VILLAGE INVESTORS PROGRAM

At WeSeeHope, we have always wanted to be more than a sticking plaster.

Our aim is to create sustainable change for vulnerable children living in poverty across Southern and Eastern Africa. Put simply, we want change that lasts.

We are delighted to share this 2022 Impact Report about our community banking initiative, the Village Investors Program (VIP), which demonstrates our fierce commitment and ability to do this.

Through the VIP we train parents and guardians living in rural and isolated areas in community banking, business and finance skills, and teach them how to run their own savings and loans groups.

Pooling small amounts of money together to create their own capital, members are able to take low-interest loans from their groups to start businesses. With their increased earnings, members have more money to spend day-to-day, whilst also saving regularly in their groups.

It is this culture of saving that creates long-lasting change.

Firstly, because as they save, the loan capital of the group rises. This enables members to take out larger and more frequent loans to build their businesses, therefore generating more profit.

Secondly, because savings mean families can plan for their long-term goals, invest in their children’s futures and cope much better when unexpected emergencies hit.

And these emergencies are sadly becoming more and more common. 2022 alone saw flooding, cyclones, droughts and disease outbreaks continue to devastate the region where we work, all severely exacerbated by the ongoing effects of the pandemic, rocketing rates of inflation, and sharply rising food, energy and fertilizer prices.

We are really proud that despite the incredible challenges caused by the pandemic, climate change and cost of living crisis, over 99% of the VIP groups set up in the last three years have continued to function, and very well at that; on average, members have increased their savings from $71 after the first year of being in a group to $193 a year after three years, a massive 172% rise.

In the face of uncertainty and devastation caused by these crises, thanks to the fantastic local partner organizations with whom we deliver the VIP, we are in a position to help families and communities to increase their income in the short-term and build their economic resilience in the long-term.

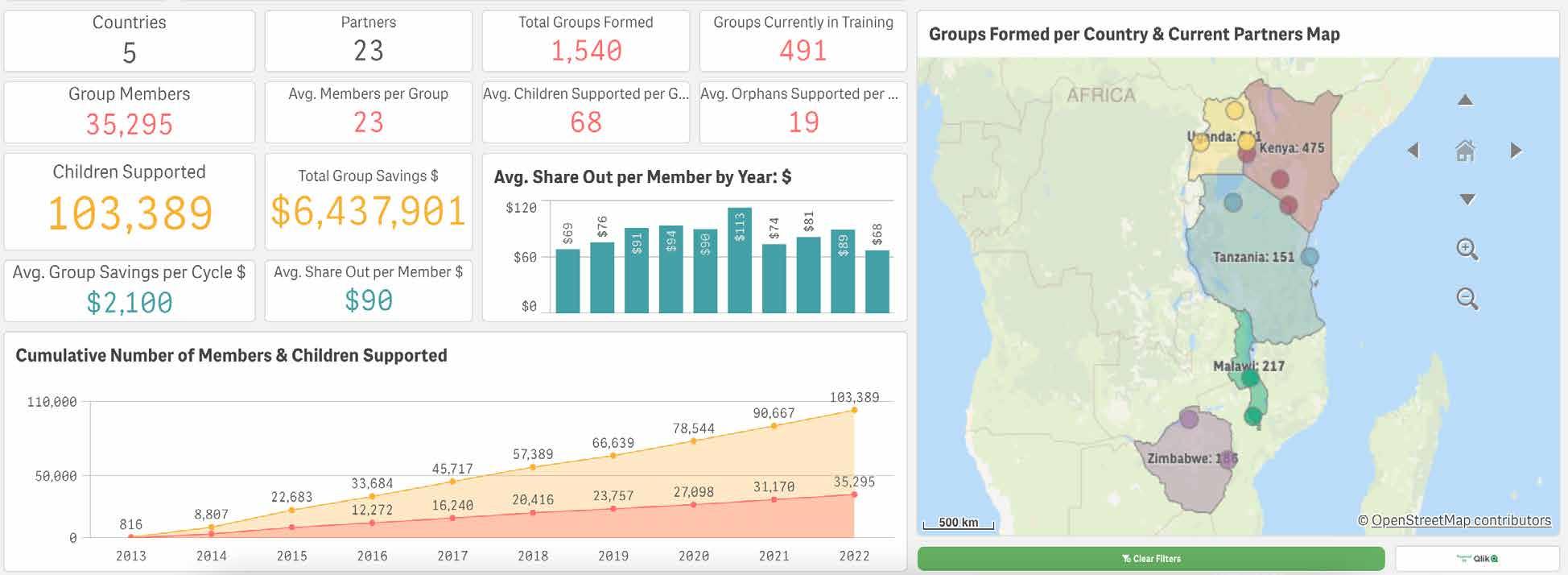

Using the dashboard developed in collaboration with our long-term supporter Qlik.org, we have continued to learn from the data we collect from VIP groups and to work with our partners to improve the running of the program.

2022 marked the end of a four-year data study in which we tracked the progress of individual members across three consecutive savings cycles. We are delighted to share the results in this report, which have provided further evidence of the transformational impact that VIP groups are having.

Thank you so much to everyone who has supported the VIP and WeSeeHope. Please know how grateful we are for your generosity and shared commitment to sustainable, community-led change.

Mark GlenRukia, a member of the VIP in Mwanza, Tanzania. She started her dried fish business with a loan of $21 in 2021. By 2022, it was worth $195.

“Saving in the group has enabled me to buy land and I have started construction on a new home. I can now say that I see hope in my life.”

Whether they are in rural northern Uganda or the informal settlements of Nairobi, we work with communities in which families do not have access to a bank, credit facilities or social safety nets.

This puts them at an acute risk. They are living day-to-day with no economic security. Without the ability to borrow money and with no savings, they have few opportunities to find new ways to generate income and are therefore trapped in the cycle of poverty.

Whether it’s dropping out of school to

find work, or facing limited access to nutritious food and healthcare, children inadvertently suffer. That’s why we have developed the VIP.

Once we have been working in a community for a year and introduced at least one out of our six child-centred programs, through the VIP we:

RUN

awareness meetings about savings and loans and its benefits for parents and guardians. Those who show interest form groups made of up to 30 members.

HOLD a VIP introduction meeting for each group during which they set their rules and elect their leaders, including a facilitator, chairperson, secretary and treasurer.

TRAIN

the leaders in how to manage the group activities and to provide support and guidance to their fellow members.

Charles, a member of the VIP in Pader, northern Uganda. He took a loan of $78 to kick-start his mechanics workshop, for which he has a stable customer base that is enabling him to save weekly.

EQUIP

each group with a savings tool kit that includes a cash safety box, savings bowls, financial notebooks and calculators, and which is used in their weekly meetings.

PROVIDE ongoing community banking, business and financial skills training sessions and support during their group meetings.

WORK with groups for 3-4 years, at which point they graduate from the program and operate independently of any support.

“Apart from the easy access to loans, my group taught me the culture of saving money weekly, diversifying my businesses, improving my record keeping, and sharpening my leadership skills.”

Beyond this training and equipment, the VIP is completely driven by its members. All groups are self-funded, self-regulated and run in the following way.

Members meet weekly in their groups where they each deposit “shares” into a Savings Fund.

With knowledge from the business and financial skills training sessions, they take loans from the Savings Fund to invest in materials for a business. They then use their profits to pay their loan back with interest over an agreed period of time.

On the right: The Itojo Parents VIP group during their weekly meeting in Ntoroko, western Uganda.

The 551 groups that were in training in 2022 saved a total of $962,538, the second highest annual amount since we launched the VIP in 2014!

2022 HIGHLIGHT

95% of groups operated a joint IGA, a crucial second income stream during the cost of living crisis.

In addition to collecting interest payments, groups build their loan capital by operating a Fines Fund, which members have to contribute to if they arrive late or break any of the rules of the group.

They also establish a joint Income Generating Activity (IGA), such as buying household items at wholesale and selling them to each other at market prices. This means that members are not solely reliant on their individual businesses in times of hardship.

On the left: VIP members from Buyama Group 1 in Busia, western Kenya, with their soap-making IGA.

2.

1.

2.

1.

Alongside their savings, groups develop social safety nets for themselves and their wider communities by contributing towards a Welfare Fund, which provides emergency interest-free loans for any member in times of hardship.

They also run an Orphan Fund to help children in their community who are in extreme need of support with food, school fees, and other necessities.

On the right: A member of the Kengatuny VIP group in Busia, western Kenya, with the children they have supported with school materials through their Orphan Fund.

11,054 children outside of the members’ households were supported through the Orphan Funds, the highest in a year so far.

On average, each member received $89 at share-out, a huge amount in countries such as Malawi where the national average monthly income is $53.

At the end of their savings cycle, which is usually annual, each group “sharesout”. This is when the Savings Fund - including the interest, fines and IGA profits - is divided among members depending on how much they have saved individually in the cycle. Members then reinvest back into the group and start the next one.

In areas where families are relying on day-to-day income, share-outs vastly improve their standard of living, enabling them to invest in assets and afford pressing expenses.

On the left: Gweng Obura VIP group share-out in Pader, northern Uganda.

3. 4.In 2022, thanks to your support, we worked with 13,193 parents and guardians through the VIP, reaching 42,080 children.

4,125 new members were introduced into the program and formed 177 new VIP groups.

12,722 more children were reached as a result, an average of 72 children per group.

UGANDA

59 new groups

1,704 new members

6,550 new children

KENYA

39 new groups

694 new members

1,846 new children

TANZANIA

24 new groups

With these new groups formed, we celebrated the milestone of reaching over 100,000 children through 1,500 VIP groups since we launched the program in 2014!

ZIMBABWE

34 new groups

709 new members

1,201 new children

MALAWI

547 new members

1,561 new children

21 new groups

471 new members

1,564 new children

9,068 members from 374 existing VIP groups were given ongoing training and support as they worked towards independence.

1,221 days of training were delivered by our partners to the new and existing VIP groups.

80% of new members were women, helping to boost gender equality in homes and communities.

29,358 children continued to be reached as a result, an average of 79 per group.

$159,483 was invested by WeSeeHope in the running of the VIP.

$962,538 was generated by all VIP groups throughout 2022, representing a 500% return on our investment.

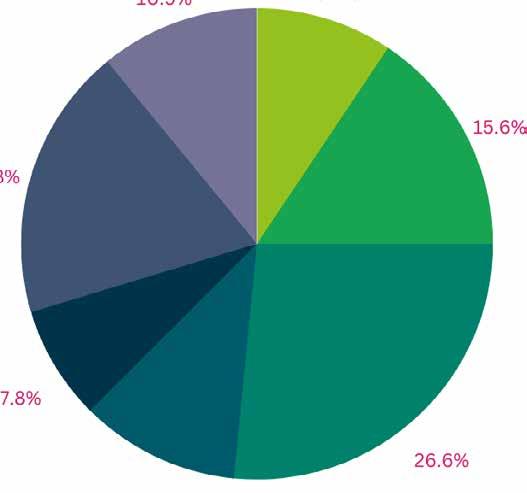

42% is the average increase in the share-out amount received by members from Cycle 1 to Cycle 3, as shown in the chart at the top.

50% of members are investing in livestock by Cycle 3 as shown by the chart on the right, a key indicator that their wealth is increasing.

Using loans from their groups, VIP members have started and grown a whole host of businesses, including farming projects, beauty salons, bakeries, phone charging stations, grocery stores, and thousands more.

With the ability to continually invest in them, these businesses give members the best chance of earning money

regularly, safely and sustainably, and to pass on the benefits of the VIP to their families, including:

Members can buy a wider variety of food and purchase fertilizer to grow their own produce. They can also afford items such as soap and detergent.

As household income increases, there is less of a risk that children will have to contribute financially through child labour.

Parents and guardians are better able to afford the necessary materials, such as books, pens and uniforms, meaning their children can attend school.

With support from their group, members can cover emergency costs, such as medical bills or weather damage to their property, without getting into debt with risky loans.

Members are able to afford larger expenses, such as school fees and improvements to their home, and make strategic life choices with their financial independence.

Members have the ability to purchase livestock, which provide back-up income if their business has a low-income month, ultimately ensuring their livelihood is more stable.

The VIP also significantly addresses gender inequality, which is often prominent in the rural and isolated communities where we work, as 80% of current members are women.

Access to savings and loans enables them to apply their skills, grow businesses, invest in themselves, and achieve financial independence, with benefits that spread throughout their homes and communities. They can:

Female members, who otherwise may have restricted access to independent ownership, can rent or buy land and property for themselves, and invest in livestock.

Women have the autonomy to make financial decisions on their own because of the income from their business and savings through the group.

Within their groups, members can discuss market opportunities, share advice and skills, and air any issues and concerns about their lives.

Women are more informed about how to spend and invest their money, and feel empowered by running and expanding their businesses, learning new skills and being breadwinners of the family.

Members are more able to afford sanitary products for their daughters and, by easing financial pressures, girls are at less risk of gendered issues such as child marriage and early pregnancy.

Esther, a member of the VIP in Nairobi, Kenya. She started her grocery business with a loan of $4 in early 2022, which she repaid on time and increased the next time in order to diversify her stock. She is already making a profit of $4-$11 a week and saving $2 in every group meeting.

Stella, a member of the VIP in Ntcheu, central Malawi, in front of her home. She took a loan in 2019 to start her tomato selling business. Since then she has set up a food garden, from which she grows enough to feed her four children and to sell surplus. Stella purchased windows, a door and an iron roof using the $517 she has received over three years at her group share-out.

“I am able to afford school fees and have adequate food. I am proud to be associated with my VIP group.”

“The VIP has changed things for me, it has given me the skills to look after my children in all areas and improve my home and life”.

Bahati, a member of the VIP in Loitoktok, Kenya. She took a loan of $43 three years ago to start her hair salon. After two years her business is worth approximately $345 and she has plans to expand.

Tifabe, a member of the VIP in Ntcheu, central Malawi, in front of the giant basket of maize she has harvested from her vegetable growing business. This will not only provide income but also food for her family for years to come. With the $348 she has received at her group share-out over the last two years, Tifabe has invested in livestock and now has five goats, nine pigs and a cow.

“At share-out I received $103. I rented a shop, paid school fees and restocked my business. I now have two employees. On a good day I can make up to $26.”

“Things are not as they were before; I am no longer dependent on piece work to support my family.”

Looking for additional ways to evaluate the VIP, we began a new project in 2019 aiming to assess its impact through data at an individual level.

We collected three cycles of data from 39 VIP members selected at random by seven of our partners. Every year, we gathered information about their

57% increase in the amount members receive at share-out.

monthly income and the amount they received at their group share-out. From this we can deduce that from Cycle 1 to Cycle 3, on average there is a:

225% growth in members’ monthly income.

We also asked members three questions after each savings cycle. Below is a breakdown of what we asked and the

members’ responses showing the trends over time and the conclusions we can draw from it.

These qualitative responses were split into two categories; direct (economic) changes and indirect (social) changes.

• Across all three cycles, income was consistently one of the biggest changes reported by the members, showing how the VIP reduces poverty from the first year it is introduced in communities.

• At the same time as the percentage of responses “start a business” dropped from Cycle 1 to Cycle 3, “expand / sustain a business” increased. This is indicative of the longevity and sustainability of the businesses being started, and the success of the program.

• The percentage of responses ‘“economic independence” rose from Cycle 1 to Cycle 3, demonstrating how over time the VIP reduces reliance and provides new opportunities for its members.

• Across all three cycles, the largest percentage of responses was for “improved standard of living”, showing how the rise in household income caused by the VIP means members can afford to better provide for themselves and their families.

• As the members progressed through the program, they were more able to afford clothes and improvements to their houses, showing how they are able to make greater investments and improvements in themselves and to their living conditions through participating in VIP groups.

• A high percentage of responses in Cycle 1 and Cycle 3 was for “community and relationships”, demonstrating how VIP groups are more than a banking group; they are support networks where members can share issues, concerns and skills.

Across all three cycles, the three largest changes the members’ reported were school, food and clothing, demonstrating how the program improves parents’ ability to provide for their children’s basic needs through their increased household income.

The members reinvested into their businesses, education for their children and agriculture, as shown by the word cloud below.

• The fact that members are reinvesting in their businesses is a key marker of the success of the VIP. By expanding their business, they are more likely to generate more income from it.

• Purchasing fertilizer is indicative of an increase in household wealth and food security as it means members can grow crops quicker and more efficiently.

• Paying for school fees and therefore investing in their children’s education is key to continuing to break the cycle of poverty.

Meet Neikesa who kindly took part in the individual data analysis project from 2019 - 2022.

“My name is Neikesa and I am a member of Suubi VIP group in Mbale, eastern Uganda. I live with my seven children and husband in Namwamba village.

I joined the VIP in 2019 as a result of the mobilization and orientation carried out by ACET (WeSeeHope’s partner in the region) in our community. Life was hard as I depended on my husband to provide for the family yet his income was too little to afford most of the basic items. We were struggling as a family to provide scholastic materials for our children and we could not save due to a lack of money.

I was elected as the facilitator of my group and therefore attended

methodology training. After this I decided to always be available for my group so that I could encourage members to save their money. I made sure my husband joined a group as well so that we could both acquire knowledge and skills to save and plan together in order to improve our family’s standard of living.

Together we started buying and selling produce such as groundnuts and rice in our community.

I borrowed 50,000UGX ($13) from my group and started selling tomatoes, onions and silverfish. After just one year, I was able to earn a profit of 30,000UGX ($8) a month

“WE ARE SURE OF AT LEAST $106 A MONTH, WHICH WAS NOT POSSIBLE BEFORE.”

NEIKESA, A MEMBER OF THE VIP IN UGANDA

which enabled me to save weekly with ease and grow my business capital to 150,000UGX ($40). I used my first share-out to invest in a cow.

After three years, I have expanded my business and now sell cabbages, cooking oil and salt, amongst other household items. I also make pancakes from which I earn an additional profit of 5,000UGX ($1) a day. At our last share-out, I received 455,000UGX ($122) and invested in three more cows.

Our produce business has now grown to 4,000,000UGX ($1,072). From all our businesses we are sure of at least 400,000UGX ($106) a month which was not possible before.

As a result, we are more able to provide food, clothing, better bedding and other needs for our family.”

$106

For context, this is in a country where the average monthly income is $74 and in an area where families are often earning much less than this.

$40 IS ENOUGH TO HELP A PARENT OR GUARDIAN LIKE

Since we launched the VIP in 2014, we have developed a very strong model of support to ensure that it continues to grow in communities and has the greatest impact on vulnerable children.

Each VIP group has their own facilitator who is responsible for:

• Attending every VIP group meeting to monitor, encourage and advise along with checking all group financial records.

• Providing ongoing training to group members in the savings and loans model, and in business and financial skills, having received training themselves.

• Continuing to run the VIP in their community after we have left.

Each of our partners who run the VIP has a full-time VIP Officer, whose responsibilities include:

• Engaging community leadership and improving understanding of the VIP model.

• Identifying, training and supporting the VIP facilitators and group leaders.

• Supporting and training each VIP group for at least three years.

• Monitoring the progress of VIP groups through regular community visits and collecting data for analysis and report writing.

In order to evaluate the growth, successes and challenges of the VIP, the WeSeeHope team are responsible for:

• Visiting each partner twice a year to monitor and evaluate the activities and outcomes related to the VIP, and to check financial records.

• Validating and verifying the stated impacts on the lives of vulnerable children.

• Operating a database where all information about each VIP group is centralized and analyzed.

We have developed a live and interactive VIP data dashboard in collaboration with Qlik.org, the corporate responsibility arm of leading data analytics company Qlik and long-term WeSeeHope partner, which:

• Specifically analyses the economic and social data collected from every VIP group until the moment they can operate independently of our support.

• Advances how we are able to monitor and evaluate the running and impact of the VIP in “real-time”.

• Enables us to tackle any challenges, enhance our decision-making and demonstrate the impact of your support.

It costs just $13 for a parent or guardian to be part of the VIP for a year, helping them to transform their family’s future.

So if you make a donation of $40, this is enough to cover the full three years of the program for a member. From our data, we know that they will go on to save $268 - a six-fold return on your investment!

Or, as part of our 1010 Challenge, if you use $10 to kickstart your own initiative and try and fundraise $100 (or much more!), you could help eight parents and guardians to join the VIP and launch their own businesses.