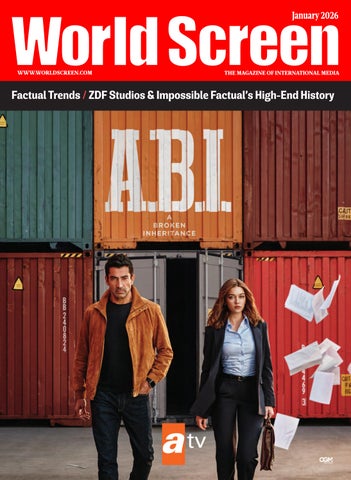

Survival Guide

Factual distributors and producers share their insights on the changes of the last year and what to expect in 2026. By Jamie Stalcup

Without a doubt, 2025 was a tough year for the industry. Fragmentation is increasingly negatively impacting consumers’ TV experience, according to Gracenote’s 2025 State of Play report, which found that 33 percent of streaming users experienced frustration. An uncertain global economic climate has led to continued budget restrictions, and as such, buyers are more risk-averse and commissioning less. This challenging time has even led to the cancellation of Sunny Side of the Doc in 2026, formerly a major event in the factual calendar.

“Across the board in 2025, buyers communicated that budgets remain extremely tight,” says Anne Olzmann, managing director of Albatross World Sales. “There are fewer commissions and acquisitions,

and a clear reluctance to take creative risks. Commissioners are largely avoiding genre experimentation or hybrid formats, prioritizing content that feels proven and dependable.”

“The landscape of unscripted has never been more dynamic, or more challenging,” add Mark Bishop and Matt Hornburg, co-presidents of Blue Ant Studios. But despite these problems, and “while global commissioning has slowed from its peak five years ago, the appetite for premium, high-quality content hasn’t gone away; it has just become more selective.”

With this selectivity in mind, it is imperative to be aware of what buyers and audiences are looking for—“clear hooks and strong storytelling,” notes Autentic’s Mirjam Strasser, head of sales and acquisitions. This must be topof-mind for producers and distributors when developing new programming.

THE TIME IS NOW

Anniversary-driven history titles and timely current affairs programs have been performing well, according to multiple distributors. “In a world where fake news and misinformation online are becoming ever more prevalent, broadcasters are relying on documentaries and factual programming now more than ever to help their audiences stay informed and go behind the headlines they see on social media,” explains Poppy McAlister, managing director of TVF International.

Bishop and Hornburg report that Blue Ant Rights has found success with Taylor, about global superstar Taylor Swift, and Matthew Perry: A Hollywood Tragedy, a look into the Friends star’s life and struggles with addiction, which ultimately led to his death in 2023.

For TVF International, “Escape from Chernobyl: 48 Hours That Changed the World, for the upcoming 40th anniversary of the Chernobyl disaster, is attracting major interest, as is 1979: The Year of the Islamist Revolution, which provides historical context on the contemporary situation in Iran,” McAlister says.

The company also has on offer The Ozempic Effect, another title that is “topical, controversial and deeply relevant to global audiences,” she adds. “Shows like this will always turn heads regardless of the market climate.”

Of course, true crime and natural history remain tentpoles, as well. “Alongside [wildlife and nature,] we are actively working in science, travel and history—genres that align well with our existing expertise, audience expectations and distribution strengths,” says Albatross World Sales’ Olzmann.

Passion Distribution has found that “returnable factual series, such as bluelight, societal tough-job follow docs, like Car Pound Cops and Call the Bailiffs: Time to Pay Up, and true crime dominate the linear channels’ weekday schedules,” says Nick Tanner, director of sales and co-productions. “These genres are relatively cost-effective, can be produced in volume and are highly repeatable, offering value for money for commissioners.”

There is also “a dearth of quality lifestyle series available in distribution,” he adds. Plus, “noisy, zeitgeist-hitting formats and factual entertainment can drive audience engagement, so they will always be crucial to channels and streamers.”

One of the most critical elements of getting these projects, regardless of genre, over the line is connecting with others in the industry and working together.

BETTER TOGETHER

McAlister stresses the importance of attending the major markets to solidify these connections. “From WCSFP to Realscreen to MIPCOM, we seize every opportunity to meet our broadcaster and producer partners in person,” she says. “In an increasingly competitive market, we are focusing on presence, relationships and partnerships.”

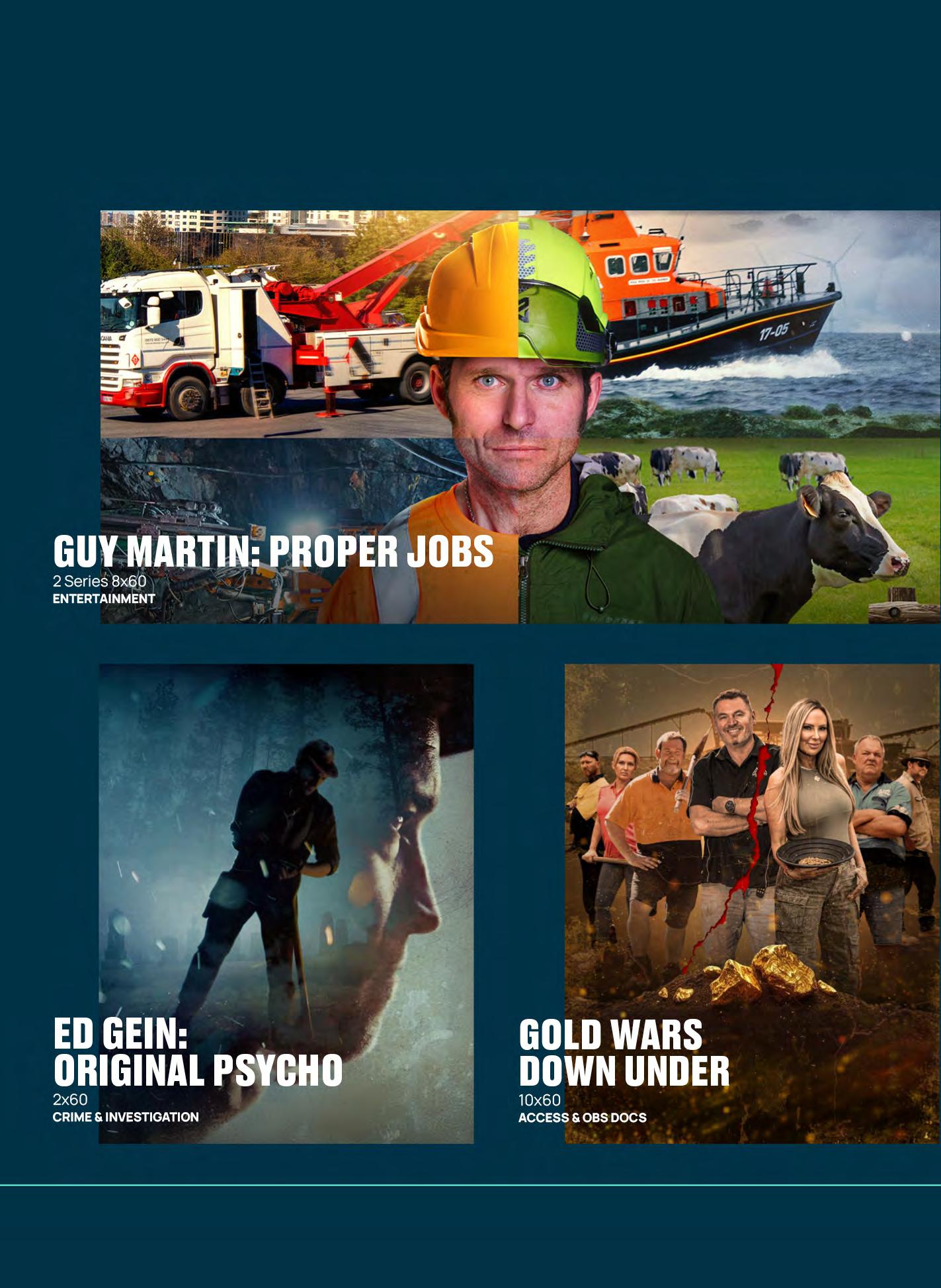

BossaNova Media’s Guy Martin: Proper Jobs sees the former racer take on different jobs.

“The industry has seen a shift in how content is financed, and co-productions are no longer just an option; they are the standard,” Blue Ant’s Bishop and Hornburg note. “In that respect, partnerships have never mattered more. Buyers are looking for trusted collaborators who can co-produce, share rights and bring creative and financial solutions to the table.”

At BossaNova Media, “we have been proactive in seeking out new relationships [that] will support securing funding for a show; S4C came on board alongside Getty Images to sponsor our most recent Development Day, and we’ve developed ongoing dialogues with organizations that can bring funding to the table through routes beyond the broadcast license fee,” explains Claire Runham, head of acquisitions.

Underscoring the importance of collaboration, in June last year, the U.K.’s Documentary Film Council, Canada’s Documentary Organization of Canada and the U.S.’s International Documentary Association formed an alliance to share research and collaborate on cross-border advocacy efforts.

EARLY BIRDS

When entering production partnerships, it is important to board a project relatively early, Runham says. “A big part of our business model is to become involved with shows very early and help to shape projects so that they are pre-sellable.”

Passion’s Tanner notes that his company has “boarded projects as early as devising project ideas ourselves, deficit funding, fully funding shows via presales and co-pros, etc.”

TVF International, meanwhile, “primarily boards projects that have at least one anchor broadcaster attached, so we can then look to the international market for deficit financing, presales or finished tape sales,” McAlister notes.

But stepping in early can be tough, especially in today’s climate. Olzmann says she has found Albatross boarding at early stages less often than before, “largely due to the decline in presales, which has made it more difficult

Untold Arctic Wars is a series available from TVF International.

to support financing during development or early production. While we continue to assess early-stage opportunities selectively, the current climate limits how much we can commit up front.”

DIGITAL DOMINANCE

While commissions are down as a whole, streamers and the digital world are a lucrative bright spot for the industry. In a recent report from Ampere Analysis, global content investment is predicted to reach $255 billion in 2026, driven by sustained investment from global streaming platforms. And in Nielsen’s latest The Gauge report, streaming dominated television viewing in the U.S., with YouTube accounting for a whopping 12.7 percent of that.

The digital world, more specifically, is serving as a boon for producers and distributors. “Our digital sales have massively increased by almost 3,000 percent from 2024 to 2025,” reports Tatiana Grinkevich, head of sales at BossaNova. “We’ve had huge success in the U.S. with Borderforce USA, which is by far our biggest leader in terms of digital sales, closely followed by true-crime content.”

“We’re also in talks to acquire older catalog titles purely to push our digital arm of the business,” she continues. “These are shows that may not travel well internationally on traditional linear platforms but have the potential to do great business for us on YouTube.”

Passion Distribution has continued to utilize its digital content agency UpStream Media—which launched its own digital-first production company last year—as a key part of its strategy. “Driving digital revenue by going B2C is central to the strategy, though this is in lockstep with TV licensing and thirdparty digital channels,” Tanner explains. “The Venn diagram of TV and digital is overlapping more each day, and with that comes opportunity for new content and new ways of taking video to audiences.”

TVF International has plans to grow its digital strategy over the next year as well,

Blue Ant Rights distributes Matthew Perry: A Hollywood Tragedy.

McAlister says. It will do so by monetizing its back catalog, doing more digital-first acquisitions and “focusing on key genres that we know perform well online like history, science and biographies.”

At Autentic, “we’re still seeing solid growth in our digital sales as we dig deeper into our expanding library with smart rights management and windowing,” Strasser says. “In addition, our increased focus on B2C channels and direct upload access to platforms, rather than relying solely on aggregators, has given us greater control and consistently improved results.”

INTO THE FUTURE

Despite all of the challenges of the current market, the growth in streaming and digital sales proves there are still bright spots. And even though Sunny Side of the Doc was canceled this year, there have been other efforts to promote and support the growth of the factual industry, including Autentic’s creation of Autentic Matchmaking Day, an international pitching event, which will take place in June. With this in mind, executives seem to have a cautiously optimistic outlook on the year ahead.

At Blue Ant, which transitioned from a private media company to a publicly traded company and acquired Insight Productions, Proper Television, MagellanTV and Thunderbird Entertainment, “we’re optimistic that our growth as a company will allow us to invest in projects we believe in and take bigger risks,” Hornburg and Bishop say. “Our expanded scale has diversified our content offering and set up a collective strength across our business units that will allow us to move into new genres, new platforms and new audiences, while staying rooted in creating and finding audiences for great stories.”

While it does seem that the market will remain difficult for a little bit, “there are positive signs,” Olzmann says. “Demand for factual storytelling is steady. Companies that operate efficiently, concentrate on proven genres, use their libraries strategically and adapt to evolving distribution models are likely to be in the strongest position moving forward.”

The key to getting through 2026 “is staying proactive and nimble,” stresses Autentic’s Strasser. “The market is evolving rapidly (especially in the digital space), so we’re not just responding to change, we’re actively preparing for it. We’re strengthening our workflows, expanding our technical capabilities and ensuring we’re fully equipped for new forms of exploitation and emerging distribution pathways.”