John & Jane Doe

WEALTH|KC

Collaborative Approach to Wealth Management

SHEAN FLETCHER, AAMS®, AIF® FOUNDER + WEALTH ADVIS0R

WILL COCKING, CFP® WEALTH ADVIS0R + DIRECTOR OF FINANCIAL PLANNING

BRADEN WILSON WEALTH ADVIS0R

BROOKE TWADDLE DIRECTOR OF OPERATIONS

LEAH FLETCHER, M.ED. DIRECTOR OF CLIENT EXPERIENCE

Financial Plan

Financial Plan Delivery

INITIAL RECOMMENDATIONS

QUESTIONS

Bricklayers Pension

Will you retire through Bricklayers and be able to request full distribution?

What does the pension benefit look like? Only cash out option?

Goals

Are we missing any goals or needs?

HIGHEST PRIORITY ITEMS

Dial In Retirement Spending Need

Current projected monthly spending - $479,600 in gross income - withholding of 17% = net income of $398,068 divided by 12 = $33,172 - mortgage of $1400 - car insurance of $916 = $30,856 in net monthly income How much is getting saved vs spent?

At $10k/mo in spending you should have the ability to save about $250k per year or $62k per quarter. $31k per year into the 401(k). $219k per year into your taxable investment account.

Refinance Mortgage and Lower Length of Loan

Recommend you refinance into a 10-year loan The average rate of 6 4% lowers the total cost of the loan from $137,196 to $84,570 and pays off the loan almost 16 years sooner. Increases payment to $1,606 76 from $1,342 13

Additional Opportunities

Correct Life Insurance Situation

Sample does not need LI as she does not have income that is needed to replace Sample’s life insurance analysis revealed a need of $1.826 million to replace 60% of his income until retirement, pay off all debt, and pay for $15k in final expenses

This is too costly to fully insure, at about $222 per month at a minimum Recommend you get $500k in additional coverage for $89 to $160/month. You will save $75/mo by cancelling Sample’s policy.

401(k) Through Work

Recommend you defer as much as possible to this account $31k Limit for 2025 To reach this amount for 2025 set your 401(k) deferrals at 9% We will adjust these back down to about 7% in 2026 for a full year of contributions

Please send us in your investment options and we can construct a portfolio for you.

Right Size the Emergency Fund and Consolidate Accounts into the Market

Recommend you hold about $30k in cash on hand for emergencies The rest should be invested for growth

Additional Opportunities

5-Year Income Plan 5 Years from Retirement

Add’s a layer of protection to your retirement income

See printout

Consider Adjusting Vehicle Expenses

Insurance expense will be a drag on retirement spending ability.

Personal property tax will be a drag on retirement spending ability

Correct Tax Withholding

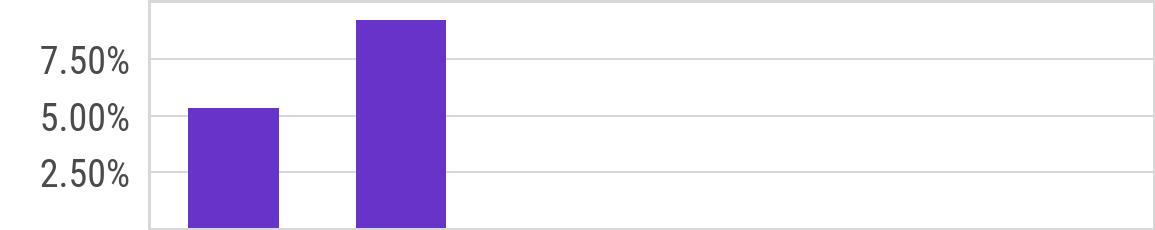

Effective tax rate for 2024 was 18.2%. Withholding from employer is 11%. Projected income for 2025 is $479,600 The effective tax rate will be 21 5% Increase withholding by 10 5% or about $4,596 per month

Additional Opportunities

Home Insurance

Dwelling coverage $636,300, home value online is estimated at $771k. Should we increase coverage?

Personal Property $504k Is this too high?

Create an Estate Plan - All for no extra charge to you

Create a Trust

Will’s POA’s

Umbrella Policy

Recommend you reduce the coverage from $5 Million to $2 million. Very unlikely someone could win a suit against you for more than $2 Million Save and invest by your reduced premium amount

Social Security Strategy

The highest probability of success is if you both delay to age 70 An increase of 3% and $404k ending portfolio value.

Future Considerations

Roth Conversions In Retirement

If you begin saving as recommended, you will have a large taxable account balance that we can withdraw from to fund your retirement This allows your AGI to be low and then we can convert to Roth at low tax rates. Targeting 22% rate for conversions.

Healthcare Plan

Looks like Sample can qualify for coverage via old employer if Minimum 17 years of service in past 20 years

Sample’s PEERs

Take the single life benefit. It is such a small amount just try to get biggest benefit. Survivor benefit doesn’t move the needle 20% Withdrawal Rate, better than we could do with that money

PLANNING CHECKLIST | Sample Client

N/AorSelfFunded

CASH MANAGEMENT

FUNDAMENTALS

CareerSalaryBenchmark

PositiveFreeMonthlyCashFlows

EmergencyFundorSavings

PROTECTION

LifeInsurance

DisabilityInsurance

UmbrellaPolicy

Long-termCareInsurance

DEBT

Recommendation

FundingShortfall

ESTATE PLANNING

HousingExpense<28%ofGrossIncome

TotalDebtPayments<33%ofGrossIncome

DebtPayoffPlan

OptimizeStudentLoanPaymentOptions

BUILDING WEALTH

SAVINGS

Receiving401(k)match

10%SavingsRate

15%SavingsRate

20%+SavingsRate

INVESTMENT PORTFOLIO

OrganizedandConsolidatedAccounts

TaxDiversifiedSavings(Traditional,Roth,Taxable)

HealthSavingsAccount(HSA)

ClientPassed

Medical+FinancialPowerofAttorney

Will Trust

HomeDeededtoTrust

EstatePlanonfileatWEALTH|KC

EstatePlanreviewedinlast3years

RETIREMENT READY

RETIREMENT INCOME

5YearIncomePlan

SocialSecurityStrategy

PensionStrategy

PLAN SECURITY

85+%ProbabilityofSuccess

StressTest

HealthinsuranceandMedicarePlan

SustainableWithdrawalRate

WEALTH PROTECTION AND LEGACY

LONGEVITY PLANNING

EstateTaxConsiderations

ElderCarePlan

FamilyPlanningMeetingevery3years

TAX DISTRIBUTION STRATEGY

EntirePortfolioAlignedtoPlan Completed

RequiredMinimumDistributions(RMDs)Plan

QualifiedCharitableDistribution(QCD)

Gifting/Charity

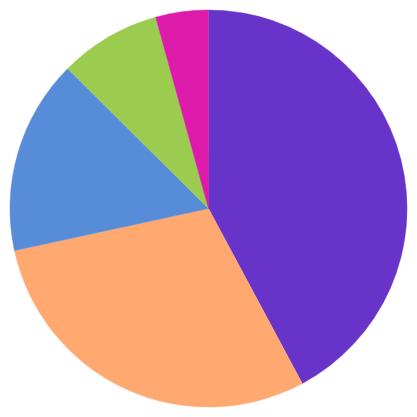

RETIREMENT INCOME PLAN

TOTAL INVESTED PORTFOLIO: $2,389,438

5-YR INCOME PLAN PORTFOLIO

$713,166 $262,838 $1,413,434

Marginal Tax Brackets: Ordinar y Income

The marginal tax rate for your ordinar y income is as follows:

to $201,050

Marginal Tax Brackets: Long Term Capital Gains & Qualifed Dividends

Your taxable income of $234,179 includes $911 of long-term gains and qualifed dividends that are taxed at lower rates compared to ordinar y income Long-term gains are added on top of your ordinar y income to determine the tax rates that apply

Schedule B - Income Sources

The tax return listed the following income sources on Schedule B

Let’s take a look at the tax efciency of your investment income

Different types of investment income are taxed differently. For example, non-qualifed dividends and short-term capital gains are taxed as ordinar y income at higher rates, while qualifed dividends and long-term capital gains are taxed at lower preferential rates And depending on your marginal bracket, it may be more tax efcient to use tax-free income vehicles like municipal bonds/bond funds instead of taxable income options.

Schedule C/E - Income Sources

The tax return listed the following businesses and entities on schedules C or E

SCHEDULE C

Net Investment Income Tax Summar y

The Net Investment Income Tax (NIIT) is a 3.8% tax on the lesser of investment income or the amount over the income threshold where the NIIT is triggered which is $200,000 (single flers) or $250,000 (joint flers)

Modifed Adjusted Gross Income (MAGI): Planning Considerations

Certain deductions and tax incentives phase out as income reaches certain levels. The defnition of “income” for these phase outs can be different. The term “Modifed Adjusted Income” (MAGI) is generally used, but there are several defnitions of MAGI that are slightly different from each other

MAGI Defnition 1

Coverdell ESA

$263,407

$190,000 - $220,000 Above Lifetime Learning Credit

$160,000 - $180,000 Above American Opportunity Credit

$160,000 - $180,000 Above Child Tax Credit

Qualifed Adoption Expenses Credit

$400,000 - $400,000 Under

$252,150 - $292,150 Phase Out Savers Credit

$46,000 - $76,500 Above Clean Vehicle Credit (New)

$0 - $300,000 Under Clean Vehicle Credit (Used)

$0 - $150,000 Above MAGI Defnition 2

$263,407

Investment Income Tax $0 - $250,000 Above MAGI Defnition 3

$263,407 Roth IR A Contribution $230,000 - $240,000 Above

Defnition 4

Loan Interest Deduction $165,000 - $195,000 Above

Defnition 5

$263,407 IR A Contribution Deductibility - Covered by Qualifed Plan

IR A Contribution Deductibility - Not Covered/Spouse Covered

MAGI Defnition 6

$123,000 - $143,000 Above

$230,000 - $240,000 Above

$263,407 ACA Premium Credit 1336% of federal poverty limit (48 States and DC)

Deductions & Credits

Deductions reduce the amount of income subject to tax while credits reduce taxes dollar for dollar.

DEDUCTIONS

Qualifed Business Income Deduction

Obser vations

Income exceeds the threshold for the 3 8% Net Investment Income Tax (NIIT) Consider strategies to reduce taxable income and be mindful of realized capital gains.

You are in the 24 0% marginal bracket Depending on your age and income projections, you might consider a Roth conversion

You were charged an underpayment penalty, which arises out of total tax payments lower than a defned threshold and/or insufciently matched payments against the timings of receipt of income You can generally avoid this penalty by paying at least the “safe harbor” amount based on your previous year ’s tax return through withholding or estimated tax payments Consider discussing a penalty proofng approach with a tax professional

The 2025 safe harbor for underpayment penalties is your total tax x 110%, or $46,987 Note that the timing of your payments is also important with respect to avoiding penalties Withholding from a paycheck or retirement account distributions are considered to have happened throughout the year, but estimated tax payments should be timed to correspond with the timing of the income earned A tax professional should be able to help in cases where income is uneven throughout the year

Your Modifed Adjusted Gross Income (MAGI) suggests you are not eligible to contribute directly to a Roth IR A. You do have eligible compensation though, so you might discuss the feasibility of the "Backdoor Roth" strategy

Your tax return suggests you may have business income Depending on your circumstances, you may be able to implement a retirement plan for the business to defer taxes.

Your tax return does not list any HSA contributions If you are eligible to contribute to an HSA, you will get a tax deduction, regardless of whether you itemize or take the standard deduction.

You owed additional taxes beyond any withholding or estimated tax payments If this was due to a one-time event, you may not need to take any action. If not, consider adjusting your withholding to avoid any surprise lump sum payments due at tax time.

This return was prepared by a paid preparer, but there is nothing in Schedule C line 17 for legal and professional ser vices If you paid a tax professional to prepare your return, the cost of the preparation attributable to your business could potentially be deducted on this line.

Schedule C does not include any expenses on line 9, car and truck expenses Do you use a vehicle for any business-related activities?

For the ACA Premium Tax Credit, taxpayers with MAGI of less than 100% of the Federal Poverty Limit (FPL) are not eligible to receive any credits. Generally, taxpayers with MAGI between 100% and 400% of the FPL are eligible to receive the credit on a sliding scale. Taxpayers with MAGI above 400% of the FPL may receive the credit, to the extent the credit will keep the cost of the benchmark plan to no more than 8 5% of household income

Review employer-provided benefts to ensure you are taking full advantage of any pre-tax options.

Your modifed adjusted gross income (MAGI) appears to be low enough to qualify for the new but not the used clean vehicle credit, assuming you purchase such a vehicle and it meets the other eligibility criteria. Note that you may still be eligible for the used vehicle credit based on MAGI, as you can use your MAGI from the year you take deliver y of the vehicle or the year before, whichever is less If your modifed AGI is below the threshold in one of the two years, you can claim the credit

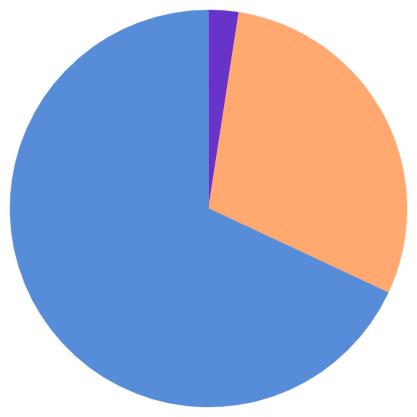

Investment Strategy

.03

GrowthPortfolio

PreparedforSampleClientbySheanFletcheratWealthKC May20,2025

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother

May20,2025

GrowthPortfolio

CumulativeReturn

3-Growth

September18,2023throughMay19,2025

PeriodicReturn

Dataasof:May19,2025

AnnualReturn

BasicInfo

Nodescriptiongiven Benchmark 3-GrowthBenchmark* AdvisoryFee 001%

*Benchmarkinformationdefinedindisclosuresection

KeyStats

Dataasof:May19,2025

Partialyeardatanotshown

Theperformancedataquotedpresentspastperformance;pastperformancedoesnotguaranteefutureresults;theinvestmentreturnandprincipal valueofaninvestmentwillfluctuate;aninvestor’sshares,whenredeemed,maybeworthmoreorlessthantheiroriginalcost;currentperformance maybelowerorhigherthantheperformancedataquoted.Themostrecentmonthendperformancedatacanbeaccessedat https://go.ycharts.com/fundcontactinfo.(SeetheStandardizedReturnssectionofthisreportforstandardizedreturnsinformation).

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother nancialinstrument THEIMPORTANTDISCLOSURESFOUNDATTHEENDOFTHISREPORT(WHICHINCLUDE DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT Forfurtherinformationregardingyouruseofthis reportpleasegoto:https://getychartscom/disclosure/

May20,2025

Dataasof:May20,2025

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother

DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT

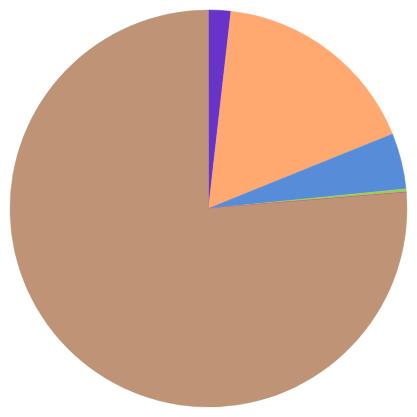

ExpandedRegionExposure

Americas 89.38%

NorthAmerica 8587%

Canada 069%

UnitedStates 8517%

LatinAmerica 351%

Argentina 000%

Brazil 050%

Chile

UnitedArabEmirates 005%

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother nancialinstrument THEIMPORTANTDISCLOSURESFOUNDATTHEENDOFTHISREPORT(WHICHINCLUDE DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT Forfurtherinformationregardingyouruseofthis reportpleasegoto:https://getychartscom/disclosure/

May20,2025

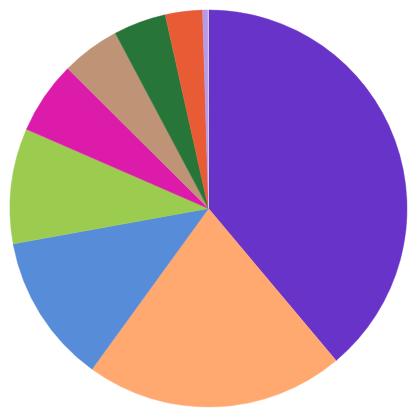

StockSectorExposure

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother

DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT Forfurtherinformationregardingyouruseofthis reportpleasegoto:https://getychartscom/disclosure/

May20,2025

Dataasof:May20,2025

BondCreditQualityExposure

Dataasof:May20,2025

BondMaturityExposure

Dataasof:May20,2025

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother

DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT

reportpleasegoto:https://getychartscom/disclosure/

Dataasof:April30,2025

3-GrowthTotalReturn%OffHigh

Dataasof:None

Theperformancedataquotedpresentspastperformance;pastperformancedoesnotguaranteefutureresults;theinvestmentreturnandprincipal valueofaninvestmentwillfluctuate;aninvestor’sshares,whenredeemed,maybeworthmoreorlessthantheiroriginalcost;currentperformance maybelowerorhigherthantheperformancedataquoted.Themostrecentmonthendperformancedatacanbeaccessedat https://go.ycharts.com/fundcontactinfo.(SeetheStandardizedReturnssectionofthisreportforstandardizedreturnsinformation).

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother nancialinstrument THEIMPORTANTDISCLOSURESFOUNDATTHEENDOFTHISREPORT(WHICHINCLUDE DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT Forfurtherinformationregardingyouruseofthis reportpleasegoto:https://getychartscom/disclosure/

May20,2025

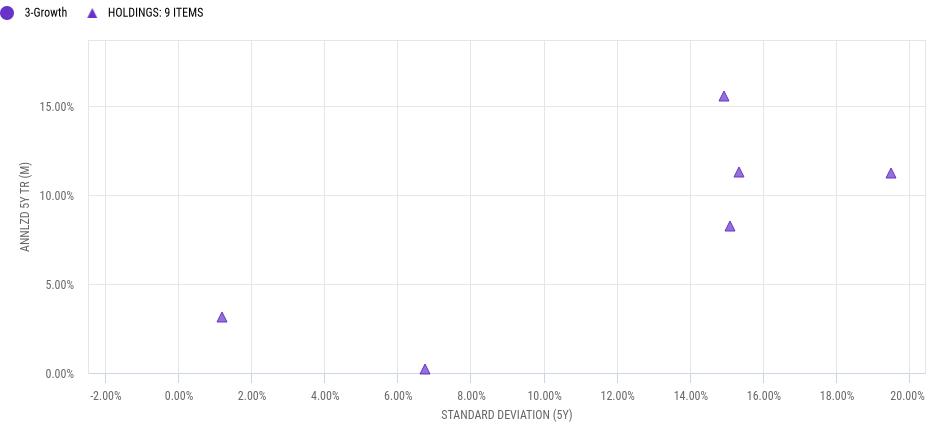

3-Growth

Risk/RewardScatterPlot(5Years)

Dataasof:--

Theperformancedataquotedpresentspastperformance;pastperformancedoesnotguaranteefutureresults;theinvestmentreturnandprincipal valueofaninvestmentwillfluctuate;aninvestor’sshares,whenredeemed,maybeworthmoreorlessthantheiroriginalcost;currentperformance maybelowerorhigherthantheperformancedataquoted.Themostrecentmonthendperformancedatacanbeaccessedat https://go.ycharts.com/fundcontactinfo.(SeetheStandardizedReturnssectionofthisreportforstandardizedreturnsinformation).

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother nancialinstrument THEIMPORTANTDISCLOSURESFOUNDATTHEENDOFTHISREPORT(WHICHINCLUDE DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT Forfurtherinformationregardingyouruseofthis reportpleasegoto:https://getychartscom/disclosure/

May20,2025

Top10Holdings

Dataasof:May20,2025

Theperformancedataquotedpresentspastperformance;pastperformancedoesnotguaranteefutureresults;theinvestmentreturnandprincipal valueofaninvestmentwillfluctuate;aninvestor’sshares,whenredeemed,maybeworthmoreorlessthantheiroriginalcost;currentperformance maybelowerorhigherthantheperformancedataquoted.Themostrecentmonthendperformancedatacanbeaccessedat https://go.ycharts.com/fundcontactinfo.(SeetheStandardizedReturnssectionofthisreportforstandardizedreturnsinformation).

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother nancialinstrument THEIMPORTANTDISCLOSURESFOUNDATTHEENDOFTHISREPORT(WHICHINCLUDE DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT

reportpleasegoto:https://getychartscom/disclosure/

Top10UnderlyingHoldings

Name

Theperformancedataquotedpresentspastperformance;pastperformancedoesnotguaranteefutureresults;theinvestmentreturnandprincipal valueofaninvestmentwillfluctuate;aninvestor’sshares,whenredeemed,maybeworthmoreorlessthantheiroriginalcost;currentperformance maybelowerorhigherthantheperformancedataquoted.Themostrecentmonthendperformancedatacanbeaccessedat https://go.ycharts.com/fundcontactinfo.(SeetheStandardizedReturnssectionofthisreportforstandardizedreturnsinformation).

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother nancialinstrument THEIMPORTANTDISCLOSURESFOUNDATTHEENDOFTHISREPORT(WHICHINCLUDE DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT Forfurtherinformationregardingyouruseofthis reportpleasegoto:https://getychartscom/disclosure/

May20,2025

AllHoldings-3-Growth

Symbol Name

Theperformancedataquotedpresentspastperformance;pastperformancedoesnotguaranteefutureresults;theinvestmentreturnandprincipal valueofaninvestmentwillfluctuate;aninvestor’sshares,whenredeemed,maybeworthmoreorlessthantheiroriginalcost;currentperformance maybelowerorhigherthantheperformancedataquoted.Themostrecentmonthendperformancedatacanbeaccessedat https://go.ycharts.com/fundcontactinfo.(SeetheStandardizedReturnssectionofthisreportforstandardizedreturnsinformation).

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother nancialinstrument THEIMPORTANTDISCLOSURESFOUNDATTHEENDOFTHISREPORT(WHICHINCLUDE DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT Forfurtherinformationregardingyouruseofthis reportpleasegoto:https://getychartscom/disclosure/

Theperformancedataquotedpresentspastperformance;pastperformancedoesnotguaranteefutureresults;theinvestmentreturnandprincipal valueofaninvestmentwillfluctuate;aninvestor’sshares,whenredeemed,maybeworthmoreorlessthantheiroriginalcost;currentperformance maybelowerorhigherthantheperformancedataquoted.Themostrecentmonthendperformancedatacanbeaccessedat https://go.ycharts.com/fundcontactinfo.(SeetheStandardizedReturnssectionofthisreportforstandardizedreturnsinformation). 2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother nancialinstrument THEIMPORTANTDISCLOSURESFOUNDATTHEENDOFTHISREPORT(WHICHINCLUDE DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT Forfurtherinformationregardingyouruseofthis reportpleasegoto:https://getychartscom/disclosure/ May20,2025

Definitions

AllocationsandExposureData:Allhypotheticalportfolioattributesarecalculatedasweightedaveragesoftheunderlyingholdingsusingthetarget weightsinputbythecreatorofthisreport Theunderlyingsecurities’attributesarebasedondatainYCharts,Inc providedbyMorningstar,Inc For individualstockpositionstheentireweightisassignedtothecorrespondingsector,marketcapgroup,style,etc

AlphavsCategory:Alphavscategorymetricsarecalculatedovervarioustimeperiodsagainstthecategorybenchmark Theymeasurehowwellan investmenthasperformedrelativetoitscategorybenchmark Positivealphaindicatesthattheinvestmentoutperformedthebenchmark,suggestingthe managerorstrategyaddedvalue,whereasnegativealphaindicatesunderperformancecomparedtothecategorybenchmark

AnnualizedPriceReturn:Annualizedreturnsareperiodreturnsre-scaledtoshowthecompoundannualgrowthrateofthesecurity.Thisallowsinvestors tocomparereturnsofdifferentassetsthattheyhaveownedfordifferentlengthsoftime.Italsogivestheinvestoranideaofthereturnsthattheywould havereturnedperyeariftheyhadbeeninvestedinthesecurityduringthetimeframeoftheannualizedmetric

AnnualizedTotalReturns:AnnualizedTotalreturnsareperiodreturnsre-scaledtoshowthecompoundannualgrowthrateofthesecurity Thisallows investorstocomparereturnsofdifferentassetsthattheyhaveownedfordifferentlengthsoftime Italsogivestheinvestoranideaofthereturnsthatthey wouldhavereturnedperyeariftheyhadbeeninvestedinthesecurityduringthetimeframeoftheannualizedmetric.

AssetAllocation:Assetallocationreflectstheassetclassweightingsofthefundorportfolio TheOthercategoryincludessecuritytypesthatarenot neatlyclassifiedintheotherassetclassesorcannotbeclassifiedbyYChartsasaresultofmissingdata Allocationsmaynotsumto100%dueto rounding

AverageCoupon:AverageCouponistheaveragerateofthecouponsofthebondsinafund,weightedbasedeachbondholding'ssizerelativetothe portfolio Averagecouponindicateswhetherafundiscarryingagreateramountofhighorlowcouponbonds Whilehighercouponbondsoffermore return,theymaycarryadditionalrisk

AverageCreditQualityScore:Shortdef:TheAverageCreditQualityScoreisanaverageofthecreditratingofthebondsheldbyafund Theaverageis calculatedbyassigningavaluetoeachunderlyingbondinthefundbasedontherelativedefaultrate,whichisdeterminedbythecreditratingofthebond. Itassumesthattheoddsofdefaultincreaseasthecreditratingdecreases Theaveragedefaultrateisthenusedtodeterminetheaveragecreditqualityof thefund

AverageMarketCap:Marketcapitalizationrepresentsthetotalvalueofacompanyasdeterminedbymultiplyingitssharepricebythetotalnumberof sharesoutstanding Itiscommonlyusedtoclassifycompaniesbysize,suchaslarge-cap,mid-cap,orsmall-cap Weightedaveragemarketcapitalization reflectstheaveragemarketcapofthesecuritiesinafundorportfolio,weightedbytheirrespectiveproportions.Itprovidesinsightintoafundorportfolio's exposuretodifferentmarket-capsegments,helpingtoassessitsoverallsizeprofileandriskcharacteristics

AveragePrice:Averagepriceindicateswhetherafundfavorsinvestinginbondsbeloworabovefacevalue Ahighervalue(above100)wouldsuggestthe latter

BetavsCategory:Betavscategorymetricsarecalculatedovervarioustimeperiodsagainstthecategorybenchmark Theymeasureaninvestment's sensitivitytotheoverallmovementsofitscategorybenchmark Abetaequalto1indicatesthattheinvestmenttendstomoveinlinewiththebenchmark, suggestingasimilarlevelofrisk,abetagreaterthan1indicatesthattheinvestmentismorevolatilethanthebenchmark,suggestinghigherrisk,anda betalessthan1indicatesthattheinvestmentislessvolatilethanthebenchmark,suggestinglowerrisk AlistofYChartscategorybenchmarkscanbe viewedherehttps://ychartscom/glossary/terms/ychartscategorybenchmarks

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother nancialinstrument THEIMPORTANTDISCLOSURESFOUNDATTHEENDOFTHISREPORT(WHICHINCLUDE DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT Forfurtherinformationregardingyouruseofthis reportpleasegoto:https://getychartscom/disclosure/ May20,2025

Definitions

BondMaturityExposure:BondMaturityExposureprovidesabreakdownofthefixedincomesecuritiesheldwithinaportfoliobasedontheirbondmaturity dates Ithighlightstheallocationofinvestmentsacrossvariousmaturityperiods,indicatingthedistributionofbondsthatareduetomaturewithinspecific timeframes Fixedincomesecuritiesaregroupedintothreecategories-short-term,intermediate-term,andlong-termmaturities Short-termbonds generallyhavematuritiesofonetothreeyears,intermediate-termbondsrangefromfourtotenyears,andlong-termbondshavematuritiesbeyondten years.

BondSectorExposure:Bondsectorexposureshowsthepercentageofaportfolio’slongfixedincomeassetsinvestedineachofsixsectors-Government, Municipal,Corporate,Securitized,Cash&Equivalents,andDerivatives TheGovernmentSectorcomprisesallstandardgovernment-issueddebt,bonds fromaCentralBankorTreasury,andbondsissuedbylocalgovernments,cantons,regions,andprovinces TheMunicipalSectorconsistsoftaxableand tax-exemptdebtobligationsissuedbystates,cities,counties,provinces,andothernon-federalgovernmententities.TheCorporateSectorencompasses bankloans,convertiblebonds,traditionalcorporatedebtsecurities,andpreferredstock.TheSecuritizedSectorcoversalltypesofmortgage-backed securities,coveredbonds,andasset-backedsecurities TheCash&EquivalentsSectorincludesbankcash,certificatesofdeposit,currency,andmoney marketholdings Italsoincludesanyfixed-incomesecuritiesmaturingwithinshorttimeframes,commercialpaper,andrepurchaseagreements The DerivativesSectorencompassescommontypesoffixed-incomederivativecontractssuchasfuturesandforwards,options,andswaps

CreditQualityExposure:Creditqualityexposuremetricsshowthebreakdownofafundorportfolio'sfixedincomesecuritiesacrossvariouscreditrating categories Creditratings,providedbyindependentagencies,guideinvestorsinunderstandingtheriskassociatedwithbondsordebtinstruments Each ratingagencyhasitsownalphabeticaldesignationsandmostrangefromhigh(AAAtoAA),tomedium(AtoBBB),andlow(BB,B,CCC,CC,C,andD) Higherratingsindicatelowerrisk,whilelowerratingssignifyhigherpotentialreturn,higherriskandpotentialfinancialdistress YChartsreceivescredit qualityexposuredataforfundsfromadataproviderwhocalculatesthepercentageforeachratingcategorybyweightingeachholding’screditratingbyits marketvaluethenaveragingbythesumofholdingvalues Anaverageratingiscomputedforholdingsthathavemultipleratings Thedistributionisbased uponavailablecreditratingsfromrecognizedcreditratingagenciessuchasaNationallyRecognizedStatisticalRatingOrganization(NRSRO)intheUS A fulllistofNRSROscanbefoundathttps://www.sec.gov/about/divisions-offices/office-credit-ratings/current-nrsros.

CurrentYield:TheCurrentYieldmetricisavailableformutualfundsandETFsonYCharts Itreflectstheincomeofthebondholdingsinafundrelativeto thefund'sprice CurrentYieldisanannualizedfigureandcanbeinterpretedastheincomeaninvestorcouldexpecttoearnfromthebondholdingsofthe fundifitwasheldforoneyear

DistributionYield:Distributionyieldisafinancialmetricthatmeasurestheincomefromdistributionsrelativetothevalueofaninvestment Itshowshow muchafundorportfoliohaspaidoutindistributionseachyearrelativetoitsprice,NAV(NetAssetValue)orlevel(forportfolios) Distributionyieldis availableforthefollowingsecuritytypesonYCharts:mutualfunds,ETFs,closedendfunds,andportfolios

DividendYield:Dividendyieldisafinancialmetricthatmeasurestheincomefromdividendsrelativetothevalueofaninvestment.Itshowshowmucha company,fund,orportfoliohaspaidoutindividendseachyearrelativetoitsprice,NAV(NetAssetValue)orlevel(forportfolios).Dividendyieldis availableforthefollowingsecuritytypesonYCharts:stocks,mutualfunds,ETFs,ClosedEndFunds(CEFs),andportfolios

EffectiveDuration:Effectivedurationisameasureofriskforfundsthatholdbondswithembeddedoptions ItestimatestheamounttheNAVofafundwill fallwheninterestratesriseby1%orwillincreasewheninterestratesfallby1% Thisactsasameasureoftheinterestratesensitivityofafund,andtakes intoaccountput,call,andprepaymentoptions.

HistoricalSharpeRatio:TheSharpeRatiomeasurestherisk-adjustedreturnofasecurity Thisisausefulmetricforanalyzingthereturnyouarereceiving onasecurityincomparisontotheamountofvolatilityexpected Thehistoricalsharperatiouseshistoricalreturnstocalculatethereturnandstandard deviation

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother nancialinstrument THEIMPORTANTDISCLOSURESFOUNDATTHEENDOFTHISREPORT(WHICHINCLUDE DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT Forfurtherinformationregardingyouruseofthis reportpleasegoto:https://getychartscom/disclosure/

May20,2025

Definitions

MarketCapExposure:Marketcapitalizationexposureshowshowaportfolio’sstockholdingsaredistributedacrosscompaniesofdifferentsizes,based ontheirmarketcapitalization Giant-capcompaniesarethelargestinthemarketandareusuallyindustryleaderswithasignificantglobalpresence Largecapcompaniesarealsowell-establishedandwidelyrecognizedbutaregenerallysmallerthangiant-capfirms Medium-capcompaniesarelargerandmore establishedthansmall-capcompaniesbuthavemoregrowthpotentialcomparedtolarge-capcompanies.Small-capcompaniesareconsideredriskierbut havethepotentialforsignificantgrowth.Micro-capcompaniesarethesmallestpubliclytradedcompanies,andusuallyhavelimitedfinancialresources andlessliquidityintheirstocks

MarketClassification:Reflectsafundorportfolio’sexposuretodevelopedandemergingmarkets

MaxDrawdown:Maxdrawdownisanindicatoroftheriskofaportfoliochosenbasedonacertainstrategy.Itmeasuresthelargestsingledropfrompeak tobottominthevalueofaportfoliobeforeanewpeakisachieved

NetExpenseRatio:Theexpenseratiorepresentsthecostofowningafund Itexpressesthepercentofassetsdeductedeachfiscalyeartocovervarious fundexpenses,including12b-1fees,managementandadministrativecharges,operationalexpenditures,andallothercoststiedtomanagingandoperating afund,lessanyfeewaiversorotherrebates.Transactionfees,brokeragecostsandsaleschargesarenotreflectedintheexpenseratio.Incontrast,the grossexpenseratiodoesnotincorporateanyfeewaiversorotheradjustmentsthatwereineffectduringthetimeperiod.Itisimportanttolookatboththe expenseratioandgrossexpenseratiowhenevaluatingafund Forexample,ifafundhasanexpenseratioof2%andagrossexpenseratioof3%,1%of potentialfeesorotherexpenseswerewaived Thereisnoguaranteethattheserebatesorreimbursementswillcontinueinthefuture,andiftheyare discontinued,thecostofowningthefundrepresentedbytheexpenseratiowouldbe3%

Numberofbondholdings:Totalnumberofuniquebondholdingsofafund.

Numberofholdings:Numberofholdingsisthesumofalltheuniqueholdingsofafund,equity,fixedincome,derivative,oralternativeinvestments included It'simportanttonotethatifamutualfundholdsbothcommonandpreferredstockofacompanythenumberofholdingswouldbe2

Numberofstockholdings:Totalnumberofuniquestockholdingsofafund.It'simportanttonotethatifafundholdsbothcommonandpreferredstockof acompany,thecompanywouldbecountedtwice

Price:Thepriceofasecuritymeasuresthecosttopurchase1shareofasecurity Foracompany,pricecanbemultipliedbysharesoutstandingtofindthe marketcapitalization(valueofthecompany)

RegionExposure:Reflectstheexposureofafundorportfolio'sinvestmentstotheindicatedgeographicarea(s)

RegionalExposure:Thisdatasetprovidesadetailedbreakdownofaninvestment'scountryexposure Eachcountry'sexposureispresentedasa percentageofnon-cashequityassetsheldbythefund

SortinoRatio:TheSortinoRatioisnamedafterFrankSortino,whoiswidelyrecognizedforhisuseofdownsiderisk TheSortinoratioisverysimilartothe Sharperatiointhatitistryingtocapturetheriskofaninvestmentoveracertainperiod However,theSortinoRatiodoesthisbycapturingthe"downside" risk,byignoringtheupsidevolatility Thetheorybeinginvestorsshouldonlybeconcernedwithharmful(negative)volatility

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations

Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother nancialinstrument THEIMPORTANTDISCLOSURESFOUNDATTHEENDOFTHISREPORT(WHICHINCLUDE DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT Forfurtherinformationregardingyouruseofthis reportpleasegoto:https://getychartscom/disclosure/

May20,2025

Definitions

StandardDeviation:Standarddeviationmeasureshowmuchaninvestment'sreturndeviatesfromitsaverageoveraspecificperiod Higherstandard deviationindicatesmorevolatility,whilelowerstandarddeviationsignifiessteadierreturns YChartsmakesfivetypesofstandarddeviationmetricsover differenttimeperiodsavailable:daily,monthly,quarterly,annualizedmonthly,andannualizedquarterly

StockSectorExposure:Showsthebreakdownofafundorportfolio'slongequityassetsacrosselevenmajorindustrygroupsandhowtheyrolluptothree broadsectors-cyclical,sensitiveanddefensive

StockStyleExposure:StockStyleExposureshowshowaportfolio'sholdingsaredistributedacrosscompaniesofdifferentsizes(basedontheirmarket capitalization)andinvestmentstyles(value,blendorgrowth).YChartscalculatesthestockstyledatabasedonthecalculationmethodsseenbelow:Stock sizeiscalculatedbyfirsttakingtheconstituentsoftheRussell3000andsortingbymarketcap.Theyarethenbrokenintosizebasedontheirpercentileof overallmarketcap Largecapismadeupofthelargest70%ofstocksintheRussell3000,stockswithamarketcapgreaterthanthe70%cutoffare groupedintolargecap Stocksinthenext15%aregroupedintomidcap Stocksinthebottom15%aregroupedintosmallcap Stockstyleiscalculated usingtheaverageZ-Scoreof6metrics:1 PricetoBookValue(3YMean)2 PERatio(3YMean)3 PSRatio(3YMean)4 ReturnonEquity(3YMean)5 Revenue(3YGrowth)6 DividendYieldEacharecomparedtoanindexbasedontheirstockssize,LargeCaparecomparedtotheS&P500,MidCapare comparedtotheS&P400,andSmallCaparecomparedtotheS&P600 TheZ-ScoreiscalculatedusingtheformulaZ-Score=[(StockValue-Index Average)/IndexStandardDeviation]forthefirst5metrics.DividendYieldZ-ScoreiscalculatedasDividendYieldZ-Score=[((StockValue-IndexAverage) /IndexStandardDeviation)-1] OncetheZ-Scorehasbeencalculatedforall6metrics,theaverageistakenandthefollowingbreakpointsareused:1 ZScore>03=Growth2 Z-Score<-03=Value3 Z-Scorebetween-03and03=Core

TotalReturn:TheTotalreturnisthechangeinpriceoveraspecificperiodoftimethatincludesdividendsanddistributionspaid

TotalReturnLevel:Thetotalreturnlevelallowsinvestorstoviewtheperformanceofasecurityinclusiveofbothpriceappreciationand dividends/distributions Totalreturnlevelisseenasthemostaccuratecalculationthatproducesreturnsconsistentwithmostothersources

ValueAtRisk(VaR):TheVaRcalculatesthepotentiallossofaninvestmentwithagiventimeframeandconfidencelevel Forexample,ifasecurityhasa 5%DailyVaR(All)of4%:Thereis95%confidencethatthesecuritywillnothavealargerlossthan4%inoneday Sincethismetricsays(All)weare calculatingthisusingallavailablepricehistoryforthesecurity.Inanotherexample,ifasecurityhasaMonthlyVaR1%(3YLookback)of15%:Thereis99% confidencethatthesecuritywillnothavealargerlossthan15%inonemonth Thisiscalculatedusingthepast3yearsofhistoricalprices Keepinmind thatVaRdoesnotgiveyouanyinformationaboutthemagnitudeofthepotentiallossinexcessoftheVaR Foracalculationthatgiveyouthisinformation youcanviewExpectedShortfall

WeightedAverageDebttoCapital:Theweightedaveragedebt-to-capitalratiomeasurestheproportionofafund'stotaldebtinrelationtoitstotalcapital witheachunderlyingholdingbeingtakenintoaccountbasedonweightinthefund'sportfolio.Thisratiohelpsassessthefund'soverallfinancialleverage anditspotentialriskexposurestemmingfromitsdebtobligations

WeightedAveragePERatio:Aweightedaverageofeachunderlyingholding’ssharepricerelativetothesalespershare StocksthathaveRevenueper Share<0areexcludedinthiscalculation

WeightedAveragePricetoBookRatio:Theweightedaverageprice-to-bookratioforafundisameasurethatquantifiesthevaluationofthefund's holdingsrelativetotheirbookvalues,whileaccountingfortheproportionofeachholdinginthefund'stotalportfolio Itiscalculatedbymultiplyingthe price-to-bookratioofeachindividualholdingbyitsportfolioweight,summingtheseproductsacrossallholdings,andthendividingbythetotalportfolio weight

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations

Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother nancialinstrument THEIMPORTANTDISCLOSURESFOUNDATTHEENDOFTHISREPORT(WHICHINCLUDE DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT Forfurtherinformationregardingyouruseofthis reportpleasegoto:https://getychartscom/disclosure/ May20,2025

Definitions

WeightedAveragePricetoSalesRatio:Theweightedaverageprice-to-salesratioofaportfolioisafinancialmetricthatgaugestheoverallvaluationofthe assetswithinaportfolioinrelationtotheircombinedsalesrevenue Thiscalculationconsidersthemarketvalueofeachasset,assigningmoreinfluenceto largerholdings,andcomputestheaveragevaluationrelativetothetotalsalesgeneratedbyallassets

WeightedMedianReturnonAssets:ReturnonAssets(ROA)measureshowefficientlyacompanyisusingitsassetstogenerateprofits Itindicateshow muchprofitisbeingearnedforeachdollarofassetsowned ItismeasuredasNetIncome/AverageTotalassetsofthelast5quarters WeightedMedian ROAofaportfolioiscalculatedbytakingintoaccountboththeindividualROAofeachinvestmentanditsweightintheoverallportfolio

WeightedMedianReturnonEquity:ReturnonEquity(ROE)isanindicationofhowwellacompanyisusingitsshareholders'moneytogenerateprofits.Itis measuredasNetIncome/AverageTTMShareholder’sEquity.WeightedMedianROEiscalculatedbytakingintoaccountboththeindividualROEofeach investmentanditsweightintheoverallportfolio ItisthemiddlevalueoftheROEsofeachindividualportfolioassetwhenarrangedinascendingorder afterbeingmultipliedbytheirrespectiveweights

YieldtoMaturity:Yieldtomaturityistheinternalrateofreturnearnedwhenbuyingthebondtodayatthemarketprice,assumingthebuyerholdsthebond tomaturity,andallthecouponandprincipalpaymentsaremade.Itisexpressedasanannualizedfigure.YChartscalculatesYieldtoMaturityforbond fundsbyweightingtheremainingcouponandprincipalpaymentsrelativetothesizeoftheportfolio.

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations

Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother nancialinstrument THEIMPORTANTDISCLOSURESFOUNDATTHEENDOFTHISREPORT(WHICHINCLUDE DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT Forfurtherinformationregardingyouruseofthis reportpleasegoto:https://getychartscom/disclosure/

ImportantDisclosure

ThisreportdoesnotreflecttheperformanceofanyaccountactuallymanagedbyyourAdviser Thisissupplementalmaterial,andwhenapplicable, shouldbeaccompaniedbyaprospectusorequivalentdocument

2025YCharts,Inc AllRightsReserved YCharts,Inc ('YCharts')isnotregisteredwiththeUS SecuritiesandExchangeCommission(orwiththesecuritiesregulatoryauthorityorbodyofanystateoranyotherjurisdiction)asan investmentadviser,broker-dealerorinanyothercapacity,anddoesnotpurporttoprovideinvestmentadviceormakeinvestmentrecommendations

Thisreporthasbeengeneratedusingdatamanuallyinputbythecreatorofthis reportcombinedwithdataandcalculationsfromYChartscomandisintendedsolelytoassistyouoryourinvestmentorotheradviser(s)inconductinginvestmentresearch Youshouldnotconstruethisreportasanoffertobuyor sell,asasolicitationofanoffertobuyorsell,orasarecommendationtobuy,sell,holdortrade,anysecurityorother nancialinstrument THEIMPORTANTDISCLOSURESFOUNDATTHEENDOFTHISREPORT(WHICHINCLUDE DEFINITIONSOFCERTAINTERMSUSEDINTHISREPORT)AREANINTEGRALPARTOFTHISREPORTANDMUSTBEREADINCONJUNCTIONWITHYOURREVIEWOFTHISREPORT Forfurtherinformationregardingyouruseofthis reportpleasegoto:https://getychartscom/disclosure/

May20,2025