NOT

Rethinking

PG 14

THE

HOW

FLEETWOOD

The

PG 20

PG 26

PG 46

BREATH YOUR WAY TO SUCCESS AND HAPPINESS

Transform your relationship with the present moment.

PG 52

NOT

Rethinking

PG 14

THE

HOW

FLEETWOOD

The

PG 20

PG 26

PG 46

BREATH YOUR WAY TO SUCCESS AND HAPPINESS

Transform your relationship with the present moment.

PG 52

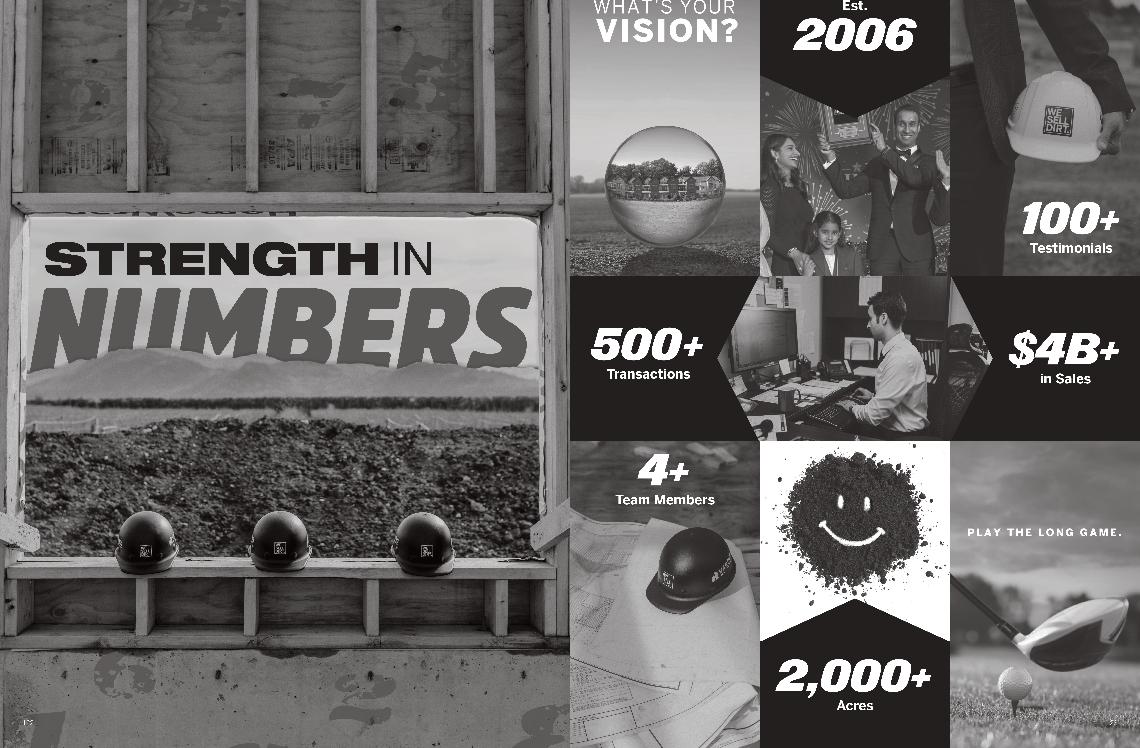

Every day, we take initiative—with integrity and courage— to elevate ourselves for the greater good of those around us.

4

A LETTER FROM JOE

2023 year in review by Joe Varing.

8

MARKET REVIEW

Three regions to watch in 2024.

10

SHARKS YOU CAN’T SEE

The importance of doing due diligence before closing on a real estate deal.

14

NOT SO STRANGER THINGS

The rethinking of land use when it comes to regional and community malls.

18

COMMERCIAL FINANCING 2024

The last few years have brought unprecedented times to the finance world.

20

FLEETWOOD ORION

The Orion Master Plan embodies Surrey's pioneering efforts to bridge the housing gap.

24

CONSTRUCTING DEFICIENCIES

Have you hired a contractor to perform work for you who is failing?

28

HOW POLICIES ARE TRANSFORMING VANCOUVER'S RENTAL PROPERTY

How provincial and municipal policy changes can affect Vancouver’s real estate professionals.

34

ALTERNATIVE INVESTMENTS SHOULD HAVE A PLACE IN EVERY INVESTMENT PORTFOLIO

Alternative investments in a portfolio can reduce risk and enhance returns.

38

RETAIL SPENDING MODERATES AS HISTORIC DISTRIBUTION DEMAND RELENTS ACROSS WESTERN CANADA

A more balanced industrial market is expected in 2024.

46

THE CITY BY THE SEA IS CALLING Mayor Megan Knight is seeking to show potential residents that it is a complete city.

52

BREATH YOUR WAY TO SUCCESS AND HAPPINESS

Transform your relationship with the present moment.

54

WEATHERING THE STORM

Four Key elements to consider.

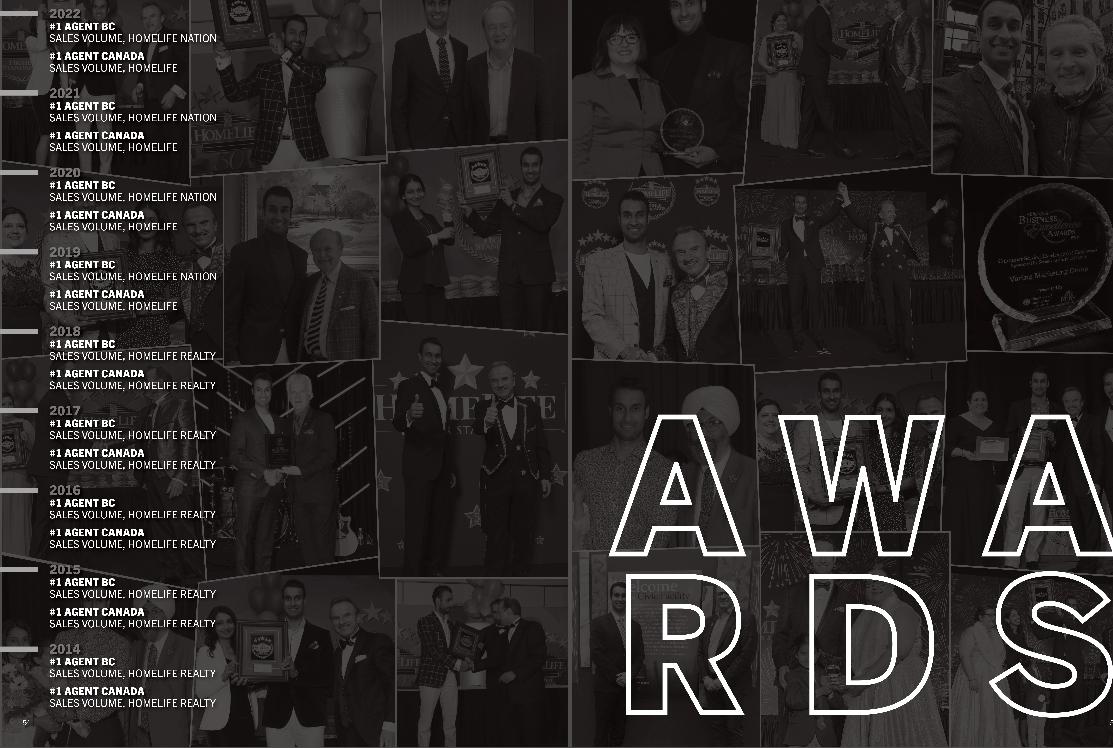

As we turn the page on another year marked by economic resilience, we extend our deepest gratitude for your continued trust and support in Varing. Our commitment to providing timely and impactful advice, tailored to your unique real estate aspirations, remains unwavering.

In 2023, Canada experienced a swift and notable increase in interest rates, sending ripples across the nation's economic landscape. Notably, we witnessed the Bank of Canada aim to orchestrate a ‘soft landing’ to prevent drastic market impacts from soaring inflation. The year-over-year interest rate and economic shifts continued to balance growth and stability within the country, the impacts of which were deeply felt by both the Canadian economy and the real estate development industry. The higher borrowing costs and tighter credit conditions dampened the enthusiasm for new real estate projects. Developers found themselves reassessing their plans, with some projects being put on hold or scaled back as the feasibility of financing became more challenging. Despite such impacts, many were left feeling cautiously optimistic as the year ended with the economic policy experts forecasting stability within the market.

As we step into 2024, our belief stands strong: tough and turbulent times are fertile grounds for innovation and opportunity. All of you are members and trailblazers of the real estate landscape in BC, and as such, we can draw on our historical experiences to know that together, we are resilient and adaptable as an industry. With your support, Varing will continue to help shape the future of real estate in our communities and beyond.

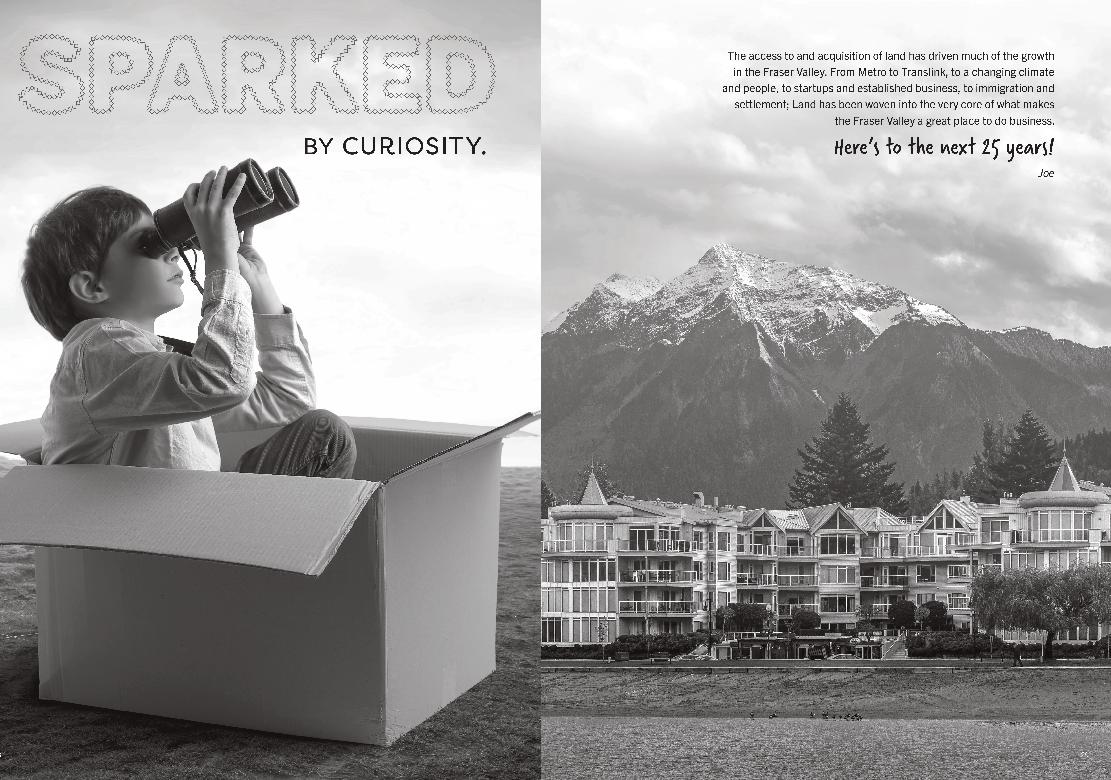

We all can appreciate that real estate is about lasting value, bridging the past and the future. We strongly believe in the Fraser Valley's potential.

The prevailing economic winds have, undoubtedly, posed challenges for all – from new homeowners to industry magnates. Yet, Varing’s optimism remains strong and we continue to champion the industry’s potential and approach at every turn. In times such as these, our greatest strength lies in unity, pledging the resilience and prosperity of our communities. The adversities we face today will soon become mere chapters in our shared history.

VMG is principled and purposeful in its approach – always has been and will always aspire to be. We recognize that our purpose is our passion. And know that our purpose is to serve you. After nearly two decades in this industry, I remain staunch in my belief: the allure of the Fraser Valley – to live, work, and relish in – persists, and with it, the need for land and homes for the growing population persists. Have ‘Trust in Land’ and you will begin to see opportunities waiting for you.

Allow us the honor of being your trusted advisors, providing our unwavering support as we navigate this market journey together, and ensuring your trust is met with expertise, dedication, and a commitment to your success. We are here to help you drive your narrative forward.

Joe Varing

To start your upgrade to the Surrey Board of Trade visit businessinsurrey.com/membership.

Your business deserves it.

Membership starts as low as $350.

2023 emerged as a year full of promise for landowners and real estate developers, but it quickly evolved into a period of uncertainty. Initially buoyed by optimism, the market soon faced the challenge of rising inflationary pressures. The Bank of Canada's aggressive stance against inflation led to significant hikes in interest rates, impacting the real estate sector. Developers found themselves navigating cautiously, marking a major market shift not seen in years.

Despite these challenges, 2023 maintained a steady flow of eager buyers and sellers, demonstrating resilience in the market and for Varing.

Looking ahead to 2024, the Fraser Valley continues to shine with potential. Its desirability as a residential area withstands market fluctuations, and its foundational strength promises long-term growth. We believe in the power of patience during such times, as they often present unforeseen opportunities. With hope and anticipation, we predict that 2024 will see at least four downward interest rate adjustments, opening new possibilities for the market. Let’s stay ready to seize these opportunities together.

Mission, British Columbia, is a town with a rich history and a promising future. Its core area combines heritage charm with modern development potential, nestled in the beautiful Fraser Valley. Recent updates to the OCP & NCP emphasize sustainable growth and revitalization efforts, including downtown beautification projects, improved infrastructure, and support for local businesses. Mission is evolving while preserving its unique character, making it an exciting place for residents and investors.

Squamish, British Columbia, is poised for remarkable future development potential. With its stunning natural surroundings, including the iconic Stawamus Chief Mountain and Howe Sound, Squamish has become a magnet for outdoor enthusiasts and adventure seekers. The town's strategic location, just a 45-minute drive from Vancouver, makes it an attractive destination for commuters and businesses alike. Data reveals a surge in housing demand, with property values steadily appreciating. Squamish is also embracing sustainable initiatives, such as the Squamish Renewable Energy Project, positioning itself as a leader in eco-friendly development. As the demand for an active, nature-centric lifestyle continues to grow, Squamish is poised to flourish as a thriving and sustainable community.

White Rock, British Columbia, boasts substantial development potential driven by its coastal charm and strong community spirit. Its scenic waterfront, highlighted by sandy beaches and a welcoming pier, offers opportunities for outdoor recreation and community gatherings. Its strategic location near the U.S. border and Vancouver positions it as a thriving hub for businesses and residents alike. White Rock's commitment to sustainability and green initiatives provides a foundation for eco-conscious projects, and the city's growing population creates demand for housing, services, and cultural enrichment. With thoughtful planning and an emphasis on preserving its unique character, White Rock is well-poised for a prosperous and diverse future.

Most people have a fear of sharks, largely instigated by movies like the 1976 blockbuster film Jaws and related sequels. Real estate development doesn’t quite have the same fear factors, but there are some similarities. Most notable, there are rules that I have learned being an avid swimmer and snorkeler, especially in Hawaii, when you go or don’t go into the water.

When it comes to risk, I normally abide by the go- or no-go rules, otherwise the risk is too high. When the risk is too high, just slide into the pool to cool off rather than take a dip in the ocean. Similarly, in real estate development, do your homework and abide by a set of rules to minimize your risk.

Now, let’s turn our attention to the importance of doing due diligence before closing on a real estate deal. The goal is to eliminate as much risk as possible by doing a deep dive into the facts affecting the development of a property. Seems straight forward enough, but some parts of discovery are not always obvious, as they are lurking just below the surface. I call them “red flags” or “deal killers”. These findings are not obvious even when the ocean waters appear calm, and the heat of the moment can cause you to make a premature decision. Yes, the emotion of qualified fear or apprehension is a good thing when it comes to making the wrong decision.

Michael von Hausen FCIP, RPP, CSLA, BCSLA, LEED AP President, MVH Urban Design & Planning Inc. Adjunct Professor SFU and VIUA good friend and experienced developer shared a story with me not long ago that reminded me to always being aware of risk when entering a potential deal. It was a Friday afternoon, and a realtor came to his office. The realtor said that he had a great deal and he needed $1 million before 4 pm. The proposal, supported by a report completed by an architect, indicated the yield on the subject property was 36 townhouses. At that density, it appeared to be a solid deal with a return on investment that was more than reasonable. After reviewing the report, my friend proceeded to put the non-refundable down payment on the property before the 4 pm deadline.

On Monday morning, the world turned upside down. On further review with his professionals, my friend realized that the density calculations did not include consideration for the 30-metre setback from the creek on the property. Suddenly, the 36-unit yield was reduced to 30 units and the project was not viable! The numbers did not pencil out to a reasonable return on investment.

Lessons from the creek incident:

1. Do not make hasty decisions.

2. Check with trusted third parties that are qualified professionals.

3. Always check important regulations.

4. Qualify the numbers behind the assumptions.

5. Always confirm with the planning and engineering departments.

6. Leave your ego at the door, even if you have more than 40 years of experience!

I have a quick checklist for my shallow due diligence to determine rudimentary feasibility and a 12-page due diligence checklist for the deeper dives. I want to make sure there are no indicators that say “no go” while others can be solved relatively easily. I look at the legal, engineering, and environmental standards and regulations to confirm that what is being proposed can be built. Then I look at the planning policies that are in place to ensure that what is being proposed can and will be approved.

Next, feeling the pulse of the decision “influencers” including the politicians, regulators, and community are necessities that can’t be ignored. These are people that, in some way, influence the project approval decision. I have seen too many times where the developers or real estate agents underestimate the role of influencers in project approvals, and it just takes one person or an informed interest group to reverse council’s decision.

Approvals are not complete until adoption by council and the ink is dry on the development agreement. Votes count, and the next term of office for politicians rely on it. Just recently, I had a developer tell me that less than 20 people would show up at the project’s public hearing. 300 residents showed up, and they were not happy. The developer did not do his homework. Council’s decision was not in his favour. The project was turned down 6 votes to 1.

Rarely do I hear from the sales side of the real estate transaction that a problem is not solvable. Remember that you have no control in the political arena, and that the approvals officer ultimately holds the signature pen. In addition, remember that lots of money thrown at a problem could only require more money. If it is a deep hole, move to the next deal. In other words, there are many sharks that are harmless, but it is important to distinguish between the harmless and the deadly.

In the end, we come back to the fundamentals that should be remembered in any due diligence exercise:

• Distinguish between shallow due diligence and deep due diligence (the 12-pager).

• Know the sharks that bite and ones that are harmlessdistinguish between the two.

• Obtain advice from a trusted third party that is a qualified professional.

• Analyze critical engineering and environmental considerations.

• Confirm the critical policy and process considerations with authorities.

• Complete an analysis of the political and community “influencers” to determine the likelihood of approval.

• Make informed (not hasty) decisions with correct information and confirmation.

Don’t fall in love with completing a real estate transaction unless you want to be heartbroken or have a (real estate) swimming experience that makes you not want to go into the water again!

Ok, perhaps that’s not the main plot in this Netflix series, but in many communities throughout North America, redevelopment of the local mall (or de-malling) is becoming more and more of a ‘thing.’ There are a few driving factors that are leading to the rethinking of land use when it comes to the regional and community malls in our neighborhoods. Two of the more prominent factors are:

1. Change in shopping behaviors

2. Housing supply crisis

Before we touch on how these two items are driving changes to our local malls, we need to first revisit how these large retail land assemblies came to be and the purpose they served. To begin with, the Mall concept was a response to weary consumers who were frustrated

with the traditional urban centers which had become very congested. Thus, the appeal of centralization (and efficiency) of the shopping experience meant that consumers could spend more time shopping at as many locations as offered, without having to drive and park multiple times. In the end, the malls designed in the 1980s and ‘90s – focused on collecting consumers through their automobiles and funneling them to the sprawling commercial development, lured by one or more anchor tenants. While there certainly were Malls around prior to the 1980s in the Fraser Valley/Lower Mainland region, the development of these properties took off in the twenty years between 1980 & 2000. It’s no wonder looking back that this transition from the old downtown core to the suburban shopping malls created a new ‘main street’ in many communities.

Jeff Tisdale Chief Executive Officer Landcor Data Corporation

Jeff Tisdale Chief Executive Officer Landcor Data Corporation

The new main street was often noted as the ‘one stop shop’ rather than the qualities that the ‘old’ main street offered - a unique experience, and the support of local/

The redevelopment of the community mall first started to gain awareness through regional newspapers during the early 2000s in the American southwest, most notably, southern California. Questions around land use efficiencies began to be more commonplace with the rise of the big box store and outlet destination shopping experience.

The shopping experience was evolving again as consumers were piling back into their cars, this time lured by breadth of selection and value for money while still appealing to the desire for consumption efficiency. Need a laptop? Go to the large electronics big box store and find the ideal system for your use. The product will fit your needs, not the other way around. Seems like something that Henry Ford would have said 100 years ago…

Just as quickly as the flight to the big box or outlet malls experience of the early 2000s occured, these destinations started to lose their appeal with the arrival of e-commerce and the ability to complete shopping tasks from the comfort of home. The mall properties, already

feeling the loss of the smaller shops at first, began to see their larger anchor tenants seek new locations or close completely. The consumer shopping experience was no longer primarily a physical destination, rather this was moving closer to the digital experience.

What was once the pinnacle shopping experience of the 1980s or ‘90s was beginning to fade away, and for a while, vacant or partial capacity malls posed a question of ‘what’s next?’

Savvy developers who are always on the lookout for good development opportunities began to turn an eye to these poor performing retail/commercial locations. Here, they quickly connected the dots that these parcels are typically large tracts of developed and serviced land with surrounding complimentary amenities already built up and relied upon. In addition, having the ability to reuse commercial sites, rather than clearing new land for a new purpose, within acceptable limits, is better for the environment. Clearing one acre of forested land leads to 21 metric tons of carbon emissions, and the area loses the potential to absorb 14 metric tons of carbon over the next 20 years. Meanwhile, one acre of redevelopment on a commercial site can accommodate dozens of homes with no loss of greenspace, embodied carbon,

or sequestration potential (i.e., capturing and storing atmospheric carbon dioxide).

A great case in point locally is the current redevelopment of the 40-year-old Chilliwack Mall and its plan for better land use of its 15 ½ acres.

For those that are unaware, the Chilliwack Mall has been in a steady decline in the local market for several years-following the pattern as mentioned above. While purchased in 2017, the new owners of the commercial development (Smart Centers) appear to have carefully and thoughtfully reimagined the site to eliminate underutilized space and bring to market a new Urban District.

As part of this plan, three new six-storey multi-family developments will be introduced, providing upwards of 200 new units to the housing stock within the city.

This redevelopment follows the same path as larger, more complex projects in Oakridge (28 acres with 2,900 new units in 13 residential towers) and Lansdowne (50 acres, 4,500 new homes in 22 residential towers). Additional projects are also underway at Brentwood, Lougheed Center, Richmond Center, Capilano Mall and Columbia Square – to name a few.

Looking a little further afield and really understanding the potential of reusing underperforming mall space is to bring Square One (Mississauga, ON) into focus.

This is a 130-acre site that, once the reimagining is completed, will evolve into 18 million sq ft of mixed-use properties. Among this will be 18,000 new residential housing units.

This ability to convert underutilized lands will be one piece of the puzzle to address housing affordability and supply in the years ahead.

In fact, in a recent study from Canada Mortgage and Housing Corporation (CMHC), they note that 3.5 million additional units will need to be added beyond what is now being built each year to help restore affordability by 2030.

The Housing Supply Act (anticipated to be approved later in 2024) will set targets for key Municipalities to bring new housing online (market, supportive/subsidized, rental, etc.) through faster approval processes that address delays in updating zoning, bylaws, and local development processes. Abbotsford is within the first 10 Municipalities identified as being assigned housing targets under the Act.

Subsequent phases have been identified to roll out in the months ahead and include both Chilliwack and Pitt Meadows. In total, the province has identified 47 Municipalities throughout BC that will come under the Housing Supply Act and be assigned housing targets.

The identification of a good redevelopment candidate, or list of candidates, can be uncovered with a seasoned and well-connected real estate professional like Joe Varing. Once a target parcel has been identified, the next step in the strategy is to work with the Municipality to build out a ‘win – win’ plan where better utilization of the parcel is contemplated. Consider the following as keys to a successful de-malling plan:

1. Create a cohesive, functional, and welcoming neighborhood.

2. Places must also be where people want to walk.

3. Capture the increased value associated with rezoning to offset affordable housing and/or community amenities.

4. Inclusionary zoning can also be implemented to ensure that a portion of the residential units are affordable across a range of income levels.

Properly redeveloped mall spaces offer Municipalities many benefits, such as an increase of tax revenues, boosting of local businesses and, through a focus on lessening the reliance on cars, decongesting roadways. In the end, clusters of redeveloped strip malls could be linked into walkable neighborhoods.

Where do we go from here? With pressures from the province to bring new housing supply to market, reimagining of underutilized land parcels (such as many of the local shopping malls) may be one of the fastest paths to achieving these goals.

The last few years have brought unprecedented times to the finance world. At the beginning of Covid, lenders literally shut their doors, leaving a lack of available capital as loan spreads increased dramatically due to the introduction of “liquidity premiums”. Then, as Covid became the new norm, lenders rushed to get money out the door, bringing loan spreads back down to pre-Covid levels, all while navigating the wild interest rate swings of up to 0.44% within a day (5-year Canada Bond, March 13, 2023). In 2023, as interest rates continued to increase, lenders became cautious again as they looked to de-risk their loan portfolio by offering lower loan leverage while increasing their expectations regarding borrowers’ liquidity, net worth, and relevant experience, with some lenders not taking on any new clients. With the Canada Prime Rate increasing almost 200% in the past 2 years, this has put a serious damper on the financing market and real estate market in general. With the projections for interest rates to decrease later in 2024, we still expect lenders to continue to be cautious until all signs point to an improving market, at which time we should see a quick shift back to more traditional lending policies with a flood of capital looking to be deployed. This includes a significant amount of investment coming off the sidelines and redeploying back into the market.

Commercial mortgages and business financing rely on the cash flow of the property or operating business to service the loan payments. With the significant increase in interest rates over the past two years, the loan leverage achievable has dropped dramatically for most of these types of loans. Furthermore, many lenders still perform a sensitivity analysis with some determining a loan amount based on an interest rate as high as 2% above market rates. Today, a well-presented loan request can still achieve higher Loan to Value ratios, even 100% or higher than the purchase price for owner-occupied property purchases, but this will also require a strong balance sheet for the borrower along with a thorough explanation of their short- and long-term plans. The lending guidelines can vary greatly from one asset class to another. Lenders are most aggressive on the financing of apartment buildings and industrial properties, whereas office and retail properties are financed with more caution as both asset classes seem to be in a state of transition and need to adapt to the decreasing demand for traditional uses of these spaces.

Mike Grudman Perry Keung

Mike Grudman Perry Keung

Mike Grudman is President, and Perry Keung is Managing Partner, at Axium Capital a mortgage brokerage comprised of experienced real estate and commercial lenders with offices in Vancouver and Surrey.

With the risk aversion in the current marketplace, land financing has seen the greatest tightening of financing terms due to the perceived high risk of this asset class. In 2023, we saw more than one lender cut back their maximum financing leverage from 65% of the land value down to 55% in anticipation of decreasing values. Then, later in the year, they would only consider financing opportunities under 50% leverage, with some even moving to the sidelines altogether. With delays to the start of many construction projects, this has made it difficult for developers to continue to carry land indefinitely in this higher interest rate environment. But where there is difficulty experienced by some, this has led to opportunities for experienced, well-capitalized developers either purchasing or partnering up on distressed development sites. This has also resulted in lenders focusing heavily on the liquidity of their potential borrowers, as not all developers will be able to weather this storm, and some large balance sheets have turned from a positive to a concern for those with most of their real estate portfolio comprised of land holdings.

Construction financing is readily available with significant capital looking to be deployed due to the limited number of construction projects starting. The beginning of 2023 saw many projects paused, with a slight improvement as the year went on. Decreasing construction costs and the increasing availability of trades so far in 2024 vs. 2023 should result in more projects starting in the near term. Despite the availability of capital, lenders are still more cautious in their underwriting, heavily scrutinizing a developer’s experience and their liquidity to ensure that the developer is well-equipped to handle any delays or cost overruns.

Overall, Axium Capital is optimistic of a more robust real estate market in 2024, with financing being available with aggressive terms and interest rates for well-heeled borrowers and/or those with strong mortgage broker representation.

Bucci Developments' visionary approach has marked a historic milestone with the third reading approval of the Master Planned Orion Project, representing a major step in transforming Fleetwood. This remarkable development has garnered support from the City of Surrey, ushering in a new era for both Fleetwood and the entire region.

The Orion Master Plan embodies Surrey's pioneering efforts to bridge the housing gap and establish a benchmark for architecture and future neighborhood development. Its approval not only addresses the pressing need for increased housing but also charts a course towards a sustainable, transit-oriented urban lifestyle. This transformative vision reflects Surrey's commitment to creating vibrant, interconnected communities that harmonize with the evolving needs of its residents and the environment.

The City of Surrey is home to the largest urban Indigenous population among major cities in British Columbia and also resides on ancestral territories that have long been home to the Semiahmoo, Katzie, Kwikwetlem, Kwantlen, Qayqayt, Tsawwassen and Musqueam First Nations. The design of the project was significantly shaped by the deep influence of this rich cultural heritage and the diverse presence of these Indigenous communities.

At the core of this innovative endeavor lies a profound respect for Indigenous vision, design, and principles. The architecture of the Orion Project transcends mere

aesthetics, intertwining in the Coast Salish weave—a distinctive design element conceived by the exceptionally talented artists, Chase Gray and Troy MacBeth Abromaitis. Chase Gray, celebrated for his deep ties to Indigenous culture and outstanding artistic prowess, has been instrumental in weaving a rich tapestry of heritage and Indigenous identity into the fabric of the Orion Project. Likewise, Troy MacBeth Abromaitis has demonstrated unwavering commitment to enhancing the project's visual narrative through an Indigenous lens. As Chase Gray eloquently articulates, “My aim was to weave the story of this land into the very fabric of these towers.”

Furthermore, Troy MacBeth Abromaitis, serving as both Director of Development at Bucci and collaborating artist, highlights the project's pivotal role in addressing Surrey's housing needs. He underscores its significance, stating, “Offering nearly 1,000 homes adjacent to the future SkyTrain station at 160th and Fraser Highway in Fleetwood is a strategic response to the escalating demand for housing in our city.”

Anita Huberman, CEO of the Surrey Board of Trade, emphasizes the potential of the Orion Project to revitalize the Fleetwood area, creating an economic-focused development where residents can live, work, and play. Huberman's endorsement underlines the broader economic impact of this initiative.

The Orion Project comprises three distinct towers, with heights reaching 39, 34, and 15 storeys, respectively. Spanning nearly 875,000 square feet, this monumental development promises to reshape Fleetwood and establish new standards for urban living in the region.

In addition to its residential offerings, the Orion Project boasts an expansive 75,000 square feet of commercial space. This retail area is poised to invigorate economic activity and serve as a focal point for various businesses, further enhancing the project's significance within the community and the City of Surrey as a whole.

However, the Orion Project goes beyond its architectural achievements. These towers symbolize visual reconciliation—an important step towards honoring the past. In an era when urban development often neglects heritage, Bucci's commitment to integrating Indigenous perspectives is commendable.

The ascent of these towers into the skyline is a testament to the collaboration between Bucci, visionary artists Chase Gray and Troy MacBeth and the City of Surrey. The support from the City Mayor and Council reinforces their belief in the project's transformative potential.

Importantly, the Orion Project marks a historic moment for Fleetwood as it introduces the neighborhood's firstever towers, signaling a shift towards modern and inclusive urban living. Fleetwood, previously characterized by single family, townhomes and low-rise buildings, is now embracing vertical living and progressive design. This architectural milestone not only changes the skyline but also reflects a fusion of market-driven pragmatism and cultural sensitivity—a significant development in Surrey's evolving urban landscape.

In this juncture of approval meeting aspiration, Bucci's Orion towers are set to usher in a new era of transformative urban living, redefining Surrey's horizon and inspiring future developments. As it celebrates Indigenous wisdom, bridges housing gaps, and fosters a legacy of visual reconciliation, the Orion Project is undoubtedly a momentous achievement for Surrey and its community.

Troy is a real estate development professional with nearly twenty years of experience, currently working as Director of Development with the Bucci Group of Companies. Troy also served as the President of the Real Estate Institute of British Columbia in 2017 – 2018 and on the Board of Governors from 2012 – 2019. He is a dedicated community builder who has balanced sustainable corporate growth with over a decade of community service via his commitment to charitable causes, volunteerism and philanthropy. Within the industry, Troy currently sits on the Boards the Canadian Home Builders Association of BC – Fraser Valley and the First Nations Housing & Infrastructure Council. Outside the industry, Troy is also the President of the Rotary Club of West Vancouver and on the Boards of the All Nations Outreach, West Point Grey Community Association and Stó:lo Business Association.

Have you hired a contractor to perform work for you who is failing to do the job properly or in a way that meets the standards set out in your contract? If so, you might be inclined to fire that underperforming contractor, and ask them to leave the job site before they have the chance to fix the issues you have identified in their work. However, it is important that you be aware that by doing so, you yourself may be breaching the contract in such a way that could entitle the underperforming contractor to sue you, and you might be limiting the amount of money you may be entitled to collect from them in order to fix their poor work. Accordingly, it is important that you pause to ensure that you fully understand your legal rights and responsibilities before taking any action like this.

Many of our clients are surprised to learn that the law generally requires homeowners or project owners to give the underperforming contractors they’ve hired the opportunity to fix any problems that they have identified in the job the contractor is performing. The reason for this is because when you sue someone else for a wrong you believe they have committed against you, the law requires that you make efforts to mitigate or lessen the impact that the wrong has on you where possible. For example, if you wanted to sue someone for causing or contributing to your personal injury, the courts would expect you to mitigate the losses you suffered because of that injury by following doctors’ orders. If you failed to, the court would likely refuse to give you the full amount of damages you were seeking.

The same is true in the construction and building context. In the eyes of the law, because the underperforming contractor is not generally permitted to charge you for the time or money that they spend fixing work they should have done correctly in the first place, the most effective way to mitigate your losses in the context of an issue like this is to give the underperforming contractor the opportunity to fix the issues. If you hired someone else to fix the work, they

Dan Moseley is the Managing Partner at McQuarrie and is well-recognized as being a highly experienced and integral member of the firm’s Dispute Resolution and Commercial Litigation team. Dan regularly assists clients with complex construction, land, and business disputes, and takes pride in helping his clients attain efficient and effective outcomes. Born and raised in British Columbia, Dan is passionate about serving and supporting his community.

would almost certainly charge you for parts and labour, and therefore, you would have exacerbated your losses.

Further, while you may be unhappy with the contractor you’ve hired and their work, you should proceed with caution before you ask them to leave the job site. Unless the contractor has done such a poor job that the issues you are seeing amount to what is called a “fundamental breach” of the contract, you are not generally permitted to kick them off the site. To do so could amount to a fundamental breach of contract by you, and subject you to a lawsuit initiated by that contractor.

While navigating and understanding your legal rights and responsibilities as a homeowner or project owner can feel overwhelming, the Dispute Resolution and Commercial Litigation Department at McQuarrie is here to help.

Bridget Shebib is an Associate on McQuarrie’s esteemed Dispute Resolution and Commercial Litigation team and assists McQuarrie’s clients with a variety of civil disputes, including complicated construction and land-related matters. Bridget’s passion, knowledge, and resolution-focused approach help her to serve her client’s needs in a cost-conscious and constructive way.

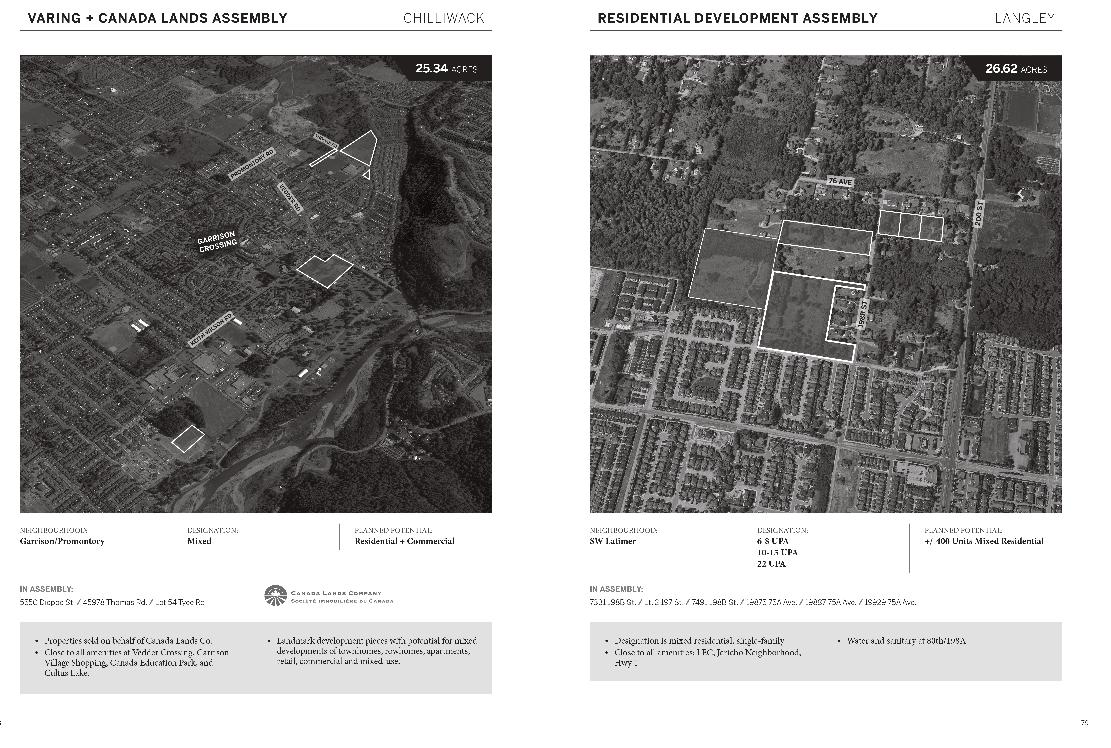

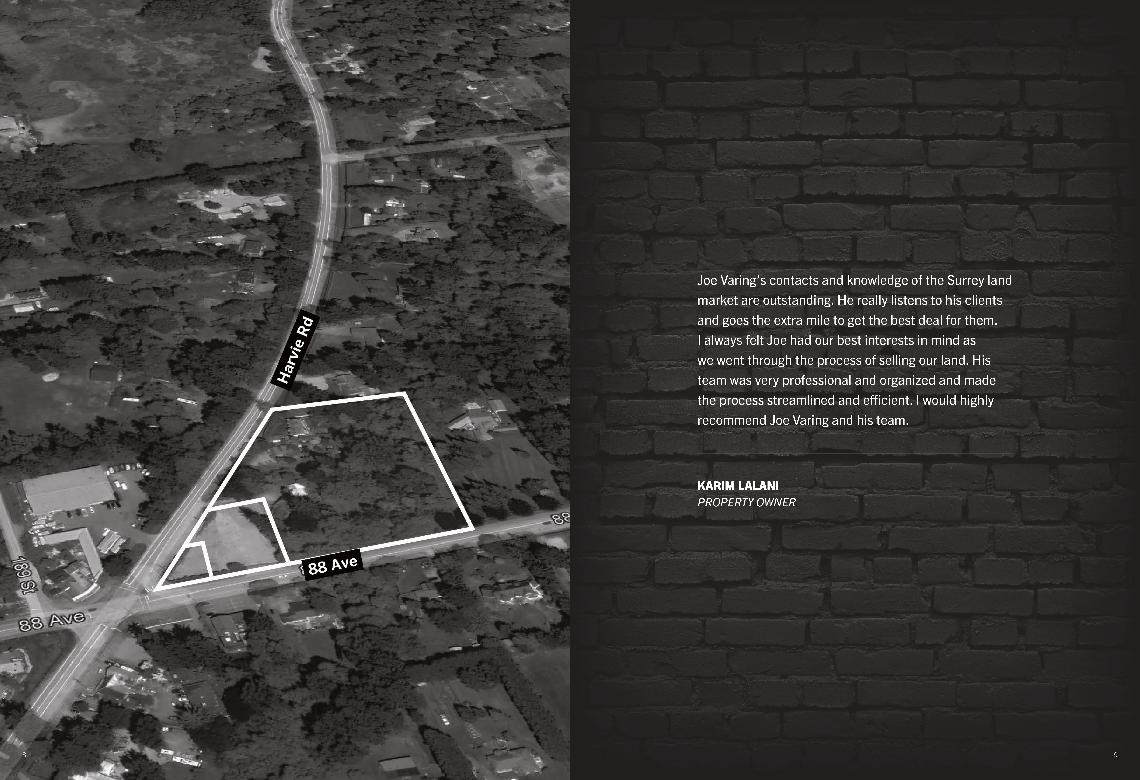

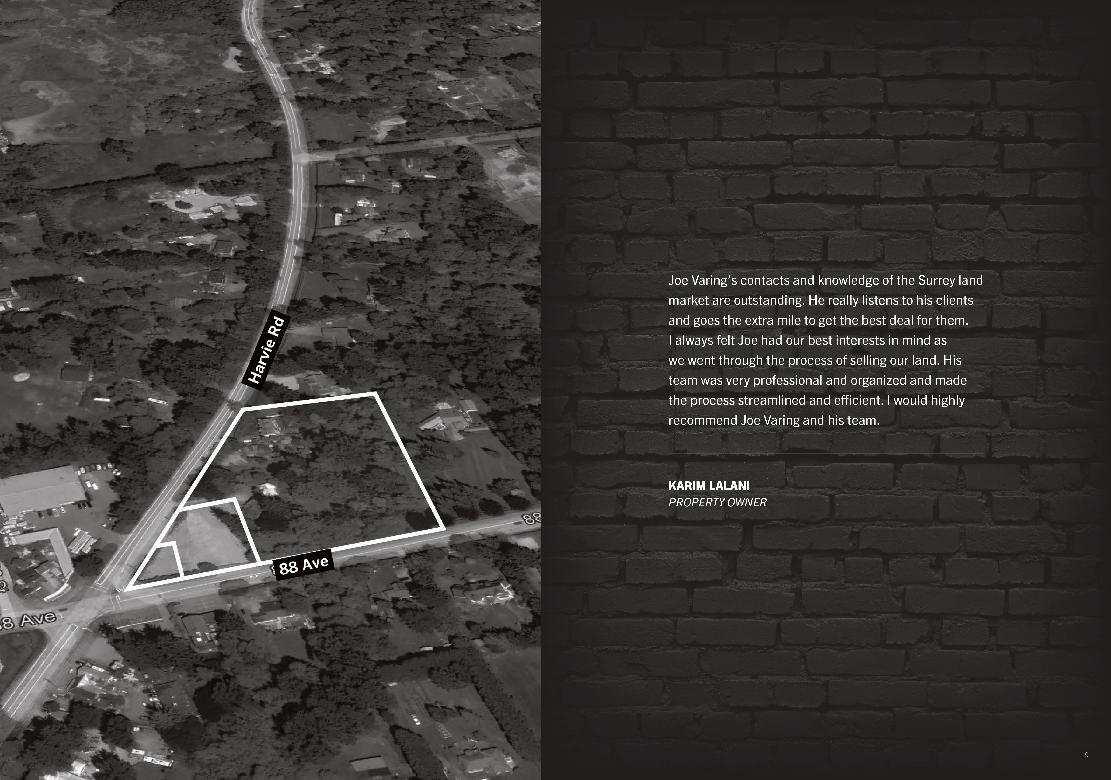

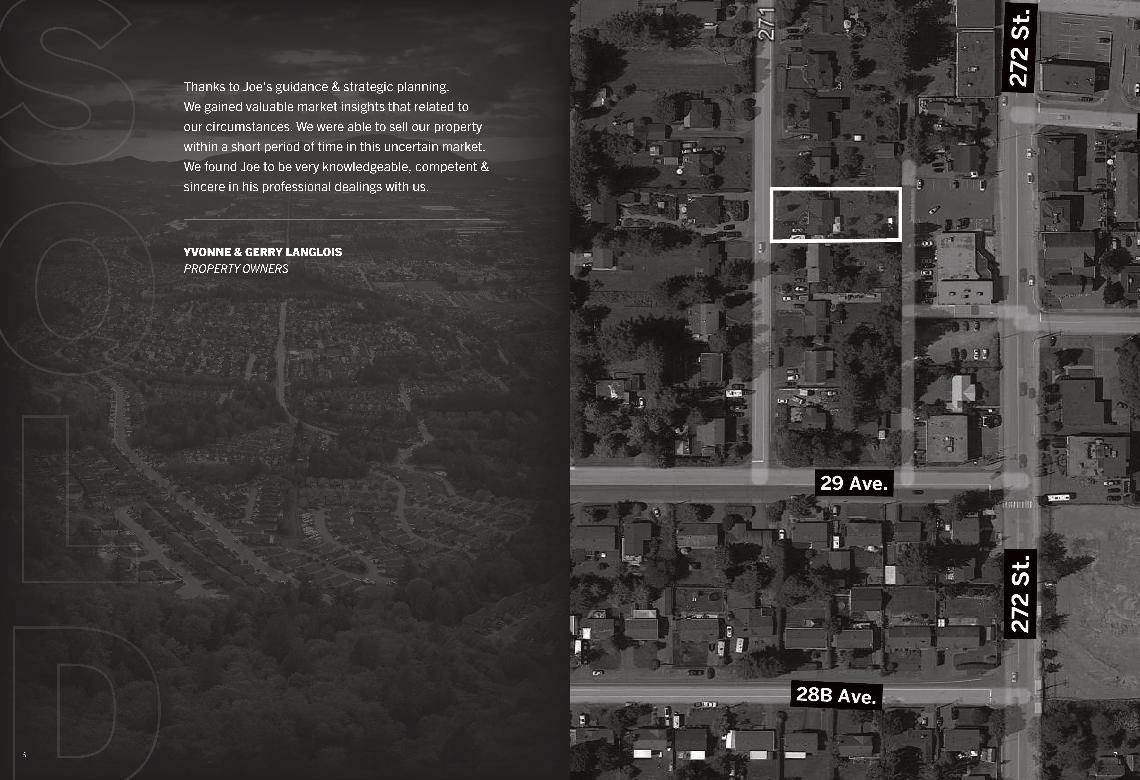

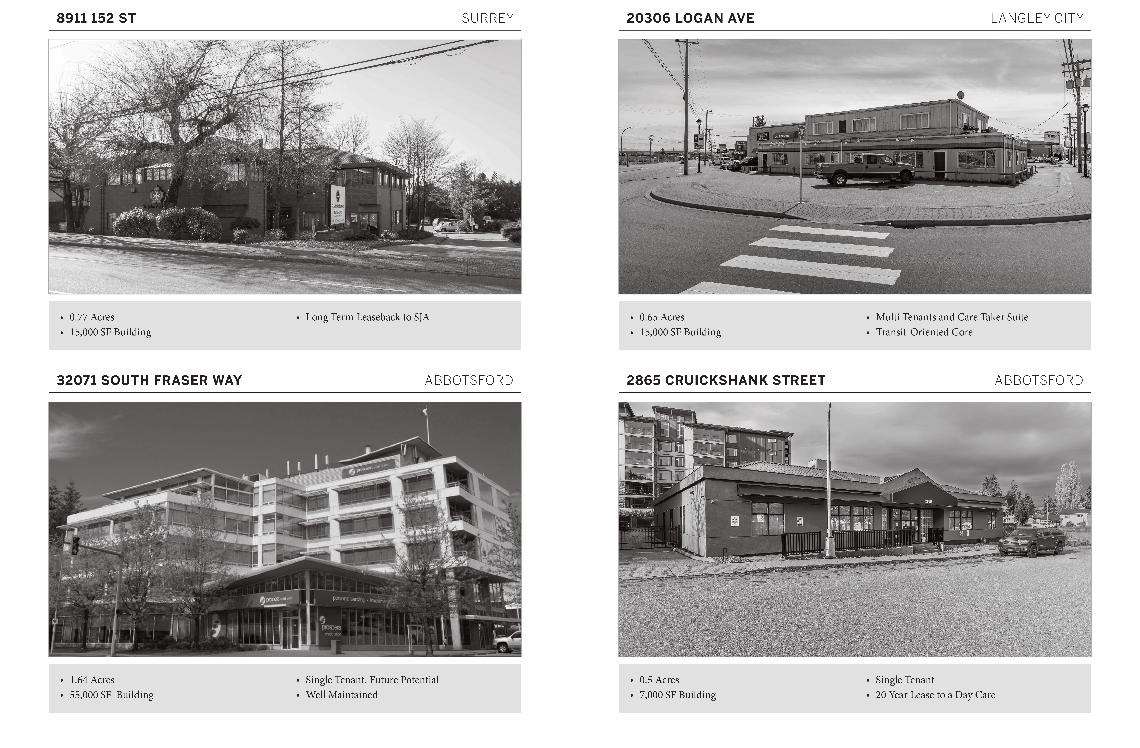

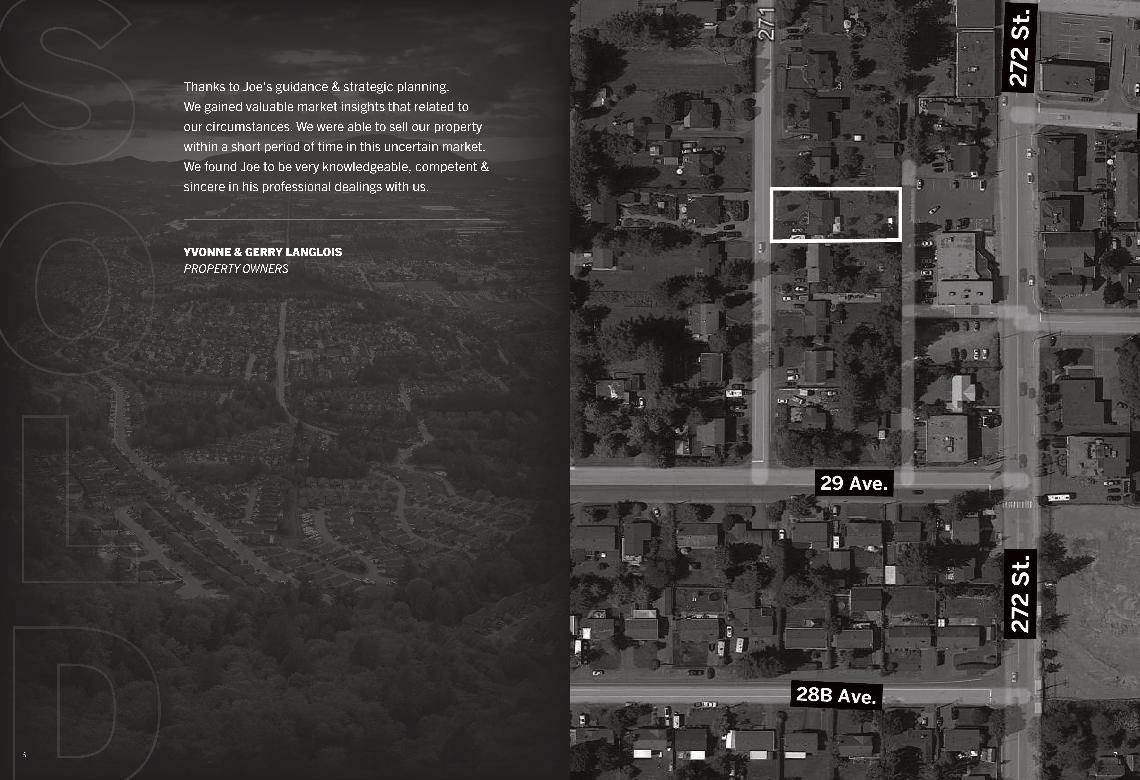

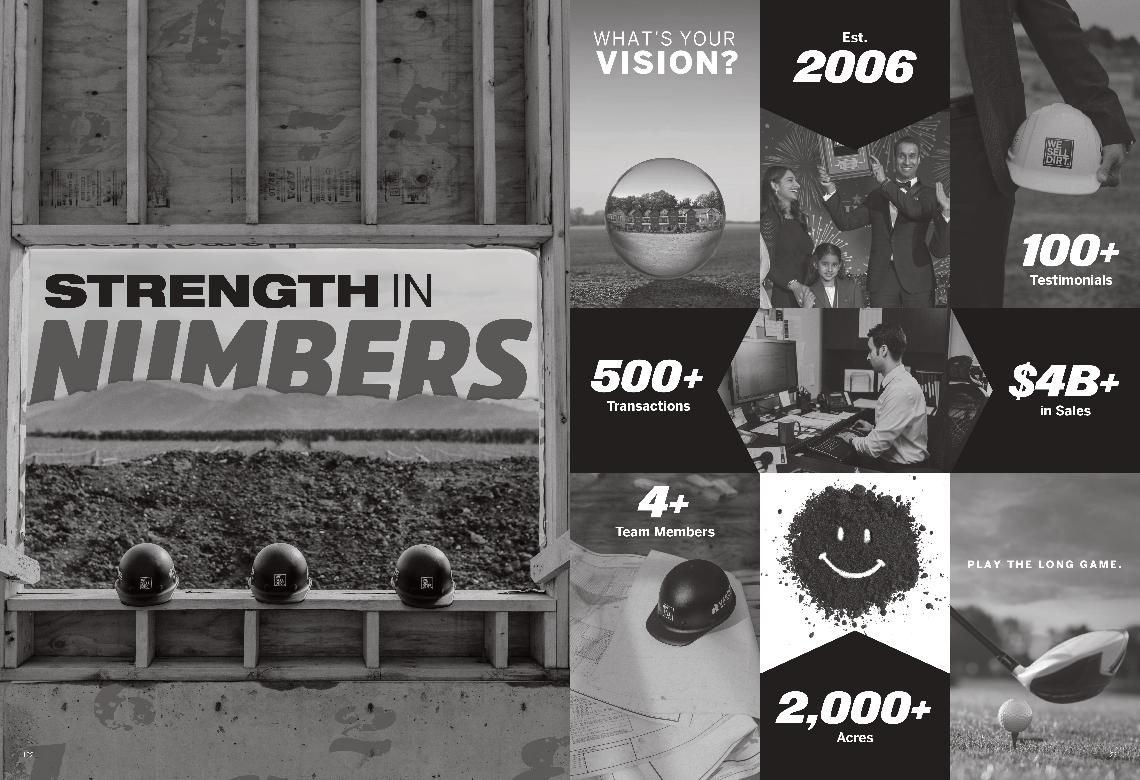

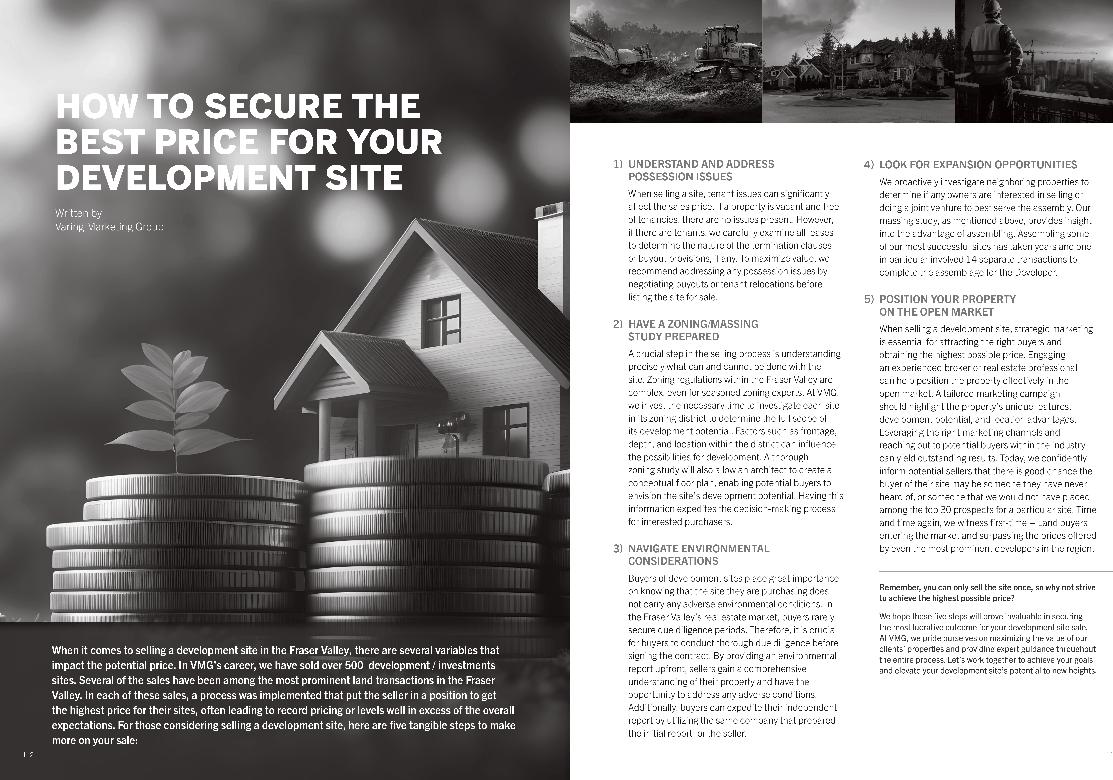

When it comes to selling a development site in the Fraser Valley, there are several variables that impact the potential price. In VMG’s career, we have sold over 500 development / investments sites. Several of the sales have been among the most prominent land transactions in the Fraser Valley. In each of these sales, a process was implemented that put the seller in a position to get the highest price for their sites, often leading to record pricing or levels well in excess of the overall expectations. For those considering selling a development site, here are five tangible steps to make more on your sale:

When selling a site, tenant issues can significantly affect the sales price. If a property is vacant and free of tenancies, there are no issues present. However, if there are tenants, we carefully examine all leases to determine the nature of the termination clauses or buyout provisions, if any. To maximize value, we recommend addressing any possession issues by negotiating buyouts or tenant relocations before listing the site for sale.

A crucial step in the selling process is understanding precisely what can and cannot be done with the site. Zoning regulations within the Fraser Valley are complex, even for seasoned zoning experts. At VMG, we invest the necessary time to investigate each site in its zoning district to determine the full scope of its development potential. Factors such as frontage, depth, and location within the district can influence the possibilities for development. A thorough zoning study will also allow an architect to create a conceptual floor plan, enabling potential buyers to envision the site’s development potential. Having this information expedites the decisionmaking process for interested purchasers.

Buyers of development sites place great importance on knowing that the site they are purchasing does not carry any adverse environmental conditions. In the Fraser Valley’s real estate market, buyers rarely secure due diligence periods. Therefore, it is crucial for buyers to conduct thorough due diligence before signing the contract. By providing an environmental report upfront, sellers gain a comprehensive understanding of their property and have the opportunity to address any adverse conditions. Additionally, buyers can expedite their independent report by utilizing the same company that prepared the initial report for the seller.

We proactively investigate neighboring properties to determine if any owners are interested in selling or doing a joint venture to best serve the assembly. Our massing study, as mentioned previously, provides insight into the advantage of assembling. Assembling some of our most successful sites has taken years and one in particular involved 14 separate transactions to complete the assemblage for the Developer.

When selling a development site, strategic marketing is essential for attracting the right buyers and obtaining the highest possible price. Engaging an experienced broker or real estate professional can help position the property effectively in the open market. A tailored marketing campaign should highlight the property’s unique features, development potential, and location advantages. Leveraging the right marketing channels and reaching out to potential buyers within the industry can yield outstanding results. Today, we confidently inform potential sellers that there is good chance the buyer of their site may be someone they have never heard of, or someone that we would not have placed among the top 30 prospects for a particular site. Time and time again, we witness first-time - land buyers entering the market and surpassing the prices offered by even the most prominent developers in the region.

Remember, you can only sell the site once, so why not strive to achieve the highest possible price?

We hope these five steps will prove invaluable in securing the most lucrative outcome for your development site sale. At VMG, we pride ourselves on maximizing the value of our clients’ properties and providing expert guidance throughout the entire process. Let’s work together to achieve your goals and elevate your development site’s potential to new heights.

Vancouver’s real estate market is faced with an economic problem characterized by the disparity between supply and demand. Contributing factors to demand include high immigration to Vancouver, population growth, and shifting demographics as baby boomers look to downsize into smaller rental properties as their children move out. However, based on current trajectories, supply isn’t paced to accommodate this influx of demand. Historically, zoning restrictions allocating 65% of land for singlefamily homes, combined with a construction industry limited in output capacity flexibility, have created an output gap that exerts considerable upward pressure on both property and rental prices.

In this article, our aim is to understand how provincial and municipal policy changes can affect Vancouver’s real estate professionals and address the rental supply shortage. To achieve this, we perform an analysis of past and future policies, look at new upzoning efforts, and provide some ideas for developers and Investors.

Written by:

The UBC Vancouver Housing Market Club Research Team

Arjun Manro, Ishan Bhatra, Alex Hachey, Kamakshai Anand and Jaimaan Singh Monga

With housing shortages and affordability issues becoming a growing concern for Vancouverites, the government has stepped in to address this. One interesting program the province introduced, launching in 2024, is the "Secondary Suite Incentive Program" (SSIP). Under this initiative, 3,000 homeowners will have the opportunity to receive up to $40,000 in forgivable loans to construct new secondary suites or accessory dwelling units on their properties with the condition that these units are rented out below market rates.

Another initiative the City of Vancouver introduced was the Empty Homes Tax. Properties designated as vacant from 2017 onwards have been subject to a 3% tax based on their assessed value. Since its inception, the Empty Homes Tax has led to a 36% reduction in the number of vacant homes in Vancouver and has generated over $115 million (as of 2022) that is currently being reinvested into affordable housing initiatives. On a forward-looking basis, the city is planning for the approval of 72,000 new homes between 2018 and 2027, with 65% of all new homes to be classified as rental.

The most intuitive solution to a lack of housing in a city constrained for space is to modify the existing zoning regulations to allow for higher population density. On the 14th of September, 2023, the Vancouver City Council approved the “missing middle” motion and decided to combine nine low-density zones into a collective residential inclusive zone. This policy allows up to 8 homes on large single-family lots if all units are built strictly for rental purposes. Registered homeowners are permitted to occupy one unit as their residence. This policy is a fantastic opportunity for real estate developers, homeowners, and investors to generate positive cash flow by constructing strataownership, multiplex-style rental properties. Although the rental rates in Vancouver are exorbitantly high, so are the property prices. Generating positive cash flow from rental properties has always felt like an impossible dream, however, this is no longer the case. More units on a single-family lot can allow for a mixture of shortterm (month-to-month basis or Airbnb) and long-term rentals, thus generating a flexible cash flow that can easily adapt to a landlord's current tenant situation.

Developers can benefit from this policy in several ways including, but not limited to, higher return on investment, increased development opportunities, reduced regulatory barriers set by the city council, and creating a positive public image by supporting the missing middle motion. Missing middle housing will significantly improve the livability of Vancouver overall by offering a mix of housing options that will accommodate all kinds of requirements for the people who call Vancouver their home.

While offering monetary benefits and opportunities to real estate business owners, this zoning reform policy is a step towards filling the gap of missing affordable middle housing rentals including duplexes, triplexes, multiplexes, townhouses, and other clustered housing types. This policy is a concrete idea to tackle the housing crisis in Vancouver.

Programs such as the provincial government’s “Secondary Suite Incentive Program” and the municipal government’s ‘missing middle’ motion open the door to new investment opportunities to commercialize the residential real estate market. While the SSIP incentive appeals more to individual investors due to its income-tested eligibility requirements, both large real estate firms and individual investors may stand to gain from the ‘missing middle’ program which grants the opportunity to convert single-family homes into multiplexes.

One complication attached to making an investment in multiplex construction is that investors and homeowners may have to take on commercial mortgage loans instead of standard mortgages. These loans typically come with higher interest rates than standard loans as well as shorter amortization periods as the lenders look to take on less risk. To determine the terms of the loan, the bank will consider the profitability of the property, the location, physical state, and liquidity on hand after financing, in addition to many other items (National Bank of Canada, 2021).

The newfound demand provided by the ‘missing middle’ program may affect developers by having them use new construction methodologies that can accommodate up to 8 different units on one property. They may incorporate new technologies such as modular or prefabricated homes to standardize the production of multiple housing units. Utilizing these processes will increase efficiency and lower the high construction costs. As a result of these new practices, a disruption in the housing market construction industry may follow, creating opportunities for new specialist firms and an overall increase in supply-side competition.

Reflecting the changing automotive times, the Taycan exemplifies dedication to the latest technology combined with the Porsche’s unique soul.

Schedule your service at Porsche Centre Langley, Western Canada’s Only High Voltage Service Hub for Taycan Models.

Porsche Centre Langley

6016 Collection Drive

Langley, BC V3A 0G2

604-530-8911

PorscheLangley.com

When you think about investing, what comes to mind? Stocks, bonds, mutual funds, and GICs? These are the traditional tools of investing that many of us are familiar with, yet they leave out a whole separate asset class that can be used to diversify and support your portfolio. That class is Alternative Investments. Alternative Investments include Mortgage Investment Corporations (MICs) and go far beyond the traditional makeup of an investment portfolio.

Alternative investments in a portfolio can reduce risk and enhance returns by lowering the portfolio’s overall correlation with traditional asset classes. They can also offer strategies designed to manage risk and preserve capital, while still achieving the desired returns.

Building an effective and stable investment portfolio is a difficult task. With so many options for investing available, it can be challenging to determine which options are the right fit for your goals and needs. As a leader in the MIC space, PHL knows how important it is to choose the right options for your portfolio. That is why we have compiled some information to demonstrate why MICs have a place in most investment portfolios.

Mortgage investment corporations can be a great addition to your investment portfolio due to the following benefits:

Real estate has always been a popular market for investing, though it is not always the most accessible market to get into. As housing prices continue to rise, MICs provide access to the private mortgage market without the volatility of ownership. There is also an added layer of safety with a MIC, thanks to the experts who carefully select the mortgages that comprise the fund while utilizing risk mitigation strategies. Additionally, the experienced team at the MIC will see the mortgage through its lifecycle from origination to payout, whatever that looks like, leaving you to take a more hands-off approach and focus on things that matter to you.

Past performance does not guarantee future results. Issuer calculated annualized returns. Please request a copy of the Offering Memorandum for further details.

Another benefit to investing through a MIC is the potential for higher yields. Investors may also start seeing returns sooner thanks to the interest fees collected from borrowers. Rather than managing a rental property, investors do not have any hands-on property maintenance or managerial responsibilities, and their investment is not tied up in the market value of a single property.

While it is typically still a good idea to have a certain percentage of your portfolio in traditional investment options like bonds and stocks, these are at the mercy of public and global events that impact the market. Private investing and alternative assets like MICs can provide some shelter from these same events, giving you the potential for steady and reliable returns.

No investment strategy is completely safe from market shifts. One of the greatest benefits of investing in mortgages is the security of not owning the physical property should there be market volatility. Most MICs invest in mortgages for a variety of residential and commercial properties, providing greater protection through mortgage portfolio diversification, portfolio Loan-to-Value controls, and mortgage priority.

To learn more about our investing solutions or to discuss your investing goals, get in touch with the team at PHL Financial Group.

Ravi Munday Vice President, Investments ravimunday@phlfinancial.com(604)

579-0844

Overall, retail spending has now moderated in Alberta and British Columbia.

As the economy continues to cool and interest rate hikes hit an increasing number of homeowners, spending will likely suffer, and with it, the demand for industrial distribution space. The increased contribution from e-commerce sales won’t be enough to prop up overall demand, leading to further cooling in the once white-hot distribution markets of Western Canada.

Consumers appear to be settling into new shopping patterns, holding off on big in-store purchases while turning to online shopping in search of discounts.

Similarly, and for the most part, distribution tenants appear to have secured the spaces they need. Future demand is anticipated; however, the torrid pace of absorption over the past two years amounts to a demand correction, with future needs coming at a more moderate and less frantic tempo.

Total industrial space under construction across the three markets has been in decline and is now 15% lower than 2022 volumes while remaining nearly double 2020’s eight million square feet. In the Alberta markets -- where land can be secured as low as a tenth of Vancouver’s pricing -- buildings have been racing out of the ground on a speculative basis and have often been delivered to the market fully occupied.

However, of the 7.5 million industrial square feet delivered through 2023, 20% remains vacant. Calgary’s 5.3 million square feet of 2023 deliveries sits 10% vacant, while Edmonton’s 2.2 million square feet is 40% vacant.

The price of land and the favourable provincial and municipal tax environments create a more palatable carrying cost for these vacancies. Vancouver’s 4 million square feet delivered this year is 9% vacant. Only two buildings offer more than 50,000 square feet of contiguous space.

Due to its land constraints, Vancouver will continue to rely on pre-leasing arrangements before starting construction projects. In most distribution or logistics building cases, it is tenants looking for buildings, as opposed to buildings looking for tenants. Spec builds in the Vancouver market will continue to be a rarity, while Alberta markets will likely see fewer of these builds as the markets adjust.

Paul Richter | Director Market Analytics

Paul Richter | Director Market Analytics

All three markets reached their vacancy low points in 2022: Vancouver at 0.7%, Calgary at 2.4%, and Edmonton at 3.5%. Unwinding or plateauing of these vacancy rates will continue in 2024, with each achieving better balance than past years. Vancouver will approach 2% in the year ahead while Calgary could unwind to 3.5%. Meanwhile, Edmonton is expected to maintain its current level of 3.5%, the result of a less feverish construction buildup over the past year.

The events of the past four years have resulted in a significant acceleration of change to consumer spending habits, construction and building innovation, and the more widely adopted notion of Western Canada as one market from a distribution perspective. As the economy continues to cool, it will provide the industrial markets with time to cool before moving forward in an even more disciplined manner as it deals with more predictable demand in an environment with better balance.

He is the Director of Market Analytics at CoStar - the leading provider of commercial real estate information, analytics and online marketplaces. Paul has worked with teams of dedicated analysts, across the country, to help clients make more informed decisions related to their commercial real estate businesses.

While White Rock is widely regarded as a desirable daytrip destination for many in the Lower Mainland, Mayor Megan Knight is seeking to show potential residents that it is a complete city where people can live, work, and play. To achieve this, Knight is relying upon effective planning and strategic partnerships with developers, builders, and other industry specialists. After all, the right partners can make all the difference in the world of planning and development.

As a long-time resident of White Rock, Knight has a deep connection to the city and a thorough understanding of the growing pains and transformation it has experienced over the years. “I have been living in the White Rock area since 1979,” says Knight. “I graduated from high school here, I went on to raise my family here, and I opened my notary public practice here. It really is one of the best places in the world.”

While White Rock holds a special place in her heart, Knight knows that there is much work to be done to ensure that the future of the city is prosperous. For Knight and her council, this work started with improving the permitting process by reducing the application backlog. “When I became Mayor, we had a huge backlog of applications,” says Knight. “My campaign promise was to improve the permitting process. I’m proud to say that, with the hard work of staff, we have reduced the backlog by 86%.”

Improving the permitting process is just one of the many avenues Knight and her council are exploring to strengthen White Rock and set it up for future success. These additional avenues include affordable housing, developing a new “Community Hub”, supporting local businesses, and investing in public transit infrastructure.

For affordable housing, Knight is implementing a few strategies to address this issue. She and her council are working to develop an affordable housing strategy framework to help identify mechanisms to incentivize affordable housing in new developments. They have also applied to the Federal Housing Accelerator Fund to help increase the production of new housing units in the community. In addition to these strategies, Knight notes that “more supply is needed. We need to encourage purpose-built rentals, laneway houses, and the replacement of aging buildings with new development that makes sense for the area.”

The City of White Rock is currently undertaking the North Bluff Study, which will take Surrey’s Semiahmoo Township Plan into consideration. Once this study is complete, it will help inform where the housing supply should be for White Rock. The goal is to determine what is going to make the most sense for White Rock through a long-term lens.

White Rock also needs to add affordable housing for seniors to its housing inventory, as 37% of the city’s residents are seniors. Data from the 2021 census reveals that White Rock residents have the highest median age in BC, so this is another high-priority item for Knight and her staff. “We have funds set aside for a new affordable housing project,” says Knight. “By 2025, the city will have 8.85 million set aside, but we need the right partners to make this project a reality.”

As a small municipality, a 1% tax increase for White Rock is equal to roughly $260,000, so bringing affordable housing projects and other endeavors to fruition will require funding partners. To that end, the city is actively pursuing partnership opportunities with the province, the federal government, non-profit organizations, and the private sector.

While affordable housing for residents of all ages is top of mind for Knight and her staff, they are also currently in the middle of a feasibility study for a project known as the Community Hub. “The vision for the Community Hub is a purpose-built amenity for the community to gather, work, and celebrate,” says Knight. “This may include new council chambers, a childcare centre, reception for emergency operations, a library, administration offices,

a community theatre, meeting and recreation rooms, commercial space, accessible public washrooms, and potentially affordable housing.”

While this project would undoubtedly breathe new life into the City of White Rock upon completion, there are several challenges faced by Knight and her team. First is the issue of space. Sitting at only five square kilometres in size, White Rock faces an extreme lack of land supply. While the proposed Community Hub would make use of existing space, some new developments would need to be properly planned to ensure that they make use of the precious land supply in an effective and efficient manner.

The second challenge is that it is extremely difficult to please everyone when it comes to new developments. “My role as Mayor along with my council is to consider the needs of the community, the entire community, both now and for the future,” says Knight. “We must make our decisions based on this. It’s a difficult balancing act. What some people want in their city might be different from someone else’s perspective, but the fact remains that we need more housing supply. But like we did with Oceana Parc, we need to do it carefully and thoughtfully.”

While creating more housing supply is crucial for existing and new residents, it’s also vital for those who seek to set up new businesses in White Rock. Despite having a modest population of roughly 22,000 residents, the City of White Rock has issued 2,205 business licences so far in 2023. This shows that there continues to be a strong interest in starting new businesses within the city. The city is also committed to supporting these businesses through

the White Rock BIA (Business Improvement Association) and the South Surrey White Rock Chamber of Commerce. Both are well-established, connected organizations who work on behalf of White Rock business owners.

With so many businesses throughout White Rock, the city also needs effective and efficient public transit to get people to them. With White Rock’s transit ridership now at 110% when compared to pre-covid numbers, investment is needed. “Transit infrastructure is critical for a healthy community, particularly one that is growing,” says Knight. “As more people move into our neighbourhoods, we are seeing congestion increasing. People need convenient options other than their cars.”

White Rock has been included as a community on one of TransLink’s recently announced new Bus Rapid Transit (BRT) corridors which is an exciting development for the city. “BRT will help to connect us to Skytrain, shape our city, and connect our communities,” says Knight. “Our corridor is very important, particularly given we are expecting a lot of growth in this area.” White Rock Council has also recently approved a new Transportation Master Plan that outlines the steps that must be taken to improve transportation options within the city including additional transit, cycling, and walking.

From affordable housing to transit improvements, Knight and her team are working hard to enhance White Rock and make it an even more desirable destination for residents and business owners alike. As part of this work, effective partners are needed to ensure that the city continues to develop efficiently and in a manner that is embraced by the general population. Since White Rock is currently experiencing a significant amount of growth and development, Knight has already partnered with several developers who have had a positive impact on the city.

“I can think of several developers who are really good corporate citizens,” says Knight. They have all continued to contribute to the neighborhood long after their developments have been completed.”

These types of partnerships are needed to allow White Rock to continue to grow now and well into the future. Through these partnerships, Knight hopes to achieve thoughtful, purpose-built developments that truly have the potential to shape a community through a long-term, sustainable lens. It’s this pursuit of partnerships that makes development within White Rock such a unique prospect for potential investors. While White Rock may be small, there’s big opportunity for those who want to explore it.

“We are known as the city by the sea,” says Knight. “We have a beautiful, desirable location where people want to live, work, and play. I want developers, builders, and other industry specialists to know that White Rock is open for business. My door is open, and I want to work with you in partnership. Opportunity abounds here, so come talk to me!”

Our team provides innovative real estate law and dispute resolution strategies to deliver the results you require.

Fasken is your legal team.

“Feelings come and go like clouds in a windy sky. Conscious breathing is my anchor.”

– Thich Nhat Hanh

In the race toward success and happiness, we often overlook one of the most fundamental and accessible tools at our disposal – our breath. In the rhythmic rise and fall of our chests lies a potent force that has the potential to transform our lives. The act of breathing, when harnessed consciously, is a simple yet profound practice that can transform our relationship with the present moment.

At the heart of conscious breathing lies the recognition that each inhalation and exhalation is more than a physiological process—it is a portal to the present moment. By anchoring our awareness to the breath, we create a doorway to mindfulness, inviting us to step out of the rush of the past or the pull of the future and into the expansive now. Conscious breathing need not be confined to meditation cushions or secluded spaces. It can seamlessly integrate into daily activities. Whether walking, working, or engaging in routine tasks, the breath can be a constant companion, infusing each moment with mindfulness.

Let us delve into the unspoken connection between breath, success, and happiness, exploring how we can use conscious breathing to navigate the complexities of our lives.

Successful individuals, from visionary leaders to accomplished artists, share a common trait—an acute awareness of the present moment. Conscious breathing becomes their gateway to presence. By anchoring themselves in the now, they cultivate a focused mind that is undeterred by the noise of past regrets or future anxieties.

The path to success is seldom a serene stroll but often a tumultuous journey filled with challenges. Conscious breathing acts as a refuge, providing a calm center amidst the storm, allowing you to respond thoughtfully rather than react impulsively.

Decisions, both big and small, mark the crossroads on the journey to success. The breath becomes a compass, guiding one to clarity in decision-making. By embracing mindful breathing, you create a mental space free from clutter, enabling you to make informed and strategic choices that align with your goals.

Success is not solely about accomplishments but also about navigating the intricate landscape of relationships and emotions. Conscious breathing nurtures emotional intelligence—the ability to understand and manage one's own emotions and those of others. We can leverage this emotional resilience to build strong connections and lead with empathy.

The pursuit of success often entails stress, but successful individuals view stress as a catalyst for growth rather than an obstacle. Conscious breathing transforms stress from a paralyzing force into a motivating energy. By embracing stress with a composed mind, we can channel its power into creative solutions and breakthrough innovations.

In the tapestry of life, conscious breathing is a thread that weaves harmony, awareness, and presence. As we navigate our own journeys, let us embrace each breath with purpose, for in each breath lies the potential for success to unfold—one conscious inhalation and exhalation at a time.

Experiment with these mindful breathing techniques to find the ones that resonate most with you. Incorporating these practices into your daily routine can bring about a sense of calm, focus, and heightened awareness in your life.

How to do it:

• With each step, synchronize your breath, fostering a sense of harmony between movement and stillness.

• Walk slowly, paying attention to each step and coordinating with your breath.

• Stay present, observe your surroundings, and embrace distractions.

• Conclude by standing still, reflecting on the experience.

How to do it:

• Inhale deeply, envisioning your goal with clarity.

• Exhale, releasing any doubt or negativity.

• Repeat, maintaining focus on your goal with each breath.

• Use this visualization to motivate and inspire action toward achieving your goals.

How to do it:

• Sit comfortably with a straight spine.

• Close your right nostril with your thumb and inhale through your left nostril.

• Close your left nostril with your ring finger, release your right nostril, and exhale.

• Inhale through your right nostril, close it with your thumb, release your left nostril, and exhale.

Jasneet has committed herself to the practice, study, and teachings of Ayurveda and Yoga since 2016. Originally trained in Kundalini Yoga, Jasneet has expanded her teaching into Yoga for Youth affected by trauma and is also a Certified Ayurvedic Counsellor on her way to becoming a Practitioner.

The last few years have seen some very challenging times for business owners having to work through a period of major world health concerns. Coming out of this health crisis period, today’s economic environment continues to be stressed. Everything has and continues to be impacted. We have recently experienced significant value declines in the stock market, interest rates have increased and inflation rates continue to remain high. Business operations around sales and customer demands through to supply chain management, costing for goods and services and tight labour markets continue to be a concern to business owners. Both consumers and almost all sectors of business are being impacted causing everyone to adapt in order to survive and continue to move forward.

As a business owner, you are facing new challenges, the likes of which you may have never experienced previously. Today’s environment is not only challenging but also happening at an increasing pace of change. Businesses can not rest on their laurels and sustain themselves with a ‘business as normal’ mindset. It is all about continued focus on sustainability to manage and weather through these trying times.

Navigating through the current challenges requires a heightened focus on four critical areas that need to be addressed by business owners and their management team. However, before we get into that in more depth, businesses firstly need to ensure their own house is in order. It is vital for the business to be working from a position of stability and not one of panic.

During these periods of uncertain and challenging times, your employees are looking for strong inspirational leadership from you. To address this business owners must have emotional control of their own situation. As a business owner, you must not only recognize and acknowledge the difficult business climate you are in, you must also accept it and embrace it. Acceptance is vital in getting the business past the why’s and time consuming look backs to what once was. Acceptance will allow you to move forward with full attention directed towards working on a plan of action. This is not the time to be passive, sitting back, waiting and accepting whatever the market throws at you. Be proactive and take control of your situation during this challenging time!

In Steven Covey’s book ‘The Seven Habits of a Highly Effective Business’, he defines habit number one, being proactive, as follows: “It means more than merely taking initiative. It means as human beings we are responsible for our own lives. Our behaviour is a function of our decisions, not our conditions.” Reflect on this statement as a guide to how you should be acting during this current period of uncertainty.

There’s lot’s happening in your business environment that you have no control over. Don’t waste your time worrying about them, there is nothing you can do directly to change that. Instead, focus your attention to those things you can control and the choices you need to make going forward. To guide your business through to times when calmer waters will prevail, you need to have company wide alignment and a cohesive effort from everyone in your business.

By working through the following four key areas, you will not only position your business to survive, but also create a platform for it to possibly grow and prosper.

Let’s take a closer look at the 4 key areas you need to address to navigate through the current challenges.

Consider stopping or slowing down any leaks to prevent your business from being overwhelmed by the current business climate. Manage employee costs to match your current and projected sales activity, reduce or eliminate unnecessary costs. Work with your suppliers to reduce costs and manage cash flow payments. Don’t under estimate the urgency to address these matters as changes will take time to implement. Focus on the bigger impact items first. The more detailed and time consuming review of smaller impact issues can wait until later. Perform a quick ‘due diligence review’ of your key processes and modify them as necessary to minimize risks and to ensure the business is managing its resources wisely. During challenging economic times reflect on the phrase ‘Cash is King’. Begin to identify and assemble available sources of cash so you have the necessary funds available for working capital as part of your ‘moving forward’ plans.

How does your business make money? Who are your customers? Why do they buy from your business? Is it because of your location, customer service, lower pricing, more convenience, best overall value, unique business offering, to name a few? Seems like pretty basic concepts, right? Success for your business generally lies in the execution process by managing these key parameters. However, in my experience, it is surprising how many business owners are complacent and take things for granted based on past performance. Failure to continually address and understand the answers to these questions will make it very difficult for your business to develop effective

customer service strategies, the kinds of strategies that not only retain existing customers but also attract new ones. To remain competitive during these uncertain times your business will likely need to do more, bring greater value, and be more flexible in its sales offerings. Focus on re-evaluating your customer’s needs and modify your value proposition to meet these changing needs.

During challenging times, businesses need to be able to respond and adapt quickly to their changing environment. There will be less time to respond and changes to improve day-to-day operations can not be hindered through a slow change process. Do a current review of the four main functional areas of your day-to-day business operations to identify what changes need to be made going forward.

1) Products and services – You should be looking closely at how the business manages inventory and make whatever adjustments are needed based on current and projected sales activity. If you are in the midst of developing or rolling out any new products or services, be mindful of the costs to launch and market these new offerings. Targeting new customer sales activity is the riskiest and most time consuming of all business development activities. You may not want to deploy valuable needed resources at this time where these sales initiatives are largely untested and reasonable success is unknown.

2) Marketing and sales – Often when times get tougher, marketing expenses are usually one of the first cost cutting target areas a business may focus on. You should exercise caution and avoid the simple temptation to slash this expense without a careful review. No doubt some cost reductions will be warranted as they may not be delivering results as expected. However, don’t be afraid to spend some time developing a well directed, targeted campaign that can be highly effective in getting more customers engaging with your business. Don’t stand pat by making the mistake of trying to manage through tougher times by just cutting costs and then hoping customers will continue to support your business.

Finally, be careful about the temptation to cut prices to keep sales activity going. You need to plan for a continuing profitable business and reducing profit margins over the long-term will jeopardize the business unless you have also altered your business model and lowered your operating costs accordingly. Consider opportunities to cost effectively bundle your products or services to provide an additional benefit to your customers. This

strategy may lower your margins slightly, but this could be more than offset by your customers increased value proposition they receive while allowing you to maintain your current pricing structure.

3) Systems and processes – This is the infrastructure that helps ensure your business operates smoothly and efficiently. When faced with times of potential sales pressure, a current review of your customer facing activities may be very beneficial. Encourage team brainstorming sessions to identify what could be done to enhance overall customer experience with your business to bring greater value. Work with your team to streamline existing internal procedures by updating or changing systems to improve efficiencies. Review your current IT investment costs and seriously consider further investment if it will increase customer service, increase productivity or reduce costs in the short run and long term.

4) People Resources – Ask most business owners and they will say their business success revolves around having a good team. During this time of uncertainty, business owners need to recognize the importance of good open communication. You need to keep your team focused on the task at hand and limit exposure to them jumping ship during this period. These are very challenging times to recruit people so focus on retention at all times. Communicate regularly with your team so they are aware of how things are going and the plans for the future for the business and how they fit into that. Now more than ever, your team needs to be focused on your customers and the critical business success factors you have identified in your “moving forward” plan.

If your business needs to address personnel reductions, be mindful of the impact to your remaining team who will be tasked to do more. In managing labour costs, keep an open mind for possible shorter term options like; temporary outsourcing or part time help in lieu of hiring full-timers, offering performance bonuses to take away some of the ‘bad news’ sting, or consider work sharing arrangements or making across the board salary cuts instead of layoffs or letting people go. You will likely require these folks when things calm down and you begin planning again for future growth.

During these trying times, management of cash flows will take priority over generating profits until things settle down and the business environment starts to turn around. You need to have heightened focus on cash management to optimize existing resources. Take every opportunity to

ensure you get paid by reviewing and tightening up your existing credit policies. Look at ways to get payment in advance, receive interim progress payments to cover your costs being laid out and secure final payment terms. Ensure your business invoices customers on a timely basis and that you have systems in place to follow up collection. You can’t afford to just sit and wait in hope for the money to come in.

Many businesses often pay for capital expenditures without any financing, but this draws away from available cash flow. Look to finance capital expenditures wherever possible to preserve cash flow needed for working capital of the business. Look to manage your supplier payments and request payment term extensions where possible without negatively impacting your supplier relationship. Pro-actively address and review inventory levels to reduce cash tied up inventory. Review whether to implement spending policies and controls by setting authority levels. Finally, maintain a culture of cost control management and cash flow preservation. Often when businesses face tough economic times, this can be the impetus for improving your company as you move forward.