4 Guernsey channelling international private finance into UK assets

Section 3 presented the Government’s growth policies, which require large amounts of investment and associated private financing to be delivered. This section describes the potential for Guernsey funds to deliver additional private financing to the UK from overseas over the remainder of this parliamentary term. It presents evidence which supports key findings above from expert interviews, quantitative analysis and relevant studies.

We also present Guernsey funds’ results to date in financing investment in particular types of UK assets (e.g. infrastructure, housing, private equity), and financing investment across all regions of the UK. This analysis illustrates that Guernsey funds could provide finance for many specific areas of the Government’s growth pillars around the country

Annex B presents our detailed theory of change for how Guernsey funds channel additional private finance into the UK, and the potential benefits to UK growth from these capital flows.

4.1 The drivers of private finance flows into the UK

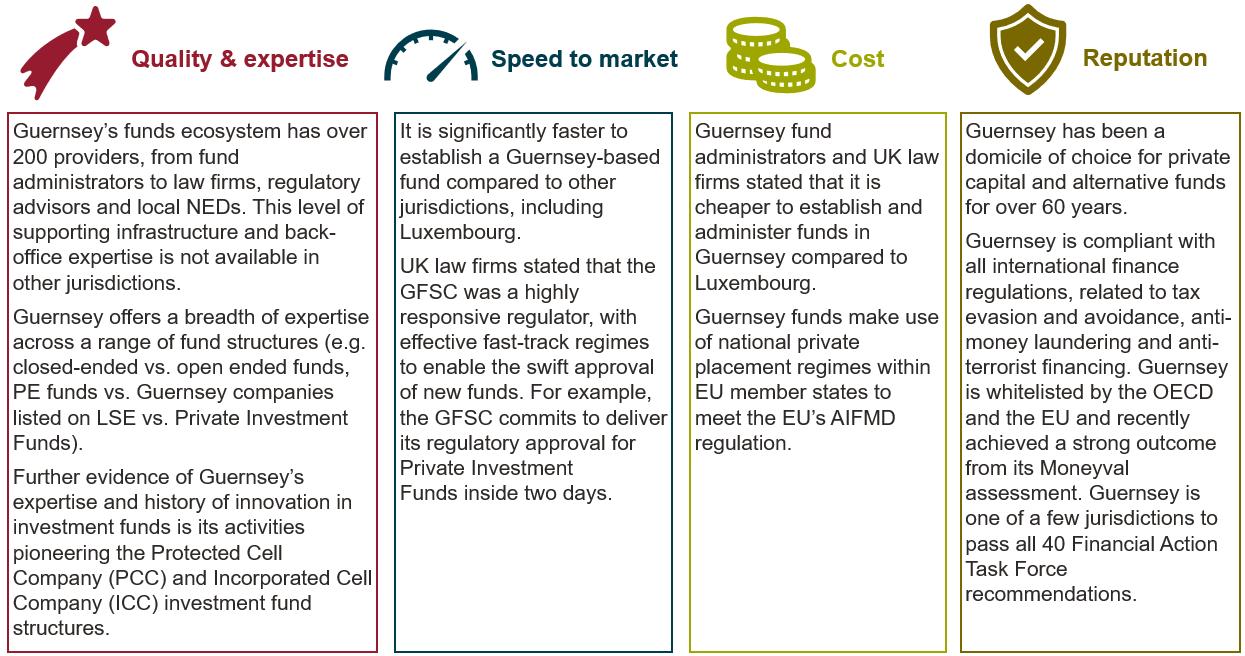

There are two components to Guernsey funds channelling additional private finance into the UK. First, the “inward leg” of financial flows, where Guernsey attracts private finance from overseas, based on its distinctive advantages as a leading international centre for establishing funds and administering them. Second, the “outward leg” of financial flows, where Guernsey funds channel a significant proportion of the international private finance that they hold into UK assets.

Figure 3 summarises the distinctive advantages of Guernsey funds over alternative jurisdictions. Key supporting evidence from UK law firms is presented further below.

Figure 3 Guernsey’s advantages as a funds domicile

Source: Frontier Economics

Guernsey’s speed to market

"Our [Private Investment] Fund was launched in under three weeks, including securing the regulatory approvals. This is testament to Guernsey’s favourable regulatory environment for private equity funds"

Partner at a European Private Equity Group

Guernsey’s cost advantages over Luxembourg

"Over a 10-year lifetime, establishing a fund in Guernsey rather than Luxembourg could save investors €2 to €3 million"

"A £100 million venture capital fund recently moved to Guernsey from Luxembourg, since the costs to run the fund from Luxembourg were too high."

Partner at a local Guernsey fund administrator

Guernsey’s advantages are embedded in its unique legislative and regulatory positions, as well as the expertise it has built over time. None of these are easily replicated by other jurisdictions, and therefore Guernsey is expected to continue to hold these advantages for many decades.

Guernsey-domiciled funds then channel a significant proportion of the international private finance that they hold into UK assets. The objectives, risk appetite and related characteristics of investors is paramount in deciding where their assets are invested; however, there are other factors strengthening Guernsey-UK links, which further capital flows directed into UK assets from Guernsey-domiciled funds. This is certainly the case compared to the propensity of other fund domiciles, such as Luxembourg, to invest in the UK.

Guernsey fund administrators stated several reasons for the large share of funds flowing from Guernsey into the UK. First, assets held in Guernsey which are then invested in the UK will be denominated in the same currency, therefore eliminating foreign exchange risk, which is attractive to investors. Second, Guernsey has close geographical proximity to the UK and is in the same time zone. As a result, there is a synergy between funds being domiciled in Guernsey which also have significant investment exposure to UK assets; it is less costly or time-consuming for fund administration activities (e.g. regular Board meetings) to take place in Guernsey and for significant investment activities of those funds to be made in the UK Third, Guernsey fund administrators and other experts have long-standing relationships with UK managers and law firms, which mean that that there is a greater awareness and a faster information flow for new investment opportunities in the UK to key decision-makers operating the funds, through Guernsey-based administrators. All of these Guernsey-specific factors contributeto funds that have a significant investment exposure in UK assets achieving a higher performance, and therefore also contribute to the ongoing competitiveness and attractiveness of funds that invest more heavily in the UK.

This reasoning is consistent with broader empirical evidence from the economic literature, related to “gravity modelling” of international trade of goods and services. Two countries that are closer geographically, have similar legal systems and the same language, tend to also have greater cross-border financial asset holdings 65

These advantages have led to asset holdings in the UK through Guernsey-domiciled funds growing at double the rate of broader UK inwards FDI asset holdings, as shown in Figure 5 below. Much of the global finance required to meet UK demand for new investment would flow to alternative destinations, if fund promoters no longer set up Guernsey-domiciled funds and used a different jurisdiction as the fund domicile. Earlier work suggested that even over the

65 Mercado 2018, Bilateral Capital Flows: Gravity, Push and Pull

long term, at least 20% of Guernsey-domiciled funds invested in the UK would be lost if Guernsey-domiciled funds were no longer used66

4.2 The scale and growth of Guernsey-domiciled funds investment in the UK

This sub-section describes the scale of investment in UK assets that is supported by Guernsey-domiciled funds. It also presents how this investment has grown over time, and the potential amount of incremental private finance for UK investments that Guernsey-domiciled funds could provide over the remainder of this parliamentary term.

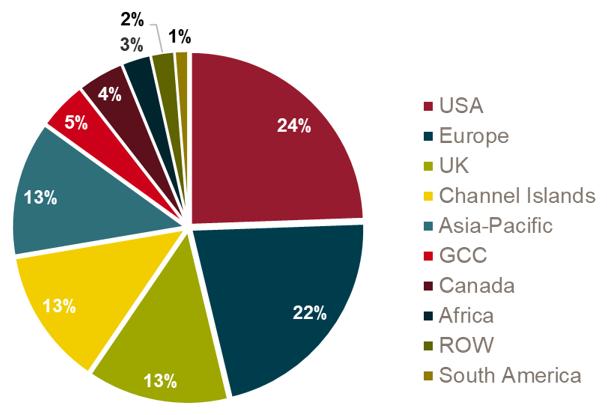

Almost 90% of Guernsey funds’ Assets Under Management (AUM) is sourced from investors outside the UK

Guernsey funds attract investment from all over the globe, as shown by Figure 4 Investors from a total of 63 countries invest over £50 million (each) in Guernsey-domiciled funds, and 87% of AUM was sourced from investors based outside the UK. The US and EU-based investors contributed the largest proportions of any region into Guernsey funds, at a combined amount that was 3.5 times the UK figure.

jurisdiction, Q3 2023

Source: Frontier Economics analysis of GFSC data

Note: Channel Islands means the Bailiwicks of Guernsey and Jersey

66 This finding is due to the reasons provided in the previous paragraphs; there are Guernsey-specific factors which mean that funds domiciled in Guernsey channel additional finance into the UK, compared to the amount of finance that would be channelled towards the UK by alternative jurisdictions acting as fund domicile. https://www.frontiereconomics.com/media/b41j02pu/rpt_value-of-gsy-finance_020124_final.pdf

Figure 4 Guernsey Funds Assets Under Administration, by investor

Guernsey-domiciled funds direct significant amounts of this finance into UK investments

Guernsey-domiciled funds direct a large proportion of their managed assets – much larger than the amount sourced from UK-based investors – into UK investments. The latest GFSC data shows that Guernsey funds had £58 billion invested in UK assets, at the end of March 2024

This figure does not fully account for the contribution of Guernsey investment management businesses, which provide advisory and active wealth management services for Guernsey residents and Guernsey-domiciled trust structures. These businesses direct additional finance into UK investments, by investing in Guernsey-domiciled funds (which invest in UK assets) and directly into UK funds and equities. The £58 billion figure excludes direct investment into UK funds and equities by Guernsey investment managers, and therefore the total amount of private finance channelled into the UK by Guernsey financial services businesses (both domiciled funds and investment companies) is larger than £58 billion.

Guernsey fund investments in UK assets are growing quickly at 7% per year

Guernsey-domiciled funds have grown their investment positions in UK assets quickly in recent years. Comparing GFSC data over time, Guernsey’s investment in UK assets has grown at an average annual rate of 7%, since 2021. This is approximately double the annual growth rate in UK total foreign direct investment since 2021, as shown by Figure 5.

Figure 5

Annual growth rate for ongoing investment into the UK, for Guernseydomiciled funds and all UK inward FDI

Source: Frontier Economics analysis of GFSC data for FY21 to FY24, and ONS Business, Industry and Trade statistics

Note: ONS data is only available up to 2023, as of date of this report.

Guernsey-domiciled funds are expected to increase their investment position in UK assets to £81 billion over the next five years

The high growth rate of funds channelled to the UK means that Guernsey is likely to significantly increase its investment in UK assets during the course of this parliamentary term The recent growth in the value of Guernsey-domiciled funds and the key advantages of Guernsey funds mean Guernsey’s investment in the UK is likely to continue (assuming there are no significant changes in the regulatory or tax treatment of Guernsey-domiciled funds by the UK authorities).

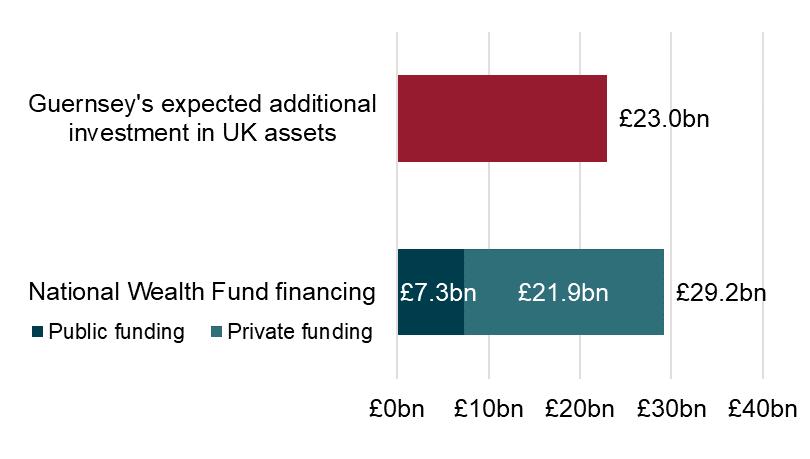

If Guernsey fund investments into the UK continue to grow at 7% per year, then in 2029 Guernsey’s ongoing investment in UK assets would reach £81 billion. This would represent an increase of £23 billion net new investment over the five years between 2024 and 2029.67

Given the UK context, the Government’s growth pillars and associated requirements for private financing, this additional contribution of Guernsey funds could play an important role in supporting UK growth.

4.3 How Guernsey-domiciled funds support the Government’s growth pillars

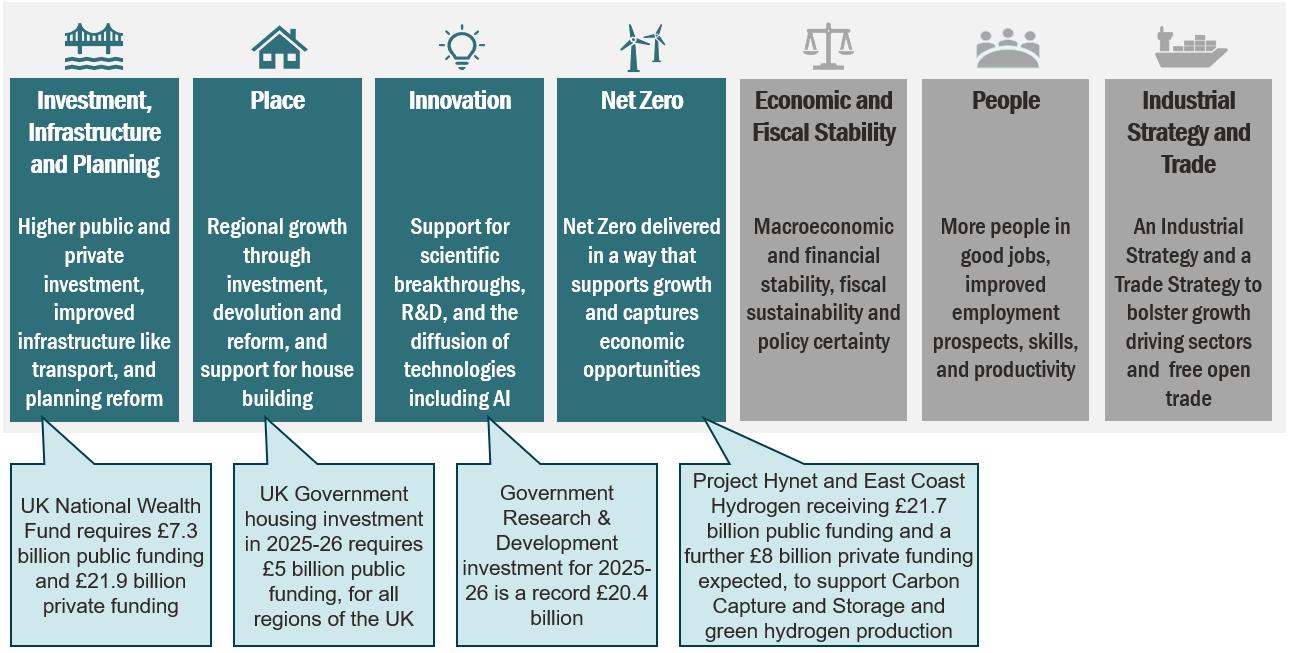

Guernsey-domiciled funds’ potential additional finance of £23 billion for UK investment projects could play an important role in financing UK economic growth. Section 3 summarised the Government’s growth agenda, and its requirement for private financing of investment.

This sub-section presents evidence on how the potential contribution of Guernsey-domiciled funds could support UK growth areas, for each Government growth pillar in turn. We use the same broad structure for each pillar:

1. Setting out Guernsey funds’ current investments in UK assets that are related to the growth pillar, with specific examples; and

2. Evidence from the academic literature on how additional investments in these assets (which would be financed through Guernsey-domiciled funds) could unlock growth for the UK.

67 In practice, more (or less) additional finance from Guernsey funds for UK investment projects may be forthcoming, depending on how well Guernsey positions as a fund domicile, and also depending on the actual demand for additional private finance from the UK.

Taken together, the evidence for each of these points demonstrates that Guernsey-domiciled funds could support the Government’s growth ambitions for each of its growth areas.

This evidence is supplemented by selected case studies on the impact of Guernsey-domiciled funds, and key statistics on UK Government investment projects related to each growth area that could be financed by Guernsey funds’ potential incremental investments in the UK.

The breakdown of Guernsey-domiciled funds investments in UK assets

We have reviewed the current breakdown of Guernsey-domiciled fund investment in UK assets. Where Guernsey already invests in particular types of assets that are related to the Government’s growth areas, then Guernsey is well placed to provide private finance for further UK investment related to those growth areas.

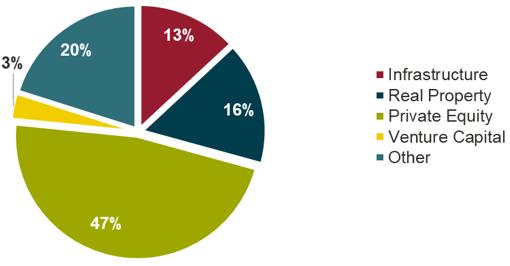

Figure 6 shows that Guernsey-domiciled funds channel significant private finance into UK private equity, infrastructure, housing (or “real property”) and venture capital. Collectively, these align to the Government’s growth areas: raising UK business investment, Infrastructure, Investment & Planning, Housing and Innovation.

Guernsey-domiciled funds invest across UK regions and align with the Government’s focus on Place-based growth, and there are several examples of Guernsey-domiciled funds investing in UK sustainability, which aligns with the UK Net Zero growth area.

Source: Frontier analysis of GFSC data.

Guernsey’s investments in UK private equity is the largest asset type. These investments finance strategic business transformation and acquisition projects. However the nature of these “private equity investments” also often involve financing infrastructure-related and real estate investments by UK businesses, that are financed through private equity. Such investments are classified as “private equity”, and therefore the overall contribution of Guernsey funds to UK infrastructure and housing is likely to be greater than the figures presented in Figure 7.

Figure 63 Guernsey fund investments in UK, by asset (FY 2024)

4.3.1 Raising UK business investment, through Guernsey private equity funds

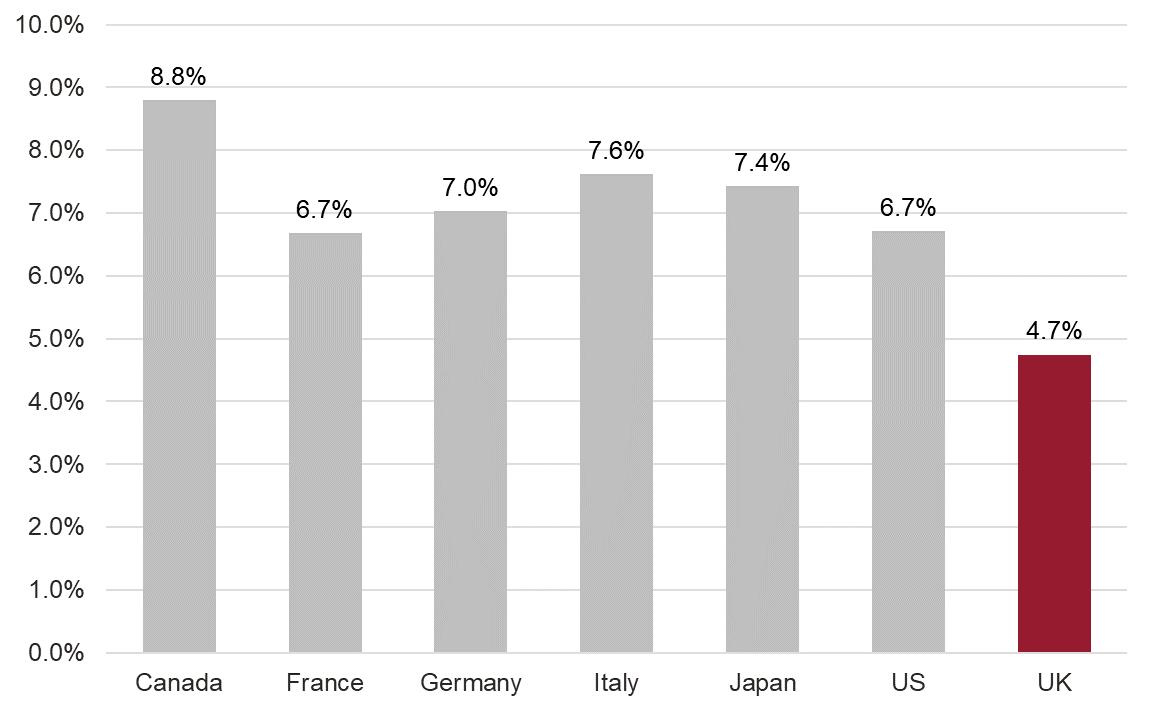

UK business investment has historically been at lower levels than other G7 nations as a proportion of GDP. Several commentators have stated that these low levels of business investment is a key reason for the UK’s limited recent productivity growth68. The UK Government has made it a key aim of its “Investment, infrastructure and planning” growth pillar to raise UK business investment.

Guernsey-domiciled funds’ current investments in UK businesses

Around half of Guernsey funds’ investment into the UK relates to private equity or venture capital (as shown by Figure 6). These funds support UK business investment. Guernsey’s private equity funds support a range of businesses across sectors but generally are used to finance particularly large investments.

Guernsey and UK industry experts stated that Guernsey private equity funds direct investment into a wide range of UK businesses. This includes biotechnology, green energy, digital, financial services and retail sectors, amongst many others. Three specific examples of Guernsey private equity funds are:

■ Apax Digital invests in digital businesses, particularly those operating in data analytics and online marketplaces. Their website shows that the fund holds significant stakes in several UK companies, including a rapidly growing provider of payment services.

■ The Synthesis Capital Fund invests in food, with an emphasis on environmentally sustainable, lab-based alternatives to meat. Their website shows that their portfolio includes a UK-based company that uses fermentation to produce mycoprotein, a highquality, fungi-derived protein.

■ The Cibus Capital Enterprise Fund invests in companies that are transitioning the food and agriculture value chain to a more sustainable model. This includes investments in Nourished (or Rem3dy Health), a foodtech company based in Birmingham that specialises in personalised nutrition

Separately, venture capital investments also finance smaller UK start-up businesses. There are significant follow-on benefits for UK innovation, which are covered in more detail in the “Innovation” pillar below.

68 For example, see NIESR 2024

Evidence for how private equity investments support economic growth

These investments are likely to raise UK productivity, based on broader evidence about the impact of private equity investment.

■ EY find that private equity-backed companies achieve an average productivity increase of 6.9% following investments, measured by EBITDA per employee69 .

■ Davis et al. analysed 9,800 private equity buyouts of US companies between 1980 and 2013, finding significant labour productivity gains for businesses post-buyout70 .

■ Frontier Economics find that although private equity-backed firms represent less than 6% of private sector employment in Europe, they are responsible for up to 12% of all industrial innovation 72

4.3.2 The Infrastructure & Planning growth pillar, supported by Guernsey Infrastructure and Real Property funds

Fresh investment in infrastructure and housing is a key element to the UK government’s plans for driving economic growth across all regions of the UK. This investment will be important for generating productivity gains and local economic development across the country.

It will also fill investment gaps, with a broader consensus that the UK has under-invested in infrastructure and housing The National Infrastructure Commission has identified a funding shortfall in UK infrastructure investment of £20 billion per year, and there is a large pipeline of 660 UK infrastructure projects, many of which require private finance for delivery. Chapter 2 presents further detail on these points.

Together, infrastructure and housing account for at least one third of Guernsey fund investments in the UK. The actual proportion is likely to be larger because much of Guernsey’s UK private equity investments relate to infrastructure and real estate.

Guernsey-domiciled funds’ investments in UK infrastructure

Guernsey and UK industry experts identified Guernsey funds directing investment into a range of different UK infrastructure, all with important social and economic benefit to local communities. This includes transport, hospitals, schools, pipelines, drainage and green energy projects. For example:

69 Ernst & Young, 2012. Branching out: How do private equity investors create value? A study of European exits, s.l.: s.n.

70 https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3465723

72 https://www.investeurope.eu/media/1110/frontier_economics_report.pdf

■ Gresham House is investing in a range of infrastructure assets including a new national network of landscape scale habitat banks to drive biodiversity net gain creation, vertical farms to provide food security for the UK and fibre-optic networks in underserved areas, through its British Sustainable Infrastructure Fund (BSIF).

■ The Basalt III Infrastructure Fund is investing in the rollout of fibre networks across the UK, as well as other telecommunication and transport infrastructure.

■ The Equitix III fund has invested in a range of UK transport projects since 2014. These include building key sections of the M25 motorway network, and Crossrail, where Equitix is a co-owner and financier of the fleet of trains operating on the Elizabeth line73

Importantly, these infrastructure investments are also taking place across UK. For example, the Gresham House fund’s regional fibre infrastructure investments are made in Birmingham, Leeds, Manchester, Cornwall, Devon and the Scottish Borders.

The expected £23 billion net additional investment from Guernsey into the UK over the next five years could significantly support the UK Government’s Infrastructure & Planning growth pillar. As shown by Figure 7, if the £23 billion additional investment is directed towards infrastructure (either through infrastructure funds or private equity investment), then this investment could account for the entirety of the UK Government’s National Wealth Fund’s required private financing.

Alternatively, the expected £23 billion additional investment could fill almost a quarter of the National Infrastructure Commission’s projected total shortfall in UK infrastructure investment over the next five years74

73 https://equitix.com/portfolio/

74 Source: National Infrastructure Commission estimate referenced in Chapter 2, that the UK currently has a shortfall in infrastructure investment of £20 billion per year.

Figure 7 Guernsey’s expected additional investment, compared with the National Wealth Fund financing required

Source: Frontier Economics analysis

Gresham House: Improving fibre infrastructure in Birmingham, Leeds, Manchester and other UK regions

Gresham House is a specialist asset manager focused on sustainable and alternative investment strategies It currently manages eight private market funds domiciled in Guernsey across its flagship British Sustainable Infrastructure Funds I, II and III (BSIF) alongside their five co-investment vehicles. Collectively, these funds manage circa £1 billion in AUM sourced from Local Government Pension Scheme funds and family offices.

Gresham House selected Guernsey from a range of international fund domiciles, due to the island’s deep expertise in specialist fund administration, the strong preference of institutional investors for Guernsey-domiciled structures, and the jurisdiction’s pragmatic and flexible regulatory environment The Guernsey Financial Services Commission has also demonstrated a clear understanding of and commitment to sustainable finance, which aligns closely with Gresham House’s focus on sustainable infrastructure investments

Gresham House recognises the important role of Guernsey fund administrators in supporting its early activities and then scaling and operating its sustainability-focused funds efficiently, while meeting the expectations of both regulators and investors In turn, Gresham House’s development has contributed significantly to improving UK sustainable infrastructure across all parts of the UK.

Gresham House focuses its investments in six key sub-sectors: decarbonisation, digital inclusion, health and education, regeneration, resource efficiency, and waste solutions. The businesses it invests in are located across all regions of the UK. Figure 9 in Section 4.3.5 presents an overview of these investments, but this case study focuses on the economic impact of Gresham House’s investments in fibre connectivity.

Gresham House investments in local fibre providers have improved connectivity in many of the major regional cities, including Birmingham, Leeds and Manchester, as well as rural areas such as Cornwall, Devon, and the Scottish Borders.

Gresham House actively invests in three platform companies, Elevate, Wildanet, and GoFibre, which are dedicated to improving digital inclusion across the UK. These companies focus on delivering full-fibre, high-speed internet to under-served areas, particularly rural communities that have traditionally been overlooked by larger broadband providers. Each company targets specific regions, ranging from major urban hubs such as Leeds and Manchester to more isolated areas in rural Scotland and Cornwall

Early-stage capital is crucial for scaling infrastructure businesses, particularly those with high upfront investment requirements. For example, the telecoms business Elevate approached Gresham House in 2021 with only a small fibre network and required £50–100 million to expand significantly. Since Gresham House’s investment via their flagship BSIF vehicles and their Northern focused funds, the company has grown from a team of 20–30 employees to

over 250 The business has also increased the network c.20 times from 33kms to 631kms and from 1,246 premises to over 132,616, demonstrating the transformative impact of early and substantial capital backing.

These businesses have already made a significant local impact and have either delivered or in the process of delivering large roll-out projects.

■ Elevate has grown the number of premises served by over 100 times, compared to the number prior to investment. It has now connected over 20 million square feet of office space in Leeds, London, Liverpool, Birmingham, Cardiff, and Manchester78

■ Wildanet is investing over £100 million to construct a brand-new broadband network in Devon and Cornwall, ensuring businesses and residents can access world-class digital infrastructure. It has also won three Government Project Gigabit contracts to provide up to 35,400 premises in Cornwall with access to gigabit-capable broadband79. Wildanet has now provided connectivity to over 50,000 deep rural premises and is targeting over 100,000 premises by 2028.

■ GoFibre are currently providing broadband in over 40 locations in various parts of Scotland and North England, including Aberdeenshire, Angus, East Lothian, Fife, and the Scottish Borders, and have been awarded three government Project Gigabit contracts to provide up to 7,700 premises with gigabit-capable broadband80. GoFibre already has provided much needed full fibre connections to over 125,000 rural homes already and is planning to reach a total of over 200,000.

The broader local economic effects of fibre roll-out are significant. A 2023 report published by policy institute Curia found that deploying gigabit-capable broadband in Devon will generate over £1 billion in additional business Gross Value Added (GVA) by 203081. Additionally, a 2022 report by the Good Things Foundation found that every £1 invested in digital inclusion yields £10 in economic and social benefits82, underscoring the critical role of broadband in driving UK growth and innovation.

Gresham House’s investments made through its Guernsey-established fund structures are significantly improving fibre infrastructure across the UK. In turn, these investments are generating large productivity gains for local businesses.

78 https://elevate.uk/our-network

79 https://www.gov.uk/government/publications/project-gigabit-progress-update-november-2024/project-gigabit-progressupdate-november-2024

80 https://gofibre.co.uk/about-us/

81 https://wildanet.com/media/3bjpymh1/curia-report-devon-2023.pdf

82 https://www.goodthingsfoundation.org/policy-and-research/research-and-evidence/research-2024/digital-inclusion-ukeconomic-impact

Evidence for the way in which infrastructure investments support economic growth

A range of studies show that improved infrastructure delivers higher productivity. In turn these productivity improvements would translate into economic growth. Two of these studies are as follows. Given the broader relationship between improved infrastructure and productivity that exists, it is reasonable to expect Guernsey funds’ financing for UK infrastructure projects to increase the prospects of UK economic growth.

■ A 2023 report by the National Infrastructure Commission highlights the importance of infrastructure in driving economic growth across UK regions, boosting competitiveness, and enhancing quality of life83. Improved transport, energy, and digital infrastructure contributes to growth by reducing costs and increasing the productivity of businesses. For example, more efficient transport networks reduce the time, cost and uncertainty of transporting goods. Moreover, strong infrastructure underpins well-functioning housing and labour markets, enabling people to find work efficiently

■ Bom and Ligthart assessed the impact of public infrastructure on economic growth, through a meta-analysis of the findings from 68 studies. They conclude that the long-run elasticity of GDP with regard to public capital stock is around 0.184, i.e. a 1% increase in public infrastructure investment would lead to a 0.1% increase in long-run GDP.

Guernsey-domiciled real estate funds’ investments in UK housing

Guernsey and UK industry experts also identified that Guernsey funds direct investment into a range of UK housing, with broader economic and social benefits. This includes social and supported housing, blocks of flats and university accommodation projects.

■ The Curlew Student Fund, domiciled in Guernsey, was set up in 2014 to invest in purposebuilt student accommodation throughout the UK, focusing on the top 24 Russell Group universities.

■ The Man GPM RI Community Housing I LP, also domiciled in Guernsey, aims to provide new affordable homes in the UK. To date, the fund has committed to 363 new homes in England, with a target of 3,500 homes by 202685

Building additional housing is a key priority for the UK Government, but doing so requires significant investment.

Guernsey’s net additional investment in the UK over the next five years could provide significant financing for the UK Government’s Housing plans. Guernsey’s expected additional

83 https://nic.org.uk/app/uploads/Final-NIA-2-Full-Document.pdf

84 Bom and Ligthart (2014) What have we learned from three decades of research on the productivity of public capital?, Journal of Economic Surveys 28(5))

85 https://www.insidehousing.co.uk/news/news/investment-management-firm-launches-400m-fund-with-homes-englandbacking-70365

£23 billion finance could fund the entirety of the UK Government’s £5 billion public funding announced for housing in 2025-2686 five times over

Evidence for the way in which housing investments support economic growth

A range of studies show that additional housing supports local economic development. On that basis, it is reasonable to expect Guernsey funds’ financing for UK housing projects to also support local economic development in the UK Two of these studies are as follows:

■ A 2023 Policy Exchange report find that increasing housing supply by 100,000 homes could directly add £17.7 billion per year to the UK economy, before accounting for additional indirect benefits87

■ Hsieh and Moretti find that stringent restrictions on housing supply in major US cities lowered aggregate US growth by 36 percent between 1964 and 200988, further emphasising the impact of constraints on housing supply in holding back growth.

4.3.3 The UK Innovation growth pillar, supported by Guernsey venture capital funds

The UK Government aims to make Britain the best place to start, scale and grow a business89 . The Government has a range of initiatives, but states that access to early-stage finance is key, as well as developing local innovation hubs, including “AI growth zones”.

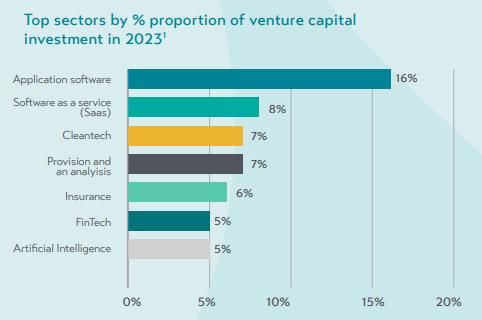

Venture capital investment is often an important element to start and scale micro businesses. These businesses are also more likely to build new products and services; Figure 8 presents findings from a BVCA 2024 report, which identifies the top UK “sectors” by venture capital investment. These “sectors” relate to the creation of new products, services and business processes, including artificial intelligence90. This demonstrates the role of venture capital funding in supporting UK innovation and the growth of micro businesses

86 https://mhclgmedia.blog.gov.uk/2024/11/01/budget-boost-for-housing-local-growth-and-remediation/

87 https://policyexchange.org.uk/publication/homes-for-growth/

88 https://pubs.aeaweb.org/doi/pdfplus/10.1257/mac.20170388

89 https://labour.org.uk/change/kickstart-economic-growth/

90 The UK government has stated that AI is “the defining opportunity of our generation”. https://www.gov.uk/government/publications/ai-opportunities-action-plan-government-response/ai-opportunities-actionplan-government-response

Figure 8

Top UK sectors by percentage of Venture Capital investment, 2023

Source: BVCA 2024, Venture Capital in the UK

Guernsey funds for venture capital investment are growing at a very fast rate (47% per year between FY21 and FY24), albeit from a smaller base The advantages of Guernsey’s speed to market are a particular strength in the context of venture capital financing, and a UK industry body also considered Guernsey at the forefront of VC funds investment for this reason. Guernsey is viewed as a leader in venture capital funds, and its fast growth in venture capital funds managed assets demonstrates that Guernsey funds could channel significant amounts of additional private finance into UK start-ups over the remainder of this parliamentary term 91

Guernsey’s position as a domicile for Venture Capital funds

"Guernsey’s regulatory environment offers a turnkey solution for venture capital funds, making it an ideal jurisdiction for UK-based fund managers. Guernsey provides a domicile for many of the UK’s top venture capital funds, channelling billions into the UK's start up economy from a global investor base.

The island has a large number of fund administrators, and one of those, HFL, specialises solely in early-stage venture capital. HFL provide a wide range of

91 This remains the case even if the starting base of venture capital funds managed assets is smaller than for private equity or infrastructure.

support to both established and emerging managers in the UK, whether it’s their first fund or a manager looking to institutionalise their operations as they scale. HFL recently supported one of the UK’s first emerging manager accelerator programmes, providing advice and support to 20 of Europe's most promising emerging VC fund managers."

James Legge, Director at HFL

Cibus Capital: Supporting a new Foodtech business in Birmingham to reach profitability

Cibus Capital is an investment advisory firm specialising in sustainable food and agriculture It currently manages four funds domiciled in Guernsey with collectively circa $1.3 billion in managed assets. A quarter of these assets is held in venture capital funds, and the remainder in private equity funds. Cibus’ Guernsey-domiciled funds invest predominantly in Europe and particularly in the UK Cibus seeks to add material value within portfolio companies, through a range of activities: strategic advice, introducing international best practice to operations and governance, new opportunities, advising on capital restructuring and foremost leveraging their wide international network of contacts across large retail, agri- and food companies.

Cibus Capital selected Guernsey from a range of international fund domiciles. The credible green designation was a key reason – the Guernsey Green Fund offers a regulated, jurisdiction-level label for environmental sustainability, giving Cibus a practical and externally recognised way to evidence Cibus’ impact thesis. Cibus states that “this includes alignment without overreach – it’s principles-based and maps to global standards like the EU Taxonomy, making it a strong fit for our strategy without unnecessary complexity or box-ticking It has also been useful for investor confidence – the regime requires independent verification and ongoing accountability, which supports transparency and helps guard against greenwashing.”

The speed to market is another key reason. Cibus confirmed that the GFSC “is very good at communicating fast and efficiently, and this is very helpful for meeting deadlines when setting up funds. Further, it also has helpful fund structuring frameworks that make having transparent partnership structures easy.” Guernsey’s long track record as a fund domicile in setting up successful funds quickly and cheaply was another factor in Cibus’ choice to use Guernsey

There are follow-on benefits to the UK from Cibus Capital funds being domiciled in Guernsey, with Cibus attracting additional investment to its funds as a result of the regulatory and cost advantages from establishing those funds in Guernsey. Cibus funds invest heavily in the UK, so this additional investment raised by domiciling in Guernsey has been channelled into UK venture capital projects.

Cibus venture capital investments supported a Birmingham-based personalised nutrition business to agree a sales deal with Boots UK and reach profitability

Since 2021, Cibus Capital’s Enterprise venture capital fund has invested in Nourished (or Rem3dy Health), a foodtech company based in Birmingham that specialises in personalised nutrition. The business offers customised health gummy vitamins (the fastest growing area of personalised nutrition), using customers’ responses to a short questionnaire, with Nourished then producing the gummies based on the responses using 3D printing. Each gummy has seven layers, each containing nutrients which can be tailored to an individual’s health needs around themes such as increasing energy, improving recovery, or sleep.

Cibus Capital’s Enterprise fund supported the growth of Nourished by financing important early-stage product development and building the team, which was critical to the business reaching scale. Alongside its finance, Cibus Capital provided Nourished with important higherlevel commercial decision-making, strategy and board support, and introductions to new investors and other corporates which has led to subsequent fundraising.

The business has grown quickly, more than 53 million units have been sold and expansion into retail is now underway with an agreed deal with Boots to sell its gummies in this year. It is also expected to reach profitability this year. Nourished has been recognised in the inaugural "Sunday Times 100 Tech" list, highlighting Britain's fastest-growing private technology companies 92

This case study demonstrates how Cibus Capital’s investments through its Guernseyestablished fund structures are supporting UK start-up businesses and innovation in new industries, such as foodtech.

4.3.4 The UK Net Zero growth pillar,

supported by Guernsey

Green Funds, infrastructure and private equity investments

The UK Government is committed to achieving net zero carbon emissions by 2050. Achieving this will require investment in new technologies and supply chain processes. The UK Climate Change Committee estimates reaching net zero will require annual investment equivalent to around 0.2% of GDP128, or approximately £57 billion, between now and 2050.

This investment is required for a range of purposes, including transport and infrastructure, housing and UK sustainability businesses. The UK Government has already committed £1.5 billion through the newly established National Wealth Fund to accelerate the rollout of Carbon Capture and Storage (CCS) and support the development of green hydrogen manufacturing129 . However, more private investment is required to meet the funding requirements of net zero.

Guernsey has a strong reputation in sustainable finance and has a track record of channelling investment into sustainability projects.

■ In 2018, Guernsey created its Green Fund designation where at least 75% of a Guernseyregistered fund’s activities must be committed to mitigating climate change, and the remaining 25%, must not lessen or reduce the fund’s overall objective of mitigating

92 Source: https://www.femtechworld.co.uk/news/3d-printing-nutrition-firm-rem3dy-health-named-in-inaugural-sunday-times100-tech-list-nourished24/

128 https://www.theccc.org.uk/publication/the-seventh-carbon-budget/

129 HM Treasury, ‘National wealth fund: Mobilising private investment’, 14 October 2024.

environmental damage. £4.7 billion is currently invested in Guernsey Green Funds as of Q1 2025, with the regime attracting finance from investors seeking exposure to sustainable assets.

■ Guernsey has been a member of the United Nations’ Financial Centres for Sustainability since 2018 and a member of the International Organisation of Securities Commissions’ (IOSCO) Sustainable Finance Network.

■ In 2024, a delegation of Guernsey sustainable finance experts met with His Majesty, King Charles III and The King’s Sustainable Markets Initiative (SMI), launched in 2021 Guernsey shared information on the Guernsey Green Fund and Natural Capital Fund designations. Subsequently, Guernsey Finance and The SMI agreed to discuss ways in which Guernsey's financial services sector can participate in the variety of The SMI’s task forces and raise awareness of financial services firms that use Guernsey and which are committed to sustainability initiatives

Guernsey-domiciled funds’ investments in UK net zero projects

Guernsey funds already invest in a range of UK sustainability projects, supporting the UK in its aims to achieve net zero. £3.5 billion of this investment is made by Guernsey Green funds. Guernsey’s investment in UK sustainability is much larger because several funds invest in sustainable assets but do not meet the threshold for a Guernsey Green Fund accreditation. Key examples of Guernsey investing in sustainable infrastructure projects or UK businesses investing heavily in sustainability are presented below.

■ Bluefield Solar Income Fund is a Guernsey Green Fund that invests in solar farms across the UK, with over 200 assets under operation today. The sites span more than 16 UK counties and offer a combined capacity of over 800 megawatts130 .

■ The Renewables Infrastructure Group Limited Guernsey Green Fund invests in various battery storage facilities around the UK, such as an 89 MW capacity site in the North East of England. It also invests in numerous onshore and offshore wind farms, with sites in Aberdeenshire and Norfolk131

■ Gresham House invested the seed capital to create the Gresham House Energy Storage Fund plc (LSE:GRID) which has now become the UK’s largest Battery Energy Storage System (BESS) operator with over 1.3GW of capacity to help balance the UK power system and has also invested in a large wind farm in North East Scotland with a capacity of 18 MW132 , through its British Sustainable Infrastructure Funds (BSIF)

130 https://bluefieldsif.com/about/

131 https://www.trig-ltd.com/portfolio/

132 Based on insight from interview with Gresham House

Evidence for the way in which net zero investments support economic growth

Investing in technologies and infrastructure to support the low carbon transition also presents opportunities for economic growth. A step change in investment and the development of new markets can drive innovation, boost productivity, and support the UK’s transition to a highvalue, low-carbon economy.

■ A recent study led by Vivid Economics estimates that sustained innovation across 12 priority low-carbon sectors could deliver £27 billion in domestic economic gains and £26 billion in export value by 2050133

■ According to a 2023 report by the Climate Change Committee (CCC), around 250,000 jobs have been created as a result of the shift away from fossil fuels.

■ Looking ahead, the CCC projects that between 135,000 and 725,000 net new jobs could be created by 2030 in low-carbon sectors, after accounting for potential job losses linked to the fossil fuel transition134

4.3.5 The UK Place growth pillar, supported by Guernsey-domiciled funds investing across UK regions

Economic growth across all parts of the UK is a key priority for the UK Government (as described in Chapter 2), and there is a clear demand for private finance across all regions of the UK.

■ In infrastructure, 74% of the 660 infrastructure projects in the latest National Infrastructure and Construction Pipeline are located outside of London and the south-east135 .

■ BVCA analysis finds that in 2023, 80% of the jobs with UK businesses using private equity and venture capital investment are located outside of London136 Businesses that need additional private equity or venture capital investment are based around the country.

133 https://assets.publishing.service.gov.uk/media/5dc5869740f0b637a38efba2/energy-innovation-needs-assessmentoverview-report.pdf

134 Climate Change Committee, ‘A net zero workforce’, 2023, p 11. Available at: https://www.theccc.org.uk/wpcontent/uploads/2023/05/CCC-A-Net-Zero-Workforce-Web.pdf

135 See Chart B1 in Annex B https://www.gov.uk/government/publications/national-infrastructure-and-construction-pipeline2023/analysis-of-the-national-infrastructure-and-construction-pipeline-2023-html#annex-b

136 https://www.bvca.co.uk/static/33d57f1c-9031-4da7-a9fa31d2efdb351a/Private-Capital-Building-a-better-economy-for-thefuture.pdf

■ Each local authority in the UK has been set ambitious mandatory housebuilding targets, with the aim of paving the way to the Government’s 1.5 million new homes target and ensuring homes are built in the areas most at need137

The UK Government has also announced several major investment projects that will support regional economic growth but also require large amounts of financing. These include:

■ The Lower Thames Crossing, a tunnel linking Essex and Kent, with an estimated cost of around £10 billion138 . This is currently exploring various financing options.

■ Progressing HS2 Phase One to improve connectivity between London and Birmingham, and increase capacity on the West Coast Mainline, will require significant private financing139

Guernsey-domiciled funds’ investments across all regions of the UK

Guernsey-domiciled funds already direct investment into a range of UK regions. For example, Gresham House using Guernsey-established funds, described in the Section 4.3.2 case study. Figure 9 presents a further breakdown of Gresham House’s investments in businesses across the UK. These investments all support local economic development, and in many cases innovation into new technology or supply chain processes. It is notable that all of the Gresham House investments presented in Figure 10 are made outside of London and the south-east.

137 https://www.gov.uk/government/news/housing-targets-increased-to-get-britain-building-again

138 https://www.newcivilengineer.com/latest/lower-thames-crossing-private-finance-options-outlined-including-semi-funded-at10-2bn-07-03-2025/

139 https://www.constructionnews.co.uk/government/private-finance-models-to-be-set-out-in-10-year-infrastructure-strategy-0404-2025/

Figure 9 Gresham House uses Guernsey-domiciled funds to invest in businesses across all UK regions

Source: Frontier Economics analysis, based on information from Gresham House

There are several other examples of Guernsey either making national investments across a range of UK regions, or targeted investments in a UK region outside of London and the southeast.

■ The Basalt Infrastructure fund invests in FullFibre, a broadband provider investing in fibrenetworks across the UK in regions such as Lancashire, Lincolnshire, Shropshire and Warwickshire140

■ The Equitix fund invests in Hornsea One, an offshore wind farm located 100km off the east coast of England, operated out of a base in Grimsby141

140 https://fullfibre.co/coverage/

141 https://pitchbook.com/profiles/fund/14610-52F#overview

■ The Curlew student fund invests in student accommodation around the UK, with sites in Durham, Exeter and Liverpool142

■ Resonance British Wind Energy Income II fund, a Guernsey-domiciled fund launched in May 2019, comprises 21MW of generating capacity over 70 sites in England, Scotland, Wales, and Northern Ireland143 .

142 https://www.curlewcapital.co.uk/

143 https://resonance.fund/our-funds/

5 Guernsey financial services firms support the UK’s global position as a hub for international finance

This section describes how Guernsey financial services firms have a wider role (i.e. beyond helping to meet demand for new private finance) in supporting the growth of the UK financial and professional services sector.

The UK is a leading international hub for private finance, second only to the United States152 . The UK Government recognises the critical role of the UK financial services sector in the UK’s growth ambitions and has committed to a UK Financial Services Growth and Competitiveness Strategy

Guernsey finance sector firms’ support the activities and competitiveness of UK providers. This has significant direct benefits for UK economic growth, based on the contribution of these UK providers to UK employment and gross value added153. There are further indirect benefits from maintaining and enhancing the UK’s reputation as a hub for international private finance to other UK financial and professional services providers.

Annex B presents our detailed theory of change for how Guernsey financial services firms support the competitiveness of UK financial services.

5.1 UK fund managers receive additional business from Guernsey funds and investment managers

UK fund managers complement those in Guernsey and are often brought into activity that originates in Guernsey. Guernsey-domiciled funds commonly use a UK-based fund manager and Guernsey investment managers will also invest heavily in funds that are domiciled in the UK.

The strong, long-standing relationships between Guernsey providers and UK professional services firms (including fund managers) means that the UK is the first jurisdiction considered by Guernsey investment managers for fund management. These relationships have been built on consistent service delivery over time, alongside shared time zones, geographic proximity for business meetings and a complementary legal system.

Interviews with two leading Guernsey investment managers clarified the scale of impact of these relationships: one directed 80% of their managed services AUM to UK fund managers,

152 https://www.thecityuk.com/media/wympuijs/key-facts-about-the-uk-as-an-international-financial-centre-2022.pdf

153 The UK’s financial services sector is one of the country’s largest and most productive industries, contributing around 9% of total economic output and employing approximately 1.2 million people nationwide. The UK is the second largest exporter of financial services in the G7 (source: https://www.gov.uk/government/speeches/mansion-house-2024-speech ).

and the other directed at least 50%. Our analysis is that UK fund managers would be expected to earn a total of £1.5 million per year from one ofthese local investment managers154, although the figure related to other Guernsey investment managers with more assets under management may be higher.155

Guernsey investment managers’ use of UK fund managers

"Our trusted, long-standing relationships as well as geographical proximity are the key reasons why we use UK-based providers"

Leading Guernsey Investment Manager

5.2 TISE supports UK issuers by listing alternative asset securities

The International Stock Exchange is used by UK investment management firms, particularly private equity houses, as a listing venue for alternative asset securities. These listings mainly relate to bonds (particularly corporate bonds), but also include some equities and investment funds.

TISE operates as a self-regulatory organisation and is the front-line regulator for its market. Therefore a UK issuer seeking to list securities on TISE requires approval from The International Stock Exchange Authority to do so. As a result a TISE listing can also help to support investor confidence, and in turn this supports UK investment management businesses in their investment activities in the UK. UK private equity firms also use TISE listings to finance specific investments; for example, they may list a debt security on TISE for the purpose of financing a specific acquisition.

TISE supports a large number of UK investment managers There were 2,481 issuers with securities listed on TISE at the end of 2024, with UK issuers accounting for a majority (61%) of these. Figure 10 shows that the number of UK issuers and total issuers has also grown over time, which indicates that TISE’s contribution in supporting UK issuers in their investment activities is expected to increase further over the remainder of this parliamentary term.

154 This calculation is as follows: a local Guernsey investment manager stated “approximately £100 million of our AUM is invested with a UK-based fund manager”. That figure was multiplied against an estimate for the UK fund manager fee rate, as a proportion of AUM, taken from earlier research (1.5%, Source: Frontier Economics - Capital Flows: Analysis of Guernsey’s Investment Funds Sector, p. 40)

155 Note that these fees are not the same as the fees earned by UK fund managers through Guernsey-domiciled funds.

Figure 104 Annual TISE issuers, UK and total, for 2022-24

Source: Frontier analysis based on TISE data

The following statistic demonstrates the significant role of TISE in supporting UK providers channelling private finance into housing and property development

TISE’s contribution to UK housing and property development

"Nearly half of all UK Real Estate Investment Trusts investing in new UK building (across London, Manchester and elsewhere) are financed through listings on TISE."

The International Stock Exchange

Fundamentum Property Group is an example of a TISE client, where a listing by an investment advisor supported investments in UK social housing. This case study is presented overleaf.

Fundamentum: Investing in social housing across all UK regions

Fundamentum Property Group is a UK and Isle of Man-based property asset manager and investment advisor. It established the Fundamentum Social Housing Real Estate Investment Trust (REIT) in September 2019, investing in supported housing across the UK Fundamentum’s investments provide homes for individuals with specialist care needs requiring on-site carers. In 2024, the REIT updated its investment objective by broadening the focus to include Affordable Housing. This change has been bought about by the housing crisis in the UK and the substantial need for affordable and social housing.

In November 2019, the REIT was listed on TISE According to Fundamentum, the purpose of this listing was to raise equity from institutional investors to assist in increasing the supply and quality of specialist supported housing in the UK. Listing on an internationally recognised exchange gave prospective investors comfort that they have invested through a credible and well-regulated jurisdiction.

Fundamentum confirmed that TISE offered two other key advantages, which also benefitted investors.

1. Firstly, TISE’s rules on fundraising which allow for a placement programme to attract investment on a rolling monthly basis. This allowed for a more efficient capital deployment programme rather than raising all the equity in one or more IPO, which would have then required swift deployment of capital to avoid cash drag.

2. TISE’s fees were significantly lower than other exchanges. This also increases investor interest, since ultimately higher exchange fees would in theory reduce their returns from investment. Fundamentum stated that its one-off and ongoing listing fees on TISE were approximately 50% cheaper than it would have spent on an alternative, larger exchange. Fundraising across multiple IPOs would also have incurred additional regulatory requirements and advisor fees for investors

Investor interest in the REIT has grown over time, and since listing on TISE, Fundamentum has scaled its supporting and affordable housing investments in the UK from around £5m in 2019 to £26 million in 2024. As Fundamentum’s REIT has grown in size, its investments have grown across the UK, and Fundamentum now holds 21 properties across all regions of the UK.

These investments provide social benefit to UK regions, with over 1 million households on waiting lists Fundamentum – and by extension, TISE, given its important contribution to Fundamentum’s REIT – supports the UK in meeting its growing demand for supported and affordable housing

5.3 Guernsey-domiciled funds support the competitiveness of UK fund promoters, with broader benefits to other UK firms

Section 4.1 presents the key advantages of using Guernsey as a fund domicile, which were a faster speed to market, Guernsey’s local expertise and funds infrastructure, and lower cost.

On top of Guernsey-domiciled funds channelling international finance to the UK, these advantages are all valued by investors and enhance the services of UK fund promoters (or investment managers) that establish funds in Guernsey. TISE also supports the investment activities of UK businesses and private equity houses (see Section 5.2).

Guernsey’s speed to market is a particular source of competitive advantage for UK fund promoters, in realising opportunities for investment transactions.

Guernsey’s

speed to market improves UK fund promoter services

"Guernsey is much faster than other jurisdictions [to establish funds]. Speed matters when it’s a competitive environment for funding and also delivering returns to investors quickly – there are hundreds of investments and deals …

… realising these opportunities requires real speed and agility and not holding up clients in raising capital. Clients will be trying to warehouse deals, there would be risk of missing out on investments if they [promoters] take too long getting regulatory clearance"

James Legge, Director at HFL

The improved competitiveness of UK investment managers and other UK providers is likely to also benefit a wider group of professional services businesses who rely on a healthy UK private finance ecosystem, or are used by UK investment managers in making deals.

Overall, Guernsey providers, including TISE, are expected to continue supporting the growth and reputation of UK financial services over the next five years. This aligns with the UK Government’s stated principles for its upcoming Financial Services Growth and Competitiveness Strategy.