TV Asia

©2022 WSN INC.

1123 Broadway, #1207 New York, NY 10010 Phone: (212) 924-7620 Fax: (212) 924-6940 Website: www.tvasia.ws

TV Asia

©2022 WSN INC.

1123 Broadway, #1207 New York, NY 10010 Phone: (212) 924-7620 Fax: (212) 924-6940 Website: www.tvasia.ws

As Netflix, Disney+ and other global OTT ser vices face slowing subscriber gains in their most mature markets, all eyes are on where AsiaPac sits in the next wave of the streaming wars. By all accounts, the region is set to be a hub of activity in the years ahead.

“Investors are increasingly focused on enhanced scale, improved monetization and real profitability across global, local and regional online video platforms,” Vivek Couto, executive director and co-founder of Media Partners Asia (MPA), said as the research firm released its Asia Pacific Online Video & Broadband Distribution 2022 report earlier this year. “In this context, Asia Pacific continues to have a critical role in the future of the global online video industry. The region remains the largest growth contributor to global online video customers and users today and is emerging as a significant contributor to revenue growth. With the U.S. and Europe fast maturing and China inaccessible, AsiaPac’s large markets—India, Indonesia, Japan, Korea and Thailand—will be increasingly important to global plat forms. Each of these markets requires local content and distribution strategies with long-term investment.”

AsiaPac video industry revenues are expected to hit $169 billion by 2027, powered by strong gains in SVOD and AVOD revenues, per MPA. Subscription and ad rev enues from free, pay and online platforms across 14 AsiaPacific markets will hit $142.5 billion this year, MPA says, a 6.4 percent year-on-year gain. Through 2027, the sector is expected to have a 3.5 percent compound annual growth rate (CAGR), with online video growing by 8.2 percent and pay TV by 2.1 percent, while free TV will diminish by 2 percent.

By revenues, China, Japan and India will remain the largest video markets in AsiaPac, followed by South Korea and Australia. Taiwan, currently in sixth place, will be overtaken by Indonesia by 2027. AVOD and SVOD will each have a 22 percent share of video industry rev enues by 2027, MPA notes, up from 17 percent today. Free TV’s share will drop from 25 percent to 19 percent, with pay TV dropping from 40 percent to 37 percent.

My report in this edition surveys several distribu tors heading to Asia TV Forum—finally back in person in Singapore—about what the streaming wars have meant for their businesses in the region this year. We also hear from Astro’s Euan Smith—who takes on the role of CEO early next year—about the role that pow erful pay-TV incumbents can play as aggregators in this new ecosystem. —Mansha Daswani

As Singapore gears up to host the first in-person Asia TV Forum since 2019, several leading distributors discuss what’s driving their businesses in the region.

Our second annual TV Asia Screenings Festival features a mix of dramas, docs and kids’ shows that will be available at Asia TV Forum.

The CEO-designate of the Malaysian platform discusses aggregation, content investments and upgrading the consumer experience.

Ricardo Seguin Guise Publisher Anna Carugati Group Editorial Director Mansha Daswani Editor Kristin Brzoznowski Executive Editor Jamie Stalcup Associate Editor David Diehl Production & Design Director Simon Weaver Online Director Dana Mattison Sales & Marketing Director Genovick Acevedo Sales & Marketing Coordinator Andrea Moreno Business Affairs Manager Ricardo Seguin Guise President Anna Carugati Executive VP Mansha Daswani Associate Publisher & VP of Strategic Development

The ABS-CBN Corporation highlight 2 Good 2 Be True tells a story of trust, forgiveness and love. When mechanic Eloy inadvertently crosses paths with Ali, their lives are changed forever in this romance. In the fantasy adventure Darna, a young woman destined to protect a magical artifact has to find the courage within herself to face malevolent forces. Also on the slate is Flower of Evil , based on the original format created by Jeong-hui Ryu and produced by Studio Dragon and CJ ENM. The thriller sees a detective investigate her husband, who becomes a suspect in a serial killer case. “These dramas make the human spirit shine through tough situations people have been in to varying degrees,” says Wincess Lee Gonzalez, ABS-CBN’s sales head for Asia, Latin America and OTT.

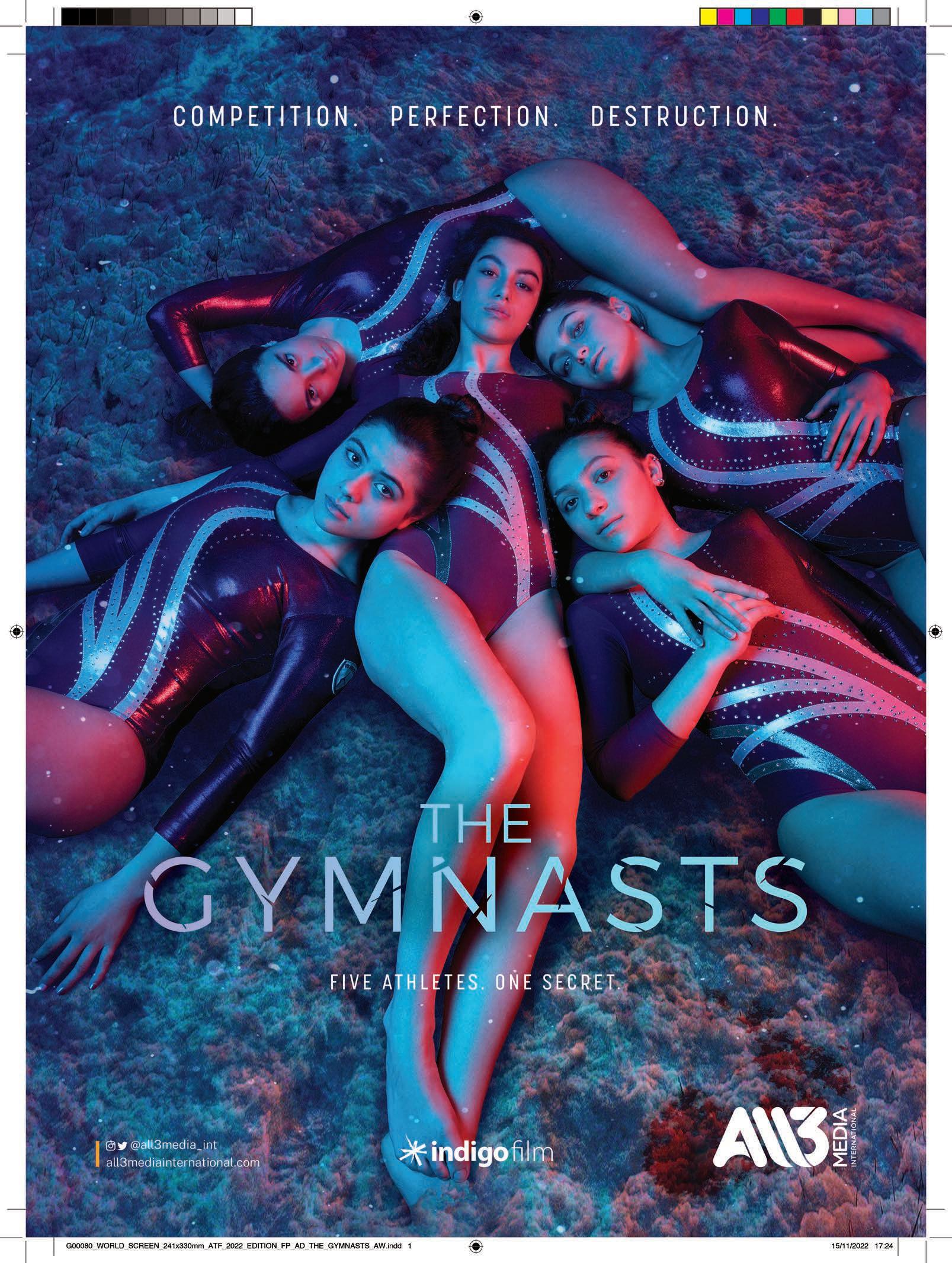

Leading All3Media International’s ATF highlights, The Larkins follows the adventures of the titular family, a loyal and hardworking unit living in the Kent countryside who share a disinterest in authority. Among All3Media International’s factual titles, Rise of the Billionaires examines how Jeff Bezos, Elon Musk, Mark Zuckerberg, Sergey Brin and Larry Page have shaped the modern world. Additional factual programs include Wild Oman: Wonder of Arabia, Stolen: Catching the Art Thieves and Saving Venice. Scripted formats are also part of the company’s offering. “Scripted formats offer a more creatively and economically efficient route for our buyers, who are currently seeing increased production budgets and competition with content on the global streamers,” says Sabrina Duguet, executive VP for the Asia Pacific.

ATV’s slate for ATF features the brand-new drama series A Little Sunshine . The drama centers on Hakan and Elif, a happily married couple whose life is only missing a child. When Hakan gets in an accident, he is found dead with a little girl beside him, and Elif learns she is listed as the girl’s biological mother. As she takes the child under her care, Elif discovers more about her husband’s double life, including that he had a lot of debt. “The series is performing very well in its local market, and it has already attracted great attention from our key international markets,” says Müge Akar, head of sales for Europe, Asia and Africa at ATV. “As we are increasing our presence in Asia, A Little Sunshine will accelerate this trend.”

“Our dramas are always rooted in values we hold dear as people and as a company.”

—Wincess Lee Gonzalez

“A Little Sunshine is a perfect, tailormade show.”

—Müge Akar

“We are looking forward to being back at the market to reconnect with clients and friends at ATF.”

—Sabrina DuguetThe Larkins

Banijay Rights’ Marie Antoinette centers on the young French queen. “Growing from a stubborn young princess navigating the rules of the French court under pressure to continue the Bourbon line to a true fashion icon, she impressed with her natural charisma and recreated life in Versailles in her image: free, independent and a feminist ahead of her time,” says Rashmi Bajpai, executive VP of sales for Asia. Rogue Heroes, written by Steven Knight (Peaky Blinders), provides a dramatized account of how the special forces unit SAS was formed under extraordinary circumstances during World War II. In addition, the singing competition format Le Plus Grand Karaoké de France (The Nation’s Greatest Karaoke) sees 1,000 people perform in front of a 6,000-person audience as singing teachers, musicians and vocal coaches choose the best.

The dinosaur-led comedy adventure series Gigantosaurus tops Cyber Group Studios’ ATF highlights. Following four dinosaurs as they grow in the world of Cretacia, “Gigantosaurus is Cyber Group Studios’ biggest hit and has already proven to be successful in more than 194 territories around the world,” says Pauline Berard, international sales executive. Season two of the slapstick comedy series Taffy, targeted at 6- to 10-year-olds and families, sees the raccoon put in double the effort to keep his bow and protect his undercover identity from the inventive and crafty Bentley. Droners, meanwhile, “addresses the issues of ecology and climate change in a very smooth way,” Berard says. “It has a message of hope for the future, as just like the characters, we can always adapt and find solutions to protect nature.”

eOne Family Brands’ Transformers: EarthSpark introduces a new generation of Transformers—the first to be born on Earth. Together with the humans who take them in, they redefine what it means to be a family. PJ Masks Power Heroes features the classic heroes alongside new faces with all-new powers. A second season of Baby Alive, which has garnered 851 million views and 81 million hours watched on YouTube, is also on offer. “Buyers at ATF are looking for content that will connect with today’s kids—a new generation that eagerly embraces diversity and celebrates individual expression,” says Monica Candiani, executive VP of content sales. “Our content reflects those priorities and explores other universal themes like friendship, self-expression and giving back while always putting fun first.”

“The Asian market is key for Cyber Group Studios, and we look forward to strengthening our position in the region.”

—Pauline BerardTransformers: EarthSpark Rogue Heroes Droners Marie Antoinette / Rogue Heroes / The Nation’s Greatest Karaoke Gigantosaurus / Taffy / Droners

“We’re looking forward to meeting more of our clients post-pandemic and in person, which is irreplaceable.”

—Rashmi Bajpai

“It’s an exciting time as we continue to delve into Hasbro’s rich catalog of IP to create world-class content.”

—Monica Candiani

On offer from Fremantle, the game show Password pairs celebrities and members of the public to attempt to convey mystery words to each other. “In Asia, we have seen a renaissance of our evergreen game shows like Family Feud and The Price is Right ,” says Ganesh Rajaram, general manager and executive VP of sales in Asia. “Password will be another great addition to this.” Made of Money with Brian Cox sees the Succession star explore what money “means and does to people of different social standing across the world,” Rajaram says. “Given the economic issues facing the world today, the relevance of this cannot be underestimated.” The Elon Musk Show gives viewers a glimpse at the billionaire through the eyes of his closest friends, family and colleagues.

GMA Network is showcasing two new titles at ATF this year: Maria Clara and Ibarra and Luv Is: Caught in His Arms Maria Clara and Ibarra marks the latest milestone prime-time drama of GMA Network. It tells the story of a young woman who finds herself in the world of Noli Me Tángere, a novel by José Rizal, a Philippine national hero. Luv Is: Caught in His Arms features a young woman who works as a cook for five notoriously mischievous grandsons—one of whom she falls in love with. “We believe that GMA dramas appeal to clients looking for themes that revolve around the values of family and country, which give hope and touch the hearts of viewers,” says Roxanne J. Barcelona, VP of GMA Network’s Worldwide Division.

Leading Guang Dong Winsing Company’s highlights, GG Bond: Kung Fu Pork Choppers embraces elements of love, friendship, heroism, humor and adventure as it follows a team of five young superhero pigs and their super-powered pets. They use their Chinese kung-fu skills to defeat evil and keep the peace. GG Bond: Ocean Mission , the seventh film in the franchise, sees GG Bond encounter a friend named Noah, who is devoted to searching for his brother in the deep ocean. Featuring an AI rescue school bus capable of transforming into different vehicles, GOGOBUS encourages basic scientific thinking skills while teaching preschoolers about modern science technology, life science, natural history and more.

“Fremantle is a one-stop shop for all your programming needs.”

—Ganesh Rajaram

“GMA remains committed to providing premium Filipino content to its clients worldwide.”

—Roxanne J. BarcelonaPassword / Made of Money with Brian Cox / The Elon Musk Show

Loaded in Paradise , a brand-new format from ITV Studios, sees party-loving pairs island hop around Greece in a race to take control of a gold card loaded with money. “In Loaded in Paradise , we see a show that is more than just a race or a game of tag, as it encapsulates aspects of ‘captive reality,’ along with travel and maybe a few elements of dating formats,” says Ayesha Surty, senior VP of licensing for Asia and India. Meanwhile, Bad Chefs addresses the trend of younger generations becoming overly reliant on food delivery apps during the pandemic. The contestants will compete to cook basic recipes. In The Voice Generations , a new spin-off of The Voice , groups of at least two people from different generations of any age compete.

Old Enough! / Vocals Like Locals / First Kiss Boys/First Kiss Ladies

Old Enough!, in which young children run errands on their own for the first time, leads Nippon TV’s slate. “ Old Enough! follows in the tradition of lovable family programming that is original, unpredictable and the sweetest entertainment,” says Yuki Akehi, director of international business development. Vocals Like Locals brings together amateur singers from all over the world to sing hits from their countries. Also on offer, the First Kiss Boys drama series is paired with the mockumentary First Kiss Ladies . The former follows a schoolboy who has his first kiss with a beautiful young girl, only to find out later that she is part of a dating reality show, First Kiss Ladies. In First Kiss Ladies, six women live under the same roof and try to capture the heart of one man.

Passion Distribution has on offer Dinosaur with Stephen Fry, fronted by the eponymous British actor, comedian and writer. “Dinosaurs are a subject of endless interest and fascination in every country on the planet, and using cutting-edge technology, this groundbreaking series immerses audiences in a 360-degree dinosaur world,” says Robert Bassett, senior sales manager. Football Dreams: The Academy goes behind the scenes at Premier League team Crystal Palace, giving viewers a rare insight into what it takes to make it as a professional footballer. Love in the Flesh, available finished and as a format, sees couples who have only ever dated each other online meet in person for the first time. The series “puts a new and innovative twist on the traditional reality dating show,” Bassett says.

“We are looking forward to introducing our exciting new slate of unscripted content.”

—Robert Bassett

“We are hoping to find partners who will embark with us on the journey of expanding great Asian stories into fun and innovative entertainment.”

—Yuki AkehiFootball Dreams: The Academy

“The demand for quality content has exploded, and the appetite for something different and fresh is stronger than ever.”

—Ayesha Surty

Bad ChefsFirst Kiss Boys/First Kiss Ladies Loaded in Paradise / Bad Chefs / The Voice Generations

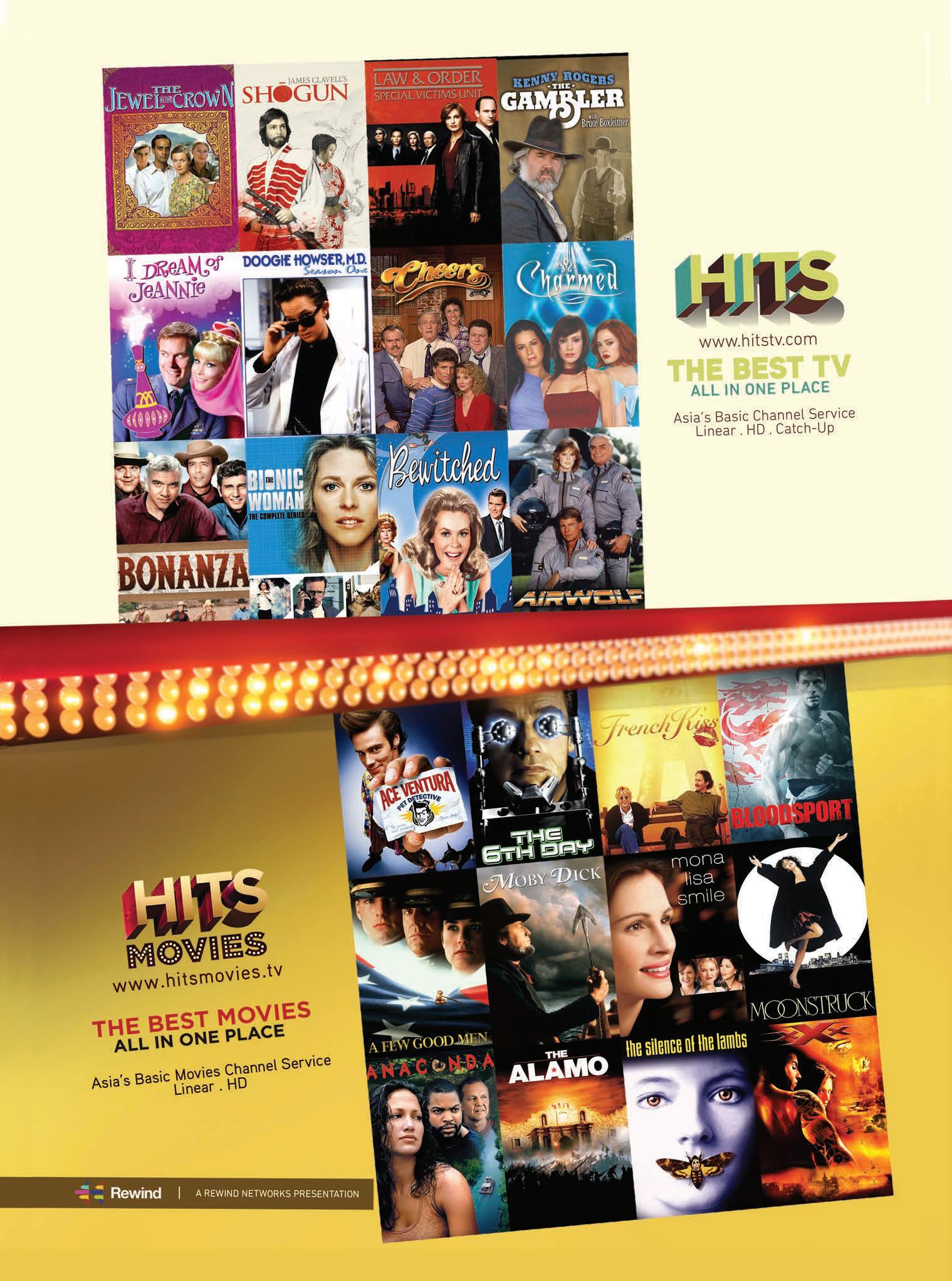

Rewind Networks’ bouquet includes the channels HITS and HITS MOVIES, which are in 24 million households across 14 countries. HITS’ offering includes series such as Airwolf, I Dream of Jeannie, The Winds of War, Shogun, Cheers and more. The HITS MOVIES channel, meanwhile, “showcases everyone’s favorite blockbusters from the 1960s through the early 2000s,” says Sandie Lee, executive VP and channel head. Its catalog features classics such as Casablanca and Gone with the Wind, as well as a slew of box-office comedies, including 50 First Dates, Miss Congeniality and Mean Girls. It also includes a variety of Christmas classics such as Scrooged, It’s a Wonderful Life and Trading Places. “Our content offerings have consistently stayed true to the brand proposition of ‘the best TV and movies—all in one place,’ ” Lee notes.

Vegesaurs / FriendZSpace / 100% Wolf

Studio 100 Media’s slate features Vegesaurs , a preschool series set in a prehistoric world populated by creatures such as Tricarrotops and Pea-Rexes. “ Vegesaurs is a fresh and unique take on the dinosaur genre with characters you can only find in this show,” says Vanessa Windhager, sales executive. She adds, “Vegetables and fruits were never so much fun!” In FriendZSpace, three human kids venture into deep space to locate planets, find alien kids and make friends. Also on offer, 100% Wolf follows the adventures of Freddy, a pink poodle who should have been a werewolf instead. “The overall concept of 100% Wolf underlines that heroes come in many forms, displaying diversity by strength in difference and self-confidence by choosing your own path and reaching your potential,” Windhager says.

This year, there have been strong hits from the Warner Bros. Discovery portfolio, including the HBO original House of the Dragon and shows made in AsiaPac. “In addition to local relevance, ‘travelability’ remains front of mind for our Asia productions, and we’re always looking for new ways to bring this content to more audiences,” says Jae Chang, senior VP, head of home entertainment and TV distribution for India, Southeast Asia and Korea at Warner Bros. Discovery. “For example, our local shows from India and Korea have aired across our networks portfolio, as well as on HBO GO and discovery+ in Southeast Asia.” Selectively premiering Discovery content on HBO GO has also proven valuable, Chang says, with titles such as Johnny vs Amber and House of Hammer growing viewership and engagement.

“Our selections of shows and movies are carefully curated and based mainly on the fact that the content resonates well with our viewers.”

—Sandie Lee

“Warner Bros. Discovery is home to many of the most iconic brands and franchises.”

—Jae ChangHouse of

theDragon on

HBO GO100% Wolf I Dream of Jeannie on HITS

“Our mission in the kids’ entertainment world is to bring brands to life that are content-driven and entertain kids and families on every platform.”

—Vanessa Windhager

It’s been a long three years since the content com munity convened in Singapore for the Asia TV Forum & Market (ATF). And according to RX Singa pore, there’s plenty of pent-up demand for a market focused on this still-growing region. While the recessionary fears plaguing the rest of the world certainly have media execs in Asia concerned, the top-line news is that the streaming sector is still expanding, pay TV isn’t dead, and free-to-air broadcasters are winning audiences with top-notch, locally resonant content.

The most significant evolution since the last in-person ATF is, of course, the dramatic ramp-up in the streaming wars, with Disney+, Netflix and Prime Video, among others, looking to grow their Asian subscriber bases as they hit maturity in most other parts of the world. At the same time, local and regional players continue to see usage gains.

“In Asia, where local content is the key driver for all chan nels and platforms, competition means that buyers will be more creative and open to finding new content to resonate with their audiences,” says Augustus Dulgaro, executive VP of distribution for the Asia Pacific at ITV Studios. “It’s worth remembering that almost every partner is, in effect, a streamer, as they pivot to a content anytime, anywhere strategy to meet the demands of audiences with their own catch-up, SVOD and AVOD offerings. Given the depth and breadth of ITV’s slate and business, we have the privilege of working with most clients in the region and are well-placed to respond to the needs of the marketplace as it has changed and morphed over the last few years—and will in the future.”

Ganesh Rajaram, general manager and executive VP for Asia at Fremantle, reports that the gains in the streaming sector have boosted the company’s business in the region, partic ular ly for its scripted slate. “A few years ago, before the big streamers landed in Asia, the scripted market was primarily dominated by English scripted content. The global streamers brought multi-language, multicultural offerings from many

different countries to Asia. This helped create a voracious appetite for high-quality scripted content, regardless of where it came from.”

The rapid proliferation of OTT platforms “has become a big opportunity for us to expand our distribution, and we have changed our strategy accordingly,” observes Keisuke Miyata, head of sales in the international business development unit at Japanese media giant Nippon TV. “Some of our popular shows have sold as finished content to major streamers over the last 12-plus months, such as Old Enough! and multiple hit drama series to Netflix, as well as our hit anime series The Files of Young Kindaichi to Disney+. The anime genre is also a huge driving force in the streaming business. We have many deals with Southeast Asian platforms to license/sublicense and dis tribute our ever-popular anime series such as HUNTER X HUNTER and DEATH NOTE.”

The intensely competitive OTT sector in India has turned that market into one of All3Media International’s best territo ries for scripted-format adaptations, reports Sabrina Duguet, the company’s executive VP for the region. And the company’s drama business is growing fast across AsiaPac, Duguet notes, powered in part by the emergence of new players.

“They’re setting up in Asia, they need local content, and then they say, now we can diversify,” Duguet explains. “On the scripted side, Japan is still one of our strongest territories. They love crime, detective, investigation and British—as you know, most of the catalog is that! It’s a very reliable market. We probably had our best year last year in Korea in scripted. The All3Media International slate becoming broader and bigger budget, and VOD platforms needing to compete, diversify and do something a little different have given us great results.”

And it’s not just British and European drama resonating across AsiaPac, distributors note.

what’s driving their businesses in the region.

Uzbekistan, Afghanistan, Pakistan, Russia, Kazakhstan, Indonesia, India and Malaysia are among the best markets for Turkish series, according to Müge Akar, the head of sales for Europe, Asia and Africa at ATV. “We are also targeting certain new regions due to the popularity of Turkish dramas. We are

willing to include more territories with the new markets we are heading to.”

Akar continues, “We have licensed our most-watched dra mas—The Ottoman, For My Family, Destan, Maria and Mustafa and Between Us—to Uzbekistan, Malaysia, Indonesia, Pakistan and Afghanistan, and we are continuously adding more series to our catalog overseas. We also aim to reach out to Thailand, Taiwan and Vietnam.”

Akar observes that audiences are responding to Turkish dra ma themes that are “unique, universal and can demon strate the world’s sincerity of life. We became thrilled when we noticed Turkish dramas’ immense popularity and fan base throughout Asia.”

Drama produced across the region is also traveling well. “With the battle for eyeballs in Asia, we have started receiving inter est for simulcast releases from regional OTT players,” com ments Wincess Lee Gonzalez, sales head for Asia, Latin America and OTT at ABS-CBN Corporation in the Philippines. “We already actively do this with our OTT clients for their Philippines feed, offering simulcast or even up to 72 hours before TV airing. We hope this would be a natural progression for the efforts we have been putting into promoting Filipino content to the region and the world.”

Drama is driving ABS-CBN’s AsiaPac business, notably romance and family series. “Interestingly, even traditional lin ear clients are now looking for shorter dramas—20 episodes to about a max of 60 episodes—whereas before, the longer, the better it was for them,” she continues. “Global, especially regional players, continue to need local content to capture the market, aside from originals that are being commissioned more and more now. We sell a lot to the local players too, with movies also a special focus for them. Our film library is big—we offer commercial films, restored classics and even indies that have made their mark in international film festivals.”

At GMA Network, “family and romance dramas travel well within the region as cultures in Asia have many similarities,” agrees Roxanne J. Barcelona, VP of the Worldwide Division. Barcelona adds that India, Thailand, China and Japan present the greatest new opportunities for GMA Network content across AsiaPac.

Nippon TV’s Miyata explains that Japanese scripted content is also traveling well, thanks partly to the proliferating OTT landscape. “The strategy by the streamers to exclusively acquire new, competitive and subscription-driving content will continue. An example would be our latest series Love with a Case , by the scriptwriter Yuji Sakamoto ( Mother , Woman –My Life for My Children— ). Before the show started airing on Nippon TV, the streaming rights were sold widely across Asia, including South Korea, Hong Kong and Taiwan, and it ranked number one in Taiwan.”

Thanks to its successful scripted-formats business, All3Media International is steadily building a slate of Asian dramas to distribute, including Masoom, the Indian version of the Irish drama Blood produced for Disney+ Hotstar. “We’re thrilled to see this premium adaptation proving a ratings and award-winning success in India,” Duguet explains. “We’ve started having some offers on this Indian remake of our for mat. It’s great that the format and the local version travel.”

All3Media International has also clinched its first scriptedformat deal in Malaysia, with Double Vision adapting the hit U.K. series Liar

The non-scripted format business across AsiaPac is also far ing well for a raft of distributors, All3Media International

Passion Distribution’s lineup for ATF includes a new season of Help! My House is Haunted ATV is looking to conquer new markets with its Turkish drama series, including The Father

included, with Duguet highlighting India as a key new territory in this space.

“For formats, we’ve seen a renaissance of our evergreen game-show titles like Family Feud and The Price is Right across Asia,” adds Rajaram at Fremantle. “Clients across the region are

renewing hundreds of episodes almost quarterly because of the tremendous success they are having with these titles.”

Rajaram adds, “With more markets opening up post-Covid, we’d like to see even more format productions sprout across the region. Another area is scripted formats—we are beginning to see a lot of interest in markets like China and Korea to make local versions of some of our hit dramas, and we hope to make a few of these versions in 2023.”

Dulgaro at ITV Studios is also bullish on the prospects of driving more scripted-format deals in Asia, particularly from India and South Korea. “ITV Studios has recently partnered with JTBC/Studio LuluLala on a South Korean version of Cleaning Up as well as with BBC Studios [and] Applause Entertainment on an Indian version of 35 Days.”

Nippon TV is also focusing on both non-scripted and scripted format sales, Miyata says. “Having the IP to shows leads to for mat sales for local adaptations. One recent example of this would be Old Enough!, which has been a hit show on Nippon TV for over 30 years. The series has also sold well as a finished program and has been adapted as an unscripted format in many international countries such as Italy, the U.K., Vietnam, China and Singapore.”

Other sectors of the content business are also receiving a boost thanks to the streaming wars, including high-quality fac tual fare. “Streamers certainly are an ever-growing part of our sales strategy in the region, and last year was a very positive one in this respect,” says Robert Bassett, senior sales manager at Passion Distribution. “Several of our shows found a local home, such as Drag Race Philippines landing on discovery+/HBO GO locally while the show launched on global streamer WOW Presents Plus.”

Specialist factual, including science, engineering and history, is doing particularly well, Bassett says, highlighting the ATF launch of Dinosaur with Stephen Fry. As far as key territories, meanwhile, “India is a market where we have been very suc cessful in the past, including bringing the format Idiotest to StarPlus; however, it was an area that struggled during the pan demic, so we are keen to work on some new projects,” Bassett continues. “We are already in a number of exciting discussions and expect 2023 to be a very productive one in this territory.”

Kids’ content also continues to be sought after by both legacy and new players alike.

“With global players expanding their presence in the region and local players emerging, there have been more opportuni ties to expand the distribution of our franchise shows like Peppa Pig, Transformers: EarthSpark and the My Little Pony brand to much wider audiences,” says Monica Candiani, executive VP of content sales at Entertainment One (eOne) Family Brands.

Per Candiani, eOne Family Brands is focusing on new and returning opportunities across the region. Still, markets like India, Indonesia, the Philippines and Thailand “are top of mind for our sales team” at present.

According to Pauline Berard, international sales executive at Cyber Group Studios, the French animation production and distribution outfit has been steadily building its AsiaPac busi ness across both distribution and co-production.

“In February 2022, we announced our partnership with Scrawl Animation. Our first common project is Alex Player —a co-production between Cyber Group Studios, Scrawl Animation and the Italian-based studio Graphilm Entertain ment—that will take you into the world of esports competition,” Berard explains.

At Annecy last year, Cyber Group Studios unveiled a pact with Nippon Animation to release the feature-length title Nanami and the Quest for Atlantis, which will be followed by a brand-new animated series based on the classic 1994 anime Tico and Friends

Looking ahead, Indonesia is an important market for Cyber Group Studios, Berard explains. “In June, Cyber Group Studios organized an off-site trip reuniting all the teams from France, the U.S., Italy, the U.K. and Singapore. That’s when, following a conversation with Choon Meng Seng, CEO of Scrawl Ani mation, our Singapore-based sister company, the idea came up to focus on the strategy for one particular territory every six months. We decided to start with Indonesia. So, we come to ATF to meet as many Indonesian companies as possi ble and explore our opportunities with them.”

While the consensus among the distributors surveyed here is that ATF will be a busy, thriving market, macroeconomic issues are a concern as broadcasters and platforms alike pre pare for a squeeze on advertising and subscription revenues. Are buyers becoming more risk-averse in this climate?

“Yes and no,” says Dulgaro at ITV Studios. “Our buyers have always been discerning. Of course, buyers are looking for IP that will work for their existing audiences, but they’re always looking for something left-field that will expand their audience and grow their reach. It’s worth remembering that buyers are now buying across many routes to market, and not all of them have the same demographic. ITV Studios has seen this with Love Island, a brand that works perfectly well in a linear envi ronment but explodes in key demos in the on-demand space. Audiences also need to be surprised, and buyers are looking for new and different content that will pop in the schedule and on an on-demand carousel.”

Rajaram at Fremantle observes that “clients are being more cautious because of fiscal concerns, but at the same time, com ing out of Covid lockdowns after almost three years is also fueling cautious optimism. And for us, given our tried and trusted brands, we are still seeing healthy demand for favorites like Got Talent and Idol and the newer titles.”

Rajaram adds, “Locally, the local linear players are beginning to be more aggressive because quite a few of the pan-regional pay-TV giants have either been absorbed by the new global streaming entities or have gone into a standstill period while determining launch plans. This has allowed local linear players to get first-run titles, and they are going for it.”

Barcelona says clients have primarily been “consistent in their acquisition of GMA content despite worldwide economic concerns. Although some complain about reduced budgets, corporate shakeups and changes in their programming, con tent is still king. Our clients are now more conservative when they buy, and they make sure that whatever is acquired is con sumed quickly.”

Some markets are being harder hit than others, ABS-CBN’s Lee Gonzalez notes. “Some have picked up their acquisitions for this year and next, while a few have pushed back their launches due to a slowdown in advertising.”

“With broadcasters and platforms keeping a close eye on their acquisitions budgets, buyers have tended to lean on wellestablished shows,” says Candiani at eOne. “We’re proud we can offer iconic franchises like Peppa and Transformers that already have great market visibility and can help attract and retain viewers.”

Passion’s Bassett reports that the global cost of living crisis is on the minds of everyone in the media business; “however, I think clients realize that viewers’ access to quality content could be more important than ever. With this in mind, we are not seeing a significant change in buyers’ appetites, and I think their attendance at ATF would attest to this.”

SMITH: It feels like the region is tracking about three years behind what’s been happening in the U.S. and Europe. There’s a surge in OTT players. We are quickly getting to the point of saturation in Southeast Asia. People increasingly see it as fertile ground, with significantly more of a mobilefirst viewership population. As markets reach maturity, you’re starting to see the first OTT disruptors get disrupted. It’s going to happen in Southeast Asia as well. I read that for every dollar that Netflix makes from its customer base, Disney makes about $0.14. Assuming that’s true, the price of the product is under a lot of threat. There’s only so much great content that can get made, and over time, the shift in the power base will be toward the guys who have the best content. That’s why many of the major OTT players are keen on keeping their content locked in and being cautious on distribution deals. They’re not interested in sharing con tent among themselves, which brings me to pay-TV land. As services proliferate and inflation increases, the OTT players all realize that the growth of their machines will come, in significant part, from distributors like Astro. We’ve got 71 percent of Malaysian eyeballs. If [an OTT platform] wants to keep telling a growth story, it has to either start raising prices—and the market is not letting it do that—or get growth in volume. For a pay-TV operator, this is good news. Our game hasn’t changed. Astro is 26 years young, and we’ve always been about three things: Make great local content that resonates. Build a home of sports offers that is compelling. And then aggregate the best of the rest. Fifteen years ago, that aggregation used to be channels. Today, aggregating the best content is increasingly the apps. That’s where the play is for a pay-TV operator. We used to put lots of channels together. Now we put lots of apps together. The OTT players will find it hard to aggregate all their services among themselves. Someone has to be agnostic. Someone has to create a compelling, simple UI and a search and dis covery function that cuts through that. When you add Astro’s own local content and sports offer to the mix, we feel pretty bullish about our role in the environment.

TV ASIA: Disney has pulled the plug on most of its linear channels. Do you expect to see more of that happening?

By Mansha DaswaniThe next battleground in the global streaming wars is Asia, and for those OTT players eyeing fast-growing markets like Indonesia and India, the role to be played by incumbent pay-TV operators should not be dis counted. That’s the philosophy guiding the growth strategy at Malaysia’s Astro, Euan Smith, the CEO of TV and group COO and soon-to-be CEO (he succeeds Henry Tan in February), tells TV Asia. With a focus on aggregation, tech innovation and high-quality local content, the Foxtel and Sky veteran is bullish about Astro’s prospects in a fastchanging media landscape.

SMITH: I think over time you will see more linear channels dropping away. But there is an inherent inertia in the busi ness model, as transitions take time. Some people are look ing at Disney’s move and thinking that perhaps that was a bridge too far. But I think you’ll see a reduction of linear channels over time and a move to assets. For Astro, it’s not really different. As an aggregator, if we’re aggregating con tent on a home screen, effectively we’re making channels; they just look like rails on the screen rather than a traditional EPG. The other interesting thing is, two, three years ago, most of the OTT players were saying, We’re a subscription play; ads are not our thing. And suddenly, with the

TV ASIA: Where do you see Asia in the global streaming wars today?

Astro is continuing to expand its original content slate, which includes Polis Evo 3

squeeze on growth, everyone now wants to have two rev enue streams: one from advertising, one from subscription. For a pay-TV operator, we’ve been running that same model for 26 years. It’s almost like the industry is heading back to square one.

TV ASIA: Tell us about the consumer proposition and how you differentiate the offerings across Astro, sooka and NJOI.

SMITH: Astro used to be a traditional satellite single play. You had one box, there were a bunch of packages, and you bought into them. The first thing we had to do was become transmis sion-agnostic and put the content that people are buying wherever they want it to happen. And then, we need to make it easier for them to find and surface what they want in this increasingly complex world. That’s why our Ultra and Ulti Boxes exist. First, you can get the premium 4K experience on the Ultra Box, but if you’re not in that market segment, our Ulti HD Box sells at a lower price with just the same UI look and feel. Second thing, the boxes can’t just be satellite these days, so they’re not. Both boxes are hybrid and work just as well over the internet. We’re no longer a “dish” company; we’re a streaming company. Third is that you need to give people value for their subscription when they are not in the home, which is why we’re spending a lot of money on improving the functionality and features of Astro GO so that a customer can carry all 65,000 titles in their pocket.

Similarly, Astro used to be a one-size-fits-all product. That’s not how the market works these days. So we’ve divided ourselves into three tents. Customers may want the full-fat experience, which is family first, big screen, all the sparkling content you possibly could want, available in various pack ages with bundled apps. That is Astro. But there are two groups of customers who don’t want that. One wants a very laid-back experience; it wants the big screen, a pick-and-mix experience. We have NJOI for those people. NJOI is a free sat service, and we make it super simple so that when you do want extra content, you can buy up. It’s a prepaid model for customers who wish to dip in and out. Then there are those who don’t choose Astro because they tend to be more mobile. For them, we have sooka. It’s single-use first and skewed to a younger demographic. It allows us to target a different audi ence in a slightly different way. Whereas Astro is sleek and premium, sooka is more fun and quirky. We’re building con tent that is exclusive to sooka. It’s an app. It’s a cool way to monetize our content in a different space, which is very differ ent from the main pay-TV engine, and we are seeing some

really good engagement in terms of stats. We built sooka such that even if you don’t subscribe, there’s an ad layer. So even if you’re just a casual user, we can serve you some ads and get value from the platform even if you’re not ready to have a fullblown relationship with Astro.

Going back three decades, we rein vent ed Malaysian TV in the pay-TV space. The journey now is to reinvent ourselves around these three products.

TV ASIA: Tell us about the introduction of Astro Fibre.

SMITH: If you buy all the [OTT subscrip tions] separately, the price you pay is at a premium to buying them all through Astro, and you don’t get Astro’s great content. In our model, you have just a single bill and an all-in-one experience. The obvious step from that is, well, our world is increasingly about streaming, about con nectivity, about the connected home. That’s why we launched Astro Fibre. We have built our own network. Now, we can take the broadband and TV bundle and cre ate really compelling offers in the marketplace. Most of the broadband providers will be selling on reliability, speed and price. We can also engage consumers around the content, which is significantly sexier than talking about reliability, speed and price! We see Fibre as being the fourth pillar of our portfolio. It’s Astro pay TV, sooka or NJOI, and Fibre across the three.

TV ASIA: How are your teams working to ensure that you’re improving the overall experience for the consumer?

SMITH: We moved to the plug-and-play set-top box and have strong lower-cost products in the marketplace to serve the lower ARPU segment. We’re constantly working on how we better the hardware, such as a new remote con trol that is simpler and more intuitive. But our main thing is obviously the content. It’s all about search and discovery and personalization. And in the background, we are enhancing the data we’re capturing so that we can make each experience better. Who is watching, what, for how long, and where are they dropping in and out? As well as being used for personalization, that data informs the addressable advertising engine we have built. Addressable advertising is now launched across almost all of our prod ucts. Clearly, that is of huge value to both consumers (they get relevant ads) and the clients we work with (their ads get to the right audience).

TV ASIA: Tell us about your investments in original content.

SMITH: We’re making sure we’re creating content for each demographic—Malay, Chinese and Indian—that is premium. We’re pushing harder on the concept of Astro and sooka originals. We’re increasingly about generating strong “appointment to view” content. Our Astro Originals brand means great, high-quality, edgy drama. We’re trying to create more of these “wow” tentpoles in local content. Astro does so much great local content; we need to shout more about it than we have in the past. It’s what makes us different from the other players in the market—70 to 75 percent of all our viewing is on our local content.

annual

Asia Screenings Festival. Visit TVAsiaScreeningsFestival.com

It’s been a long three years since the content community convened in Singapore for the Asia TV Forum & Market (ATF). And per organizer RX Singapore, there’s plenty of pent-up demand for a market focused on this growing region.

All3Media International arrives in Singapore with an extensive slate of dram a, factual and formats. On the drama front, the company is showcasing Marriage with Sean Bean and Nicola Walker, which Kit Yow, VP for AsiaPac, says “delivers a tender and truthful look at the insecurities, ambiguities, hopes and fears that are part of the risks and gifts of a long-term partnership.” On the scripted-formats front, a key offering is the Irish drama Blood, recently adapted in India as Masoom. In unscripted, Yow and her team will be talking to clients

We put the spotlight on hot properties for Asia TV Forum in our second

TV

to screen this mix of dramas, docs and kids’ shows.ABS-CBN Corporation’s Love in 40 Days

about the fact-ent series The Dog House, which is “feel-good television at its best,” she says, and Hauntings: “True crime meets paranormal in this premium anthology series,” Yow notes.

ABS-CBN Corporation from the Philippines is putting the spotlight on its extensive slate of dramas and romantic comedies, among them A Family Affair, which Wincess Lee, sales head for Asia, LatAm and OTT, bills as a “story of family and forgiveness.” A Viu original, Flower of Evil is based on a Korean show created by Jeong-hui Ryu and produced by Studio Dragon and CJ ENM. ABS-CBN is also showcasing 2 Good 2 Be True , a light romance series; the fantasy/romance series Love in 40 Days; and the buzzy fantasy adventure Darna.

Cyber Group Studios’ Gigantosaurus

ATV is seeing solid gains in its Turkish drama business across AsiaPac, according to Müge Akar, the head of sales for Europe, Asia and Africa, led by titles such as The Ottoman, For My Family, Destan and Maria and Mustafa. Several kids’ content distributors will be on-site in Singapore, including Studio 100 Media, which is highlighting Vegesaurs, “a fresh and unique take on the dinosaur genre with characters you can only find in this show,” says Vanes sa Windhager, sales executive. “Targeting kids 4 to 7 years old, the show is the perfect edutainment for preschoolers.”

Cyber Group Studios arrives at ATF with an extensive slate of animated series. “At this market, we’re highlighting our preschool series Gigantosaurus,

Studio 100 Media’s Vegesaurs

which is already broadcast in China on CCTV, Japan on NHK and Singapore on Mediacorp services, to name a few,” says Pauline Berard, international sales executive.

The array of channel and platform representatives attending the market in Singapore includes Rewind Networks’ Sandie Lee, execu tive VP and channel head, who acquires for the HITS and HITS MOVIES pay-TV networks, which are in 24 million households across 14 countries. “Our content offerings have consistently stayed true to the brand proposition of ‘the best TV and movies—all in one place,’” Lee notes.