Wilmin G ton B iz MAGAZINE

Promised

Land?

With seaside spots in short supply, the spotlight shines on pristine places

STOP-MOTION DEVELOPMENT

SOCIAL CLUB CONCERNS

ONE INVESTOR’S JOURNEY

With seaside spots in short supply, the spotlight shines on pristine places

STOP-MOTION DEVELOPMENT

SOCIAL CLUB CONCERNS

ONE INVESTOR’S JOURNEY

On March 20, U.S. stock indexes hit record highs after the Federal Reserve did nothing that day. Earlier in the day, the Fed held interest rates unchanged, again keeping the target range of 5.25% to 5.5%.

Maintaining comes after raising rates 11 times between March 2022 and July 2023 to combat inflation.

Though the decision to do nothing was expected, the markets were buoyed by the central bank’s outlook for three rate cuts still this year despite recent data that shows that inflation has eased but remains high.

Investors, banks and college students who recently applied for a credit card to pay for spring break have a particular interest in the Federal Reserve’s interest. But so do commercial real estate developers.

Business Journal commercial real estate reporter Emma Dill talked to developers behind some of the projects that have been put on hold the past couple of years because of the pressures of rising costs and securing funding that stemmed from higher interest rates for the story “Pause & Reflect.”

“I would say probably one in 10 deals got done last year,” McKay Siegel, partner with East West Partners, told Dill about the rate’s impact on timing. “That’s probably trending to be true for this year … with the exception that maybe people are a little more optimistic about the back half of the year.”

Read more about the status of those paused projects on page 24.

Other commercial projects are moving ahead in the area – particularly with multifamily, retail

and office space.

Apartment projects continue to be announced and site work is visible in the Mayfaire area for the major mixed-use project Center Point. And bucking the national landscape, office vacancy rates are low in the Wilmington market, with new office buildings under construction. Read more about that and other area commercial real estate trends on page 36.

As investors read the tea leaves on interest rate decisions, mortgage bankers also are keeping their eyes on the horizon, particularly with refinancing. An estimated $1.2 trillion of U.S. commercial real estate debt is set to mature in the next two years, according to the Mortgage Bankers Association, with a quarter of that coming from loans in office and retail.

There’s a lot to watch ahead for the commercial real estate sector, and a bird’s eye view couldn’t hurt.

VICKY JANOWSKI, EDITOR vjanowski@wilmingtonbiz.com

VICKY JANOWSKI, EDITOR vjanowski@wilmingtonbiz.com

P ublisher

Rob Kaiser

rkaiser@wilmingtonbiz.com

P resident

Robert Preville

DARIA AMATO is a native New Yorker and School of Visual Arts graduate. Throughout her 30 years of experience, she has photographed a range of editorial, advertising, company branding and corporate clients in addition to music, fashion, portraiture, weddings and still life. She is an enthusiastic storyteller of moving and still images within lifestyle, food and travel. Amato photographed GLOW digital media students for the Takeaway final shot on PAGE 49.

EMMA DILL , a Wisconsin native, graduated from the University of Minnesota in 2019 with a journalism degree. In 2020, she moved to North Carolina for a job at the Wilmington StarNews. Dill joined the staff of the Greater Wilmington Business Journal last year, covering commercial real estate. Dill wrote about commercial projects paused because of rising interest rates ( PAGE 24 ) and social groups whose longstanding buildings are seeing development around them ( PAGE 28 ).

AUDREY ELSBERRY is a graduate of the University of South Carolina’s journalism school and a reporter for the Greater Wilmington Business Journal. She previously interned on the business desk at the Charlotte Observer and trained in New York City with the Dow Jones News Fund. Elsberry wrote about the debate over oceanfront development on PAGE 18 and interviewed Erik Hemingway on PAGE 32

ARIS HARDING is a Wilmington-based freelance photographer originally from southern Maryland. The UNCW graduate returned to Wilmington to pursue her love of storytelling, specializing in editorial and portrait photography. She photographed Erik Hemingway, co-owner of real estate investment firm Nomad Capital ( PAGE 32 ), and the Elks Lodge building on Oleander Drive ( PAGE 30 ).

rpreville@wilmingtonbiz.com

e ditor

Vicky Janowski

vjanowski@wilmingtonbiz.com

M anaging e ditor

Cece Nunn

cnunn@wilmingtonbiz.com

r e P orters

Emma Dill edill@wilmingtonbiz.com

Audrey Elsberry

aelsberry@wilmingtonbiz.com

V ice P resident of s ales & M arketing

Angela Conicelli

aconicelli@wilmingtonbiz.com

s enior M arketing c onsultants

Maggi Apel

Craig Snow

Kimberly Stamper

Stacey Stewart

M arketing c onsultants

Alexis Alphin

Jillian Hon

d igital c lient success c oordinator

Jessie Vincoli

jessie@wb360marketing.com

e V ents d irector

Jamie Merrill jmerrill@wilmingtonbiz.com

e V ents & M arketing c oordinator

Alecia Hall ahall@wilmingtonbiz.com

a rt d irector - e ditorial

Suzi Drake art@wilmingtonbiz.com

a rt d irector - M arketing

Tara Weymouth

tweymouth@wilmingtonbiz.com

M edia c oordinator

Julia Jones

jjones@wilmingtonbiz.com

d irector of f east W il M ington

Jessica Maurer jmaurer@wilmingtonbiz.com

c ontributing P hotogra P hers

Daria Amato, Megan Deitz, Madeline Gray, Aris Harding, Jeff Wenzel

s ubscribe

To subscribe to WilmingtonBiz Magazine,visit wilmingtonbiz.com/subscribe or call 343-8600 x201. © 2024 SAJ Media LLC

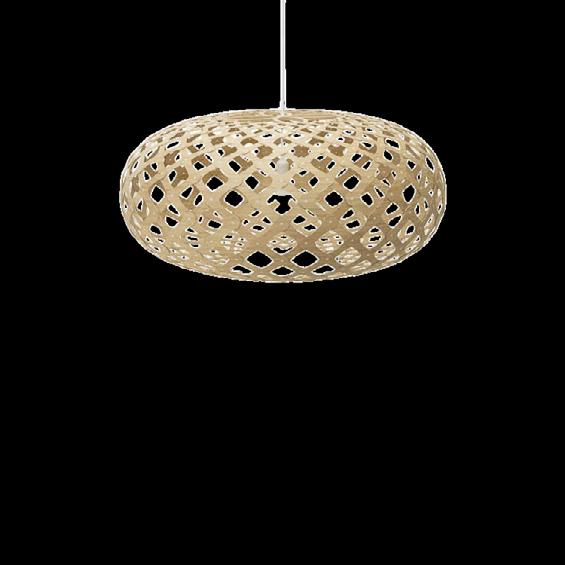

A tugboat pulls the Commodore Club, a $9 million indooroutdoor social club and restaurant, down the Cape Fear River on its way to Wrightsville Beach in January. The club now resides on a custombuilt barge at Wrightsville Yacht Club on the Intracoastal Waterway.

At 120 feet long and 30 feet wide, the club had to be built at a shipyard near the Battleship North Carolina in Wilmington while crews made the barge in Florida, said Bryan Thomas, president of club builder Monteith Construction. Wilmingtonbased Kersting Architecture designed the facility. In the works for several years, the Commodore Club evolved from a napkin sketch, Thomas said.

The remaining, unanswered question is why we need a replacement bridge with a 135-foot vertical clearance for maritime traffic, or twice the height of the current Cape Fear Memorial Bridge in its lowered, standard position?

NCDOT estimates that a 135-foot fixed bridge will cost $437 million, whereas cost estimates for a 65foot fixed bridge are consistently $150 million cheaper. A 65-foot fixed bridge could be funded and constructed quicker, without a toll, and is the least environmentally damaging practicable alternative.

Advocates for the 135-foot fixed bridge state that a 65-foot fixed bridge hinders industry upstream due to larger ships being unable to navigate underneath the shorter bridge.

Yet, NCDOT identified only one business utilizing ships taller than 65 feet: Kinder Morgan, which sold last June with perpetual, restrictive covenants restricting the property’s future uses and leaving vertical clearance requirements undetermined.

Even when Kinder Morgan was in operation, bridge openings for industry vessels were just 18% of openings between June 2020 and June 2023.

Over half of the bridge openings were due to training and

Moreover, a 65-foot fixed bridge would not be the sole barrier to maritime-based industrial development upstream of the Cape Fear Memorial Bridge.

INDUSTRY REQUIRING MORE THAN 65-FOOT VERTICAL CLEARANCE UPSTREAM FROM THE PORT OF WILMINGTON SIMPLY DOES NOT EXIST AND ITS FUTURE EXISTENCE REQUIRES MORE DREDGING, WETLANDS DESTRUCTION, DEFORESTATION – AND ALL THEIR NEGATIVE IMPACTS.

” ”

maintenance. Of the 350 times the bridge was lifted for maritime traffic, 221 lifts accommodated pleasure crafts, such as sailboats. Bridge logs unfortunately do not clarify if these openings were precautionary or essential.

Significantly, the standard bridge clearance on the Intracoastal Waterway, robustly utilized by pleasure boat traffic, is 65 feet.

Do we really need to spend $437 million for a bridge twice the height of bridges over the Intracoastal

Between the Cape Fear Memorial Bridge and where the river channel ends just south of the Interstate 140 Bridge, the channel depth decreases from 41 feet to 25 feet. This section of river is excluded from dredging projects that seek to deepen the channel.

The eastern riverbank north of Smith Creek is designated as conservation in New Hanover County’s Future Land Use Map. Across the river, the Highway 421 corridor continues to grow and diversify industry for our region.

Yet, this growth is dependent upon interstate shipping, not maritime shipping.

Recent 421 corridor projects, including Kessebohmer’s facility and the recently completed Wilmington Trade Center, are distribution centers for vehicular shipping, not waterbased shipping.

Industry requiring more than 65-foot vertical clearance upstream from the Port of Wilmington simply does not exist and its future existence requires more dredging, wetlands destruction, deforestation – and all their negative impacts.

So, if a 135-foot replacement bridge isn’t necessary, why is this option inputted into the State Improvement Transportation Plan?

This plan, called STIP, scores infrastructure projects using many

variables, including the total cost of the project. Based on the STIP algorithm, the highest-scoring projects receive funding.

Replacing the Cape Fear Memorial Bridge continues to score low due to the $437 million price of a 135-foot fixed bridge.

Now, tolls are being considered to reduce the project’s cost and increase the project’s score, which still does not guarantee timely state funding.

Advocates for a toll prefer leveling a financial burden on thousands of commuters each day to preserve “what if” dreams of upstream industry.

Little to no discussion is afforded to an option over $150 million cheaper with higher likelihood of state funding: a 65-foot fixed bridge.

The fact remains that we are not to have arrived at any preference between a 65-foot and 135-foot fixed bridge until the planning and environmental study process, or merger process, is completed at the conclusion of 2024.

However, our region has been convinced, without regulatory standing, that we must accept a 135-foot fixed bridge and we must accept a toll to fund this bridge.

It’s time to be straightforward with our region: A 135-foot fixed bridge is not essential, and the Coast Guard has a process for reducing clearances of navigable waters.

When we accept these facts, replacing the Cape Fear Memorial Bridge will be achieved faster, cheaper, without a toll, and with the least adverse impact on Eagles Island and the Wilmington Historic District.

Travis Gilbert is the executive director of the Historic Wilmington Foundation. The group is advocating for a Cape Fear Memorial Bridge replacement that has the least adverse impact to the Wilmington Historic District.

REACTIONS, OPINIONS AND QUOTABLES FROM OUR ONLINE SOUNDING BOARDS ON FACEBOOK.COM/WILMINGTONBIZ

WHO SHOULD COME TO PERFORM AT LIVE OAK BANK PAVILION?

“LIVE LOCAL MUSIC. No reason we are not using that space every week to showcase our wonderful and talented people who call Wilmington home! Wilmington Wednesdays and only have local talent and LOCAL food trucks!” – RAY BACA

“ THE ROSE • MARY J. BLIGE • VANILLA ICE • GARTH BROOKS • CHICAGO • BONNIE RAITT • BILLY STRINGS • THE BLACK KEYS

• FUTURE • LABRINTH • LORD HURON • MY MORNING JACKET • THE NATIONAL • 311 • METALLICA • ZACH BRYAN • BIGX • BON

JOVI • CAGE THE ELEPHANT • THE AVETT BROTHERS • DARIUS RUCKER • CHRIS STAPLETON • TREY SONGZ • PINK • GUCCI

MANE • OAR • BRANDI CARLILE • LEON BRIDGES • WU-TANG

CLAN • J. COLE • TAYLOR SWIFT • JAMES TAYLOR • SZA • HER • THE DECEMBERISTS” – COMPILATION OF READER RESPONSES

X (FORMERLY KNOWN AS TWITTER) POLL: @WILMINGTONBIZ

HAS WAGE GROWTH KEPT UP WITH INFLATION AT YOUR ORGANIZATION?

20%

40%

40% YES

WILMINGTONBIZ.COM

sye NO

DEPENDS ON THE JOB

“WE LOOK FORWARD TO EMERGING from this process as a stronger company with a solid financial foundation and better positioned to be a leader in the future growth of the wood-based biomass industry.” – GLENN NUNZIATA, ENVIVA’S INTERIM CEO AND CFO, IN AN ANNOUNCEMENT ABOUT THE WOOD PELLET COMPANY’S CHAPTER 11 BANKRUPTCY FILING. THE COMPANY, THE WORLD’S LARGEST WOOD PELLET SUPPLIER, HAS A STORAGE FACILITY AND TERMINAL AT THE WILMINGTON PORT.

SIGN UP FOR DAILY NEWS UPDATES AND SUBSCRIBE TO THE GREATER WILMINGTON BUSINESS JOURNAL AT WILMINGTONBIZ.COM

THE RISE IN INFLATION AS A RESULT OF SIGNIFICANT SUPPLY CHAIN ISSUES AND AGGRESSIVE FISCAL POLICY TO OFFSET THE PANDEMIC CLOSURES HAS CAUSED THE FEDERAL RESERVE TO INCREASE INTEREST RATES SHARPLY TO QUELL THE RATE OF INCREASE IN PRICES.

This has, obviously, had farranging consequences.

For families, inflation is a tax on earnings as their dollars are only able to buy a portion of the goods and services they are accustomed to purchasing.

This is, however, only true if wage growth is below the rate of inflation. In other words, people care what happens to their real wages – which are nominal wages adjusted for inflation – as that is what determines changes to their purchasing power and therefore is the metric that matters.

During previous episodes of high inflation, workers’ wages rarely kept up.

This time, however, what we saw was a different story as wages increased by a significant rate, especially in sectors that were

experiencing labor shortages.

To lure workers back from the sidelines, employers had to offer higher wages, which in many sectors increased by more than inflation. There is, however, significant variation across sectors and regions.

In North Carolina, average hourly wages as of November 2023 were 21% higher than the same month in 2019. During that same time span, prices were 20% higher.

This means, on average, North Carolina workers’ wages kept up with inflation, and people’s purchasing power was constant, which partially helps explain the strong consumer spending trends we have witnessed.

People were able to continue spending even when most economic observers were calling for an economic recession because their wages were allowing them to absorb the inflationary pressure. There is, however, considerable heterogeneity with leisure and hospitality wages increasing by 28% while the financial sector’s wages only increased by 12%.

In the Wilmington metropolitan area, average hourly wages have increased by 41% between November 2019 and November 2023, which is more than any other metro in the

state.

This points to the growth of the area and the changing composition of jobs but also to the shortages of workers that the region experienced post-COVID.

It is important to note that these wage increases were not evenly distributed and accrued largely to job switchers and workers in lower-wage occupations.

The recent inflation reports indicate that the Federal Reserve’s fight might not be won yet as price increases reaccelerated.

As a result, there are significant questions about whether the rise in wages in a post-pandemic world can keep up with inflation. Many of the worker shortages have been resolved and people’s ability to continue spending will partially depend on whether their wages can keep up with inflation.

One of the important questions going forward is whether the economy can continue surprising to the upside. The answer to that question will rest on the inflation path and that of wages.

At the local level, lower-wage workers employed in leisure and hospitality have been partially sheltered from the pinch of inflation, but there is uncertainty about whether the strong wage growth can continue into the next year.

Mouhcine Guettabi is a regional economist with UNCW’s Swain Center and an associate professor of economics at UNCW’s Cameron School of Business.

URANIUM-235 ENRICHMENT LEVEL GNF CAN NOW MAKE (HIGHER THAN THE 5% PREVIOUSLY ALLOWED)

$3 M

CFCC’S

,

% $

Global Nuclear Fuel facility in Castle Hayne secured regulatory approval to handle fuel with higher enrichment levels.

The approval from the U.S. Nuclear Regulatory Commission allows the facility to “manufacture, ship and analyze the performance” of fuel with uranium-235 enrichment levels up to 8% by weight, according to a company news release issued in midFebruary. Before the latest approval, the facility was limited to processing uranium enriched at up to 5% by weight.

“The significance of this approval is that it positions us to broaden our product offering and be ready to serve the industry with advanced fuel products,” according to Jon Allen, a spokesperson for GE Vernova.

It makes the Castle Hayne campus the first commercial facility in the U.S. to hold a license to fabricate fuel enrichments up to 8 weight percent, according to the company’s release.

Today, 5 weight percent is the maximum level of enrichment used in traditional power reactors, but those in the nuclear industry are increasingly interested in using higher enrichment levels, according to Allen.

The higher enrichment fuels are expected to improve “nuclear fuel cycle economics,” according to the company’s release, through power uprates for existing boiling water reactors and for “the next generation of reactor technology, including advanced and small modular reactors.”

In 2022, the company announced its plans to expand operations at its campus at 3901 Castle Hayne Road by adding nearly 500 jobs with an average salary of $131,000 over the next five years.

Global Nuclear Fuel and TerraPower, a Bill Gates-founded nuclear innovation company, announced an agreement to build the Natrium Fuel Facility at the Castle Hayne plant in 2022.

The project’s timing has been adjusted to align with when fuel for the first Natrium demonstration plant will be needed, Allen wrote in an email to the Business Journal.

Construction of the $200 million facility is set to begin in 2026.

GE Aerospace in March announced a $22 million investment to increase capacity at its Castle Hayne plant.

The announcement is one portion of a broader, $650 million investment in its aerospace manufacturing facilities in Massachusetts, Alabama, Ohio and North Carolina, according to the company.

In Wilmington, the investment will go toward machines and specialized tooling to increase capacity and building improvements. The Wilmington plant “plays a critical role in producing parts that go into engines used by our commercial and military customers,” according to a company spokesperson.

“These investments allow us to build on the strong 40-year history we have here in Wilmington to meet our customers’ needs and ensure a bright future for GE Aerospace as we become an independent company,” said Jackson Autry, site leader at the Wilmington facility.

The company’s Asheville plant is set to receive $11 million for highprecision machines, its Durham facility will receive more than $7 million for tooling and equipment to increase the assembly capacity of engines, and its plant in West Jefferson will get nearly $5 million.

GE Aerospace also plans to invest $107 million in facilities in the greater Cincinnati region, $54 million in a plant in Auburn, Alabama, and $30 million in a facility in Lynn, Massachusetts.

According to the company, GE Aerospace and its partner engines power three out of every four commercial flights and two-thirds of U.S. military aircraft.

This year’s investment plan aims to expand the company’s capacity to continue “ramping LEAP engine production, prepare for production of the GE9X and to continue supporting the U.S. military and its allies around the world,” the release stated.

Wilmington’s largest park could see sweeping changes as a part of a proposed master plan to revitalize the space.

The city has a master plan to improve all 48 of its parks, but the 250-acre Greenfield Park, which turned 100 this year, merited its own plan due to its size and community significance, officials said.

The most needed improvements, according to a surveyed group of parkgoers, were to restroom and concessions facilities, the walking loop, the shelters, picnic areas and Lions Bridge. Safety was a significant challenge the park faces, according to the community survey.

370,000 ACCOUNTS CREATED IN THE FIRST 2 DAYS AFTER ONLINE SPORTS BETTING BECAME

LEGAL IN N.C. LAST MONTH

Source: GeoComply

In 1949, brothers-in-law E.I. Clancy and Johnny Theys founded Clancy & Theys Construction Company in Raleigh. A er a generation of growth in the Raleigh market, new blood sought to expand locations and enter a familiar market, just a few hours down the road in Wilmington. In 1984, the establishment of the Wilmington division marked the first o ce expansion of Clancy & Theys.

At the time, Wilmington was an expanding coastal city, but a far cry from the growth we see today. Back then, our projects were small, matching the drum beat of the city. Our first major project was located at the north end of Wrightsville Beach, constructing a condominium project we eventually expanded over the decades as the greater Wilmington area grew.

Through generations of leadership, our team and our projects mirrored the growth of the city. Our once sleepy town is now one of the fastest growing regions in the country and has projects of a scale we’ve never seen before. Our team is proud to be a part of developments that continue to shape Wilmington and our communities today.

Our partnerships with local developers, higher education institutions, local science and art museums, as well as community centered projects like the groundbreaking earlier this year at MLK Community Center have offered us the opportunity to be a part of something bigger than ourselves, while we continue to develop a community our team and our families proudly call home.

We’re excited to see what the next 40 years have in store for our team and our community.

FEW LARGE WATERFRONT PROPERTIES REMAIN UNDEVELOPED IN COASTAL NORTH CAROLINA UNLESS WEALTHY, PHILANTHROPIC BUYERS OR CONSERVATION GROUPS FRONT THE BILL TO KEEP DEVELOPERS AWAY.

Preserved oceanfront properties are becoming increasingly scarce. So, what happens when a beloved parcel of undeveloped beachfront property is caught between a willing buyer planning to build and a passionate community hoping to conserve it?

About 150 acres of beachfront property with 1.6 miles of shoreline, known as Serenity Point to locals of Topsail Island in Pender County, were the subject of a tug-of-war between a buyer and community members for over a year before the buyer withdrew a rezoning request. Now the land’s future could lie with a regional conversation group that recently stepped in.

Topsail Island is a 26-mile-long barrier island about 40 minutes north of Wilmington. The island contains three municipalities: North Topsail Beach, Surf City and Topsail Beach. The 7 miles at the southernmost portion of the island are home to the town

ACRES OWNED BY COASTAL LAND TRUST FOR PRESERVATION BRUNSWICK

of Topsail Beach, which remains primarily residential, while the commercial and tourism markets descend on neighboring Surf City.

“(The town) has remained true to what the residents and property owners have requested,” said Steve Smith, the mayor of Topsail Beach. “They want a residential community … They’re not interested in lots of businesses or high rises or anything like that.”

Serenity Point is on the island’s southern tip in Topsail Beach. Cape Fear Commercial had marketed it as “one of the last remaining large oceanfront tracts in the region.” The tract is home to 31 different species, wetlands and primary dunes that protect the island from erosion, said Michele Rivest, a part-time resident of Topsail for over 35 years.

Rivest is the board of directors’ vice president for Conserve the Point, a community-led group dedicated to precisely what it sounds like: conserving the property Rivest refers to as the “crown jewel of Topsail Island.”

According to Conserve the Point, the 150-acre parcel has belonged to the McLeod family since the 1960s. The McLeods unsuccessfully tried to sell the property in 2005, which resulted in the first iteration of Conserve the Point and national coverage from The Wall Street Journal. The Great Recession compelled the owners to take the property off the market in 2008 until it was marketed again in 2019.

tip of Topsail would be developed.

“What became a huge crisis for our family, and for so many others, was when we heard that the property was for sale and that there was a prospective buyer,” she said, “an applicant who would put forth a proposal for development.”

Todd and Laura Olson, who live in Raleigh full time but are part-time residents of Topsail, requested that “conditional rezoning” be added to the town’s code to allow them to develop an enclave on Serenity Point. Topsail Beach approved the change in September 2022, and an official zoning application was submitted the following January.

Todd Olson is the CEO of Raleighbased software firm Pendo.

According to town documents, the Olsons’ rezoning proposal included seven single-family homes, a swimming pool and pool house, a beach access walkway with a gazebo and a private dock to accommodate six vessels. The proposal would develop 20 acres out of 150 acres. The family stated an intention to conserve the remainder of the property. Although most of the property would remain untouched, community members and state and federal agencies maintained that any development on the property would be ill-advised.

The town placed conditions on the potential rezoning, and the Olson family withdrew the application in November.

NEW HANOVER

542.8

1,658 PENDER

2,784.4

The current owners of Serenity Point didn’t respond to requests for comments on this story.

Although it has been privately owned for over 60 years, residents across Topsail Island have expressed a sense of shared ownership over Serenity Point. Several impassioned community members shared stories of their connection to Serenity Point at Topsail Beach Planning Board meetings. Rivest’s granddaughter, who’s now 21, called the stretch of beach “our beach” as a child. Rivest said many community members never considered the idea that the southern

The Olsons’ retreat spurred members of Conserve the Point and Coastal Land Trust to renew their mission to place to property into permanent conservation.

In March, after months of negotiations with the McLeod family via Cape Fear Commercial, Coastal Land Trust signed an agreement to purchase Serenity Point for $8 million.

The organization is pursuing state and federal grants to raise the majority of the funds as well as private donations to fund the rest, executive director Harrison Marks said.

The organization has one year to raise the money, he said.

I CAN’T THINK OF ANOTHER INSTANCE RIGHT NOW, ALONG OUR COASTS OR BARRIER ISLANDS, WHERE YOU’VE GOT A HIGHLY DEVELOPED ISLAND THAT STILL HAS THAT SIZE TRACT OF LAND UNDEVELOPED. IT’S PRETTY AMAZING.

HARRISON MARKS executive director of Coastal Land Trust, at Brunswick Nature ParkConserve the Point last year began raising money to help with conservation efforts, before and separate from the recent announcement – exceeding its $5,000 goal with $25,000 in donations.

“We heard from people all over the country, really, which was shocking to us,” Rivest said, “that there was such widespread love and interest in conserving the point.”

Now, Coastal Land Trust will rely on that kind of support – and a lot more – to help fund its purchase agreement.

Coastal Land Trust officials call the agreement to purchase Serenity Point an “ambitious campaign.”

Marks said if the group can’t raise $8 million by early next year, the trust will forfeit some earnest money and will be unable to purchase the property then.

The group will have to take out a bridge loan to fund the purchase because the grants it’s applied for will not be available in time, Marks said.

“We’ll end up borrowing a pretty substantial amount of money until

the grant funders actually provide the money,” he said. “So, that nearly $8 million includes interest costs to borrow the money.”

The deal was worth the risk to ensure the property remains undeveloped, Marks said.

“I can’t think of another instance right now, along our coasts or barrier islands, where you’ve got a highly developed island that still has that size tract of land undeveloped,” Marks said. “It’s pretty amazing.”

About 5,000 acres have been purchased and preserved by the Coastal Land Trust across Pender, Brunswick and New Hanover counties, according to the group’s database. Through varying methods, they’ve helped conserve and monitor almost 36,000 acres in the tri-county area.

Even if the Olson family had successfully purchased Serenity Point, Marks said his group had worked out a deal to preserve the 130 acres left undeveloped by the family.

“This is one of the visible and most beloved properties that I'm aware of,” Marks said. “I don't know that we've had any quite like this.”

The purchase agreement was

made between the property owners and Coastal Land Trust without contributions from Conserve the Point, Marks said. But he hopes the community group will help stoke efforts to raise private donations.

If the Coastal Land Trust were to acquire the property, the town of Topsail Beach would want to discuss who would maintain it, Smith, the mayor, said.

If Coastal Land Trust closes on the property, it would be transferred to the state to be managed by the N.C. Department of Environmental Quality's Division of Coastal Management, according to Coastal Land Trust officials.

The group plans to meet with town officers and host public meetings in the future.

Topsail town officials hoped to buy Serenity Point about five years ago, Smith said. They offered to pay a sum based on conservation value, but the McLeod family turned it down.

Often, those who plan to develop a property can pay more to acquire it than those who plan to conserve

it, as was the case with the town’s offer. But when the seller is determined to sell to conservationists, they forgo the more valuable price tag.

In October, a 30-acre property in New Hanover County was sold from one private conservationist to another. The $17 million deal was still record-breaking for the county, but the seller could have gotten a significantly larger sum had they sold to developers, said Buzzy Northen, the Intracoastal Realty Corp. agent who represented the previous owners in that sale.

Queens Point, now called Angel Point after its new owner, Dolores Angel, is a marsh and wetlands property on Howe Creek in Wilmington. The parcel was sold by a group of friends who owned it for 20 years and did not want to list it on the market like any other property. They wanted to find buyers independently who were committed to conserving the land.

Northen was asked to find a buyer who would meet the seller’s guidelines, and he found Angel. A deal like this, where a dozen parcels with the capacity to be split up and developed are sold in one package with the intent to conserve, is “very rare,” Northen said.

There is no contract, however, ensuring Angel will never develop Angel Point, but a family representative told the Greater Wilmington Business Journal in October that the family does not plan to build more houses on the property, where two already exist.

The owners of Serenity Point could have received much more money in exchange for the property, Marks said. Their willingness to sell to the Coastal Land Trust made clear that they want to see the property conserved, he said.

“They could have done other deals, I feel quite confident,” he said. “I feel like they cut us some slack.”

Marks said the Coastal Land Trust has been successful in its past attempts to conserve land. The Point needs to be preserved and is very important to the group, he said.

“With thousands of people interested in doing this,” Rivest said, “we think that this is the time to put together that kind of funding package to purchase and conserve The Point.”

SPIRITS WERE HIGH AT WILMINGTON INTERNATIONAL AIRPORT AS NEW HANOVER COUNTY LEADERS AND AIRPORT OFFICIALS UNVEILED RENDERINGS OF WHAT WOULD BECOME THE CAPE FEAR REGION’S FIRST AIRPORT HOTEL: A 150-ROOM CROWNE PLAZA NOT FAR FROM THE TERMINAL WITH A RESTAURANT AND ROOFTOP BAR.

That announcement came in April 2022. Nearly two years later, the hotel’s developers have yet to break ground, and they blame climbing interest rates.

At the time of the announcement, nationwide interest rates had just started to climb. The first rate hike came in March 2022, and since then, the Federal Reserve has raised rates 11 times in attempts to tamp down inflation.

Those rising rates have raised the cost of the hotel at ILM and made it more difficult to secure funding, said Chip Weiss, the New York City-based developer who’s leading the project with his brother Andrew.

“Because of interest rates, it’s been an uphill struggle,” he said. “It adds millions of dollars to the upfront costs, and it adds millions of dollars over the years to the debt service.”

developers remain optimistic about the future

Chip Weiss said 75% of the $53 million project will be financed by bonds with the remaining 25% funded by private equity. They’re working to secure a bond rating from credit rating agency S&P, a move they hope will attract more investors.

The developers have already secured two due diligence extensions from airport officials as they work to finalize the project’s financing. They have until early October to show the airport they can close on the financing.

“We think it’s plenty of time, actually,” Weiss said. “Really, as soon as this stuff is settled, we’ll have shovels in the ground.”

He said the pause on the project at ILM isn’t unusual in the current environment. His development firm has a handful of other projects on hold because they haven’t been able to secure financing with the higher interest rates. Since early 2022, rising rates have presented a common challenge for commercial developers across the Cape Fear region, forcing them to pause projects and get creative with financing.

“It’s not just the fact that rates went up as much as they did; it’s how quickly they went up,” said David Rizzo, market executive with First Carolina Bank. “That’s what made it really difficult for bankers and developers alike because it was hard to predict how high they were going to really go.”

Commercial projects typically generate income in the form of rent. An apartment complex, for example, collects rent from individual renters, while a retail center or office building collects from the businesses or other entities that occupy its space.

A mismatch between rental rates and interest

A previous rendering shows what developers envisioned for the Gateway Project, a public-private partnership that would have transformed cityowned land in northern downtown Wilmington into residential and commercial space.

rates led to funding shortfalls for commercial developers, Rizzo said.

“Rents didn’t go up as fast as interest rates did, and so every dollar that a developer could finance wouldn’t go as far when rates had basically doubled over the course of 12 months,” he said. “There’s more expense covered by the same income, so you couldn’t borrow as much, and that did cause some projects to take a pause.”

Ultimately, the rising rates have pushed some small-sized or amateur developers out of the market, Rizzo said. Developers need to come to a project with much more initial equity to make the numbers work.

McKay Siegel, with East West Partners, said he’s felt the pressure of climbing rates on some of the group’s projects.

“It killed a lot of things, frankly,” Siegel said about rising interest rates. “I would say probably one in 10 deals got done last year. That’s probably trending to be true for this year … with the exception that maybe people are a little more optimistic about the back half of the year.”

Siegel said he sees development firms as, essentially, financial institutions.

“Interest rates directly impacted everything that we do from how we

raise money to how we sell assets, how we borrow money from the bank, the loan interest on an asset,” he said. “And when they go up, particularly when they go up steeply, quickly, it causes issues.”

One project affected by interest rate hikes was a partnership between East West and Wilmington city leaders to bring a massive, multi-use project to the north end of the city’s downtown. The Gateway Project, as it was dubbed, was planned to usher residents and visitors into the heart of Wilmington.

But plans broke down last fall when a memorandum of understanding between the city and the developer expired, and neither party moved to renew it. The memorandum had called for a project that included hundreds of apartments, workforce housing, retail space, a hotel, a grocery store and public parking.

Siegel said rising interest rates weren’t necessarily “the final nail in the coffin” for the project, but they had some impact on its feasibility. “There was just a lot that we were trying to accomplish in the same project, and the interest rates didn’t help,” Siegel said.

In addition to higher rates, developers have also faced rising materials and labor costs, along with

climbing insurance rates and general economic uncertainty, Siegel said. Still, he believes developers will start finding ways to kickstart the projects that have faced pauses.

“People are just very creative on getting things financed,” he said, “and I think people are gonna start to find a way to push some of these projects forward.”

Bryan Thomas, president of Monteith Construction, agrees. He thinks the industry is “on the cusp” of viewing higher interest rates as part of a “new normal” and finding a way to finance projects and get them done.

Monteith works on governmentfunded projects such as schools and hospitals and privately funded apartment complexes, senior living facilities and hotels in the Wilmington area, Thomas said. While the school and hospital projects haven’t experienced significant impacts from rising rates, Thomas said about half of the privately funded projects have faced slowdowns.

“Fifty percent of the group have slowed things down, and the numbers won’t work,” he said, “and the other half had some other type of financing set up through other means.”

One upside of the slowdown in

projects is it’s created a prime market for bidding out work for the projects that do have financing in place, Thomas said.

“We are in the best bid market that we’ve seen in the last four to five years,” he said, “just because people are nervous that work could dry up, so they’re getting aggressive.”

Wilmington developer Dave Spetrino had to get creative when financing Midcastle, his latest mixed-use project on the site of a former bus facility on Castle Street. City leaders have eyed the 1.5-acre tract at 1110 Castle St. for redevelopment for years.

Spetrino submitted the high bid for the property last year and is now moving forward with plans for 98 apartments and more than 4,200 square feet of commercial space. But because of rising interest rates, the project will be built in two phases instead of one.

For this project, Spetrino said he was able to borrow around 60% of the project’s value, while he’d normally borrow between 70% and 80%. That means he’s had to put more of his own equity into the project.

“If this were 2022, and rates were basically 4%, we would have figured out how to build the entire project simultaneously,” he said. “In this circumstance, we’re going to have to build half the project, get it leased up, save up some money, set aside some cash and then we can go to the next phase.

“We used twice as much cash than we would typically use to be able to build the first phase,” he added, “and because of that, the second phase has to wait.”

Coupled with rising rates, Spetrino said developers are facing higher costs all around, making it more difficult for the math to make sense.

“Now I’m dealing with high construction costs, high labor costs, high material costs and high-interest rates,” he said, “and so that’s gonna make projects that much harder to make them work.”

Members chartered Elks Lodge No. 532 in Wilmington in 1899. The group’s original charter still hangs in a frame above the door of its meeting room inside the Elks Lodge on Oleander Drive.

After receiving the charter, the Elks first met in a downtown building before moving into the nearby Dudley Mansion at 400 S. Front St., according to Bob Shields, who’s been a member of the lodge for more than two decades. Starting in April, Shields will also serve as the group’s next “exalted ruler,” elected by lodge members.

The original group’s downtown “temple” is long gone, Shields said. The Elks moved out to 5102 Oleander Drive at a time when there wasn’t

much in the area except trees, he added.

In the roughly 50 years since, development has transformed the landscape along Oleander Drive and other major corridors throughout the Wilmington area. According to the U.S. Census Bureau, the population in the city of Wilmington alone climbed by nearly 14,000 between 2010 and 2022, the most recent population estimate.

That uptick in residents in Wilmington and throughout the Cape Fear region has helped fuel new apartment complexes and commercial projects. But even as development grows up around them, many of Wilmington’s fraternal groups, sororities and social organizations are holding onto the buildings that have been gathering spaces for generations of members and area residents.

The Elks first secured land along Oleander Drive in 1970, according to property records, with additional land purchased in 1980 and 1987. The group’s nearly 10,000-square-foot lodge was built in 1971 on just over 5

acres, records show.

The building’s interior, which features an expansive hall, hosts bingo on Monday nights and can be rented for weddings and vendor fairs. Shields said an outside group typically rents it out about once a week.

The lodge also includes a social area with a bar, a game room and a formal meeting room, where the group holds member meetings on the second and fourth Thursdays of each month. The names of members who have died are etched in stone on plaques that cover the room’s walls.

During meetings, members sit in theater-style seats around the room while the lodge’s exalted ruler and those in other top positions lead the meeting from the room’s center, Shields explained.

The group, which has close to 500 members, has invested in minor improvements in recent years, such as adding a digital sign along Oleander Drive to advertise events. “Basically, some facial changes more than anything else,” Shields said. “And so, with that, we’re looking at now moving to the inside and start doing some work in here.”

By far, the biggest change in the area’s scenery is the ongoing construction of The Range on Oleander, a project set to include more than 340 apartments and about 12,000 square feet of commercial space.

Crews are working on the complex, developed by Chapel Hill-based East West Partners, on about 15 acres next to the Elks Lodge. The site at 5026 Oleander Drive formerly held a golf driving range and is bordered on one side by Wilmington Municipal Golf Course.

The construction towers over the neighboring Elks Lodge. When the project was first announced, it was a cause for concern among some members, Shields said, but the

group was able to negotiate with the developers, making it a win-win for both parties.

The Elks are allowing project contractors to store materials and equipment on the land at the back of their lot. Once the project is complete, developers have agreed to install a new power station for the motorhomes and buses of the “traveling Elk” who occasionally park at the site.

“We’ll have the larger amperage services for the larger buses back there,” Shields said. “We’re currently sitting right at the edge of what they need.”

Shields said several of the contractors working on the project have even become lodge members and have

supported the group’s needs during its construction.

“Everything that we’ve asked for, they’ve either worked with us, or they said, ‘We’ll help you take care of that,’” he said. “We’re very fortunate to have them as neighbors, let’s put it like that.”

About five years ago, before work started on the Range, developers offered to buy the Elks Lodge, Shields said. Even though the group was “actively” looking for another building, members shot their offer down.

“There were several places that we took a look at that … money-wise they just didn’t pan out to where it was going to be beneficial for us to move,” Shields said.

That hasn’t been the only offer the group has gotten.

“We have had offers on the building, and we’re holding on,” Shields said, “because basically, besides up the road where Casey’s (Buffet) is, this is about the only piece of property right here that’s left on the market for development.”

The Elks Lodge has a focus on service, Shields said. Members volunteer to deliver Meals on Wheels, put together Christmas baskets for families in need and collect canned goods, among other things. Across town, Loyal Order of the Moose members also have a similar service-minded purpose, hosting fundraisers, collection drives, along with an array of social events, including bingo, trivia and local band performances.

On Carolina Beach Road, the Moose Lodge is hanging on to their long-time building despite ongoing development along the corridor.

The Moose Lodge was chartered in Wilmington in 1937 and first met downtown over a pool hall at the corner of Front and Market streets, said Pam Fiske, lodge president and the group’s first female leader.

The lodge then moved to a building at Third and Grace streets in the 1940s. When they were unable to make payments on the building, they moved

to a rented space on Eastwood Road before purchasing the former Famous Club restaurant on Carolina Beach Road, Fiske said.

According to property records, the group acquired its current site at 4610 Carolina Beach Road in 1977 and built the lodge in 1985. They later added a roughly 3,400-square-foot “social wing” with a bar, room for tables and a small stage.

Today, the lodge has just over 12,000 square feet under its roof. That includes an expansive hall that hosts weekly bingo and the group’s meetings and can be rented out for events, said lodge member Nick Benson.

While Fiske said development pressures have largely spared the Moose Lodge, the possibility of selling isn’t unheard of.

“A few years ago, we had several members who said we ought to sell the lodge property, and we’ll buy and build a whole brand-new building,” Benson said. “They decided at that time that the property wasn’t valuable enough to try to build a whole new building and give up what we have here.”

From Fiske’s perspective, the uptick in growth has brought in new members as people move to Wilmington from other parts of the country. The

600-member lodge is working to recruit younger, more active members. She said the lodge’s location along a well-traveled stretch of Carolina Beach Road helps with the group’s visibility.

In downtown Wilmington, Alpha Psi Omega, the Wilmington chapter of historically African American sorority Alpha Kappa Alpha, is facing its own real estate strife – the group has outgrown its meeting place.

The Wilmington group, chartered in 1932, purchased a two-story home at the corner of Red Cross Street and Fifth Avenue in 1982, said current chapter president Onya Gardner. Before buying the house, the group’s members would meet in each other’s living rooms.

But more than 40 years later, the group no longer fits inside the home.

“Formally, we now have 80 members. So, if you’re looking at the house on Red Cross Street,” Gardner said, “you know that there’s no way that we can fit the majority of our membership into that space.”

They instead host their chapter meetings at Brunswick Community College’s Leland Center, where Gardner serves as dean of continuing education and workforce development.

Gardner said they still use the home, which is adorned with AKA letters, for certain initiatives, such as collecting food or packing donation bags. The home’s high visibility near downtown and the evolving Brooklyn Arts District has made the group a presence in the community.

“Visibility is so important, and so there may be people who drive by and say, ‘Yes, that’s the AKA house.’ There’ll be others who drive by and say, ‘What is AKA?’ The visibility can connect to those who are familiar and those who are not familiar,” she said.

But they need a larger, likely commercial space to house their meetings and facilitate ongoing initiatives. Getting a larger building is one of the group’s long-term goals.

“Planning is critical to that. That’s not going to happen in the next year,” she said. “Maybe in the next three to five years, if it’s planned right, we can have that commercial building.”

ERIK HEMINGWAY, co-owner of real estate investment firm Nomad Capital, sailed through the 2008 housing crisis on a boat with his wife and six children.

He bought the boat in 2009 off a remote island in Greece using money he obtained from selling some properties the year before in Arizona, where he began his career in construction. The Hemingway family moved to Costa Rica and then decided to set sail instead of going home, motivated by the economic downturn in the States.

“We’re from Arizona, so we don’t know that much about boats,” Hemingway said. “But we said, ‘Let’s go for it.’ So, we thought we were going to be on the boat for one year and just sail around in Greece, one island to the next, and then sell the boat.”

The family of seven ended up living on the boat for three-and-ahalf years, turning into a family of eight. They visited 25 countries and sailed from the Mediterranean Sea to the Cape Fear River. Hemingway returned to real estate in 2012 once he and his family settled into life on land in Wilmington. He began fixing and flipping homes until he and his son, Levi, began working on commercial projects in 2016. It was then that Erik Hemingway first had the idea to turn warehouse sites into self-storage facilities, Nomad Capital’s specialty.

Converting properties feels like a creative outlet, Erik Hemingway said, seeing potential in something others do not. His first conversion was a vacant warehouse on Fourth Street across from Flytrap Brewing. Erik Hemingway was there having a beer when he saw the lot for sale. He said he immediately saw dollar signs where the listing agent saw a tear-down.

Erik and Levi Hemingway

began to revive the self-storage business Erik had established in Arizona but with a conversion twist. They brought on partners to invest in the projects, leading to Nomad Capital’s inception in 2021.

“That’s why it’s Nomad Capital,” Erik Hemingway said, “because we were living like nomads on the boat.”

When the Hemingway family crossed the Atlantic Ocean in 2012, they spent 18 days on the open seas without seeing a speck of land, Erik Hemingway said. His wife had a newborn baby then, so it was up to him and his children, Levi and Maggie in particular, to man the helm. “People ask me, ‘Were you scared?’ I’m like, ‘Yeah, every day,’” Erik Hemingway said. “All your family’s on the boat.”

“It was awesome,” said Levi Hemingway, who was 15 during the transoceanic trip. He’s 28 now. “I absolutely loved every second of it. It was incredible.”

The father and son built a great working relationship on the boat, Levi Hemingway said. They were the ones who usually docked, anchored and sailed the ship.

“You had to communicate a lot, just about everything,” he said. “Stressful situations arose, for sure.”

At first, Levi Hemingway worked for his father in the construction and self-storage companies. Later, the opportunity arose for the father and son to become business partners.

Erik Hemingway and his father had tried to start a business together before his career in construction. It ultimately failed, however, to create sufficient income for them both. So, he got a job in construction, which led to his own father-son business venture years later.

“We said, hey, let’s partner on this through the good and the bad and the ugly,” Levi Hemingway said. “I’m signing the notes with my dad now, so, it was obviously

a lot of risk there, but we were doing it together and that feels really good to be to be on that level with him as a partner.”

Nomad Capital has now raised about $14 million from investors, manages about $150 million in assets and has embarked on its first formal capital raise, cheekily named El Fundo. Erik Hemingway said they’ve raised $4 million of the goal sum of $10 million, which is planned to be distributed across five properties.

In a way, Nomad’s business model capitalizes on the decline of manufacturing and big-box store retail in the region. Vacant retail stores and manufacturing plants are ideal sites, Erik Hemingway said. They’re usually in central locations, climatecontrolled and available for a fraction of the price of building a facility from the ground up.

“We’re really excited for what we’re doing now at Nomad Capital,” Erik Hemingway said. “We feel like there’s a lot of opportunity and whether we’re going to do storage forever, who knows? But we feel like we’re good at spotting deals and finding opportunities. And so maybe it’ll be converting one of these huge mills into multifamily someday.

“I like to always be challenged, so if things become too routine and are too easy, I’m like, ‘Let’s shake it up.’”

Something Levi Hemingway learned on the boat was to only focus on the next task at hand and not think too far ahead, he said. At first, he and his father didn’t know how to sail or start the engines on the ship, but they began to learn step by step until they gained enough skill to cross the ocean.

As an adult, Levi Hemingway connects this idea with growing and scaling the business — focusing on what is in front of them, one thing at a time.

The local commercial real estate industry continues to follow some of the same trends this year as it did last year. Gas station brands new to the Wilmington area made progress toward welcoming customers, with some under construction and others moving forward in the local planning and permitting pipelines. The office, industrial and retail sectors forged ahead, in some cases diverging from the performance of those sectors in outside markets.

BY CECE NUNNGas station developers advanced plans to bring popular players to the Wilmington area’s offerings.

Wawa and Sheetz have new locations in the works on Carolina Beach Road. The chains, which are both Pennsylvania based, confirmed plans to enter the Wilmington market in the last year. Now, planning is underway for two new stores. A Sheetz is proposed at 6401 Carolina Beach Road, and developers have been working on a Wawa about a mile south at 6800 Carolina Beach Road.

A 6,100-square-foot Sheetz convenience store is proposed at the intersection of Carolina Beach and Golden roads. Site plans show a fuel canopy with eight fuel pumps, 42 parking spots and access driveways off Carolina Beach and Golden roads.

Another Wawa is on the way to South 17th Street near Novant Health New Hanover Regional Medical Center. Sheetz and Wawa are among several new convenience store chains breaking into the Wilmington market. Others include 7-Eleven, Royal Farms and Refuel, which announced its first store inside Wilmington’s city limits in October 2023.

The national office vacancy rate set a new record during the last quarter of 2023, according to Moody’s Analytics.

According to Moody’s, the nearly 20% national rate reflects an ongoing mix of remote and inperson working. “The permanence of dynamic hybrid models has effectively muted office demand,” Moody’s reported in January 2024.

But in the Wilmington market alone, the vacancy rate is minuscule, according to market data and local brokers. An office building coming to midtown serves as an example. N.C. Farm Bureau Mutual Insurance Co. will move its office in Hanover Center off Independence Boulevard to The Offices at Iron Gate at 2725 Iron Gate Drive, which is under development by Wilmington-based SAMM Properties Inc.

Parker Anderson, of SAMM Properties, said in February, “With not having started construction yet on The Offices at Iron Gate and having the potential for the entire building to be leased before construction begins, I think that is a great testament to the high demand for class-A office space in Wilmington.”

Developers bought 187 acres on U.S. 421 in Wilmington in October for a major expansion of one of their existing industrial projects.

Edgewater Ventures, a commercial real estate investment company, purchased the property next to Wilmington Trade Center for $7.65 million from Invista.

“The acquisition will expand Wilmington Trade Center to 212 acres and is master planned to provide up to 3.3 million square feet of class-A industrial facilities,” a news release stated.

“The park will be one of the largest of its kind in the state of North Carolina and is designed to accommodate industrial users up to 1 million square feet.”

Like the office market, the industrial sector in the area continues to see low vacancy rates.

At Wilmington Trade Center, Edgewater has already developed and nearly filled two buildings totaling 315,000 square feet on the original 25-acre parcel acquired in 2021.

4

National retailers put Wilmington on their lists in 2023, with businesses coming and going at bustling centers.

A second Wilmington Target store is coming to The Village at Myrtle Grove. Office supply store Staples, which anchored the shopping center alongside The Home Depot, closed its doors in July.

Commercial brokers told the Greater Wilmington Business Journal earlier this year that the national retailer had been considering entering the Monkey Junction market for more than a decade.

Across town, more changes are in store for Hanover Center, Wilmington’s first suburban shopping center, which was built in 1955. At the end of September, retailer Homesense opened in a 24,000-square-foot section of the storefront once occupied by Stein Mart at Hanover Center.

At Mayfaire Town Center, clothing and accessory retailer Anthropologie opened in the space formerly occupied by Pier 1.

5

Health care organizations in the Cape Fear region continue to expand with recent openings and planned projects.

“As the supply of existing medical spaces remains limited, the demand for the newly developed properties should remain healthy,” said Cal Morgan, a real estate appraiser and owner of Wilmington-based JC Morgan Co. “As new residential developments expand outward from central Wilmington, development of such medical facilities should follow.”

In June, officials marked the opening of a 34,000-square-foot medical office building at the Novant Health Brunswick Medical Center campus in Bolivia. The two-story building houses heart and vascular services, family medicine, urology, surgical care and an infusion center.

In the city of Wilmington, a $28 million project will allow MedNorth Health Center, 925 N. Fourth St., to expand access to existing and new services including family medicine, pediatrics, obstetrics, gynecology, dentistry, podiatry, integrated behavioral health and more. The new construction is slated to add about 30,000 square feet.

MEMBERS OF THE CURRENT WILMINGTONBIZ 100 SHARE MEMORIES OF THEIR FIRST PAYCHECKS.

THIS YEAR’S GROUP WILL BE ANNOUNCED IN SEPTEMBER.

TO SEE THE FULL GROUP, VISIT WILMINGTONBIZ100.COM

CO-FOUNDER & CEO, RALEON

“WHEN I WAS 11, I GOT MY FIRST JOB WORKING AS A WEB DESIGN CONSULTANT AND DEVELOPER. I WORKED WITH EARLY E-COMMERCE ENTREPRENEURS, RADIO SHOW HOSTS AND EVENTS.

I LEARNED THAT MORE OFTEN THAN NOT, THE MOST CHALLENGING THINGS ARE THE ONES MOST WORTH DOING. I ALSO LEARNED THAT ONE OF THE GREATEST SKILLS YOU CAN HAVE IS LEARNING HOW TO TEACH YOURSELF.”

DIRECTOR, WILMINGTON REGIONAL FILM COMMISSION INC.

“MY FIRST JOB IN THE INDUSTRY WAS DRIVING A MOTORHOME FOR THE ACTOR CHARLTON HESTON. I LEARNED THAT EVERYONE ON THE PRODUCTION WAS ON THE SAME TEAM, NO MATTER YOUR POSITION, AND WE ALL HAD A PART TO PLAY IN MAKING IT A SUCCESS. IF YOU WORKED HARD AND SHOWED INTEREST, PEOPLE WOULD TAKE NOTICE AND GIVE YOU OPPORTUNITIES.”

“MY FIRST JOB OUT OF GRADUATE SCHOOL WAS AS A RESEARCHER AT THE NATIONAL INSTITUTE OF OCEANOGRAPHY, WHERE I WORKED ON A TEAM THAT INVESTIGATED THE EFFECTS OF ENVIRONMENTAL POLLUTION ON MARINE ECOSYSTEMS. I APPRECIATED THE COLLABORATIVE WORK THAT IS NECESSARY TO ANSWER COMPLEX PROBLEMS, AS WELL AS THE IMPORTANCE OF HAVING BACK-UP PLANS – OR EVEN BACK-UP PLANS FOR THE BACK-UPS – SINCE UNEXPECTED THINGS ALWAYS HAPPEN, ESPECIALLY DURING FIELDWORK. BEING FLEXIBLE, ADAPTABLE, FOCUSED ON A LONG-TERM GOAL AND COMMITTED TO WORKING AS A TEAM HAVE ALWAYS BEEN PART OF MY THINKING.”

“I WAS THE LOCAL PAPER GIRL! IN JUNIOR HIGH, I MANAGED MY ROUTE, DELIVERING THE WILMINGTON MORNING STAR EARLY BY BIKE AND COLLECTING MONTHLY PAYMENTS. I LEARNED THAT IT WAS IMPORTANT TO HAVE MY OWN INCOME, THAT GETTING UP EARLY AND WORK BEFORE PLAY HAS ADVANTAGES, AND TO HAVE A DEPENDABLE TEAM WHEN TIME WITH FRIENDS AND FAMILY OR ELSEWHERE IS YOUR PRIORITY. LASTLY, KEEP UP YOUR STRENGTH AND BEWARE OF EARLY MORNING DEWY SPIDER WEBS.”

SUPERINTENDENT, NEW HANOVER COUNTY SCHOOLS

“MY FIRST JOB IN EDUCATION WAS DRIVING A SCHOOL BUS. COMMITMENT AND PREPARATION WERE THE TOOLS OF SUCCESS I LEARNED IN THAT ROLE. AS A COLLEGE STUDENT, I DIDN’T REALIZE THE AMOUNT OF PREP TIME NEEDED TO METICULOUSLY PLAN A BUS ROUTE AND BE WELLPREPARED FOR UNFORESEEN CIRCUMSTANCES. AS A LEADER, I CONTINUE TO APPLY THESE LESSONS. SUCCESS OFTEN HINGES ON CAREFUL PLANNING AND ADAPTING TO UNEXPECTED CHALLENGES. I PRIORITIZE PREPARATION IN MY DECISION-MAKING AND ENSURE MY LEADERSHIP TEAM HAS EVERY TOOL THEY NEED TO SUCCEED.”

New Hanover

Brunswick

Columbus

Duplin

Onslow Pender

Sampson

BY ALL ACCOUNTS, PHILLIP JONES III, OWNER OF THE JELLY CABINET, IS A MAGICIAN IN THE KITCHEN. CUSTOMERS SWOON OVER HIS HOMEMADE CINNAMON ROLLS AND OTHER BAKED TREATS, AND THE BAKERY HAS GAINED A LOYAL FAN CLUB THAT INCLUDES LOCALS AND VACATIONERS.

Multiple factors contribute to The Jelly Cabinet’s success, but Jones attributes it to his passion for cooking.

“I do it all from my heart,” Jones said. “I enjoy feeding people, and I enjoy preparing things for them. That is sacred to me.”

Jones has loved cooking since he was a child. He often helped his grandmother by getting the ingredients for the goodies she was baking from her “jelly cabinet.” As an adult, Jones turned his passion into a career. After attending Cape Fear Community College’s culinary arts program, Jones worked at Apple Annie’s Bake Shop and the Whole Foods bakery department. Along the way, he was offered a position as an adjunct professor at CFCC, which turned into a full-time job in 2021.

Though Jones had flirted with the idea of owning a bakery, he did nothing to further his dream until his sister found a bakery space at 1011 N. 4th St. for sale in July. It was the impetus Jones needed to take the plunge.

“This was totally fly by the seat of my pants,” Jones said. “I just did it. I’m not a businessperson. I just knew I had a passion for food and wanted to do it, so I just jumped in.”

Doing so took courage and perseverance – something else Jones

learned from his grandma. While still teaching, a job Jones loves and plans to continue doing, he dove into action.

In deference to the bakery’s tiny kitchen, Jones created an exceptional but limited menu. The Jelly Cabinet always carries six or seven standard items, including the above-mentioned classic cinnamon rolls, specialty cinnamon rolls, blueberry biscuits, cranberry-orange cake, coffee cake and JCB Bars – a sweet treat Jones’ mom made for him as a child. Jones also adds a weekly special, such as a bread pudding or brownie with his special touch.

Another element central to Jones’ success is his refusal to take shortcuts. For example, he makes everything from scratch.

“I’d rather have a smaller menu where stuff is made good, and it’s made right,” Jones said. “I don’t use canned pie filling or cake mixes. I don’t believe in that.”

While many of Jones’ pastries are made from time-honored family recipes he has tweaked, he also “conjures new recipes” on the many nights when sleep eludes him. If the recipes don’t turn out, Jones said he goes back to the drawing board and makes them work.

Jones’ late-night forays in the kitchen yield mouth-watering results, such as his flavored cinnamon rolls. There are bananas Foster, Apple Brown Betty and strawberry Nutella cinnamon rolls, to name just a few, as well as other Jones innovations such as his pumpkin chai bread pudding and dark chocolate espresso cake.

“I have a crazy functional culinary brain,” Jones said.

Since opening The Jelly Cabinet, Jones has added to-go holiday boxes, which feature his signature cinnamon rolls in take-and-bake form, and a selection of cakes, pies or other sweets.

Jones has also begun branching out by collaborating with other businesses. His German pretzels

were a hit at neighboring Palate’s Oktoberfest, as were the gourmet chocolates Jones made for the bottle shop’s Valentine’s Day Gift Set. Jones also created pastry boxes for Edge of Urge’s Valentine’s selections.

Jones hopes to work with more businesses in the future.

“It’s exciting to come up with ideas that we bounce back and forth and see what we come up with,” he said.

The Jelly Cabinet’s popularity has surpassed Jones’ wildest expectations. The bakery is busy from opening to closing every Saturday and Sunday (the only days of the week it is open), with people willingly waiting in long lines to buy pastries.

However, the bakery’s success has a downside: disappointed customers who arrive too late to get their favorite cinnamon roll or croissant or who can’t get to the bakery on the weekend.

According to Jones, the simple solution of making more pastries isn’t feasible. As the sole baker working in a minuscule kitchen, he just can’t increase the amount of baked goods he offers each day.

Jones devised a solution to address the problem. He holds occasional cinnamon roll evenings, during which customers can feast on cinnamon rolls and other gustatory delights.

For now, Jones has all he can handle at The Jelly Cabinet. Expanding the business, however, has crossed his mind. Jones said he wouldn’t mind finding a bigger kitchen in which to bake his goods. And, if things continue to go well, he might consider a second location.

“I don’t want to grow too quickly,” Jones said. “We’ll see what the future holds.”

For more restaurant news, sign up for the Business Journal’s weekly Restaurant Roundup email by going to WilmingtonBiz.com.

GIRLS LEADERSHIP ACADEMY OF WILMINGTON STUDENTS PRACTICE READING FROM A PROMPTER in the school’s studio, which Sony Pictures Entertainment and Sony Global Social Justice Fund donated funds to build at the all-girls charter school in 2021. Students use the space for classes in visual design, video design, and film and television production, said Michael Frederick, GLOW’s digital media teacher. The classes are part of Adobe Academy, which falls under N.C. Career and Technological Education. About 80 GLOW students are involved this year, Frederick said. “We’ve had the opportunity for our students to attend and display work at Cucalorous (Film Festival) and speak with industry standouts like Jonas Pate, the creator of Outer Banks ,” Frederick said. “We have only begun to scratch the surface on what is possible in the space.” photo by DARIA AMATO