This is WDP

Strategy

ESG

2020 perfomance

Governance

Financial statements

WDP 2020 Annual Report

87

PROPERTY REPORT Review of the consolidated property portfolio Description of the portfolio as at 31.12.2020

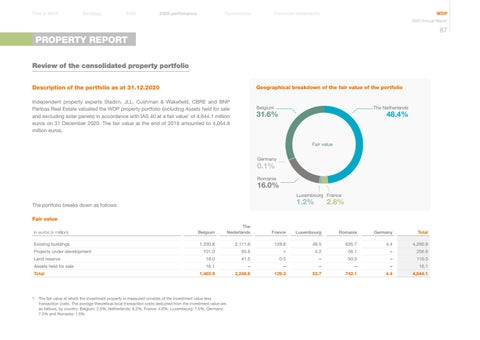

Geographical breakdown of the fair value of the portfolio

Independent property experts Stadim, JLL, Cushman & Wakefield, CBRE and BNP Paribas Real Estate valuated the WDP property portfolio (including Assets held for sale and excluding solar panels) in accordance with IAS 40 at a fair value1 of 4,644.1 million euros on 31 December 2020. The fair value at the end of 2019 amounted to 4,054.8 million euros.

The Netherlands

Belgium

48.4%

31.6%

Fair value Germany

0.1%

Romania

16.0% Luxembourg France

2.8%

1.2%

The portfolio breaks down as follows: Fair value in euros (x million)

Belgium

The Nederlands

France

Luxembourg

Romania

Germany

Total

Existing buildings

1,330.8

2,111.6

128.8

49.5

635.7

4.4

4,260.9

101.0

95.6

–

4.2

56.1

–

256.9

Land reserve

18.0

41.5

0.5

–

50.3

–

110.3

Assets held for sale

16.1

–

–

–

–

–

16.1

1,465.9

2,248.6

129.3

53.7

742.1

4.4

4,644.1

Projects under development

Total

1 The fair value at which the investment property is measured consists of the investment value less transaction costs. The average theoretical local transaction costs deducted from the investment value are as follows, by country: Belgium: 2.5%, Netherlands: 8.2%, France: 4.8%, Luxembourg: 7.0%, Germany: 7.5% and Romania: 1.5%.