Supply Chain and Operations

Hemant Porwal

Executive Vice President, Supply Chain and Operations

VIPEliteBusinessMeeting–June5,2025

Supply Chain and Operations

Hemant Porwal

Executive Vice President, Supply Chain and Operations

VIPEliteBusinessMeeting–June5,2025

Repetitivetasksareseamlesslyautomated, freeing employees tofocusonhigh-valuetasks drivingincreasedproductivity

* Color Coding Matches Colors on Network Segmentation Slide

• GoalAchievement–Wastetolandfillreductiongoalwasmetandexceeded in2023.

• IncreasedReporting–PrimarydataforGHGcovered94%of ourglobal locations.ContinuingresearchanddatacollectionforfutureScope3 reporting.

• FreightOptimization–Ongoingresearchintoshiftingfreightmodes.For example-overnightairtogroundorrailtransport.

• GreaterTransparency–Addedseveralmorecategoriesofglobalemployee populationdatainthe2024SustainabilityReport.

• IncreasedFleetSafety–600fleetvehicleshavebeeninstalledwithAI safetydevices.

• CustomerEfficiencies–OurcustomersavoidedpotentialCO2emissions totalingmorethan53,000MTCO2ewithWescoenergysolutions.

2030 Sustainability Goals

• Reducelandfillwasteintensityby 15%acrossourU.S.andCanadian locationsfroma2020baselineby2030.

Baseline:0.64

• Provide425,000hoursofsafety traininganddevelopmenttoour employeesby2030

• ReduceabsoluteScope1andScope2 greenhousegas(GHG)emissionsby 30%froma2021baselineby2030.

Baseline:84,253MTCO2e

• Achievea15%reductioninTotal RecordableIncidentRate(TRIR) by2030from2020baseline.

Baseline:0.47

We are taking actions to be a Sustainability Leader in B2B Distribution

Hemant Porwal, on behalf of Akash Khurana

Executive Vice President, Supply Chain and Operations

VIPEliteBusinessMeeting –June5,2025

Artificial Intelligence and Machine Learning

AIismoving fromexperimentationtoexecution and isbeingembeddedintocore workflows

Automation and Robotics

Cloud and Edge Computing

Cloudisnolonger aboutinfrastructure,it’s aboutagility,scalabilityandcollaboration

Digital Twin and Advanced Analytics

Intelligentautomationisaccelerating productivityinsupplychainsandoperations

Thephysicalanddigitalworldsare converging throughreal-timemodeling andsimulation

Cybersecurity and Zero Trust Architecture

Securityisshifting fromperimeter to identitybasedandisrisk-aware bydesign

Sustainable Tech and Smart Infrastructure

Tech-drivensustainabilityisnowa business imperative andnotjustaside project

Pillar

What Wesco is Doing Value to Ecosystem

Innovation Velocity

Embedding AI in pricing, fulfillment and sales support

Faster, more personalized service for customers and suppliers

Operational Discipline

Unified cloud-native platform, MDM and integration stack

Seamless onboarding, cleaner data and shared visibility

Cybersecurity by Design

Building a zero-trust architecture with risk-based governance

Shared trust, IP protection and operational continuity

We’re not just digitizing Wesco, we’re building an ecosystem where our partners thrive with us, securely and intelligently

Wescocanbeabetter partnertooursuppliers byprovidinginventory informationand demandgeneration

Supplier integration

• More accurate demand signals

• Consolidating volumes in efficient channels

• Increased supply chain flexibility through better integration

Drive efficiency gains

• Optimizes rebates through consolidated volumes

• Reduces distribution costs through supply chain efficiency

• Streamlines global supply chain logistics opportunities

Working capital benefit

• Improves inventory locations to drive flexibility

• Centralized real-time inventory data to be accessible to multiple users

• Accelerate inventory receiving procedures

Integrated capabilities

• Integrated delivery management

• Reduced cost of serving complex demand

• For a food manufacturing customer, integrated digital commerce across channels to create better spend management controls

Providingmoremeaningful, value-addedrelationships

Simplified ordering and inventory insight

• Visibility of Wesco inventory alongside customers

• Automatic re-ordering from customer

• Same-day order and delivery for global software company using API stack

Current services beyond the product

• Integrated storeroom management

• Customized solutions: kitting and assembly

• Technical expertise: product and application training

Enablesmoreaccuratedemand signalsthroughoutthevaluechain, consolidatingvolumesinefficient channelsandacceleratedworking capitalvelocity

Enhancedgrowthopportunitiesthrough visibilityoncrossselling,internalefficiency gainsfromreducedorganization complexity,platformforaccelerated organicgrowthandacquisitions

Steppedupintegrationwith customersforimprovedorder managementandinventory visibility, integrationofproducts withwiderrangeofWescoservices

Digital transformation touches all parts of the value chain enabling efficiency gains across the company and our partners

Chris Wolf

Executive Vice President and Chief Human Resources Officer

VIPEliteBusinessMeeting –June5,2025

85% of skilled trade business owners report challenges with talent attraction and retention, with 67% citing a talent shortage due to an aging workforce and 43% noting limited interest from younger generations

Navigating Critical Labor Challenges

Wesco’s Observations and Strategies

• Companies facepersistent worker shortages,particularlyinskilledtrades,healthcare, andtechnology. TheU.S.projectsa4.9millionworkershortfallby 2032, drivenbyanagingworkforce, decliningbirth rates, andmismatchedskills.

• Over53% of U.S. skilledtradesworkersareover 45, with2.7millionBabyBoomers expectedtoretire by2030, exacerbatingtheskillsgap. Onlyoneworker enters thetradesfor everyfivewhoretire.

• Theapplicationratefor technicaljobs(e.g.,electricians,plumbers)droppedby 49% between2020and 2022,partlyduetoaculturalemphasis onfour-year collegedegrees.

• Overthenexttwoyears, economicuncertainty, emergingbusinessopportunities,andrapid technological advancementswilldriveworkforcestrategies.

Our industriesfaceacuteshortagesofskilled workerssuchaselectricians, automationtechnicians, andlogistics specialists. US manufacturinghad622,000unfilledjobsinearly2024,withprojectionsof2.1millionby 2030.

• RetirementofSkilledWorkers:Aging BabyBoomersexitingtheworkforce reduceavailabletalent.

• DecliningVocationalEducation: Reducedemphasisontrade-focused traininginschools.

• RapidTechAdvancements:Adoptionof AI,automation,andgreentechrequires skillsmanyworkerslack.

• EconomicandPolicyShifts: Uncertaintyandchangingregulations disruptworkforceplanning.

• IncreasedCosts:Higherwages(3.9% yoy,BLS, January2025)andrecruitment expensesstrainbudgets.

• ProjectDelays:Unfilledrolesandskill gapsdelayprojects, impacting profitabilityinconstructionand manufacturing.

• ReducedCompetitiveness:Inabilityto adoptnewtechnologiesduetoskill shortageshindersinnovation.

• TurnoverPressure:Skillmismatches leadtoemployeefrustration, exacerbating4%quitratesinhighturnover sectors(BLS, 2024).

• UpskillingPrograms:Investintrainingto bridgeskillsgaps(85%ofemployersplanto prioritizeupskilling).

• Cross-FunctionalTraining:Trainworkers inversatileskills(e.g.,projectmanagement, digitalliteracy) toadapttodiverseroles.

• TargetedRecruitment:Usedigital marketingonplatformslikeInstagram,X andTikToktoattractyoungerworkers.

• AIinRecruitment:UseAItoolslikeresume parsingandchatbotstostreamlinehiring.

• ImplementKnowledgeTransferSystems: Usedigitaltoolstocaptureexpertisefrom retiringworkersfor broaderroles.

Theretirementofexperiencedworkers, particularlyBaby Boomers,leadingtoalossofinstitutional knowledgeandexpertise("braindrain")incriticalindustries, especiallyconstructionand manufacturing.

• DemographicShifts:BabyBoomers (born1946–1964) areretiringinlarge numbers.

• LowBirthRates:Feweryounger workerstoreplaceretireesdueto decliningbirthrates.

• PandemicAcceleration:Early retirementsspikedduringCOVID-19.

• LackofKnowledgeTransfer: Insufficientprocessestopassexpertise toyoungerworkers.

• KnowledgeLoss:Criticalexpertise leaveswithretirees,affectinginnovation andefficiency.

• IncreasedCosts:Companiesfacehigher recruitmentandtrainingcoststoreplace experiencedworkers.

• SuccessionChallenges:Lackof preparedsuccessorsdisruptsleadership andoperations.

• CompetitiveDisadvantage:Firmslose edgeifunabletoretainorreplaceskilled workers.

• MentorshipPrograms:Implementtwo-way mentorshipstofacilitateknowledgetransfer betweengenerations.

• RevitalizeApprenticeships:Expand programsandpublic-privatepartnerships withhighschoolsandcommunitycolleges.

• SuccessionPlanning:Createformalizedjob successiontimetables,startpreparingearly.

• UpskillingInitiatives:Trainyoungerworkers tofillgapsleftbyretireesbeforetheyretire.

• IncentivesforRetention:Offerflexible schedules, reducedphysicaldemands,and pensionbonusestodelayretirements.

Declininginterest amongMillennials andGenZ inpursuing careersinskilled trades, favoringwhite-collar or tech-relatedjobs.

• CulturalBias:Societalemphasison collegedegreesastheprimarypathto success.

• Misconceptions:Tradesperceivedas alwaysphysicallydemandingor unstable.

• LackofExposure:Fewervocational programsinschoollimitearlyexposure.

• AlternativeIncomeSources:Younger generationspursuedigitalcommerce (e.g.,socialmedia, gigeconomy).

• ShrinkingTalentPipeline:Fewer entrantsintosomeindustriesworsen shortages.

• IncreasedCompetition:Companies competeforasmallertalentpool, drivingupwages.

• InnovationLag:Lackofnewtalent hindersadoptionofmoderntrade techniques.

• ProjectDelays:Insufficientworkers delaycriticalprojects,impacting profitability.

• RebrandTrades:Usesocialmedia campaignstochallengestereotypesand highlightcareer benefits.

• EarlyExposure:Partnerwithschoolsfor careerfairs,internships, andco-op programs.

• ShowcaseOpportunities:Emphasize competitivesalaries, jobsecurity, and advancementpotential.

• ScholarshipsandSupport:Offerfinancial aidandnetworksforalltypesofpeopleto entertrades.

Economicuncertainty, emergingbusinessopportunities, andrapidtechadvancementswilldriveworkforce strategies,requiringcompaniestoadapthiring, training, andleadershipdevelopmenttoremaincompetitive.

• EconomicUncertainty:Globalriskslike inflationandtradedisruptionscreate unpredictablelaborconditions.

• EmergingBusinessAreas:Growthin sectorslikecleanenergy,AI, andinfrastructuredemandsnewskillsandroles.

• RapidTechAdvancements:Adoptionof AI,automation,andgreenrequires upskillingandreskilling.

• ShiftingWorkforceExpectations: Youngerworkersprioritizeflexibility, purpose,andtech-drivenroles.

• IncreasedCosts:Upskillingfornew technologiesandhiringforemerging rolesstrainbudgets.

• CompetitivePressure:Firmsslowto adapttotechadvancementsorgrowth opportunitieslosemarketshareto innovativecompetitors.

• TalentMismatches:Rapidtechchanges outpaceworkforceskills,risking productivitylossesandinnovationlag.

• LeadershipChallenges:Lackofagile leadershindersadaptationtoeconomic andtechnologicalshifts.

• UpskillingPrograms:Investintrainingto bridgeskillsgaps(85%ofemployersplanto prioritizeupskilling).

• DevelopAgileLeaders:Trainleadersin changemanagementanddual-focus strategies(short-termresults, long-term transformation)

• ScenarioPlanningforUncertainty:Model workforceneedsunderdifferenteconomic scenariostoensureflexibility.

• EngageYoungerWorkers:Promotetechdrivenandpurpose-drivenrolestoalign withGenZvalues.

Costcuttingpressuretorespondtoeconomicuncertainty,fundtransformational investmentsand alignwithevolvingbusinessneeds

• Realignorganizationstructures,rolesandresourcestogrowthopportunities

• Centralizefunctionsfor greaterefficiency

• AssesshowAIandother newtechnologiesarereshapingworkandroles

• Reskillingandupskillingvs.recruitingpeoplewithrequiredcapabilities

• Respondingtoaccelerateddecisionmaking

• Developchangereadyleaderswhocandealwithdisruption

• Buildagilityintotheorganizationculture

Dave Schulz

Executive Vice President and Chief Financial Officer

VIPEliteBusinessMeeting –June5,2025

Globally, we expect real GDP growth will slow to 2.4% yoy in 2025, reflecting headwinds from higher US tariffs. We expect global core inflation to remain relatively steady this year and end the year at around 2.8% as the tariffdriven boost to inflation in the US is largely offset by disinflationary impulses from declines in shelter inflation and wage inflation as well as lower energy prices.

In the US, we expect real GDP growth to slow to 1.1% in 2025 on a Q4/Q4 basis as the rise in tariffs we expect and elevated policy uncertainty weigh on disposable income, consumer spending, and business investment. We see a 35% probability of entering a recession over the next 12 months. We expect core PCE inflation to rise to 3.6% yoy by end-2025 reflecting a boost from higher tariffs. We expect the unemployment rate to rise to 4.5% by end-2025.

We expect the Fed to deliver a series of three 25bp rate cuts starting in December and cut at every other meeting to a terminal rate range of 3.53.75%.

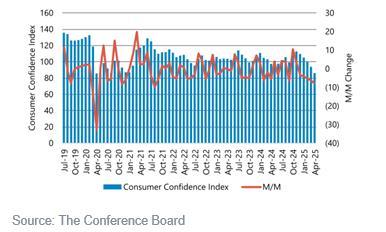

AprilConsumerConfidenceIndexDeclined8pts M/M

Keyquestion: impactofuncertainty,interestratesand tariffs

Expect organic growth of 2.5% to 6.5%; reported growth to be flat to up 4%