Begging to build

Cash-strapped governments seek financial aid for infrastructure

Trading blows

Trump’s frenzy of tariffs has wreaked havoc on global trade

In deep water

Deep-sea mining for critical minerals provokes criticism

Cash-strapped governments seek financial aid for infrastructure

Trump’s frenzy of tariffs has wreaked havoc on global trade

Deep-sea mining for critical minerals provokes criticism

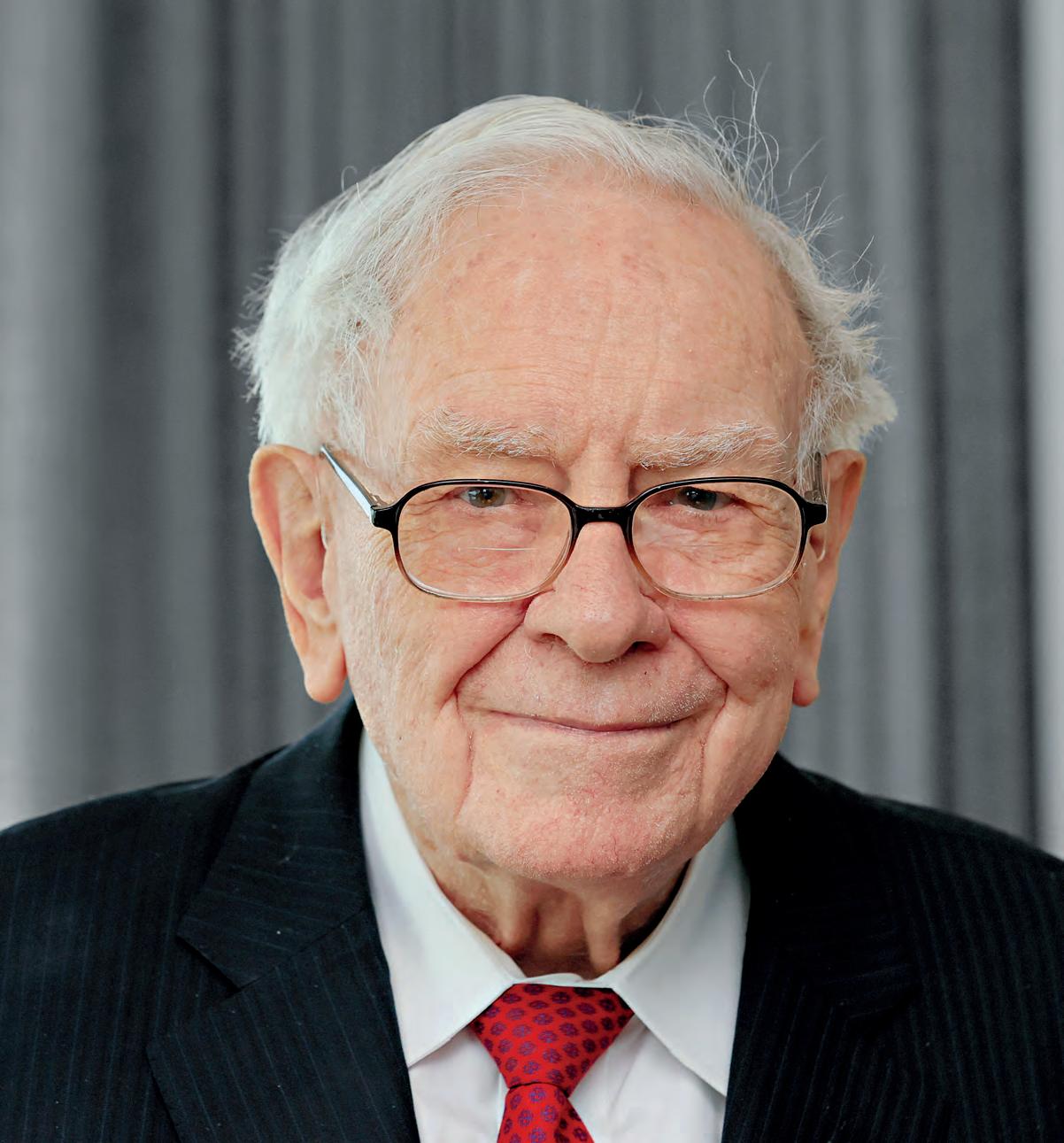

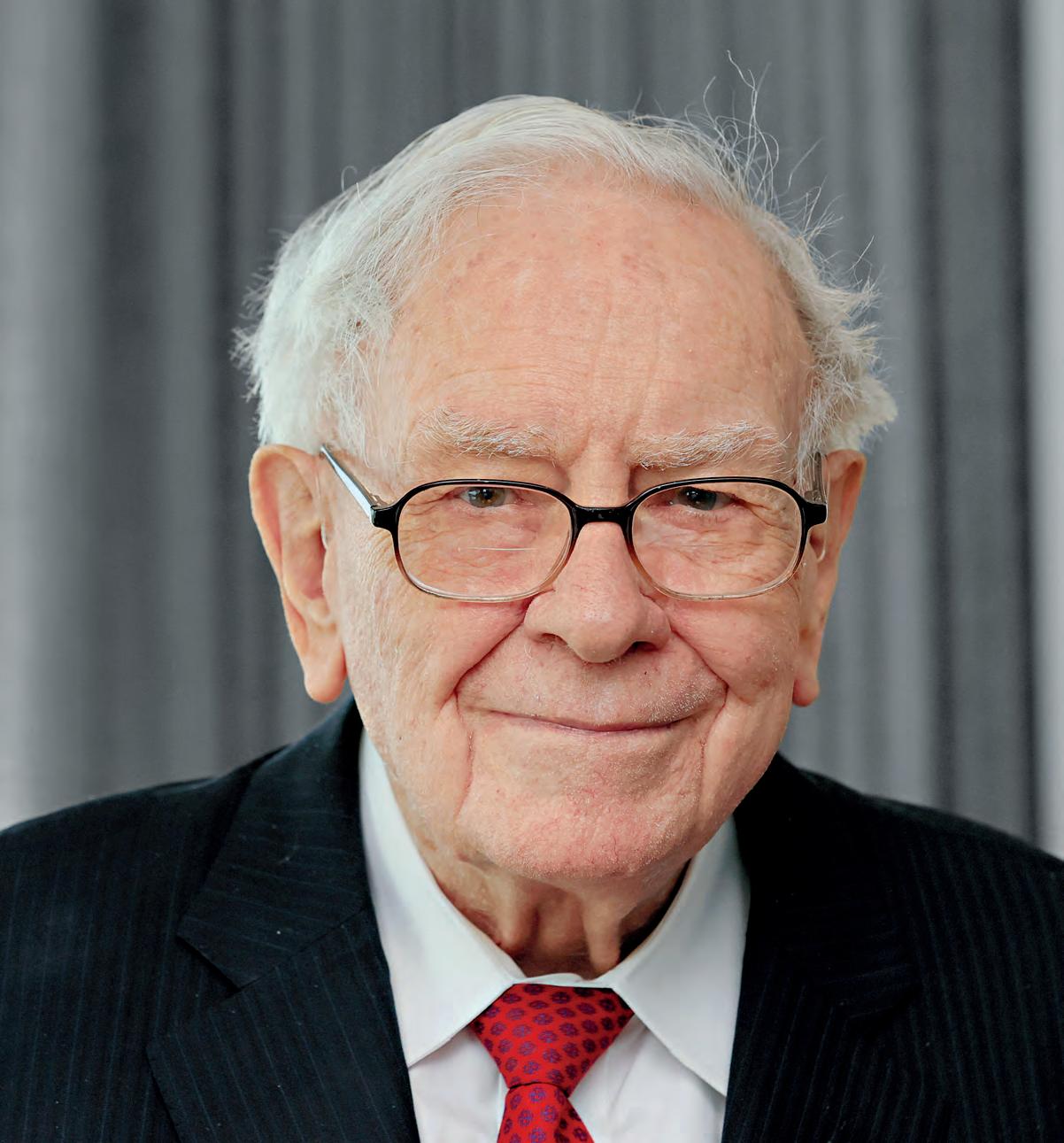

After 60 years at the helm of Berkshire Hathaway, Warren Buffett has decided to step down as CEO, leaving behind a lifetime of invaluable advice and a trillion-dollar company

www.investbarbados.org

Warren Buffett retires after 60 years at the helm of Berkshire Hathaway, leaving a lasting legacy of value investing, ethical leadership, and philanthropy that remains relevant in today’s uncertain markets

Governments face major infrastructure funding gaps and are urging private investors to help. Despite available capital, concerns over risk, liquidity, and shifting policies are hindering investment

DESIGNER:

Sam Millard

REPROGRAPHER: Robin Sloan

PRODUCTION MANAGER: Richard Willcox

WEB AND MOBILE DEVELOPMENT:

Scott Rouse

VIDEO PRODUCER:

Paul Richardson

EDITORIAL: Laura French

Courtney Goldsmith

Neil Hodge

Jemima Hunter

Graham Jarvis

Alex Katsomitros

Claire Millins

John Muchira

David Orrell

Selwyn Parker

Rachel Richards

Khatia Shamanauri

David Worsfold

Offshore finance has evolved from secretive tax havens into complex, adaptive systems. High-net-worth individuals now use crypto, second passports, and legal loopholes, as regulations struggle to keep pace globally

Trump’s sweeping tariffs have disrupted global trade, raising costs and triggering tensions among allies and rivals. Businesses now face uncertainty amid supply chain strain and geopolitical divisions

CONTRIBUTORS:

Martyn Cornell

Vikki Davies

Antonia Di Lorenzo

Barry Eichengreen

Anastassia Fedyk

Catherine Gooderham

Antara Haldar

Nick Hodgson

Emma Holmqvist

Ruth Kibble

Indrabati Lahiri

Stephen Roach

Hannah Smith

ACCOUNTS:

Gemma Willoughby

ILLUSTRATORS:

Richard Beacham

Jim Howells

BUSINESS DEVELOPMENT:

Bryan Charles

Tom Crosse

Michael Harris

Terry Johnson

James Watson

Monika Wojcik

Deep-sea mining in the Clarion-Clipperton Zone promises critical minerals but threatens fragile ecosystems. Amid geopolitical tensions, the US is pushing ahead despite global calls for caution

With climate-conscious Gen Z and Millennials demanding that brands adopt net-zero goals, ESG values, and transparent practices, businesses must act decisively or risk losing market share and talent

The information contained within this publication has been obtained from sources the proprietors believe to be correct. However, no legal liability can be accepted for any errors. No part of this publication may be reproduced without the prior consent of the Publisher.

Editorial on pages 30–37, 52–53, 116 & 124 © Project Syndicate, 2025

Web: www.WorldFinance.com

Email: enquiries@wnmedia.com

9

22

24 Financial History

We look at the evolution of banking, from ancient Mesopotamian grain and gold deposits, to merchant banking in Europe

26 Profile

Nvidia CEO Jensen Huang has helped steer the chipmaker to market dominance, placing it at the centre of the AI revolution

30 Comment

Anastassia Fedyk on the EU’s defence plan, Antara Haldar on the soul of economics, Barry Eichengreen on the dollar’s future and Stephen Roach on stagflation

186 The Econoclast

There is a marked contradiction between real world events and the persisting myths of mainstream economics

44 Neobanks

A hostile regulatory environment is holding back neobanks in Europe as they set their sights on the US market

46 Kazakhstan

Kazakhstan is on a path of economic growth as banks embrace AI and digital banking

50 Sri Lanka

Sri Lanka’s remarkable economic recovery continues, with its banks leading the efforts

56 Nigeria

Despite a global economy in turmoil, Nigeria’s economy actually grew in 2024, relying on its strong financial services sector

62 Macao

The bond market in Macao has exploded in recent years and is now an essential part of the financial ecosystem

64 Digital

CBDCs have become a political issue as China looks to internationalise the renminbi and challenge the dollar’s reserve status

74 Project Finance

Rapid growth of project finance in the GCC could see the Gulf becoming a post-oil leader in global infrastructure financing

78 Investment

Barbados has become a premier jurisdiction and investment hub for global business

88 Trade

Several obstacles stand in the way of Africa’s ambitious plan to revolutionise trade, investment and economic development

90 Insurance

A tailored approach for HNWIs in the form of Private Placement Life Insurance is helping to protect access to global assets

92 Private Equity

The explosion of private credit in the past 15 years could now be heading towards a geopolitical reckoning

94 Pensions

Retirement plans are at risk from global volatility, trade tensions and policy shifts 104 DORA

With a growth in the prevalence of cyber threats, the EU has introduced landmark regulation to protect digital infrastructure

106 Artificial Intelligence

An examination of the effects of AI-trading strategy on market predictability

110 Gaming

Gaming is now a multi-billion-dollar industry, redefining monetisation strategy, user engagement and digital economies

112 Trading

An influx of new traders has reinforced the need for innovation and financial literacy

118 Construction

The building materials industry must adapt to the challenges presented by climate change and resource scarcity

122 Geopolitics

Shifting geopolitical winds have set the stage for India to ramp up its production capabilities with renewed investor interest

132 Security

A structured and proactive approach is needed to combat personal threats levied at executives and leaders

134 Corporate Governance

The role of the board has evolved into one of individual competencies, emphasising longterm success and sustainable growth

144 Wellness

The growth of the wellness sector has made treatments such as cryotherapy and hyperbaric oxygen therapy more accessible

148 Indonesia

Dr Mulyani Indrawati has helped to transform Indonesia’s economy over a long and illustrious career as finance minister

150 Education

A look at how educators can support students in times of global conflict

152 The Arctic

An area of strategic value, the Arctic has long been part of Moscow’s long-term ambitions

160

False narratives spread online can have catastrophic reputational damage for companies and must not be downplayed

162 Revenue

There are increasingly a number of signs that the subscription economy has run into stark economic reality

164 Aviation

The shift towards sustainable aviation may require a multi-pronged approach. And how close are we to seeing autonomous aircraft?

170

A surge in demand for data centres has heightened the focus on more eco-friendly development, aimed at conserving resources

As the 8th largest bank in North America by assets1,2 , we’re fueling progress for individuals, families and businesses.

We’re proud to be recognized as Best Private Bank and Best Commercial Bank in Canada, and Best Commercial Bank in the US by World Finance Magazine.

1 As at January 31, 2025.

A freight train hauls goods along tracks in Brampton, Ontario earlier this year. Trade talks continue between Canada and the US after President Trump imposed 25 percent tariff s on Canadian steel, aluminium and assembled vehicles. Canada responded with 25 percent retaliatory tariff s on approximately $43bn of US imports.

Businesses and markets loathe uncertainty. Obviously, enterprises want to operate in an environment with predictable policies and where they can plan short to long term. Today, however, the marketplace is grappling with an environment that is changing at electric speed. US President Donald Trump is solely responsible for igniting and fuelling the uncertainties with his trade and tariff s war. Trump’s disruptive and flip-flopping policies have become a source of exasperation in boardrooms. The lack of clarity, stability and predictability is creating pandemonium in forecasting. In fact, institutions like the International Monetary Fund (IMF), World Bank, governments, corporations, economists and everyone else are finding it near impossible to make sound projections.

The quagmire is real. In April, for instance, the IMF, which is the heartbeat in economic forecasting and setting the tone in global growth, revised its outlook for 2025 downward to 2.8 percent, slashing some 0.5 points. In the same month, Boeing did something that is very rare – providing shareholders with two sets of earning guidance. One was based on the assumption that the US economy would plunge into recession while the second supposed it didn't. Undoubtedly, the inability to make reliable forecasts does not inspire hope. Coming when the world is easing from the pangs of high interest rates, runaway inflation and biting costs of living, the expectation was a rather optimistic immediate future. For companies, forecasting is critical. By painting a picture of the future, it informs decision-making, risk mitigation, and strategic planning. In short, it creates confidence. On the flip, failure to see the future means walking blind. The fact that predictions made at the beginning of the year have all been rendered ineffective means that businesses must keep going back to the drawing board. For investors, the apparent is elevated risks going by the volatility being witnessed across global markets. Good thing is that after going off a cliff following Trump’s April 2nd ‘Liberation Day’ tariff s, stocks have largely recovered. However, with the cloud of uncertainty still hovering, they remain deep in the woods.

TO READ MORE FROM WORLD FINANCE COLUMNISTS, VISIT: www.worldfinance.com/contributors

The price of gold soared to a record high in April as the safe haven continued its sharp rise over 2025. Spot gold prices hit $3,500 an ounce (see Fig 1), jumping up from $2,623 an ounce in January. The ballooning price means gold has already beaten many analysts’ predictions for the year. As recently as February, Goldman Sachs Research forecast the precious metal would rise to $3,100 a troy ounce by the end of the year, and that was already revised up from a previous prediction of $2,890. Now, experts say gold prices could be on course to $4,000.

It comes as part of a broader shift away from investments that are typically seen as safe havens during times of economic turbulence thanks to US President Donald Trump’s unpredictable trade policies, such as the US dollar and treasury bonds. JPMorgan expects gold prices will surpass its next milestone in 2026 – but it could come even sooner. “Underpinning our forecast for gold prices head-

The $3,500 mark was surpassed in the wake of Trump’s attack on Jerome Powell, the chair of the Federal Reserve. These comments caused an immediate spike over concerns around the future independence of the Fed, and gold prices may rise higher, faster, if Trump’s threats to fire Powell turn into action. But Stephen

SOURCE: TheGuardian

ing towards $4,000 per ounce next year is continued strong investor and central bank gold demand averaging around 710 tonnes a quarter on net this year,” the bank noted. In an “extreme” scenario, gold could even reach $4,500 by the end of 2025.

Innes, managing partner at the Swiss wealth management firm SPI Asset Management, told The Guardian that, regardless of what happens, the bigger picture is driving gold prices higher: “This is about more than Trump vs Powell. It’s about every corner of fiscal and monetary policy flashing one big red warning: confidence erosion.”

Lip-Bu Tan CEO Intel

Chipmaking giant Intel Corporation has appointed LipBu Tan as chief executive officer. Tan, an accomplished technology leader with 20 years of semiconductor and software experience, said he was “honoured” and “eager” to join the company. “I have tremendous respect and admiration for this iconic company, and I see significant opportunities to remake our business in ways that serve our customers better and create value for our shareholders,” he said. From 2009 to 2021, Tan served as CEO of Cadence Design Systems, during which time the company more than doubled its revenue.

VOICE OF THE MARKET

Market analysts celebrated the news of Tan’s appointment, with the company’s stock rising 15 percent immediately after the announcement. Recent financial struggles have made Intel an attractive target for a takeover. Tan, who Intel’s chair Frank Yeary called an “innovator,” is now tasked with turning around the company’s fortunes.

Ivan

Espinosa

CEO Nissan

Nissan has appointed 46-year-old Ivan Espinosa, a Mexico native with two decades of experience at the company, as its new CEO. Succeeding Makoto Uchida, Espinosa previously worked as Nissan’s chief planning officer, and his appointment came amid Nissan’s announcement of a “significantly renewed leadership line-up” in order to set the company up for future longterm growth and success.

Raja Akram CEO Deutsche Bank

The company has faced a string of scandals dating all the way back to 2018, when Carlos Ghosn was arrested on financial misconduct allegations before fleeing to Lebanon while on bail.

VOICE OF THE MARKET

After years of crises, Espinosa is on a mission to change the corporate culture at Nissan, which he has said is “lacking empathy.” He told reporters in March; “we need to work together as one single team.” While he faces a challenging start, Uchida believes he has youth on his side, describing Espinosa as “still in his 40s and full of energy.”

Deutsche Bank’s chief financial officer James von Moltke will be succeeded by Raja Akram, deputy chief financial officer at Morgan Stanley, following a brief transition period. Akram will join as designated CFO from October 2025 and become a member of the board effective January 2026. Prior to taking up his role at Morgan Stanley in 2020, Akram worked for Citigroup from 2006 to 2020, holding leadership positions in finance across multiple regions and businesses. Akram said he was “impressed” with the bank’s transformation in recent years and saw “immense growth potential.”

VOICE OF THE MARKET

Christian Sewing, CEO, praised Akram’s “excellent reputation as one of the most capable finance managers in the industry.” He added that Deutsche Bank will benefit from Akram's experience in senior positions at two leading global banks. The appointment is part of a broader leadership shake-up as the bank seeks to streamline operations.

The US dollar has long been the go-to currency for global trade. As the world’s top reserve currency, the greenback is the most widely used currency for trade and international transactions. However, analysts are starting to consider what ‘de-dollarisation’ would look like – what are the implications if the use of dollars in world trade suddenly plunges?

The dollar's global reserve currency status has been in place since the end of the Second World War, when, at the 1944 Bretton Woods Conference, 44 countries agreed to create the International Monetary Fund (IMF) and the World Bank. There, exchange rates as we know them today were created when the value of each currency was pegged to the dollar. As of 2023, the US dollar accounted for 59 percent of global foreign exchange reserves, with the euro in second place at 19.8 percent, and the Japanese yen in third with just 5.5 percent. Is it time for one of these or the other five major reserve currencies – the Australian dollar, the British pound sterling, the Canadian dollar, the Chinese renminbi or the Swiss franc – to take its throne?

“The narrative that the US dollar’s reserve currency status is being eroded has gained momentum as the world is dividing into trading blocs in the aftermath of Russia’s invasion of Ukraine and heightened US–China strategic competition,” Joyce Chang, chair of global research at JPMorgan, said late last year. The global trade crisis has only deepened in 2025. The BRICS countries, including Brazil, Russia, India, China, South Africa and five others, favour gold as a potential alternative to the dollar, though a central bank digital currency has also been suggested.

Meanwhile, European financial leaders could seize an opportunity. In April, the euro achieved its strongest level in three years, and European Central Bank vice president Luis de Guindos has touted the euro as an alternative to the dollar as a reserve currency in the coming years, so long as Europe continues to integrate. While the appetite for alternatives is growing, dedollarisation is unlikely to be right around the corner. For a framework as entrenched as the global financial system, change will not happen overnight.

TO READ MORE FROM WORLD FINANCE COLUMNISTS, VISIT: www.worldfinance.com/contributors

Streets filled with frustrated workers walking back home. Traffic lights and ATM machines out of service. Hospitals relying on generators to keep their intensive care units running. No, these are not scenes from the latest MadMaxsequel. The blackout in Spain and Portugal in April plunged both countries into chaos, a stark reminder of how critical energy security remains. Sure, older citizens may remember three-day weeks and power outages during the two oil crises in the 1970s. Yet, few anticipated witnessing such apocalyptic scenes half a century later. Modern economies were supposed to rely on a diverse mix of energy sources to ensure a minimum level of security. Is this a glimpse of the future? Hopefully not, but some caution is warranted. Climate change has pushed developed economies to accelerate their transition to clean energy and reduce carbon emissions. Spain has emerged as a world leader in renewable energy, tapping into its Mediterranean climate and vast swathes of land that are ideal for solar panel installation. One key takeaway is that the infrastructure has to be there before we bet the house – often quite literally – on renewables. International power grids have to be reliable. The problem seems to have originated in Spain due to a sudden spike in solar energy supply, but it soon spread to Portugal and parts of southern France. Alternatives like nuclear power should not be off-limits. Overreliance on renewables could prove disastrous for a continent grappling with war, inflation and strained relations with its trade partners. This does not mean that we should scrap net zero and revert to the good old days of ‘drill, baby, drill.’ Despite the Trump administration’s attempt to undo massive investment in renewables through the Inflation Reduction Act under Biden, Western economies should keep investing in green technologies. Environmental concerns aside, this is a geopolitical imperative if we want to reduce our dependence on gas and oil producing countries run by authoritarian regimes. However, this transition has to be smooth, cost-effective and secure. The chaotic scenes in Madrid and Lisbon last April suggest we still have a long way to go.

TO READ MORE FROM WORLD FINANCE COLUMNISTS, VISIT: www.worldfinance.com/contributors

Search giant Google announced its largest, most expensive acquisition to date, with a $32bn deal to buy the cloud security start-up Wiz. Wiz will join Google Cloud to ‘turbocharge’ cloud security as the company seeks to invest in trends accelerated by the AI era. Google CEO Sundar Pichai said businesses and governments that run in the cloud today are looking for stronger security solutions and greater choice in cloud computing providers. “Enabling more companies to prevent cyber attacks, including in very complex business software environments, will help organisations minimise the cost, disruption and hassle caused by cybersecurity incidents,” added Google Cloud CEO Thomas Kurian. The two companies “share a joint vision to make cybersecurity more accessible and simpler to use for organisations of any size and industry,” he said. The deal, Google hopes, will boost its cloud services arm, which lags behind those of rivals Amazon and Microsoft. While Google’s cloud earnings rose to $43bn in 2024, Amazon’s swelled to $107.6bn and Microsoft’s to $105.4bn. Wiz has quickly become a go-to name in the industry, with annual revenue

M&A

Rio Tinto has established itself as a global leader in the supply of lithium – a crucial element in products from smartphones to electric vehicles – following the completion of a $6.7bn deal to buy Arcadium Lithium. The acquisition, which will see Arcadium renamed to Rio Tinto Lithium, means the metals and mining corporation will have one of the largest lithium resource bases. “Together, we are accelerating our efforts to source, mine and produce minerals needed for the energy transition,” said Rio Tinto chief executive officer Jakob Stausholm. “By combining Rio Tinto’s scale, financial strength, operational and project development experience with Arcadium’s Tier one assets, technical and commercial capabilities, we are creating a world-class lithium business which sits alongside our leading iron ore, aluminium and copper operations.”

soaring from $1m to $100m in just 18 months in 2022. Now, the business is turning over $350m per year. The acquisition, Assaf Rappaport, co-founder and CEO of Wiz, said, will “bolster Wiz’s mission to improve security and prevent breaches by providing additional resources and deep AI expertise.”

However, Google’s success in leveraging this will require navigating a challenging integration, as well as regulatory concerns. Despite this, industry experts believe the acquisition could be a shot in the arm for the IPO market, as M&A activity has slowed. Cybersecurity companies have become particularly appealing in light of the rapidly growing AI market, with CB Insights naming it as a top acquisition target area of 2025.

M&A

Two Swiss insurers have agreed to merge to create Switzerland’s largest employer and its second-largest insurance company. The boards of Helvetia and Baloise decided on a merger of equals, creating a firm called Helvetia Baloise Holding, which will be listed on the SIX Swiss Exchange. With a combined market share of 20 percent, the deal is one of the biggest in Europe’s finance sector this year, and it is the biggest in Switzerland. Thomas von Planta, chairman of Baloise Holding, called the merger “a significant milestone in the history of the Swiss insurance industry,” and said it was “the next logical step” for both companies. “We are very excited about this amazing opportunity to build a European insurance leader with strong Swiss roots,” added Fabian Rupprecht, CEO of Helvetia.

A view of the Los Indianos Festival in Santa Cruz de La Palma, Canary Islands. It reenacts the return of Canarians who emigrated to the Americas and symbolises prosperity, nostalgia, and the historical ties between the Canary Islands and Latin America. Last year, holidaymakers spent a record breaking €22.9bn in the Canary Islands.

Two major US stock indices had their worst quarter since 2022 amid uncertainty in the US market sparked by president Donald Trump’s trade policy. The S&P 500 fell by more than 4.5 percent for the first quarter, but the tech-focused Nasdaq dropped even further, notching a 10.4 percent decline (see Fig 1). Meanwhile, the Dow Jones Industrial Average closed 1.3 percent down. This marked its first consecutive monthly drop since October 2023.

The losses bring an end to five straight quarters of gains and represent the worst quarter since 2022, when Russia’s invasion

Back in January, as the world was either anticipating or bracing itself for President Trump’s inauguration, few were expecting that his agenda would be as brutally fast as it has turned out to be. Internationally, the first salvos came in week two, with the announcement of tariffs against Canada, China and Mexico; now in week 10 we are embroiled in a full-scale trade war. Not even the man himself could accurately predict the state of US international trade or opinion by the time this issue hits the shelves.

of Ukraine shook the global economy and sanctions lifted prices of commodities like oil. The key difference this time around is that much of the economic pain is isolated to the US. Indeed, the first quarter was the S&P’s worst performance compared with the rest of the world since 1980, according to Dow Jones. In Europe, the Euro Stoxx 600 index rose five percent in the first quarter; the UK’s FTSE 100 jumped by more than five percent; and the MSCI index in China soared 16 percent. However, the wide-ranging impact of Trump’s tariffs mean that the rest of the world will not be immune for long.

stocks struggled during the first quarter of 2025

Domestically, in January corporate defence expert Kai Liekefett was advising companies to “buckle up and prepare themselves” for a rough proxy season. “Activist [investor]s were champing at the bit, they were popping champagne when Trump was elected,” he said in a video interview with WorldFinance

There were three main reasons why activist investors had supported Trump’s candidacy, he explained: “Number one, it’s taxes, it’s all about taxes. Trump, in his first administration, adopted massive tax cuts set to expire at the end of 2025, and activist investors – like many other investors – hope that those tax cuts will be extended.

“The second reason is deregulation. Trump was campaigning on the promise to deregulate America, and the hope, just generally speaking, is that deregulation will result in more economic growth.”

The third reason was tariffs. “Some activist investors I’ve spoken to say ‘well look, there may be market disruption as a result of those tariffs – that might not necessarily be bad for us activists because it’s going to result in market dislocation that we can exploit’,” he said.

However, the stock market volatility and potential impact to businesses caused by the tariffs may now be giving activists pause. “If activists launch a proxy contest, they generally must be prepared to remain in the stock… at least until the shareholder meeting and, if successful in obtaining board seats, at least six–12 months beyond that,” Liekefett explains in a shareholder activism update published to sidley.com. “From an activist’s perspective, now is a risky time to make a multi-year commitment to a particular company.”

TO FIND OUT MORE:

www.worldfinance.com/videos

percent market share and is one innovation, agility, and digital technologies; providing a memorable experience to our clients, supported by the best talent in the country,” said BPD’s Executive Vice President of Personal Business and Branches, Francisco Ramirez, in a video interview. “We promote innovation: streamlining project implementation and fostering an innovative culture through an Innovation Lab, where agile teams operate under scrum methodology.”

Some of these innovations have been recently launched as part of the Banco Popular Apps ecosystem – individual apps targeting niche segments of the population with services to meet their specific needs, instead of a single, overwhelming, all-or-nothing application.

“In the Micro-business App, the main goal is to drive cashless transactions within a vital sector of the economy,” Ramirez said. “This new application facilitates collections through QR technology, mobile top-ups, service payments, fund transfers, and cash withdrawals, offering an excellent user experience.”

A Remittance App “allows recipients to become bank clients and receive remittances through digital onboarding – offering convenient account management, direct remittance deposits, and versatile transactions through the extensive ATM network,” while the Youth Segment App “provides young individuals with a 100 percent digital user experience, facilitating their first account, debit card issuance, savings goal planning, and credit card requests.”

BPD’s long-term goal is supporting the economic health of the Dominican Republic and its people, Francisco explained. “Our digital transformation and ongoing innovations will play a huge part in achieving that.”

TO FIND OUT MORE: www.worldfinance.com/videos

Cryptocurrency supporters have called on the Swiss National Bank (SNB) to hold bitcoin in its reserves. The campaigners say that by buying bitcoin alongside its gold reserves, it will diversify its assets considerably, setting it on a much stronger footing amid the fallout of global trade tensions. In late 2024, the campaigners launched a referendum to change the Swiss constitution to require the SNB to buy bitcoin.

“Holding bitcoin makes more sense as the world shifts towards a multipolar order, where the dollar and the euro are weakening,” campaigner Luzius Meisser, a member of the advocacy group Bitcoin Initiative and board member of Bitcoin Suisse, said recently. Three-quarters of the bank’s foreign currency holdings are in dollars and euros, Meisser said. “Politicians eventually give in to the temptation of printing money to fund their plans, but bitcoin is a currency that cannot be inflated through deficit spending.”

Of any central bank that might take a punt on cryptocurrency, Switzerland is well placed. The country is home to ‘Crypto Valley’ in the small city of Zug, where decentralised blockchain and cryptocurrency Ethereum was founded. As of 2021, it was the most mature global blockchain hub, with a valu-

The SNB has rejected the idea, saying liquidity and volatility remain issues. “For cryptocurrencies, market liquidity, even if it may seem OK at times, is, especially during crises, naturally called into question,” said Martin Schlegel, SNB president, at the bank’s general assembly in April. “Cryptocurrencies also are known for their high volatility, which is a risk for long-term value preservation. In short, one can say that cryptocurrencies, for the moment, do not fulfill the high requirements for our currency reserves.” The campaigners have argued that by adding bitcoin to the treasury, the Swiss bank will complement its portfolio and gain hefty returns. “We are not saying ‘go all in with bitcoin,’ but if you have nearly one trillion francs in reserves, like the SNB does, then it makes sense to have one to two percent of that in an asset that is increasing in value, becoming more secure, and that everyone wants to own,” said Yves Bennaim of the Bitcoin Initiative.

ation over $500bn and boasting 14 unicorn companies. Along with a favourable regulatory environment, the Swiss have an open mind about crypto. One study by the Lucerne University of Applied Sciences and Arts found that 11 percent of the Swiss population has invested in cryptocurrency assets.

Marquinhos lifts the Champions League trophy at the end of final between Paris Saint-Germain and Internazionale in Munich on May 31, 2025. In its quest for silverware, PSG have spent over €1.9bn on players since state-operated Qatar Sports Investments (QSi) arrived ahead of the 2011–12 season.

Compounded by geopolitical tensions, the rise of AI and ever-evolving tools, cybercrime is predicted to cost an estimated $10.5trn by the end of this year, and it’s on the up; a recent cyber-attack on British retailer Marks & Spencer wiped £500m off its stock market value in a single week. Below are the statistics behind this growing threat, and its cost to individuals, businesses and economies.

Confidence in cyber resilience by country

Cybercrime expected to skyrocket

ESTIMATED ANNUAL COST OF CYBERCRIME WORLDWIDE (IN TRILLION US DOLLARS)

450,000+

New pieces of malware detected each day

$1.54 million

The average ransomware pay-out globally in 2023

$12.5 billion

Losses from cybercrime in 2023 in the US alone

1.24 million

Employees in cybersecurity in the US in September 2024

$9.36 million

Average cost of a data breach in the US in 2024

$15.63 trillion

Estimated global annual losses from cybercrime by 2029

$4.88 million

Average cost of a data breach globally in 2024

$29 billion

Projected global cyber insurance premiums by 2027

1 in 6 Internet users in Europe have experienced a data breach

78%

Increase in cybercrime spending from 2018 to 2024

97 %

Of organisations have seen an upsurge in cyber threats since the start of the Russia-Ukraine war in 2022

87%

Of C-level employees say their company isn’t adequately protected from cyber-attacks

69%

Increase in cybercrime victims from 2019 to 2020

climate agreement, it feels like the international commitment to keep global warming “well below 2°C” is ancient myth. President Trump has once again pledged

plans will see warming of 3.8°C by 2100, and barely five percent of signatory countries have submitted their latest 10-year plans to reduce emissions ahead of Brazil’s COP30 in November.

Some forward-thinking businesses, however, like Qatar-headquartered telecoms multinational Ooredoo, are serious about their responsibilities to mitigate climate change.

“Sustainability is a core value for Ooredoo,” Hilal Mohammed Al Khulaifi told WorldFinancein a video interview.

“To reduce our impacts on the environment, we are working towards reducing our carbon footprint,” the Group Chief Legal, Regulatory and Governance Officer explained. “We are increasing our usage of renewables to power our data centres, and implementing effective e-waste management programmes.”

Ooredoo has expanded rapidly through the MENA region, and serves 51 million customers across 10 different countries. This “posed some challenges in terms of governance,” Al Khulaifi said. “To ensure uniformity while allowing local execution, we adapted a centralised framework. This means that core governance principles remain the same, but there is flexibility to adapt to local regulations and cultural norms.”

For Al Khulaifi, “the sky is the limit. I see Ooredoo becoming a market leader in every country we operate – not just in numbers, but also in customer satisfaction and innovation.

“Sustainability will remain a cornerstone, with a goal to become a zero-carbon company by 2030… we also want to make sure that our workforce is as diverse and inclusive as the market we serve. Our guiding principles remain customer focus, innovation, integrity, and social responsibility. These aren’t just words; they are the DNA of Ooredoo.” TO FIND OUT MORE: www.worldfinance.com/videos

By the end of the decade, global public debt levels could rise to nearly 100 percent of the world’s gross domestic product (GDP), soaring above levels seen during the Covid-19 pandemic. Public debt will rise 2.8 percentage points to 95.1 percent of global GDP in 2025, according to the International Monetary Fund’s (IMF) Fiscal Monitor projections.

The group said debt would then continue to grow, reaching 99.6 percent of global GDP by 2030, and exceeding the 2020 rate of 98.9 percent of GDP, when governments around the world borrowed for economic relief during the pandemic. However, there is a chance global debt could balloon even higher.

The IMF’s forecast, as well as its projections for global GDP to rise 2.8 percent this year, is based on trade tariff developments through to April 4th. If higher tariffs and weakened growth prospects cause economic output to decline more than expected, the IMF said debt levels may rise above 117 per-

Global debt numbers are hiding a wide diversity across countries, with larger economies bearing the brunt of much of the recent debt growth, the IMF said. Of the IMF’s member countries, debt for around a third is growing at rates faster than before the pandemic, but these countries make up about 80 percent of

cent of GDP by 2027. This would represent the highest figure since the Second World War. An unpredictable trade war is not the only factor contributing to global debt. European countries have also taken an unprecedented stance to public spending in recent months as countries seek to boost defence spending following expectations President Donald Trump will pull back from prior US commitments to protect allies in Europe. “In view of the threats to our freedom and peace on our continent, ‘whatever it takes’ must now also apply to our defence,” said German chancellor Friedrich Merz. Germany made significant reforms to the cap on its budget deficit to allow it to direct more money into defence and infrastructure.

While this strategy still poses risks, the move marks “one of the most historic paradigm shifts in German postwar history,” Robin Winkler, chief economist at Deutsche Bank Research, told Politico

the global GDP. Finance ministers face “stark tradeoffs and painful choices,” said Vitor Gaspar, the IMF’s fiscal affairs director. “In these times of high uncertainty, fiscal policy must be an anchor for confidence and stability that can contribute to a competitive economy, delivering growth and prosperity for all,” Gaspar said.

Amid ongoing cost-of-living rises across the world, we look at how countries tally up and compare, as ranked by Wise’s Cost of Living Index. The index takes into account rent, food, transport and other factors, for nations spanning the globe

1 Switzerland (Rank 1)

Topping the list as the most expensive place to live in the world is Switzerland, where salaries averaged more than £75,000, gross per year, in 2022, according to the Federal Statistics Office. Business opportunities abound here, but they come with a hefty price tag; a one-bedroom flat in Geneva’s city centre costs an average of around £1,847 per month, according to Numbeo, and a threecourse lunch for two at a midrange restaurant in the city will set you back around £110. The city of Zurich follows closely behind Geneva for rent and food, while capital city Bern is a little more affordable, with monthly rent averaging around £1,096.

2 Singapore (Rank 4)

Following closely behind is Singapore, where rent is especially high – around £2,078 for a onebedroom flat in the centre of the city – but food is a little cheaper here; a three-course lunch costs an average of £48 for two people. A well-developed housing system means around 90 percent of residents in Singapore own their own homes, and the country benefits from a good public health system as well. The average gross salary is around £40,220 a year, according to research by Morgan McKinley, with a UBS 2024 report finding that the average Singaporean adult has £300,000 in wealth. There is also an impressive 330,000 millionaires currently living in the country too.

3

(Rank 7)

Among the most expensive countries in Europe is Denmark in the north. The city of Copenhagen ranked 11th in the world in Mercer’s Cost of Living City Ranking 2024, with rent for a central onebedroom flat in the city costing around £1,384 on average, and other living expenses estimated at around £890 per month, according to Numbeo. Three courses at a mid-range restaurant in the capital comes in at an average price of around £90 for two people. The costs are well compensated for by an exceptionally high standard of living and this is perhaps reflected in the fact that the country has featured in the top 10 of the World Happiness Report every year since 2013.

4 US (Rank 9)

The US makes the top 10 and ranks 9th on the cost-of-living list, with New York officially the country’s most expensive city to live in. The city scores 100 on Wise’s Cost of Living index (compared to a nationwide average of 70.4), with monthly rent averaging around £2,110, according to Zillow. It is followed closely by San Francisco, where rent averages about £2,031 per month, while Tucson, Las Vegas, Phoenix, San Antonio, Austin and Boise are all counted among the cheapest spots. As a country-wide average, statistics by Numbeo say a three-course meal at a mid-range restaurant will cost around £56 for two people, a loaf of bread costs around £3 and a pint of beer costs around £6.

5 Australia (Rank 10)

Following hot on the heels of the US is the country of Australia in tenth place. Sydney ranks as the world’s 58th most expensive city, according to Mercer’s Cost of Living Ranking, with the average monthly rent in the city centre coming in at around £1,193, compared with the marginally cheaper offerings of around £894 in Melbourne and about £839 in Perth. Groceries in Australia are among the most expensive in the world, with the cost of meals comparable to London. The country’s minimum wage is also among one of the highest in the world, coming in at £11.60 an hour, with average salaries around 30 percent higher than in the UK, according to Clear Currency.

6

(Rank 27)

Ranked as the second most expensive country in the Middle East, the UAE has an average cost of living score of 55.8. Dubai is the country’s priciest city, with rent for a city-centre, one-bedroom apartment averaging around £1,314, according to Pacific Prime Insurance. On average, Numbeo says a mid-range three-course meal in the country costs around £60 for two, a local beer costs around £8, and a loaf of bread costs around £0.95. The World’s Wealthiest Cities Report 2025 by Henley & Partners meanwhile found there were 72,500 millionaires and 20 billionaires in Dubai in 2024, although the average monthly net salary across the country after tax is only £31,260.

7

(Rank 53)

Mexico ranks third in Latin America after Costa Rica and Panama, but prices vary significantly across the country. Mexico City, Los Cabos, Monterrey, Cancun, Curenavaca and Guadalajra rank among its most expensive cities, while Tlaxcala, Zacatecas, Guanajuato and Tuxtla Gutierrez are its cheapest. Rent in a large apartment in Mexico City averages roughly £800 a month, compared to around £462 in Guadalajara and around £527 in Cancun. Average household net-adjusted disposable income per capita is around £12,264 a year, according to the OECD Better Life Index, giving the country a relatively high cost of living, with the biggest salaries in Mexico City and Nuevo León.

Counted among the cheapest countries featured in the ranking is India, with an overall cost of living score of 21.2. Mumbai ranks as the country’s costliest city, with Gurgaon (India’s second biggest tech hub and largest civil aviation hub), Bangalore and Delhi following behind. A three-course meal in a mid-range restaurant in Mumbai costs around £16 for two people, an inexpensive meal costs around £3.50 and a local beer is around £1.80, according to Numbeo. Rent in the city is on average 81.4 percent lower than in New York, the same source says, with a one-bedroom city centre flat going for an average of £517 per month; the equivalent in Delhi is just £190 per month.

From grain and gold deposits in the temples of ancient Mesopotamia and Greece to the rise of merchant banks across Europe and beyond, the financial system is no new phenomenon. Here we chart its evolution, from the birth of central banks to the digital era, and explore just how far banking has come in the past five millennia.

3000–200 BC

The world’s first banking systems emerged in ancient Mesopotamia over 5,000 years ago. Temples were used to store grains, gold and other commodities; these would be lent to local farmers and merchants, who would repay the loans with interest from the harvest. Centuries later in ancient Greece and Rome, temples were used again, and argentarii bankers would provide loans, accept deposits and offer currency exchange.

and then redeem it in Jerusalem, protecting pilgrims from theft en route. Templars also offered loans to monarchs, brokered deals and managed estates, mirroring many modern financial services.

In the 14th and 15th centuries, Italy became a leading hub for banking. In 1397, the Medici family founded Medici Bank in Florence, introducing double-entry bookkeeping, bills of exchange and letters of credit. They also used their wealth to support Italian artists, helping to fuel the Renaissance. Other banks followed, including Banca Monte dei Paschi di Siena in 1472, and Berenberg Bank, founded in Germany in 1590.

The following years saw several institutions founded across Europe, including the Bank of Amsterdam in 1609. Considered by many as the first central bank, it was established to stabilise local currency and support the city’s trade. At the time, coins from different countries were circulating without a stable exchange rate system; the bank adjusted supply to match demand and issued deposits backed by metal reserves.

A number of other central banks began to appear in the 17th century – including Sweden’s Sveriges Riksbank in 1668, and the Bank of England, founded in 1694. The following year, the Bank of England became one of the first to issue banknotes. These first came in the form of handwritten promissory notes, then printed notes backed by reserves. By the mid-1700s, notes from £20 to £1,000 were in circulation.

As banking continued to grow in Europe, Alexander Hamilton – the first secretary of the US Treasury – argued for a national financial system in the US. As it stood, there was no single currency, and states printed their own money. The First Bank was founded in 1791 to support the federal government. It closed 20 years later, but laid the foundations for the Federal Reserve, founded in 1913, which established a uniform national currency. 1694

The 19th and 20th centuries saw several innovations, including the invention of the telephone, which transformed communication between banks, enabling the first wire transfers. 1967 saw the introduction of the first ATM, installed by Barclays Bank. In the 1980s, digital banking began to appear; the Bank of Scotland offered home banking as early as 1985, and Stanford Credit Union launched the first online banking website in 1994.

The 2000s saw the dawn of mobile banking, revolutionised by smartphones. In the 2010s, digital-only challenger banks such as Revolut and Starling appeared and banks began to use AI and machine learning. How these technologies will impact the sector is uncertain, but one thing is clear – it is unlikely the Mesopotamians, Greeks and Romans could have envisaged just quite how far their temple deposits and seed loans legacy would develop.

Whether you're starting a new project or looking to grow your business, we're here to support you every step of the way.

We're proud to have been recognised as the Best Retail Bank in Portugal 2025, by World Finance magazine. This recognition inspires us to continue helping you turn your ideas into reality.

Find out more at santander.pt The prize is the sole responsibility of the entity who awarded it.

Jensen

Huang

CEO & CO-FOUNDER, NVIDIA

After decades of quiet success building chipmaker Nvidia, Jensen Huang is reaping the rewards of hugely profitable bets. Can the CEO of the now-trilliondollar company’s winning streak continue?

It would be virtually impossible to find a member of the public, let alone one who works in business and finance, who could not recognise six of the seven socalled ‘Magnificent Seven’ technology stocks. These companies – Apple, Microsoft, Googleparent Alphabet, Amazon, Facebook-owner Meta and Tesla – have long been household names. They are makers of products and software that millions of consumers use on a daily basis. But the seventh and most-recent entrant into the ranks of the most valuable tech companies is still unknown to many, despite being at the very centre of today’s most explosive market.

Nvidia is a trillion-dollar company that still manages to fly under the radar. A swift acceleration in its share price, from around $14 per share at the start of 2023 to more than $153 this year, has sent its valuation soaring, but the company is no newcomer to the tech world – and neither is its CEO, Jensen Huang.

Huang has been at the helm of Nvidia since its founding more than three decades ago, steering the company through economic shocks, near collapse and, finally, to wild success. What started as a maker of computer chips designed to render realistic 3D video game graphics now provides the technology that trains the world’s most powerful artificial intelligence (AI) programs.

Many attribute Nvidia’s success to Huang’s leadership and vision. “Nvidia’s rise from a

small graphics chip maker to the AI giant it is today is nothing short of remarkable, and the success story has a lot, if not everything, to do with Nvidia’s co-founder and CEO, Jensen Huang,” Kate Leaman, chief market analyst at AvaTrade, told World Finance.

For some CEOs, a little bit of luck can lead to overnight success. But despite achieving this in the most literal sense – Nvidia’s market value increased by about $200bn in one day alone after it became known that its chips powered ChatGPT – Huang’s slow and methodical rise is a different story.

Still, critics question whether the AI boom, which has powered Nvidia’s growth, is sustainable. And as chips become prized national assets, geopolitical tensions are ramping up over these precious materials, but a fragmented market could be a problem for a company with global ambitions. Is Huang, who is tasked with walking the line between the world’s largest global powers all while staying at the cutting edge of a rapidly growing industry, the man for the job?

A vision of the future

Invariably dressed in his iconic black leather jacket, Huang’s uniform is reminiscent of Steve Jobs’ plain black turtleneck or Mark Zuckerburg’s casual T-shirts. But while he looks the part of the CEO of a $3trn tech company today, he was not entirely confident of Nvidia’s success from day one. About the company’s

early days, Huang is said to have described its prospects with his typical down-to-earth sense of humour, saying it had a “market challenge, a technology challenge, and an ecosystem challenge with approximately zero percent chance of success,” according to a report by Quartr. What, then, led him to overcome those challenges to reach such great heights?

“Huang is a visionary,” Leaman said. “He saw, since 1993, the year of Nvidia’s inception, a bigger future for the company than just chips for gamers. Today, Nvidia’s chips are used to train and run some of the most powerful AI computing systems in the world.”

Indeed, under Huang’s leadership, Nvidia has capitalised on the explosive interest in AI. Today, more than 35,000 companies use its AI technologies, including most major tech firms, from Amazon to Google to Microsoft. Tech heavyweights and even world leaders court Huang as they jostle for a larger share of Nvidia’s sought-after chips.

Huang bet on the right technologies to propel Nvidia to success. But there is more to it than his vision alone, according to Alex de Vigan, founder and CEO at Nfinite, a Parisbased tech firm that works with Nvidia. “For me, what sets Jensen Huang apart isn’t just vision – it is patience and precision. Nvidia didn’t pivot to AI overnight. They invested in developer ecosystems, scientific computing and graphics at a time when few others saw the throughline.”

CURRICULUM VITAE

BORN: 1963 | EDUCATION: OREGON STATE UNIVERSITY, STANFORD

1992

Huang gained a master’s degree in electrical engineering from Stanford after graduating from Oregon State University, where he met his future wife.

1993

Alongside Chris Malachowsky and Curtis Priem, Huang created Nvidia in a Denny’s booth with $40,000 of starting capital and a plan to bring 3D graphics to gaming.

From dishwasher to CEO

Huang has attributed the resilience that helped him build one of the world’s biggest tech companies to his childhood. Born JenHsun Huang in 1963 in Taiwan, Huang arrived in the US when he was nine years old and soon became the youngest child at a boarding school in rural Kentucky. His first working experience was a typical teenager’s first job, working as a dishwasher at a local Denny’s restaurant. This experience has stayed with him, and he has claimed his ability to stay calm and perform under pressure is down to spending his formative years working through long rush hours at the diner chain. Huang worked his way up from dishwasher to waiter, and, years later, in a Denny’s booth outside of San Jose, he, along with Chris Malachowsky and Curtis Priem, founded Nvidia. Huang’s connection with the diner chain has been immor-

1999

After nearly crashing out of business in 1996, Nvidia invented the graphics processing unit (GPU), which would go on to reshape the computing industry.

2006 Nvidia launched its CUDA architecture, which created the possibility for GPUs to be used in other sectors and subsequently opened the door for explosive growth.

talised with a commemorative plaque on the booth where it all started. After graduating high school early, Huang attended Oregon State University to study electrical engineering. There, he met his wife Lori, and the pair eventually moved to Silicon Valley to join the fast-growing market for semiconductors. Before starting Nvidia, Huang gained industry experience with a short stint at AMD, working on microprocessors, and climbing the ranks at LSI Logic, a semiconductor manufacturer. AMD and Broadcom, which bought LSI Logic, are now rivals of Nvidia.

From the Denny’s booth, Huang and his two co-founders named their company after the Latin word for envy, invidia, and competitors today would surely agree it was a prescient word to choose. But Nvidia’s road to success wasn’t easy or straightforward. Just a few years after its founding, Nvidia came danger-

“Building a company turned out to be a million times harder than any of us expected it to be”

Jensen Huang

2024

Huang announced Nvidia’s Blackwell chip, “a processor for the generative AI era,” at GTC, an annual developer conference. The entire 2025 production quickly sold out.

2025

This year, a stock market filing revealed Huang would receive his first pay rise in more than a decade, with total pay rising to just under $50m, with a base salary of $1.5m.

ously close to bankruptcy, but it was saved by the launch of the RIVA 128 graphics card in 1997. This was the first chip that put Nvidia on the map. “Building a company, and building Nvidia, turned out to be a million times harder than any of us expected it to be,” Huang said on the podcast Acquired, which covers tech listings and acquisitions. “If we had realised the pain and suffering and just how vulnerable you are going to feel and the challenges that you are going to endure and the embarrassment and the shame and the list of all the things that go wrong, I don’t think anybody would start a company.”

But those struggles paid off because Nvidia built more than a product. “Nvidia has succeeded because it didn’t just build chips, it built an ecosystem,” said de Vigan. The creation of CUDA, Nvidia’s computing platform, in 2006, was “brilliant,” he said. CUDA allowed

graphics processing units (GPUs), which were then only for gaming, to be used more widely, thus expanding Nvidia’s potential market size. “By enabling developers early on to build and scale (machine learning) workloads on their architecture, they locked in relevance before AI was mainstream.”

This strategy is one Huang continues to employ. “Today, their edge is not just silicon, but platforms like Omniverse,” de Vigan con tinued. Omniverse, according to Nvidia’s web site, “plays a foundational role in the building of the metaverse, the next stage of the inter net.” De Vigan said this platform “speaks di rectly to where AI is going: physical simula tion, robotics, and digital twins. They are not selling hardware, they are really enabling the future of machine perception and autonomy.”

Breaking conventions

Nvidia’s company culture is as eye-catching as its product, and another likely cause of its success, yet Huang receives almost as much criticism for it as he does praise. In an inter view with CBS News’ ployees labelled Huang as ‘demanding’ and a ‘perfectionist’ and said he wasn’t easy to work for. Huang, who is known for his angry out bursts, didn’t disagree with this assessment. “It should be like that,” he told journalist Bill Whitaker. “If you want to do extraordinary things, it shouldn’t be easy.”

Start-ups are known for challenging con ventions in workplace culture and company structure, but it is much less common to see large companies like Nvidia bucking trends. Huang has made a point of doing so as Nvidia’s size has grown exponentially. For example, Huang has as many as 50 direct reports, compared with most CEOs, who have a dozen or fewer. The reason? To do away with unnecessary management and keep the company agile. However, it could also be seen as an attempt to micromanage rather than delegate.

dollar club,” Leaman explained.

As well as keeping up with dozens and dozens of direct reports, Huang receives tens of thousands of emails per week detailing employees’ priority areas. The T5T, to ‘top five things’ emails are brief, bullet-pointed notes where employees can discuss what they are working on or most interested in, and they have become a way for Huang to keep his finger on the pulse of the business. It all feeds into his vision of constantly being on the lookout for the next big thing. He reads each email, and it is not unusual for him to reply.

It is evident that Huang still enjoys being deeply involved in the day-to-day operations of Nvidia. “More than just a CEO, Huang is an engineer,” Leaman said. “He likes to get involved in the details.”

School of Business, harking back to his days at Denny’s washing dishes and cleaning toilets. “If you send me something and you want my input on it and I can be of service to you – and, in my review of it, share with you how I reasoned through it – I have made a contribution to you,” he said. He doesn’t simply jump into his reports’ projects and take over. “I show people how to reason through things all the time: strategy things, how to forecast something, how to break a problem down,” he said. “You’re empowering people all over the place.”

Huang is known for explaining difficult tech in simple words and for creating a company culture where taking risks is part of the job, Leaman said. “Inside Nvidia, it is common to hear people say ‘fail fast.’ They know that trying, failing, and trying again is how breakthroughs happen.” Indeed, Huang frequently asks employees to act as if the company has only 30 days until it goes bust.

It is this culture – reminiscent of Mark Zuckerberg’s famous motto, ‘Move fast and break things’ – that has driven Nvidia to where it is today. “In the 2000s, during the tech crash, while his counterparts were cutting back, Huang went all-in on research, a move that surely helped propel the company

While his leadership style may be unconventional, his longevity and many loyal employees speak to its success. Still, his greatest asset may be his ability to predict the next big thing in tech. “What makes Huang stand out is his ability to see 10 years ahead and build the tools the world will need when it catches up,” Leaman said. If he can leverage this skill today, when uncertainty is on the rise worldwide, the coming years could prove another pivotal point for Nvidia.

With the artificial intelligence sector in the midst of rapid growth, the question experts are asking now is how much more room it has to grow. The US remains the hottest market, with private investment in the sector growing to $109.1bn in 2024, nearly 12 times China’s $9.3bn, according to Stanford’s 2025 AI Index Report. More and more companies are integrating AI into their systems, with 78 percent of organisations reporting using AI in 2024, up from 55 percent the previous year. As AI remains in its early development phase, there are still opportunities to take a slice of the market, and companies continue to crop up in the sector.

$3.6trn

he agreed that some speculative capital will “evaporate,” he called the overarching changes “foundational.” “AI isn’t a single product category – it is becoming the operating system of both the physical and digital economy.”

bad thing. It is driving innovation. The key is that this can benefit everyone if we maintain open access to models, new AI algorithms, model training innovations and responsible AI safety standards.”

$130.5bn

Full-year revenue of fiscal 2025, up 114%

Nvidia’s record market value $50m

Huang’s annual salary for 2025 32

Years Huang has been CEO of Nvidia 3

Between 2010 and 2023, the number of AI patents has grown from around 3,800 to more than 122,000. In the last year alone, the number of AI patents rose 29.6 percent. For some critics, the AI industry’s ballooning growth is ringing alarm bells. Jim Chanos, the founder of Kynikos Associates, a short-selling specialist, pointed out to Reuters that tech capex in the US contributed almost a full percentage point to gross domestic product (GDP) in the first quarter of 2025. The last time it did that was just before the peak of the dotcom bubble.

“There is no question we are in a phase of inflated expectations,” said Neil Cawse, founder and CEO of Geotab, a Canadian creator of fleet management technology. “But calling it a bubble misses the point. AI isn’t a passing trend; it is infrastructure. Like electricity or the internet, it is becoming part of the baseline of how work gets done.” Cawse admits there is a lot of hype surrounding AI, and not every start-up or use case for the technology will succeed. “But the core technology is already delivering. At Geotab, we are starting to see 30–50 percent efficiency gains. That is not speculative; it is real, measurable output. A potential game changer on the scale of the Industrial Revolution,” he said.

De Vigan believes that AI is not a bubble but a “restructuring of the value chain.” While

Yet even if there is no bubble, more challenges will arise as companies like Nvidia are forced to keep pace with competition. With companies like AMD snapping at Nvidia’s heels and threatening to take more GPU market share, and growing ranks of new start-ups entering the sector, AI will remain a fiercely competitive industry. Meanwhile, the very foundations of the sector are being shaken by geopolitical forces.

As the go-to chipmaker around the world, Nvidia has seen demand soar, but the US government is attempting to put the brakes on some avenues for growth – namely, the Chinese market. “Chips are now strategic assets, sitting at the intersection of national security, industrial policy, and economic sovereignty,” de Vigan said.

With much at stake in this still-young industry, geopolitics has the power to reshape AI, especially in semiconductors and AI infrastructure, said Cawse. “We are seeing a new kind of race: not just for economic dominance, but for technology, data, algorithms, and talent.” In an aim to restrict China’s military from accessing advanced US technology, president Donald Trump, like Joe Biden before him, has sought to limit China’s access to the technology by blocking exports of key microchips. Huang called these export controls “a failure,” as they cause more harm for US businesses than China.

Losing access to the world’s second-largest economy, essentially abandoning a $50bn market, would cause Nvidia to take a huge hit, Huang has said. Speaking at the Milken Institute annual meeting, he said it risks letting Huawei step in to take Nvidia’s place, allowing it to become a significant competitor and cutting American technology – currently the world standard – out of a huge market.

De Vigan agreed that the block on exports puts Nvidia in a tough position. “I think the challenge will be continuing to lead globally while navigating increasing pressure to localise or decouple,” he said. Beyond this, the sector could see more fragmentation as regions of the world, such as the US, China and Europe, create their own regulatory and computing backbone.

As Cawse sees it, there are positives to be found even in the challenging outlook. “The China–West dynamic is pushing investment and competition, which isn’t necessarily a

While challenges remain, Nvidia is nearly untouchable thanks to its novel position of market dominance. “Today, Nvidia finds itself at the very heart of the AI revolution,” said Leaman. “The world’s biggest tech players –Microsoft, Amazon, Google, and Meta – are not just customers; they are partners, relying on Nvidia’s GPUs to drive everything from cloud computing to the next breakthroughs in generative AI.

“Nvidia isn’t competing with companies like OpenAI or Google to build AI apps or chatbots,” Leaman continued. “It plays a different role. You could think of Nvidia as the engine under the hood as its chips are what power the AI models these companies create.” With AI finally delivering in real, measurable ways, Nvidia now has countless pathways to further growth. “It doesn’t matter if it is a chatbot, an image generator, or an autonomous car. Behind the scenes, chances are Nvidia is providing the hardware – and increasingly, the software – that makes it all possible.

“And it is not only tech giants in Silicon Valley using it,” Leaman said. “Hospitals are using Nvidia’s AI for medical imaging. Car companies are using it to develop self-driving vehicles. Industries far beyond tech are now part of what Nvidia calls multibillion-dollar AI markets in areas like automotive and healthcare.”

Huang, as the architect of this success, is now tasked with continuing to steer the company on an upward trajectory. Based on the amount of money big tech firms have pledged for investing in computing infrastructure in the coming years, analysts at the Bank of America calculated that Nvidia’s data centre networking solutions stand to benefit significantly, with the stock expected to rise to a whopping $190 per share. Elsewhere, however, questions are rising over Nvidia’s nearmonopoly of the sector.

Yet, Huang’s unique position of power in the AI space gives him the authority not only to negotiate with geopolitical forces but also to look into his crystal ball to see where the sector is headed next – and have a hand in steering it there, too. One day in the coming years, Nvidia’s many fans and loyal employees may begin to worry over the company’s lack of succession planning, but for now, they are all in on Huang. n

Stephen Roach

Amid seismic shifts in trade policy, supply chains, and political interference in central banking, the world may be headed for a sustained downturn that rivals the turbulence of the 1970s as protectionism rises and global economic uncertainty deepens

Nearly five years ago, I warned that stagflation was only a broken supply chain away. A temporary outbreak did indeed occur in the immediate aftermath of the Covid-19 shock, as a surge in inflation coincided with an anemic recovery in global demand. But, like the pandemic, that economic disruption quickly subsided. Today, a more worrisome form of stagflation is in the offing, threatening severe and lasting consequences for the global economy and world financial markets.

An important difference between these two strains of stagflation is the nature of the damage. During the pandemic, supply chains were stressed by significant demand shifts – during early lockdowns, people consumed more goods and fewer services, with a sharp reversal taking place after reopening. This led to soaring commodity prices, semiconductor shortages, and global shipping bottlenecks, which collectively accounted for about 60 percent of the surge in US inflation in 2021–22. It took roughly two years for those supplychain disruptions to begin to fade, allowing inflationary pressures to ease.

Such temporary disruptions now seem almost quaint compared to the fundamental reordering of global supply chains sparked by US President Donald Trump’s ‘America First’ protectionism. The US, for all intents and purposes, is disengaging, or decoupling, from global trade networks, especially from China-centric supply chains in Asia and potentially even from the supply chains that knit together North America through the US-Mexico-Canada Agreement, the so-called ‘gold standard’ of trade agreements.

These actions will reverse the supplychain efficiencies that academic research suggests have reduced the US inflation rate by at least 0.5 percentage points per year over the past decade. This reversal, driven by

“The US, for all intents and purposes, is disengaging, or decoupling, from global trade networks”

America’s newfound disdain for its former trading partners, will likely be permanent. Whereas the Covid-19 turmoil had a clear end point, distrust of the US will persist long after Trump has left the scene. This time, there will be no quick or easy fi x.

The reshoring of production to the US will not be seamless. Trump points to foreign and domestic firms’ outsize investment announcements as signs of a phoenix-like rebirth of US manufacturing. Yet production platforms cannot be snapped apart and reassembled like Lego. Under the best of circumstances, these projects take years to plan and construct before gradually coming online.

But in today’s climate of extraordinary policy uncertainty, with tit-for-tat retaliatory tariffs and sanctions dangerously dependent on Trump’s whims, reshoring investments are likely to be deferred, if not cancelled altogether. Nor will it be easy for the rest of the world to pick up the pieces after America’s retreat from globalisation, and develop new supply chains.

Just as it will take time for the US to rebuild domestic capacity, other countries’ efforts to restructure trade arrangements will be drawn out over a long period. To the extent that global value chains reflect the efficiencies of comparative advantage, this reconfiguration of production, assembly, and distribution platforms threatens to add new inefficiencies that will raise costs and prices worldwide.

There is an even more insidious ingredient in this stagflation cocktail: the politicisation of central banking. Here, again, the US is leading the way. Trump insists that he has the right to weigh in on the Federal Reserve’s policy actions, and has loudly and repeatedly conveyed his displeasure with the Federal Open Market Committee’s recent decisions to keep policy rates on hold.

The risk is that Trump will go even further in attacking the Fed’s independence. The president recently proclaimed that he could force out Fed Chair Jerome Powell, noting that his “termination can’t come fast enough.” While Trump has since backtracked from that threat, such a move would be consistent with

his broader – and seemingly unconstitutional – push to expand executive authority. As part of this power grab, he has already taken aim at other independent agencies, illegally firing leaders of the National Labor Relations Board, the Equal Employment Opportunity Commission, and the Federal Trade Commission for political purposes. Who is to say the oft-volatile Trump won’t backtrack again and renew his attacks on Powell?

At a minimum, Trump is ramping up political pressure on US monetary policy precisely when inflationary pressures are mounting in the face of new supply-chain disruptions. Add to the mix Trump’s well-known preference for a weaker US dollar, and the current circumstances bear a striking resemblance to those of the late 1970s, when a weak dollar and a weak Fed compounded America’s first outbreak of stagflation. Remember the clueless G. William Miller, who was Fed chair at the time? That is a painful part of my own experience as a Fed staffer that I would rather forget.

The other side of the stagflationary coin is the increasing risk of US and global recession. Again, this goes back to the growing possibility of a pervasive, long-lasting uncertainty shock bearing down on the US and global economies, and the associated paralysis of business and consumer decision-making. Trump celebrated the imposition of so-called ‘reciprocal’ tariffs on April 2 as ‘Liberation Day.’ To me, it was more like an act of sabotage, triggering retaliation and a likely decline in the global trade cycle. If this continues, it will be exceedingly difficult for the world to sidestep recession.

The outcome of Trump’s agenda could be as destructive as that of the early-20thcentury global trade war that followed the 1930 Smoot-Hawley Tariff Act, another protectionist policy blunder. With US tariffs now even higher than they were back then (and, in fact, higher than at any point since 1909), it is worth remembering the 65 percent contraction in global trade that occurred from 1929 to 1934. Today’s world might be lucky to get away with stagflation. n

Anastassia Fedyk ASSISTANT PROFESSOR OF FINANCE AT THE UNIVERSITY OF CALIFORNIA, BERKELEY

With war on Europe’s doorstep and the transatlantic alliance under strain, the EU’s bold €800bn rearmament plan marks a pivotal shift in defence strategy

The European Commission recently unveiled a plan for rearming the European Union and strengthening the bloc’s defence capabilities. By 2030, the Commission intends to arm Ukraine and develop member states’ militaries to the extent needed to deter or counter Russian aggression. To fund this effort, the Commission plans to borrow €800bn over the next four years.

It is encouraging that Europe has fi nally woken up to the Russian threat and developed a credible medium-term defence strategy, especially as the transatlantic rift widens. But the bloc may not have as much time to prepare as it would like. Fortunately, there are ways to accelerate the plan’s implementation.

Perhaps the most important question concerns funding. Around one-quarter of the €800bn that the Commission wants to mobilise can be obtained immediately by exchanging frozen Russian assets (90 percent of which are in cash) for EU bonds. Given the reluctance of some member states to seize Russian state assets, exchanging them for, say, 20-year, zero-interest bonds could be a politi-

cally palatable compromise. More generally, there is little to suggest that the seizure or exchange of these assets would materially affect the euro or the rule of law in Europe. In fact, it may even increase the likelihood of ultimately collecting compensation from Russia for the damages caused by its aggression.

Second, while information and soft-power threats may be less tangible than the cyber threats that the Commission’s plan rightly emphasises, they are just as dangerous and must be addressed. A prime example is the rising popularity of far-right and far-left populist forces supported by Russian and Chinese influence operations on TikTok and other social-media platforms. These political parties often promote the Kremlin’s agenda, including ending support for Ukraine.

The consequences of such forces coming to power could be devastating. Aside from aligning with Russia, their inclination to implement simplistic solutions to complex problems would create uncertainty and chaos,

undermining the EU’s governing institutions and its internal cohesion. This institutional weakness and fractured unity would only spur Russian aggression.

Freedom of speech should not apply to disinformation peddlers. The EU must therefore ban Russian and Russia-related media, including seemingly independent outlets, and more closely monitor the use of TikTok, Telegram and other social-media platforms for potential dissemination of pro-Kremlin propaganda. European politicians with ties to Russian President Vladimir Putin, like those who lobbied for the Nord Stream II project, should also face repercussions, so that the domestic costs outweigh the benefits conferred by these connections.

Similarly, the governance mechanisms of Europe’s rearmament effort should be ‘Orbánproof’ to prevent a single Kremlin-aligned European country – such as Hungary under Prime Minister Viktor Orbán – from derailing the project. Creating a ‘coalition of the willing’ would also allow Canada, Japan, South Korea and other countries to join the effort.

To be sure, Russian influence campaigns are not the only or even the main reason why populist far-right parties have gained traction in Europe. To erode support for these parties, European leaders must address the genuine problems that have fuelled their rise. For example, European leaders can weaken antiimmigrant sentiment by reforming migrantsupport programmes in ways that encourage employment, such as by coupling integration services (including language training) with the gradual phase-out of social benefits.

The bloc can also counter populism by improving outcomes for European workers and economies. The very act of rearming will create new jobs, while soft-power efforts could also benefit European industry. The ‘Grain from Ukraine’ humanitarian programme, which supplies Ukrainian products to countries in Africa and Asia facing food shortages, could easily be expanded to include European foodstuffs (which the EU can finance through its Common Agricultural Policy).

Lastly, the EU should use options other than hard force to mitigate the strategic

threat posed by Russia. For example, EU leaders could discreetly assure the leaders of nations currently occupied by Russia of the bloc’s recognition of them as independent states. This has worked before: Polish leaders privately told Leonid Kravchuk, who subsequently became Ukraine’s first president, that Poland would recognise an independent Ukrainian state.

The Kremlin’s paper tiger Russia may seem like a powerful monolith, but in reality it is a paper tiger with a crumbling economy. Regional elites will soon realise that they no longer have to tolerate the Kremlin’s racism, economic exploitation and expansionism. In fact, many free countries (including Poland and Finland) emerged from the disintegration of the Russian Empire in 1917, after its defeat in World War I, and from the collapse of the Soviet Union in 1991, after its withdrawal from Afghanistan two years earlier. Extending the life of an imperial entity that is seemingly permanently at war makes little sense.

“Russia may seem like

a powerful monolith, but in reality it is a paper tiger”