Passing the torch

Will the Paris Olympic Games set the standard for budget-friendly events?

Planet portfolios

Has climate finance mobilisation now become a global imperative?

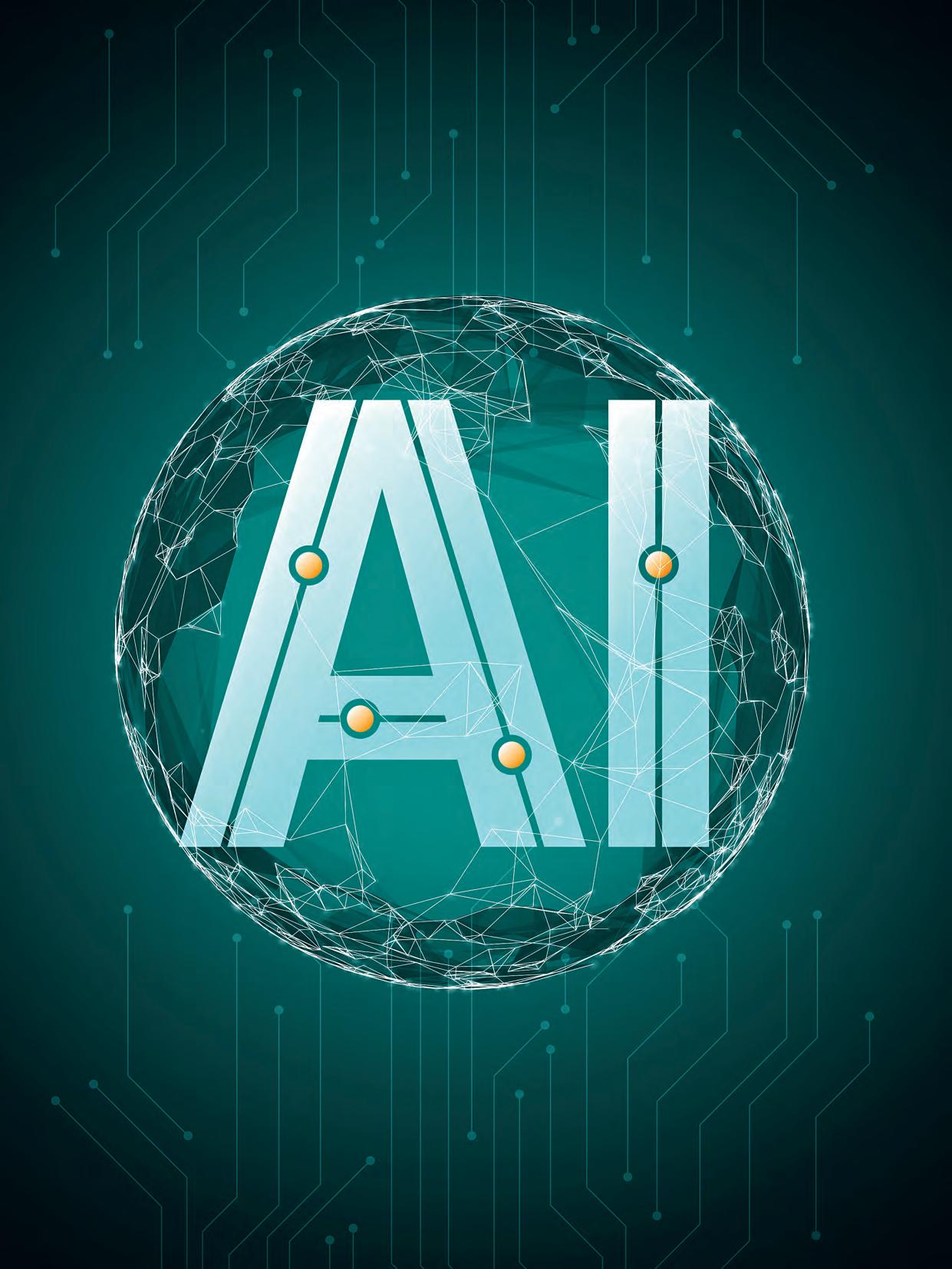

Man vs. machine

Can the EU’s Artificial Intelligence Act provide effective regulation?

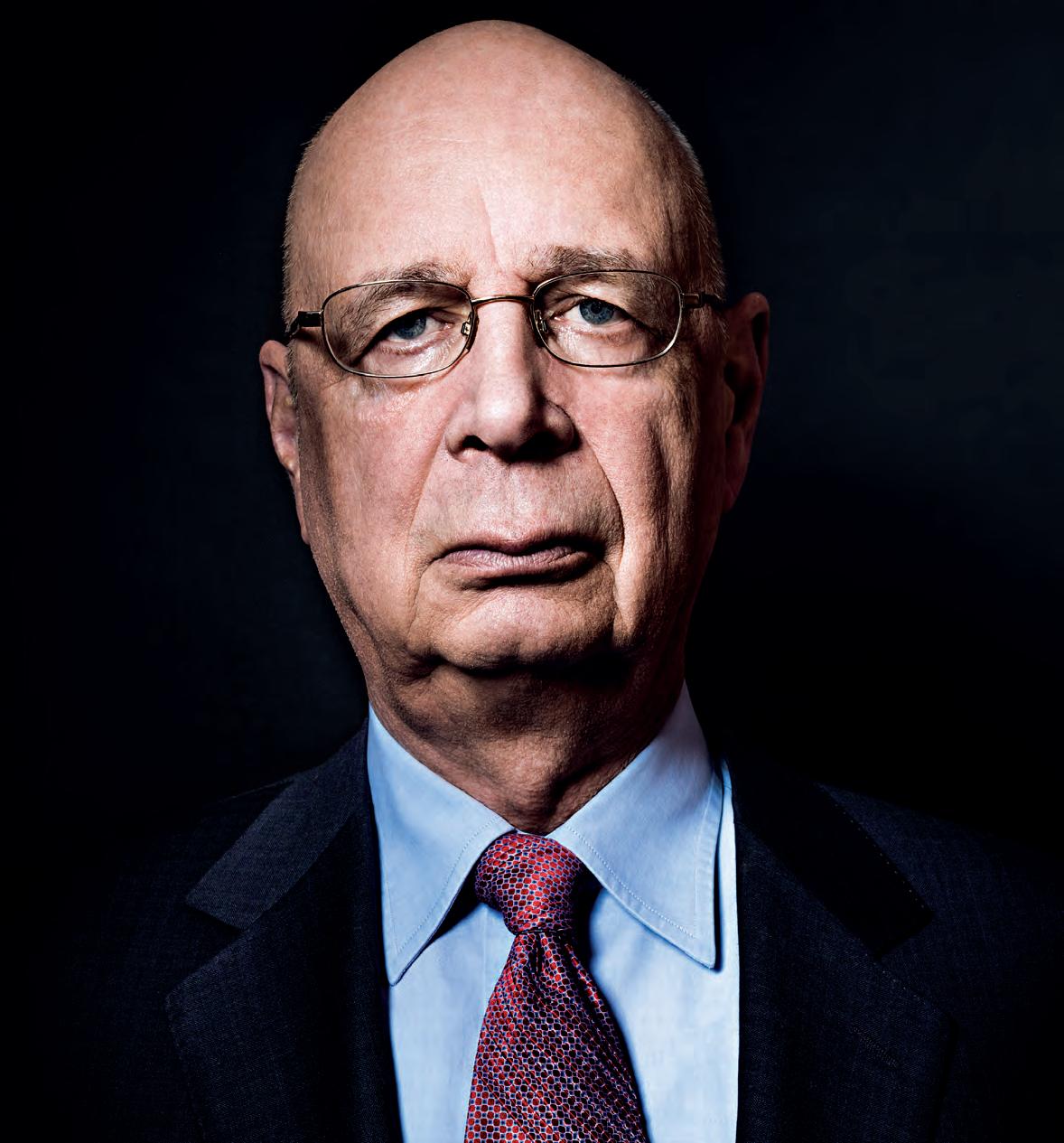

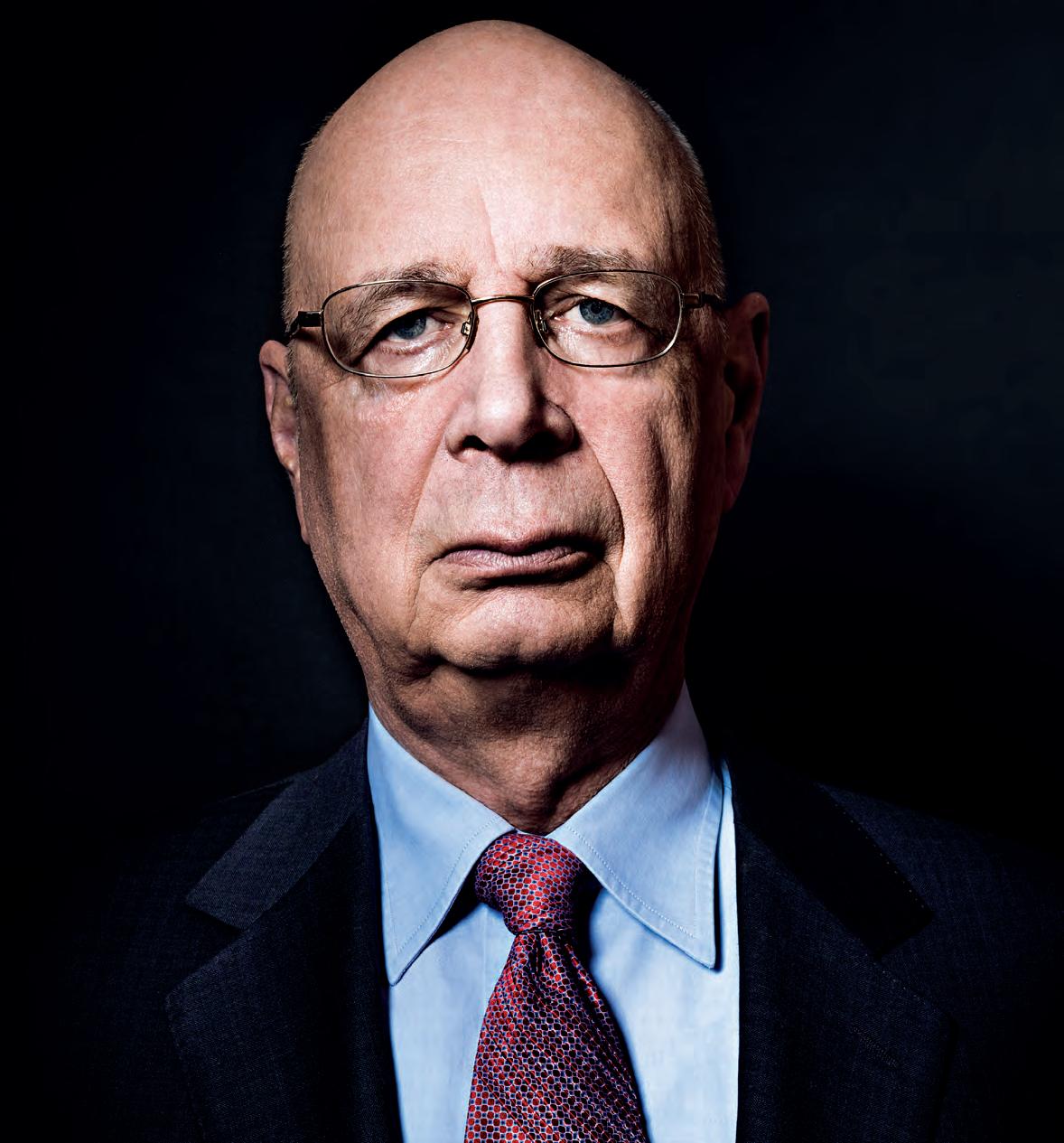

Klaus Schwab, founder of the World Economic Forum, has decided to step down as its executive chairman after more than 50 years. What legacy does he leave?

PUBLISHED BY WORLD NEWS MEDIA

LAWRENCE SUMMERS IAN BREMMER DAVID ORRELL MANUELA FRANCISCO UK £4.95 CAN $15.75 FRANCE €6.50 ITALY €6.50 GERMANY €15.00 BENELUX €10.95 SPAIN €7.00 USA $8.99

DANIEL GROS HOWARD DAVIES

Summer 2024 | worldfinance.com THE VOICE OF THE MARKET Plus ASSET MANAGEMENT ELECTRIC VEHICLES PROXY CONTESTS PRIVATE EQUITY LYNN MARTIN PENSIONS GOLD

THE ORIGINAL INFLUENCER

The Best Investment Bank in Brazil, Chile, and Colombia.

We thank our clients for their trust.

Actively participating in the sustainable development of the economy, o ering customized solutions and innovations with positive impact on society and the planet, with the best ESG (Environmental, Social, and Governance) practices that reinforce our commitment to deliver, in Latin America, the best experience as a Private Bank, Investment Bank, and ESG, aligned with our values.

Management Forum in 1971. He will soon stand down as chairman having helped shape the global agenda over five decades

66 Walking through a storm

The phenomenal growth in the Private Equity market has fallen foul of the Fed’s interest rate rises over the past couple of years, with high borrowing costs knocking investor confidence and leading to a slump

DESIGNER: Sam Millard

REpRoGRaphER: Robin Sloan

pRoDucTIoN MaNaGER: Richard Willcox

WEb aND MobILE DEVELopMENT

Scott Rouse

VIDEo pRoDucER: Paul Richardson

EDIToRIaL: Deborah Cicurel

Antonia Di Lorenzo

Laura French

Courtney Goldsmith

Adrian Holliday

Jemima Hunter

Alex Katsomitros

Claire Millins

John Muchira

Selwyn Parker

Rachel Richards

Hannah Smith

Sara Ver-Bruggen

must implement sustainable policies, businesses must reduce their carbon footprint and investors must choose wisely

114 Lighting the fuse on debt

Over the past 50 years, global debt has tripled, leading many economies into debt distress. To avoid detonating the global debt supercycle, nations must invest borrowed funds wisely and learn to live with less

coNTRIbuToRS: Ian Bremmer

Prof. John Coates

Howard Davies

Vikki Davies

Manuela Francisco

Catherine Gooderham

Daniel Gros

Nick Hodgson

Emma Holmqvist

David Orrell

Maryam Shahvaiz

Lawrence Summers

Peter Vindevogel

accouNTS: Gemma Willoughby

ILLuSTRaToRS: Richard Beacham

Jim Howells

buSINESS DEVELopMENT:

Bryan Charles

Tom Crosse

Michael Harris

Terry Johnson

James Watson

Monika Wojcik

The EU’s recently introduced AI Act is the first piece of legislation aimed at providing a regulatory framework to address the risks associated with the use and misuse of artificial intelligence amid its rapid growth

164 The Seine approach to hosting

Reluctance often creeps into Olympic Committee hearts when factoring in the cost of hosting. However, Paris is looking to take gold this summer with private sector funding and a low build, low spend approach

The information contained within this publication has been obtained from sources the proprietors believe to be correct. However, no legal liability can be accepted for any errors. No part of this publication may be reproduced without the prior consent of the Publisher.

Front cover photo of Klaus Schwab

© Henry Leutwyler/Contour by Getty Images

Editorial on pages 30–37, 74, 112 & 156 © Project Syndicate, 2024

6 | Summer 2024 Contents Summer 2024 x.com/WorldFinance Facebook.com/WorldFinanceMag Linkedin.com/showcase/World-Finance-Magazine YouTube.com/WorldFinanceVideos

World Finance World News Media Ltd 40 Compton Street London EC1V 0BD, UK Tel: +44 (0) 207 253 5100 Web: www.WorldFinance.com Email: enquiries@wnmedia.com © World News Media Ltd, 2024 Printed in the UK - ISSN 1755–2915

38 66 90 114 138 164

9

22

24 Financial History

We look back over the history of currency, from the bartering systems used millennia ago to digital currency today

26 Profile

Lynn Martin is the President of the NYSE, the world’s largest stock exchange. We explore the journey she went on to get there

30 Comment

Daniel Gros on global ‘slowbalisation,’ Howard Davies on global capital rules, Lawrence Summers on the climate crisis and Ian Bremmer on the role of NATO

170 The Econoclast

Immigration is useful, but it doesn’t necessarily equal a better economy

96 Trading

A record-setting rally in gold reinforces its reputation as a safe haven asset to wait out stubborn inflation and geopolitical risk

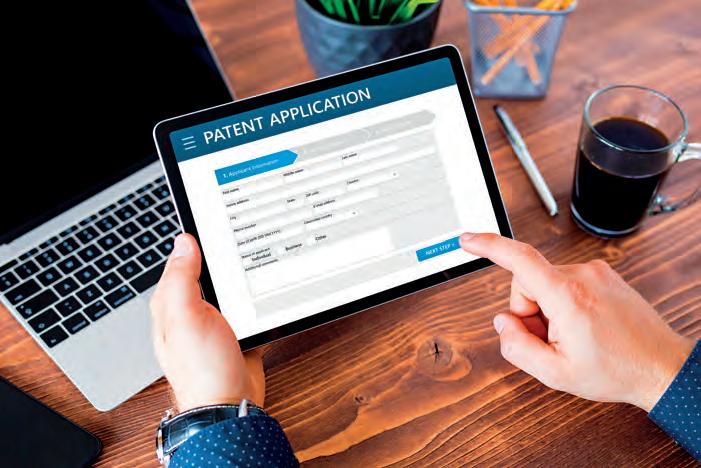

Despite a market cap in the trillions, crypto is still searching for stable regulatory footing 106 Intellectual Property

The European Patent Office sets its sights on a more equitable patent system for all

108 Africa

Currency reform in struggling nations is necessary to stabilise debt burdens and reverse the exodus of foreign investors

110 Germany

Productivity growth and an aging workforce urgently need to be addressed amid a turbulent geopolitical climate

112 International Development

The weakest economies need ambitious domestic reforms and to do this they require financial and policy support from abroad

44 Regulation

Proposed banking reforms in the US have provoked outcry but could determine a global shift in capital regulations

48 Digital

The transformative effect of technology in Macau bodes well for its banking industry

56 Cooperative

A bank owned by its customers can focus more completely on supporting their aims

58 Nigeria

A challenging macroeconomic environment has tested the nation’s banking sector

62 Sri Lanka

Following its worst-ever crisis in 2022, the country has been navigating a hard path back to recovery

64 Taiwan

Through system optimisation, talent cultivation and sustainable initiatives, one bank has reinvented itself

120 Dubai

Climate change looks likely to exacerbate extreme weather events and recent floods have exposed poor contingency planning

126 India

The natural resources sector is acting as a catalyst for India’s economic resurgence and helping to shape an eco-conscious future

128 Packaging

Sustainable packaging relies on biodegradable and compostable materials

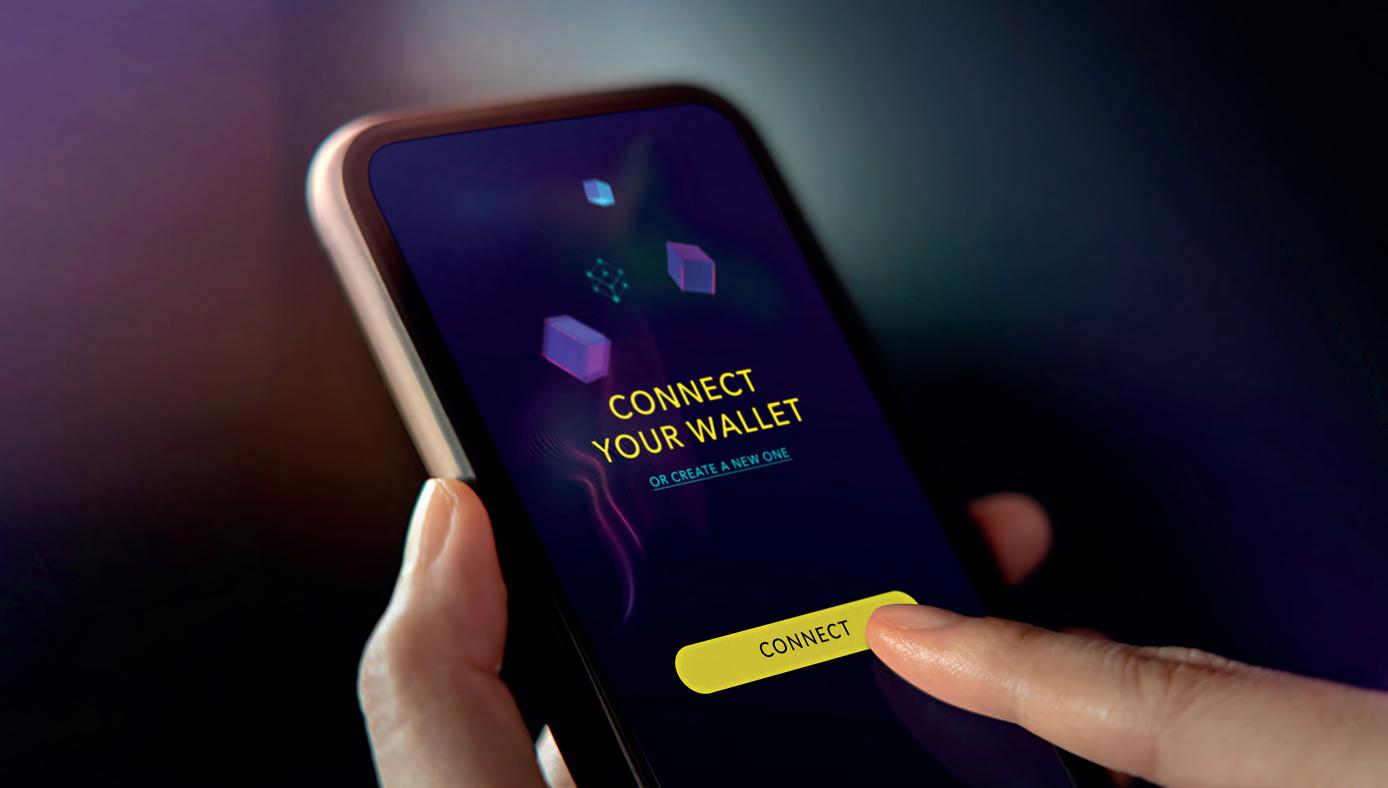

130 Supply Chains

War and climate change are threatening waterborne trade routes with longer transit times adding significantly to shipping costs

132 Proxy Contests

A lack of integrity in corporate elections must be addressed by Congress and the SEC

134 Technology

Immersive VR and mixed reality is contributing to consumers’ desires for more personalised and interactive experiences

72 Private Equity

Prof. John Coates discusses how to tackle the problem of outsized index funds and runaway private equity

74 Debt Management

Meaningful progress in managing debt is within reach for low-income countries

76 Private Banking

Including a look at Nigeria’s new generation of HNWIs and how the future of the private wealth industry is shaping up

80 Pensions

Mexico is moving towards a more inclusive financial landscape with the introduction of several new measures aimed at pensions

82 Luxury Sector

A new generation of consumers will drive the sector to new heights over the next decade

84 Asset Management

An appetite for responsible investing is helping to satisfy ethically minded investors

144 Electric Vehicles

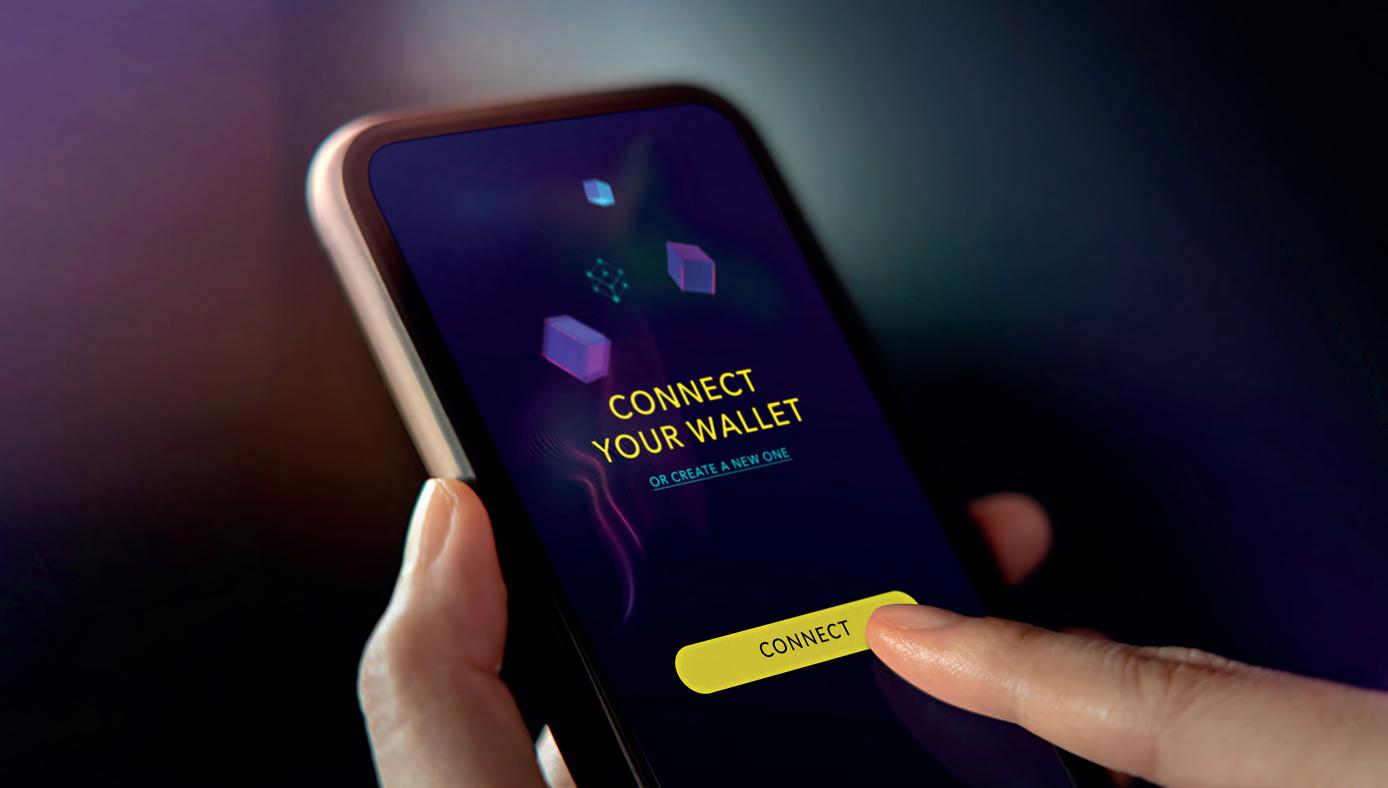

Recent EV market growth has opened up tantalising opportunities for savvy investors

146 Sustainability

The transition to a lower-carbon economy will heavily depend on powerful initiatives and innovations in the transportation sector

156 Clean Energy

Guyana has a unique approach to funding green growth through its vast oil reserves

158 Solar Power

Force majeure events must be considered when investing in solar photovoltaic projects

160 Management

Diversity at the top contributes to unique perspectives and better business outcomes

Summer 2024 | 7 The 2024 World Finance Awards can be seen on pages 122–124 Regulars Markets Analysis Strategy Banking Wealth Management

The Ledger Financial news, expert opinion and analysis of the financial markets

Global Review Analysing the Human Development Index

104 Cryptocurrency

A leading investment and private bank in the Nordics.

Carnegie Private Banking is a leading Nordic investment and private bank. We provide tailored wealth management services to private investors and entrepreneurs, along with access to unique investment opportunities and top-rated equity research.

Our long heritage dating back to 1803 gives us the experience to succeed. We have market leading expertise in stock brokerage, tax, law, pension and financial planning. Based on a holistic understanding of our clients’ individual wealth management needs and objectives, our committed team proactively advises them on their entire financial situation.

Carnegie Private Banking is where knowledge and capital connects.

Visit us: www.carnegie.se/privatebanking

Private Banking

Trading blows

The uK-owned Rubymar cargo ship sinks in the Red Sea following a missile attack by houthi rebels. With an estimated 12 percent of global trade passing through the Suez canal, disruption of shipping routes can quickly become a costly affair, with longer routes transiting the cape of Good hope contributing heavily to shipping costs.

Summer 2024 9 The Ledger buSINESS

FIScaL DIGEST columnists | insights | appointments | mergers & acquisitions | markets | statistics | global review | financial history

NEWS &

A revolution or a risk?

In april, Foxconn – one of Apple’s largest suppliers –announced a surprising shift in its executive leadership team. The company said it would introduce a rotating chief executive position in the hopes of building strong succession pathways and boosting corporate governance by separating the roles of cEo and chair. The move is a significant and fairly unusual step for the world’s largest contract electronics maker. but chairman Young Liu stressed that developing in-house talent is crucial for sustainable development. Through the setup, a rotating cast of cEos “can further understand operations of the company,” he said, by overseeing the six core businesses – including smartphones, personal computers and televisions.

Foxconn joins a small group of businesses that use a rotating cEo system, the most notable of which is Chinese tech firm huawei. Since 2011, the business has rotated its CeO every six months. In 2012, founder ren zhengfei admitted the change was a gamble, “huawei hasn’t found a way to adapt well to a rapidly changing society. Time will tell if the rotating cEo system is the right move or not.” over a decade on, it seems to be working. In April, huawei reported a soaring net profit to outpace rival apple.

Those embracing the rotating cEo idea are quick to point to the benefits. Financial services conglomerate aMTD Group said rotating its cEo would “create a much more diverse workplace” and “bring renewed energy and inspiration.” For paris-based insurtech start-up lovys, a rotating co-CeO role offered the opportunity for increased collaboration and personal development. At Poland’s digital games marketplace Kinguin, founder Viktor Romaniuk believed the shift would “bring fresh perspectives on prioritising and solving any issues the company faces, and overturning these complexities.” however, questions remain. Might the introduction of cEo responsibilities – on top of their current workload – encumber executives? Is six months enough to accomplish substantial innovations? Will they get a fair crack at the cEo whip, or just be kept busy? It will be worth waiting and watching to see whether Foxconn’s rotating cEo – and others like it – stick around long enough to see substantial results. If huawei’s success is anything to go by, the gamble may be worth it.

To REaD MoRE FRoM WoRLD FINaNcE coLuMNISTS, VISIT: www.worldfinance.com/contributors

Big tech is braced for downgrade

After technology giants experienced a boom in profits over recent years, warning bells are ringing. The “surging” earnings momentum that drove their huge growth over the last year is expected to “collapse” over the coming quarters, said UBS Global Research. The bank downgraded its rating of the ‘big six’ tech stocks, including Apple, Amazon, Google-owner Alphabet, Facebook-parent Meta, Microsoft and Nvidia.

The growth in earnings per share (EPS) of these stocks is expected to fall to 15.5 percent by the first quarter of 2025 (see Fig 1), down from 42 percent in the same period this year. The downgrade from ‘overweight’ to ‘neutral’ was not based on extended valuations or doubts about artificial intelligence (AI), Jonathan Golub, chief US equity strategist for UBS Investment Bank, wrote in a note to investors. “Rather, it is an acknowledgement of the difficult comps and cyclical forces weighing on these stocks.” While the warning might seem stark, the decline constitutes a normalisation following unprecedented cyclical waves

Aware that the warning of profit collapse may seem not to take into account factors like the buzz around aI, Golub reiterated it “simply refocuses the conversation on the cyclical nature of this profit cycle, and its pandemic origins.” In fact, while mega-cap tech firms are set to decline, UBS predicts companies that

caused by the pandemic. Tech stocks’ earnings soared in lockdown, driven by demand for personal computers, online shopping and social media, and then declined when the economy reopened. Profits were boosted again in 2023 thanks to a reduction in costs and easier comparables that peaked in the fourth quarter.

did not feel as sharp an impact during covid will perform considerably better. By the first quarter of 2025, gains of 25.5 percent are expected for the so-called ‘rest of tech’ stocks, up from 11 percent in 2024, and 19.4 percent growth for non-tech stocks, up from a decline of 3.3 percent this year.

10 | Summer 2024 The Ledger Summer 2024

insights columnists

VOICE of the maRkEt

TEch+

UBS projections on EPS growth

includes retail, media and home entertainment n Q1 2024 estimates n Q1 2025 estimates

Fig 1

SOURCE: UBS

42.2 BIG tECh+RESt OF tECh+S&P 500 EX- tECh+ 15.5 11.1 25.5 -3.3 19.4

Courtney Goldsmith

Raman Bhatia CEO

Starling Bank

Raman Bhatia CEO

Starling Bank

British neobank Starling Bank poached Raman Bhatia, CEO of energy firm OVO, to become the group’s chief executive. Founder Anne Boden, who stepped back from the role in 2023, said she believed Bhatia would “take Starling into its next phase of growth.” Bhatia holds an MBA from Harvard Business School, and before working at OVO was the head of digital banking for HSBC’s retail banking and wealth management business in the UK and Europe. Bhatia said he had long admired Starling “because it believes passionately, like I do, in using the power of tech to do the right thing for its customers and its people.”

VoIcE oF ThE MaRKET

Leaving oVo, a tech-led energy disruptor, bhatia brings a unique skillset blending consumer technology, fintech and banking. Starling bank is hoping the experience will drive forward its plan to continue capturing a larger share of the retail banking market. The appointment may also stir excitement for a public listing, which was shelved after boden left.

Christophe Fouquet CEO ASML

Europe’s largest technology company, ASML, welcomed Christophe Fouquet as its new chief executive. Based in the Netherlands, the fi rm provides hardware, software and services to chipmakers for smartphones, cars and more. “I am very happy to be able to write the next chapter of ASML and to continue to build significant value for our shareholders,” Fouquet said at the company’s annual meeting in April. A 15-year ASML veteran, Fouquet replaces retiring CEO Peter Wennink, who oversaw the company’s stratospheric growth, in which its share price rocketed to give it a valuation of more than €300bn.

VoIcE oF ThE MaRKET

Wennink suggested he expects more growth under Fouquet’s leadership. “people have been telling me recently, ‘you are retiring at the height of the company’s form’,” Wennink said. “No, we are not even in the middle.” but Fouquet faces an immediate challenge, with the company firmly in the middle of a trade war between china and the uS.

Manmohan Mahajan CFO Walgreens Boots Alliance

Manmohan Mahajan CFO Walgreens Boots Alliance

The global drugstore chain named Manmohan Mahajan as its permanent CFO amid a string of leadership changes aimed at boosting the fi rm’s healthcare business. The announcement, CEO Tim Wentworth said, “solidifies the leadership team that will carry WBA into its future as we look to expand our reach into the fastest-growing areas of healthcare.” James Kehoe, former CFO, stepped down in 2023, and WBA named Mahajan its interim global finance head. He has since “played an integral role” aligning cost structure with business performance, including increasing cash flow and lowering cap ex.

VoIcE oF ThE MaRKET

Since 2016, Mahajan has worked his way up from chief accounting officer at WBA. Strong financial nous will be critical as the company expands beyond its core business in pharmacies. after losing market share to rivals during the pandemic, Wba acquired healthcare services operator VillageMD and urgent-care provider Summit health.

The power of tariffs?

Joe biden has announced several barricades on chinese imports. More than $18bn of chinesemade goods will be hit by fresh US tariff s. But will American voters buy it in an election year? let’s kick away some puffery. china barely sells any electric vehicles to the uS, for example. biden has previously said he does not want a trade war with china. and he does not want more inflationary pressure on US consumers. China’s economy is in bad shape and exporting its way out of trouble, flooding overseas markets with product, is one way of compensating for domestic weakness.

Chinese ‘product’ isn’t the flimsy tat it was two decades ago. Its electric vehicles are well built and skillfully marketed. Earlier this year Elon Musk reportedly told analysts that if trade barriers aren’t established “china will pretty much demolish most other companies in the world.”

as it is an election year that trade gap is especially sensitive. according to the uS census bureau, the US imported $427bn in Chinese goods in 2023 but exported $148bn back. Pennsylvania and Michigan, with big manufacturing and industrial voter bases, tend to appreciate tough tariff talk and sentiment formerly taken up by Trump with gusto, now repackaged by biden.

For Biden, it is a more ‘targeted’ approach in key industries while Trump is about tariff s across the board, not just from China. A major difference. The irony is that many tariff s previously introduced by Trump were unpopular, driving up prices for many working americans, especially those without a college degree. Yet the uS economy is booming.

The problem is the US consumer doesn’t feel the power of ‘Bidenomics’ – yet – as it’s dominated by massive investment in green manufacturing. Nor does the world. Tariff s will feature big in election talk but, really, it’s about trade-off s, political strategy and calculus.

Europe is increasingly importing supercompetitively priced chinese EVs. If it follows the more protectionist uS language then trade stagnation may follow, with more drag on growth. Covid-19 and russia’s invasion of Ukraine was the starting gun. For now, it is all eyes on brussels.

To REaD MoRE FRoM WoRLD FINaNcE coLuMNISTS, VISIT: www.worldfinance.com/contributors

Summer 2024 | 11 columnists

appointments

Adrian Holliday

Reinvigorated pharma

The new raft of blockbuster obesity drugs has been a shot in the arm (or leg) for the pharma and biotech sectors. The so-called GLp-1 drugs have been flying off the shelves, with shortages reported as production has failed to keep pace with soaring global demand. Goldman Sachs has estimated that up to 70 million Americans will be taking these drugs by 2028, while barclays predicts the market for them will be worth $200bn within the next decade. Their success has propelled the share prices of their makers to new heights.

Novo Nordisk, the Danish pharma company behind Wegovy, Saxenda, and Ozempic, became europe’s most valuable listed company this year. Its shares have risen 270 percent since the launch of Wegovy to the uS three years ago. Eli Lilly, uS-based maker of Mounjaro and zepbound (tipped by one pharma analyst to become “the biggest drug of all time”), increased its annual sales forecast by $2bn in its latest results, and is ramping up manufacturing capacity to tackle supply shortages.

With so much at stake, the race is on to fund research and development which can bring new options to the marketplace. Biotech company Amgen’s shares soared after it announced it is trialling a new monthly injectable called MariTide, designed to help patients maintain weight loss long term.

Pfizer is working on once-daily pill danuglipron, and astrazeneca will pay up to $2bn to chinese company Eccogene to license its experimental pill to treat obesity and diabetes. Novo Nordisk has just signed a deal with US biotech firm Metaphore to develop at least eight more therapies for obesity.

As well as lighting a fire under r&D, obesity drugs have also prompted a wave of merger and acquisition activity which is gathering momentum. In December, roche spent $2.7bn to acquire unlisted obesity drug developer carmot Therapeutics. Last year, Eli Lilly snapped up Versanis bio for its drug which stops loss of muscle mass in GLp-1 patients. Investors take note. as the demand for obesity drugs soars, it seems likely that many more of these smaller producers will become acquisition targets in a reinvigorated global pharma sector.

To REaD MoRE FRoM WoRLD FINaNcE coLuMNISTS, VISIT: www.worldfinance.com/contributors

HSBC sells to RBC in Canada deal

Royal Bank of Canada (RBC) completed its acquisition of HSBC Bank Canada for around $10bn. The deal signifies the merging of Canada’s largest and seventh-largest lenders in order to drive growth in RBC’s domestic business and boost its position on the global stage. “RBC’s acquisition of HSBC Canada expands the depth and breadth of our international banking capabilities and builds our ability to connect Canadians to the global economy,” said RBC’s Neil McLaughlin.

“Through this combination, RBC is now exceptionally positioned as the bank of choice for commercial clients with international needs, newcomers to Canada and affluent clients who need global banking and wealth management capabilities.” At times, it was uncertain whether the deal would go through. A deal of this size had not been attempted in Canada’s banking sector since the 1990s, when RBC’s plan to take over Bank of Montreal was blocked by regulators. The deal had to overcome opposition from environment groups and the Conservative Party of Canada. Canada’s Competition Bureau said the deal was unlikely to hurt competition, but

M&a

Synopsis serves up an ace

In one of the largest tech deals to be announced in recent years, semiconductor design and software maker Synopsys is set to acquire Ansys, an engineering and product design software company, in a cash-and-stock deal valued at $35bn. The companies said the deal would create a leader in silicon to systems design solutions. Technology megatrends like artificial intelligence “are requiring more compute performance and efficiency in the face of growing, systemic complexity,” said Sassine Ghazi, president and CEO of Synopsys. Building on the hype around AI, Synopsys’ share price has grown nearly 50 percent. Ansys, which makes simulation software used to help analyse products across a range of industries, was behind the software used to create products from aeroplanes to Novak Djokovic’s tennis rackets.

would “result in a loss of rivalry.” As a condition of the acquisition, RBC agreed to create a global banking hub in Vancouver, donate one percent of net income before taxes to communities and provide $7bn in financing for affordable housing construction across Canada. For HSBC, the deal was part of the bank’s plan to focus on growth in Asia. “The reality is that HSBC Canada only has a market share of around two percent, and we cannot prioritise the investment needed to grow it further,” HSBC group chief executive Noel Quinn said. It follows the bank’s sale of its retail banking activities in France in early 2024.

M&a

Firm’s assets acquired

Labcorp scooped up Softbank-backed Invitae Corp’s assets following the genetic test maker’s bankruptcy. Invitae fi led for voluntary Chapter 11 protection in February, and its estimated assets were said to be in the $500m to $1bn range, while liabilities were in the $1bn to $10bn range. All the bankrupt firm’s assets will be acquired on a going concern basis for $239m in cash consideration and non-cash consideration. The transaction will generate around $285m in annual revenue, Labcorp said, with the “vast majority” in speciality testing areas like oncology and rare diseases. “The agreement with Labcorp marks a significant step in our financial restructuring and supports our efforts to continue to deliver innovative and industry leading products and services for healthcare,” said Ken Knight, president and CEO of Invitae.

The Ledger Summer 2024

mergers & acquisitions 12 | Summer 2024 columnists

Hannah Smith

Furious farmers

Farmers march in protest in Madrid, demanding answers to the many problems facing the agricultural sector. historic drought in the Iberian Peninsula, insufficient government proposals and inflexible eU policy have contributed to gross production value projections of $44bn in 2024, down from $68bn in 2022.

news in pictures Summer 2024 | 13

What DORA means for board members

operational t, is the European regulation created to ensure financial services providers across Europe can defend against the ever-changing threats to their IT capabilities. Rather than specifying technical requirements based on the current cybersecurity landscape, it sets the principles for businesses to follow. In this way they can manage the risks presented by GenaI, post-quantum cryptography, and whatever comes next.

“You need to stay at pace with what is happening – you cannot rely on a standardised list of threats,” said Fabio Colombo, Accenture’s Global Cybersecurity leader for Financial Services. “These threats need to be evaluated each year, each quarter, to make sure that you are managing correctly your perimeter and your maturity in this area.”

IPO activity continues to rebound

Markets have kicked off 2024 on a “cautiously optimistic” note, with 287 deals in the first quarter, raising $23.7bn, according to EY’s report, Global IPO Trends Q1 2024 (see Fig 1). By number, the top three sectors for Initial Public Offerings (IPOs) were industrials, consumer and technology sectors. The financial sector, on the other hand, saw a “substantial decrease” in the number of IPOs that performed well.

The trends seen in the first quarter of the year were a “major shift” in the global IPO market share from the past five years, said George Chan, EY global IPO leader. However, he warned, “As 2024 unfolds, participants in the IPO market are entering uncharted territory.” Looking forward, there is significant interest around artificial intelligence (AI). Many of these companies are still in the early stages of funding, but they could bring a wave of IPOs in the coming years.

“IPO candidates are influenced by the recent pivot in investors’ preference toward proven profitability in an altered interest rate landscape and are doing this while facing the

SOURCE: EY

intricate dynamics of an intensified geopolitical climate and the buzz around AI,” Chan said. “To succeed in this shifting environment, IPO prospects must remain flexible and prepared to seize the right moment for their public debuts.”

“one goal of the regulation is to bring enough level of accountability in the financial institution – starting with the board of directors, down to the cEo and then to the c-suite and all employees," he explained. "but the important part is that the board of directors and c-suite and cEo need to be trained.”

This training, he stressed, can’t just be academic: as well as learning about and understanding the latest cyber risks, the board must actively practise managing the threats they pose to their company.

“And you can do that by having these two different forms of exercise,” said colombo. “one is a tabletop exercise, simulating a crisis that is started as a cyber incident. and the second one is by participating as the white team in the threat-led penetration testing that is a pillar of DoRa regulation.”

Although targeted at financial institutions, the act will also affect third parties that provide ICT services to them – including accenture itself. “We studied the DoRa regulation, the RTS, the ITS [the Regulatory and Implementing Technical Standards],” said colombo. “We did a gap analysis because we already have a good set of standards and procedures that come from our global company. but we need to understand if there is any gap or good practice that we need to put in place.”

The act will apply from January 2025.

To FIND ouT MoRE: www.worldfinance.com/videos

Summer 2024 | 15 The Ledger Summer 2024

markets

The trading floor of the New York Stock Exchange

videos

Global IPO activity NumbEr of ipos Fig 1

Fabio Colombo

2,600 2,400 2,200 2,000 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 2020 202120222023 Q1 2024

Nearshoring hopes far from fruition

The nearshoring trend has failed to yield the dividends expected for Mexico, according to a recent Reuters report. Rising costs of materials and real estate, as well as creaking infrastructure, have slowed the influx of foreign uS manufacturers bringing their production closer to home in response to postpandemic supply chain disruption.

This was part of the risk matrix that Mexican commercial bank Grupo Financiero Banorte identified in its Zoom Nearshoring report, published in 2023, and discussed by banorte chairman carlos hank González in a video interview with WorldFinance . Industrial growth due to nearshoring represents a structural change, the report said, and a number of challenges could stem that growth before it truly begins: from poor infrastructure putting a hard cap on any real capacity growth, to low educational attainment reducing the effectiveness of local human capital. These challenges, the report continued, must be addressed in a ‘four-helix’ model that includes government, the private sector, education institutions, and society.

“These entities need to work together to maximise the potential benefits of nearshoring,” González explained. “From improving public infrastructure to fostering policies that incentivise investments, the ‘four-helix’ model aims to bring comprehensive development to Mexico.”

"The potential gains of nearshoring for Mexico could reach up to $168bn of additional non-oil exports in the next five years," he said. "Our research department has identified the industries that are most likely to grow due to nearshoring, including agriculture, machinery, and electronics, to name a few. We’re adding 1,200 jobs to specifically support these growing industries, [and] building technological capabilities to create fully digital environments that will serve the needs of newly established companies in Mexico."

but the country is yet to see any real growth or nearshoring benefit. A report by Deloitte found that FDI has remained at three percent of Mexican GDp for the last 10 years, and a minority of Mexican companies have reported any increase in demand due to nearshoring. To FIND ouT MoRE: www.worldfinance.com/videos

Resilient markets showing growth

but steadily in the coming years, the International Monetary Fund (IMF) said in its World Economic Outlook report in April, largely thanks to the driving force of the US economy. The Washington, DC-based group slightly revised up its forecast of global growth at 3.2 percent for 2024 and 2025, matching the level of growth in 2023. The global economy has shown “remarkable resilience,” said PierreOlivier Gourinchas, the IMF’s chief economist. He cited stronger-than-expected activity in the US, China and other large emerging economies – but not, notably, in Europe. Risks to growth remain centred around inflation, as Gourinchas said progress towards targets had stalled, and there is geopolitical instability in the Middle East and Ukraine.

Going forward, more work must be done to “rebuild fiscal buffers to guard against future shocks, make room for priority investments, and to ensure debt sustainability,” Gour -

With the US fiscal deficit forecast to stay elevated, interest rates and the dollar will also be pushed up, contributing to tighter funding costs throughout the rest of the world. What makes debt levels even more concerning is the fact that history shows governments spend more and tax less during election years.

inchas said. Indeed, US and Chinese fiscal debts were found to be a concern in the IMF’s semi-annual Fiscal Monitor report. In the US, a deficit of 7.1 percent is expected to be recorded next year, while in China, high debt is a concern amid weak demand in the country’s housing crisis. These countries must “address fundamental imbalances between spending and revenues,” the IMF warned. Four years after unprecedented responses to the Covid-19 pandemic, public debt and deficits remain higher than usual – even rising slightly in 2023 after falling in 2021 and 2022. Only half of the world’s economies tightened fiscal policy in 2023, down from about 70 percent in 2022. “Looking ahead, global public debt is projected to approach 100 percent of GDP by the end of the decade,” said IMF director of fiscal affairs department Vitor Gaspar. In China and the US, he said, public debt is now higher and expected to grow faster than prepandemic projections.

Deficits in election years tend to exceed forecasts by 0.4 percentage points of GDP, the IMF reported – and 2024 happens to be an exceptional year for elections, including in the uS, India and the uK . With much at stake, the IMF urged governments to exercise financial restraint in order to preserve public finances.

16 | Summer 2024

Summer 2024 insights videos

The Ledger

Carlos Hank González

V OICE of the ma R k E t

International monetary Fund

Chief Economist pierre-olivier Gourinchas

Building bridges

The Maanshan Yangtze River highway and Railway bridge under construction in Maanshan, Anhui province, China. It is the world’s first threetower cable-stayed bridge with dual main spans exceeding one kilometre and the world's longest steel-girder cable-stayed bridge. The project is expected to cost around $1.3bn.

Summer 2024 news in pictures 18 | Summer 2024

The Ledger

SCI-FI FUTURE

The value of the global AI market is expected to hit $1.3trn by 2030, with generative AI models, self-driving cars, humanoid robots and plenty beyond propelling the industry to new heights. From AI adoption rates by country to the sector’s contribution to global GDP, we look at the stats behind this booming industry, and the business sentiment surrounding its rapid growth trajectory.

AI adoption rates across the globe n Deployed aI n Exploring aI

Projected growth of the global AI market from 2020-2030 n Total n computer vision n aI robotics n Machine learning n Natural language processing

Artificial intelligence market size

Top ways business owners use artificial intelligence

statistics Summer 2024 19

56%

HOW THEy CURRENTLy USE OR PLAN TO USE AI WITHIN THEIR BUSINESS

USD $ BILLIONS

Sou R c E S statista.com, precedenceresearch.com, ibm.com, marketsandmarkets.com, bluetree.digital, goldmansachs.com, mckinsey.com, forbes.com 37% ESTIMaTED coMpouND aNNuaL GRoWTh RaTE oF ThE GLobaL aI MaRKET FrOM 2023 TO 2030 76% oF coNSuMERS aRE coNcERNED abouT aI cauSING MISINFoRMaTIoN 64% oF buSINESSES ExpEcT aI To IMpRoVE cuSToMER RELaTIoNShIpS aND INcREaSE pRoDucTIVITY 58% oF chINESE coMpaNIES aRE uSING aI 14% The FINANCe INDUSTry’S MaRKET ShaRE IN aI $184bn Value of the global aI market in 2024 400 million The number of workers that could be displaced by aI $1.3trn projected worth of the global AI market by 2030 97 million The number of people expected to work in the AI space by 2025 Customer service australia India Spain canada Italy uaE china Latin america uK France Singapore uS Germany South Korea Global 24% 28% 58% 31% 34% 57% 42% 29% 39% 22% 31% 38% 26% 25% 34% 44% 48% 30% 44% 44% 27% 41% 43% 46% 46% 45% 40% 47% 43% 42% Cybersecurity/fraud management 51% Digital personal assistants 47% Customer relationship management 46% inventory management 40% Content production 35% product recommendations 33% accounting 30% Suppply chain operations 30% recruitment and talent sourcing 26% Audience segmentation 24% $2,575 2032 $2,156 2031 $1,807 2030 $1,516 2029 $1,273 2028 $1,070 2027 $900 2026 $757 2025 $638 2024 $538 2023 $454 2022 2020 2023 2026 2021 2024 2027 2029 2022 2025 2028 2030 7%/

projected increase in global GDp as a result of generative aI

$7trn

Together, we achieve more.

As the 8th largest bank in North America by assets 1, we’re fueling progress for individuals, families and businesses. We’re proud to be recognized as Best Private Bank, Best Commercial Bank and Best Retail Bank in Canada; and Best Commercial Bank in the US by World Finance Magazine.

1

As of January 31, 2024

The price to be paid for unsustainability

The Biscay Bridge first opened in 1893. Spanning the estuary of lbao in Spanish basque country, it was a unique design: a gondola, suspended by steel cables from a mechanical trolley running the length of the high bridge, would carry up to six cars and 200 people from one side of the river to the other.

after its completion, many similar bridges were built around the world, but few survive. The biscay bridge, however, has been in continuous operation since it opened. Now a uNESco heritage site, the bridge operates 24 hours a day. It has transported an estimated 650 million people since it opened; its gondola travelling the equivalent of 31 trips around the earth.

And in November 2023, BBK broke it.

“The biscay bridge… is a symbol of the progress of the basque country,” bbK chairman xabier Sagredo told our sister publication EuropeancEoin a video interview. “We wanted to reflect on it, by ‘breaking’ a part of the bridge, how if we do not take into account this concept of sustainable competitiveness, our progress will fail.”

India achieves $100bn investment

bbK is a private banking foundation. once a savings bank, it was forced after the financial crisis to divide into a banking entity (now called Kutxabank) and a banking foundation that divests its investment income into biscay through the largest per capita social work programme in the state.

Sustainable competitiveness is BBK’s guiding principle. It’s a model “that aspires to generate the greatest contribution of value to all its stakeholders and the society in which it operates,” explained Sagredo: sustainability must be at the heart of competition, or we risk a race-to-the-bottom that jeopardises our progress.

“Take a sustainable company and a non-sustainable company. Is it fair to compare the prices they charge? one will be lower, but at what cost to the workers, or environment, or society? It leaves a price to be paid.”

This simple idea – the price to be paid – lends its name to BBK’s latest art installation on the Biscay Bridge: 60 cubic metres of display screens, installed 50 metres above the river, creating the illusion of a broken bridge.

To FIND ouT MoRE: www.europeanceo.com/videos

A trade deal has been negotiated between India and four European countries that will see the world’s most populous country lift a majority of import tariffs on industrial products in return for an investment of $100bn over 15 years. The deal sealed nearly 16 years of negotiations with the European Free Trade Association (EFTA) – an intergovernmental organisation of Switzerland, Norway, Iceland and Liechtenstein – and is part of Prime Minister Narendra Modi’s aim to boost annual exports to $1trn by 2030. It also follows deals inked with Australia and the United Arab Emirates, while another trade deal with Britain is said to be in its final stages.

Trade minister Piyush Goyal confirmed in March that India would lift or partially remove its high customs duties to drive investment in its market of 1.4 billion people. Of the trade deal, he said, “It is a modern trade agreement, fair, equitable and win-win for all five countries.” It is hoped the deal will boost

The news of the landmark trade deal comes as the World Trade organisation forecast a gradual rebounding of global trade in 2024, with a further rise in 2025 as the impacts of high inflation ease. af ter a larger-than-expected 1.2 percent decline in

exports for a range of industries in India, including manufacturing, machinery and pharmaceuticals, as well as driving investment in automobiles, food processing, railways and the financial sector.

The news came ahead of India’s general elections, where, at the time of writing, Modi was seeking a record third term with his Bharatiya Janata party (BJP). Members of the EFTA – which has a combined population of 13 million and a gross domestic product of more than $1trn – also stand to benefit. India is the group’s fifth-largest trading partner, with two-way trade reaching an impressive $25bn in 2023.

In Switzerland, the largest member of the bloc, manufacturers of machinery, transport and luxury goods like watches will see increased opportunities, while elsewhere in the EFTA makers of pharmaceutical and medical devices, processed food and drink and engineering products are expected to benefit.

2023, global trade volumes are now expected to increase by 2.6 percent this year and a further 3.3 percent next year, according to the WTO’s Global Trade Outlook and Statistics report. While geopolitical risks remain, the rebound is expected in large part thanks to growth in trade in Europe.

The Ledger Summer 2024 Summer 2024 | 21 videos

Xabier Sagredo

V OICE of the ma R k E t

indian minister of Commerce and industry piyush Goyal

Uneven progress

The split between rich and poor countries is growing, according to the latest Human Development Index, published by the United Nations. By measuring each country’s gross national income (GNI) per capita, education and life expectancy, the index shows how well and how long people live

1 Switzerland (Rank 1)

Leading the HDI with the highest level of human development was Switzerland. With a score of 0.967, the country boasts a life expectancy at birth of 84 years, and children entering school age now are expected to receive 16.6 years of education. The high score represents Switzerland’s stable government, strong economy and quality education and healthcare, and it exceeds its pre-Covid score. In fact, all 38 countries in the Organisation for Economic Co-operation and Development achieved higher scores compared to their pre-pandemic levels. Since 1990, Switzerland’s HDI value has grown by nearly 14 percent, with GNI per capita growing over 21 percent.

2 Ukraine (Rank 100)

Despite the ongoing war with Russia, Ukraine remains in the ‘high level of human development’ category. However, its HDI fell to the lowest level since 2004. While development has proved resilient, Jaco Cilliers, the United Nations Development Programme (UNDP) resident representative in Ukraine, warned that challenges still lay ahead. “We still don’t know the full impact of the invasion on Ukraine, due to the difficulty of collecting data, particularly in occupied areas,” Cilliers said. “But the overall picture is a challenging one for Ukraine, and action and support will be required to mitigate adverse effects and keep Ukraine on the path to sustainable development.”

3 Chile (Rank 44)

The Latin America and Caribbean region (LAC) improved more than any other region. However, despite the impressive and significant growth, it still failed to reach pre-pandemic levels of progress. Chile notched a score of 0.860, the highest in the region. Nine in 10 people value democracy in the LAC, the UNDP found, but there is growing dissatisfaction, especially among women and vulnerable populations. The region is also experiencing the most rapid rise in political polarisation in the world, and, according to a recent Latinobarómetro survey, trust in institutions has decreased quite significantly, with only one in five people expressing trust in their government.

Ranking in the ‘low human development’ classification, Afghanistan’s Human Development Index was the lowest in the South Asia region. The country achieved its highest ever level in 2019, but in the years since, the score has been knocked back by 10 years. The country’s Gender Development Index (GDI) took a particularly hard hit, with all measures falling over the last year. It comes after the Taliban regained power in Afghanistan in 2021, creating what Human Rights Watch called “the world’s most serious women’s rights crisis.” At the global level, Afghanistan’s Gender Development Index ranks as the secondlowest in the world, above only Yemen.

4 Afghanistan (Rank 182)

22 | Summer 2024 world finance Global Review 3

No data Low Very high high Medium

5 Montenegro (Rank 50)

Montenegro maintained its proud position among the countries with ‘very high human development’ for an impressive seventh year running. The country scored a value of 0.844, which represents a 12.7 percent jump since 2003. The Gender Development Index has also increased by around 65.4 percent in that same period of time.

The Gender Development Index score, which measures the gender differences between female and male, found the value for women on the HDI was 0.833, compared to 0.852 for men. The measure of gender inequality placed Montenegro 33rd out of 166 countries. Women were found to live longer but overall received less time in education.

6

South Sudan

(Rank 192)

At the bottom of the Human Development Index, ranking in next-to-last place, was South Sudan. The country moved up one place from the previous year, but its score has fallen even lower. Between 2010 and 2022, the country’s HDI value fell 6.2 percent, while life expectancy at birth and expected years of schooling inched up slightly. However, the GNI per capita in the period dropped 44 percent. The UN discovered that all developing regions failed to meet their anticipated HDI levels based on the trend before 2019.

“It appears they have shifted to a lower HDI trajectory, indicating potential permanent setbacks in future human development progress.”

7

Hungary

(Rank 47)

Hungary sat within the ‘very high human development’ ranking, with an HDI value of 0.851. After falling in the previous two years, Hungary’s HDI rose in the latest index. However, human development is not plain sailing for the country. The UN’s report cites research indicating that countries with populist governments have lower GDP growth rates. “15 years after a populist government assumes office, the GDP per capita is found to be 10 percent lower than it might under a non-populist government scenario,” it said. Viktor Orbán has led Hungary for 14 years, turning the country into what the European Parliament called a “hybrid regime of electoral autocracy.”

Kyrgyzstan

Moving up one place from the previous year with a score of 0.701, Kyrgyzstan slightly improved its position in the latest HDI ranking. The growth lifted it into the ‘high human development’ category, moving it even closer to other regional peers such as Uzbekistan (106th), Turkmenistan (94th), Azerbaijan (89th) and Armenia (76th). For the most part, the improvement was down to growth in its GNI per capita score, which increased by more than five percent in the period. Positive changes were also seen in life expectancy and in the distribution of human development within the country. However, the gender gap in human development remains a problem issue.

8

(Rank 117)

Summer 2024 | 23 world finance Global Review

1 2 4 5 6 7 8

SOUrCe: hUMAN De velOPMeNT INDe x 2024

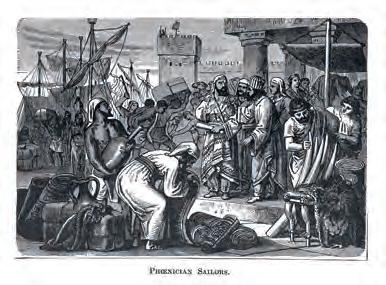

The evolution of mon€y

From millennia-old bartering systems to modern-day paper currency, cards and crypto, money has undergone something of an evolution since its earliest days in ancient Mesopotamia. Here we trace the history of currency across the world, and how trading systems have adapted, grown and transformed throughout the centuries to reflect the changing nature of societies.

6,000 BC

3,000 BC

rtering laid the foundations for modernday money more than 8,000 years ago – beginning with Mesopotamian tribes in the Middle East, who would trade produce, labour and other essentials for livestock and vice versa. The phoenicians and babylonians also created their own bartering systems, exchanging goods across cities. Later, as humans began travelling more, spices, shells, precious stones and other goods started to take over.

1816

Exchanging cumbersome physical commodities was eventually replaced by symbolic representations of value. In ancient Mesopotamia, symbols were inscribed onto clay tablets to represent debts, simplifying trading systems as societies grew. This created a new way to do commerce, and paved the way for the emergence of coins and paper money that was to follow more than 2,000 years later.

the ‘lydian Slater’ was the first coin to be officially issued by a government. chinese coins meanwhile featured a hole in the middle so they could be strung together for bigger transactions. coins later began to circulate in ancient Greece; gods were traditionally depicted, until alexander the Great made an appearance, setting the stage for rulers to feature.

1900

In 1816, england adopted the gold standard – meaning notes issued by the bank of England represented a certain amount of gold that owners could exchange for bullion. A British pound was defined as 113 grains of gold, although the rate varied according to the cost of shipping. proponents of the system argued that by limiting the number of notes printed, it would prevent inflation, and give measurable backing to the country’s currency.

countries began adopting the gold standard – including the uS, which introduced the Gold Standard Act in 1900, allowing global trade to flourish. however, governments realised relying on finite reserves would stall growth; Britain stopped using the gold standard in 1931, followed by the uS two years later. It was eventually replaced by the modern Fiat system, meaning money would be backed by the state rather than by physical gold.

1950s

difficult. Around the 10th century AD, merchants in china started to use paper receipts as a lighter way to do commerce. under the Song Dynasty, certain shops were given permission to give out the receipts; the government then started to issue receipts themselves, marking the world’s first official paper currency. This made global trade significantly easier.

Money underwent its next major transformation in the 1950s, when credit cards emerged in the uS – in the form of charge cards issued by the Diners’ Club. In 1958, American express launched a paper charge card, while bank of america introduced the bankamericard. uK banks soon caught on, and debit cards emerged in the 70s and 80s. The launch of point of sale terminals and then chip and pin technology made card transactions easier.

Bitcoin was born in 2009, signifying the world’s first decentralised cryptocurrency. It was followed by multiple others, with annual trading volume in crypto reaching $82.12trn in 2022. Several governments have since piloted their own central bank digital currencies, from China’s digital yuan to Sweden’s e-krona – marking a fascinating next step in a system that first began more than eight millennia ago.

24 Summer 2024 world finance Financial History

Breaking from tradition

From teaching herself to code to being named the boss of the world’s biggest stock exchange, Lynn Martin is now one of the most powerful women in finance. Can she use her roots in tech and data to bolster the New York Stock Exchange in a time of volatility?

At the turn of the millennium on Wall Street, there was a feeling in the air that anything was possible. The dotcom bubble was growing and companies like Amazon and Google were beginning to reshape how we use technology from a useful tool to an integral part of everyday life. Tech was also fast becoming a key force underpinning financial markets, and someone who was taking notice was Lynn Martin, a programmer at IBM who had just graduated from Manhattan College with a degree in computer science and a passion for writing code. As a lover of puzzles, it was no surprise that Martin soon developed an interest in the mathematics of financial markets, leading her to gain a master’s degree in statistics from Columbia University and leave IBM for the New York Stock Exchange’s (NYSE) derivatives business.

Today, technology is even further entangled in global financial markets, which means Martin’s unique blend of skills and experience make her a fitting boss for the world’s largest stock exchange. When she was named president of the NYSE in late 2021, two decades after beginning her career there, Martin said she was “floored” – and not only because of what the promotion meant for her future. “I was honoured, mainly because I understood the gravity of being asked to do this role as a woman and what it represents to have the confidence of a Fortune 500 CEO and entrepre-

neur whom I have admired for years,” she said, referring to Jeff Sprecher, chair and CEO of Intercontinental Exchange (ICE), which owns the NYSE. The appointment of a woman with Martin’s vast experience and potential opens the door to even more innovation for the exchange, Carole Crawford, chair of the board of directors for the non-profit 100 Women in Finance, told World Finance. Indeed, Martin is the first to admit that her route from computer programmer to exchange boss was not a traditional career path that girls could follow when she was young.

From Commodore 64 to the Big Board

While Martin was growing up on Long Island in Smithtown, New York, her parents did something that changed her life: they brought home a Commodore 64 computer. “That initial exposure to computers turned into a college major, got me my first job, and then created the cornerstone of my career,” Martin wrote in an op-ed for Fortune in January 2022, just as her tenure as president of NYSE began.

Martin’s first full-time job as a programmer at IBM during the dot-com boom put her at the heart of a pivotal moment in the tech industry, and her early experience with technology instilled a lifelong “appreciation for the value of data and what technology can create,” she wrote. This understanding catapulted her from “that girl who loved to code” on Long Is-

Lynn Martin IN NuMbERS

$40trn

The combined market cap of companies listed on the NYSE

$4.4bn

ICe’s exchanges segment’s revenue in 2023

$25trn

The value of the entire NYSE portfolio as of December 2023

23

Years Martin has worked at NYSE and its parent company IcE

land right into the centre of the action in lower Manhattan, heading up one of the world’s most significant exchanges. Her familiarity with technology is one of Martin’s superpowers, and she is keenly aware that succeeding at the NYSE “will require me to look both forward and back, to view the future through the lens of my unique experience and to help guide an iconic institution in an uncertain age.”

Martin came to the top job at the NYSE at a time when the economy was still reeling from the pandemic. Two years in, and while Covidrelated issues are fading, the exchange is under increasing pressure from rival Nasdaq, which beat the NYSE in the battle for initial public offerings (IPOs) in 2023 for the fifth consecutive year.

Lynn Martin

pRESIDENT, NYSE

world finance Profile

26 | Summer 2024

“I don’t accept the phrase ‘We’ve always done it that way.’ Because with that mindset you don’t grow and innovate”

Lynn Martin

CurriCulum viTAe boRN: 1976 | EDucaTIoN: MaNhaTTaN coLLEGE, coLuMbIa uNIVERSITY

1998 after graduating from Manhattan college in 1998 with a bachelor of science degree in computer science, Martin would go on to gain a master’s degree in statistics from columbia university.

2001

Martin joined technology giant IbM as a consultant within its Global Services unit shortly after graduating. She worked there until 2001, when she made the switch over to the NYSE.

There is also the rapidly shifting landscape for environmental, social and governance (ESG) standards to contend with, and the small task of ensuring that global firms continue to see the US capital markets as the most attractive place to take their business. Martin is tackling the challenges head-on, applying her unique brand of data-driven insights to come up with new ways for the NYSE to work. In ICE’s fourth-quarter earnings for 2023, its exchanges segment posted a 16 percent rise in revenue to $1.1bn, equating to half of the total company revenue in the quarter.

Recalling the first time he spoke with Martin in 2013, just after ICE acquired the NYSE in a massive $8.2bn deal, CEO Sprecher said, “I remember thinking about how bold and determined she was. And I liked that about her.” It is what led him to appoint Martin, who had been working in the NYSE’s listed derivatives

2008

As COO of NySe liffe (London International Financial Futures and options Exchange) from 2008 to 2013, Martin was the main point of contact from an operational perspective.

2013

After spending 10 years across senior customer and business development roles and as coo at NYSE liffe US, Martin was named cEo of the futures and options exchange in 2013.

business at the time, to run Interactive Data, a market data company that ICE bought for $5.2bn in 2015. Although the business had potential, growth was lagging, and Martin was challenged with improving its prospects. She did this and then some, proceeding to double the company’s growth rate and build it into ICE’s multi-billion-dollar fixed income and data services segment. However, considering current market challenges, the NYSE still faces hurdles. Despite earnings from the exchange business helping ICE to beat Wall Street’s fourth-quarter expectations, the listings segment declined by four percent due to a lacklustre market for IPOs. IPO proceeds in the US reached $23.9bn in 2023, according to Jessica Chen and Joel Rubinstein, partners at White & Case, but this was less than half of the $62.6bn in proceeds seen pre-pandemic in 2019.

2015

Following on from ICe’s purchase of NYSE, Martin was named president and coo of Ice Data Services, where she managed the global data teams and also the platforms of the firm.

2022 after taking her next step as president of the Fixed Income and Data Services division, Martin was then named president of the entire NYSE Group, a role she has now held for the last two years.

While 2023 was yet another year of stubbornly low IPOs, experts say the tide could finally be turning this year. So far, 2024 was off to a good start, Chen and Rubinstein said, and what’s more, “the US’s position as a global magnet for cross-border listings has remained undiminished,” with listings like Germany’s Birkenstock on the NYSE securing a market valuation of $8.6bn. “It is hoped that the steady performance observed post-IPO and across US stock markets generally will encourage more companies to pursue IPOs in the coming months,” they added, noting that the Renaissance IPO Index, which tracks the performance of companies that have listed within the past three years, rose 44 percent in 2023, beating the S&P 500. Plus, there is strong interest in the technology sector, where deals involving chipmakers and artificial intelligence (AI) are gathering momen- »

world finance Profile Summer 2024 | 27

tum. In March, social media platform Reddit went public after a long-awaited IPO, and on the first day of trading, shares jumped 48 percent. “The IPO markets are definitely opening back up,” Martin told CNBC in April. “Deals are getting done,” she said, adding that these were “really optimistic signs for the IPO market.”

The issue, then, is attracting them to the NYSE over its rivals. Between January 2018 and July 2023, the NYSE’s market cap for domestic listed companies grew from $23trn to $25trn, according to data from Statista. Meanwhile, Nasdaq’s shot up from $11trn to $22trn. Nasdaq, which has a reputation for being the ‘tech exchange,’ boasts lower listing fees and costs, which can attract smaller companies. NYSE, meanwhile, is associated with a sense of prestige and history – executives who list on the exchange have the opportunity to ring its famous opening bell in front of live traders. Yet as Mark Mandel, chair of Baker McKenzie’s North America capital markets group, told the Financial Times, choosing between the two is like picking between a Bentley and a Tesla: “You won’t go wrong with either, but companies, like people, tend to gravitate towards certain brands.”

Blazing a trail

Becoming president of the NYSE, Martin had big shoes to fill. She replaced Stacey Cunningham, who was the first woman to lead the exchange in its more than two centuries of operation in 2018. Following ICE’s acquisition of NYSE, Cunningham “embraced the challenge to reinvent a global icon,” Sprecher said. The NYSE’s entire portfolio was worth more than $25trn as of December 2023, including four fully electronic stock exchanges and two options exchanges. Running this operation requires a skill set balancing strong leadership with in-depth knowledge of the fundamentals of its systems.

As a leader, Martin is focused on innovation. “I don’t accept the phrase ‘We’ve always done it that way.’ Because with that mindset you don’t grow and innovate,” she said in a NYSE Communications release. In a sign of her openness to new ideas, the NYSE revealed in April that it was polling market participants on round-the-clock trading. The poll followed news of start-up 24 Exchange, backed by Steve Cohen’s Point72 Ventures fund, going to the Securities and Exchange Commission (SEC) for approval to launch the first 24-hour exchange. Such a move could shake up US stock markets, which, unlike cryptocurrencies or even US treasuries and major currencies, don’t operate at all hours.

As someone who has continually been at the cutting edge of a rapidly growing indus-

try – and as a trailblazer herself – Martin is in tune with the bold thinking needed to in novate in financial markets. In 2013, she was named CEO of NYSE Liffe US, the American division of NYSE Euronext’s international derivatives business. Having worked her way up from COO of the firm and senior vice president at NYSE Euronext, the appoint ment made her the first woman to head a US exchange since the 1980s. Martin didn’t know about this milestone until it was pointed out to her in an interview with John Lothian News, but she did not shrug off the landmark moment, saying it made the appointment spe cial “not just from a professional standpoint, but also from a personal standpoint.”

Martin continued, “When I was growing up, my mom and my grandma always used to say to me that I was so fortunate to be born when I was born, at a time when a woman had all the opportunities in the world in front of her. Being reminded of that every day forced me to work hard throughout my life, and it motivates me to continue to work hard, and also to be thankful for any opportunities that are presented to me, because women in the past didn’t always have those opportunities.”

Within global financial services institutions, as of 2021, women held 21 percent of board seats, 19 percent of C-suite roles and just five percent of CEO positions, according to the report by Deloitte, Advancing more women leaders in financial services. While progress has been made over the past two decades, the report’s authors concluded that these efforts must continue, as inaction could reverse hardwon gains by as soon as 2030. “These statistics illustrate that more work needs to be done to advance gender equity across the industry,” they said. To find evidence of this, one does not have to look far. In April, a Wells Fargo employee accused the company of an “unapologetically sexist” workplace, the latest in a slew of lawsuits against large US banks related to their treatment of women employees. Other suits have been lobbied against the likes of Citigroup and Goldman Sachs, the latter of which agreed to pay $215m to settle a class action lawsuit alleging widespread bias against women in pay and promotions.

What’s more, the independent think tank the Official Monetary and Financial Institutions Forum found in its Gender Balance Index 2023 that progress is very slow going. At the current rate, it will take 140 years to achieve parity between men and women in leadership positions in the industry, it found.

However, Deloitte’s report identified an important caveat: when there are enough women in leadership ranks at the organisational level, there is strong evidence for the ‘multiplier effect,’ whereby for each woman

added to the C-suite, there was a positive, quantifiable impact on the number of women in senior leadership levels just below the Csuite. “For decades, companies have focused largely on activities to improve the pipeline for DEI [diversity, equality and inclusion] efforts. Based on our findings related to the multiplier effect it is equally, if not more, important to focus on diversity at the highest levels of the organisation to drive progress and improve the overall pipeline of diverse talent,” said Neda Shemluck, Deloitte’s US financial services industry DEI leader. “In the finance industry, female role models are not just desirable, they are imperative,” Crawford of 100 Women in Finance said. “Their presence not only inspires confidence and ambition in aspiring women but also challenges the status quo, driving much-needed diversity and innovation.”

“Lynn Martin,” she told World Finance, “is a trailblazer whose journey exemplifies the immense potential of female talent and reaffirms the necessity of ensuring representation of women at every level of leadership in the industry.”

The ESG question

One of Martin’s core guiding principles is her belief that ESG considerations are only growing in importance in the US market. ESG is “top of mind for virtually every public company CEO and board of directors,” Martin wrote in Fortune. And the reason was not, she said, government regulations or quotas, but instead “the free market at work.”

Ioannis Ioannou, an associate professor of strategy and entrepreneurship at London

world finance Profile 28 | Summer 2024

»

lynn Martin with reddit CeO Steve huffman ringing the NySe bell

Business School, agreed that businesses – and investors – are recognising the importance of addressing ESG. “The impacts of climate change, resource scarcity, and shifting consumer preferences because of these issues pose significant risks to companies’ operations, supply chains, and overall business models and strategies,” he told World Finance “Therefore, businesses cannot afford to ignore these challenges; addressing ESG issues is crucial for building resilience, cultivating innovation, and maintaining a competitive edge.” Andreas Hoepner, a professor at University College Dublin’s School of Business, identified the biggest ESG issues of the moment as: carbon emissions, the energy transition, the gender power gap and responsible AI. He said these areas of focus are becoming “increasingly important in fundraising and risk management.”

NYSE and ICE are keenly aware of the way the market environment has changed over recent decades. In a note to staff in late 2021, Sprecher outlined what $130trn worth of finance commitments pledged by the private sector to address climate change at the COP26 gathering in Glasgow meant for ICE, saying it “provides great opportunity in many areas of our exchanges segment.”

Today, investors are demanding that companies pay close attention to issues like climate change and diversity, and shareholders are making their voices heard through their investment decisions. “Investors recognise that environmental, social, and governance issues pose genuine risks to a company’s business model, performance, and long-term viability,” Ioannou said. “Therefore, they are

looking for ESG data that effectively captures these risks and enables them to make wellinformed choices.”

As a financial data scientist, Hoepner told , he regularly checks updates on corporations’ individual risks filed with the SEC – which he is seeing more and more of. “Filing risks on key ESG issues and even greenwashing accusations themselves keep rising at considerable pace,” he said.

However, the quality, accuracy and comparability of this data “still leaves significant room for improvement,” Ioannou said. Especially at a time when ‘anti-ESG backlash’ in the political domain has led some companies to take a more cautious approach to ESG issues – at least publicly – to minimise the risk of ideological targeting, Ioannou said. “Given the current political climate, I expect the term ‘ESG’ to become more contested in the US during this election year, even as the approach remains pragmatic and necessary in other parts of the world, with the EU leading the charge,” he added.

Yet despite these challenges for ESG investing, Martin remains a big believer in the work the NYSE can do to boost transparency. It’s an area Martin has direct experience with, having helped to create databases that tracked board diversity, climate risk and other ESG measures as part of her previous role at ICE.

Ioannou said he expects the current quality and accuracy of ESG data to continue improving as issues like climate change, biodiversity loss, societal issues and political division underscore the need for robust ESG risk management, enabling more informed decision-making by companies and investors alike. And with more transparent data will come increased interest from investors. “As these efforts progress, I believe that ESG considerations will inevitably become a core component of investment decision-making,” Ioannou said.

In 2022, Martin put another stake in the ground when she launched the NYSE Sustainability Advisory Council. The council brings together select sustainability leaders within the NYSE community of more than 2,400 listed companies to identify and share global best practices addressing ESG issues. “The NYSE Sustainability Advisory Council is designed to help companies navigate this complex and evolving terrain,” Martin said in a press release about the council’s launch. Chair Elizabeth King added that the group hoped to leverage the power of the NYSE community to “raise all boats and advance the identification, development and adoption of best practices at organisations of all sizes.”

As Martin wrote in Fortune, “The Fearless Girl statue stands vigil outside the NYSE and

reminds us every day that while there is still much work to be done, ESG-driven risk management is here to stay, and will only become a larger factor in the years ahead.”

What is next?

While Martin has taken a tech-led approach to issues like ESG investing, the creation of the Sustainability Advisory Council shows she recognises that it is people working together that make the difference in business. “Data and technology allow each of us to do much more, much faster, but at the core of any successful enterprise is people collaborating toward common goals,” she wrote in her oped. “It is important that we keep this in mind as we move into a future that will demand the best combination of humanity and processing power that we can muster.”

To do this in practice at the NYSE, she takes a collaborative and open approach, inspiring colleagues to work together across business lines in order to inspire innovation and creative thinking. For Sprecher, Martin’s transparency with colleagues was a key reason he has kept her as part of his inner circle. “When she took that job running our data division, I would periodically receive an unsolicited communication from her that told me exactly what was going on in the business,” he said. “She is very organised and she shares a lot of data and information with others. She is very transparent, which builds a level of trust and endearment that very few people really have.”

In 2022, Martin launched a new initiative to build trust further, not only within the NYSE, but within US capital markets on the world stage. “As the world’s largest stock exchange with a storied history of more than 230 years, the NYSE has a unique platform and substantive role to play as a leading advocate for capital formation around the world,” said Martin at the launch of the NYSE Institute. The institute was created to use the NYSE’s resources, expertise and relationships to support public companies, advance sound public policy and foster economic growth around the world. “The NYSE Institute provides us with a new structure to formally advance this agenda and offer a strong voice supporting the innovative work of our listed companies and the markets we operate,” Martin said.

Martin has long used her voice to champion her core beliefs around the values of technology in our modern world, the importance of transparency of ESG risks and the resilience of US capital markets. As her position as president of the NYSE amplifies her voice further than ever before, executives, exchanges and business leaders around the world are sitting up and taking note. n

world finance Profile Summer 2024 29

The hidden costs of ‘slowbalisation’

The imposition of trading tariffs, most notably between the US and China and those sanctions made against Russia, have radically shifted the global trading pattern, but for those who prioritise geopolitical strategy and put up barriers to trade, it could end up costing them dearly

The emergence of an open multilateral trading system that separated trade from geopolitics played a pivotal role in driving the postWorld War II economy. But with trade policies increasingly shaped by geopolitical considerations, a new paradigm is becoming visible.

This trend started with the tariffs that former US President Donald Trump imposed on Chinese imports in 2018, which President Joe Biden’s administration has maintained, and which caused China to impose its own tariffs on imports from the US. Then, in 2022, following Russian President Vladimir Putin’s invasion of Ukraine, G7 countries and the European Union imposed sweeping economic sanctions on Russia, effectively prohibiting exports to Russia and imports of Russian goods. Instead of causing global trade to fall, as many expected, these trade barriers and restrictive measures merely slowed down globalisation, turning it into ‘slowbalisation.’

Remarkably, despite the war in Ukraine and the supply-chain disruptions of the past few years, trade as a percentage of GDP reached a record high in 2022, underscoring

the resilience of the international trading system. In fact, the increases in containershipment prices since 2022 can be attributed to an unexpected surge in the volume of goods being shipped globally. But while it may be tempting to argue that geopolitically motivated measures have had a negligible economic impact, the perceived resilience of global trade can be misleading. Although the recent trade barriers led to higher trade volumes, many of them carry significant costs.

At first glance, the notion that a tariff could boost trade may seem paradoxical. But almost all the tariffs and trade restrictions imposed by the US since 2018 have been specifically aimed at China, leaving imports from other countries untouched. Consequently, imports from China have fallen sharply, while imports from countries like Vietnam have surged. Many consumer products shipped to the US are now assembled in Vietnam and other Southeast Asian countries. But these imports still rely on intermediate inputs from China. Consequently, trade volumes have grown because, while US imports of consumer goods

from Asia have remained consistent, China’s exports of intermediate inputs to its Asian neighbours have increased. Similarly, although Mexico has overtaken China as the leading exporter of goods to the US, its own imports from China have surged by nearly 40 percent since 2018.

Trading tolerance

The electric-vehicle (EV) market illustrates how discriminatory practices can boost trade. Tariffs on Chinese EVs are approaching 30 percent, and US regulations disqualify EVs containing components produced or assembled in designated ‘entities of concern’ from receiving tax credits, effectively excluding Chinese manufacturers from the American market.

By contrast, European EVs are subject to a significantly lower tariff of 2.5 percent and qualify for a $7,500 subsidy under the Inflation Reduction Act when leased. Consequently, Chinese EV exports have shifted to Europe, while European automakers have found success in the US.

world finance Comment

Daniel Gros

DIREcToR oF EuRopEaN poLIcYMaKING aT boccoNI uNIVERSITY

30 | Summer 2024