The WK Way

We deliver results, with the care you deserve.

Our promise: to have a measurable impact on the success of our clients.

As our clients’ trusted advisors, we are committed to being an invaluable resource and to applying our professional expertise to deliver exceptional service and results.

Our clients enjoy a relationship with a group of professionals that not only have the expertise to help them, but the compassion to do it in a way that differentiates WK from the other firms. They appreciate the way we anticipate their needs, and we’re proactive at providing ideas and solutions to their problems. Our clients know they can count on us to help them with their compliance needs, but they also understand our goal is to provide them value…to help them be successful. They appreciate knowing that our firm has their best interest at heart, a trusting relationship neither party takes for granted.

This is all part of serving clients the “WK Way.”

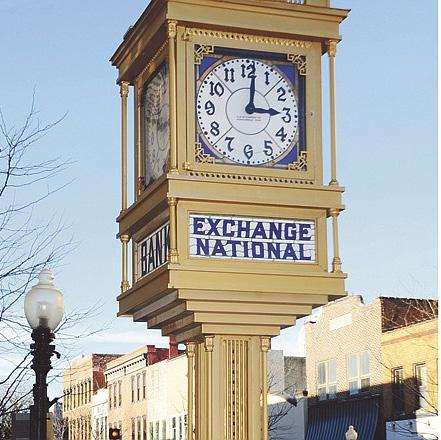

IRS for the 1937 tax year. “State and university employees did not file returns at that time period. So Columbians filed one return for every 23 citizens.” A 1938 Columbia Daily Tribune editorial said “Columbia fared better than other Missouri towns. Sedalia filed one tax return for every 34 residents; Hannibal, one for every 30; Fulton, one for every 30; and Cape Girardeau, one for every 27.

“Columbia’s average income for a typical family of 3.7 persons was $1700, a rate that placed it in the upper third of 18 cities the Federal Bureau of Home Economics surveyed.”

Paul endured the accounting profession’s growing pains, including a series of clarifications with banks and lawyers. He kept abreast of the Missouri Society of CPAs Committee on Cooperation with Bankers to

help bankers learn about accounting services and increase the verification of financial statements. Likewise, in 1937, MOCPA initiated meetings with the Missouri Bar to clarify the roles of lawyers and accountants in the preparation of tax returns. MOCPA members felt strongly that income tax preparation services fell within the scope of CPA practice. Lawyers felt differently. By 1940, the MOCPA code of practice included provisions clarifying activities considered a practice of law, and activities within the sphere of accounting.

The 1938 McKesson & Robbins scandal led to major reforms in auditing corporations. The scandal reads like a John Grisham novel, with felons using aliases to hide bootlegging activities through a shell game of front businesses and money laundering. According to Rice University professor Stephen A. Zeff, “McKesson & Robbins had grossly inflated its receivables and merchandise inventory, and its auditor, Price, Waterhouse & Co., had neither confirmed the receivables nor verified the existence of the inventory.

“Neither of these tests was a required auditing practice at the time.” In response, a special committee formed by the American Institute of Accountants promptly issued a bulletin requiring that both tests become standard auditing procedures.

In many ways it was a battle for the profession of public accountancy to gain prominence. Scandals didn’t help. The Securities and Exchange Commission reports that the term “generally accepted accounting principles” (GAAP) was not in vogue until the late 1930s. Indeed, in 1937, future Accounting Hall of Famer and “one of the most influential ‘high priests’ of the profession in the twentieth century,” Carman G. Blough, wrote in “Some Accounting Problems of the Securities and Exchange Commission”: “I am very much afraid it is difficult to name many principles that are generally accepted.”

As the 1930s drew to a close and a world war threatened to draw America into the conflict, Paul Williams was nearing forty years old. His family had survived the Great Depression, and he looked forward to building a growing business. He soon would find reinforcements from a cadre of veterans returning home from World War II.

13

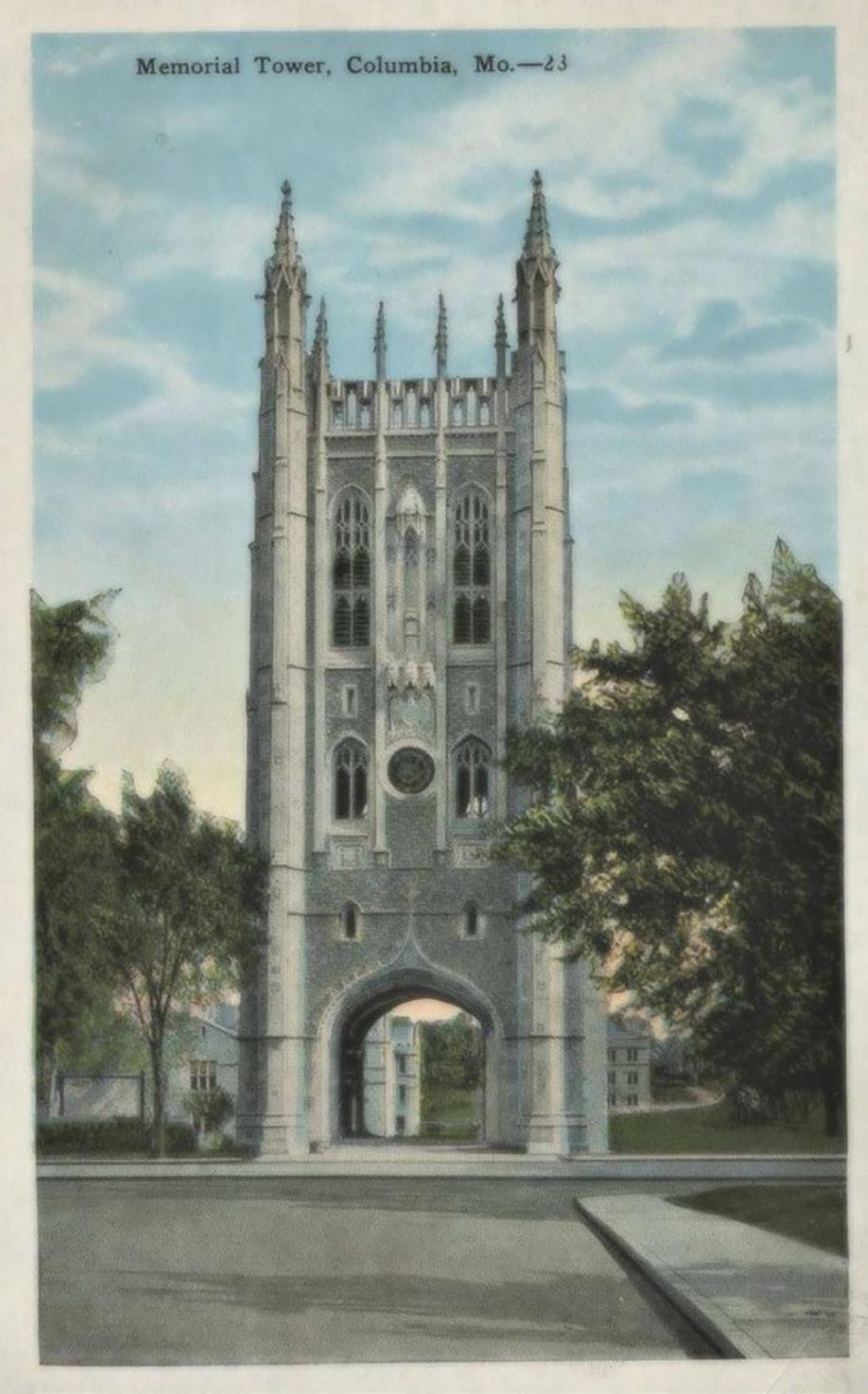

Memorial Tower, University of Missouri campus. State Historical Society of Missouri.

1940s: EXPANDING BEYOND COLUMBIA

The Williams Romack Company was the first CPA firm in Jefferson City, catering to a rapidly growing cross section of not-for-profits, associations, and individual clients.

15

LEFT: 1940. Railroad Station in Jefferson City. Library of Congress.

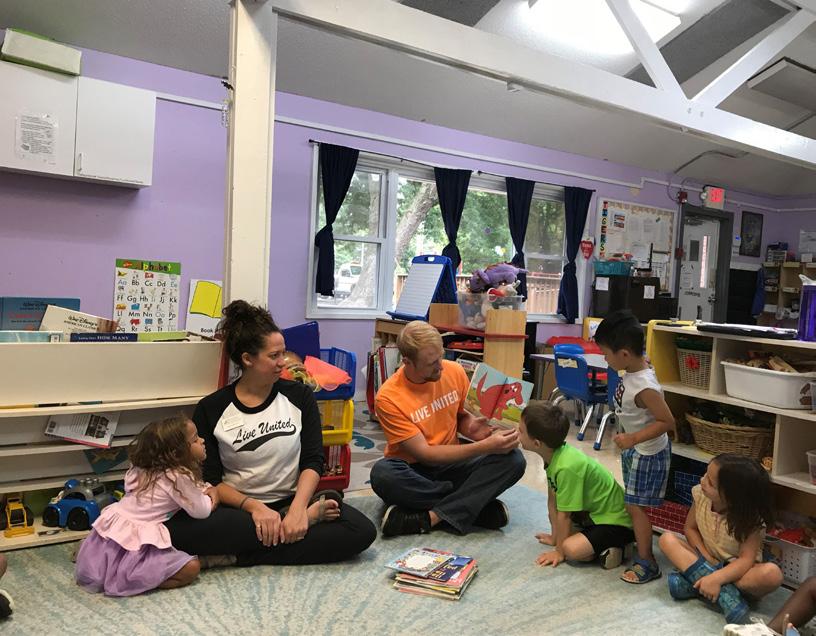

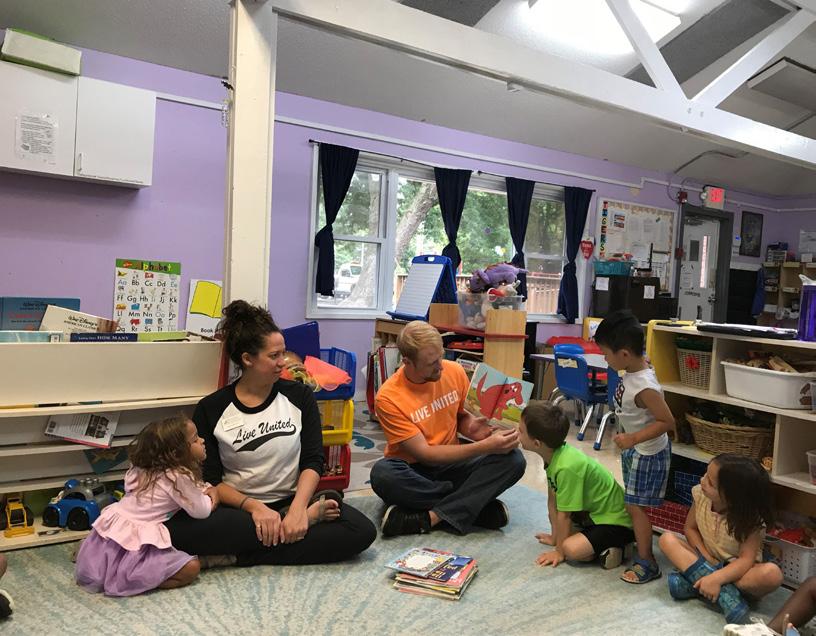

THEN… The Williams Romack Company thrived in the postwar environment. And they made sure to give back to the community. In June 1947, the firm conducted the first financial audit of Columbia Community Chest, predecessor to the Heart of Missouri United Way. AND NOW… “We help clients grow their businesses and accomplish their goals. As for helping our people, WK provides mentorship throughout our careers. WK also helps improve our communities by serving on boards, volunteering, and providing donations and sponsorships.”

PaulWilliams brought Richard Wesley Romack into his accounting firm in 1940. Born in Wausau, Wisconsin, Romack had been an IRS auditor in Saint Louis and Columbia. He was a CPA known professionally as R. W. Romack; the firm’s employees called him Mr. Romack.

Paul’s brother Jay Williams joined the team shortly thereafter, working at the firm during the entire decade.

The 1940 census saw Columbia’s population reach 18,399, still smaller than Jefferson City’s 24,268.

At the beginning of the decade, the American Accounting Association published An Introduction to Corporate Accounting Standards. The book, which “provided an elegant rationale for the conventional accounting model, profoundly influenced accounting thought, education, and practice for decades thereafter,” according to Stephen Zeff.

During World War II, IBM built more than 5,000 accounting machines used in Washington for military logistics. IBM also created

An Accountant Looks Back, an Advisor Looks Forward

An accountant could be viewed as a historian, looking backward to help you understand what already happened. Your tax return is a picture of the previous year. Financial statements describe assets and liabilities from prior periods. Bookkeeping functions report activity that has already occurred.

But a trusted business advisor can help you look ahead to future opportunities. How can you minimize your tax liabilities going forward? What can you do to plan for growth, or to plan for the succession of your business? How can you structure your various business entities to minimize risk?

WK works to ensure clients make business moves with intention and advance planning.

Being proactive instead of reactive can save time and money.

the W-2 form and the equipment to track withheld taxes. 1941 witnessed the first parking meters in downtown Columbia: five cents per hour. That same year the Williams Romack Company moved from its lofty perch in the Guitar Building to 14A North Ninth Street, across from the Varsity Theater.

For example, we have spent months helping one client unravel an accounting mess, which we are happy to do when it’s needed. But we’d much rather help clients set up their accounting system the right way from the start, so they’ll have the accurate information they need to make better business decisions.

—Lee Merrick, CPA, Partner

16

1940s. An IBM accounting system. IBM Archives.

CLOCKWISE FROM

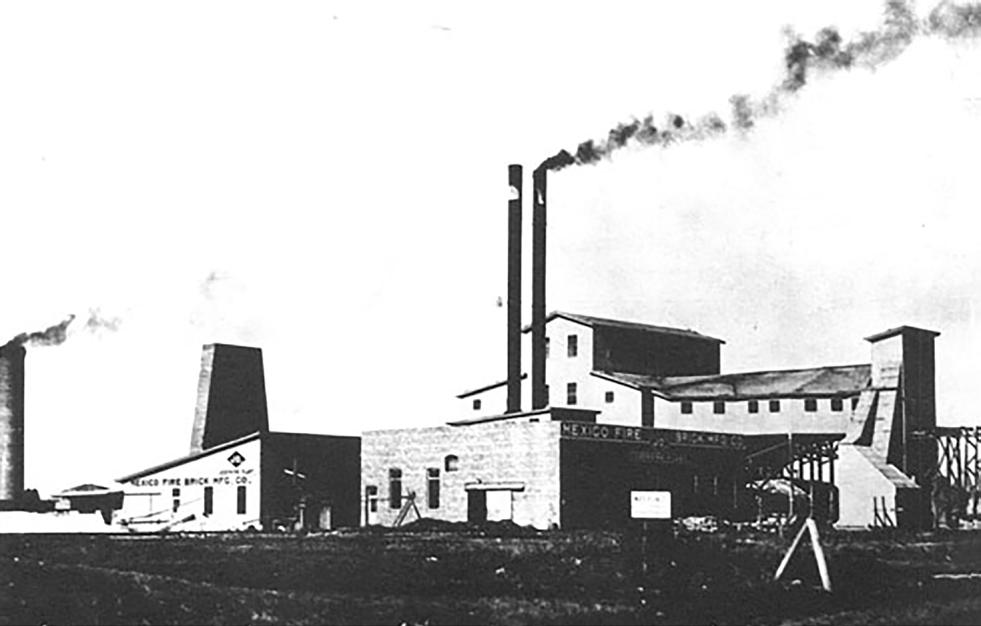

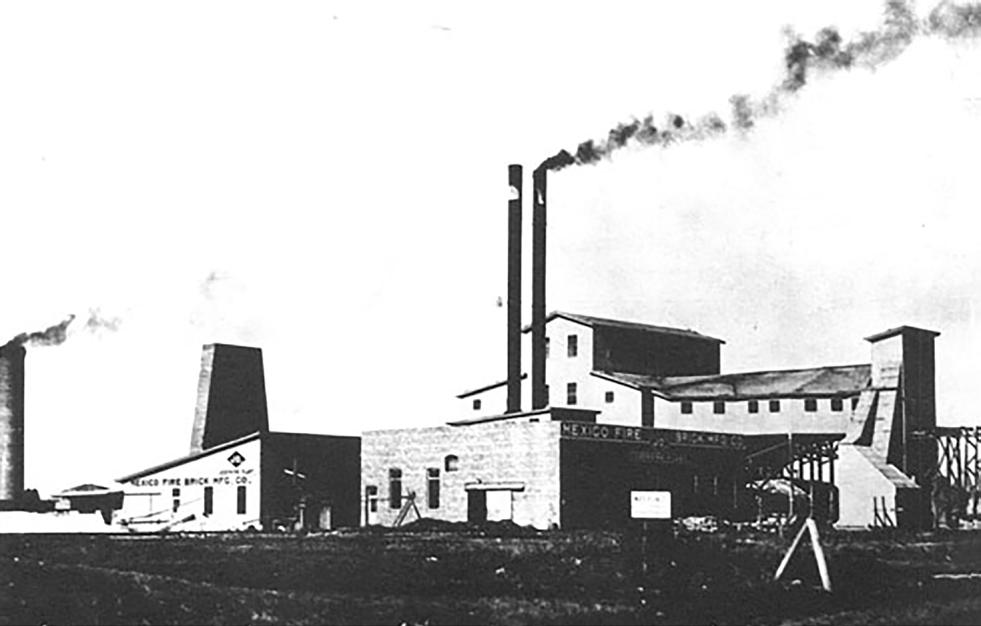

ABOVE: Firebrick Company.

Prominent on the Mexico landscape was a firebrick company that traced its origins to 1886 when fire clay was discovered nearby. Eventually, Jefferson City native Allen Percival “Percy” Green bought the company in 1910, changing the name to A. P. Green Firebrick Company in 1915, after he had repaid creditors. Green had left the Missouri School of Mines and Metallurgy at Rolla after one year of college, going to work as an engineer for the city of Sedalia. He later moved to Pittsburgh before he came to Mexico. He began mining the veins of prized fire clay in and around Audrain County with steam shovels in open pits rather than conventional shaft mines. State Historical Society of Missouri. 1942. The Hotel Governor opened across from the Governor’s Mansion, replacing the Madison Hotel, which burned in the 1930s. Construction of this concrete post-and-beam building began in March 1941 and was completed in September 1942—at a cost of approximately $700,000—following delays caused by a shortage of steel as well as skilled and unskilled labor as the United States entered World War II. COMO Magazine 1945. In old Munichburg, Ecco Lounge was serving great food at the same location where it stands today. Ecco Lounge. 1946. The post-war mood was lively, especially on the Mizzou campus. Fred and Deary Gaebler ran a place called the Black and Gold Inn, where students could get a good meal and spend time jellying. Columbia Missourian

17

In 1942, the Board of Tax Appeals got a name change to the Tax Court of the United States. The next year, the United States began income tax withholding.

Paul Williams’ work status would change thanks to the state’s second accountancy law passed in 1943 by the Missouri General Assembly. MOCPA members believed the original 1909 accountancy law was too permissive. The new legislation required all practitioners to register with and come under the jurisdiction of the state. The new law had twenty-seven sections and included provisions to lower the eligible age of CPAs from twenty-five to twenty-one, designated use of the CPA title, and grandfathered in practicing accountants if they could pass an oral accounting proficiency test.

Having been an accountant for two decades, Paul Williams easily passed the oral test and was grandfathered in as a CPA.

HELLO JEFFERSON CITY!

Perhaps it was Paul Williams’ affinity for politics that made Jefferson City an attractive location to expand his accounting business. It could also have been his close friendship with Jefferson City newspaperman James C. Kirkpatrick. Or maybe it was the fact that in 1944 Jefferson City boasted a larger population than Columbia.

Then again, it could have been R. W. Romack who prompted the move into Jefferson City. After all, it was Mr. Romack who drove down from Columbia to open the Jefferson City office, located at 118 1/2 High Street, above Nancy’s Hat Shop.

Although individual CPAs had established offices in the capital city, the Williams Romack

Company was the first CPA firm in Jefferson City, catering to a rapidly growing cross section of notfor-profits, associations, and individual clients.

Back then the company’s telephone number was 258.

WILLIAMS ROMACK OPENS MEXICO OFFICE

The same year Williams Romack Company expanded into Jefferson City, the firm opened an office in Mexico, Missouri, located at 16 1/2 East Jackson Street. The town was a hub of farm commerce and would accelerate the Williams Romack Company’s special focus on agricultural accounting services.

When Ed Oliver came on board the Williams Romack Company in 1952, he was instrumental in building the Mexico office. Later Don Decker would further build the Mexico practice with key clients including local ammunition supplier Graf & Sons, agricultural clients from an acquired Vandalia accounting business, and a local company that made the plastic newspaper bags

newspaper carriers used on rainy days. Most Mid-Missourians probably are not familiar with the company Mexico Plastics, operating under the name Continental Products, but the bags they made and distributed nationwide kept newspapers dry for the Los Angeles Times, the Chicago Tribune, and many others. Don landed that account through a Rotary contact.

VETERANS GO TO SCHOOL

When the veterans came home to Mid-Missouri from World War II, they arrived at the Wabash and the KATY train stations in downtown Columbia. They arrived at the Missouri Pacific station on the Jefferson City riverfront. Veterans with names like Keepers and Rackers, Romack and Payne, Oliver and Chronister and Weber.

Thousands of veterans used the GI Bill to go to school. And it would have a positive impact on the Williams Romack Company. The GI Bill—the Servicemen’s Readjustment Act of 1944—made it possible for war veterans to attend Mizzou. Within two years almost 70

The Mexico office. WK Archive.

The Mexico office. WK Archive.

18

Wabash Station. Travelers at the Wabash Train Station in Columbia. Missouri State Historical Society.

The First Computer

In 1822, Charles Babbage, called the father of computers, developed the first mechanical computer, the difference engine. By 1833 he created the analytical engine, a general-purpose computer. The first modern electronic digital computer, the Atanasoff–Berry computer (ABC), was built in 1942 by Iowa State College (now Iowa State University) professor John V. Atanasoff and graduate student Clifford Berry. Weighing more than seven hundred pounds and using vacuum tubes, the computer operated a rotating drum slightly bigger than a paint can affixed with small capacitors. The ABC could solve problems with up to twenty-nine different variables, but it had no storage. In 1943, IBM produced the first large-scale computer, the Mark 1. It measured fifty feet long and eight feet high, and it weighed nearly five tons. The first electronic digital computer, the ENIAC, appeared in 1946. The first personal computer, the Altair, was invented in 1974 by a small company named MITS. It used Intel Corporation’s 8080 microprocessor and was popular among computer hobbyists, but it had scant commercial appeal. In a garage, Steve Jobs and Steve Wozniak developed the first Apple computer in 1976. The first IBM PC was released in 1981. The Apple Macintosh hit the shelves in 1984.

percent of the school’s eleven thousand students were veterans.

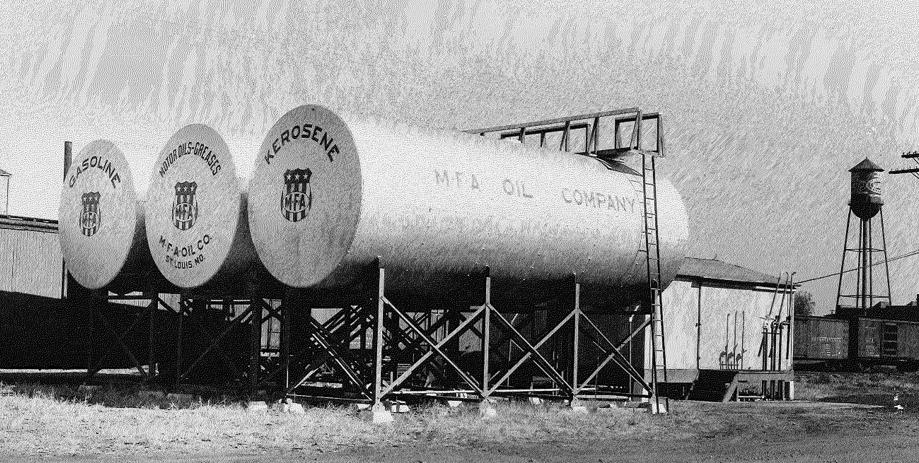

And Columbia kept growing. By the end of the war the Missouri Farmers Association created the MFA Insurance Company, later renamed Shelter Insurance.

During this period of economic growth the Williams Romack Company took on a distinctly family feel. Just as Paul Williams brought his brother, Jay, into the business, likewise Mr. Romack brought his son, Richard Edward “Ed” Romack, to the firm. Ed served in the Army Air Corps as a navigator in the Pacific during World War II. Upon his return, he completed college at the University of Missouri and came to work for his father as a certified public accountant in the Columbia office. After several years Ed and his wife, Anne, moved to her hometown of Idaho Falls.

The postwar boom launched Columbia’s economy. As more and more veterans moved to Columbia to take advantage of educational opportunities afforded by the GI Bill, they found a growing community.

In downtown Columbia Ernie’s Steakhouse opened for business in 1947. Woolworths was located where American Shoe and Saffee’s would eventually open.

In 1947, Congress passed the Taft–Hartley Act, requiring labor unions to file financial statements. That same year the American Institute of Accountants (now the AICPA) Committee on Auditing Procedure recommended a set of

“generally accepted auditing standards” approved at an annual meeting in September 1948. The institute also began publishing case studies on auditing procedure.

In 1948, the National Committee on Municipal Accounting was reactivated and renamed the National Committee on Government Accounting. The American Accounting Association issued Accounting Concepts and Standards Underlying Corporate Financial Statements and a preliminary statement of the fundamental concepts of cost accounting. The American Institute of Accountants began publishing annual surveys of corporate reports.

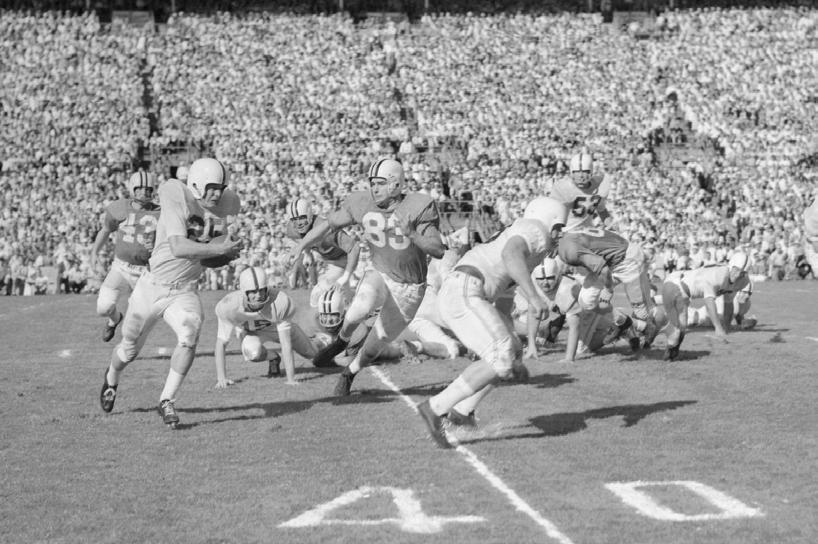

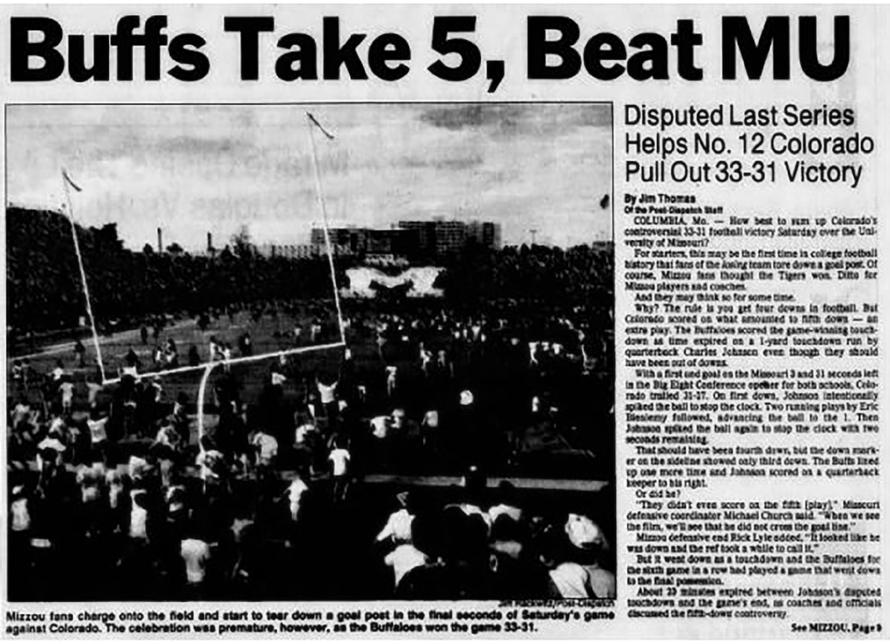

On the home front in 1948, as Columbia’s Hulen Lake filled in behind two massive fifty-foot dams, the University of Colorado joined the Big 6 Athletic Conference, making it the Big 7.

The next year Lenoir Manor opened. Columbia approved the city manager form of government. Locals flocked to eat at the shiny new Minute Inn. Later the popular breakfast spot became known as Fran’s. Eventually it was renamed the Broadway Diner.

Broadway Drive-In Theater showed movies where the Broadway Shopping Center now sits at the corner of Clinkscales and West Broadway. Back then the pavement of West Broadway ended at Clink scales Road.

After his service in the United States Army during World War II, Jim Weber graduated from Saint Louis University before returning to his

hometown of Jefferson City to marry Julia Ann Mueller on June 18, 1949. Two weeks later he joined Williams Romack Company.

Amid the postwar boom, in the coming years Williams Romack Company would welcome six more war veterans into the firm as key members.

19

1950s: VETERANS FIND A HOME

21

George Keepers joined the firm in 1950 and quickly became a key member.

LEFT: 1955. A new Missouri River bridge at Jefferson City opened. State Historical Society of Missouri.

George

Keepers joined the firm in 1950. Born in Gallup, New Mexico, George had Missouri connections. His mother was from Bloomfield, Missouri, and his family eventually moved to Columbia, where he graduated from Hickman High School in 1937 as senior class secretary. He was a Marine Corps captain in World War II and saw action in the Pacific. He survived the Battle of Tarawa, where 894 of his Second Marine Division brothers were killed and 2,188 wounded. When he returned home from the war, he married Tennessee native Dorothy Dell Clary—who went by the name Dell—on June 8, 1945. He graduated from the University of Missouri.

George quickly became a key member of the firm. He often came to work at 4:00 a.m. and would take lunch at 9:00 a.m. He was loved by his coworkers at the company that would incorporate his name, and he spent quality time mentoring the young accountants, teaching them to be precise. To wit, one day George noticed the books were off by a penny. He spent all day looking for that penny. “Why?” fellow employees asked. “Well, it could be off $1,000 one way or $999.99 the other way.”

From 1940 to 1950 Columbia’s population grew an astounding 78.3 percent, surpassing Jefferson City for the first time: 31,974 to 25,099. In 1950, a gallon of gas cost 19.2 cents, a loaf

Missouri River Bridge

of bread 14 cents. Boone County National Bank got a new bookkeeping machine allowing operators to sort checks by bank routing numbers. On June 3, President Harry Truman received an honorary degree from the University of Missouri and delivered the commencement address in the rain.

By 1950, all American states and territories had enacted CPA laws. All jurisdictions but one had adopted the Uniform CPA Examination. Nearly all major universities offered accounting courses, and the profession had amassed a large body of literature on accounting and auditing. The Major League Baseball Hall of Fame failed

In 1893 the City of Jefferson decided to build a bridge across the Missouri River, a bridge that would facilitate commerce between the capital city and communities like Columbia, Fulton, and Mexico, north of the river. Local residents formed a committee called the commercial club to raise $225,000 for the bridge project, which would extend Bolivar Street across the river to Cedar City. In 1895, workers began construction on the bridge, which featured a swivel to allow steamboats to pass. The bridge opened on February 17, 1896, as a toll bridge operated by Jefferson City Bridge & Transfer Company. In 1932, the third owner of the bridge—Capital City Highway Bridge Company—retired the debt and turned the span over to the state.

In 1955, the old bridge came down and a new bridge opened, averaging 9,200 vehicles per day. In 1991, a second bridge was added to carry northbound traffic and pedestrians and cyclists. Today both bridges carry a combined average of 50,000 vehicles per day.

to elect a single inductee to Cooperstown that year, for the first time ever. But, down the road in Columbus, Ohio, the brand-new Accounting Hall of Fame opened at The Ohio State University.

In Missouri, the disastrous 1951 flood killed twenty-eight people and caused nearly $1 billion in damages (in 1951 dollars; total damage would be $6.4 billion today). On July 17, President Truman surveyed the damage by airplane and declared the disaster “one of the worst this country has ever suffered from water.” Many Williams Romack farm clients were hit hard.

SERVICE

In the wake of the flooding, Lou Rackers joined the company.

Louis H. Rackers Jr. was born and raised in Jefferson City, graduating from Saint Peter High School in 1943. He served in the United States Navy during WWII from 1943 to 1946. Newly married to Louise Horton, Lou graduated cum laude from Saint Louis University in 1949 with a degree in accounting.

Lou was employed at Williams Romack in 1950 but was called back into service during the Korean War in 1951. He returned to the business in 1955, becoming a partner in 1961. Lou served both Columbia and Jefferson City offices until the 1970s, when he worked only in Jef ferson City.

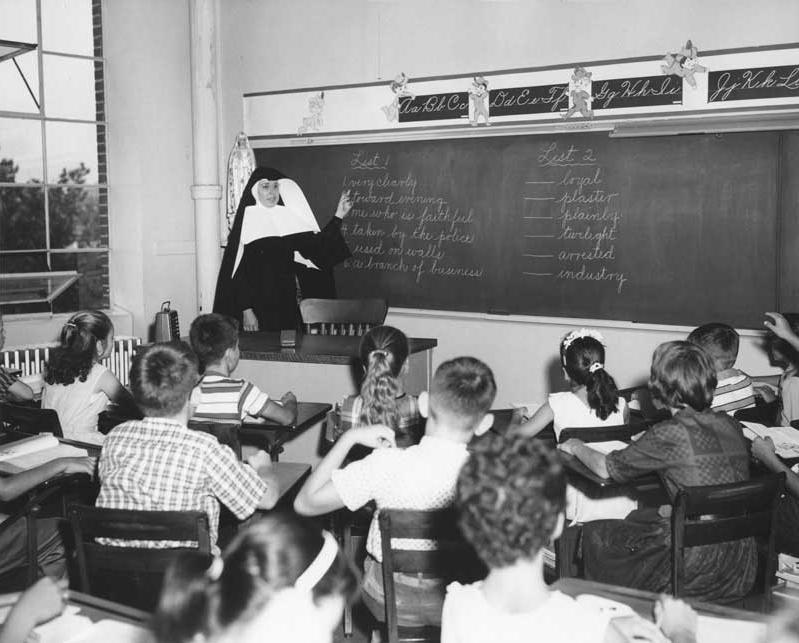

Service was important to Lou, especially his work with Immaculate Conception Catholic Church, the Knights of Columbus Helias Council, and the Helias Catholic School Board. Lou’s impact on behalf of the Catholic community in Jefferson City cannot be overstated.

In 1952, the firm added two key CPAs whose names soon would appear on the company’s masthead, and one key administrative assistant who would devote fifty-four years to the company.

Thomas Johnson Payne was born February 9, 1920, in Columbia to Eva Johnson and Thomas Robnett Payne. He grew up in Columbia and graduated from Hickman High School. During World War II Tom was a captain in the Air Force, where he trained pilots and served in the Pacific Theater.

After the war Tom returned to Columbia and graduated from the University of Missouri–

22

George Keepers. WK Archive.

Columbia School of Business and Public Administration. In 1948, he married his childhood sweetheart, Frances Taylor, known affectionately as “Tatie.” The newlyweds initially settled in Chicago, where he worked as a CPA for Arthur Young and she worked in advertising for Marshall Field & Company.

Tom and Tatie returned to their hometown of Columbia, and he joined the firm in 1952, where he became the office manager.

Like George Keepers, Tom kept very tight fiscal reins. “George Washington would scream when Tom grabbed ahold of a dollar bill,” David Rawlings laughed. (David would later serve the firm for many years as managing partner.)

Employees affectionately called Charles Edward Oliver the “old man.” Ed was born June 10, 1913, in Columbia. He grew up in the First Christian Church and graduated from Hickman High School. He served with the Marine Corps during World War II and married Erma Anderson on his birthday in 1951, shortly before joining the firm. As his partner George Keepers always encouraged, Ed became deeply involved in his community, a member of the VFW, American Legion, and Disabled American Veterans. Like the other partners, Ed would be instrumental in forming the Central Chapter of MOCPA in 1970.

“THE GLUE”

Jeanette Nieman grew up in Hartsburg, Missouri, and married Fritz Klemme of Hartsburg in November 1951. She had been working in Jefferson City at the Missouri Public Expenditure Survey, now called Taxpayers Research Institute of Missouri (TRIM), a part of Associated Industries of Missouri. At that time she was putting out mailings of the survey’s most recent publication, Five Years Under The New Missouri Constitution, by Martin Luther Faust, a professor at Mizzou. Her job was ending, and her supervisor recommended her to Paul Williams, who hired her on the spot.

Jeanette quickly became a trusted office organizer during income tax season, deftly handling hundreds of tax returns in various stages of readiness. George Keepers called her “Nettie.” She remembers when she first started at

THEN…

Williams Romack, if somebody needed a copy of a return, she had to handwrite the copy. She described the company’s first mimeograph copy machine. “It was wet. We had to hang the copies with clothespins to dry. Later we had a new copy machine which we had to keep in a dark room to develop the copies. Paul Williams would come in with his flashlight looking for a particular copy, always saying a few choice words,” she laughed.

The staff kept everything running, a fact not lost on the partners, who called the support staff “the glue.” Dorothy Strope. June Groner. Lawanda Proctor. Betty Fisher.

During tax season—called busy season by the staff—“the glue” often worked into the night, and occasionally overnight, organizing and collating tax returns to be ready for signatures the

next morning. The office always had a family feel. Nola Williams and Martha Romack often came in during busy season to help collate and send out tax returns.

Known for his networking as well as his precise accounting work, Williams had several farm clients and automobile dealership clients. He kept a cabin on Swan Lake where he would invite partners and clients to go duck hunting. “They never got out of the cabin,” Jeanette laughed.

Over his lifetime, Paul Williams loved working with people to solve problems, which is to say he loved politics. In 1952, he became a trusted advisor to Stuart Symington in his successful campaign for the United States Senate. Williams remained a close adviser to Symington during his campaigns for reelection. Paul even got involved

The Jefferson City Chamber of Commerce began raising money during the early 1950s to fund a Community Chest to fight diseases and sponsor various social service agencies. The Community Chest became the United Community Fund in 1954. Today it’s called The United Way of Central Missouri. The Chamber also was instrumental in building Charles Still Osteopathic Hospital (now Capital Region Medical Center) in 1951 and Memorial Hospital in 1959. AND NOW… “Our mission statement of ‘WK Helps’ refers to an attitude of service that goes well beyond just getting a job done. It means doing everything we can to positively impact our clients, our people, and our community.”

—Ryan Henry, CPA, Partner

23

LEFT COLUMN, TOP: 1951. Christian College celebrated its centennial with a concert by alumna Jane Froman. The college graduated 111 students that spring. In June Columbia residents voted to ban the sale of liquor by the drink by a two-to-one margin. Columbia Missourian. MIDDLE: 1952. Ozark Air Lines began regular passenger service to Columbia. The first flight was to Springfield on September 4. In downtown Columbia, Rowe Carney of Rolla—inventor of a movie format called Rotoscope—bought the Tiger Hotel. General Dwight Eisenhower became president. Columbia raised bus fare to fifteen cents, a dime for children. Alton Ford occupied the building that became Ford’s Theater, later called the Fieldhouse. Iron streetlights bordered Broadway. KSMU. BOTTOM: 1954. The Columbia municipal golf course opened to the public. Coach John “Hi” Simmons and the MU baseball team won the NCAA national championship. The city’s footprint was six square miles encompassing four hotels, eight motels, 6,912 motor vehicles, eight public schools, one television station, and one radio station. iStock.

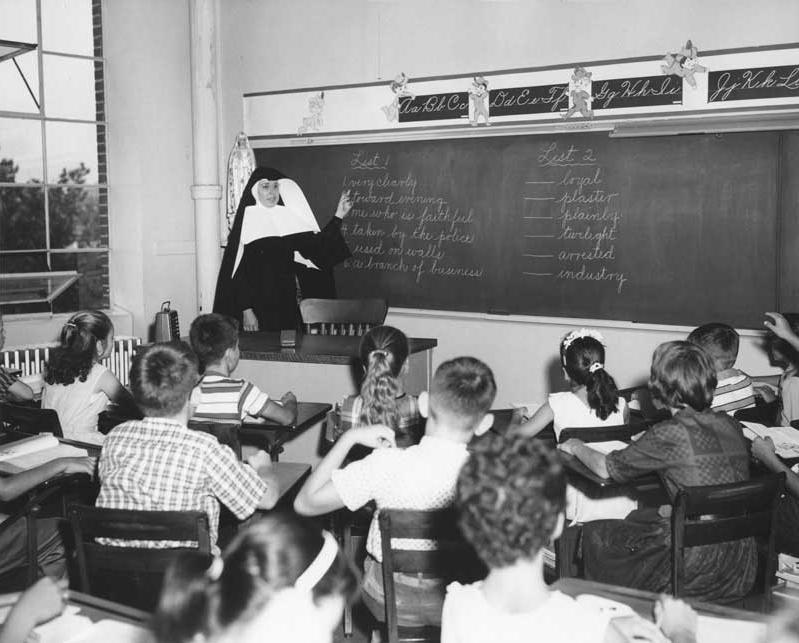

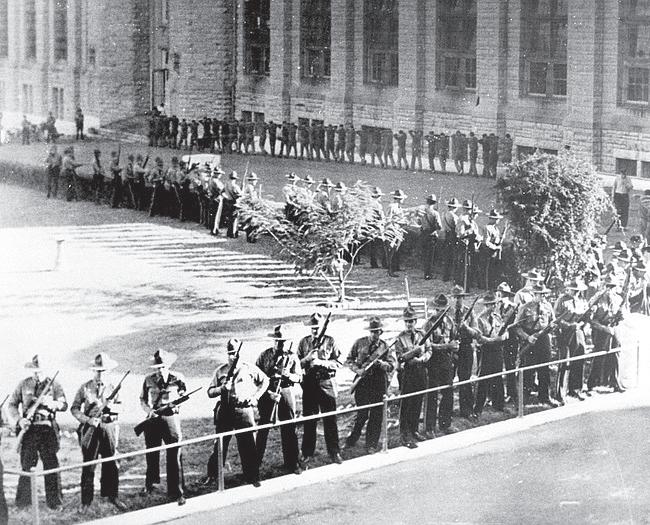

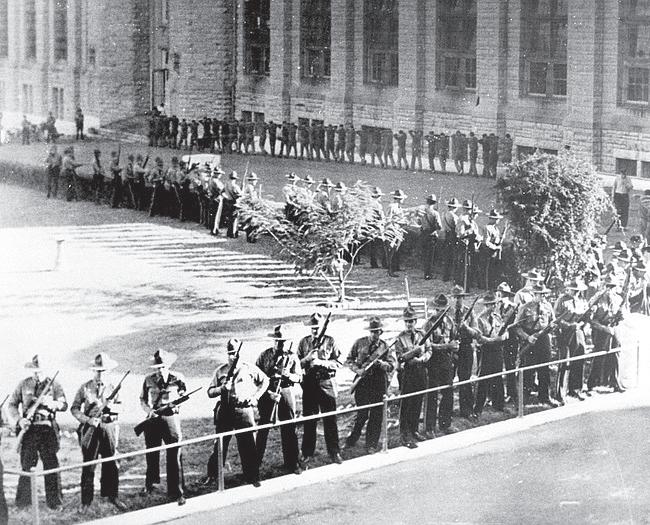

CENTER COLUMN: On September 22, 1954, a deadly prison riot broke out at the Missouri State Penitentiary in Jefferson City. The event is retold in the popular Missouri State Penitentiary tours. News Tribune (top) State Historical Society of Missouri (bottom). RIGHT COLUMN, TOP: 1956. In Jefferson City, Saint Peter High School closed its doors, and Helias High School first opened for the school year with 467 students taught by the Christian Brothers and School Sisters of Notre Dame. School Sisters of Notre Dame. 1957. The Big 7 Athletic Conference became known informally as the Big 8 when Oklahoma State University joined. OSU, however, didn’t play a league schedule in football until 1960, so most historical records categorize the 1957–59 football seasons as Big 7 years. The Athletic.

24

in campaign operations for Harry Truman in Boone County. Apparently he continued to ignore George Keepers’ advice to stay neutral in political matters.

In 1953, Thomas Coleman Andrews became the first CPA to head the Internal Revenue Service. He would run for president in 1956 as a third-party candidate against Dwight Eisenhower. The Korean War truce went into effect on July 27, 1953. Soon, Lou Rackers would return home from the war and eventually rejoin the firm. That same year KOMU-TV went on the air as Mid-Missouri’s first television station. Columbia’s tax rate of $1.25 per $100 assessed valuation included a dollar for the general fund, twenty cents for bond retirement, and five cents for the library. Alarmingly that year, the city health officer noted a serious increase in the incidence of polio. In response to the polio outbreak, the city began distributing polio vaccines in schools to first, second, and third graders in 1954.

The firm’s Jefferson City office moved to 308 Monroe Street in 1955. At the same time a brandnew Missouri River bridge pointed the way up Highway 54 to Mid-Missouri’s second television station. KRCG-TV was owned by the Jefferson City News Tribune. The station’s call letters reflect the initials of the newspaper’s late publisher, Robert C. Goshorn, who died before realizing his vision of bringing a television station to the area.

The new bridge and the new television stations further accelerated Mid-Missouri’s economy. And the Williams Romack accounting business kept growing.

SHIFTING TRENDS

With improving highways and bridges, America’s preferred mode of travel was shift-

ing quickly from rail to the automobile. In 1955, the Missouri Public Service Commission denied the Wabash Railroad’s request to discontinue passenger service between Centralia and Columbia. Sadly, such requests would continue and eventually become successful. Meanwhile, on the streets and highways, Columbia police began using radar speed equipment. The city’s entire operating budget was $20,000, which today would barely cover radar guns in Columbia’s police car fleet.

The year 1956 witnessed an expansion in Columbia’s power, comfort, and shopping options. Various developers launched four separate proposals for shopping centers at Garth and Broadway, Pershing Road and Broadway, West Boulevard and Worley, and on Broadway just west of Clinkscales Road next to the drive-in theater. Columbia’s I-70 inner and outer loop construction began. Traffic lights were installed downtown. The municipal power plant opened on the business loop, and the municipal building became air conditioned. Williams Romack Company did work for both the city and municipal utilities.

In 1958, as a seven-mile segment of Interstate 70 opened to traffic, Paul Williams began a two-year term as chair of the MOCPA board. Throughout the company’s history, Williams-

Keepers has maintained a close working relationship with MOCPA.

At the end of the decade another World War II veteran, Darrell L. Chronister, joined the Jefferson City office, coming from the Missouri Department of Revenue Division of Taxation. A certified public accountant, he had also been an IRS agent. Known to family, friends, and clients as “DC,” Darrell was born in 1925 in Sikeston, Missouri. A graduate of Ellington High School, he served in the United States Navy during World War II, then graduated from the University of Missouri at Columbia in 1951. He married Joan Gerling in 1984 in Jef ferson City.

The platoon of veterans who landed at Williams Romack would guide the firm through the next decade and beyond.

THEN… In 1954, the filing deadline for individual tax returns moved from March 15 to April 15. AND NOW… “As far as a busy career mixing with a busy home life, Williams-Keepers is definitely very flexible. I’m always able to participate in my kids’ school activities. Those are really encouraged.”

—Kristen Brown, CPA, Audit Manager

25

1950s. Businesses such as Hays Hardware, J.J. Newberry Store, Midwest Loans, Dick Barnett’s, and Uptown Theater thrived in downtown Columbia. State Historical Society of Missour i.

1960s: ON THE MOVE

Williams Keepers Oliver Payne & Rackers grew the business during the turbulent 1960s.

27

LEFT: Williams Keepers Oliver Payne and Rackers associate Mary Stotler pauses for a photo with firm partners (from left) George Keepers, Paul Williams and Ed Oliver in front of the firm’s Ash Street office in Columbia WK Archive.

Aftertwenty years with the company, R. W. Romack retired in 1960. Mr. Romack had been instrumental in helping build clientele. He helped preside over the company’s expansion into Jefferson City and Mexico. Just as important, he helped attract solid CPAs to the firm from The Greatest Generation.

Indeed, the Williams Romack Company had grown substantially with clients brought in by George Keepers, Ed Oliver, and Tom Payne. It was a natural move to expand the firm’s name to Williams Keepers Oliver & Payne. Yet even with the expanded name, each partner kept his own client list, while sharing a pool of capable office personnel.

Looking back over his thirty-six years in business, Paul Williams could be proud of the company he built. He still worked hard and maintained one steadfast rule: he demanded his personal clients file their tax returns at least a few days before April 15. One mid-April, University of Missouri head football coach Dan Devine—obviously a busy man—brought Paul his paperwork at the last minute. Williams sent him away. George Keepers finished the coach’s taxes.

At the beginning of the decade Columbia had expanded to eleven square miles. Its population had increased to 36,650. Jefferson City’s census remained steady at 28,228 residents. The 1960s in Jefferson City saw the construction of Memorial Hospital and the city’s development as a manufacturing center.

In 1961, Lou Rackers became a partner in the firm and assumed the role as chair of the Partner/Management Group. Lou would be partner-in-charge of the Jefferson City office for many years.

In 1962, Paul Williams and crew moved the firm’s Columbia business again, to 16 North Ninth Street, just across the alley from the old location. Jeanette Klemme remembers that the firm had outgrown the old upstairs office and moved downstairs across the alley.

In 1963, the first issue of the Journal of Accounting Research was published.

Meanwhile the city of Columbia continued its rapid expansion. In 1964, Columbia annexed 8.2 square miles. Two years later, Columbia annexed

another 23 square miles. By 1970 Columbia encompassed 41.7 square miles.

While Columbia experienced dramatic growth, the accounting firm continued to expand its business clientele. Even its name had become longer, adding Lou Rackers to the masthead: the firm became Williams Keepers Oliver Payne & Rackers.

VISION

George Keepers could see that the firm was outgrowing its current location. He had a vision to build a modern new building in the heart of central Columbia. In 1966, George made good on his vision, and the firm built a new Columbia headquarters at 105 East Ash Street. It was George Keepers’ bold move to place the building at this specific location. “George was very community minded,” said Mariel Liggett, who later would become the firm’s first female partner.

Eventually the firm built an addition, where the company occupied all three floors.

“The old building now looks very pedestrian and 1960ish,” recalled Bea Smith, the wife of former WK partner Stephen B. Smith. “But it was also interesting to think about the symbolism of the civic philosophy that led that generation of partners to dare to construct a new building in a part of town that they knew could use an economic boost.” Jeanette remembers that it was a great place to work. But occasionally the building would flood.

George Keepers was visionary. Yet it was widely known among his staffers that, although he was a great manager, George hated the process of billing his clients. Fellow partners would encourage him to catch up on past accounts receivable, even to the point of suggesting that paychecks would be suspended for anybody with a certain level of outstanding accounts receivable.

Over the years the firm experienced a growing rivalry between the Columbia and Jefferson City offices. For a while that rivalry enhanced the competitive spirit of both offices. But soon partners realized that a truly unified company would operate even more efficiently. Today that rivalry only exists when the partners and associates root for their local sports teams.

The Typewriter

Christopher Latham Sholes invented the first manual typewriter in 1868. He contracted with gunmaker Remington and Sons to introduce it to the public in 1874. A writer named Samuel Clemens bought a Remington typewriter that same year, and eventually he was the first author to submit a typewritten manuscript to a publisher (Life on the Mississippi, 1883), although he didn’t type it himself, preferring to dictate.

Thomas Edison invented the first electrically operated typing machine in 1872. His rudimentary printing wheel later became the ticker-tape printer. James Smathers introduced the electric typewriter as an office writing machine in 1920.

In 1961 IBM introduced the first commercially successful typewriter using a sphere-shaped typing element, eliminating the need for a movable paper carriage.

In 1965, Congress passed a law allowing CPAs to represent clients before the IRS. That year, two new publications appeared: The Abacus and Management Accounting.

28

iStock.

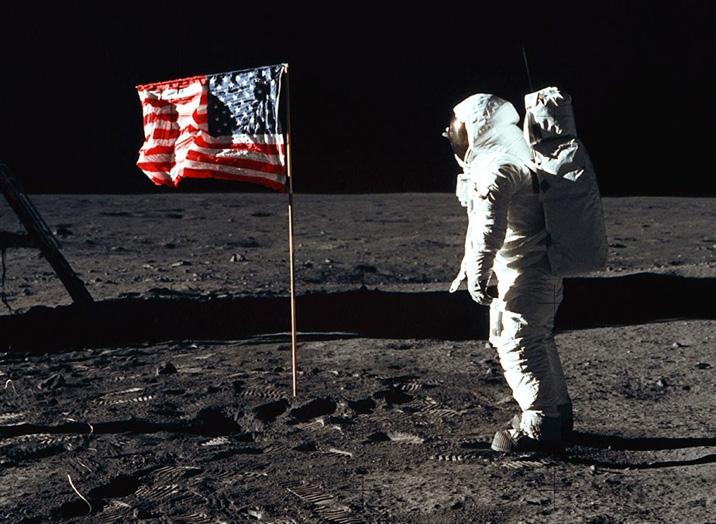

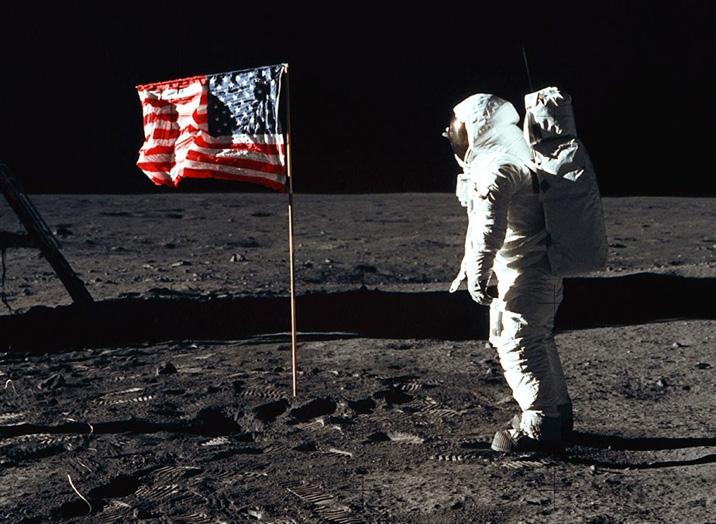

CLOCKWISE FROM ABOVE: 1961. President John F. Kennedy appointed Rex M. Whitton as Federal Highway Administrator of the U.S. Bureau of Public Roads (BPR), now part of the Federal Highway Administration. Jefferson City celebrated Whitton, former chief engineer of the Missouri Highway Department, with a parade and a key to the city. Restauranteur John Adcock gave Whitton the grand champion Cole County ham. And on August 18 of that year, the state dedicated the new Rex M. Whitton Expressway—a $7.6 million U.S. 50 expressway project through the heart of Jefferson City. Federal Highway Adminstration. 1966. Mid-Mo Mental Health Center opened. Christian College alumna Deborah Bryant became Miss America. And on October 7, 1966, the Hickman Kewpies defeated the Jefferson City Jays, snapping the Jays’ 71game winning streak, a national record at the time. Prior to that the Jays had defeated Hickman eight straight times by a combined score of 186–40. With the Kewpies’ dramatic win, the rivalry between the two cities only got hotter. Columbia Missourian. 1967. The University of Missouri Hospital and Clinics were completed. Across the street the Veterans Hospital was constructed from 1966 to 1972 at a cost of $15 million. Down the road, Rock Bridge State Park opened. MU HealthCare. 1968. Mid-Missouri entered the aeronautical modern age when Columbia Municipal Airport closed and Columbia Regional Airport opened, capable of landing jet aircraft. iStock. July 20, 1969. Mid-Missourians were glued to their television sets as they heard the words, “The Eagle has landed” on the moon. National Geographic.

29

In 1966, the Dow Jones hit 1,000 points. Don Caldwell joined the firm in 1967. For many years he also served as Boone County Auditor while he was a partner with the firm.

In Jefferson City, the Central Trust Building had been the town’s only skyscraper until a new round hotel moved in. Designed by famed architect T. Y. Lin and built in 1967, the thirteen-story hotel began as a Holiday Inn in 1969. Only the state capitol is taller. When that new circular hotel opened, management called on Williams Keepers Oliver Payne & Rackers partner Darrell Chronister to handle its accounting needs.

In 1968, the National Committee on Governmental Accounting published an authoritative GAAP for state and local governments, called Government Accounting, Auditing, and Financial Reporting (GAAFR). The Tax Reform Act of 1968 changed the focus of income tax from economic incentives to social objectives.

The end of the decade saw the building of a concrete canopy to cover Columbia’s downtown sidewalks. Designed by Pon Chinn, the canopy was intended to give Columbia’s downtown the ambience of a mall.

Meanwhile, Williams Keepers Oliver Payne & Rackers had grown the business during the turbulent 1960s. From their new building in the heart of Columbia, the partners were poised to enter a new decade of growth, a decade in which they would attract a group of young CPAs who would become known as “The Gang of Eight.”

Congress Enacts the Alternative Minimum Tax

When the secretary of the treasury testified that 155 people with adjusted gross income above $200,000 paid zero federal income tax on their 1967 tax returns, Congress enacted the alternative minimum tax (AMT) in 1969, designed to prevent wealthy taxpayers from using loopholes to avoid paying taxes. But the AMT was not automatically updated for inflation. As a result, more middle-class taxpayers fell into the AMT category each year. For more than four decades Congress passed an annual patch to fix the AMT. Finally in 2013, Congress enacted a permanent patch to the AMT.

THEN… “It is a curious and noteworthy fact that the tremendous growth of the U.S. accounting profession in the postwar years has taken place almost unnoticed by most Americans,” T. A. Wise said in a 1960 Fortune magazine article, “The Auditors Have Arrived.” This article introduced the term, “the Big Eight.”

AND NOW… “WK’s greatest attributes are our people, past and present. Generations of hard work and community involvement have earned us a well-respected position in the community. We have a smart and helpful crew, continuing that tradition today.”

30

—Jessica Lehmen, CPA, Partner

1970s: SETTING THE TABLE FOR CHANGE

31

Prior to this point 90 percent of the firm’s business focused on taxes. But with the infusion of new talent came new ideas.

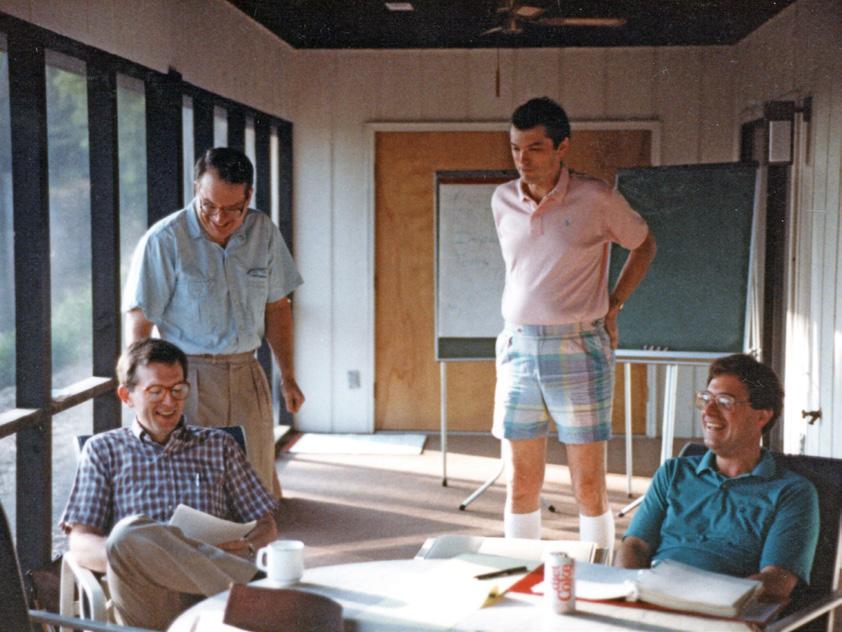

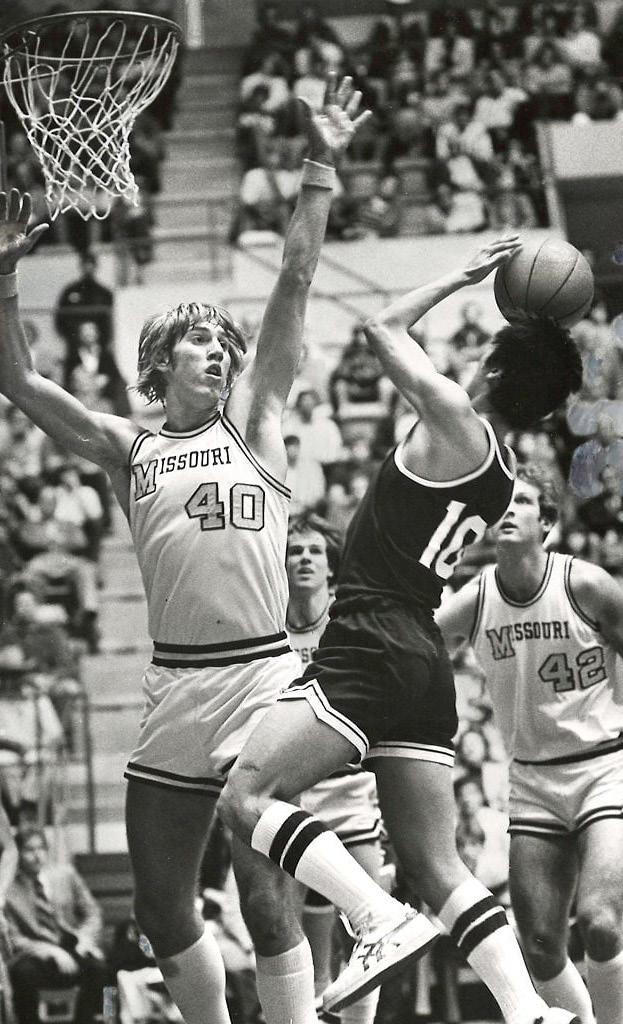

ABOVE: Late 1970s. Partners gather at the Columbia Country Club for a leadership meeting. Front row (from left): Tom Payne, John Rucker, Don Caldwell. Back Row (from left): Don Decker, Lou Rackers , Jim Weber, David Rawlings, George Keepers. WK Archive.

The1970s continued the dramaic changes in Columbia. The city population had reached almost 60,000, nearly doubling Jefferson City’s relatively stable population of 32,407.

The decade would see Williams Keepers Oliver Payne & Rackers grow as well, merging with practices in Rolla and Lebanon, opening a Moberly office, and acquiring a Fulton practice.

During this time Paul Williams reorganized the group of CPAs, including Columbia partners Williams, Keepers, Oliver, and Payne, and Lou Rackers in Jefferson City. Each of those CPAs retained his own practice, still individual accountants sharing a central staff. That business model would slowly evolve over the next three decades.

The changes began with key new hires.

Harry Otto graduated from the University of Missouri in 1969 and a week later went to work for the firm. He interviewed with George Keepers. Harry remembers when he began with the firm, Keepers told him to go see Elmo Cleek. Cleek helped initiate Harry by playing the role of a tough customer. “You think you can handle my business finances?”

Harry did.

Back then the firm’s auditing work still was performed manually, including typing carbon copies. Answering machines had yet to be invented, and George Keepers’ left pocket was always full of unanswered telephone messages, according to well-placed sources.

In the early 1970s, Harry Otto recalls, each accountant had a ten-key adding machine, and they shared one Smith Corona Marchant-I calculator. “When typing tax forms, if you made a mistake, you started over with a new form.”

Harry worked two hundred hours in the last two weeks of his first tax season. He remembers the Ash Street location had a vault and a library. For years during busy season, the firm ritually mailed returns to Saint Louis for processing. When the company installed its first computer, accountants mailed the punch cards to Saint Louis for processing. Later the firm sent the punch cards by plane to Saint Louis. Soon after, Williams Keepers Oliver Payne & Rackers launched Columbia EDP, a com-

puter processing company located in the firm’s basement. From that point forward, tax forms were processed through Columbia EDP. From the second-floor bullpen of the firm’s office on Ash Street, Harry Otto vividly recalls hearing the giant mainframe computers whirring downstairs, where Columbia EDP cleared checks all night for banks.

Harry eventually left the firm to work for the Department of Revenue. “But I didn’t burn any bridges.” He returned to work in the firm’s Jefferson City office in 1976.

In 1971, the Missouri Society of CPAs welcomed a new chapter—the Central Chapter became the fifth chapter of the society, with strong support from Williams Keepers Oliver Payne & Rackers, whose members would play active roles in the organization. Statewide, by the mid-1970s, MOCPA had grown to more than two thousand CPA members and eventually would feature a second member of the firm to chair the state organization.

Even as Williams Keepers Oliver Payne & Rackers kept growing, the business always had a family feel, but in 1971 partners’ spouses stopped doing filing, one small indication that the company was evolving from a local family business into a regional accounting firm.

There were other signs of growth. In 1972, the company built its Jefferson City office at 107 Adams Street. The modern brick, glass, and concrete structure stood two stories and offered the staff more space.

Along with the new building came new technology. A single new copy machine sat in the office bullpen. It used rolls of shiny paper, Harry Otto remembers, one of the first copiers sold by client Hallie Gibbs.

Another positive impact on the firm occurred in 1972 with the hiring of David Rawlings. David grew up in Marshall, Missouri, and graduated from the University of Missouri with degrees in both accountancy and law, a rare combination that would serve the firm well. Eventually the firm would hire more professionals with both accountancy and law degrees.

When he joined the company, Rawlings was fresh out of the military, having served in Vietnam as a U.S. Army captain.

THEN… In 1972, the AICPA rescinded its fifty-yearold ban on advertising AND NOW…“Williams-Keepers has so many different types of clients, you really have an opportunity to touch a lot of different projects. It’s really fun to look back and see how much my confidence has grown. Some projects that I wouldn’t have known how to handle when I first started, I’m now able to turn around with confidence and even help younger staff with the same project.”

32

—Caroline Boeger, CPA, Tax Supervisor

Leaving that wartime experience behind, David adjusted to new challenges as a civilian, and he learned the meaning of two new terms: “tax season” and “busy season.”

With a military background, David Rawlings was accustomed to hard work and long hours. He also appreciated the firm’s dedication to community. George Keepers was a Rotarian and encouraged fellow employees to join civic organizations. David became a Kiwanian and also worked with 4-H and United Cerebral Palsy.

Rawlings helped refine the Williams Keepers Oliver Payne & Rackers business model. He had a keen eye for management. “When I joined the firm,” David said, “I noticed the employee punch clock was in the basement. There was a lot of wasted time going downstairs to punch in and punch out.” David Rawlings eliminated the punch clock.

The business was growing. When David joined the firm, there were eighteen employees

at the Columbia location, five in Jefferson City, and two in Mexico. David eventually would become the firmwide managing partner.

The business couldn’t have been so successful without key personnel.

Rawlings remembers Mary Stotler—the firm’s checker—coming into his office, the checker tape flowing out of her adding machine and trailing out the door. He praises Kay Semon as one of the firm’s key problem solvers, especially in information technology. “If something went wrong, she would make sure it never happened again.” Kay worked for the firm for forty years before retiring in 2022.

Ron Callis and John Rucker also joined the firm in 1972. Callis graduated from the University of Missouri in 1969 and had recently become a CPA when he joined Rawlings in the Columbia office. During his tenure, Ron was considered the firm’s data processing troubleshooter. He later established a satellite

office in Moberly, which he bought in 1982 as the company began gravitating toward a onefirm concept.

“What I like about accounting is the variety,” said John Rucker, who joined the Jefferson City office at 107 Adams Street and served twelve years before opening his own practice at the Lake of the Ozarks and Jef ferson City.

BREAKING THE G LASS CEILING

Williams Keepers Oliver Payne & Rackers employed several females on the accounting staff, and of course, the firm was held together by “the glue,” as the partners called the predominantly female administrative staff. But there were no female CPAs until the firm welcomed Mariel Liggett in 1973.

Mariel grew up in Indiana with six brothers, five of them older. The family moved to Kansas City when she was a sophomore in high school. Five older brothers and a move during high school gave her the ability to navigate a male-dominated profession. She graduated from Mizzou in 1971 with a degree in accounting and a 4.0 grade point average. “I even got an A in bowling,” Mariel laughed. At graduation she wasn’t sure she wanted to be an accountant.

“Actually, I owe it all to my brother Tom,” she said in an interview with COMO Magazine. “We were both attending college, and he was in an accounting class and recommended I take a course in accounting because I liked math so much. I was all set to be a teacher, so I declined. Tom persisted, so finally I gave in and signed up for Introductory Accounting. I loved it and immediately changed my major to accounting.”

At the time, female accountants—especially female CPAs—were rare. There were only a few other female accounting majors in Mariel’s Mizzou accounting classes. Even with her degree in accounting, she was set to begin work on her master’s degree in education. In the meantime, Big Eight accounting firm Arthur Andersen in Kansas City recruited her. Eventually she took a leave of absence from Arthur Andersen to work on her master’s at Mizzou. That’s when she and her husband, George, agreed they would like to live in Columbia. She interviewed with Williams

33

1973. Firm partners Ed Oliver, David Rawlings, Tom Payne, Paul Williams, George Keepers and Don Caldwell. WK Archive.

Keepers Oliver Payne & Rackers and joined the firm in 1973.

Mariel remembers interviewing with George Keepers. She told him she wanted to work in the tax division. He agreed but soon assigned her to an audit. She was surprised. “I thought I was in the tax department.”

“You are, during tax season,” Keepers responded.

Mariel has high praise for the partnership’s handling of her role. “I was the first female professional hired by the firm. But I never thought it was an issue because George Keepers and Tom Payne made it a point to not make that an issue. Instead, they treated me like all the other staff members, always equally in all areas. It was a non-issue for them.”

She recalls telling Keepers at one point, “I’m the only female professional here.”

“So what?” Keepers responded, assuring her that he only saw a good CPA, not a male or female.

“George was so well respected and well-liked by his clients. He was always open door, he and Tom Payne both. Their offices were side by side in the Ash building.”

Mariel became the first female partner in 1976.

abused children and women. One of her most painful memories came when the organization had to close the boys’ home. The kids were understandably upset. When Mariel talked to the workers at the boys’ house, the mentors were not as concerned about losing their jobs as they were about their charges: “What about the boys?” Instead of turning the boys out onto the street, Mariel enlisted Boys and Girls Town, forming a partnership in Columbia that still exists today. She serves on the advisory board.

The women’s center is now called True North.

She watched another favorite program grow and flourish: SEED Success sets up 529 accounts for Columbia children K–12. SEED stands for Student Educational and Economic Development. The program works with youth and families to “seed” and grow College/Career Incentive Savings Accounts (CISA). The accounts are bolstered with matching funds and allow young recipients to have a financial foundation when they reach college age and adulthood. SEED has funded nearly six hundred college/career accounts for K–12 students in Boone County and is on track for hundreds more.

In 1973, the Financial Accounting Standards Board (FASB) was created, a result of demands by the SEC and Congress for more reliable and comparable financial reporting. The FASB and the Governmental Accounting Standards Board (GASB) are now two of the main organizations responsible for establishing generally accepted accounting principles (GAAP) in the U.S. For the first time, the American Institute of Accountants (now AICPA) ceded accounting standards authority to a body outside the organized accounting profession.

NEW IDEAS

In 1974, the firm welcomed Stephen B. Smith, who arrived from Arthur Andersen in Saint Louis.

work and studies. He graduated in 1968 with a business degree and subsequently received the Missouri Gold Medal Award for the highest grade among the 750 individuals seated for the CPA examination.

As one of the Big Eight accounting firms in the nation, Arthur Andersen exposed young Stephen to the patina of big-city accounting firms, according to his wife Bea. After graduation he went to work full time for Arthur Andersen, eventually leaving to become president of a manufacturing company. But a tornado wiped out the company.

At that point Arthur Andersen enlisted Stephen, who spoke several languages, to work for the company in Switzerland. He was all set to go. But when Stephen came back to Columbia to attend a class reunion at Hickman High School, George Keepers and Ed Oliver were eagerly waiting, intent on hiring this promising young professional. They already had talked to Stephen’s mom. Before their meeting with him, Stephen wasn’t very interested in coming back to a hometown accounting firm. But the trio hit it off in a big way, and Stephen saw an opportunity for great things with WK. He knew he could bring elements of the Big Eight accounting firm mindset to this small but mighty Mid-Missouri accounting firm.

Just as important, Stephen realized that back in his hometown, with this quality local firm, he would have the ability to “breathe.” Coming back to Columbia, he looked forward to engaging in entrepreneurship, something he would not be able to do with a major national accounting firm.

Steve became a member-owner in 1976, along with Mariel Liggett. “Dave, Steve, and I worked together a lot. We had quite a few clients together. We were all left-handed,” Mariel said with a smile.

GIVING BACK TO THE COMMUNITY

George encouraged Mariel, along with all the firm’s employees, to “give back to the community that gives so much to you.” Mariel took that advice to heart, working with the Mid-Missouri Food Bank early on. But her heart belonged to a program called the Front Door in Columbia, for

In the mid-1960s Stephen had entered the University of Missouri, combining his collegiate work with a full-time job to help his mother after his father died suddenly. Arthur Andersen hired him on a special basis in their Saint Louis office during his junior year, and he commuted between Columbia and Saint Louis, balancing

Already the new cadre of CPAs was moving toward a grand new model, one that would launch the company’s accountants into specific areas of expertise. And they all liked the one-firm concept. They looked for ways to grow the company’s footprint, to reimage the business from small market ideas to working among the elite national firms.

34

1976. Mariel Liggett became the f irst female par tner in the firm’s history. WK Archive.

Pension Reform

In 1875, the American Express Company established the first private pension plan in the United States, and, shortly thereafter, utilities, banking, and manufacturing companies also began to provide pensions. Most of the early pension plans were defined benefit plans that paid workers a specific monthly benefit at retirement, funded entirely by employers. Until 1974, there was little or no protection for pensions. One of the most shocking incidents of workers losing their retirement benefits occurred in 1963 when Studebaker terminated its employee pension plan, and more than four thousand auto workers at its automobile plant in South Bend, Indiana, lost some or all of their promised pension plan benefits. Workers everywhere were in jeopardy of losing their pensions when companies went out of business, and there was nowhere they could turn for help.

In 1974, Congress passed the Employee Retirement Income Security Act (ERISA), the foundation for a sound and workable pension insurance program that guaranteed workers’ benefits in private pension plans. President Gerald R. Ford signed ERISA into law, which established the Pension Benefit Guaranty Corporation (PBGC). “Under this law,” President Ford remarked, “the men and women of our labor force will have much more clearly defined rights to pension funds and greater assurances that retirement dollars will be there when they are needed.”

The Kline-Miller Multiemployer Pension Reform Act was enacted on December 16, 2014. In Kline-Miller, Congress established a new process for multiemployer pension plans to propose a temporary or permanent reduction of pension benefits if the plan is projected to run out of money.

OVERHAULING PENSION PLANS

One of the firm’s big changes occurred when Congress passed the Employee Retirement Income Security Act of 1974 (ERISA), the federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry. The goal was to provide protection for workers in these plans.

Prior to the new law, pensions and retirement income basically operated under the rules of the Wild West. There were few regulations. Consequently, when Congress tightened the rules many executors in the pension industry referred to ERISA as “Every Rotten Idea Since Adam.” Yet companies and employees loved the safeguards and the new programs such as profit sharing.

Seeing these monumental changes, Mariel Liggett stepped up and quickly became an expert in the nuances of the more restrictive ERISA. She rewrote all of her clients’ plans to meet ERISA requirements to provide participants with plan information, features, and funding.

CHANGES

The year 1975 saw some big changes on the WK roster. Ed Oliver retired after twenty-three years with the firm, content that he had helped hire and train a platoon of sharp young CPAs to carry on the company’s legacy. Mike Odelehr joined the company’s Jefferson City office. Mike took an active role in the community as a member of Host Lions. And he still worked with his alma mater, Lincoln University, until he retired in 2018.

In 1976, the century-old Maplewood Home opened as a historic house and museum. Fifty miles northeast in Audrain County, Don Decker, who in 1965 had come from Deloitte in Saint Louis to the A. P. Green Company in Mexico, joined the Mexico office of Williams Keepers Oliver Payne & Rackers. Decker was admitted as a partner in the firm. “I don’t believe anybody else had ever joined the firm straightaway as a partner,” Don recalls. It was a perfect fit: Ed Oliver had just retired, and the Mexico office did not have a partner. So the firm gladly met Decker’s stipulation that he be admitted as a partner. At about the same time the Mexico office moved to 222 East Jackson.

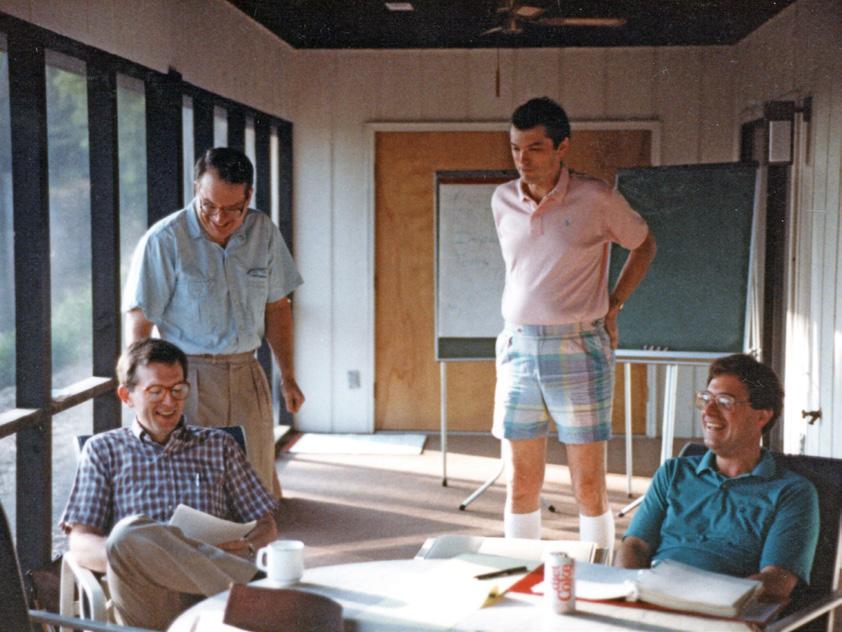

“On my first day we had a partners’ meeting at the Lake of the Ozarks,” Decker recalls. “Lou Rackers and Tom Payne had a property down there. It was in January. I’m the newbie and I walk in and these guys are working on calculators, with big wide green bar paper. They were doing the firm’s books for the year.”

It’s not something Don would have seen during his days at the buttoned-down A.P. Green, “an international company where we got computerized consolidated financial statements on the seventh working day of every month.”

Don, a Mizzou grad, quickly felt at home in this Mid-Missouri accounting firm. And he admired George Keepers’ work ethic. “I’d be in the office at six o’clock in the morning, and if I ran into a problem I’d call the Columbia office. George would answer the phone.”

Don also remembers Paul Williams. “I would come to the Columbia office,” Don said, “and occasionally I would see Paul in the office. He would come by to pick up his retirement check. A hundred dollars a month.

“When you think about company assets, you think about goodwill. You think about Paul and George, and Lou Rackers—those names were powerful.”

The same year Don Decker came on board, Jefferson City native Sid Dulle joined the firm. A graduate of Lincoln University, Sid worked as an audit partner until 1989, when he opened his own practice.

At this point in the story it becomes obvious that several local accounting firms with names you know and trust came out of Williams

35

The ERISA Act, signed President Gerald Ford in 1974, was jokingly referred to as “Every Rotten Idea Since Adam” by business leaders. US Department of Labor.

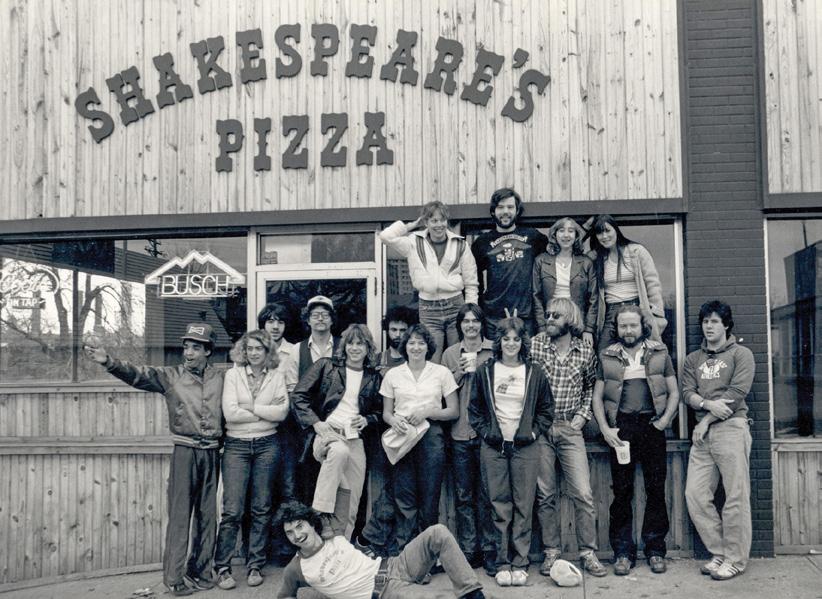

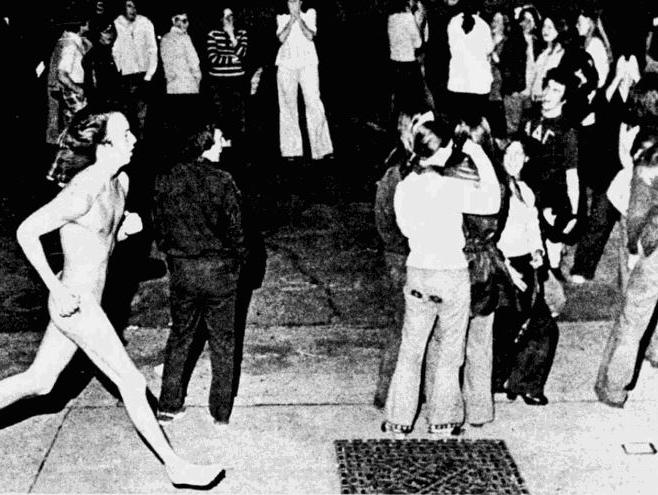

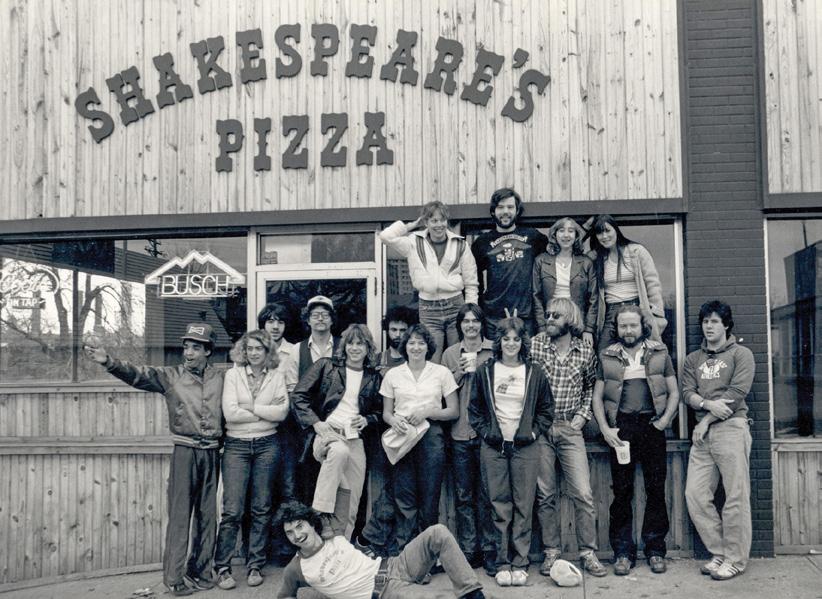

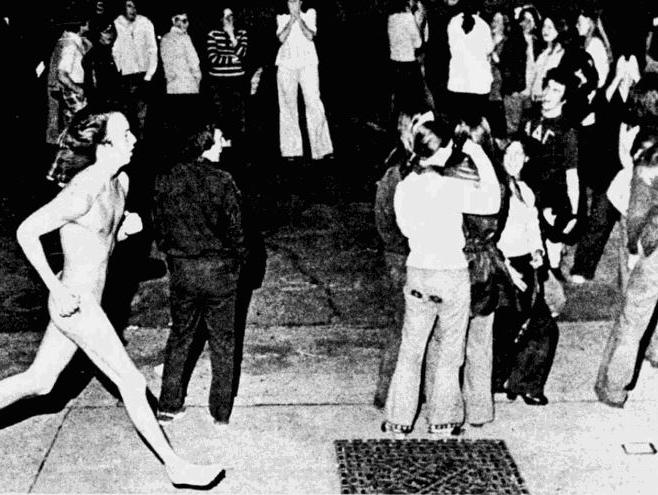

CLOCKWISE FROM ABOVE: 1971. A new Columbia Public Library rose at Garth and Broadway. On December 30, 1972, a human book brigade passed the collection of books from the old Columbia Public Library at Seventh and Broadway to the new library. By the year 2000 a new library would stand on the spot. Daniel Boone Regional Library. 1970s. In Jefferson City demolition crews tore down the old Central Hotel to present a better view of the state capitol. Missouri State Historical Society. 1973. As the brand-new Biscayne Mall sprawled on the western edge of Columbia off Stadium Drive, on the south edge of town Rock Bridge High School opened. It was the second centrally air-conditioned school built in Columbia after Oakland Junior High School. Cinema Tour. 1973. Susan Wooderson became Columbia’s first female police officer. Shakespeare’s Pizza opened at Ninth and Elm Streets, on the site of old Poor Richard’s across from J-School. University of Missouri. 1974. Columbia Regional Hospital opened. The fad of streaking hit the Mizzou campus and, for some reason, the eclectic Interstate Pancake Howse. St. Louis Post Dispatch.

36

Keepers Oliver Payne & Rackers. Russ Starr, who later would join the firm and eventually serve as managing partner, adds perspective with this revelation: “For every person who left WK and established their own accounting firm, or went to another accounting firm, there were ten who went to Emery Sapp and the Landrum Company and Central Bank and others. They became really valuable members of the financial leadership of companies.”

SAYING GOODBYE

In a short span, the firm would say farewell to two members of the WK family. James Monroe Weber died unexpectedly on March 19, 1978. He was fifty-two, in the prime of his life, a dynamic, beloved member of the community and a longtime partner at Williams Keepers Oliver Payne & Rackers. At the time of his death, Jim was a district governor-elect for Lions Club International. He was a member of the American Legion, the VFW, and the Fourth Degree Knights of Columbus. Jim served as a lay minister and member of the Holy Name of Saint Joseph Cathedral. He was an active supporter of Babe Ruth Baseball, the Boy Scouts, the Girl Scouts, and Jefferson City park board programs.

Thirteen days later, on April 1, 1978, Arminda “Minda” Williams, mother of Paul Williams, died and was laid to rest in Appleton City. She was ninety-nine. Her life had seen tragedy, but she also saw her son Paul establish a strong regional accounting firm.

That same year the MKT Railroad abandoned its rail line from McBaine to Columbia. President Jimmy Carter visited Columbia and spoke to the Missouri Farmers Association. Muriel Battle became the city’s first African American principal, at West Junior High School. And another Stephen Smith—Stephen C. Smith—joined the team. What are the odds?

Stephen C. Smith shares his Norfolk, Nebraska, roots with an American icon: “I never met Johnny Carson, but Johnny and I had the same English teacher. He even had her on The Tonight Show a couple of times.”

Steve received his accountancy degree from the University of Nebraska. A United States

Army veteran, Steve came to WK from Snyder, Grant and Muehling in Lincoln, Nebraska, where he had worked for four years preparing financial statements and performing other duties. Steve and his wife, Pat, wanted to move to a college town. Pat was looking for a good journalism school. Columbia made sense. He remembers he got a phone book from the Columbia Public Library to see which accounting firm had the most names. His research led him to Williams Keepers Oliver Payne & Rackers, and the first person the receptionist introduced him to was Stephen B. Smith. “Well, the firm probably didn’t want another Steve Smith to confuse things,” he laughed. “But they hired me, and I went to work in December 1977.”

Steve got right to work on clients including Riback Supply and B. D. Simon. He remembers working with Marty Riback to bolster and enhance the Big Brothers Big Sisters organization.

It was early 1978 when Steve first began working on a Columbia College audit. He enjoyed addressing the financial issues of a venerable Columbia institution. “When I presented the audit,” board member B. D. Simon said, “he did a good job for us.” From that point, Steve began specializing in auditing colleges and universities.

Steve’s expertise and insight, especially in the audit business, would make him a valuable member of the Gang of Eight.

Prior to this point 90 percent of the firm’s business focused on taxes. But with the infusion of new talent came new ideas. The company was evolving from a collection of individual CPAs to a universe of service. As David Rawlings, Mariel Liggett, Harry Otto, and the two Stephen Smiths presided over big changes, the company gained momentum toward becoming a multiple-service firm.

Gradually at first, and increasingly, members began to specialize in specific areas of accounting and financial management. With the hiring of Stephen C. Smith, the shift to specialization was well under way. Stephen B. Smith was evolving into an expert in forensic accounting litigation, increasingly in demand as a tax expert. In court there are two types of witnesses: fact witnesses and expert witnesses. Stephen B. Smith

was considered one of the nation’s preeminent expert accounting witnesses and was called many times to testify at trials, and even to Congress. He also became an expert in business valuation and lost profits.

Meanwhile, Stephen C. Smith shored up the audit practice. Mariel Liggett had become the recognized expert on large and small company retirement programs. Darrell Chronister became a go-to expert with colleges and universities, and he had many agricultural clients as well.

David Rawlings began doing more estate planning. John Sheehan—who later would join the firm and Rawlings in providing estate planning—reports that WK became the leading CPA firm in Mid-Missouri to perform statewide association work.

As the firm increased its focus on business valuations and consulting, WK accountants executed business functions like payroll and accounting for more and more companies who wanted to outsource and save overhead.

Splitting out duties helped partners become experts in their chosen pursuits. But it had another benefit: Specialization helped partners get unvarnished answers from one another about specific business situations. Those interconnected insights were value-added benefits to customers.

As the decade ended, Columbia annexation increased the city’s size to 41.54 square miles. The Wabash Station was added to the National Register of Historic Places.

Late one afternoon in the middle of tax season in 1980 George Keepers approached Jeanette Klemme and said, “Nettie, I don’t think I’ll come in tomorrow.” He gave her a hug.

The following morning, March 9, 1980, news came that George Keepers had died.

Heartbroken, his WK family could only hold on to memories of the man who had given them so much. There’s a reason Mariel Liggett called him “my father away from home.”

His family buried George at Memorial Park Cemetery in Columbia.

37

38

Don Decker

Mariel Liggett

Harry Otto

David Rawlings

John Sheehan

Stephen B. Smith

Stephen C. Smith

Russ Starr

1980s: MOMENTOUS CHANGES

During the 1980s the firm was guided by increasingly strong leadership, the nucleus of key CPA partners who became known as the Gang of Eight.

39

LEFT: WK’s Gang of Eight. WK Archive.

were conducted with the use of many ledger sheets of paper and a black binder. WK has also improved at promoting a work/life balance. When I first started at WK, it was nothing to work from 7:30 a.m. until midnight or later during the busy season.

overtime hours,

Itwas a decade that began with a tearful farewell to George Keepers.

As his coworkers gathered at the Ash Street headquarters that George built—one block from the Frederick Douglass School, newly added to the National Register of Historic Places—they soon would become part of events inside and outside the firm that would bring significant changes to the business Paul Williams built.

The 1980 census showed Columbia’s population at 62,061. Jefferson City’s population remained stable at 33,619.

That year the firm welcomed Emil Ortmeyer as the newest CPA. Emil grew up in Westphalia and graduated from Fatima High School and Lincoln University. He worked for a decade at the Jefferson City office before beginning his own practice in Jef ferson City.

During the 1980s the firm was guided by increasingly strong leadership, the nucleus of key CPA partners who became known as the Gang of Eight: David Rawlings, Stephen B. Smith, Stephen C. Smith, Mariel Liggett, Harry Otto, Russ Starr (who joined in 1982), Don Decker, and John Sheehan (who joined in 1989). The group presided over a period of growth, not only in size of the company but in breadth of services.

The decade saw the firm grow its consulting and business valuations. It attracted more quality CPAs. And more key adjustments would encourage the firm’s move into specialization.

According to Troy Norton, “The firm had grown, but in essence we still functioned as many separate practices under one roof with shared staff. The Gang of Eight realized that to compete with

the bigger firms, the firm needed to specialize even more in specific industries. So we accelerated developing our industry specialization. We went from everybody trying to do everything,

THEN AND NOW…Technology of course would have to be the biggest evolution. When I started at WK in Jefferson City, there were no personal computers. Tax information was manually entered onto input pages and then keyed in. Audits

We still work

but the expected number of hours is much more manageable, and the firm allows alternative work schedules.”

—Kathy Graessle, CPA, Partner

40

Late 1980s. Members of the firm’s leadership team pose for a group photo. (Front row, from left) Stephen B. Smith, David Rawlings, Harry Otto, Don Decker. (Back row, from left) Mariel Liggett, Stephen C. Smith, Russ Starr, Jennifer DuPont, Darrell Chronister, Emil Ortmeyer, John Sheehan. WK Archive

each being a generalist, to people focusing on specific industries, whether it be banks or contractors or colleges and universities or healthcare or construction.”

It was the beginning of the movement toward a one-firm concept. The firm soon would undergo a peer review that would accelerate consolidation into one firm.

In the meantime, another key accelerant in the firm’s growth was technology. And technology would lead to networking.

Years before the technological revolution gained widespread momentum, Ken Lange joined WK in 1980. His first job was a general document-processing position. Eventually he became the firm’s director of information technology. Ken’s steady guidance for more than forty years kept WK at the leading edge of innovations in the IT field.

THE LEADING EDGE

The timing was perfect to hire Ken Lange. Within the next year, WK’s individual CPAs with separate practices started on the road to organizing into a more cohesive firm. They continued to share staff, but as they specialized they also began to share expertise.

Facilitating all of these moves was the firm’s evolution into networking, data sharing, and the elec tronic age.

The decade saw dramatic changes in the way tax forms were processed. “When I first started at the firm we were ‘Purolating,’” said Ken, who retired in 2023, after 43 years of service. “That was the courier service at the time. We were Purolating paper documents back and forth every day.”

SOUNDING AN ALARM

Early in the decade Bob McKay in the Rolla office suggested Williams-Keepers join an accounting association. WK chose the influential peer group known then as Associated Regional Accounting Firms (ARAF). ARAF is now known as Allinial Global.

An ARAF member profile described the company:

“Admitted to ARAF in May 1981, WilliamsKeepers-Oliver-Payne & Rackers brings to the

association considerable experience with nonprofit organizations, serving 180 trade associations and lobby groups. Their six offices are located in Jefferson City, Columbia, Mexico, Moberly, Lebanon and Rolla. They have 13 partners and a total staff of 84. Founded in Columbia in 1923, the firm is the largest in the area.

“The Jefferson City office serves industrial, governmental and nonprofit organizations. Columbia is the home of the University of Missouri and two other colleges which the firm audits. That office also audits several banks and savings and loan associations and several insurance companies. Williams-Keepers also serves manufacturers and distributors, municipalities and others. The mix of services is approximately 45% tax, 45% accounting and auditing services and 10% management advisor y services.

“The firm has an IBM System/34 which processes all individual income tax returns and all financial statements. They own four buildings, renting some space out for offices. WilliamsKeepers is directed by a management committee composed of Louis H. Rackers, Donald W. Caldwell, Darrell L. Chronister and David L. Rawlings. All partners are members of the AICPA and the MOCPA.”

As a new ARAF member, the firm was required within a year of joining to undergo review by a peer panel. The review covered operations and the audit practice.

The company got a wakeup call. The review team sat down with all the firm’s partners and verbally shared their findings. The panel did not mince words. ARAF told the firm to centralize management and step up its audit procedures. One retired partner vividly recalls a “Come to Jesus” meeting of the partners after the ARAF evaluation.

The issue was not the capabilities of the existing partners and CPAs. Rather, ARAF suggested that the firm address its growing pains, tighten its audit processes, and entertain a pivot from a relatively small collection of CPAs with their own individual clients, several profit centers, and a shared staff, to a modern plan with merged profit centers, and eventually a support system of managers to handle administrative tasks such

as human resources, billing, and internal financial operations.

A ONE- FIRM CONCEPT

Always eager to improve the business, the firm’s partners studied the ARAF recommendations and responded to the challenge by beginning the evolution from a small accounting firm to a well-connected regional powerhouse. Stephen C. Smith brought the company’s audit procedures to professional standards. The partners installed a management committee, and members chose David Rawlings to become the firmwide managing partner.

David’s management style was firm but fair. He became comfortable with delegating projects.

Around the same time, Stephen B. Smith created a capital equalization plan to merge profit centers. Smith and Rawlings worked together to implement the plan, eliminating separate profit centers in Columbia, Jefferson City, Mexico, and the satellite offices. “It took a while to work through the idea that we really were going to consolidate,” Don Decker said.

Tax Reform Act of 1986

Congress lowered the highest tax rate for ordinary income from 50 percent to 28 percent, raised the tax rate on long-term capital gains, and raised the lowest tax rate from 11 percent to 15 percent. This was the first time in U.S. income tax history that the top tax rate was lowered and the bottom rate was increased at the same time. The act also eliminated certain loopholes and tax shelters, and expanded the Alternative Minimum Tax. For the first time people claiming children as dependents were required to provide Social Security numbers for each child on their tax returns. The act also increased the Home Mortgage Interest Deduction to stimulate homeownership.

41

The transition would take a few years because of the complexity of the profit center issue, but WK had begun in earnest the evolution to a onefirm concept.

Not all the satellite office partners bought into the one-firm concept. Presented with the option of signing a single partnership agreement or remaining independent, Ron Callis bought the Moberly office, Robert McKay bought the Rolla office, and Dan Waterman bought the Lebanon office.