GUIDE 2 0 23/2 0 24

zdf-studios.com

Kristin Brzoznowski

Associate Editors

Jamie Stalcup

Alexa Alfano Editor, Spanish-Language Publications

Elizabeth Bowen-Tombari

Production & Design Director

David Diehl

Online Director

Simon Weaver

Sales & Marketing Director

Dana Mattison Sales & Marketing Manager

Genovick Acevedo

Ricardo Seguin Guise President Anna Carugati Executive VP Mansha Daswani Associate Publisher & VP of Strategic Development © 2023 WSN INC. 1123 Broadway, #1207 New York, NY 10010 Phone: (212) 924-7620 Website: www.tvdrama.com No part of this publication can be used, reprinted, copied or stored in any medium without the publisher’s authorization. For a free subscription to our newsletters, please visit www.subscriptions.ws A Note from the Editor . . . . . . . . . . . . 8 Interviews . . . . . . . . . . . . . . . . . . . . . . . . . 9 Distributors . . . . . . . . . . . . . . . . . . . . . . 21 Publisher Ricardo Seguin Guise Editor-in-Chief Mansha

Editor-at-Large

Daswani

Anna Carugati Executive Editor

Bookkeeper Daphne Menard Contents 4

The Drama Destination

TVDrama.com

TVDRAMASCREE

CREENINGS.COM The only video portal for the global TV drama community.

A Note from the Editor

Mansha Daswani

Mansha Daswani

I’ve been telling anyone who will listen that they absolutely must make time to watch Jubilee on Prime Video. The response has largely been, “What’s that?”

Now I know that even though peak TV has peaked, there is still a shocking number of scripted TV shows for one to sample. So I guess I shouldn’t be expecting everyone to have heard of Prime Video’s lush, stunning drama set against the backdrop of the early days of Indian cinema. But given how long it took me to discover it, and I actively seek out new Indian dramas to watch on a regular basis, I’m beginning to think that the platforms aren’t doing the best job of making sure that the shows they’re spending a lot of money on to deploy globally are actually being sampled globally. It never came up in my recommendations—I maintain that those algorithms are deeply flawed—and I’m fairly certain I was scrolling for a long, long time before I saw the thumbnail in Prime’s long list of originals.

Addressing subscriber erosion at Disney+, Disney CEO Bob Iger alluded to the abundance of content being made by the streamers— and the need to be “surgical” in the months ahead. Will beautiful, expensive pieces like Jubilee, which perhaps have niche appeal, still get made? And if they do, will they even be discovered?

Audiences are tired; frustrated with rising monthly SVOD fees and how much time is being wasted trawling through poster after poster. Streamers, which have been the driving force behind so much high-end content creation over the last few years, are under significant pressure, Deloitte noted in its latest Digital Media Trends report. Almost half of consumers believe they are paying too much for SVOD services, and a third intend to reduce the number of services they subscribe to. With the proliferation of services, consumers are increasingly frustrated with “chasing content” across multiple services.

One thing’s for sure: viewers are still spoiled for choice. The broad range of offerings in the TV Drama Guide is a testament to this.

8

INTERVIEWS

Tom Fussell CEO BBC

Tom Fussell CEO BBC

Studios

TV DRAMA: What are the plans for expanding your U.S. scripted slate ?

FUSSELL: We’ve acquired six scripted labels now, all based in the U.K. Mark Linsey oversees those [as managing director of scripted]. Mark has relocated to L.A., not because we’re going to shift our production base to L.A., but because it’s very important when so much funding comes from L.A. for us to have a senior leader who is plugged into our U.K. scripted producers so close to the customers. I still see our sweet spot as making scripted content primarily from the U.K. Our shows, often commissioned by the BBC, do not always share the budget of programs on other platforms; they’re not on the scale of a £10 million ($12.6 million), £20 million ($25.2 million) an episode. They’re sometimes limitedrun, made with a U.K. tax credit and quirky British.

TV DRAMA: What’s the roadmap for achieving the goal of doubling commercial revenues in five years?

FUSSELL: We have the support of a BBC commercial board chaired by the well-respected U.K. businessman Sir Damon Buffini. We’re in it for the long term and making long-term investments. We are continuing our investment in distribution rights and building for the future. The path doesn’t need course correcting because it is the right pace and the right level of risktaking. That creative risk-taking, driven by the BBC’s mission and purpose, makes us unique. People know what the BBC stands for.

TV DRAMA: What other priorities will you be focused on in the year ahead?

FUSSELL: Part of our strategy is about empowering people around the organization to be their authentic selves to help them deliver their best work. Inclusivity is something I am passionate about. We’ll get the best storytellers when we reflect the most authentic organization. The teams are doing well taking those creative swings and bringing different voices into the organization. We want to represent all the voices of the country.

10

Jennifer Mullin CEO Fremantle

TV DRAMA: Scripted has been a big push for Fremantle over the last few years. What’s the overarching strategy there?

MULLIN: Our strategy is simple: We work with the best creatives that we possibly can. Great IP is key, whether it’s books, originals or reboots. We recognize where our broadcast and streaming partners are challenged and remain agile in our dealmaking, financing and distribution.

TV DRAMA: Are you finding that the streamers are a bit more open now to content licensing or co-productions than before, when they were so insistent on global rights and owning everything everywhere?

MULLIN: We are seeing a shift. It’s great to see because we’re well-positioned to support with our great content. We’re seeing opportunity on all sides of the business, including the entertainment side. As the streamers’ strategies evolve, we adapt.

TV DRAMA: What are you hearing from your traditional “linear” clients about how they are facing increased competition from streamers and the pressure on ad revenues?

MULLIN: I think there’ll be a lot more scrutiny on commissions on both sides, whether streaming or linear broadcast, and, of course, there’s pressure on budgets. Linear broadcast networks have a schedule to fill; the streamers don’t. But recognizing the pressure they’re under and the challenges they’re navigating is key for us.

TV DRAMA: How did the deal with Angelina Jolie come about?

MULLIN: We heard through a consultant we work with that she was looking for a home. We had a series of meetings with her; we heard her ambition and the types of stories that she wanted to tell. We felt we were the right home for her because we’re platform-agnostic—we can sell to anybody—and we’re global. We can provide talent with the best flexibility and support to realize their creative vision.

11

Jane

CEO All3Media

Turton

TV DRAMA: What has been All3Media’s strategy for scripted series?

TURTON: For us, scripted is critical to the program slate. Our drama titles form a broad and diverse catalog that drives primary and secondary margins over several cycles of exploitation. Scripted builds reputations and profiles and creates value for our production and distribution business. People in TV talk a lot about the incredible talent of development and how crucial it is to sell, but perhaps don’t emphasize enough how important production excellence is. There is nothing better than a returning scripted series that sells internationally and establishes a reputation for quality.

TV DRAMA: How is the group discovering and nurturing new talent and diverse voices?

TURTON: Diversity of talent is a key focus for us across the business, on- and off-screen. We have appointed a head of diversity, equity and inclusion. Our talent, HR and resources teams work closely with industry bodies, agencies and individuals to diversify our talent pools and reflect our diverse audiences and communities. Across the group, we run numerous initiatives—including script writing, directing, accountancy and production—to support diverse voices, and we also provide training on disability, unconscious bias and so on.

TV DRAMA: In the U.K., there’s been a lot of discussion about the role of the public-service broadcasters (PSBs). How do you see their future?

TURTON: Speaking as an independent producer, they underpin this whole sector in the U.K. We want them to be strong because this ensures a strong independent production community. The PSBs have gone through, and continue to go through, numerous challenges, structural and cyclical. We have always worked closely with the PSBs. We’ve worked very closely for years trying to ensure that we develop and produce content that appeals to U.K. audiences.

12

Cathy Payne

CEO Banijay Rights

TV DRAMA: We’ve heard that there is more aversion to risk among broadcasters and platforms.

PAYNE: We are operating at a time when all large platforms are reviewing the economics of their operations, and the cost of original content is right at the center of those discussions: What is affordable and sustainable? We have all seen the announcements from large studios and platforms and the need to double down on their financials. Reversals of season pickups or cancellations of development [projects] have been widely reported. Does this mean broadcasters are more risk-averse? No doubt, with more focused spend. Having initial feedback on their SVOD launches, tough decisions have had to be made. Putting that aside, all platforms and broadcasters need content that delivers; it is a question of how they run their commissioning process and what is handled globally or locally.

TV DRAMA: How have risk avoidance and caution impacted scripted commissions?

PAYNE: The days of commissioning shows just to have volume are gone—it was never sustainable. While we will always see the high-end, premium and expensive original signature pieces, the rest of the slate needs to reflect a more affordable price point. How we produce at these price points will require innovation.

TV DRAMA: How important are international partnerships on scripted productions?

PAYNE: At the premium price point, some domestic commissions cannot proceed without an international partner being secured up front. As a distributor, the increased pressure on providing deficit finance is obvious, and what they can risk is a reflection of where they believe the program will be licensed. Nevertheless, all distributors will have those anomalies where they may step up at a higher level of risk.

13

Dr. Markus Schäfer President & CEO ZDF Studios

TV DRAMA: Have you seen inflation impact the programming budgets of broadcasters and platforms?

SCHÄFER: Private broadcasters and AVOD services see a decline in advertising income, and SVOD services see stagnating and even declining subscription numbers. In Europe, public-service broadcasters experience pressure on license fees. Programming budgets are the most flexible items in any broadcaster’s P&L, so it’s natural for them to look at their slates and budgets per commission. However, that creates a toxic situation. Because on the other side, the producers are also affected by inflation. Production costs have gone up significantly. It’s not rocket science to expect that, at least in the short term, there will be fewer commissions so that the remaining commissions are sufficiently budgeted. We are also seeing that the big-budget shows are being scrutinized on the streamer side—shows are not getting recommissioned or not getting commissioned at all. On the production side of the business, we and other companies need to be open to new approaches to how shows are made. And, of course, that applies to broadcasters and streamers as well.

TV DRAMA: What genres of programming are channels and platforms investing in?

SCHÄFER: We see a demand for shows with feel-good elements, more cozy, even escapist. There is less demand for programs you would describe as being kind of dark. De-risking is important for buyers, so returnable, multi-season shows, book- or other IP-based, are in demand. Scripted formats are also on the rise, as there is less risk when taking proven stories from other territories. We see broadcasters and streamers not commissioning eight but rather six episodes, at least for the first season. Maybe this is also due to a change in viewership behavior. And the economics of shows are becoming more important; budget, returnability and shelf life are key parameters.

14

Henrik Pabst

Chief Content Officer, Seven.One Entertainment Group Managing Director, Seven.One Studios

TV DRAMA: How and why did Seven.One Studios come about?

PABST: We established Seven.One Studios as our new production umbrella in November 2022, bringing together all our production subsidiaries in Germany, the U.K., Denmark and Israel, and our worldwide distribution arm. With the growing demand for local programming, Seven.One Studios is producing across all our platforms and for the external market.

TV DRAMA: As ProSiebenSat.1 has transitioned from being a traditional linear television business to operating multiple linear and nonlinear platforms, what is the strategy for offering content and reaching viewers?

PABST: Our strategy is best illustrated by a triangle: We have our linear platforms, a strong AVOD offering and an exclusive SVOD offering. Within this triangle, we play our programs always with the goal of maximum reach and the best monetization. Having flexibility here is key to us. We [signed] a major partnership with NBCUniversal, granting the rights we need within that triangle.

TV DRAMA: Many people believe AVOD is the future of the business. Is AVOD a primary way you are monetizing content?

PABST: We strongly believe in advertising. Our in-house media marketer, Seven.One Media, is the largest, strongest and most innovative sales organization in the German market. Ad-supported content is here to stay, and with Joyn, we have a well-established streaming platform with a clear focus on AVOD. We also have the right ad-tech solution tools across the ecosystem to meet the needs of our advertisers. And let’s not forget that people are used to watching ad breaks. The strategy shift from some global players toward AVOD is a clear sign that the strategic approach we started with the setup of Joyn was the right way.

15

Can Okan

Founder & CEO Inter Medya

TV DRAMA: Inter Medya has moved into miniseries. Why was that important?

OKAN: When we decided to move into the production business, we did not want to have a conflict of interest with producers who are our suppliers. So we said, instead of producing traditional long-running Turkish dramas, let’s go into production of titles made for the OTT platforms. We are also [producing] feature films, where, again, there is no clash or conflict of interest with any third party. That’s how the whole journey started. These miniseries are much faster-paced than Turkish dramas; they are edgier and even sexier.

TV DRAMA: Have miniseries brought you new clients?

OKAN: We have seen a lot of interest from Western European and Nordic companies, streaming platforms and also from Englishspeaking U.S. and Canada. These are different territories from Latin America, U.S. Hispanic or Central and Eastern Europe, where Turkish content is already very strong.

TV DRAMA: How are you keeping up with rising production costs?

OKAN: It is quite tough. All costs have increased not only because of the inflation rate but also because of the new big international players that entered the market. They overpaid all the talent, writers, directors and crews. Once you reach a certain level, you can’t go back down. But still, with our good relations and amazing team, we can continue to produce.

TV DRAMA: What demand do you see in the market?

OKAN: In certain territories, some broadcasters that had been weak on the production side have started producing themselves. So, on the one hand, demand in some countries has gone down, but we are still opening up new territories, which balances revenues. Also, in some regions, the economic situation is not that good, and prices go down. In others, prices go up because of the success of the content and the numbers increase, so again, it balances out.

16

Herbert L. Kloiber Founder & CEO Night Train Media

TV D RAMA: How are you navigating the current landscape?

KLOIBER: We are financing shows that, if commissioned by a big streamer, would cost them a lot of money, and they’re all rolling back budgets. We can get these things into production with smarter budgets using local subsidies and tax credits out of Europe mainly and then offer them to the marketplace as a co-pro or acquisition, probably at a more affordable rate and a faster path to production than through the commissioning route. Not everybody still needs to own rights for the world forever.

TV DRAMA: What prompted the investment in Eccho Rights?

KLOIBER: We partnered with external distributors initially because we didn’t want to build up our own distribution business with big overheads. We didn’t have the product flow to sustain that. Eccho has built a huge business on the Turkish drama side over the last ten years. It’s very different from the markets we usually deal with selling English-language shows; it’s complementary. At the same time, they’ve started building their own English-language and Western drama development and co-pro slate with a similar approach to how we see that market opportunity. We felt it was a great fit to have a successful distributor that is a well-oiled and profitable machine but, at the same time, is looking in the same direction for growth in that Western space. That was the perfect fit and allowed us to vertically integrate into distribution. We will continue working with different distributors going forward on a project basis.

TV DRAMA: Are streamers becoming more flexible when it comes to scripted deals?

KLOIBER: They are becoming more flexible and pragmatic. We try to be nimble partners to all and always have bespoke relationships. We are co-producing more and having more discussions between partners in various markets to bring them together for a specific project.

17

Vanessa Shapiro

CEO & Founder

Nicely Entertainment

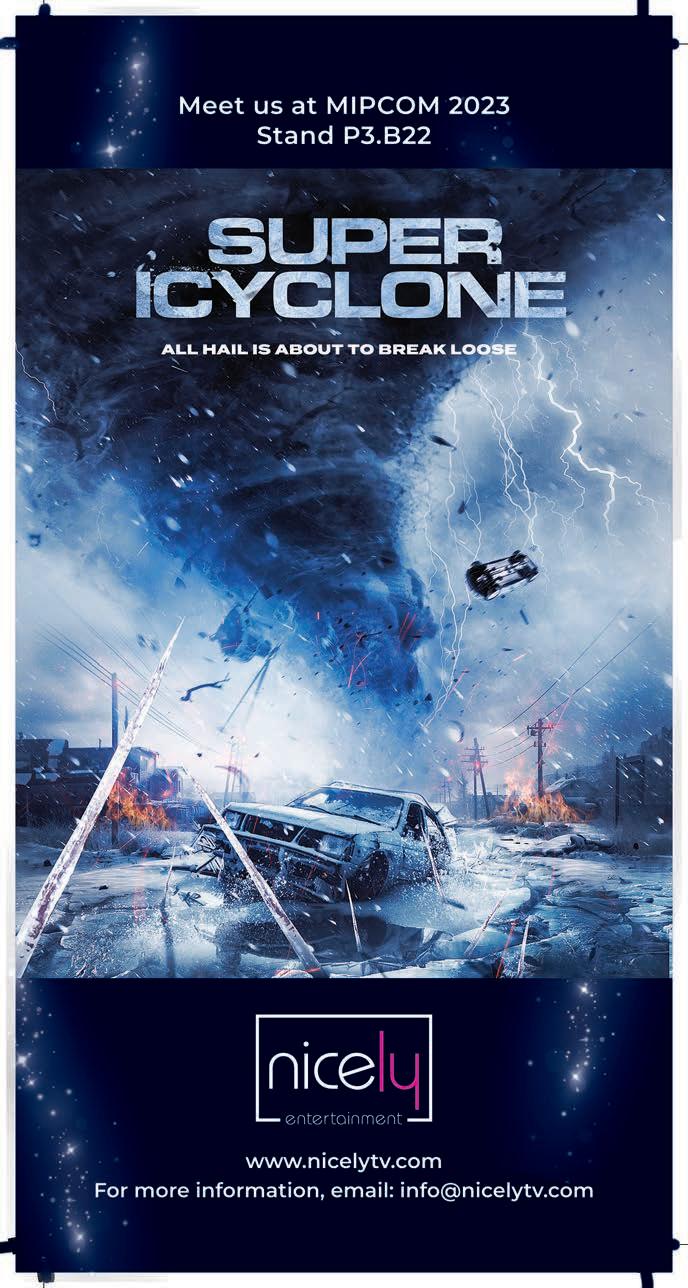

TV DRAMA: What are you hearing from your clients about their needs?

SHAPIRO: The demand for quality content never slows down. What varies year to year in terms of market climate are price points and windowing expectations. Although it can be a bit hard to forecast in constantly changing environments, that’s what makes our industry fun and what allows smaller boutique distributors like Nicely Entertainment to really thrive. We can produce content efficiently and have been able to provide great titles on tight turnarounds. As we remain nimble, we’re able to pivot quickly when opportunities pop up or new rights categories take hold.

TV DRAMA: Are broadcasters and streamers becoming more risk-averse?

SHAPIRO: Broadcasters and streamers have always been riskaverse. Although there has certainly been a great deal of belttightening from larger players, the type of content Nicely Entertainment provides tends to be quite reliable and low-risk. We really speak to a core need in the market: modestly budgeted genre films. Our titles organically target a female audience and are very co-viewer friendly, which makes them perfect for advertisers, streamers and traditional broadcast outlets.

TV DRAMA: How are you managing increased production costs?

SHAPIRO: Inflation and interest rates have definitely impacted budgets for everyone. From a technology standpoint, equipment is only getting more efficient. And with increased efficiency, we’ve been able to keep our budgets in alignment with cost increases. The real costs are now related to financing; with higher interest rates, we’ve had to rethink our financing models on several projects. The real problem within all of this is that the license fees and MGs paid out from traditional outlets have essentially remained unchanged—which has caused those dollars to no longer stretch as far as they once did (especially when payment terms extend over multiple quarters).

18

James Durie

Head, Scripted Cineflix Rights

TV DRAMA: How are your financing models evolving in this changing landscape?

DURIE: Between the need for compelling IP and series with international appeal and the demand from broadcasters and streamers for standout series, the landscape for premium drama from independent producers is incredibly competitive. We’ve also seen a steady rise in production budgets over recent years, so we’ve had to be more creative as a company when we look at financing models and be flexible in our approach. This has meant a greater emphasis on getting in the door at an earlier stage and looking at development funding, but also co-production opportunities to assist in closing off the financing. Traditional deficit financing remains core to our business model, but we are seeing bigger deficits, so finding projects that stand out creatively and commercially for us is essential.

TV DRAMA: What’s your sense of what buyers and platforms need in drama series today?

DURIE: The two most consistent things we hear from buyers are cast and IP. Firstly, premium-level talent can make noise, assist in the promotion of the series and bring audiences to a given project. Secondly, IP they can market effectively, connect with an audience with more immediacy and build into a high-profile, returning brand.

TV DRAMA: What trends do you see in the drama business?

DURIE: On-screen diversity is certainly at the forefront of our minds and something we speak to buyers about regularly when discussing our slate. It comes down to great storytelling and an intriguing mix of characters, so whether you have a series in the true-crime space or a thriller or a drama, audiences will be drawn to these qualities. For us, Australia has been a strong point of creative interest lately. We’re seeing some great projects coming from producers there, and we fully expect to further invest in more series there in the future.

19

Michael Ellenberg Executive Producer,

The Morning Show

Founder & CEO, Media Res

TV DRAMA: What kind of input do you get from The Morning Show stars

Reese Witherspoon and Jennifer Aniston, who are also executive producers?

ELLENBERG: They’re involved in everything, from script notes to casting decisions. They live a lot of the issues in the show, so their perspectives on the narrative and everything else are pretty inspired and special. The show is big and vast and takes a lot of brilliant minds. This is the third season, so we’ve learned how to do it well together. Their biggest contribution now, besides the things that are obvious, is their ambition. They’re fearless. We tackle some insane subjects—dangerous, provocative subject matter. Any time they get pitched the most ambitious idea, that’s what gets them excited. They give everyone the courage to go as far as they want. That’s how they’re leaders behind the scenes, cheering everyone to take the big swings, not being conservative.

TV DRAMA: How does The Morning Show fit in with the kind of projects you want Media Res to bring to the TV landscape?

ELLENBERG: Media Res was built to do premium, unique, cuttingedge, cinematic television. The Morning Show was, and remains, our anchor. It’s topical. You never know what you’re going to get. It’s at a scale of brilliant, glittering actors that only our show can provide. Every show should be a unique, distinct experience for the audience—one that they can’t get anywhere else. There is no other show on television that comes close to having Reese Witherspoon, Jennifer Aniston, Jon Hamm, Billy Crudup, Greta Lee, Mark Duplass (and the list goes on and on), but that’s also super smart and moving and you can’t look away from. We want our shows to be really entertaining and provocative. That’s what I’m drawn to and what everyone at the company is drawn to. We also want material that speaks to the issues of our time and has something to say. That’s what the public is yearning for. No one wants to be preached at; we get enough of that in the real world. We’re very proud of this show.

20

DISTRIBUTORS

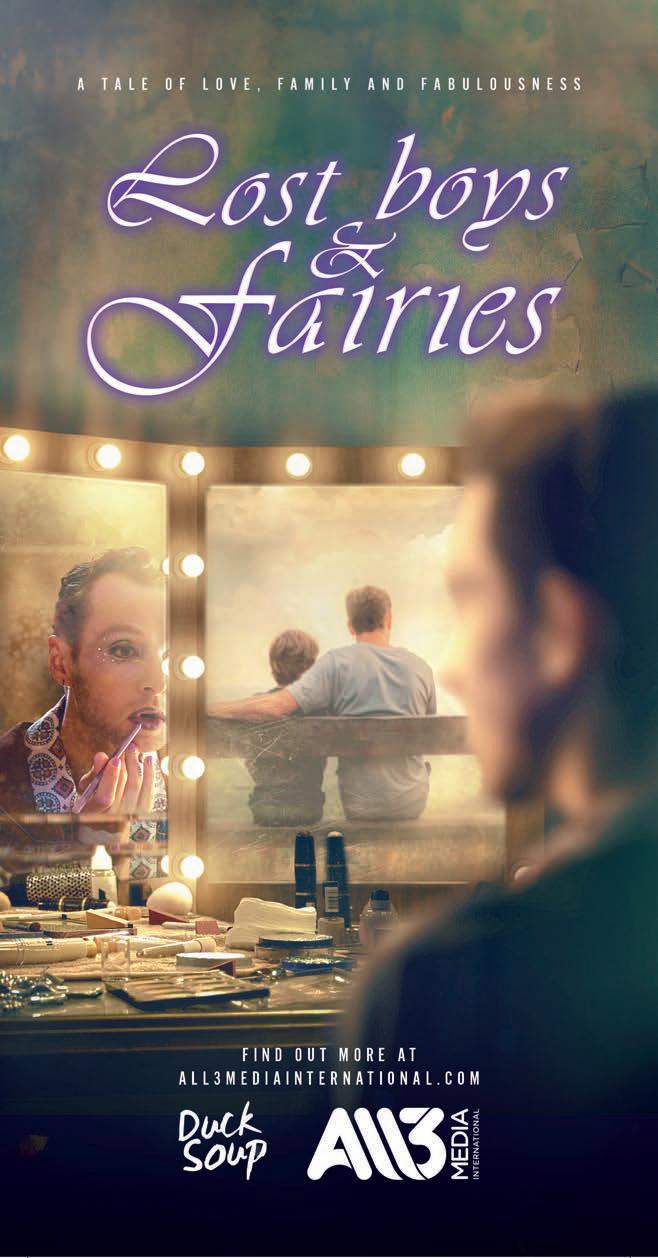

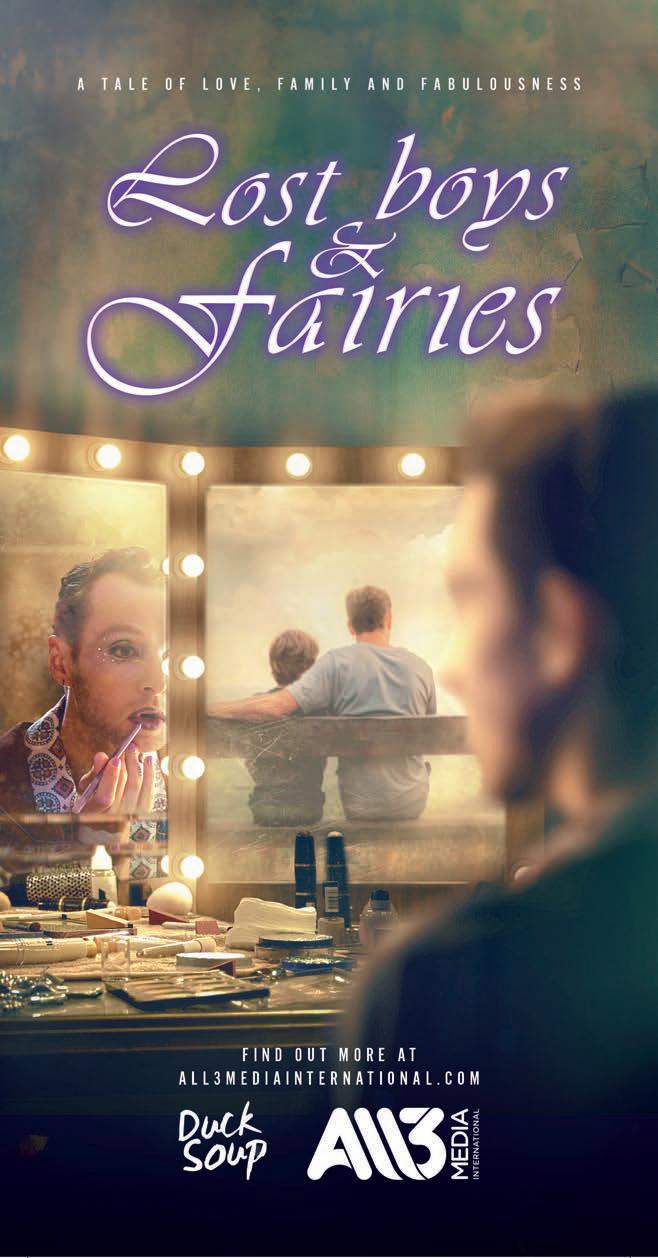

All3Media International

KEY CONTACTS:

David Swetman, Senior VP, Content & Commercial Strategy

Sally Habbershaw, Executive VP, Americas

Stephen Driscoll, Executive VP, EMEA & European Co-Productions

Sabrina Duguet, Executive VP, AsiaPac

PROGRAMS:

The Long Shadow: 7x60 min., crime/drama, New Pictures, ITV, U.K./Sundance Now, U.S. & Canada; Boat Story: 6x60 min., drama/thriller, Two Brothers Pictures, BBC One, U.K./Amazon Freevee, U.S. & Germany; Lost Boys & Fairies: 3x60 min., drama, Duck Soup, BBC One, U.K.; Trigger Point: S2 6x60 min., drama, HTM Television, ITV, U.K.; A Tree on a Hill: 6x60 min., drama, Fiction Factory, BBC Wales/S4C, Wales; Far North: 6x60 min., crime/drama, South Pacific Pictures, Warner Bros. Discovery, New Zealand/Paramount+, Australia/Sundance Now, U.S.; The Night Caller: 4x60 min., drama, Story Films, Channel 5, U.K.; The Tourist: S2 6x60 min., drama/thriller, Two Brothers Pictures, BBC One, U.K./Stan, Australia/ZDF, Germany; Dinosaur: 6x30 min., drama, Two Brothers Pictures, BBC One, U.K./Hulu, U.S.; The Hunted: 4x60 min., drama/thriller, Story Films, Channel 5, U.K.

“All3Media International’s drama offering features an outstanding variety of premium series. Leading our scripted slate is New Pictures’ The Long Shadow, a definitive depiction of the desperate five-year hunt for serial killer Peter Sutcliffe, sensitively focusing on the lives of the victims who crossed his path. The poignant drama Lost Boys & Fairies marks our first series with acclaimed producer Duck Soup. It’s a tender, beautifully told story of singer Gabriel and his partner Andy’s journey to adoption. Three series from award-winning Two Brothers Pictures also feature: the action-packed thriller Boat Story; the return of Jamie Dornan in season two of the smash-hit thriller The Tourist, this time set in Ireland; and the six-part comedy Dinosaur. Also featuring on our slate are HTM’s anticipated second season of Trigger Point, South Pacific Pictures’ hit true-crime drama Far North, Story Films’ tense new thrillers The Night Caller and The Hunted and Fiction Factory’s dark comedy-drama Tree on a Hill.”

—David Swetman, Senior VP, Content & Commercial Strategy

22

w www.all3mediainternational.com

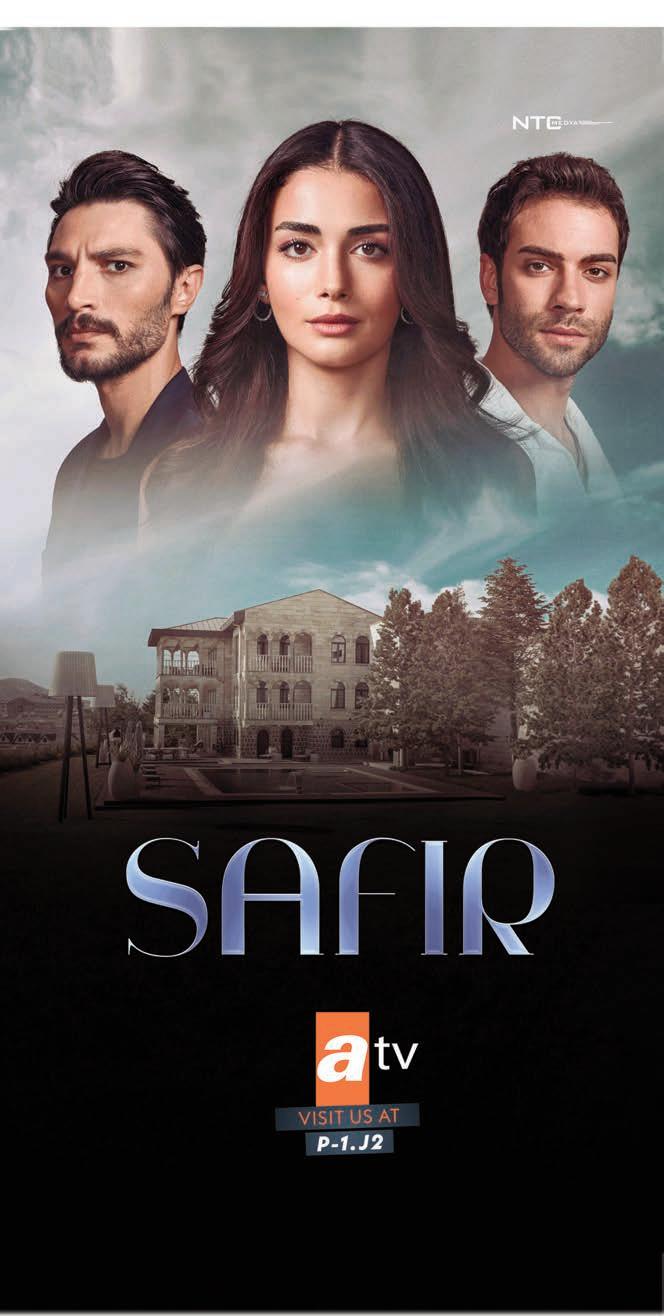

atv

O (90-212) 354-3701

w www.atvdistribution.com

m info@atvdistribution.com

KEY CONTACTS:

Müge Akar, Head, Sales, Europe, Asia & Africa

Emre Görentaş, Head, Sales, Americas & MENA

Gözde Dinç Özcan, Sales Deputy Manager

Merve Dogan, Sales Specialist

Merve Altuncu, Marketing Specialist

Sena Kul, Sales Assistant Specialist

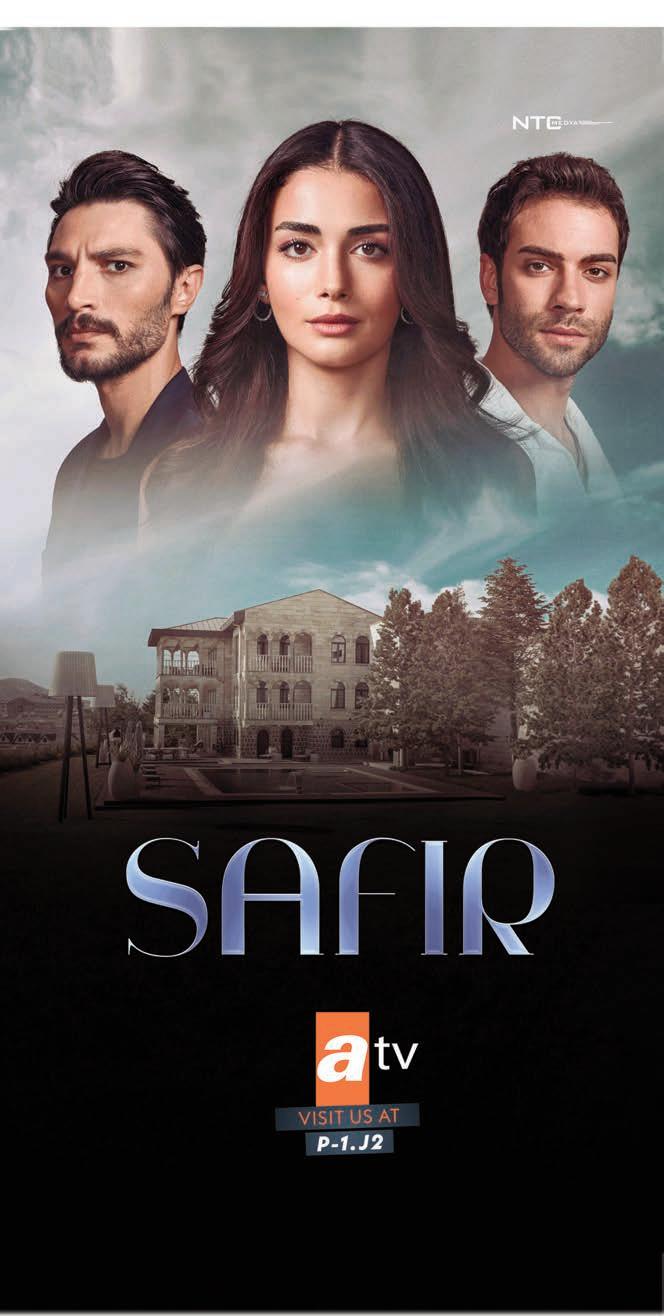

PROGRAMS:

Safir: 45 min. eps., drama; Street Birds: 45 min. eps., drama; A Little Sunshine: 45 min. eps., drama; The Father: 45 min. eps., drama; For My Family: 200+x45 min., drama; The Ottoman: 321+x45 min., drama.

Founded in 1993, atv’s reputation is built on creating unique dramas and exploring what has not been explored before. With years of experience and being the pioneer in various fields of Turkish dizis, atv plays a major role in Turkish drama being acknowledged universally. Moreover, atv continues to be more than just a channel but a trademark in its field of production with the same passion, excitement and quality. Throughout the years, atv Distribution has provided highquality dramas that lead the industry by the key factors of authentic yet global, unique but common.

24

BEC World

O (66) 262-3249

w www.becworld.com

m inter-sales@becworld.com

KEY CONTACTS:

Ziraviss Vindhanapisuth, VP, International Business Ratsarin Phaisantanamol, Senior Manager, International Business Account

PROGRAMS:

Love Destiny 2: 26x70 min., romance/drama/time travel, Broadcast Thai Television, Channel 3, Thailand; Love at First Night: 20x70 min., romance/comedy, Raklakorn, Channel 3, Thailand; Never Enough: 22x70 min., romance/drama, Thong Studio, Channel 3, Thailand; My Secret Zone: 16x70 min., romance/drama, Maker Group, Channel 3, Thailand; To the Moon and Back: 21x70 min., rom-com/drama, Maker Y, Channel 3, Thailand; Royal Doctor: 22x70 min., rom-com/time travel, Sonix Boom 2013, Channel 3, Thailand; Doctor Detective: 20x70 min., action/drama/romance, Magic If One Entertainment, Channel 3, Thailand; The Office Games: 16x70 min., romance/drama, BEC Studio; My Undercover Chef: 16x70 min., action/comedy, BEC Studio; The Scammer Games: 16x70 min., action/comedy, BEC Studio.

BEC World Public Company Limited (BEC) is a world-class media company leading the industry in producing and distributing Thai- language content for over 53 years in Thailand. BEC owns and operates a DTT (Channel 3) and a streaming platform (3Plus). BEC produces daily news, variety and approximately 1,000 hours of Thai drama series annually for its shoulder and prime-time slots, with over 150 renowned Thai celebrities.

BEC aims to produce and deliver fresh, relevant and engaging content for today’s audiences in Thailand and beyond through its licensing distribution network, digital and streaming platform, 3Plus, with both AVOD and SVOD services offering exclusive live broadcasts and over 10,000 hours of library content. To further support its growth, BEC has set up an in-house production house, BEC Studio, to produce original content for its platforms as well as other local and international partners.

26

Calinos Entertainment

O (90-216) 999-4999

w calinosentertainment.com

m info@calinosentertainment.com

KEY CONTACTS:

Asli Serim, Head, International Sales

Duda Rodrigues, Sales Executive, LatAm

Gamze Besler, Sales Manager, Asia, CIS, Russia & Baltics

Goryana Vasileva, OTT & Format Sales Manager

Akshit Sandhu, Format Acquisitions & Sales Manager

Burcu Anis, Marketing & PR Manager

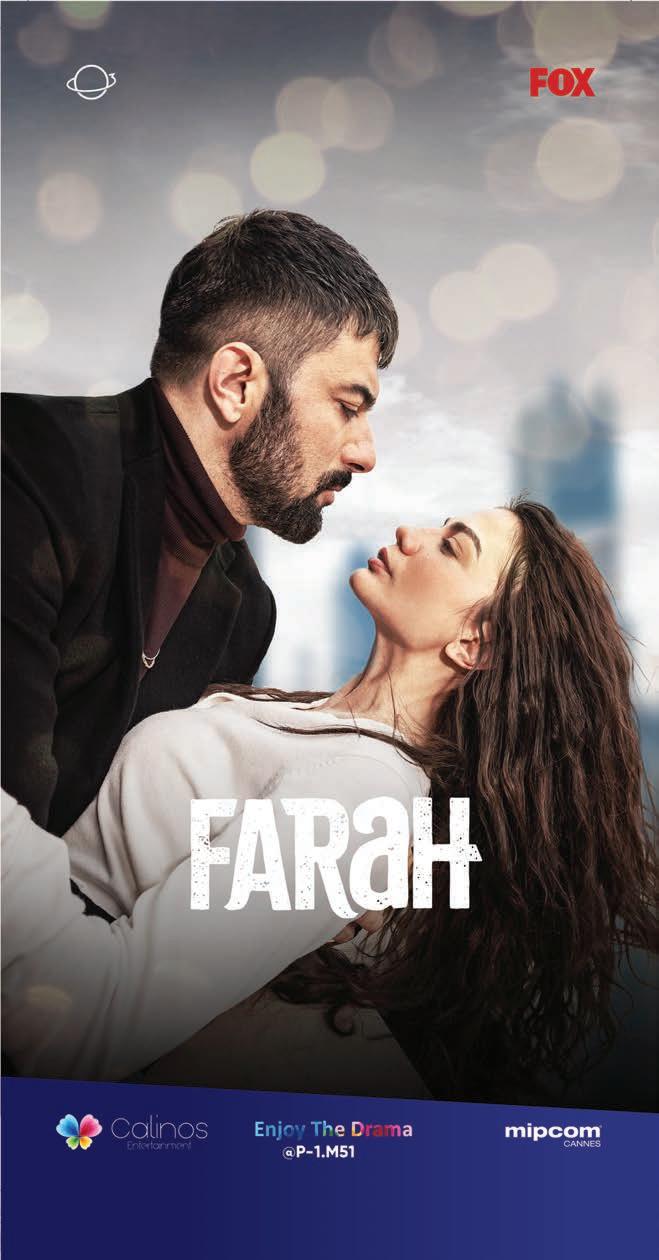

PROGRAMS:

Farah: S1 47 TV hrs./S2 on air, drama, O3 Medya, FOX, Turkey; Indefensible : S1 120x30 min./S2 on air/S3, crime/drama, Pixcom/Quebecor Content, TVA, Canada; EGO: 40 TV hrs., drama, Pastel Film, FOX, Turkey; Forbidden Fruit: S1-6 499 TV hrs., drama, Med Yapım, FOX, Turkey; Adela: 158 TV hrs., drama, Dream Film Production, Antena 1, Romania.

Calinos Entertainment is the first Turkish company to export Turkish series, movies and television programs on international platforms. So far, Calinos has sold over 112,000 hours of TV programming to more than 105 countries on five continents by distributing more than 200 programs. Calinos Entertainment’s mission is to spread joy to global audiences, to make them “enjoy the drama” by enhancing the presence of Calinos’ dramas on all platforms, in every country, with phenomenal content.

28

Cineflix Rights

O (44-20) 3179-5050

w www.cineflixrights.com

m sales@cineflix.com

KEY CONTACTS:

James Durie, Head, Scripted

Tom Misselbrook, Senior VP, Scripted Sales & Development

PROGRAMS:

Men Up: 1x90 min., drama/comedy, Quay Street Productions/BOOM, BBC One, U.K.; Late Bloomer: 8x30 min., drama/comedy, Pier 21 Films/Bell Media, Crave, Canada; The Doll Factory: 6x60 min., thriller, Buccaneer, Paramount+, U.K.; Good Morning Chuck: 10x60 min., drama/comedy, Connect3 Media/St-Laurent TV, Crave, Canada; Last King of The Cross: S1-2 18x60 min., crime/drama, HELIUM, Paramount+, Australia; Reginald the Vampire: S1-2 20x60 min., supernatural drama, Great Pacific Media/Modern Story/December Films/Cineflix Studios, SYFY, U.S.; Irvine Welsh’s Crime : S1-2 12x60 min., crime/drama, Buccaneer/Off Grid Film and TV, BritBox/ITVX, U.K.; The Minister: S1-2 16x60 min., political drama, Sagafilm, RÚV, Iceland/SVT, Sweden/NRK, Norway/DR, Denmark/Yle, Finland; Manayek: S1-3 30x60 min., crime/drama/thriller, Yoav Gross Productions, Kan 11, Israel; Happily Married: S1-3 28x60 min., crime/comedy, Productions Casablanca, Radio-Canada, Canada.

“Cineflix Rights is the U.K.’s largest independent TV content distributor, with a catalog of standout scripted series and movies as well as must-watch, returning factual programming. Our scripted slate includes Men Up from multi-award-winning writer Russell T Davies for BBC One; Crave’s millennial comedy Late Bloomer; The Doll Factory, a suspenseful period drama with a sharp modern gaze for Paramount+ U.K.; Last King of The Cross, featuring Tim Roth and Lincoln Younes for Paramount+ Australia; Reginald the Vampire, starring Spider-Man’s Jacob Batalon for SYFY; Irvine Welsh’s Crime with Dougray Scott in his International Emmy Award-winning role for ITVX/BritBox; Good Morning Chuck, an official selection at Canneseries 2023 for Crave; the International Emmy best drama award-winning espionage series Tehran for Apple TV+; Acorn TV’s cozy crime procedural Whitstable Pearl; the acclaimed Israeli police corruption series Manayek; and the Icelandic political drama The Minister.”

—James Durie, Head, Scripted

30

Dori Media Group

O (972-3) 647-8185

w www.dorimedia.com

m sales@dorimedia.com

KEY CONTACTS:

Nadav Palti, CEO

Carolina Sabbag, VP, Sales, Western Europe, U.S. & Canada

Maria Perez Campi, Director, Sales, LatAm & U.S. Hispanic

Camila Premet, Sales Manager, CEE, CIS & Africa

Haikal Jamari, Sales Manager, Asia & Middle East

PROGRAMS:

Amia: 8x45 min., political/action/drama, Dori Media, Reshet 13, Israel; Indal: 8x45 min., action/drama, Dori Media, HOT, Israel; Lalola: 20x30 min., comedy, Dori Media, ViX, LatAm & U.S. Hispanic; 15 a la Hora (Minimum Wage): 10x30 min., drama, Paramount; Shtisel: 33x45 min., drama, Abot Hameiri, yes, Israel; Hammam: 6x45 min., drama, Dori Media, Kan 11, Israel; Losing Alice: 8x60 min., psychological thriller, Dori Media, HOT, Israel; Nehama: 10x60 min., drama, Yoav Gross, HOT, Israel; Little Mom: 51x30 min., comedy, Yoav Gross, Reshet 13, Israel; Milan High: 54x30 min., teen drama, Dori Media/Abot Hameiri, Kan Kids, Israel.

“Dori Media Group produces and distributes dramas and comedies in various languages suitable for all clients. Our catalog contains over 150 titles of various genres, which we sell to a wide variety of audiences in more than 100 countries. The demand for scripted content (and especially dramas) in the last few years has increased, and in order to meet the demand, Dori Media is constantly producing new high-quality content targeting large platforms and channels. For MIPCOM 2023, we are delighted to bring our newest dramas, including the political action drama Amia, the action drama Indal and the two new remakes Lalola, the award-winning comedy, and 15 a la Hora (Minimum Wage), the highly acclaimed drama. We believe that remakes of excellent formats [alongside] new stories are the best combination for success. We are looking forward to meeting our clients again in Cannes and together offering viewers all around the world amazing content.”

—Nadav Palti, CEO

32

Eccho Rights

O (46-8) 5560-9380

w ecchorights.com

m felicia@ecchorights.com

KEY CONTACTS:

Herbert L. Kloiber, CEO

Handan Özkubat, Director, Turkish Drama

Adam Barth, Director, Co-Productions, Acquisitions & Development

PROGRAMS:

Fallen: 8x50 min., drama, Silver Reel/Night Train Media; The Vanishing Triangle: 6x45 min., drama, Park Films/Paperplane Productions/87 Films, Virgin Media, Ireland/Sundance Now, U.S.; The Inheritance: 8x22 min./4x45 min., drama, Lonesome Pine Productions/Peer Pressure, Channel 5, U.K.; Grapes of Love: 120x45 min., drama, Süreç Film, FOX, Turkey; Golden Boy: S2 131x45 min., drama, OGM Pictures, Star TV, Turkey; Ömer: S2 80x45 min., drama, OGM Pictures, Star TV, Turkey; Legacy: S4 254x45 min., drama, Karamel Yapım, Kanal 7, Turkey; Redemption: S2 273x23 min., drama, Karamel Yapım, Kanal 7, Turkey; Threesome: S2 8x23 min., drama, Yellow Bird, Viaplay, Sweden; Everyone But Us: S2 10x22 min., drama, Warner Bros. International, discovery+, Sweden.

“Eccho Rights is launching a record slate this fall with no less than eight returning series together with some of our strongest launches ever. From Night Train Media and Silver Reel, we are launching the amazing new drama Fallen , directed by Matt Hastings ( The Handmaid’s Tale, The Originals). We are also very [proud] to launch The Inheritance , which started as the number one series in the U.K. On the Turkish side, we have four returning series together with the brand-new Grapes of Love from Süreç Film and a brand-new project from O3 Productions. Since last summer, Eccho Rights is part of Night Train Media, which focuses on Englishlanguage drama, while Eccho does distribution for any language. With our five offices around the world and a target to invest in new development and distribution, we are well equipped for the coming year as producers will need more support to retain and develop top drama series.”

Herbert L. Kloiber, CEO

34

Global Agency

O (90-212) 240-5769

w www.theglobalagency.tv

KEY CONTACTS:

Izzet Pinto, Founder & CEO

Işıl Türkşen, Sales Director, Asia & Baltics

Şenay Taş, Sales Director, CEE & Greece

Ivan Sanchez, Sales Director, LatAm

Gözde Sergili, Sales Director, Europe

Deniz Tüzün, Sales Director, Russia, CIS, Poland, North America, U.K., Australia & New Zealand

Miroslav Radojevic, Sales Director, MENA & Africa

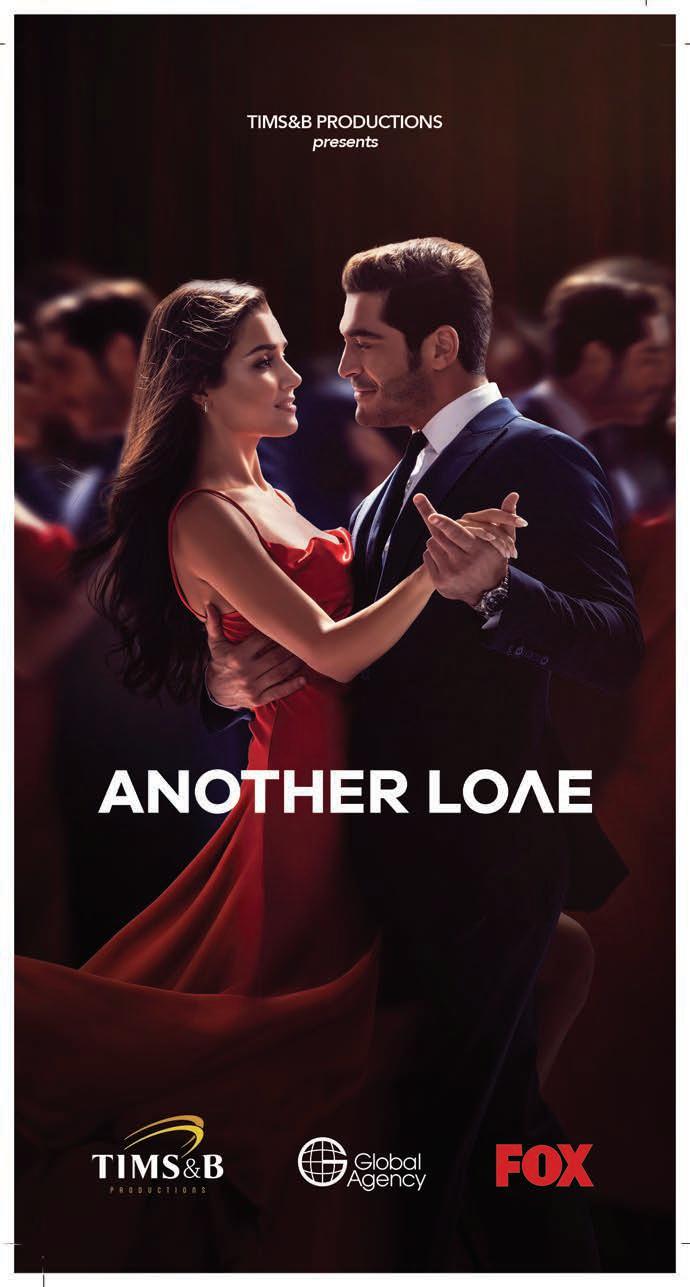

PROGRAMS:

Another Love: drama, TIMS&B Productions; One Love: drama, Gold Film; Vendetta: drama, Unik Film/Rains Pictures; Lonely Hearts: 100x60 min., drama, Bros Film; Modern Woman: 9x60 min., dramedy, TIMS&B Productions; The Beauty Inside:

42x60 min., dramedy, Gold Film; The Game of My Destiny: 85x60 min., drama, NG Media; When a Man Loves: 26x60 min., dramedy, Gold Film; Redemption: 112x60 min., drama, 25 Film; Mr. Wrong: 43x60 min., dramedy, Gold Film.

“Global Agency, the world’s leading independent TV content distributor, offers a broad portfolio of powerful dramas and innovative formats that continue to capture the imagination of audiences worldwide.

Putting customers first, our dedicated team blends top-quality and original content with a dynamic marketing approach. Growing quickly to encompass more than 150 projects, Global Agency has enjoyed international hits with hard-hitting dramas such as 1001 Nights, Magnificent Century, Broken Pieces and Mother. The agency draws upon a rich pool of creativity and has diversified into formats such as lifestyle, talent, dating and game shows, achieving success with programs such as Shopping Monsters, Keep Your Light Shining, Perfect Bride and The Remix.

Its executives attend more than 15 major entertainment content market events annually to reinforce its worldwide reach. With its powerful programs, trendsetting formats and innovative strategies, Global Agency is well-placed to keep providing ‘content that creates buzz.’ ”

—Izzet Pinto, Founder & CEO

36

GMA Network

O (632) 8333-7633/34

w www.gmaworldwide.tv

m gwi@gmanetwork.com

KEY CONTACTS:

Roxanne J. Barcelona, VP & Consultant, Worldwide Division

Reena Garingan, Consultant, Business Development & Strategic Content Partnerships

PROGRAMS:

Love the Way You Are: 20x45 min., romance/drama/action, GMA Network, Philippines; The Missing Husband: 40x45 min., drama/mystery, GMA Network, Philippines; Love Before Sunrise: 35x45 min., romance/drama, GMA Network, Philippines; Royal Blood: 35x45 min., drama/crime/thriller, GMA Network, Philippines; AraBella: 40x45 min., drama, GMA Network, Philippines; Maria Clara and Ibarra: 54x45 min., historical drama/fantasy, GMA Network, Philippines; Hands on the Dream: 82x45 min., medical drama, GMA Network, Philippines; The Fake Life: 37x45 min., family/drama, GMA Network, Philippines; Break Shot: 35x45 min., drama, GMA Network, Philippines; Return to Paradise: 33x45 min., romance, GMA Network, Philippines.

“GMA has embraced a ‘glocal’ outlook in producing content aimed at local and global markets. While the shows are locally produced, all have global appeal. Our drama series have universal themes and stories that revolve around love, friendship, family and ambition, which resonate with viewers worldwide. The dramas also combine elements that transcend cultural boundaries with a respect for diversity. It’s a delicate balance that requires a thoughtful approach to storytelling.

GMA delivers programs and drama series that are global, cutting-edge and high quality. We remain committed to providing premium Filipino content to international buyers, with GMA programs dubbed into different languages and well-loved by international viewers.”

Roxanne J. Barcelona, VP & Consultant, Worldwide Division

38

Inter Medya

O (90-212) 231-0102

w www.intermedya.tv

m info@intermedya.tv

KEY CONTACTS:

Can Okan, Founder & CEO

Ahmet Ziyalar, President & COO

Beatriz Cea Okan, VP & Head, Sales & Acquisitions

Hasret Ozcan, VP & Head, Legal & Business Affairs

Pelin Koray, Sales

Sinem Aliskan, Sales

Melissa Simsek, Sales

Neset Ersoy, Sales

Zeynep Balto, Sales

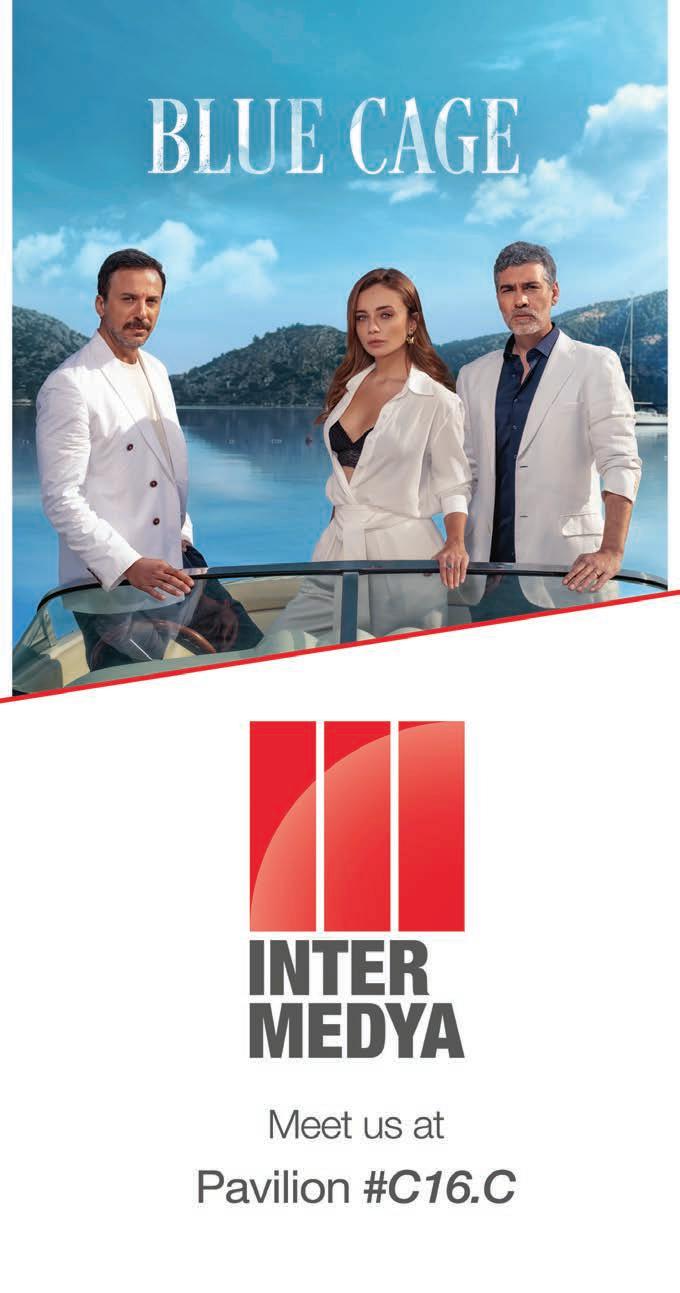

PROGRAMS:

Blue Cage: drama, O3 Medya/Inter Medya/Telemundo Global Studios; Deception: drama, TIMS&B Productions; Tuzak: 82x45 min., drama, Acun Medya/Fabrika Yapım; Another Chance: 138x45 min., drama, BKM; Poison Ivy: 83x45 min., drama, TMC Film/Alim Yapım; Hicran: 210x45 min., drama, Filmevi; Leylifler: 120x45 min., drama, Alim Yapım; The Trusted: 74x45 min., drama, TIMS&B Productions; Scorpion: 91x45 min., drama, 1441 Productions; Last Summer: 93x45 min., drama, O3 Medya.

Inter Medya is a dynamic media powerhouse founded in 1992. From being a film distribution company operating within the domestic market, we have grown into an international entity distributing content in over 160 countries. Our products range from TV series and telenovelas to reality and game shows. As part of our ongoing expansion, we have ventured into production, with our own production department launching in 2019. Today, we stand not just as a successful content distributor but also as a powerful business developer and consultant with significant experience in the industry.

40

Nicely Entertainment

O (1-323) 682-8029

w www.nicelytv.com

m info@nicelytv.com

KEY CONTACTS:

Vanessa Shapiro, CEO

Scott Kirkpatrick, Executive VP, Distribution & Co-Productions

Scott Kirkpatrick, Executive VP, Distribution & Co-Productions

PROGRAMS:

A Christmas Frequency: 1x90 min., holiday/romance, Nicely Entertainment, Hulu, U.S.; The Holiday Proposal Plan: 1x90 min., holiday/romance, Nicely Entertainment/The Ninth House, Lifetime, U.S.; Super Icyclone: 1x90 min., disaster, Nicely Entertainment/Northern Soul Film Company, Canada; Romance at the Vineyard: 1x90 min., romance, Nicely Entertainment/Jaggi Entertainment, Australia; The Abigail Mysteries : 1x90 min., mystery/faith/romance, Nicely Entertainment, Great American Family, U.S.; A Christmas Vintage: 1x90 min., holiday/romance, G It’s Entertainment, U.S.; Labor, Lies & Murder : 1x90 min., thriller, Triventure Films, Lifetime, U.S.; The Christmas Venue : 1x90 min., holiday/romance, 377 Films/Traverse Family, U.S.; Reporting for Christmas : 1x90 min., holiday/romance, Very Merry Entertainment, Hulu, U.S.; Christmas at the Amish Bakery : 1x90 min., holiday/romance, Nicely Entertainment, UPtv, U.S.

“Based in Los Angeles and founded in 2020, Nicely Entertainment brings 20 brand-new ‘feel-good’ TV movies to the global market each year and has built a library of over 50 films. Although Nicely’s main focus has been producing original romance and Christmas films for U.S. and VOD broadcasters, the company has expanded to include narrative TV series, including our newest family-friendly holiday series for CBC Canada, The Christmas Checklist. Nicely’s first series, the Netflix original Dive Club, premiered in September 2021 to rave reviews. Its Netflix original YA series Gymnastics Academy: A Second Chance premiered globally in September 2022. Nicely has developed several projects as co-productions in Australia and Canada and continues to produce original content for major U.S. outlets such as Lifetime, Hallmark, Netflix, Roku, AMC and GAC Media.”

—Vanessa Shapiro, CEO

42

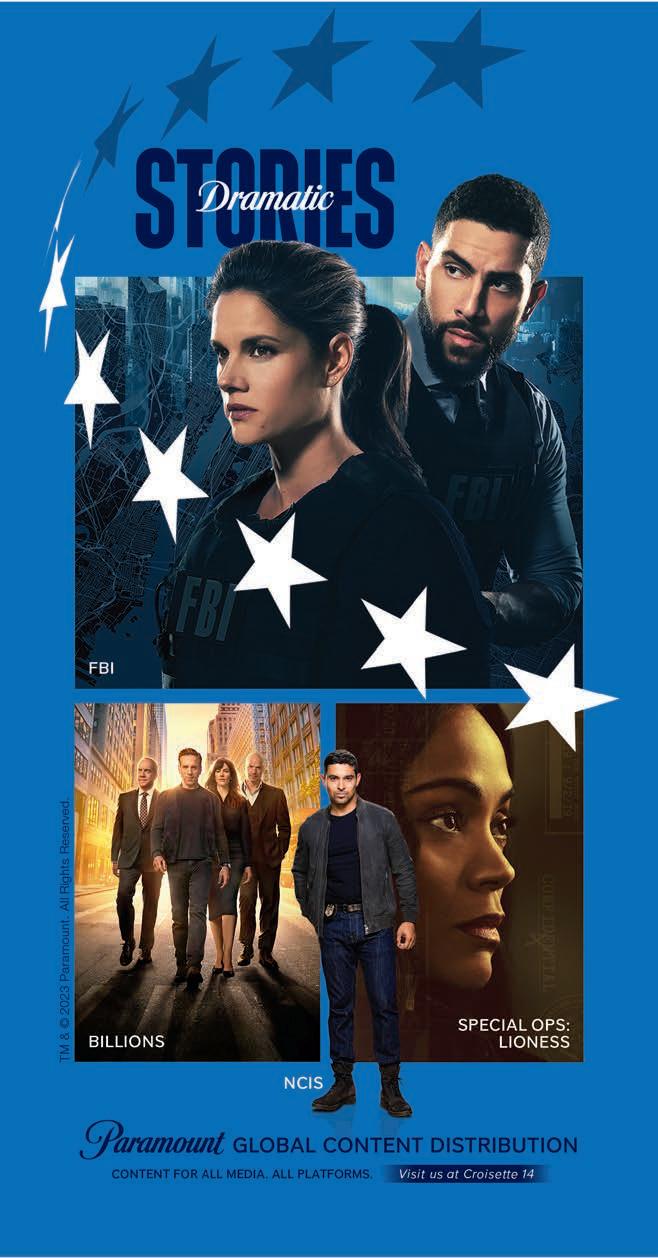

Paramount Global Content Distribution

O (1-323) 956-9994

w www.paramount.com

m gdgsales@viacomcbs.com

KEY CONTACTS:

Dan Cohen, Chief Content Licensing Officer, Paramount Global & President, Republic Pictures

Lisa Kramer, President, International TV Licensing

PROGRAMS:

Elsbeth: 60 min. eps., drama, CBS Studios, CBS, U.S.; Matlock: 60 min. eps., drama, CBS Studios, CBS, U.S.; The Turkish Detective: 60 min. eps., drama, Miramax/Ay Yapım; Bargain: 30 min. eps., drama, Paramount+/TVING/SLL/Climax Studio, Paramount+; NCIS: Sydney: 60 min. eps., drama, CBS Studios/Paramount Australia/Endemol Shine Australia, Paramount+ Australia.

“This year, we have fantastic new dramas, including titles such as Elsbeth, Matlock and The Turkish Detective Elsbeth comes from the incredible team of Robert and Michelle King, starring Carrie Preston as the beloved character Elsbeth Tascioni from The Good Wife and The Good Fight. Inspired by the classic television series of the same name, Matlock stars Emmy and Academy Award winner Kathy Bates as Madeline ‘Matty’ Matlock. Based on the series of bestselling novels by Barbara Nadel, The Turkish Detective is a warm yet thrilling detective drama set in the multifaceted city of Istanbul. Our division, Paramount Global Content Distribution, will be at MIPCOM to show the top-quality content that we have to offer to licensees around the world. The slate we have to present encompasses gripping storytelling, incredible talent in front of and behind the cameras and is relatable to viewers across the globe.”

—Lisa Kramer, President, International TV Licensing

44

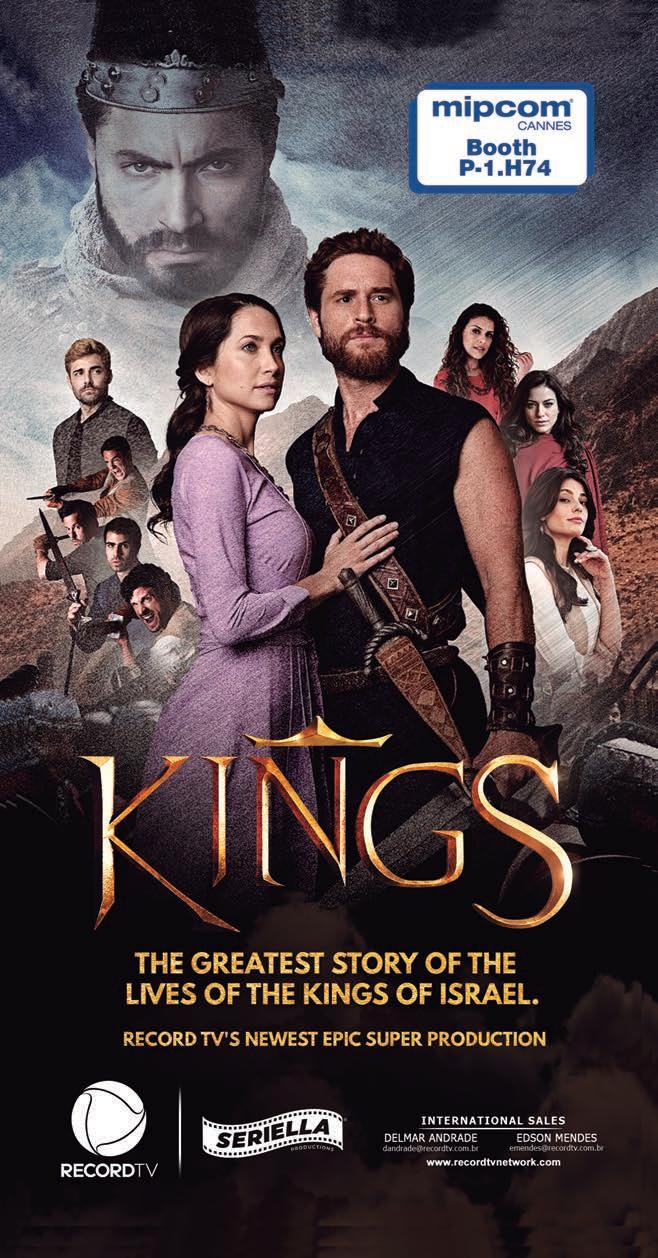

Record TV

O (55-11) 3300-4022

w www.recordtvnetwork.com

m emendes@recordtv.com.br

KEY CONTACTS:

Delmar Andrade, International Sales Director

Edson Pfutznereiter Mendes, International Sales Manager

PROGRAMS:

Kings: 205x45 min., biblical drama, Record TV, Brazil; Genesis: 221x45 min., biblical drama, Record TV, Brazil; Jesus : 196x45 min., biblical drama, Record TV, Brazil; Moses and the Ten Commandments: 242x45 min., biblical drama, Record TV, Brazil; The Promised Land: 179x45 min., biblical drama, Record TV, Brazil; Ultimate Love: 148x45 min., romance/drama, Record TV, Brazil; Topíssima: 145x45 min., romance/ drama, Record TV, Brazil; The Slave Isaura: 167x45 min., historical drama, Record TV, Brazil; The Slave Mother: 151x45 min., historical drama, Record TV, Brazil; The Rich and Lazarus: 187x45 min., biblical telenovela, Record TV, Brazil.

Record TV was created in September 1953. Back then, Record was one of the broadcasters that helped popular Brazilian music evolve, and its history is made up of a series of successful shows. The company’s initiatives help Brazil’s society and culture. Record TV is today the oldest broadcaster in Brazil, still scoring excellent ratings and extending its market share in the Brazilian landscape. Record TV has strengthened its performance in the international market by giving foreign clients and viewers some of the highest quality products from Brazil. The company’s list of products features telenovelas, series and documentaries, synonymous with information, entertainment, culture, diversity and tremendous success.

46

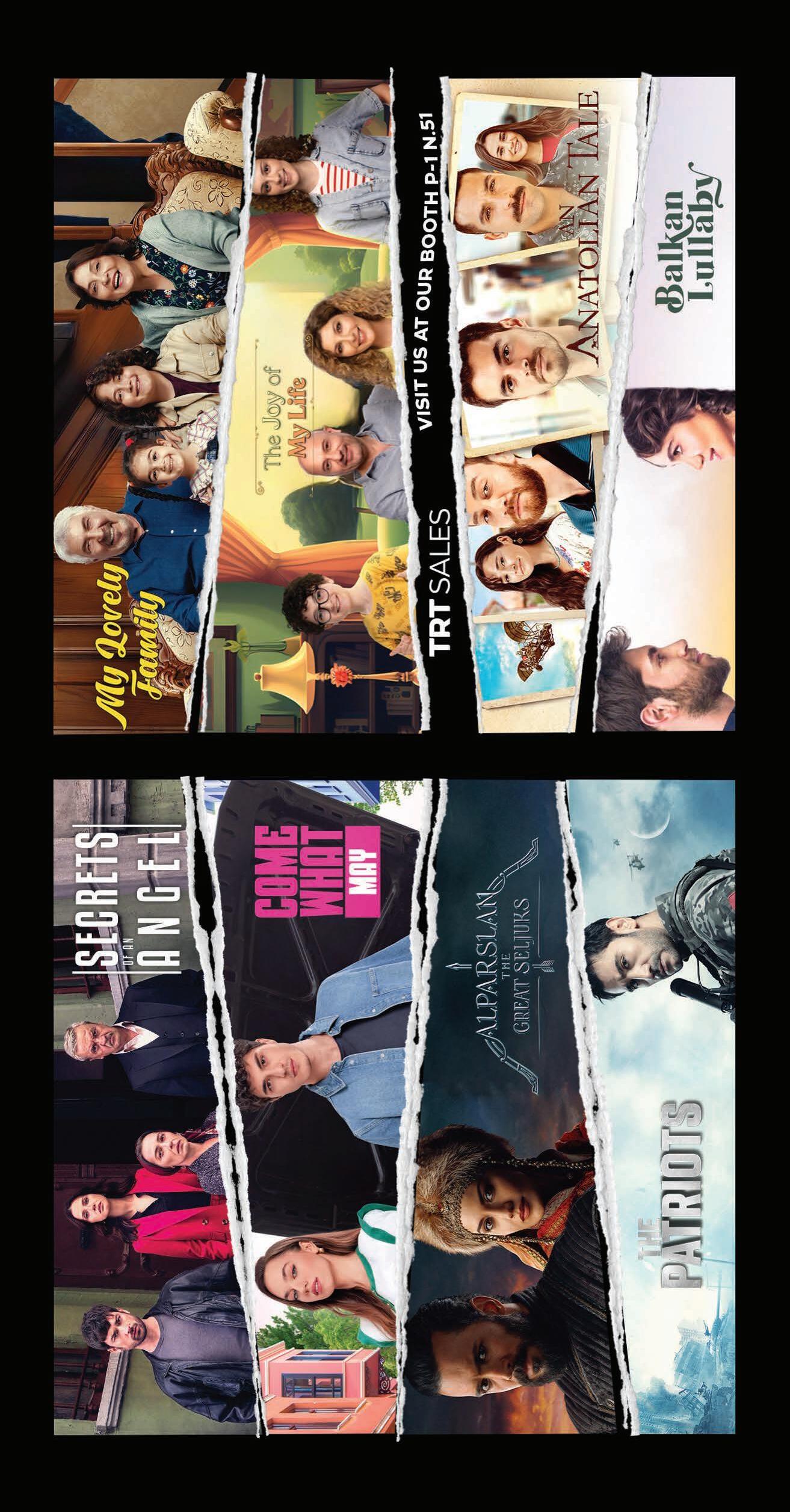

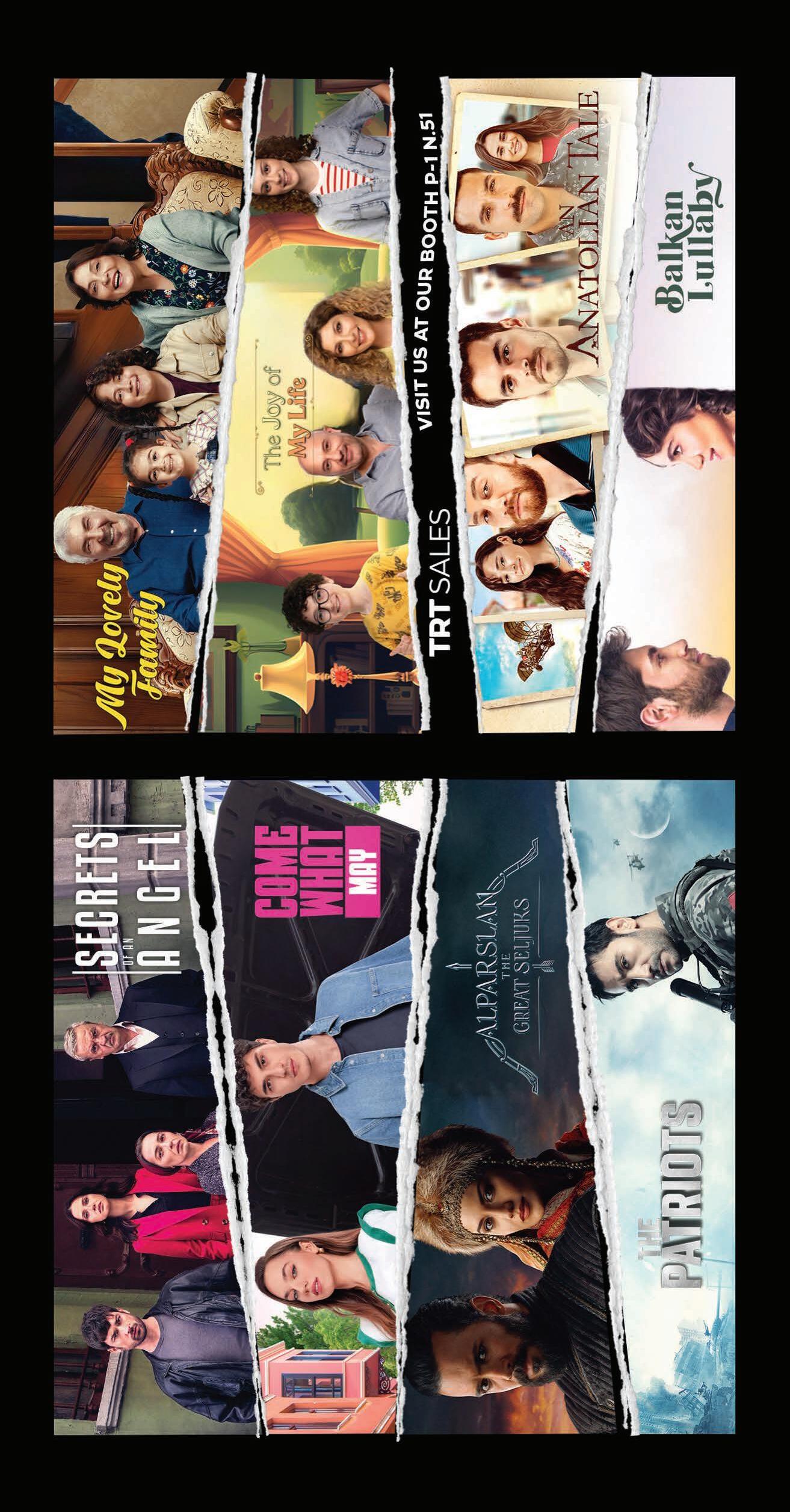

Turkish Radio and Television Corporation (TRT)

O (90-312) 463-2540

w www.trtsales.com

m isik.uras@trt.net.tr

KEY CONTACTS:

Mustafa İlbeyli, Director, Advertising & Sales

Mustafa Aydoğan, Sales Manager

Mustafa Aydoğan, Sales Manager

PROGRAMS:

Come What May: 100x45 min., comedy/drama/family, NGM Yapım, TRT, Turkey; The Joy of Life: 100x45 min., comedy/family, Goya Entertainment, TRT, Turkey; My Lovely Family: 100x45 min., comedy/drama/family, Fabrika Yapım, TRT, Turkey; Secrets of an Angel: 90x45 min., drama, Gold Film, TRT, Turkey; An Anatolian Tale: 365x45 min., comedy/drama, Köprü Film, TRT, Turkey; The Shadow Team: 263x45 min., action/drama, TIMS&B Productions, TRT, Turkey; The Great Seljuks: Alparslan: 198x45 min., action/history/war, Akli Film, TRT, Turkey; Barbaros: Sultan’s Order: 53x45 min., action/history, ES Film, TRT, Turkey; The Patriots: 100x45 min., action, Bozdağ Film, TRT, Turkey; The Town Doctor: 107x45 min., drama/romance, ARC Film, TRT, Turkey.

“I am thrilled to share our commitment to delivering exceptional television content to audiences around the world. Our mission has always been to create and distribute content that captivates and entertains our audience.

In today’s ever-evolving media landscape, it’s important to find ways to reach diverse markets and platforms. We pride ourselves on our dedication to quality, innovation and storytelling that transcends borders. Our portfolio reflects the diversity of the human experience.

Our team is driven by a passion for content that knows no boundaries. We believe in the power of television to connect people, cultures and ideas. In an era of constant change, we embrace emerging technologies, adapt to shifting consumer preferences and forge strategic partnerships that enable us to thrive in the digital age.

We look forward to continuing this journey of growth, creativity and collaboration. Together with our valued partners, we are committed to shaping the future of television and bringing exceptional stories to screens everywhere. Thank you for your ongoing support and trust in TRT.”

Mustafa

İlbeyli, Director, Advertising & Sales

48

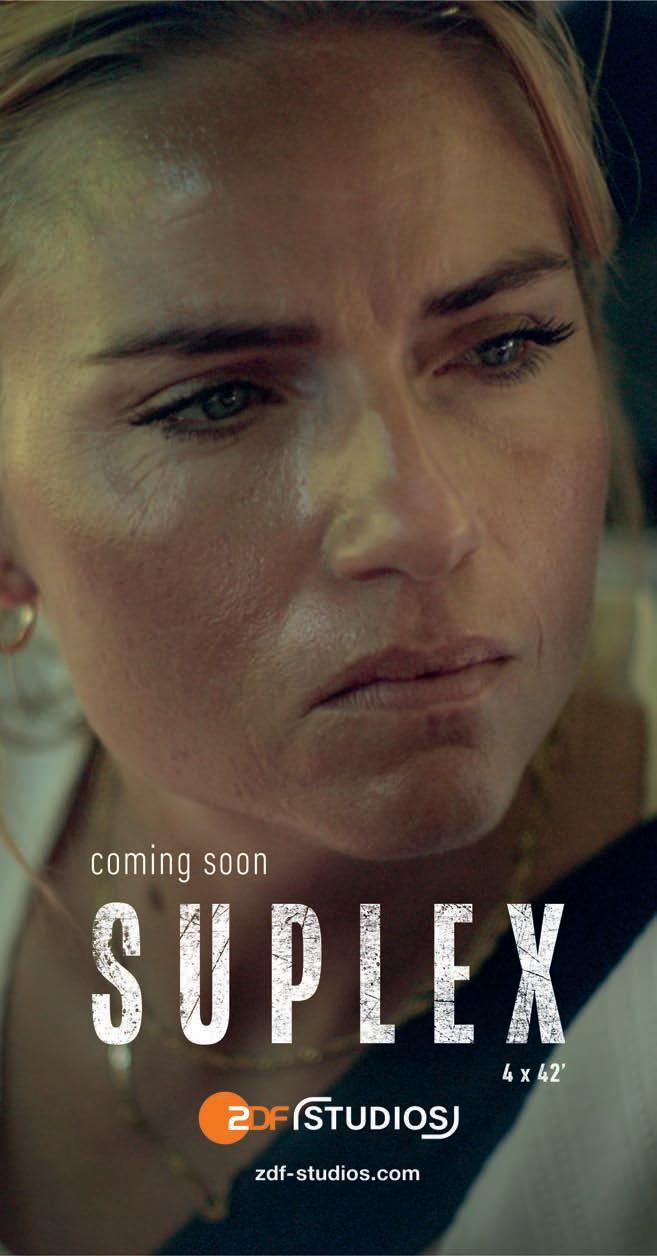

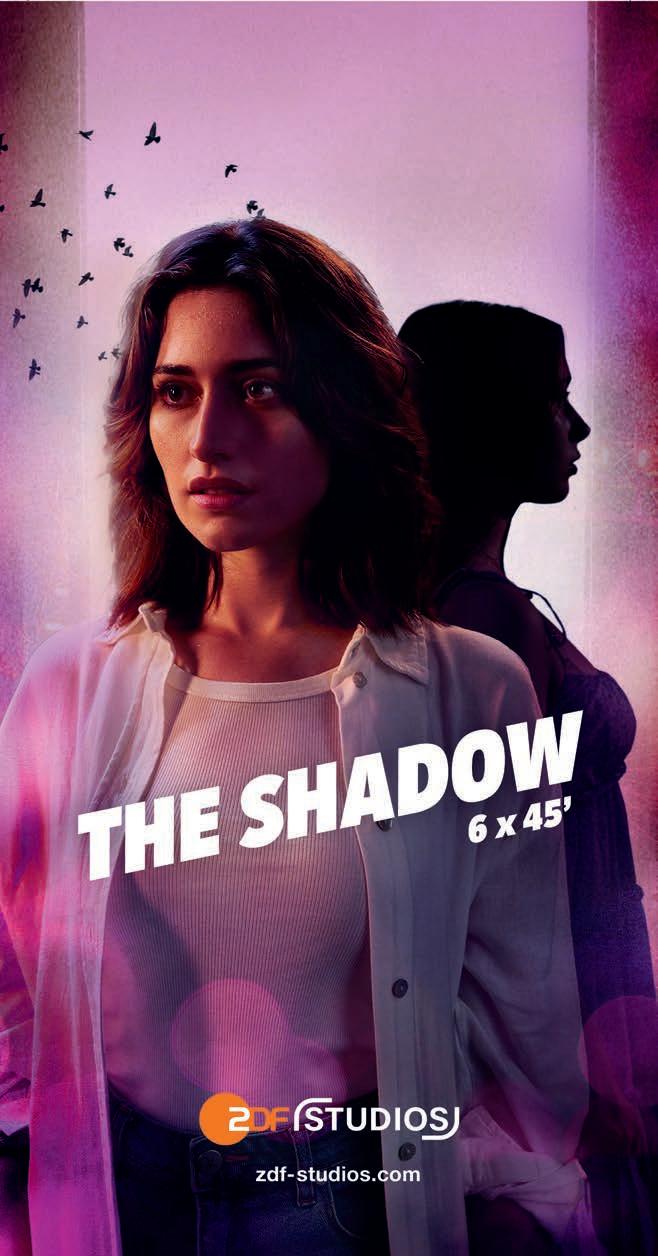

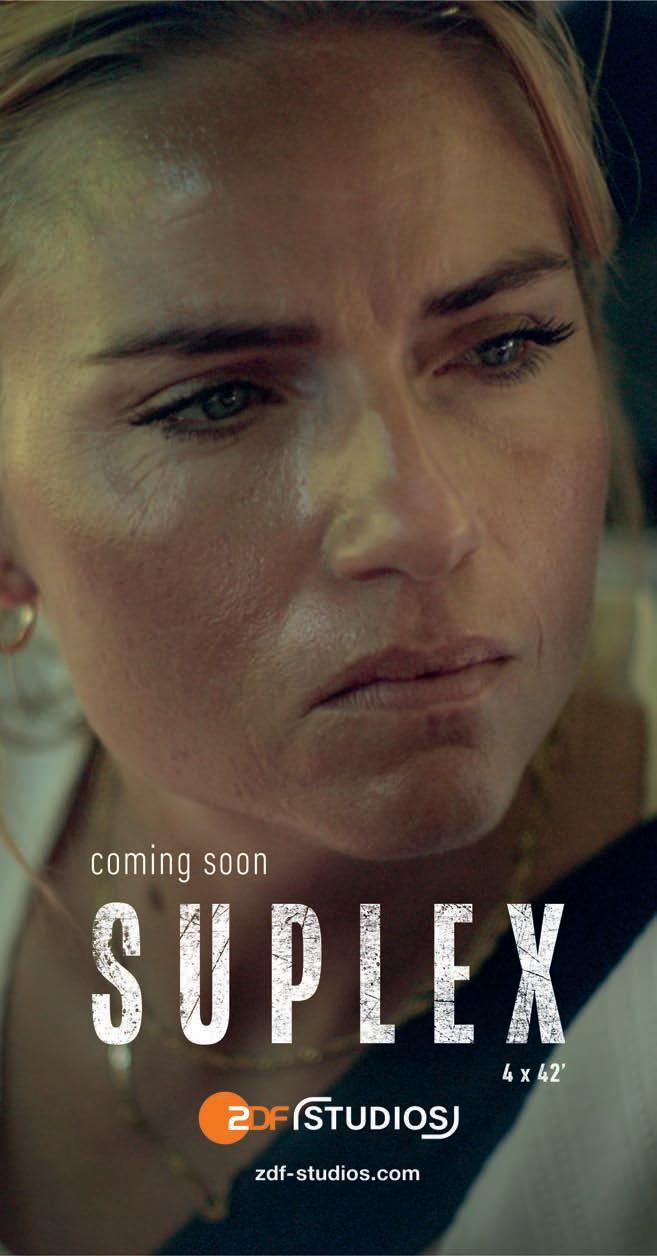

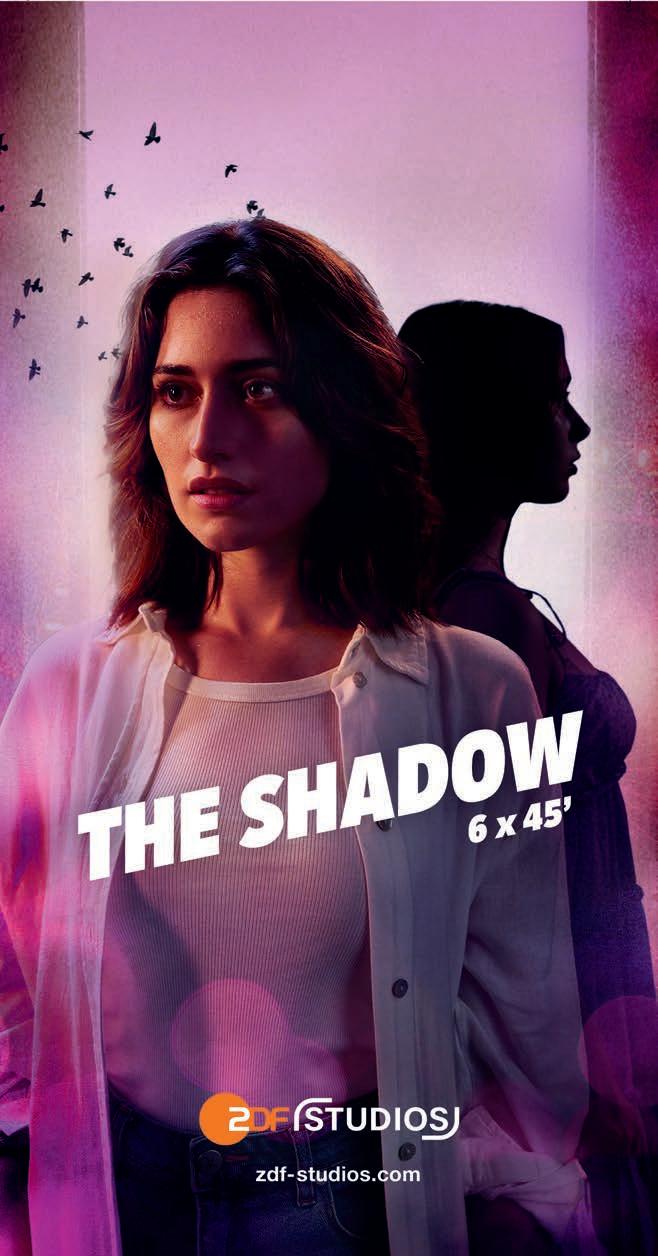

ZDF Studios

O (49) 6131-9910

w www.zdf-studios.com

m info@zdf-studios.com

KEY CONTACTS:

Dr. Markus Schäfer, President & CEO

Robert Franke, VP Drama

Yuliya Fischer, Director Drama

Susanne Frank, Director Drama

Mirela Nastase, Director Drama

PROGRAMS:

The Swarm: 8x45 min., drama, Schwarm TV Production/Bravado

Fiction/Beside Productions/ATHOS, France Télévisions/Rai Fiction/Viaplay Group/Hulu Japan/ORF/SRF/ZDF; Stories to Stay

Awake: S2 4x50 min., crime/suspense, Prointel e Isla Audiovisual/Paramount; Before We Die: S2 5x52 min., crime/suspense, Eagle Eye Drama; Feelings: 10x20 min., drama, Studio Zentral; Boundless : 6x45 min./1x120 min., crime/suspense, Mono Films/Fulwell 73 Productions/ZDF Studios/RTVE/Prime Video; Clean Sweep : 6x52 min., crime/suspense, ShinAwiL/Incendo; The Window: 10x45 min., drama, Boogie Entertainment/Fuji Television Network/ZDF Studios; Top Dog: S2 6x45 min., drama, Filmlance; Legacy: 104x45 min., love/romance, Tshedza Pictures.

“At ZDF Studios, our ethos centers on forging relationships and strategic collaborations with producers globally. We actively seek to comprehend their visions, ensuring our projects echo our shared ambitions. Take, for instance, The Swarm —a testament to the power of co-production and the incredible outcomes diverse partnerships can achieve in the worldwide arena. Similarly, Boundless epitomizes our zeal for narratives that bridge cultures, intertwining historical depth with modern-day significance. Our extensive portfolio celebrates a kaleidoscope of themes and perspectives, always underscoring tales with a global resonance. Additionally, ventures like Clean Sweep depict the balance we strive for: engrossing stories that merge episodic intrigue with overarching, character-centric narratives. As our journey unfolds, we remain steadfast in our commitment to championing stories that not only captivate but also mirror the intricate mosaic of our collective human journey.”

—Robert Franke, VP Drama

50

If you wish to reserve a TV Drama Premiere, please contact Ricardo Guise (rguise@worldscreen.com) or Dana Mattison (dmattison@worldscreen.com) Please visit TVDramaPremieres.com to see examples of previous Premieres. SHOWCASE YOUR NEW SERIES ON

Mansha Daswani

Mansha Daswani

Tom Fussell CEO BBC

Tom Fussell CEO BBC

Scott Kirkpatrick, Executive VP, Distribution & Co-Productions

Scott Kirkpatrick, Executive VP, Distribution & Co-Productions

Mustafa Aydoğan, Sales Manager

Mustafa Aydoğan, Sales Manager