The Evolving Benefits BrokerEmployer Relationship By Ron Neyer, M.B.A., AIRC, CLU, ChFC

Employee benefits brokers are valued, but their role is evolving rapidly toward strategic services. This was one of five megatrends emerging from the landmark “Harnessing Growth and Seizing Opportunity” research jointly conducted by LIMRA and EY in 2021. Many signs at that time suggested that brokers were bringing a more strategic approach to clients and quickly embracing changes to remain in step with changing client needs. Market dynamics have further evolved over the past two years. As COVID-19-specific concerns have faded, many of the prominent workforce trends accelerated by the pandemic remain. These include the use of independent contractors, the rise of the gig economy and the emergence of remote and hybrid work arrangements. New worker needs also surfaced, particularly in areas such as mental, financial and physical wellness. How do brokers fit into today’s ecosystem?

Current Picture LIMRA and EY partnered again earlier this year to uncover current workplace benefit trends. We surveyed 830 private U.S. employers with at least 10 employees. Roughly 4 in 5 of these businesses currently work with an outside broker/benefits advisor for assistance with their insurance benefits. Most employers highly value these relationships, with about 70% very or extremely satisfied with the services provided by their broker (a rating of “6” or “7” on a 7-point scale). They also expect to continue working with their benefits professionals, with 35 percent anticipating a greater reliance on brokers in five years’ time (again a top-two rating on a 7-point scale; up from 26% in 2021).

Once a differentiator, digital benefit platforms are now table stakes in the fading-pandemic landscape. While different sources provide technology to employers, more than 2 in 5 now use broker-provided platforms for their insurance benefits — either solely or alongside a carrier or third-party provided platform. These employers express higher satisfaction levels with benefit platforms coming from their advisor compared to similar tools provided by carriers or third parties, with 7 in 10 very or extremely satisfied. Over half expect to be at least somewhat more reliant on broker technology in five years.

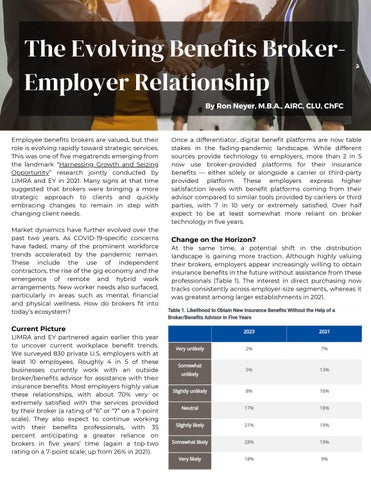

Change on the Horizon? At the same time, a potential shift in the distribution landscape is gaining more traction. Although highly valuing their brokers, employers appear increasingly willing to obtain insurance benefits in the future without assistance from these professionals (Table 1). The interest in direct purchasing now tracks consistently across employer-size segments, whereas it was greatest among larger establishments in 2021.