CALL TO ORDER

PUBLIC COMMENTS AND QUESTIONS

EXECUTIVE DIRECTOR’S REPORT

PRESENTATIONS

• Discover the Palm Beaches

REGULAR BOARD MEETING AGENDA

Downtown Development Authority

Tuesday, September 19, 2023

8:30 AM

107 S. Olive Avenue, Suite 200 West Palm Beach, FL 33401

https://downtownwpb.com/DDA

Dial: +1 301 715 8592

Webinar ID: 850 0090 8071

Rick Reikenis

Raphael Clemente

CONSENT CALENDAR (Action Required)

• Minutes of Regular Board Meeting August 15, 2023

• Financial Statements of August 31, 2023

OLD BUSINESS

• Compassion Fund

• Community Safety and Policing Plan

• RFP 2023 – 001 Financial Audit Services Selection Committee Recommendations

NEW BUSINESS (Action Required)

• Circuit Extension

ANNOUNCEMENTS

• November Board meeting

ADJOURNMENT

Sergio Piedra

Rick Reikenis

Raphael Clemente

Raphael Clemente

Samantha Moore

Teneka James-Feaman

107 S. Olive Avenue, Suite 200, West Palm Beach, FL 33401 Phone: 561.833-8873|Fax: 561.833.5870| www.downtownwpb.com

REGULAR BOARD MEETING MINUTES

Downtown Development Authority

Tuesday, August 15, 2023

8:30 AM

300 Clematis Street, Suite 200 West Palm Beach, FL 33401

https://downtownwpb.com/DDA

Dial: +1 301 715 8592

Webinar ID: 827 5398 6097

ATTENDANCE

DDA Board members in attendance: Vice Chairman William Jacobson, Samantha Bratter, Tim Harris, Daryl Houston, Varisa Lall Dass, and Bob Sanders. DDA Staff in attendance: Raphael Clemente, Vivian Ryland, Catherine Ast, Krystal Campi, Tiffany Faublas, Sabrina Lolo, Samantha Moore, Sherryl Muriente and Attorney Max Lohman. Guests in attendance: Kameron Taylor. DDA Staff Virtual Attendance: Teneka James-Feaman.

CALL TO ORDER

Vice Chairman Jacobson called the meeting to order at 8:34 a.m.

PUBLIC COMMENTS

None.

EXECUTIVE DIRECTOR’S REPORT

Clemente welcomed Sanders back. He reported that the proposed FY23-24 Budget presentation to the CRA Board went well and will be presented for approval during the September Budget Hearings. He explained that Jennifer Ferriol from City of West Palm Beach HUD will likely join the September board meeting to review current programs and resources available and to help us determine how to best structure the Community compassion fund so that we do not duplicate services and utilize those dollars effectively.

He notified the board that the Cohen Pavilion at the Kravis has been reserved on October 18, 2023, to begin community engagement outreach process for the new 5-year work plan that will begin October 01, 2024. Along with the DDA Board, City Leadership, property owners, business owners, and residents will all be invited to participate and provide feedback about downtown and what we should be doing as a special district

PRESENTATIONS

None

CONSENT CALENDAR

Minutes of Board Workshop Meeting July 11, 2023

Minutes of Organizational and Regular Board Meeting July 18, 2023

Financial Statement of July 31, 2023

Harris made a motion to approve the consent calendar. Lall Dass seconded the motion. The motion passed unanimously.

107 S. Olive Avenue, Suite 200, West Palm Beach, FL 33401 Ph: 561.833.8873 Fax: 561.833.5870 * DowntownWPB.com

OLD BUSINESS

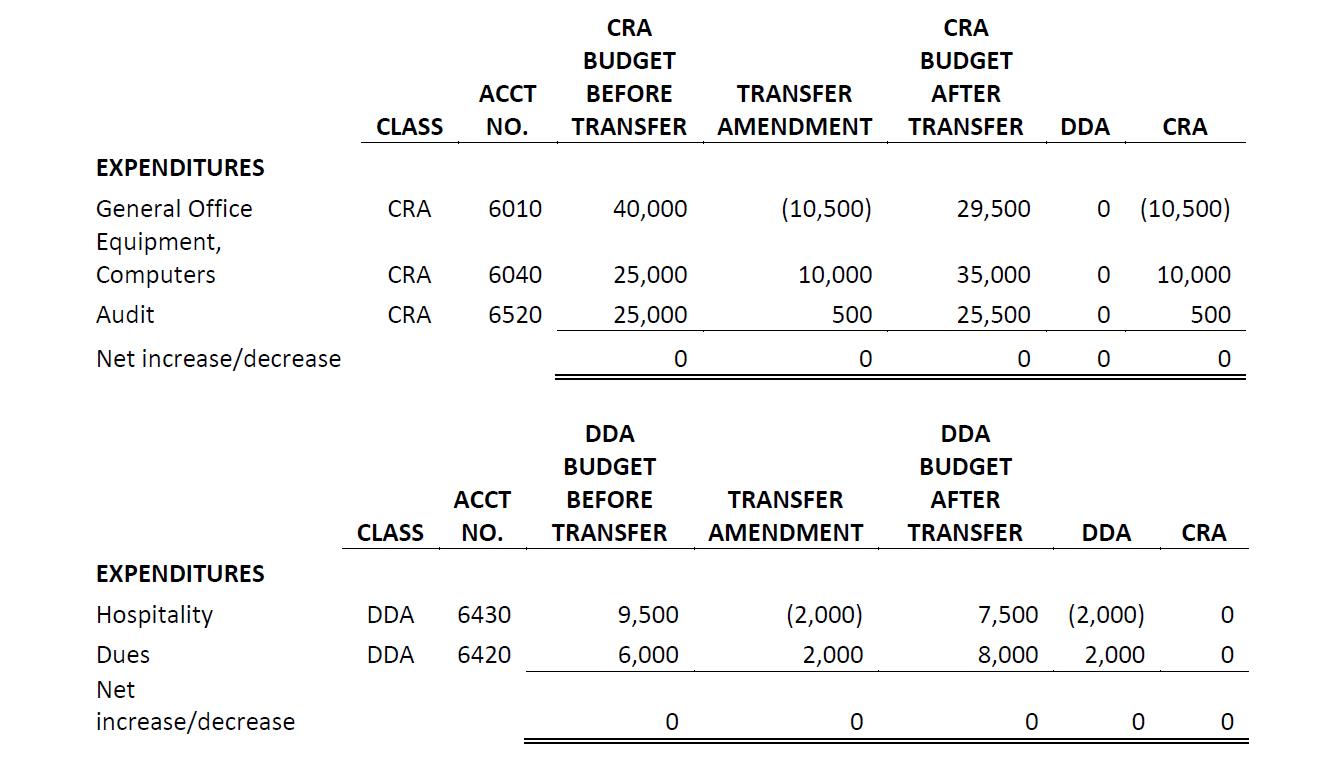

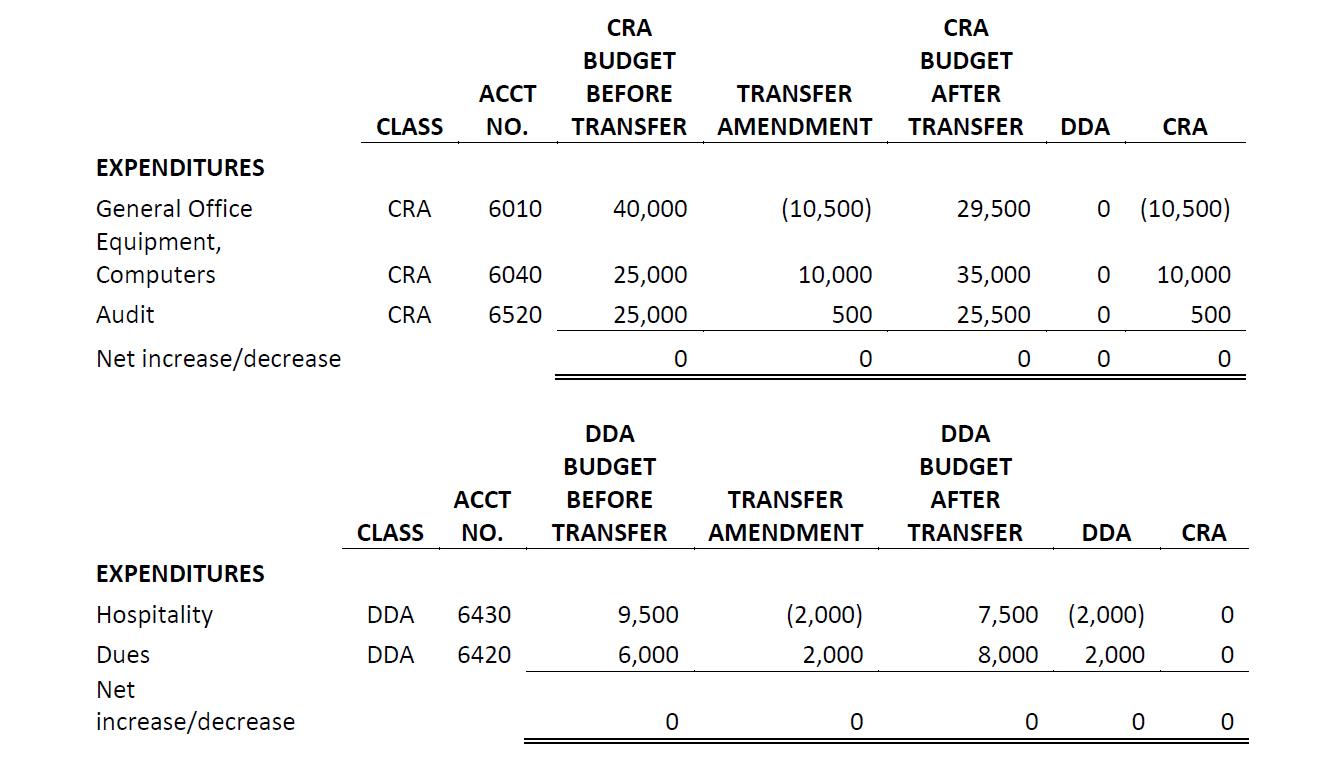

None NEW BUSINESS Budget Amendment No. 06-2023

Ryland explained that the purpose of the attached budget amendment is to balance line items that are over budget and to add funding to line items that need additional funding to cover expenses through the end of the year. The net change to the budget is zero.

Sanders made a motion to approve Budget Amendment No. 06 - 2023. Bratter seconded the motion. The motion passed unanimously.

Wayfinding Agreement

Ast explained that in 2019, through an RFP process, Don Bell Signs was selected as the contractor to build, paint, and install the pedestrian level wayfinding system that we have. During the RFP process, we found that the job's fabrication and size provided few companies that submitted to do the project, and Don Bell Signs was the only one qualified. Don Bell Signs was very reliable and helpful in executing this project with effectiveness.

At this time, we have multiple items that need to be updated on all signs and have received a quote from Don Bell Signs to do this work. Items that will be addressed include repair of any damage to frames, repaint, update graphics on map including, new logos and branding colors, removal of trolley routes, and visitor center and additional items as requested

Staff requested approval of the Don Bell Signs contract at $85,000.

Sanders made a motion to approve the wayfinding agreement up to $85,000. Houston seconded the motion. The motion passed unanimously.

107 S. Olive Avenue, Suite 200, West Palm Beach, FL 33401 Ph: 561.833.8873 Fax: 561.833.5870 * DowntownWPB.com

Ambassador Renewal

Ast presented a review of the ambassador program and explained that the DDA has a contract with PSC for the Downtown Ambassador Program. In addition, the City has multiple security contracts with PSC covering numerous city properties in and around downtown. Last year staff determined it best to adjust our terms to be in line with the City agreement so that all programs were under the same terms and timelines. That agreement was renewed for one year with a two-year option. Currently, the city has elected to only renew the agreement for one year.

After review of the agreement, DDA Staff is recommending the following changes:

A. Renew the agreement for one year

B. The living wage will increase from $15 to $17 per hour.

C. Increase weekly hours to serve the growing residential and business community. The additional hours for this increase will expand staffing needs from 14.5 full-time positions to 17 full-time positions.

D. Utilize two patrol vehicles to improve coverage and response time

Staff requested approval of the one-year renewal with PSC.

Sanders made a motion to approve renewal of the ambassador contract with PSC for one year. Harris seconded the motion. The motion passed unanimously.

Amendment to Retirement Plan

Ryland explained that under the current rules of the DDA’s retirement plan, employees are 100% vested in the plan immediately. To make the plan more financially sound, staff is recommending that the plan be amended to change the plan for future employees only and that these employees will become 100% vested after three years of employment.

Sanders made a motion to approve amending the retirement plan for future employees to be 100% vested after three years of employment Houston seconded the motion. The motion passed unanimously.

ANNOUNCEMENTS

None

ADJOURNMENT

Sanders made a motion to adjourn the meeting. Lall Dass seconded the motion. The motion passed unanimously Meeting adjourned at 9:32 am

107 S. Olive Avenue, Suite 200, West Palm Beach, FL 33401 Ph: 561.833.8873 Fax: 561.833.5870 * DowntownWPB.com

ASSETS

West Palm Beach Downtown Development Authority

Balance Sheet

August 31, 2023

No CPA provides any assurance on these financial statements.

Current Assets PNC Bank Operating 702,841 Valley National Bank - MMA 161,993 PNC Investment Management Acct 3,099,240 Petty Cash 50 Interest Income Receivable 14,214 Total Current Assets 3,978,338 Other Assets Lease Security Deposit 23,000 Total Other Assets 23,000 Total Assets 4,001,338 LIABILITIES AND FUND BALANCE Current Liabilities Due to Lincoln National 5,496 Vision Premium Payable 74 Flexible Spending Withholding 1,048 Suppl Med Ins. Premium Payable 95 Total Current Liabilities 6,713 Fund Balance 3,601,875 Net Income 392,750 Total Fund Balance 3,994,625 Total Liabilities and Fund Balance 4,001,338

West Palm Beach Downtown Development Authority

No CPA provides any assurance on these financial statements.

Trolley Gross Annual Budget Work Plan Services Marketing Security Incentives Month Year-to-Date Budget % Y-T-D Y-T-D Y-T-D Y-T-D Y-T-D Current Year Revenues - Schedule 1 75,415 6,339,183 6,366,707 99.6% 3,449,183 875,000 1,265,000 650,000 100,000 Expenditures Business Development - Schedule 2 68,336 314,514 868,987 36.2% 109,611 204,903 Public Realm Maintenance - Schedule 3 134,897 1,625,328 2,560,700 63.5% 1,625,328 Marketing/Public Relations- Schedule 4 128,730 798,116 1,580,000 50.5% 0 798,116 Neighborhood Services - Schedule 5 102,181 1,828,607 2,420,000 75.6% 269,397 881,277 677,933 General Office - Schedule 6 3,952 60,504 69,260 87.4% 60,504 Operations - Schedule 7 4,844 24,015 31,328 76.7% 24,015 Professional Services - Schedule 8 7,446 158,488 210,500 75.3% 158,488 Total Personnel Expense 88,671 917,293 1,060,000 86.5% 917,293 Insurance Expense 0 44,775 45,000 99.5% 44,775 Total Rent Expense 14,074 148,399 200,000 74.2% 148,399 Tax Collection 1,799 19,043 20,000 95.2% 19,043 Travel and Training 3,500 7,351 16,000 45.9% 7,351 Reserves 0 0 886,807 0.0% Total Expenditures 558,430 5,946,433 9,968,582 59.7% 3,384,204 881,277 798,116 677,933 204,903 Current Year Surplus (Deficit) (483,015) 392,750 (3,601,875) 64,979 (6,277) 466,884 (27,933) (104,903) DDA Carryforward 564 576,739 0 0.0% 576,739 0 0 0 0 CRA Carryforward 75,740 1,596,176 0 0.0% 791,209 100,000 274,967 230,000 200,000 Total Carry Forwards 76,304 2,172,915 0 0.0% 1,367,948 100,000 274,967 230,000 200,000 Net Total Surplus (Deficit) (406,711) 2,565,665 (3,601,875) 1,432,927 93,723 741,851 202,067 95,097

Statement of Revenues And Expenditures August 31, 2023

Supplemental Schedules

August 31, 2023

SCHEDULE 1 - CURRENT YEAR REVENUES

No CPA provides any assurance on these financial statements.

-

Gross Trolley Annual Budget Work Plan Services Marketing Security Incentives Current Year Revenues Month Year-to-Date Budget % Y-T-D Y-T-D Y-T-D Y-T-D Y-T-D Tax Revenues 201 2,993,756 2,945,187 101.6% 2,893,756 100,000 TIF 0 (2,821,581) (2,763,173) 102.1% (2,821,581) Rosemary Square MOU 0 135,000 135,000 100.0% 135,000 DDA/CRA Interlocal 0 5,765,076 5,768,493 99.9% 2,975,076 875,000 1,265,000 650,000 CRA Project Funding 0 0 0 0.0% 0 DDA/City Interlocal Agreement 32,220 119,120 280,700 42.4% 119,120 Interest Income 42,905 119,671 500 23934.2% 119,671 Dividend Income 0 0 0 0.0% 0 Gain or (Loss) on Investments 0 22,525 0 0.0% 22,525 Virgin Trains USA Ticket Sales 0 0 0 0.0% 0 Sponsorships 0 0 0 0.0% 0 Fees and Services 0 267 0 0.0% 267 Grants and Contributions 0 1,288 0 0.0% 1,288 Total Reimbursements 89 4,001 0 0.0% 4,001 Other Miscellaneous Income 0 0 0 0.0% 0 Gain (Loss) on Sale of Assets 0 60 0 0.0% 60 0 Total Current Year Revenues 75,415 6,339,183 6,366,707 99.6% 3,449,183 875,000 1,265,000 650,000 100,000

West Palm Beach Downtown Development Authority

August 31, 2023

No CPA provides any assurance on these financial statements.

Supplemental Schedules

Gross Trolley Annual Budget Work Plan Services Marketing Security Incentives Month Year-to-Date Budget % Y-T-D Y-T-D Y-T-D Y-T-D Y-T-D SCHEDULE 2 - BUSINESS DEVELOPMENT Total Property and Buss Incentives 53,572 204,903 375,000 54.6% 204,903 Facade Improvements 0 22,923 160,000 14.3% 22,923 Leasing/Brokers Meeting 951 21,711 30,000 72.4% 21,711 Total Business Training and Support 6,300 19,050 177,987 10.7% 19,050 Business Partnerships 7,513 44,184 106,000 41.7% 44,184 Grand Open/New Business 0 1,743 20,000 8.7% 1,743 Total Business Development 68,336 314,514 868,987 36.2% 109,611 0 0 0 204,903 SCHEDULE 3 - PUBLIC REALM MAINTENANCE Pressure Washing/Street Clean 75,241 584,042 760,000 76.8% 584,042 Clean Team 31,018 297,091 641,300 46.3% 297,091 Graffitti Maintenance 1,000 14,160 25,000 56.6% 14,160 Landscape Maintenance 27,638 386,480 684,400 56.5% 386,480 Holiday Lights 0 173,555 235,000 73.9% 173,555 Signage & Pedestrial Wayfinding 0 0 40,000 0.0% 0 Capital Projects/Alleys 0 170,000 175,000 97.1% 170,000 Total Physical Environment 134,897 1,625,328 2,560,700 63.5% 1,625,328 0 0 0 0

West Palm Beach Downtown Development Authority

August 31, 2023

No CPA provides any assurance on these financial statements.

Supplemental Schedules

Gross Trolley Annual Budget Work Plan Services Marketing Security Incentives Month Year-to-Date Budget % Y-T-D Y-T-D Y-T-D Y-T-D Y-T-D SCHEDULE 4 - MARKETING/PR Survey 0 0 0 0.0% 0 Collateral Materials 12,759 85,492 150,000 57.0% 85,492 PR/Marketing 18,924 88,159 225,000 39.2% 88,159 Retail Promotion 0 19,967 80,000 25.0% 19,967 Value Added Events - Other 11,533 64,917 150,000 43.3% 64,917 Advertising and Promotion 64,575 251,058 500,000 50.2% 251,058 Marketing Programs 356 69,139 150,000 46.1% 69,139 Community & Cultural Promotion 20,583 219,384 325,000 67.5% 219,384 Total Marketing/PR 128,730 798,116 1,580,000 50.5% 0 0 798,116 0 0 SCHEDULE 5 -NEIGHBORHOOD SERVICES Homeless Outreach 0 150,000 150,000 100.0% 150,000 Transportation 25,470 881,277 975,000 90.4% 881,277 Security and Policing 56,022 677,933 1,040,000 65.2% 677,933 Public Space Programs 10,000 10,720 155,000 6.9% 10,720 Community Engagement 195 37,422 37,000 101.1% 37,422 Residential Programming 10,494 51,255 63,000 81.4% 51,255 Mobility Coalition Funding 0 20,000 0 0.0% 20,000 Total Res. Services/Quality of Life 102,181 1,828,607 2,420,000 75.6% 269,397 881,277 0 677,933 0

West Palm Beach Downtown Development Authority

August 31, 2023

SCHEDULE 7 - OPERATIONS

No CPA provides any assurance on these financial statements.

Supplemental Schedules

Gross Trolley Annual Budget Work Plan Services Marketing Security Incentives Month Year-to-Date Budget % Y-T-D Y-T-D Y-T-D Y-T-D Y-T-D

OFFICE General Office Expense - Other 804 11,679 29,500 39.6% 11,679 Investment Expenses 0 11,031 0 0.0% General Postage 173 1,063 4,760 22.3% 1,063 Equipment, Computers, Programs 2,975 36,333 35,000 103.8% 36,333 Total General Office 3,952 60,504 69,260 87.4% 49,473 0 0 0 0

SCHEDULE 6 - GENERAL

Dues 2,811 9,656 8,000 120.7% 9,656 Hospitality 564 2,739 7,500 36.5% 2,739 Board Meeting 253 2,018 5,500 36.7% 2,018 Publications 0 103 328 31.4% 103 Telephone Expense 1,216 9,499 10,000 95.0% 9,499 Total Operations 4,844 24,015 31,328 76.7% 24,015 0 0 0 0

West Palm Beach Downtown Development Authority

August 31, 2023

SCHEDULE 8 - PROFESSIONAL SERVICES

Some rounding error may occur.

No CPA provides any assurance on these financial statements.

Schedules

Supplemental

Gross Trolley Annual Budget Work Plan Services Marketing Security Incentives Month Year-to-Date Budget % Y-T-D Y-T-D Y-T-D Y-T-D Y-T-D

Accounting 2,500 25,100 30,000 83.7% 25,100 Professional Service 1,804 32,300 60,000 53.8% 32,300 Audit 0 25,500 25,500 100.0% 25,500 Studies and Surveys 0 61,692 65,000 94.9% 61,692 Legal 3,142 13,896 30,000 46.3% 13,896 Total Professional Services 7,446 158,488 210,500 75.3% 158,488 0 0 0 0

MEMO

TO: DDA Board

Rick Reikenis, Chairman

William Jacobson, Vice Chairman

Samantha Bratter

Tim Harris

Daryl Houston

Varisa Lall Dass

Robert Sanders

FROM: Raphael Clemente

RE: Community Safety and Policing

DATE: Tuesday, September 19, 2023

The combination of mental illness and homelessness, and the lack of services for people affected by these issues, have become the most urgent challenge being faced by downtown stakeholders. I have participated in numerous meetings over the past several weeks regarding the problem and how we can best respond to it. Unfortunately, there is not a lot of agreement on how to approach the situation in the long term, but there is consensus for the short term.

A meaningful response to these issues in the short term necessitates increased police presence in specific areas, better communication with service organizations, and education of the community on the issue and how we can collectively work together to address it.

Considering the urgency of the problem, and in response to community outcry, staff proposes that the Ambassador Program be scaled back, and funds allocated for that purpose be reallocated to pay for additional police hours. This is based on feedback from the police department, homeless outreach and mental health professionals, the community, City staff and administration, DDA staff, as well as my own observations.

In addition to increased policing in specific area, additional changes to how the Ambassador Program is utilized, how data is collected and shared, and how the community is informed and engaged in this process are steps that can be taken now to affect positive change and assist those in need as well as residents and business owners who have been negatively impacted by these issues.

Staff will present additional information during the meeting and will be requesting board approval to make the described changes to the programs and hire additional police officers for special detail assignments

107 S Olive Avenue, Suite 200, West Palm Beach, FL 33401 Phone: 561.833.8873 - DowntownWPB.com

MEMO

TO: Mayor Keith James DDA Board Chairman Rick Reikenis City Administrator Faye Johnson

FROM: Raphael Clemente, Executive Director

RE: Community Safety and Policing Plan for Downtown

DATE: August 28th, 2023

Due to growing community concerns about homelessness and individuals struggling with mental health on the streets and in public spaces, and the increased number of incidents of crime in the downtown area, the following plan of action is proposed to provide the most rapid response possible to address these issues.

The elements defined below are not comprehensive, and additional information is necessary to further develop this plan, however it is requested that we take a “learn as we go” approach as this will allow us to move as quickly as possible and refine the program based on results and feedback.

It is envisioned that these measures will remain in place for a period of 6 months, at which time their effectiveness can be evaluated, and additional steps taken.

1. Restructured Ambassador Program: The DDA’s Ambassador Program will be significantly reduced in size and scope. Residual funding (amount to be determined) will be reallocated to provide increased police presence in the Downtown area.

a. The total number of hours worked weekly by PSC under contract to the DDA will be reduced by approximately 50%.

b. The most experienced and effective members of the Ambassador Program will be retained and will receive additional training.

c. The program will be restructured to work more closely with Police in a coordinated effort to decrease crimes and behaviors that are currently undermining residential quality of life and business activity.

2. Enhanced Police Deployment: Increased police presence will be achieved through the deployment of Special Detail officers to specific zones and times, with a focus on the enforcement of laws in hotspot areas.

a. DDA will provide funding (amount to be determined) for law enforcement officers to be stationed in zones throughout the Clematis corridor and waterfront area.

b. The Entertainment District Unit (EDU) Commander will identify times and zones with input from the Safety Task Force (see below).

300 Clematis Street, Suite 200, West Palm Beach, FL 33401 Phone: 561.833.8873 Fax: 561.833.5870 DowntownWPB.com

c. Special Detail officers will coordinate with existing EDU officers to provide a coordinated, tailored enforcement plan designed to improve community safety, protect businesses and their customers, and preserve residential quality of life in the downtown district.

3. Downtown Security Task Force: The DDA will form a Security Task Force for the Downtown area. The task force will be comprised of representative members from the community, including residential, business, property ownership interests, Housing and Community Development, Police, and Fire Rescue. The task force will provide feedback and advice to law enforcement, City Administration, DDA, and the community.

a. Task force deliverables will include a monthly report that includes calls for service, enforcement activity, and other pertinent information.

b. A sample of downtown businesses will be asked to provide regular updates on business activity, incidents of crime and nuisance behavior, perception, and customer experience. Business types will include restaurant, retail, and office uses, as well as specific locations that have been heavily impacted by activity related to homelessness.

4. Data and feedback: Information will be collected and compiled into weekly and monthly reports that will be made available to both the private and public sector.

MEMO

TO: DDA Board

Rick Reikenis, Chairman

William Jacobson, Vice Chairman

Samantha Bratter

Tim Harris

Daryl Houston

Varisa Lall Dass

Robert Sanders

FROM: Samantha Moore

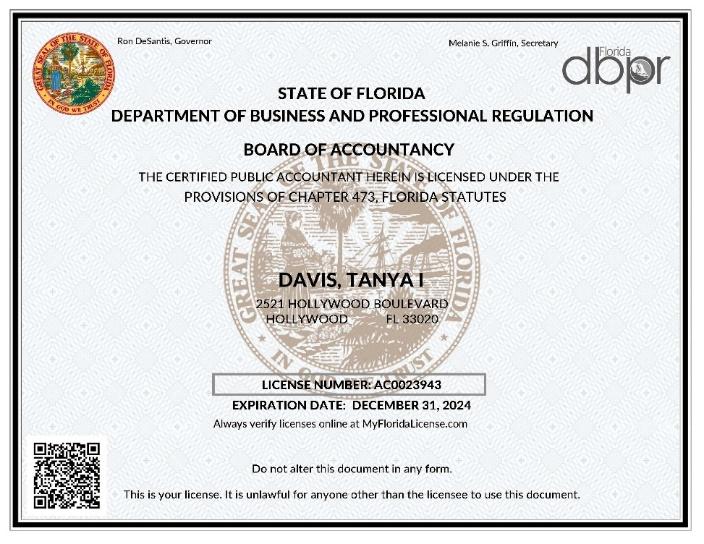

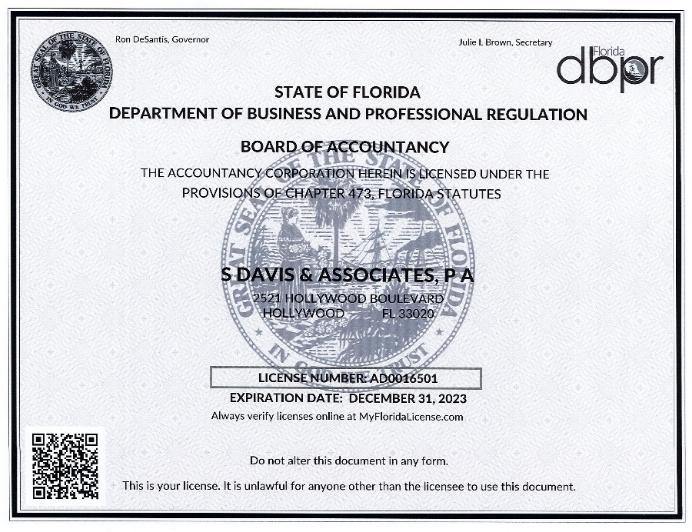

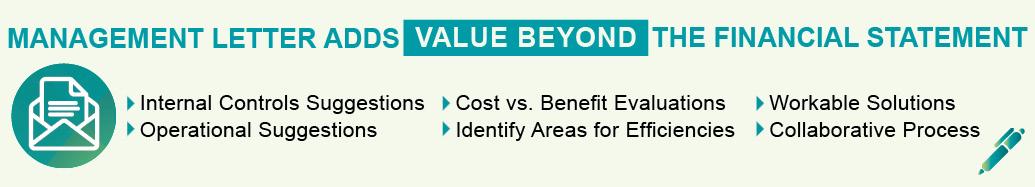

RE: RFP 2023 – 001 Financial Audit Services – Selection Committee Recommendations

DATE: Tuesday, September 19, 2023

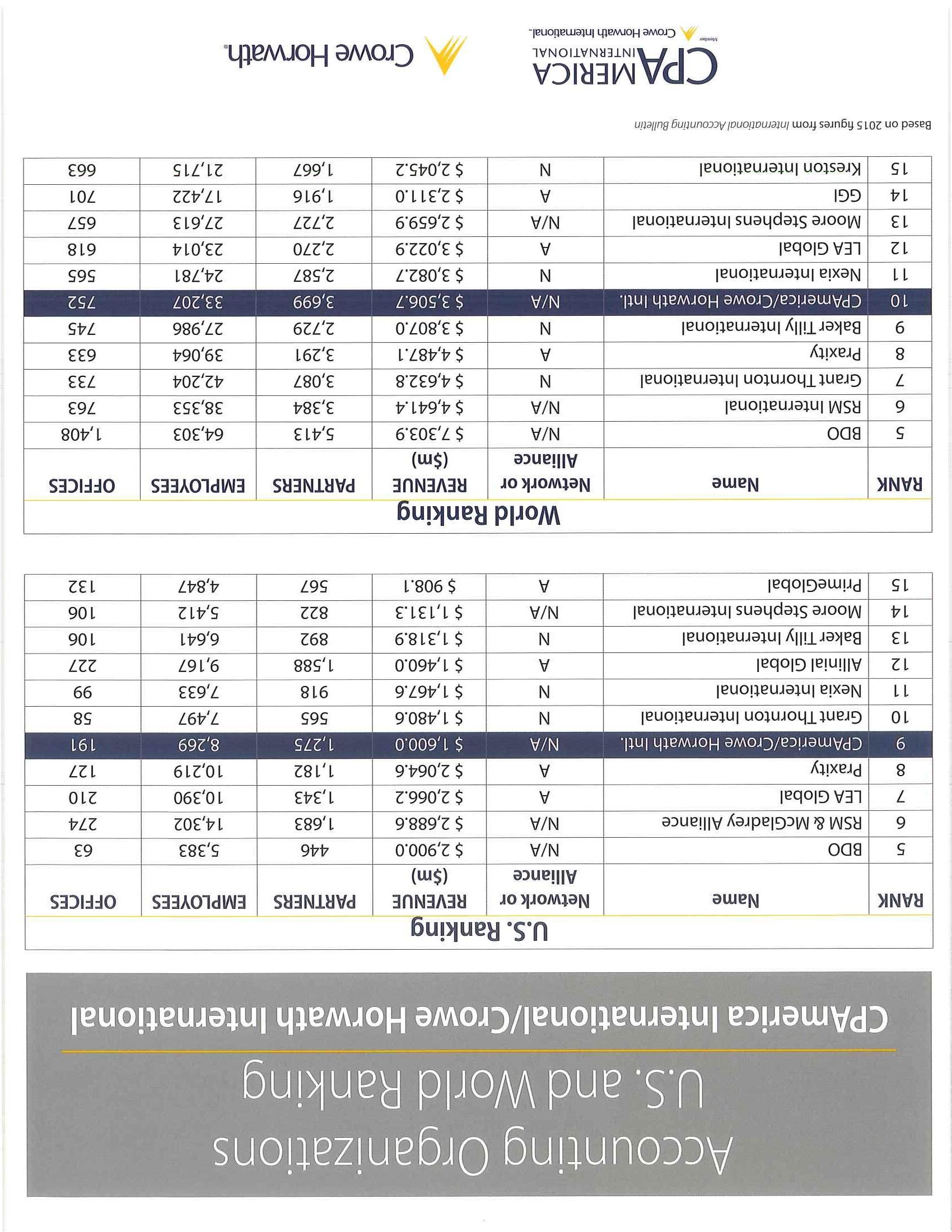

In July, the Downtown Development Authority (DDA) released a Request for Proposals (RFP) for Financial Audit Services. The RFP was released via DemandStar, the DDA website and advertised in the Palm Beach Post.

The scope of the RFP included requests for Proposals from qualified and experienced firms, licensed to practice in the State of Florida, with demonstrated skills and experience in financial auditing services. To be eligible to respond to this RFP, the proposing firm shall demonstrate that they have been continuously engaged in providing similar audit services to those specified herein for a minimum of five (5) years.

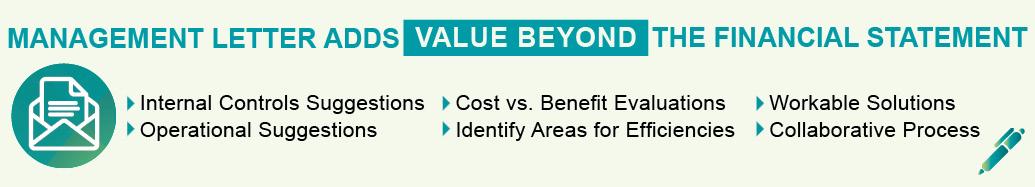

The proposals were required to meet the following minimum qualifications:

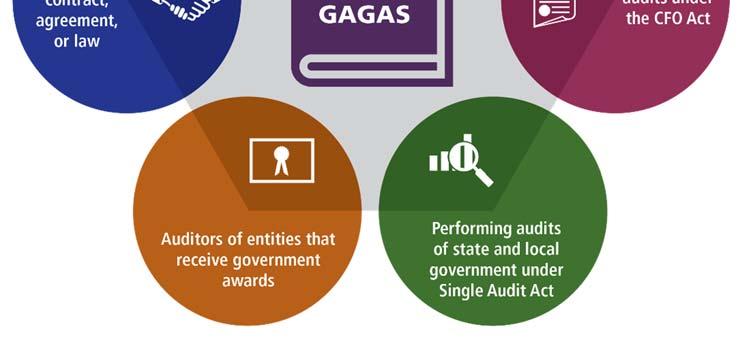

a. Reports to be Issued. Following the completion of the audit of the fiscal year’s financial statements, the auditor must prepare reports required by adherence to the auditing standards, including but not limited to:

i. A report on the fair presentation of the financial statements in conformity with generally accepted accounting principles;

ii. A report on the internal control over financial reporting and compliance and other matters based on an audit of financial statements performed in accordance with Governing Auditing Standards;

iii. A management letter required by Section 10.550, Rules of the Auditor General;

iv. An independent accountant’s report on Compliance with Section 218.415, Florida Statues.

b. Firm Qualifications and Experience. The proposal shall state the size of the firm, the size of the firm’s governmental audit staff and the number and nature of the professional staff to be employed on this engagement on a full-time basis and the number and nature of the staff to be

107 S Olive Avenue, Suite 200, West Palm Beach, FL 33401 Phone: 561.833.8873 - DowntownWPB.com

employed on a part–time basis. The firm must provide an affirmative statement that they are in good standing with the American Institute of Certified Public Accountants.

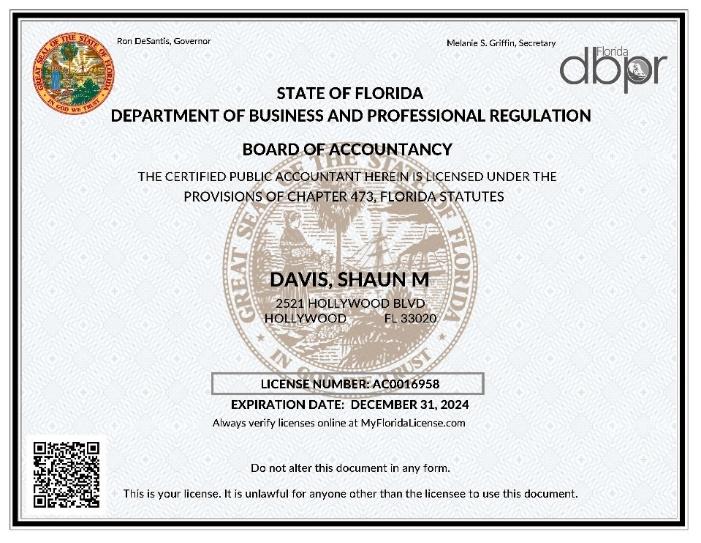

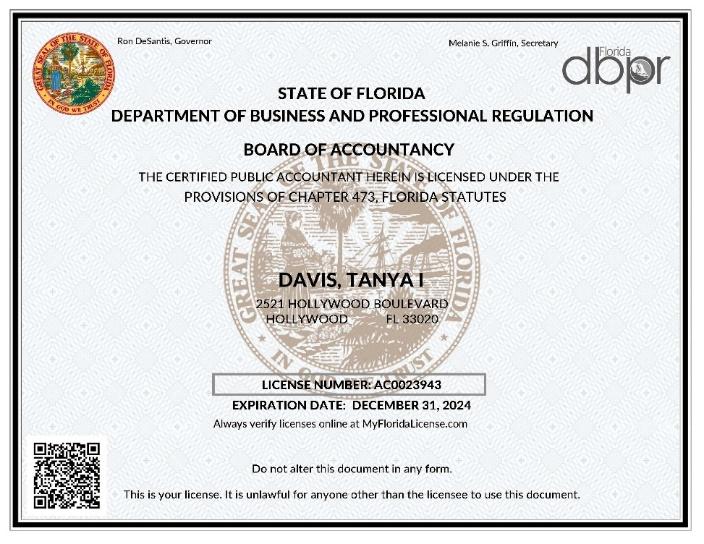

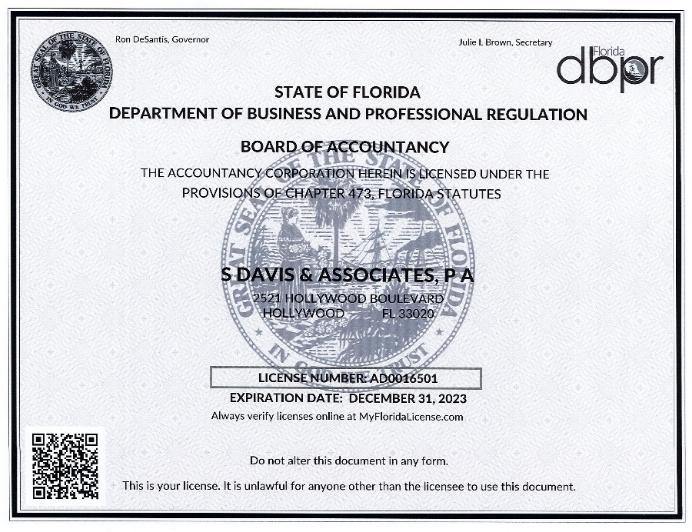

c. Partner, Supervisory and Staff Qualifications & Experience. The firm must identify the principal, supervisory and management staff, including engagement partners, managers, other supervisors, specialists, and staff who will be assigned to the engagement and indicate whether each such person is registered to practice as a certified public accountant in the State of Florida.

d. Similar Engagements with other Governments. For the firm’s office that will be assigned the responsibility of the audit, list the most significant engagements (maximum of 5) performed in the last five (5) years that are similar to the engagement described in this RFP.

e. Specific Audit Approach. The proposal should set forth a work plan, including an explanation of the audit methodology to be followed, and a transition schedule, if applicable, to perform the services required in this RFP.

f. Identification of Anticipated Potential Audit Problems. The proposal shall identify and describe any anticipated potential audit problems, the firm’s approach to resolving these problems and any special assistance that will be requested from the DDA.

Selection Committee for this RFP process included:

1. Bill Jacobson Esq., WPB DDA Vice Chairman

2. Bridget Souffrant, City WPB Chief Financial Officer

3. Kasia Marczyk, Certified Financial Planner Practitioner

Three (3) proposals were received. The agencies that responded to the RFP are:

1. Marcum LLP

2. Nowlen, Holt, & Miner, P.A.

3. S. Davis & Associates, P.A.

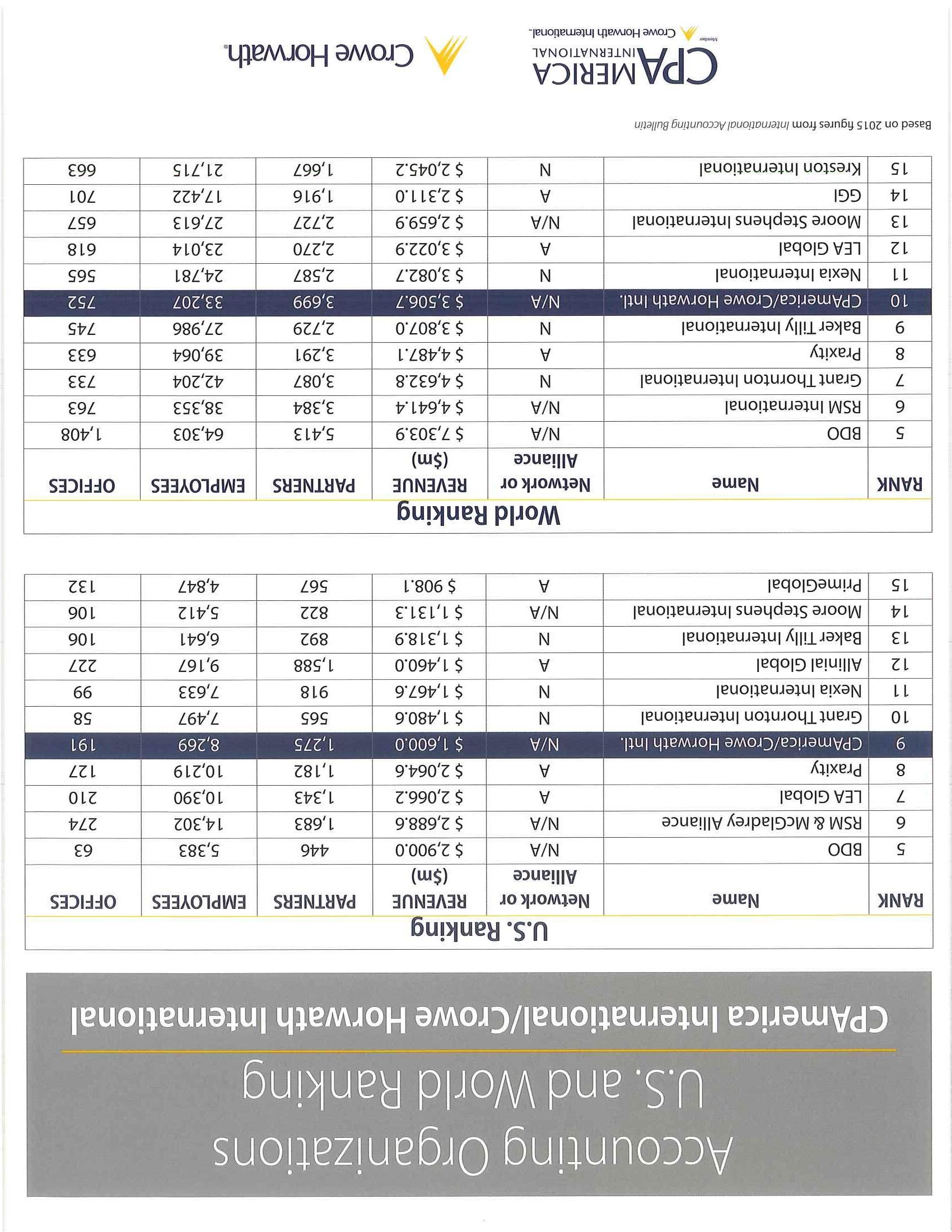

The Selection Committee ranked each proposer based on the following scale:

107 S Olive Avenue, Suite 200, West Palm Beach, FL 33401 Phone: 561.833.8873 - DowntownWPB.com

Evaluation Factors Factor Points Description 1 30 Audit Approach Firm’s Technical Response to RFP’s Scope of Services. 2 40 Expertise and Experience Experience, Strength, and Qualifications of Firm as it relates to this solicitation. 3 25 Fee Information Fee Proposal 4 5 Local Preference Businesses located within the DDA District will be afforded 5 additional points Total 100

Members of the Selection Committee ranked the proposers as follows:

At this meeting, staff are requesting that the DDA Board award the contract for a Financial Audit Services company and allow staff to begin contract negotiations. The final agreement will be presented to the DDA Board for review and approval in October 2023

107 S Olive Avenue, Suite 200, West Palm Beach, FL 33401 Phone: 561.833.8873 - DowntownWPB.com

Selection Committee Chair - Bill Jacobson Total Score Selection Committee MemberBridget Souffrant Total Score Selection Committee MemberKasia Marczyk Total Score # Proposer Name Name Name 1 Marcum LLP 28.75 68.75 82.50 60.00 2 Nowlen, Holt & Miner, P.A. 52.50 85.00 100.00 79.17 3 S. Davis & Associates, P.A. 85.00 68.75 71.25 75.00

WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY Financial Audit Services RFP 2023-001 August 23, 2023 Moises D. Ariza, CPA, CGMA, Partner moises.ariza@marcumllp.com

DOWNTOWN DEVELOPMENT AUTHORITY

August 23, 2023

West Palm Beach Downtown Development Authority

Raphael Clemente, Executive Director 107 S. Olive Avenue, Suite 200 West Palm Beach, FL 33401

Marcum LLP (“Marcum” or “the Firm”) is pleased to respond to the RFP to provide professional external auditing services for the West Palm Beach Downtown Development Authority, (“the DDA” or “the Authority”).

For 70 years, Marcum, a National Top 12 Firm, has provided professional services to the public sector, including counties, local governments, government pension plans, public utilities, charter schools, community redevelopment agencies, special districts, and other government entities. We believe our service, technical competency, and value to you will be unparalleled. Some of our key qualities that will benefit the DDA include:

SIGNIFICANT EXPERIENCE IN THE PUBLIC SECTOR

In the past year alone, the Florida region of Marcum has performed more than 45 audits of government entities. At a national level, we provide services to more than 300 government entities. We have extensive experience in the Federal and Florida Single Audit Acts including the OMB Uniform Guidance.

SMALL-FIRM CARE AND ATTENTION WITH LARGE-FIRM RESOURCES

Our local-office approach provides the personal service and timely communication of a small firm with access to the resources and capabilities of a large firm, resulting in the DDA receiving the best of both worlds. We have approximately 350 employees, located in West Palm Beach, Fort Lauderdale, Miami, and Tampa.

SMOOTH TRANSITON

Our extensive experience with transitioning new clients has led to a streamlined process that is respectful of your time and resources. As a result, you’ll receive the benefit of a new team with significant government experience as well as a fresh look at your systems, with minimal disruption.

EXPERIENCED TEAM

For this proposed engagement Marcum has assembled an audit team, whose skills and experience match the requirements of the DDA. The proposed client service and audit engagement partner, Moises D. Ariza, CPA, CGMA, has extensive experience in performing audits of government pension plans. He will be supported by a quality control director, Beila Sherman, CPA; IT risk audit partner, Joe Layne, CISA; senior manager, Scott Montgomery, CPA and audit supervisor, Jason Relyea. All decisions that affect the planning, execution, and completion of the proposed audit will be made by Moises D. Ariza, Partner.

PROPOSAL FOR WEST

PALM BEACH

DOWNTOWN DEVELOPMENT AUTHORITY

AUDIT QUALITY

The issues of audit quality and technical proficiency are important matters for consideration. We ensure that professional standards are exceeded on all of our engagements through a robust quality control system that encompasses a Partner and Manager Review Process, Professional Development, Technical Support, Internal Inspections, and the AICPA Peer Review Process.

Our technical competencies will be essential over the next several years with the implementation of new significant standards set by the Governmental Accounting Standards Board. This assistance will be provided at no additional cost to the DDA.

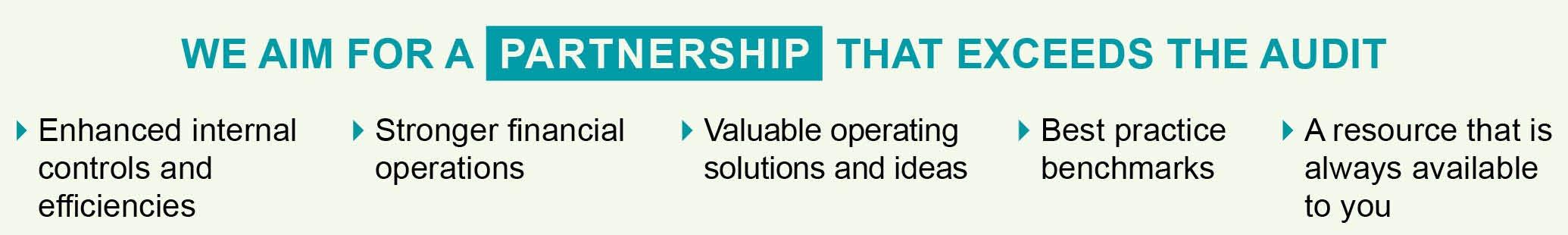

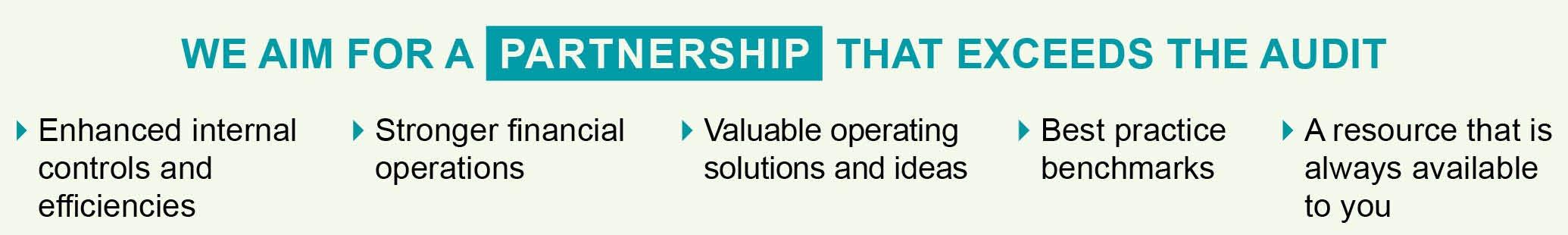

COMPLEMENTARY RESOURCES THAT ADD VALUE BEYOND THE AUDIT

We are committed to providing our clients with educational insights and timely updates on matters relevant to their industry through complimentary webinars, newsletters, and other communications Additionally, annually we offer a full day government CPE seminar (Marcum’s Government Symposium) featuring both local and national speakers. This seminar is geared towards offering our clients training on key audit and accounting issues at no cost to the DDA.

PROACTIVE COMMUNICATION & PARTNERSHIP

Perhaps the quality that best describes Marcum is our ability to go beyond the routine, to provide an extra dimension in quality, effort and service to our clients. The members of our firm are always accessible and are sensitive to your needs. We will be available to answer questions, discuss audit issues, and provide solutions throughout the year. We believe that this commitment sets Marcum apart from other firms.

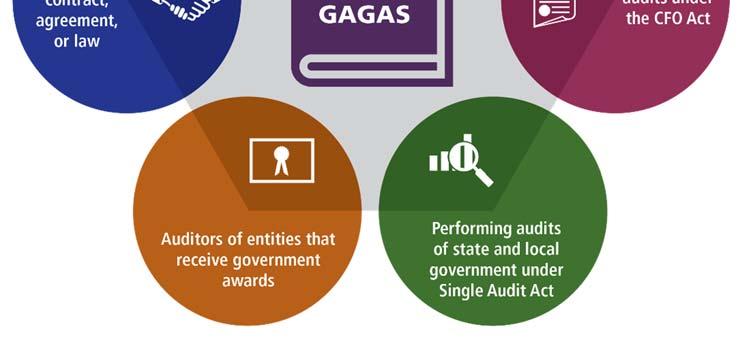

This proposal will detail our methodology and how we will work with the DDA to develop a strong partnership. We will perform an audit on the financial statement of the DDA for the fiscal years ending September 30, 2023 through 2025, with the option to renew for two (2) additional one (1) year terms for fiscal years 2026 and 2027. Marcum is independent of the DDA as defined by generally accepted auditing standards and Government Auditing Standards issued by the Comptroller General of the United States.

We welcome the opportunity to answer any questions and to provide further information regarding our services and experience. Thank you for your consideration.

Sincerely,

Moises D. Ariza, CPA, CGMA Partner, Government Services Authorized to represent and contractually bind the Firm moises.ariza@marcumllp.com

PROPOSAL FOR WEST PALM BEACH

ii

PROPOSAL

WEST PALM BEACH DOWNTOWN

CONTENTS Tab 1: Transmittal Letter ...................................................................................... i-ii Tab 2: Table of Contents............................................................................................ Tab 3: Independence 1 Tab 4: License to Practice in the State of Florida 2 Tab 5: Firm Qualifications and Experience 3 Tab 6: Partner, Supervisory and Staff Qualifications & Experience ..................... 11 Tab 7: Similar Engagements with Other Governments 20 Tab 8: Specific Audit Approach 23 Tab 9: Identification of Anticipated Potential Audit Problems 34 Tab 10: Public Entity Crimes .................................................................................35 Tab 11: Project Fees 36 Appendix A: Peer Review Reports Appendix B: Licenses Appendix C: Insurance Appendix D: Reference Letters Appendix E: Required Forms

FOR

DEVELOPMENT AUTHORITY T AB 2: T ABLE OF

TAB 3: INDEPENDENCE INDEPENDENCE

Marcum LLP (the Firm) is independent of the DDA as defined by generally accepted auditing standards and the U.S. General Accounting Office’s Government Auditing Standards issued by the Comptroller General of the United States.

Marcum’s policy is that all professional personnel be familiar with and adhere to the independence, integrity, and objectivity rules, regulations, interpretations, and rulings of the American Institute of Certified Public Accountants, the state Board of Accountancy and state CPA societies, relevant statutes, and applicable regulatory agencies. In addition, all professionals – from partner to staff auditor – are required to sign affidavits annually attesting to their independence.

Marcum’s quality control document contains detailed policies related to maintaining independence. These policies are the most stringent policies adopted by the AICPA and the various state boards of accountancy. Engagement team members are required to consider any possible situations where independence may be impaired during the acceptance or continuance process and if any arise during the performance of an engagement.

PROPOSAL FOR WEST PALM BEACH DOWNTOWN

1

DEVELOPMENT AUTHORITY

2

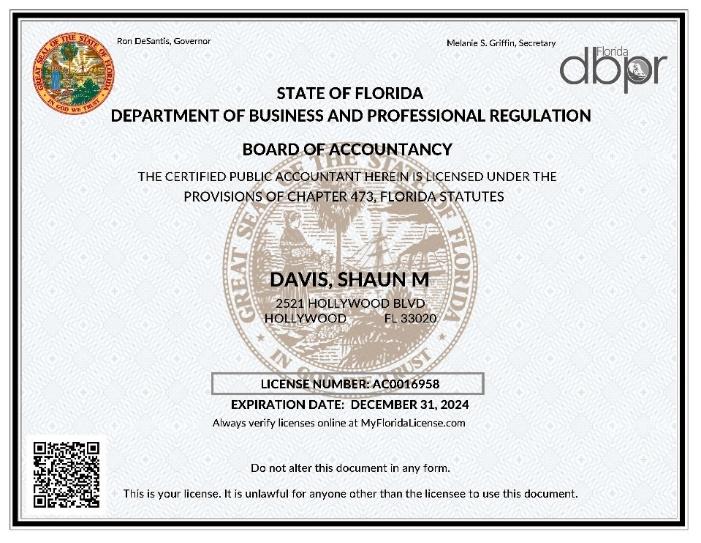

TAB 4: LICENSE TO PRACTICE IN FLORIDA

LICENSED TO PRACTICE IN FLORIDA

We affirm that Marcum LLP is a licensed certified public accounting firm and is in good standing with all regulatory agencies. The Firm is a member of the American Institute of Certified Public Accountants (AICPA) and the Florida Institute of Certified Public Accountants (FICPA). All professional staff, upon successful completion of the CPA exam, become members of both the AICPA and their respective state society of CPAs. The Firm is properly licensed and certified to practice in Florida and is registered annually with the Florida Department of Business and Professional Regulation – Board of Accountancy.

All key team members assigned to this engagement are licensed to practice in the State of Florida. Each individual on the engagement has maintained the required CPE in government accounting and has attended an Ethics course for CPAs in Florida. All applicable licenses are provided in Appendix B.

PROPOSAL FOR WEST PALM BEACH DOWNTOWN

2

DEVELOPMENT AUTHORITY

TAB 5: FIRM

FIRM OVERVIEW

QUALIFICATIONS AND EXPERIENCE

MARCUM LLP (a Limited Liability Partnership) is a national accounting and advisory services firm dedicated to helping clients like the DDA achieve their goals. Since 1951, clients have chosen Marcum for our deep expertise and insightful guidance in helping them forge pathways to success, whatever challenges they’re facing.

Marcum offers a complete spectrum of tax, assurance, and advisory services, as well as an extensive portfolio of industry-focused practices with specialized expertise for the public sector including local government entities. As part of the Marcum Group, the Firm also provides a full complement of technology, wealth management, executive search and staffing, and strategic marketing services.

Headquartered in New York City, Marcum has 50 offices in major business markets across the U.S. and select international locations.

The Florida Region of Marcum includes offices in West Palm Beach, Fort Lauderdale, Miami, and Tampa. The audit will be staffed from our West Palm Beach office located at 525 Okeechobee Boulevard, Suite 750, West Palm Beach, FL 33401. All audit team members are full-time employees. We have a complete government service team of 46 locally based individuals and more than 4,100 associates nationwide.

The size of our Florida team is as follows:

PROPOSAL FOR WEST PALM BEACH DOWNTOWN

3

DEVELOPMENT AUTHORITY

Personnel Total CPA Government Specialist Partners 35 35 3 Directors 31 11 2 Senior Managers 33 17 2 Managers 34 16 3 Supervisors 42 14 3 Seniors 64 21 11 Staff Accountants 69 9 20 Operations 42 0 2 TOTAL 350 120 46

CLIENT-DRIVEN

Understanding the governmental sector and helping clients identify their needs and meet their challenges and uncovering opportunities that propel them towards success is Marcum’s mission. Our own success is based on our commitment to building meaningful, trusted relationships with our clients, creating positive service experiences, and delivering unexpected value wherever and whenever we can, while maintaining our professional independence and objectivity.

Our assurance professionals, most who have been focused on the government arena throughout their entire careers, have an in-depth understanding of the complex economic and political environment in which these entities operate. Their knowledge and experience allow us to provide the highest level of professional service to our government clients.

COMMITMENT TO EXCELLENCE

From the way we service clients to the training and development of our professionals, Marcum is committed to excellence in every aspect of our operation.

Our focus on client success compels us to look beyond the numbers to see the opportunities, challenges, and solutions in every engagement. Innovation, proactivity, teamwork, and open communication are the hallmarks of our approach.

UNDERSTANDING OF THE GOVERNMENTAL SECTOR

Understanding the governmental sector and helping clients identify their needs and meet their challenges and uncovering opportunities that propel them towards success is Marcum’s mission. Our own success is based on our commitment to building meaningful, trusted relationships with our clients, creating positive service experiences, and delivering unexpected value wherever and whenever we can, while maintaining our professional independence and objectivity.

Our assurance professionals, most who have been focused on the government arena throughout their entire careers, have an in-depth understanding of the complex economic and political environment in which these entities, like the DDA, operate. Their knowledge and experience allow us to provide the highest level of professional service to our government clients.

One of the many advantages of choosing Marcum as your auditor is that our team has significant knowledge and understanding of the DDA and its operations. The combination of our Firm’s resources, level of partner involvement and experienced team members provides an excellent service team of professionals capable of servicing your needs.

PROPOSAL FOR WEST PALM BEACH DOWNTOWN DEVELOPMENT

4

AUTHORITY

EXPERIENCE SERVING THE PUBLIC SECTOR GOVERNMENT SERVICES

For over 70 years, Marcum has successfully provided professional auditing, accounting, financial reporting, and management advisory/consulting services to a broad spectrum of government entities, including preparing government financial statements. Annually, we perform more than 300 government entity audits, 400 employee benefit plan audits, and 200 Single Audit engagements.

The assurance services we provide to government entities includes pension audits, single audits, compliance audits, forensic audits, IT audits, internal audits, Governmental Accounting Standards Board (GASB) implementation, financial statement audits, aiding in obtaining the Certificate of Achievement for the ACFR, and Annual Financial Report preparation and assistance, performance or operational reviews and a wide range of consulting services for local governments.

In addition, the partner and quality control director on the proposed engagement team have been instrumental in assisting clients with the implementation of new pronouncements. Most recently, to note significant GASB pronouncements, the team assisted our clients with the implementation of GASB Statement No. 87, Leases and GASB Statement No. 96, Subscription-Based Information Technology Arrangements.

IT RISK AND ASSURANCE

Our IT Risk and Assurance Services team can assess your information risk management and operational effectiveness. We can then provide you with privacy, compliance, and technology consulting solutions. Experienced professionals hold CISA, CISSP, CISM, CRISC, or CPA accreditations along with many years of experience in bringing unique solutions to your business and IT needs. This unique combination allows us to start with your business challenges and then tailor IT solutions to match your needs.

PROPOSAL FOR WEST

5

PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

Our IT Risk and Assurance Services team helps clients achieve optimum results in their ability to manage IT risk, mitigate those risks, and improve performance with cost-effective solutions. Our goal is to deliver practical solutions to the problem of “digital insecurity,” which means helping to identify the most cost-effective ways to address specific concerns regarding IT-related compliance and control issues relevant to your environment and needs. In addition, the IT Risk and Assurance Services team can design and implement ERP solutions that will integrate your operations more efficiently

As a result of our robust expertise, in 2019 and 2022, Marcum was named a Best Firm for Technology by Accounting Today, an independent third party, in its review of accounting firms that are innovating the use of technology to build more responsive, profitable, and sustainable practices.

ROBOTIC PROCESS AUTOMATION

At Marcum LLP, we understand that government entities are always looking to stay at the forefront of innovation. Technological advances are transforming concepts that seemed impossible just a few years ago into today’s reality. Our goal as your trusted advisor is to provide you with the most cutting-edge resources available to streamline your work processes while delivering the best possible return on your investment.

Marcum’s team of consulting and technology experts offer clients Robotic Process Automation “Bot” Services. These services have the capability to change the way our clients are conducting business by automating and in many cases eliminating manual process that employees would be otherwise spending hours to complete. Utilizing Digital Workers can replace many tedious functions and tasks that are time consuming and often prone to human error, including data entry, periodic reporting, and accounts payable invoicing. They can also be used to generate and distribute reports, process inbound leads, and retrieve data from the web.

A CTIVE PARTICIPATION ON BOARDS AND COMMITTEES

The partners, directors, and managers of the Firm are actively involved in recognized standardsetting organizations at the national, state, and local level. These organizations include the Florida Government Finance Officers Association (FGFOA), Florida Association of Special Districts (FASD), and the Florida League of Cities (FLC).

PROPOSAL FOR WEST

6

PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

AUTHORITY

Marcum is also a member of the AICPA Employee Benefit Plan Audit Quality Center (EBPAQC) and the AICPA’s Governmental Audit Quality Center (GAQC). Our involvement in these organizations further demonstrates our commitment to the public sector and helps keep us on top of issues affecting government entities. Marcum affirms it is a member in good standing with the AICPA.

RESOURCES FOR OUR GOVERNMENT CLIENTS

Marcum LLP is also committed to providing professional development programs to the entire South Florida community involved in the government sector. For the past 27 years, Marcum has presented an annual Government Symposium, an 8-hour accounting and auditing seminar that focuses on current developments in government affairs, including accounting, legal and operational topics. We encourage our clients and non-clients alike, to attend this technical (CPE) Symposium at no cost. During 2021 and 2022, our Annual Government Symposium was hosted virtually, with the hopes of continuing the virtual series next year. Additionally, Marcum provides more than 40 virtual courses that can be attended live or at a later date. All Marcum clients have access to this database at no cost.

7

PROPOSAL FOR WEST PALM BEACH DOWNTOWN DEVELOPMENT

PROPOSAL FOR WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

INTERCONNECTED SERVICES

Our group provides interconnected professional services to help government entities achieve their operational, strategic and compliance goals. Our service offerings grew from government entities seeking our advice beyond audit and compliance and our drive to do more for these organizations like the DDA.

By providing a vast array of expertise and service lines to support our clients’ operations, our capacity and passion to serve and strengthen every aspect of our clients’ operations remains unparalleled.

8

QUALITY CONTROL AND PEER REVIEW

The quality of our professional practice is of utmost importance to the Firm, our clients, and to the users of our reports. As such, we maintain a quality control program that ensures our internal policies are met and professional standards are exceeded on all of our engagements. To ensure that the Firm's performance is in conformity with our stated standards and those issued by the AICPA, our quality control system encompasses the following:

Professional Development. Marcum provides a minimum of 40 hours (five days) of CPE in-house to all professional staff. These seminars include sessions in accounting, auditing, financial reporting, and internal controls. In addition to the in-house training, our partners and professional staff attend various outside seminars.

Internal Inspections. Annually the Firm selects a random sample of accounting, auditing, advisory and tax engagements and performs a review to ensure compliance with firm policies and professional standards.

Centralized Financial Statement Review Process. The quality control department performs a review of our audit binders and financial statements prior to the release of the finished product. Their involvement includes participation in engagement planning to approve the audit approach, review of high risk and complex areas throughout fieldwork and a review of the financial statements and related information. Their involvement in the planning and fieldwork stages helps eliminate any last-minute surprises and assures the high level of quality we demand from our professionals is maintained.

Peer Review. The Firm participates in an external quality review program requiring an on‐site independent examination of our Accounting and Auditing practice. The Firm has consistently received clean opinions (rating of “Pass”) on the quality of the Firm’s audit practice. This is the highest level of achievement and recognition in the peer review program. Please refer to Appendix A for a copy of our latest peer review report which includes our government engagements.

FEDERAL OR STATE DESK REVIEWS OR FIELD AUDITS

There are no actions as a result of any federal or state desk reviews or field audits to Marcum or its auditors of government entities during the past three (3) years.

There has been no disciplinary action taken nor pending against Marcum or any of the professional staff during the past three (3) years with the State Board of Accountancy or the Auditor General or any other regulatory bodies.

PROPOSAL FOR WEST PALM BEACH

9

DOWNTOWN DEVELOPMENT AUTHORITY

GOVERNMENT SERVICES - LITIGATION AND DISCIPLINARY ACTIONS

Marcum LLP (“Marcum”) is a national firm with significant operations and as a result, it is a party to ordinary course litigation. No litigation, proceeding or investigation by any regulatory body will have a material impact on Marcum’s ability to operate its business and to provide the services contemplated hereunder.

GOVERNMENT / AICPA LITIGATION AND DISCIPLINARY

Not applicable - Marcum LLP affirms there has been no litigation whereby a court has ruled against the firm in any matter related to the professional government auditing services of the Firm. The firm has been providing audit services to government entities for over 70 years and has never been a party involving a government entity.

There have been no pending indictments, litigation or proceeding relevant to the subject matter of this solicitation.

There have been no pending indictments, litigation or proceeding during the past five (5) years, whereby a court or any administrative agency has ruled against the firm in any matter related to its professional government auditing services of the Firm.

There have not been any terminations, suspensions, censures, reprimands, probations or similar actions against any member of Marcum LLP by the Florida State Board of Accountancy in the last three (3) years.

NON-GOVERNMENTAL SETTLEMENTS

In 2023, the Securities & Exchange Commission & Public Company Accounting Oversight Board both announced settled administrative proceedings with Marcum LLP. None of the partners nor associates to be assigned to your engagements have participated in audits of public filing companies or special purpose acquisition company (SPAC’s). None of the government audit team members practice under the PCAOB or SEC.

PROPOSAL FOR WEST PALM BEACH DOWNTOWN

10

DEVELOPMENT AUTHORITY

TAB 6: PARTNER, SUPERVISORY AND STAFF QUALIFICATIONS & EXPERIENCE ENGAGEMENT TEAM

The team members proposed for the DDA have comprehensive industry knowledge and possess the critical regulatory, technical, and business process skills necessary to provide you with an effective and efficient audit. These professionals are well-versed in the complexities of governmental accounting, auditing, and financial reporting, including all GASB pronouncements, Florida Statutes and Rules of the Auditor General.

Moises D. Ariza, Audit Partner; Beila Sherman, Quality Control Director; Scott Montgomery, Senior Audit Manager; Joe Layne, IT Partner; Jason Relyea, Audit Supervisor; and Staff Auditors are from the South Florida offices and will be assigned to this engagement on a full-time basis.

Moises D. Ariza and Scott Montgomery are “key” team members. We anticipate key team members to remain consistent over the term of the engagement. No personnel changes will be made without the express prior written by the DDA.

ENGAGEMENT TEAM STRUCTURE

ASSURANCE IT AUDITOR QUALITY CONTROL

Beila Sherman CPA Quality Control Director

Moises D. Ariza CPA, CGMA Lead Engagement Partner

Joe Layne CISA, CISM, MSCA, PCIP IT Risk Audit Partner

Scott Montgomery CPA Senior Manager

Jason Relyea Audit Supervisor

PROPOSAL FOR CITY OF WEST PALM BEACH 11

Audit Staff

MOISES D. ARIZA, CPA, CGMA PARTNER ASSURANCE SERVICES

moises.ariza@marcumllp.comriza@marcumllp.com

Moises D. Ariza is a partner in the Firm's Assurance Division. He has more than thirteen years of experience in the accounting profession providing accounting, assurance, and advisory services to a wide range of clients. Much of his client base includes nonprofit organizations, local governments, employee benefit plans, manufacturing companies and retail entities.

In addition, Mr. Ariza has significant expertise in performing Federal and Florida Single Audits in accordance with OMB Uniform Guidance and the Florida Single Audit Act, as well as program-specific compliance audits.

Mr. Ariza is involved in all phases of the audit process, from planning and initial risk assessment to ensuring compliance with all State and Federal laws, and the preparation and review of financial statements. He is a qualified peer reviewer and regularly performs peer reviews under the AICPA Peer Review Program.

Within the firm, Mr. Ariza develops in-house training seminars for the Firm’s professional staff as well as continuing education programs for various outside organizations. Moises is an active team leader in the Firm's Employee Benefit Plan Group, Nonprofit Sector and Government Services Group.

Professional & Civic Affiliations

Chartered Global Management Accountant (CGMA)

American Institute of Certified Public Accountants (AICPA)

Florida Institute of Certified Public Accountants (FICPA)

Government Finance Officers Association (GFOA)

GFOA Special Review Committee, Active Member Association of Latin Professionals in Finance and Accounting, Member (ALPFA)

Miami-Dade, Broward and Palm Beach County League of Cities, Associate Member South Florida Government Finance Officers Association, Associate Member Florida Government Finance Officer Association, Member (FGFOA)

YMCA of South Florida, Finance Committee Member

Awards & Accolades

Top 20 Professionals Under 40, Brickell Magazine, 2021 Young Horizons Award, Florida Institute of CPAs, 2021

Articles, Seminars & Presentations

Navigating through GASB No. 68, Published Article

The Importance of Governmental Financials, FGFOA Conference

GASB Statement No. 68, 2015 Marcum Governmental Symposium Government Auditing Standards and OMB Uniform Guidelines, Internal Training

Risk Assessment and Audit Approach, Internal Training Related Party Transactions, Internal Training Employee Benefit Plans, Internal Training

PRACTICE FOCUS

Financial Audits

Federal & Florida Single Audits

Financial Reporting

Program-Specific Compliance Audits

INDUSTRY FOCUS

Local Governments

Government Pension Plans

ERISA Pension Plans

Special Districts

Nonprofits

Wholesale & Retail Distributors

Manufacturers

EDUCATION

Bachelor of Accounting –

Florida International University

Master of Accounting –

St. Thomas University

Master of Accounting –St. Thomas University

*Licensed by the State of Florida #AC45440

PROPOSAL FOR WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY 12

(two years) Government 105 Other (Accounting, Auditing, Technical and Behavioral) 60 Total 165

CPE Hours

PROPOSAL FOR WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

MOISES D. ARIZA CURRENT AND FORMER GOVERNMENT CLIENTS

13

Government Experience Year on Job Pension Audit Single Audit CRA Broward County 2 ✓ ✓ Children’s Services Council of Broward County 5 ✓ City of Boca Raton 7 ✓ ✓ ✓ City of Boynton Beach 2 ✓ City of Coconut Creek 5 ✓ ✓ City of Deerfield Beach 6 ✓ ✓ ✓ City of Delray Beach 2 ✓ ✓ City of Florida City 10 ✓ ✓ ✓ City of Hallandale Beach 5 ✓ ✓ ✓ City of Hollywood 5 ✓ ✓ ✓ City of Homestead 12 ✓ ✓ City of Miramar 2 ✓ ✓ City of Palm Beach Gardens 5 ✓ City of Pompano Beach 5 ✓ ✓ ✓ City of Sunrise 10 ✓ City of West Palm Beach 5 ✓ ✓ ✓ East Central Regional Wastewater Treatment Facilities 2 Housing Finance Authority of Palm Beach County 1 Indian Creek Village 2 Florida Keys Aqueduct Authority 5 ✓ ✓ Miami-Dade Water & Sewer Department 10 ✓ ✓ Northern Palm Beach County Improvement District 2 The Children’s Service Council of Palm Beach County 2 ✓ The Children’s Trust 7 Town of Bay Harbor Islands 8 ✓ ✓ Town of Jupiter 2 ✓ Town of Palm Beach 2 ✓ ✓ Town of Southwest Ranches 5 ✓ Town of Surfside 5 ✓ ✓ Village of Key Biscayne 10 ✓ ✓ Village of Palmetto Bay 2 ✓ Village of Royal Palm Beach 1 Village of Tequesta 3 ✓

BEILA SHERMAN, CPA QUALITY CONTROL DIRECTOR ASSURANCE SERVICES

beila.sherman@marcumllp.com

Belia Sherman has more than 25 years of experience providing accounting, auditing and advisory services for a wide range of entities. As a Director in the Firm’s Assurance division, her primary responsibilities include on-site supervision and review of audit engagements to ensure they are prepared in accordance with professional and Firm standards.

Ms. Sherman provides guidance to clients ranging from complex accounting issues to general business and accounting developments. She has significant experience in the evaluation of internal controls.

In addition, Ms. Sherman develops in-house training seminars for the Firm’s professional staff as well as continuing education courses for various outside organizations, on current accounting and auditing matters. She is actively involved in the division’s professional development activities.

Professional & Civic Affiliations

American Institute of Certified Public Accountants (AICPA)

Florida Institute of Certified Public Accountants (FICPA)

Florida Institute of Certified Public Accountants – CIRA Section

Government Finance Officers Association (GFOA)

Canadian Institute of Chartered Accountants (CPA)

South Florida Government Finance Officers Association, Associate Member (SFGFOA)

Miami-Dade, Broward, and Palm Beach Counties Leagues of Cities

Articles & Presentations

Internal CPE Training, Instructor

“Governmental Accounting (GASB) and Government Auditing Standards”

PRACTICE FOCUS

Financial Audits

Federal Single Audits

Florida Single Audits

Operational & Performance Reviews

Agreed-Upon Procedures

Attestation Services

Advisory Services

Peer Reviews

INDUSTRY FOCUS

Local Governments

Nonprofit Organizations

CIRA Organizations

Wholesale & Retail Distributors

Manufacturers

Construction Companies

Real Estate Companies

EDUCATION

Bachelor of Business

Administration, Mount Saint Vincent University

PROPOSAL

14

FOR CITY OF WEST PALM BEACH

Internal Training

and

Audits Acts,” Internal Training Florida School of Government Finance Instructor FGFOA Presenter FASD Presenter CPE Hours (two years) Government 168 Ethics 8 Other (Accounting, Auditing, Technical and Behavioral) 40 Total 216

“Federal

Florida Single

PROPOSAL FOR WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

BEILA SHERMAN CURRENT AND FORMER GOVERNMENT CLIENTS

15

Government Experience Year on Job Pension Audit Single Audit CRA Bal Harbour Village 8 ✓ ✓ Broward County 5 ✓ ✓ Children’s Services Council of Broward County 5 ✓ City of Boca Raton 9 ✓ ✓ ✓ City of Coconut Creek 5 ✓ ✓ City of Deerfield Beach 3 ✓ ✓ ✓ City of Florida City 15 ✓ ✓ City of Hallandale Beach 6 ✓ ✓ ✓ City of Hollywood 3 ✓ ✓ ✓ City of Homestead 10 ✓ ✓ City of Miramar 4 ✓ ✓ City of North Miami 15 ✓ ✓ ✓ City of North Miami Beach 15 ✓ ✓ ✓ City of Oakland Park 4 City of Palm Beach Gardens 5 ✓ ✓ City of Pembroke Pines 10 ✓ ✓ City of Pompano Beach 3 ✓ ✓ ✓ City of Sunny Isles Beach 5 City of Sunrise 8 ✓ City of West Palm Beach 5 ✓ ✓ ✓ Florida Keys Aqueduct Authority 7 ✓ Miami-Dade Water & Sewer Department 12 ✓ The Children’s Trust 6 ✓ Town of Bay Harbor Islands 15 ✓ ✓ Town of Surfside 8 ✓ ✓ Village of Key Biscayne 8 ✓ ✓ Village of Tequesta 5 ✓

JOE LAYNE, CISA, CISM, MSCA, PCIP PARTNER ADVISORY SERVICES

joe.layne@marcumllp.coms.ariza@marcumllp.com

Joe Layne is a Partner in Marcum's Advisory Services practice. He oversees IT audits for large clients, including public and private businesses. He is an experienced Information Systems Auditor with dynamic information systems risk, compliance and audit experience spanning 19 years across external Big Four Audit, Internal Audit and Information Technology.

Mr. Layne has worked in Information Technology as well as Internal and External audit developing a unique perspective having experienced the client side as well as performing client services. This allows him to better bridge the gap between broad regulations and the realistic impact or implementation of IT Risk and Controls with clients.

Mr. Layne offers ongoing education for clients around risk mitigation as well as risk assessments and consulting around prevention strategies and procedures. He assists clients develop protocols and internal controls for IT risk management.

Professional & Civic Affiliations

Information Systems Auditing and Control Association (ISACA)

Payment Card Industry Security Standards Council

Professional Designations

Certified Information Systems Auditor (CISA), ISACA

Certified Information Security Manager (CISM), ISACA

Payment Card Industry Professional (PCIP), PCI Security Standards Council

Microsoft Certified Systems Administrator (MCSA), Microsoft

PRACTICE FOCUS

IT Risk Management

IT Governance

IT Security Assessments

IT Audits

Sarbanes-Oxley Act (SOX)

SOC 1, 2, 3

HIPAA Security Rule

Internal Controls

PCI Compliance

INDUSTRY FOCUS

Government Agencies

Nonprofit Organizations

Public and Private Companies

Healthcare Organizations

EDUCATION

Bachelor of Science, Information Studies, Florida State University

PROPOSAL FOR WEST PALM BEACH DOWNTOWN

16

DEVELOPMENT AUTHORITY

CPE Hours (two years) Government 30 Other (Accounting, Auditing, Technical and Behavioral) 72 Total 102

FOR WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

SCOTT MONTGOMERY, CPA SENIOR MANAGER ASSURANCE SERVICES

scott.montgomery@marcumllp.com

Scott Montgomery is a senior manager in our Assurance Services Division with 25 years of experience in public accounting. He has experience in all audit phases, including planning, organization, supervision, and review of the fieldwork. Mr. Montgomery works with clients in a variety of industries including government, nonprofit, real estate, construction and privately held businesses.

Mr. Montgomery’s public accounting experience is primarily focused on financial reporting compliance, including audits, reviews, and compilations of privately held and regulated businesses. His experience also includes the planning and administration of audits of the financial statements of municipalities, private companies, real estate companies and a variety of nonprofit entities including social service agencies, religious organizations, schools, and private foundations.

Additionally, Mr. Montgomery has a significant background in internal controls and compliance, including performing audits with reporting requirements related to government funding, in addition to those required by the Federal Uniform Guidance (formally OMB Circular A-133) and State auditor general.

Professional & Civic Affiliations

American Institute of Certified Public Accountants (AICPA)

Florida Institute of Certified Public Accountants (FICPA)

FICPA Committee on Accounting Principles and Auditing Standards, Past Committee

Member

Government Finance Officers Association, Special Review Committee for the Certificate of Achievement Program

Florida Government Finance Officers Association

Housing Leadership Council of Palm Beach County, Treasurer

Capri West Condominium Association, President

Meadows on the Green Condo Association, Past Treasurer

Poinciana West Condominium Association, Treasurer

Palmland Villas Homeowners Association, Past Treasurer

PRACTICE FOCUS

Internal Audits

Assurance Services

Government & Municipal

INDUSTRY FOCUS

Local Governments

Nonprofit Organizations

Special Districts

Real Estate

EDUCATION

Bachelor of Accounting

St. Mary’s University

Master of Taxation

Baylor University

PROPOSAL

17

City

City

City

City

City

Martin County Town of Jupiter Palm Beach County Village of Palm Springs Village of Royal Palm Beach Village of Wellington CPE Hours (two years) Government 86 Other (Accounting, Auditing, Technical and Behavioral) 31 Total 117

Partial Listing of Clients:

of Boynton Beach

of Coconut Creek

of Delray Beach

of Miami

of North Miami Beach

JASON RELYEA SENIOR ASSURANCE SERVICES

jason.relyea@marcumllp.comises.ariza@marcumllp.com

Jason Relyea is a Senior in the Firm’s Assurance Division. He has approximately 5 years of experience in the accounting profession providing accounting, and auditing, for local government and nonprofit organizations. Some of the clients Jason has assisted in providing auditing services to include the School district of Palm Beach County, School District of Broward County, Palm Beach County BOCC, Broward County BOCC, Martin County BOCC, Canaveral Port Authority along with over a dozen cities throughout the Tri-County area. Jason also has experience working with nonprofit organizations (Conservation Organizations, Education Agencies etc.). Mr. Relyea has significant experience in performing Federal and Florida Single Audits in accordance with OMB Uniform Guidance and the Florida Single Audit Act, as well as program-specific compliance audits.

Mr. Relyea is involved in all phases of the audit process, from planning and initial risk assessment to ensuring compliance with all State and Federal laws, and the preparation and review of financial statements. He is client service driven and is always willing to assist clients with accounting, auditing and financial reporting issues, including but not limited to, implementation of new accounting pronouncements.

PRACTICE FOCUS

Financial Audits

Federal Single Audits

Florida Single Audits

Program-Specific

Compliance Audits

INDUSTRY FOCUS

Nonprofit Organizations

Special Districts

Local Governments

Governmental Pension Plans

EDUCATION

Masters of Accounting, St. Thomas University

PROPOSAL FOR WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY 18

Partial Listing of Clients: City of Boynton Beach City of Delray Beach City of Palm Beach Gardens City of Sunrise Palm Beach County Town of Bay Harbor Islands Town of Surfside CPE Hours (two years) Government 57 Other (Accounting, Auditing, Technical and Behavioral) 32 Total 89

STAFF DEVELOPMENT

Having the best-qualified professionals requires a continuous investment in training and resources that improve and maintain competencies. As the guidelines and compliance requirements of our industry change frequently, we are proactive in keeping up with the changes in the profession and providing the necessary training for our staff. Technical training for all of our staff covers accounting, auditing, federal regulations, tax, employee benefits and computer systems. In addition to the standard technical training required to maintain our certifications, we include training on mentoring, interviewing, time management, coaching and more.

Our training initiatives help our professionals maintain the highest level of technical and business competencies that our clients have come to expect. Our team encourages and requires continuing education and training at all levels, and this steadfast commitment to our own personal and professional growth benefits our clients and us.

Every year, Marcum provides a minimum of 40 hours of continuing professional education (CPE) in-house to all professional staff. These seminars include sessions in government accounting, auditing and financial reporting, including Yellow book, single audit, IT audits and information systems and other accounting and auditing issues. In addition to the in-house training, our partners and professional staff attend various outside seminars/conferences.

Marcum affirms all members of the audit team meet or exceed the CPE requirements mandated by professional auditing standards (including Government Auditing Standards) and all CPAs assigned meet or exceed the CPE and ethics training mandated by the Florida State Board Accountancy (including Florida State Statutes, Chapters 473.3101 and 10.550 as well as, Sections 218.391 and 218.415)

PROPOSAL FOR WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY 19

FOR WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

TAB 7: SIMILAR ENGAGEMENTS WITH OTHER GOVERNMENTS

MARCUM’S CURRENT GOVERNMENT CLIENTS

City of Boca Raton

City of Boca Raton CRA

City of Boca Raton ERP

City of Boca Raton GERS

City of Boca Raton Police and Firefighters

Retirement System

City of Boynton Beach

City of Delray Beach

City of Palm Beach Gardens

East Central Regional Wastewater Treatment

Facilities Operations Board

Healthy Start Coalition of Palm Beach County

Northern Palm Beach County Improvement District

Palm Beach County Housing Finance Authority

South Central Regional WW Treatment and Disposal Board

The Children's Services Council of Palm Beach County

Town of Jupiter

Town of Palm Beach

Town of Palm Beach Retirement System

Village of Palm Springs

Village of Royal Palm Beach

Broward County (IT Dept.)

City of Deerfield Beach

City of Deerfield Beach CRA

City of Fort Lauderdale Police and Firefighters Retirement System

City of Hollywood

City of Florida City

City of Florida City CRA

City of Homestead

City of Homestead CRA

City of Miami Firefighters & Police Officers

Retirement Trust

City of Sunny Isles

Miami-Dade County (WASD)

Miami Police Relief and Pension Fund

City of Hollywood CRA

City of Hollywood GERS

City of Pompano Beach Police and Firefighters Retirement System

City of Sunrise

City of Tampa Police and Firefighters’ Pension Plan

The Children's Trust of Miami-Dade County

Town of Bay Harbor Islands

Town of Bay Harbor Islands ERS

Town of Surfside

Town of Surfside Employees’ Retirement Plan

Village of Palmetto Bay

20

PROPOSAL

1.) Palm Beach County

2.) Broward County

3.) Miami-Dade County

4.) Monroe County Florida Keys Aqueduct Authority

5.) Hillsborough County

FOR WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

REFERENCE LETTERS

The Reference Form is available in the next page and Reference Letters are provided in Appendix D: Reference Letters of the proposal.

LOCAL PREFERENCE

The audit will be staffed primarily from our West Palm Beach office located at 525 Okeechobee Boulevard, Suite 750, West Palm Beach, Florida 33401

CANCELLED OR TERMINATED ENGAGEMENTS

We consider relationships with our clients to be our most important responsibility. We communicate with our clients openly, honestly, and frequently. As a result, we have experienced long and mutually rewarding relationships with our clients – many for 15 years and longer. Based on the strength of our people and our practice, we continue to grow our client roster over the years.

Marcum has not been terminated for cause by any government audit engagement within the past five (5) years. Marcum has not withdrawn or resigned from a government engagement in the past five (5) years. Most recently, Marcum completed a five-year contract with The Children’s Trust of Miami-Dade (the “TCT”). The contract ended after five (5) years and Marcum did not re-bid due to a mandatory auditor rotation policy the TCT has in place.

The Children’s Trust

3150 SW 3rd Ave, Miami, FL 33129

William Kirkland, CPA, CFO

Willliam.kirkland@thechildrenstrust.org

305-571-5700 Ext 334

Years of Service: 5 years

Audit Services

21

PROPOSAL

PROPOSAL FOR WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

SIMILAR ENGAGEMENTS WITH OTHER GOVERNMENT ENTITIES

The following page represents several engagements similar to the engagement described in the RFP performed in the last five (5) years by Marcum LLP.

401 Clemantis Street, West Palm Beach, FL 33401 Donna L.Levengood, Fiscal Services Manager of Public Utilities DLevengood@wpb.com

561-494-1050

Services: Financial Audit

Term: September 30, 2020 to Current

Total Hours: 300

1801 North Congress Avenue, Delray Beach, FL 33445 Beatrice Good, Finance Administrator bgood@scrwwtp.org

561-272-7061 Ext. 303

Services: Financial Audit

Term: September 30, 2022 to Current

Total Hours: 200

350 SE 1st, Delray Beach, FL 33483 Laura Simon, Executive Director lsimon@downtowndelraybeach.com

561-243-1077

Services: Financial Audit

Term: September 30, 2022 to Current

Total Hours: 175

2.

210 Military Trail, Jupiter, Florida 33458 Scott Reynolds, Finance Director scottr@jupiter.fl.us

561-741-2327

210 Military Trail, Jupiter, Florida 33458

Services: Financial Audit and Single Audit

Term: September 30, 2021 to Current

Total Hours: 500

4.

1100 Kennedy Drive, Key West, FL 33040 Cindy Kondziela, Director of Finance ckondziela@fkaa.com

305-295-2234

Services: Financial Audit, Single Audit

Term: September 30, 2012 to Current

Total Hours: 650

22

1. East Central Regional Wastewater Treatment Facilities Operations Board

Town of Jupiter

3. South Central Regional WW Treatment and Disposal Board

Florida Keys Aqueduct Authority

5. Delray Beach Downtown Development Authority

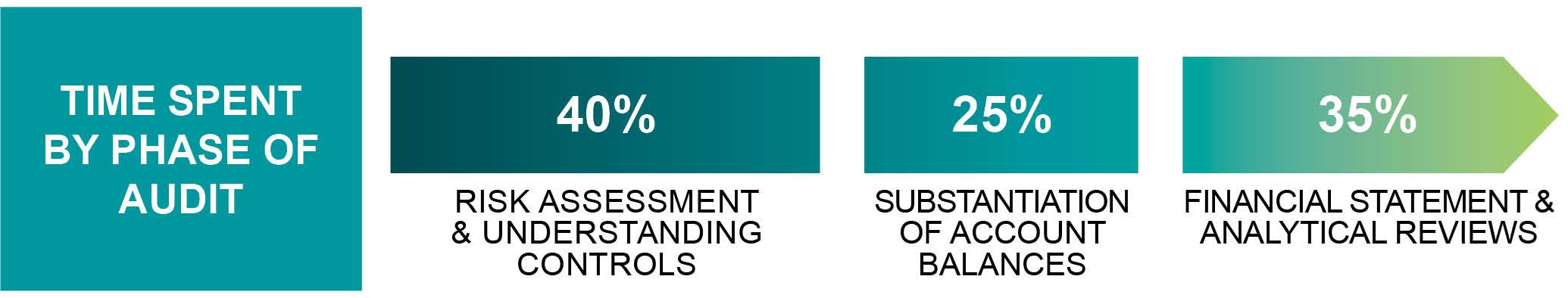

TAB 8: SPECIFIC AUDIT APPROACH

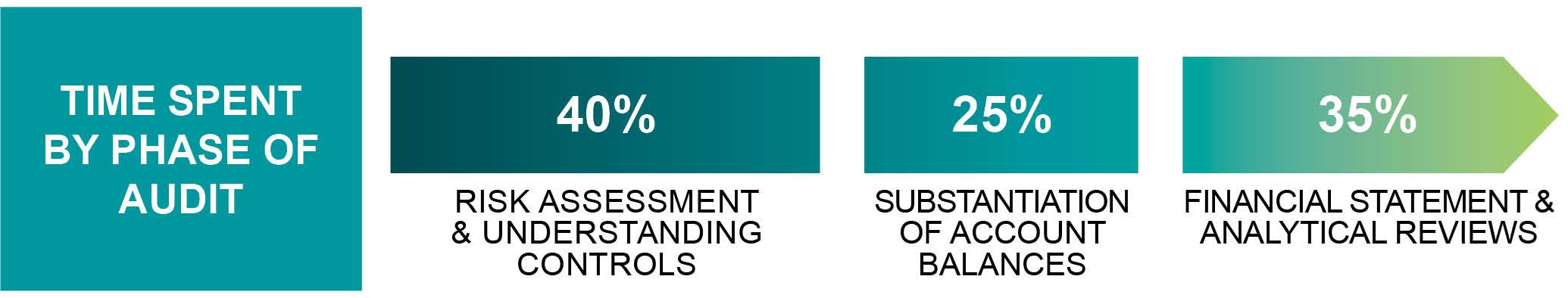

PROPOSED STAFFING PLAN AND SEGMENTATION

Note: In the first year of an engagement, additional hours are required to transition the audit to a new audit Firm. Our extensive experience with transitioning new clients has led to a streamlined process that is respectful of your time and resources. As a result, the DDA will receive the benefit of a new team with significant government experience as well as a fresh look at your systems, with minimal disruption. The above schedule does not include the first year “transition hours” which we intend to absorb.

Note: The Uniform Guidance states that the auditor must use a risk-based approach to determine which federal programs are major programs. This determination will affect the scope of the Uniform Guidance compliance audit and the compliance requirements to be tested. The schedule of expenditures of federal awards, prepared by the Village, is the basis of the auditor's identification of type A and type B programs and documentation of our risk-based approach. Upon determination, audit hours for testing a major program significantly range due to program size, program compliance requirements, weaknesses in internal control over federal programs, if any, prior audit findings, program longevity, program clusters, program subrecipients, etc. As such, related Singe Audit hours will vary on an annual basis.

PROJECT APPROACH & PHILOSOPHY

Through the audit, we strive to understand your vision, entity operations, financial performance, accounting systems, and internal controls. While this process ultimately leads to an audit opinion on your financial statements, our goal is to provide value beyond this assurance.

PROPOSAL FOR WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY 23

PHASE Audit Partner & Quality Control Director IT Risk Audit Partner & Audit Manager Audit Supervisor & Seniors Staff TOTAL Phase 1: Strategic Planning 5 15 20 20 60 Phase 2: Execution of Audit Plan 5 15 15 25 60 Phase 3: Evaluation of Audit Results 5 10 15 20 50 Phase 4: Reporting 5 5 15 0 25 Total Hours 20 45 65 65 195

Our professionals will complement the DDA’s team with the right blend of technical, practical, and personal insight to help you successfully deliver on all of your initiatives

AUDIT METHODOLOGY

The audit will be conducted in four phases, as shown below. These phases are discussed in more detail on the following pages.

Obtain an Understanding of the DDA’s Operations

Evaluate Internal Controls Information Technology Review

Develop Audit Plan and Strategies; Risk Assessment

Prepare Audit Programs

Perform Test of Internal Controls (as applicable)

Perform Tests of Account Balances

Test Compliance with Laws, Rules, Regulators, and Contracts

PHASE I: STRATEGIC PLANNING PROCEDURES FOR INTERNAL CONTROL

Documentation

Reviewed by Partner and Quality Control Department

Auditor’s Conclusions

Documented

Preliminary Discussion with Management of Audit Findings (as applicable)

Prepare Auditor’s Reports

Review the Draft Financial Statements

Discuss Final Results with Management in Exit Conference

Presentation to the DDA Board

A thorough understanding of the DDA, its agencies, and your operating environment is essential for developing an efficient, cost-effective audit plan. During this phase, the engagement partner and key supervisory personnel will meet with the appropriate personnel to ensure we have an understanding of your operations. You will also have the opportunity to express your expectations

24

PROPOSAL FOR WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

regarding the services that we will provide. This effort will be coordinated so that there will be minimal disruption to your staff. During this phase, we will perform the following activities:

Review the current regulatory and statutory compliance requirements within which the DDA operates. This will include a review of applicable state regulations; ordinances, contracts, and other agreements; meeting minutes of the elected body, as applicable; Review major sources of information such as budgets, organization charts, procedures manuals, financial systems and management information systems;

Determine the most practical and effective way to apply computer-aided audit tools to convert and analyze data and generate reports;

Performance of fraud inquiries and retrospective review;

Determination of materiality levels;

Regarding controls that are relevant to the audit, Marcum will evaluate the design of the controls and determine whether they have been properly designed and implemented; Documentation of current year activity expectations and performance of preliminary analytical procedures;

Review internal control systems, including determining an audit risk assessment; Consider the methods used to process accounting information that influence the design of the internal control system. This includes understanding the design of relevant policies, procedures, and records and whether they have been placed in operation; Design audit programs to ensure that they incorporate financial statement assertions, specific audit objectives and appropriate audit procedures to achieve the specified objectives;

Identify and resolve accounting, auditing and reporting matters; and Prepare detailed audit plans, including a list of schedules to be prepared by the DDA’s personnel.

RISK-BASED AUDIT TECHNOLOGIES