By Serhat Oztop

As the new leader of Home Lending at Wells Fargo, I’m really excited to jump in. I’ve got a clear idea of where we’re headed, with a focus on making things simpler and better for our customers. With a strong background in financial services and a passion for expanding access to homeownership, I step into this role at a time when our commitment to serving low-to-moderate income communities is more important than ever.

Wells Fargo remains focused on helping address the homeownership gap in a sustainable and impactful way. This includes not only our internal efforts but also close collaboration with industry partners, government agencies, and local stakeholders in markets across the country. Our goal is to create lasting pathways to homeownership that reflect the diverse needs of the communities we aim to empower.

One of the most powerful examples of this commitment is the Homebuyer Access grant we launched in July 2023. This grant provides $10,000 in down payment assistance for eligible homebuyers in selected areas and has now ex-

In Memoriam Dr. Calvin W. Rolark, Sr. Wilhelmina J. Rolark

PUBLISHER

Denise Rolark Barnes

THE WASHINGTON INFORMER NEWSPAPER (ISSN#07419414) is published weekly on each Thursday. Periodicals postage paid at Washington, D.C. and additional mailing offices. News and advertising deadline is Monday prior to publication. Announcements must be received two weeks prior to event.

Copyright 2016 by The Washington Informer. All rights reserved. POSTMASTER: Send change of addresses to The Washington Informer, 3117 Martin Luther King, Jr. Ave., S.E. Washington, D.C. 20032. No part of this publication may be reproduced without written permission from the publisher. The Informer Newspaper cannot guarantee the return of photographs. Subscription rates are $55 per year, two years $70. Papers will be received not more than a week after publication. Make checks payable to:

THE WASHINGTON INFORMER

3117 Martin Luther King, Jr. Ave., S.E

Washington, D.C. 20032

Phone: 202 561-4100

Fax: 202 574-3785

news@washingtoninformer.com

www.washingtoninformer.com

STAFF

Micha Green, Managing Editor

Ron Burke, Advertising/Marketing Director

Shevry Lassiter, WIN-TV Producer

Ra-Jah Kelly, Digital Asset Manager

Lafayette Barnes, IV, Editor, WI Bridge DC

Desmond Barnes, WIN Daily Editor

Anthony Tilghman, Social Media Strategist

ZebraDesigns.net, Graphic Design

Mable Neville, Bookkeeper

Angie Johnson, Office/Circulation Manager

Jada Ingleton, Content Editor

REPORTERS

Stacy Brown, National Reporter

Sam P.K. Collins, Political/Education Reporter

Brenda Siler, Lifestyle Reporter

Ed Hill, Sports Reporter

Richard Elliott, Reporter

James Wright, Business Reporter

Skylar Nelson, Sports Reporter

Mya Trujillo, Environmental and International Reporter

PHOTOGRAPHERS

Shevry Lassiter, Photo Editor

Ja Mon Jackson, Asst. Photo Editor

Roy Lewis, Jr.

Robert R. Roberts

Anthony Tilghman

Abdullah Konte

Cleveland Nelson

INTERNS

Keith Golden Jr., Fall Intern

By Micha Green WI Managing Editor

Happy October!

It’s that time of year where the weather is changing, the leaves are beginning to fall and many people are already preparing for the rush of expensive holidays starting at the end of the month: Halloween, Thanksgiving, Christmas, and even the New Year! The final quarter of the year is a great time to start working to get personal finances in order and set financial goals for 2026.

Moreover, while knowing how to save money has always been key, financial literacy is becoming increasingly important as the nation faces challenging socio-economic times: a federal government shutdown, people searching for jobs as a result of the Department of Government

panded to 23 markets. Since its inception, the grant has helped over 700 homebuyers achieve their homeownership goals.

Potential homebuyers looking to purchase a home in any of the eligible areas and those who currently live in those areas can find out more about the program, including how to contact a local Wells Fargo Home Lending office, at https://wellsfargo.com/homegrant.

We continue to build on this momentum, ensuring that our products and services are inclusive, innovative, and responsive to the evolving needs of our customers. Our focus on community impact will help shape the future of Home Lending at Wells Fargo and reinforce our role as a trusted partner in the journey to homeownership.

I’ve witnessed the transformative power of this program. The Homebuyer Access Grant isn’t just financial assistance, it’s a launchpad for generational progress. Hearing directly from individuals who’ve unlocked homeownership through this initiative is a powerful reminder: a single, well-placed opportunity can turn long-held aspirations into lasting realities.

g

Efficiency’s (DOGE) federal furloughs, cuts to diversity, equity and inclusion programming and funding, and inflation, to name a few.

“The economy is on ice: hiring has slowed, prices for essentials are up, and consumer confidence is down. Because of the Republican tax bill, families face massive premium hikes and millions risk losing insurance,” Breyon Williams, chief economist with Groundwork Collaborative, wrote on X Sept. 30, the day before the official start of the government shutdown. “This shutdown fight is clear: one side is trying to stop the damage to working families, the other is prioritizing the wealthiest 1 percent.”

In addition, while Americans across the country are working to pay household expenses and navigating uncertainty at the moment, Black communities nationwide— with many already facing housing, economic, health and educational disparities— are feeling the sting in a major way.

“Black women bear the brunt of everything because when white folks get a cold, we get pneumonia, but the point is this harm is coming for everyone,” Rep. Ayanna Pressley said during the Congressional Black

Caucus Foundation 54th Annual Legislative Conference in a discussion about her work in Congress to uplift Black women and families. Despite tough times, The Washington Informer is here to offer tips and tools for navigating this moment and beyond. Although it's tough to “budget while broke,” this edition has some suggestions to make saving a bit easier even when money is tight. Further, while it might be hard trying to keep up with technological and economic developments such as crypto, this special edition works to break down the digital currency and how African Americans are engaging with and investing in cybercash assets. With shopping about to commence for Halloween costumes and candy, Thanksgiving feasts, and Christmas and Kwanzaa treats, hold onto this special edition as a resource this year and going forward, as it has a lot of useful information to help save money, make smart investments and create generational wealth.

And, remember, sharing is caring! Pass on this financial literacy edition to family and friends so the whole crew is set up for financial success! g

What does it mean to be self-employed?

Submitted by Wells Fargo Home lending

If you’re self-employed or own a business, you may be wondering if it’s possible to get a mortgage.

The short answer is yes, you can, but the process will look different. You’ll need to provide documentation verifying your employment, and lenders will be analyzing your financial situation and the financial situation of your business to see how likely you are to pay back your loans in a timely manner.

To help you put your best foot forward, Wells Fargo is offering guidance on navigating the home loan process.

Typically, lenders consider an applicant self-employed if they meet any of the following:

• They own at least 25% of a business

• The ownership of a business is their major source of income

• They complete a 1099 tax form during tax filing instead of a W-2

• They’re an entrepreneur or sole proprietor whose income is filed under Schedule C of their tax returns

• They’re an independent contractor or service provider

If you fit into these categories, you’ll also need to show lenders verified employment records or proof of self-employment during the past two years. Lenders are ideally looking for your business to have been active for at least 12 consecutive months. They review the overall health of the business, looking at both net income and expenses.

What employment documentation is needed?

When lenders review your application, they’re analyzing items like how stable your income is, if your business has strong finances, and what the future may look like for you and your business. Any of the following forms of documentation can help you show lenders proof of your employment verification:

• Business licenses and/or DBA certificates

• Proof of correspondence with CPAs and/or clients

• Proof of business insurance

• Profit/loss statements or balance sheets reflecting your business’s performance Lenders’ requirements vary. Check with yours for what will be required for your situation.

What tax return requirements are needed?

Personal tax returns under IRS Form 1040 include various schedules. Commonly used schedules are:

• Schedule B (Form 1040) – Interest and ordinary dividends

• Schedule C (Form 1040) – Profit or Loss from Business (Sole proprietorship)

• Schedule D (Form 1040) – Capital Gains and Losses

• Schedule E (Form 1040) – Supplemental Income and Loss

• Schedule F (Form 1040) – Profit or Loss from Farming For business tax returns, a business may choose to report taxable income either on a calendar year or fiscal year basis. Commonly used forms include:

• IRS Form 1065 – U.S. Return of Partnership Income

• IRS Form 1120S – U.S. Income Tax Return for an S Corporation

• IRS Form 1120 – U.S. Corporation Income Tax Return

What factors show the strength of your borrowing ability?

Having a favorable debt-to-income ratio and credit score. A strong credit history shows lenders your ability to repay debts and utilize credit responsibly.

Staying organized. Keep expenses separate if you have multiple income sources, and separate business and personal accounts so that lenders can more easily tell which assets are which.

Having additional support, especially for closing. Certain factors may lower your risk for lenders, like utilizing a co-signer or borrower or paying a higher-percentage down payment than what’s required.

If you are self-employed, there are methods available to help make your goal of homeownership a reality. For example, eligible self-employed borrowers with Wells Fargo may have access to a variety of loans, such as VA or FHA loans or Wells Fargo products like Dream. Plan. Home. and the Homebuyer Access grant. Information can be found online about the eligibility requirements and personal tax implications of these products. Talk to a home mortgage consultant to learn more about what your mortgage process may look like. Also, check out Wells Fargo’s home lending portal for helpful articles and personalized rate quote tools.

“While self-employment makes obtaining a mortgage a bit more complex, your lender will walk you through the process, step by step,” says Rulon Washington, mortgage sustainability, Wells Fargo. g

Homeownership allows more households to gain access to a proven way to build personal and intergenerational wealth.

Markets change but that does not mean buying a home is out of reach. At Wells Fargo, we can help you navigate the home buying journey during all types of economic cycles.

Go to wellsfargo.com/mortgage/calculators to find calculators that can help you determine which mortgage options best align with your financial goals.

When you are ready to talk, our Home Mortgage Consultants are here to help you create a plan to optimize the benefits of homeownership now and over time.

Scan code with your mobile device camera to learn more about our Home Lending Priorities.

Ewunike N. Brady is a leader whose work is reshaping the future of homeownership. With over 20 years of experience in the mortgage industry, she has dedicated her career to expanding access to homeownership for multicultural communities. As Vice President of Customer Growth Segments at Wells Fargo Home Lending, Ewunike brings to her work passion, purpose, and a deep understanding of the systemic challenges that have historically limited homeownership opportunities.

In this Q&A, Ewunike shares her insights, values, and the driving force behind her commitment to helping families build generational wealth through homeownership.

Q: What inspires your work in homeownership?

Ewunike: My favorite part of the job is being part of the change. I have two quotes on my office wall that guide me: “Be the change you wish to see” and “Create the things you wish existed.” These are daily reminders that the work I do matters.

We’re at a pivotal moment in the mortgage and finance industry. The work we’re doing now is laying the foundation for a future where equitable access to housing is not just a goal, it’s a standard. Being able to contribute to increasing homeownership rates in the local communities is both an honor and a responsibility. It’s more than just helping individuals buy homes; it’s about empowering communities to thrive.

Q: What values guide your approach to this work?

Ewunike: Authenticity and connection are everything. I believe in showing up as my full self and building genuine relationships with the people I work with and serve. When you connect with people on a personal level, the work becomes more meaningful. It’s no longer just about metrics it’s about accountability to real lives

Q: “What are the foundational drivers of success in the housing industry today?”

Ewunike: Success in the housing industry today demands that organizations lead with purpose and integrity. When values are deeply embedded in how a company operates, they shape everything—from the products we deliver to the way we communicate and the impact we create. It’s not enough to make statements; we must live our principles through consistent, intentional action. This commitment must be active and visible in every decision, every interaction, and every outcome we pursue.

Q: What advice would you give to someone navigating the workplace while building toward long-term goals like homeownership?

Ewunike: Start by cultivating healthy habits early and practicing them consistently. That means prioritizing your physical and mental well-being, recognizing your value, and surrounding yourself with people who uplift and inspire you. Whether it's affirmations, scripture, or quiet reflection, find what keeps you grounded. Protect your peace so you can show up fully ready to lead with clarity and strength. And remember, just like homeownership, career growth is a journey. Stay intentional, build equity in your relationships and reputation, and invest in yourself every step of the way.

Q: What’s the best guidance you’ve received?

Ewunike: It wasn’t advice in words—it was a visual. A mentor once shared an image of a dove sitting calmly in the middle of a chaotic storm. That image stuck with me. It reminded me that no matter what’s happening around you, you must stay grounded and present. Whether you’re facing challenges or celebrating wins, being centered is key to leading effectively.

Q: Who inspires you most in your journey?

Q: What advice would you give to others who want to make an impact

Own your narrative. Share your story and your aspirations. People want to support you, but they need to know what you’re working toward. Be intentional about your goals and vocal about your purpose. That’s how you build momentum and attract allies who can help you move forward.

Ewunike: My daughter. At just nine years old, she’s, my hero. Her joy, innocence, and perspective remind me why this work is so important. I want her experience with homeownership to be empowering, not burdened by the inequities that shaped her parents’ and grandparents’ experiences. She’s my motivation to keep pushing for change.

Q: How do you support fellow women in your field?

Ewunike: I support women by being real and present. I take time to connect beyond work to understand their stories, celebrate their wins, and offer encouragement. When we find common ground and build trust, we can do powerful work together. It’s also important to make space for empathy and humanity. That’s how we build lasting relationships and meaningful impact.

Q: How do you ensure your work aligns with your values?

Ewunike: Whether I’m in a formal leadership role or not, I lead by example. My values show up in how I engage with others, how I present my work, and how I build partnerships. Alignment isn’t just about titles, it’s about how you show up every day. Your actions reflect your core values, and they should be visible in everything you do. g

“Success in the housing industry today demands that organizations lead with purpose and integrity.”

Make a new home yours with a 3% down payment

Buying a home may be possible with a low down payment. It may be just what you need to get into your first or next home.

Giving you flexibility

Our Dream. Plan. Home.® mortgage1 is a fixed-rate loan with a 3% down payment2 option. It provides flexibility if you have limited credit history or credit challenges, and is available for a variety of loan amounts, including in high-cost areas. I’ll help you understand the available options for you so you can choose what works for you. Talk with me about loan amount, loan type, property type, income, first-time homebuyer, and homebuyer education requirements to discuss eligibility.

Helping you get home.

By Chuck Bishop, Business Growth Strategy Executive at Wells Fargo

Buying a home is one of the biggest steps a person can take. But for many people, it can feel confusing and even scary. There are so many things to think about: credit scores, saving money, choosing the right loan, and understanding how the entire process works. That’s why housing counselors are so important. They help people feel ready and confident to buy a home.

I recently talked with Barry Coleman, Vice President of Program Management & Education at the National Foundation for Credit Counseling (NFCC). We discussed how housing counselors can make a big difference for people who want to become homeowners. This con-

versation is part of NFCC’s national effort to help more people learn about homeownership and how to prepare for it. At Wells Fargo, we’re proud to support this work and help more families reach their dream of owning a home.

Coleman: HUD-approved Housing Counseling Agencies (HCAs) are nonprofit groups supported by the U.S. Department of Housing and Urban Development. These agencies offer free or low-cost help to people who are buying a home, trying to avoid foreclosure, or just need advice about housing. Their goal is to make sure everyone has access to good information and support.

Coleman: From a lender’s point of view, I see housing counselors as trusted guides. They are trained pro-

Wells Fargo understands that our strength comes from working together across the country to achieve homeownership for more families.

Our close collaboration with prominent civil rights organizations, real estate professionals, and housing counseling agencies helps bring homebuying information and resources to more communities.

At Wells Fargo we also continue to optimize our teams to better serve you and help you create a homebuying journey that is right for you and your family.

Scan code with your mobile device camera to learn more about our Home Lending Priorities.

fessionals who give honest, helpful advice based on your personal financial situation. And the best part? Their help is often free or very affordable. Counselors can help you understand your credit, improve your score, and even speak on your behalf when working with lenders. They’re like a coach in your corner.

Coleman: Housing counselors and credit counselors often work together. Housing counselors help you get ready to buy a home, while credit counselors help you manage debt and fix credit problems. Together, they give you a full support system to help you feel financially strong and ready.

Coleman: Some people think housing counseling is only for those with bad credit. That’s not true. Even people with good credit can benefit. Maybe you need help making a budget, understanding different types of loans, or figuring out how much house you can afford. First-time buyers, existing home homeowners facing foreclosure, or anyone who feels unsure about their finances can all benefit from talking to a counselor.

Coleman: I recommend starting 6 to 12 months before you plan to buy a home. That gives you time to fix any credit issues, save for a down payment, and learn about the homebuying process. If you’re facing financial problems, it’s even better to start earlier. The sooner you begin, the more prepared you’ll be.

Coleman: As a lender, I can tell you that you should see housing counseling as a good thing. It shows that a person is serious about becoming a responsible homeowner. People who work with counselors often make better choices and are more likely to succeed with their loans.

Coleman: You don’t have to wait until something goes wrong to ask for help. Housing counseling is for anyone who wants to make smart choices about where they live— whether they’re buying, renting, or just trying to manage their money better.

Coleman: If you’ve ever thought about buying a home but didn’t know where to start, now is the time. Housing counselors are here to help you every step of the way. They can answer your questions, help you make a plan, and give you the confidence to move forward.

You don’t have to figure it all out on your own. Whether you’re just starting to think about buying a home or you’re already looking at houses, a housing counselor can be your guide.

Visit https://www.nfcc.org to find a HUD-approved housing counseling agency near you. Or talk to your lender to learn how counseling can help you on your journey.

Homeownership is possible, and with the right support, it’s closer than you think.

We are proud to partner with HUD-approved agencies whose trusted expertise plays a vital role in helping individuals and families take meaningful steps toward homeownership. Through this collaboration, we’re able to support and empower customers with the resources, education, and guidance they need to navigate the path to owning a home with confidence.

g

By James Wright and Richard Elliott WI Staff Writer and WI Contributing Writer

Amid a government shutdown, uncertain national economy and rising prices on consumer goods, economic experts note financial literacy is important for all Americans to navigate the current times and beyond.

Spending less than one earns is the soundest financial principle, but that alone is not enough to develop longterm assets without additional steps.

Treasurer Dereck E. Davis, Maryland’s second African-American treasurer, has emphasized financial literacy education as a priority of his office since his December 2021 swearing-in.

“I firmly believe that financial education cannot begin too early, as it builds the foundation for responsible decision-making and strategic financial planning in the years ahead,” Treasurer Dereck E. Davis told The Informer. “These skills are essential for strengthening our families, ensur-

ing a better quality of life, and creating a more secure financial future for our state.”

• Research available tax credits.

There are tax credits for paying student loans, paying interest on a mortgage, or paying up to $2500 of student loan interest annually. Independent contractors can write off qualified business expenses such as electronics and furniture on their income tax. Further, when paying down debts, try to prioritize debts with higher interest rates.

• Set up an emergency fund.

A flat tire, a missed paycheck, or a broken washing machine can happen at any time. Having an emergency fund makes it easier to address these problems without going into unnecessary debt at high interest.

Robin Hood, an electronic trading platform, reports that 41% of Black adults report having emergency savings, compared to 60% of white adults.

• Avoid gambling, sports betting, and other high-risk investments.

Less than 5% of sports bettors

turn a long-term profit, and gambling is highly addictive, according to Boyd’s Bets.

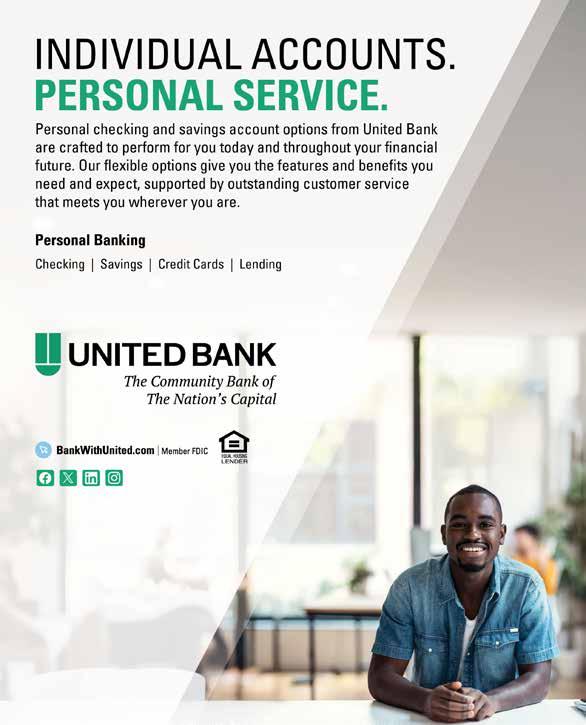

In addition, high-risk investments can also be dangerous. A Federal Reserve report reveals that more Black

consumers own cryptocurrency, an asset that can rapidly change in value, than stocks and mutual funds, which are more secure for long-term growth.

The value of cryptocurrency can fall to nothing in a matter of seconds, a phenomenon known as a “rug pull.” Investors with large concentrations of crypto can mass-sell, leaving remaining investors with worthless coins and few consumer protections.

• Avoid high-interest loans.

Advanced pay loans, now legalized in Maryland, allow over 200% interest rates. The high interest rates make loan repayment difficult, often necessitating further debt and creating a debt cycle. Bank loans and credit cards both offer lower interest rates than advanced pay loans.

These high-interest loans disproportionately target Black communities and low-income users, according to a 2024 report by the Maryland Department of Labor.

D.C. Attorney General Brian Schwalb filed a lawsuit in 2024 against EarnIn, which offered payday loans at 12 times the legal interest rate in the District. The lawsuit

alleges that over 1 million loans were approved without required licensing.

“EarnIn lures in hard-working, cash-strapped workers with the false promise of free instant cash advances and then charges them unlawfully high interest,” said Schwalb. “This predatory business model is illegal. Especially at a time when the cost of living is already too high, my office will always have Washingtonians’ backs. Today, we’re suing to hold EarnIn accountable and to put money back in District residents’ pockets where it belongs.”

• Unsubscribe from marketing emails.

Marketing emails are sent to encourage extra sales and leave your e-mail inbox filled while giving a permanent sense of Fear of Missing Out, also known as FOMO. Unsubscribing from emails is an easy way to declutter and avoid unnecessary purchases.

• Keep realistic expectations.

Remember that a significant percentage of social media content is a combination of product advertising and personal highlights. Comparing one’s daily life to others on social media is a very quick way to overstretch budgets and unnecessarily raise expenses.

JP Morgan Chase advises that some debts can be viewed as investments while reminding consumers to be cautious when taking on debts.

• Open a high-yield savings account.

The interest rate in a traditional checking account is often below 1%, meaning that interest on that account is lost to inflation annually. While most extra funds should be spent to pay off debt or to boost retirement savings, an emergency fund in a high-yield savings account (HYSA) can generate more than 3% interest annually.

• If responsible, get a credit card.

Improving credit will improve lending terms for housing, cars, and bank loans. However, the high interest rates mean that missing even one payment can start a downward slope.

The cashback rewards, travel miles, and other perks enjoyed by diligent credit card payers, are funded by the interest payments of credit card holders who don’t pay off their monthly balance.

• Get life insurance.

For just a few dollars a month, ensure that family members have the resources to stay afloat in the event of an unfortunate circumstance.

Some options for life insurance include New York Life, Liberty Mutual, and North Carolina Mutual, the largest Black-owned life insurance company in the nation.

• Protect assets with a will and/ or trust.

“Not all debt is created equal. It’s possible to invest for the future while you’re paying down debt,” read a September 2024 financial advice column written by JP Morgan Chase in The Informer. “A good practice is to pay down any high-interest debt before starting to invest, but you can consider investing if you’re paying down low-interest debt.”

• If receiving a tax refund, file taxes as early as possible.

A tax return is money that could be invested or spent to pay off debt or purchase necessities.

• Use coupons.

A penny saved is a penny earned. Coupons are mailed monthly for various grocery chains, and allow shoppers to price-compare between available options. Even fast food chains offer coupons through their apps.

Wills and trusts ensure that assets are properly and quickly assigned to beneficiaries after loved ones’ death. Without proper planning, resources that could be used to pay for funeral costs or other immediate expenses could be inaccessible.

For state Sen. Cory V. McCray (D-Baltimore)— who recently published The Apprenticeship That Saved My Life, detailing the importance of the trades as an opportunity for economic uplift— financial literacy and implementing such tools as those listed above can improve overall outcomes in African American communities.

“When we teach financial literacy, we don’t just change one life,” said McCray, “we shift the trajectory of entire neighborhoods by creating households that are stable, informed, and invested in their future.”

g

For too long, workers have been stuck in a pay system that does not match the realities of modern life. Bills, rent, and everyday expenses don’t wait for payday, yet most employees are still paid only every two weeks. That mismatch pushes people toward credit cards, overdraft fees, or even payday loans, each of which carries costs that can spiral into long-term financial stress.

EarnIn was created to give workers more control. Its suite of tools helps people access their wages in ways that are safe, flexible, and designed around the needs of everyday households.

• Cash Out (Earned Wage Access) is a flexible option when expenses can’t wait. Workers draw from wages they’ve already earned with no interest, mandatory fees, or debt. It’s a direct alternative to payday loans and overdrafts, designed to cover emergencies with your own

money, not borrowed funds.

• Early Pay is a smoother paycheck cycle. Instead of waiting for payday, workers can receive their paycheck up to two days sooner. That extra time can prevent late fees, keep the lights on, or help pay rent on time.

• Live Pay gives workers access to pay in real time (up to $1,500 per pay period) as they work. With Live Pay people can budget day by day, match income to expenses as they come up, and avoid the anxiety of a once-a-month or biweekly payday.

Live Pay points toward the future of work itself where workers can stream portions of their paycheck in real time as they work.

The impact on the lives of EarnIn’s customers is clear. One DC resident, Brian B., shared: “No amount of budgeting can

Together, these products operate at different levels. Cash Out helps when unexpected bills hit. Early Pay keeps households on track by closing the gap between ACH processing and payday, so that paychecks arrive the same day employers submit payment. And

fix a system where the cost of living vastly outpaces wages, and essential expenses mean I have to plan every dollar I earn and spend. And for those of us living within a tight budget, waiting days or weeks for a paycheck could mean the difference between on-time payments and late fees, overdraft

charges, or disconnection notices. Apps like EarnIn are a critical tool for my financial survival. EarnIn allows me to access money I have already earned, without the interest rates or credit score impact of payday loans. It has kept me from overdrafting my account and incurring hefty bank fees. It has allowed me to pay my bills on time, maintain my car so I can get to work, and manage the endless financial demands of living in DC.”

Jamel S., another DC resident, put it this way:

“Before I started using EarnIn, I had overdrafted my bank account multiple times to cover emergencies, racking up $20 to $30 fees each time. Since I started using the app, my financial health has improved. My bank account stays in the black, and

my credit score has gone up. I even qualified for a credit card recently, something I never thought was possible before.”

Critics may try to conflate EarnIn’s tools with existing services on the market, but the reality is very different: EarnIn’s products don’t create debt, don’t rely on mandatory fees, and are built on wages workers have already earned. The bigger story, though, isn’t about defending against old misconceptions but embracing what comes next.

As costs rise and families stretch every dollar, EarnIn is showing that the way we pay workers doesn’t have to stay stuck in the past. The promise is simple but powerful: to build a future where every household has the freedom to align income with expenses and where waiting weeks for a paycheck becomes a thing of the past. g

Melanee Woodard Vice President, Strategic Marketing Manager Industrial Bank

Many parents strive to provide their children with things they themselves did not have growing up, and for a single parent with one income this could be extra challenging. Sometimes, to the detriment of their financial situation, a parent will do whatever he or she needs to do (including going into debt) to provide those “things”; that new toy, pair of tennis shoes, expensive birthday parties etc. Before they know it, they are depending on various types of credit, or even retirement funds to acquire these “things”. It is not until thousands of dollars later, they find themselves deep in debt, on the brink of financial ruin. It doesn’t matter if you are a one- or two-income household the results are the same if you are not using sound financial principles.

When making purchases it is important to determine the difference between a want vs. a need. Ask-

ing the question, “Why do I need this” before making a purchase will bring insight as to whether making the purchase is an appropriate decision. It takes self-reflection and accountability to change life patterns. A single parent may hear or read about how to live on a budget and think the speaker doesn’t know what it feels like to raise a child with one income, or that the speaker has plenty of money. While a speaker may not have children, in many cases a person has experienced the

worst in a situation before they have experienced the best including being financially successful. As a single parent, we often delay or sacrifice our dreams. Having your own dreams and goals in addition to the dreams you have for your children is vital to your personal and financial success. It also helps to maintain a life balance. Pursuing your dreams gives you something to strive for and most dreams require money. A lack of money and having lots of debt can be a hindrance to accomplishing your goals. Though you don’t need money to get started with researching and developing your plan for success, you will need money to buy goods and services relevant to your dreams.

Following a budget/spending plan is extremely important, even if it shows you don’t have enough money at the end of the month. It may not feel like it, but this process can be the start to a prosperous future. It doesn’t matter if you only have one income, as long as you can learn to work within that budget/ spending plan. Whatever your cur-

rent financial situation, it’s never too late to develop sound financial principles. If you wish to achieve financial freedom, it is imperative that you obtain and act upon as much financial knowledge as possible. Equally important, share that knowledge with your children.

Here are a few money tips and resources. Keep in mind, information and knowledge are great, but without action they have no value!

STOP! Before making your next purchase, take your bank statement and bills from the previous month and create your spending plan/budget.

START! Living within your budget. Habits take time to break as well as adopt. Research money management topics and find what works for you. For example, using a budget app to track your spending. Try to include an amount (even if

it starts out small) for saving and self-care. Self-care is important for your health and can be something as small as buying your favorite scented candle or tea. Remember, choose what works for YOU –that’s the best way to gain discipline in any area.

FOCUS! Stay focused on your long-term goal of being financially free and living your dreams. Always ask, “Will this purchase delay my goals and dreams?”

TEACH! Teach your children what you have learned about financial education. You can grow together.

Websites: Our Money Matters: Financial Wellness https://industrial-bank. enrich.org

https://www.thepennyhoarder. com/budgeting/single-mom-budget/ g

By Hermond Palmer SVP Outreach & Engagement National Foundation for Credit Counseling (NFCC)

Raise your hand if you’ve heard someone say, “Black people don’t do counseling.” That’s more than just a phrase—it’s a barrier. And it’s one that keeps many of us from accessing tools that could transform our financial lives. If we accept counseling for our health, careers, or relationships, then surely, we can demand it when it comes to our credit and financial future.

Credit counseling is not a luxury. It’s not a last resort. It’s foundational. It is the education, support, and discipline that helps you know your financial condition, make better decisions, create better outcomes, and build wealth.

Credit counseling is a service—usu-

ally through nonprofit or HUD-approved organizations—that helps consumers:

• Examine their credit reports to find errors, negative marks, or issues that can be improved

• Understand how credit scores are calculated (payment history, credit usage, length of credit, new accounts, etc.)

• Build a realistic budget that works with income, expenses, and debt obligations

• Create a plan to reduce debt, possibly through a Debt Management Plan (DMP), which often consolidates payments, reduces interest rates, and removes or lowers certain fees

Good credit counseling also helps people understand how their credit affects borrowing costs, access to mortgages, and other opportunities. It’s an education, a strategy, and a path forward—and as a nonprofit, works in your best interest.

Because of historical inequities— discriminatory lending practices, redlining, wealth gaps—many in Black and diverse communities start homebuying or wealth-building at a disadvantage. But credit counseling

In diverse communities across this nation, credit counseling has provided the education, support, and discipline that has helped individuals understand their financial situation, make better decisions, create better outcomes, and build wealth.

Why should our community be any different?

Nonprofit credit counseling can begin to close the wealth gap that decades of redlining, predatory lending, and inequality created.

HUD-certified, nonprofit credit counseling offers guidance, and a strategy to help you understand your financial standing, make wiser decisions, reduce debt, and unlock opportunities.

Take control. Build confidence.

Reach out to the National Foundation for Credit Counseling today.

Visit nfcc.org or call (833) 691-6299 to connect with a nonprofit certified credit counselor today.

offers tools to begin closing that gap.

• Research from Washington University’s Brown School found that people who received nonprofit credit counseling reduced revolving debt (credit card balances, etc.) by about $3,637 on average over 1½ years; total debt dropped by over $11,000.

• From the NFCC’s Sharpen Study, among people who got credit counseling: 73% became more consistent in paying their debts; 70% reported better financial confidence; 67% improved their money management skills in just a few months.

These are not just numbers, they represent real people reclaiming financial power and moving toward stability.

Credit counseling isn’t just about paying off debt. It teaches you the language of money, and how to use financial tools to your advantage.

• You learn to budget: understand wants versus needs, map income and expenses, set priorities, and plan for emergency savings.

• You understand credit behavior: how your payment history, utilization, the age of accounts, and new credit affect your score.

• You gain negotiating power: counselors can help you work with creditors to reduce interest, fees, or set up manageable repayment schedules while not destroying your credit score in the process.

• You become more confident interacting with financial institutions: applying for loans, seeking mortgage options, knowing what terms are fair. Literacy builds confidence—and confidence leads to action.

Wealth isn’t just what you make— it’s what you keep, protect, and grow. Nonprofit credit counseling can play a role in all three.

1. Lower interest and costs: Better credit means better rates on credit cards, loans, and mortgages. Over time, the savings from even a few percentage points can add up.

2. Access to better financial products: Good credit opens doors — favorable mortgages, lower insurance rates, options for refinancing or buying down interest.

3. Preventing financial loss: Late fees, high interest, defaults, foreclosures—these undo wealth, slicing away at savings. Advisors help map out paths to avoid these pitfalls.

4. Leverage credit responsibly: With solid credit and understanding, you can use credit as a tool — buying a home, investing, expanding opportunities — rather than letting debt control you.

5. Multiplying returns over time: As you reduce debt, your savings increase. Over years, that can be the difference between carrying heavy monthly burdens or having room in your budget for investment, retirement, or passing legacy wealth to children.

To get real benefits, you want reputable, nonprofit, certified credit counseling — not quick fixes or scams. Here’s what to look for:

• Nonprofit and/or HUD-approved counselors; look for certifications from the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

• Free or low-cost initial sessions. Many NFCC agencies offer the first meeting (and materials) without charge.

• Transparent fees, clear plans, realistic timelines.

• Debt Management Plans only if truly necessary, and only after you understand the trade-offs.

There are different ways to find a HUD-approved housing counselor:

• Use the Consumer Financial Protection Bureau’s (CFPB) “Find a Counselor” tool to get a list of HUD-approved counseling agencies in your area.

• Call the HOPE Hotline, open 24 hours a day, seven days a week, at (888) 995-HOPE (4673).

• Call the CFPB at (855) 411-2372 to be connected to a HUD-approved housing counselor.

• Contact the National Foundation for Credit Counseling at nfcc. org or call (833) 691-6299.

Let’s stop buying into the myth that

“Black people don’t do counseling.” It’s an old story that keeps us small and silenced. Real power starts with clarity, knowledge, and action. Credit counseling offers all three: it improves your financial literacy; it helps you reduce debt, build your credit, and access better financial tools; and over time, it helps you build wealth—not

just income.

If you’re ready to change your story, start with a nonprofit credit counselor you trust. Ask questions, learn your credit standing, build your budget, understand your options. The path to financial wellness is real, it’s available, and it begins with taking that first step. g

By Hermond Palmer SVP Outreach & Engagement National Foundation for Credit Counseling (NFCC)

Okay, here’s a question: Who wants to be rich? Here’s my honest answer— ME! Too often we are taught to live “paycheck to paycheck” to simply make ends meet. But real financial freedom and generational wealth come when we go beyond just earning and instead choose to spend time saving and investing. For Black Americans who face persistent wealth gaps, these tools aren’t optional luxuries; they are essential.

• Bridges the wealth gap. Wealth inequality in America is steep: The top 10 percent of households own over

$1.5 million in assets in many cases, while average households have far less.

• Provides flexibility and security. The Federal Reserve notes that savings and investments help retirees supplement Social Security and income sources, contributing to financial stability in later years.

• Helps unlock opportunities. Whether saving for a down payment on a home, paying for a child’s college education, or preparing for retirement, disciplined saving and investing create the capital you need.

1. Saving for a Home

Owning a home remains one of the most reliable paths to upward mobility. Home equity has historically served as a “forced” savings vehicle. Over time, as you pay a

mortgage and your home value rises, that equity becomes a major part of your net worth.

By saving consistently even modest amounts over months or years, you build a down payment fund. That gives you leverage, better loan terms, faster mortgage approval, and less risk of being overextended.

2. Saving for Education

College is expensive. Scholarships and grants help, but there’s often a gap you must fill. Investments (or well-managed education savings vehicles) can help you accumulate funds, so your student debt burden is lower or possibly eliminated altogether.

3. Planning for Retirement

We don’t know how long we’ll live, but we do know that relying solely on Social Security is risky. In 2024, many retirees also relied on private income (dividends, interest, pensions, retirement accounts) to maintain comfortable living standards.

By investing early, say, through a 401(k), IRA, or other vehicles, you harness the power of compounding. Even small contributions over decades can grow considerably.

Benefits:

• Growth potential — Investments (stocks, mutual funds, real estate) historically yield returns above inflation.

• Diversification — You can spread money across asset types so one downturn doesn’t wipe you out.

• Passive income — Dividends, interest, rents can flow to you without trading time for money.

Risks:

• Market volatility — Values go up and down; losses are possible.

• Inflation — If your returns don’t beat inflation, you lose purchasing power.

• Timing risk — Investing too much just before a market drop can hurt.

• Lack of knowledge/scams — Without know-how, you might pick poor investments or fall prey to fraud.

• Educate yourself. Learn the basics of investing (risk vs. return, fees, fund types), so you can see through hype.

• Use reputable platforms/advisors. Work with fiduciary advisors or lowcost index funds. Beware of “get rich quick” schemes.

• Stay long-term focused. Shortterm dips are inevitable; long timelines allow for recovery and growth.

• Start with a solid savings cushion. Before investing heavily, build an “emergency fund” (3–6 months of living costs). This stops you from needing to sell investments in a down market.

• Diversify. Mix stocks, bonds, real estate, and other asset classes to spread risk.

Stay consistent. Use “dollar-cost averaging,” investing a fixed amount regularly so you don’t try to time the market.

Treat each dollar as if it were an employee working for you. With this mindset every dollar you invest is like a worker whose job is to attract more workers (dollars) and equity (wealth) to work for you. Whether your dream is owning a home, sending a child to college, or retiring on your own terms, the path runs through saving and investing.

If you haven’t yet, start by opening a savings or retirement account. Even $20 a week compounds faster than you might expect. Next, educate yourself, take a class, read up, talk to credible, certified advisors. As confidence grows, shift from just saving to investing, using strategies that match your goals and risk tolerance.

We cannot afford to wait while others pull further ahead. The wealth gap is real, and the tools to close it—saving, investing, discipline, and knowledge— are available to us all. Let’s claim them, build security for ourselves and our families, and shift the narrative: Black wealth is not just possible, it starts with our choices today. g

“Blackpeopledon’tdocounseling.”

It’s a phrase rooted in stigma—and it’s one that keeps many of us from using powerful tools for change. But nonprofit credit counseling isn’t about shame or failure. It’s about knowledge, control, and building a stronger future.

In Black communities especially, credit counseling can begin to close the wealth gap that decades of redlining, predatory lending, and inequality created.

It offers education, guidance, and a strategy to help you understand your financial standing, make wiser decisions, reduce debt, and unlock opportunities.

Are you ready to rewrite your financial story? Don’t let stigma hold you back from the tools that others use to grow. Reach out to the National Foundation for Credit Counseling today.

Visit n f c c . o r g to connect with a nonprofit certified credit counselor or call (833) 691-6299 to start a confidential session today

America’s trusted financial coach for more than 70 years, the National Foundation for Credit Counseling offers education and solutions that ensure better financial futures for all.

Op-Ed by Theodore “Ted” Daniels

Should Washingtonians and the rest of Americans be left ignorant about managing personal finances? When I founded the

New Study Shows: Financial Education is Worth the Effort

America faced, and still faces, a financial illiteracy crisis.

Financial literacy wasn’t a wellknown term in the 1990s—no study documented its positive effects. Yet, as I taught and watched other SFEPD educators teach, I knew it worked. I saw the light bulb go off for students and heard stories about how they started budgeting or investing because of what they learned.

Now, SFEPD has an independent evaluation study by ICF showing what I've always known: financial education is not a waste of time. It provides a life skill that changes lives.

The study found that SFEPD learners with extended financial education saw large gains in knowledge, confidence, behavior, and well-being. Learners who participated in other SFEPD programs also improved. Our most

intensive effort is training HBCU college students to become Student Ambassadors. They teach personal finance to their peers and community members.

The results are compelling. SFEPD Ambassadors scored 32% higher on a financial well-being measure than a comparison group drawn from FINRA Investor Education Foundation’s 2024 National Financial Capability Study. Other SFEPD learners scored 17% higher. Our Ambassadors scored 132% higher on an objective financial knowledge assessment, and other SFEPD learners scored 35% higher. Notably, 92% of SFEPD Ambassadors and 73% of other SFEPD learners reported feeling confident in achieving financial goals, compared to only 61% of the comparison group.

On specific behaviors, SFEPD

Ambassadors were seven times more likely to make student loan payments on time, while other SFEPD learners were two times as likely. Our Ambassadors were five times more likely to maintain a rainy-day fund and 2.5 times more likely to have a retirement plan. Many learners shared their knowledge with family and friends, creating a ripple effect of learning.

This study adds to the growing body of research showing that financial education works. Since financial education is a lifelong journey, I hope those reading this will take action to learn more themselves and to help others learn.

Financial education is a lifelong journey. I encourage readers to continue learning and to share what they know with others. Our experience offers lessons for program designers: tailor programs to the audience, ground them in the community, and use peerto-peer education to break down barriers and taboos around money.

Those who asked me why I bothered teaching financial education, the answer is now clear. Lives are transformed and communities are strengthened.To see more about the study go to www. sfepd.org.

g

DANIELS

that meet you where you are.

Whether you need lending assistance or help consolidating debt, our team is here to o er guidance and help you find solutions that fit your needs. Flexible financing options, including our STAR (Steps Toward Achieving Results) program, o er mortgage, home equity and personal loans with a ordable terms — all powered by personal support to help you navigate the process. Let’s talk about what’s possible.

Our STAR home equity and mortgage loans are available to assist lower income families with a ordable terms. Learn more today.

| Business | Wealth | Home Loans

Sponsored by JPMorganChase

As we near the holiday season, you may be looking to treat yourself to those set of wheels you’ve been eyeing, or perhaps it’s time to purchase your loved one their dream car. In today’s financial climate, managing your vehicle costs efficiently is key, as it could help you save money and limit potential headaches down the road. Here are some helpful tips to finally make that purchase for your (or a loved one’s) dream vehicle this holiday season:

1. Set your holiday budget, and stick to it. There are a variety of different expenses that come with getting a car – the purchase cost, insurance, maintenance and fuel being a few of them. Knowing how much you can afford, especially if you plan to pay for it over time, is key to avoiding a car bill that stretches your finances. Look for access to different budgeting tools and tips that can help you save for your purchase.

2. Look for the best holiday deals. Like many other items, vehicles have a price cycle; the end of the year tends to be when you can find a better deal, as dealers may need to meet quotas or clear out inventory. Generally, make sure you are considering multiple vehicles and shopping around at several dealerships to get the best price.

3. Test drive the vehicle to

make sure it fits your needs. This is your time to see how the vehicle looks and feels, try out the interior systems and figure out if the vehicle fits your needs. Schedule test drive appointments to ensure the car you want is still available, ideally a few in the same day or week to keep your impressions fresh in your mind. It’s also helpful to simulate your daily driving conditions as much as possible, such as bringing any car seats or equipment you may have in your car daily. After your test drive, you can ask about the car’s warranty and fuel and maintenance requirements, as well as the possibility of getting an extended test drive or bringing the car to your own mechanic for a second opinion.

4. Determine whether you are financing or leasing. There are benefits of both a lease and a loan. With a loan, there is no milage limit and you are free to customize and change the car as you see fit. After completing your finance payments, you own it. Leases typically have lower upfront costs than loan payments, and at the end of the term you can return, purchase or trade the vehicle in. But keep in mind that most leases have a mileage limit, so it might not be the best option if you travel often.

5. How to know if an electric vehicle is right for you. With so many major manufacturers building EVs, there are more options than ever before. However, cost, maintenance, range and charging logistics are all key factors to consider. For maintenance, EVs typically require

less maintenance than traditional cars. EV batteries tend to be covered by 8-10 year warranties (outlasting the amount of time most people own their cars) but EV tires degrade faster due to the weight of the battery. And just as gas prices vary, so do electricity costs – based on your location, your driving style and the size of your battery.

The median range of an EV with a fully charged battery is roughly 250 miles, but that number depends on the make and model as well as other factors like weather, traffic conditions and driving style. And when it comes to charging infrastructure, some cities and states may have more charging stations than others. Make sure to plan your trip ahead of time and map your route.

Be sure to do your homework first before making that big purchase. There are many tools available that can help you plan for costs in addition to the vehicle loan or lease payments, such as sales taxes, registration fees, and insurance—which can vary depending on the car make, model and even the color. For instance, using a car payment calculator can help estimate your monthly car payment for different scenarios, by

inputting the ballpark amount you’d like to finance along with some other basic info.

For more auto budgeting tools and tips, visit autofinance.chase.com.

For informational/educational purposes only: Views and strategies described in this article or provided via links may not be appropriate for everyone and are not intended as specific advice/recommendation for any business. Information has been obtained from sources believed to be reliable, but JPMorgan Chase & Co. or its affiliates and/or subsidiaries do not warrant its completeness or accuracy. The material is not intended to provide legal, tax, or financial advice

or to indicate the availability or suitability of any JPMorgan Chase Bank, N.A. product or service. You should carefully consider your needs and objectives before making any decisions and consult the appropriate professional(s). Outlooks and past performance are not guarantees of future results. JPMorgan Chase & Co. and its affiliates are not responsible for, and do not provide or endorse third party products, services, or other content.

Deposit products provided by JPMorgan Chase Bank, N.A. Member FDIC. Equal Opportunity Lender.

© 2025 JPMorgan Chase & Co.

By Dr. Willie Jolley

Most people say they want to be wealthy, but studies show that the majority of those people don’t know how to achieve that goal. I want to help you in that effort!

After 2 decades of hosting The Willie Jolley Wealthy Ways Show on Sirius XM Radio and growing the show from zero ratings to the #1 show for self-help, I’m excited to announce my new book, Rich Is Good, Wealthy Is Better!

This book is the result of my interviewing some of the greatest wealth creators on the planet. People like Bill Marriott, David Rubenstein, David Steward, Ted Leonsis, Bob Johnson, Sheila Johnson, Steve Case, Les Brown and other billionaires and multi-millionaires,

Many people know of the iconic book, Think and Grow Rich by Napoleon Hill, which has made more millionaires that any book other than the Bible. This book could be thought of as the sequel to that book! Rich is Good, Wealthy Is Better, states that it is good to become rich, but encourages people to not stop at getting rich, but to keep going to become wealthy.

Rich Is Good, Wealthy Is Better has two distinct groups it focuses on. First are all the people who say they want to be wealthy, but don’t know the difference between being rich and being wealthy. They spend money on items that make them look rich but are really making them poorer!

The second group this book focuses on are people who have worked hard all their lives - scrapped, saved and sacrificed to create a comfortable nest egg, and now worry their children will treat their money like a lottery win.

One man said his greatest fear is that his children will not treat his money like he treated it! He said, “I need help educating my children about how to keep and grow my nest egg and not squander it!”

This book is a tool to educate family members about growing the wealth that they have been blessed with by their parents.

The ceiling of one generation should be the floor for the subsequent generation. Yet to maintain and grow wealth, it must be taught! This book is the answer for that problem.

A centerpiece of the book is the “five types of wealth”:

1) Financial wealth

2) Health wealth

3) Relationship wealth

4) Reputational wealth

5) Intellectual capital wealth

I also share the fact that not everyone will become rich, but anyone, who is willing to be disciplined and determined, can create wealth!

This book tells you how others have done it and how you can do it too.

This is a book that every household needs to own, and everyone in the family needs to read!

Put it on the kitchen table. Read it together. Teach it to your kids. Build wealth that lasts.

g

By Shuron Morton, United Brokerage Services, Inc.

Senior Vice President, Regional Manager

When was the last time you sat down with a professional to evaluate your finances? A few months or years ago? Never? If you chose the latter, you’re not alone. A recent Charles Schwab survey found that only 20% of Americans believe they are financially comfortable. Yet, despite the overwhelming need for one, only 31% say they have a formal financial

plan. So, where does this discrepancy come from?

Financial planning can be intimidating, but it allows you to take control of your financial future, avoid common mistakes, and be prepared for life’s uncertainties. With a solid plan, you can make smarter decisions and stay on track to reach your goals. Regardless of age and income, anyone can benefit from planning. Here’s what you need to know to set yourself up for success this National Financial Planning Month and beyond.

Simply, financial planning means planning for the future. This could be the near or long-term future, and you might have different objectives based on the time frame and risk you’re comfortable with.

Financial advisors and planners play an important role in this process, helping to manage your investments to achieve your financial goals. We assess your entire financial picture and provide advice in areas such as saving, investing, and retirement planning. Creating a financial plan is a great first step, but to go the extra mile; speak with a financial planning professional to make the most of your money.

As an advisor, I’ve heard several reasons why people put off financial planning, from believing they don’t make enough money to thinking they’re too young to start. Sometimes it just comes down to their exposure to financial planning.

Planning is more crucial now than ever before. Living paycheck to paycheck is not sustainable, and traditional savings and retirement funds are not stretching as far as they once did.

We account for our financial needs in life such as major purchases, bills, and home costs. However, not many people intuitively consider what happens when we need additional care later in life or when unexpected challenges arise. Ultimately, if you want to be able to retire, and live comfortably long past, it is important to start making strategic money moves sooner rather than later.

1) Sit down and write things out. Take time to document your current assets, liabilities, monthly income, and monthly expenses.

2) Have an emergency fund. Save six months’ worth of living expenses in an easily accessible account to cover any unexpected expenses.

3) Create a budget and begin saving and investing early. Once you know how much you spend on fixed and necessary expenses and you’ve set money aside in an emergency fund, take 30% of your remaining income and invest into your 401k and regular brokerage account. Diversify your investments to allow maximum opportunities for returns.

4) Take advantage of employer-sponsored plans. Set up regular monthly contributions to a retirement plan – especially those where employers match contributions and offer tax benefits – and other non-retirement investments such as mutual funds or managed portfolios.

5) Plan for taxes. Work with an accountant to take advantage of tax-efficient investing, such as traditional IRAs, Roth IRAs, college savings plans, and HSAs.

6) Review and adjust your plan. Your life and goals will change, and so should your plan. Do regular financial check-ups and make changes to stay on track to reach your goals.

Anyone looking to learn more about financial planning can check out resources like the CFP Board website, financial blogs, or talk to a financial planner or advisor. There are many tools available online to get you started. We have a lot of resources on BankWithUnited.com, from helpful articles and calculators to tips for investing and economic snapshots. You can also fill out a form to be connected with a financial advisor who can help you with your needs. g

By James Wright and Richard Elliott WI Staff Writer and WI Contributing Writer

While cryptocurrency has surged in both relevance and popularity, many Americans remain puzzled by what it is and how safe of an investment vehicle it can be.

“We are here to try to demystify a lot of this,” said Kevin Harris, the owner of Crypto.com and a panelist at the Congressional Black Caucus Foundation 54th Annual Legislative Conference (ALC)’s issue forum “Beyond the Bank: Digital Assets and Financial Inclusion in Black America” on Sept. 24. “There is a lot of interest in this in the Black community.”

Harris was on the panel with Cleve Mesidor, the executive director of the Blockchain Foundation. Talking about the work advocates like he and Mesidor must do to educate the African American community on cryptocurrency, he said outreach on their part is a must.

“We are responding and engaging with Black organizations on digital currency,” he said.

Cryptocurrency, also known as crypto, is a form of digital currency. The dollar, euro, and yen respectively are all printed by national banks while crypto is not reliant or dependent upon a bank or country to print additional currency or maintain the value of the currency.

Bitcoin is the most well-known cryptocurrency, first developed in 2008 and first issued in January 2009. One bitcoin was worth 1 cent on February 22, 2010 and is now worth over $100,000. Wyoming issued the first state stablecoin in August, and some banks are already issuing stablecoins.

During President Donald Trump’s second presidential term, cryptocurrency has become a major topic, from the DOGE coin launched the weekend of his inauguration, to an August executive order allowing employees to invest their retirement savings into cryptocurrency, and additional federal regulations enacted under the GENIUS Act.

“We are very excited about the

GENIUS Act,” said U.S. Sen. Angela Alsobrooks (D-Md.), who led, “Seizing the Moment: Empowering Black Entrepreneurs and Small Businesses Through AI, Digital Innovation and Venture Capitalism” issue forum on Sept. 25, as part of the ALC. “This summer, we debated the GENIUS Act in the Banking Committee, of which I am a member."

While tapping into crypto can be lucrative, there are many regulation and oversight questions about the digital currency.

“There was vigorous debate from both sides of the committee room on how to regulate these technologies and eliminate fraud,” said Alsobrooks about the GENIUS Act, “but no one left until we resolved our differences.”

Some experts, including former hedge fund head Warren Buffett, argue that cryptocurrency is inherently a speculative bubble— a rapid rise in asset prices as a result of irrational investor behavior and expecting future price increases— due to limited guardrails and consumer protections.

CRYPTO Page FL-22

Crypto has experienced several speculative bubbles within the past 15 years, significantly more than Wall Street.

“Crypto assets have experienced higher levels of volatility relative to more traditional investment assets, meaning that price swings— and any investment value— may go up and down dramatically and unpredictably, and the risk of losing all of your investment is significant,” according to the Financial Industry Regulatory Agency (FINRA). “Crypto assets are also less liquid than more traditional financial instruments like stocks and bonds, which can exacerbate price volatility and make it more difficult to sell.”

In addition, D.C. Attorney General Brian Schwalb recently filed a lawsuit against bitcoin ATM operator Athena for allegedly profiting from fraud and scams targeting the elderly.

“Athena’s bitcoin machines have become a tool for criminals intent on exploiting elderly and vulnerable District residents,” Schwalb said.

An investigation by his office found that more than 90% of all deposits made at Athena ATMs were the result

of scams.

“Athena knows that its machines are being used primarily by scammers yet chooses to look the other way so that it can continue to pocket sizable hidden transaction fees,” the report continued.

Further, crypto assets are significantly more concentrated among the wealthy than traditional assets.

“A growing share of Bitcoin’s circulating supply is now concentrated in the hands of major institutional players and centralized entities,” authors report in a June 2025 study by Cryptoslate. “According to our findings, over 30% of Bitcoin’s supply is now controlled by just 216 centralized holders across six key categories, including crypto exchanges, ETFs and funds, publicly traded companies, privately held firms, DeFi protocols, and government bodies.”

Recent polling shows that Black and Latino consumers are more likely to engage with cryptocurrency than white consumers.

“Unlike white consumers, Black

consumers are in fact more likely to own cryptocurrencies than assets such as stocks and mutual funds. Our data suggests that Black consumers have a higher ownership rate for cryptocurrency than for stocks and mutual funds,” according to a 2022 report from the Federal Reserve Bank of Kansas City on Black cryptocurrency ownership trends. “In contrast, white consumers have a higher ownership rate for stocks than for cryptocurrency.”

While some forms of cryptocurrency including Bitcoin have massively increased in value over past years, some experts warn that they are a risky long-term investment. The collapse of trading markets giant FTX and other crypto market liquidations can render assets completely inaccessible, akin to consumers during the Great Depression bank failures.

“Cryptocurrency, or crypto, is virtual or digital assets purchased with real money ($, £) traded on blockchain technology. It does not have all the values of real or fiat currencies. Cryptocurrencies, like Bitcoin and Ethereum, are different from stocks and real money,” according to a warning from the District of Columbia Department of Insurance, Securities, and Banking

(DISB). “Crypto is not regulated like stocks or insured like real money in banks. Crypto’s high risks can offer big rewards or huge losses.”

If investing in cryptocurrency, economists suggest using it as one option in a diverse investment portfolio, while tech experts emphasize maintaining strong cybersecurity measures to keep digital currency safe from hackers. Meanwhile, regulators from across the globe have urged for more consumer protections.

Harris understands that many African Americans are new to the cryp-

tocurrency dialogue and more engagement and education is needed to understand it.

“Think of this as technology to help do things more efficiently,” he said. “It’s just technology.”

Mesidor emphasized cryptocurrency offers African Americans a new way to view money.

“We have the opportunity to be a part of a new financial system that is more diverse and open,” Mesidor declared. “We have the chance to negotiate the terms of engagement.”

g

100%

At The Greater Washington League’s Center for Financial Inclusion (CFI), we’re committed to uplifting Black and other systemically disenfranchised communities in the DC Metro Area with the knowledge, tools, and strategies to break through financial barriers and create generational wealth. We are dedicated to addressing the root causes of financial inequities with cultural competence and without judgment. Our mission is to help participants take control of their financial futures and envision a community where wealth-building opportunities are accessible to all. By equipping individuals with the skills to seize opportunities, we’re working toward a prosperous future for generations to come.

94%

understood the neuroscience behind financial decision-making reported improvement in at least one area of their financial situation

Financial Empowerment Center Services

• The Financial Empowerment Spark Series

• Financial Empowerment Lab Cohorts

• One-on-One Financial Coaching

Department of Human Services Program

• Career Mobility Action Program

Other Center for Financial Inclusion Services

• Small Group Financial Therapy & Coaching

• Workforce Readiness Spark Series

• Subject-Matter Expert Workshop

• Small Group Workforce Wellness & Coaching

•

• Online Learning Platform

87%

felt more confident in their ability to achieve financial goals.

80% gained clarity about the root causes of their relationship with money

Wells Fargo understands that our strength comes from working together across the country to achieve homeownership for more families.

Our close collaboration with prominent civil rights organizations, real estate professionals, and housing counseling agencies helps bring homebuying information and resources to more communities.

At Wells Fargo we also continue to optimize our teams to better serve you and help you create a homebuying journey that is right for you and your family.

Scan code with your mobile device camera to learn more about our Home Lending Priorities.