This is WDP

Strategy

ESG

2020 perfomance

Governance

Financial statements

WDP 2020 Annual Report

81

MANAGEMENT OF FINANCIAL RESOURCES Financing policy

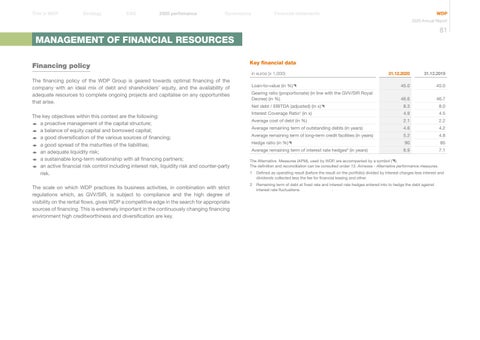

Key financial data in euros (x 1,000)

The financing policy of the WDP Group is geared towards optimal financing of the company with an ideal mix of debt and shareholders’ equity, and the availability of adequate resources to complete ongoing projects and capitalise on any opportunities that arise. The key objectives within this context are the following: ◆ a proactive management of the capital structure; ◆ a balance of equity capital and borrowed capital; ◆ a good diversification of the various sources of financing; ◆ a good spread of the maturities of the liabilities; ◆ an adequate liquidity risk; ◆ a sustainable long-term relationship with all financing partners; ◆ an active financial risk control including interest risk, liquidity risk and counter-party risk. The scale on which WDP practices its business activities, in combination with strict regulations which, as GVV/SIR, is subject to compliance and the high degree of visibility on the rental flows, gives WDP a competitive edge in the search for appropriate sources of financing. This is extremely important in the continuously changing financing environment high creditworthiness and diversification are key.

31.12.2020

31.12.2019

Loan-to-value (in %)

45.0

45.0

Gearing ratio (proportionate) (in line with the GVV/SIR Royal Decree) (in %)

46.6

46.7

Net debt / EBITDA (adjusted) (in x)

8.3

8.0

Interest Coverage Ratio1 (in x)

4.9

4.5

Average cost of debt (in %)

2.1

2.2

Average remaining term of outstanding debts (in years)

4.6

4.2 4.8

Average remaining term of long-term credit facilities (in years)

5.2

Hedge ratio (in %)

90

85

Average remaining term of interest rate hedges2 (in years)

6.9

7.1

The Alternative Measures (APM), used by WDP, are accompanied by a symbol (). The definition and reconciliation can be consulted under 13. Annexes - Alternative performance measures. 1 Defined as operating result (before the result on the portfolio) divided by interest charges less interest and dividends collected less the fee for financial leasing and other. 2 Remaining term of debt at fixed rate and interest rate hedges entered into to hedge the debt against interest rate fluctuations. .