A Special Th Our Sp

hanks to All ponsors

FEATURE

Breaking the Rules CONTENTS

16 CHANGING THE GAME

From refining co-production skills to adapting existing IP and driving digital-first content rollouts, a crosssection of producers and distributors weigh in on navigating a business in transition.

Ricardo Seguin Guise

Publisher

Mansha Daswani

Editor-in-Chief

Jamie Stalcup

Managing Editor

Grace Katich

Associate Editor

David Diehl

Production & Design Director

Simon Weaver

Online Director

Dana Mattison

Sales & Marketing Director

Genovick Acevedo

Sales & Marketing Manager

Ute Schwemmer

Bookkeeper

While it’s not a piece of advice parents would necessarily offer their kids, the consensus I’ve been hearing from folks in the kids’ media business is that it’s time to break some of the rules.

There are no easy solutions for where the business finds itself. Deflated from the sudden decrease in SVOD investment, kids’ media producers are having to find new ways to get their shows off the ground. Securing an audience has never been harder amid fragmented platforms and an untenable sea of content. And big-budget, beautifully animated shows are often finding themselves losing audiences to properties made on shoestring budgets in the creator economy. Curating the latest edition of the TV Kids Summer Festival, we set out to grapple with these game-changing developments to see if we could find some consensus on the way forward.

The conversations we’ve had with senior production, distribution and programming executives indicate that, more than ever, it is time to throw out many of the old rules about exclusivity and walled gardens. YouTube simply cannot be ignored—whether you’re in the business of serving kids or adults. Whether it’s developing shorts based on existing IP to maintain engagement between seasons, dropping exclusive online content in the run-up to launches or partnering with leading digital creators, IP owners and channels are taking myriad approaches to the world’s most dominant video platform.

Our trends report in this edition highlights digital-first rollout strategies from several perspectives, the surging importance of co-production models, especially for pubcasters, and the continued value of known IP.

INTERVIEWS

Ricardo Seguin Guise

President

Mansha Daswani

Associate Publisher & VP, Strategic Development

TV Kids

©2025 WSN INC

401 Park Avenue South, Suite 1041, New York, NY 10016, U.S.A.

Phone: (212) 924-7620

Website: www.tvkids.com

This edition also includes a wide-ranging conversation with creator economy pioneer Chris M. Williams, who has scaled pocket.watch into the leading network of channels for kids and families on YouTube, with a stable of some of the business’s biggest personalities, including Ryan Kaji.

Milkshake!, which has a deep legacy of serving preschoolers in the U.K., has also set itself up on YouTube, knowing that while its linear and on-demand ecosystems remain valuable, not having a presence on YouTube is just not an option. “We are trying to ensure that we are in step with the audience,” Louise Bucknole, who heads up the service at Paramount in the U.K. and Ireland, told me in an interview you’ll find later in this edition. Mansha Daswani

26 CHRIS M. WILLIAMS

The founder and CEO of pocket.watch on building franchises from the creator economy.

28 LOUISE BUCKNOLE

A Q&A with the general manager and senior VP for kids and family at Paramount in the U.K. and Ireland about Milkshake!’s strategy.

9 Story Media Group/Scholastic Entertainment

Momoguro / Paris & Pups / The Woohoos!

9 Story Media Group is arriving in Annecy with titles for varying age demographics. Momoguro , based on Baobab Studios’ Roblox game, features action-filled episodes for kids ages 6 to 11. Paris & Pups, a digital-first series for girls ages 5 to 8, takes inspiration from Paris Hilton and her real pets. For preschoolers, The Woohoos! has “a lovable cast of animal friends, playful humor and universal themes of curiosity and wonder,” says Alix Wiseman, senior VP of distribution and acquisitions. The slate also features Scholastic classics such as Clifford the Big Red Dog and The Magic School Bus. Plus, the offering includes hits like Daniel Tiger’s Neighbourhood and Wild Kratts, as well as newer titles such as Dylan’s Playtime Adventures , Open Season: Call of Nature and many more.

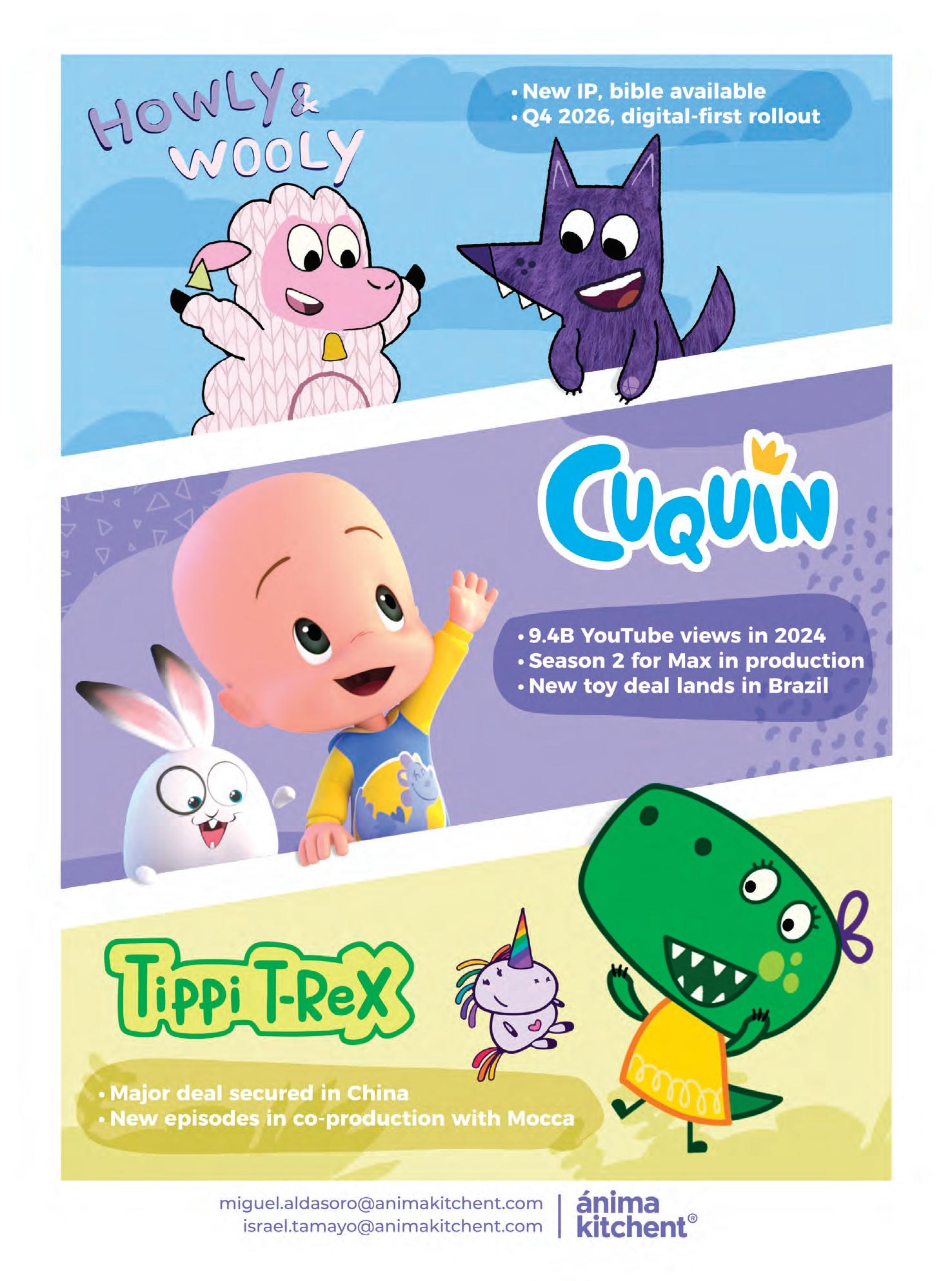

Ánima Kitchent

Cuquín / Tippi T-Rex / Howly & Wooly

Ánima Kitchent is bringing to Annecy/Mifa new seasons and titles, including a second season of Cuquín . The 3D series’ first season reached 9.4 billion views in 2024. Season two is in production for Max and has a toy deal clinched in Brazil. Tippi T-Rex is a 2D property with new episodes in production and follows the adventures of a curious dinosaur girl. Howly & Wooly marks the debut of a brandnew 2D IP, with a digital-first test planned by the end of 2025. Ariana Villalobos, Ánima Kitchent’s head of studio, said, “Titles such as Cuquín , Tippi T-Rex and Howly & Wooly are strategically developed to succeed across broadcasters, streaming platforms, YouTube, apps and beyond, maximizing both their global reach and long-term brand potential.”

“With a library of over 5,000 half-hours, 9 Story offers something for every buyer.”

—Alix Wiseman

“At Ánima

Kitchent, we are committed to producing high-quality content that not only performs strongly across platforms but also resonates deeply with audiences.”

—Ariana Villalobos

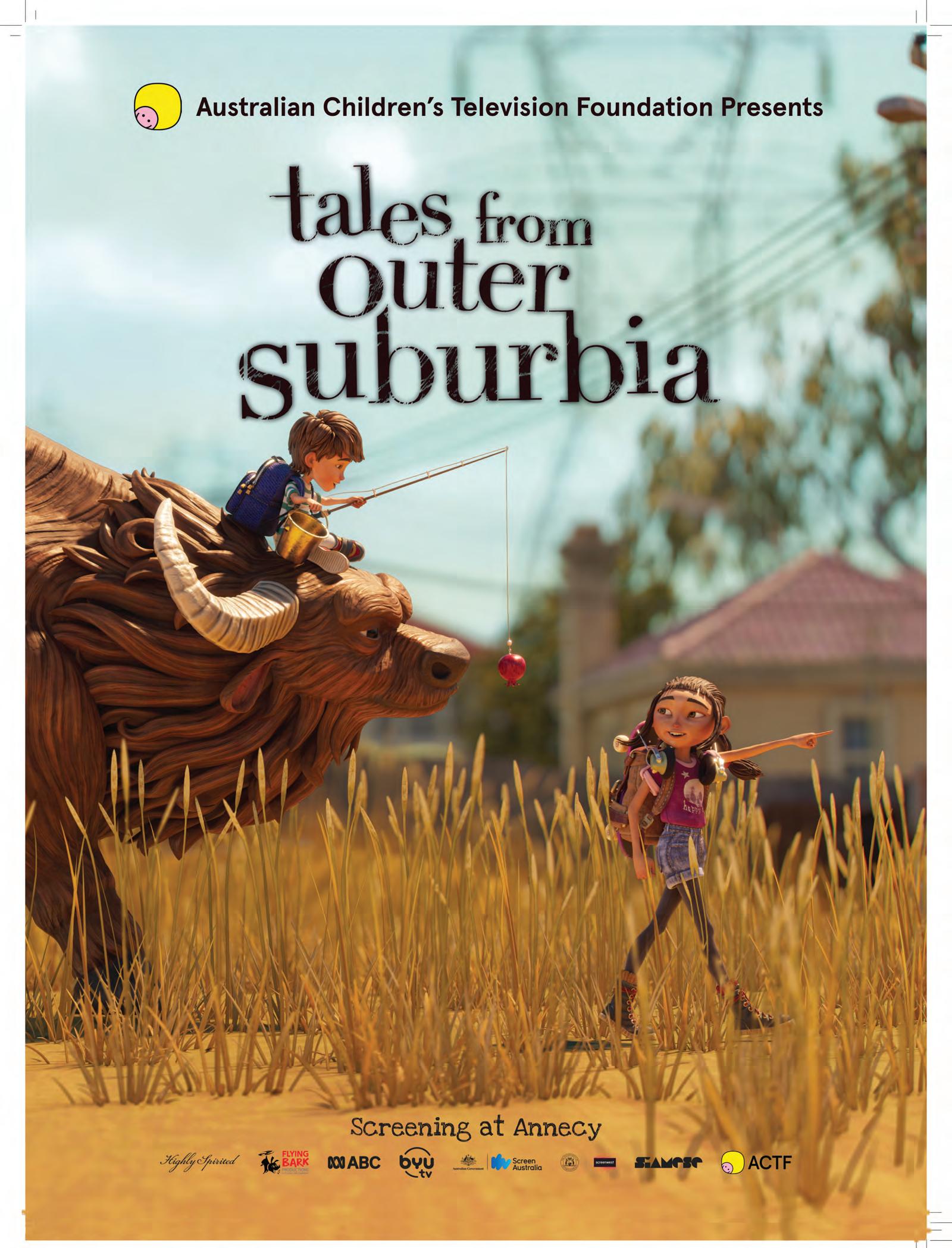

Australian Children’s Television Foundation

Tales from Outer Suburbia / Kangaroo Beach / Eddie’s Lil’ Homies

Leading the Australian Children’s Television Foundation (ACTF) lineup, Tales from Outer Suburbia tells the story of Klara and her brother Pim, whose holiday in Outer Suburbia evolves into a surreal experience. The adaptation of Shaun Tan’s illustrated anthology “delivers a cinematic storytelling experience that is rarely seen in episodic animation,” says Roberta Di Vito, international sales manager. “Its imaginative, surreal adventures explore big emotional themes—family, belonging and resilience—that will relate to viewers around the world.” Also on offer, Kangaroo Beach pairs adventure with water safety education, following four animal cadets as they train with lifeguard mentors. Eddie’s Lil’ Homies, which centers on an 8-year-old as he navigates life on the playground, celebrates themes of diversity, friendship and community.

“The ACTF is excited to showcase the strength and diversity of Australian children’s content on a global stage.”

—Roberta Di Vito

Dandelooo

The Upside Down River / Born in the Jungle / Tuiga

Dandelooo has a jam-packed catalog for Annecy/Mifa. Emmanuèle Pétry, head of international and development, highlights The Upside Down River , “which has been selected in the best TV program Annecy awards category,” she says. The Upside Down River tells the story of Tomek and Hannah’s meeting on the way to the Qjar River and their series of quests. Born in the Jungle takes place in late 1950s Venezuela, where 9-year-old Elizabeth’s summer break takes a wild turn when her little brother Leo vanishes into the jungle. Tuiga brings to life a giraffe in a balloon as he makes deliveries around the world. He is accompanied by a pilot, flower and rock. Dandelooo’s offering also includes PongPong Dino , Pompon Little Bear , Billy the Cowboy Hamster and many more.

“These programs have a high visual impact with a strong setting in nature—an imaginative art-like nature, but nevertheless a true inspiration for kids today.”

El Reino Infantil

La Granja de Zenón (Zenon’s Farm) / Bichikids (Boogie Bugs)

El Reino Infantil is bringing to the global market La Granja de Zenón (Zenon’s Farm), its flagship IP. The series “remains a solid and reliable choice for platforms and buyers seeking guaranteed success,” says Ylka Tapia, acquisition and partnership manager. The musical series Bichikids (Boogie Bugs) sees little bugs suggest tasks and activities that match the rhythm of songs. El Reino Infantil also has on offer the new IPs Wadoo and Pili Pilota, as well as a smattering of other digital series. “For us, diversification is key,” Tapia notes. “We want families to have access to their favorite content anytime, anywhere and on any device. While YouTube remains our primary brand, prioritizing digital expansion to other platforms has enriched the user experience and significantly increased the visibility of our IPs.”

HARI

The Weasy Family / Grizzy & the Lemmings / Mystery Lane

On offer from HARI, the slapstick comedy The Weasy Family blends silly antics with emotion. It centers on the well-meaning but unprepared weasel named Weasy, who suddenly finds himself having to raise twin ducklings after accidentally sitting on their giant egg moments before hatching. Also available from HARI are four seasons of Grizzy & the Lemmings and its new preschool spin-off, Baby Lemmings . The former sees a bear take over a forest ranger’s house to live like a man, only to be disrupted by the lemmings, little furry mammals who have the IQ of a pea. In Mystery Lane , which also features a Christmas special, a detective hamster and her little brother take on investigations that baffle Scotland Yard.

“What makes these projects appealing is, above all, their proven effectiveness with a massive international audience.”

—Ylka Tapia

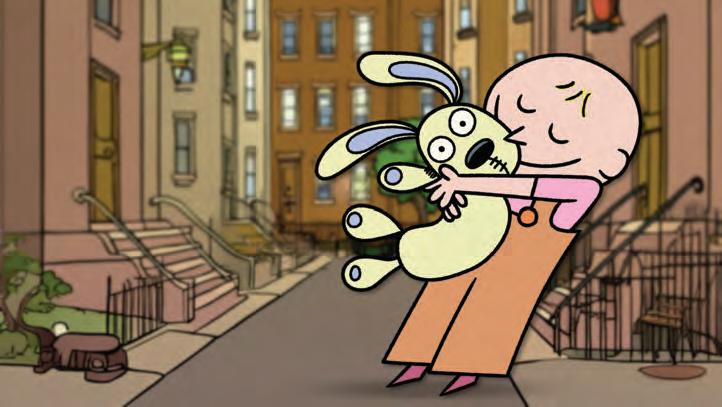

Hidden Pigeon Company

The Pigeon Show! Starring The Pigeon / Knuffle Bunny / Cat the Cat Tries That!

At Annecy, Hidden Pigeon Company is presenting a variety of programs that bring Mo Willems’ characters to life. The Pigeon Show! Starring The Pigeon , like its title suggests, centers on a pigeon who lives large and dreams big. Knuffle Bunny tells the story about the Knuffles, plush rabbits, and the chaotic human families they are part of. Cat the Cat Tries That! centers on a curious, confident cat who loves her family, her friends and trying new things. These “showcased projects appeal to a global audience because of the universally relatable kids’ and family themes, distinctive animation styles and the diverse cast of characters that connect emotionally with audiences no matter where in the world they reside,” says Karen K. Miller, CEO of the Hidden Pigeon Company.

Kedoo Entertainment

Booba / Sonya From Toastville

Kedoo Entertainment is bringing a variety of titles from the digital-first Booba franchise to Annecy. With five seasons and 130 episodes, Booba is available in over 45 countries and has racked up more than 22 billion YouTube views. It consistently ranks in the top ten kids’ animation titles on Netflix and has grown into a franchise with spin-offs such as Booba: Food Puzzle , Booba’s Bedtime Stories and Booba Live Show, plus games, toys and more. Another title from Kedoo, Sonya From Toastville targets kids aged 6 to 9. Since launching in 2024, the series has already surpassed 200 million YouTube views. In the show, Sonya’s adventures in Toastville champion friendship, self-belief and resilience. A second season is now rolling out exclusively to broadcasters and streaming platforms worldwide.

Magic Light Pictures

Tiddler / Pip and Posy / The Gruffalo

Tiddler, based on the book of the same name by Julia Donaldson and Axel Scheffler, leads Magic Light Pictures’ Annecy slate. It follows a little fish who is lost at sea and saved by his own imagination. “It’s a vibrant and imaginative underwater adventure with themes of creativity, storytelling and self-expression that resonate with audiences of all ages,” says Muriel Thomas, international distribution director. The preschool series Pip and Posy, now in production on three new stand-alone seasonal specials, centers on the world of a mouse and rabbit whose lives revolve around play. It “continues to delight young viewers with its gentle humor, relatable stories and warm celebration of friendship and emotional learning,” Thomas says. The catalog also features The Gruffalo, another IP based on a book from Donaldson and Scheffler.

“We

are excited to be further introducing global attendees to Mo Willems’ work and to celebrate all the amazing talent throughout the world.”

—Karen K. Miller

“Our projects are grounded in universal themes—friendship, adventure, curiosity— that resonate across cultures.”

—Muriel Thomas

MIAM! distribution

The Tinies / Goat Girl / Tweedy & Fluff

Among the titles on offer from MIAM! distribution, The Tinies, a character-driven comedy for upper preschoolers, takes place in the toy-built world of Attic Town. Each day, Ollie and her best friend Titus use their crafting skills to solve everyday problems in a sustainable way. Goat Girl, a coming-of-age comedy, centers on a 13-year-old girl who was raised by mountain goats. After becoming a teenager, her Nanny and Billy send her to a boarding school to spend time around other humans. Tweedy & Fluff follows Tweedy, a little plush made from tweed cloth, and Fluff, a ball of woolly fuzz, who are inseparable. Also in the MIAM! catalog, Edmond and Lucy follows a squirrel and bear cub, siblings who live together with their blended family in a chestnut tree.

Pocket.watch

Love, Diana Musical Mysteries / Toys and Colors holiday special / Ryan’s World The Movie: Titan Universe Adventure

From pocket.watch’s portfolio of creator-driven content, Love, Diana Musical Mysteries provides a new avenue for kids to experience Kids Diana Show. The new series features 3D animation, puzzles, learning opportunities and original songs. An upcoming holiday special for Toys and Colors will include festive music, activities, storylines and special guest stars. Content also continues to pour from the Ryan’s World brand, with Ryan’s World The Movie: Titan Universe Adventure standing alongside the five hit seasons of Ryan’s Mystery Playdate. David B. Williams, senior VP and general manager of channels, says, “For Ryan, Diana, Toys and Colors and the rest of our ever-expanding roster of creator stars, we have the best of their most popular YouTube content, all thoroughly vetted, enhanced and packaged for distribution.”

Serious Kids

The Unreal / Operation Ouch! / Flix

The Unreal, a live-action miniseries for families on offer from Serious Kids, “blends supernatural mystery and comedy with real-world issues relevant to younger audiences, such as mental health struggles and the impact of social media on teenagers,” says Leila Ouledcheikh, senior VP of global distribution and commercial development. Operation Ouch! has a 13th season available. “The show continues to be incredibly entertaining, relatable and globally marketable,” Ouledcheikh notes. Flix, the first series based on Tomi Ungerer’s work, has been renewed for a second season, available in January 2026, to further the themes of “tolerance, courage, friendship and community, [which] strongly resonate with buyers seeking content with meaningful values and universal appeal.”

“We have over 30,000 hours [of content] from the most popular stars out there.”

“Our programming stands out for its universal themes, emotional authenticity and crossgenerational appeal.”

—Leila Ouledcheikh

Studio 100 International

Mortina / Gifted / Dino Mates

Studio 100 International has multiple kids’ titles for Annecy/Mifa. Mortina is based on the book series by Barbara Cantini. The 2D animated show revolves around Mortina, a quirky 9-year-old zombie girl, and her friends as they solve strange mysteries at Crumbling Manor. Gifted, a live-action series based on the novels by Marilyn Kaye and aimed toward ages 8 to 14, follows a diverse group of teens with special powers who find themselves hunted by a shadowy organization. “The characters’ powers are not simply tools to fight villains—they’re metaphors for personal growth and overcoming challenges, adding layers of heart and suspense,” said Dorian Buehr, head of global distribution. Dino Mates, inspired by Madame Freudenreich Curiosités, tells the story of two children who help their grandmother care for dinosaurs.

ZDF Studios

Space Nova / Klincus / Sam & Julia

The ZDF Studios kids’ slate is led by a second season of Space Nova, an animated series that takes place in the year 2162. Aussie siblings Jet and Adelaide Nova, along with their parents, spend their days traveling to rogue planets in the name of science. In Klincus, a big feast is held to celebrate the 100th anniversary of the founding of the industrial town Umghard. Klincus uses this as a chance to escape and search for his parents, but he ends up captive in Frondosa, an isolated town in the middle of nature. Sam & Julia centers on the she-mouse Julia, who moves into a residential building from a distant island, and the he-mouse Sam, who welcomes her to the new environment and helps her feel at home. It is based on the best-selling Dutch book series The Mouse Mansion by Karina Schaapman.

“While preschool and kids’ programming remain key, we are also expanding into teen and family-oriented content—a diversification that allows us to cater to a wider audience.”

CHANGING GAME THE

From refining co-production skills to adapting existing IP and driving digital-first content rollouts, a crosssection of producers and distributors weigh in on navigating a business in transition.

By Mansha Daswani

Announcing its landmark deal to become the new home of Sesame Street globally (sharing U.S. rights with PBS KIDS), Netflix included a data point that, while unlikely to comfort those still recovering from the drastic reduction in investments by the global streamers, is, at the very least, a sign that all is not lost.

“Kids and family viewing represents 15 percent of Netflix’s total viewing,” the streamer said. “Whether it’s laughing alongside their favorite characters with Ms. Rachel, Gabby’s Dollhouse, CoComelon Lane, Blippi and Hot Wheels Let’s Race or diving into exciting new adventures with The Sea Beast and Leo, we’ve built a space where kids can watch, play and learn.”

Many of the titles referenced were born from YouTube, a theme that we’ll return to later in this piece, but Netflix and other SVOD platforms, while not investing in kids’ fare at the level they were at the height of the pandemic boom, still see the segment as key to their ability to maintain subscribers.

“Children are not a major motivating factor for consumers when deciding to subscribe to a service,” said Olivia Deane, research manager at Ampere Analysis, at the TV Kids Festival earlier this year. “However, they still play an important role in subscriber behavior. Households with children are not only more likely to have more viewing devices, but they also make up a large proportion of Netflix viewing activity. While children’s content isn’t enticing people to sign up, it is stopping them from leaving. Across the board, households with children were less likely to churn. While streamers are limiting their budget for new, original and exclusive children’s content, they are also acquiring large volumes of existing children’s content to appease this important consumer group.”

While SVOD commissions have plummeted, Ampere’s data did show one bright spot; the “crown jewels” of the sector, Deane said, are public broadcasters, mainly in Western Europe and North America.

“Between the first half of 2023 and 2024, not only did public broadcasters announce the highest volume of children’s commissions, but they were also one of only three

commissioner types to show growth in the volume of children’s commissions announced,” Deane explained.

Pubcasters, themselves facing funding challenges (including in the U.S., where President Donald Trump has left the fate of public broadcasting in doubt), are increasingly pooling their limited resources to maintain their commitments to high-quality kids’ fare. Indeed, partnerships are very much back in vogue now that global deals are rare.

Among the numerous studios and distributors attending Mifa to explore potential partnerships for new projects is Dandelooo.

The boutique independent has weathered the storm facing the French animation sector, which has seen a string of high-profile casualties in the last year.

Gennarino Romano, international sales manager and head of acquisitions, describes the European animation sector as being “relatively resilient” amid the broader challenges facing the ecosystem.

“Its strength lies in robust public funding systems, creative talent and a strong tradition of international co-productions,” Romano says. “Our series The Upside Down River and Billy the Cowboy Hamster are good examples of European co operation,” he notes, referencing partners in Germany, Portu gal and Belgium. “These co-productions help to share financial risk and keep the industry dynamic and adaptable, even in the face of ongoing market difficulties. We are fortunate to be in production simultaneously with two French broadcasters: CANAL+ for Max & Bunny and TF1 for Hold on Gaston!”

Both are based on known IP, a theme that remains paramount in a business where discovery continues to confound everyone.

BY THE BOOK

“A published book is proof that someone has already said yes,” Jeremy Colfer, the director of development at Lion Forge Entertainment, told delegates at the TV Kids Festival. “When you’re bringing it into someone, the risk is lower because someone already put their neck out. You’re not taking a flier on something completely original, which we all would love to see more of, but it’s just not done a ton right now.”

“Book adaptations have always been a proven and successful model for us,” said Oliver Grundel, Director Junior at ZDF Studios, at that same session, highlighting shows like Sam &

Birthed on YouTube, Booba has become a huge hit for Kedoo Entertainment with slots across streamers and linear channels and a successful L&M rollout.

Julia. Based on the Dutch book series The Mouse Mansion created by Karina Schaapman, the series attracted several partners, including ZDF and France Télévisions.

Kristofer Updike, senior VP of creative at Hidden Pigeon Company, which was created to adapt the work of beloved author Mo Willems, expects known IP to remain prominent for the foreseeable future.

“I thought this year would be the year of new original content,” Updike said, “but we’re not quite there yet. I think we have another year or so of this kind of content being in high demand. 2025 is a year of IP, brands and so forth. We’re on the cusp of an AI-driven creator model, where creators can use AI to animate their own content, and therefore, there’ll be a lot of fun, new original ideas coming out, and we’ll be able to see them visually.”

FROM THE GROUND UP

Even amid the known IP mantra, new brands are emerging from the digital-first economy, with the likes of CoComelon and Booba sitting alongside Bluey and SpongeBob SquarePants on retail shelves. You can build a hit with a digital-first model (digital-only, less so), and understanding how to do so involves a fair bit of trial and error.

“ Booba started life on YouTube as a 3-minute short, quickly becoming a firm audience favorite,” says Olivier Bernard, COO of Kedoo Entertainment, which created the show. “We could see the fan base growing exponentially, with each episode achieving huge numbers. Keen to build on this success, the logical next step was to extend the 3- minute format. While the appetite for Booba was huge, we learned from linear TV habits that extending the length of a non-dialogue show was risky. Being on YouTube enabled us to be flexible and nimble, delivering what the audience wanted and learning from it. Sometimes it works and sometimes it doesn’t. But we knew it was a risk we had to take. We gradually crept up to 5 minutes in season three, and the audience continued to grow. We are now at 7 minutes from season four onward, and Booba is loved more than he ever has been.”

Several IP owners are also using YouTube and other digital ecosystems to reintroduce properties, as Ánima Kitchent has done with Cleo & Cuquín , its flagship IP.

Indeed, a successful digital strategy has led the show back into a premium streaming environment.

“It was originally launched as a television-first IP,” says Miguel Aldasoro, international sales and co-production director at the Spanish production and distribution outfit. “After completing the first season, we began shifting toward a digital strategy, developing content specifically for YouTube, including songs and short episodes focused on the character Cuquín. The new Cuquín: Discover & Explore episodes performed well digitally, which led us to expand production and move to an always-on content model. These strong results also caught the attention of Max, and we’re now producing the second season of the Cuquín original for the platform.”

Reiterating the importance of trial and error, Aldasoro says Ánima Kitchent used a similar model with Tippi T-Rex, resulting in “a new co-production for additional episodes and a new deal in China. We are now preparing to apply the same model to our newest IP, Howly & Wooly, with a first digital test planned for Q4 2026.”

El Reino Infantil, meanwhile, is a YouTube channel that evolved from a series of DVDs, serving Spanish-language audiences with music videos, educational fare, games and more. “We currently produce over 40 new weekly content pieces across various platforms,” says Ylka Tapia, acquisition and partnership manager at the channel, which logs more than 250 million views a day.

DIGITAL PLUS

While Ánima, El Reino Infantil and Kedoo are all operating in slightly different digital-first spheres, pursuing revenue opportunities outside of the YouTube ecosystem is a common priority.

“While YouTube was instrumental in building Booba ’s initial audience, with over 22 billion views accumulated now, we always envisioned the character as a cross-platform brand,” Kedoo’s Bernard says. “Our distribution strategy focused first on global streaming platforms, but since season three, we have also formed partnerships with regional and local TV broadcasters. Booba launched on Netflix and is now established as a top ten kids’ animated series. The show is also available on Prime Video.”

ITVX and Nine Network have also acquired the show, which has a successful licensing and merchandising program managed by IMG. “In 2024 alone, more than 40,000 plush toys—produced in-house by 3D Sparrow—were sold via Ama zon and other e-commerce channels, reflecting strong consumer momentum,” Bernard continues.

FINDING THE FUNDS

“Monetization on YouTube depends on many variables— sea sonality, trends, events and territories all play a role,” says Aldasoro at Ánima. “The main objective is to generate strong viewership, ideally in regions with higher CPMs. With the introduction of new formats like YouTube Shorts, monetization dynamics have shifted significantly. CPMs tend to be lower compared to traditional content. Success comes down to building strong engagement with the audience and continuously expanding the reach into new markets and demographics.”

Aldasoro adds, “Outside the YouTube and AVOD window, we see monetization opportunities through licensing and merchandising. While securing deals in this space is not always easy, given the competitive landscape and the need for brand recognition, it remains a crucial avenue for consolidating the value of an IP. Licensing partnerships help extend a property’s reach beyond the screen, strengthening brand engagement and opening up additional revenue streams.”

Tapia says that El Reino Infantil has been able to fund its content thanks to its multiple revenue streams.

“Our large audience allows us to generate revenue across multiple areas such as YouTube, strategic partnerships, consumer product licensing, live shows and agreements with streaming platforms like Netflix, Prime Video, Max and ViX. The development of FAST channels and distribution via platforms like The Roku Channel, Pluto TV, Samsung TV Plus and Tubi has also opened up new monetization streams. We only move forward with theatrical releases or licensing deals once digital metrics confirm that a property is mature and scalable.”

Data is paramount, whether you’re developing for a digital-first rollout or pursuing a traditional commissioning route. You need to have a sense, early, of how your IP is connecting with viewers.

“Data is a fundamental part of our day-to-day operations,” Aldasoro notes. “It allows us to understand not only whether an IP is performing well, but also why it’s resonating or not with audiences, and how we can evolve it strategically. We have a dedicated team of data analysts and mathematicians who monitor a wide range of metrics, including performance trends, audience behavior and competitive benchmarks. This approach goes beyond basic KPIs; we use tools like YouTube Analytics and Tubular Labs to gain deep, actionable insights that inform everything from creative development to release strategies. Thanks to this data-driven mindset, we have been able to refine our IPs to better meet audience demand, identify new market opportunities and support commercial deals such as licensing and co-productions.”

TRACKING THE NUMBERS

“Data is a core pillar of our content strategy,” says Tapia at El Reino Infantil. “We combine native analytics with proprietary systems built in-house to measure performance, reach and engagement at every level—video, channel, playlist. We leverage a dedicated content analysis and trends team that meticulously analyzes content performance, including viewership, engagement and retention across all our SVOD and AVOD platforms. We also monitor global consumption trends, understand cross-platform viewing habits and benchmark our performance against competitors across different countries. This data-driven approach allows us to make informed decisions on content acquisition, licensing and development, ultimately maximizing the reach and value of our content for young audiences worldwide. Every expansion is data-validated. We pivot based on this information to make informed decisions about production and publishing. This allows us to scale efficiently, minimize risk and deliver measurable impact across audiences and partners.”

For Bernard at Kedoo, data has been utilized to make creative and strategic decisions. “We track performance across platforms to understand which formats, characters, episode structures, publishing schedules and even thumbnail designs appeal to our audiences the most, helping us grow viewership globally. On the distribution side, performance

Kitchent’s Cuquín has benefited from the company’s digital strategies, with YouTube success helping to secure a new commission

insights guide our go-to-market strategy, highlighting where Booba is gaining traction and helping us prioritize broadcast and licensing deals in specific regions. We also use real-time feedback constantly to test new concepts in short-form content before scaling them into longer formats or spin-offs.”

EUROPE TOONS IN

“Most of the shows we’ve produced since Cleo & Cuquín have followed a digital-first testing approach, allowing us to validate concepts early and adapt them based on performance,” Aldasoro says. “Some of these projects have also been developed as co-productions, enabling us to share costs and resources. With others fully financed by Ánima with our production hub located in the Canary Islands, we benefit from highly attractive tax incentives, which make our production costs significantly more competitive and sustainable.”

And we return to the value of Europe’s funding ecosystems, which are helping to deliver content to a broad range of platforms.

“Government funding programs like France’s CNC and the EU’s Creative Europe MEDIA play a central role in funding development, production and, of course, distribution,” Dandelooo’s Romano says. “These mechanisms allow studios, especially independents, to stay competitive. Without them, many productions simply wouldn’t happen. Due to these subsidies, we are fortunate to be self-funding on projects such as Max & Bunny.”

And new co-pro opportunities are still emerging, Romano adds, referencing increased activity in Ireland and great potential in Portugal. “It’s also worth mentioning the significant tax credits available in certain regions. The Canary Islands, for example, offer particularly advantageous tax credits, which have played a key role in making projects such as Jasmine & Jambo and Under the Sofa possible.”

While becoming more selective about which projects to board amid budgetary concerns, commissioning broadcasters are also eager for content that can live in their linear, on-demand and digital ecosystems, Romano says.

“At first, we used to separate content by platform, developing different formats for digital and for broadcasters,” adds Ánima’s Aldasoro. “Our goal now is to create content that can travel seamlessly across platforms, which is why production quality needs to be consistently high. Traditionally, broadcast content required longer durations, while digital favored shorter formats. Today, we often adapt by combining multiple short episodes or songs to meet broadcasters’ time slots.”

Kedoo is applying the lessons learned from its Booba journey to a show for the 6- to 9-year-old set, Sonya From Toastville. A co-production with Lakeside Animation and Studio Metrafilms, the series launched on YouTube last year and, after logging more than 200 million views, has now been greenlit “exclusively for broadcasters and streamers,” Bernard says.

Monkeys vs Robots , meanwhile, is a nondia logue animated comedy designed for co-viewing that is starting with four to six 2- to 3-minute pilot episodes. These are “designed specifically for YouTube and digital-first platforms as a trial to gauge market and audience response ahead of a potential full season,” Bernard says.

Chris M. Williams pocket.watch

By Mansha Daswani

Amid the teeming, fragmented landscape that is YouTube, pocket.watch has assembled a network of 50-plus creators, logging more than 855 billion lifetime views. From top-rated channels like Toys and Colors to the ubiquitous Ryan’s World, pocket.watch has been collaborating with its partner creators to transform beloved YouTube shows into complete franchises. That approach has included bringing this content into walled gardens, expanding into L&M and even tapping into linear viewing habits with a pair of FAST channels. In this wide-ranging interview, Chris M. Williams, pocket.watch’s founder and CEO, discusses the company’s early-mover advantage and o ff ers some advice for those understanding how best to work inside the YouTube economy.

TV KIDS: Everyone is talking about the creator economy now, but this is a space that you’ve believed in for a while. What motivated that belief back then?

WILLIAMS: I spent two stints at The Walt Disney Company, both times via acquisition. The second time, I had been the chief audience officer at Maker Studios. During that period, I saw a profound shift in how kids were

con suming content. They were moving from traditional linear television to YouTube. It was apparent in my house as a dad—I would see my kids sit in front of my big screen TV and fire up their iPhones to watch YouTube videos—and, of course, in the data. It begged the question from a Disney perspective—a company that I admire tremendously, particularly for their franchise orchestration—why aren’t we looking at these stars, characters and IP on YouTube with massive fan bases and expanding them into franchise economics? And that is what led to the launch of the company.

TV KIDS: What do you look for when identifying new creator partners?

WILLIAMS: It starts with popularity. We are not necessarily the folks who find a creator who’s small and make them big. We generally partner with them after they have been through the democratic process on YouTube for determining what is going to be popular with kids and families. We will never partner with anyone who does not share our values. From day one, we’ve partnered with kids and family creators who prioritized the health, safety and well-being of kids. They don’t necessarily always know exactly how to embody this mission to do right by kids, but as long as they have the desire, we can help. We’ve created things like a creator handbook that we update every year. It tells them what the appropriate amount of screen time is for a kid to be in front of a camera and how to book a studio teacher. And then we look at it as a chessboard of diversity. We want kids reflected back at themselves in the content, so diversity of race, nationality, ethnicity, gender. And also diversity of formats. This is one of the gifts of YouTube. We can have gaming content, but we can also have art instruction. We can have a family that does everything on a farm in Texas. We can have imaginative role play. We are examining the mix to present the best packages to our potential content distribution partners.

TV KIDS: Ryan Kaji and his family present an amazing case study of how you can take a single YouTube unboxing show and transform it into a full-on franchise with his own theatrical feature, SVOD platform and FAST channel! Talk about that journey and the lessons that you’ve taken from it as you continue to build on your partnerships with other creators.

WILLIAMS: He proved the model. He created the category. When we were going out with Ryan and his family and engaging with business partners, we had a lot of biases to overcome. Having that proof of concept [was crucial]. A hit Emmy-nominated Nick series with Ryan’s Mystery Playdate . The success of Ryan’s World content and series on over 40 platforms, including Hulu, Peacock and Prime Video. A billion in retail sales. Fifty million game downloads. A feature film in theaters. And, of course, a balloon in the Macy’s Thanksgiving Day Parade! These

opened the doors and helped us create an entirely new category that our creator partners and others can also now walk through. We take a lot of pride in having been one to take the arrows at the beginning to open up that door more widely for not just kids’ and family creators, but all sorts of creators. I contend there’d be no Feastables without Ryan’s World toys, because Ryan’s World toys really proved the model. It gave Walmart the appetite to expand into this category. There is still friction in the market. With all our success with Ryan, being the first, it did get looked at as a little bit of an anomaly. Now, with success from MrBeast, Ms. Rachel, CoComelon and others, it definitely feels more like a trend. That’s a good place for us to be because the doors are more open.

TV KIDS: How do you use all the data you receive as you’re making programming, marketing and distribution decisions?

WILLIAMS: We look very closely at data. It starts with the YouTube data. We created a new tool for ourselves to use internally. Maybe even before we’ve partnered with somebody, we’ve deployed this against their channel to determine a few different things. What within their content needs to be done to make it exportable to premium platforms? Where is their most popular content and how can it be repackaged? Where the data falls down, of course, is on the non-YouTube platforms; it becomes a little more challenging. We do get measurement though. Typically, YouTube creator [content on other platforms] will perform to the relative success they found on YouTube. One extra layer of viewership and watch time from our third-party platforms and owned-and-operated channels and services gives us some additional information with respect to what’s hardest to measure, which is love. Love is what you need to drive a viewer into a consumer. In the kids’ category, it’s very hard to measure, rightfully. We have laws to protect the data of children, as we should, and so it becomes more difficult. There are lots of missing data points that would help understand love. So, when we distribute the content onto other platforms, it helps us understand whether there’s demand for that IP and that content off of YouTube, and that can steer future investment as well.

successful with our partners at Hulu, Peacock and Amazon, who’ve expanded their portfolio of our creator content and are making investments in additional content with other creators. All the major global players certainly have or are formulating strategies around digital creators. The local players, particularly internationally, will be slower to adopt. I expect that flood to come after. It’ll start with the global players who are all clearly leaning in, and I think at that point, the local players will realize that in order to compete with YouTube, they’re going to have to adopt some of these strategies and embrace creator content.

TV KIDS: There are questions about the health of the kids’ media ecosystem right now. Where do you see the business headed? What are the growth opportunities that you’re most excited about going forward?

TV KIDS: What would your argument be to broadcasters who are still reluctant about creator content in their ecosystems?

WILLIAMS: You’ve seen new data come out of Nielsen over the last 18 months, two years, that shows that YouTube is not only dominating mobile screens and PCs, but it is dominating the living room television. It’s the only one that’s truly growing. It’s gone from 6 percent when they started reporting to 12 percent of all watch time in the U.S. on television. The next closest is Netflix with about 8 percent, and no one else is really growing. This did open up some eyes. The early adopters will see the most success. We’ve been very

WILLIAMS: It was great news a couple of weeks ago when Netflix picked up new episodes of Sesame Street globally. As someone who appreciates the full breadth of the kids’ and family content landscape, a brand like that is critical. A lot of the opportunities, obviously, are going to come from YouTube and digital creators. We’re going to continue to bet big there. It’s only going to grow in success. Another area is gaming. Some people have done this well. There’s been a lot of experimentation. Roblox and Minecraft will continue to do well, and Fortnite could emerge as a winner there as well. These are similar ecosystems to YouTube. They are driven primarily by a creator class that’s actually creating these games. The best use of those platforms is going to come from collaborations between existing creators on those platforms and traditional IP or maybe new IP. It’s going to come from a mix of all those things in the same way that we see it landing for YouTube.

pocket.watch is building out the popular Toys and Colors YouTube channel across a range of platforms.

Louise Bucknole Paramount

By Mansha Daswani

With the recent rebranding of Channel 5 and My5 to a unified 5 for linear and digital, Milkshake!, the broadcaster’s popular preschool block, has landed its first FAST channel, creating an additional touchpoint for audiences across the U.K. to engage with the brand.

Led by Louise Bucknole, senior VP for kids and family in the U.K. and Ireland at Paramount (whose remit also includes Nick Jr.), Milkshake! is continuing to see audience gains across its multiple platforms. TV Kids caught up with Bucknole to hear about her programming strategy, approach to YouTube and the importance of well-thought-through digital extensions.

TV KIDS: What’s driving your success in the U.K.?

BUCKNOLE: There are four areas that drive our success. Number one is always the content. We have some amazing brands like PAW Patrol, Rubble & Crew, Peppa Pig, The Adventures of Paddington , Milo and Pip and Posy. We have a mix of animation and live action. We have favorites like Thomas & Friends and Fireman Sam, and then U.K. commissions like Tweedy & Fluff , Mixmups, Odo and The Woohoos! and live-action series like Reu & Harper’s Wonder World and Animal Care

Club . There’s the continuity that we have with our pre senters—it’s a daily touchpoint with viewers. We have six presenters and also our puppet, Milkshake! Monkey. That means that seven days a week, we’re able to have that connection with viewers and their families. We have a live stage show, Milkshake! Live, and a magazine. We also produce a ton of shorts each year that can cover all sorts of different subjects. We’re representative of the U.K. audience and their families. We’re a safe and trusted brand. We’re on linear. We’re on VOD on 5. We just launched a FAST channel on the 5 platform. We have Milkshake! on Paramount+, our streaming service, and also on YouTube. So, we’re focused on everywhere that kids are.

TV KIDS: Are you seeing differences in how audiences engage on linear, streaming or on-demand?

BUCKNOLE: Platforms and viewership are evolving in different ways. There is a lot more viewing on the VOD platforms and on YouTube. It’s very title-led; they’re drawn into their favorite shows and the IP that they love, and also new content. We launch new content on the linear platform. We roll it out straight away onto our VOD platform. It’ll then sit on a FAST channel. There’ll be promotions across all of the platforms. It’s about being accessible to that audience. We know kids are agile. They can download and take the content with them. They want to watch their favorite show again and again on the VOD platform. We’re a very habit-based brand because we are on in the morning on 5. We have that regular return viewing of the fans that come back to Milkshake! as well as attracting a new audience all the time. We’ve just launched Tim Rex in Space , and it’s performed very well. We ran a lot of clips and content on YouTube to highlight that the series was coming and then it was launched on the platform. It’s on our VOD service. We will be putting a full episode up on YouTube in due course. It’s about making sure that you’re agile with how you’re presenting that content to your audience so that it suits them.

TV KIDS: Tell us about your overall programming remit across commissions and acquisitions.

BUCKNOLE: We commission animation and live-action content. We have an Ofcom commitment to U.K. content. This is mixed in with acquisitions as well. Our content is focused on 2- to 5-year-olds, but we do go up to 7-year-olds. We want to reflect British children—their families, habits, desires and interests. We focus on things that are humorous, have adventure, fun and friendship and can inspire them to be curious about the world. We follow the Early Years Foundation framework for preschoolers in the U.K. We pick up about two to three [new or returning] series a year. We have a mix of fantastic Nick Jr. content as well. We don’t necessarily require movies or specials unless they’re related to some of the IP that we already have. We also don’t look for shorts—anything under three minutes—because we have an in-house team that produces a lot of that content. An area that we are looking for is slapstick comedy. We also ensure that we have a sustainable theme in most of our content. It’s about having a clear hook and being slightly different. We don’t want the same as what we already have.

TV KIDS: How important are co-productions for you?

BUCKNOLE: Co-pros are really important to us. We’ve been working around these models for many years. Tim Rex in Space is our first co-pro with Nick Jr. globally. We’ve also had a co-production with Sky and ZDF, Pip and Posy . Odo , from Sixteen South, is with KiKA. It’s about how we can access those funding opportunities and collaborate with multiple partners to make the budget and the finance plan work. We all know that it is challenging at the moment, so we’re flexible on rights. We’re open to discussing how the productions work. We want productions to go ahead. We will be involved at any stage, whether that’s development or a bit later on in the show. We’re open to all sorts of different models, and co-pros are at the center of how we produce our shows.

TV KIDS: How has your approach to exclusivity changed?

BUCKNOLE: Shared rights are something that we’re very open to reviewing if it’s a commission. We have to have the first broadcast on 5. For acquisitions, it’s a little bit different. We share many shows that might be on different platforms, whether that’s something like Chip and Potato, which is on Netflix, or Thomas & Friends, where we take the first run and then it’s on other platforms around the world as well. It’s thinking about what the IP is and how it fits in with our brand and what the funding model is.

TV KIDS: Are there types of shows that you’re not seeing enough of?

BUCKNOLE: One thing that we would like to see more of is…a well-rounded digital launch proposition. Content that you can roll out across YouTube and social media that enhances the shows that you have on the other platforms. [You need a] well-thought-through strategy of how you can reach an audience and be discovered in this very fragmented world that we have for kids. We’re always competing for kids’ time. You’ve got to be present on the platforms they’re on. Looking at that as part of your production plan is interesting to us.

TV KIDS: What’s been the approach to YouTube?

BUCKNOLE: YouTube is absolutely essential. It’s about discovery and engagement, and YouTube is often the entry point for kids into new brands. We have recently been releasing full episodes on YouTube. We have short-form and other assets to drive that engagement and awareness. Linear and VOD are still key—we have to drive those ratings. We’re a commercial business. But we understand that the engagement from kids happens in different ways. The linear block on 5 in the morning is so important because it’s part of their routine. In the afternoon, they can then catch up on our VOD platform, or they might want to go onto YouTube. Kids will go wherever is suited to them. Particularly for preschoolers, safe platforms are important. We know that YouTube and our linear and VOD platforms are well-curated, and they follow all of the compliance guidelines. We look to develop that further. For Nick Jr., we’re seeding content on YouTube to see how that develops. We are trying to ensure that we are in step with the audience.

TV KIDS: We all know it’s a challenging time. What keeps you excited about serving this demographic?

BUCKNOLE: Everybody who works in kids’ media is so passionate about the audience. They’re a brilliant audience to work with because they give you such honest feedback straight away. You will know straight away whether a show is going to go well or not, because an audience will connect with it very quickly. It is tough right now for creators and producers. That’s something that we’re mindful of. Content models are changing. But we get so much feedback about how much the audience enjoys Milkshake! We see it from our viewing figures. Milkshake! has grown 2 percent this year. It grew last year on linear. It was up 24 percent on VOD. So, we know that the audience wants the great content. There is a supportive and celebratory community in kids. We ensure that we are very much part of that and agile in how we work with different partners.