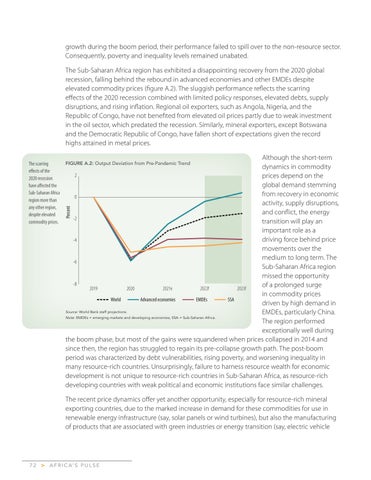

growth during the boom period, their performance failed to spill over to the non-resource sector. Consequently, poverty and inequality levels remained unabated. The Sub-Saharan Africa region has exhibited a disappointing recovery from the 2020 global recession, falling behind the rebound in advanced economies and other EMDEs despite elevated commodity prices (figure A.2). The sluggish performance reflects the scarring effects of the 2020 recession combined with limited policy responses, elevated debts, supply disruptions, and rising inflation. Regional oil exporters, such as Angola, Nigeria, and the Republic of Congo, have not benefited from elevated oil prices partly due to weak investment in the oil sector, which predated the recession. Similarly, mineral exporters, except Botswana and the Democratic Republic of Congo, have fallen short of expectations given the record highs attained in metal prices. Although the short-term dynamics in commodity 2 prices depend on the global demand stemming from recovery in economic 0 activity, supply disruptions, and conflict, the energy -2 transition will play an important role as a driving force behind price -4 movements over the medium to long term. The -6 Sub-Saharan Africa region missed the opportunity -8 of a prolonged surge 2019 2020 2021e 2022f 2023f in commodity prices World Advanced economies EMDEs SSA driven by high demand in Source: World Bank staff projections. EMDEs, particularly China. Note: EMDEs = emerging markets and developing economies; SSA = Sub-Saharan Africa. The region performed exceptionally well during the boom phase, but most of the gains were squandered when prices collapsed in 2014 and since then, the region has struggled to regain its pre-collapse growth path. The post-boom period was characterized by debt vulnerabilities, rising poverty, and worsening inequality in many resource-rich countries. Unsurprisingly, failure to harness resource wealth for economic development is not unique to resource-rich countries in Sub-Saharan Africa, as resource-rich developing countries with weak political and economic institutions face similar challenges. FIGURE A.2: Output Deviation from Pre-Pandemic Trend

Percent

The scarring effects of the 2020 recession have affected the Sub-Saharan Africa region more than any other region, despite elevated commodity prices.

The recent price dynamics offer yet another opportunity, especially for resource-rich mineral exporting countries, due to the marked increase in demand for these commodities for use in renewable energy infrastructure (say, solar panels or wind turbines), but also the manufacturing of products that are associated with green industries or energy transition (say, electric vehicle

72

>

A F R I C A’ S P U L S E