has been a milestone year for Rainbow Group. The Italian-headquartered company, founded by animator Iginio Straffi, is marking its 30th anniversary of serving the kids’, family and YA segments worldwide; its bestselling Winx Club franchise is back with a new animated reboot as well as a Roblox game; and its live-action activities, boosted by the 2017 acquisition of Colorado Film, are seeing lucrative results at the box office and on streaming platforms. In this wide-ranging interview, Straffi talks to World Screen about navigating the challenges of the kids’ sector, the enduring legacy of Winx Club and his goals for Rainbow in the year ahead.

STRAFFI: We have been very active with Winx since the phenomenon exploded about 21 years ago. Winx has been the primary focus of the company for the last 20 years: new stories, seasons, toys, style guides and marketing efforts. We created musicals and other forms of entertainment to keep the audience engaged. We have a very strong fan base, now in their 20s and early 30s. This audience is a nostalgia target that we are catering to with our events, activities and Fate: The Winx Saga, the YA live-action adaptation on Netflix. We are now trying to find a new audience with the reboot. It’s been six years since the last season.

We thought it was time to produce another show that could engage new generations. It took a long time to conceive and develop, moving in a more contemporary direction while trying to keep the DNA intact. To write the story took almost two years. We are using CGI, not 2D. The Alfea College for Fairies has been renovated to be more grand and in line with today’s world. The story itself has the kind of pace, storytelling and twists that could be more appealing to a new generation. At the same time, we don’t want to disappoint our young adult fan base. I try to explain to them that I didn’t conceive a new season only for them. The whole series needs to be appreciated and understood by the audience from 6 to 12. When you have to create a new season, you can’t think only about your 20-plus audience! “Winx Club forever!” is the favorite slogan of the fan base. It debuted in September on CBBC and in October on Netflix, Rai, TF1 and other free TV channels. This is an exciting moment. The young adults are our primary target now for licensees, but hopefully, toys, back-to-school and other categories will be revitalized by the reboot and the new audience we are targeting.

WS: How are you approaching YouTube and social media to build brands?

STRAFFI: We are very proud of our channels, which have reached millions of subscribers and billions of views. We recognize that we need to work more closely with social media, and YouTube in particular, for our kids’ audience. We are producing a lot of content. We have a team that only produces content for YouTube and other social media. With the reboot of Winx, as well as for other IPs, we are continuing to maintain very strong engagement through special content on social media linked to the TV show, while also exploring other aspects and providing additional information. There will be a lot happening in the social media space over the next few weeks and months. We know we need to be there to find our audience.

WS: And you’ve also expanded into the metaverse with a Roblox game for Winx Club.

STRAFFI: We invested in creating a Roblox game to launch with the series. Our goal is to introduce Winx to a new audience.

WS: What are your goals for Rainbow in the next 12 to 18 months?

STRAFFI: For animation, of course, we have Winx and are looking at other big IPs, like we are doing in live action, acquiring books to turn into series or movies. We believe in the power of IPs and the emotional connection that an already established IP can bring to the audience. We continue to be a company that focuses on IP, with only two or three per year in the animation space. There is no space to bring ten shows to the market.

There are fewer competitors, but other companies also need to sell their shows. You can’t believe that you can flood the market with so many new IPs. We must focus on creating quality to continue with Winx , Mermaid Magic and new IPs we have the rights to develop.

For Colorado, we acquired the rights to major IPs in Europe. We want to turn them into successful movies and TV series. We have at least four or five projects in the pipeline, with some already scheduled for production at the end of this year and the beginning of next year. Some others are in the developing stages to go into production in the second half of next year and deliver within the next 24 months. We have live action and animation, and we still believe in licensing, which has been our successful strategy from the beginning. If we can continue to be successful in our licensing, this will give us the chance to buy other rights, other companies, and keep being on the market far beyond the 30 years we are celebrating.

The acquisition of Colorado Film allowed Rainbow to dramatically expand its live-action slate with off erings like the YA movie The Tearsmith.

WS: What factors have contributed to the success of CJ ENM’s scripted titles?

SEO: The recent wave of Korean drama successes, especially with Jeongnyeon: The Star is Born , Marry My Husband and LTNS, underscores the power of CJ ENM’s commitment to well-crafted and original storytelling. It comes as no surprise that Jeongnyeon: The Star is Born was nominated for best scripted limited series at the 2025 Banff Rockie Awards and won a Gold Award for best drama series at the 2025 ContentAsia Awards. Similarly, Marry My Husband secured the series production category at the 2025 Asia-Pacific Broadcasting+ Awards, while LTNS was nominat ed for best comedy series: non-English-language at the 2025 Banff Rockie Awards. Ultimately, all these successes stem from CJ ENM’s

By Mansha Daswani