Homeownership BUYER’S GUIDE TO

Homeownership made simple.®

Homeownership made simple.®

There’s a lot of information out there about how to buy a home. You might know you want to work with a real estate agent, but do you know the difference between a listing agent and buyer’s agent? Or what makes you a client vs. a customer? Here’s a quick breakdown to help you.

The relationship between a real estate agent and a customer is different than a relationship between a real estate agent and a client.

Only statutory duties from the real estate agent, such as reasonable skill and care, honesty, and the disclosure of material facts.

A fiduciary relationship where the real estate agent will promote and protect the best interests of the client by providing obedience, loyalty, disclosure, confidentiality, accounting and reasonable skill and care. A client relationship is secured by a buyer and agent signing a buyer representation agreement.

The seller’s representative (also known as a listing agent or seller’s agent) is hired by and represents the seller. All fiduciary duties are owed to the seller, meaning this person’s job is to get the best price and terms for the seller. The agency relationship usually is created by a signed listing contract.

The buyer’s representative (also known as a buyer’s agent) is hired by prospective buyers by signing a buyer representation agreement, and works in the buyer’s best interest throughout the transaction. The buyer can pay the agent directly through a negotiated fee as outlined in the agreement, or the buyer’s representative may be paid by the seller or the seller’s broker through the offer negotiation process.

No matter what type of agent you work with, please know that agent commissions are negotiable. REALTORS® are bound by the National Association of REALTOR®’s Code of Ethics to always further clients’ best interests, including showing homes that meet buyers’ needs regardless of compensation offered. Additionally, Vylla Home is committed to fair housing and ethical practices to assist all potential homeowners in their search for a new home.

Let’s review ten simple steps to purchasing your new home!

STEP 1:

Initial Consultation

Understand the buying process and buyer representation agreement upfront so you know what to expect.

STEP 2: Assess Your Goals

Confirm your preferred timeframe, location, home size and features – what are your “must haves”?

STEP 3:

Select a Real Estate Advisor

Select a professional real estate advisor to ensure you have an experienced guide on your journey to homeownership.

Determine your purchasing power and lending options that best meet your financial goals.

Set up your search, screen homes, tour and compare – finding your dream property can take time!

TURN THE PAGE FOR YOUR FIVE FINAL STEPS

STEP 6: Offer Submission & Negotiation

Create a compelling offer considering the property, timeline and finances. If needed, prepare to negotiate the deal.

STEP 7: Contract Acceptance

Congratulations, your offer was accepted and now you can take the next steps to ensure a timely and clear closing.

STEP 8 : Under Contract

It’s time to finalize financing, obtain your home inspection and appraisal, and shop around to secure homeowners’ insurance.

STEP 9: Pre-Closing & Final Walk-Through

Tour the home with your real estate advisor to make sure everything is as expected before closing.

STEP 10: Closing & Owning

The final step… congratulations! You’ve closed on your new home and can officially start moving in.

WELCOME HOME!

Congratulations, you’re ready to buy a new home! You might be wondering what comes next. Whether you are a first-time homebuyer or a seasoned pro, having a well-developed plan and the proper team in place will make your experience exciting and seamless. At Vylla Home, our mission is to make homeownership simple. This guide will walk you through exactly how we can make your homeownership dream a reality, guiding you every step of the way!

There are a few initial steps that will help yield a smooth transaction, ultimately landing you in your desired home: beginning with our consultation and establishing your goals, financing and understanding your budget, and then launch our search. Let’s delve into each part of homebuying preparation.

The initial buyer consultation held between you and your real estate advisor is important to establish your homeownership needs and develop a strategy to help you successfully make a purchase. Together, we will discuss your preferences, lifestyle, goals, price range and local market conditions. We will also discuss real estate advisor commissions, which are always negotiable. The information you share at this stage may impact your homebuying timeline and determine our approach and search parameters.

Establish desired purchase time frames

Discuss services, the buying process and overall expectations

Learn about your past experiences with purchasing real estate

Align on preferred home location, size and key features – your “must have” and “nice to have” list

Discuss pre-approval and financing (if a loan is required) or steps to establish proof of funds (if you are a cash buyer)

Identify risk tolerance, if any

Outline the best strategy to meet your needs and get you into your new home

Before beginning to search for a home, you’ll need to examine your buying power. In some cases, buyers can pay cash for their property purchases. If you’re planning to borrow all or part of your funds however, we encourage you to speak with a trusted mortgage lender before starting your home search.

A qualified lender will help determine your purchasing power and what type of loan options may best meet your financial goals. The lender will also provide you with a pre-approval letter for the loan amount you qualify for, which is a necessary piece in the homebuying process when it comes time to submit your offer.

Be sure to speak with your Vylla Home real estate advisor to learn more about our family of companies, which includes Carrington Mortgage Services, LLC (NMLS ID #2600). Our unique family of companies can assist you with all aspects of homebuying – real estate, mortgage lending and closing and settlement services – and together we offer you a robust team of trusted, experienced professionals that collaborate to serve all your buying and selling needs.

NOTE: A pre-approval letter and pre-qualification letter are not the same! A pre-qualification is an initial estimate of how much you may be able to borrow and doesn’t dive into your financial details. A pre-approval is a conditional commitment from your mortgage lender that is more formal, based on a thorough review of your finances and gives you a true view of your potential buying power.

Preparation: Getting Started

Mortgage loans are determined by a number of financial factors including your credit score, personal assets, income and the property value of the home you wish to purchase. Mortgage rates also fluctuate, and therefore should always be considered in your overall purchasing power. You can review current rates with your mortgage lender and discuss rate-locking options.

Your mortgage lender will also evaluate your debt-to-income ratio and your PITI (principal, interest, taxes and insurance.) These factors will be discussed in detail with your lender upon application for pre-approval, and to prepare, you can gather the following documentation.

Items typically necessary for pre-approval*

Social Security Number(s)

Two most recent pay stubs

Two most recent bank statements

Past two years of tax returns

Past two years of W-2 forms

*Requirements may vary by lender or program.

When purchasing a new home, it’s important to consider all the additional expenses that you may incur beyond the sales price of the home. Working closely with your Vylla Home real estate advisor and mortgage lender, you’ll be in good hands to best understand your purchasing power and how to calculate any necessary fees and expenses to navigate your way to your new home. Some fees and closing costs may include:

Earnest money is essentially a deposit a buyer makes on a home they want to purchase. Earnest money is held in an escrow account by a real estate broker, closing attorney or title agency depending on the state you are purchasing. The earnest money deposit is typically made at the time of an offer, and these funds are credited to your purchase at closing. Earnest money deposits can be anywhere from 1–10%* of the sales price, depending mostly on market interest.

A home inspection by a qualified and licensed home inspector is highly recommended. The typical cost of a general home inspection ranges between $300 – $700* depending on the location and size of the home. There may be other inspections to consider based on the home you

are purchasing, such as radon testing, septic system inspection or pest inspection.

A home appraisal conducted by a licensed appraiser is required for any financed home purchase. The lender will order the appraisal and the buyer typically will cover the cost, which can range between $450 and $1,000.*

A homeowners association clearance letter, or estoppel letter as it’s known in some states, is required prior to close on a condo or home that is associated with a homeowner’s association (HOA.) Clearance letters can range from $25 to $550* depending on state regulations, so pay close attention to disclosures.

Depending on the type of loan you obtain, your down payment amount can range significantly. The down payment amount will be expressed as a percentage of the purchase price and only certain types of funds may be used.

*Amounts may vary. Consult your real estate advisor for additional information.

Keep in mind your prepaid expenses, taxes, mortgage and lender fees, title insurance, attorney fees (if applicable in your state), homeowner insurance and more are all included in this cost. Your lender will give you a more accurate estimate of what these costs will look like depending on the price of your new home.

During the preparation phase, your real estate advisor will:

Represent you and your interests, working as your trusted real estate advisor from start to finish.

Advise on current market conditions and trends that could impact your buying power and set expectations based on your budget.

Recommend trusted mortgage lenders who can provide financing options and ensure the successful funding of your purchase.

Explain agency relationships and obtain staterequired legal consent to represent you, if required, along with answering questions on federal and state fair housing laws.

Inform you of the working relationship between a buyer and real estate agent based on state law, the REALTORS® Code of Ethics and any applicable business policies created by the brokerage your agent is licensed with.

Work with you to complete a homebuyer’s checklist.

Walk you through the homebuying timeline for house hunting, mortgage approval and closing.

Finding the perfect home can be challenging and time consuming. Working with a trusted real estate advisor is key to offsetting those challenges. Our goal is to get as close to perfect as possible, and we often discover that a home which meets about 85 percent of your wants and needs will actually be the “perfect fit” once you find it. Keep this in mind when viewing homes and determining which factors are most important to you. Next we’ll walk you through all the steps of your home search next.

Search:

Your real estate advisor will help create a digital search to find homes quickly and efficiently according to your criteria. With your Vylla Home advisor, this process will include:

Developing search criteria based on the key features of your desired home:

Location – school systems, work commute, neighborhood amenities, etc.

Size & property type

Property condition

Features and amenities

Price

Determining which home features can be compromised on and which are truly non-negotiable.

Ensuring you have access to the latest inventory of homes on the market. Find our free app by searching for

With our search app, you can easily save, share and track properties right from your phone! Your Vylla Home real estate advisor can see all the properties you like, helping you find the perfect home even faster!

Once there is a home you think is a fit, your real estate advisor will do the legwork for you and pre-screen the property. A great real estate advisor will ensure that research is done prior to you ever visiting a property, maximizing your valuable time on homes that truly meet the criteria established in the preparation stage together. Research may include:

Screening off-market or “coming soon” listings through Vylla Home’s exclusive and vast real estate advisor network.

Attending private broker open houses to view new listings in advance.

Contacting the listing agent to inquire about property details and seller needs.

Investigating the home, neighborhood and other key features.

As your trusted guide, your Vylla Home real estate advisor will help educate you on many different factors during the home search process.

Help you select homes that truly fit your needs before you go to property tours

Explain the local market, current list prices and how this impacts you

Inform you of new or popular home features

Identify current average days on market and listing months of market inventory

Discuss effective home pricing and offer strategies

Explain the concept of absorption rate, or the rate at which homes sell in a certain area over time, and how it impacts the buying process

Assist you in reviewing loan estimates and comparing financing options

Help you account for the complete cost of homeownership, and estimate potential out-of-pocket costs

Review a sample sales contract so you’re prepared when it comes time to make an offer

Now you’re ready for your tour! You can ask your real estate advisor to schedule private showings, or there may be showings and open houses scheduled when you can visit. While touring, take note of your overall considerations for the property and any “red flags” you may spot. After your tour, it’s important to share feedback with your real estate advisor and allow them to review any issues you foresee.

Whether you visit one or multiple properties, you’ll want to start considering some factors:

Your overall interest level

The comparative market analysis (CMA) your real estate advisor will provide, which will help determine a competitive offer you would extend for the home

Seller needs and timelines

Offer terms

During the home search phase, your real estate advisor will:

Set up a home search and provide auto-notifications for listings that fit your desired criteria.

Search for exclusive “coming soon” listings, new developments and off-market opportunities.

Schedule and accompany you to all tours, showings and open houses. They may also arrange a tour of local areas, schools and key points of interest for your target neighborhood(s).

Follow up on your homes of interest, or questions you have about potential homes.

Contact listing agents to inquire about property details and seller needs.

Consider all feedback from showings and adjust search parameters as needed.

Monitor the market for fluctuations.

Check and assist you in considering applicable zoning and building restrictions, as well as public property and tax information.

In accordance with state law, provide information on how to check the sex offender registry and crime statistics for the neighborhood.

Discuss available resources that you can utilize to learn more about prospective neighborhoods.

Share data on values, taxes, utility costs, etc. that can inform your search.

Prepare a comparative market analysis (CMA) on homes you are seriously considering to help you formulate a competitive offer.

Search: Finding Your New Home

Once you find a home that you would like to purchase, your real estate advisor will recommend a strategy specific to your desired property, timeline and financial criteria to give you the best chance of making the winning bid. Together you will decide upon your purchase plan and move forward with the exciting step of making an offer!

Your real estate advisor has the important role of submitting an offer based on your needs, the selected property, market factors and their own experience in securing their buyers the winning bid. A written offer is submitted through a state-specific, standardized form which is used on all purchase and sale agreements. The offer will be crafted based on:

Price

Timeline

Earnest money

Any financial, appraisal, inspection or home sale contingencies

Seller concessions

Your real estate advisor can help you successfully draft a competitive offer, working to:

Provide timely communication between you and the listing agent.

Advise you on how to create the most attractive offer given the market, property conditions and your personal requirements and finances.

Prepare the entire offer package which typically includes a cover letter, your pre-approval letter, proof of funds, agency documents and other key paperwork which may be specific to state and local guidelines.

Submit all offers for seller and listing agent consideration.

Assist with reviewing counter offers and negotiating on your behalf.

Once an offer is submitted, you can expect a period of review and in many cases, negotiation. Market factors such as home inventory and interest rates can play a big role during the offer phase, where you may be competing against other potential buyers. Your real estate advisor will not only work with you to ensure your initial offer is highly competitive, but also negotiate for you to have your offer accepted.

Once your offer is officially presented to the listing agent, the offer may be accepted, rejected, or countered.

ACCEPTED:

Great news! Your offer was favorable to the seller and you can continue to move forward on your journey to homeownership.

A seller may reject an offer for many reasons, from the offer price to terms and conditions, multiple appealing offers from other buyers, or even personal circumstances. Your real estate advisor will help you navigate and understand any rejected offers.

COUNTERED:

If the offer is countered, the seller would submit a counteroffer through their listing agent for you to review. The counter may include a difference in price, timeline or contingencies for you to consider. You may also be countered to submit your highest and best offer. A counteroffer may be based on many market conditions including price, other offers presented, the property condition, timing and more. Motivated sellers are often willing to negotiate and each situation is unique, which is why a trusted and experienced real estate advisor can best assist you in navigating the offer stage.

Much like in the home search stage, your real estate advisor should provide education and options during every step of the offer and negotiation phase.

During the offer phase, your real estate advisor will:

Explain common contract elements including contingencies and all state and federally required disclosure forms.

Help create a negotiating strategy and goals to prioritize your needs.

Prepare you to have the best, most attractive offer for the property you desire that has a reasonable chance of being accepted.

Inform you about optional contingencies and explain the benefits and risks of using them.

Prepare you to navigate multiple offer situations.

Provide information on purchasing incentives or financing alternatives that may be available.

Utilize hyperlocal expertise and strong communication skills to assist you in presenting a successful offer.

Your journey to homeownership is getting closer! Now that you are under contract, there will be several steps to take with your real estate advisor to ensure a timely and clear closing. This includes everything from finalizing your financing to appraisals and inspections, all of which will clear the path to the final step of closing and owning you new home!

Your Vylla Home real estate advisor will assist you in navigating contract conditions and any final negotiations to help you get to closing, all while providing clear communication to you and the other parties involved in the transaction every step of the way. Let’s review what comes next: escrow and title, financing and appraisal, disclosures, inspections and final negotiations or credits.

First, the purchase and sale agreement must be accepted and signed by all parties, becoming a legally binding agreement.

From there, your closing agent will assist with a timeline based on the date the contract is finalized as well as the closing date outlined in the contract.

This is also the stage in which you’ll be depositing your earnest money towards the purchase.

A title report for the property will also be initiated and any terms of note are reviewed.

Title insurance is an insurance policy that protects you against loss that could result from issues regarding the title of a property you are purchasing. This protects you from issues that may already exist, rather than future events like many common types of insurance.

Title insurance is handled through a one-time premium payment and the insurance policy is valid until a property’s ownership, also known as title, changes.

The financing process is initiated with your mortgage lender to complete and finalize your loan.

An appraisal is ordered and scheduled, upon which the condition of the property is assessed by the appraiser and documented in a detailed report. The appraisal will also compare properties to recent sold prices of similar homes and properties in the neighborhood.

If there are any potential issues or discrepancies discovered in the appraisal, additional negotiation may occur with the listing agent and seller, as well as your lender if necessary.

You’ll review and sign the appraisal as well as finance contingency removal documents, if any.

Your mortgage lender will confirm all items are finalized and signed accordingly.

Your real estate advisor will review all disclosures and reports in detail with you before you officially sign all documents. You’ll retain a copy of all documents along with the other parties in the transaction.

There may be additional written disclosures or inspections requested if needed based on terms or findings.

Next come inspections, which are in addition to the appraisal and provide a thorough look at many aspects of the property’s condition. The listing agent will coordinate timing and access for the inspections, and you’ll receive a copy of the inspection report.

The inspector’s report is reviewed, and any action items or additional inspections are discussed with the seller, listing agent and your real estate advisor upon your direction. If needed, this is where you can negotiate repairs or credits.

Addendum and contingency removals are drafted, reviewed and signed. All final reports are signed.

During the contract phase, your real estate advisor will:

Guide you to meet all contract deadlines and assist to coordinate communications.

Assist you and encourage you to fully investigate your options in terms of a home inspector, title company, appraiser, mortgage lender and other services.

Present a list of the types of required and optional inspections such as environmental, roofing, and mold, as well as schedule and join all applicable inspections. They’ll also review and discuss home inspection concerns you may have.

Address concerns, questions or clarifications with the listing agent, and negotiate repair requests.

Ensure all inspections and repair requests are completed within the contract’s due diligence period.

Ensure all required documents are reviewed and signed, and all terms of the contract are met on time to be ready for closing.

Schedule a final walkthrough and prepare for closing by assisting you to review the settlement statement, schedule and advise upon where the closing will occur, and confirm the clear-to-close date with your mortgage lender.

The finish line is near! Once all due diligence items have been completed, and the underwriting of your loan is underway, you will move towards your final steps in the transaction process. This includes confirming the property condition and reviewing all final documents to ensure the move into your new home is seamless.

Your mortgage lender or title company may request additional documents, which will be important to provide in a timely manner as to not delay closing. You’ll also be required to obtain homeowners insurance for your new home, so shop around and submit for insurance quotes now.

During this time, there may also be certain activities you should avoid to ensure the closing occurs successfully, such as moving funds that would be used towards your down payment or making a large purchase like a vehicle. Your lender will inform you of any parameters to follow.

In preparation to move, you can contact local utility companies to schedule services to coincide with your move-in schedule. This will save you hassle and surprises on moving day and in your first few days at your new home!

With guidance and assistance from your real estate advisor, you will schedule a final walkthrough of the property to verify everything is in acceptable condition, and any negotiated repairs were completed. If there are any issues, you’ll work together to address any concerns that came up during the final walk-through.

Gather all required forms and documents for closing

Review flood insurance and homeowners insurance requirements

Explain title insurance and refer you to a qualified insurance provider as necessary

Order any surveys needed, appraisal and title search

Confirm the status of your mortgage loan funding

Check addendums and alterations for agreed terms

Review your closing statement to ensure accuracy

Explain wire fraud risks and remind you to verify all wiring instructions before transferring funds

Double-check all tax, homeowners’ association dues, utility and applicable prorations, if relevant

Request final closing costs and figures from the closing agent (often an attorney or title company) and receive and review these documents carefully

Receive and carefully review title insurance commitment

Advise you on important move-in tasks, such as re-keying your locks upon taking ownership, and considering a one-time cleaning or landscaping service before moving day

Support you through any final closing activities

To complete your closing, final loan documents, closing disclosures and closing documents from the mortgage lender will need to be signed and submitted. You’ll also need to send closing funds via wire transfer – please see page 48 for crucial information on security and avoiding wire fraud. Title insurance will also be purchased ahead of time to protect against any potential losses from title issues that affect ownership of the property. The deed will then be transferred and recorded.

During closing, your Vylla Home real estate advisor will usually be in attendance to answer final questions, but will also confirm all paperwork is signed and ready prior to closing to ensure the transaction is closed on time. Although closing is complete, you can rely on your Vylla Home advisor for continued support such as providing helpful moving checklists, maps and important websites to assist you in familiarizing yourself with your new neighborhood and continued property value updates.

We know buying a home is a big step.

A home is likely the largest purchase you’ll ever make, so it’s important that you’re well prepared. As you make such a big life decision, keep in mind that a professional and experienced agent can help you navigate the complexities of the homebuying process so you don’t have to worry.

Your Vylla Home real estate advisor can provide the industry resources and guidance through our family of companies that no other real estate agent can provide, as well as the many benefits listed below:

Property Search: Leverage multiple sources including the MLS, for sale by owners, and builders to identify viable properties.

Mortgage Financing: Provide recommendations for securing appropriate financing, helping you navigate the financial aspects of the purchase with confidence.

Efficient Property Viewings: Accompany you on viewings, or preview properties on your behalf to confirm they meet your criteria, and hear your feedback for future properties.

Property Research: Research selected properties to uncover any potential problems or concerns that you should be aware of.

Insight on List Price: Provide a comprehensive comparable market analysis, enabling you to make a well-informed purchasing decision.

Provide Education Around Offer Process: Educate and help buyers understand the main negotiating pieces of an offer, such as price, terms, dates, inclusions/ exclusions and contingencies.

Strategic Offer Structuring: Assist in crafting a strategically sound Offer to Purchase with terms and conditions that align with the property’s value, market conditions, and your best interests.

Offer Presentation: Presenting your offer to either the seller’s agent or the seller directly, ensuring that your interests are represented effectively.

Skilled Negotiations: Working diligently on your behalf to secure the best possible terms for the purchase, always keeping your interests at the forefront.

Document Guidance: Explain all forms, disclosures and contracts related to the purchase, ensuring you are fully informed and comfortable with your options.

Streamlined Inspections: Coordinate property inspections to ensure a thorough assessment, providing you with accurate insights into the property’s condition.

Post-Closing Support: Connect you with trusted vendors to cater to your post-closing needs, ensuring a seamless transition into your new property.

Vylla Home makes homeownership simple, providing the easiest way to find, finance and own. Team up with a knowledgeable, licensed Vylla Home real estate advisor to help you expertly navigate the complexities of the homebuying process and simplify your homeownership journey from start to finish. We offer the highest level of service available to ensure you have a place to live, grow and make memories with a home.

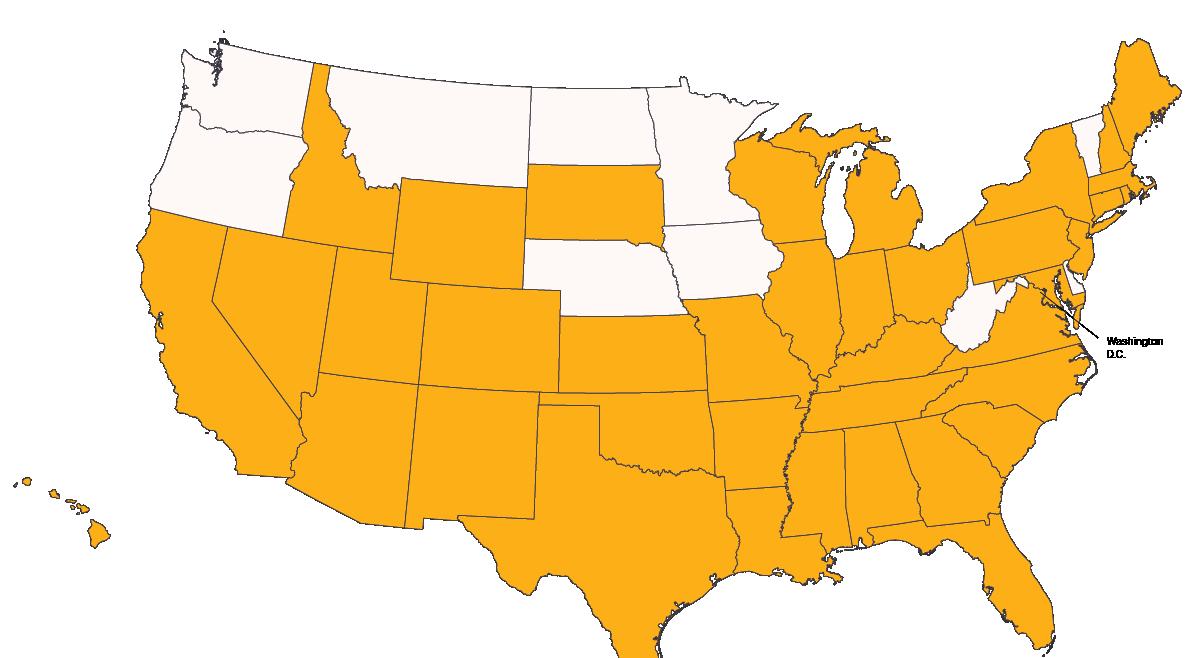

Vylla’s national footprint and full-service model provide a truly progressive approach to the real estate process, creating extraordinary experiences for our clients. We are part of the Carrington family of companies which means we can offer all aspects of homeownership under one roof.

MORE THAN $21 BILLION sold since inception

113, 684+

Transactions sold since inception.

16 years of real estate experience

To learn more about VH local offices/locations, visit vyllahome.com/offices

What does it mean to be a homeownership company?

We represent every aspect of the real estate transaction under one roof for our clients. From asset management and mortgage operations to title and escrow, our family of companies offers much more than your standard real estate brokerage.

Carrington Mortgage Services, LLC (NMLS ID #2600) is a fully integrated mortgage company with lending and mortgage servicing operations. We are committed to providing superior customer service, from assisting our customers in selecting the right loan for their needs to closing loans on time, every time.

carringtonmortgage.com

Vylla Title is an industry-leading expert providing simple, cost-effective, and specialized title and settlement services nationally. We work with institutional clients and the real estate community, nationally, to transform the real estate process by managing transactions quickly and smoothly, every time. When it comes to our customers, they always come first.

vyllatitle.com

Carrington Charitable Foundation gives back to the communities in which we live and work. CCF is proud to support our Veterans by providing Mobility, Stability, Purpose and Prosperity.

carringtoncf.org

Unfortunately, some steps in a real estate process require private information and transfer of funds that create targets for potential scams and illegal activity. Remember that it is easy to avoid wire fraud or any transaction issues if you stay alert and follow the instructions below!

Obtain the best phone number for your Closing Officer or Office at the beginning of the transaction, and do not use any other number as a contact. Provide important information in person or over the phone directly with your contact instead of within emails or text messages.

Never provide personal information or banking details in emails or text messages. When you do email, ensure you are using a secure email account with strong passwords and/or multistep authentication. Do not use public computers or Wi-Fi.

DO NOT EVER WIRE FUNDS PRIOR TO CALLING YOUR CLOSING OFFICER OR TITLE OFFICE TO CONFIRM WIRE INSTRUCTIONS. ONLY USE THE PHONE NUMBER YOU WERE PROVIDED PREVIOUSLY.

When you call, verbally confirm the wire transfer instructions with your contact, and confirm the bank routing number, account number and any other figures before transferring funds.

Being attentive will help keep you secure.

Please verify that email messages are from the expected sender, your closing officer or title office. This includes emails that appear to be from your contact but are sent from an account such as Gmail or Yahoo.

Beware of any wire instructions from an unknown contact, or instructions asking you to wire funds to any company than your title company.

Also watch for changes in contact details or unfamiliar contacts, such as a text message or call claiming to be from your title company with an unknown or new phone number.

Any sudden sense of urgency for you to wire funds should raise a red flag. You will be informed by your contact at your title company of upcoming wires and provided clear instructions.

Agency creates a legally binding relationship between the licensed real estate advisor and their client during the buying and selling process Agency terms are set once an agreement is signed.

An opinion of the market value of a home expressed by a real estate appraiser.

Value placed on a property by a municipality for purposes of levying taxes. May differ widely from appraised or market value.

The buyer’s representative (also known as a buyer’s agent) is hired by prospective buyers by signing a buyer representation agreement, and works in the buyer’s best interest throughout the transaction.

Document signed by a title examiner stating that a seller has an insurance title to the property.

Process by which the deed to a property is legally transferred from seller to buyer, and documents are recorded.

Expenses in addition to the price of the home incurred by buyers and sellers when a home is sold. Common closing costs include escrow fees, title insurance fees, document recording fees and real estate commissions.

Fee (usually a percentage of the total transaction) paid to an agent or broker for services performed.

An estimate of a home’s price used to help sellers set listing prices and help buyers make competitive offers. The analysis considers the location, age, size, construction, style, condition and other factors for the property and comparables.

Condition in a contract that must be met for the contract to be binding.

Binding legal agreement between two or more parties that outlines the conditions for the exchange of value (for example: money exchanged for title to a property.)

A legal document conveying ownership of property.

Percentage of the purchase price of a property that the buyer must pay in cash. It may not be borrowed from the lender.

When a single agent represents both the buyer and seller in a real estate transaction. It can also occur when the same real estate company represents both parties in a purchase and sale or rental transaction.

The difference between a home’s value and the mortgage amount owed on the home.

The holding of documents and money by a neutral third party prior to closing.

Any object permanently attached to a property by way of bolts, screws, nails, glue, cement or other means. Items like chandeliers, ceiling fans and window treatments are generally seen as fixtures and will stay with the home in a real estate transaction.

A form of insurance in which the insurance company protects the insured from specified losses, such as fire, windstorm and the like.

A claim upon a piece of property for the payment or satisfaction of a debt or obligation.

The seller’s representative (also known as a listing agent or seller’s agent) is hired by and represents the seller.

Agreement whereby an owner engages a real estate broker for a specified period of time to sell a property for which, upon the sale, the brokerage receives a commission.

The actual price at which a property is sold.

The highest price a buyer would pay and the lowest price a seller would accept on a property. Market value may be different from the price a property could actually be sold for at a given time.

The service combines the listings for all available homes in an area, except for For-SaleBy-Owner properties, in one directory or database.

To divide or assess proportionately

A contract between buyer and seller that outlines the details of the property transfer.

A strategic arrangement in a real estate transaction where the seller covers certain costs or fees associated with purchasing a home. These concessions can make home ownership more accessible for buyers by reducing upfront expenses.

Another term for the closing of a real estate transaction. Settlement occurs when the buyers, sellers, and their agents sign the closing documents of a transaction, and the closing agent or attorney facilitates payment of all closing costs. Settlement or closing procedures vary by location.

A document that indicates ownership of a specific property.

Insurance to protect the buyer and lender against losses arising from disputes over the ownership of a property.

An examination of public records to determine the legal ownership of property. Usually the records are recorded with the County Recorders office. The search is usually performed by a title company using computerized records.

A transaction broker (sometimes referred to as a facilitator) is permitted in states where nonagency relationships are allowed.

© 2024 Vylla Home and its affiliates. Vylla Home, Inc. CA DRE# 02075076. This document is a guide and does not include all local and state-level regulations or processes. Please consult your local real estate advisor for additional information. All rights reserved.