Report

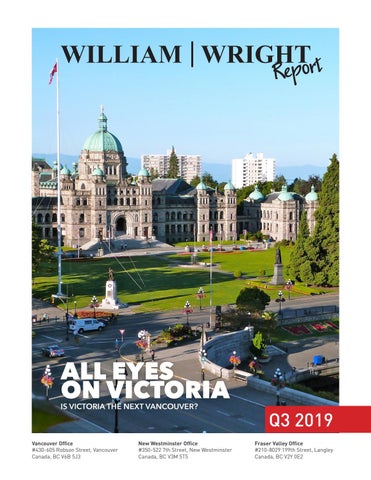

ALL EYES ON VICTORIA IS VICTORIA THE NEXT VANCOUVER?

Vancouver Office #430-605 Robson Street, Vancouver Canada, BC V6B 5J3

New Westminster Office #350-522 7th Street, New Westminster Canada, BC V3M 5T5

Q3 2019 Fraser Valley Office #210-8029 199th Street, Langley Canada, BC V2Y 0E2