Jennifer Daniel Aflac

Jack Holder EBIS

Paul Hummel

Rachel McCarter Mercer

Editors

Heather Garbers | Trevor Garbers

For Media and Marketing Requests Contact:

Heather@voluntary-advantage com

Trevor@voluntary-advantage com

Mailing Address

10940 S Parker Rd #257 Parker, Colorado 80134

Steve Clabaugh CLU, ChFC

Mark Rosenthal PwC

Seif Saghri Founder

Tim Schnoor Birch Benefits

Sydney Consulting Group A d v i s o r y B o a r d

Hunter Sexton, JD, MHA

If you’ve followed the rise of the Savannah Bananas, you’ve witnessed a master class in reimagining tradition. They took one of America’s oldest pastimes and, without changing its essence, made it new, exciting and unforgettable. By shifting focus from the rigid structure of innings and stats to the joy of the fan experience, they created something bigger than baseball they captured the importance of placing the fan first in everything they do

In a different way, life insurance follows a similar principle On the surface, it may look like a stack of paperwork, premiums, and policies hardly as thrilling as a choreographed dance on the pitcher’s mound But when you look deeper, its purpose is just as profound as the Bananas’ approach to the game: it’s about what truly matters placing the policyholder first in everything we do

The Savannah Bananas have proven that baseball doesn’t have to look like baseball to capture attention, and I believe our industry must take the same approach with life insurance Too often, our current system puts process over people From product development and marketing to distribution, administration, and even claims, we rarely design with the policyholder at the center That must change

Families don’t invest in life insurance because they love the mechanics of underwriting They invest because it provides peace of mind, continuity, and protection for the people they love Just as the Bananas remind us that baseball is about more than balls and strikes, life insurance reminds us that planning is about more than numbers on a page It’s about preserving memories, safeguarding futures and ensuring that what matters most lasts beyond the moment

One gives us laughter and joy today The other provides stability and security for tomorrow Both show us the power of rethinking the familiar and focusing on what truly endures

In closing on a personal note, if you haven’t reviewed your life insurance recently, now may be the perfect time. Just as the Bananas reinvented baseball to focus on what matters, you can rethink your financial protection to ensure your family’s future is secure no matter what the scoreboard of life brings.

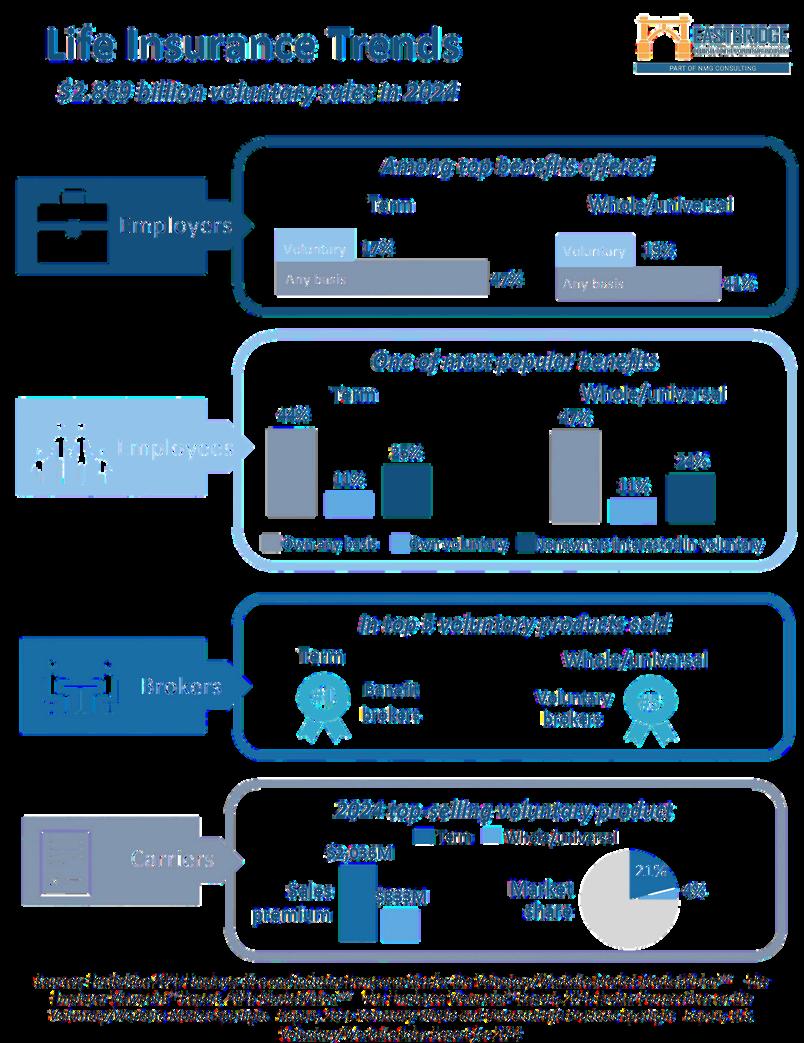

Voluntary life insurance continues to play an important role in workplace benefits portfolios Understanding who opts into this coverage and why they do helps brokers better support employers in building relevant, employee-focused offerings

According to survey data by OneAmerica, “Although just over a quarter of employed Americans (27%) have voluntary group life insurance, 68% of workers who say they don’t because their employer doesn’t offer it would be somewhat or very likely to purchase it if offered at their company” (OneAmerica, 2024). This tells us that demand extends beyond current policyholders many employees are eager for the option if their employer makes it available.

Among those who already have voluntary group life, the top reasons for purchasing include:

60% say it’s “to protect family/loved ones from future financial hardship”

44% cite “peace of mind”

40% say it is “to pay off debts and final expenses in the event of their passing”

27% report it’s intended “to replace a spouse/partner’s income”

26% aim “to leave an inheritance for children or grandchildren” (OneAmerica, 2024)

These motivations point to a highly considered decision-making process, one driven by both financial protection goals and emotional reassurance

Based on these findings, the most common voluntary life insurance buyers through the workplace include:

Employees with dependents or significant financial obligations, such as parents, mortgage holders, or students supporting families

Individuals selecting peace of mind, even if they have no immediate dependents especially younger workers starting to plan for unexpected events

Those with limited access to affordable individual policies, whether due to health circumstances or financial capability

These profiles overlap: someone might be seeking protection for loved ones, peace of mind, or both.

For brokers, this insight opens opportunities to better target voluntary life offerings during open enrollment.

Consider:

Segmented messaging: Tailor messaging to resonate with different employee profiles parents, dualincome households, younger individuals planning ahead

Employees are more likely to buy when enrollment is easy Clear, jargon-free communication about benefits and costs (eg, cost of coverage per $10,000) increases uptake

Highlight emotionally compelling use cases: Share stories like debt coverage, inheritance planning, or income replacement to connect with emotional rationales

Voluntary life insurance isn’t just another add-on, it’s a benefit with tangible emotional and financial value for employees at key life stages. Brokers who truly understand the “who” and “why” behind voluntary life purchases can better advise employers and design programs that resonate.

Source: OneAmerica (2024), Harris Poll of over 2,000 US adults, via Insurance News Net “Survey Says: Group Life Insurance a Desirable Voluntary Employee Benefit.”

PES Benefits is dedicated to revolutionizing the employee benefits landscape with cutting-edge technology, administration, education, and virtual care solutions. Since its inception, PES Benefits has focused on simplifying the benefits experience, making it more accessible and meaningful for all involved.

By Severine Suski

When it comes to selling life products to young Americans, there are some overarching commonalities we see regardless of whether we’re talking about retail life insurance or employer-provided coverage

LIMRA recently spoke with 33 young people, between the ages of 24 and 35, in a qualitative study We found that young people who do not own coverage cite their perceptions of the cost as the top barrier to purchasing individual life insurance It’s important to note the difference between the cost insurers quote individuals and consumers’ assumptions around what they expect the cost of coverage to be. As LIMRA research shows, individuals between the ages of 24 – 35 overestimate the cost of individual life by 6 to 15 times its actual price.

This is notably higher than other age ranges Generally speaking, the healthier the person, the more they overestimate the true cost

“Perceived price has kept me from purchasing life insurance because I’ve heard that it can be expensive, so I haven’t even made it a priority because of that.” – Alanna, non-owner of individual life coverage, 35.

Thirty-nine percent of young employees say that their reasons for not enrolling in workplace life insurance benefits are costrelated, while fewer individuals from older generations cite the same barrier. Eighteen percent of young people who choose not to enroll in workplace life coverage say that they are not able to afford the benefit at this time, while 15% of young people who choose not to enroll don’t think the benefit is worth the cost

At the same time, 6% would like to put the money towards other benefits As the methods of disclosing the cost of coverage vary among employers, we can draw the conclusion that additional awareness of cost could benefit employees' understanding of life insurance, just as it would for consumers of individual life insurance.

The cost can be a big barrier, and I wouldn't want to do a bunch of digging just to not even be able to afford it.” ― Arec, non-owner of individual life coverage, 27.

It is paramount that the industry focuses on educating young people about the factors that underlie how policies are priced, whether it is explaining how risk pooling works, or explaining terminology, like “premium,” in context Young consumers need to better understand the true value of life insurance, all while being supported and educated through the complex purchasing process

The lack of understanding around cost alludes to a wider issue among this demographic and other consumer segments, showing the lack of understanding with life insurance products This is true for general information about policies and the industry, as respondents in our qualitative research have cited a lack of knowledge about life insurance as the second-largest barrier to purchasing coverage.

“It's a lack of knowledge on who to trust, where to get it, what coverage is best for me, etc.” Gab, non-owner of individual life coverage, 28.

Similar conclusions could be drawn about employer-provided coverage Seventyseven percent of young employees, between the ages of 24 and 35, say they would prefer to receive information about their employee benefits a few times or frequently throughout the year

This indicates that young employees, like young retail consumers, want more information about coverage.

Similar conclusions could be drawn about employer-provided coverage Seventyseven percent of young employees, between the ages of 24 and 35, say they would prefer to receive information about their employee benefits a few times or frequently throughout the year This indicates that young employees, like young retail consumers, want more information about coverage

When asked specifically how well employees understand the life insurance benefits offered by their employer, 17% of 24 – 35-year-olds say that they either don’t understand the coverage at all, or they understand only slightly. Only 52% of young people within this age range feel they have a good understanding of the coverage provided by their employers, which is 5 percentage points lower than 36–49 year olds and 8 percentage points lower than 50–64 year olds

This mirrors LIMRA’s findings among young retail consumers who shared that a lack of knowledge was a top barrier to purchasing coverage

Increasing consumer and employee awareness and education around the cost of life insurance is a vital step for the industry if it wants to win over prospective young consumers Supporting individuals through their research and purchasing process by explaining the terminology used by the industry and increasing transparency around pricing will help the industry better meet the needs of this demographic

Sources:

Insurance Barometer Study, LIMRA and Life Happens, 2025

BEAT Study: Benefits and Employee Attitude Tracker, 2025

Opportunities in Underserved Markets: Young Consumers, 2024

Severine Suski, Assistant Research Director - Severine has a background managing primary research studies at Kadence International and joined LIMRA in 2024 She is part of the Markets Research team, focusing on the underserved markets, and also facilitates the Diverse Markets Committee Severine received a bachelor's degree in global capitalism and sustainable business from New York University.

By Andrew Wayt

As we head into a busy fall season, the Voluntary Advantage team remains focused on one guiding principle: impact. New benefits and initiatives continue to enter the market at a rapid pace, but the real question for advisors and employers is: What difference will this make for the people we serve?

One area where impact is becoming impossible to ignore is long-term care (LTC)

Back in 2021, Washington State made headlines with the passage of the WA Cares Fund, the nation’s first public long-term care insurance program For millions of residents, the choice was clear: opt into coverage through WA Cares or secure private LTC insurance before the exemption window closed The reaction was polarized, but one fact was undeniable demand for long-term care solutions could no longer be put off

Fast-forward to today and WA Cares is not only still standing, but into a model that could reshape how states, employers, and carriers approach long-term care. To better understand the progress, I sat down with Benjamin Veghte, Director of WA Cares, who has been instrumental in shaping the program’s direction and forging connections with the private market.

1.The demand is universal. Caregiving is something nearly every family will face, and costs remain staggering averaging more than $5,000 per month

2 Public-private models ease the strain. Blending taxpayer funded programs with supplemental private insurance reduces the burden on families while creating new opportunities for carriers and brokers

3 Planning is still the missing link. Despite growing awareness, too many Americans remain unprepared, making advisor guidance more essential than ever

For Benjamin Veghte, WA Cares is more than just policy it’s personal. Veghte’s journey to Washington’s pioneering program was unconventional. In his early career, he spent 15 years in Germany researching how strong social protections can coexist with a thriving market economy That experience convinced him that “if you give people a degree of security, they work harder and are more productive” After returning to the US, including a stint leading policy work at the National Academy of Social Insurance, Veghte zeroed in on America’s looming long-term care crisis

Hebelievesthatwhenpeoplefeelsecure, theyaremoreproductiveandbetter preparedtothrive.

With fewer stay-at-home caregivers and a growing elderly population, he saw disaster on the horizon: “No family can afford to have a stay-at-home caregiver anymore… and at the same time, you have longevity increasing and dementia increasing” In 2019, when Washington State created WA Cares Fund – a universal long-term care insurance program financed by a modest payroll premium – Veghte jumped at the chance to put his ideas into practice “I saw it as an opportunity If this can be successful here, it could really be a model,” he recalls

He believes that when people feel secure, they are more productive and better prepared to thrive For Veghte, helping Americans prepare for long-term care is a calling, one he believes could transform how the country handles aging and caregiving.

Washington’s program provides eligible Washingtonians with up to $36,500 (adjusted annually) in lifetime long-term care benefits, funded by a 058% payroll tax on wages But early on, gaps in the program design sparked confusion and criticism In 2021, tens of thousands of workers rushed to buy private insurance for an exemption from the tax, unsure what WA Cares would bring These challenges prompted lawmakers to pause the program’s implementation in 2022 for an 18-month reboot to make significant adjustments, including:

Portability for workers who retire or move out of state. Originally, if a worker paid into WA Cares for years then retired in another state, they would have lost access to the benefit. “Maybe you pay in 40 years and then you retire near your grandkids… you lose all the money you paid in. That was intolerable,” Veghte says Now, under revised rules, participants can keep their earned benefit if they move out of Washington and even continue contributing if still working elsewhere Partial vesting for near-retirees to ensure fairness Originally, near-retirees wouldn’t have the ten years of contributions required to vest for full benefits Now, “anybody who is born before 1968 earns 10% of the full benefit for each year they pay in,” Veghte notes, so late-career workers can still get value from the program even if they can’t contribute for a decade.

These refinements helped stabilize the program and boost public confidence, and by July 2023, premium collections resumed and the program was “completely on track” with the early kinks ironed out. Actuarial projections now show solvency for at least 75 years a significant milestone

Perhaps the most innovative evolution of WA Cares is its new supplemental insurance framework. Instead of competing with private carriers, the state invited insurers into the design process, creating policies that stack on top of the WA Cares benefit

In 2023, Washington legislators approved a supplemental private insurance market that will layer on top of WA Cares, allowing residents to purchase additional long-term care coverage to augment the state benefit These new “WA Cares supplement” policies would treat the public program’s $36,500 as a deductible, paying out once the state-funded benefit is exhausted. Crucially, the legislation creating this market was co-designed with insurers from the start. “We formed a working group with five carriers… as well as consumer protection advocates and got a unanimous recommendation of how to design the supplemental market so that it works – so that it’s profitable for carriers, but also serves beneficiaries well,” Veghte says

Bycoveringthe“firstdollar”ofrisk throughthestatebenefit, supplementalpoliciescanbepriced farlowerthantraditionalLTC coverage—makingthemaccessible tomiddle-incomefamiliesforthefirst time.Forbrokers,thisopensanew voluntarybenefitsmarket: affordable,workplace-distributedLTC coveragethatemployeesactuallysee asrelevant.

Youcontribute0.58%ofyourwages eachmonththroughpayroll

Aftercontributingfor10years(for thosebornafter1968),youwillbe eligibleforupto$36,500inlifetime benefitsifyourequirecareandare unabletocomplete3of6Activitiesof DailyLiving

By covering the “first dollar” of risk through the state benefit, supplemental policies can be priced far lower than traditional LTC coverage making them accessible to middle-income families for the first time For brokers, this opens a new voluntary benefits market: affordable, workplacedistributed LTC coverage that employees actually see as relevant

As Veghte explains: “We’ve stimulated people’s appetite for coverage Now there’s room for public and private options to complement each other”

Notably, Washington’s supplemental plans will be allowed to qualify as “Long-Term Care Partnership” policies, meaning policyholders could shield some assets from Medicaid spend-down requirements if they ever need to rely on Medicaid. That integration is another way the public and private sides complement each other. In general, Veghte sees WA Cares easing pressure on Medicaid over time. States’ Medicaid budgets are already strained by aging populations, and federal support is uncertain Having a dedicated funding source for long-term care through WA Cares “will be really invaluable to residents in the coming decades,” he says, because it provides an alternative to impoverishing oneself to qualify for Medicaid In short, WA Cares is not just a new benefit for individuals, but a buffer for broader social benefit systems

States like California and Minnesota are watching closely Policymakers see WA Cares not just as a safety net but as an economic driver funds for local caregiving can spur job growth in rural communities while easing Medicaid pressures In Minnesota, for example, interest is high Veghte, who has spoken there and consulted with policymakers, wouldn’t be surprised to see Minnesota adopt a WA Cares-style program in the next five to ten years.

States with large rural populations may find the idea especially attractive. He explains that giving every senior a modest fund for care (say $36,500) can have a ripple effect in local economies “You have a lot of older adults living in rural areas who need care [WA Cares] gives every older adult [with a care need] [BV1] as they age $36,500 to spend on long-term care,” Veghte says “Businesses are going to form in those areas – home care agencies are going to form”

For benefits advisors, the implications are clear:

Expect LTC to rise on clients’ priority lists

Be ready to explain how public programs and private supplements work together

Position yourself as a guide in helping employers and employees plan for caregiving challenges before they become financial crises.

WA Cares is still young, but its trajectory shows that long-term care is no longer a fringe issue it’s central to financial wellness, workforce planning, and public policy As Veghte reminds us, the need isn’t going away: “We need WA Cares, and we need more Any carrier, any broker, any company that wants to expand long-term care coverage we’re here to collaborate”

For the voluntary benefits community, the opportunity is here The question is whether we’re ready to meet it

Andrew Wayt is a long-term care specialist with an emphasis on helping advisors and benefit brokers better understand the solutions available to their clients He can be reached at hello@ltcherocom

By Mitch Bagley & Rebecca Richey

September reminds us that life insurance protects loved ones from financial devastation in the event of untimely death In a world where health trends are deteriorating alarmingly, life insurance isn't just a safety net it's a frontline tool for combating elevated mortality and morbidity Founded in 2023 by insurance experts, medical doctors, and actuaries, Insurance Collaboration to Save Lives (ICSL) is a nonprofit dedicated to empowering global insurers to “save a million lives” through proactive health initiatives Life Insurance Awareness Month presents the critical opportunity for advisors to address the escalating public health crisis impacting the workforce.

ICSL’s research team has identified five key drivers of mortality: cardiac and circulatory, neurological and nervous system, metabolic and digestive, cancer and external causes (eg, mental health issues) Conditions such as hypertension, stroke, kidney disease, liver disease and obesity have significantly increased across various age groups as both underlying and contributing causes of death While mortality from lung and breast cancer is declining for most age groups due to widespread screening, other cancers (including colorectal and liver cancer) are rising at an alarming rate, particularly among younger populations.

As of July 2025, morbidity is running at an alltime high for the US population and those eligible for the workforce according to the U.S. Bureau of Labor Statistics. The recordbreaking surge in disability rates among working-age populations has significantly reduced employee productivity. This has strained absence leave management, leading to increased operational disruptions for employers. Escalating health costs further divert employers' focus from core business activities, as they grapple with managing higher claims and supporting affected employees Morbidity is a leading indicator of future mortality and is currently heading in a disastrous direction

The life insurance industry mitigates mortality and morbidity risk primarily through reinsurance and other risk transfer methods in contrast to the practices commonly deployed in property and casualty insurance

With few exceptions, efforts historically to develop cost effective health programs meant to improve policyholders’ longevity and wellbeing have been nonexistent. Operational complexities, regulatory challenges and consumer acceptance have long posed significant hurdles to the widespread adoption of preventative care management on this side of the industry. Collaborative initiatives can overcome these challenges by streamlining their implementation processes using standardized workflows built on advanced digital health platforms that seamlessly integrate data into existing systems By transforming life insurance from a reactive financial tool into a proactive health strategy, advisors can help employers reduce morbidity, enhance employee wellbeing, and strengthen workforce resilience

Here's how you can lead the charge:

Educate Employers: Demonstrate how integrating health screenings and wellness programs can reverse declining health trends, reducing claims and enhancing employee health

Overcome Hurdles: Partner with insurers to implement digital health platforms that streamline preventative care, using standardized workflows and AI-driven insights to boost employee engagement and participation

Assess Workforce Risks: Encourage employers to evaluate employees' exposure to key mortality drivers (cardiac, neurological, metabolic, cancer, and mental health-related). Use risk assessment tools to identify at-risk individuals and prioritize interventions.

Champion Collaboration: Work with insurers, health providers, and employers to create comprehensive support systems that promote early detection and proactive health management, saving lives and reducing long-term costs

The time to act is now By leveraging life insurance as a frontline tool, trusted advisors can help employers combat the public health crisis, protect their workforce, and redefine employee benefits as a force for longevity and vitality. Take action this September by starting the conversation with employers, introducing risk assessments, and laying the groundwork for programs that make prevention part of everyday workplace culture Together, we can build healthier, more resilient workplaces

A not-for-profit global initiative leading the life insurance industry in deploying targeted screening, testing and triage to identify those policyholders most at risk for sudden death or critical care incidents providing the framework to mitigate loss by saving one million lives

Our contributors & leadership are dedicated to meeting the challenges ongoing excess morbidity and mortality bring to the industry as a whole and society at large

By Dan Kraft

Every September, Life Insurance Awareness Month prompts a familiar conversation: “I know I should get life insurance, but it’s too expensive” Among younger employees, that perception is remarkably persistent and remarkably off-base. LIMRA finds that adults 30 and under overestimate the cost of life insurance by 10 to 12 times its actual cost. Many assume premiums run into the hundreds each month when, for a healthy 25-year-old, coverage can often be closer to $9–$12 per week.

This mismatch between perception and reality is more than a messaging problem It’s a barrier to financial resilience in the workforce and a missed opportunity to deliver a high-value benefit that employees will actually use The good news: the fix is less about changing the product and more about changing the way we talk about it

The Perception Problem (and why it sticks)

Behavioral economics gives us a useful lens When employees hear “life insurance,” they anchor to other large, long-term obligations mortgages, car loans, medical debt and assume the price tag is comparable Meanwhile, their weekly spending tells a different story: small, discretionary outlays on coffee, takeout, rideshares and streaming services add up quietly in the background. When we quote life insurance monthly or worse, annually we force employees to compare a single, visible line item to a set of invisible, incremental purchases. The premium looks bigger than it is.

Reframing the conversation to the cadence of a paycheck changes that calculus. “About two coffees a week” is a clearer, truer comparison than “$48 a month.” The cost didn’t change; the context did. And context is often what decides whether a 24-year-old checks the box during enrollment or opts out “for now.”

Young adults frequently miss the most favorable moment to buy: when they’re young and healthy Premiums are lower, underwriting is simpler, and coverage can often be locked in at a level rate A straightforward comparison what $20 buys at 25 versus at 35 can be eyeopening, especially when employees realize that “waiting” is, effectively, a decision to pay more for less later

This is where employers can make a real difference

New-hire windows and open enrollment are prime opportunities to communicate guaranteed-issue availability (where applicable) and to underscore the longterm advantage of acting early. After all, life insurance is one of the few places in personal finance where youth is a genuine discount. Framing it that way resonates.

It’s tempting to assume Gen Z isn’t interested in life insurance because they have fewer dependents The data suggests otherwise LIMRA reports that millennials and Gen Z are eager to discuss life insurance with an advisor At Trustmark, we see that interest translate into action: roughly 22% of our universal life purchasers are between 20 and 29 Curiosity isn’t the obstacle Confusion is

Employees don’t need a lecture on mortality; they need a clear sense of value Plain-English explanations at the point of decision What does this really cost per paycheck? How much coverage do people like me choose? Can I take it with me if I change jobs? How do I update a beneficiary? do more to move enrollment than any number of hypotheticals Decision-support that essentially behaves like e-commerce (think sliders for coverage amounts with real-time paycheck impact) helps people buy the way they buy everything else online: quickly, confidently and on their phones.

Life Insurance Awareness Month arrives at a useful time in the plan year, but the opportunity is larger than a single campaign. Use this moment to recalibrate the entire conversation around affordability and timing. That doesn’t require a dramatic overhaul just a consistent shift in tone and framing:

Quote per-paycheck by default, with a monthly toggle for those who want it Make the “cost of waiting” visible with a simple age-based comparison woven into meetings, microsites and new-hire packets

Bring portability and beneficiary updates out of the fine print and into the core message

Those are small changes, but they speak directly to the questions younger employees have at the moment they decide

The bottom line is straightforward: life insurance is often far more affordable than young adults think The barrier isn’t price; it’s perception When brokers and HR leaders anchor the conversation in everyday spending, highlight the advantages of buying young, and simplify the path to yes, participation rises and so does the financial resilience of the workforce.

Dan Kraft, Vice President of Product & Innovation at Trustmark - Dan joined Trustmark in 2014 with more than 20 years of experience in product management, marketing, and sales Dan oversees the product development and innovation team, which is responsible for incorporating the voice of the customer and staying abreast of the latest market trends to deliver valuable solutions to our customers

VoluntaryAdvantagehaspartneredwithNABIPtoupdatetheirVoluntary/WorksiteCertificationand itisliveandavailabletoyou24/7virtually.

ThecostoftheVoluntary/WorksiteCertificationcourseis$304.70forNABIPmembersand$401.50fornonmembers,whichincludesonlineinstructioninthreeone-hourwebinarmodules,afinalexamand continuingeducationcredits.Uponcompletion,youwillreceiveacertificateofcompletionas voluntary/worksitecertified.

CourseHighlights:

Mastertheproductwithinnovativesolutions

Understandcontractdifferences

Reviewimplementationandadministration

Obtaincrucialcomplianceinsights

By Steve Clabaugh, CLU, ChFC

Relationalleadersdemonstratethattheycarefortheirteammembersasmuchasthe organization.Asaresult,theycreate,buildandleadhigh-performanceteamsthat consistentlyachieveexcellence.

Just the other day, Gretchen and I stopped at our local big box store to pick up a few items we needed. We walked across the parking lot on this very hot day and there she was, sitting up against the wall beside the door going into the store.

The little girl was maybe four or five years old, wearing a pink baseball cap that was way too big for her, bunched up in the back so she could keep it on her head Her head was down, and she looked sad and very alone We sensed that something was not quite right, so we leaned down, said hello and asked her if she was okay

She looked up at us with eyes shiny from her tears and, after determining that even though we were strangers we were safe, she slowly shook her head no.

Gretchen leaned down and very gently asked her what was wrong. With tears now streaming down her face, she stammered out, “I lost my Mommy. I saw her in the line and now she’s gone.”

Gretchen: “No, your Mommy isn’t gone Come with me and let’s go find her”

We slowly made it to the customer service counter where all four of the ladies working there were moms and recognized the situation immediately

It took several tries to get through the sobs and tears to understand that her name was Angela One of the ladies got on the intercom and made an announcement requesting Angela’s mom to come to the customer service counter where her daughter was waiting

Less than 5 minutes later a little boy, maybe 7 or 8 years old arrived and called out for Angela to follow him because mom was waiting for them Angela bolted across the room and grabbed her big brother in a bear hug of relief and appreciation. Unimpressed, her brother gave her a look that communicated an attitude of “whatever” and said again, “Let’s go. mom’s waiting.”

I followed them, from a distance, to make sure they got successfully re-connected with their mother. In addition to Angela and her brother, I saw a younger sister and baby brother waiting for them with the mom

I had planned to fill mom in on the details of Angela’s experience Instead, I was stopped in my tracks as I watched the interaction between this young mother and her daughter

Those of you who read our monthly articles (or who have participated in a Relational Leadership Experience program, will know that the core of what we teach about relational leadership is centered on the 6 principles of Championship Team Behavior

We work together as Colleagues.

We don’t accept Case Building.

We don’t tolerate Blaming.

We deal with Breakdowns not problems.

We say the Unsaids

We Negotiate Relationships and Conditions of Satisfaction.

1.WeworktogetherasColleagues

2.Wedon’tacceptCaseBuilding

3.Wedon’ttolerateBlaming

4WedealwithBreakdownsnot problems

5.WesaytheUnsaids

6.WeNegotiateRelationshipsand ConditionsofSatisfaction

I believe that the practice of relational leadership applies to all aspects of human relationships – not just in business. This young mom recognized in the moment that she had the opportunity to teach a lesson to her daughter that could be learned and applied to all 4 of her children Without ever having participated in a Relational Leadership Experience program she, instinctively, used every one of the principles of championship team behavior

Here was the dialog I observed with the championship team behavior principles noted:

Angela runs up to her mom not sure what to expect but hopeful that it will be a happy reunion. It didn’t work out exactly that way.

Mom: “Angela where were you? We were worried.” (Colleagues/Family).

Angela: “I thought you left, and I was scared. I waited outside for you to come back.”

Mom: “Why did you think that we left you? You know that we would never leave without you” (No Case Building)

Angela: “I saw you up front and I thought you were leaving”

Mom: “We’re still up front and we haven’t left yet What were you doing when you thought we were leaving?” (Dealing with Breakdowns)

Angela: “Well Joey was looking at some toys and I wanted to look at some too and then you were gone”

Mom: “Angela this is not about Joey This is about what you did” (No Blaming) “Your behavior caused us to worry and now we’re late for going home and getting dinner ready.” (Saying the Unsaids).

Mom: “You need to remember that we are all together and it makes all of us worried if you’re not with us. You need to set a good example for your little brother and sister. Now, can I count on you to be where you’re supposed to be?” (Negotiating Relationships and Conditions of Satisfaction)

Angela: “Yes ma’am I’m sorry” They hug

In short, what I had the privilege of watching was a master class in relational leadership conducted in less than 2 minutes It reminds me that relational leadership is, at its core, an organic practice and not something invented in an artificial environment

Unfortunately, as a society, it often seems like we have gotten away from the basics of caring about each other as much as we do the organization. The RLE program is based on an organized set of principles and practices that help organizations get back to the basic positives of human relationships in the workplace

Now, I’m not saying that we should expect “yes ma’ams” and “hugs” for resolving breakdowns and building high-performance teams But I am saying that we can achieve our greatest success by consistently practicing relational leadership

As noted, leadership author and speaker Simon Sinek says: “We become leaders the day we decide to help people grow, not numbers”

Steve Clabaugh, CLU, ChFC - started his career in insurance as a Field Agent, moving on to Sales Manager, General Manager, Regional Manager, Vice President, Senior Vice President, and President/CEO A long time student of professional leadership, Steve created the Relational Leadership program that has been used to train home office, field sales associates, mid-level managers, and senior vice presidents

TheVoluntaryBenefitsIndustryisenjoyingunprecedented growth.Yourproductshelpemployersattractandkeeptheright employees.

But Did You Know? More than 90% of the time, the reason employees leave has to do with issues related to CULTURE!

Relational Leadership Experience (RLE) can give your clients the tools they need to build or enhance their positive culture.

Find out how RLE can help your clients and add a valuable revenue source for you. Request a copy of our report “RLE and You – A Winning Combination.”

Call, Text or Email: Steve Clabaugh, CLU, ChFC 910-977-5934 | relational.leadership@yahoo.com https://www.relationalleadershipexperience.com/ Relational Leadership Experience – We Build Championship Culture