Form

990

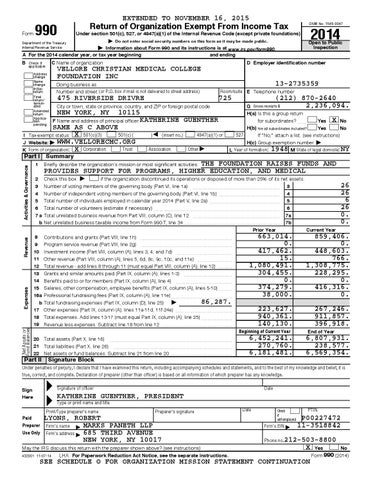

EXTENDED TO NOVEMBER 16, 2015

Return of Organization Exempt From Income Tax

OMB No. 1545-0047

| Do not enter social security numbers on this form as it may be made public.

Open to Public Inspection

2014

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations)

Department of the Treasury Internal Revenue Service

| Information about Form 990 and its instructions is at www.irs.gov/form990. A For the 2014 calendar year, or tax year beginning and ending

B

C Name of organization

Check if applicable: Address change Name change Initial return Final return/ terminated Amended return Application pending

Doing business as Number and street (or P.O. box if mail is not delivered to street address)

475 RIVERSIDE DRIVRE

Activities & Governance Revenue Expenses

13-2735359 Room/suite E Telephone number

725

City or town, state or province, country, and ZIP or foreign postal code

NEW YORK, NY

10115

F Name and address of principal officer:KATHERINE

SAME AS C ABOVE 501(c) ( I Tax-exempt status: X 501(c)(3) WWW.VELLORECMC.ORG J Website: | Trust K Form of organization: X Corporation Part I Summary

Net Assets or Fund Balances

D Employer identification number

VELLORE CHRISTIAN MEDICAL COLLEGE FOUNDATION INC

GUENTHER

) § (insert no.) Association

4947(a)(1) or Other |

(212) 870-2640 2,236,094.

G H(a) Is this a group return for subordinates? ~~ H(b) Are all subordinates included? Gross receipts $

Yes X No Yes No 527 If "No," attach a list. (see instructions) H(c) Group exemption number | Year of formation: 1948 M State of legal domicile: NY L

THE FOUNDATION RAISES FUNDS AND PROVIDES SUPPORT FOR PROGRAMS, HIGHER EDUCATION, AND MEDICAL

1

Briefly describe the organization's mission or most significant activities:

2 3 4 5 6 7a b

Check this box | if the organization discontinued its operations or disposed of more than 25% of its net assets. 26 Number of voting members of the governing body (Part VI, line 1a) ~~~~~~~~~~~~~~~~~~~~ 3 26 Number of independent voting members of the governing body (Part VI, line 1b) ~~~~~~~~~~~~~~ 4 6 Total number of individuals employed in calendar year 2014 (Part V, line 2a) ~~~~~~~~~~~~~~~~ 5 26 Total number of volunteers (estimate if necessary) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 6 0. Total unrelated business revenue from Part VIII, column (C), line 12 ~~~~~~~~~~~~~~~~~~~~ 7a 0. Net unrelated business taxable income from Form 990-T, line 34 •••••••••••••••••••••• 7b Prior Year Current Year 663,014. 859,406. Contributions and grants (Part VIII, line 1h) ~~~~~~~~~~~~~~~~~~~~~ 0. 0. Program service revenue (Part VIII, line 2g) ~~~~~~~~~~~~~~~~~~~~~ 417,462. 448,603. ~~~~~~~~~~~~~ Investment income (Part VIII, column (A), lines 3, 4, and 7d) 15. 766. Other revenue (Part VIII, column (A), lines 5, 6d, 8c, 9c, 10c, and 11e) ~~~~~~~~ 1,080,491. 1,308,775. Total revenue - add lines 8 through 11 (must equal Part VIII, column (A), line 12) ••• 304,455. 228,295. Grants and similar amounts paid (Part IX, column (A), lines 1-3) ~~~~~~~~~~~ 0. 0. Benefits paid to or for members (Part IX, column (A), line 4) ~~~~~~~~~~~~~ 374,279. 416,316. Salaries, other compensation, employee benefits (Part IX, column (A), lines 5-10) ~~~ 38,000. 0. Professional fundraising fees (Part IX, column (A), line 11e)~~~~~~~~~~~~~~ 86,287. | Total fundraising expenses (Part IX, column (D), line 25) 223,627. 267,246. Other expenses (Part IX, column (A), lines 11a-11d, 11f-24e) ~~~~~~~~~~~~~ 940,361. 911,857. Total expenses. Add lines 13-17 (must equal Part IX, column (A), line 25) ~~~~~~~ 140,130. 396,918. Revenue less expenses. Subtract line 18 from line 12 •••••••••••••••• Beginning of Current Year End of Year 6,452,241. 6,807,931. Total assets (Part X, line 16) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 270,760. 238,577. Total liabilities (Part X, line 26) ~~~~~~~~~~~~~~~~~~~~~~~~~~~ 6,181,481. 6,569,354. •••••••••••••• Net assets or fund balances. Subtract line 21 from line 20

8 9 10 11 12 13 14 15 16a b 17 18 19 20 21 22

Part II

Signature Block

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge.

= =

Sign Here

Signature of officer Type or print name and title

Print/Type preparer's name

Paid Preparer Use Only

Date

KATHERINE GUENTHER, PRESIDENT Preparer's signature

LYONS, ROBERT MARKS PANETH LLP Firm's name 685 THIRD AVENUE Firm's address NEW YORK, NY 10017

9 9

Date

Check if self-employed

Firm's EIN

9

PTIN

P00227472 11-3518842

Phone no.212-503-8800

May the IRS discuss this return with the preparer shown above? (see instructions) ••••••••••••••••••••• 432001 11-07-14 LHA For Paperwork Reduction Act Notice, see the separate instructions.

X

SEE SCHEDULE O FOR ORGANIZATION MISSION STATEMENT CONTINUATION

Yes No Form 990 (2014)