5 minute read

The Evolving Benefits Broker-Employer Relationship

By Ron Neyer, M.B.A., AIRC, CLU, ChFC

Employee benefits brokers are valued, but their role is evolving rapidly toward strategic services. This was one of five megatrends emerging from the landmark “Harnessing Growth and Seizing Opportunity” research jointly conducted by LIMRA and EY in 2021. Many signs at that time suggested that brokers were bringing a more strategic approach to clients and quickly embracing changes to remain in step with changing client needs.

Market dynamics have further evolved over the past two years. As COVID-19-specific concerns have faded, many of the prominent workforce trends accelerated by the pandemic remain. These include the use of independent contractors, the rise of the gig economy and the emergence of remote and hybrid work arrangements. New worker needs also surfaced, particularly in areas such as mental, financial and physical wellness. How do brokers fit into today’s ecosystem?

Current Picture

LIMRA and EY partnered again earlier this year to uncover current workplace benefit trends. We surveyed 830 private US employers with at least 10 employees. Roughly 4 in 5 of these businesses currently work with an outside broker/benefits advisor for assistance with their insurance benefits. Most employers highly value these relationships, with about 70% very or extremely satisfied with the services provided by their broker (a rating of “6” or “7” on a 7-point scale). They also expect to continue working with their benefits professionals, with 35 percent anticipating a greater reliance on brokers in five years’ time (again a top-two rating on a 7-point scale; up from 26% in 2021).

Once a differentiator, digital benefit platforms are now table stakes in the fading-pandemic landscape. While different sources provide technology to employers, more than 2 in 5 now use broker-provided platforms for their insurance benefits either solely or alongside a carrier or third-party provided platform. These employers express higher satisfaction levels with benefit platforms coming from their advisor compared to similar tools provided by carriers or third parties, with 7 in 10 very or extremely satisfied. Over half expect to be at least somewhat more reliant on broker technology in five years.

Change on the Horizon?

At the same time, a potential shift in the distribution landscape is gaining more traction. Although highly valuing their brokers, employers appear increasingly willing to obtain insurance benefits in the future without assistance from these professionals (Table 1). The interest in direct purchasing now tracks consistently across employer-size segments, whereas it was greatest among larger establishments in 2021.

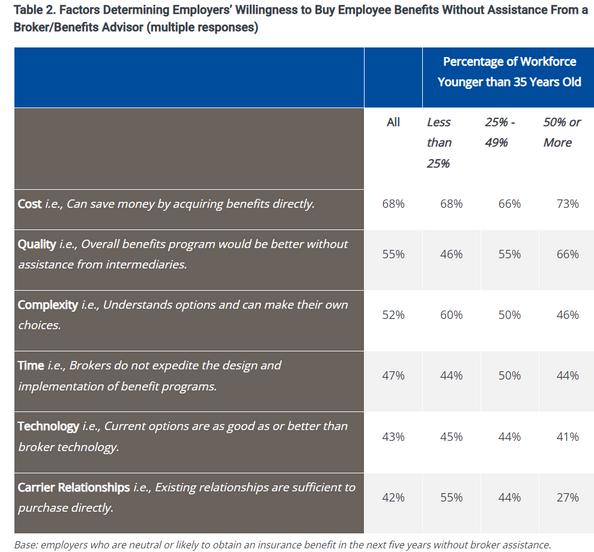

It seems that employers are sending mixed signals. Many expect to develop deeper relationships with brokers over time, so why would they consider a self-directed approach regarding their benefits plans? Several factors are in play, with potential cost savings being the top rationale. (Table 2).

However, this growing independent mindset appears deeply rooted. More than half feel that the quality of their overall benefits program could improve without assistance from intermediaries. Businesses with higher percentages of younger employees are most inclined to feel this way. Their workers likely have greater interest in newer types of offerings such as wellness programs, student loan assistance and paid family leave. While many brokers are undoubtedly currently discussing these options with clients, some longer-tenured professionals may be reluctant, preferring to focus on the traditional insurance plans.

A slightly lower majority of employers are comfortable with their market knowledge and ability to make benefits decisions. These businesses tend to have lower concentrations of young workers and are longer tenured. While brokers likely helped them make decisions in the past, they now feel empowered to make changes on their own.

Time, technology and carrier relationships also factor into the growing willingness of employers to shop for insurance benefits without assistance from a broker. Again, no significant differences emerge based on group size for the various motivations for exploring a direct approach. Employers are also contemplating this arrangement for a wide array of benefit types. While medical is most often cited, many are also interested in testing the waters for core nonmedical insurance plans and/or supplemental options.

Implications

Looking ahead five years, the broker-employer relationship will remain deep and continue to evolve. This puts pressure on benefits professionals to continuously enhance their skill sets and strategies to maximize their value to clients. Employers’ needs are changing, and they expect more help from advisors in some areas and require less assistance in others. The brokers who embrace a strategic approach, and focus on helping clients with emerging, high-value tasks such as navigating digital tools and new benefit options will continue to thrive, at the expense of those clinging to older, more transactional models. To remain a trusted resource, brokers need to understand how employers expect the future of benefits to unfold.

Originally published in LIMRA LOMA MarketFacts digital magazine, December 2023

Ron Neyer, M.B.A., AIRC, CLU, ChFC, Associate Research Director, Workplace Benefits Research LIMRA and LOMA - is an experienced and well-respected research professional, specializing in the distribution of workplace insurance benefits. His work at LIMRA LOMA allows their member financial services companies to monitor industry trends and formulate marketing strategies.