This benefit guide is a compilation of employee benefits. It is intended for informational purposes only. The actual benefits available and the full descriptions of these benefits are governed in all cases by the relevant plan document, insurance contracts, and Ordinances and Resolutions of the City of West Lafayette and where applicable, collective bargaining agreements If there are discrepancies between the benefit guide and the actual plan documents, insurance contracts, and Ordinances and Resolutions, the documents, contracts, and Ordinances and Resolutions will govern.

Additional resources may be found by logging onto Munis Employee Self Service, under the Resources tab. A 2026 benefits presentation is available and is an exceptional tool to understand West Lafayette’s benefit plan selections covered by the AIM Medical Trust

The Health Insurance Portability and Accountability Act (HIPAA) requires that your health insurance plan limit the release of your health information to the minimum necessary required for your care. If you have questions about your claims, contact your insurance carrier first

If after contacting the Plan administrator you need a representative of the Employee Benefits Division to assist you with any claim issues you may be required to provide written authorization to release information related to your claim. If you would like a copy of the HIPAA Notice of Privacy Practices or if you have any questions please contact HR.

What is a Qualifying Life Event?

A change in your situation that can make you eligible for a Special Enrollment Period allowing you to enroll in health insurance outside the annual open enrollment.

Employees must report a benefit election change within 31 days of the qualifying event on MSS Munis Self Service Employee. If the qualifying event is not submitted timely, including required supporting documentation, according to IRS regulations the request will not be accepted, and the change cannot be made until the subsequent open enrollment. If you experience a qualifying life event, reach out to HR to help you through this process.

$698.84 $1,367.66

can I avoid the $480

To avoid the additional premium, you must certify during benefits open enrollment that you have been a non-tobacco user for the 6 months immediately prior to completing your enrollment or provide documentation that you were a tobacco user who has completed an approved tobacco cessation program during the plan year.

What if I was a non-tobacco user, but started to use tobacco during the Plan year?

If you and/or your spouse start using tobacco products after the date of your original certification, you must recertify your tobacco use status immediately.

What if employees certify that they are not tobacco users when, in fact, they are?

When you certify your tobacco use status, you attest that you are telling the truth. If it is later discovered that you gave a false or inaccurate statement on the certification form without notifying Human Resources, you will be subject to penalties, including, but not limited to, payment of 50% of the City’s full employee monthly premium. A nicotine blood test may be required in order to determine the truthfulness of an employee and/or spouse which will screen for recent first or secondhand tobacco exposure.

If I complete an approved tobacco cessation program, can my additional premium be waived at that time?

If you complete an approved tobacco cessation program by one of the dates below, your additional premium will be waived on or after the below listed waiver date.

o Complete approved cessation program by March 31 and qualify for waiver of the additional premium beginning on May 1. Complete approved cessation program by July 31 and qualify for waiver of the additional premium beginning on September 1.

How do I complete an approved tobacco cessation program?

The City’s tobacco cessation program is called “Aspire” through Franciscan Health. Aspire is a 7week program; 5 sessions with a tobacco treatment specialist and a check-in/oversight with a Nurse Practitioner. Call 765-428-5850 to speak with the Aspire program staff to learn program details. The program will continue to be provided to you and your spouse at no cost and on your own terms. If you choose to utilize a different resource and quit the use of tobacco products, you will be required to be tobacco free for a six month period before qualifying for a waiver of the additional premium.

Should you have additional questions, please contact the Human Resources Department

Studies show that people who actively engage in their health care decisions have fewer hospitalizations, fewer emergency visits, higher utilization of preventive care and overall lower medical costs.

You can take an active part in your health by seeking out and choosing a Tier 1 provider when you need care.*

Your UnitedHealthcare Tiered Benefit plan is designed so you pay less when you see Tier 1 doctors and specialists. We update our Tier 1 providers list annually.

Look for the Tier 1 blue dot when searching for a doctor on

app and you may be surprised by how much you can save.

Maximize your health and savings with the exclusive programs offered through UnitedHealthcare!

24/7 Virtual Visits

24/7 Virtual Visits

With 24/7 Virtual Visits, you can connect to a Provider by phone or video through myuhc com or the UnitedHealthcare app

Child and family behavioral heath coaching from Bend

Health can help with anger issues, anxiety, self-esteem, and many other concerns

Bariatric Resource Services clinical team works to help understand how obesity affects your overall health The team provides guidance to bariatric Centers of Excellence, personalized clinical case management and lifestyle management

The Cancer Support Program identifies potential program participants early to help improve impact on treatment decisions. Dedicated nurses build relationships with employees and their families, helping individuals focus on their health while continuing to go about daily routines.

Behavioral Health

Self Care from AbleTo

Get access to cliniciancreated self-care techniques, coping tools, medications and more

UHC offers employees solutions across the type 2 diabetes care continuum. Engaging health and prevention programs, program referrals, and care and condition management to slow or reverse type 2 diabetes.

Employee Assistance Program

Your EAP offers up to 3 provider visits for $0 by phone or in-person counseling sessions

Vital Medications Program

Behavioral health providers

Connect virtually or in-person with a licensed therapist, counselor, psychologist or psychiatrist for ongoing support.

The new Vital Medication Program offers certain drugs at no additional cost. This means there may be no out-of-pocket costs for preferred insulins and certain other medications, including

Good news your health plan comes with a way to earn up to $300. UnitedHealthcare Rewards is included in your health plan at no additional cost. There’s so much good to get

With UHC Rewards, a variety of actions including things you may already be doing, like tracking your steps or sleep-lead to rewards. Here are just a few of the ways you can earn:

Connect a tracker

Take a health survey

Get an annual checkup

Get a biometric screening

Earn up to $300 including $20 today when you activate UHC Rewards

Visit UHC Rewards for the full list of rewardable activities that are available to you and look for new ways of earning rewards to be added throughout the year.

There are 2 ways to get started

Scan this code to download the app

Sign in or register Select UHC Rewards

Activate UHC Rewards and start earning Though not required, connect a tracker and get accesss to even more reward activities.

Sign in or register Select UHC Rewards Activate UHC Rewards Choose reward activities

With UnitedHealthcare Rewards, you can earn rewards for a variety of actions. What’s more, the dollars you earn can be deposited right into a health savings account (HSA), which you can use to help pay for eligible health care expenses.

Earn dollars for completing activities with UHC Rewards

Add your HSA to UHC Rewards to redeem your earnings

You can use an HSA to help pay for eligible expenses

WellBridge tells you up front what each procedure will cost. And designed to be more affordable for both patients and employers

Indiana is the fourth most costly state in which to have surgery.

WellBridge Surgical was created to change that by providing quality surgical services at transparent, up--front prices.

Now these services and benefits are available to UnitedHealthCare members.

We offer over 3,500 procedures within 16 surgical specialties.

Wellbridge hand-picked its Surgical Team from quality surgeons in the area, many performing the same procedures at nearby Indiana hospitals. One of the main differences is that Wellbridge may be a more affordable location.

WellBridge puts you in control throughout the process Here’s how it works:

Whether you have been referred by your doctor, or you simply think you might need surgery, call WellBridge and schedule a consultation.

The surgeon performs an examination anddiscusses your options with you.

The WellBridge team will take it from there!

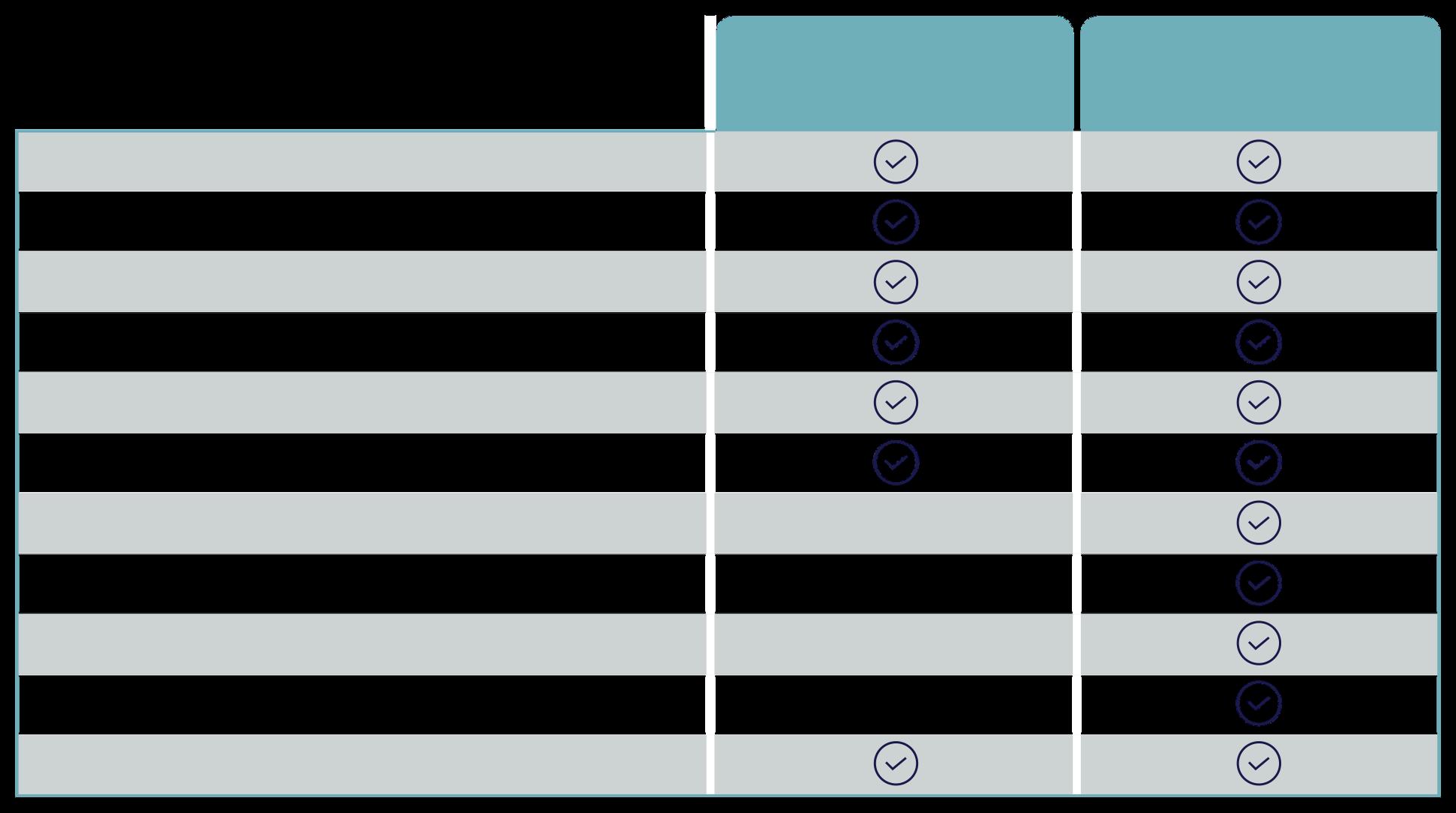

Delta Dental PPO™ (Point-of-Service) Summary of Dental Plan Benefits

This Summary of Dental Plan Benefits shouldberead along with your Certificate. Your Certificate provides additional information about your Delta Dental plan, including information about plan exclusions and limitations. If a statement in this Summary conflicts with a statement in the Certificate, the statement in this Summary applies to you and you should ignore the conflicting statement in the Certificate. The percentages below are applied to Delta Dental's allowance for each service and it may vary due to the Dentist's network participation.*

Control Plan – Delta Dental of Indiana

Benefit Year – January 1 through December 31

Covered Services –

* When you receive services from a Nonparticipating Dentist, the percentages in this column indicate the portion of Delta Dental's Nonparticipating Dentist Fee that will be paid for those services. This amount may be less than what the Dentist charges and you are responsible for that difference.

Oral exams (including evaluations by a specialist) are payable twice per calendar year.

Prophylaxes (cleanings) are payable twice per calendar year.

People with specific at-risk health conditions may be eligible for additional prophylaxes (cleanings) or fluoride treatment.

Fluoride treatments are payable twice per calendar year for people age 18 and under.

Bitewing X-rays are payable twice per calendar year and full mouth X-rays (which include bitewing X-rays) or a panorex are payable once in any three-year period.

Sealants are payable once per tooth per three-year period for permanent bicuspids and molars for people age 13 and under. The surface must be free from decay and restorations.

Composite resin (white) restorations are payable on all teeth, including posterior teeth.

Implants are payable once per tooth in any five-year period. Implant related services are Covered Services.

Crowns over implants are payable once per tooth in any five-year period. Services related to crowns over implants are Covered Services.

People with special health care needs may be eligible for additional services including exams, hygiene visits, dental case management, and sedation/anesthesia. Special health care needs include any physical, developmental, mental, sensory, behavioral, cognitive, or emotional impairment or limiting condition that requires medical management, healthcare intervention, and/or use of specialized services or programs. The condition may be congenital, developmental, or acquired through disease, trauma, or environmental cause and may impose limitations in performing daily self-maintenance activities or substantial limitations in a major life activity.

Having Delta Dental coverage makes it easy for you to get dental care almost everywhere in the world! You can now receive expert dental care when you are outside of the United States through our Passport Dental program. This program gives you access to a worldwide network of Dentists and dental clinics. English-speaking operators are available around the clock to answer questions and help you schedule care. For more information, check our website or contact your benefits representative to get a copy of our Passport Dental information sheet. Maximum Payment – $1,500 per Member total per Benefit Year on all services except orthodontic services. $1,500 per Member total per lifetime on orthodontic services.

Payment for Orthodontic Service – When orthodontic treatment begins, your Dentist will submit a payment plan to Delta Dental based upon your projected course of treatment. In accordance with the agreed upon payment plan, Delta Dental will make an initial payment to you or your Participating Dentist equal to Delta Dental's stated Copayment on 30% of the Maximum Payment for Orthodontic Services as set forth in this Summary of Dental Plan Benefits. Delta Dental will make additional payments as follows: Delta Dental will pay 50% of the per month fee charged by your Dentist based upon the agreed upon payment plan provided by Delta Dental to your Dentist. Deductible – $50 Deductible per Member total per Benefit Year limited to a maximum Deductible of $150 per family per Benefit Year. The Deductible does not apply to diagnostic and preventive services, emergency palliative treatment, brush biopsy, X-rays, sealants, and orthodontic services.

Waiting Period – Enrollees who are eligible for Benefits are covered on the date of hire.

Eligible People – Also eligible are your Spouse and your Children to the end of the calendar year in which they turn 26, including your Children who are married, who no longer live with you, who are not your dependents for Federal income tax purposes, and/or who are not permanently disabled.

Enrollees and Dependents choosing this plan are required to remain enrolled for a minimum of 12 months. Should an Enrollee or Dependent choose to drop coverage after that time, he or she may not re-enroll prior to the date on which 12 months have elapsed. Dependents may only enroll if the Enrollee is enrolled (except under COBRA) and must be enrolled in the same plan as the Enrollee. An election may be revoked or changed at any time if the change is the result of a qualifying event as defined under Internal Revenue Code Section 125.

Coordination of Benefits – If you and your Spouse are both eligible to enroll in This Plan as Enrollees, you may be enrolled as both an Enrollee on your own application and as a Dependent on your Spouse's application. Your Dependent Children may be enrolled on both your and your Spouse's applications as well. Delta Dental will coordinate benefits between your coverage and your Spouse's coverage. Benefits will cease on the date of termination.

With your Delta Dental PPO (Point-of-Service) plan, you may save more money and receive higher levels of coverage when visiting a Delta Dental PPO dentist. Our PPO dentists have agreed to accept lower fees as full payment for covered services. However, if you go to a dentist who doesn’t participate in Delta Dental PPO, you can still save money if your dentist participates in Delta Dental Premier® Like our PPO dentists, Delta Dental Premier dentists agree to accept Delta Dental’s fee determination as full payment for covered services

Your VSP Vision Benefits Summary

Prioritize your health and your budget with a VSP plan through AIM MEDICAL TRUST (PLAN 1) BENEFIT

Provider Network:

VSP Choice

Effective Date: 01/01/2026

Focuses on your eyes and overall wellness

Routine retinal screening

Retinal imaging for members with diabetes covered-in-full

Additional exams and services beyond routine care to treat immediate issues from pink eye to sudden changes in vision or to monitor ongoing conditions such as dry eye, diabetic eye disease, glaucoma, and more Coordination with your medical coverage may apply Ask your VSP network doctor for details

$10 Up to $39 Every calendar year

$20 per exam

Available as needed

$150 Frame allowance

$170 Featured Frame Brands allowance 20% savings on the amount over your allowance

$80 Walmart/Sam’s Club/Costco frame allowance

Single vision, lined bifocal, and lined trifocal lenses

Impact-resistant lenses for dependent children

Standard progressive lenses

Premium progressive lenses

Custom progressive lenses

Average savings of 30% on other lens enhancements

Glasses Every calendar year Every calendar year

(INSTEAD OF GLASSES)

$150 allowance for contacts; copay does not apply

Contact lens exam (fitting and evaluation)

Glasses and Sunglasses

Up to $60 Every calendar year

Discover all current eyewear offers and savings at vsp.com/offers 20% savings on unlimited additional pairs of prescription or nonprescription glasses/sunglasses, including lens enhancements, from a VSP provider within 12 months of your last WellVision Exam.

Average of 15% off the regular price; discounts available at contracted facilities

Contact lens rebates, lens satisfaction guarantees, and more offers at vsp.com/offers.

Save up to 60% on digital hearing aids with TruHearing. Visit vsp.com/offers/special-offers/hearing-aids for details.

Enjoy everyday savings on health, wellness, and more with VSP Simple Values.

With so many in-network choices, VSP makes it easy to maximize your benefits Choose from our large doctor network including private practice and retail locations Plus, you can shop eyewear online at Eyeconic. Log in to vsp.com to find an in-network doctor. Your plan provides the following out-of-network reimbursements;

vsp.com 800.877.7195 (TTY: 711) VSP members

Did you know an eye exam is the only non-invasive way to view blood vessels in your body? Your VSP® network doctor can detect signs of more than 270 health conditions during your annual eye exam including diabetes and high blood pressure, as well as eye conditions such as glaucoma and diabetic eye disease ** Savings you'll love

See and look your best without breaking the bank VSP members get exclusive savings on popular frame brands and contact lenses, and they get additional discounts on things like LASIK, and more The choice is yours!

With private practice doctors, Visionworks®, and Eyemart Express retail locations to choose from nationwide, getting the most out of your benefits is easy at a VSP Premier EdgeTM location

Let your plan do the most it can. When you create an account on vsp.com, you can view your in-network coverage details, find a VSP network doctor that is right for you, and discover extra savings to maximize your

• View benefit info, claim details and account balances

• Search network providers and facilities for the type of care you may need

• Quickly compare cost estimates before you get care

• Learn about covered preventive care

• Access your health plan ID card and add your plan details to your smartphone’s digital wallet

Start by downloading the UnitedHealthcare app or going to myuhc.com and then:

• Tap Register Now on the app, or select Register on the website

• Fill in the required fields and create your username and password

• Enter your contact information and select SMS text or phone call for twofactor authentication --then, agree to the terms and conditions

• Opt in to paperless delivery from your communication preferences Now you're registered for and connected to the app and the website

Scan this code to download the app and register, or visit myuhc.com

Select Register on the app or on the website Sign Up

Complete the required fields and follow the on-screen instructions

You will need the subscriber’s SSN

Create your username and password and verify email address

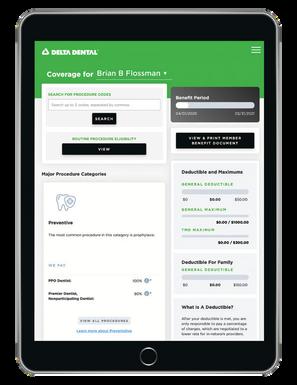

The Member portal allows you to view eligibility, review coverage details, review claims, print or download ID cards, find dentists, and so much more!

Get started by downloading the myVSP app or go to vsp.com then:

Click Create an Account

Enter the required information

Click Create an Account

You’ll receive a code along with instructions to finish setting up your account.

Once your account is set up, you’ll receive a confirmation email.

This the avai to s

Certificate A person is not necessarily entitled to insurance because he or she received this summary A person is only entitled to insurance if he or she is eligible in accordance with the terms of the Policy This summary was published on November 15, 2022

Policyholder: City of West Lafayette

Policy Effective Date: January 1, 2014

Policy Number: GLUG-ARBI

Class(es):All Eligible Full Time Employees

Policy Anniversary: January 1 Group Number: G000ARBI

You (the Employee) must be performing the normal duties of Your regular job for the Policyholder on a regular and continuous basis 30 or more hours each week to be eligible for insurance Your eligible Dependents must be able to perform normal activities and not be confined (at home, in a hospital, or in any other care facility) to be eligible for insurance

An eligible Employee will become insured on the day the Employee becomes eligible, subject to certain conditions (as described in the When Insurance Begins provision in the Certificate). An eligible Dependent will become insured on the latest of the day the Employee becomes insured, the Employee acquires the eligible Dependent, or the Employee submits a Written Request to enroll the Dependent for insurance (if required), subject to certain conditions (as described in the Exceptions to When Insurance Begins provision in the Certificate)

Additional eligibility conditions apply as described in the Certificate

BENEFIT AMOUNT(S)

Insurance for You (The Employee)

Your amount of life insurance is an amount equal to 1 timesYour Annual Earnings, but in no event less than $10,000 or more than $100,000 Your amount of life insurance will be rounded to the next higher multiple of $10,000 Your amount of accidental death and dismemberment (AD&D) insurance is equal toYour amount of life insurance IfYou have questions regarding the amount of Your insurance,You may contact the Policyholder.

Your Spouse’s amount of life insurance is $10,000

The amount of life insurance for Your eligible Dependent child(ren) is based on the age of the Dependent, as follows:

Age of Dependent Child

Amount of Life Insurance

Six months and older

$2,000 14 days to less than six months............................................................................$100

Less than 14 days

$0

If You have questions regarding the amount of insurance for Your Dependent(s), You may contact the Policyholder.

Benefit Reduction(s)

on the date of Your

Living Benefits

In the event Youincur a Terminal Condition while insured under the Policy, You, Your Spouse or Your legal representative may submit a Written Request for an advance payment of part of Your life insurance death benefit The maximum amount of Living Benefits available is 80% of the amount of life insurance for You in effect at the time of the request or $80,000, whichever is less

In addition to basic AD&D benefits, You are protected by the following benefit(s):

As You grow older, the amount of life and AD&D insurance for You will be reduced according to the following schedule: At the Age of: The Original Amount of Insurance Will Reduce to: - Paralysis - Child Education

Continuation of Insurance for Layoff or Leave, Injury or Sickness, or Partial Disability

You may be able to continue insurance for You and Your Dependent(s) from the day You cease to be Actively Working, subject to certain conditions.

Continuation of Insurance for Total Disability with Waiver of Premium

You may be able to continue insurance for You from the day You cease to be Actively Working due to Your Total Disability, subject to certain conditions

Conversion

If group life insurance ends or the benefit reduces, You or any of Your Dependent(s) may apply for an individual policy of life insurance, subject to certain conditions.

Several exclusions apply to the accidental death and dismemberment (AD&D) benefits as described in the Certificate - Airbag - Seat Belt

Disability Plans & Eligibility

Ineligibility

Pre-1990 Disability Plan

Eligible members were hired before Jan. 1, 1990, and elected NOT to be covered under the 1990 Disability Plan or made no election.

Members are NOT eligible for disability benefits in either plan if the disability resulted from a non-covered impairment (IC 36-8-8-12.3) such as: a deliberate or self-inflicted injury or attempted suicide, committed or attempted a felonious act, due in whole or in part by a fund member engaging in any use of a controlled substance or unlawful use of a prescription drug. beginning within 2 years after a fund member’s entry or reentry into active service with the department and that was caused or

Eligible members were hired for the

after Dec 31, 1989, and chose the

Disability Application Process

The local board or INPRS may request a yearly medical review while you are receiving disability benefits.

1.Submit an application to the local department board to request a hearing. Your local board must conduct a determination hearing no later than 90 days after you submitted your application.

2.The '77 Fund & the INPRS Medical Authority will review local board findings. The review will decide if a covered impairment exists. You may provide INPRS with more records and evidence for review before INPRSˈ initial determination is finalized.

3 After the hearing, the local board has 30 days to submit its written determination to both you and the safety board regarding whether you have a covered impairment. The submission states if you have a line of duty or non-line of duty impairment.

4.Send the disability application, local board hearing minutes and determination, a statement from your appointing authority that certifies there is no suitable and available work, considering accommodations required by ADA, medical records from treating physicians present at the hearing, and an explanation of how the disability occurred.

If eligible, you will receive disability benefits equal to your full regular retirement benefit at age 52.

1990 Disability Plan

Eligible members were hired for the first time on or after Dec. 31, 1989, and chose the current plan.

Ineligibility

Members are NOT eligible for disability benefits in either plan if the disability resulted from a non-covered impairment (IC 36-8-8-12.3) such as: a deliberate or self-inflicted injury or attempted suicide, committed or attempted a felonious act, due in whole or in part by a fund member engaging in any use of a controlled substance or unlawful use of a prescription drug. beginning within 2 years after a fund member’s entry or reentry into active service with the department and that was caused or ib d b l h i l di i h if d Disability Plans & Eligibility

Eligible members were hired for the

or after Dec 31, 1989, and chose the

1.You must submit an application to the local board. Your local board must conduct a hearing no later than 90 days after you submitted your application to decide if you have a covered impairment.

2.The local board decides the class of your impairment. The local board will consider reasonable accommodations as required by the ADA and if there is suitable and available work in the department for you.

3.After the hearing, the local board has 30 days to submit its written determination to both you and the safety board regarding whether you have a covered impairment. The submission states if you have a Class 1, 2, or 3 impairment.

4.Send the disability application, local board hearing minutes and determination, a statement from your appointing authority that certifies there is no suitable and available work, considering accommodations required by ADA, medical records from treating physicians present at the hearing, and an explanation of how the disability occurred.

5.The '77 Fund & INPRS Medical Authority will review the local board findings to decide if you qualify as well as your class and degree of your disability. Disability benefits are based on the class of impairment if you qualify. One North Capitol, Suite 001 Indianapolis, IN 46204 toll-free: (844) GO-INPRS ■ www.inprs.in.gov ■ ■

Disability Benefit Based on Type of Impairment in the 1990 Fund Plan

Class 1: You will receive a monthly base benefit equal to 45% of the first-class salary, plus an additional amount based on your degree of impairment as determined by the INPRS Medical Authority.

Class 2: You will receive 22% of the base pay plus 0.55% of that pay for each year of service, up to a maximum of 30 years. You will also receive an additional amount based on the degree of your impairment The INPRS Medical Authority determines your degree of impairment.

Class 3: You will receive a monthly benefit equal to your years of service, up to a maximum of 30 years, multiplied by 1% of the base pay (first class salary). You will also receive an additional amount based on the degree of your impairment as determined by the INPRS Medical Authority. NOTE: If you are hired with a pre-existing medical condition that is not covered by this plan, you will not qualify for a Class 3 benefit when the impairment is related in any manner to the pre-existing condition.

Additional Monthly Benefit for Classes 1, 2, and 3: INPRS uses a formula to convert the degree of your impairment into a benefit percentage. The amount represents your additional monthly benefit. The minimum benefit (10% of the certified salary) and maximum benefit (45% of the certified salary) is set by statute.

If you return to work after a covered impairment and are disabled within 2 years with the same disability, you are eligible to receive disability benefits The benefit amount will equal the benefit amount you were previously receiving on a disability. More information about the classes of impairments is in the '77 Fund Member Handbook.

Disability

Benefit Based on Type of Impairment in the 1990 Fund Plan Mental Illness Disability and the Mental Health Disability Review Panel

As of July 1, 2020, mental illness disabilities are classified as Class 1 or Class 3 impairments. Class 2 is a possibility if a mental illness is combined with some other non-mental illness disability. The Mental Health Review Panel reviews all mental illness disabilities determined by INPRS after Jan. 1, 2013. Members subject to the panel will submit up to 2 provisional review periods of 2 years each.

During both review periods, the member must actively participate in a mental health treatment plan as determined by the member’s treating physician.

The employer is required to pay for the mental health care and treatment relating to the disability during these review periods.

For each review period, the panel will conduct an evaluation of the member, including reports and records submitted by the member’s treating physician and any other mental health provider seen by the member.

After each review period, the panel determines if the member is no longer impaired and can return to active duty or if the member continues to be impaired. If the member is no longer impaired, the benefit stops. After the second review period, if the panel determines that the member is still disabled, then the member will be considered to have a permanent impairment.

Members during this process may also be subject to other reviews conducted under '77 Fund law. If a member does not comply with requests for information from the review panel, their benefit may be suspended.

This handout is an overview of the '77 Fund plan provisions. Complete details are available in the Police Officers’ and Firefighters’ Member Handbook. You may read it or print your copy from the INPRS website. You may also request a copy in writing or by calling our toll-free number, (844) GO-INPRS or 844-464-6777.

It is your responsibility to keep your name, address, and beneficiary choices current. Visit your online account at myINPRSretirement.org to make changes.

Every attempt has been made to verify that the information in this publication is correct and up-todate. Published content does not constitute legal advice. If a conflict arises between the information contained in this publication and the law, the applicable law shall apply.

10 years of PERF and/or TRF-covered service

8 years for specified elected positions

The employer pays 100%

The INPRS Board of Trustees determines the employer contribution rate annually No member contributions.

Members do not direct the investment of the Defined Benefit

Employer, or Employee, or Shared by both employee and employer. Voluntary Contributions

The employee can elect to make additional post-tax contributions.

Member can choose from 8 funds:

Age 65 with 10 years of service

Age 60 with 15 years of service.

At age 55 if age and creditable service total at least 85 (“Rule of 85”)

Early retirement with reduced benefits between ages 50-59 with 15 years of service

Age 65 with 20 years of service Special provisions for certain elected officials.

Qualified for Social Security disability benefits and provided proof of qualification

Received a salary from a PERF-covered position within 30 days of the termination date Minimum of 5 years of service.

Members receive PERF Annual Member Statements (AMS) by mail. The AMS includes an estimated annual defined benefit amount, years of service, and DC account investment information. Members can choose to have the AMS sent via email every year. Copies are also available from the member’s online account at myINPRSretirement.org.

eligibility to withdraw DC balance if receiving a disability benefit. Mandatory 3% of gross wages paid by:

Inflation-Linked Fixed Income Fund Large Cap Equity Index Fund Small/Mid Cap Equity Fund International Equity Fund Target Date Funds

eligibility to withdraw DC balance once member separates from service Members separated from service may retire with the PERF Hybrid Plan and continue to work in a nonINPRS covered position if they meet age and service requirements

None – members are not eligible for the Defined Benefit until they reach age and service requirements and separate from employment

The monthly lifetime benefit amount is determined by: 1 Age 2 3 4 Years of service

Average annual compensation (Final Average Salary) based on 20 quarters Multiplier of 1 1 percent ( 011)

Members who are NOT separated from service may take a DC withdrawal if: the member is at least age 59½ AND age & service eligible for full retirement benefits; or the member is working in non PERF Hybrid position, is at least age 59½, AND age & service eligible for full retirement benefits

Members who are disabled or separated from service: may leave the DC account invested in INPRS or receive a distribution, or

Benefit amount is taxable as ordinary income Survivor options are available may roll over the DC account to a qualified plan or other eligible retirement accounts

The monthly benefit amount is affected by the payment option election made at retirement.

Any Cost of Living Adjustment (COLA) must first be approved by the Indiana General Assembly

Monthly paymentFollowing the death of a retired member under applicable payment options

Following the death of an active member based on eligibility

Member chooses the form of payment May choose monthly payment for the lifetime benefit May defer payment until RMD (required minimum distribution) age May choose direct payment or rollover distribution

The amount of distribution is determined by account balance, taxes withheld, and distribution option chosen.

Balance paymentReceives the total accumulated amount after the death of an active member or retired member who elected to defer payment. Receives remainder of the accumulated amount per retirement payment options chosen by the member

Hybrid plan member handbook You may read it or print your copy from the INPRS website You may also request a copy in writing or by calling our toll-free number, (844) GO-INPRS Keep your name, address, and beneficiary choices current Visit your online account at myINPRSretirement org to make changes Without a current address, INPRS can’t reach you when you may be retirement eligible. INPRS can pay 6 months of retroactive pension benefits only INPRS can pay death benefits to designated beneficiaries on file Don’t let death benefits go to the wrong person Every attempt has been made to verify that the information in this publication is correct and up-to-date Published content does not constitute legal advice If a conflict arises between the information contained in this publication and the law, the applicable law shall apply.

Member

Eligibility and Participation

Contributions

Eligibility for Retirement Pension Benefit

Membership in the 1977 Fund is mandatory if:

• •

•

• You are a full-time, fully paid police officer, or You are a full-time, fully paid firefighter (does not include volunteer firefighters), Your employer participates in the Fund, and You were hired or rehired after April 30, 1977

To become a member of the 1977 Fund, a police officer, school resource officer (SRO), or firefighter must:

• • • Pass the required statewide baseline test and the local board’s mental examinations, and Firefighters, school resource officers, and police officers must be less than 40 years of age, or Be a veteran with 20 years of armed forces service with a maximum age of 40 years and 6 months

An SRO rehired by a school corporation or charter school that participates in the 1977 Fund, after June 30, 2024, and is a member of the 1977 Fund will remain a member of the fund per IC 36-8-8-3(g)

• •

Employee pays 6% of certified first-class officer salary, deducted from each pay period Employer pays a contribution rate determined annually by the INPRS Board of Trustees

Deferred Retirement Option Plan (DROP)

For a full, unreduced pension benefit, you must be:

• Age 52 with at least 20 years of service credit in 1977 Fund

Retirements after 06/01/2019: pension benefit is 52% of the base salary for your department You will receive another 1% of the base salary for each 6 months of active service over 20 years. The most you can receive is 12 years, making the maximum annual benefit 76% of the annual salary at the time of your separation from service

For early retirement with a reduced benefit:

• Age 50 with at least 20 years of service credit in 1977 Fund

Your pension benefit is reduced for each month of benefit payments prior to age 52 The reduced percentage rate is actuarially calculated & approved by the INPRS Board of Trustees.

The 1977 Fund has a mandatory retirement age of 70.

1977 Fund members must be eligible for an unreduced pension benefit to select the DROP option. Under DROP, members may continue to work and earn a salary while accumulating a DROP benefit payable in one lump sum or 3 annual installments Also, you will get a monthly pension benefit equal to your DROP frozen benefit The percentage used for DROP is based on the DROP entry date

If you entered DROP AFTER June 03, 2024, your DROP retirement date cannot be less than 12 months and not more than 60 months after the DROP entry date You cannot exit, then re-enter DROP The DROP may be entered only once.

If you entered DROP prior to July 1, 2024, and have not exited, you may extend your DROP retirement date up to 60 months after your DROP entry date You must notify your employer within 30 days of making this election if you make this change

Eligible beneficiaries for members of the 1977 Fund are set by statute in IC 36-8-8-13.9 and IC 36-8-814 1 However, you may designate one or more beneficiaries to receive your member contribution balance plus interest (rate determined by the INPRS Board) if you die before:

2.

receiving a retirement pension benefit, or receiving a disability benefit, or a survivor entitled to receive a benefit, or INPRS distributing your member contributions

If you fail to designate a beneficiary, your contributions plus interest will be paid to your estate.

Survivors of active, vested inactive, and retired members (non-line of duty):

If you are an active and vested member at the time of death, your designated beneficiary or estate will receive a one-time lump sum benefit of $12,000

If no surviving spouse or children, surviving parent(s) will receive a lifetime benefit that equals 50% of your monthly benefit. 1 2 3

Spouse will receive a lifetime monthly benefit that equals 70% of your monthly benefit The benefit is calculated as if you were receiving benefits at age 52 with 20 years of service. If you have more than 20 years, the benefit will increase 1% for each 6 months of additional service

Each surviving child will receive a monthly benefit that equals 20% of your monthly benefit until the child reaches age 18, or until age 23 if the child is enrolled in and attends a secondary school, or the child is no longer a full-time student at an accredited college or university

If you are an inactive member with less than 20 years of active service and you die, there is no survivor benefit payable The $12,000 death benefit is not payable to inactive non-vested members

members who die in the line of duty after July 1, 2020:

1 Spouse will receive a lifetime monthly benefit that equals 100% of your monthly benefit. The benefit is calculated as if you were receiving benefits at age 52 with 20 years of service If you have more than 20 years, the benefit will increase 1% for each 6 months of additional service Each surviving child will receive a monthly benefit that equals 20% of your monthly benefit until the child reaches age 18, or until age 23 if the child is enrolled in and attends a secondary school, or the child is no longer a full-time student at an accredited college or university. If no surviving spouse or children, surviving parent(s) will receive a lifetime benefit that equals 50% of your monthly benefit

If you separate from service in a 1977 Fund-covered position for a reason other than death or disability prior to completing 20 years of active service, you may apply for a distribution of your contributions plus interest The interest rate is specified by the INPRS Board of Trustees

This handout is an overview of the 1977 Fund plan provisions Complete details are available in the 1977 Police Officers’ and Firefighters’ member handbook You may read it or print your copy from the INPRS website You may also request a copy in writing or by calling our tollfree number, (844) GO-INPRS

It is your responsibility to keep your name, address, and beneficiary choices current Visit your online account at myINPRSretirement.org to make changes.

Every attempt has been made to verify that the information in this publication is correct and up-to-date. Published content does not constitute legal advice. If a conflict arises between the information contained in this publication and the law, the applicable law shall apply.

Your future is all about what you make of it You might want to enjoy retirement more fully than what a pension or Social Security benefits can provide.

Your employer offers two tax-advantaged ways that could help make that happen

Your employer makes the contributions and you control how they’re invested You contribute a specified amount and you control how it’s invested.

:

Nationwide® can help you build an extra resource that could give you more options to enjoy your retirement to the fullest Our Retirement Specialists can help educate and guide you as you manage your investments

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

Your 457b Contributions will be matched at 50% on up to 6%, for a maximum match of 3%.

Scan this code to enroll online or visit Hoosier START to sign up.

Information provided by Retirement Specialists is for educational purposes only and not intended as investment advice. Nationwide Retirement Specialists and plan representatives are Registered Representatives of Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio. Nationwide and the Nationwide N and Eagle are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

Hoosier START is sponsored by the Indiana State Comptroller.

What is a 457 deferred compensation program?

The Internal Revenue Code defines a number of contributory retirement programs These include Section 457 programs, commonly called 457 deferred compensation programs Deferred compensation programs allow you to save and invest pre-tax dollars through voluntary salary deferrals, supplementing any existing retirement/ pension benefits Your employee pre-tax contributions and any earnings grow tax deferred until you withdraw the money which will likely be at retirement when you may be earning less income and in a lower federal income tax bracket than you are now. Withdrawals of pre-tax money are subject to ordinary income tax You also have the option to contribute to a Roth 457 account, which offers after-tax savings. For enrollment information, call 1-317-810-4266.

If you are a qualified State employee, or an employee of one of the more than 275 local government units that have adopted the Plan, you are eligible to participate Participating in Hoosier START may help you achieve a more comfortable financial future. Not only can you save and invest on a tax-deferred basis, but you can also take advantage of the Plan’s quality investment options, local service representatives, financial education services and planning tools that can help you prepare for retirement

How much may I contribute?

The minimum contribution amoun 0 5% of includible compensation Yo contribute a combined pre-tax and Roth contributions maximum of 100% of includible compensation, not to exceed the IRS-established contribution limits

If you will attain age 50 or older during the current calendar year, you may take advantage of the Age 50+ Catch-Up provision, which allows you to contribute more than the maximum limit This amount was $7,500 over the $22,500 limit for calendar year 2023

If you are within the three calendar years that end prior to the calendar year of your normal retirement age, you may be eligible to use the Special CatchUp provision to contribute even more to your Hoosier START account The Special Catch-up provision allows you to defer up to double the normal limit for up to three years.

Am I eligible to participate in the Hoosier START Deferred Compensation Plan (the Plan)? If so, why should I participate?

Note: you cannot use the Age 50+ Catch-Up provision and the Special Catch- Up provision in the same calendar year. Please see your Retirement Specialist for more information.

Employees of counties, cities, towns or other political subdivisions may be eligible to receive a matching contribution Please check with Nationwide or your employer to determine if a match is available to you

The Hoosier START Plan offers you flexibility in how you save for retirement. You may choose to make pre-tax, Roth, or both types of contributions to the 457(b) Plan.

Pre-tax contributions

Come out of your pay before taxes are deducted (meaning more money goes into your account than how much your take-home pay is reduced)

Lower your taxable income now

Earnings grow tax-deferred until withdrawn

Withdrawals are taxed as ordinary income

Roth contributions*

Comes out of your pay after taxes are deducted

Contributions are returned tax-free, and related earnings may be withdrawn taxfree during retirement if certain criteria are met

Participation has no income restrictions (like a Roth IRA does) Can be used for estate planning

Offer tax planning flexibility in retirement

How much income tax will be withheld from my pre-tax distribution?

Distribution withholdings will vary depending on the type of distribution you request. Generally, the mandatory 20% federal income tax withholding will apply to distributions unless you elect a direct rollover of the entire amount or take periodic payments that last more than 10 years. Currently, Indiana does not mandate state income tax withholding at the time of distribution. The Plan will withhold state income taxes upon request. A Form 1099-R for the distribution amount will be mailed to you by January 31 of the year(s) following the year(s) in which you receive a distribution.

Your Roth distribution is income tax free from your contribution portion no matter what. For tax-free earnings, you must hold the account for at least five tax years and meet one of the following: You are at least age 59½

You have a disability

Upon your death, after which your beneficiaries will take the withdrawal If you or your beneficiary make a distribution without meeting the above qualifications, you will owe ordinary income tax on any earnings that are

Join us at one of our Hoosier START webinars Scan the QR code to sign up

How do you pay for your mortgage, bills, food and other monthly expenses? If your paycheck stopped today, could you maintain your current lifestyle?

American Fidelity Assurance Company’s ShortTerm Disability Income Insurance is designed to help protect you if you become disabled and cannot work due to a covered Accidental Injury or Sickness.

If you become disabled due to a covered accident or sickness, Short- Term Disability Income Insurance will pay the disability benefit once you have satisfied the elimination period. Your benefit amount is dependent on your salary and the amount you select at the time of application. Disability benefits will be payable up to the benefit period stated in your policy.

Benefits Begin (Elimination Period)

For the Short-Term Disability Income plan, benefits can begin on the eighth day - 181st day, depending on the plan selected at the time of application. Benefits are payable for a covered Injury or Sickness up to 90 days or 180 days, based on the plan your employer has selected. Refer to your employer’s plan and your Certificate for details regarding benefit amounts and more

All full-time employees and employees of members on active service working 25 hours or more per week. Applicant’s eligibility for this program may be subject to insurability. It is your responsibility to see the American Fidelity representative once you have satisfied your employer’s waiting period.

Coverage Feature What It Means for you

Benefit Paid Directly to You, Regardless of Other Coverage

Age at Entry

Accidental

Death Benefit

Competitive Premiums

Deducted

Guaranteed Issue

Use the money however best fits your financial needs, regardless of other insurance.

Your premiums will be based on the date your policy becomes effective

Receive a benefit if you die as the direct result of an Accidental Injury and death occurs within 90 days after the date of the Accidental Injury.

Your monthly premiums could be paid with only one hour of a week’s paycheck.

Enjoy the convenience of having your premiums deducted straight from your paycheck.

Receive a benefit if you receive treatment by a Physician due to a covered Injury.

First-time eligible employees may be able to receive coverage without being subject to insurability.

Limitations, exclusions, and waiting periods apply. Refer to your policy for complete details.

From weekend warriors to active families and those of us just living everyday life, accidents can happen without warning anytime, anywhere. As healthcare expenses continue to rise, are you financially prepared for the unexpected costs resulting from an injury?

Limited Benefit Accident Only Insurance may help manage out-of-pocket expenses to treat injuries resulting from a covered accident. This plan pays benefits directly to you, and may help you with unplanned accident medical expenses. And, for some policies, the Accident Screening Benefit pays annually for routine physical exams, preventive testing and more.

Our Accident Only Insurance policy pays according to a wide-ranging schedule of benefits. In addition, the policy provides 24-hour coverage for accidents that occur both on and off the job.

All benefits are only paid as a result of Injuries received in an Accident that occurs while coverage is in force. All treatment, procedures, and medical equipment must be diagnosed, recommended and treated by a Physician. All benefits are paid once per Covered Person per Covered Accident unless otherwise specified in the Limitations and Exclusions section. Twenty-four-hour (24-hour) coverage not applicable on Non- Occupational policies. Refer to your brochure and/or policy for details.

Learn more at americanfidelity.com/info/accident.

View a more in-depth look at plan highlights, tiers, and pricing for Levels 1-3

View a more in-depth look at plan highlights, tiers, and pricing for Levels 4

Coverage Feature What It Means for you

Plan Options: Levels 1,2,3,4

Four Choices of Coverage

Wide-Ranging Schedule of Benefits

Choose the plan to meet your financial needs.

Choose the coverage that fits your lifestyle.

Benefits for many types of covered injuries.

Accident

Screening Benefit

Initial Treatment Benefit

Benefit Paid Directly to You, to use as you see fit

Guaranteed Renewable

24-Hour Coverage

The plan pays an annual Accident Screening Benefit for one Covered Person to receive a covered screening including routine physical exams, preventive testing, and more.

Receive a benefit when treatment is received by a Physician or Medical Professional within 30 days of a covered accident

Use the benefit however best fits your financial needs

Keep your coverage as long as premiums are paid as required.

You are covered on or off the job. Twenty-four-hour (24-hour)

coverage not applicable on NonOccupational policies. Refer to your brochure and/or policy for details.

Portable

Payroll Deducted

You own the policy. Take the coverage with you if you choose to leave your current job. Your premiums will remain the same.

Enjoy the convenience of having your premiums deducted straight from your paycheck

A cancer diagnosis may be overwhelming. Even with a good major medical plan, the out-ofpocket costs of cancer treatment, such as travel, childcare, and loss of income, are considerable and may not be covered.

American Fidelity Assurance Company’s Limited

Benefit Individual Cancer Insurance offers a solution to help you focus your attention on fighting cancer. We offer plans that can help assist with out-of- pocket costs often associated with a cancer diagnosis.

Our plans are designed to help cover expenses if you are diagnosed with a covered Cancer With over 20 benefits available to you, these plans can provide benefits for the treatment of cancer, transportation, hospitalization and more. We provide the benefit directly to you, to be used however you see fit.

Riders

Enhance your base plan with the following ridders:

Critical Illness Rider

May include option to choose lump sum benefit for diagnosis of internal cancer only, heart attack/stroke (first to occur) only or both.

Hospital Intensive Care Unit Rider

Learn more at americanfidelity.com/info/cancer.

View a more in-depth look at plan highlights, tiers, and pricing.

Coverage Feature What It Means for you

Plan Options: Basic, Enhanced and Enhanced Plus

Three Choices of Coverage

Wide-Ranging Schedule of Benefits

Benefit Paid Directly to You

Guaranteed Renewable

Diagnostic and Prevention Benefit

Choose the plan to meet your financial needs.

Choose the coverage that fits your lifestyle.

Covers a wide range of treatments.

Use the money however best fits your financial needs.

Policy is guaranteed renewable as long as premiums are paid as required.

Receive a benefit for visiting your doctor for a cancer screening test, which helps with early detection. Transportation and Lodging

Receive benefits if you travel more than 50 miles from your home using the most direct route for covered treatment.

Portable

Additional Coverage Options

You own the policy. Take the coverage with you if you choose to leave your current job. Your premiums will remain the same.

Enhance the base plan by choosing from a selection of optional riders.

Enjoy the convenience of having your premiums deducted straight from your paycheck.

Surviving a critical illness, such as a heart attack or stroke, can come at a high price. With advances in technology to treat these diseases, the cost of treatment rises more and more every year. Even with major medical insurance, the out-of-pocket expenses associated with a critical illness can affect anyone’s finances.

American Fidelity Assurance Company’s Limited Benefit Critical Illness Insurance can be the solution that helps you and your family focus on recovery, and may help you with paying bills. Our plan can assist with the expenses that may not be covered by major medical insurance. You may also have the option to add an infectious disease rider to this policy in select states.

Coverage Feature What It Means for you

Plan Options

Coverage Option

Choose from three lump sum benefit amounts: $10,000, $20,000 or $30,000.

Children are automatically covered under the Employee base plan. If elected, Spousal Benefit Amounts will be 50% of the Employee Benefit Amount.

Wellness Benefit

Receive a benefit for your annual health screening test.

How the Plan Works Guaranteed Renewable

Benefit Paid Directly to You

If you are diagnosed with a covered Critical Illness, such as a heart attack or stroke, this plan is designed to pay a lump sum benefit amount to help cover expenses. Also, this plan offers a Recurrent Diagnosis Benefit for certain specified Critical Illnesses that provides an additional 50% of the Critical Illness benefit amount after the second occurrence date. Covered Critical Illness events include Heart Attack, Permanent Damage Due to a Stroke, and Major Organ Failure.

You are guaranteed the right to renew your base policy until age 75 as long as you pay premiums when due or within the premium grace period. The insurer has the right to increase premium rates if the policy so provides.

Learn more at americanfidelity.com/info/criticalillness.

View a more in-depth look at plan highlights, tiers, and pricing

Portable

Additional Coverage Options

Deducted

Use the benefit however best fits your financial needs.

You own the policy. Take the coverage with you if you choose to leave your current job. Your premiums will remain the same.

Enhance the base plan by adding an optional rider.

Enjoy the convenience of having your premiums deducted straight from your paycheck

Limitations, exclusions and waiting periods apply. Please refer to your policy for complete details. This product is inappropriate for people who are eligible for Medicaid coverage.

If you experienced a medical emergency, would you be prepared to cover the out-of-pocket medical expenses? And, what about everything else that adds up like bills, groceries, and housing?

Major medical insurance plans are designed to pay a large portion of your medical costs. But with a high deductible plan, you must pay out of your own pocket until you meet your deductible and plan maximum. That’s where AF Hospital Assist™ can help.

Limited Benefit Group Hospital Indemnity Insurance, or AF Hospital Assist™, is a Health Savings Account (HSA)-qualified plan designed to help pay for out-of-pocket expenses, like an inpatient stay, while also allowing the tax benefit and potential savings from an HSA.

This plan includes a health screening benefit and provides benefits paid directly to you for hospitalization, unexpected accidents, and certain high-dollar critical illnesses.

Learn more at americanfidelity.com/info/hospital-indemnity

View a more in-depth look at plan highlights,

What It Means for you

Simplified underwriting No medical exams or health questions are required to apply

Health Savings Account compatible

Multiple plan options: Basic, Enhanced, Enhanced Plus

Three choices of coverage

Benefits paid directly to you

Guaranteed renewable

Portable

Help offset your high deductible while allowing your HSA savings to grow

Choose the plan to meet your financial needs

Choose the coverage that best fits your lifestyle

Use the money however best fits your needs

Keep the policy as long as premiums are paid

Take the policy with you even if you change employers

This product may contain limitations, exclusions and waiting periods. This product is inappropriate for people who are eligible for Medicaid coverage. The insurer has the right to increase premiums

January 1

Pay Dependent Daycare Provider

February 6 February 5 January 1-30 January 30 January 30

Reimbursement is Issued Via Direct Deposit or Paper Check

Care is Provided

Contribution is Withheld from Paycheck

Contributions Received from Employer and Posted to Participant Account

This is for illustrative purposes only. Dates and terms may vary by employer.

A Dependent Care Account (DCA) is used to reimburse yourself, with tax-free funds, for eligible dependent day care expenses. Your contribution is withheld from your paycheck before tax, which in turn reduces your overall tax burden.

You may allocate up to $5,000 pre-tax per calendar year for reimbursement of dependent day care services or $2,500 if you are married and file a separate tax return.

Incur Your Expense Before Submitting a Reimbursement Request

It’s important to understand that federal Treasury regulations require that an expense may not be reimbursed under a DCA until the service has already been received.

For example: If you prepay for a month of dependent day care, you may not get reimbursed for your expenses until the care has been fully provided Claims received for services that have not yet been provided will be denied. The claim will need to be resubmitted once the services have been fully provided.

Submit Reimbursement Request for January’s Care

Submit Your Full Expense Amount

As DCA contributions are withheld from your paycheck and placed into the account, these funds become available for reimbursement. A tip to maximize your reimbursement opportunities is to submit the entire amount of your incurred dependent day care expenses, even if it exceeds your monthly contribution amount. This allows you to build up a “pool” of incurred expenses, with pending amounts ready for reimbursement as soon as the next payroll contribution is received from your employer.

Getting Reimbursed

Use these tips to receive your reimbursement faster:

Use AFmobile, our mobile app, to submit claims on the go.

File claims electronically through our secured online portal.

Enroll in direct deposit to ensure a faster rembursement experience.

It’s total access. It’s total freedom.

What is LegalShield?

Everyone deserves legal protection. And now, with LegalShield, everyone can access it. No matter how traumatic. No matter how trivial. Whatever your situation is, we are here to help. From real estate to child custody issues, and all types of identity theft, we have your rights covered. LegalShield gives you the ability to talk to an attorney for less than $20 a month, and you never have to worry about hourly costs. Welcome to total peace of mind.

GUN OWNER SUPPLEMENT - Provides legal defense for your use of a firearm anywhere you are legally licensed to carry and be in possession of a firearm. For personal use only

Don’t be one of them.

Safeguarding your identity has never been more important. Nearly 500,000 cases of identity theft were reported in 2018 – an increase of nearly 20% over the previous year. IDShield is a comprehensive identity protection plan with proprietary features that go beyond other plans in monitoring your personal data and restoring it if a data breach occurs.

MONITOR MORE OF WHAT MATTERS

We monitor your identity from every angle, not just your social security cards and bank accounts.

WE’RE ALWAYS HERE TO HELP, NO MATTER WHAT

Our licensed investigators are available to answer your questions, even for simple advice, ready to assist your 24/7.

RESTORE YOUR IDENTITY COMPLETELY

IDShield is committed to spending an unlimited amount of time to restore your identity. Now includes $1MM insurance coverage for lost wages, legal defense fees, and more.

Gun Owner Supplement: Add $12.95 per pay to your Legal plan

What is payroll deduction life insurance?

Payroll deduction life insurance is a voluntary program brought to employees by a professional insurance agent in the workplace. Employees may purchase life insurance coverage and pay premiums through the convenience of payroll deduction.

In the event of a claim, you may use insurance proceeds to help with:

•Unpaid medical bills

•Replacement income for survivors

•Final expenses, such as burial costs

How can payroll deduction life insurance benefit you?

Lifetime protection

Your policy is secure. The Cincinnati Life Insurance Company will not cancel your policy as long as you pay the required premiums on time.

Financial security

Your policy provides financial security for those who depend upon you financially.

Convenience

Your premiums are paid through the convenience of payroll deduction, so you won’t have to worry about remembering to write checks or submit payments.

Cost

You determine the coverage that fits your budget Purchase insurance for as little as $2 per week

No medical examination

Medical examinations are not required, although issuance of the policy may depend upon answers to health-related questions in the application. If you apply for more than $200,000, your agent arranges for you to do a blood profile and urine analysis and check your height, weight, blood pressure and pulse.

Family protection

Coverage is available for your spouse, children, stepchildren, legally adopted children and grandchildren, ages 15 days through 17 years. You also may apply for a policy for your children ages 18 through 25 who are full-time students, unmarried and not in military services.

Portable policy

You own your policy. If you leave your employer or retire, you may continue coverage by paying the premiums directly to Cincinnati Life at the same price with no change in coverage.

This is not a policy. For a complete statement of the coverages and exclusions, please see the policy contract. All applicants are subject to eligibility requirements. Products available in most states.

Owners of birds, reptiles and exotic pets can get 50% or 70% reimbursement on eligible veterinary expenses with coverage from Nationwide.¹

•Includes veterinary exams, surgeries, diagnostic testing, prescriptions, wellness² and more

•$250 annual deductible applies just once per policy term, no matter which plan you choose

•Use any veterinarian, anywhere

Coverage available for:

• Amphibians

• Birds

• Chameleons

• Chinchillas

• Ferrets

• Geckos

• Gerbils

•Guinea pigs

• Hamsters

• Iguanas

• Lizards

• Mice

• Rats

• Rabbits

• Snakes

• Tortoises

• Turtles

•And more

All webinars are online at NOON EST. Find the link at www.hgi-solutions.com/medicare

January 20, 2026

March 24, 2026

June 9, 2026

September 15, 2026

RSVP to Medicare@henriott.com All seminars are in person at 5PM

1020 Gemini Lane Suite 100

West Lafayette, IN 47906

April 14, 2026

August 18, 2026

3905 Vincennes Road Suite 505

Indianapolis, IN 46268

April 21, 2026

August 25, 2026

When you turn 64 ½, it’s almost automatic –your mailbox will start filling up with Medicare-related information, and you may receive numerous calls from insurance companies encouraging you to enroll.

Don’t let it overwhelm you, but don’t ignore it either. Here’s what you need to know: If you’re still working, you are not required to enroll in Medicare. In fact, if you contribute to a Health Savings Account (HSA), you’ll need to stop those contributions once you have Part A. However, you don’t have to enroll in Part A unless you’re already receiving Social Security benefits.

It's also important to understand that Medicare comes with two potential penalties. As you approach retirement, make sure you’re aware of your enrollment window to avoid penalties and ensure you secure guaranteed coverage in the plan of your choice.

This is just the beginning when it comes to Medicare. For more information, feel free to join one of my free educational seminars in 2025 or schedule a complimentary consultation.

Maria Pearson Certified Medicare Advisor

Lorrainne Lewis Certified Medicare Advisor

StrengtheningIndividualsandFamiliesAcrosstheLifespan

It is tough for employees to do their best at work when faced with challenges such as finding child or elder care, dealing with substance abuse, or managing family relationships. That’s where an EAP can help.

Counseling Services at Willowstone provides therapy for children from 3 through 18 years old, adults, couples, and families in the treatment of clinical depression, anxiety, bipolar disorder, PTSD, substance abuse, parenting and behavioral issues, OCD, divorce adjustment, grief, domestic violence, childhood sexual abuse, and other mental health issues. Their excellent level of care for struggling clients provides interventions to help them heal so that they can continue as productive, happy members of society. Willowstone is also able to provide employees parenting education and support to assist you in providing the best possible family life and your children’s success and happiness.

Indiana Department of Health has designated Tippecanoe County as a Mental Health Provider shortage area. This means that all of the area’s mental health providers are struggling to meet the needs of people in our county, resulting in high costs and waiting lists to receive counseling.

Counseling is effective in keeping mental health problems from growing into bigger problems, but often people fail to seek assistance. Because the City of West Lafayette values your health and service, we contract with Willowstone to reduce the wait for our employees who need counseling appointments. Employees may receive up to 8 (eight) confidential counseling sessions per year. If you feel you need help with dealing with any mental health issues due to stressors, anxiety, life changes, crises, trauma, or just feel the need to talk with someone, please do not hesitate to reach out to your supervisor to get started with Willowstone today.

Willowstone Family Services

Howarth Center, Suite 101 615 N. 18th Street, Lafayette, IN 47904

For more information call 765-423-5361 or visit www.willowstone.org

EAP- Employee Assistance Programs are mental health and wellness services that an employer pays for at no cost to the employee! (8 sessions per calendar year)

Suncrest provides specialized psychological support with a trauma focus for first responder organizations that have many unique needs that a typical mental health or generalized EAP program is not able to address

All Services are anonymous and confidential per HIPPA and mental health laws and regulations

Employees can call Dr Dardeen or Suncrest directly; they do not need HR or supervisor approval to do so.

EAP can treat a variety of needs such as: trauma exposure, issues with sleep, irritability/anger, stress at work or in your personal life, marital stress, depression, anxiety, panic symptoms, PTSD, at risk substance abuse or alcohol use, and many other things. Our office now has 4 providers! We offer individual treatment, group services after a critical incident, and marital therapy

Repeated exposure to trauma causes predictable reactions in our brains These changes can be seen on fMRI (Functional MRI) scans.

Over time our thoughts become more negative, and this impacts day to day functioning and often negatively impacts our relationships Symptoms such as irritability, poor sleep, and increased substance use can develop after trauma exposure.

Learning how to process traumatic exposures (even if the trauma was something you witnessed with no direct threat to your own wellbeing) can help first responders recover more quickly and keep negative symptoms from lingering after an event

How do I start visits?

Call Dr Dardeen directly at 812-629-4999 for a brief screening and you will be scheduled with the provider that best fits your needs!

Visit our website for more information! www.suncrestpsychologicalservices.com

Drdardeen@suncrestpsychologicalservices.com

Cell: (812) 629-4999

Need money AND don’t want to pay EXORBITANT loan interest and fees?

Save money and worry less with the Small Dollar Loan Program!

Community Loan Center Features:

Up to $1,000 loan

18% interest with up to 52 weeks to repay

$20 per loan origination fee

Low, affordable payments

Convenient payroll deduction

Easy approval no credit checks and no collateral

Quick loan approval

Funds transferred directly into employee bank account

No prepayment penalty

Loans proceeds can be used for any purposes, including payoff payday loans

Improved credit through credit bureau reporting

Free financial education through HomesteadCS

To find more information and apply visit: www.clcwestcentralindiana.org

2060 Sagamore Parkway W Suite S West Lafayette, IN 47906

As part of your benefits through, you and your eligible family members now have access to Marathon Health.

Same-and next-day visits for immediate care needs

24/7 virtual access to manage your care

Little to no wait

More time with your provider

Sick and immediate care Cold/Flu Sinus infection Earaches & infections and many more Annual physical exams

Condition management Health coaching Labs and onsite testing

School and sports physicals

Patient portal

Access online or through the Marathon Health app Schedule appointments Secure video chats

Communicate securely with your provider

Manager your prescriptions and request refills

Access your medical history, lab results, and other health documents

Connect your health apps to track your progress Monday Tuesday Wednesday Thursday Friday

The Marathon Health patient portal and mobile app are powerful tools to help you conveniently manage your healthcare needs. This guide walks you through the process of creating your account and exploring all features.

Web-based patient portal

Visit my.marathon.health

Click “Register My Account”

Proceed to step 2

OR Mobile app

Scan the QR code below or follow these steps to download from Apple App or Google Play store

Search for “Marathon Health” in the search bar

Locate the Marathon Health app and tap on it

Press the “Download” or “Install” button to begin installing the app

Once the app is successfully downloaded, you’ll find the icon on your home screen

Proceed to step 2

Enter the following information to create your secure online account

Email address

Social Security Number

Not required but will improve the account creation process

Date of birth

Home address and phone number

Client name

Once complete, you will receive a confirmation email to complete the registration and log in to schedule your first appointment

Appointment scheduling: Book appointments with your provider

Video visits: Meet virtually with your care team

Messaging: Communicate securely with your care team

Medications: Manage your prescriptions and request refills

Health records: Easily access your medical records

Incentives: Earn rewards by prioritizing your health

United Healthcare Group #903864 866-414-1959 myuhc.com

VSP Group #30061360 800-877-7195 VSP.com

Optum Bank 866-234-8913 optumbank.com

(844) GO-INPRS inprs in gov

gayle@rossbusinesssolutions.com legalshield.com American Fidelity Assurance Company 800-662-1113 americanfidelity.com Maria Pearson 765-838-8614 hgi-solutions.com Nationwide 800-540-2016 petinsurance.com

OneAmerica 800-555-5318 oneamerica com Indiana 529 phillip.waddles@ascensus.com indiana529 com

cinfin.com