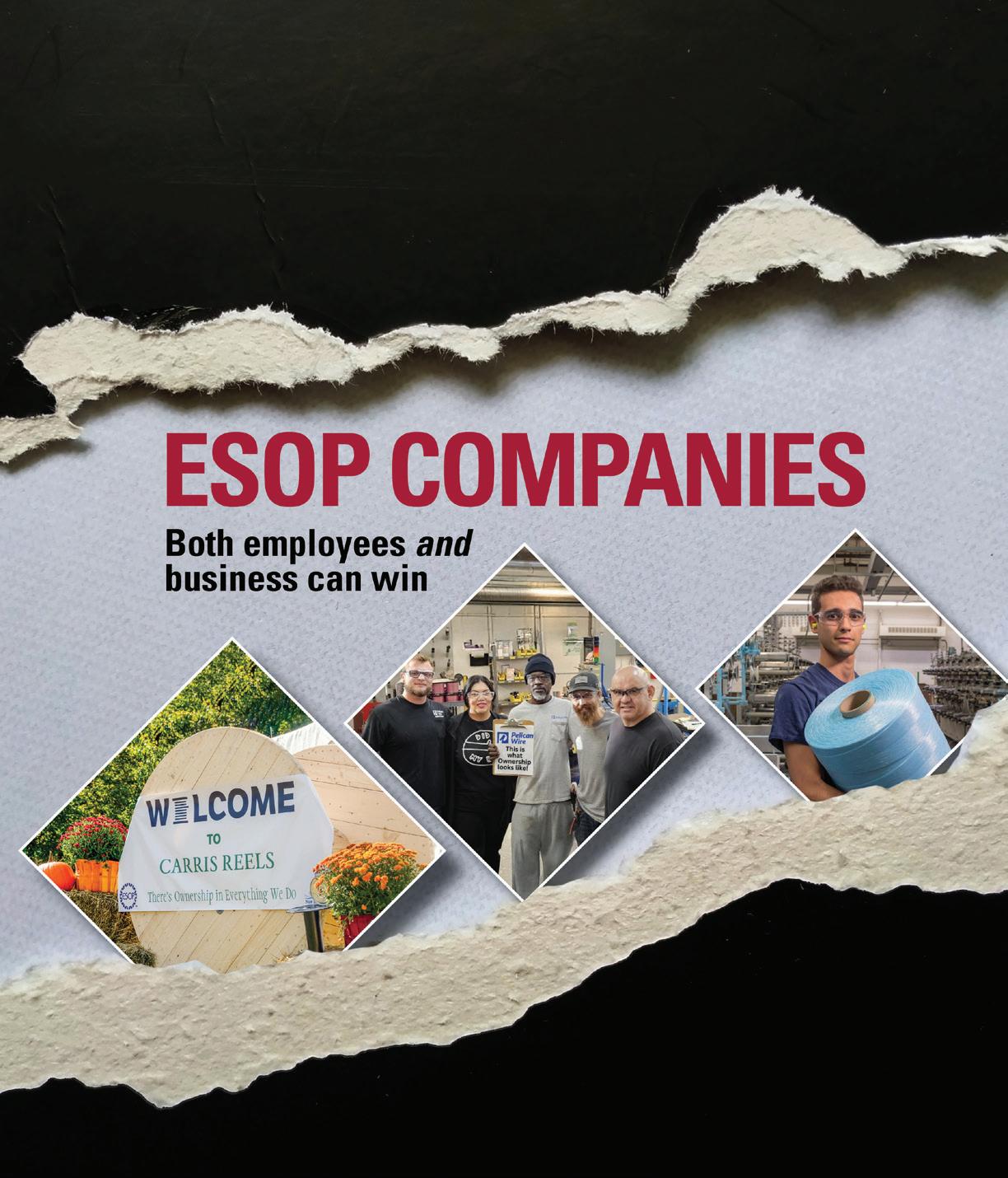

Dedication may feel distant on the shop floor, but at a handful of wire and cable companies, it’s grounded in something tangible: ownership through an Employee Stock Ownership Plan (ESOP). In this feature, Carris Reels, Pelican Wire, and Web Industries share what happens when employees have a real stake, not just in the work, but in the outcome. It also includes a Q&A with an ESOP association, and more.

ESOP firms grow 5.4% faster than comparable non-ESOPs due to higher employee engagement, retention, and productivity. The National Center for Employee Ownership (NCEO), 2025.

Publix Super Markets is the largest ESOP company, with over 200,000 employee-owners. MBO Ventures, 2025.

The ESOP implementation process in manufacturing averages six to 12 months, varying with company size, complexity, and regulatory requirements. Deliberate Directions, 2025.

About 140,000 U.S. companies employing 33 million people are estimated candidates for ESOP adoption. Aspen Institute, 2025.

Employee turnover is significantly lower at ESOP companies—voluntary quit rates are about one-third the national average. NCEO.

The smallest ESOP companies can have as few as 15-20 employees. ESOP Partners, 2022.

Top reasons for companies avoiding ESOPs include cost concerns, trustee complexities, financing challenges, seller payout timing, and loss of control fears. Merit Investment Bank, 2024.

More than 8 in 10 ESOP workers are confident they’ll retire comfortably—nearly double the confidence level of non-ESOP workers. John Zogby, 2025

Nearly 4,000 S corporation ESOPs cover over 1.2 million participants owning $183 billion in assets, emphasizing ESOP prevalence in S corps. ESCA, 2025.

Top ESOP industries include professional, scientific and technical services (20.8%), manufacturing (19.3%), and construction (17.8%). ESOP.org, 2025.

11 million active employees plus 4.2 million retired workers participate in ESOPs. Aspen Institute, 2025.

At a given point in 2025, there were 6,358 ESOP companies in the U.S., covering 14.9 million participants and holding over $1.8 trillion in assets. Harvard Business Review, NCEO.

If you’re not part of an ESOP plan—and there are relatively few in the wire and cable industry—here is an overview compiled from multiple sources: National Center for Employee Ownership, The ESOP Association, Rutgers Institute for the Study of Employee Ownership and Profit Sharing, Menke Group, PCE Companies, and the U.S. Department of Labor.

Employee Stock Ownership Plans (ESOPs) are a uniquely American model that gives employees the ability to own a stake in the companies where they work. While the idea of employee ownership is as old as American industry itself, the ESOP as we know it today traces back to “stock bonus plans” approved by Congress in 1921. These allowed employers to offer company shares as a retirement benefit. At one point in early 2025, 6,358 companies were reported to have ESOPs that covered nearly 15 million participants. They held more than $1.8 trillion in assets, a significant sum.

The early programs were important because they set the foundation for what was to follow, but they lacked the “empowerment” of true ownership. That was to come as ESOP plans would provide profit-sharing and stock grants that made the process more feasible and effective. Equally important, they made the concept of employee ownership a realworld business strategy.

ESOPs served nearly 14 million Americans, with $1.8 trillion in assets. .

The breakthrough came in 1956, when economist Louis O. Kelso pioneered the first leveraged ESOP at Peninsula Newspapers, Inc. For the first time, a company was able to borrow against future earnings to buy shares that were allocated to employees unable to invest directly. While not the first instance of employee ownership, Kelso’s innovation made it much more feasible for owners to sell to employees for succession planning, shaping modern ESOP practice.

A major shift came in 1974, when the Employee Retirement Income Security Act (ERISA) made ESOPs federally recognized benefit plans. This key legislation provided rules to protect employee interests, reporting requirements, and legal credibility nationwide. Subsequent laws in the 1970s, 80s and 90s added tax advantages, deductions, rollover options, and expanded eligibility. In 1997, Congress allowed S-corporations, a common private business structure, to adopt ESOPs, broadening the model to many smaller firms.

By 2000, there were about 8,800 ESOPs in the U.S. Those numbers plateaued as consolidations, mergers and rising compliance costs took effect. By 2020, about 6,500

Modern ESOPs are more structured, secure and accessible than earlier models. Today, an ESOP is typically established as a trust holding company stock for employees, with shares allocated over time based on payroll, tenure, or other criteria. Financing allows companies to borrow, often with pre-tax dollars, to fund share purchases, making ESOPs both retirement plans and succession strategies. S Corporation ESOP rules include tests for broad-based coverage to prevent concentration and ensure fairness. Participants are protected by ERISA’s fiduciary duty standards, allowing legal claims for mismanagement. ESOPs aren’t limited to large corporations. Nearly any privately-owned U.S. company, except partnerships and most professional corporations, can establish one. Many plans start with employees owning a minority (30-49%) stake, with opportunities to increase to majority or full ownership over time. This flexibility enables gradual transitions and liquidity options for retiring owners. Less than half of all ESOPs are 100% employee-owned, yet majority-owned firms continue to rise as shares shift from founders to staff.

A defining feature now is the link between company performance and employee benefits: employees accrue shares as the business succeeds, often at no personal cost. ESOP tax benefits include deferred taxes on allocated shares and deductions for dividends paid on ESOP shares. For S corporations, ESOP-held profits are generally exempt from federal income tax, making full ownership highly attractive.

Currently, efforts are underway to make ESOPs even more feasible. In 2025, Senate bills such as the Retire Through Ownership Act aim to clarify valuation rules and make ESOP formation safer with outside experts, while representation measures would give employee-owners a stronger voice. These reforms, which must get House approval and President Trump’s signature, could lead to more growth for American ESOPs.

“Every expert was once a beginner”

— R.B. Hayes

WAI’s on-demand video training courses are designed in manageable segments that are ready to go when you are. You set the pace.

Check out:

• Introduction to Ferrous Metallurgy

Led by industry experts each course includes engaging interactive content, a quiz, and a certificate of completion to track your progress.

See how quickly you can achieve more career milestones.

New content is added regularly. Courses are offered separately or bundled; and WAI members get discounts.

Learn more with WAI https://wirenet.org/education/online-courses/ or contact: education@wirenet.org

• Single-Layer Extrusion Overview

• Extrusion Applications

• Extrusion Materials

• Extrusion Special Process Considerations

• Manufacturing Safety