The Weekly Financial

www.treko.gr

Global growth is expected to decline and downside risks to intensify as major policy shifts unfold.

By: IMF

The estimates and projections in the April 2025 WEO Chapter 1 and Statistical Appendix are based on statistical information available through April 14, 2025, but may not reflect the latest published data in all cases. Find out More

The 2025 Spring Meetings of the World Bank Group (WBG) and the International Monetary Fund (IMF)

By: WBG

Key events will include the Development Committee Meeting, the International Monetary and Financial Committee, and events and fora focused on international development, the global economy, and financial markets. Discover More

Getting serious about euro internationalization

By David Marsh

Donald Trump’s egregious comments about Jerome Powell, the Federal Reserve chairman, together with many other recent impulsive actions by the US president, have damaged the standing of the dollar. On that broad question, most economists and commentators on world monetary affairs are in general agreement. Yet to assess what difference this might make to the way to the way the world’s reserve currency system works, we need to ask a further question.

Can the politicians and central bankers behind the world’s number two reserve currency, the euro, turn it into a real contender to dislodge the US, say over the next 10 years, from its position of monetary supremacy? Whatever happens, Europe will want to avoid hubris. European financial officials with long memories still recall with a shudder a statement by Yves-Thibaut de Silguy, France’s enthusiastic commissioner for monetary affairs in the years before the euro’s birth,

who said in 1996 that the single currency would be ‘quickly understood in New York and London, sooner than in Paris or Frankfurt, as the tangible sign of re-emerging European power’. Although China’s economic size makes it a longer-term contender to take the dollar’s throne, the renminbi’s low share of international reserves, plus fundamental political factors, hold back its chances of becoming a serious shorterterm rival. Continue Reading.

As Trump undermines the dollar, Merz and Macron must take the lead

www.treko.gr

Electricity use from AI-optimised data centres is set to more than quadruple by 2030.

By: IEA

The development and uptake of artificial intelligence (AI) has accelerated in recent years – elevating the question of what widespread deployment of the technology will mean for the energy sector. There is no AI without energy – specifically electricity for data centres Find out More

The 2025 AEJ Best Paper Awards Have Been Announced

By: AEA

The 2025 AEJ Best Paper Awards have been announced. The papers selected are highlighted below. Discover More

The Global Economy Enters a New Era

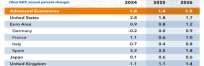

By Pierre-Olivier Gourinchas

Amid trade tensions and high policy uncertainty, the path forward will be determined by how challenges are confronted and opportunities embraced The global economic system under which most countries have operated for the last 80 years is being reset, ushering the world into a new era. Existing rules are challenged while new ones are yet to emerge. Since late January, a flurry of tariff announcements by the United States, which started with Canada, China, Mexico

and critical sectors, culminated with near universal levies on April 2. The US effective tariff rate surged past levels reached during the Great Depression while counter-responses from major trading partners significantly pushed up the global rate. The resulting epistemic uncertainty and policy unpredictability is a major driver of the economic outlook. If sustained, this abrupt increase in tariffs and attendant uncertainty will significantly slow global

growth. Reflecting the complexity and fluidity of the moment, our report presents a range of forecasts for the global economy. Our World Economic Outlook’s reference forecast includes tariff announcements between February 1 and April 4 by the US and countermeasures by other countries. This reduces our global growth forecast to 2.8 percent and 3 percent this year and next, a cumulative downgrade of about 0.8 percentage point relative to our January 2025 WEO update. Continue Reading.

The Global Economy Enters a New Era

Rebalancing the world economy: Right idea but wrong approach

By: Richard Samans

Tariffs alone won’t fix global imbalances, but a four-part “G3” accord across fiscal, monetary, development, and trade policy could. The U.S. has leverage, China has urgency, but Europe may be best positioned to lead the way out of the crisis. Find out More

Here are the coolest cars at New York International Auto Show 2025

By: sam rutherford

There are tons of vehicles including all-new EVs, concepts and more.

Discover More

Trump team needs a trade deal to stop investor panic

By Charles Gasparino

About 10 days ago, an increasingly confident Scott Bessent began telling Wall Street executives that he was on the verge of removing the big dark cloud hovering over the US markets and economy: The Treasury Secretary said he was making significant progress in cutting trade deals with India, Japan, South Korea, and Australia, some of our biggest trade partners. The markets would love the move; President Trump could move forward with his broader plans of isolating the

rogue of the global trade, China, with its high tariffs and frequent theft of US intellectual property. He would avoid an existential threat to his young presidency in a tariff-induce economic meltdown that could lead to rampant inflation and a recession.

But that was last week, and there are still no deals at least none that look imminent by press time Monday which is why the markets resumed added to the uncertainty, when he called Fed Chair Jerome Powell a

“major loser,” more than hinting that he will try and remove him over his reluctance to cut interest rates because tariffs might stoke inflation. Stocks fell more than 2%, depending on the index. The Dow crashed 1,200 points at one point, bond yields spiked, and other more ominous signs: A flight not to US treasuries or the dollar but gold and Bitcoin, the world’s largest crypto currency that has no inherent value other than what some bro in his basement thinks it’s worth.

Continue Reading.

www.treko.gr

The Rise and Fall of the Neoliberal Order: America and the World in the Free Market Era

By: Jason Furman

The New Deal order was based on the premise that unfettered capitalism was a destructive force and the government needed to play a significant role in taming and channeling it

Find out More

New York Auto Show 2025

By: John Velasco

A big price drop over last year is a

Inside Trump's tariff brain

By: Marc Caputo

Stop trying to predict and appraise President Trump's tariffs policies based on economic theories or market realities. Tariffs are pure psychology for the president, fused into his brain like no other topic. Why it matters: Trump's tariff brain is unpredictable to the outside (and to market analysts) but wholly knowable to those who know how his mind works. "There'll be trial and error. There'll be pushing the envelope.

There'll be all of that Trumpian stuff," said a top adviser involved in trade discussions. The big picture: Trump approaches tariffs, the remaking of the U.S. economy and the reshaping of global trade as a continuation of his presidential campaign. He ignored experts and assembled a team dedicated to executing his will and shrugging off the consequences of his unpredictability.

He's not changing now rocky rollout and chaotic financial markets be damned. "Donald Trump works at his own tempo, and he doesn't change the subject until he's sure he's clubbed people into seeing it as he does," the adviser said. Between the lines: In Trump's first term, free traders such as thenNational Economic Council Director Gary Cohn controlled Trump's impulses to impose tariffs the way he has now. Trump's current NEC chief, Kevin Hassett, is pro-tariff. Continue Reading.

Photo illustration: Sarah Grillo

www.treko.gr

ECB shows increased sense of urgency to cut rates further

By: Carsten Brzeski

At the press conference following the 25bp rate cut decision, European Central Bank President Christine Lagarde showed an increased sense of urgency in light of ongoing trade tensions and increased disinflationary pressures

Find out More

«Nobody Can Win This Trade War»

By: George Magnus

Economist and China expert George Magnus is not overly optimistic. «The rupture is so big now that it’s difficult to imagine peace breaking out in the traditional sense,»

Discover More

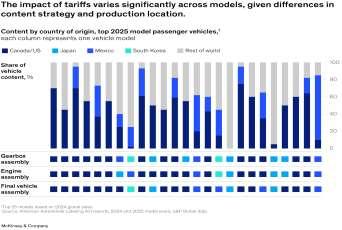

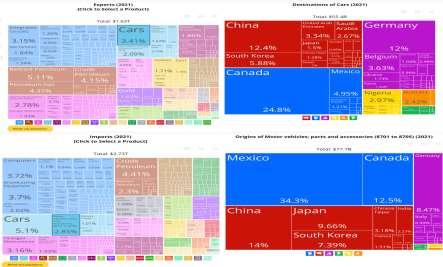

Navigating tariffs with a geopolitical nerve center

By: McKinsey & Company

Tariffs and trade controls are expanding rapidly around the world.

Macroeconomic uncertainty is growing. Second-order effects of government actions are multiplying. The first global economic shock since the COVID-19 pandemic has arrived. While geopolitical tensions have been rising for several years, the recent wave of trade controls and reciprocal tariffs has come on quickly and intensely.

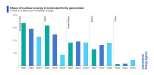

Not since the 1930s has the world seen this level of tariff activity. The impact on businesses is high, unevenly distributed, and likely to remain that way. In the automotive industry, for example, the amount of content that comes from different countries ranges widely by car model, making the impact of tariffs highly variable and creating cascading effects through automakers’ supply chains (exhibit). Take the example of one 2025 hybrid electric

vehicle: Its gearbox is made in Japan, roughly 30 percent of its parts originate in the United States or Canada, and another quarter are sourced from Mexico; the engine is assembled in the United States and the final vehicle in Mexico. Other car models comprise almost entirely imported parts; a few are largely sourced and assembled in a single country. This complexity is not limited to the automotive industry many sectors and regions face similar challenges. Continue Reading.

Content by country of origin, top 2025 model passenger vehicles.

The Weekly Financial

www.treko.gr

Does Trump Know What He Wants from Europe or How to Get It?

By: Jason Furman

President Trump has had two consistent views about trade for decades. The first is that trade deficits in goods (he ignores one of America’s strongest exports, services) reflect a net loss for the United States.

Find out More

Mapping China's HBM Advances

By: Ray Wang, Lily Ottinger

Nvidia’s H20 GPU with HBM3 had become the most sought-after accelerator in China amid rapidly increasing inference and computing demand. Prior to the new restrictions, shipments were projected to reach 1.4 million units in 2025.

Discover More

New Tariffs & the Hobby

By: Olivia McCommons

On April 2, called “Liberation Day,” President Donald Trump imposed “reciprocal tariffs” on imports from around 90 countries that are above the 10-percent tax that applies to all imports to the United States. The Treasury states that these tariffs are necessary to rebalance America’s economy: “Regulatory barriers to American products, environmental reviews, differences in consumption tax rates, compliance

hurdles and costs, currency manipulation and undervaluation all serve to deter American goods and keep trade balances distorted. As a result, U.S. consumer demand has been siphoned out of the U.S. economy into the global economy, leading to the closure of more than 90,000 American factories since 1997, and a decline in our manufacturing workforce of more than 6.6 million jobs, more than a third from its peak.”

On April 9, due to concerns from about 75 nations, Trump announced a 90-day pause on the reciprocal tariffs and lowered the tariff rate for most nations to 10 percent except for China, whose rate has been raised to 125 percent. “Reciprocal. That means they do it to us, and we do it to them,” Trump says. As of April 9, collectible items are not exempt from these taxes, meaning collectors who purchase coins, bank notes, medals, and other numismatic items Continue Reading.

Photo: Getty Images/zimmytws

The Weekly Financial

www.treko.gr

The Rise of the Silver Economy: Global Implications of Population Aging

By: IMF

The analysis reveals that while population aging poses challenges such as slower growth and increased fiscal pressures, healthier aging trends offer a silver lining by boosting labor force participation, extending working lives, and enhancing productivity.

Find out More

The Other Cost of Protectionism

By: Vincent Geloso

But protectionism the broader policy goal tariffs are meant to serve does produce a trend shock by slowing long-run growth. This is because protectionism functions like a disease on institutions, undermining their effectiveness over time.

Discover More

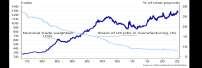

What the Weak Dollar Means for the Global Economy

By: Chelsey Dulaney, Alistair MacDonald

The unexpected weakening of the U.S. dollar is suddenly becoming the rest of the world’s problem. For foreign sellers of all manner of goods, including cars, cognac and Scottish tweed, the dollar’s steep slide is a double whammy, compounding losses caused by President Trump’s import levies. For central banks around the world, the rapid strengthening of their own currencies heaps pressure to cut interest rates more aggressively.

The U.S. currency resumed its rapid weakening Wednesday, hitting fresh lows against the euro, the Japanese yen and the Swiss franc. The dollar decline has been historic, with the ICE U.S. Dollar Index, a measure of the greenback against a basket of currencies, slipping 8% this year, the worst start to a year in the index’s fourdecade trading history. Because of its role as the primary currency used for global trade and finance, swings in the dollar have

significant global consequences. “For exporters, you’re not getting the currency eroding some of the tariff impact for the end U.S. consumer,” said Derek Halpenny, the London-based head of global markets research for the Japanese bank MUFG. “It has a bigger negative impact for sure.” A weak dollar makes the profits that foreign companies earn from their U.S. divisions worth less when translated back into euros or yen Continue Reading.

Illustration: Rachel Mendelson/WSJ, iStock (4)

The Weekly Financial Digest

www.treko.gr

Things Everyone Should Know about Trade Deficits

By: Scott Lincicome

Trade balances can tell us stuff about an economy but much less about a nation’s trade policy and much more about its citizens spending and saving, as well as the economic and noneconomic forces affecting those millions of individual decisions. Find out More

‘Mar-a-Lago Accord’ explained: A new era for the dollar?

By: Lars Mouland

In order to bring the system more into a “fair” balance, the US should demand a weaker dollar and disincentivize imports to rekindle domestic manufacturing. Discover More

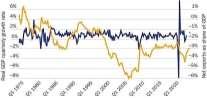

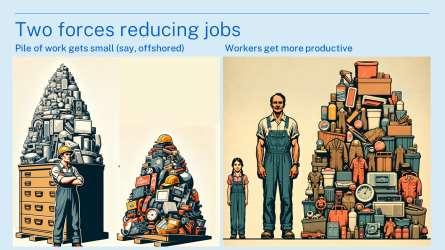

Where in the world are manufacturing jobs going?

By: Richard Baldwin

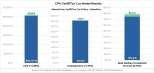

Today's “Factful Friday” focuses on manufacturing jobs – changes in the number of manufacturing jobs around the world, to be precise. All the data is from the OECD’s Trade in Employment dataset, which ranges from 1995 to 2018. The world has lost about 20 million manufacturing jobs. Start with this simple, but perhaps startling fact: the world has lost about 20 million manufacturing jobs since 2013. This follows a rather

spectacular rise in the number of jobs by about 50 million between 1995 and 2013. The evolution of jobs is shown in the left-hand chart. The dip in jobs around 2000 is related to, I believe, the Asian crisis (maybe someone can clarify it in the comments?). To check that the drop in jobs wasn't due to some enormous decrease in the output of manufacturing, the right chart shows that world manufacturing GDP grew at a healthy clip all through this period.

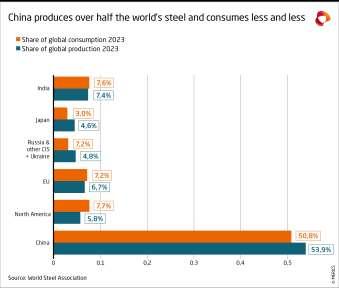

Now I turn to considering the possible options of where these jobs went. Did the jobs go to China? Nope! As it turns out, China lost 22.5 million manufacturing jobs from 2013 to 2018 (the last year in the database). Of course, things are never as simple as they seem, but it is astonishing, at least to me, that the worldwide job loss of 23 million is almost identical to China’s (see charts below).

Continue Reading.

The answer is simple: productivity gains ate them.

www.treko.gr

Don't Make the Mistake of Thinking That What's Now Happening is Mostly About Tariffs

By: Ray Dalio

The far bigger, far more important thing to keep in mind is that we are seeing a classic breakdown of the major monetary, political, and geopolitical orders. This sort of breakdown occurs only about once in a lifetime, but they have happened many times in history when similar unsustainable conditions were in place.

Find out More

The Class Politics of the Dollar System

By: Yakov Feygin , Dominik Leusder

A closer look at the underlying dynamics that sustain this arrangement reveals why seemingly no one wants to ‘buck the dollar’ but why all countries, including the US, have an interest in doing so.

Discover More

China and America Aren’t Just in a Trade War. It’s a Fight for the 21st Century.

By: Matt Pottinger, Liza Tobin

Welcome to the Great Divorce: a messy breakup between the world’s two largest economies with the rest of the world up for grabs as part of the settlement. What began mainly as a trade beef for Trump is, for Xi Jinping Chinese president and general secretary of the Chinese Communist Party nothing less than a contest for mastery of the 21st century. Xi is right.

This is about much more than trade. And like it or not, the competition is pretty much zero-sum. While Trump has seized the upper hand in the trade war, Xi is gaining ground in areas that may be even more consequential: artificial intelligence, advanced manufacturing, and the military might be required to seize the most important piece of real estate in the world Taiwan.

The moment when China would be singled out from the rest of the world as the primary target of Trump’s ire was a long time coming but it was always coming. For much of his first term, Trump believed he could negotiate down China’s trade surplus with the United States, which today accounts for roughly onethird of America’s nearly $1 trillion overall trade deficit. Continue Reading.

Xi and Trump are now in a zero-sum contest for global supremacy.

The Weekly Financial Digest

www.treko.gr

The Case for a U.S.-UK Tech Alliance

By: Paul Steidler

According to Stanford University’s 2024 AI Index Report, which is issued annually in April, the United Kingdom ranks third globally for AI private investment, behind the United States and China. In 2023, the UK attracted $3.8 billion in such investments, nearly twice as much as Germany ($1.9 billion) and Sweden ($1.89 billion). Indeed, only four EU countries had investments of $0.36 billion or more in AI. Find out More

The Digital Markets Act: ensuring fair and open digital markets

The Digital Markets Act establishes a set of clearly defined objective criteria to qualify a large online platform as a “gatekeeper” and ensures that they behave in a fair way online and leave room for contestability. Discover More

The Optimum Tariff: The Idea Behind Trump’s Trade Strategy

By: John Carney

The core insight is this: when a country is big enough, it can influence world prices. The United States is not a small, open economy. We are the world’s largest buyer. When we buy less of something, the world notices. Prices move. Now imagine we put a tariff on imports. That’s just a tax at the border. It raises the domestic price of a foreign good. As a result, we buy less of it. But if we’re a major share of global demand for that product steel, semiconductors, autos, solar panels, whatever the global

price starts to fall. The country selling it can’t easily find other buyers. Supply outstrips demand. So, prices drop. In this case, the tariff doesn’t just make the product more expensive at home. It pushes down its world price, so we end up paying less for it than we would without the tariff. We give up some volume of trade, yes but what we do trade, we trade on better terms. This is what economists call a terms-oftrade gain. Here’s where the theory gets its name.

If you raise tariffs too high, you lose too much volume and the gains vanish. If you don’t raise them at all, you leave bargaining power on the table. But there’s a “just right” rate a point at which the termsof-trade improvement outweighs the lost trade volume. That’s the optimum tariff. Think of it like this: if your local supermarket doubled its prices tomorrow, you’d probably shop somewhere else.

Continue Reading.

The Forgotten History of Strategic Tariffs

The Weekly Financial Digest

www.treko.gr

Econ 101 is wrong about tariffs

By: Brian Albrecht

By shielding domestic producers from foreign competition, tariffs allow these producers to charge higher prices and give them a new opportunity to expand production. The yellow region of producer surplus grows. That’s why companies facing import competition will lobby for trade barriers. For some people (and this is a normative argument, not a positive economic argument), the benefit to domestic producers and their employees is worth more than the harm to consumers; there’s a redistributive reason for the tariff. Find out More

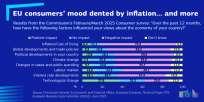

European Business Cycle Indicators: The impact of selected factors on consumers' views of the economy. 1st Quarter 2025

By: Directorate-General for Economic and Financial Affairs

The special topic analyses the impact of selected factors on consumers' views of the economy. Discover More

China's formidable logistics sector challenges Trump tariff enforcers

By: STELLA YIFAN XIE and PAK YIU

Tens of thousands of logistics companies are helping manufacturers minimize the impact of US tariffs through strategies that include undervaluing shipments or disguising their origins. These entities offer "double clearance and tax inclusive" services, and have exploded in numbers since Trump’s trade war on China in his first term. For bargain rates advertised on Chinese social media, they oversee customs compliance on both sides of the trade, sometimes working through related companies that act as importers of record. One of the tricks is double

invoicing, which can include understating the cost of a product on one invoice, while putting the rest on another for a service not subject to tariffs, like "marketing.“ It's an open secret in our industry.”

Logistics players have helped companies shrug off Trump's trade war so far. Before Trump embarked on tariff hikes in Feb, a Shenzhen lighting manufacturer was paying logistics companies roughly 10 yuan per kg to handle the lighting products sold in the US. As of this week, the total cost of seaborne double clearance services had only risen by 1 or 2 yuan (14 to 27 cents). While the costs might increase

further, they are not expected to climb anywhere near as much as Trump's total tariffs on China (145% currently). Evasive maneuvers like those employed by the logistics companies help some exporters stay competitive. Enforcing tariff payment has not been easy. The tariffs Trump imposed on China during his first term led to evasion worth up to $110B to $130B in 2023, with underreporting and mislabeling each contributing $40B and rerouting accounting for $30B to $50B. The number of crossborder e-commerce logistics companies reached over 167,400 as of Oct 2024 Continue Reading.

Photo by Ken Kobayashi

The Weekly Financial Digest

www.treko.gr

It's the end of the world, as we know it... (But there's no reason to feel good about it)

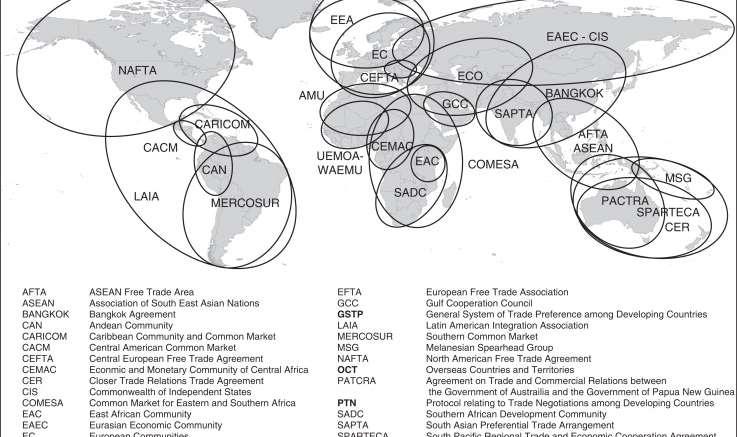

The most important part of this EU response is probably: forging alliances. All countries in the world that continue to support international trade and the international division of labor must act as united as possible. Free trade agreements should be concluded more quickly, and remaining trade restrictions between countries should be dismantled swiftly. Find out More

Macroprudential and monetary policy tightening: more than a double whammy?

The interaction between monetary and macroprudential policies has become a key area of focus in policy discussions and economic research. Discover More

All the arguments for Trump's tariffs are wrong and bad

By: Noah Smith

Lots of people are claiming that the tariffs are simply a way of getting leverage for negotiations with other countries, so that Trump can pressure those countries into doing a bunch of stuff that he wants. This argument will inevitably get stronger in the wake of Trump’s 90-day pause, with some apparatchiks pivoting seamlessly from “tariffs are good” to “art of the deal”. This might seem like a reasonable thing to assume, since in his first term, Trump did cancel some of his plans for China tariffs

after China promised to buy a bunch of U.S. farm goods (which of course it never bought). And Trump is now holding talks with some of America’s trading partners, in which he presumably plans to demand various concessions ahead of the new July Liberation Day. One obvious problem with this idea is that Trump put tariffs on way more countries than he could realistically negotiate with. The administration, possibly using ChatGPT,1 made a list of tariff rates for 90 countries, even including some uninhabited islands. Even if Trump negotiated with one tariffed country per week a far greater rate of work output than the President is known for it would take him almost two

years to make deals with all of them. I suppose it’s possible that Trump might make deals with a few key trading partners Japan, the EU, and so on and leave the rest out to dry. This would be horribly unfair, but at least it would be logistically possible. But even then, it’s hard to imagine what kind of concessions Trump would ask for. Most countries already have low or zero tariff rates on American goods far lower than the imaginary rates that Trump’s team attributed to them. When Vietnam offered to lower its tariffs on American goods to zero, Trump’s guru Peter Navarro said that the offer “means nothing”. Continue Reading.

By: BIS ORG

By: MARTIN KOCHER

Photo by Barthelemy de Mazenod on Unsplash

The Weekly Financial Digest

www.treko.gr

Potential Implications of Announced Tariffs for Monetary Policy

By: Neel Kashkari

In this essay I will briefly discuss potential implications of the recent tariff announcements for the path of monetary policy.1 Trade policy is not the purview of the Federal Reserve; it is the domain of Congress and the executive branch. However, trade is an important factor monetary policymakers must consider when analyzing and forecasting the path of the U.S. economy in order to determine how best to achieve the dual mandate goals of stable prices and maximum employment that Congress has assigned us. Find out More

Digital Assets: Dedollarization Moves Bitcoin Towards Monetary Role

By: Matthew Sigel

The Trump administration’s April 2 tariff package targeting imports from China and the EU has reignited global trade tensions and increased the risk of monetary and geopolitical fragmentation. Discover More

Trump's middle class tax hike

By: Matthew Yglesias

The United States imports a lot of cars and also exports a lot of cars. We import a lot of car parts, and we also export a lot of car parts. Notably, we both import car parts from China and export cars to China. If we taxed imported Chinese car parts, that may increase the number of Americans who get jobs working in factories that manufacture car parts. But it’s not only going to increase the price that Americans pay for cars, it’s going to make it harder to sell cars to China.

American car factories will close, and those workers will need to get new jobs. Chinese car part factories will close, and the workers will need to go get new jobs. The transition would be costly and pointless. But note that we also sell a lot of cars to places like Saudi Arabia, the UAE, and Nigeria, countries that don’t really have domestic automobile industries. When imported car parts get more expensive in the United States, that’s going to make American car exports less competitive in those Middle Eastern and African markets. Customers there will buy cars made in Germany or Japan or Korea instead, and

American manufacturing will be hurt by tariffs that are supposed to help it. Reality is complicated, and to fully game this out, you’d need to know what happens to exchange rates and a million other things. What we can know is that the general tendency of a flat tax on all imports is to advantage American producers of primary components, but to hurt American exporters of complicated machines. We’d be making fewer cars, but more fan belts. More steel and aluminum, but fewer airplanes. Continue Reading.

The Weekly Financial Digest

www.treko.gr

Goals of Expo 2025

Osaka Kansai

In 2025, the world will be a mere five years away from 2030, the year the United Nations has set as the target for achieving the Sustainable Development Goals (SDGs), making it a crucial one for ramping up efforts to achieve these goals. Therefore, Expo 2025 Osaka, Kansai will become a key platform for reaching the SDGs by 2030. Find out More

The China Shock revisited

By: Kyle Chan

The ”China Shock” paper (actually a set of papers)1 sent shockwaves through the US political world when it was first released by a team of high-profile economists in January 2016. It estimated the US lost nearly 1 million manufacturing jobs from 1999 to 2011 due to a surge in Chinese imports starting around the time of China’s accession to the WTO in 2001. Discover More

Beyond overcapacity: Chinesestyle modernization and the clash of economic models

By: Mercator Institute for China Studies

Overcapacity is commonly defined as a company, country or market having higher production capacity than can be utilized profitably, leaving some of that capacity unused. This is mainly driven by overinvestment and subsequent overproduction, and/or underconsumption.

In a functioning market economy, this is a normal part of the business cycle as excessive supply drives down prices and only the strongest survive as weaker companies close shop. This normal pattern can be disrupted by extensive market interventions, as is the case with China. According to the European Union Chamber

of Commerce in China Business Confidence Survey 2024, conducted among 529 companies in China, 36 percent of respondents already see overcapacity, and 10 percent see it on the horizon. Within sectors, 51 percent see overcapacities looming for chemicals, 55 percent for industrial machinery, 56 percent for pharmaceuticals, and 62 percent for automotive. Continue Reading.

By: Expo 2025 Osaka Kansai

The Weekly Financial

www.treko.gr

From Partner to Rival: Understanding China’s Technological Rise through Patent Data

By: ST.LOUIS FED

In today’s global economy, a country’s technological capabilities increasingly determine its economic power and influence. One way to track these capabilities is through international patent filings the legal protections countries seek for their citizens’ innovations in foreign markets. These patents can signal how nations position themselves in the global innovation landscape. Find out More

Internationalization of the RMB: Status, Options and Risks

By: Bert Hofman, Johannes Petry

The main conclusion of the report is that the international use of the RMB has seen only modest progress in the past 15 years, but that China has substantially expanded the institutional infrastructure that underpins this internationalization. Discover More

Are U.S.-China Relations Heading Toward Breakdown?

By: Lingling Wei

Markets world-wide are melting down and U.S.-China relations are at risk of completely breaking down.

Are we already at the worst-case scenario China has feared? In response to Beijing’s retaliation against the sweeping tariff hikes

President Trump announced last week, Trump on Monday threatened to escalate his trade assault on China further, raising the specter of a full decoupling from the world’s second-largest economy.

Trump, in a social-media post, urged China to roll back the 34% retaliatory tariffs on the U.S. it announced Friday, saying if Beijing doesn't do so by Tuesday, the U.S. will immediately impose an additional 50% tariff on China. Interpretations of his latest threat were that if it is carried out, it could take U.S. import taxes on Chinese goods imposed just in his second term above 100%.

Xi Jinping has every reason to avoid a breakdown. Keeping engaged with the U.S. is crucial as China builds up its industrial and technological capabilities.

China has made great strides but has ways to go.

However, the Chinese leader is unlikely to back down.

Even before the latest threat from Trump, Beijing already viewed the extra 34% tariffs announced last week as too much to bear. In keeping with his strongman persona, Xi directed his government to strike back, hard, with a broad set of countermeasures ranging from retaliatory tariffs to blacklisting U.S. firms to export controls. Continue Reading.

China said it will impose 34% tariffs on all

goods in response to sweeping Trump tariff action. BRYAN SMITH/ZUMA PRESS WIRE

www.treko.gr

The Supply Problem In The Fed's Framework

By: Employ America

The Fed's main tool the federal funds rate is intended to influence aggregate demand. Raising interest rates makes borrowing more expensive, slowing how businesses and households spend, whether that be on capital or labor, investment or consumption. Less consumer spending puts marginally less demand-side pressure on consumption, and thereby limits scope for price increases. Tariffs, however, do not operate through this channel. Instead, higher tariffs can push up prices even as nominal consumer spending slows. Find out More

Germany wants its gold back!

By: Alasdair Macleod

The problem is that either the gold is not there, or if it is there it is encumbered by being leased out to other parties. In other words, it has at least two owners with further rehypothecation extremely likely.

Discover More

Trump's tariffs are designed for maximum damage—to America

By: Maurice Obstfeld

President Donald Trump touted his bewildering array of "Liberation Day" import tariffs as carefully calibrated to offset trade partners' tariff, nontariff, and currency barriers to US exports. However, details of the calculations released by the office of the US Trade Representative (USTR) show that in reality, the tariffs' effect will be to curtail US trade the most precisely where it provides America with the biggest benefits.

The result will be a direct hit on US consumers and businesses. No wonder the stock market is swooning. The tariff plan displays a basic misunderstanding of the reasons why nations trade in the first place reasons that imply the United States will run deficits with some trade partners (bilateral deficits) and surpluses with others (bilateral surpluses). The reasons reflect the operation of comparative advantage. For example, the US imports aluminum from countries that can produce it most efficiently, while embodying it in exports where it has

the advantage, such as aircraft. This will tend to lower US trade balances with efficient aluminum producers and raise them with aircraft importers. The same is true for households and businesses. I have a surplus with my textbook publisher, Pearson, because I am relatively better at writing textbooks while they are better at publishing and distributing. But I chose to have a deficit this year with my ophthalmic surgeon rather than trying to remove my cataracts myself.

Continue Reading.

Photo Credit: REUTERS/Amanda Perobelli

The Weekly Financial Digest

www.treko.gr

Principles of the trading system

By: WTO

The WTO agreements are lengthy and complex because they are legal texts covering a wide range of activities. They deal with: agriculture, textiles and clothing, banking, telecommunications, government purchases, industrial standards and product safety, food sanitation regulations, intellectual property, and much more. But a number of simple, fundamental principles run throughout all of these documents. These principles are the foundation of the multilateral trading system.

Find out More

EU | United States to impose Reciprocal Tariffs on goods originating from the European Union

By: ING

On 2 April 2025, US President Trump gave a press conference in the Rose Garden to announce reciprocal tariffs. This announcement followed a February 2025 presidential memorandum (the Memorandum) ordering the Office of the US Trade Representative (USTR) and the Department of Commerce to initiate investigations of "harmful" nonreciprocal trade arrangements by foreign trading partners. Discover More

Analyses, simulations and commentaries on all issues related to the impact of tariffs and trade wars.

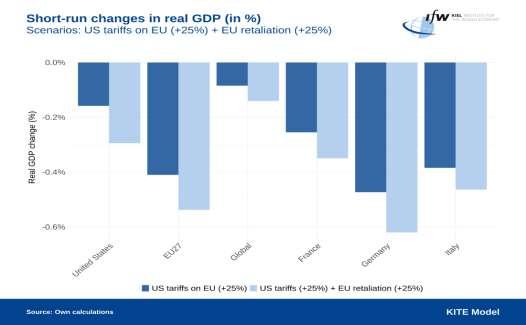

Kiel Trade and Tariffs Monitor

By: IfW Kiel

The Kiel Trade and Tariffs Monitor offers in-depth analyses, simulations, and commentaries on the economic impacts of tariffs and trade conflicts. Utilizing the KITE model, the we evaluate scenarios such as the effects of U.S. tariffs on European goods, potential EU countermeasures, and the broader consequences of escalating trade tensions on global economies. To support informed discussions on trade policies, the platform provides access to the raw data used in these analyses, providing structured data of newly announced tariffs. The research is continually updated to reflect current developments,

ensuring relevance and accuracy. The Kiel Institute Trade Policy Evaluation (KITE) model suite represents a collection of state-of-theart quantitative trade models developed to assess the impact of international trade policies on global economies. Rooted in the New Quantitative Trade Model (NQTM) framework pioneered by Eaton and Kortum (2002), the KITE suite implements on this approach by incorporating sectoral heterogeneity, input-output linkages, and various policy instruments. The model suite is continuously refined to address increasingly complex policy questions, from tariff liberalization to sanctions,

and regional economic integration. The foundational model builds on the multi-sector extension developed by Caliendo and Parro (2015), which introduced intermediate input linkages into the Ricardian framework of Eaton and Kortum (2002). Recent extensions, such as the one presented in Chowdhry et al. (2024), have incorporated additional mechanisms, including international transfers for burdensharing in sanctions scenarios, while preserving the tractability and theoretical consistency of the original framework.

Continue Reading.

The Weekly Financial Digest

www.treko.gr

Volume 1 Issue 9

Debunking Myths about the Trade Deficit

By: Erica York

Politicians usually refer to the trade deficit as a scorecard between nations. They claim having a trade deficit with another country means we’re losing, and that’s the end of the story. But that story is incomplete. Understanding how saving and investment affect the trade deficit tells the rest of the story. The flip side of spending more than we produce is that we also save less than we need to fulfill the American economy’s investment opportunities. To make up the difference and finance our borrowing and investment opportunities, foreigners lend money to the U.S. and reinvest dollars into the U.S. economy. The result is a capital surplus. Find out More

Germany Releases a Bavarian Bullion

By: Sebastian Wieschowski

For decades, German collectors and investors have lacked a homegrown bullion coin despite the success of international counterparts like the Krugerrand, Maple Leaf, and Britannia. A dedicated investment coin has remained elusive in Germany even though the country has issued gold commemorative coins. Discover More

Down the drain: Protectionism was not the initial cause of the decline in world trade but it certainly made it much worse.

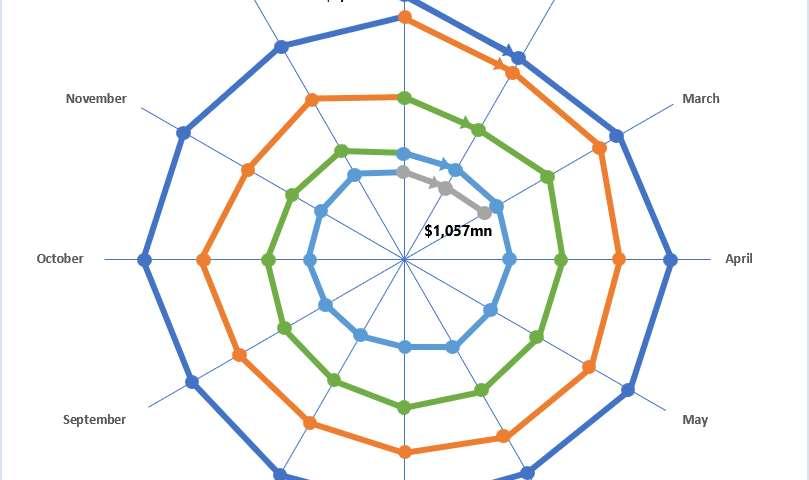

Tariffs: Kindleberger spiral back from the dead, and who pays the tariffs?

By: Peter Ungphakorn

Hear that sucking noise? It’s the sound of the world economy going down the drain. Or at least it might be if world trade follows the pattern of the last Great Tariff War of almost a century ago, as some are suggesting. Economists are starting to dig out an old, almost forgotten chart sometimes called the Kindleberger spiral, named after the American economic historian, Charles P Kindleberger. He created it to trace the decline in world trade month by month, from January 1929 to March 1933, when almost two thirds of trade was wiped out.

For now, it’s unlikely that we’ll see the spiral repeated. But Donald Trump is unpredictable and he has threatened the whole world with higher taxes on their exports to the US (and then announced on April 2, 2025 ), so who knows? The Kindleberger spiral is better seen as a warning than a prediction. It shows world trade falling from almost $3 billion per month in January 1929 to just over $1 billion in March 1933, a fall of almost two thirds (about 65%). Immediately before that, trade had risen by an annual average of 6% in 1924–1928. In those three years and a quarter,

leading economies competed to raise trade barriers against each other, particularly with the tariffs of the US Smoot-Hawley Act and followed by rounds of retaliation by other countries. Naturally, trade took a hit. So did economies. In those three years and a quarter, leading economies competed to raise trade barriers against each other, particularly with the tariffs of the US Smoot-Hawley Act and followed by rounds of retaliation by other countries. Naturally, trade took a hit. So did economies. Continue Reading.

The Weekly Financial

www.treko.gr

Five systemic threats and what to do about them

By: Jón Danielsson

Robert Macrae

Systemic financial risk has both internal and external drivers. So, when we focus too strongly on preventing internal crises, such as the 2008 Global Financial Crisis, we tend to miss out on the more important external risks. Five external risk factors stand out: populism, debt-driven death spirals, manufactured tensions, artificial intelligence and geopolitics. To combat these threats, the macroprudential authorities should reorient away from derisking the financial system and towards resilience and economic growth via deregulation and diversification. Find out More .

The False Promise of Populism

By: Christopher Coyne, Andre Quintas

Populism is one of the most important political phenomena of our time. Yet, it is still poorly understood. At its core, populism is built on the notion that the masses are engaged in a struggle against corrupt elites who have rigged the political and economic system to their advantage. Discover More

“Uncertainty is here to stay” as Trump’s tariffs reshape trade policy

By: EuroFinance

The United States is at the centre of a trade policy revolution, driven by the return of President Donald Trump to the White House. His second term has adopted an aggressive approach to trade, one that is rewriting the rules of international commerce and disrupting global supply chains. Mary E. Lovely, a senior fellow at the Peterson Institute for International Economics,

describes the current situation as an “upheaval,” a term she has never before used to describe trade policy. What makes this moment particularly challenging, she argued, is the deep uncertainty surrounding United States trade actions. “Uncertainty is not a bug of this administration; it’s a feature,” she emphasises. Businesses, investors, and policymakers must navigate an environment where trade rules and tariffs shift rapidly, complicating long-term planning.

The Trump administration’s aggressive trade stance is built around three key pillars: reshoring American manufacturing, using tariffs as revenue, and leveraging trade policy for geopolitical influence. But while these goals are clearly stated, the impact on businesses, consumers, and the broader economy is more complex and often destabilising, according to Lovely. Continue Reading.

Tariffs as the cornerstone of Trump’s trade agenda

www.treko.gr

Beautiful as well as smart

2025

Delta presents transformative solutions for a smart industry at first hand at HANNOVER MESSE 2025, for example the designaward-winning collaborative robots of the D-Bot series (cobots), and opens up opportunities for the joint development of a more sustainable and connected world. Find out More .

Big banks predict catastrophic warming, with profit potential

By: Corbin Hiar

Top Wall Street institutions are preparing for a severe future of global warming that blows past the temperature limits agreed to by more than 190 nations a decade ago, industry documents show. Discover More

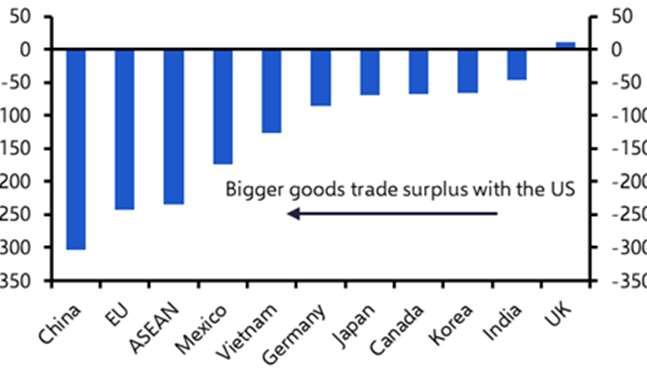

The only certainty about “Liberation Day”? Everyone loses when tariffs rise

By: Neil Shearing

The President is calling it

“Liberation Day”, but nobody knows exactly what the White House will come up with when the longawaited reciprocal tariffs plan is finally unveiled on 2nd April –including, it seems, the administration itself. Initial reporting suggested the focus would be on the so-called “Dirty 15”

of countries with which the US runs its largest trade deficits. That includes China, Mexico, Germany (and by extension, the EU), Japan, South Korea, Taiwan, and Vietnam. But the narrative won’t stop shifting. After announcing sweeping tariffs on autos and auto parts last week, President Trump suggested that further sectorspecific tariffs are coming, with pharmaceuticals and lumber seemingly next in line, but also that

reciprocal tariffs on individual countries could be more modest than initially feared. This approach would appear to blend large tariffs on certain goods with smaller tariffs on particular countries. However, subsequent reports over the weekend have suggested that large country-level tariffs are still on the table. What this will all amount to in practice is anyone’s guess. Continue Reading.

Bilateral Goods Trade Deficits with the US ($bn, 2023).

The Protectionist Road To Depression

By Edward Yardeni

It's time to talk about an unpleasant subject: Is a depression possible? We aren't forecasting a depression, just worrying about one. And we suspect you are too. We continue to believe that the economy will muddle down the middle between boom and bust. Find out More

The European Tax Policy Scorecard (ETPS)

The European Tax Policy Scorecard seeks to measure the extent to which a country’s tax system adheres to two important aspects of tax policy: competitiveness and neutrality. Discover More

European automotive industry: What it takes to regain competitiveness

By: McKinsey & Company

Historically, the relevance of Europe’s automotive industry expands far beyond its core in terms of spillover effects: every euro invested in the automotive industry results in 2.6 times the value added for the wider economy. The industry contributes more than ten million jobs indirectly to downstream and adjacent industries.

Projects for the automotive industry make up 10 percent of the gross value added for both manufacturers of basic metals, rubber, and plastic products and manufacturers of fabricated metal products. European automotive OEMs also make up 40 percent of European semiconductor demand across EMEA, and the automotive industry accounts for 75 percent of European battery sales.

Moreover, in 2023, the European automotive industry contributed around €1.7 trillion in gross value added to the European economy, with technology and car exports generating about €570 billion.7 And by 2030, 30 percent of Europe’s green steel demand is projected to be attributable to the automotive industry. Continue Reading.

www.treko.gr

Trump places 25% tariff on imported autos, expecting to raise $100 billion in tax revenues

By JOSH BOAK

The tariffs, which the White House expects to raise $100 billion in revenue annually, could be complicated as even U.S. automakers source their components from around the world. Find out More

The right place at the right time: Why business location matters for firm success

What Makes Business Location Friendly Economies Different

B-READY analyzed 50 economies on property registration, building permits, and environmental clearances, in the Business Location topic assessing regulatory effectiveness, governance quality, and service delivery efficiency. Discover More

Finding an Alternative to Populist Trade Policies

By: David Henig

Even before the chaos of Trump’s second term, bringing back factory jobs and talking about tariffs were the predominant trade policy discussions in many countries. While these clearly have some significance, they’re part of a far bigger picture that makes specific efforts liable to fail. For production is now largely organized in global supply

chains operated by large companies. Consumers across the world directly trade services via smartphones as ideas and technologies flow almost seamlessly. Across sectors there is a far greater range of products than was ever previously available, serving many functions from keeping us healthy to offering domestic products affordably. There is a significant side-effect of this evolving world economy.

Governments have lost powers to influence their national economies. While that may please libertarians, it is leaving an unsustainable vacuum, arguably in turn leading to a vicious cycle of failed promises. Politics needs to be the forum for argument on how a country should operate, but at the moment too much of that will continue whoever is elected. As consumers, we like the choice, as citizens we feel the lack of control.

Continue Reading.

The Weekly Financial

GlobalMoneyWeek2025

GMW is an annual global awareness-raising campaign to ensure that young people, from an early age, are financially aware, and are gradually acquiring the knowledge, skills, attitudes and behaviours necessary to make sound financial decisions and ultimately achieve financial wellbeing and financial resilience. Read More

The Numismatist Magazine

This beautifully illustrated monthly magazine is packed full of articles and features written by leading numismatic experts covering all facets of the hobby, from coins and tokens to medals and paper money … plus hobby news from across the globe. Read More

Ship Wars: Confronting China’s Dual-Use Shipbuilding Empire

Report by Matthew P. Funaiole, Brian Hart, and Aidan Powers-Riggs

China has rapidly established itself as the world’s dominant shipbuilding power, marginalizing the United States and its allies in a strategically important industry.

In addition to building massive numbers of commercial ships, many Chinese shipyards also produce warships for the country’s rapidly growing navy. As part of its “militarycivil fusion” strategy, China is tapping into the dual-use resources of its commercial

shipbuilding empire to support its ongoing naval modernization Foreign companies are inadvertently helping to propel China’s naval buildup by buying Chinesemade ships and sharing dual-use technologies with Chinese shipyards. Read the Full Report.

Photo: Tian Yuhao/China News Service/Getty Images

The Weekly Financial

www.treko.gr

2025 Is Going To Be Wild For Silver And The

US Dollar. Take A Look…

By KWN

One of the most significant breakouts in history is in the making. 2025 will be silver’s year. Read More

Personal Finance

Yet another enlightening experience is offered this year in our Museum, as a specifically rearranged area on its first level hosts the new temporary exhibition Personal Finance, accompanied by additional informative and educational features and activities, specially designed for secondary education students. Read More

During the 2018-19 U.S.-China trade war, the U.S. levied 10 to 50 percent import tariffs on more than $300 billion of imports from China (and some other countries).

Do Import Tariffs Protect U.S. Firms?

Mary Amiti, Matthieu Gomez, Sang Hoon Kong, and David E. Weinstein

One key motivation for imposing tariffs on imported goods is to protect U.S. firms from foreign competition. By taxing imports, domestic prices become relatively cheaper, and Americans switch expenditure from foreign goods to domestic goods, thereby expanding the domestic industry.

In a recent Liberty Street Economics post, we highlighted that our recent study found large aggregate losses to the U.S. from the U.S.-China trade war. Here, we delve into the cross-sectional patterns in search of segments of the economy that may have benefited from import protection.

What we find, instead, is that most firms suffered large valuation losses on tariff-announcement days. We also document that these financial losses translated into future reductions in profits, employment, sales, and labor productivity.

Read more.

The Weekend Read

Museum of the Bank of Greece

www.treko.gr

The Path to a New Era for Nuclear Energy

A new era for nuclear energy beckons as projects, policies and investments increase. Nuclear power is set to reach a new record in 2025 and can improve energy security as electricity demand accelerates – but costs, project overruns and financing must be addressed.

Read the Report

There will be pain

Continuing low tax rates for the rich and corporations will hurt working families. Summary: Extending Trump’s Tax Cuts and Jobs Act will have painful tradeoffs for the U.S. economy and most Americans.

Read the Report

For Xi Jinping, 'Made in China 2025' has been worth every penny

Weekend Read

Bill for technology upgrades and increased self-reliance reaches trillions of yuan

HONG KONG Until recently, Chinese consumers and companies did not shy away from foreign brands when buying high-performance cars and trucks for their own use.

Windrose Technology is part of a wave of Chinese startups that is starting to change this. Earlier this month, the vehicle maker started delivering its nextgeneration heavy-duty electric trucks to Chinese customers, led by a subsidiary of S.F. Holding, the country's largest logistics group. Windrose has another 5,000 orders on its books from U.S.

customers, as well as hundreds from other Chinese and European clients. Backed by investors including municipal authorities in the Chinese cities of Hefei and Suzhou, Windrose has benefitted from preferential deals for land and proximity to the sprawling EV supply chain around its headquarters in Hefei. Read more.

A shipyard in Qidong, China, on Dec. 1: The country has become by far the world's largest producer of ships. (FeatureChina via AP Images)

www.treko.gr

Global 10% Tariffs on U.S. Imports Would Raise Incomes and Pay for Large Income Tax Cuts for Lower/Middle Class

A combined tariff/tax cut policy is likely to stimulate the U.S. economy, generating greater production, more employment, and more investment in domestic industries, with small and perhaps imperceptible costs. Read the Report

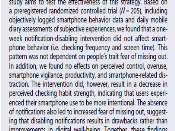

Beyond the Buzz: Investigating the Effects of a Notification-Disabling Intervention on Smartphone Behavior and Digital Well-Being Read the Report

In terms of orders for LNG carriers, Greek shipowners are tied with the Japanese with 19 orders each.

The future of the global LNG fleet and the dominance of Greek shipowners

Greek shipowners, with significant shares in the global market, seem to be leading the developments in the LNG carrier sector

The market for liquefied natural gas (LNG) carriers is in continuous growth, with the global fleet expanding and Greece maintaining a leading role.

The Weekend Read

With demand for LNG growing, particularly in Asia, and the US market boosting supply, 2025 is shaping up as a landmark year for the sector. The Greek shipowners, with significant global market shares, appear to be driving developments in the LNG carrier sector.

According to Poten & Partners Group, the global fleet of LNG carriers with a carrying capacity of more than 100,000 cubic meters as of December 31, 2024, included 668 vessels, with another 330 on order.

Forecasts for 2025 indicate that a total of 102 new LNG vessels are expected to be delivered, reflecting increased demand and market needs. Read more

The Weekly Financial Digest

An Economic Approach to Homer's Odyssey: Part I

By Tyler Cowen

“The economic approach to Homer’s Odyssey also may help us understand both the strength and limitations of economics as a method. How does economics fare when confronted with extremely complex narratives, taken from a very different time and from a culture somewhat removed from the environment in which economics itself originated?”

Read More

Climate initiatives need a heavy push to start

There are positive signs for blended finance, but momentum must not be lost

Read More

How

Congress can turn tariff lemons into lemonade: A border-adjustment tax

Adam Looney and Elena

Patel

President Donald Trump’s efforts to impose widespread tariffs on imports (widely condemned by economists) can be half of a good idea. A better idea would be to pair the tariffs with an equivalent export subsidy, thus creating a tax regime (called a borderadjustment tax or BAT) similar to the

one used by many other countries. Enacting this plan would reduce the trade gap, increase GDP, raise significant revenue, and make America the world’s best place to invest and build businesses. And unlike unilateral tariffs alone, this combination would be justifiable under international trade rules,

avoid costly trade wars, and limit the effects on consumer prices and inflation. Ideally (but not necessarily), the tariff and subsidy rate would be set at 21% to match the corporate tax rate and would be designed to replace America’s complicated and inefficient international business tax system.

Read more

The

www.treko.gr

From the Reichsbank to the Bundesbank

In 2017, the Deutsche Bundesbank commissioned a comprehensive study on the history of central banking in Germany between the years 1924 and 1970. A team of academics led by renowned historians Professor Magnus Brechtken and Professor Albrecht Ritschl examined the Reichsbank’s history as the central bank during the National Socialist era. Their Research also focused on continuities in terms of Reichsbank personnel after the central banks Bank deutscher Länder and Deutsche Bundesbank were established in the years after the war. Read More

Money Metals Online

By Joshua D Glawson

Money Metals Online: Your Go-To Platform for Buying, Selling, and Storing Precious Metals. Read More

Bundesbank new reputation: central bank that says ‘yes’

By David Marsh and Emma McGarthy

For a central bank that over past decades built a steely reputation for rejecting policies deemed as inflationary or destabilising, Germany’s Bundesbank is starting to gain significant practice in saying ‘yes’ rather than ‘no’. The Bundesbank published on 4 March the culmination

of work over several months on reforming Germany’s constitutionally enshrined ‘debt brake’. This coincided with a far-reaching decision on relaxing borrowing rules by the parties likely to form the next Berlin government – paving the way for several hundred billions of euros of investment for defense and infrastructure in coming years.

Prospective Chancellor Friedrich Merz, leader of the Christian Democratic Union, which won the 23 February general election, unveiled a plan for massive fiscal stimulus to counter the twin threats of economic stagnation at home and military confrontation on Europe’s eastern borders. Read more.

Proposals on German debt brake give backing for Berlin’s fiscal stimulus plans

NEWSLETTER

The Weekly Financial Digest

Inside This Issue :

is essential to thrive

Greek shipping: Success factors and opportunities

Top Stories:

is essential to thrive

Articles and Ideas

digital innovation

Emerging and Developing Economies in the 21st Century

The Numismatist ANA

Mckinsey Insights OMFIF

“You may not be interested in geopolitics, but geopolitics is interested in you ”

Business leaders must go beyond mitigating geopolitical risks to seizing the opportunities presented by the new world order. Here’s how.

Greek shipping: Success factors and opportunities

Mckinsey Insights

Greek shipping plays a pivotal role in global trade and

has done so for centuries How might this sector build on its strengths for the future? I think you should read this article about link text

Numismatic Programme 2025: :

How could a composer, a mathematician, an astronomer, a sculptor and an insect combine in the concept of a numismatic programme? In ancient Greece, the Pythagoreans regarded proportions in the movements of celestial bodies as a form of music (music of the spheres or harmony of the spheres), fusing together mathematics, music and astronomy Using cutting-edge sonification technology, NASA has actually managed to capture the eerie music of planetary motion Thus, this year’s programme features a leading modern Greek composer, Mikis Theodorakis; the mathematical genius Eratosthenes, the first to calculate the circumference of the Earth (in our Mathematicians series); Ptolemy, inventor of the spherical astrolabe (in our Ancient Greek technology series); and the path-breaking sculptor Takis, creator of musical sculptures (Musicals) Together they compose the harmony of the spheres, to the accompaniment of the incorrigible cicada of Aesop’s fable The cicada and the ant All the new coins here

Moving towards a digital euro

The European Central Bank is working to innovate retail

and

wholesale payments. The preparation phase for the digital euro is entering its second year, while trials for wholesale central bank digital currencies are advancing In Frankfurt, OMFIF’s Future of payments forum brought together representatives from central banks, scheme operators, regulators, commercial banks and technology providers to unpack the progress and challenges in upgrading the payments infrastructure within Europe. Digital Euro: What you must know

Emerging and Developing Economies in the 21st Century

Bank Group

Global growth is expected to hold steady at 2.7 percent in

2025-26. However, the global economy appears to be settling at a low growth rate that will be insufficient to foster sustained economic development Emergin market and developing economies are set to enter the second quarter of the 21st century with per capita incomes on a trajectory that implies feeble catch-up toward those of advanced economies Read the full report

The Numismatist ANA

Monthly features exploring the past, present and future of numismatics with topics including: American classics, ancients, paper money, tokens and medals, modern world coins, counterfeit detection and more.

Enjoy this complementary online edition.

Bank of Greece

Macroeconomics &FinancialEco

Development &Growth

History& Geopoli cs Environmental &ResourceEco

TheWeeklyFinancialDigestNewslettersArchive

MonetaryPolicy,Trade,Investment

Growth,Produc vity,Innova on

Labor,Health,Poli calstability

Agriculture,Energy,Environment

Vol 1,No 1

McKinsey Insights

McKinsey Insights

OMFIF

World Bank Group The Numisma st Magazine

Topicareasthat collec vely spanthefield ofeconomics

References availableat: 2025 February10

McKWebsite:

Ar clesandIdeas Getclarityontopicsthatma ertoyou

Aproac veapproachto naviga nggeopoli csisessen altothrive

Greekshipping:Successfactorsand opportuni es

PromotingEuropeanintegrationthrough digitalinnovation

EmergingandDevelopingEconomiesin the21stCentury

Monthlyfeaturesexploringthepast,presentandfutureofnumisma cs

Numisma cProgramme2025:BankofGreece Websiteh ps://wwwbankofgreecegr/

Curatedanalysiswithtopfivear clesweekly

OMFIFWebsite:

WBGWebsite:

h ps:// wwwmckinseycom/ h ps:// wwwomfiforg/ h ps:// wwwworldbankorg/ext/ en/home

ANAWebsite: h ps://wwwmoneyorg/ numisma st/

loca

on:Athens

The Weekly Financial Digest Newsletters

Archive

Topics

Macroeconomics&FinancialEco.

Monetary Policy, Trade, Investment

Development&Growth

Growth, Produc vity, Innova on History&Geopoli cs Labor, Health, Poli cal stability

Environmental&ResourceEco.

Agriculture, Energy, Environment

2025

February 10

Vol. 1, No. 1

McKinsey Insights

Aproac veapproachto naviga nggeopoli csis essen al tothrive

McKinsey Insights

Greek shipping:Success factors andopportuni es

OMFIF

PromotingEuropeanintegrationthroughdigitalinnovation

EmergingandDevelopingEconomies in the21stCentury

TheNumisma stMagazine Monthly features exploringthepast,presentandfutureofnumisma cs

Numisma cProgramme2025:BankofGreece Websiteh ps:// www.bankofgreece.gr/

Curatedanalysiswithtopfivear clesweekly

Referencesavailable at:

McKWebsite:

h ps://www.mckinsey.com/

OMFIFWebsite:

h ps://www.omfif.org/

WBGWebsite:

h ps://wwwworldbankorg/ext/en/home

ANAWebsite:

h ps://www.money.org/numisma st/ Publica onYear:2025

ApópseisPublica ons loca on:Athens