M A G A Z I N E

Jennifer Daniel Aflac

Jack Holder EBIS

Rachel McCarter Mercer

Mark Rosenthal PwC

Steve Clabaugh CLU, ChFC

Editors

Heather Garbers | Trevor Garbers

Marketing Director

Marin Daniel

For Media and Marketing Requests Contact:

Heather@voluntary-advantage.com

Trevor@voluntary-advantage.com

Mailing Address

10940 S Parker Rd #257 Parker, Colorado 80134

Seif Saghri BenefitHub

Tim Schnoor Birch Benefits

Sydney Consulting Group A d v i s o r y B o a r d

Hunter Sexton, JD, MHA

Michael Stachowiak

From Benefit Administration to Employee Care

Future-Proofing Insurance: The Necessity of Updated Policy Administration Systems

Lifestyle Spending Accounts: Elevating Benefits Towards More Flexibility & Personalization

How Incidental Mentoring Can Change Your Life

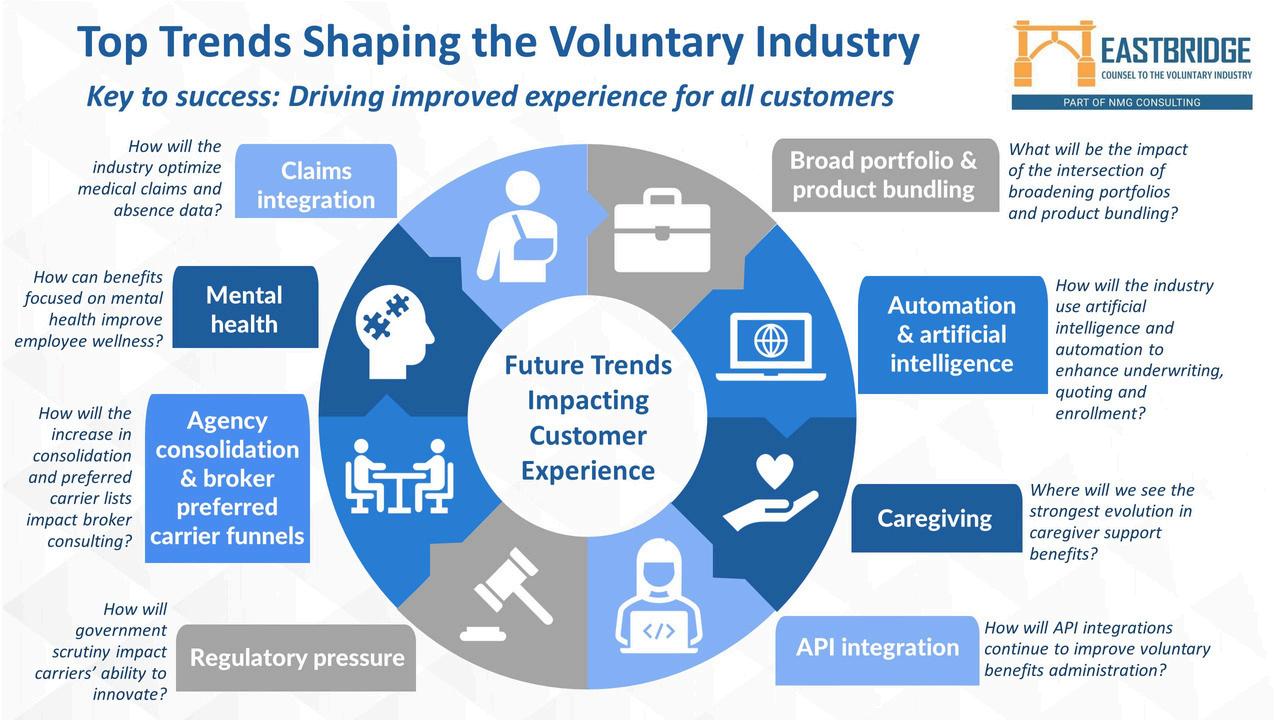

Top Trends Shaping the Voluntary Industry Impact of Economic Factors On Workplace Benefits

The Future of the Voluntary Benefit Industry: Trends and Innovations

While preparing this month’s article, I had the privilege to spend a few days back at our farm with my 83-year-old father who’s a retired farmer Now, don’t let the retired piece fool you. He still wakes the birds up a little before 4:00 a.m., eats his oatmeal, argues with the TV then, like every day ties his work boots up and heads out to his impeccable garden. While home each morning like clockwork as the sun rose, he and I would head down to the garden and we’d water, pull weeds but more importantly we just chatted about life. Now, don’t get me wrong this is by no means a Hallmark movie that I’m portraying because at 47, I was quickly reminded by my father that I still can’t pull weeds the right way, correctly cut grass and my watering skills could vastly improve By the way, I’m pretty sure a few of you reading this right now can fully relate

Yes, I’m joking about silly little things, but it was the discussions we had that really took center stage We discussed everything in life from politics, economy, religion, current events, etc I then asked him a question that made him stop and look up at me – the question waswith everything happening in our country today are you nervous or scared?

Trevor Garbers

With zero hesitation, he replied “if you think our country is worse today than it was yesterday, 50 or 80 years ago, then you’re looking for an easy exit, excuse and not for opportunities!” At this point in the gardening process combined with the look on my father’s face, I didn’t know if I should drop the rake and run, take cover or, man up and continue in this discussion I elected the later where we agreed yes, there is a lot of noise out there today and it’s easy to almost drown yourself in the noise that doesn’t do you and anyone else any good. However, we still live in a country where you can create a billion-dollar housing organization and never own one home (AirBnB), you can build a billion-dollar transportation organization and never own a car (UBER) and, with hard work, grit and determination, the opportunities to succeed in our country today are at an all time high for all of us.

In comparison, right now the absolute same principles are happening in our voluntary benefits marketplace. The top carriers are blocking out the noise all while re-focusing their organizations on the policyholder experience in improving their operations from quote to claim As with the brokerage community, we are building out internal solutions for claims experience, data exchanges, AI and other items that our clients need and demand The list goes on and on!

So yes, my father was right (again), when he respectfully explained to me not to focus on things I can’t handle rather sharpen my focus on what I can handle and be an absolute champion at it and when you perfect this behavior others will take notice and follow suit We all know our time in this world is very limited and we do not get a choice to what year we entered this world nor, what year we will exit However, we all can define that “dash” that so quietly sits between those two dates Like my father at 83, who’s still driven by passion, my goal is very clear in making our marketplace a better place for future generations as I live out my “dash” to the absolute fullest! Here's to cancelling the noise – defining your dash – and living out your dreams to the fullest!

Nick Rockwell President Danielle Lehman Senior Consultant

Eastbridge is the source for research, experience, and advice for companies competing in the voluntary space and for those wishing to enter For over 25 years, they have built the industry’s leading data warehouse and industry-specific consulting practice Today, 20 of the 25 largest voluntary/worksite carriers are both consulting and research clients of Eastbridge.

By Tom Brinton

The voluntary benefit industry is experiencing a transformative shift driven by changing workforce demographics, technological advancements, evolving employee expectations, and product enhancements. Employers seeking to attract and retain top talent need to offer an array of voluntary benefits in order to offer a flexible and comprehensive benefits package Here are key trends and innovations shaping the future of the voluntary benefit industry

In an age where personalization is crucial, employees expect benefits that meet their individual needs and lifestyles As a result, employers are leveraging data analytics and AI to understand employee preferences and offer tailored benefit options Personalized benefits can range from financial wellness programs and student loan repayment assistance to mental health resources and lifestyle benefits such as gym memberships or wellness stipends.

Technology is at the forefront of transforming the voluntary benefit market. Platforms that integrate benefits administration, enrollment, and management are becoming essential. These platforms offer a seamless experience for employees to explore, select, and manage their benefits. Additionally, mobile apps and digital portals provide real-time access to benefits information and decision support tools, making it easier for employees to make informed decisions

Financial stress is a significant concern for many employees, impacting their productivity and overall well-being As a result, financial wellness programs are gaining traction as a vital voluntary benefit Employers are offering tools and resources such as: financial planning, debt management, retirement planning, and emergency savings plans These programs empower employees with the knowledge and resources to achieve financial stability

The importance of mental health has gained widespread recognition, particularly in the wake of the COVID-19 pandemic Employers are increasingly offering mental health benefits, including counseling services, therapy sessions, mindfulness programs, and mental health apps These benefits not only support employee wellbeing but also contribute to a more productive and engaged workforce.

The range of voluntary benefits is expanding beyond traditional offerings. Employers are now providing benefits such as cyber security, health and financial wellness, and genetic testing including prevention and counseling. This expansion reflects the diverse needs of the modern workforce and the desire for benefits that support various aspects of employees’ lives

Educating employees about the value and options of voluntary benefits is crucial for maximizing participation and satisfaction Employers are investing in communication strategies that include informational sessions, webinars, and interactive tools to help employees understand and appreciate their benefits Engaged employees are more likely to take full advantage of the benefits available to them, leading to higher satisfaction and retention rates

The voluntary benefit industry is also influenced by regulatory changes and compliance requirements Employers and benefit providers must stay abreast of evolving regulations to ensure that their offerings remain compliant. This includes understanding tax implications, benefits eligibility criteria, and data privacy concerns. Staying compliant not only avoids legal pitfalls but also builds trust with employees. In particular, the Long-Term Care marketplace has seen significant movement as states consider implementing a program similar to the Washington Cares Act.

Tom Brinton - Tom has been involved in employee benefits for over 20 years and has a strong background in providing brokers and customers with value-based results that specifically promote core EOI values and solutions. His focus centers on providing clients with strategic solutions for their employees, specifically around benefit communications and open enrollment needs. Since joining EOI in 2015, Tom has helped develop the Dallas-Fort Worth market through his work with key broker relationships.

Collaboration between employers, benefit providers, and technology platforms is vital for delivering a comprehensive and cohesive benefits experience

Strategic partnerships can lead to innovative benefit solutions and enhanced service delivery For example, partnering with companies for financial wellness programs or telehealth providers for virtual health services can enrich the benefits portfolio

The future of the voluntary benefit industry is marked by innovation, customization, and a holistic approach to employee well-being. As the workforce continues to evolve, so too will the benefits that support them. Employers that prioritize personalized, technology-driven, and diverse benefit offerings will be well-positioned to attract, retain, and engage top talent in an increasingly competitive landscape. Embracing these trends and innovations will not only enhance employee satisfaction but also contribute to a thriving and resilient workforce

VoluntaryAdvantagehaspartneredwithNABIPtoupdatetheirVoluntary/WorksiteCertificationand itisliveandavailabletoyou24/7virtually.

ThecostoftheVoluntary/WorksiteCertificationcourseis$304.70forNABIPmembersand$401.50fornonmembers,whichincludesonlineinstructioninthreeone-hourwebinarmodules,afinalexamand continuingeducationcredits.Uponcompletion,youwillreceiveacertificateofcompletionas voluntary/worksitecertified.

CourseHighlights:

Mastertheproductwithinnovativesolutions

Understandcontractdifferences

Reviewimplementationandadministration

Obtaincrucialcomplianceinsights

By Ben Yomtoob

Advancements in Benefit Administration technology have been coming fast and furious One of the leading drivers of this change is the Voluntary Benefits industry. If we look at today’s Benefit Administration product roadmaps, we see that much of the innovation taking place is VBdriven and includes things like decision support, APIs and claims nudges.

Employers and brokers have always had a variety of options to support benefit enrollment / administration – among them, standalone Benefit Administration systems, Human Capital Management (HCM) systems that support both benefits and other HR functions, and Enrollment Platforms that are specifically designed to support Voluntary Benefit enrollment In recent years, the industry has seen employers cycling between standalone Ben Admin and HCM in an effort to find the best solution for their employee needs

On one hand, standalone Ben Admin provides a specific capability designed to meet all employee administration needs, including Voluntary Benefits. On the other hand, HCM provides HR with the proverbial “single throat to choke” for all things HR: payroll, HRIS, workforce management AND benefits. That said, HCM systems are notoriously bad at supporting Voluntary Benefits which is why we continue to see the need for Enrollment Platforms for employers that use HCM systems.

The new challenge facing all who support Benefit Administration is this: In today’s world, Benefit Administration by itself is no longer enough Study after study reveals that employees expect much more from their employers than just being able to enroll in benefits Metlife’s 2024 Employee Benefit Trends Study makes clear that “Employee Care” must become the new mantra in employee benefits

Voluntary Benefits that are paired with the right Benefit Administration technology is the foundation for delivering on this new necessity of “Employee Care”

The Ben Admin technology of today is much more focused on administration than care The key evolution we will see in coming years is a movement from “Benefit Administration” to “Employee Care” Many of the building blocks of an Employee Care platform already exist, and success will come to the platform providers who capitalize on this and figure out how to deliver a multi-vendor experience under a single umbrella.

Education and communication are at the core of an Employee Care experience. In today’s world, employees are stuck in a shotgun communication system that provides disparate messages from competing sources such as their employer, carriers and other 3rd parties. The right tools will accomplish the following:

Consolidate the messaging from various sources into a cohesive, practical and easily accessible source of information

Make Employee Care tools visible and available to employees at all times

Prompt employees to make good decisions regarding their health

Encourage use of Employee Care / benefit tools by giving “nudges” to file claims and participate in other activities that improve wellness such as annual physicals and financial planning

Support easy access to provider appointment scheduling, claims data, and other 3rd parties

Recraft benefit education programs to address the “confusion crisis”, where 84% of employees report being confused about their benefits

Communicate with employees through the channels they are most comfortable in, whether it’s mobile messaging, group collaboration tools such as Microsoft Teams and Slack, email, or something else

Leverage AI to evaluate and refine message effectiveness to improve reach

“The key evolution we will see in coming years is a movement from “Benefit Administration” to “Employee Care”. Many of the building blocks of an Employee Care platform already exist, and success will come to the platform providers who capitalize on this and figure out how to deliver a multi-vendor experience under a single umbrella ”

Decision support tools provide helpful insight in guiding employees through the process of choosing benefits Proprietary decision support tools are embedded into many Ben Admin systems today Alternatively, standalone decision support systems are offered by companies such as Nayya and Jellyvision. Going forward, we can expect these systems to receive better AI training and data, which will improve the algorithms that drive the recommendation engine. As these tools analyze and process greater volumes of data, they will be able to provide better insight and more effectively guide employees toward optimal decisions. This may prove to be a double-edged sword for privacy-sensitive employees who dislike software that knows so much about them Ultimately if employees can be assured that the information is being used for their benefit, privacy concerns can be overcome

Wellness / well-being is a continued area of focus for employers and employees There are multiple frameworks for describing what all the constituent pieces are – physical, mental, social, financial, spiritual, intellectual, emotional, and so on Forrester Research does an excellent job of pulling all of these into an overall concept referred to as Employee Actualization. The most effective Employee Care systems will be designed with a priority on fostering Employee Actualization. This in turn will be what ultimately improves productivity, engagement and sense of well-being.

There’s a robust community of providers such as Health Advocate, Accolade, Quantum Health and Healthjoy focused on providing employees with personalized support in navigating complex healthcare systems and improving their healthcare experiences

These capabilities need to be tightly integrated with future Employee Care systems Rather than accessing these capabilities through separate websites and apps, including them in an Employee Care system makes them more accessible.

API capabilities and AI form the technology backbone of supporting future Employee Care systems

API capabilities and AI form the technology backbone of supporting future Employee Care systems Job 1 is to successfully address the benefit industry’s persistent data exchange challenges In a world where Amazoncom can deliver an item ordered in the morning by later that afternoon, the idea that a VB enrollment takes a week or longer to show up in a carrier’s system just doesn’t fly. The good news is that we already know how to fix this: transition from file feeds for data exchange to APIs. The bad news is that we’re all moving much too slowly.

Integrating APIs with existing systems can be technically challenging, especially if legacy systems are involved, as is often the case with insurance carriers In many cases, carriers still need to invest in upgrading or replacing outdated systems to fully leverage the benefits of API integration

The fact that file feeds “work” (sort of) has also slowed down progress The greatest success in APIs have been in areas where file feeds are a bad option – areas such as new product setup and providing evidence of insurability

Integration players such as Noyo, Ideon and Integrate.io can provide strong support in accelerating this process for carriers and Benefit Administration providers.

Beyond data exchange, APIs are also needed to provide a holistic experience for Employee Care system users. While some providers may look to bring all the needed capabilities under one roof, savvy providers will take an ecosystem approach and create software that will allow their clients to choose different vendors for different capabilities For instance, one client may choose Nayya for decision support and Accolade for Personal Assistance and Advocacy, while another might go with Jellyvision and Health Advocate

When it comes to Artificial Intelligence, AI will come into play in multiple areas within Employee Care systems including:

Developing employee-specific insights that can be used in communication and decision support

Effectively communicating to employees in language and terms that are most relatable to them

Delivering customer support experiences for Personal Assistance and Advocacy

The evolution from Benefit Administration to Employee Care represents a significant shift in how organizations will approach employee well-being and engagement This transition reflects the growing recognition that employees expect more comprehensive support from their employers than just managing benefits enrollment

The future of Employee Care platforms will likely involve a multi-vendor ecosystem approach, allowing organizations to customize their offerings based on specific needs. This shift towards a more comprehensive and personalized approach to Employee Care has the potential to significantly improve employee satisfaction, engagement, and overall well-being.

Ben Yomtoob - is the Founder and Lead Consultant at BuckleyRoberts. He has more than 25 years of experience in corporate technology with over 15 years in Employee Benefits and HR Technology Consulting Prior to founding BuckleyRoberts, Ben served as the CEO of Workterra, a Benefit Administration Software and Service company serving mid-market employers Before Workterra, Ben led the HR Technology Consulting practice for carriers, technology providers and investors at Gallagher Benefit Services.

MetLife 2024 Trends Benefit Trends Studyhttps://www.metlife.com/workforceinsights/employee-benefit-trends/

While some providers may look to bring all the needed capabilities under one roof, savvy providers will take an ecosystem approach and create software that will allow their clients to choose different vendors for different capabilities For instance, one client may choose Nayya for decision support and Accolade for Personal Assistance and Advocacy, while another might go with Jellyvision and Health Advocate.

Employee Actualiazation: https://www.forrester.com/blogs/culture-tools-tostay-afloat-in-2024/

By Patrick T. Leary, M.B.A., LLIF

Economic indicators measure the health of the US economy, its businesses and consumers. As such, they also provide insights into the health of the workplace benefits market. A strong and healthy business environment gives employers the confidence to invest in their businesses and offer comprehensive benefits packages to attract and retain workers. A strong economy affords employees the willingness and ability to participate in workplace insurance programs, retirement savings plans and other benefits

While the specter of a recession or economic downturn has loomed for quite some time now, the economy remains strong Bolstered by a strong second half of the year, real gross domestic product (GDP) increased 25 percent in 2023, according to the US Bureau of Economic Analysis (BEA) GDP increased at an annual rate of 143 percent in the first quarter of 2024, according to the most recent estimate provided by the BEA Strong consumer spending continues to lead the way

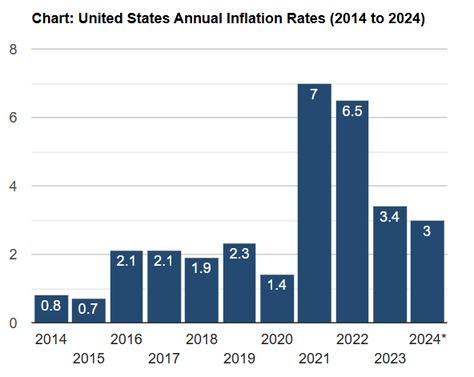

One economic indicator that continues to cause concern is inflation. While the increases in the inflation rate have waned, prices remain high across a range of goods and services. According to LIMRA research, cost and affordability were top of mind with workers as they reviewed their benefits in 2023.

In an inflationary environment, “wallet share” is an important consideration for providers of insurance, retirement and related workplace benefits.

Another form of inflation and a major contributor to the cost of benefits (for both employers and employees) is the cost of health insurance An employee’s share of rising health insurance premiums limits their ability to participate in other workplace benefits, such as retirement savings plans, wellness programs and voluntary benefits

According to the Kaiser Family Foundation, the average annual premium for employer-sponsored health insurance coverage increased 66 percent in 2023 for single coverage and 6.7 percent for family coverage. On average, covered workers contribute 17 percent of the premium for single coverage and 29 percent of the premium for family coverage. Since 2019, health insurance costs are up 17.3 percent, and 16.5 percent for single and family coverage, respectively.

By the end of 2022, the labor market overall had recaptured the job losses experienced during the pandemic and continued its momentum, posting strong growth across most industry sectors in 2023 Through June 2024, the monthly jobs reports published by the Bureau of Labor Statistics continued to show solid gains However, the unemployment rate has slowly increased from 34 percent in January 2023 to 41 percent in June 2024, and June’s report may signal likely interest rate cuts by the Federal Reserve before the end of the year

Wage-based benefits such as life and disability insurance are highly impacted by employment, wage and salary levels. During 2023, the rate of inflation declined to levels below that of wage growth; by mid-year, wage growth was outpacing that of inflation. As is the case with employment growth, wage growth, which has been strong, is also expected to moderate and revert to longterm growth trends as employment slows and falling inflation restrains wage increases.

Over the past several years, new dynamics were introduced to the labor markets, the employment landscape and the world of work The pandemic accelerated many trends already underway with regard to remote work and digital transformation. The Great Resignation created worker shortages, particularly in service-related jobs, as workers stepped back and re-evaluated the meaning of work in their lives and the relationships they desired with their employers. Technology and the breakthroughs of artificial intelligence (AI) are rapidly transforming work and jobs themselves

Source: U.S. Inflation Calculator

Other trends point to encouraging signs for the labor market and opportunities for organizations that sell workplace benefits

The labor force participation rate is increasing, particularly among prime-age workers (25-54) The prime-age labor force participation rate increased from 799 percent in April of 2020 to 836 percent by May 2024, returning to levels not seen since prior to the pandemic. Women’s employment has seen broad improvement. Female workers were disproportionately impacted by the pandemic, taking on childcare and family caregiving more so than their male counterparts. Among women, the labor force participation rate bottomed at 54.6 percent in April 2020. By May of 2024, it had rebounded to 57.6 percent.

After experiencing a drop during the pandemic, the percentage of foreign-born workers continued its longterm upward trend By May of 2024, there were 309 million foreign-born workers in the labor force Foreignborn workers and workers of different ethnic and cultural backgrounds have different, and in some cases, unique needs with regard to insurance and related protection products

The freelance and gig economy continues to grow (Figure 1) According to research conducted by LIMRA and EY, approximately one-third of the workforce participates in the gig economy to at least some extent, with the highest participation among younger workers In five years, up to 29 percent of the workforce may rely on gig work as their primary source of income. The expansion of the gig workforce is a potential growth opportunity for insurers and benefits providers that can develop innovative strategies to supply benefits to these workers, either directly or indirectly.

Economic indicators and the business cycle have a direct impact on the market and opportunities for organizations providing workplace benefits. Broader social and demographic trends also drive change While the world of work continues its transformational shift, one thing remains certain: workplace benefits remain central to employers’ value propositions in the competition for talent

Previously published in LIMRA’s MarketFacts July 2024 digital magazine

Patrick Leary, Corporate Vice President, Workplace Benefits Research - senior research professional and leader focused on workforce benefits. Pat’s team helps organizations develop and enhance their workforce benefits strategies by leveraging researchbased insights

https://wwwbeagov https://wwwlimracom/en/research/researchseries/employee-insights-series/employeeenrollment-in-workplace-benefits/ https://wwwkfforg/health-costs/report/2023employer-health-benefits-survey/ https://fred.stlouisfed.org/series/LNS11300060 https://fredstlouisfedorg/series/LNS11300002 https://www.usinflationcalculator.com/inflation/ current-inflation-rates/

By Heather & Trevor Garbers

When we talk about the future of the Voluntary / Workplace Benefits industry, something the market really hinges on is the capabilities of the administration platforms of the carriers available in the marketplace.

What do I mean by that? When it comes to a certain billing methodology, have you ever heard “we can’t accommodate that”? When it comes to data processing, have you ever heard “this needs to be in our format or it will not process” or “this didn’t process because this field errored out”? Do you work with carriers today that have multiple bills or require multiple file feeds based on product selection? Are you selecting not to work with carriers today because they cannot vest commissions at the member level, or at all? Have you run into plan design limitations or are you confused when a carrier isn’t able to offer claims integration across multiple plans they offer (eg having to file for the same wellness visit three times to account for three different lines of coverage)?

An outdated administrative platform limits the carrier’s ability to be nimble to meet the client’s needs and market expectations, and creates cumbersome processes for the client, the consumer, and even us the broker.

To help us better understand what an administrative platform is, and why it bears so much weight in the overall experience, we’ve interviewed Anthony Grosso, Head of Growth & Marketing / GWB Insurance Markets, with EIS; Denise Garth, Chief Strategy Officer with Majesco; and Arun Kalyanaraman, SVP & GM, L&AH Products with Majesco

Let’s start by explaining what a Policy Administration System (PAS) actually is.

Anthony describes the PAS as the central nervous system of an insurance company, orchestrating processes essential for efficient delivery of insurance It manages distribution, quoting, underwriting, policy administration, billing, claims processing, customer service, and compliance

This platform acts as a hub for data management, workflow automation, and communication, ensuring seamless interactions between insurers, brokers, employers, and members

Per Denise, the PAS is also the system of record for all group and voluntary plans, contracts, members, dependents and certificates for the business of an insurer It provides product design and configuration and plan design configuration, in addition to capturing the data and information for all the plans and products they offer including: policy or contract coverage amounts, benefits and riders, duration of the policy or contract, date of issue, history of the group member’s policies and contracts from enrollment through payout, termination, cancellation, and/or reinstatement.

What impact does an outdated administration platform have on the experience of the client (employer group) and end user (member)?

Anthony - Using outdated administration platforms severely degrades the experience for clients and end users. Employer groups face inefficiencies, increased administrative burdens, and integration challenges, leading to errors and delays, especially in billing, which increases friction. Members experience slow response times, cumbersome claim processes, and limited access to real-time information, leading to uncertainty about coverage and claim status These issues erode trust and satisfaction, ultimately impacting the insurance provider's effectiveness Modern legacy systems, despite being relatively new, lack the cloud-native capabilities needed for today’s dynamic needs and hold carriers back

Arun - Over the last 10-15 years, we have seen a shift in core systems, both in terms of technology and business capabilities, from monolithic core on mainframes to on-premise modern core components that were the start of modernization and transformation programs But most of these programs were painful and expensive, often running over many years and costing tens to hundreds of millions of dollars due to the highly customized, on-premise implementations that have been difficult or nearly impossible to upgrade In addition, too often the older systems that were to be replaced remained in place due to the cost of converting to the new system

The result has been that those legacy systems never went away, remaining the same or growing. The lack of movement in replacing core with next-gen cloud solutions is now causing growing operational and business challenges. These patchwork legacy solutions struggle to leverage the data held to provide meaningful, actionable insight or ingest new data sources to improve decision-making Spending tells a story While insurers recognize that they must address operational costs, they continue spending on legacy with a patchwork of enhancements to try to address today’s market demands But too often, it is throwing good money after bad and not moving forward to the future

Using outdated administration platforms severely degrades the experience for clients and end users

The biggest impact with the outdated admin platforms is the lack of ready to use APIs across all capabilities, an inherent event driven architecture and real time & straight through processing across the business lifecycle. All this not only affects the ability of a carrier to offer a powerful digital experience for the employer or member, but also completely prevents or slows down the ability of the carrier to use new GenAI based tools like Copilot that cannot just leverage the OOTB AI models but also real time transactional data to offer unparalleled customer service and operational efficiencies and effectiveness

What advances in PAS are available today? What questions should Brokers / Consultants be asking to learn about them?

Denise - Next-gen insurance PAS platforms must be designed to meet insurers’ needs of tomorrow, today With the speed and flexibility of cloud, power of embedded advanced analytics, and the limitless possibilities of GenAI, it empowers insurers to accelerate operational optimization and innovation, providing a competitive edge to rapidly launch new products, drive employee productivity, and deliver exceptional customer experiences. It leverages the power of next-gen architecture with native cloud, open APIs, headless, microservices and containerization, and embedded analytics including Gen AI to unlock growth and operational superiority to stay at the forefront of the competition It includes preintegrated customer journeys with an intelligent sales & underwriting workbench to transform new stages of the customer lifecycle, from onboarding and enrollment to automated renewals and individual medical underwriting for worksite and voluntary benefits – and works effectively with brokers

Embedded analytics, and particularly GenAI, enables productivity for tasks and transactions that can take 10-15 minutes on a new moder solution down to 30-60 seconds, providing 10-20 times productivity improvements that accelerate customer servicing, operational processing, and a competitive edge Knowing if a carrier partner’s PAS has access to embedded analytics, will also offer out-of-the-box content and configuration for products, processes, workflows and more to enable speed-toimplementation and use of best practices In addition, it will not only support group and voluntary benefits it should also support worksite and individual, allowing for portability and sale of individual products outside of the enrolment period for group and benefit products for employees Given the shift in employee demographics, this becomes increasingly important to not only retain the employer but also employees who port or buy individual products in addition to state mandated COBRA coverages where applicable.

Because today’s workforce is rapidly changing, with major implications for group and voluntary benefits insurance, the state of play in the market, from both employer benefits and customer needs, is highly dynamic posing new questions for employers and insurers alike Group and voluntary benefits increasingly are a key factor to attract and retain talent, fueling a demand for existing and new, innovative products The need for innovation around group and voluntary benefits for changing needs and lifestyles are what is needed and expected to succeed in today’s market, regardless of the size of the business. Elevating the insurance business operation with a next-gen, intelligent technology foundation built on a robust cloud-native architecture is now a must-have to compete in today’s marketplace.

Anthony - Today’s administration platforms,, incorporate cutting-edge technologies such as microservices, APIs and artificial intelligence These platforms offer real-time data integration, predictive analytics for proactive decision-making, and enhanced user interfaces for a more intuitive experience Brokers and consultants should inquire about the platform’s cloud-native capabilities, its ability to integrate seamlessly with existing systems, scalability, level of automation, and how it leverages data to enhance decisionmaking and user experience The characteristics of the platforms of tomorrow include:

API-First: By prioritizing APIs, these platforms ensure seamless integration with other systems and services, allowing for a more cohesive and interconnected ecosystem. This facilitates smoother data exchange and interoperability, which are critical for efficient operations.

Cloud-Native: Built specifically for cloud environments, these platforms offer unparalleled scalability, reliability, and accessibility Cloud-native platforms can handle large volumes of data and traffic with ease, ensuring high performance and uptime This is especially important during those peak enrollment seasons

Headless: This architecture decouples the backend services from the front-end user interface, providing greater flexibility in delivering customized user experiences across different devices and channels Thereby meeting clients and members with true digital experiences that they’ve grown to expect

Modern legacy systems, despite being relatively new, lack these crucial characteristics They are often monolithic, difficult to integrate, not designed for cloud environments, and limited in their ability to deliver flexible user experiences This makes them ill-equipped to meet the evolving demands of the voluntary benefits market

Brokers and consultants should ask the following questions to evaluate the capabilities of modern platforms:

"Is your platform built using a microservices architecture?"

"How does your platform support API-first integration with other systems?"

"Can you describe how your platform leverages cloud-native technologies for scalability and reliability?"

"Does your platform utilize a headless architecture to provide flexible and customized user experiences?"

"How does your platform support an eventdriven design to address the scalability limitations of modern legacy systems?"

By asking these questions, brokers and consultants can ensure they are partnering with carriers that offer advanced, future-proof solutions capable of transforming the voluntary benefits landscape

How can an updated PAS assist the member with a streamlined claim process?

Anthony - An updated administrative platform can revolutionize the claim process, making it more streamlined and user-friendly. By automating routine tasks and utilizing AI-driven insights, these platforms significantly reduce the time and effort required to process claims. Members benefit from faster claim approvals, real-time status updates, and a more transparent process. Features such as digital document submission, automated notifications, and integrated customer support channels enhance member satisfaction and reduce frustration Additionally, with all modules across underwriting, admin, billing and claims working from the same set of data, errors are greatly reduced leading to increased customer satisfaction and a heavy reduction in leakage

Arun - Claims should provide flexible, simplified, and straight-through processing (STP) first automation capabilities, allowing insurers to streamline the entire claims lifecycle for a wide range of insurance products – from simple to complex - including eligibility checks, benefit applicability, claims summary, and post-submission claim form editing. The wide range of insurance products such as dental, life, vision, accident, long-term care, disability, critical illness, hospitalization, and more, would be supported in a simplified, STPfirst, and automated claims operating environment that offers extensive calculation and payout options for benefit amounts, payment schedules, adjustments, overpayments, delayed claim interest, and OFAC checks

The end-to-end claims management, from intake to settlement and payment, would manage appeals, reopen claims, hold/release claims, void claims, resubmit claims, and archive claims efficiently with single-point-ofchange functionality as well as provide access to a comprehensive 360-degree dashboard based on the embedded analytics for each claim, allowing a unique cross-LOB claim view, effective discrepancy management to align claim data with policy, and an event center to monitor claims timelines and action plans. Finally, it would provide an exceptional customer experience through digitally enabled claims handling that empower claims adjusters to meet the evolving expectations of policyholders

Finally, it would provide an exceptional customer experience through digitally enabled claims handling that empower claims adjusters to meet the evolving expectations of policyholders

Lastly, the new age administrative systems should be able to take the data in the form of a real-life event, probe further through reflexive questioning and automatically derive the nature of claims that are applicable, validate the ones that the claimant has coverages for and automatically trigger the claims process for all eligible coverages continuing on to real time settlement of the claims without any manual intervention.

What innovations do you expect PAS to be able to bring to the marketplace in the future?

Denise & Arun - As the group and voluntary benefits industry accelerates transformative change, demand for exceptional and speed to value capabilities provided by next-generation intelligent core platforms are vital Key innovations include:

Embedded analytics, including GenAI

Use of IoT devices for wellness and underwriting of products

New products for Gig workers that turn on and off benefits

Use of new sources of data with AI/ML models across the value chain from underwriting to billing and claims

Digital billing options including Venmo, bitcoin and more

Anthony - Looking ahead, we anticipate administration platforms will continue to evolve, driven by advancements in cloud technology and the increasing demand for personalized experiences Future innovations may include several interconnected advancements:

Hyper-Personalization: Using advanced data analytics to tailor benefits offerings and communication based on factors other than traditional underwriting, such as lifestyle

Medical Integration: Seamless integration with medical claims systems to automatically detect and pay voluntary coverages, enhancing the member experience and addressing regulatory concerns.

Enhanced Mobility: Greater mobile integration for instant access to benefits information and services.

Proactive Health Management: Leveraging IoT and wearable technology for proactive health insights and personalized wellness programs

Seamless Ecosystem Integration: Integrating with a broader ecosystem of health, wellness, and financial services for a holistic approach to member well-being

These innovations will streamline administrative processes and transform member interactions, leading to a more engaged and satisfied user base. However, this transformation begins with adopting the right core administrative platform one that serves as the interconnected foundation of a comprehensive ecosystem. Organizations that embrace this advanced technology will gain a significant advantage over those still relying on outdated, modern legacy systems.

Denise Garth, Chief Strategy Officer, Majesco – Denise has been named to the 30 Most Powerful Women in Business: The Titans of Industry in 2024 by International Business Times, InsurTech Influencer Making Waves inaugural winner, a Top 50 Women in SaaS in 2020 and 10 Women in Fintech to know in 2022 She leads the company’s strategy, marketing, industry relations, and innovation in support of Majesco’s clientcentric strategy With both P&C and L&A insurance experience, Garth has also authored research and articles grappling with the key issues and opportunities facing the insurance industry

Anthony Grosso, Head of Growth & Marketing / GWB Insurance Markets, EIS - Tony has over 25 years of hands-on experience leading innovation, business development, product and marketing across all sectors of the insurance industry Tony is leading the GWB market for EIS, a high growth company, helping Voluntary Benefits insurers to achieve their ambitious plans and incredible potential

un Kalyanaraman, SVP & GM, L&AH Products, Majesco – Arun is responsible for e entire product lifecycle, from product strategy, management, solution & design, gineering and customer support, for the L&AH lines of business He specializes in terprise architecture, Group benefits and individual life business segments and stribution management

By Mark Head

The buzz for Lifestyle Spending Accounts (LSAs) is mirroring their nigh-on meteoric rise in both interest and actual implementation That two recent reports on LSAs come in at 34 and 59 pages speaks to how these plans are rapidly transforming employers’ and consultants’ approach to increasing employee satisfaction and engagement by better addressing employee stress and frustration across diverse lifestyles and rapidly-changing needs.

The dynamics of the employer-employee relationship continue evolve and shapeshift in both expected and unexpected ways. One thing, however, is still crystal clear: employers are keen on meeting employees’ increasing demands for more flexible and comprehensive benefits packages. According to 2024 Lifestyle Spending Accounts Benchmark Report by Forma (citing a Mercer study), 70% of employers are considering adding an LSA to their benefits package

That’s both remarkable – and not so surprising –given that the entire industry continues to grapple with the growing gap between traditional health insurance and the holistic well-being needs of employees. LSAs offer a versatile solution, addressing various aspects of wellness, from physical and mental health to financial well-being and family care.

One of the most compelling advantages of LSAs is their flexibility. Unlike Health Spending Accounts (HSAs) and Flexible Spending Accounts (FSAs), which are heavily regulated, LSAs are largely unregulated, so it’s much easier to tailor them to meet the diverse needs of the employees at any given company, as well as the diverse needs of the employers themselves

Whether well-being-oriented stipends, work-fromhome allowances, family care support, pet care, or even caregiving, belonging and connection, LSAs can handle them all.

According to the JOON LSA Report 2024, the flexibility of LSAs enables employers to consolidate multiple benefit categories under one umbrella, providing a seamless and user-friendly experience for employees This consolidation not only reduces administrative overhead but also increases employee engagement by offering benefits that are truly valuable to them

The ability to personalize benefits through LSAs plays a crucial role in enhancing employee satisfaction and reducing stress The JOON report highlights that a successful LSA program can significantly impact workforce engagement and appreciation. For example, companies that implement LSAs often see improvements in employee responses to engagement surveys, with higher scores in areas such as recommending the company as a great place to work and believing that their managers genuinely care about their well-being.

Furthermore, LSAs help alleviate the stress associated with rigid and complicated benefits programs Traditional pre-tax benefits, while offering tax advantages, often come with a host of regulations and limitations that can be frustrating for employees LSAs, in contrast, provide a straightforward and adaptable benefits solution Employees can use their benefits as needed without worrying about restrictive merchant lists or pre-determined contribution limits

Incorporating psychographic insights into how LSAs are offered (and evaluated) can significantly enhance their perceived value By understanding the attitudes, interests, and lifestyles of employees, employers can tailor benefits that resonate on a deeper level with the diverse world views and attitudes of their employees.

For instance, employees interested in wellness might value gym memberships and mindfulness apps, while those focused on professional development may prefer stipends for courses and certifications

Then, there’s the opportunity for truly new business intelligence by mining into LSA enrollment and utilization patterns, broken out by employees’ psychographic profiles How valuable would it be to know that the types that want to “be in charge” are 2x more likely to use lifestyle and holistic well-being benefits Or that those whose families are their top priority spend 3x every other type on work-from-home, flex-time and caregiving benefits? By aligning benefits with employees’ personal goals and interests, LSAs become more relevant and appreciated. This alignment not only boosts utilization but also strengthens the emotional connection employees have with their employer, which can translate in stronger trustand support-based cultures.

Most employers actively seek to design plans that enhance employee engagement, improve retention, and attract top talent. And they want their consultants to be proactive in helping them select and configure the right mix of programs to do just that LSAs’ broad flexibility and personalization capabilities are fueling this dramatic rise in excitement, and shortening the decision time frames for implementing them

According to the Forma report, LSAs can be implemented with as little as 1% of existing payroll, offering a high return on investment Metrics such as productivity boost, retention rate, and accelerated time-to-hire all improve when LSAs are part of the benefits package The JOON report emphasizes the importance of utilizing modern LSA technologies that offer a card-connected experience, making it easier for employees to use their benefits and for employers to administer the program.

While accident, hospital indemnity, critical illness and life with long-term care may still be the “standard VB chassis,” so to speak, LSAs can function as a turbocharger: employees can get “exactly what they need and want for today”, while backstopping tomorrow’s risks with more traditional VBs – which, as we all know, are also evolving at a much more rapid pace than just a few years ago. Add in AI, APIs, and claims integration to recommendation and decision support tools, and wow. This ain’t your father’s old sedan.

LSAs provide a unique opportunity to expand data analytics capabilities around employee uptake and utilization patterns. By analyzing how employees use their LSAs, employers can gain insights into what benefits are most valued and identify trends and preferences within the workforce This data can be correlated with Social Determinants of Health (SDOH) to better understand how different factors such as socioeconomic status, education, and environment impact benefit utilization

Employers and consultants can use these insights to calibrate core health plans and traditional voluntary benefits more precisely For example, if data shows a high uptake of mental health services through LSAs, employers might consider enhancing mental health coverage in their core health plans.

Similarly, if LSAs reveal a strong interest in fitness and wellness programs, companies can introduce more comprehensive wellness initiatives

Implementing an effective LSA program requires careful planning and execution The JOON report outlines several best practices for creating, launching, and administering LSAs:

Analyze Workforce Needs - Conduct surveys and one-on-one conversations to understand the unique needs and preferences of the workforce This ensures that the benefits offered are aligned with employee priorities

Keep It Simple - Start with a straightforward program, focusing on popular categories such as health and wellness. Avoid overcomplicating the program with too many rules and restrictions.

Set Appropriate Allowances - Offer sustainable allowances that enable employees to actively engage in the program. Monthly "use it or lose it" allowances are particularly effective in encouraging employees to prioritize their wellness

Remove Friction - Ensure that the benefits program is easy to use and free from administrative burdens Avoid requiring proof of usage or attendance, which can signal distrust and reduce engagement

Continuously Iterate - Regularly analyze utilization and feedback to fine-tune the program Pilot new benefits with a subset of employees before rolling them out companywide

As employers continue to navigate the challenges of a competitive labor market and evolving employee expectations, LSAs are poised to become a cornerstone of modern benefits programs. Their inherent flexibility and personalization capabilities make them an ideal solution for addressing the diverse needs of today's workforce By adopting LSAs, employers can not only enhance employee satisfaction and engagement but also build a more productive and motivated workforce

As they integrate psychographic insights and advanced data analytics, both CHROs and CFOs will better understand the psychological and social factors that influence employee behavior This will take core, voluntary, and LSA plan designs and complementarities to the next level Companies can not only meet, but exceed employee expectations, create increasingly targeted and customizable benefit portfolios, and increase the relevance and value of their employee experience across increasingly diverse workforces.

As core, voluntary and LSA data is increasingly correlated to SDOH data, employers will gain a closerto-360-degree view of factors influencing employee health and well-being, leading to more informed decision-making and better resource allocation

Lifestyle Spending Accounts are perhaps the most promising new pathway for transforming voluntary benefits By delivering flexibility, personalization, and ease of use, LSAs help employers and benefit consultants achieve their goals while providing employees with the support they need to thrive As more organizations recognize the value of LSAs, these accounts will undoubtedly play a pivotal role in shaping the future of employee benefits The integration of psychographic insights and data analytics further enhances the potential of LSAs, enabling employers to create more precise, effective, and impactful benefits programs that drive engagement, satisfaction, and overall well-being, all of which are critical to shaping the future of employee benefits.

https://helpjoonio/hubfs/JOON%20LSA%20Report%202024pdf

Mark Head, President, Benefit Personas - - Mark Head has 40+ years of experience in insurance, employee benefits, health management and engagement methodologies. He focuses on innovation, strategy, business culture, business intelligence and analytics, as well as sales and marketing Starting as an independent benefits consultant, he moved into the well-being industry in 2001, and was a co-founder and Chief Solutions Officer of Viverae – now a part of Virgin Pulse / Personify Health In 2015, he established BenefitPersonas™ in recognition of the need to drive increased enrollment and engagement in benefit programs He works with enrollment firms, consultants and other benefit vendors to develop personalized, values-based communications using behavioral science and psychographic profiling.

By Steve Clabaugh, CLU, ChFC

Sam Walton, founder of Walmart, was famous for his constant connection to his stores, employees and customers He was known to show up at warehouses, bringing coffee and donuts, to talk with the truck drivers about their routes, stores they delivered to and relationships with the managers and employees they interacted with. In his travels around the country to inspect the stores, he often greeted and chatted with employees as they arrived for work. In this way, he learned more about their experience and concerns than he could have just from reviewing daily, weekly, monthly and yearly business results (which he also watched closely) And he didn’t neglect the customer’s perspectives; he spent time talking with shoppers and hearing their compliments, concerns and ideas

Sam’s practices not only demonstrate his commitment to staying in close contact with his business, but illustrates the deliberate practice of,, what I have come to call, Incidental Mentoring Certainly, Sam knew more about how to run a successful superstore than his drivers, employees, managers or customers

But he kept his mind open to constantly learning from those who were vital to his business world

We define Incidental Mentoring as the serendipitous experience of a mentor learning valuable lessons from their mentees. In this context the lessons learned are often as valuable, or more so, than those being taught by the mentor. The experience of incidental mentoring isn’t limited to businesses; it can occur in commercial and charitable organizations or the community at large. And it can have life changing impact for the mentor and the mentee

Recently some companies have begun utilizing what is referred to as “reverse mentoring ” The concept is to pair a senior leader with a lower ranking employee to give the leader the opportunity to learn what the work environment is among the general workforce It is not certain whether this approach will be beneficial in the long-term, but it does reinforce the idea that it is important for leaders to understand that they can gain valuable knowledge from those they are leading

Here is a story of a recent personal experience of Incidental Mentoring (told in 3rd person for ease of storytelling) that has powerfully impacted my life

Steve and Harry were residents of a retirement community in North Carolina Harry had some serious questions about life and faith that he had been wrestling with for many years Since Steve had a background in a faith-based tradition he agreed to help Harry address his concerns. Each week they met over coffee and discussed many things including faith, family, friends and more. They both shared beliefs, doubts, concerns and more than a few laughs (more about the laughs soon). In the process they became close friends, and in fact, very close friends.

One day, Harry didn’t show up for coffee at the appointed time He had fallen the night before and broke his hip At age 93 this is a very serious problem Over the next 5 months Harry had 4 major surgeries, intensive physical and occupational therapy to try and help him recover During this time Steve visited him daily both in the hospital and the nursing home as he transitioned back and forth Their interaction during each of the four trips to the hospital demonstrates some of the depth and joy of their relationship

1st Surgery - Steve smiling (upon arriving at Harry’s room): “Harry, if you didn’t want to have coffee with me you could have just said so instead of doing this.”

Harry smiling: “I’ve been trying – you just didn’t get it.”

2nd Surgery - Steve smiling: “I tried to tell you that you can run but you can’t hide – I will find you”

Harry smiling: “I guess I’m going to have to try harder”

3rd Surgery - Harry laughing: “You again!” Then to the medical staff treating him as Steve entered the room: “Can’t you people do something to keep him out of here?”

Steve laughing: “They tried their best but I slipped through the blockade”

Harry Sandgren

4th Surgery – in ICU early in the morning following surgery

Steve: “Good morning Harry – I told you I would always find you.”

Harry: “I knew you would find a way to come. Thank you”

Despite the best efforts of Harry and his health care team, he experienced great pain as his physical and mental health began to decline Over time he lost the ability to provide even the most basic of his physical needs and he began to experience periodic hallucinations Throughout the process, as he became more and more helpless and confused, his friend Steve was there with him to try and provide some comfort and personal support They were together early in the morning of the day Harry passed away In those last moments together, Harry was lucid and they held hands and prayed together, as their wives sang some of his favorite hymns.

At Harry’s funeral, his family shared recollections about his life as a husband, dad and decorated Air Force pilot. They told the story of Steve and Harry and of their gratitude for this precious friendship and how much it had been a help to Harry.

When they asked Steve to share some of his thoughts about their relationship. Steve’s response was that theirs was not a one-way mentor –mentee relationship. In fact, Steve believed he had been the one who learned the most. He had always hated dealing with the reality of death and had concerns about how to handle his own ultimate end of life experience. “The truth is,” he said, “Harry taught me how to deal with pain, fear, humiliation and finality with grace and dignity. He never stopped being an encouragement to the health care staff, friends and family He taught me how to finish well This is a lesson I will never forget and that I hope will help me when my time comes”

The primary cause of incidental mentoring is the commitment, on the part of the mentor, to building a true relationship with the mentee and not just checking off the boxes of subjects to be covered There is so much that we can learn and benefit from if we are open to learning from each other regardless of age, position, experience or knowledge And again, incidental mentoring isn’t just valid in a business context, as you can see from the story of Steve and Harry, it can be found in all types of interpersonal relationships

Just like me, mentors can gain a wealth of personal, practical and sometimes life changing knowledge from incidental mentoring. If an organization teaches and promotes the concept it can help to build a positive culture that can respond effectively to changes in the marketplace and society. I hope that you will be deliberate about seeking opportunities to benefit from incidental mentoring. As always, please feel free to contact me if you have questions or would like to discuss how relational leadership can benefit your organization or that of your employer clients.

Steve ChFCstarted his career in insurance as a Field Agent, moving on to Sales Manager, General Manager, Regional Manager, Vice President, Senior Vice President, and President/CEO A long time student of professional leadership, Steve created the Relational Leadership program that has been used to train home office, field sales associates, mid-level managers, and senior vice presidents

In-person, online and combination

To learn more about Relational Leadership Experience Contact: Steve Clabaugh, CLU, ChFC at sjcsr@hotmail.com or 910-977-5934