GUIDE 2 0 23/2 0 24

Kristin Brzoznowski

Associate Editors

Jamie Stalcup

Alexa Alfano

Editor, Spanish-Language Publications

Elizabeth Bowen-Tombari

Production & Design Director

David Diehl

Online Director

Simon Weaver

Sales & Marketing Director

Dana Mattison

Sales & Marketing Manager

Genovick Acevedo

Ricardo Seguin Guise President Anna Carugati Executive VP Mansha Daswani Associate Publisher & VP of Strategic Development © 2023 WSN INC. 1123 Broadway, #1207 New York, NY 10010 Phone: (212) 924-7620 Website: www.tvkids.com No part of this publication can be used, reprinted, copied or stored in any medium without the publisher’s authorization. For a free subscription to our newsletters, please visit www.subscriptions.ws A Note from the Editor . . . . . . . . . . . 10 Interviews . . . . . . . . . . . . . . . . . . . . . . . . 11 Distributors . . . . . . . . . . . . . . . . . . . . . . 23 Publisher Ricardo Seguin Guise Editor-in-Chief

Mansha Daswani Editor-at-Large Anna Carugati Executive Editor

Bookkeeper

Contents 6

Daphne Menard

The only video portal for the kids’ media industry.

A Note from the Editor

Mansha Daswani

Mansha Daswani

“Discoverability” is a word that’s cropping up in all of our conversations with children’s media executives these days. Indeed, the sector is facing its own version of peak TV—except it’s not just other TV shows you’re up against.

TikTok, YouTube, Snapchat, Roblox, Discord and so many other platforms are taking up that little bit of time kids have outside of school and hanging out with friends. How do you begin to make an impact, let alone build a 360-degree brand that will have young ones playing the game, asking for the apparel and a ticket to go see a live show?

Evan Shapiro, a veteran media executive who now spends much of his time tracking media usage, has some clear advice for children’s content executives: you need a “yes/and” strategy. Netflix and YouTube and TikTok and, well, anywhere else children are spending an abundance of their time. “The content still is king, and you have to think like these young consumers if you’re going to get inside their minds and their pockets,” Shapiro said at the TV Kids Summer Festival.

Shapiro also weighed in on the challenges of discoverability. “We have created this series of walled gardens that makes finding content incredibly hard. We’ve also oversaturated the market in storytelling to a certain extent because of all these different walled garden platforms. We’ve created a massive paradox of choice issue for publishers and audiences. The more choice you give consumers, the fewer choices they will actually make.”

FAST channels are also making waves in the media ecosystem. If this year is a watershed for FAST in general, it is also marking a bit of a turning point for the children’s media sector, with a slew of IP owners and platforms eyeing FAST services as a critical way to boost engagement, enhance L&M sales and even drive traffic to SVOD platforms.

All of these factors are at play in the kids’ media landscape at present. What hasn’t changed, though, is an unwavering commitment to delivering children top-flight programming, as seen here in this edition of the TV Kids Guide

10

INTERVIEWS

Ayo Davis President Disney Branded Television

Ayo Davis President Disney Branded Television

TV KIDS: What’s the strategy behind the Disney Branded Television offering?

DAVIS: Our group fuels kids’ and family content for Disney+, Disney Channel and Disney Junior. We have this huge slate that helps serve a global audience for preschoolers through adulthood. What all these shows have in common is that they are filled with signature Disney qualities of magic and wonder, adventure and heart, and with heroic characters that are relatable and reflective of the world that we live in and are truly guided by kindness, understanding, respect and optimism. It’s about creating stories and characters that encapsulate the best of Disney and forge deep emotional connections that stay with the hearts of our audiences for their entire lives.

TV KIDS: How do you determine how many new shows you need each year?

DAVIS: There is no real hard and fast answer to that. It does depend on the timing of our development and production cycles. It’s really about the performance of our current titles in any given year. In many cases, though, with our franchise properties, we can opt to hold back on a launch or extend a rollout to better align with the companion movies or even retail windows, which mostly happens in our Disney Junior space with the preschooler audience. Ultimately, our goal is to create the best content and ensure we’re finding the best time frames to capture the largest viewership.

TV KIDS: Given your array of linear and on-demand services, how do you decide where to place a show?

DAVIS: When you think about linear networks, we’re looking for highly repeatable shows. They lean into comedies. We emphasize multi-cams and music. Ultimately, it’s our volume play. And when we’re thinking about Disney+, the storytelling here always appeals to our broader audience and has that premium “wow” factor. We tend to do more limited episodes, and, depending on the story, we’ll do an all-at-once drop or week-over-week cadence.

12

Francesca Newington

Director, POP Channels

Narrative Entertainment

TV KIDS: Tell us about the positioning of the POP channels in the U.K.

NEWINGTON: POP is for boys and girls, and its current average age is 8. Tiny Pop is aimed at upper preschool, and its current average age is 6. POP Max is for 6 to 8s, but it’s more boy-skewed. POP Max takes the content that previously aired on POP. We have a mixture of well-known franchises and new content across all three channels.

Although the market [has been] tough, the important thing to remember is that linear TV is still the most preferred way for parents to find kids’ content. It’s such an important tool for them to have that easy, free, fully complied and guaranteed safe route, put together by kids’ content specialists. Also, sometimes there’s just too much choice out there and people want a curated feed—we’re there for that, too.

We don’t just have linear over-the-air channels. We’ve launched FAST channels. We also have the POP Player, which is our AVOD app.

TV KIDS: What do you keep top of mind when buying across the channels?

NEWINGTON: To start with, anything that pops; anything with that vibration to it, that energy, and anything that’s funny. Franchises are very important. Anything that already has built-in recognition and nostalgia that appeals to parents for co-viewing. Also, we always look for content that has diversity embedded within it.

As for rights, we’re looking for content that can be used across all our platforms without limitations. With formats, we’re after all sorts. Alongside the usual 11 or 22 minutes, it could be short-form snackable content or longer-form movies, specials, anything for the holiday periods, and anything that could be used across all platforms is quite key for us.

13

Benoît Di Sabatino CEO Banijay Kids & Family

TV KIDS: What are the advantages of having several production companies under the Banijay Kids & Family banner?

DI SABATINO: It’s about talent, creativity and a strong position for financing and commissioning. With six production companies, we have six times more opportunities to develop amazing shows and potentially global brands. Every company within Banijay Kids & Family is led by a great producer with strong teams and good track records in creating high-quality shows. All those companies are based in important financial territories with key commissioning broadcasters and tax incentive policies.

TV KIDS: How do your teams work with producers to help craft shows?

DI SABATINO: Banijay Kids & Family is an umbrella for production companies with an entrepreneurial DNA. We provide background support around distribution, digital marketing, PR and consumer products with our exploitation department, led by Delphine Dumont. We are also keen to help with the editorial developments if needed. Each label is building its own financing, but we help with our distribution network around gap financing, presales, co-production and minimum guarantees. Our method is to encourage producers’ initiatives and provide them with support if needed.

TV KIDS: How is Banijay Kids & Family helping to finance shows?

DI SABATINO: Every show is a financial prototype. The broadcast market is constantly changing and, for us, challenging. We have to adapt our business model and be creative in terms of financing. It’s being agile to find solutions to suit the players. For me, financing kids’ shows is like a Rubik’s Cube. We have to find the perfect strategy to align commissioning broadcasters and ensure that the huge range of rights they ask for to protect their expansion strategies can coexist. The producer must ensure he retains enough rights to address this business model.

14

Iginio Straffi Founder & CEO Rainbow

TV KIDS: What has been your strategy in making investments and growing the company?

STRAFFI: My vision for the last ten years has been to grow the company with some strategic acquisitions, starting with Bardel, an established animation service provider in Vancouver and Kelowna, in 2015. We wanted a fully integrated company, from the preproduction and postproduction facilities in our studios in Italy to original and top-quality animation in Canada, and to have everything in-house—from the concept to the finished show. In 2017, I acquired Colorado Film, an Italian leader in comedies. They have a network of screenwriters, directors, directors of photography and even a talent agency. We thought we could grow much faster in live-action production through Colorado Film, and that has been the case.

TV KIDS: Is it necessary for a company to be of a certain size to compete in today’s market?

STRAFFI: You have to have a certain size to sit at certain tables to be able to finance certain projects and retain their rights. If you don’t have money, you have to produce IPs just as a service provider; you will not get a contract where you own the IP. Our main strategy is to own IPs and their rights and try to exploit them in every media, including licensing and merchandising. We have to make investments to finance our IPs and shows, and then the platforms will start to pay on delivery and, in the next two years, with quarterly payments. But you have to upfront the investments, so when you are too small, you don’t even find bank facilities to help.

TV KIDS: If you look ahead 12 to 24 months, in which businesses do you see the most growth potential?

STRAFFI: I believe we have a lot of potential in licensing and merchandising, and my live-action division, Colorado Film, is growing by double digits every year in revenues and the number of projects.

15

Dominique Bourse

Chairman & CEO

Cyber Group Studios

TV KIDS: How has Cyber Group Studios’ production pipeline been expanding?

BOURSE: Our production pipeline has been growing steadily, fueled by our global production capabilities and proven track record. We consistently launch four to five new productions per year, which means a recurrent volume of eight to ten series at various stages of production at all times. A significant R&D endeavor, as well as our best-in-class global network of partner studios, support this sheer volume.

TV KIDS: What led to the decision to open production services up to third parties?

BOURSE: Several requests for production services from long-term broadcast partners led to our decision to launch this activity. We have created a scalable model that enables us to offer a complete service (i.e., from scripts to postproduction) or any combination of production tasks according to our clients’ needs. We can also advise them on making the production work that is done in France eligible for the significant competitive advantages of the French ecosystem in terms of access to talent and financing (international tax credit). Depending on the project, we can do the production services ourselves or with a partner studio while remaining the sole contact for our client.

TV KIDS: What has been driving the gains for Cyber Group Studios’ distribution business?

BOURSE: We have built a commercial team with strong entrepreneurial and business development skills. We have developed our distribution business with large broadcasters and streamers in big countries and with more local players all around the world to ensure the largest possible international coverage. We look at distribution with two key objectives: program monetization and brand awareness. Generating the latter is more complex with an increasingly fragmented audience, but we love seeking, testing and finding solutions.

16

Maud Branly

Director, Children’s Acquisitions & International TV Channels Children’s Programming M6 Group

TV KIDS: How has your acquisition strategy had to adjust to kids’ changing viewing habits?

BRANLY: We all know that the media industry as a whole is still going through an intensive shift. We communicate with children of the digital-native generation, and we have to adapt our content and strategy to these new consumer habits. It is now more important to acquire “deep rights” and to be able to propose the right combination between linear broadcast and nonlinear exploitation. We are looking for content that we can exploit across all our platforms.

TV KIDS: Has securing exclusivity become more important?

BRANLY: Competition is stronger as there are more [players] in the market. In this competitive context, it is essential for us to propose exclusive content for kids that they will find only on our channels and services. We are taking exclusive rights wherever we can and covering broader usage across VOD. Having said this, if something is outstanding and already on pay TV or a [digital] platform, we are happy to be part of it anyway. We work on a case-by-case basis and have different approaches depending on the program.

TV KIDS: With regard to acquisitions, what are you looking for?

BRANLY: We are always looking for high-profile content in live action and animation. We want well-told stories with fresh and funny designs. We are looking for shows that fit the Gulli DNA: comedy, laughter and based in reality for kids to recognize themselves. The positioning of Gulli is to target kids from 4 to 12, so we’re also looking for upper-preschool, action-adventure, girls’ shows and live-action series. For TiJi in France, our priority is to find upper-preschool shows targeting kids from 5 to 7. The channel is slightly more girly. Canal J is our action-adventure channel for kids from 6 to 10. For all our channels, we are looking for shows with a lot of volume, if possible, so that we can create big blocks of programs in the grid and create brands in the long term.

17

Cecilia Persson Managing Director BBC Studios Kids & Family

TV KIDS: How are you finding talent?

PERSSON: [Last] November, Edward Barnieh joined us as our VP of development. He leads our internal development team and has brought an external look to the market and knowledge and awareness of people we haven’t necessarily worked with, both on the talent and the broadcast sides. He’s working very closely with our team to get out there and find new ideas, new approaches to content and talent that we hadn’t previously worked with. We’ve also continued relationships with the talent we’ve been working for years with, like Jacqueline Wilson, and also brought in established writers like Eoin Colfer.

It’s very important that you give individuals the space and the support needed to realize the original idea that was appealing to us and fit with what we needed for our slate in the first place. But then also, one of the reasons we’ve gotten much positive interest in what we’re developing is the trust that comes with being the BBC and our values.

TV KIDS: How is BBC Studios Kids & Family connecting with kids?

PERSSON: It was very important for us to create a content strategy team that will look at our programs and characters and work closely with our broadcast partners, the internal digital team and consumer products (if applicable) to make sure that we are approaching the audience at the same time, harnessing what the characters and the stories are about and giving the best opportunity for our shows to land when they launch or as they continue to connect with audiences. Also, we ensure consistency in how our characters are presented and that they embody the characteristics and the joy that the shows are about so that they connect with the audience. It’s essential for this audience now, particularly in preschool, that they can connect and see the characters and the stories in many places, dig deeper and learn more. That access is important for kids today.

18

Traci Paige Johnson

Creator & Executive Producer

Gabby ’s Dollhouse

TV KIDS: How did you decide to go with a mixed-media style of animation and live action?

PAIGE JOHNSON: We know through Blue’s Clues and YouTube that kids really respond to that live-action person or kid looking into the camera and asking questions. So, we knew we wanted to bring that in. When we did the unboxing, the catalyst to the story, we knew that the animated part would be more fun if [Gabby] shrunk into the dollhouse and became animated in those worlds and all that wishfulfillment. It really started as wanting to feel unique and different. Then, as we were playing in the mixed media, some of the fantasy happened where it not only bookends the show now, it does happen within the show. It really makes it stand out. A wonderful byproduct of that mixing of the media is that it feels so different from anything else you’ve ever seen.

TV KIDS: Talk about the growth mindset curriculum that’s evidenced by Gabby in this show.

PAIGE JOHNSON: When we were developing, we came across Carol Dweck’s growth mindset book, and we were very much inspired by that because we’re all about celebrating our mistakes, being perfectly imperfect and letting kids know that. And that there’s power in asking for help, and you don’t need to do everything perfectly the first time. We love to bake that organically into the DNA of the show. Gabby just has that naturally and is role modeling that for our audience. So, we always have that “I don’t know how to do that yet” moment.

TV KIDS: Why was incorporating elements of DIY and play that extend beyond the episodes important to you?

PAIGE JOHNSON: As parents, we love kids doing things off the screen as well. We inspire kids to use their creativity once the show is over. And also, that seems to be the essence of the ecosystem of the internet now, doing recipes together, doing crafts together.

19

Chris M. Williams Founder & CEO pocket.watch

TV KIDS: What led you to expand into the FAST space?

WILLIAMS: A big part of what we do at pocket.watch is working with massively popular creators on YouTube, primarily in the kids and family space. Extending their businesses in franchise-like ways, including content distribution, is our core mission. When I started the company, if you said, “You’re going to have two linear channels,” I would have said, “You’re crazy.” VOD was taking over at that point. It took me by surprise how quickly these new FAST services came on. It was always important to me to get real estate early. We also like that these are walled gardens. When we’re extending these massively popular creators’ IP into other areas, we don’t focus on the open platforms like Facebook or Snapchat. We focus on walled gardens because we know there will be limited options and choices, and you want to be curated into those services. FAST was providing a new way of doing that. We want to bring kids and families the creator content they crave in ways that parents and the FAST channel platforms can embrace.

TV KIDS: How are pocket.watch’s FAST offerings curated?

WILLIAMS: We are curating, enriching and packaging content to be distributed more broadly onto premium platforms. We give a lot of confidence to business partners like FAST platforms, and to parents directly, that this is now a safe environment to give kids what they crave. We take that YouTube content and package it as 22-minute episodes, applying those standards of enrichment, finding the best of the best and making them more like TV. That makes it much more flexible in terms of how we program our FAST channels, utilizing these YouTube-to-TV exports. We’re doing “best of”s. We’re doing promotional episodes for new series. We’ll do things around Halloween or Black History Month and try to eventize programming, not unlike traditional television has always done. Data informs what’s working and what’s not working and gives us roadmaps to curate and program our channels.

20

Eric Berger CEO & Co-Founder

Common Sense Networks

TV KIDS: What’s guiding Common Sense Networks’ multiplatform strategy?

BERGER: We started Common Sense Networks’ business in 2020, inspired by the work of Common Sense Media, which is a leader in providing families with ageappropriate information at the center of technology and media. We launched Sensical [in June 2021], and it came out as a critically acclaimed AVOD service to provide kids and families with engaging video experiences that are proudly algorithm-free. From there, we moved from our ownedand-operated apps into the FAST space. FAST is increasing tremendously, but the kids’ sector is lagging in terms of monetization. Brands are concerned about trust, privacy issues and a lack of standards. We offer solutions that work not only for kids and families, but also for the brands and the platforms.

TV KIDS: What gaps do you see in the ecosystem?

BERGER: The FAST sector is narrow when it comes to the kids’ space. It’s missing the bridge age, kids 6 to tween. There are about 75 FAST channels in the kids’ space, mostly focused on preschool animation—missing out on a lot of the content that the young kids love, the ones above preschool; shows from digital-first creators that focus on a wide range of topics of interest such as DIY, cooking, sports, video games, STEM, etc. It’s very difficult to find digitalfirst content that is appropriate. We’ve spent the last few years identifying well-produced, safe, digital-first content that’s widely appealing to kids and families.

TV KIDS: How does Common Sense Networks approach the content curation process for FAST channels?

BERGER: We source, but we vet. On the source side, it’s about understanding the audience deeply. We have a heritage of understanding the parent audience as it relates to media, but here, we need to understand kids at very specific age segments. We’re following trends, and we work with and across the major creator platforms as well to understand the content habits of these kids.

21

Evan Shapiro

Thought Leader & Media Cartographer

TV KIDS: How is Generation Alpha spending time outside of school?

SHAPIRO: Seventy percent of kids between the ages of 8 and 15 say they game every single day. It’s not just gameplay. A tremendous amount of the time is social. There is a metaverse that’s taking place on Roblox, Minecraft, Fortnite and PUBG—if you want to see where Web 2.5 is taking shape, it’s in these fully functional, always-on platforms that we call games but are much more than that.

When you look at where they spend their video time, increasingly there’s this “yes/and” point of view among all consumers, but especially among those under the age of 20. YouTube is one of the first places that they’ll go for video content. Netflix is the second place. Twitch is a place where they spend a tremendous amount of time, but then also Disney+. There’s this acceptance of jumping from free media on social video to premium video on a subscription platform and back and forth. The idea that publishers don’t see social video as premium video is a big mistake. The amount of time that young people spend on Twitch, YouTube and TikTok and all these other social media platforms is really important to pay attention to.

TV KIDS: Are they willing to pay for content?

SHAPIRO: We did a study with Publishers Clearing House and found that 64 percent of people under the age of 34 are willing to pay for content. When we asked these consumers under the age of 34 what they are planning to do in the year ahead with their subscriptions—across audio and video and other areas—41 percent said, I’m going to pay more to get rid of ads. That doesn’t mean that they won’t watch free stuff with ads, but their intention is, as they get resources, to create environments where they’re ad-free because that is seen as a better experience. The content still is king, and you have to think like these young consumers if you’re going to get inside their minds and their pockets.

22

DISTRIBUTORS

ADK Emotions NY

O (1-646) 284-9801

w adkemotions.com

m sales@adkemotions.com

KEY CONTACTS:

Natasha Gross, Head, Content Distribution & Strategic Partnerships

Alexis Wilcock, Senior Manager, Sales & Licensing

PROGRAM:

BEYBLADE X: 51x22 min., animation, action, 8-13.

ADK Emotions NY, a New York-based subsidiary of ADK Emotions, is a content and rights-management company specializing in bringing Japanese animated IP (anime) to the global market. From media placement and marketing to creative planning, localization and merchandise licensing, we help partners navigate the complexities of global distribution in order to bring engaging anime titles to a new and expanding demographic. Through deeper collaboration with our broad network of partners, we are building a content business that moves audiences worldwide.

24

Atlantyca Entertainment

O (39-02) 430-0101

w www.atlantyca.com

m distribution@atlantyca.it

KEY CONTACT:

Claudia Mazzucco, CEO

PROGRAMS:

Berry Bees : 52x12 min., 2D, spy/action, 5-9; Bat Pat : 104x11 min., 2D, creepy sitcom, 5-9; Geronimo Stilton : 78x23 min., 2D, adventure, 6+.

Atlantyca Entertainment is a leading award-winning, transmedia entertainment company maintaining production, distribution, publishing, foreign rights, licensing and live events divisions.

Atlantyca is most recognized as the IP owner and producer of the popular Geronimo Stilton, Bat Pat and Berry Bees. The company has produced three fully completed seasons of the globally popular Geronimo Stilton , the successful animated property featuring the adventures of the most famous mouse journalist. Bat Pat is a spooky animated adventure-comedy series with funny and creepy “good” monsters. Berry Bees is an award-winning buzz-kicking spy-action series featuring three extraordinarily talented girls who have been selected by the B.I.A. (Bee Intelligence Agency) for special spy missions.

Since 2007, Atlantyca has pursued the mission to create successful transmedia projects and inspiring characters with 360-degree development for kids all over the world.

26

Australian Children’s Television Foundation

w www.actf.com.au

m roberta.divito@actf.com.au

KEY CONTACTS:

Roberta Di Vito, International Sales Manager

Tim Hegarty, International Sales Manager

PROGRAMS:

MaveriX: 10x30 min., live action, drama, 10-15; Crazy Fun Park: 10x30 min., live action, horror/comedy, 12-16; Built to Survive: 10x30 min., live action, factual/adventure, 8-14; Barrumbi Kids: 10x30 min., live action, comedy, 7-12; Kangaroo Beach : 50x11 min. & 2x22 min. specials, animation, preschool 4-6; More Than This : 6x30 min., live action, drama, teen/young adult 15+; The Inbestigators : 20x24 min., live action, comedy, 7-12; Hardball: S1 13x24 min./S2 10x24 min., live action, comedy, 7-12; First Day: 8x24 min., live action, drama, 8-13; Little J & Big Cuz: 50x12 min., animation, early childhood 4-7.

Children from all over the globe enjoy watching Australian shows. The Australian Children’s Television Foundation (ACTF) distributes over 450 hours of Australia’s best children’s programming to more than 100 countries around the world— including live-action and animated series, preschool programs, short-form content, telemovies and documentaries—to a global audience of preschoolers through to teenagers. Our programs are very successful, attracting large audiences for broadcasters and winning a slew of international awards, including an International Emmy Award, the Prix Jeunesse, a Banff Rockie Award, the Japan Prize and many Australian Academy of Cinema and Television Arts Awards. Kids love to watch quality shows that engage, inspire and make them laugh. It doesn’t matter where they’re from or what device they’re watching it on; they just want to see good shows. And that’s universal! Buyers from around the globe will find content from the ACTF that offers kids a fabulous and engaging viewing experience.

28

BBC Studios Kids & Family

O (49-151) 1819-2581

w productions.bbcstudios.com/our-production-brands/kids-family

m katharina.pietzsch@bbc.com

KEY CONTACTS:

Katharina Pietzsch, VP, Content Sales

Jodi Mackie, Director, Content Sales

Barbara Jerzyk Alvarez, Sales Director

PROGRAMS:

Hey Duggee: 196x7 min., 2D, preschool; Popularity Papers: 26x22 min., live action, comedy, 6-9; Stan Can: 52x11 min., 2D, preschool; Peter & the Wolf: 1x30 min., 2D, kids/family; Lagging: 10x24 min. & 10x30 min., live action, comedy, 6-9; Bluey: 153x7 min., 2D, preschool/co-viewing; Deadly Sharks: 10x30 min., live action, natural history, 6-9/co-viewing; Nova Jones: 20x24 min. & 10x25 min., live action, musical drama, 6-9; JoJo & Gran Gran: 129x11 min. & 1x22 min., 2D, preschool.

“This will be my first MIPCOM with the Kids & Family division, an integral part of the BBC Studios content powerhouse, and I’m really looking forward to meeting execs and broadcasters face to face in my new role. We have a dynamic slate of entertaining and distinctive content, which covers scripted with Popularity Papers, our upbeat drama about cracking the code of what it is to be popular; preschool animation with Hey Duggee, Bluey and the new series Stan Can; a beautiful animated special with Peter & the Wolf; and natural history with Deadly Sharks. We can’t wait to introduce these to international buyers and share the raft of exciting projects we’ve been working on.”

—Katharina Pietzsch, VP, Content Sales

30

Boat Rocker

O (1-416) 591-0065

w www.boatrocker.com

m sales@boatrocker.com

KEY CONTACTS:

Jon Rutherford, President, Global Rights, Franchise & Content Strategy, Boat Rocker Studios

Gia DeLaney, Senior VP, Global Sales, Kids & Family

PROGRAMS:

Dino Ranch: S1-3 52x11 min. each & shorts S1-2 4x1.5 min. each, 3D, comedy/adventure, 2-5; The Next Step: S1 30x30 min./ S2 34x30 min./S3 30x30 min./S4 40x30 min./S5 20x30 min./ S6 26x30 min./S7 26x30 min./S8 27x30 min./S9 22x30 min., live action, scripted, 8-12; The Strange Chores: S1-3 26x11 min. each, 2D, adventure/comedy, 6-11; The Bigfoots: 26x11 min., 3D, family sitcom/adventure, 4-7; Trulli Tales : S1 52x11 min. & 23x1 min. specials/S2 52x11 min., 2D, comedy/adventure, 3-6; Daniel Spellbound : S1-2 10x30 min. each, 3D, action/adventure, 6-11; Badanamu: 52x12 min. & 52x11 min. & 26x5 min. & 178x2-2.5 min. & 11x12 min. & 26x6.5 min., 3D, edutainment, 3-7; Love Monster: S1 54x7 min./S2 25x7 min. & 1x11 min. special, 2D, comedy/adventure, 2-5; Kingdom Force: 52x11 min., 3D, action/adventure, 3-6.

“Boat Rocker develops, produces and monetizes a catalog of premium live-action and animated entertainment for audiences around the world. The Kids & Family division collaborates with Rights & Brands on multiple franchise properties.

With leading in-house animation capabilities and artful storytelling through Jam Filled Entertainment (2D and 3D animation) and an investment in Industrial Brothers (kids’ and family animation), Boat Rocker is an award-winning global provider of truly original kids’ and family content. Current productions include Dino Ranch (Disney Junior, Disney+, CBC) and The Next Step (CBBC, YTV).”

—Jon Rutherford, President, Global Rights, Franchise & Content Strategy, Boat Rocker Studios

32

CAKE

w www.cakeentertainment.com

m info@cakeentertainment.com

KEY CONTACTS:

Ed Galton, CEO

Giannina

Antola, Head, Sales

Daniel Bays, Senior VP, Development

PROGRAMS:

Cracké Family Scramble: 52x7 min., 3D, non-dialogue/comedy, 4+; Sherwood: 10x22 min., 3D, adventure, 8-12; Toru Superfox: 52x7.5 min., 2D, preschool 4-7; Angry Birds Summer Madness: 32x11 min. & 4x22 min., 2D, comedy, 6-11; Total Drama Island: 26x22 min., 2D, comedy/reality/adventure, 6-12; Lucas the Spider : 78x7 min., 3D, comedy, preschool; Super Sema : 20x5 min. & 12x11 min., 2D, adventure, 4-8; Mush-Mush & the Mushables: 96x11 min. & 4x22 min., 3D, comedy/adventure, 4-8; Tish Tash: 104x5 min., 2D, adventure, preschool; Draw with Will: 40x7-9 min., live action/2D, art/educational, 5-12.

CAKE is a leading independent entertainment company specializing in the production, distribution, development, financing and brand development of kids’ and family properties. CAKE Distribution distributes over 1,600 half-hours of animation and live-action content, working with renowned producers, including Rovio Entertainment, Fresh TV, Channel X, Kickstart and Ragdoll Productions, on the worldwide rollout of their brands.

CAKE Productions drives CAKE’s development and production activities on shared and originated projects. With over 13 properties in development, productions include Angry Birds: Summer Madness for Netflix; Mama K’s Team 4 with Triggerfish Animation for Netflix; Angelo Rules with TeamTO for France Télévisions, Canal+ and Super RTL; Space Chickens in Space with Ánima Estudios for Disney EMEA; Pablo with Paper Owl Films for CBeebies; and Mush-Mush & the Mushables with La Cabane Productions and Thuristar, premiering internationally on Boomerang. An award-winning company, CAKE is based in London with offices in Berlin, Los Angeles and Toronto.

34

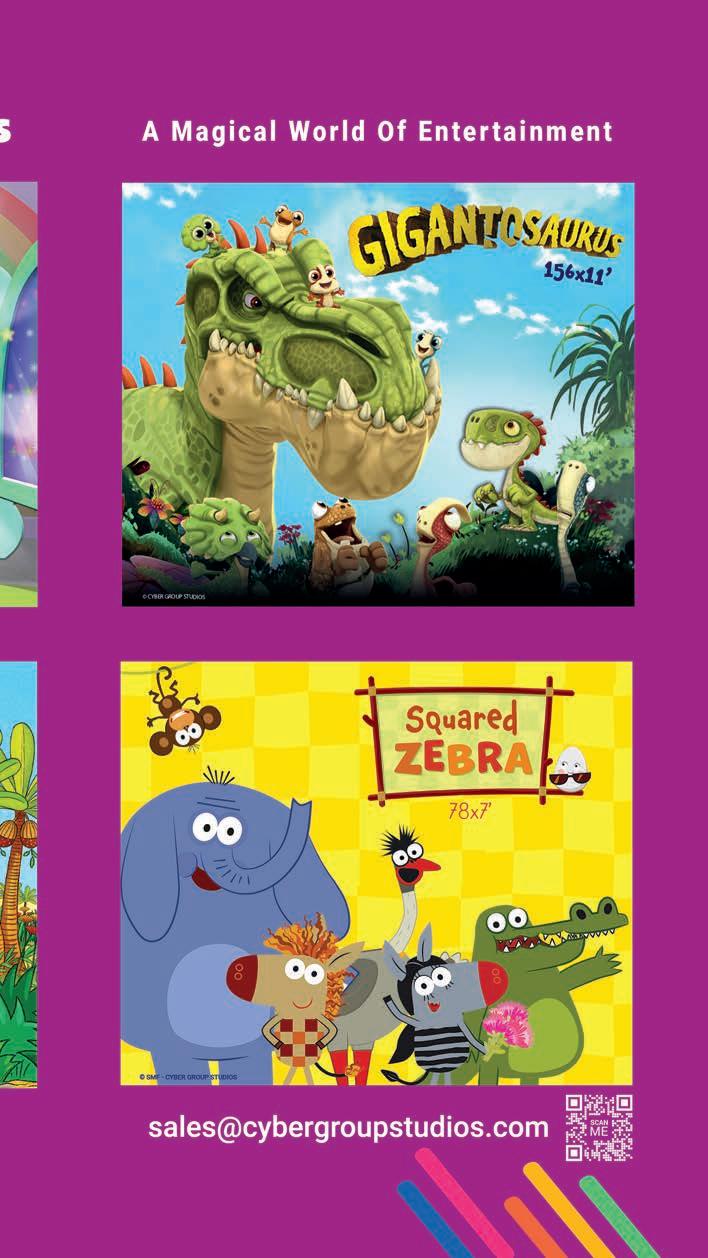

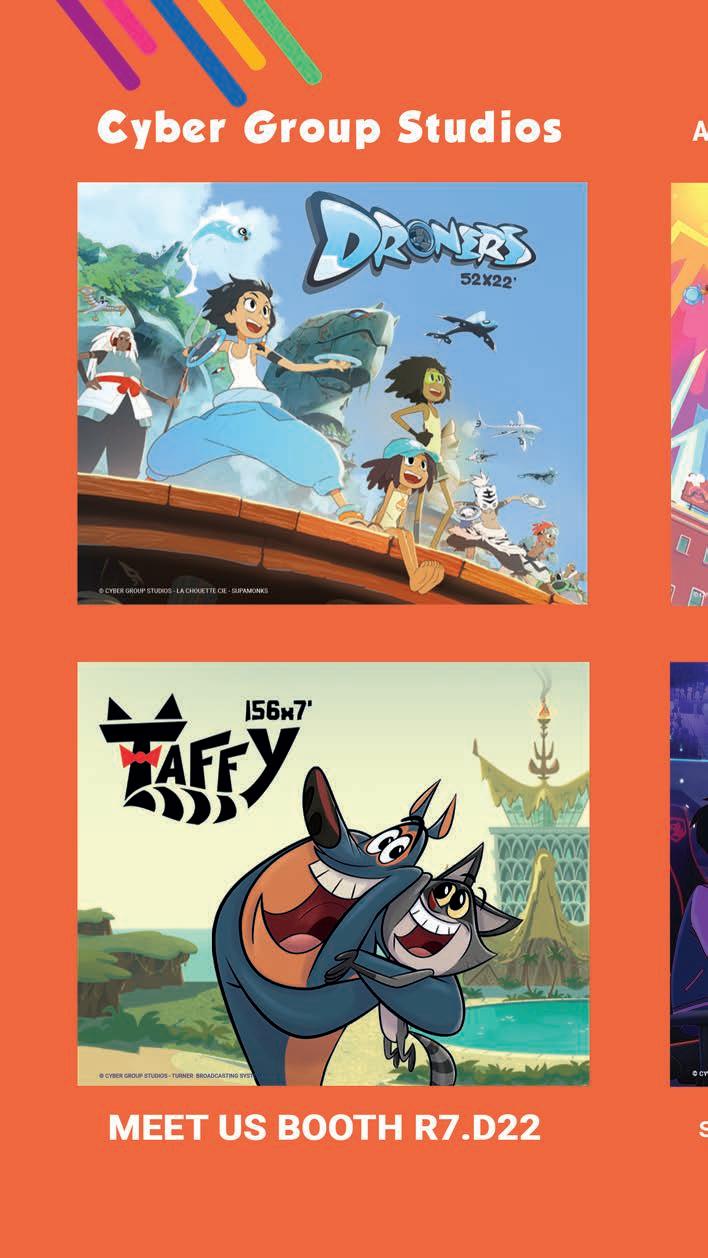

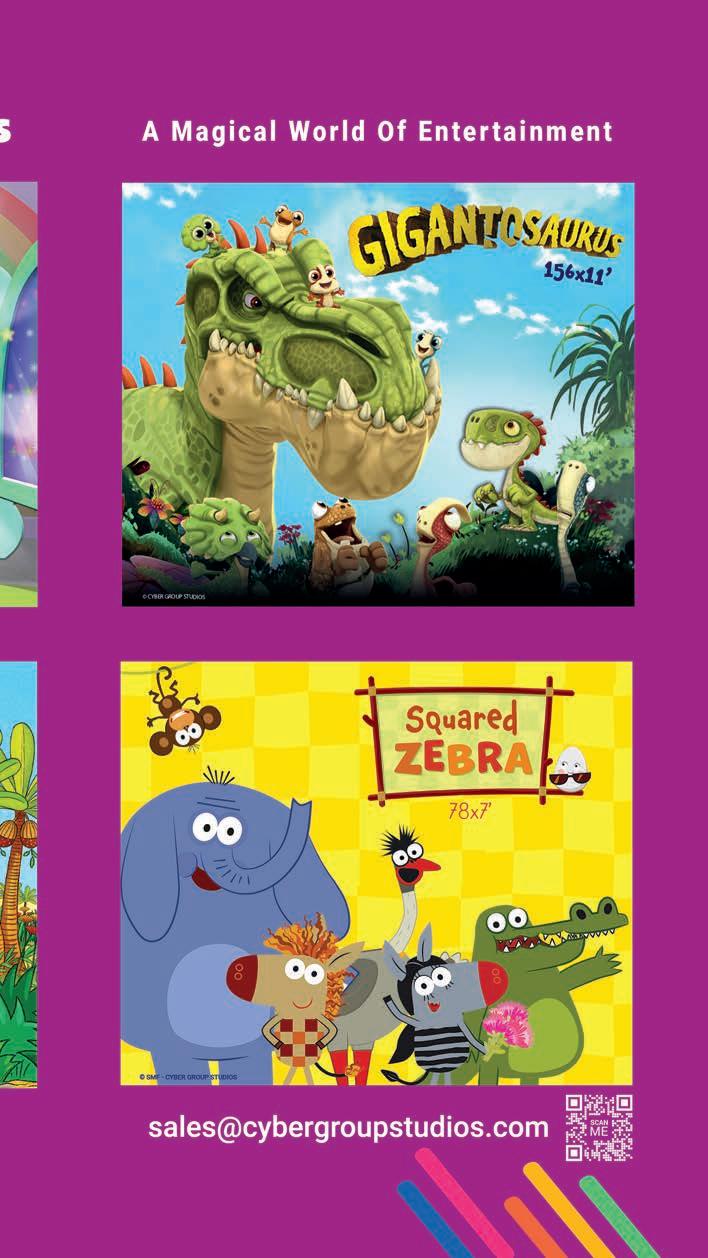

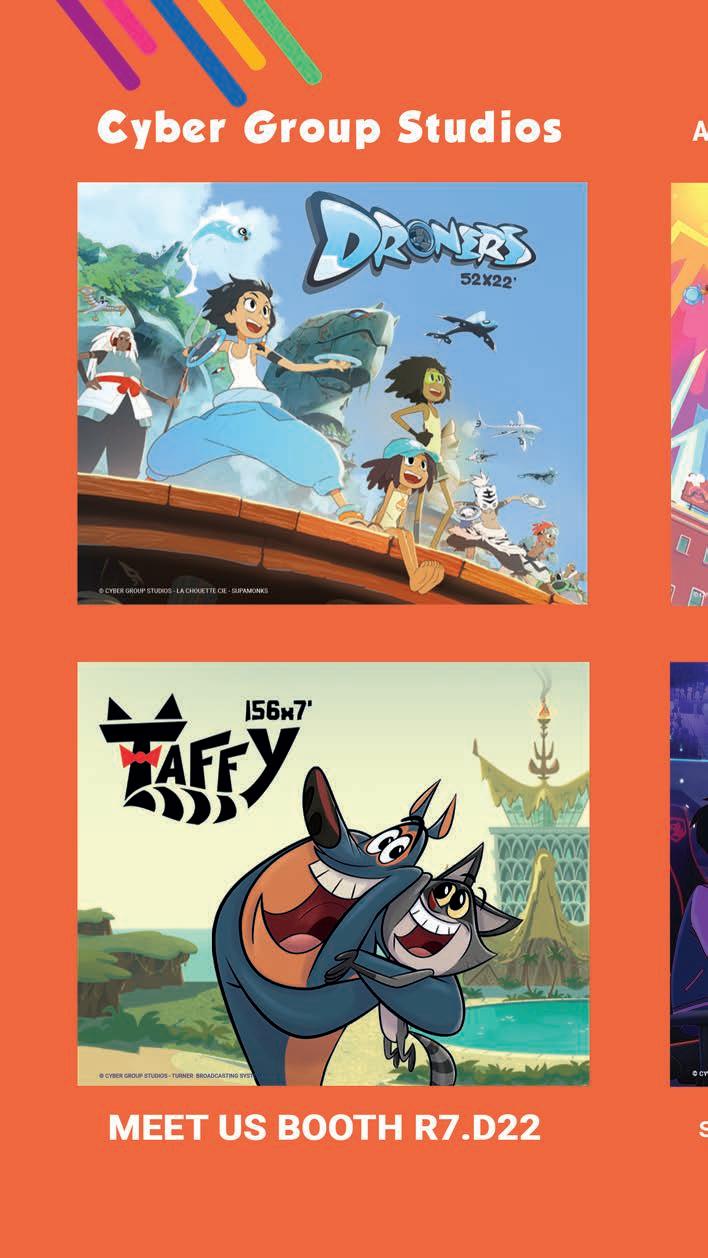

Cyber Group Studios

O (33-1) 5556-3232; (1-818) 844-1660

w www.cybergroupstudios.com

m sales@cybergroupstudios.com

KEY CONTACTS:

Dominique Bourse, Chairman & CEO

Raphaëlle Mathieu, Chief Operating Officer

Karen K. Miller, President & CEO, Cyber Group Studios USA

PROGRAMS:

Press Start!: 52x11 min., CGI, comedy/adventure, bridge; Alex Player : 26x22 min., 2D/CGI, adventure/esports, kids; Droners : S1-2 52x22 min., 2D/CGI, adventure/comedy, kids; Gigantosaurus : S1-3 156x11 min./78x26 min., 2D/CGI, comedy/adventure, upper preschool; 50/50 Heroes: 52x11 min., 2D, comedy/adventure, kids; Taffy : S1-2 156x7 min., 2D, cartoon/comedy, kids/family; Dive Olly Dive!: S1-2 104x13 min., 2D, comedy/adventure, preschool; Nefertine on the Nile : 52x13 min., 2D/CGI, comedy, bridge; Zak Jinks: S1-2 104x13 min., 2D, adventure/comedy, kids; Squared Zebra: 78x7 min., 2D, comedy/edutainment, preschool.

“Founded in 2005, Cyber Group Studios is a leading, multi-award-winning international producer and distributor of animated programs for kids to young adults. The company is based in France, the U.S., the U.K., Italy and Singapore. Our team is driven by a passion for creating great and inspiring stories targeted at a global audience on all continents. Our five development and production studios share a strong culture of innovation, offering audiences the best storytelling, animation and music experiences. Cyber Group Studios produces its own con tent as well as third-party programs that are distributed worldwide on all digital and linear platforms. It also engages in large-scale marketing and consumer-products licensing programs of its series’ characters.”

Raphaëlle Mathieu, Chief Operating Officer

36

DeAPlaneta Entertainment

O (34) 934-928-000

w www.deaplanetaentertainment.com

m info@deaplaneta.com

KEY CONTACTS:

Ignacio Segura de Lassaletta, CEO

Diego Ibáñez Belaustegui, Chief Brand Officer, DeAPlaneta Kids & Family

Carlos Biern, Content & Distribution Director, DeAPlaneta Kids & Family

PROGRAMS:

Milo : S1 52x11 min./S2 52x11 min. in prod., 2D, adventure/edutainment, 3-5; Monster Shaker : 52x11 min., 2D, sitcom/adventure/action, 6-9; Magic Lilly: 26x22 min. in dvpmt., 3D, fantasy/adventure/coming of age, 6-9; Bernard: S1 78x7 min./S2 & 2 features in dvpmt., 3D, fantasy/ comedy/adventure, 8-12; Karters: 52x11 min. in dvpmt., 3D, adventure/comedy, 6-9; Superpigs: S1 20x11 min. in dvpmt. & 1x80 min. in dvpmt., 3D, mystery/action/adventure, 5-8; Hero Inside : 20x13 min., action/comedy, 3D, 6-9; Nina & Olga: S1 52x7 min./S2 52x7 min. in prod., 2D, fantasy/adventure/ comedy, 3-5; Adventurer Carly : 52x13 min. in prod., 3D, adventure/mystery, 6-9; Mia & Codie: 40x4.5 min. in prod., 3D, STEAM/comedy, 3-5.

DeAPlaneta Entertainment is a leading global company that provides all audiences with an extensive selection of quality entertainment that combines creativity with innovation. It manages and produces recognized children’s and family brands, including Miraculous Ladybug, Milo, Gormiti, Heidi and Maya the Bee. For over 20 years, it has been a European leader in the creation and marketing of entertainment content and IPs with an extensive territorial presence in Europe thanks to the opening of its own offices in Spain, Italy, the U.K., France, Eastern Europe and Germany. One of its goals is to continue developing its role as brand creator, with exciting projects such as season two of Milo and the series Monster Shaker and Magic Lilly, among many others. Since 2000, the company has been creating and consolidating strategic agreements with the most important European creators, production companies and studios to jointly create brands that can expand globally. One of DeAPlaneta Entertainment’s immediate objectives is to co-produce and/or acquire ten new IPs annually over the next three years.

38

Guru Studio

O (1-416) 599-4878

w gurustudio.com

m sales@gurustudio.com

KEY CONTACTS:

Frank Falcone, President & Executive Creative Director

Jennifer Oppenheimer, International Sales & Licensing Manager

PROGRAMS:

123 Number Squad!: 104x11 min., 3D, preschool; Big Blue: 52x11 min., 2D, comedy, 5-9; Pikwik Pack: 52x11 min., 2D, preschool; True and the Rainbow Kingdom: 30x22 min. & 5x22 min. seasonal specials & 1x44 min. holiday special & bonus content, 3D, preschool; Justin Time: 74x11 min. & 2x22 min., 2D, preschool.

“We can’t wait to showcase some incredible shows at this year’s MIPCOM.

In addition to our phenomenal roster of original IP, we have the international distribution and L&M rights to the fun and fast-paced educational adventure series 123 Number Squad! from Omens Studios, which is available for worldwide distribution. We’re counting up a number of broadcast partners, including Sky Kids in the U.K., Mediacorp in Singapore, MBC Shahid in the Middle East, Hop! in Israel, Youku in China, PCCW in Hong Kong, TRT in Turkey, Canal Panda in Portugal and HRT in Croatia.

Our original 2D comedy-adventure series Big Blue has launched with prestigious broadcast partners, including EBS in South Korea, RTVE’s Clan in Spain, RTS in Switzerland and MBC in the Middle East. The series continues to perform extremely well on CBC Kids in Canada, Nicktoons in the U.K. and Cartoon Network in Africa by offering young viewers a comedic and heartfelt look at what it means to be part of a close family while underscoring the timely message of how caring for our planet and each other is the most important thing of all.”

Jennifer Oppenheimer, International Sales & Licensing Manager

40

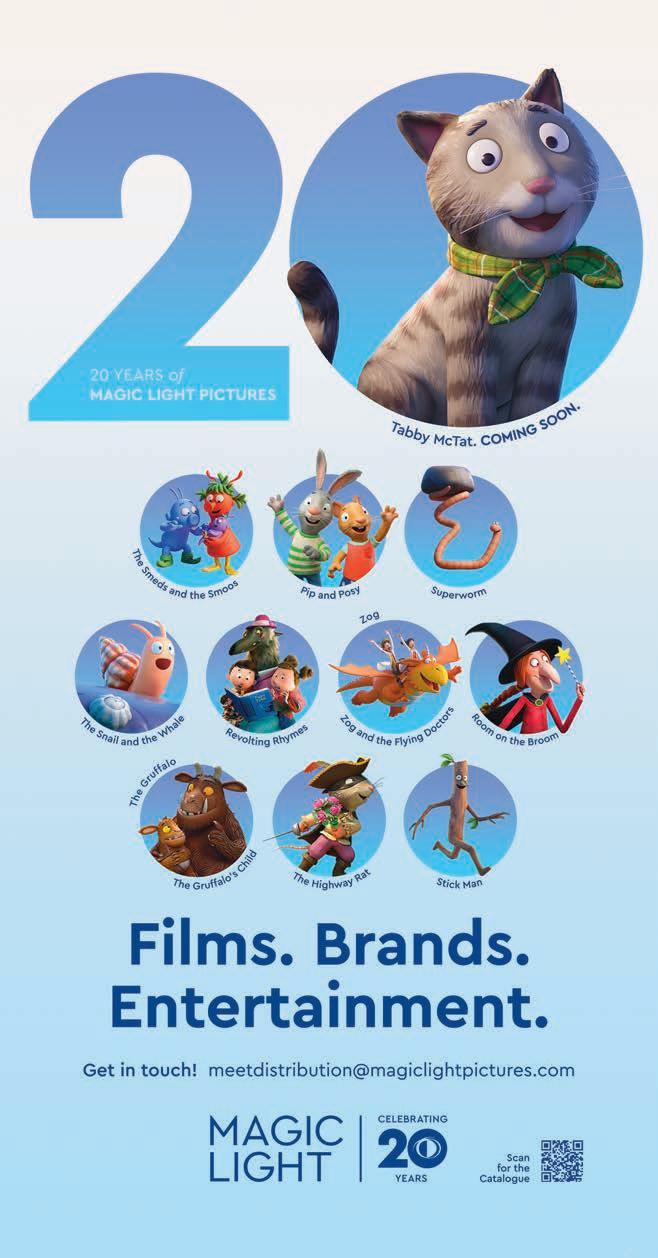

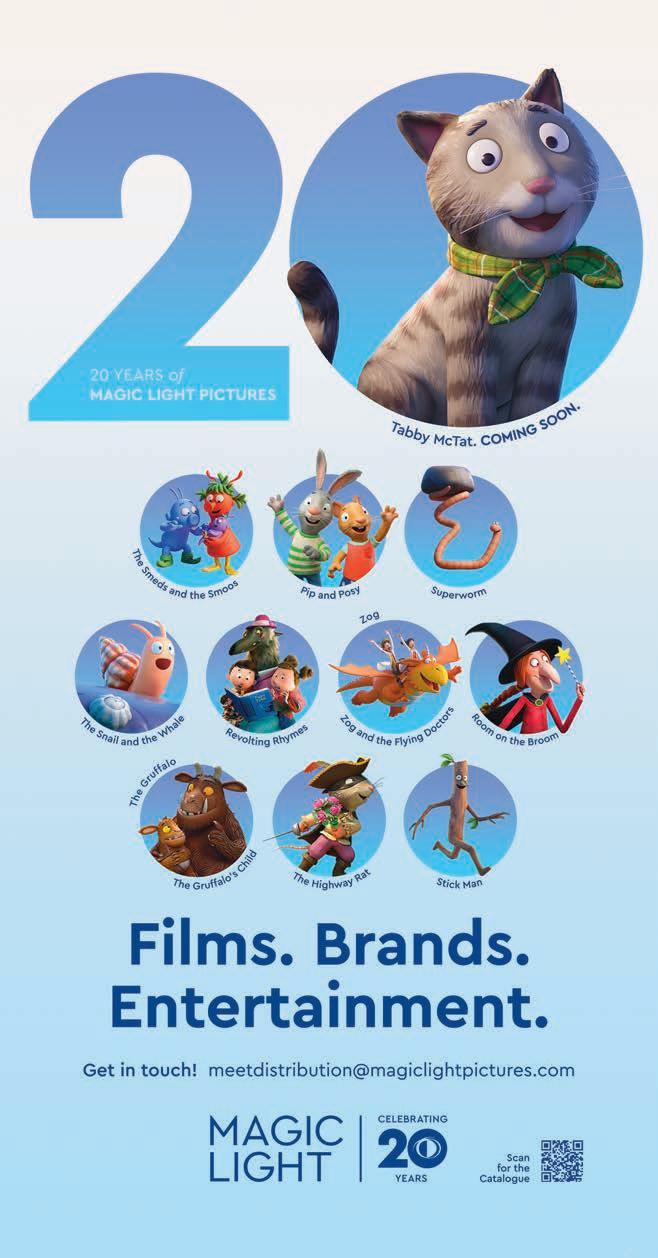

Magic Light Pictures

O (44-20) 7631-1800

w www.magiclightpictures.com

m meetdistribution@magiclightpictures.com

KEY CONTACTS:

Michael Rose, Managing Director

Martin Pope, Managing Director

Muriel Thomas, International Distribution Director

PROGRAMS:

The Gruffalo & The Gruffalo’s Child: 2x27 min., 3D, 3-7; Room on the Broom: 1x26 min., 3D, comedy/adventure, 3-7; Stick Man: 1x27 min., 3D, comedy/adventure, 3-7; Revolting Rhymes: 2x26 min., 3D, comedy/adventure, 6-11; The Highway Rat: 1x26 min., 3D, comedy/adventure, 3-7; Zog & Zog and the Flying Doctors: 2x27 min., 3D, comedy/adventure, 3-7; The Snail and the Whale: 1x27 min., 3D, adventure, 3-7; Pip and Posy: 104x7 min., 3D, comedy, 3-5; Superworm: 1x26 min., 3D, comedy/adventure, 3-7; The Smeds and The Smoos: 1x27 min., 3D, comedy/adventure, 3-7.

“Magic Light Pictures is renowned for its captivating CG-animated half-hour specials, which are adored by millions of viewers in the U.K. and worldwide. We have won a multitude of awards, including three International Emmys and two BAFTAs, and have been nominated for three Oscars. We work consistently with the finest acting and creator talent to ensure that our productions have the Magic Light vein of quality running through them. Our in-house distribution team sells and distributes our productions internationally, working with over 300 partners all over the world. Endeavoring to build long-term relations and always expanding our worldwide network of contacts, we work with carefully chosen partners in each territory to connect our shows with the widest audiences locally and globally through television, home entertainment, platforms, cinemas and festivals.”

—Muriel Thomas, International Distribution Director

42

Mattel Television

O (1-310) 252-3384

w www.mattel.com

m content_sales@mattel.com

PROGRAMS:

Barbie: A Touch of Magic: 26x22 min., 3D, comedy/adventure, 6-11; Polly Pocket: S5 26x11 min. & 1x65 min., 2D, friendship/adventure, 6-11; He-Man and the Masters of the Universe: S1-3 10x25 min., CGI, action, 6-11; Thomas & Friends: All Engines Go : S27 26x11 min. & 1x60 min., 2D, friendship/educational/adventure, preschool 2-6; Monster High

The Movie 2: 1x88 min., live action, musical, 6-14; Monster High

The Series: S2 20x22 min., live action, 6-14; Barney’s World: 52x11 min., 3D, friendship/educational, preschool 2-6.

“As our Mattel Television portfolio continues to grow, we are in an advantageous position to continue delivering family entertainment across both animated and live-action offerings. By the end of 2023, Mattel Television will have launched 13 series and specials, even more than in 2022, with many other animation, liveaction, short-form, scripted and unscripted projects in production or development.

Our presence in live action grew tremendously this year with the debuts of Hot Wheels: Ultimate Challenge and Barbie Dreamhouse Challenge, as well as the second season of Pictionary. Due to the popularity of Mattel’s dolls portfolio, we’ve seen great success with Barbie and Monster High content and look forward to delivering new content from both this fall. As we look to 2024, we’re excited for fans to experience the next chapter of Masters of the Universe: Revolution, as well as Mattel’s relaunch of the iconic Barney IP with Barney’s World.” —Alex Godfrey, VP, Content Distribution

44

Mediatoon Distribution

O (33-6) 0968-5565

w mediatoon-distribution.com/en/home

m g.milagres@mediatoon.com

KEY CONTACTS:

Solène Crépin, Sales & Business Affairs Manager

Franklin Cadre, Sales & Business Affairs Manager

PROGRAMS:

The Fox-Badger Family: S2 52x12 min., adventure/comedy; The Marsupilamis : 52x11 min., action/adventure/comedy; SamSam : 52x11 min., CGI, adventure/comedy; Trotro & Zaza: 78x3.5 min., edutainment; Zoobox: 1x26 min., adventure/comedy; Nicholas’ Fantastic Summer: 52x12 min., comedy; Versailles Unleashed: 26x22 min., adventure/comedy; Living with Dad: 52x12 min., comedy; Eden Zero: S2 25x24 min., manga/anime; Sardine: 52x12 min., adventure/comedy.

Mediatoon is part of Média-Participations, comprising leading comic, novel and graphic publishing houses (Dargaud, Urban Comics, Kana, Dupuis, Le Seuil, Abrams, La Martinière), animation studios and digital media. Média-Participations is one of Europe’s key players in family entertainment. Mediatoon Distribution successfully manages and markets iconic shows worldwide.

The company’s expertise has been recognized internationally through awards such as Best Distributor of the Year and Best Export prizes for series such as Cedric, SamSam, Trotro and, in 2020, The Fox-Badger Family.

Thanks to its in-house studios (Ellipse Animation, Belvision), third-party producers and other major anime partners, Mediatoon’s catalog consists of more than 10,000 half-hours of animated series. This includes iconic shows such as Garfield, SamSam, Tintin, Trotro, Code Lyoko and Naruto, all of which continue to cement Mediatoon’s position as one of Europe’s leading kids’ and family IP managers and distributors.

46

Mondo TV Group

O (39-06) 8632-3293

w www.mondotvgroup.com

m silvia.darchivio@mondotvgroup.com

KEY CONTACTS:

Matteo Corradi, President & CEO

Luana Perrero, Head, Content Sales

Alex Venturi, International Sales Manager

PROGRAMS:

Monster Loving Maniacs (presented by Mondo TV & Toon2Tango): 52x11 min., 2D, comedy/adventure, 6-10; Agent 203 (presented by Mondo TV & Toon2Tango): 26x22 min., 3D/CGI, spy-fi/ adventure/comedy, 6-10; MeteoHeroes : S1 52x7 min./ S2 52x13 min. & 4x26 min. specials, 2D, comedy/adventure/ edutainment, 6-10; Grisù : 52x11 min., 3D/CGI, comedy/ adventure, 6-10; One Love: 26x7 min., 2D, edutainment, preschool; Lola on Board: 26x7 min., 3D/CGI, edutainment, preschool; Action Kidz : 57x7 min., live action, sports, 6-10; The Wee Littles (presented by Mondo TV & Toon2Tango): 46x5 min., simulated stop-motion animation, comedy/adventure, 3-6.

“Mondo TV and Toon2Tango co-produced and are distributing the kids’ adventure-comedy Monster Loving Maniacs and the spy-fi children’s show Agent 203, along with a new version of the classic hit Grisù. One Love, a 26x7-minute preschool co-production with T-Rex Digimation, is completed, while Lola on Board, a 26x7-minute preschool show presented at MIPJunior 2022 and co-produced with Tile, Digitalcomoedia and Toonz Station, will be ready by summer 2024. Mondo TV’s distribution plans include LEE Editorial’s Action Kidz, a 57x7-minute series designed to inspire kids to take up sports. MeteoHeroes is a hit in over 180 countries and 20-plus languages. It has won a Silver Telly Award and best animated kids’ program at the Atlanta Chil dren’s Film Festival and has been recognized for environmentally aware production work. It has also inspired a Sony PlayStation video game.

And, of course, our L&M and distribution performance remains strong across multiple properties and territories.”

—Matteo Corradi, President & CEO

48

NBCUniversal Global Distribution

O (1-818) 777-1300

w www.nbcuniversal.com

KEY CONTACTS:

Belinda Menendez, President & Chief Revenue Officer, Global Distribution

Carolyn Stalins, Executive VP, International Distribution

Chloe Van den Berg, Senior VP, Head, Kids & Family Entertainment Sales

PROGRAMS:

Gabby’s Dollhouse: 60x30 min., 3D/live action, 2-6; Not Quite Narwhal: 26x30 min./52x15 min., 3D, adventure, 2-6; Pinecone & Pony : 16x30 min., 2D, comedy/adventure/fantasy, 6-11; Lil Stompers : 13x30 min./65x5 min., 3D, education/adventure, 2-4; Superbuns: 39x7 min./13x30 min., 2D, comedy/kindness, 4-7; Tea Town Teddy Bears: 26x11 min./13x30 min., 3D, 4-7; Fright Krewe: 20x30 min., 2D, action/adventure/mystery, 8-12; Megamind Rules: 16x30 min., 3D, action/adventure/comedy, 6-11; LEGO Jurassic Park: The Unofficial Retelling: 1x30 min., 3D, comedy/adventure/sci-fi, 6-11; Spooky Files: 10x30 min., live action, mystery/comedy, 7-12.

NBCUniversal Global Distribution is responsible for the licensing and distribution of NBCUniversal product to all forms of television and new media platforms in the U.S., Canada and in over 200 territories internationally. NBCUniversal’s content portfolio includes a vast and diverse library of more than 6,500 feature films and 170,000 television episodes, including current and classic titles, non-scripted programming, kids, sports, news, long-form and short-form programming from Universal Pictures, Focus Features, Universal Television, UCP, Universal International Studios, Sky Studios, Universal Television Alternative Studio, NBC Late Night properties, DreamWorks Animation, Telemundo and more, as well as locally produced content from around the world. Global Distribution is a division of Comcast NBCUniversal.

50

PBS International

w pbsinternational.org/programs/childrens

KEY CONTACTS:

Joe Barrett, VP, Global Sales

Jamie Shata, Senior Manager, Global Sales

PROGRAMS:

Lyla in the Loop: 80x11 min./40x25 min., 2D, 4-8; Work It

Out, Wombats! : 80x11 min./40x25 min., 2D, 3-6; Baby Animals: The Top 10: 6x60 min., documentary, 6+; Elinor Wonders Why: 74x11 min./37x25 min. & 1x55 min. special, 2D, 3-5; Arthur: 428x12 min./214x26 min. & 4x60 min. specials, 2D, 4-8; Molly of Denali : 122x11 min./61x25 min. & 2x60 min. specials, 2D, 4-8; Pinkalicious & Peterrific : 168x11 min./84x25 min. & 3x60 min. specials, 2D, 4-8; Nature Cat: 20x30 min. & 2x55 min. specials, 2D, 3-7; Martha Speaks: 81x26 min., 2D, 4-7; Cyberchase: 23x23 min., 2D, 6-11.

“PBS International is proud to introduce Lyla in the Loop to the global marketplace at MIPJunior. We are delighted to further expand our portfolio of award-winning children’s content from PBS KIDS, making it available to children around the world.”

—Joe Barrett, VP, Global Sales

52

Rainbow S.p.A.

O (39-071) 7506-7500

w www.rbw.it/en

m info@rbw.it

KEY CONTACTS:

Andrea Graciotti, Head, Sales, TV & VOD Rights

Matteo Olivetti, Sales Director, Global Consumer Products

PROGRAMS:

Mermaids—Magic of the Deep: 10x24 min., CGI, adventure/action, 6-12; Gormiti—The New Era: 20x22 min., live action w/VFX, action/adventure/drama/comedy, 6-11; Pinocchio and Friends: S1 26x12 min., CGI, adventure/comedy, 4-7; Pinocchio and Friends: S2 26x12 min., CGI, adventure/comedy, 4-7; Summer & Todd—Happy Farmers: 52x7 min., CGI, comedy/edutainment, 2-5; 44 Cats: S1-2 52x13 min. each, CGI, comedy, 4-7; Winx Club: S1-8 26x26 min. each, 2D, adventure/ action/comedy, 5-10; Regal Academy: S1-2 26x26 min. each, 2D, comedy/adventure, 5-10; Maggie & Bianca Fashion Friends: S1-3 26x26 min. each, live action, comedy, 8-12; World of Winx: S1-2 26x26 min. each, 2D, action/mystery, 5-10.

Rainbow was established in 1995 by creative genius Iginio Straffi, president and CEO of the group, and has emerged among the largest animation studios in the world following the extraordinary success of the Winx Club fairies, a saga loved and followed by millions of fans since its debut in 2004. In over 25 years of growth, Rainbow Group has achieved increasingly important milestones in the entertainment industry, operating worldwide in the creation and production of both animated and live-action TV and film projects. The group’s creative core has expanded year after year, also through the acquisition of major players such as Bardel, an Emmy Award-winning Canadian studio offering CGI and VFX animation services, and Colorado Film, an Italian company of excellence in live-action production. Creating and distributing original content for the whole family, Rainbow also reaches more than 150 countries globally with editorial projects, talent scouting and the production of merchandise and toys also under license.

54

Sixteen South Rights

O (44-28) 9538-0413

w www.sixteensouth.tv

m rights@sixteensouthrights.tv

KEY CONTACTS:

Colin Williams, Managing Director

Alexandros van Blanken, General Manager

PROGRAMS:

Coop Troop: 52x11 min., 3D, comedy, 6-9; ODO: 52x7 min., 2.5D, comedy, 3-5; Claude: 50x12 min. & 11x2 min., 2D, comedy, 2-6; WildWoods: 26x11 min., live action, comedy, 2-6; Lily’s Driftwood Bay: 96x7 min. & 4x14 min., 2D/mixed media, comedy, 2-6.

“Sixteen South Rights is an independent distributor that is part of the Sixteen South Group. It represents all of the studio’s original IP, four multi-award-winning completed titles, one further series currently delivering and a second season of ODO in the pipeline. As a boutique independent distributor, we are completely aligned with the ethos of the studio that we were born from, and the three pillars of passion, heart and quality underpin everything that we do. We want to see our innovative and inspiring stories being enjoyed by every child in every home in every country around the world.”

—Alexandros van Blanken, General Manager

56

Studio 100 Media

O (49-89) 960855-0

w www.studio100group.com

m info@studio100media.com

KEY CONTACTS:

Martin Krieger, CEO

Dorian Bühr, Head, Global Distribution

PROGRAMS:

Vegesaurs: S1-2 40x5 min., CGI, comedy/adventure, preschool 4-7; 100% Wolf—The Book of Hath: S1-2 52x22 min., CGI, comedy/adventure, 6-10; FriendZSpace: 52x11 min., CGI, comedy/adventure, 5-9; SeaBelievers: 52x11 min., CGI, ecotainment, preschool 4-7; Mia and me: S1-4 104x23 min., live action/CGI, fantasy/adventure, girls 6-12; Game Keepers: S1-2 20x25 min., live action, action/adventure/game, 9-16; Heidi: S1-2 65x22 min., CGI, adventure, 5-8; Tip the Mouse: S1-3 104x7 min., CGI, comedy/adventure, preschool 3-6; Wissper: S1-2 104x7 min., CGI, adventure/comedy, preschool 4-8; Maya the Bee : S1-2 130x13 min., CGI, adventure, preschool 4-7.

“Studio 100 Media is a leading international production and distribution company specializing in high-quality children’s and family entertainment. Based in Munich, the company represents a portfolio of well-known brands, including Maya the Bee, Mia and me, Heidi, Vic the Viking and 100% Wolf. Studio 100 Media further engages in international brand rights licensing and manages its state-of-the-art production studio, Studio Isar Animation. The company belongs to the Belgian Studio 100 Group that also boasts a strong presence in the theme park industry across Belgium, Germany, the Netherlands, Poland and the Czech Republic.”

Dorian Bühr, Head, Global Distribution

58

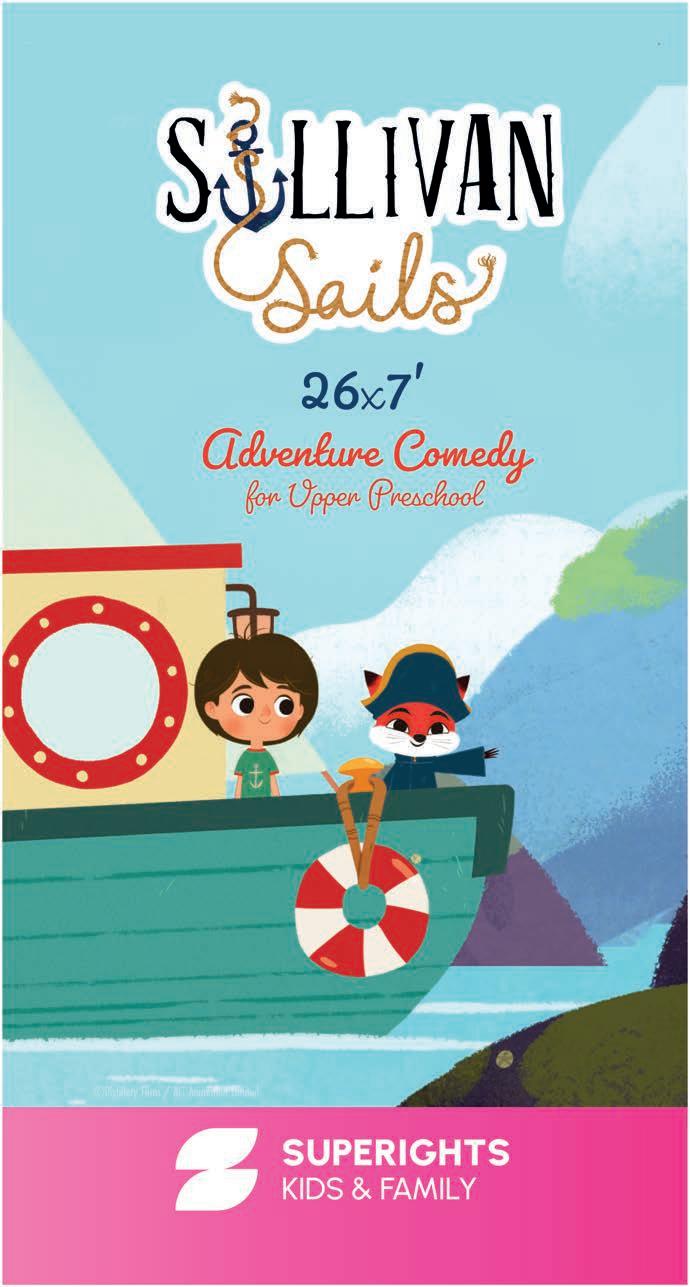

Superights

w www.superights.net/en

m sales@superights.net

KEY CONTACTS:

Nathalie Pinguet, Deputy Managing Director, Sales & Acquisitions, Pan Deals, Canada, Western Europe, Nordics & Russia

Juliette Béchu, Sales Manager & Acquisitions, AsiaPac, U.S. & MENA

Hugo Brochard, Central & Eastern Europe, Africa, Spain, Portugal, LatAm & Inflight

PROGRAMS:

Tara Duncan : 52x13 min., 3D, fantasy/comedy, 6-9; Home Sweet Rome! : 13x26 min., live action, coming of age, kids/teen; Sullivan Sails: 26x7 min., 2D, adventure/comedy, 3-5; Deep in the Bowl : 52x5 min., 3D, comedy, 8-12; I Love This Job : 26x7 min., 2D, edutainment/comedy, preschool; Maelys’ Mysteries: 30x13 min., 2D, adventure/comedy, kids; Clay Time : 90x4.5 min., 2D, DIY/edutainment, 3-5; Croco Doc : 52x7 min., 2D, edutainment, kids; Koumi’s Animated Picture Book: 104x5 min., 2D, edutainment, preschool; Momolu & Friends: 78x7 min., 2D, edutainment/comedy, preschool.

“Founded in 2013, Superights distributes kids’ and family programs covering all genres and demographics. Superights is a key international youth content provider for the global market, with well-established broadcasting partners all over the world and more than 25 producers. Our activity includes all rights—from traditional TV to VOD platforms, licensing and merchandising, theatrical and home video—with an expert team speaking multiple languages. We operate from Paris, Milan and New York. Superights was nominated for Unifrance’s TV Export Award in 2022 and was awarded Best European Investor/Distributor of the Year by Cartoon Forum Tributes in 2015.

Superights constantly adds fresh properties to its available content and seeks out new markets for its programming. The catalog includes Go! Go! Cory Carson, produced by VTech and Kuku Studios; The Adventures of Little Penguin, produced by Tencent Video; Sullivan Sails, produced by Distillery Films; I Love This Job, produced by Animoon; Home Sweet Rome!, produced by Red Monk Studio and First Generation Films; and Tara Duncan, produced by Princess Sam Pictures.”

—Nathalie Pinguet, Deputy Managing Director, Sales & Acquisitions

60

Thunderbird Distribution & Brands

w thunderbird.tv

m sales@thunderbird.tv

KEY CONTACTS:

Richard Goldsmith, President

Nelson Huynh, Director, Sales

Nelson Huynh, Director, Sales

PROGRAMS:

Mermicorno: Starfall : 26x22 min., 2D, action/comedy, 6-9; Rocket Saves the Day : 1x45 min., 2D, preschool; Mittens & Pants: 81x7 min., live action, preschool; BooSnoo!: 41x7 min., mixed media, preschool/neurodiverse.

“We are excited about sales and presales for original series created by Thunderbird’s kids and family division, Atomic Cartoons. Rocket Saves the Day is a television special for PBS that is based on the best-selling How Rocket Learned to Read book series by Tad Hills that premieres in late 2023. Mermicorno: Starfall, our epic 26x22-minute animated actioncomedy for ages 6 to 9, inspired by tokidoki’s hit collectibles and fashion brand, debuts on Warner Bros. Discovery’s Max and other platforms in 2025.

Thunderbird Distribution & Brands has also recently acquired exciting new properties with the potential to become global franchises. Mittens & Pants, the adorable live-action preschool animal series from Canadian producer Windy Isle, premiered this year and continues to expand globally. BooSnoo!, commissioned by Sky Kids (U.K.) and co-produced by Visionality and Mackinnon & Saunders, is an incredibly inventive mixedmedia and dialogue-free series that encourages neurodiverse and other kids to sit back and follow the series’ little red ball as it leads a calming exploration of themes like music, wheels and shapes.”

—Richard Goldsmith, President

62

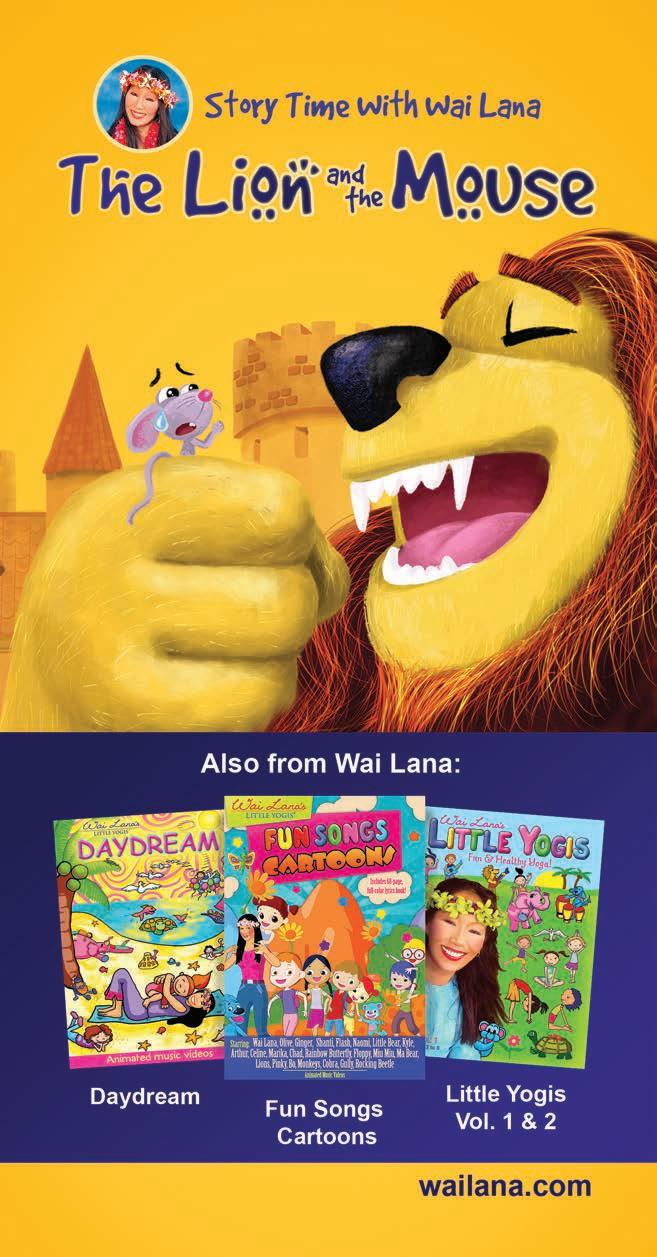

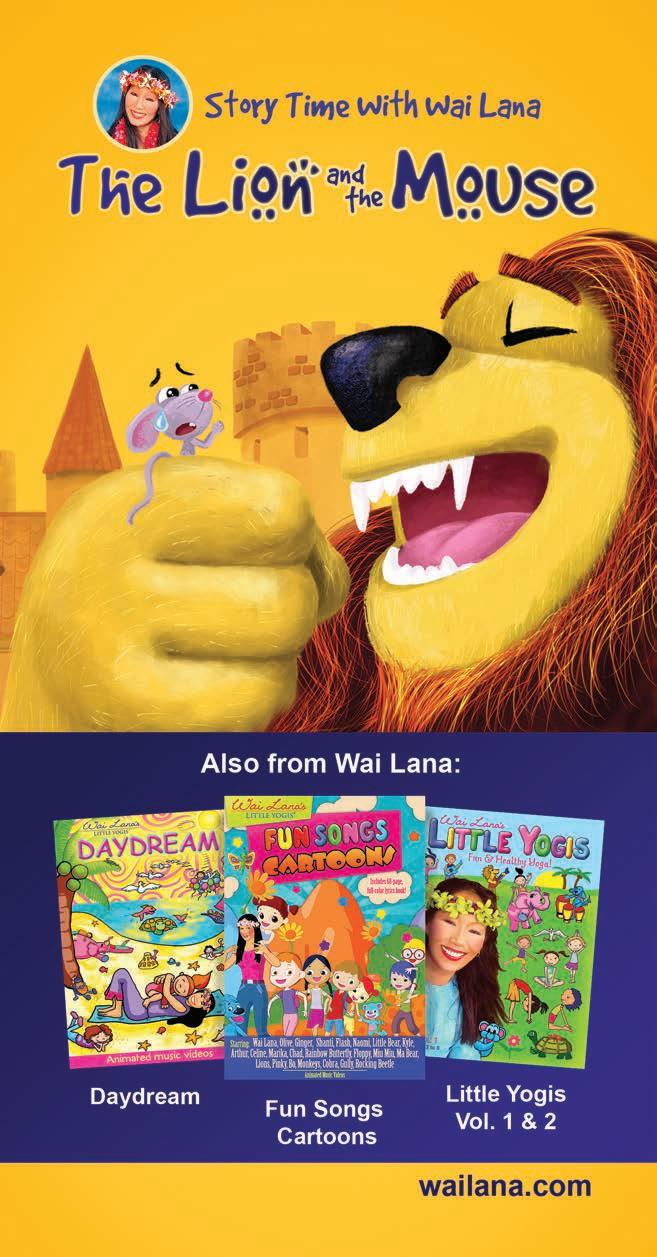

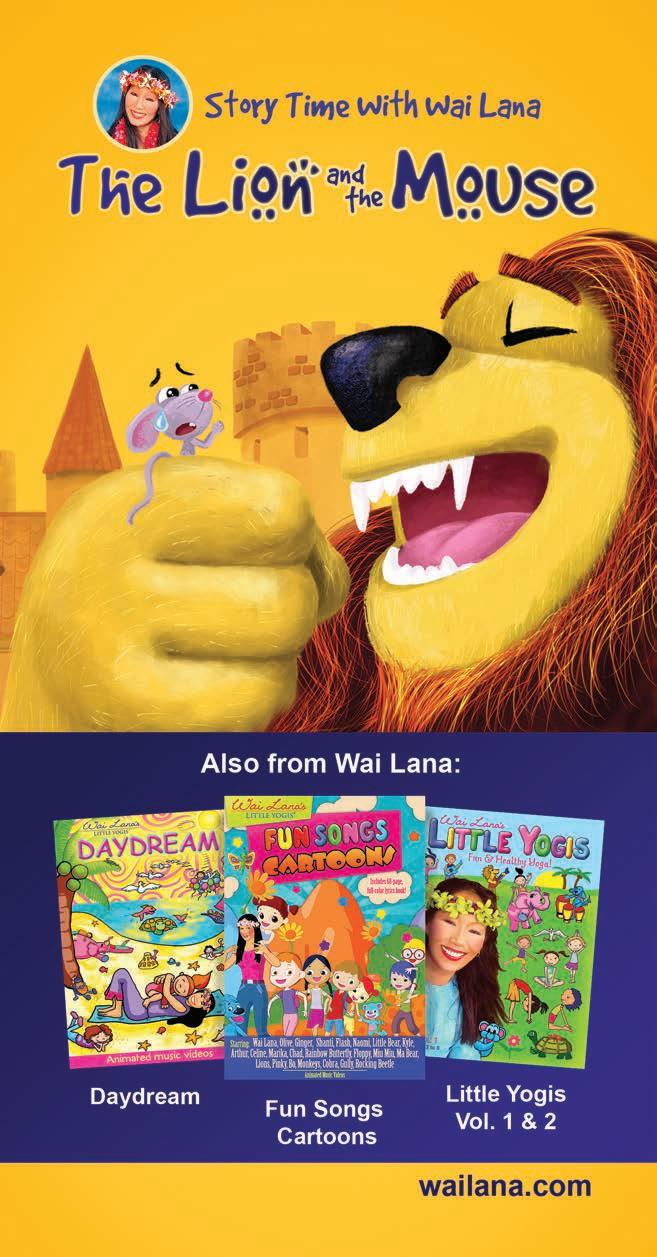

Wai Lana Productions

O (1-808) 224-2927

w www.wailana.com

m admin@wailana.com

KEY CONTACTS:

Sunil Khemaney, Executive Director

Richard Bellord, CEO

PROGRAMS:

The Lion and the Mouse: 1x26 min., 3D, comedy/action/musical, 3-8; Fun Songs Cartoons : 1x50 min., 3D, comedy/action/ musical, 3-8; Little Yogis: volume 1 1x30 min., 2D/live action, how-to/musical, 3-8; Little Yogis : volume 2 1x30 min., 2D/ live action, how-to/musical, 3-8; Daydream : 1x30 min., 2D, comedy/action/musical, 3-8; Wai Lana Yoga: 182x30 min., live action, how-to/exercise, all ages; Wai Lana Insights: 78x3-5 min., live action, inspirational, all ages.

Inspired by an Aesop fable and the moral and spiritual values of yoga, the characters of the exciting, action-packed romp titled The Lion and the Mouse will have kids on the edge of their seats—sometimes laughing, sometimes tearing up—as our heroes try to overcome the challenges before them. It is a unique adventure filled with catchy, feel-good songs revolving around a moral tale. As the little mouse tries to save the very lion she just escaped from, all the excitement wraps up in a touching tale of pride and humility.

This is programming that stimulates creativity and develops healthy mindsets for kids. The 26-minute program is a classic fable with six original songs by international yoga icon Wai Lana.

Wai Lana’s Little Yogis award-winning programs introduce young children (and their parents and teachers) to a healthy and happy lifestyle in a fun and playful way.

64

WildBrain

O (1-416) 363-8034

w www.wildbrain.com

m sales@wildbrain.com

KEY CONTACTS:

Stephanie Betts, Chief Content Officer

Deirdre Brennan, Chief Operating Officer

Caroline Tyre, VP, Global Sales & Rights Strategy

PROGRAMS:

Pet Hotel: 26x11 min. & 100x2 min., 2D, comedy, 7-9; Jonny Jetboy: 40x11 min./20x22 min., 3D, action/adventure, preschool 4-7; Brave Bunnies: 100x7 min. & 4x7 min. specials, 2D, adventure, preschool 3-5; Johnny Test: S7-8 40x11 min., 2D, comedy, 6+; Strawberry Shortcake: Berry in the Big City: 120x4 min./ 60x9 min., 2D, family, preschool 4-7; Strawberry Shortcake: Berry Big Specials: 4x44 min., 3D, family, preschool 4-7; Summer Memories: 40x12 min./20x23 min. & 20x4 min., 2D, comedy, 6+; Caillou: 52x11 min., 3D, family, preschool 4-7; Fireman Sam: S14-15 52x11 min., 3D, action/adventure, preschool 4-7; Ruby and the Well: S1-2 20x45 min./S3 8x45 min. in prod., live action, family drama, family.

“At WildBrain, when it comes to distribution, we explore what’s possible rather than what’s expected.

As a leader in audience engagement, we leverage our global reach and expertise in premium and omni-platform content to connect with audiences and build communities for kids and families around our owned and partner-led properties.

This MIPJunior and MIPCOM, we’re launching Jonny Jetboy, an original kids’ series from PAW Patrol creator Keith Chapman, produced by iQIYI in collaboration with WildBrain and Winsing. Keith’s terrific new series has all the right ingredients to entertain families worldwide, including actionpacked adventures, heroic characters and high-tech gadgets. Our slate of new kids’ content also includes two new seasons of the hilarious classic Johnny Test, plus the laugh-outloud animated show Pet Hotel from Tencent and Miaow’s House. Our lineup for younger viewers includes a brand-new CG-animated series from preschool favorite Caillou, plus a second season of the adorable Brave Bunnies.”

—Caroline Tyre, VP, Global Sales & Rights Strategy

66

A DIVISION OF World Screen TVKids.com OUR PLAYGROUND IS GETTING BIGGER!

Mansha Daswani

Mansha Daswani

Ayo Davis President Disney Branded Television

Ayo Davis President Disney Branded Television

Nelson Huynh, Director, Sales

Nelson Huynh, Director, Sales