ADOPTED BUDGET FY 2026

ADOPTED BUDGET FY 2026

Douglas G. Pons MAYOR

Andrew O. Trivette

CITY MANAGER

Michele Mixner DeWitt

ASSISTANT CITY MANAGER

Christina Shelton CITY ATTORNEY

W. Pat Dent VICE MAYOR

Barbara L. Ramsey MEMBER

Stacy Kern-Scheerer MEMBER

Ayanna T. Williams MEMBER

Dustie McCay CLERK OF COUNCIL

Mark A. Barham CHIEF INFORMATION OFFICER

Barbara Dameron DIRECTOR OF FINANCE

Sean Dunn POLICE CHIEF

Wendy Evans DIRECTOR OF HUMAN SERVICES

Tevya Griffin DIRECTOR OF PLANNING & CODES COMPLIANCE

Robbi Hutton DIRECTOR OF PARKS & RECREATION

Yuri Matsumoto DIRECTOR OF ECONOMIC DEVELOPMENT & TOURISM

R. Jackson Reed

DIRECTOR OF PUBLIC WORKS & UTILITIES

Larry W. Snyder Jr. FIRE CHIEF

OUTSIDE AGENCIES

Finance Director, Tourism and Human Services send outside agency notices.

BUDGET GUIDANCE

Finance Director and Manager provide budget guidance to staff.

PUBLIC REVIEW

City Council holds public hearings on budget proposal and advertises planned tax rate.

FISCAL YEAR BEGINS

City fiscal year begins July 1 and runs through June 30.

BUDGET RETREAT

City Council holds Budget Retreat

AUDIT

An independent auditor conducts onsite review of financial reporting and compliance. The audit is reviewed with the Finance and Audit Committee.

CITY MANAGER’S BUDGET

After input from Planning Commission and Econ. Development Authority, the City Manager delivers a proposed budget.

MAY

BUDGET ADOPTION

City Council adopts the budget in May of each year, setting the tax rate. WATCH HERE

AUGUST

MID-YEAR ADJUSTMENTS

Staff presents the current budget forecasts for FY end and recommends any adjustments through June 30.

ACFR

The Annual Comprehensive Financial Report relates the actual performance of the City’s budget plan. VIEW HERE

July 1, 2025

Mayor and Members of Council,

Since February, we have worked together to consider internal and external influences on the City’s finances, developed strategies to address those influences, and reached consensus on a Fiscal Year 2026 (FY26) budget that meets the needs of both our organization and our community. I am pleased to presented the adopted FY26 budget and the associated fiveyear Capital Improvement Plan (CIP).

Over the last few years, we have compared our budgeting process and its outcomes to running a marathon. Our finish line is a Williamsburg 2040 that we can all be proud to share. Our route is guided by our biennial strategic planning process, the Goals, Initiatives, and Outcomes (GIOs). This past year, we renewed our focus on 2040 by again conducting the GIO process, and this budget reflects those priorities. Like the GIOs, marathons often have waystations, providing course announcements that can require a runner to adjust strategy to finish in the best position.

The FY25-26 GIOs continue the emphasis on major public infrastructure renewal projects. Reaching the 2040 finish line with significant projects addressed or completed requires proper trajectory and pacing. We must align our spending plan with the priorities set by our community while ensuring that we have sufficient resources to deploy at the right time to finish the course in a position that satisfies our community vision. That vision includes milestone construction projects like the library, police station, and fire station; programming objectives like growing our youth achievement programs, participating in regional solutions to homelessness, and addressing affordable housing; and intermediate targets, such as taking advantage of the 250th commemoration of the nation in 2026, which coincides with the 100th anniversary of Colonial Williamsburg.

Over the years, we worked to advance at a pace that maintains the lowest real estate tax rate of the 38 cities in Virginia and lower than 65% of the 95 counties. We achieve this low rate while simultaneously providing a high level

of service without adding fees for services such as stormwater management and garbage and recycling collection. In the past, our strong tourism economy has offset the natural growth in the expense of providing services. Experts are unsure how the world and the domestic economy will react to recent changes in federal policy. However, Greater Williamsburg has been fortunate that our tourism economy has shown resilience when, in similar periods of uncertainty, travel trends shift from international visits to regional drive markets.

The adopted budget realigns our approach with past trajectory and pace in mind. It reduces spending, wisely applies one-time funds, and increases revenue to meet needs consistent with our community’s values by:

• eliminating 34 capital projects, or $22.8M, in FY26.

• reducing departmental operating costs by $725K or 2%.

• instituting a funding freeze that saves $207K by holding nine positions vacant through June 2025.

• reassigning $5.5M in COVID relief funds and $1M in reserve funds to the CIP.

• adjusting the water rate by $1.59/1,000 gallons for necessary infrastructure upgrades, effective July 1, 2025.

• increasing meals and lodging tax rates by 1.5% and 2%, respectively, and adding a new 10% admissions tax, all to become effective in January 2026.

Together, these strategies for FY26 allow us to directly address aging water utility infrastructure, slowed revenue growth, and a structural imbalance in the CIP. We find ourselves at a waystation moment in the marathon to the Williamsburg of 2040. The adopted FY26 budget represents a corrected trajectory and pace to ensure a strong finish.

The City of Williamsburg's Fiscal Year 2026 Proposed Budget was published on March 31, 2025, and presented at the April 7, 2025, City Council Work Session. Following public input at three City Council meetings, Council directed changes to the budget prior to adoption at its regularly scheduled business meeting May 8, 2025, satisfying the City's Charter requirement. This Reconciliation page reviews these changes, which have been incorporated into the Fiscal Year 2026 Adopted Budget.

6,400,000

QUARTERPATH CDA FUND: NO CHANGES

$10,319

The City’s participation in the joint school system is predicated on a five-year contract. FY26 will be Year 4 of the newest version of that contract. During this school year, the City has 1,134 students enrolled. The cost to the City per student for the operation of the school system is $10,319.

The City’s role as the minority funding partner in the WilliamsburgJames City County School System requires that the City contribute a percentage of WJCC OPERATING AND CAPITAL COSTS that is based on City student enrollment and state funding each year. The adopted FY26 budget includes the calculated percentage increase, 11.6%, of the initial school request total. During the budget process, the school board considers proposed budgets from the superintendent for both operating and capital expenses anticipated for the coming fiscal year. These initial budgets are based on estimated state and federal funding, resulting in a gap that local funding partners must address. The school board-approved budgets are then considered as part of the James City County budget. Ultimately, the local funding is determined by the JCC Board of Supervisors, and the City decides whether to adjust its provided funds based on that approval. Typically, the City’s adopted budget meets the needs represented in the school board’s approved budget. The FY26 Adopted Budget honors this tradition with a contribution of $12.7 million in annual operating funds, a $1.4 million increase or 12.4%, and capital funds totaling $1.4 million. In total, the school system represents 13.6% of this year’s total budget.

Each year, as the budget is assembled, we estimate revenues, compile a list of mandatory and discretionary changes to the operating budget, and adjust the capital plan to include new projects along with revised schedules and costs for planned projects. To MANAGE

17.4%

This budget implements significant reductions in planned and requested spending to offset the impact of mandatory expenses in service costs for outside agencies, such as participation in the regional jail, regional transportation, and the joint school system.

in the FY26 budget, we reduced the planned total expenditure by lowering costs in the operating budget by $725K; eliminating 29 projects from the capital plan, including $15 million proposed and $7.8 million previously planned projects that totaled $22.8 million in FY26 reductions and $14.1 million over the next four years; and making available $5.5 million in ARPA funds and $1 million in reserve funds. These reductions mean stretching the lifespan of major equipment, eliminating new projects and ideas proposed by departments, and reducing operating expenses, all of which will constrain services and employees.

$1.59

The adopted FY26 budget includes an increase in the utility rate from $5.30 to $6.89 per 1,000 gallons consumed — a 30% increase. This change is expected to raise the average residential utility bill by approximately $6.36 per month and the median commercial utility bill by $28.62 per month.

For many years, we have planned for INVESTMENT IN OUR WATER UTILITY and have studied the necessary upgrades to both the water treatment facility and the distribution network — upgrades that can no longer be postponed. We aim to implement a 10-year work plan that will require $27.1 million to complete. To fund this work as we progress through the work plan, we need to raise the utility rate. Starting in at least 2000, the City increased utility rates annually to keep up with rising service costs and reduced consumption with the introduction of higher efficiency fixtures. That practice was suspended in 2018, and the rate has not increased from $5.30 since. From 2000 to 2017, the average increase per year was 6%. If that trend had continued, the rate in FY26 would be nearly $8 per 1,000 gallons consumed. The adopted budget increases the utility rate from $5.30 to $6.89 per 1,000 gallons.

$3.0M

Adopted adjustments of 1.5% and 2% to meals and lodging tax rates, respectively, along with the introduction of a 10% admissions tax, are expected to increase revenue by $1.4M from meals, $775K from lodging, and at least $793K in admissions collections.

Implementing a modest increase in excise taxes, such as those on meals and lodging, along with the introduction of an admissions tax, can improve our city’s fiscal health. Since 2017, we have been cautiously monitoring the growth of revenue from excise taxes, including meals, lodging, and sales. Our concern has been that these revenues play a crucial role in funding our operations and capital expenses. SLOW GROWTH TRENDS led to a requested real estate tax increase of $0.08 in 2022 to help balance the capital plan amidst planned expenses for the joint school system. That need was postponed by a smaller increase of $0.04, which was reduced in the following year to $0.02 by deploying reserve funds, tourism funds, and COVID relief funds as a stabilization strategy. With those committed stabilization funds depleted, now is the time to improve recurring revenue. Increasing the meals tax by 1.5%, the lodging tax by 2%, and instituting an admissions tax of 10% with an effective date in January increases a proven recurring revenue stream that addresses the long-term needs of our capital plan.

The Capital Improvement Plan (CIP) Fund is a five-year plan for major infrastructure projects. The adopted FY26 CIP has projects totaling $33.2 million – $28.8 million in City projects, $1.4 million for the City’s share of school projects, and $3 million in debt service – for an increase of $5.7 million since last year. The FY26 projects are funded by $7.5 million in sales tax and interest income, $11.2 million in grants, $7.5 million in regional contributions, $2.5 million in private donations, $1.6 million in Budget Stabilization funds, $2.0 million transfer from the General Fund, $850K from CIP Reserves, and $40K in Courthouse maintenance funds.

The FY26 budget provides for the next steps in the generational replacement of critical municipal structures through a financing plan that extends over years, such as the new downtown Williamsburg Regional Library ($20 million) and the new home of the Williamsburg Police Department along Lafayette Street ($22 million). It also includes funding necessary to implement projects included in the City’s Goals, Initiatives, and Outcomes (GIOs), such as improving Williamsburg Area Transit Authority bus stops ($400K) and completing the African American Heritage Trail ($1,088,100).

A project’s inclusion in the CIP does not always indicate that it will proceed. Projects are often included in the CIP but depend on outside financing, such as grants or fundraising. If grants or donations are not received or enough to satisfy targets, the City Council may delay or cancel the project. Projects included in the CIP with an expense of more than $100,000 require additional review and approval by the City Council before implementation despite their inclusion in that year’s budget.

The City’s CIP includes a stabilization fund added in FY23 to provide needed one-time funding that reduced the real estate tax rate and prevented an increase for several years. In the FY26 budget, that stabilization fund is exhausted, and new revenues in the form of increased excise taxes fully fund the plan for the next five years, reducing the pressure on local real estate taxes. The City will debt fund many of the larger building projects, spreading the cost over the generations benefitting from the facilities. Leveraging debt to fund generational projects – while increasing revenues from meals, lodging, and admissions taxes paid by millions of our visitors who help cover the cost of services –enables the full five-year CIP to be funded without placing the burden solely on property owners.

The FY26 Adopted Budget adds $26.8 million to our outstanding debt. This total includes debt funding projects like the new downtown Williamsburg Library. While the City Council has not given final approval, the City must plan for any potential project’s financing to allow the work to occur if the decision is to move forward. Budgeting for projects does not mean the City will ultimately bear the entire cost. We can and will aggressively seek grants and private donations to offset City expenses and debt when possible. Budgeting provides a vehicle to proceed if the City Council elects to do so within FY26.

The budget puts the City’s outstanding debt total at $72.8 million as of June 30, 2026. The current and proposed debt meets or exceeds all of the City’s debt policies to ensure the wise and limited use of debt. A portion of the outstanding debt includes the FY25 refunding of bond Series 2023 and past refunding of the Series 2010 and 2012 debt. The debt service, or annual debt payment, totals $3.35 million during FY26, of which $653K is funded from the Utility Fund, with the remaining $2.7 million funded from the general government Capital Improvement Fund.

The City uses debt as a tool to make money go further. By bonding expensive projects such as fire stations, police stations, libraries, parks, and schools, our annual commitments to these projects are less, and we can accomplish more in a truncated timeline. However, like any wise account holder, we must monitor the amount of debt and the associated debt payment to not overburden the available revenue for other projects to proceed.

The Tourism Fund was adopted in 2017 to improve transparency regarding the City’s total expenses for tourism-related activities. The Tourism Fund’s estimated total revenues in Fiscal Year 2026 are $7.2 million. Revenue estimates from sales tax have increased by approximately 0.8% compared with FY25, while the $2 lodging tax estimate has risen by 27%. Revenues for the fund include $1.2 million from the $2 per night per room tax, $2.62 million from the City’s half of the 1% Historic Triangle Region Sales Tax, and a state-mandated transfer from the General Fund totaling 2.2 million, interest income of 100K, and a transfer from fund balance reserves of 1.1 million.

The fund is intended to provide opportunity for investment in new or expanded tourism offerings to drive overnight stays in Williamsburg. The primary tools to accomplish this goal are the Tourism Development Fund Grant Program (TDF) and the Tourism Promotion Contingency Fund (TCPF). The Tourism Development Grant Review Committee (TDGRC) guides any TDF expenses, evaluating the applications and recommending projects for funding to the City Council. The last grant cycle in 2023 included 11 applications, representing $35.8 million in total requested funds. After review, the TDGRC recommended, and the City Council approved, $1.6 million in grant awards for FY24, $900K in FY25 and additional funding in future years. The FY26 budget considers these funds committed. A grant cycle will not open this year as committed funds are disbursed to past grant recipients for projects such as the Greater Williamsburg Sports and Events Center and a new arrival center along Lafayette Street, among others.

The TPCF process uses a staff committee to review rolling applications throughout the year. The committee presents recommendations for City Council consideration and funding. In 2015, the City created the grant, which has provided $556,970 in funding to 15 applicants since Fiscal Year 2016. The funds have assisted in opening and promoting new events like art exhibits at the Musacrelle Museum of Art and recruited conferences like A Common Cause to All, which has attracted thousands of attendees from across the country in Williamsburg over the past three years.

Additional FY26 Tourism Fund expenses are the tourism-oriented outside agency funds totaling $7.2 million, an increase of 27.6% from FY25, some of which are mandated by the Code of Virginia, and the Tourism Fund’s administration totaling $328K, an increase of $7.8%.

The federal and state governments provided the City of Williamsburg with pandemic relief funds between 2020 and 2022 that totaled $21,419,663. The City used these funds to provide immediate relief and aid programs to businesses and residents, deployed $8.0M to reduce costs associated with the CIP, and designated $13.4M for new projects designed to generate revenue and meet social needs. A public survey and a steering committee guided this final funding category of investments, which City Council ultimately approved.

The FY25 Adopted Budget designated these relief funds for affordable housing projects and programs, initial infrastructure for a research village for data science businesses, and seed money for the redevelopment of the Blayton Building as continued public housing. Instead of those designations, the FY26 budget makes this $5.5 million in funding available for use to reduce the immediate need for new revenues. The increased revenues realized from increased excise taxes provide the opportunity to leave these funds unused or restore funding to these planned projects in future budgets.

Since 1927, the City has operated a well-respected water utility. Today, the enterprise Utility Fund is an independent fund of the City that supports itself through the water rate, paying for infrastructure and operations.

For years, we have watched the margin between revenue and expense shrink, with customer growth inherently limited and demand decreasing as higher-efficiency fixtures replace legacy items. At the same time, the cost of manufacturing water, distributing water, and collecting sewage has increased.

However, the City needs to make legacy improvements to the manufacturing and distribution of our potable water now. A review of our system shows that modernization of the utility system requires an investment of $27.6 million over the next 10 years. Modernization includes work at the Water Treatment Plant to repair structural flaws and replace the hardware and software that handles settling sediment and adding treatments. We will also invest in upgrades to a well-aged distribution system, including replacing four of 15 pump stations, and replacing clay and other substandard pipe throughout the city. These investments can no longer be delayed as they will guard against system failure in future years.

Monthly Cost

5,000 Gallons

To fund this 10-year work plan, we will use revenue bonds specific to the Utility Fund. These bonds will be issued as needed to make progress on the work plan using a combination of our small utility workforce and contractors. Financing the bonds includes raising the water rate in FY26 from $5.30 to $6.89, an increase of 30%. The last rate increase occurred in 2017. Until Fiscal Year 2018, the water rate increased every year since 2000 with an average rate increase of 6%. If that trend had continued, today’s rate would be over $8 per 1,000 gallons consumed. Increasing the rate by $1.59 generates $1.5 million in revenues for the fund. Despite this increase in our rate, we will maintain one of the lowest rates of any full-service water utility in Hampton Roads.

The Fiscal Year 2026 budget process began and ended with efforts to manage government costs. Estimated new revenue of $2.4 million was quickly consumed by $2.4 million in mandatory spending. Mandatory expenses include the rising costs of the City’s membership in regional organizations, personnel costs for existing employees, contractual service agreements, state-required funding arrangements, and the general increase in costs such as fuel, energy, and telecommunications. The only discretionary expense funded in this budget is a Cost-of-Living Adjustment (COLA) to salaries for City employees.

Given the lack of strong revenue growth anticipated in FY26, none of the new 21.5 requested FTE positions are funded, and one position is eliminated. One position was eliminated to help reduce expenses. The Utility Fund adds a new engineer to assist in the planned upgrades to the City’s water system and a FOG (Fats, Oils, and Grease) Inspector to ensure food service establishments comply with regulations required for all Hampton Roads localities under a consent order.

$1.7M

Every year, personnel costs increase. The FY26 budget provides $19.2 million for personnel-related expenses; $582K is directed to compensate for increased taxes, insurance, and benefit coverages associated with current employees. Additionally, the budget provides $564K for a 3% cost-ofliving adjustment.

$1.4M

The FY26 budget fully funds the WJCC schools funding request. Public education faces the same salary and staffing challenges as the City. This budget provides $12.7 million, the City’s share (10.53%) of the school’s initial requested budget of $114 million, which includes 62.85 new positions, a 3% increase for systemwide salary adjustments based on recent benchmarking, and efforts to remain competitive in hiring and incentivize retention.

$809K

The City's cost to provide the same services increases year over year. The FY26 Adopted Budget provides $809K to accommodate this increase, which includes $303K for increased contractual services, $209K for increased maintenance, and $297K for general service increases.

$525K

City services are augmented through the 70 outside agencies and regional joint service providers, which also receive funding through the budget. This adopted budget provides $525K to meet outside agency requests including the recommended and mandatory increases. The largest increases include Virginia Peninsula Regional Jail ($226K), Williamsburg Area Transit Authority ($97K), and Williamsburg Regional Library ($56K).

The budget process includes receiving budgetary requests from outside agencies, City departments, constitutional officers, and jointly funded offices. However, this year, mandatory increases exhausted anticipated new revenues, leaving no room to accommodate new budget requests in Fiscal Year 2026. More than $6.5 million in new requests were received, and only a cost-of-living increase for full-time equivalent employees, totaling $564,000, is funded, leaving $2.8 million in unmet needs.

Williamsburg Redevelopment & Housing Authority - $721K

Several years ago, the City Council established a budget priority of funding the Williamsburg Redevelopment and Housing Authority (WRHA) without federal assistance to complete the merger of WRHA with the City government. This change would reduce reliance on the federal government for funding, limitations on improving public housing, and operational costs. This priority is unfunded in the FY26 budget.

In October each year, the City opens applications for outside agency funding. Associated staff, committees, and the City Council consider these applications. This year, the City received five new applications from previously unfunded agencies. These requests totaled $175,000; none are funded in the FY26 budget.

The adopted budget includes estimates for state funding revenue streams. Adjustments may need to be made once there is clarity regarding the continued availability of federal assistance programs.

The primary request of each department included new employees to assist with meeting increased workloads, improve staff coverage, and provide redundancy of coverage. The total number of unfunded but requested FTE positions for the FY26 budget is 21.5, which would have added $1.9 million in new personnel costs to the operating budget. Positions requested but unfunded include:

POLICE

6 FTEs ($475K)

• Patrol Officers

PUBLIC WORKS & UTILITIES

6 FTEs ($439K)

• Landscaping, general management and oversight, and facilities maintenance

FIRE

5 FTEs ($658K)

• 3 Firefighters, 1 Captain, 1 Community Risk Reduction

WILLIAMSBURG REDEVELOPMENT & HOUSING AUTHORITY

1 FTE ($83K)

• Neighborhood Revitalization Coordinator

PARKS & RECREATION

1 FTE ($84K)

• Farmers Market administration

PLANNING & CODES COMPLIANCE

1 FTE ($74K)

• Administrative support

VOTER REGISTRAR

0.5 FTE ($15K)

• Election support staff

ECONOMIC DEVELOPMENT & TOURISM

0.5 FTE ($21K)

• Existing business service and administrative support

CITY MANAGER’S OFFICE

0.5 FTE ($21K)

• Communications support

The Fiscal Year 2026 Adopted Budget includes two significant impacts on our community: addressing the needed upgrades to our public utility, which manufactures and distributes potable water while collecting and transferring wastewater for treatment, and increasing revenues to address the structural imbalance in our capital plan.

As we move through FY26 and the nine years that follow, we must closely monitor our progress on utility upgrades. Recent events in Virginia underscore the importance of maintaining a resilient water utility. Our position along Virginia’s coast makes us vulnerable to many threats to service. By implementing the warranted and necessary improvements through a long-standing financing strategy of phased revenue bonds over the next 10 years, the City will be well-positioned to respond to any emergency without worrying about our water manufacturing and distribution system. Additionally, we are switching from quarterly to monthly billing to lessen the financial impact on our customers. We are also adopting the standard practice of having Hampton Roads Sanitation District (HRSD) directly bill for sanitary sewer services. We hope these changes to our billing will make it easier for residents to manage these expenses month to month.

At the same time, we will examine the increased revenue from meals, lodging, and admissions excise taxes. Raising these rates closer to, and in some cases exceeding, those of other cities in the region and state is likely a long-term solution to the structural imbalance in the capital plan as we try to meet the demands of our joint school system and community. While our tourism economy has shielded the City from recent economic challenges, we remain vulnerable to fluctuations in consumer confidence.

In light of national and international events, Virginia’s economy, and that of Greater Williamsburg is uncertain. However, recent investments in sports tourism, which tends to be a recession-resistant travel demand among families, are likely to generate significant new revenues. Annually, meeting the needs of our community will get more expensive, and more revenue is needed to meet the current and future demands of our locality despite substantial constraints on planned and requested spending. By increasing the excise tax rates, we can spread the cost of services across not only our thousands of residents but also our millions of visitors as well. The improved revenue likely meets the known needs of our community for many years.

Improved revenue should not also mean increased spending. The FY26 Adopted Budget reduces the requested expenditures of the Williamsburg government by $23.4 million in FY26 and $14 million over the next five years. As we watch the impacts of raising excise taxes and utility rates on our budget after Jan. 1, 2026, we will not rush to reinstate or expand projects. These changes are intended to preserve our low real estate tax rate and reduce the impact of revenue adjustments to meet the community’s needs and values. If we act too quickly to restore projects, programs, and staffing, we may erode the positive effects of prudent action.

We should also modernize the joint school contract with James City County. We have made significant progress over many months of discussion and negotiation. Now that the hiring process for a new superintendent has concluded, we can work more expeditiously to identify ways the funding partners and the School Board can collaborate to improve available funding in a dependable and dedicated way to address student outcomes. Community wealth building begins with a strong education system, and investing in education will pay dividends in future years.

When we look at financial news from around the world, the word we hear most often is “uncertainty.” We can and have taken the steps to be ready for whatever “uncertainty” might mean as we move into the next fiscal year. If the worst occurs, we will be grateful for actions taken that shore up revenues and trim expenses. However, we have faced challenges in the past, and the City of Williamsburg has emerged from such periods stronger.

Looking around at our community, I know you are as proud as I am of what we have accomplished in a few short years. We have not shied away from the tough challenges like improving our education system, addressing generational needs in public safety, and launching new programs to meet the needs of the most vulnerable in our community – and our community is better for it. Williamsburg has nearly 16,000 residents from all walks of life who welcome millions more visitors each year to share in the community we love. We are all working to preserve and grow what makes Williamsburg special. While it is easy to become mired in our own thoughts and ideas about what preservation or growth means, Williamsburg has consistently evolved to meet the needs of the many since 1699. Our community has served as a beacon for this nation’s founding, and continuing to be that model remains our aspiration.

As I consider the whole of Williamsburg, I see that my friends, neighbors, and colleagues are helping us earn that reputation anew every day. Thank you for the continued honor of serving as your city manager. I am privileged to offer the City of Williamsburg’s Fiscal Year 2026 Adoption Budget in the pages that follow.

Andrew Omer Trivette

PREPARED BY

Andrew O. Trivette, AICP, ICMA-CM

Andrew Trivette was appointed to the role of City Manager in 2018 after joining the City team as Assistant City Manager in 2016. He has 25 years of experience in local government.

Barbara Dameron has served as the City’s Finance Director since 2018. She has 26 years of governmental finance experience, 14 years of private sector accounting experience, and is a CPA. Currently, she is a member of the GFOA’s Accounting, Auditing, and Financial Reporting Committee and is a past president of the Virginia Government Finance Officers Association.

Davin Diesburg was hired as a budget analyst in the summer of 2023. He is a Spring 2023 Graduate from Old Dominion University with a bachelor’s degree in Business Administration Finance.

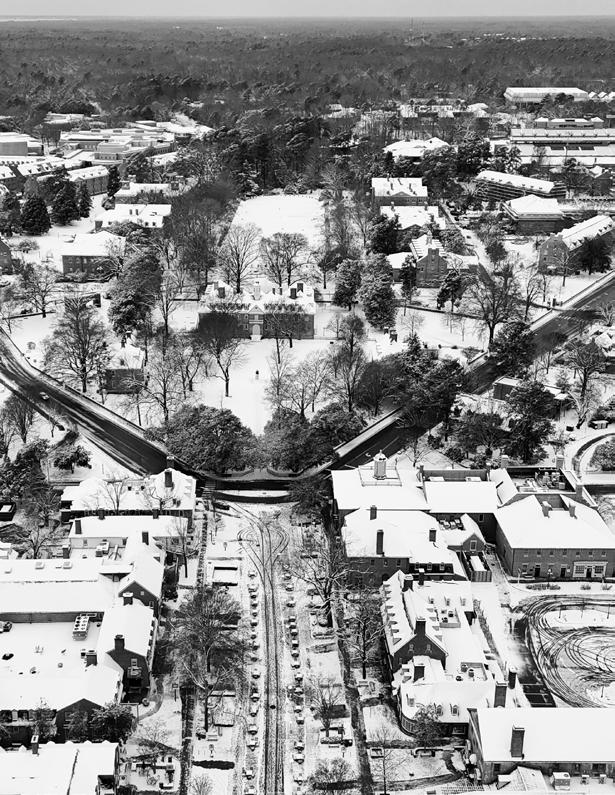

Williamsburg was founded as the capital of the Virginia Colony in 1699 and celebrated its 300th anniversary in 1999. Founded in 1607, Jamestown was the original capital and first permanent Englishspeaking settlement in the New World. Colonial leaders petitioned the Virginia Assembly to relocate the capital from Jamestown to Middle Plantation, 5 miles inland between the James and the York Rivers. The new city was renamed Williamsburg in honor of England’s reigning monarch, King William III. From 1699 to 1780 Williamsburg was the political, cultural, and educational center where the dream of American freedom, independence, and self-government was nurtured by the leadership of historical figures such as George Washington, Thomas Jefferson, George Mason, and Peyton Randolph.¹

Williamsburg was one of America’s first planned cities. Laid out in 1699 under the supervision of Gov. Francis Nicholson, it was to be a “new and well-ordered city” suitable for the capital of the largest and most populous of the British colonies in America. A succession of beautiful capitol buildings became home to the oldest legislative assembly in the New World. The young city grew quickly into the center of political, religious, economic, and social life in Virginia.²

Williamsburg also became a center of learning. Famous political leaders emerged from the College of William & Mary, founded in 1693, such as Presidents Thomas Jefferson, James Monroe, and John Tyler. Today, William & Mary is the second-oldest higher learning institution in the U.S.

In 2025, the university ranked No. 54 in National Universities and No. 6 in Best Undergraduate Teaching.³ Although William & Mary has a 332-year history, it remains a cutting-edge research university that is innovative, vibrant, and engaged. As a public university, William & Mary is an important partner in the region’s economic success, both in terms of local and regional impact, as it collaborates with businesses, nonprofits, and the public sector to strengthen the economic core.

Eastern State Hospital, the first hospital established in America for the care and treatment of mental illness, was founded in Williamsburg in 1773. The public hospital was built near the College of William & Mary in what is now known as Colonial Williamsburg. While the hospital remains in operation today, it has since moved from the original restored building to a new location on the outskirts of Williamsburg.

In 1780, the capital was again moved, this time up the James River to Richmond, where it remains today. Williamsburg reverted to a quiet college town and rural county seat. In retrospect, Williamsburg’s loss of capital city status was its salvation, as many 18th-century buildings survived into the early 20th century. The restoration of Williamsburg began in 1926, after the Rector of Bruton Parish Church, the Rev. W.A.R. Goodwin, brought the city’s importance to the attention of John D. Rockefeller Jr., who then funded and led the massive reconstruction of the 18th-century city we see today. National attention soon focused on the restoration effort. During a landmark visit in 1934, Franklin D. Roosevelt proclaimed its main thoroughfare, Duke of Gloucester Street, “the most historic avenue in America.”

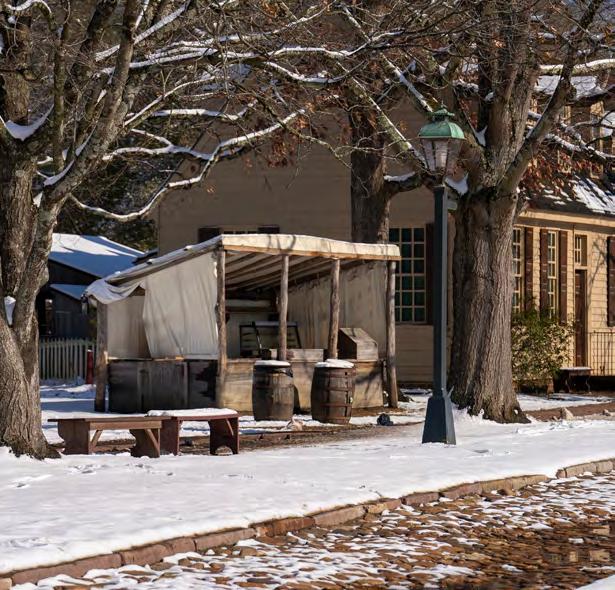

Today, Colonial Williamsburg is still the only place that takes you back to a time when our country was being born, and the ideals that established the United States of America were being defined. In the Historic Area of the City, the 18th century is happening right now. You can step back in time and experience the people who made America.3

Downtown Williamsburg is adjacent to the Historic Area and offers 21st-century shopping and dining experiences – both indoors and outdoors. From April through November, you can enjoy a Saturday morning at THE WILLIAMSBURG FARMERS MARKET. Flowerbeds and benches offer a tranquil setting for market shopping while listening to live music. This award-winning produce-only market offers vegetables, fruit, fish, meats (including free-range chickens, beef, lamb, and pork), artisan cheese, honey, peanuts, baked goods, pasta, handmade soap, potted plants, cut flowers, and many other offerings.

The SHOPS AT HIGH STREET offer the perfect combination of dining, entertainment, and shopping. This area also offers a special community of luxurious condominiums, townhomes, and apartments – a vibrant downtown within a neighborly embrace.

MIDTOWN ROW, opened in 2021 in the heart of Williamsburg. This unique experience-based retail, entertainment, and residential district is adjacent to the campus of William & Mary, less than a mile from Colonial Williamsburg, and near Jamestown, Yorktown, Busch Gardens, and Water Country USA. The development is designed as a pedestrian- and bicycle-friendly community with a village green, where outdoor programming and community events are hosted. Midtown Row includes restaurants, 233,047 square feet of retail space, 6,219 square feet of premium office space, entertainment, and new residential apartments that accommodate up to 628 residents.

QUARTERPATH AT WILLIAMSBURG is a community designed to support a life of wellness. The neighborhood has walking trails, greenspaces, and world-class healthcare, anchored by Riverside Doctors' Hospital Williamsburg. This mixed-use village also features shops, restaurants, and office space.

One Williamsburg that is courageously leading, innovating a modern city, prioritizing safety and wellness, engaging with our partners, while connecting with the world.

WILLIAMSBURG-JAMES CITY COUNTY PUBLIC SCHOOLS (WJCC) serves the students of the City of Williamsburg and James City County. There are 16 schools: nine elementary, four middle, and three high schools. Of the 11,900 students served, about 10.4% are City residents.

All WJCC schools have earned full accreditation for the 18th year in a row. WJCC ranked 9th out of 130 Virginia school divisions in Niche’s 2025 Best School Districts rankings, scoring an overall A grade in this rigorous assessment of academic and student-life data.4

Tourism has historically been the economic backbone of this region. The area’s rich history provides a journey into the battles and sacrifices that secured the nation’s liberty and independence. Sharing this history requires both marketing and infrastructure. Legislation passed by the General Assembly of Virginia (Senate Bill 942) on April 18, 2018, created a revenue stream to assist with promoting the region’s many attractions. The bill established a 1% sales tax for the Historic Triangle (City of Williamsburg, James City County, and York County). Fifty percent of this tax fund goes to the Williamsburg Tourism Council (Visit Williamsburg) for the marketing, advertising, and promoting of the Historic Triangle as a tourism destination. The other half of this tax is distributed to the locality in which the tax was collected. The City of Williamsburg contributes its share of the tax to fund the Tourism Development Fund (TDF).

The purpose of the TDF is to increase patronage to restaurants, attractions, hotels, and events in the City of Williamsburg through financial assistance and reinvestment in tourism products, place-making projects, and public-private partnerships. Through an application process, the first series of grants were awarded in 2019. The TDF paused in Fiscal Year 2020 due to the pandemic and relaunched for its second full award cycle in February 2023. The

TDF also contributes to annual tourism-related outside agencies and has an annual grant program for events.

The City of Williamsburg operates under the Council-Manager form of government. The members of City Council are elected at- large and consist of a mayor, vice mayor, and three other members. City Council members serve four-year staggered terms, with the mayor selected from among City Council members every two years. The mayor serves as chair of City Council and the official head of City government.

City Council performs the legislative function (establishes laws and sets policy) and appoints a city manager to administer the day-to-day operations of the City and to serve as the chief advisor to City Council.

Williamsburg is in the northern part of the Hampton Roads metropolitan area, located on the Virginia Peninsula and bordered by the counties of James City and York. The City is located along Interstate 64, with easy access to Richmond, Virginia Beach, and the East Coast. The City has a unique blend of history, tourism, college, and a small-town feel with the benefit of access to big-city amenities.

The City offers numerous festivals and special events throughout the year, including:

• An Occasion for the Arts – an arts and music festival, complete with food vendors

• Williamsburg Christmas Market – on select days in November and December, enjoy craft vendors, Santa visits, live entertainment, and gluhwein in a European-style village

• Winter Blues Jazz Festival – a fourday jazz festival

• Ampersand International Arts Festival (formerly William & Mary Global Film Festival) – an annual celebration of film and live performances

• Grand Illumination – Colonial Williamsburg’s annual winter holiday celebration with unique decorations, musical performances, and fireworks

There is no better way to celebrate our nation’s birth than spending July 4th in Williamsburg. Activities stretch from morning until after sundown. There are historic reenactments to enjoy as well as concerts, recreational activities, and a variety of foods –everything from hot dogs to gourmet dining. At nightfall, the historic area adds the finishing touch to the celebration with an amazing firework display.

The City of Williamsburg has a strong commitment to providing quality parks, recreation programs, and facilities that make Williamsburg a premier community in which to discover, imagine, and grow. Williamsburg maintains 12 parks that provide residents with varied uses, from passive activities to structured play. Park amenities include playground equipment, sand volleyball, tennis, basketball, picnic pavilions, athletic fields, and outdoor fitness equipment. Nestled among the trees is the scenic 2,705-acre WALLER MILL PARK. Featured at the park is a 360-acre reservoir that is open for fishing, boating, pedal boating, canoeing, and kayaking. There are over 7 miles of hiking trails with water and wooded views. Additional park features include an 18-hole disc golf course, playground structures, picnic shelters, grills, wheelchair-accessible docks, watercraft rentals, and a 1.5-acre fenced dog park with agility equipment.

The QUARTERPATH RECREATION CENTER is a 35,000-square-foot facility that offers a wide array of activities and amenities. Various instructional classes, athletic programs for youth and adults, sports camps, open gym time, and special events are held throughout the year at this facility. There are four rooms available for rent that are ideal for meetings, sports banquets, birthday celebrations, and other special events.

The PARKS & RECREATION DEPARTMENT is proud to host a variety of special events throughout the year that contribute to the individual, social, economic, and environmental health and well-being of our community. You can learn to play pickleball at a clinic or participate in a pickleball tournament. Bring Fido to Pups in Pastels, our dog Easter egg hunt, or our Canine Carnival. Let your kids drop a line at our Kids Fishing Derby or go dip netting for the invertebrates that call the reservoir their home in our Water Exploration Program. There are endless opportunities to get outside and get active with Williamsburg Parks & Recreation.

The WILLIAMSBURG

(WRL) enriches lives, opens doors to new learning experiences, and welcomes everyone. Named the 2023 Virginia Library of the Year by the Virginia Library Association, WRL is a key part of our vibrant community, offering collections, programs, and services for all ages. Residents can watch and listen to thousands of streaming movies, music, and audiobooks as well as read ebooks and magazines at wrl.org.

People interested in learning a new life skill such as crocheting, using a green screen, or speaking a new language can access thousands of online instructional videos on the library website.

Visitors to our library buildings can explore new book displays and discover copies of the hottest bestsellers as well as audiobooks and DVDs, pursue in-depth reading and research, consult expert staff, and experience the visual arts, multi-media presentations, and interactive learning. The library offers a wide range of film series, talks, book groups, concerts, and performances for all ages. Residents can be part of a local community of readers and learners, make new friends, bring their families to take part in a hands-on learning activity, or just sit back and enjoy a great read.

The Regional Library serves Williamsburg, James City County, and York County with two locations: one in downtown Williamsburg and one in James City County. Also available is a mobile library, which has scheduled stops in neighborhoods, adult care facilities, camps, preschools, and schools.

The Williamsburg Police Department (WPD) is celebrating its 37th anniversary as a CALEAaccredited agency, the gold standard in policing. The WPD is committed to ensuring the safety and security of all residents and visitors to the city through community engagement in all areas of service, including the Neighborhood Resource Officer Program that assigns a dedicated police officer to each neighborhood in the city.

WPD is currently staffed with 52 career personnel who manage approximately 41,000 calls per year. All officers are required to attend Crisis Intervention Training as well as verbal de-escalation training to ensure an officer’s presence creates the opportunity to manage situations without the need for higher levels of force whenever possible.

The WPD is committed to technology as a force multiplier. The department has implemented

a citywide license plate reader program to quickly identify wanted vehicles that enter our community. In addition, officers are required to use body-worn and in-car cameras during police incidents. At the same time, WPD maintains best practice policies to purge data to best protect the rights of residents. This technology aids with training, record-keeping, accountability, transparency, and overall efficiency of the agency. A Citizen Advisory Committee works to ensure the WPD is doing its very best every shift.

In addition to traditional law enforcement services like prevention, education and responding to police emergencies, officers are equipped with medical supplies, including Narcan, and are often the first on the scene for life-threatening medical emergencies.

In partnership with our public schools, WPD has assigned an officer to every City school. Events like Coffee with a Cop, Skate with a Cop, and Cone with a Cop offer a casual setting for the community to interact with officers of all ranks.

For more than 270 years, the Williamsburg Fire Department has protected our nation’s Colonial Capital and stands ever ready to serve all those who visit or call Williamsburg home. Through comprehensive emergency response to all hazard types and community-focused programs, the department strives to ensure the safety and well-being of all.

The Fire Department is currently staffed with 46 career personnel. Personnel are cross-trained to handle both fire and emergency medical services (EMS). In 2024 the department responded to 4,729 calls for service, a decrease of approximately 5.65% compared to in 2023.

The department’s Community Risk Reduction Division works to identify and prioritize local risks and to strategically invest resources to reduce their occurrence and impact. This comprehensive approach has several supporting programs like smoke alarm checks and installations, child safety seat education, fire inspections, home safety surveys, and public education events.

The department reached more than 3,373 people members through its community risk reduction programs in 2024.

The City’s Mobile Integrated Healthcare (MIH) program supported more than 76 clients and community members through a total of 2,085 interactions in 2024.

The Community Emergency Response Team (CERT) is also a vital outreach program that utilizes community members to assist with the safety and well-being of our neighborhoods and serves as an integral part of the City’s emergency management and preparedness efforts.

Since 1754, the Williamsburg Volunteer Fire Department has supported the community. The organization is made up of 23 local and collegiate members. In 2024, members of the program provided more than 3,413 service hours to the community. The volunteer organization is a 501(c)(3) and assists with purchasing supplies and equipment needed to support Williamsburg’s career staff.

1,095,969

Circulated Items in FY24

*as of June 1, 2025

A Population of 15,564 in 2023

Age* Gender*

8,225 FEMALE

7,339 MALE 1-17 18-24 25-34

*per U.S. Census 2023

CURRENT & NINE YEARS AGO

EMPLOYER

1 Includes part-time and seasonal employees

Source: Virginia Employment Commission; https://virginiaworks.com/

1 Weldon Copper Center for Public Service - Demographics Research Group, demographics.coopercenter.org ² U.S. Dept of Commerce, Bureau of Economic Analysis, Regional Economic Data—Statistical Areas/Metropolitan Counties by State income & area population figures based on figures for the City of Williamsburg and neighboring James City County combined ³ Williamsburg-James City County Public Schools 4 Virginia Employment Commission; https://virginiaworks.com/

1 “Brief History.” City of Williamsburg, williamsburgva.gov/490/History-of-City-Government. Accessed April 7, 2021.

2 “College of William & Mary.” U.S. News, usnews.com/best-colleges/william-andMary-3705. Accessed April 7, 2021.

3 “Explore Colonial Williamsburg.” Colonial Williamsburg, colonialwilliamsburg.com/explore Accessed Aug. 20, 2018.

4 Williamsburg-James City County Public Schools, wjccschools.org. April 2024

To advance our City’s vision, every two years the Williamsburg City Council identifies new strategic initiatives for our city government. The Williamsburg City Council and staff presented the 2025/2026 Goals, Initiatives, and Outcomes in the Fall of 2024.

In 2020, the City of Williamsburg launched a new vision statement that is meant to carry us through the next two decades. It is our vision for the Williamsburg of 2040, and we will fulfill that vision with a strategic approach.

Goals, Initiatives, and Outcomes (GIOs) provide an expression of priorities, as specific and measurable as possible, and cover a twoyear period. They are not intended to be a comprehensive list of all city services and activities. Instead, GIOs are a concrete, coordinated expression of the City Council’s direction and focus. City Council will adopt new GIOs for 2027/2028 in the Fall of 2026.

The City of Williamsburg has a highly interactive strategic plan that links the GIOs to the City’s strategic plan, performance measures and budget. In the Budget Guide section of this document, there are details on the goal-setting process.

To obtain more information about the plan and to follow along with the progress, please visit williamsburgva.gov/GIO.

One Williamsburg that is courageously leading, innovating a modern city, prioritizing safety and wellness, engaging with our partners, while connecting with the world.

A welcoming city where all people who live, work, and visit have the opportunity to thrive, regardless of age, race, ethnicity, income, sexual orientation, religion, or gender identity. The culture of our city will promote a variety of housing and employment options that welcome a diversity of backgrounds and opinions.

Evaluate the establishment of a City of Williamsburg first-time homebuyers program, including consideration of lower down payments, better interest rates, closing costs assistance, grants, tax credits, and education.

Investigate the expansion of the City’s workforce housing program to include the development of lowdensity, low-impact housing on the City’s surplus properties.

Propose zoning amendments to enable additional detached accessory dwelling units for owneroccupied homes as a vehicle to make the home more affordable and facilitate aging in place.

Assess neighborhood support for a Highland Park CDBG Housing Rehabilitation Program as a tool to slow gentrification and enable generational home improvement.

Continue to preserve downtown neighborhoods and community character by considering the impact of a Preservation Assistance Program for those with income-based restrictions or first-time homebuyer status to make historic properties more accessible by defraying the costs of Architectural Review Boardcompliant renovations in historic neighborhoods.

Analyze the potential impact of a Contingent Interest Mortgage Program by identifying a lending partner or partners.

Continue to advance Truth & Reconciliation by issuing a Request for Proposals for the redevelopment of the Blayton and Triangle buildings that encourages minority respondents and provides for minority commercial tenants post-redevelopment.

Secure funding for Phase 2 of the African American Heritage Trail and substantially complete its construction by July 4, 2026, to include a trailhead at the corner of Virginia and Lafayette streets, offering an appropriate space for reflecting and gathering.

A commitment to leadership that is willing to embrace change with compassion, innovation, and aspiration to serve and engage the community. Our creativity, professionalism, and ability to deliver results will be recognized as a national governance model.

Carbon Emission Reduction

Formally establish the 40-By-40 Plan – the City Council’s desire to reduce the City’s carbon emission footprint 40% by the year 2040 – and identify reduction strategies.

Quantify the City resident student pre-K demand and identify strategies to supplement early childhood education inside the City, focusing on affordability and opportunity.

Review existing equity in education standards within the joint school division and research methods of pairing innovative curricula with the City of Williamsburg assets, such as William & Mary and Colonial Williamsburg Foundation, to improve opportunities for all children.

Modernize the joint operating contract for the public school division to identify existing models that have successfully differentiated and targeted resources to address specific challenges; facilitate improved student performance; streamline the education-to-career pipeline; and allow for smallerscale additive programs within the larger public school division.

Smart City Initiatives

Consider the deployment of Smart City infrastructure to enable better data collection and policy development in service areas such as parking, downtown trash collection, visitation, air quality, lighting, road conditions, and code enforcement.

Consolidate existing transitional and emergency housing programs in a new responsive housing model that is less reliant on grant funding.

The equitable enhancement and protection of our entire city’s natural beauty by respecting our past and building our tomorrow. Our modern city will include attractive streetscapes, diverse housing and employment options, inviting public spaces, appropriately located infill redevelopment, and modern connectivity — all to position our city so it can attract the next big opportunity.

Complete utility relocation and roadway improvements for the Capitol Landing Road Corridor and intersection of Capitol Landing and Bypass roads.

Identify a funding strategy for and work toward completing the construction of a downtown children’s park that complements the design requirements of the Historic Area and facilitates interactive history.

Commission the completion of a Comprehensive Plan that, when complete, recommends a Complete Streets Policy; considers the appropriateness of existing Architectural Review Board District boundaries; reviews opportunities for additional housing downtown, infill development, and two-story development requirements; identifies school planning concerns; includes a citywide pedestrian/bike plan that considers existing facility improvements, expansion of assets, and trail connectivity; and a revised economic development strategic plan that emphasizes economic diversification, including opportunities for a Research Village as part of the megaregion that satisfies requirements of the Virginia Business Ready Sites Program.

Following public input on the building’s design, select a general contractor, approve a finance plan, and begin construction for the replacement of the downtown library.

Placemaking

Continue to support existing special events inside the City and identify opportunities to further diversify the type and location of events offered.

Facilitate the expansion of public art by developing approved art installation locations, evaluating a temporary or rotating exhibit approach, and completing the installation of the first gateway lantern feature.

Initiate design and secure funding for additional access to the regional indoor sports center such that completion of the work coincides with the improvement of the Bypass-Capitol Landing Road intersection.

Focus economic development recruitment efforts on the redevelopment of existing hotel properties and consider highest and best use of City-owned properties along Capitol Landing Road.

Targeted services that support, improve, and sustain individual health and community safety. Our city will proactively address public safety and social health by daring to be creative in our practices as we address homelessness and racial equity, as well as pursue a robust parks and recreation system that reimagines the use of green space.

Continue implementation of the comprehensive enhancements plan for the City’s Parks & Recreation facilities to boost visitation through the reconstruction of the Kiwanis Park tennis courts, completion of a new Wales neighborhood playground and fence, and redevelopment of the Strawberry Plains neighborhood playground.

Identify locations for public restrooms and construct two public restroom sites.

Replace the stationary canoe/kayak launch at College Landing Park with a structured shoreline ADAcompliant launch that includes an accessible pathway.

Complete the utilities master planning process, establish a funding plan, and initiate two identified infrastructure improvements for the City’s system.

Consider opportunities for increased usage of the existing Waller Mill Park, reservoir, and surrounding City-owned land through the development of a Waller Mill Usage Plan.

Complete the improvement of Waller Mill Dam fortification to comply with the Department of Conservation and Recreation to secure against failure in the result of a worst-case rainfall event.

Collaborations that re-energize and reimagine relationships with our partners that result in mutual success. The city will leverage our position in the middle of the evolving Hampton Roads / Richmond Mega Region, establish future priorities with William & Mary and Colonial Williamsburg Foundation, and explore other partnership opportunities. The city will maximize strategic partnerships with James City and York counties, as well as expand our partner base to reinforce our national prominence and top-tier brand.

Research and deploy local government best practices for employment of or contracting for grant writing and management services as well as private fundraising for municipal projects.

Complete initial design of the Williamsburg live performance venue, determine regional support, and evaluate facility completion by July 4, 2026.

Continue to evaluate consistent parking hardware, software, and pricing models that emphasize convenience, ease of use, and turnover while implementing a new parking solution in the Prince George Parking Garage.

Regional Homelessness Strategy

Consider the findings of the regional Virginia Peninsula Homelessness Study and work to identify two regionally supported strategies.

Complete public review of the Williamsburg Rent Ready Program and consider adoption while planning for staffing needs.

Evaluate the cost, economic impact, and local need of additional sports tourism facilities associated with the regional indoor sports center, including aquatic and ice sports.

Leverage our strategic location on the Interstate 64 corridor to our economic advantage by expanding technology and infrastructure and ensuring the daily mobility of our residents and visitors.

15-Minute City

Expand Williamsburg Area Transit Authority Route 15 to connect the Colonial Williamsburg Historic Area and Transportation Center with the Monticello commercial corridor, including pharmacies, grocery stores, and general shopping areas using a 15-minute frequency and electric bus infrastructure.

250th Commemoration

Facilitate the work of the Williamsburg 250th Committee, with particular focus placed on completing the identified 250th legacy projects and measuring tourism impacts of 250th-related travel.

Identify the needed improvements to provide each City bus stop with a defined standard level of service, including a shelter and trash can, and then improve five stops to the new standard of service.

Support the continued expansion of broadband providers to improve pricing, availability, and speed while seeking an appropriate solution to provide internet connectivity as a next-generation public utility.

Revised Communication Strategy

Evaluate current public outreach tools for effectiveness; identify new approaches aligned with community input; and redesign communication approaches for greater engagement.

Trail757

Establish the Williamsburg portions of Trail757, including connection to the expanded Capital Trail by obtaining funding for Phase 3 of the College Woods Circuit and planning for the trail’s continued routing through the City.

The preceding section on the biennial Goals, Initiatives, and Outcomes links the City Council's six broad goals to 35 specific initiatives. Further, the preceding section identifies desired community outcomes that relate to each goal.

This next section aligns budget and performance data to the City’s operating departments. For each department, a summary page includes the department mission, expenditures, and staffing, covering four years. Importantly, desired community outcomes related to each department and observed outcomes are shown. Many of these measures parallel the measures arrayed under the six goals in the preceding section, including the National Community Survey™ (NCS) results and ratings. Comparisons of Williamsburg resident ratings with the national benchmark from the latest 2024 NCS results are shown for service areas.

Finally, under each department are the budgetary Cost Centers that comprise that department. Detailed information is presented, including four years of expenditures and staffing, as well as performance trends, projections, and targets. Performance metrics – including workload measures, efficiency measures, and other useful indicators of performance – are shown with operating data for the last two fiscal years, the projected number for the current year, and the target or expected number for next year.

To provide leadership, strategic direction, and administrative oversight to all aspects of City operations.

& STAFFING

CITY MANAGER

• Administration

• Clerk of Council

• Communications

• Human Resources

Receive improving National Community Survey ratings for indicators of overall community well-being and value of City services “higher” than the national benchmark.

Residents rated value of services for the taxes paid and quality of life “higher” than the national benchmark comparison, with all other results shown as “similar” to benchmark for 2024.

Percent Rating “Good” or “Excellent”

Overall quality of life in Williamsburg

Williamsburg as a place to live

Services provided by City

Value of services for the taxes paid

*Comparison to the national benchmark

Percent Rating “Good” or “Excellent”

Overall appearance of Williamsburg

Cleanliness of Williamsburg

Overall quality of new development

Quality of overall natural environment

Receive improving National Community Survey ratings for Overall Appearance, Natural Environment and Built Environment “higher” than the national benchmark.

The overall appearance and cleanliness and overall quality of new development and natural environment were all ranked “higher” than the national benchmark. The quality of overall natural environment ranked “similar” to the national benchmark for 2024.

*Comparison to the national benchmark

Receive improving National Community Survey ratings for Overall Image, Direction, Opportunities for Participation in Community Matters and Public Information Services “higher” than the national benchmark.

Overall image of Williamsburg rated “higher,” with all other responses “similar” to the national benchmark for 2024.

Percent Rating “Good” or “Excellent”

Overall image or reputation of Williamsburg

Overall direction that Williamsburg is taking

Opportunities to participate in community matters

Public information services

*Comparison to the national benchmark

Percent Rating “Good” or “Excellent”

Generally acting in the best interest of the community

Overall confidence in Williamsburg government

Overall customer service by employees

Receive improving National Community Survey ratings for other Governance survey responses “higher” than the national benchmark.

Overall confidence in Williamsburg and Generally acting in the best interest of the community ranked “higher” in 2024 in comparison to the 2022 NCS. All categories ranked similar to the national benchmark for 2024.

*Comparison to the national benchmark

Exceed budget expectations by having operating revenues exceed operating expenditures each year.

Operating revenues surpassed budgeted expectations and mirror pre-pandemic percentage variances.

Maintain sound fiscal health by exceeding City Council’s reserve policy of a minimum 35% of operating revenues each year.

Shown is year-end unassigned fund balance. Prior to July 1, 2019, the General Fund and the Capital Improvement Fund were combined for reporting purposes. Effective July 1, 2019, the General Fund was reported separately for transparency. The year-end fund balance for FY18 has been restated.

*Unaudited

Maintain annual employee turnover rate of 10% or less of the permanent workforce.

This is an indicator of retention of employees who resign, retire, or otherwise terminate employment. The Covid-19 pandemic skewed the FY21, FY22, and FY23 results. The 2024 average annual turnover rate for surrounding localities is 15.2%.

To drive economic growth in Williamsburg through business support, strategic recruitment, tourism development, and public art – fostering a vibrant, diverse, and resilient local economy.

Receive improving National Community Survey responses for metrics related to business climate and economic vitality, with ratings “higher” than the national benchmark.

Received improved ratings related to Economic Development and Williamsburg as a place to work, though ratings for both, with the addition of employment opportunities, remain “similar” to the national benchmark for 2024.

Percent Rating “Good” or “Excellent”

Economic development

Employment opportunities

Williamsburg as a place to work

*Comparison to the national benchmark

Percent Rating “Good” or “Excellent”

Variety of business and service establishments

Overall quality of business and service establishments Shopping opportunities

Receive improving National Community Survey responses for the quality, variety, and availability of business and shopping opportunities, with ratings “higher” than the national benchmark.

Shopping opportunities were rated “higher,” while variety and quality of business and service establishments were rated “similar” to the national benchmark.

*Comparison to the national benchmark

Receive improving National Community Survey responses for Williamsburg as a place to visit, vibrancy of the downtown commercial area, and availability of inviting public spaces, with ratings “higher” than the national benchmark.

Residents rated public spaces and vibrancy of the downtown commercial area as “higher,” with Williamsburg as a place to visit rated “much higher” than the national benchmark.

Percent Rating “Good” or “Excellent”

*Comparison to the

To provide exceptional stewardship and safeguarding of City assets by maintaining financial management, reporting and internal control systems, with accountability to the public in a responsible and timely manner.

Maintain real estate property tax collections of at least 98% annually.

Finance collects all City revenues, with Real Estate Taxes being the single highest revenue source. Collections rates consistently fall between 97% and 99% each year. Staff follow-up on delinquent accounts raises collections close to 100% in subsequent years.

Maintain Personal Property tax collections of at least 97% each fiscal year.

Personal property tax collections include the State’s $773K Personal Property Tax Relief Act program each year. Follow-up action on delinquent accounts includes state programs with debt set-off and DMV matching to increase collections in subsequent years.

Maximize yield on investments while maintaining stringent City policy requirements of safety and liquidity.

City’s investment portfolio diversified earning average yield of 1.08% fully insured by FDIC, with balances in State Local Government Investment Pool (LGIP), bond proceeds in State Non-arbitrage Investment pool, SNAP, and interest-bearing checking accounts.

Maintain residential property assessments at 99.5% of market value.

The City Assessor closely tracks all property sales. Assessments are based on the latest market sales of properties with similar characteristics, including neighborhoods.

Residential Properties

To provide exceptional information technology systems and services to our customers, both internal and external, that support the mission of the City of Williamsburg in an efficient and cost-effective manner.

& STAFFING

Respond to all IT Helpdesk service calls in less than two hours.

Helpdesk response time achieved the goal of being less than two hours in FY 2024. The average response time for all Helpdesk service calls since FY 2015 is 2.57 hours.

Increase website visitors by 10% annually.

Overall website traffic decreased in FY 2024 compared to FY 2023. Alternatively, website traffic has increased since pre-pandemic levels. This can be attributed to improved interconnectivity with social media sites.

Expand the use of the City’s website to conduct City business by increasing eGov transactions at least 10% annually.

The total number of eGov transactions increased significantly from FY15 through FY24. Transactions have steadily increased since FY22.

Increase total dollar amount of online transactions received from residents by 10% annually.

$4,000,000

$3,500,000

$3,000,000

Financial transactions over the City's website totaled $22.2 million from FY15 through FY24. The average increase in receipts over the 10 fiscal years was 13.6%.

$2,000,000

$1,500,000 $2,500,000

$1,000,000

To work in partnership with the residents of Williamsburg, providing a safe and secure environment consistent with community values, with an emphasis on responsive community-based policing, integrity, fairness and professionalism.

LAW ENFORCEMENT OPERATIONS

• Support Services

• Uniformed Bureau

• Investigative Bureau PUBLIC SAFETY COMMUNICATIONS PARKING GARAGE

*City is part of consolidated E-911 operations with neighboring James City County and York County.

Receive improving National Community Survey ratings for all services provided by the Police Department “higher” than the national benchmark.

The percentage of Williamsburg citizens’ ratings of “good” or “excellent” were “higher” for crime prevention, with police services and traffic enforcement “similar” compared to the national benchmark for 2024.

Percent Rating “Good” or “Excellent”

*Comparison to the national benchmark

Percent Rating “Good” or “Excellent”

Safety in your neighborhood

Safety in downtown/ commercial area

Overall feeling of safety in Williamsburg

Receive improving National Community Survey responses “higher” than the national benchmark for resident ratings when asked if they feel safe in the City.

Overall safety is “higher” than national benchmark. Other responses for FY 2024 were “similar” to the national benchmark for the other categories.

*Comparison to the national benchmark

Maintain an average response time of three minutes or less for service calls. Response time is measured from the time the call is received by a regional dispatcher to arrival at the scene.

Police response time target of three minutes or less has been met from FY 2014 through FY 2018 and in FY 2024.

Clear Part I crimes at a rate above the national average. Part I crimes are major crimes such as murder, rape, robbery, aggravated assault, burglary, larceny, and auto theft.

Williamsburg’s Police Department clearance rates for Part I crimes averaged 42% in FY 2024. This is 66.3% higher than the national rate.

To ensure a prompt, safe and timely response to emergencies of an all-hazards nature. To diligently enforce all life safety measures to ensure a safe and livable community for residents and visitors.

FIRE SUPPRESSION

FIRE PREVENTION & EDUCATION

EMERGENCY MEDICAL SERVICES

EMERGENCY MANAGEMENT/ DISASTER PREPAREDNESS

Note: Emergency Management staffing provided by the Fire Department included above.

Receive improving National Community Survey ratings for all services provided by the Fire Department “higher” than the national benchmark.

Residents rated “similar” to the national benchmarks in all survey categories for 2024.

Percent Rating “Good” or “Excellent”

Fire services

Emergency medical services (EMS)

Fire prevention & education

Emergency preparedness

*Comparison to the national benchmark

Maintain an average fire response time of five minutes or less, from the time calls are received to arrival of first apparatus on the scene.

Average response times have increased gradually since FY15, driven by rising call volumes. In FY23, moving to temporary facilities and higher demand contributed to a further increase. While response times stabilized since moving into the new station, they remain above the target due to increased call volume, population growth, and traffic congestion.

Maintain an average Emergency Medical (EMS) response time of five minutes or less, from the time calls are received to arrival of first apparatus on the scene.

Average response times have increased gradually since FY15, driven by rising call volumes. In FY23, moving to temporary facilities and higher demand contributed to a further increase. While response times stabilized since moving into the new station, they remain above the target due to increased call volume, population growth, and traffic congestion.

To provide a safe and efficient transportation system, including effective signage, beautiful landscaping of City-owned properties, and maintenance of Cedar Grove Cemetery.

ENGINEERING, STREETS, STORMWATER OPERATIONS

REFUSE & RECYCLING COLLECTION

BUILDINGS & FACILITIES MAINTENANCE LANDSCAPING CEMETERY

Percent Rating “Good” or “Excellent”

Receive improving National Community Survey ratings for street services provided “higher” than the national benchmark.

Street repair and street cleaning were rated “higher” than national benchmark with all other categories rated “similar” to the national benchmark for 2024.

*Comparison to the national benchmark

Increase residential participation in the citywide recycling program.

Target set-out rate for recycling material is 65%. Recycling information is available to residents in a variety of ways, including the City’s website, the Williamsburg Farmers Market during summer months, and the Neighborhood Council of Williamsburg.

To meet the state goal of recycling 25% of the City’s solid waste stream each year.

Since 2015 the City has exceeded the State’s 25% goal. For 2024, the recycling rate was 25%.

Percent Rating “Good” or “Excellent”

Receive improving National Community Survey ratings for essential services provided by the Public Works department “higher” than the national benchmark.

Garbage collection and recycling are contracted services. All survey responses were “similar” to the national benchmark for 2022.

*Comparison to the national benchmark

To provide quality recreational facilities, parks and programs that are safe, diverse, affordable and enriching to the community through our commitment to public service.

& STAFFING

Percent Rating “Good” or “Excellent”

Recreational opportunities

City parks

Recreation programs or classes

Recreation centers or facilities

Receive improving National Community Survey ratings for Recreation services and facilities “higher” than the national benchmark.

All survey responses were “similar” to the national benchmark for 2024.