STRIKING OUT

PUBLIC PENSION FUNDS, PRIVATE EQUITY, AND A NEW WAVE OF LABOR UNREST

PUBLIC PENSION FUNDS, PRIVATE EQUITY, AND A NEW WAVE OF LABOR UNREST

Pension funds are investing more of their capital in private equity and real estate—the 2023 Milliman Public Pension Funding Study found that these investments accounted for 34% of funds’ aggregate asset allocation, or over $2 trillion.i

The private equity and real estate investment model, with its short-term investment horizon and emphasis on decreasing labor costs, makes the industry uniquely vulnerable to labor unrest. One academic analysis found that private equity-owned hotels experienced a significant and lasting improvement in departmental profit margins because the firms slash labor costs in the rooms department. Another study concluded that firms subject to institutional buyouts were associated with job losses, lower wages, and lower productivity.

Private equity and real estate firms have faced numerous high-profile strikes and labor disputes, among them the “Justice for Janitors” SEIU organizing drive in the 2000s and hotel workers’ rolling strikes across Southern California in 2023. Half of the Class-A office buildings in the Westside of Los Angeles were owned through pension fund investment at the time, and 40% of the hotels struck in 2023 were owned or operated with pension fund investment.

Labor unrest is growing across the country. Strikes increased by 141% from 2022 to 2023, with a total of 24,874,522 individual days of work stoppages, the highest number of lost workdays to labor disputes since 2000.

Strikes and work stoppages have very real financial impacts. An analysis of Bureau of Labor Statistics data estimated the average loss to a company facing a strike at between $285.4 million and $344.9 million.ii The recent six-week autoworkers strike reportedly cost companies $10.4 billion.iii

Strikes also have indirect impacts. The 2003-2004 grocery strike in Southern California saw a sizeable loss of market share and eventual credit downgrade of the companies by S&P to “its weakest investment grade rating” in 2008, citing the impact on profits from the strike.iv

Labor strife presents headline risk for pension funds. Blackstone-owned Packer Sanitation Services Inc, which saw its earnings halved following revelations that the firm employed over 100 children in meatpacking plans, and Advent-owned Aimbridge Hospitality, which operates Southern California hotels accused of abusing migrant refugee workers, have attracted significant media coverage.

Pension funds should strengthen policy to protect investments from the growing risks associated with strikes and labor unrest. Current Responsible Contractor Policies have failed to prevent strikes and adequately mitigate human capital risk.

Public pension funds across the country allocate significant portions of their assets to private equity and real estate. The 2023 Milliman Public Pension Funding Study found that these investments accounted for 34% of all aggregate asset allocation—about $2 trillion in the United States—up from only 23% ten years prior.v These investments are everywhere. From ownership stakes in our supermarkets and hospitals to hotels and food service companies, private equity and real estate managers have become major financial players in the 21st-century economy. But with their expansion comes exposure to human capital risk as firms invest in labor-intensive industries like healthcare and hospitality.

Strikes and work stoppages, once considered isolated incidents with limited financial impact, now pose significant threats to private equity and real estate investments. The private equity investment model—buy a company or real estate asset, load it with debt, squeeze profit from it, and sell it to a buyer in five to ten years—exacerbates pressures faced by workers at publiclytraded firms. An analysis by Christophe Spaenjers of HEC

The US has lost more workdays to labor disputes in 2023 than any other year since 2000

The Wall Street Journal

Paris and Eva Steiner from Penn State University found that private equity-owned hotels experience a significant and lasting improvement in “departmental” profit margins because the firms slash labor costs in the rooms departmentvi. In another study, researchers found that “leveraged buyouts lead to job satisfaction declines for long-tenured, low-skill, and less-educated workers,”vii and a report published in the Human Resources Management Journal concluded that firms subject to a specific type of private equity acquisition–institutional buyouts–are associated with job losses, lower wages, and lower productivity.viii

But the linkage between pension fund investments and labor unrest is not new. When the Service Workers International Union (SEIU) began organizing janitors and security guards in the late 1990s and early 2000s, they engaged pension funds invested in office buildings. As Harold Meyerson noted in The

American Prospect at the time, SEIU found that more than half of the class-A properties in Los Angeles’ Westside were owned by pension funds, including the California Public Employees’ Retirement System (CalPERS) and the California State Teachers’ Retirement System (CalSTRS).ix The strikes and direct labor actions that became the hallmark of SEIU’s Justice for Janitors campaign targeted these real estate properties and eventually spread to multiple cities across the country. Janitors testified repeatedly at pension fund board meetings, and SEIU made the argument that “not only did they as workers stand to benefit from union recognition, but that it was in the long-term interests of the pension fund’s real estate investments to employ a skilled and well-paid workforce with a low annual turnover.”x

But the sort of labor unrest SEIU’s Justice of Janitors propelled forward has been making a comeback. Since the global pandemic there has been a

surge in private sector strike action. The Cornell University and the University of Illinois Labor Action Tracker found that 2023 saw an estimated 539,000 workers across the country involved in work stoppages. Strikes increased by 141% from 2022 to 2023, seeing a total of 24,874,522 individual days of work stoppages, and have increased each year of the past

three years.xi The Wall Street Journal noted that the US had lost more workdays to labor disputes than any other year since 2000.xii

This report highlights the risk of labor disruption associated with investment in private equity and real estate. It reviews the financial impact of work stoppages and their associated headline and reputational risks,

drawing on both academic research and recent highprofile examples. The report examines the implications of labor discord on private equity and real estate investments and underscores why pension funds should prudently evaluate this emerging risk.

24,874,522

The financial impact of a strike varies depending on factors such as duration, the number of workers, the firm’s market capitalization, industry, geography, and the specific demands of the workers involved. Direct costs of a strike typically include lost revenue due to halted production or disrupted services, as well as expenses incurred from implementing contingency plans such as hiring temporary workers, increased security measures, and legal fees associated with negotiating or litigating with the striking workers or their representatives. These direct costs can escalate rapidly, particularly in industries with high fixed costs or tight profit margins.

Estimating the precise cost of a labor strike or work stoppage is challenging due to their multifaceted nature and the complexities involved in measuring both immediate and long-term impacts. After the 2003-2004 grocery strike in the Southern California, the Los Angeles Times reported that the three largest grocery companies where workers walked out saw their market shares shrink by 8% while rival grocers saw a 6% gain.xiii The stores on strike lost an estimated

$1.5 billion in sales as many shoppers took their business to other stores.xiv Labor disruptions caused by workers can impose significant direct and indirect financial burdens on companies.

Despite these complications, researchers have investigated the financial costs associated with labor disruption. Professor Brian Becker of the School of Management at the State University of New York at Buffalo and Professor Craig Olson of the University of Wisconsin-Madison examined industry data from the Bureau of Labor Statistics over a 20-year span, finding that strikes substantially affected shareholder equity.xv The average strike caused a 4.1% drop in stock price, equivalent to the loss of between $285.42 million and $344.89 million in today’s dollars.xvi In their report, “The Impact of Strikes on Shareholder Equity”, they estimated the average daily loss to a company facing a strike was between $7.93 million and $51.53 million.

Researchers also pursued the question of whether strikes or work stoppages negatively affect firm value. Researchers Wallace Davidson, Dan Worrell and Sharon Garrison jointly published their research in The

Academy of Management Journal, entitled “Effect of Strike Activity on Firm Value.” Their initial theory was that strikes represent a “negative corporate investment” and thus should induce a reduction in firm value that would be reflected in negative stock returns. They reviewed five years of stock value from the Wall

Street Journal Index and studied the impact of over a hundred strikes. Their research found that “the beginning of a strike is associated with statistically significant, negative abnormal returns.”xvii Markets reacted adversely to labor disruption and losses to shareholders of companies that experienced the disputes appeared to be The average daily loss to a company facing a strike was

permanent. Their research confirmed that of Becker and Olsen, underscoring the academic analysis that work stoppages and strikes are financially damaging to companies.

Industrial and Labor Relations Review

In today’s world, strike actions and labor disruptions appear frequently in the mainstream and online media. From Starbucks baristas and hotel housekeepers to autoworkers and teachers, we read the headlines and see the protests. While it can sometimes be challenging to quantify the financial impact of these disputes, a few recent examples of labor discord provide telling examples of how damaging work stoppages can be to companies.

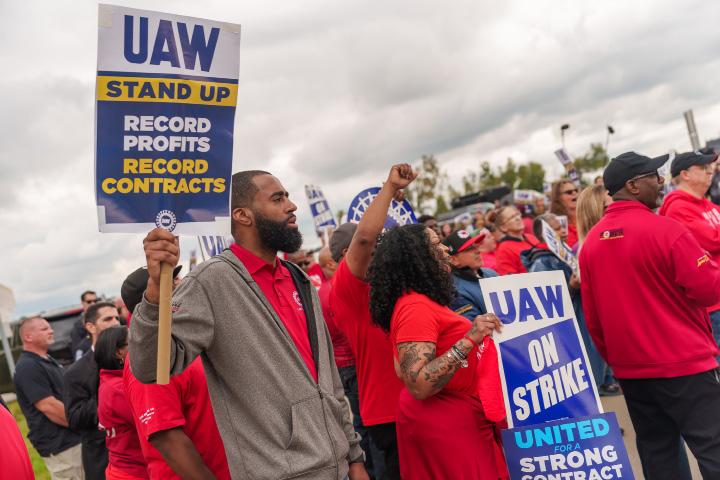

In August 2023, members of the United Auto Workers voted overwhelmingly to strike

the Big Three automakers (General Motors, Ford Motor, and Stellantis).xviii At the time, independent researchers at the Michigan-based Anderson Economic Group wrote that a 10-day strike could result in a total economic cost of $5 billion.xix Peter Berg, director of the School of Human Resources and Labor Relations at Michigan State University told the press that representatives from Deutsche Bank estimated the strike could cost $400 to $500 million per week.xx But instead of a standard walk out, UAW pioneered a rolling set of “Stand Up” strikes that placed enormous financial pressure up

and down the supply line. By October, General Motors had to secure a $6 billion credit line to weather the strike.xxi By the end of the strike, the Anderson Economic Group estimated that the six week-long labor dispute that spanned over 70 facilities in multiple states cost firms $10.4 billion.xxii

The autoworkers, however, were not the only ones walking off the job this past year. In May, screenwriters represented by the Writers Guild of America went on strike. They were soon joined by members of the actor’s union, SAG-AFTRA. Paramount Global – the owner

of CBS, MTV, and Nickelodeon –revealed to investors that over three months the strike had cost the company $60 millionxxiii. In filing with the US Securities and Exchange Commission, Global entertainment giant Warner Bros. Discovery adjusted their financial projections for the year, stating they would be “negatively impacted by approximately $300 to $500 million, predominately due to the impact of the strikes.”xxiv In June, Business Insider wrote that the ongoing writers and actors strike in California would cost the state $4 billion worth of economic damage.xxv The Milken Institute’s analysis on

the last mayor entertainment industry strike, The Writers’ Strike of 2007-2008: The Economic Impact of Digital Distribution, found that the work stoppage had a $2.1 billion impact on the California economy and pushed it into a recession in early 2008.xxvi

This past year also saw the largest strike of healthcare workers in U.S. history. From October 4th to 7th, over 75,000 Kaiser Permanente workers went on strike.xxvii The labor dispute included nurses, medical technicians and support staff at hundreds of Kaiser hospitals and clinics

across the country.xxviii The Wall Street Journal stated there would be a “brief but sharp decline on provider revenues” the week of the strike.xxix But the work stoppages also seemed to pressure other healthcare companies facing similar threats of labor action. When union members at Tenant Healthcare voted to strike at 11 hospitals across California, the company’s stock prices tumbled down 12.1% within only days.xxx The copycat effect for labor action poses further financial risks for companies.

Indirect impacts of strikes can be just as significant as direct costs, if not more so. They may include long-term damage to relationships between companies and customers, harm to the company's reputation and brand image, loss of market share to competitors who are unaffected by the strike, and decreased investor confidence leading to financial declines or credit rating downgrades. For example, the commercial real estate form CoStar posited that the hotel strike by 15,000 members of UNITE HERE Local 11 in southern California contributed to the dampening of investment activity in the Los Angeles hospitality market.xxxi

Similarly, Entertainment Partners, an industry leader in film production finance and management, saw its credit ratings lowered and were placed on “CreditWatch negative placement” by S&P Global Ratings due to the recent strikes in Hollywood.xxxii Moody’s also downgraded Hudson Pacific Properties, a real estate investment trust with over 1.5 million square feet of sound stages on the west coast, because of the ongoing labor unrest in the television and film industries.xxxiii

Even years after a strike, a firm’s credit rating could still be affected. S&P downgraded Kroger, Safeway and Albertsons grocery stores’ credit rating to “its weakest investment grade rating” in 2008, citing the impact on profits from the 2003-2004 grocery strike.xxxiv Strikes can also have broader economic impacts on local communities, suppliers, and other businesses connected to the affected industry, amplifying the overall cost to the economy.

The indirect financial impacts of a labor

strike reverberate across various facets of the economy, extending beyond the immediate costs borne by the targeted company. Work stoppages can disrupt supply chains, causing ripple effects throughout interconnected industries. As the Hollywood Reporter noted during the writer and actors’ strike, suppliers reliant on the production output of the striking companies experienced delayed orders and reduced demand, leading to revenue losses and operational inefficiencies.xxxv During the 2023 autoworkers strike, downstream suppliers saw an estimated financial loss of $3.34 billion.xxxvi

Prolonged strikes may prompt suppliers to seek alternative sources or diversify their client base, eroding the long-standing relationships that underpin stable business networks.

Indirect costs may include long-term damage to relationships, harm to reputation and brand, loss of market share to competitors, and decreased investor confidence leading to financial declines or credit rating downgrades

saw earnings cut in half in the aftermath of the child

Bloomberg News

Labor discord can inflict reputational damage on the affected company, tarnishing its brand image and undermining consumer trust. In today's hyperconnected digital age, news of labor disputes spreads rapidly through social media and online platforms, amplifying the visibility of the company's labor practices. As researchers at the Kellogg School of Management at Northwestern University found, consumers increasingly scrutinize companies' ethical standards and social responsibility commitments, making them more likely to switch to competitors perceived as more socially consciousxxxvii. Consequently, the negative publicity surrounding a strike could lead to decreased sales, diminished market share, and lasting repercussions on brand loyalty, impacting the company's bottom line far beyond the duration of the labor dispute.

As labor union and their allies become more adept at media outreach, the potential risk

of exposure for private equity and real estate firms and their portfolio companies only grows during labor disputes. Internal documents from UNITE HERE Local 11–which represents over 32,000 workers in the hospitality industry in southern California and Arizona–highlights the scope of this media spotlight. As workers walked off the job at over 50 hotels whose union contracts had expired, Local 11 estimates they reached over 2.6 million television viewers, 26.9 million radio listeners, and saw the equivalent of $150 million in earned online publicity to the story. In an era characterized by heightened scrutiny of corporate practices, companies embroiled in labor disputes risk enduring reputational damage and regulatory scrutiny, exacerbating the financial toll of labor disputes.

The egregious working conditions workers expose in the media amplify headline risks. Such was the case with Packer Sanitation Services Inc, or PSSI, which is owned by

private equity firm Blackstone. PSSI provides cleaning services to some of the country’s major meat producers. Federal investigators found the company had employed over 100 children, some as young at 13-years-old, to clean razor-sharp meat processing equipment.xxxviii Investigators with the Department of Labor’s Wage and Hour Division subpoenaed school records and used confidential sources to determine the company was using minors to work overnight shifts at multiples plants. The company was fined $1.5 million and its CEO retired after a 24year career.

Bloomberg reported that two major clients cut ties with the company and that the price of the company’s loan decreased

announcement of boycott of Los Angeles hotels, 2023.

following the scandal.xxxix The Minnesota State Board of Investment, which has other investments with the private equity firm, met with Blackstone representatives and stated publicly they will be reviewing their investments with the fund.

In a letter to Blackstone CEO Stephen A. Schwarzman, New York state Comptroller Thomas DiNapoli demanded to know “Blackstone and PSSI’s plan to eliminate any improper dependence on child labor, as well as its plan to implement strict measures that would prevent it from occurring in the future”.xl Bloomberg News reported that Blackstone’s PSSI saw earnings cut in half in the aftermath of the child labor scandal.xli

Pension funds are entrusted with safeguarding the retirement investments of millions of Americans. But the rise of labor unrest in the country represents a new and growing threat to these pension investments and their private equity and real estate partners. The previous experience of SEIU’s Justice for Janitors organizing drive shows that pension funds can and should take labor unrest seriously. Strikes can significantly impact an investment’s financial performance by disrupting operations, reducing productivity, and increasing costs, and can have

ripple effects across the supply chain that in some cases permanently decrease firms’ market share. Pension funds should be concerned about the rising financial impact of labor strikes as it directly affects the profitability and long-term viability of their investments.

Some extant policies adopted by pension funds address human capital risk. In the public markets, funds can engage with firms by supporting or opposing shareholder resolutions in line with prudent risk mitigation strategies. But in the

private markets, public pension funds lack policy to adequately address escalating risks associated with strikes and labor disputes.

For example, Responsible Contractor Policies adopted by many public funds apply only to co-investments where the fund owns a majority stake in a real estate investment. The CalPERS Responsible Contractor Policy resulted in $980

million paid to contractors in FY22, 1% of the fund’s $71.2 billion real assets portfolio.xlii

Worker Power Institute recommends that public pension funds modernize Responsible Contractor Policies and other policies by including enforceable language to protect beneficiaries from risks associated with strikes.

Worker Power Institute recommends that public pension funds modernize Responsible Contractor Policies and other policies to include enforceable language to protect beneficiaries from risks associated with strikes.

“2023 Corporate Pension Funding Study.” Milliman, 20 Apr. 2023, www.milliman.com/en/insight/2023-corporate-pension-funding-study.

ii Becker, Brian E., and Olson, Craig A., “The Impact of Strikes on Shareholder Equity.” Industrial and Labor Relations Review, vol. 39, no. 3, 1986, pp. 425-438, https://journals.sagepub.com/doi/abs/10.1177/001979398603900309?journalCode=ilra. Accessed 13 February 2024. Adjusted using the US Bureau of Labor Statistics CPI Inflation Calculator, where $1 in 1980 is $3.96 in January 2024: https://www.bls.gov/data/ inflation_calculator.htm

iii “Week Six: Economic Losses from UAW Strike Top $10.4 Billion.” Anderson Economic Group, 1 Nov. 2023, https://www. andersoneconomicgroup.com/news-archives/week-six-economic-losses-from-uaw-strike-top-10-4-billion/

iv Sullivan, Tom, and Simona Covel. “S&P Cuts Ratings on Top 3 Grocery Chains, Downgrading Kroger, Albertsons, Safeway.” The Wall Street Journal, 23 June 2008, https://www.wsj.com/articles/DJFHYW0020080623e174000h1.

v “2023 Corporate Pension Funding Study.” Milliman, 20 Apr. 2023, www.milliman.com/en/insight/2023-corporate-pension-funding-study.

vi Spaenjers, Christophe, and Steiner, Eva. “Specialization and Performance in Private Equity: Evidence from the Hotel Industry.” 30 June 2023, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3738265.

vii Gornall, Will, et al. “Do Employees Cheer for Private Equity? The Heterogeneous Effects of Buyouts on Job Quality.” 21 Sept. 2021, https:// foster.uw.edu/wp-content/uploads/2021/10/SSRN-id3912230-1.pdf.

viii Goergen, Marc, et al. “The consequences of private equity acquisitions for employees: new evidence on the impact on wages, employment and productivity.” 7 Jan. 2014, https://onlinelibrary.wiley.com/doi/10.1111/1748-8583.12032.

ix https://prospect.org/features/clean-sweep/

x Dixon, Patrick. “Capital Strategies for the Common Good: A Tool for Labor’s Revival.” 22 Jan. 2021, https://journals.sagepub.com/doi/full/1 0.1177/1095796020983010.

xi Ritchie, Kathryn, et al. “Labor Action Tracker: Annual Report 2023.” 2024, https://www.ilr.cornell.edu/sites/default/files-d8/2024-02/LaborAction-Tracker-2023-Annual-Report.pdf.

xii Evans, Melania. “Kaiser Permanente Union Workers Strike, Mounting Largest U.S. Healthcare Walkout on Record.” The Wall Street Journal, 4 Oct. 2023, https://www.wsj.com/health/healthcare/healthcare-worker-strike-kaiser-permanente-b404e9d5.

xiii Hirsch, Jerry. “Grocery conflict rooted in last strike.” The Los Angeles Times, 23 Apr. 2017, https://www.latimes.com/archives/la-xpm-2007apr-23-fi-strike23-story.html.

xiv Peltz, James F., and Melinda Fulmer. “Supermarkets Still Feel Pain of Long Strike and Lockout.” 15 Dec. 2004, https://www.latimes.com/ archives/la-xpm-2004-dec-15-fi-super15-story.html.

xv Becker, Brian E., and Olson, Craig A., “The Impact of Strikes on Shareholder Equity.” Industrial and Labor Relations Review, vol. 39, no. 3, 1986, pp. 425-438, https://journals.sagepub.com/doi/abs/10.1177/001979398603900309?journalCode=ilra. Accessed 13 February 2024.

xvi Ibid. Adjusted using the US Bureau of Labor Statistics CPI Inflation Calculator, where $1 in 1980 is $3.96 in January 2024: https://www.bls. gov/data/inflation_calculator.htm

xvii Davidson, Wallace N., and Worrell, Dan L., “Effect of Strike Activity on Firm Value.” The Academy of Management Journal, vol. 31, no. 2, 2017, https://journals.aom.org/doi/full/10.5465/256554. Accessed 14 February 2024.

xviii White, Joseph, et al. “UAW votes overwhelmingly to authorize strike at Detroit Three automaker.” Reuters, 27 Aug. 2023, https://www. reuters.com/business/autos-transportation/uaw-members-authorize-strike-detroit-three-automakers-2023-08-25/.

xix “10-day UAW strike against Big Three could cause economic losses exceeding $5 billion.” Anderson Economic Group, 17 Aug. 2023, https://www.andersoneconomicgroup.com/10-day-uaw-strike-against-big-three-could-cause-economic-losses-exceeding-5-billion/.

xx Berg, Peter. “Ask the expert: What to know about the potential UAW strike.” MSU Today, 25 Aug. 2023, https://msutoday.msu.edu/ news/2023/ask-the-expert-potential-uaw-strike.

xxi Wayland, Michael. “GM secures new $6 billion credit loan as UAW strike costs reach $200 million.” CNBC, 4 Oct. 2023, https://www.cnbc. com/2023/10/04/gm-secures-new-6-billion-credit-line-as-uaw-strike-costs-200-million.html.

xxii “10-day UAW strike against Big Three could cause economic losses exceeding $5 billion.” Anderson Economic Group, 17 Aug. 2023, https://www.andersoneconomicgroup.com/10-day-uaw-strike-against-big-three-could-cause-economic-losses-exceeding-5-billion/.

xxiii White, Peter. “Strikes Cost Paramount $60M in Latest Quarter As CEO Bob Bakish Hopes Actors’ Walkout Ends Soon.” Deadline, 2 Nov. 2023, https://deadline.com/2023/11/paramount-strike-costs-1235591437/.

xxiv “Warner Bros. Discovery. Form 8-K: September 5, 2023.” Securities and Exchange Commission, 2023, https://d18rn0p25nwr6d.cloudfront. net/CIK-0001437107/3e191628-0662-48f4-9bcf-c46db56a8c46.pdf.

xxv Glover, George. “The Hollywood strikes could cost the economy billions.” Business Insider, 25 Jul. 2023, https://www.businessinsider.com/ hollywood-writers-actors-barbie-oppenheimer-economy-recession-growth-milken-institute-2023-7.

xxvi “Writers’ strike leaves California with a $2.1 billion loss, more to come is SAG contract not resolved, according to Milken Institute.” Milken Institute, 1 Apr. 2014. Press Release. https://milkeninstitute.org/article/writers-strike-leaves-california-21-billion-loss-more-come-if-sag-contractnot-resolved.

xxvii Leo, Leroy and Bhanvi Satija. “Explainer: Why are Kaiser Permanente healthcare workers on strike?” Reuters, 5 Oct. 2023, https://www. reuters.com/business/healthcare-pharmaceuticals/why-are-kaiser-permanente-healthcare-workers-strike-2023-10-05/.

xxviiiLeo, Leroy and Bhanvi Satija. “Kaiser healthcare workers ratify new contract.” Reuters, 9 November 2023, https://www.reuters.com/ business/healthcare-pharmaceuticals/kaiser-healthcare-workers-ratify-new-contract-2023-11-09/.

xxix Portnoy, Jenna, et al. “More than 75,000 Kaiser Permanente workers begin multistate strike.” The Washington Post, 4 Oct. 2023, https:// www.washingtonpost.com/dc-md-va/2023/10/04/kaiser-strike-healthcare-staffing-wages/.

xxx Wainer, David. “Healthcare Strikes Threaten to Prolong Wage Pressure on Hospitals.” The Wall Street Journal, 10 Oct. 2023, https://www.wsj. com/health/healthcare/healthcare-strikes-threaten-to-prolong-wage-pressure-on-hospitals-280549fb.

xxxi “Hospitality Market Report: Los Angeles – CA (USA).” CoStar Group, 15 March 2024, https://product.costar.com/pds/report/5885b86db79f-4db2-a04c-0bf3181a3a2d/retrieve/blue/Los%20Angeles%20-%20CA%20-USA-Hospitality-Market-2024-02-24#view=Fit.

xxxii “EP Global Production Solutions LLC Downgraded to ‘B-‘; Ratings Placed on CreditWatch Negative.” S&P Global Ratings, 11 Sept. 2023, https://disclosure.spglobal.com/ratings/en/regulatory/article/-/view/type/HTML/id/3053334.

xxxiii The Registry Staff. “Moody’s Downgrades Hudson Pacific’s Preferred Stock in Response to Ongoing Screenwriters’ Strike.” The Registry, 14 Jul. 2023, https://news.theregistryps.com/moodys-downgrades-hudson-pacifics-preferred-stock-in-response-to-ongoing-screenwriters-strike/.

xxxiv Sullivan, Tom, and Simona Covel. “S&P Cuts Ratings on Top 3 Grocery Chains, Downgrading Kroger, Albertsons, Safeway.” The Wall Street Journal, 23 June 2008, https://www.wsj.com/articles/DJFHYW0020080623e174000h1.

xxxv Giardina, Carolyn. “Postproduction Trade Group Warns of ‘Dire’ Impact of Strike in Open Letter to Hollywood.” The Hollywood Reporter, 11 Aug. 2023, https://www.hollywoodreporter.com/business/business-news/open-letter-strike-warns-dire-impact-1235561941/.

xxxvi “Week Six: Economic Losses from UAW Strike Top $10.4 Billion.” Anderson Economic Group, 1 Nov. 2023, https://www. andersoneconomicgroup.com/news-archives/week-six-economic-losses-from-uaw-strike-top-10-4-billion/.

xxxvii Luttrell, Andrew, et al. “Yes, Consumers Care if Your Product Is Ethical.” KellogInsight, 4 Oct. 2021. https://insight.kellogg.northwestern. edu/article/consumers-care-if-your-product-is-ethical.

xxxviii Funk, Josh. “Firm that hired kids to clean meat plants keeps losing work.” The Associated Press, 1 May 2023, https://apnews.com/article/ meat-processing-child-labor-pssi-slaughterhouses-ffbce0861e28a02b0c66e264ba9c6cc5.

xxxix Basu, Reshmi, and Erin Hudson. “Child-Labor Scandal Hits Blackstone-Backed Slaughterhouse Cleaner.” Bloomberg, 28 Apr. 2023, https:// www.bloomberg.com/news/articles/2023-04-28/slaughterhouse-scandal-sends-blackstone-firm-s-debt-tumbling-44?sref=LW7poGYk.

xl Steyer, Robert. “New York comptroller questions Blackstone on child labor at portfolio company.” Pensions & Investments, 31 Mar. 2023, https://www.pionline.com/esg/dinapoli-questions-blackstone-child-labor-portfolio-company.

xli Hudson, Erin and Ellen Schneider. “Blackstone-Backed Slaughterhouse Cleaner Sees Earnings Halved.” Bloomberg, 2 Nov. 2023, https:// www.bloomberg.com/news/articles/2023-11-02/blackstone-s-slaughterhouse-cleaner-earnings-halved-after-child-labor-scandal.

xlii CalPERS Real Assets Annual Program Review. June 20, 2023, https://www.calpers.ca.gov/docs/board-agendas/202306/invest/item06e01_a.pdf

Cover photo. UFCW 770, WGA strike, Wikimedia Commons, 21 June 2023, https://commons.wikimedia.org/wiki/File:WGA_ Strike_6.21.2023_064_(52992407860).jpg.

Fig. 1. UNITE HERE Local 11, Workers on strike in Beverly Hills, CA, UNITE HERE Local 11 Facebook, 7 September 2023, https://business. facebook.com/photo.php?fbid=759172236219665&set=a.242751197861774&type=3.

Fig. 2. The White House, UAW strike picket line at GM Willow Run Distribution Center in Belleville, MI, Wikimedia Commons, 9 October 2023. https://commons.wikimedia.org/wiki/File:United_Auto_Workers_Strike_2023.jpg.

Fig. 3. SEIU-United Healthcare Workers West. Providence Saint Joseph Medical Center workers on strike, SEIU-UHW West Facebook, 23 October 2023, https://www.facebook.com/photo.php?fbid=713505994142549&set=a.222444876581999&type=3.

Fig. 4. Lance Cheung, UAW Local 450 workers on strike at the John Deere Des Moines Workers in Iowa, Wikimedia Commons, 23 December, 2021, https://commons.wikimedia.org/wiki/File:20211020-OSEC-LSC-1195_(51614690519).jpg.

Fig. 5. SEIU-United Healthcare Workers West, Day 3 of Kaiser ULP strike, SEIU-UHW West Facebook, 6 October, 2023, https://www.facebook. com/photo.php?fbid=702703121889503&set=a.701521042007711&type=3.

Fig. 6. UFCW 770, WGA strike, Wikimedia Commons, 21 June 2023, https://commons.wikimedia.org/wiki/File:WGA_Strike_6.21.2023_064_ (52992407860).jpg.

Fig. 7. UNITE HERE Local 11, Billboard truck at announcement of boycott of Los Angeles hotels, UNITE HERE Local 11 Facebook, 24 August 2023, https://www.facebook.com/photo.php?fbid=750612843742271&set=a.750611700409052&type=3.

Fig. 8. UFCW 770, LiUNA Local 724 workers at WGA strike, Wikimedia Commons, 21 June 2023, https://commons.wikimedia.org/wiki/ File:WGA_Strike_6.21.2023_010_(52992056191).jpg.

Fig. 9. SEIU-United Healthcare Workers West, Providence Saint Joseph Medical Center worker on strike, SEIU-UHW West Facebook, 23 October 2023, https://www.facebook.com/photo.php?fbid=713505937475888&set=a.222444876581999&type=3.

workerpower.com/wpi