13 minute read

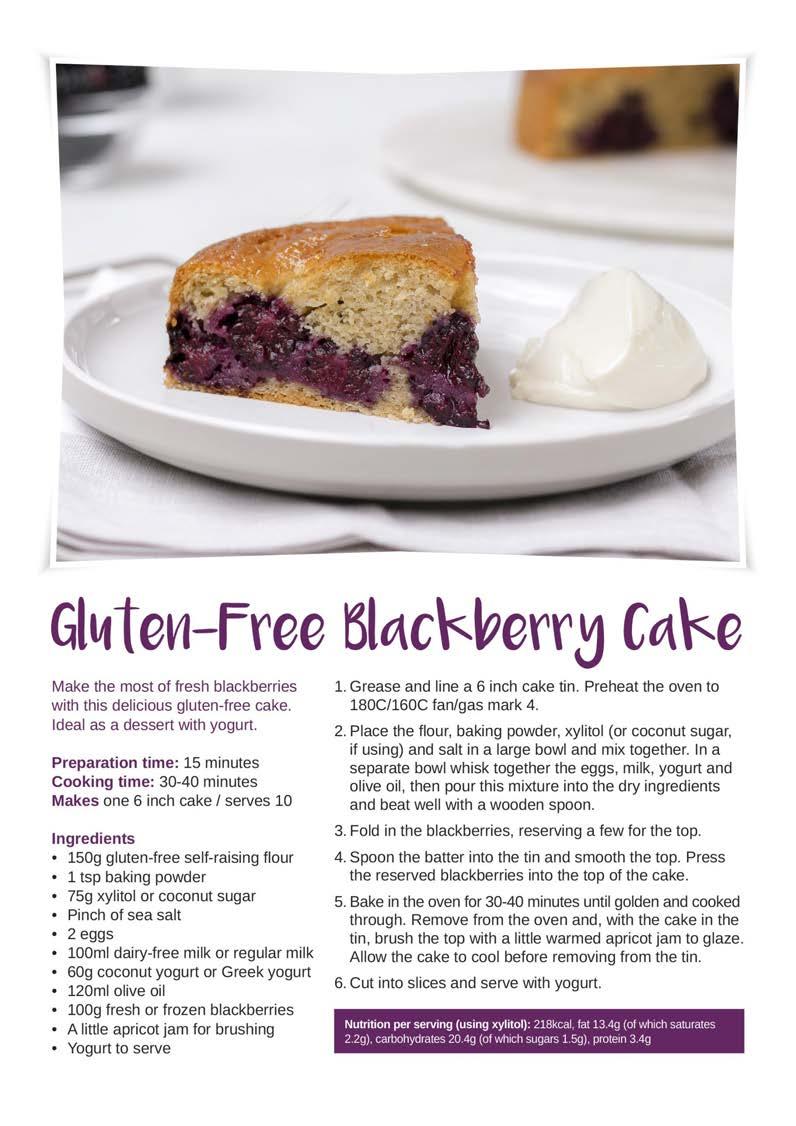

Recipe: Gluten-Free Blackberry Cake

28 36

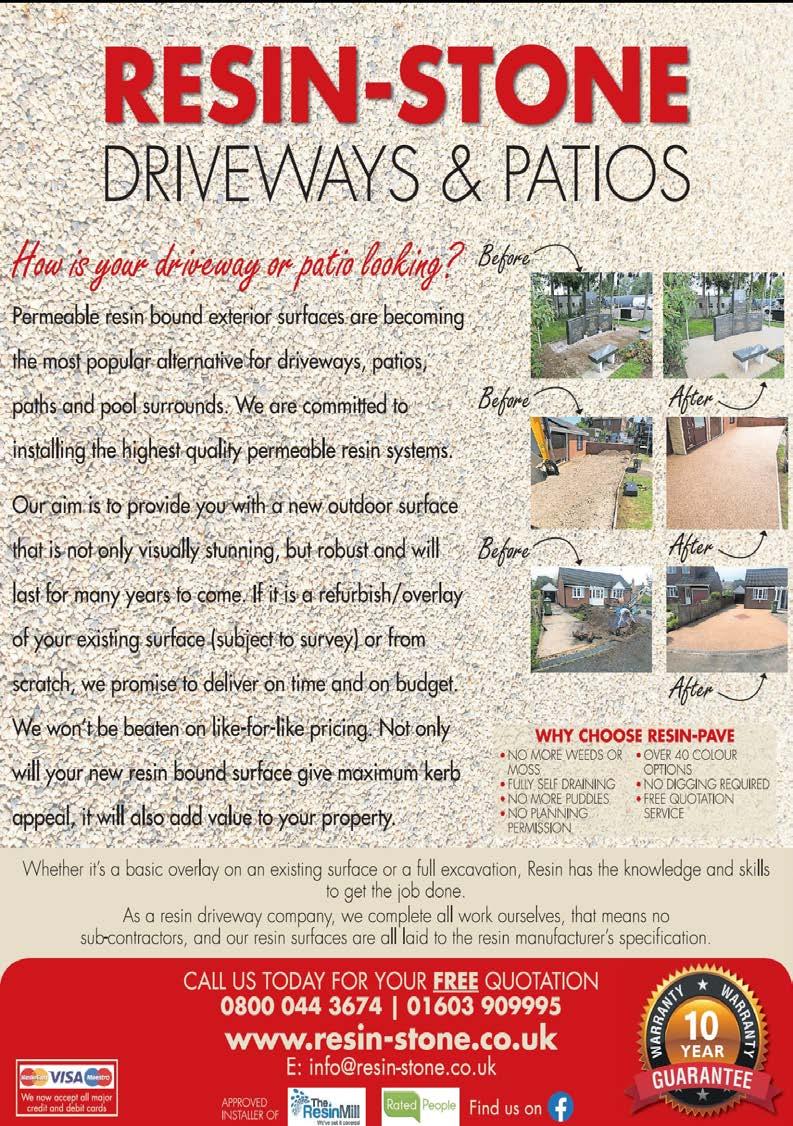

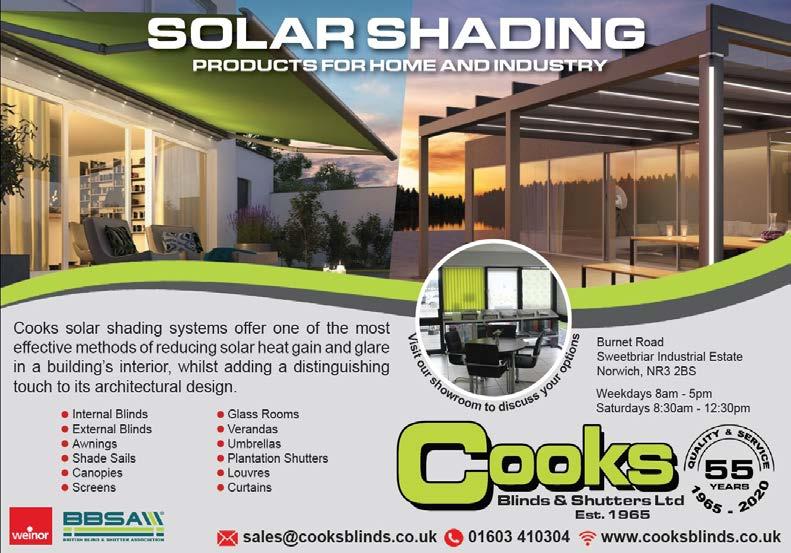

Advertisement

Heart Disease

Knowing the early signs of heart disease can really make a difference to your pet’s life. Heart disease is any condition of the heart or great blood vessels which affects the way the heart works and prevents blood and therefore oxygen being transported normally around

the body. It is estimated that heart problems can affect up to 10% of dogs and cats in the UK. Some heart diseases may be present when the animal is born, however the majority develop in adulthood. Whilst some heart diseases are mild and cause no symptoms or problems whatsoever in the animal’s lifetime, others may cause severe problems, even sudden death, so an early accurate diagnosis is essential.

Diagnosis:

What are the signs of a problem?

Cats are very good at hiding signs of heart disease (and it's often harder to pick up these changes at home as we don't tend to take our cats for a walk around the block!).

The signs to look out for in both dogs and cats:

· Laboured or fast breathing - the most common sign in cats · An enlarged abdomen · Weight loss or poor appetite · Cyanosis (where the gums become blue in colour)

Signs to look out for in dogs only:

· Coughing · A reluctance to exercise and tiring more easily on walks · Weakness or fainting associated with exercise Sometimes the only symptom of a problem is a heart murmur or an irregularity in the heart rhythm picked up by your vet at a routine examination. If we are concerned about your pet's heart, we will initially recommend echocardiography (ultrasound scan of the heart), we may also advise an ECG, blood pressure checks and blood tests. The echocardiography is the most important tool, as it can show the structure of the heart, in particular it can show if it is enlarged, along with how effectively it is functioning.

Some common types of heart disease we see:

· Mitral Valve Disease (MVD) is by far the most common acquired heart disease in dogs. This can affect any breed but is more commonly seen in the smaller dogs. In this condition the valve becomes leaky, eventually leading to heart failure. · Hypertrophic Cardiomyopathy (HCM) is the most common form of heart disease in cats. The muscle of the heart thickens, preventing the heart from pumping properly. This condition can be both a disease on its own, or caused by other illnesses such as an overactive thyroid gland. · Dilated Cardiomyopathy (DCM), is more common in dogs than cats, is a condition where the · heart muscle thins and weakens, reducing its ability to pump effectively. · Occasionally we find cancers of the heart muscle or pericardium (the sac the heart sits in) · Congenital Heart Diseases are seen less often but may include malformations of valves or a failure of the closure of a blood vessel after birth.

Please Keep Safe!

Treatment:

Thankfully we have several medications available to help improve your pet's heart function and therefore their quality of life. Management of heart disease is advancing quickly; recent studies have shown that early treatment when there are any signs of heart enlargement can help your pet lead a much longer and happier life. If your pet has any of these signs, or just for a routine health check then give our team a call on 01603 783920.

David Martin BVM&S MRCVS

37 29

30 34

Full a la Carte Menu

Monday to Saturday 12-8pm Lunch Specials

Monday to Saturday 12pm-3pm Breakfast

Daily from 8.30-10am Sunday Traditional Roasts

from 12-4pm Booking always advisable See website for menu details 01603 737426

contact@kingsheadcoltishall.co.uk www.kingsheadcoltishall.co.uk

What’s the Difference Between an Investor and a Speculator?

Investing and speculating are similar activities –they both involve buying assets or trading on the stock market. But the motivations for each are very different, and so are the time scales and attitudes employed. Investing vs. Speculating

Traditionally, an investor is looking to purchase parts of businesses in the hope that the company will take that investment money and use it to generate a profit. When you invest in a business, you would expect to have your money within that asset for some time – and often you’re looking to earn an income from the investment either through dividends over a period of years, or to sell your assets for a profit later on. Typically, with investments we’re measuring our assets in terms of yearly growth – so we’re envisaging holding over a period of several years. Of course, investments don’t always work out, and sometimes investors will sell quickly if new information comes to light. In general, the process is fairly slow, investors will do their research into companies and funds, choose the right opportunities for them, and then hold over a period of years. By contrast, speculators are people who are looking to make quick money by “flipping” assets. This means looking for stocks or other assets (such as currency, cryptocurrency or oil) which they expect to swiftly go up in price and selling them quickly to take advantage of the price shift. Speculators don’t particularly care what it is that they buy – so long as they think it’ll go up in price and do so quickly.

A speculation boom?

There has been a massive boom in speculation and speculative assets recently. Fuelled by cryptocurrencies and so-called “rocket stocks” or “meme stocks”, like AMC Cinemas or Gamestop, a lot of the discourse in the stock market over the past year has been focused on these speculative assets. There are lots of reasons why these assets have become more popular. Things like coronavirus giving casual investors more free time and money, the internet making it easier to organise, and a shift in stock market sentiment encouraging people to try and make quick, easy money using options trading (essentially betting on stocks, without purchasing the underlying stock itself). We’re seeing more and more amateur traders purchase speculative assets and engage in this speculative buying behaviour, whether they’re buying crypto, trading Forex (foreign exchange), or even simply buying stocks en masse based on online tip-offs.

What are the risks?

There’s nothing necessarily wrong with speculating, so long as it’s with money you can afford (and even expect) to lose. Speculating is essentially gambling. You’re taking risky bets that prices will move the way you want them to, but as we’ve seen with high profile crypto and stock collapses recently, prices can go down as well as up. Unlike with an investment, where you expect to put your money away for years and can therefore withstand any short-term downturn in stocks or markets, if you’ve bought speculative assets you stand to lose a lot more if the price takes a temporary dip. And we often see that a lot of these assets will drop in lockstep with each other. When Bitcoin prices tumble, the entire cryptocurrency space can have millions in value wiped out in a matter of minutes, so it doesn’t matter which currency you’ve bought.

Does speculation create bubbles?

We often see that the prices of these speculative assets are linked together. When prices increase massively like this, we refer to it as a “bubble”. As more and more people pile into the stocks, the prices get pushed higher and higher, often multiples of what the company is really worth. At that point, most speculators are simply relying on the “greater fool” theory – the idea that there’ll always be someone willing to pay more than they bought the stock for, so they can always make money selling it on. Eventually, this will run out – there’ll be nobody else willing to pay a higher price for the stock. The price will tumble, and the last people to buy it at the highest price will lose all their money on the way down. These bubbles can be dangerous places to purchase assets. There can be money to be made if you get in early enough, but how do you know when the bubble will burst? Often, this happens in a matter of minutes, and suddenly all the value is gone. Even professional investors have difficulty timing their asset purchases. So, speculation is a risky approach to purchasing assets. With any investment opportunity, take the time to do your research and identify assets you’d be happy to hold over the long-term. That way, even if the share price does fall, you’re happy to ride out the dip because you believe in the business’ fundamentals. Need some help with your Investments? Get in touch with Face to Face Finance to arrange an appointment: 01603 625 100.

www.ftof-finance.co.uk

This article is for informational purposes only. It should not be considered as investment advice. Your capital is at risk when you invest.

35 31

32

33

30 34

Full a la Carte Menu

Monday to Saturday 12-8pm Lunch Specials

Monday to Saturday 12pm-3pm Breakfast

Daily from 8.30-10am Sunday Traditional Roasts

from 12-4pm Booking always advisable See website for menu details 01603 737426

contact@kingsheadcoltishall.co.uk www.kingsheadcoltishall.co.uk

What’s the Difference Between an Investor and a Speculator?

Investing and speculating are similar activities –they both involve buying assets or trading on the stock market. But the motivations for each are very different, and so are the time scales and attitudes employed. Investing vs. Speculating

Traditionally, an investor is looking to purchase parts of businesses in the hope that the company will take that investment money and use it to generate a profit. When you invest in a business, you would expect to have your money within that asset for some time – and often you’re looking to earn an income from the investment either through dividends over a period of years, or to sell your assets for a profit later on. Typically, with investments we’re measuring our assets in terms of yearly growth – so we’re envisaging holding over a period of several years. Of course, investments don’t always work out, and sometimes investors will sell quickly if new information comes to light. In general, the process is fairly slow, investors will do their research into companies and funds, choose the right opportunities for them, and then hold over a period of years. By contrast, speculators are people who are looking to make quick money by “flipping” assets. This means looking for stocks or other assets (such as currency, cryptocurrency or oil) which they expect to swiftly go up in price and selling them quickly to take advantage of the price shift. Speculators don’t particularly care what it is that they buy – so long as they think it’ll go up in price and do so quickly.

A speculation boom?

There has been a massive boom in speculation and speculative assets recently. Fuelled by cryptocurrencies and so-called “rocket stocks” or “meme stocks”, like AMC Cinemas or Gamestop, a lot of the discourse in the stock market over the past year has been focused on these speculative assets. There are lots of reasons why these assets have become more popular. Things like coronavirus giving casual investors more free time and money, the internet making it easier to organise, and a shift in stock market sentiment encouraging people to try and make quick, easy money using options trading (essentially betting on stocks, without purchasing the underlying stock itself). We’re seeing more and more amateur traders purchase speculative assets and engage in this speculative buying behaviour, whether they’re buying crypto, trading Forex (foreign exchange), or even simply buying stocks en masse based on online tip-offs.

What are the risks?

There’s nothing necessarily wrong with speculating, so long as it’s with money you can afford (and even expect) to lose. Speculating is essentially gambling. You’re taking risky bets that prices will move the way you want them to, but as we’ve seen with high profile crypto and stock collapses recently, prices can go down as well as up. Unlike with an investment, where you expect to put your money away for years and can therefore withstand any short-term downturn in stocks or markets, if you’ve bought speculative assets you stand to lose a lot more if the price takes a temporary dip. And we often see that a lot of these assets will drop in lockstep with each other. When Bitcoin prices tumble, the entire cryptocurrency space can have millions in value wiped out in a matter of minutes, so it doesn’t matter which currency you’ve bought.

Does speculation create bubbles?

We often see that the prices of these speculative assets are linked together. When prices increase massively like this, we refer to it as a “bubble”. As more and more people pile into the stocks, the prices get pushed higher and higher, often multiples of what the company is really worth. At that point, most speculators are simply relying on the “greater fool” theory – the idea that there’ll always be someone willing to pay more than they bought the stock for, so they can always make money selling it on. Eventually, this will run out – there’ll be nobody else willing to pay a higher price for the stock. The price will tumble, and the last people to buy it at the highest price will lose all their money on the way down. These bubbles can be dangerous places to purchase assets. There can be money to be made if you get in early enough, but how do you know when the bubble will burst? Often, this happens in a matter of minutes, and suddenly all the value is gone. Even professional investors have difficulty timing their asset purchases. So, speculation is a risky approach to purchasing assets. With any investment opportunity, take the time to do your research and identify assets you’d be happy to hold over the long-term. That way, even if the share price does fall, you’re happy to ride out the dip because you believe in the business’ fundamentals. Need some help with your Investments? Get in touch with Face to Face Finance to arrange an appointment: 01603 625 100.

www.ftof-finance.co.uk

This article is for informational purposes only. It should not be considered as investment advice. Your capital is at risk when you invest. 35 31