WIND FARMS AND HYDROGEN HUBS ISO 30415 TO INTEGRATE DE&I ESG COMPETENCE – BOARDS OF DIRECTORS FLAG STATES APPLIED RISK GREEN STEEL ASSURANCE VEFF – THE DNV EMPLOYEE ASSOCIATION VEFF MAGAZINE 2023 VEFF//23

Cyber security is a journey and a process of constant adaptation as attack vectors keep changing. DNV is growing a significant cyber security business to help our customers manage the risk. Applied Risk

The VEFF magazine is produced by employees in DNV and sponsored by VEFF union, which is a union for DNV employees.

© VEFF 06-2023

Editor: Nina Ivarsen

Front cover photo: Barbara Schoon responsible for Country Communications in The Netherlands

Back cover photo: Nina Ivarsen

Design and print: Aksell

Decent work is good for society and for business

NINA IVARSEN, CHAIR VEFF

Decent work involves employment that is productive and delivers a fair income. It should also ensure workplace security, social protection, prospects for personal development and social integration.

Social sustainability is about identifying and managing business impacts, both positive and negative, on people. The quality of a company’s relationships and engagement with its stakeholders is critical. Directly or indirectly, companies affect what happens to employees, workers in the value chain, customers, and local communities, and it is important to manage impacts proactively. We are looking at challenges and opportunities that colleagues work with in DNV and will try to give insight and highlights of this in this magazine.

Union chairs like myself, like to discuss geopolitical issues because these issues can have a significant impact on our members and the industries they represent. Geopolitical issues can affect international trade, labor laws, and regulations, which can impact the working conditions and job security of union members.

For example, if a union represents workers in a business area, changes in trade policies or tariffs can affect the demand for their products and ultimately impact their jobs. Similarly, changes in immigration policies can impact the availability of workers in certain industries and markets, which can affect working conditions of union members. In addition, geopolitical issues can also impact the global economy and financial markets, which can have a ripple effect on DNV and our workers around the world.

Union chairs need to stay informed about these issues to advocate for their members and ensure that their rights and interests are protected. Discussing geopolitical issues can help us to stay informed about the broader economic and political landscape and make informed decisions that benefit our members and the businesses.

Climate change

Climate change is one of the biggest geopolitical challenges the world is facing today, and our experts will play a critical role in developing and implementing solutions to mitigate its impact. This includes developing renewable energy sources, improving energy efficiency, and reducing greenhouse gas emissions.

I EDITORIAL I

2

As the world becomes increasingly interconnected, we as a company together with colleagues will face several geopolitical challenges in the years ahead.

2

Nina Ivarsen, Chair VEFF

Green steel is produced using renewable energy sources, such as wind and solar power, instead of fossil fuels. This eliminates the carbon emissions associated with traditional steel production, which relies heavily on coal and other fossil fuels. Green steel is still in the early stages of development, but it has the potential to revolutionize the steel industry and significantly reduce its impact on the environment.

Blue hydrogen, on the other hand, is produced using natural gas, but with the carbon emissions captured and stored underground. This process is known as carbon capture and storage (CCS), and it has the potential to significantly reduce the carbon footprint of hydrogen production. Blue hydrogen can be used as a fuel for transportation and other applications, and it has the potential to replace fossil fuels in a number of industries.

EDITORIAL

8 Tackling emerging industrial cyber threats – Applied Risk

12 The Netherlands is making significant strides towards a greener future through the development of hydrogen hubs

15 ESG competence in the boardroom: What are we seeing?

19 The EU Taxonomy: A Deep Dive

23 How well are top teams set up for success?

26 Folkehelseforeningen: Occupational health

28 Profit Share

29 Compliance: Conflict of interest

30 The potential of green steel in decarbonization

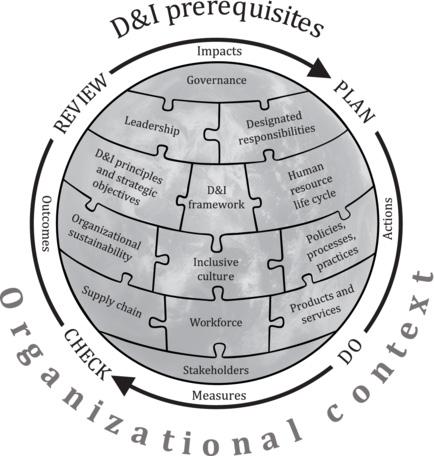

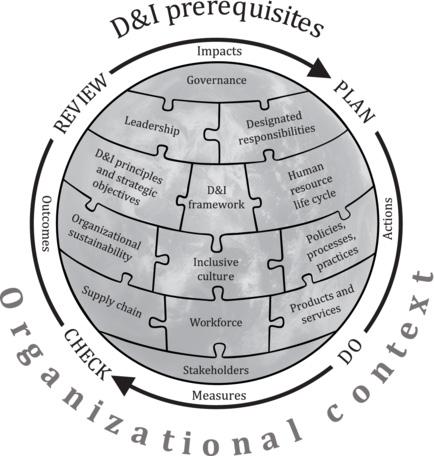

34 How can customers use ISO 30415 to integrate DE&I into their operations, and how can DNV support this journey?

37 The flag states and why they are important to DNV

40 Interview: Espen Erstad

42 Time to celebrate

43 Join VEFF today!

However, there are still significant challenges to overcome, including the high cost of renewable energy and the need for large-scale infrastructure to support these technologies. Nevertheless, with continued investment and innovation, these technologies could play a critical role in the transition to a more sustainable and low-carbon economy where DNV is an important contributor.

You can read about Green Steel Assurance and Windfarms and Hydrogen hubs in articles in this magazine.

2

Climate change is one of the biggest challenges facing the world today, and the steel industry is one of the largest contributors to greenhouse gas emissions. However, there are two emerging technologies that could help to reduce the industry’s carbon footprint: green steel and blue hydrogen.

Both green steel and blue hydrogen are promising technologies that could help to reduce the carbon footprint of the steel industry and other industries that rely heavily on fossil fuels. We meet with colleagues that works with this in the Netherlands when the Board of Directors visited this spring, Nina Ivarsen.

I CONTENTS I

3

Cybersecurity

With the increasing reliance on technology, cybersecurity has become a major concern for governments and businesses around the world. We as a company have developed new technologies and systems to protect against cyber threats and ensure the security of critical infrastructure.

Cybersecurity is a critical area of concern for individuals, businesses, and governments alike. With the increasing reliance on digital technologies, the risk of cyber-attacks and data breaches has become more significant than ever before.

This can include implementing firewalls, antivirus software, and other security measures to protect against cyber-attacks.

It can also involve training employees on best practices for cybersecurity, such as using strong passwords and avoiding phishing scams, like we do in DNV today. One of the biggest challenges in cybersecurity is the constantly evolving nature of cyber threats. Hackers and cybercriminals are constantly developing new tactics and techniques to breach security systems and steal data. As a result, it is essential to stay up to date on the latest threats and vulnerabilities and to implement proactive measures to mitigate those risks.

Another important aspect of cybersecurity is the need for collaboration and information sharing. Cyber-attacks can have far-reaching impacts, and it is essential for businesses to work together to share information and resources to prevent and respond to cyber threats.

Cybersecurity and applied risk are critical areas of concern in today’s digital age. By identifying potential vulnerabilities and implementing proactive measures to mitigate those risks, businesses and governments can help to protect against cyber-attacks and safeguard sensitive data.

Collaboration and information sharing are also essential to staying ahead, you can read more about this in the article Applied Risk and meet the founders of the company Applied Risk that is now a part of DNV.

Resource scarcity

As the global population continues to grow, the demand for resources such as water, food, and energy will increase. To tackle these challenges we need to develop new technologies and systems to ensure the sustainable use of these resources and reduce waste.

As the global population grows and economies expand, the demand for resources increases, putting pressure on natural ecosystems and depleting finite resources. Climate change is also exacerbating resource scarcity, as rising temperatures and changing weather patterns affect the availability of water and agricultural productivity.

I EDITORIAL I

Applied risk is a concept that refers to the process of identifying and mitigating risks in a specific context. In the context of cybersecurity, applied risk involves identifying the potential vulnerabilities in a system or network and implementing measures to mitigate those risks.

Resource scarcity is a growing concern, as the global population continues to grow and demand for resources increases. Resource scarcity refers to the limited availability of natural resources, such as water, food, energy, and minerals, which are essential for human survival and economic growth. One of the main causes of resource scarcity is overconsumption and wastefulness.

4

Resource scarcity can have significant economic, social, and environmental impacts. It can lead to higher prices for essential goods and services, as well as increased competition for resources, which can lead to conflict and instability. Resource scarcity can also exacerbate poverty and inequality, as those who are most vulnerable are often the ones that will be hardest hit by resource shortages.

It is also important to promote international cooperation and collaboration to address global resource challenges. By adopting sustainable practices and promoting international cooperation, we can work towards a more equitable and sustainable future with our customers and stakeholders.

#ClimateChange is undoubtedly the defining issue of our time.

I EDITORIAL I

To address resource scarcity, it is essential to adopt sustainable practices that promote resource conservation and efficiency. This can include investing in renewable energy sources, promoting sustainable agriculture and water management practices, and reducing waste and consumption.

5

Nina at the Board of Directors dinner in Amsterdam.

Urbanization

The world’s population is increasingly concentrated in urban areas, which presents several challenges for how we look at the world. These include developing sustainable infrastructure, improving transportation systems, and reducing the environmental impact of urbanization.

Urbanization refers to the process of the growth and expansion of cities and towns, as people move from rural areas to urban areas in search of better economic opportunities and improved living standards. Urbanization is a global phenomenon, with more than half of the world’s population now living in urban areas.

Urbanization has significant economic, social, and environmental impacts. On the one hand, urbanization can lead to increased economic growth and development, as cities become centers of innovation, trade, and commerce. Urban areas also tend to have better access to education, healthcare, and other essential services, which can improve the quality of life for residents.

However, urbanization also has its challenges. Rapid urbanization can lead to overcrowding, congestion, and pollution, which can have negative impacts on public health and the environment. Urban areas also tend to have higher levels of inequality, with marginalized communities often living in slums or informal settlements with limited access to basic services.

To address the challenges of urbanization, it is essential to adopt sustainable urban planning and development practices. This can include investing in public transportation, promoting mixed-use development, and creating green spaces and parks to improve the quality of life for residents. It is also important to address the root causes of urbanization, such as rural poverty and lack of economic opportunities, to reduce the pressure on urban areas.

Political instability

Political instability and conflict can have a significant impact on engineering projects, particularly in regions where there is a high risk of violence or instability. Engineers will need to work closely with governments and other stakeholders to ensure the safety and success of their projects in these regions.

Political instability is a significant concern for many businesses also for us, and there are several factors that could contribute to it going forward. One of the primary drivers of political instability is economic inequality. When a significant portion of the population feels left behind or marginalized by economic growth, it can lead to social unrest and political instability. Another factor that could contribute to political instability is the rise of populist movements. Populist leaders often appeal to people’s fears and frustrations, and they may use divisive rhetoric to gain support. This can lead to polarization and social unrest, particularly if these leaders are elected to power.

Globalization and the increasing interconnectedness of the world can also contribute to political instability. As countries become more reliant on each other for trade and other economic activities, they may be more vulnerable to external shocks, such as economic downturns or political crises in other countries.

Climate change and environmental degradation could also contribute to political instability. As natural disasters become more frequent and severe, they could lead to social unrest and political instability, particularly in countries that are already struggling with economic or political challenges.

To address these challenges, it is essential to promote inclusive economic growth and reduce economic inequality. Governments must also work to address the root causes of populism and polarization, such as social and economic exclusion.

I EDITORIAL I

6

Urbanization is a complex and multifaceted phenomenon that has both positive and negative impacts. By adopting sustainable urban planning and development practices, we can work towards creating more livable and equitable cities that promote economic growth and improve the quality of life for all residents. Our business area - Management system certification, supply chain and product assurance work with services that involves urbanization, such as, food and beverage, aquaculture, automotive and aerospace, ICT and medical technology and healthcare.

Geopolitical issues are important to discuss because they have a significant impact on DNV and its workers. Geopolitics refers to the study of how geography, politics, and economics intersect and influence each other. Geopolitical issues can have far-reaching consequences, such as affecting international trade, security, and human rights. By discussing geopolitical issues, we can gain a better understanding of the complex factors that shape our world and the challenges that we face as a global community in DNV. It can also help us to identify potential solutions to these issues and work towards a more peaceful and prosperous future for all. Do you have topics you like to discuss, please contact us at veff@dnv.com

Some DNV highlights from 2022:

• Emerging from the pandemic, Baby Boomers approaching retirement are susceptible to employment risks, volatility i

• The number of employees at DNV as of 31 December 2022 was 12,708.

• In 2022 we welcomed six acquired companies into DNV from the energy, health, and business assurance sectors.

• During 2022 DNV published a Human rights statement to underscore our commitment to advancing human rights across our operations and value chain.

• In 2022 we reduced our carbon footprint by -50 % (on 2019 baseline).

• We investigated carbon capture and storage projects and are now part of the Seaweed Carbon Solutions project.

• At the end of 2022, the DNV-classed fleet stood at 10,291 vessels and mobile offshore units, totaling 283.8 million gross tons. With 18% of the total world fleet measured by gross tonnage, DNV retained its position as the world’s largest classification society.

Some VEFF highlights from 2022:

• We are approximately 800 members.

• The salary negotiations for 2022 was influenced by uncertainties, but we ended up with a frame of 6,5 % to be distributed.

• We did report on salary-discrimination (+/- 5% deviation) and discrimination at work and the findings was minor compared to common standards.

• All together we have helped more than 70 individual members and had about 10 cases with help from our legal team.

The following are members of the Central Board in VEFF:

• Nina Ivarsen, Chair

• Lin B. Karsten, Deputy Chair

• Ivar Magnus Næsset, Board Member

• Andreas Herzog, Board Member

• Marit Kvale Thom, Board Member

Overall, we will need to be adaptable and innovative to address these and other geopolitical challenges in the years ahead. We will need to work closely with governments, businesses, and other stakeholders to develop solutions that are effective, sustainable, and socially responsible.

I EDITORIAL I

7

The VEFF board. From top left to bottom right: Andreas Hertzog, Nina Ivarsen, Lin B. Karsten, Marit Kvale Thom, and Ivar Magnus Næsset.

Tackling emerging industrial cyber threats – Applied Risk

Under the guardianship of the Accelerator business area, we are building a cutting-edge industrial cyber security business that helps our customers outpace new threats posed to the critical infrastructure that society depends on.

Our cyber security growth journey began in February 2021 with a small team of DNV cyber security experts based in Norway. By the end of the year, DNV had acquired Applied Risk, a specialist industrial cyber security company headquartered in the Netherlands. In 2022, the cyber security unit from our Maritime business area joined the Accelerator. Within two years, our cyber security business had grown to more than 100 people.

“Cyber security will play an important role in DNV's growth story as we work to make our company 45% bigger by the end of 2025. Bringing together an impressive team of industrial cyber security experts from Applied Risk and the Accelerator's Cyber Security unit is the first step in our plan to build a cyber security powerhouse through acquisitions and partnerships with top-tier cyber security firms around the world," said Liv Hovem, CEO, the Accelerator, DNV.

When the Board of Directors in DNV visited Amsterdam, I met with Jalal Bouhdada, DNV’s Global Segment Director for Cyber Security and Founder of Applied Risk, Auke Huistra, Managing Director of Applied Risk, and Jules Vos, Director of OT Cyber Security Services at Applied Risk.

TEXT: NINA IVARSEN

Jules Vos, Director of OT Cyber Security Services

Jalal Bouhdada, Global Segment Director for Cyber Security at DNV and Founder of Applied Risk

Auke Huistra, Managing Director

Cyber security is a journey and a process of constant adaptation as attack vectors keep changing. DNV is growing a significant cyber security business to help our customers manage the risk.

8

Alongside our growing team of industrial cyber security experts, they are playing an important role in helping our customers to manage new risks emerging from digital transformation.

DNV cannot deliver on our purpose of safeguarding life, property, and the environment in an increasingly digitalized world without further addressing cyber security aspects of our customers' assets and processes. That’s why we have placed cyber security at the heart of the company’s growth strategy.

Nina Ivarsen with Auke Huistra.

9

Assets such as windfarms, oil and gas infrastructure, ships, manufacturing facilities, and medical equipment are at a higher risk of new forms of cyber-attack as their control systems become increasingly networked and connected. Recovery from an attack can cost organizations hundreds of millions of dollars, and companies face increasing pressures to comply with tighter regulations.

Moreover, attacks are becoming increasingly dangerous. Technology research firm Gartner predicts that cyber-criminals will go beyond making attacks for financial gain this decade and will progressively weaponize industrial control systems to cause harm to human life. Adding to this challenge is the fact that 60% of organizations with industrial operations are not yet aware of where their technologies are vulnerable.

With unrivaled knowledge and experience in the industrial cyber security world, our cyber security experts draw on expertise multiple industrial sectors and their related critical infrastructures, including maritime energy, water management, healthcare and manufacturing. The team enables our customers to identify their cyber security vulnerabilities, build effective measures of defence and demonstrate their security posture to stakeholders.

Dr. Stephan Lechner

Dr. Stephan Lechner, Coordinator for Cyber Security in the Energy Sector at the European Commission

Based in Luxembourg, Dr. Lechner is Director of Euratom Safeguards at the European Commission’s Directorate General for energy. He also coordinates the policy activities for the European Commission on cybersecurity in the energy sector.

He managed international expert teams in Germany and in China and has more than 25 years of experience in collaborative European projects. He holds a degree in mathematics and computer sciences and a doctoral degree in cryptography.

10

During the Board’s visit to Amsterdam, we were joined by key customers for an inspiring session with Jalal Bouhdada and Dr. Stephan Lechner, Coordinator for Cyber Security in the Energy Sector at the European Commission, on key trends emerging on this increasingly important topic.

Jalal Bouhdada

Jalal Bouhdada – Global Segment Director for Cyber Security at DNV and Founder of Applied Risk

Jalal is the founder of Applied Risk, a DNV company, and serves as DNV’s Global Segment irector for Cyber Security. Jalal is recognized as a global thought leader on industrial control systems (ICS) security and critical infrastructure protection. He is an active member of several professional security societies and has coauthored ICS security best practice guidelines for ENISA and the ISA 99.

Here is a short summary from the presentation with Jalal Bouhdada and Dr. Stephan Lechner:

The rise of artificial intelligence - a driver for cybercriminals

As technology continues to advance and democratize cybercrime, it has become increasingly important to be prepared to prevent potential attacks. Cybercriminals are constantly innovating and expanding their repertoire of tactics, including the use of artificial intelligence and its innovative applications, cyberattacks exploiting the world’s increasing fragmentation, digital supply chain attacks with large-scale reach, ransomware-as-a-service, and multi-channel phishing.

When technical precautions fail, remaining vigilant and having a strong security culture can make all the difference in protecting your organization. Staying ahead of the evolving threat landscape is key to strengthening resilience to security risks.

Geopolitical crises - exploiting the increasing global fragmentation

Geopolitical conflicts are often beyond the control of companies and individuals. However, we can take steps to prepare for and respond to the new cyberspace challenges that arise from these conflicts.

As regulatory requirements become stricter, companies should invest in ramping up their security measures, reviewing their current setups, and patching vulnerabilities. As cyberattacks become more diverse and frequent due to geopolitical tensions, cyber resilience heavily depends on how well-prepared organizations are for different threats.

This includes preparing on the supply chain level. Organizations should identify their critical processes, the resources they need to run these processes, and set up business continuity plans in case a supplier fails. Keeping up with the race between attackers and security professionals and continuously adjusting incident response and recovery plans to new circumstances can make a decisive difference.

Cybersecurity has become a political issue, and this should be reason enough for companies to finally move the topic to the C-level and give it the attention and resources it deserves.

11

The Netherlands

towards

greener future through the development of hydrogen hubs

At my visit with the DNV Board of Directors in Noordwijk, Amsterdam I meet collague, Victoria Monsma, Hans Cleijne and Maksym Semenyuk that did a presentation on ‘the Dutch North Sea as the green power hub for Europe’.

TEXT: NINA IVARSEN

Known as the living lab for hydrogen worldwide, the Dutch are developing, innovating, and validating this green energy. More than 50 years ago, the Netherlands discovered natural gas reserves. Since then, the country has gone on to develop one of the world’s most sophisticated gas grids. Strong regional tech clusters contribute immensely to the knowledge that the Dutch have on gas storage and distribution of hydrogen. One of the most flexible and versatile carbon-neutral fuels, hydrogen is the missing link in the global energy transition. Hydrogen has enormous potential as a clean energy (green hydrogen could meet 25% of the world’s energy needs by 2050). But there is a substantial effort required – from increasing production capacity and demand to developing infrastructure and global logistics.

The Dutch government has adopted a hydrogen strategy to boost production and the use of low carbon hydrogen. The National Hydrogen Program (Nationaal Waterstof Programma)

is making significant strides

a

The Netherlands: Fueling a green hydrogen future. DNV is helping to change the timeline from hydrogen on the horizon to hydrogen in homes, businesses, and transport systems.

12

supports applications of hydrogen in various sectors. It helps achieve goals and agreements in the hydrogen industry, one of many initiatives fueling a green hydrogen future.

As a hub for global energy, the Netherlands takes a proactive approach in accelerating the world’s green energy transition. Dutch expertise and innovation focus on transitioning to a low-carbon energy ecosystem and a sustainable future for all, building upon a rich history in the energy sector.

Hydrogen Forecast to 2050

DNV’s latest hydrogen research provides our forecast for a most likely hydrogen future to mid-century, across production, transport, and end use. It offers insights into factors crucial to scaling hydrogen, including policy, regulations, safety, and investment.

Seaports, and the Province of Groningen, are constructing a large-scale electrolysis plant at the Eemshaven seaport. The plant will produce green hydrogen using renewable energy sources such as wind and solar power. The hydrogen produced will be used to power heavy-duty transport, industry, and heating, and is expected to produce up to 800,000 tonnes of green hydrogen per year, enough to power around 2 million households. The capacity of offshore wind in the Dutch part of the North Sea is increasing from 2.5 GW this year to 21 GW in 2030. This impressive rise, in combination with the country’s unique gas-infrastructure, offers great opportunities for the Netherlands as a hydrogen hub.

The Wind farms Hydrogen Hub's location at the Eemshaven seaport is ideal for the production and distribution of hydrogen, with excellent connections to the North Sea and the rest

One of the most exciting projects is the Wind farms Hydrogen Hub, which is set to become one of the largest green hydrogen production facilities in Europe. The consortium of companies involved in the project, including Shell, Gasunie, Groningen

At the innovation Technology center on Campus Groningen, DNV are a global advisor to the entire hydrogen economy from production to end use. Ultramodern laboratories and test facilities stimulate collaboration and knowledge sharing, propelling the transition of a sustainable energy system leading hydrogen.

Hans Cleijne

© iStock 13

of Europe. The seaport is also home to several large industrial companies that will be able to use the green hydrogen produced at the facility.

The development of the Wind farms Hydrogen Hub is part of the Netherlands' broader push towards a greener future, with ambitious targets for reducing greenhouse gas emissions and achieving net-zero emissions by 2050.

Hydrogen is seen as a key part of the country's strategy for achieving these targets, as it can replace fossil fuels in a wide range of applications. The development of hydrogen hubs like the Wind farms Hydrogen Hub is also an important step towards creating a hydrogen economy.

A hydrogen economy is a system in which hydrogen is produced, stored, and distributed on a large scale and used as a primary energy source. This could help to reduce reliance on fossil fuels and create a more sustainable and environmentally friendly energy system.

The Wind farms Hydrogen Hub is still in the early stages of development, with construction expected to begin in 2023. However, the project is already generating a lot of excitement and is seen as a major step towards a greener future in the Netherlands and beyond.

In addition to the Wind farms Hydrogen Hub, there are several other hydrogen projects underway in the Netherlands, including

Wind farms and hydrogen hubs

the Hystock project, which involves the development of a green hydrogen production facility in the province of Groningen, and the HyStock project, which involves the development of a hydrogen storage facility in the city of Veendam. The Netherlands is also an important member of European Hydrogen Backbone initiative, established to contributed to the development of a European hydrogen market. The national backbone must be ready by 2027, connecting all industrial clusters, storage facilities and neighbouring network operators from Germany and Belgium, and around 2030 it will function as a ring network. This requires reuse of existing natural gas infrastructure but also build new ones, aprox 85% natural gas pipes will be reused, supplemented by new pipes.

farms

By producing green hydrogen using renewable energy sources, these facilities can help to reduce greenhouse gas emissions and create a more sustainable and environmentally friendly energy system. The Netherlands is leading the way in the development of hydrogen technology and is set to become a major player in the global hydrogen economy.

More than 50 years ago, the Netherlands discovered natural gas reserves. Since then, the country has gone on to develop one of the world’s most sophisticated gas grids. Strong regional tech clusters contribute immensely to the knowledge that the Dutch have on gas storage and distribution of hydrogen.

A consortium of Gasunie, Groningen Seaports and Shell Nederland launched NortH2 in Q1 2020. The NortH2 project will produce green hydrogen using renewable electricity generated by a mega offshore wind farm, 3 to 4 gigawatts in 2030, contributing to the objectives of the Dutch Climate Accord. Additionally, it has the ambition to grow to about 10 gigawatts around 2040. The project plan provides for a large electrolyser in the Eemshaven, where wind energy is converted into green hydrogen. Green hydrogen production from the NortH2 initially in the Eemshaven and later possibly also offshore, is expected to be around 800,000 tonnes per year by 2040. Finally, a smart transport network in the Netherlands and Northwest Europe is required to deliver the green hydrogen to mainly industrial consumers. This could save an estimated seven megatonnes of CO2 emissions per year around 2040 Nouryon, Tata Steel and Port of Amsterdam bundled their forces to build at the time) Europe's largest green hydrogen cluster, in Umulden. A 100 MW electrolyser will start producing green hydrogen from offshore wind energy in 2023 with possible further upscaling in 2030. Part of the hydrogen will be used at Tata Steel, the other part could be used in the Port of Amsterdam. This hydrogen should be transported through a densely populated area and Port of Amsterdam was looking for guidance to map the different transportation options and their characteristics.

Overall, the development of hydrogen hubs like the Wind

Hydrogen Hub and a national hydrogen backbone is a significant step towards a greener future.

Victoria Monsma

14

What are we seeing?

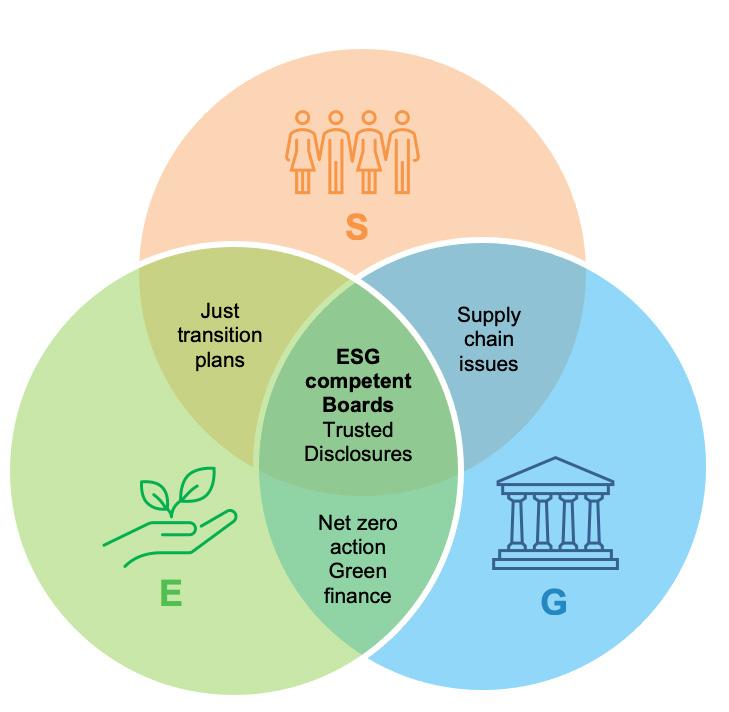

With a spotlight on sustainability, boards must address ESG factors to outpace competition and gain new sources of value creation.

We find ourselves in a point in time where a gradual but significant shift to sustainable business models has occurred. Organisations that were once predominately shareholder-led, now realise that this model no longer guarantees a ‘social license’ to operate in modern society.

More specifically, organisations are urged to adopt a ‘double materiality’ approach, which means considering not only how a business may be affected by external factors, but also about the impact it creates for its stakeholders, society, and the environment in which it operates. Boards in particular, face pressure to be accountable for this shift. However, they also have the opportunity to access lower costs of capital, reduced operating costs and

improve resilience through effective management of Environmental, Social and Governance issues.

Why is ESG competence in the boardroom crucial?

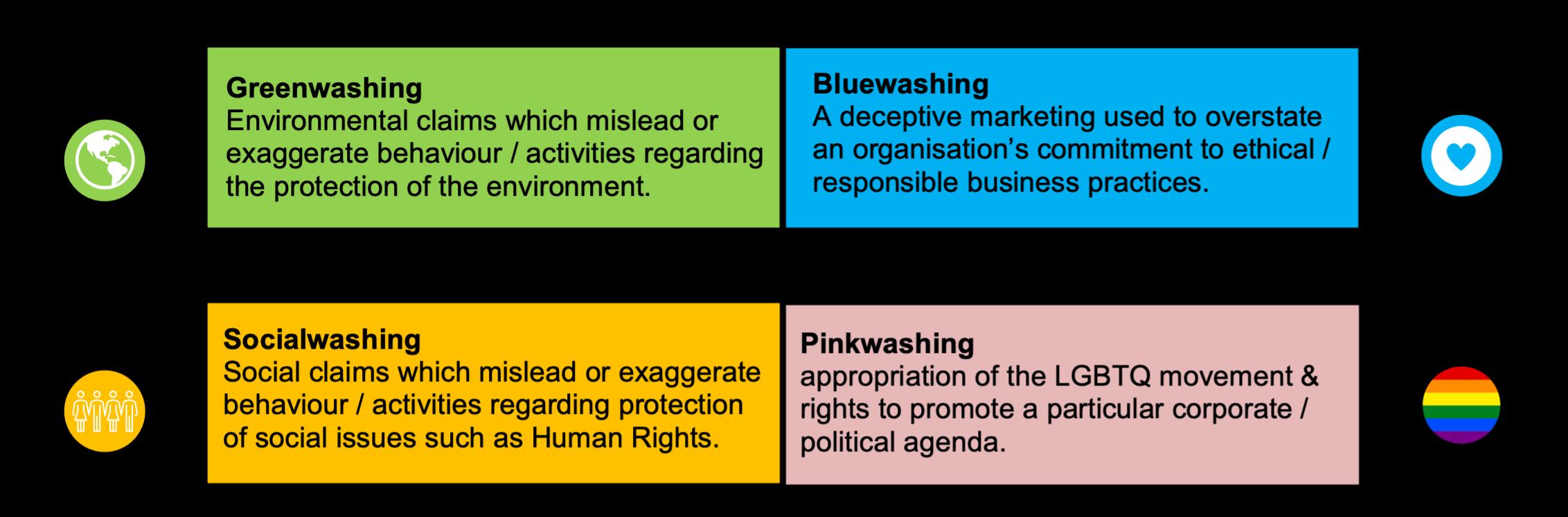

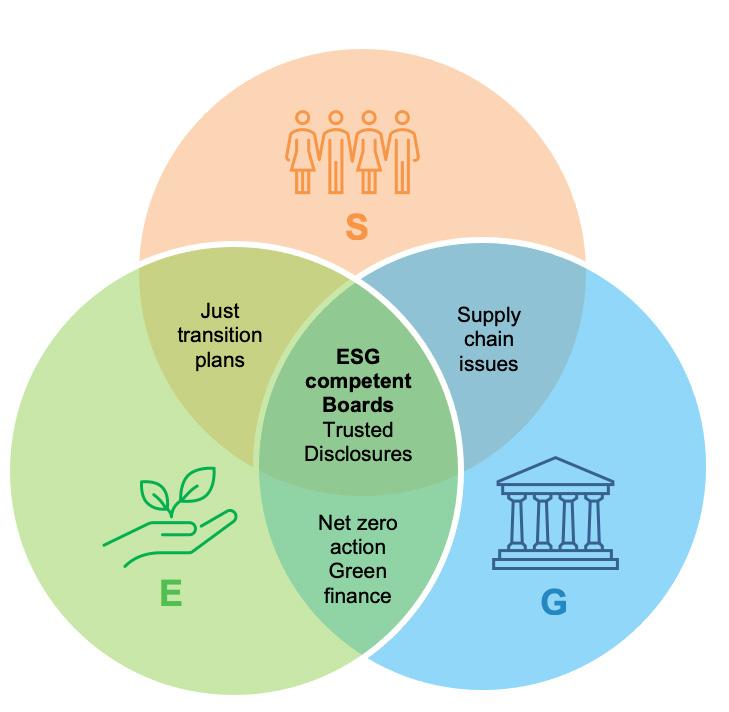

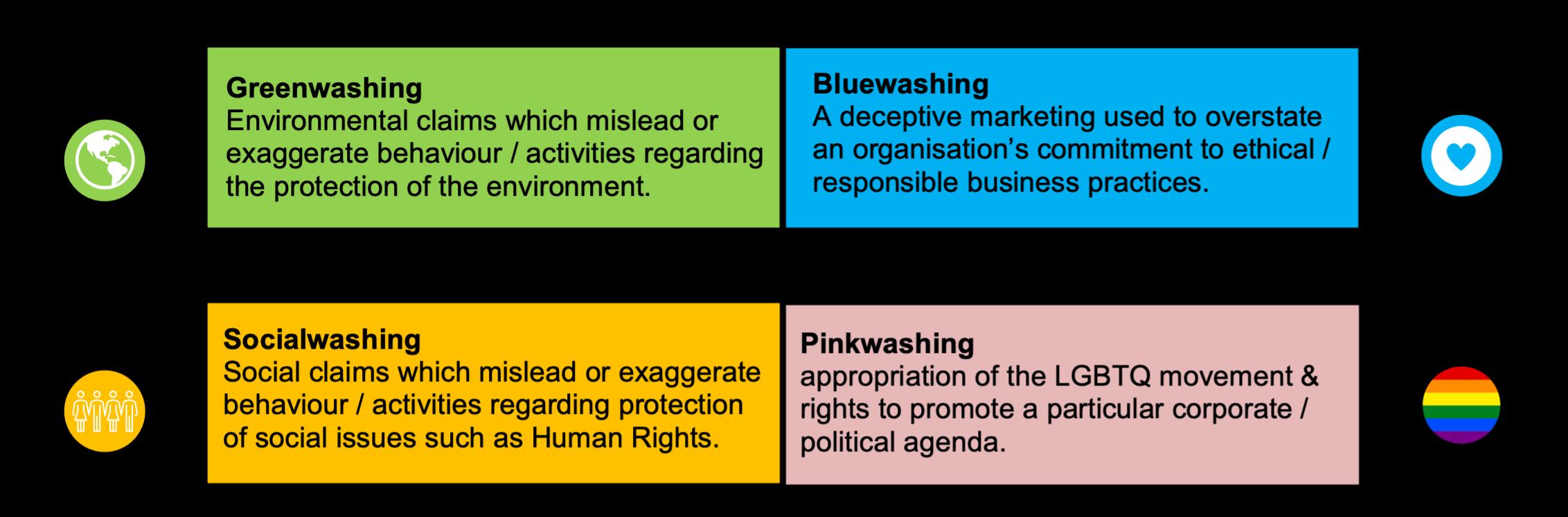

ESG competence in the boardroom is crucial for establishing a connection between an organisation’s purpose, its impact on addressing societal issues and creating and maintaining value for stakeholders. Boards need to possess the necessary competence to understand and implement best practices in ESG reporting, to ensure that claims are substantiated by appropriate action. This is particularly important when communicating performance to stakeholders to avoid the various forms of ESG-washing, including those shown below:

Furthermore, board members hold a significant responsibility in overseeing materiality assessments. A materiality assessment is a process by which an organisation identifies Environmental, Social and Governance (ESG) issues which are material to the organisation and its stakeholders.

ESG COMPETENCE

IN THE BOARDROOM

TEXT: SAM DRESNER BARNES, LAURE DAVIS, INGEBJØRG NUEVA FINNEBRÅTEN

The ever-increasing public awareness of climate change in particular, along with pressures arising from investor expectations and regulatory compliance have prompted organisations to think about their Environmental, Social and Governance (ESG) issues.

Sam Dresner Barnes

Laure Davis

15

Ingebjørg Nueva Finnebråten

What are possible implications from a lack of board competence?

If a board doesn’t have a firm grasp of ESG issues, these considerations will not be integrated into the decision-making processes that determine the strategic direction and evolution of an organisation. Consequently, this lack of ESG competence will impact top-line growth. A strong ESG proposition enables organisations to access new markets and expand their presence in existing ones whilst addressing stakeholders’ increasing concerns about ESG issues.

Considering organisational culture, a weak ESG proposition communicated from top management can make it challenging for a company to attract and retain high-quality talent. Employees often prefer positions that align with their personal values. Organisations that fail to create a positive workplace environment or demonstrate a commitment to societal and cultural issues can expect to see high employee turnover and decreased productivity.

Moreover, a lack of demonstrable ESG competence may have a negative impact on an organisation’s investment returns or its ability to secure external funding. Equity managers are increas-

ingly focused on developing actionable investment strategies that target social and environmental issues. Investors seek to reduce portfolio risks and direct their investments toward sustainable opportunities that offer long-term returns. For instance, if an organisation aims to build a new coal-fired power plant, it will likely struggle to secure external funding due to societal expectations and the market’s orientation toward renewable energy sources. Similarly, allocating capital to assets at risk of becoming stranded due to long-term environmental issues will likely result in poor investment returns. Moreover, organisations that fail to comply with regulations or do not fulfil their implicit obligation to contribute to the mitigation of global ESG issues face the risk of corporate litigation initiated by individuals, NGOs, or other parties. Inadequate management of ESG issues has already resulted in regulatory and legal damage. Boardrooms are increasingly aware of how a lack of demonstrable action, referred to as “green crowding” by Planet Tracker, can lead to reputational damage. A report by the UN Environment Programme (UNEP) revealed that the number of climate change litigation cases almost doubled from 2017 to 2020. It is not surprising that a study by Norton Rose Fulbright identified litigation risk related to ESG issues as a top concern for the financial services sector in 2023.

Competent board involvement ensures that a representative stakeholder engagement process is conducted through the assessment and that the material topics identified are actioned appropriately in strategy, investment decisions and risk management.

From left Turid Solvang (FutureBoards), Lars Erik Lund (Veidekke), Ulrike Haugen, Ellen Skarsgård and Ingebjørg Nueva Finnebråten

16

Photo: Ingebjørg Nueva Finnebråten

Typically, cases are filed against companies for damages as a result of operations, but a recent lawsuit in February 2023 directed against the Board of Shell PLC could establish a new precedent by holding boards personally liable. In this case, the claimants (ClientEarth) argue that Shell’s Board is legally obligated to manage organisational risks that may impact the company’s future success and recent strategic decisions reflect a failure to prepare Shell for the transition to net zero. This case could set the stage for further lawsuits specifically targeting boards for their failure to incorporate ESG considerations into strategic decision-making processes.

What is the current status of ESG competence amongst boardrooms?

Boards need to take steps to increase their knowledge on sustainability and ESG issues. However, a lack of relevant skills among board directors was cited as one of the biggest barriers to improved governance in these areas. According to CERES, only 17% of 475 companies of the Fortune 2000, demonstrated ESG credentials in 2018.

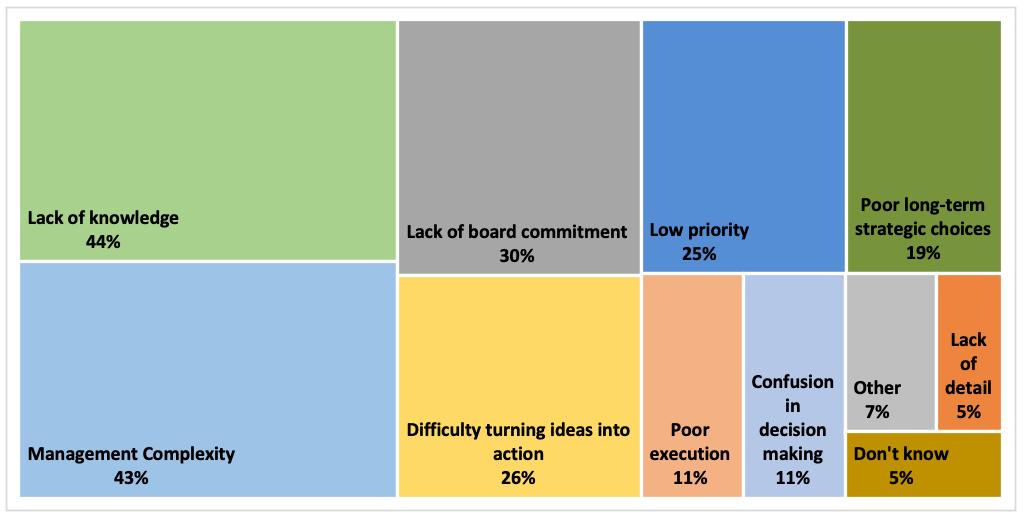

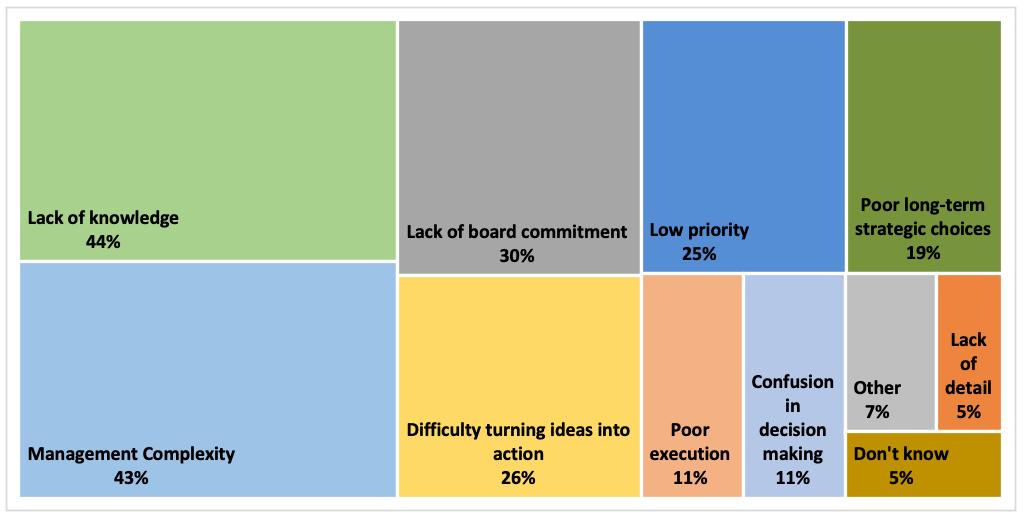

Additionally, a study conducted by Boston Consulting Group (BCG) and INSEAD Corporate Governance Centre in 2022, found that 70% of directors stated that they are ‘only moderately or not at all effective at integrating ESG into company strategy and governance’. As shown below, 44% of directors cited a lack of data, knowledge, or capabilities as a key barrier to addressing ESG issues.

In many cases, boards consist of former CEOs who operated at a time when ESG considerations were not commonly seen as financially material. This lag between board diversity, board recruitment and the increasing focus and understanding of ESG issues could help explain the ESG competency gap. Furthermore, in addition to regulatory compliance, the sudden uptake of ESG as a material topic may be attributed to the shift in stakeholder opinion and the natural replacement of existing Board members with new ones who have a firmer grasp on societal expectations.

Expanding the board’s knowledge and expertise

For opportunities to be grasped and for risks to be managed in the short, medium, and long term – and in doing so making their companies “future-fit”, it is crucial to educate existing board directors on the fundamental sustainability and ESG issues affecting the business. Adding these topics to board training may therefore play a crucial role in facilitating strategic discussions concerning ESG risks and opportunities.

In 2021 FutureBoards and DNV launched a joint initiative: The ESG for Boards program. Aimed specifically at board directors and senior management within global organisations, the program focuses on how the ESG agenda affects the boards’ role, strategy, composition, and work processes. By enhancing ESG competence in board and senior management positions, organisations are more capable of developing and delivering a purpose-driven sustainable strategy, and communicating this to their stakeholders in a clear, transparent way. Citing Turid Solvang, Founder & CEO of FutureBoards, “board of directors must not primarily be ESG experts, but they must know enough to be able to ask the critical questions – and ensure the quality of the answers”.

Barriers to effective board level ESG oversight, Directors Opinions (INSEAD 2022)

INSEAD 2022 17

This Spring we kicked off our third season, with a record number of participants from a record number of countries. Bringing chairs and senior management, expert industry-speakers, global voices and fresh thinkers together, the program provides the perfect arena for insights and best practices, to ultimately help close the ESG competency gap in many boards.

DNV’s board participated in the 1st round of ESG for Boards program, ensuring that the existing board directors are up to speed on sustainability and ESG issues for the company. In 2023 we invited DNVs ‘aspiring board members’ – the newly elected employee members for DNVs Board of Directors and the Council, to attend the program as it is an excellent opportunity to expand the knowledge and expertise in the boardroom.

According to Egon Zehnder survey of global executives, boards with more environmental experts, shorter tenure, a younger average age, and gender diversity – and also, cognitive diversity, tends to have a positive impact on corporate sustainability.

What we are observing is that boards that ignore the increasingly higher expectations of companies with regards to Sustainability and ESG, do so at the risk of losing their license to operate. Boards need to sharpen up and get a base-level understanding and relevance of what ESG could bring to the table.

Failure to integrate ESG considerations at the board level poses significant risks to organizations, including missed growth opportunities, reputational damage, and legal liabilities. However, the ESG for Boards program offers a solution by equipping board members with the necessary knowledge and skills to navigate the ESG landscape effectively. By participating in this program, boards can enhance their decision-making processes, drive sustainable growth, and align their organizations with the expectations of stakeholders and the broader society. Embracing ESG at the board level is not only a responsibility but also a strategic imperative for organizations aiming to thrive in an increasingly complex and interconnected world.

“Board of directors must not primarily be ESG experts, but they must know enough to be able to ask the critical questions – and ensure the quality of the answers”

Turid Solvang, CEO of FutureBoards

“Boards that ignore the increasingly higher expectations of companies with regards to ESG, do so at the risk of losing their license”

Peter Bakker, CEO Business Council for Sustainable Development, Speaker ESG for Boards

© iStock

18

From left Ingebjørg Nueva Finnebråten, Jerome Colombe, Ellen Skarsgård and Turid Solvang (FutureBoards).

THE EU TAXONOMY: A Deep Dive

TEXT: SAM DRESNER BARNES, SUPPLY CHAIN & PRODUCT ASSURANCE

Hundreds of pages long, with amendments, additions, and FAQs being released in a seemingly constant stream of technical jargon, the EU Taxonomy is certainly a daunting topic. So, what is it? Why is everyone talking about it? Why do so many of our customers now care about it? This article explores the purpose of the Taxonomy, how it works, how it affects different sectors, its limitations, and how we in DNV can support our customers with their EU Taxonomy needs.

What is it?

Before explaining what the EU Taxonomy is, it is important to understand why it exists in the first place. In 2019, the EU introduced its Green Deal, an ambitious growth strategy aimed at facilitating the transition towards a sustainable economic model. This sustainable model aims to ensure that economic growth is decoupled from profligate resource use, that the transition is just and leaves no person or place behind, and to achieve no net emissions of greenhouse gases by 2050. However, these ambitions require significant investment to catalyze the transition. To this end, approximately €1 trillion will be made available for financing through a dedicated budget, the EU ETS, and the InvestEU programme. It is crucial to ensure that this fund is channeled towards activities that contribute to the Green Deal objectives. To achieve this, a clear definition of what is considered "sustainable" was necessary, and thus in 2020, the EU released its sustainable investment Taxonomy, also known as the EU Taxonomy.

How does it work?

In short, the EU Taxonomy is a list of environmentally sustainable economic activities spanning multiple sectors. The EU creates a definition of 'sustainable' for each activity by ensuring it meets a set of criteria before it can be considered

aligned with the Taxonomy. These criteria are called Technical Screening Criteria (TSCs) and are elaborated within the Taxonomy Delegated Acts (DAs). Currently, there are 94 activities listed within DAs, with a further 35 under review. The idea is that more activities will be added, with specific TSCs that define them as environmentally sustainable. The taxonomy aims to clarify which activities are environmentally sustainable, and this information is used by capital markets, organizations, and policymakers to direct investment flows into those activities.

Under paragraph 23 of the Taxonomy Regulation ((EU) 2019/2088), a list of environmental objectives was laid down in order to define the sustainability of an activity. These environmental objectives are as follows: (1) climate change mitigation, (2) climate change adaptation, (3) sustainable use and protection of water and marine resources, (4) transition to a circular economy, (5) pollution prevention and control, and (6) protection and restoration of biodiversity and ecosystems. For an economic activity to be classified as environmentally sustainable, it must do three things: (1) substantially

contribute to at least one environmental objective, (2) do no significant harm (DNSH) to any of the other objectives, and (3) the operator of the activity must comply with the minimum safeguards outlined in Article 18 of the regulation. Most technical screening criteria currently relate to activities that substantially contribute to climate change mitigation or adaptation, but other TSCs were recently released for the remaining objectives, and organizations will be able to report against these activities from 2024.

The criteria that underpin the specific requirements for each step are laid down in the TSCs for each activity within the DAs. The TSCs for substantial contribution and DNSH define the environmental impact of an economic activity, and these are assessed on an activity level. The minimum safeguards, however, are assessed at an entity level. They are a precautionary measure to ensure that an activity cannot be considered sustainable if, for example, it violates human or labour rights or engages in corrupt, anti-competitive, or non-compliant taxation practices.

19

An activity which substantially contributes to one of the six environmental objectives can be may also be categorised as ‘enabling’ or ‘transitional’. Enabling activities, such as electricity storage, are those which substantially contribute to any of the environmental objectives and transitional activities are those which there are no technologically- or economically-feasible low-carbon alternatives, such as the manufacture of cement. Transitional activities must ensure the embodied GHG emissions are aligned with or exceed the best performance in the sector and do not cause a carbon-lock in which would inhibit the development of a low-carbon alternative.

How does the EU Taxonomy interact with the wider Regulatory Landscape?

The EU Taxonomy is situated amongst a vast array of EU regulatory instruments, making navigation through them both difficult and often confusing. As with other instruments, the Taxonomy can both influence and be influenced by others. Its value lies in its ability to assess the sustainability of an economic activity, and these assessments are underpinned by pre-existing thresholds defined in other EU Directives, such as the EIA Directive and the Water Framework Directive. The Non-financial Reporting Directive (NFRD) currently defines the reporting requirements of non-financial organizations with respect to the Taxonomy. However, when the Corporate Sustainability Reporting Directive (CSRD) supersedes the NFRD, these requirements will change, and more companies will be obliged to report Taxonomy disclosures, unlike the NFRD, the CSRD will require limited assurance of disclosures.

Within financial markets, the EU Taxonomy offers an assessment framework for the categorization of funds under the Sustainable Finance Disclosures Regulation (SFDR). The SFDR applies to financial market participants and, like the Taxonomy, aims to enhance the transparency of sustainability claims. Funds that draw capital from external investors must classify themselves as either Article 6, 8, or 9; with all funds that promote social or environmental characteristics (Article 8), or those that have sustainable investment (Article 9) as their objective required to assess their portfolio alignment against the EU Taxonomy. Under the Green Bond and Green Loan Princi-

ples, issuers are encouraged to include Taxonomy alignment in order to give trust to investors that the proceeds allocated will go to sustainable activities. The proposed EU Green Bond Standard contains Taxonomy alignment as a mandatory criterion, but some say the limitations of the Taxonomy may make this difficult, more on this later.

How does an entity report under the Taxonomy?

As of 1st January 2023, non-financial entities falling within the scope of taxonomy reporting are expected to report the eligibility and alignment for the previous calendar year. Organisations who fall within the scope of the NFRD are obliged to report, the relative shares of turnover, capital expenditure (CapEx) and operational expenditure (OpEx) that are aligned with the EU Taxonomy. When reporting turnover, organisations include taxonomy aligned activities from which they derive revenue, this must be calculated based on the same accounting principles applied to financial statements. This KPI indicates an organisation’s contribution the EU’s environmental goals. OpEx must be reported following the same principles and includes the proportion of OpEx related to assets or processes which are associated with Taxonomy aligned activities or with the CapEx Plan; this may include research and design, renovation and maintenance which enables the continued operation of aligned activities. CapEx too is reported in the same way, and it indicates an organisation’s ambition to align with the Taxonomy, and by consequence contribute to the environmental objectives. CapEx can include a variety of expenditures, including that which is related to assets or process associated with aligned activities, that which is related to the purchase of the output of Taxonomy aligned activities and the CapEx plan. A CapEx plan may include a description of how an organisation plans to expand their Taxonomy aligned activities or how an organisation plans to upgrade Taxonomy eligible activities to become aligned within the next 5 years. Organisation’s must include not only the proportion of the KPIs which are aligned, but also the proportion of those which are not, and any aligned activities should be supported by sufficient evidence which substantiates the claim.

How does the EU Taxonomy affect different sectors?

The value of the Taxonomy lies within its ability to make finance available to different sectors, industries, and organisations who wish to become more sustainable. For an organisation to grow and remain profitable it must invest in its own evolution, in other words, it must direct expenditures toward areas of strategic growth. Investors are increasingly looking to de-risk their portfolios whilst meeting regulatory requirements, one way in which this is achieved is through identifying investment opportunities which offer environmental benefits and align with societal trends as well as their own declared values.

There is often an intersection between sustainability issues. For example, the energy transition has a significant impact on people and employment opportunities and for a transition to be just, it will

20

require the equitable distribution of the economic benefits. Consequently, investors have shown increasing proclivity in investment strategies that explicitly address the intersection of environmental and social issues. This preference is being publicly voiced, with asset managers like BlackRock, Goldman Sachs, and UBS Group all establishing dedicated sustainable investment funds. If a project or development can demonstrate alignment with the EU Taxonomy, it gives investors confidence that what they are investing in will create a tangible benefit with a positive environmental impact, which theoretically will increase investment in such opportunities. Within the DA’s it is common that activities which by definition are more sustainable, for example wind or solar power, will have less stringent TSCs in order to make alignment simpler for those activities compared to their more carbon intensive alternatives, which should make access-

ing sustainable finance for such projects

easier.

The Taxonomy’s effect on specific sectors is dependent on the sector in question. There are currently 9 sectors which contain different economic activities that are eligible under the Taxonomy, including sectors such as, forestry, transport, energy, and manufacturing; more activities will be added as TSCs for different economic activities are developed. As explained, the TSCs outline the criteria which must be met for an activity to be classed as sustainable, however these TSCs will change to encourage activities to become more sustainable. Under Article 19(5) of the Taxonomy Regulation, the Commission is able to review the TSCs for an activity at least every 3 years, this aims to ensure that all activities remain on a credible transition pathway consistent with a climate-neutral economy. Ultimately, as TSCs change, report-

ing organisations will have to prioritise the distribution of CapEx into the activities for which they wish to remain aligned.

Are there any limitations of the EU Taxonomy?

In principle, a sustainable investment taxonomy which defines how specific economic activities can be classified as sustainable is an invaluable tool to facilitate a transition to a low carbon economy. However, in reality the EU Taxonomy has limitations to its general useability and applicability.

First, some criteria within the Taxonomy require extremely granular data, and lots of it. Some companies may not have access to this level of information, especially for projects currently under development and for some activities, assessments require extremely technical understanding of the activity which

© iStock 21

increases the effort and resources needed for an assessment.

Some technical screening criteria, particularly for substantial contribution are not always described with sufficient clarity, consequently there are overlaps in scope between different activities, and in some cases not all of the criteria reflect the same concept consistently across different activities. While this is frustrating for an assessor, it introduces something much riskier – subjective interpretation. A fundamental pillar of the taxonomy is the reliability of criteria, as this is what underpins the definition of a ‘sustainable activity’; ultimately ambiguity makes it difficult to apply certain criteria in a standardised and verifiable way, taxonomy-aligned comparability becomes impossible, and the credibility of assessments is reduced.

The international applicability of the EU Taxonomy is another issue. Taxonomy criteria are built upon existing EU Directives and Regulations, while this is okay for EU member states who have implemented the Directives and are subject to the Regulations, Taxonomy alignment suddenly becomes more difficult non-EU and non-EEA countries an issue which is intensified in developing countries or those who do not have the same level of governance common across the EU and EEA. This creates issues for non-EU/EEA

organisations wishing to raise finance for sustainable projects from EU/EEA financial institutions who need to report their share of taxonomy aligned assets from 2024 as it may deter financial institutions from investing in such projects.

A major issue for the EU Taxonomy has been created from the backlash of the inclusion of fossil-gas and nuclear energy projects in the Delegated Acts in 2022, meaning if organisations engaging in these activities and meet the TSCs they can be classified as sustainable. While it is acknowledged that nuclear is a form of clean energy, the idea that the nuclear waste can be disposed of without significantly harming the environment is strongly debated. Similarly, while fossil-gas presents a low-carbon alternative to more polluting energy sources such as coal, it is not free of GHG emissions. There has been huge fallout from this decision, propagating the idea that nuclear or fossil-gas based activities are ‘green’ has led to questions whether the Taxonomy is fit for purpose, of it is rather just another mechanism which perpetuates greenwashing. As a result, various NGO’s have left the EU Taxonomy working group, including BEUC and WWF as they believe the Taxonomy is not aligned with science-based targets, however as some large EU states such as France and Germany are reliant on these

power sources, the commission argues they are necessary transitional activities. In April 2023, as a result of the EU’s steadfast position on the inclusion of nuclear and fossil-gas energy, several NGOs including Client Earth, the WWF Policy Office, and others, filed a case in the Court of Justice against the European Union to review its decision. Issues arising from the inclusion of these activities may manifest for organisations wishing to issue Green Bonds or Loans as some investment firms explicitly exclude fossil gas and nuclear energy from their investment portfolios.

What can DNV do for our customers?

DNV offers multiple services in the realm of the EU Taxonomy, all of which aim to provide value to our customers. We are able to verify disclosures, substantiating claims with DNV’s globally trusted voice. We can guide our customers through the labyrinth of Taxonomy reporting with an advisory service, and we can even offer our expertise to financial institutions and governments who wish to develop their own bespoke, sustainable investment taxonomies. DNV’s expertise in this domain is strong, created through the variety of project we have worked on, and we wish to leverage this to help our customers toward a sustainable economic transition.

© iStock 22

How well are top teams set up for success?

Shareholders, employees, and the broader community need to be confident that top teams are making the best possible decisions.

TEXT: NINA IVARSEN

Top teams need to have a clear understanding of the organization's goals and objectives. This includes understanding the company's mission, vision, and strategic priorities.

Top teams need strong leadership to guide the organization and make critical decisions. This includes having leaders who are knowledgeable, experienced, and able to inspire and motivate others. Top teams that are diverse and inclusive are more likely to be successful. This includes having a mix of back-

grounds, experiences, and perspectives that can help the organization make better decisions and adapt to changing circumstances. We also see the important of the need to communicate effectively with each other and with the rest of the organization. This includes being transparent, open, and honest in their communication and actively listening to feedback. Ensuring that top teams are high performing usually drives attention to the qualifications, skills, and experience of individual members. While the capabilities of each team member are critical, there is an emerging emphasis on the collective intelligence of top teams. This overall team IQ isn’t a reflection of the average or even the maximum intelligence of team members; research demonstrates that groups are more than the sum of their parts and collective intelligence is the property of the group itself. [i] Moreover, collective intelligence has measurable value. Just as individual intelligence enhances individual performance on complex problem-solving tasks, collective intelligence improves the group’s performance.

© iStock 23

Collective intelligence refers to the ability of a group of individuals to work together effectively to solve complex problems and make better decisions than any one individual could make alone. This concept has gained increasing attention in recent years as organizations seek to leverage the power of their teams to drive innovation and growth.

Studies have found that teams with higher levels of collective intelligence are more effective at problem-solving, decision-making, and innovation. These teams are also more likely to achieve their goals and outperform their peers.

So how can organizations measure collective intelligence?

One approach is to use assessments that measure factors such as team cohesion, communication, and problem-solving ability. These assessments can provide valuable insights into the strengths and weaknesses of teams, and help organizations identify areas for improvement. In addition, organizations can foster collective intelligence by promoting collaboration, diversity, and inclusion. By creating a culture that values teamwork and encourages the sharing of ideas and perspectives, organizations can tap into the collective intelligence of their teams and drive better outcomes.

Top team composition

Do top teams have diversity of thinking? When problems are solved from a single perspective, be it that of an individual or a homogenous group, there is an inherent error rate of approximately 30 percent. [ii]

Structure of conversations

Are discussions between top team members designed to ensure that each person has an equal voice? Without structure, conversations are likely to be dominated by a vocal few and are subject to unconscious biases.

Leadership

Does the chairperson create an inclusive environment where all members are treated fairly, feel valued, and are encouraged to speak up? The objective is to stimulate robust and thoughtful debates.

Conversational structure and inclusive leadership are well covered ground. It is the first of these elements, top team composition and diversity of thinking, that is the most difficult. The challenge lies in defining the kinds of diversity that lead to collective intelligence, as well as their proportions and how they are interconnected. Without these details, diversity of thinking is no more than an enticing concept, and certainly not a practical tool.

Diversity of gender, experience, race, age, and problem-solving approach has clear benefits, but some factors influence diversity of thinking much more directly than others. A combination of direct and indirect factors is ideal for optimal performance and collective intelligence.

Direct factors

Individual approaches to problem solving. Individuals tend to solve problems using one or two of six approaches, particularly

when they are under pressure or in like-minded groups. These six approaches are:

• Closely defining desired objectives

• Creating an exhaustive list of possibilities

• Giving absolute clarity to an implementation plan

• Relying on robust and multiple sources of data

• Identifying diverse audiences and their interests

• Predicting and addressing multiple scenarios

All six approaches are critical to a well-rounded solution and all top team members can address them to some degree, but as individuals, we tend to believe that one or two are the most important.

This results in a tendency to favor those options and produces conversations and solutions that overemphasize some dimensions and undervalue others. Indeed, executive groups are often dominated (75 percent) by people who tend to focus on defining the outcomes they want to achieve and identifying the options for getting there. [iii] Individuals who think of problems in terms of the other four dimensions as people, process, risk, and evidence, report that much less time and attention are given to their views. This presents obvious risks, both in the selection of team members and in the solutions that are likely to be developed by executive teams and presented to boards.

Variety of disciplines or functional roles

A second direct influence on diversity of thinking comes from the mix of functional roles (such as general counsel, CRO, CIO, CMO, or CHRO) held by team members. These executive roles expose members to different domains of knowledge and social networks. The productive value of this kind of knowledge diversity has been well documented, and it is one reason why leaders often take a tour of duty in roles outside their initial field of expertise. The additional value of diverse social networks for sourcing and disseminating ideas is, by comparison, often overlooked and underestimated.

Greater transparency into individual approaches and the weight of the group’s preference enables top teams to select members for diversity of thinking in terms of problemsolving approaches, or at least to self-correct if there is a natural conversational bias.

24

Indirect factors

Collective intelligence is also influenced by gender balance and racial and cultural diversity. Top teams should reflect the diversity of the organization’s underlying employee and customer populations to promote market confidence and sensitivity, but there are additional indirect benefits.

The bottom line is that by attending to the factors that drive collective intelligence, top teams can help themselves make smarter, more innovative decisions and boost their own confidence, as well as that of their stakeholders. Viewing top teams as needing a balance of individual problem-solving approaches and a diverse set of experience will help members focus on the direct drivers of diversity of thinking. A focus on gender balance and racial diversity, worthy in its own right, will also help create a team environment that is more conducive to diverse views.

In summary, top teams that have clear goals and objectives, strong leadership, diversity and inclusion, effective communication, collaboration and teamwork, and a commitment to continuous learning and development are more likely to be set up for success. By focusing on these factors, organizations can create top teams that are well equipped to lead the organization to success.

Questions for top teams (and their HR advisors)

• Who are we? Does our team display diverse thinking? Have we held diverse roles? Do we approach problems in different ways? Do we develop organizational strategies that are balanced?

• How do we converse? Do we operate in a collaborative and respectful way? Would each team member say he or she feels confident to speak up, even to express a point of view that is different from the majority?

• How are we led? Do we have a chairperson and/or CEO who is highly inclusive?

• How do we influence our organization? Do we ask powerful questions to ensure that diversity of thinking is a priority?

References

[i] A. Williams Woolley, C. F. Chabris, A. Pentland, N. Hashmi, and T.W. Malone, “Evidence for a Collective Intelligence Factor in the Performance of Human Groups,” Science, Vol. 330, pp. 686–688, 2010

[ii] L. Hong, S. E. Page, and M. Riolo, Incentives, “Information and Emergent Collective Accuracy,” Managerial and Decision Economics, Vol. 33, pp. 323–332, 2012

[iii] J. Bourke, Which Two Heads Are Better Than One? How Diverse Teams Create Breakthrough Ideas and Make Smarter Decisions, Australian Institute of Company Directors, 2016

[v] L. Gratton, E. Kelan, A. Voigt, and H. J. Wolfram, Innovative Potential: Men and Women in Teams, The Lehman Brothers Centre for Women in Business, London Business School, 2007

[vi] S. S. Levine, E. P. Apfelbaum, M. Bernard, V. L. Bartelt, E. J. Zajac, and D. Stark, “Ethnic Diversity Deflates Price Bubbles,” PNAS Early Edition, www. pnas.org/cgi/doi/10.1073/ pnas.10407301111, 2014

Embracing disruption, the 2017 Directors’ Alert published by the Deloitte Global Center for Corporate Governance. Juliet Bouke, on diversity of thinking.

Gender balance promotes psychological safety and more conversational turn- taking, thereby encouraging people to speak up, offer their views, and elaborate on the ideas of others.

[v] Racial diversity triggers curiosity, causing people to ask more questions, make fewer assumptions, listen more closely, and process information more deeply.[vi] The indirect value lies in the positive influence of gender balance and racial diversity on conversational dynamics, subtly helping to elicit latent diversity of thinking.

25

FOLKEHELSEFORENINGEN

Occupational health

In April Chair Nina Ivarsen, Deputy Char Lin B. Karsten and HVO Ellen Margrethe Phil Konstad went to an interesting forum arranged by Folkehelseforeningen. The topic was discussed with national politicians, doctors, professors, and NAV represented by Ulf Andersen, responsible for statistics in NAV.

TEXT: NINA IVARSEN

TEXT: NINA IVARSEN

We have made some short articles to share with you on some of the interesting topics discussed.

However, there are still many challenges related to equality and diversity in the workplace. Women and minorities often experience discrimination and various forms of injustice in the workplace, and there is still a significant wage gap between men and women. To ensure a rightful place in the workforce for all, it is important to work towards equality and diversity at all levels of society.

Arbeidshelse, also known as occupational health, is the branch of public health that focuses on the health and safety of workers in their workplaces. The goal of “arbeidshelse” is to prevent work-related injuries, illnesses, and deaths, and to promote the overall health and well-being of workers.

Occupant health professionals at DNV, HVO and VO (Main safety delegate and Safety delegates) work to identify and assess workplace hazards, such as exposure to toxic chemicals, noise, or physical strain, and develop strategies to minimize or eliminate these hazards.

They also work to promote healthy work practices, such as proper ergonomics, regular breaks, and stress management techniques. In addition to preventing workplace injuries and illnesses, occupational health professionals also play an important role in managing work-related health problems together with BHT (bedrifts helsetjenesten).

All people have the right to a rightful place in the workforce, regardless of gender, age, ethnicity, religion, ability, or sexual orientation. This is a fundamental human right, and it is important that society facilitates equal participation in the workforce for all.

It is important to have an inclusive work environment where all employees feel valued and respected. This can be achieved through open dialogue and communication, as well as offering training and development opportunities for all employees.

26

Deputy Chair Lin B. Karsten, HVO Ellen Margrethe Phil Konstad and Chair VEFF Nina Ivarsen.

Disability-free life expectancy

Disability-free life expectancy (DFLE) is a measure of the number of years a person can expect to live without experiencing any disability or limitation in their daily activities. It is a useful indicator of the overall health and well-being of a population and can be used to monitor trends in health and to identify areas where improvements in health care and public health interventions are needed.

DFLE is calculated by subtracting the number of years a person is expected to live with a disability from their total life expectancy. This calculation takes into account the prevalence of different types of disabilities and the severity of those disabilities. DFLE is an important measure because it reflects the quality of life of a population, as well as the burden of disability on individuals, families, and society.

It can also be used to identify disparities in health and well-being between different groups within a population, such as age, gender, or socioeconomic status.

Improving DFLE requires a comprehensive approach to health care and public health, including prevention and early detection of chronic diseases, access to high-quality medical care, and support for healthy lifestyles.

It also requires addressing social determinants of health, such as poverty, education, and access to healthy food and safe living environments.

Befolkningen i Norge

Presenteeism

“Sykenærvær”, also known as presenteeism, refers to the phenomenon where employees come to work despite being ill or experiencing health problems. This can be due to a variety of factors, such as fear of falling behind on work, concerns about job security, or a culture that values productivity over employee well-being.

When employees come to work while sick, they may be less productive, make more mistakes, and spread illness to others. They may also experience more severe health problems in the long run, as they are not taking the time they need to rest and recover.

In addition, “sykenærvær” can create a culture where employees feel pressured to come to work even when they are not feeling well, which can lead to a cycle of illness and decreased productivity.

To address this issue, organizations can take steps to promote a culture of wellness and encourage employees to take time off when they are sick. This can include sick leave, providing resources for managing stress and maintaining good health, and creating a supportive and flexible work environment that values employee well-being. By prioritizing employee health and well-being, organizations can create a more productive and sustainable workplace for all.

It is also important that employers also facilitate for employees do not have 100% working capacity for a shorter or longer period during their working life.

// NAV 0 10000 20000 30000 40000 50000 60000 70000 80000 90000 0 år 2 år 4 år 6 år 8 år 10 år 12 år 14 år 16 år 18 år 20 år 22 år 24 år 26 år 28 år 30 år 32 år 34 år 36 år 38 år 40 år 42 år 44 år 46 år 48 år 50 år 52 år 54 år 56 år 58 år 60 år 62 år 64 år 66 år 68 år 70 år 72 år 74 år 76 år 78 år 80 år 82 år 84 år 86 år 88 år 90 år 92 år 94 år 96 år 98 år 100 år 102 år 104 år

Hovedalternativet i befolkningsfremskrivningen 2022. Kilde: SSB 2030 Hovedalternativet i befolkningsfremskrivningen 2022. Kilde: SSB The main alternative in the population projection for 2022. Source: SSB Before working Workforce Retired Norway’s population in 2030 27

Profit Share

One of the main benefits of a profit share scheme is that it can help to align the interests of employees with those of the company.

A profit share scheme is a type of incentive program that companies use to reward their employees for their contributions to the company's success.

In a profit share scheme, a portion of the company's profits is distributed among the employees as a bonus or additional compensation. The amount of the bonus is usually based on the company's profits, and the percentage of profits that are allocated to the profit share scheme can vary depending on the company's policies.

Some companies may allocate a fixed percentage of profits to the scheme, while others may use a sliding scale based on the company's performance. Profit share schemes can be structured in different ways. Some companies may distribute the bonus equally among all employees, while others may use a formula that takes into account factors such as job level, tenure, or performance. Some companies may also offer the option for employees to receive their bonus as cash or as shares in the company.

By providing employees with a financial stake in the company's success, they are more likely to be motivated to work harder and to contribute to the company's growth and profitability. Another benefit of a profit share scheme is that it can help to improve employee retention and loyalty.

When employees feel valued and rewarded for their contributions, they are more likely to stay with the company and to be committed to its long-term success. A profit share scheme is a type of incentive program that can provide numerous benefits to both.

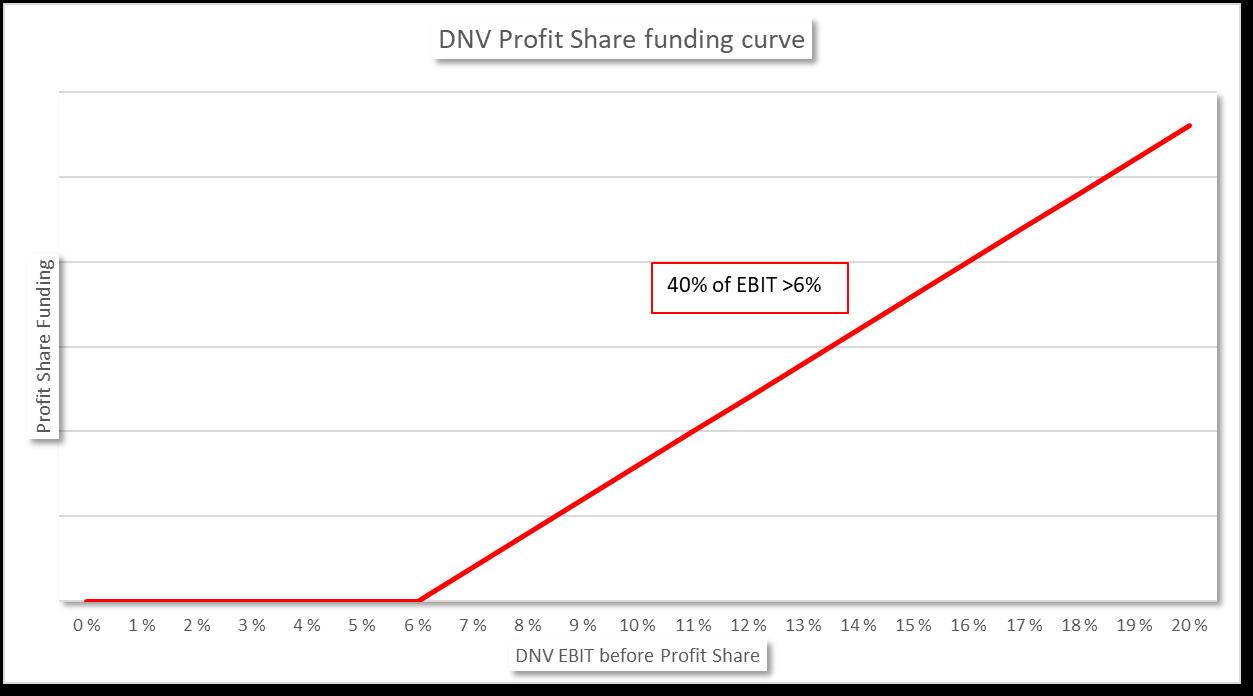

DNV has a global profit share scheme

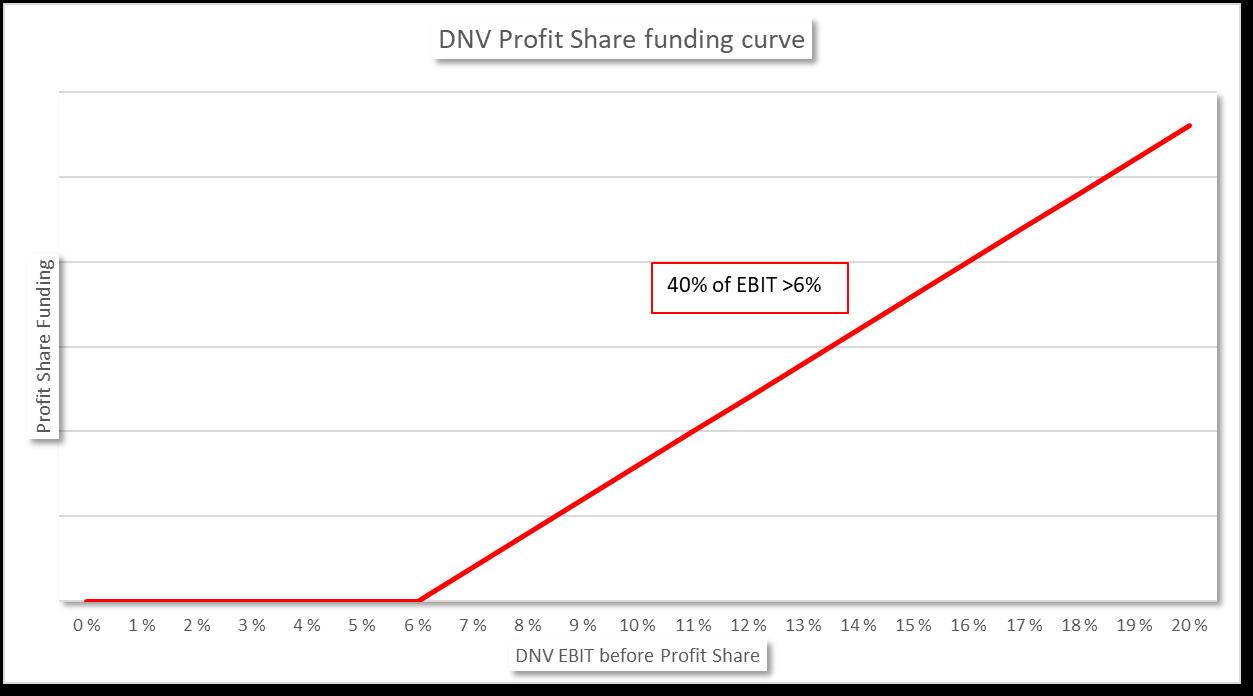

40% of DNV's EBIT (Earnings Before Interest and Taxes) above 6% is distributed among the employees.

The profit share scheme aims to share the profit between DNV and the employees, appreciate the efforts of our employees, and is an element of a Total Compensation approach. The amount of available funding is based on the DNV year-end results and distributed based on the principles described below.

The individual pay-outs are based on the following parameters:

DNV EBIT (profit), BA performance relative to BA target, employee grade, employee individual performance rating (for grades 10-15 only), and annual salary.

For DNV's performance in 2022