Overall Campaign Performance - Leisure Interim

FY24 Leisure Interim - HOT Funds (October ‘24 - December ‘24)

FY24 Leisure Interim - HOT Funds (October ‘24 - December ‘24)

KPI FY24 Leisure Interim (HOT)

SPEND $420,066

ENGAGEMENTS 5,589,869

COST PER ENGAGEMENT $0.08

INQUIRIES 13,138

COST PER INQUIRY $31.97

*Spend includes paid digital + paid social + paid search. Excludes media tech.

October ‘24 - December ‘24

Impressions

October ‘24 - December ‘24

Campaign

39,982,415 Impressions $0.05 CPE

Cost Per Engagement

Impressions Goal: 31,471,536

Delivery CPE Goal: $0.08 Engagements Goal: 5,589,869

8,375,362 Engagements

Our Leisure Interim campaign CPE outperformed goal coming in 37% more efficient than anticipated, allowing us to deliver 2.8M more engagements than projected. We delivered over 39.9M total impressions throughout the campaign across all channels. Goals are determined by examining historical performance, vendor benchmarks and industry standards.

Website visits, video completions, and 3rd party content all count towards engagements to demonstrate success against creating engagement with content and moving consumers to seek out vacation planning information.

Leisure Interim (HOT) Campaign Goal Delivery

Click Through Rate

$26.25 CPI

Cost Per Inquiry

16,035 Inquiries Inquiry Goal: 13,138 CPI Goal: $31.97 0.38% CTR

Digital Benchmark: 0.07% - 0.10% Our CTR significantly outperformed the digital benchmark by 3-5X.

We ended the campaign with a CPI that was 18% more efficient than goal due to reaching a highly engaged and relevant audience through effective targeting strategies. Across all channels, we delivered 16K inquiries at an efficient CPI of $26.25. Goals are determined by examining historical performance, vendor benchmarks and industry standards.

Inquiries are inclusive of actions take on the Corpus Christi website to learn more or start the vacation planning process (i.e. outbound partner referral clicks, contact form submissions, visitor guide downloads).

Leisure Interim (HOT) Campaign Added Value

$44,232

MMGY delivered an estimated $44,409 worth of added value impressions on top of what was contracted with media partners.

*Observed data

● Dallas/Fort Worth, Houston and Charleston, SC were the top markets in regard to driving media engagements

● Columbus, OH most efficiently drove engagements during this time period with a $0.04 CPE

● 7 of the 13 top DMAs either matched or outperformed overall Leisure Interim CPE

FY24 Leisure Interim - HOT Funds (Oct ‘24 - Dec ‘24)

Partner - Google Ads/Bing (Microsoft Ad)

Leisure: October 2024 - December 2024

About/Approach

● Focus on incremental keywords and identify new queries and search trends

● Utilize new Google and Microsoft Ads features and ad types

● Look for untapped keyphrases – lower than market value

● Dominate competitors through granular targeting Performance Highlights

● 16.9% Goal Conversion Rate

● 14,536 total Key Events

● 86,132 clicks

● $0.67 CPC ($1.92 Travel Industry average)

● 1,280 keywords driving impressions

● Ads on Google.com, Bing.com, and their partners

● Discovery ads on Android devices

● Remarketing Lists and Similar Audiences

● Utilizing All Appropriate Ad Extensions on Google & Bing

FY24 Leisure Interim - HOT Funds (Oct ‘24 - Dec ‘24)

Over the past year, paid social has raised awareness, drove traffic to the Visit Corpus Christi website and inquiries from Meta lead forms.

● Meta and Pinterest together were able to generate 21.2M impressions at an average CPM of $3.83 which is more efficient than our projected goal of $5.

● There were 46,802 link clicks with an average CPC of $1.73. Meta was the higher traffic driver due to its lower CPC which was driven by retargeting efforts.

● 138K engagements were garnered at a $0.59 CPE which is in line with industry standard. Meta also drove a higher video completion rate, with a total of 87K video completions.

● This year paid social drove 746 inquiries at a $109.11 CPI which is on par with our outlined goal.

Inspire | Trip Ideas

CPM: $2.01

Impressions: 940,687

FY24 Leisure Interim - HOT Funds (Oct ‘24 - Dec ‘24)

Oct ‘24 - Dec ‘24

● Our paid media efforts drove a $0.04 CPE, outperforming our $0.05 goal for HOT funds portion of the FY24 Leisure Interim campaign.

●

● Spotify was the top performer for engagements with the most efficient CPE of $0.02.

●

● Digilant was the only partner to deliver inquiries for this campaign, which was expected.

●

● Digilant also drove the strongest CTR of all partners at 0.15%.

● The 160x600 banner drove the most efficient CPE, while the 300x250 achieved the best CPI for the campaign.

●

● Unsurprisingly, video creative drove the highest volume of engagements.

○ The You're Home - Clean B :15 spot was the best performer for video completion rate.

○ The You're Home - Clean A :15 spot delivered a higher web engagement rate and more efficient CPI compares to the other two videos.

●

● Connected TV platforms accounted for the most efficient CPE, while desktop placements drove more efficient CPIs.

○ Excluding video completions, desktop was the top performer for CPE.

Within Terminal addressable placements, all five personas drove the same CPE - largely due to high video completion rates.

When looking at action taken on site, Unbound Urbanites were the most efficient audience for both engagements and inquiries.

Roaming Boomers came in better than average for both goals, through the Upscale Adventurers audience performed similarly for CPE.

➔ 11.2M impressions served across tactics

➔ $0.06 CPE; 1.8M engagements

➔ $147.05 CPI; 753 inquiries

➔ 0.15% CTR

● Native Terminal Addressable drove the most efficient CPE and highest CTR, followed by Native - Terminal Modeled

● Top performing geos included San Antonio, Dallas, Austin, Houston, Chicago, Minneapolis, Kansas City, Oklahoma City, Denver, and Harlingen-Weslaco-Brownsville-McAllen

● Top performing domains included Yahoo, New York Post, AccuWeather, MSN, Dailymotion, and People

● Our audience is interested in electronics, cooking, reading and home decor

*Overall FY24 insights (across all Digilant media)

➔ 4.1M impressions served across tactics

➔ $0.02 CPE; 4M engagements

➔ 0.05% CTR

● The Roaming Boomers audience drove the highest ACR and most efficient CPE of all placements

● Desktop drove the highest CTR and most efficient site CPE

➔ 2.2M impressions

➔ $0.04 CPE; 2.2M engagements

● Top genres of programming included sports, news and entertainment

● The top networks were ABC, Fox and CBS

● Our audience spent the most time watching NFL Football, College Football and 60 Minutes

FY24 Leisure Interim - TPID Funds (October ‘24 - September ‘24)

KPI FY24 Leisure Interim (TPID)

COST PER ENGAGEMENT $0.48

INQUIRIES 548

COST PER INQUIRY $200.69

*Spend includes paid digital + paid social. Excludes media tech.

October ‘24 - December ‘24

Spend Goal:

Impressions Goal: 11,186,409

October ‘24 - December ‘24

Leisure Interim (TPID) Campaign Goal Delivery CPE Goal:

11,186,409 Impressions

$0.30 CPE Cost Per Engagement

369,114 Engagements

Engagements Goal: 227,833 Impressions Goal: 10,728,257

Due to MMGY’s media oversight, CPE came in at 38% more efficient than goal, achieving 141K more engagements than projected. We delivered 458K bonus impressions during this time period with our campaign advertising. Goals are determined by examining historical performance, vendor benchmarks and industry standards.

Website visits, video completions, and 3rd party content all count towards engagements to demonstrate success against creating engagement with content and moving consumers to seek out vacation planning information.

Leisure Interim (TPID) Campaign Goal Delivery

0.39% CTR

Click Through Rate

Digital Benchmark: 0.07% - 0.10%

Cost Per Inquiry

621 Inquiries

Inquiry Goal: 548 CPI Goal: $200.69

Our TPID campaign also outperformed goal for inquiries, CPI coming in 11% lower than our projected goal. This is a result of delivering 73 more inquiries than expected. Goals are determined by examining historical performance, vendor benchmarks and industry standards.

Inquiries are inclusive of actions take on the Corpus Christi website to learn more or start the vacation planning process (i.e. outbound partner referral clicks, contact form submissions, visitor guide downloads).

Leisure Interim (TPID) Campaign Added Value

$3,202

MMGY delivered an estimated $3,194 worth of added value impressions on top of what was contracted with media partners.

● Dallas/Fort Worth, New York, and Houston were the top markets in regard to driving media engagements

● Phoenix most efficiently drove engagements during this time period with a $0.10 CPE

● All DMAs, with the exception of Texas DMAs, either matched or outperformed overall TPID Interim CPE

FY24 Leisure Interim - TPID Funds (Oct ‘24 - Dec ‘24)

Over the past year, paid social has raised awareness, drove traffic to the Visit Corpus Christi Merry Days website and inquiries from Meta lead forms.

● Meta was able to generate 2M impressions at an average CPM of $4.94 which is more efficient than our projected goal of $8.

● There were 22K link clicks with an average CPC of $0.45.

● 34K engagements were garnered at a $0.29 CPE.

● This year, paid social drove 129 inquiries at a $77.52 CPI which is on par with our outlined goal.

FY24 Leisure Interim - TPID Funds (Oct ‘24 - Dec ‘24)

Oct ‘24 - Dec ‘24

● Paid media came in at a CPE of $0.30, outperforming our $0.47 goal for the TPID funds portion of the FY24 Leisure Interim campaign

●

● Sojern drove the most efficient CPE of the campaign, coming in at $0.09

●

● Paid media ended the campaign short of inquiry goal, our CPI coming in at $202.65 vs our $182.45 goal

●

● Sojern was also the top performer for CPI at $94.10

●

● Expedia delivered strong performance against clicks to site with a CTR of 0.14%

● The 300x250 size generated the most efficient CPE and CPI for the TPID campaign. The 300x50 size was the next best performer for CPE, while the 300x600 was the next best performer for CPI.

● Looking at video creative, the You’re Home :15 spot achieved a higher video completion rate as well as a lower CPI than the :30 spot.

○ Both creatives delivered the same CPE, though the shorter video accounted for a site engagement rate 2x that of the :30 video.

● Desktop drove the most efficient CPE, while mobile delivered the more efficient CPI, but these devices performed similarly.

○ Looking only at on-site engagements, mobile was the top performer for CPE.

608.1K impressions served across Expedia, VRBO, and Hotels.com

$22.25 CPE; 927 engagements

$528.90 CPI; 39 inquiries

0.14% CTR

● The campaign achieved an overall 1.8:1 ROAS

● $32.0K in gross booking was generated as a result of this campaign

● Expedia had the highest performing ROAS, followed by Hotels.com

● Expedia had the highest gross booking, followed by Hotels.com

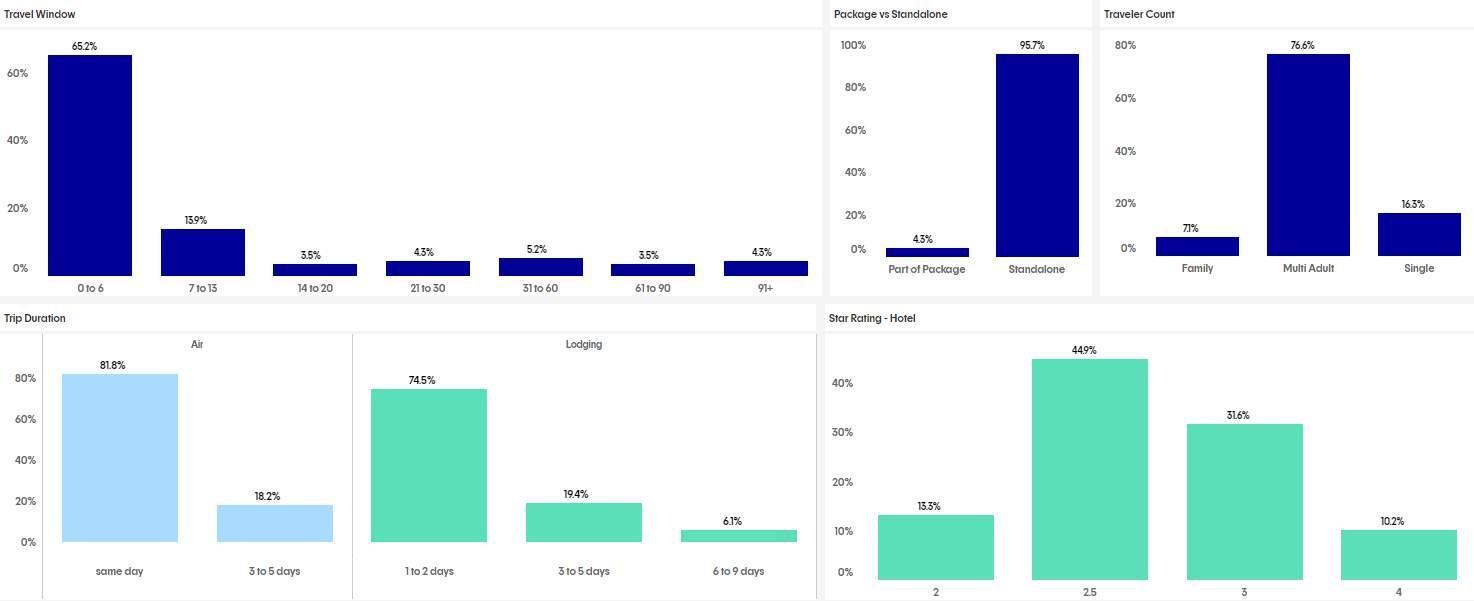

● The most popular travel window was 0 - 6 days, resulting in over 65% of total bookings

○ 7 - 13 days was the next most popular travel window at 13.9%

○ 31 - 60 days came in at 5.2%

○ 21 - 30 days came in at 4.3%

○ 91+ days came in at 4.3%

● Nearly 75% of all trips were 1 - 2 days in duration, followed by 3 - 5 days at 19%, and 6 - 9 days at 6%

● There were more multi-adult bookings than family or single bookings meaning more friends or couples trips were booked than family trips and solo trips

➔ 3.8M impressions served

➔ $0.09 CPE; 314K engagements

➔ $94.10 CPI; 309 inquiries

➔ 0.04% CTR

● $11,520 in travel bookings for a 0.46:1 ROAS

● $96,624 in foot traffic for a 3.86:1 ROAS

● 6 flights booked and 119 rooms booked as a result of the Sojern campaign

● Travelers who booked a flight to Corpus Christi came from Houston, Austin, Chicago, Miami, and Philadelphia

● Travelers who booked a room in Corpus Christi came from Houston, San Antonio, Dallas, Austin, Beaumont-Port Arthur, Wichita-Hutchinson, Harlingen-Weslaco- Brownsville-McAllen, Abilene-Sweetwater, Chicago, and Denver

➔ 2.0M impressions served

➔ $2.01 CPE; 14.9K engagements

➔ $3,000.00 CPI; 10 inquiries

➔ 0.83% CTR

● Between the different weather conditions, the clear weather creative performed the best for CTR

● The top performing weather trigger was ForecastUnseasonably Cold & Dry

● The top 5 performing DMAs were Austin, San Antonio, Houston, Ft. Smith-Fayetteville-Springdale-Rogers, and Waco-Temple-Bryan

➔ 2.6M impressions served across tactics

➔ $4.76 CPE; 4.2K engagements

➔ $149.25 CPI; 134 inquiries

➔ 0.07% CTR

● Top performing geos included San Antonio, Dallas, Austin, Houston, Chicago, Minneapolis, Kansas City, Oklahoma City, Denver, and Harlingen-Weslaco-Brownsville-McAllen

● Top performing domains included Yahoo, New York Post, AccuWeather, MSN, Dailymotion, and People

● Our audience is interested in electronics, cooking, reading and home decor

*Overall FY24 insights (across all Digilant media)

October ‘24 - December ‘24

$32.0K

In Expedia revenue driven directly through paid media advertising $108.1K In Sojern-reported travel bookings and foot traffic driven directly through paid media advertising

Our paid media tactics with Sojern drove $11,520 in travel bookings and $96,624 in foot traffic, resulting in a 0.46:1 ROAS for travel bookings and a 3.86:1 ROAS for foot traffic.

Paid media through Expedia has directly contributed to total of 17 tickets and 221 room nights booked in Corpus Christi, resulting in a 1.8 ROAS.

Sojern saw their highest advance purchase window at 0 - 7 days with the majority of trips lasting 1 - 3 days. Expedia saw their highest advance purchase window at 0 - 6 days with the majority of trips lasting 1 - 2 days.

THANK YOU. LET’S DISCUSS.

○ Goals are determined based on a mix of historical performance, seasonality trends, and partner benchmarks.

○ CTR is based on a blend of industry standards - it is the total number of clicks divided by the number of impressions, then turned into a percentage

○ CPE is based on estimated amount of engagements per partner dependent on media spend, impression volume and tactic. It’s calculated by spend divided by engagement (video completions, site actions, custom unit interactions, etc.). We want CPE to be as low as possible to demonstrate efficiencies through media buying power and optimizations.

○ CPI is based on estimated amount of inquiries per partner dependent on media spend, impression volume and tactic.

●

○ CPM = Cost Per 1,000 Impressions

○ CTR = Click Through Rate

○ CPE = Cost per engagement. Site visits to landing pages, video completions and social post activity are examples of metrics that count toward engagements to demonstrate success against creating engagement with content and moving consumers to seek out vacation planning information.

○ CPI = Cost per inquiry. Inquiries - eNewsletter opt ins, Guide Download/request, Coast Your Own Way pass downloads/sign ups, etc.

○ CPC = Cost Per Click

○ Link Click = When a user clicks the link in an ad or post

○ Landing Page View = When a user who clicks a link successfully views the landing page after it loads.

○ Reactions = Interactions with social media posts/ads such as Like, Love, Care, Haha, Wow, Sad and Angry.

○ Reach = Total number of people exposed to messaging

○ Impressions = How many times the an ad was delivered to users.

○ Net New = Users exposed to messaging who have never been exposed previously

○ Frequency = The average number of times each person saw your ad.

○ Engagement Rate = The total number of engagements divided by the number of impressions, then turned into a percentage